Introduction

In 2025, Taylor Swift told us about her “Wi$h LiSt” in her latest “Life of a Showgirl” album but what would an economist wish for in 2026? Here is an economist’s wish list!

1. No RBA rate hikes

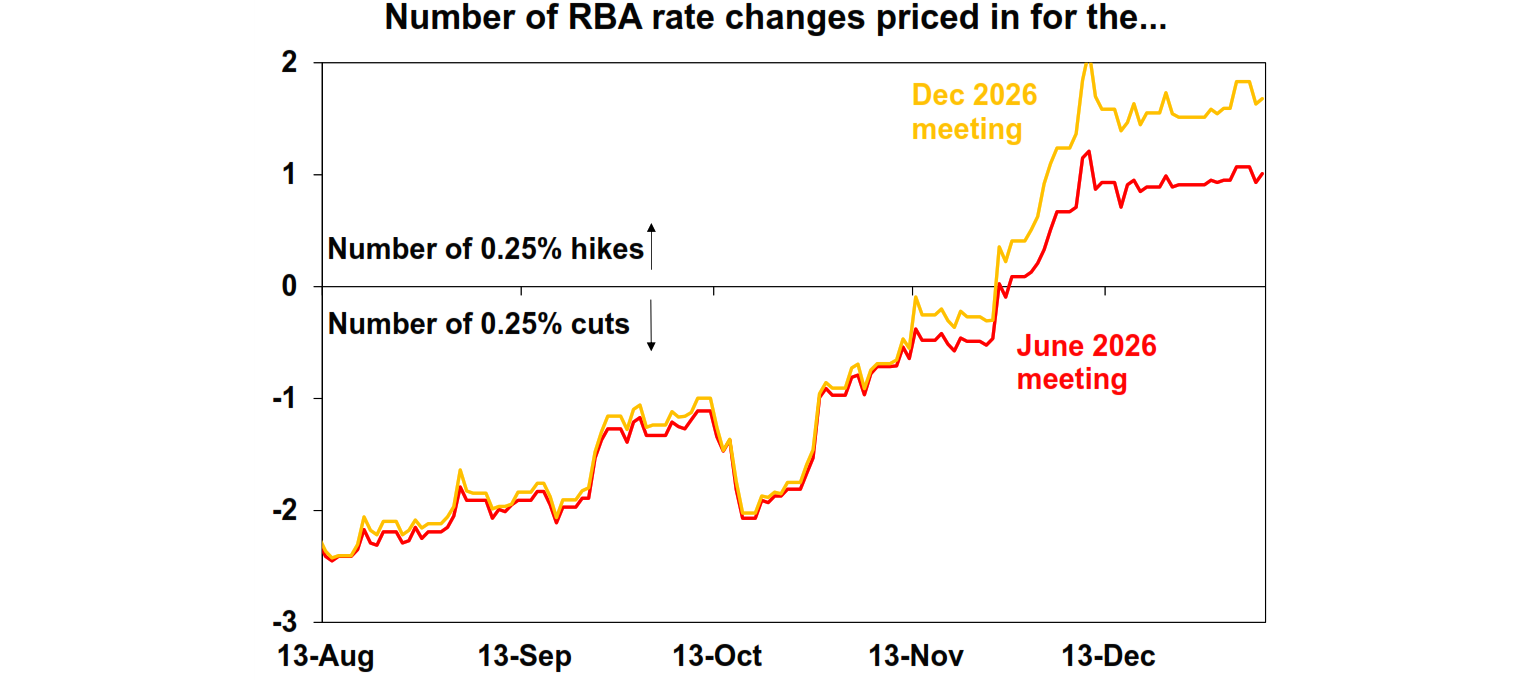

Towards the end of 2025, there was a run of stronger Australian economic data. Importantly, the last 4 monthly inflation prints surprised higher, with the RBA having to revise up their inflation forecasts significantly. The September quarter GDP figures also showed a stronger pace of growth in the economy, running close to the RBA’s estimates of potential. This led to financial markets pricing in 1.5 RBA rate hikes by the end of the year.

