Key points

The strength of the Australian dollar is likely to persist, supported by its prior undervaluation, the RBA’s position as the first major central bank to begin tightening after a rate‑cutting cycle, ongoing US‑dollar weakness, and elevated average commodity prices.

Another 5% appreciation in the $A is possible in the short term. We expect the $A to settle between 0.70-0.75 USD over the coming months.

A stronger $A is a form of “tightening in stealth” as it should help to dampen tradable (or imported) inflation which will help in slowing trimmed mean inflation to below 3% by late 2026.

A higher $A also puts upward pressure on imports and reduces exports, which is a headwind to GDP growth. Inbound tourism could soften from the higher currency, but outbound tourism will benefit.

Introduction

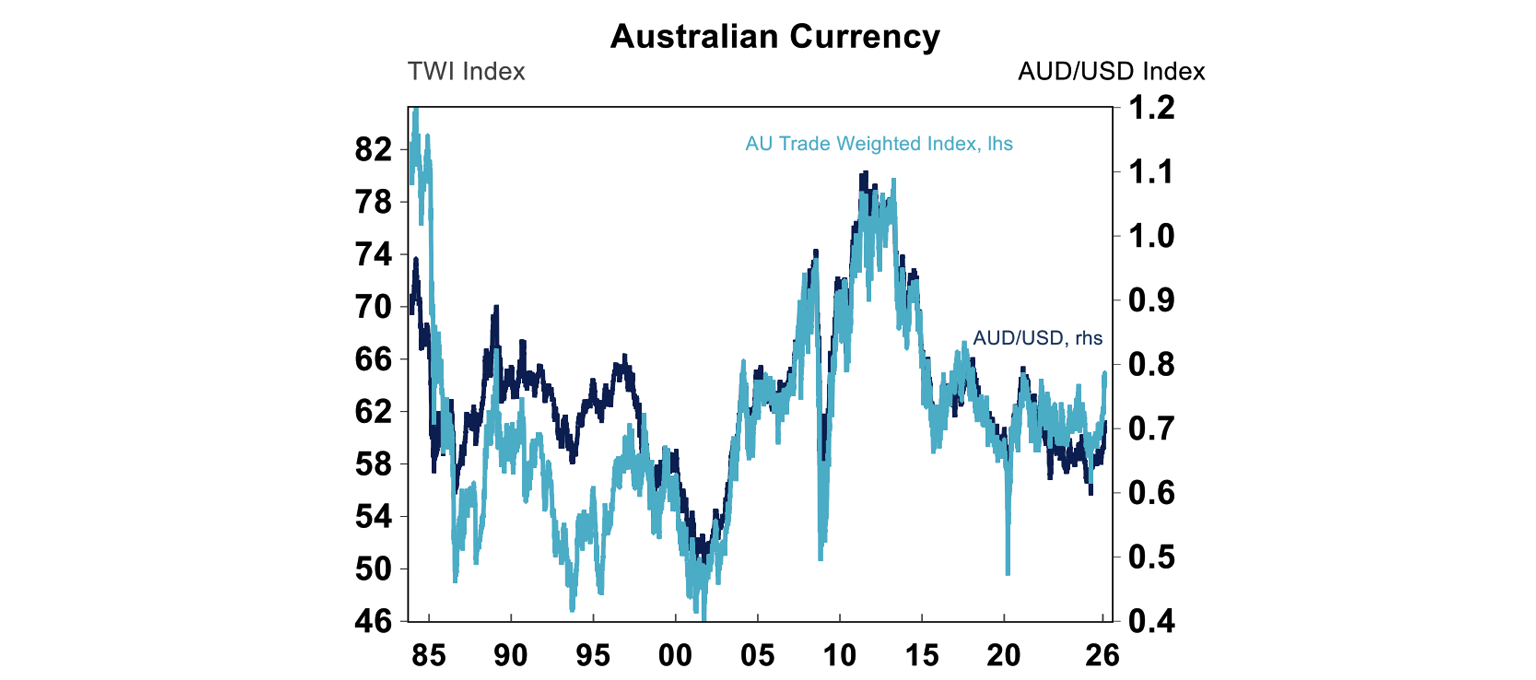

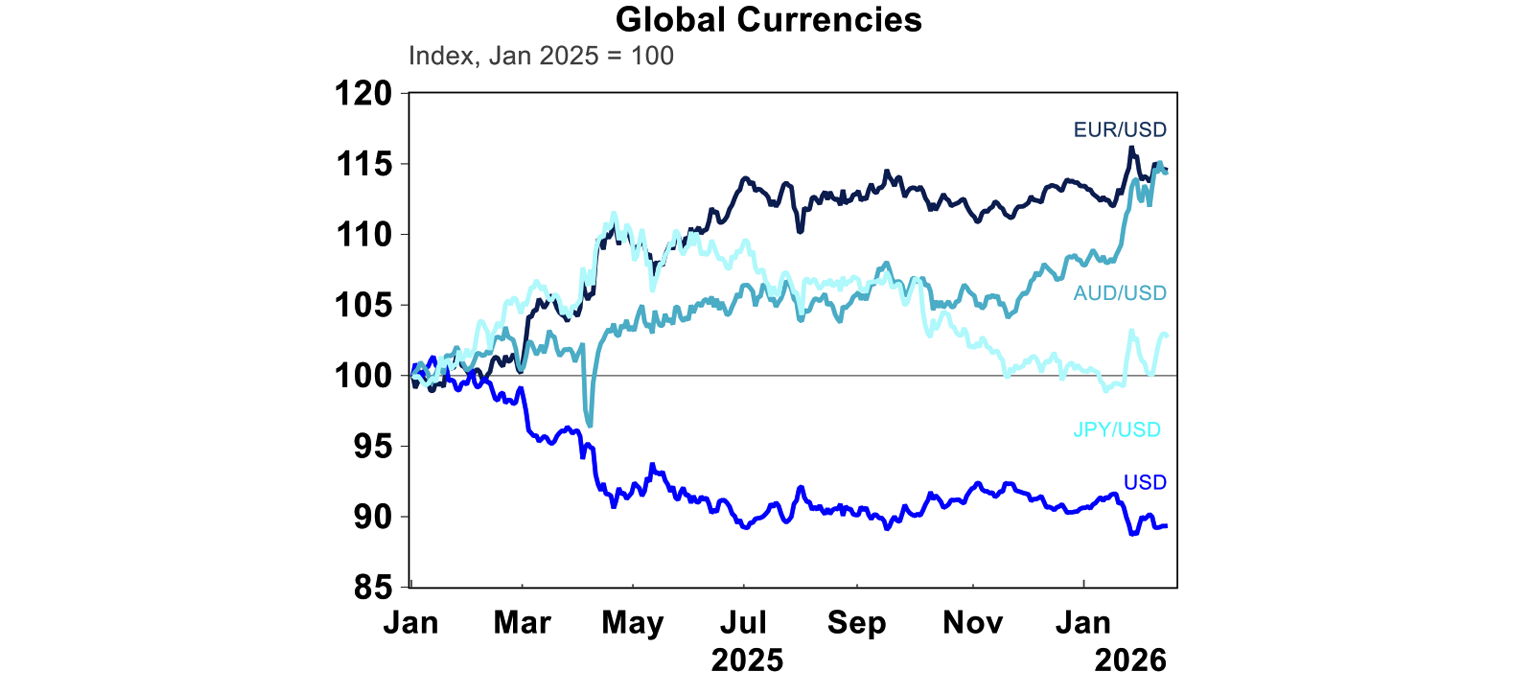

The Australian dollar has been appreciating (in other words rising) in early 2026. It is common to look at the Australian dollar relative to the US dollar and on this measure, it has increased to just under 0.71 US dollars, from an average of USD 0.64 throughout 2025, or a ~10% appreciation. This has taken the AUD/USD to its highest level in 3 years – see the chart below.

But you can also measure the value of the Australian currency against a basket of other currencies, that Australia trades with. This is known as the “trade weighted index”, with the largest weight to the Chinese renminbi, the US dollar, the Japanese Yen, the Euro, with these currencies making up over 60% of the index. On this measure, the Australian dollar has appreciated by 8% from its 2025 average, the highest level in ~5 years (see the chart above).

In this edition of Econosights we look at why the Australian dollar has been rising, if the stronger currency is here to stay and what the implications of this are for the economy.

Why is the Australian dollar appreciating?

There are three main reasons for the stronger Australian dollar in recent months.

