Learn more about Lifetime Boost

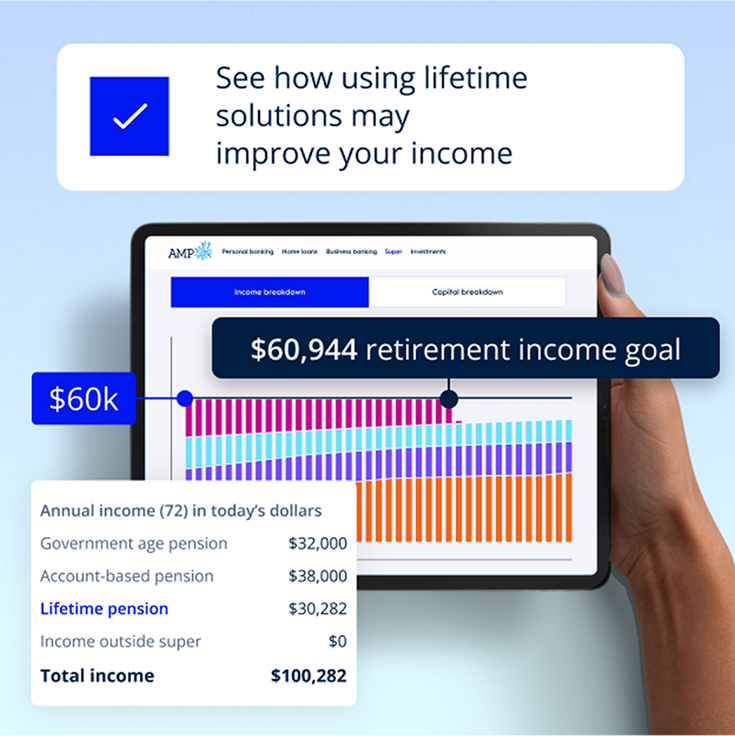

Get expert insights, tips and updates on Lifetime Boost - including how it works and how the average Aussie could be as much as $100,000 better off in their first 10 years of retirement - delivered straight to your inbox.

-

Retirement needs calculator

Use our Retirement Needs Calculator to estimate how much money you may require in retirement, taking into account your ongoing expenses and any potential one-off costs.

-

Advice and education

AMP Super members can access advice and education to help them get super close to their super.

-

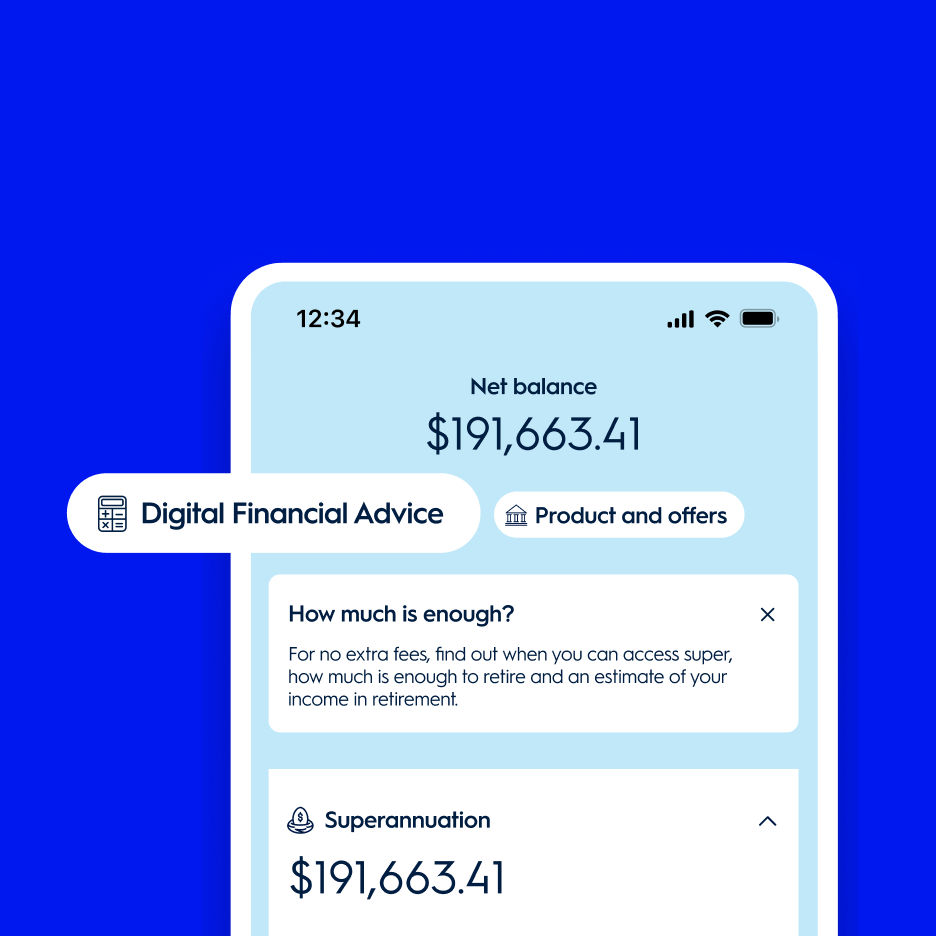

Manage your super with My AMP

Staying on top of your super is easy thanks to our online portal and app - My AMP. My AMP allows you to view and manage your super, investments and insurance in one place in real time.

Important information

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination from AMP at amp.com.au or by calling 131 267.

The AMP Lifetime Pension is not currently available for clients but is expected to be available by mid-2026. The issuer of AMP Lifetime Pension is NM Super.

The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on https://www.amp.com.au/resources#pds.

Please review the PDS before deciding to acquire or hold the product.

Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd (AWM Services) ABN 15 139 353 496 AFSL 366121, which is part of the AMP group (AMP). All information on this website is subject to change without notice.

Digital Financial Advice is provided by AWM Services to eligible members of the AMP Super Fund.