We are not against rate hikes, if required. But, the risk is that if there is a knee-jerk reaction from the central bank to raise interest rates in response to higher quarterly inflation print, it risks hurting the private sector of the economy, which was (finally) looking stronger in 2025. The consumer remains fragile, with sentiment falling back to negative again after a brief turn higher and the risk is that prior impacts of rate cuts and tax cuts wane in their impact on consumer spending.

Effectively you could say that there has already been an effective monetary tightening, without the RBA changing interest rates because of the signal from the RBA that rate cuts are no longer on the agenda and bond yields moving up. The evidence of this tightening is in signs of slowing growth in home prices and a decline in auction clearance rates.

2. More US tariff concessions

The US will have mid-term elections in 2026. This will mean that more market friendly policies are likely needed from the Republican, to avoid the “mid-term curse” (i.e. the governing party to lose seats in Congress). Democrats won governor elections in Virgina and New Jersey in 2025 and the New York mayoral race was won by a far left Democrat which could be seen as a response to Trump and his team. Cost-of-living (i.e. inflation) is still a big problem for voters, and these issues could be partly eased by more tariff deals with major trading partners, especially for consumer goods.

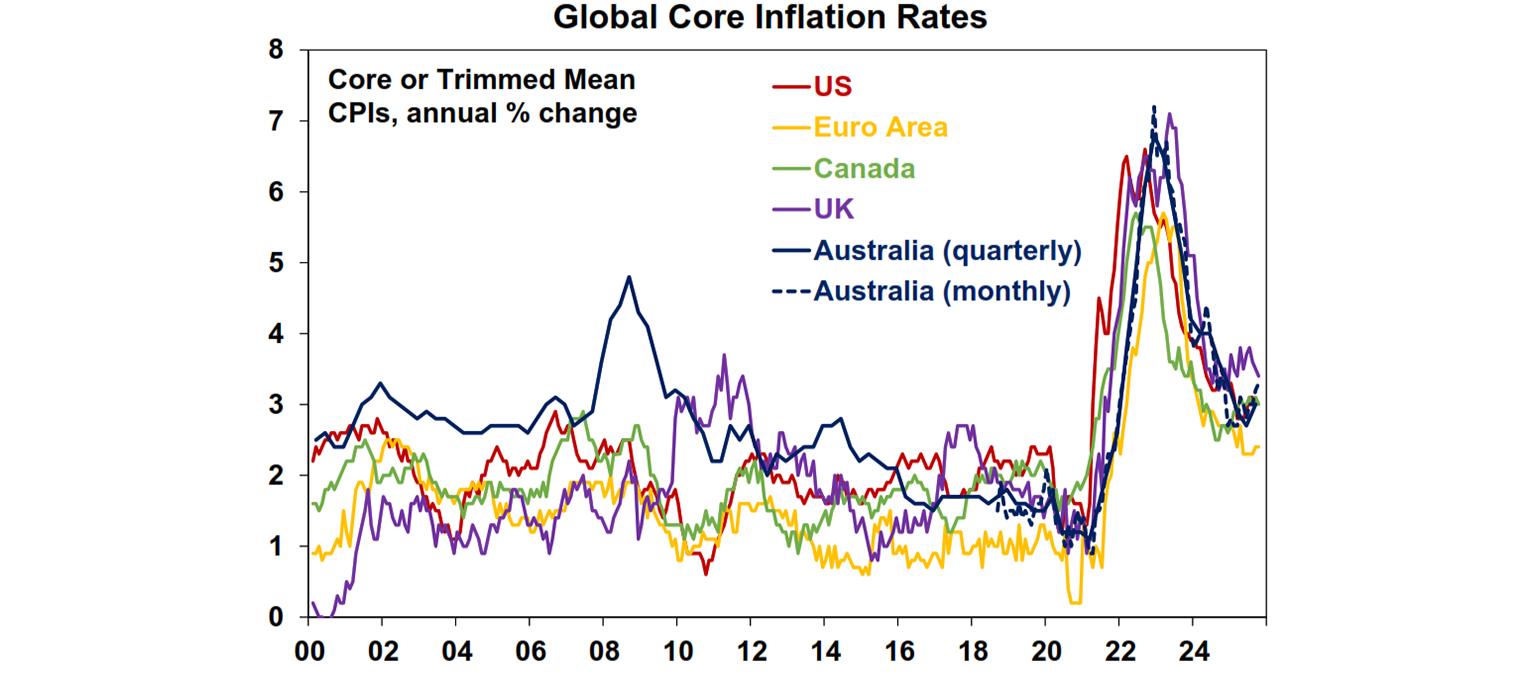

3. Lower inflation

After inflation slowed noticeably over 2024 across the advanced world, there was a slight rebound in inflation in 2025. While each country is experiencing its own domestic dynamics, services inflation has been broadly surprisingly sticky in the post-Covid world which probably reflects tight labour markets. Last year, US inflation was boosted by tariffs (although probably not as much as expected) while in Australia there was broad-based inflation across goods and services that made the RBA concerned. In 2026, most countries would like inflation to moderate a little further as high price growth presents a continual cost-of-living challenge to consumers.