1. Diverging interest rate paths across countries

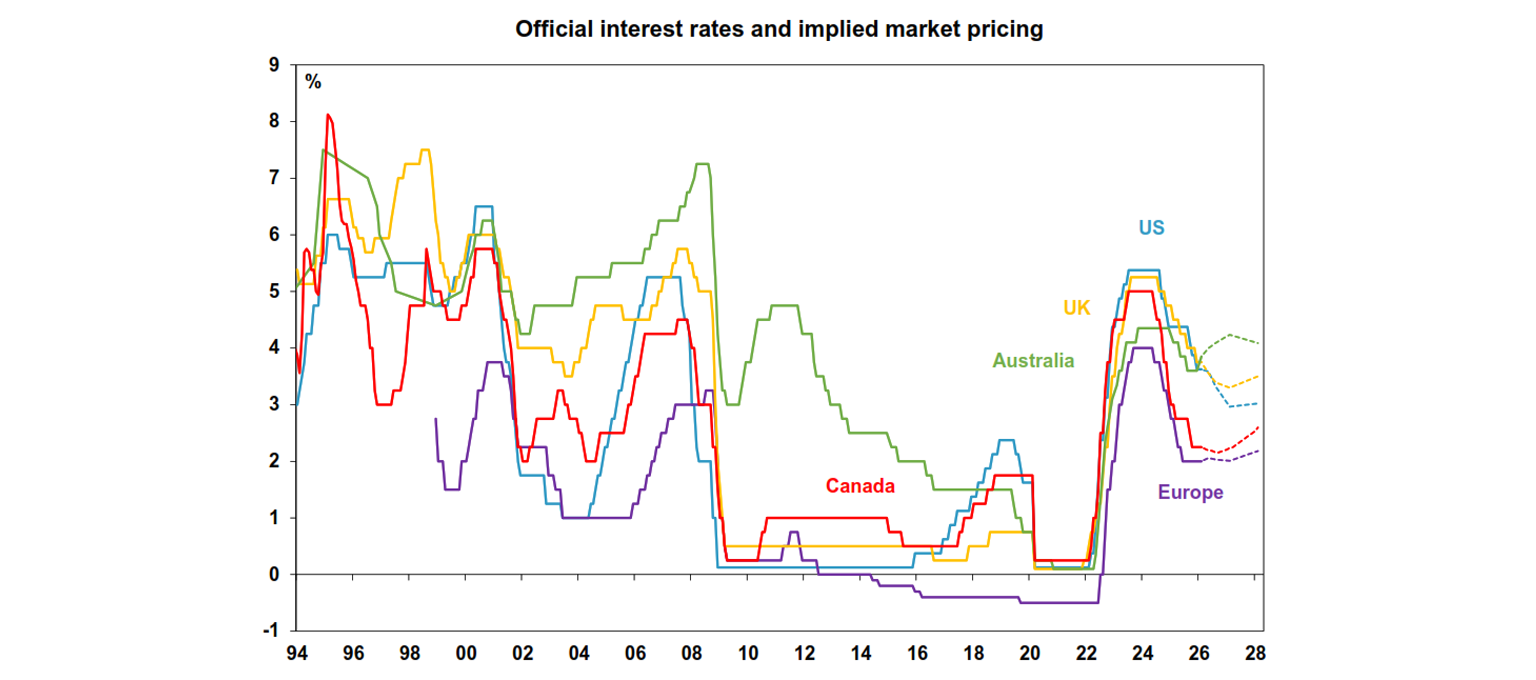

Interest rate differentials reflect not only differences in current policy rates across countries, but also investor expectations about the future path of rates. As a result, currency movements often track changes in interest rate differentials. Expectations of Reserve Bank interest rate hikes in Australia started in late 2025, following a few months of stronger-than-expected inflation data. In contrast, investors have continued to expect further rate cuts from the US Federal Reserve due to concerns about a slowing labour market and better signs on inflation. The path for interest rate hikes is most aggressively priced for Australia compared to other major Western countries (see the chart below), which are likely to have a tightening cycle over coming years, rather than in the short-term. Higher (relative) interest rates support a currency because investors are attracted to the higher rate of return.