4. Fiscal sustainability

The latest update from Australia’s Treasury on the budget outlook shows a slight reduction in projected budget deficits, compared to the March budget. However, this has come about predominantly from windfalls for government income, rather than significant spending restraint. Looking ahead, there are still significant structural pressures on the budget which will keep public spending high as a share of the economy, which weighs on productivity growth and contributes to higher inflation. While it’s good to see some near-term spending restraint from the government, the longerterm outlook is still problematic as there is no plan to get the budget towards neutral, let alone a surplus, which would help the economy in the event of a potential future crisis.

5. A less tight labour market

Australia’s “tight” labour market has resulted in a low unemployment and underemployment rate, both are which still below pre-Covid averages. This is great news for workers, as it has been relatively easy for those unemployed or entering the labour market to find new work. The bid for workers by businesses led to a build-up in wages growth and as a result, services inflation. Wages growth has moderated, after peaking at ~4.3% in 2023, it has since slowed to 3.4%. However, this is still high and accounting for lower productivity growth, business labour costs remain elevated. An easing in labour market “tightness” would help to alleviate business labour costs and help inflation to be closer in the RBA’s 2-3% target band. The unemployment rate trended up in 2025, but at a glacial pace, increasing from 4% in late 2024 to 4.3% in late 2025. Some further rise is likely, as leading indicators of employment growth are indicating flat to down employment growth.

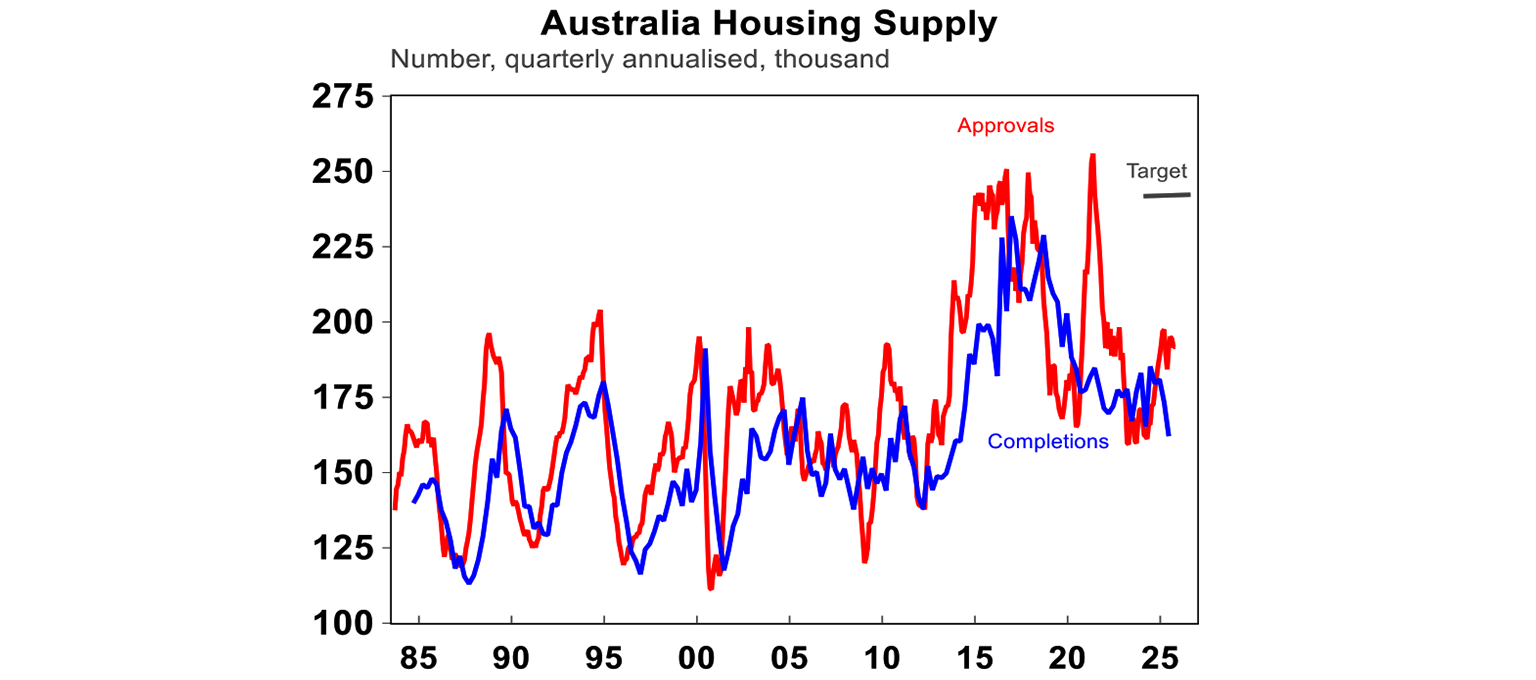

6. More home building

Australia’s housing construction fell short of its goals (again) in 2025. Residential building completions were running at an annual rate of 162K in June 2025, well short of the 240K level National Housing Accord “target”. Building approvals picked up in the second half of 2025, and are tracking at around 192K (see the chart below) but this is still below required levels to keep up with housing demand (based on population growth) or the backlog of prior undersupply. Some recent recommendations from The Productivity Commission to boost housing construction include: streamlining the planning and approval process, freeze the National Construction Code, encourage take-up of new technologies in building sector, reduce red tape that just leads to higher housing costs and encourage mobility of movement between workers across states.