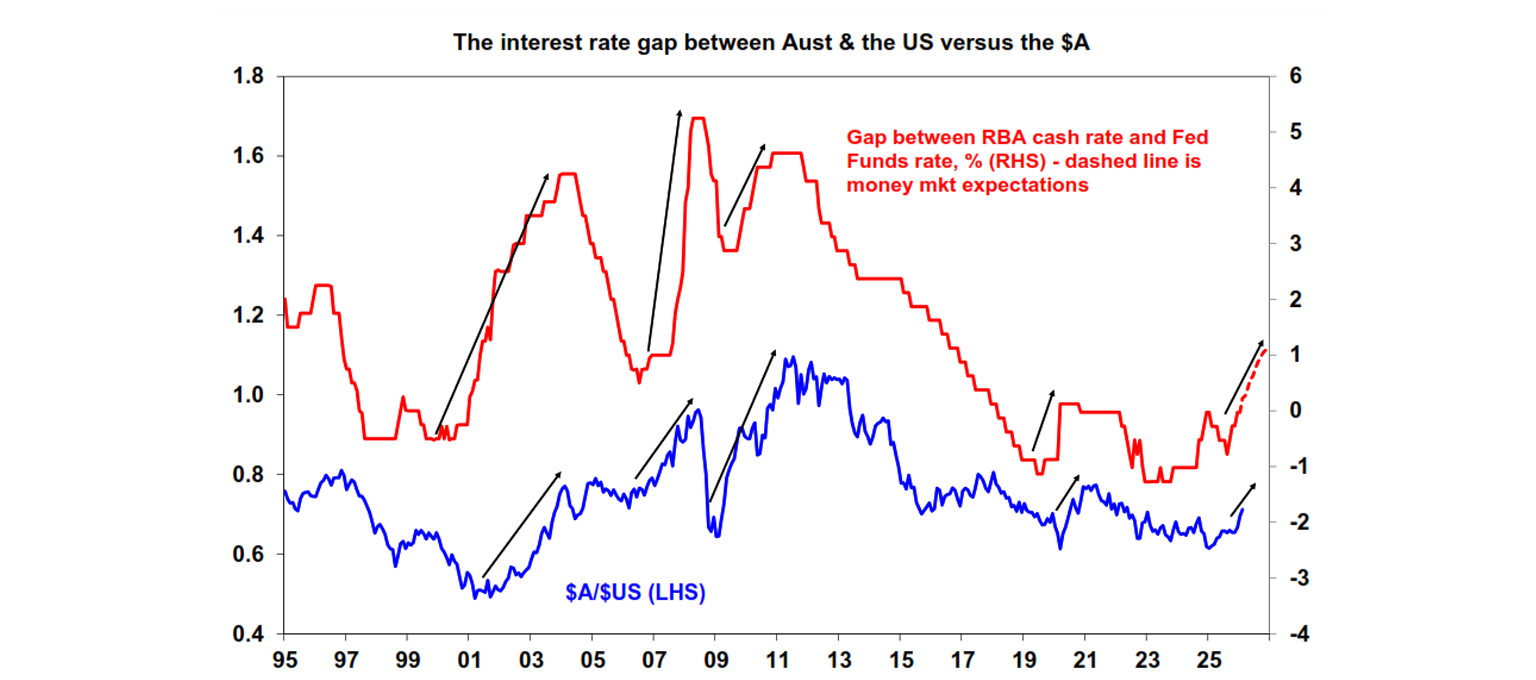

The US Federal Funds rate is at a level of 3.625% now versus 3.85% in Australia after the recent rate hike. While we may not agree with the precise market pricing for interest rates (and expect the RBA to remain on hold from here), the risk of more rate increases means markets will still price in these risks. Another 1-2 rate cuts from the US Fed is likely this year, so even if the RBA keep rates unchanged, the gap between Australian and US interest rates is widening. Historically this has led to the Australian dollar appreciating against the US dollar (see the chart below).

2. A lower US dollar

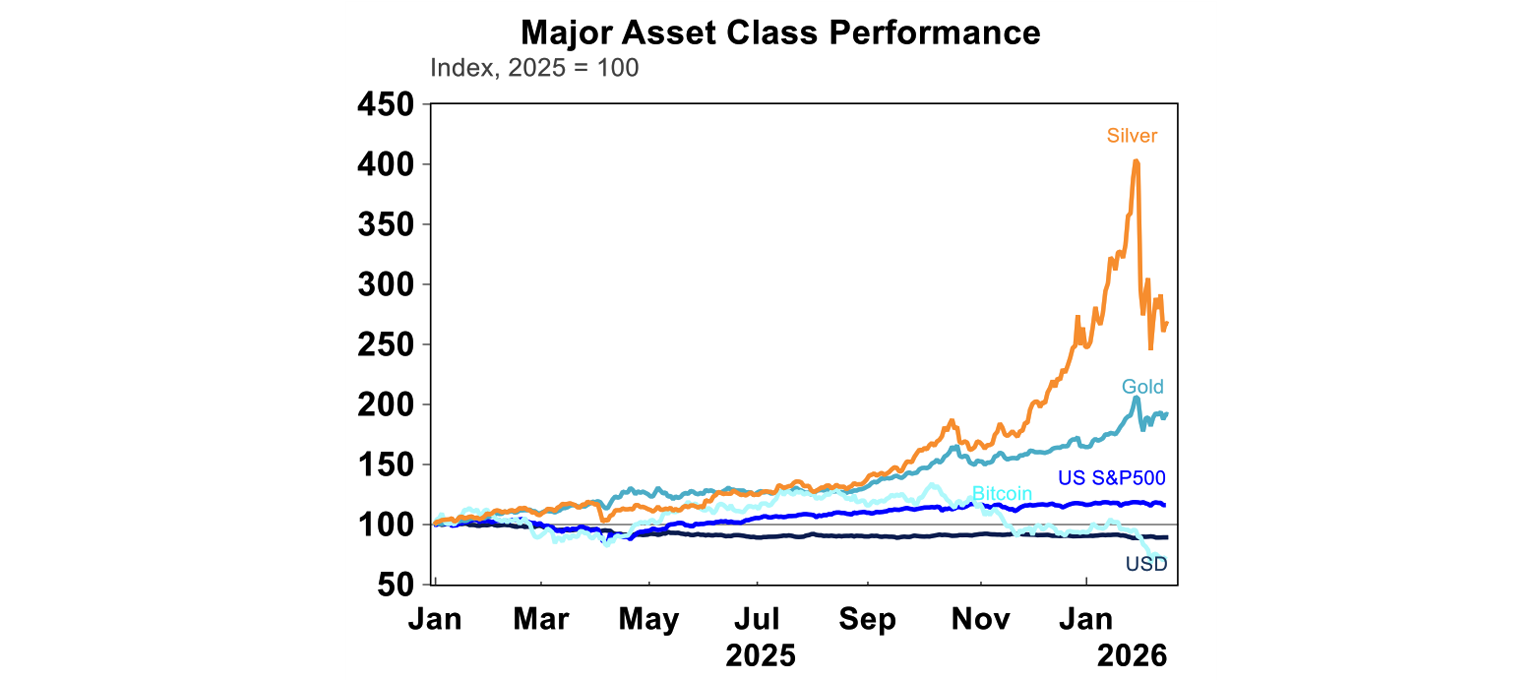

The US dollar has been under significant pressure since Trump took office in early 2026 and has fallen by more than 10% while investors are flocking to precious metals like gold and silver instead, as a form of safe havens.

Investors are concerned that the US is no longer a safe place to park money given the US attack on allies like Europe, reframing of international agreements and norms, the erratic nature of policy making from the Trump administration and US sanctions or freezing of foreign-owned US assets leading countries to wonder if they are next. These trends are unlikely to completely abate whilst Trump is in office which argues for some persistent downward pressure on the US dollar. However, given the large sell-off of the US dollar in the last year, it could be due for a bit of a short-term bounce. Major beneficiaries of the softer US dollar besides the $A has also been the Euro (see the chart below). The Japanese Yen fell into 2025 as the Bank of Japan has been slow in raising rates and expansionary fiscal policy weighed on confidence in the Yen.

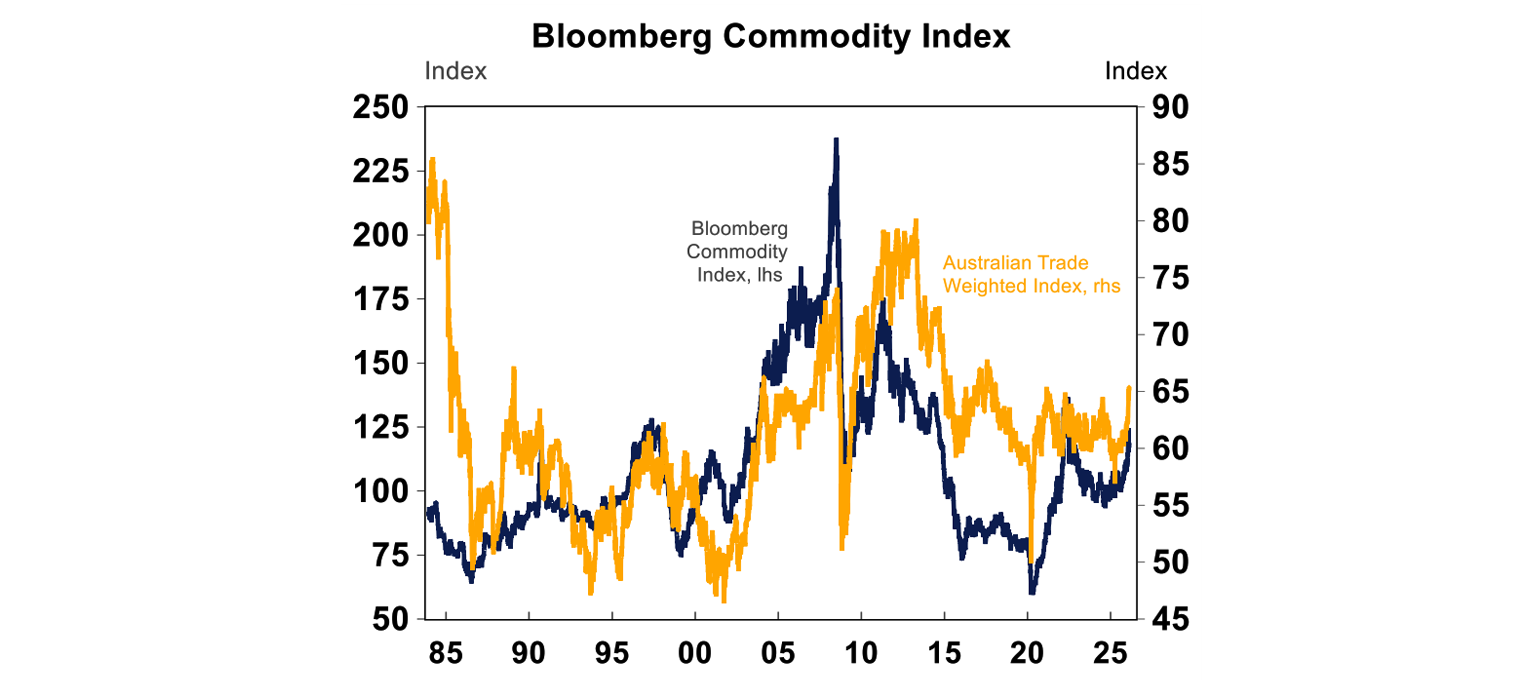

3. Higher commodity prices

The Australian dollar is a pro-cyclical and risk-sensitive currency because we are exposed to global trade through our large commodity export sector (which makes up around a quarter of GDP). This means that usually when commodity prices are increasing, it leads to a higher Australian dollar and vice versa (see the chart below).

Some commentators are of the view that we are in a period of a commodity price “super-cycle”, which basically just means that there is going to be a multi-year (or even decade) period of higher commodity prices, driven by structural demand (like what happened in the early 2000’s with China’s industrialisation).

The current drivers of commodity prices are mostly higher metals demand from AI/data centre investment and electrification as part of the climate transition against a backdrop of constrained supply. In the near-term there is likely to be some further upside for some commodities like copper, lithium, nickel, graphite and aluminium given higher tech spending and demand. But, this is not a broad-based commodity super-cycle, which means that the upside pressure on the $A from higher commodity prices have not have a multi-year impact.