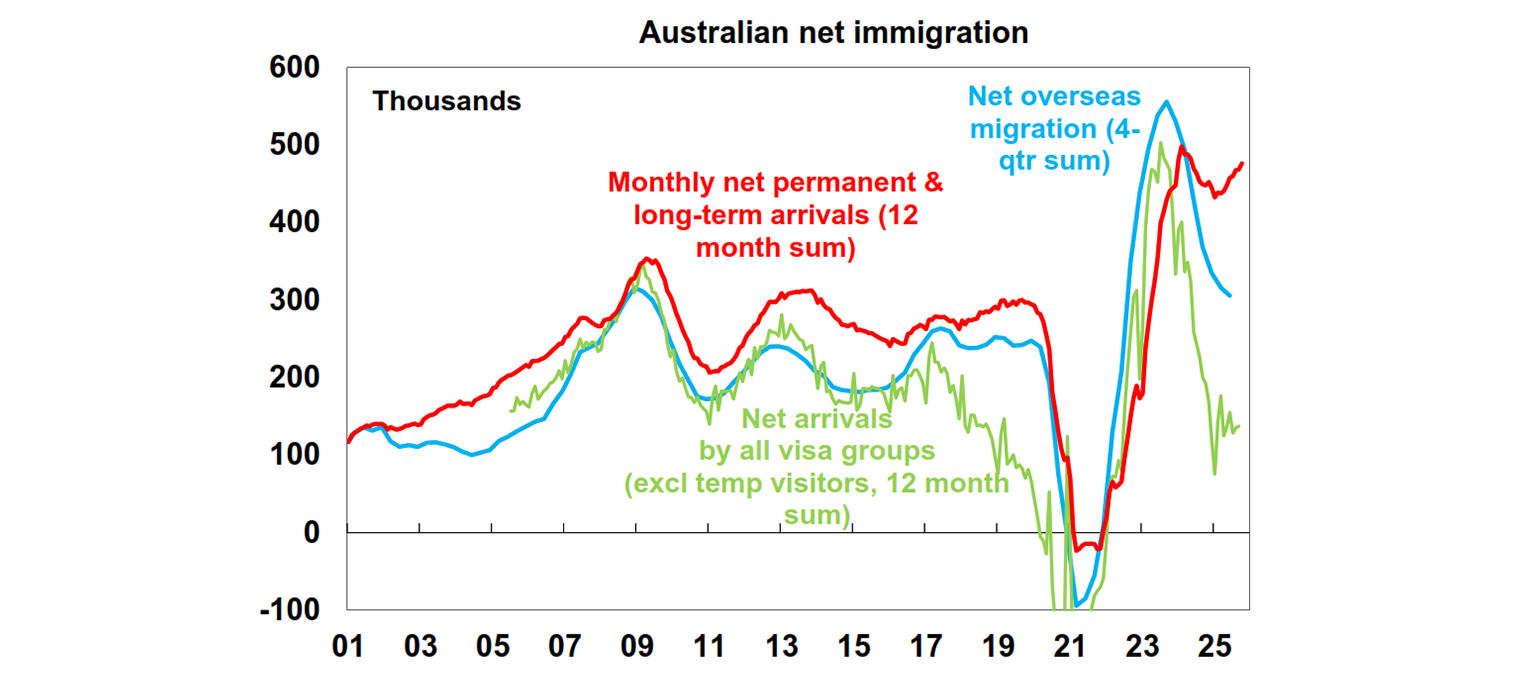

7. More sustainable population growth

A significant factor affecting higher demand for housing is elevated immigration, especially at a time when supply is constrained. In the 12 months to June 2025, net migration rose by ~310K persons. Treasury estimates that in 2025-26, net migration will slow to 260K. The latest data from monthly arrivals and departures figures has been mixed with permanent and long-term arrivals picking up again (red line below) but arrivals ex-temporary visitors is much lower, which reflects the drop-off in students (which may not all be captured in long-term arrivals). If arrivals data continues to rise and exceeds Treasury forecasts, this would provide an additional challenge into the housing market.