What is the outlook for the currency from here?

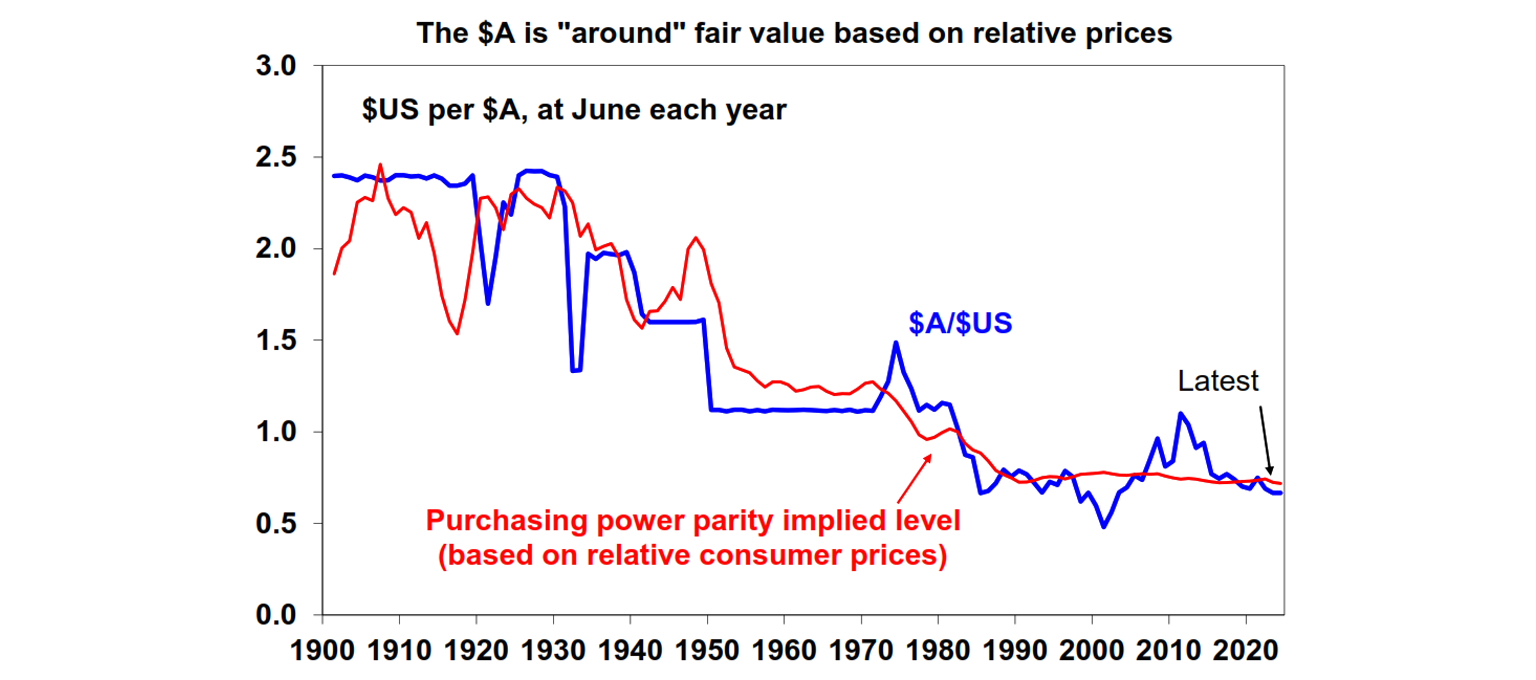

Higher Australian interest rates compared to its peers, persistent downward US dollar pressure and continued support for commodity prices points to further upside in the Australian dollar in the near-term. But how much further can it appreciate? To try to understand this, we can use a Purchasing Power Parity (PPP) framework. A PPP model is used to estimate the fair value of an exchange rate, by comparing how much identical goods cost across countries and adjusting for inflation. Based on this model, the fair value of the Australian dollar is around 0.72 US cents, relatively close to its current value – see the chart below.

So, on this measure the $A may not have much more upside. However, the Australian dollar has a tendency to overshoot once momentum builds, meaning a short-term move towards 0.75-0.80 US dollars cannot be ruled out. That said, such high levels are unlikely to be sustained. Over the next few months, we expect the Australian dollar to average around USD 0.70 – 0.75 with a trade-weighted index of around 69.

What is the impact of the higher currency on inflation and growth?

A stronger Australian dollar means that Australian goods become more expensive (relatively) to foreigners, so export prices increase and volumes decline. However, buying overseas goods for Australians becomes cheaper (which is why Australians love a strong currency, because it means overseas holidays are cheaper), so import prices fall and import volumes tend to increase. So a higher currency tends to lead to lower exports and higher imports, which shrinks the value of the trade balance. A depreciation in the currency has the opposite effect, it increases exports and decreases imports, which helps to lift the value of the trade balance.

An academic research paper from the Reserve Bank of Australia in 2014 models the exchange rate shocks and the impact on the economy. The RBA’s model found that a 10% appreciation in the real exchange rate (adjusting the exchange rate for inflation differences) decreases GDP growth by 0.3 percentage points 18 months after the shock. A similar impact is estimated on trimmed mean inflation. There are also big differences to the impact if it is a temporary or permanent exchange rate shock. The industries most impacted are unsurprisingly mining, manufacturing and personal and business services – those exposed to trade. Social services are not impacted much. Of course, this is purely a model and becomes less realistic when we know that currencies can bounce around all the time, but it’s good to get a ball-park figure of potential exchange rate movements on the economy.

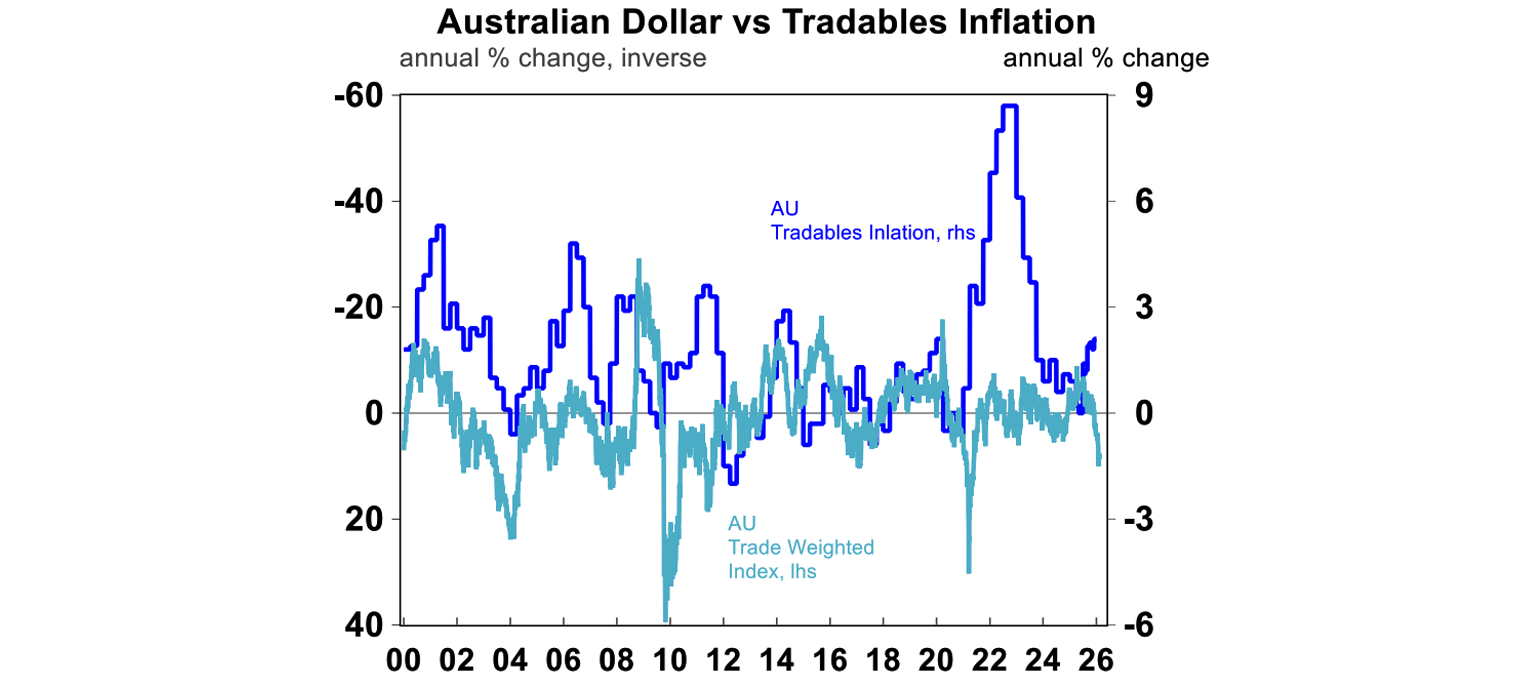

The recent appreciation in the Australian exchange rate is around 10%. The impact on inflation from currency moves is through “tradable” goods, items whose prices are mostly set on a global basis, because they are significantly influenced by international trade and competition. Tradables make up 35% of the inflation “basket”. If the stronger $A persists, then tradable inflation will most certainly have to slow from its current pace of 2.1% (over the year to December 2025). In many periods prior to 2020, the inverse relationship between the Australian dollar and tradables inflation was evident (see the chart below).

The RBA’s recent update to its inflation forecast would have assumed recent changes in the currency but any downside impact to inflation from a higher $A was offset by broader inflation pressures due to full capacity utilisation across the economy. The RBA expect trimmed mean inflation to decline to 3.2% by end 2026, only slightly below its recent rate of 3.4% (over the year to December 2025). We are more optimistic and see trimmed mean inflation at 2.8% by late this year – within the RBA 2-3% inflation target band but above the RBA’s preferred 2.5% target.