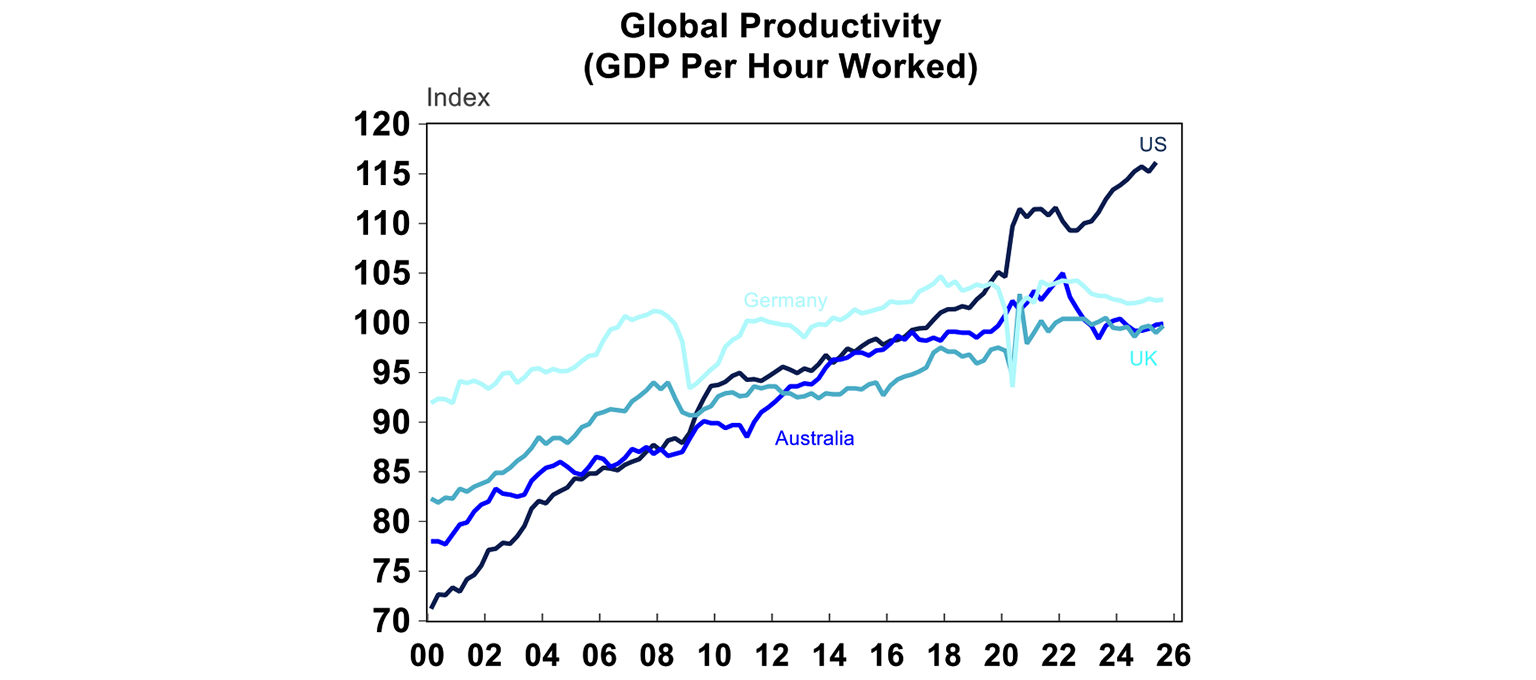

8. A turnaround in productivity growth

Australia’s productivity growth has been lacklustre in recent years but really appeared to become a bigger problem in 2025, with the Treasurer even calling for an Economic Reform Round Table to address the issue. Productivity growth (as measured by GDP per hour worked) rose by just 0.7% over the year to September and has basically flat-lined in the last 10 years. Mining and construction productivity have been particularly poor. Non-market services productivity has also been low, but this partly reflects measurement issues of productivity in these sectors. The government focus on productivity is a positive sign for long-term productivity, and the AI revolution should also provide a boost.

9. Stronger business investment

Private business investment growth in Australia over 2025 was focussed inthe tech sector, with a lot of growth related to data centre investment.Stronger business investment is a good signal for future productivitygrowth. But, it would be good to see spending broadening out outside oftech. Most service sector capex growth is still low.

10. Earnings broadening out (outside of tech)

Tech earnings growth slowed in 2025, but still outperformed the broader index outside of tech. US sharemarkets returned % in 2025, with tech earnings returning xx%. The “bubble” concerns in the tech sector remained high in 2025 due to very high valuations, concentrated exposure and high interconnectedness between other tech companies. In our view, there is still more upside for tech earnings as AI adoption is still in its early stages. The same pace of growth for US tech stocks is unsustainable, but this does not mean that prices have to “pop”. The bubble could just deflate a bit!

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.