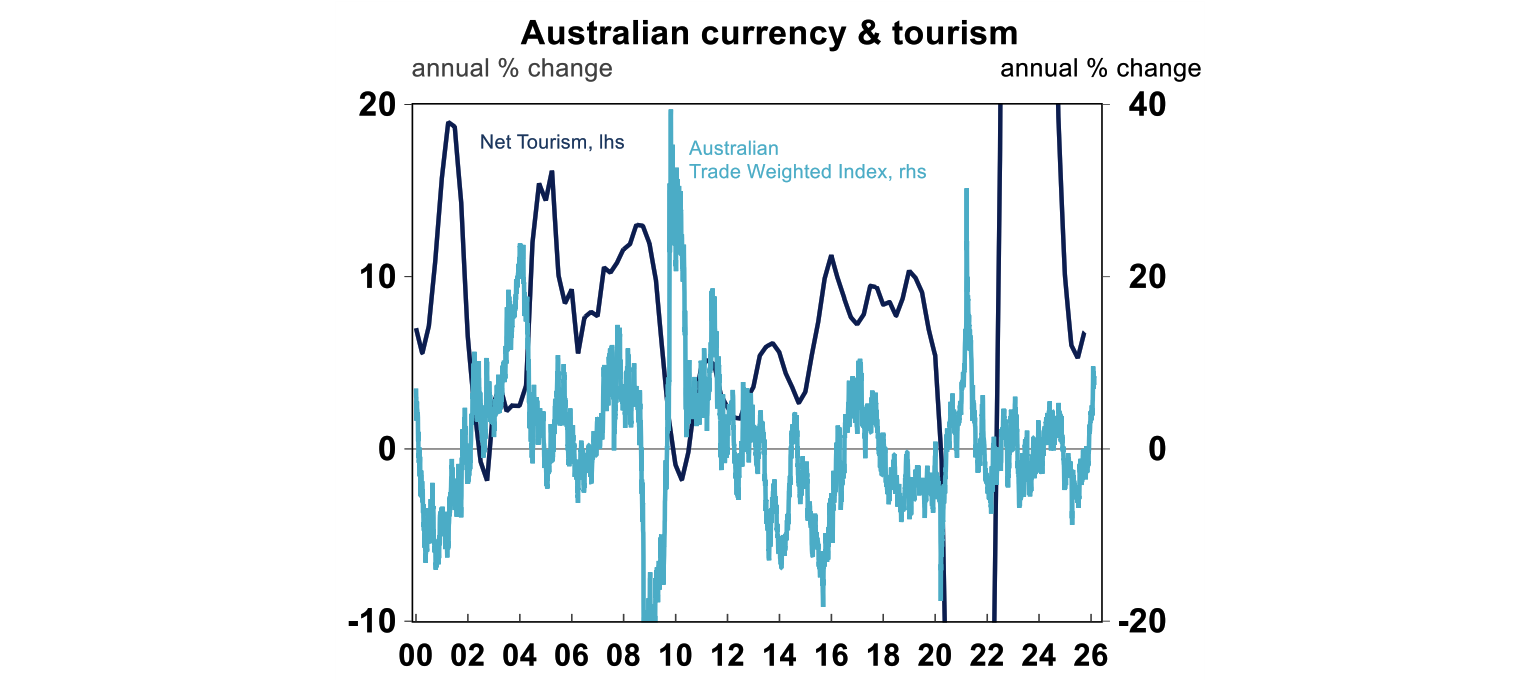

Changes in the $A also impact the tourism balance. The tourism balance or “net tourism” is the number of tourism “exports” (how much foreigners spend in Australia) less tourism “imports” (how much Australians spend overseas). So when it is positive, foreigners are spending more in Australia than Australians are spending overseas. Most of the time in Australia, net tourism is positive in Australia, but currency movements have played a role in changing tourism flows. When the currency has depreciated noticeably, net tourism has lifted (like in the early 2000’s or 2015) and when the currency has appreciated significantly net tourism has slowed (like in the early 2010’s). But the relationship is not as clear-cut in the post-Covid world because of the huge disruption from closed borders. The recent appreciation in the $A is likely to see stronger outbound tourism as more Australians travel overseas or choose overseas rather than domestic holidays. The rate of foreigners coming to Australia for tourism (or even education) could also slow slightly, but the impact is likely to be more modest as travel can sometimes be price inelastic (i.e. some consumers will travel regardless of cost).

Implications for investors

Fundamentally, an appreciating $A is a tightening impulse on the economy, on top of the recent RBA rate hike (and talk of more to come). The stronger currency could do some of the work for the RBA in terms of reducing inflation and slowing GDP growth (which would help capacity utilisation pressure). Exporters and trade-exposed sectors may see some slowing in AUD-derived revenue.

Investors may need to look more closely at hedging strategies, as a stronger $A will suppress global returns (in $A terms).

For consumers, a stronger currency tends to be seen as a sign of economic strength and security by its consumers. And for those consumers who are purchasing items from overseas or planning overseas holidays, it’s seen as a positive.

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements. -

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching. -

Weekly market update - 13-02-2026 US shares fell over the last week on the back of ongoing concerns about AI disruption, excessive related capital spending and tech sector valuations.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.