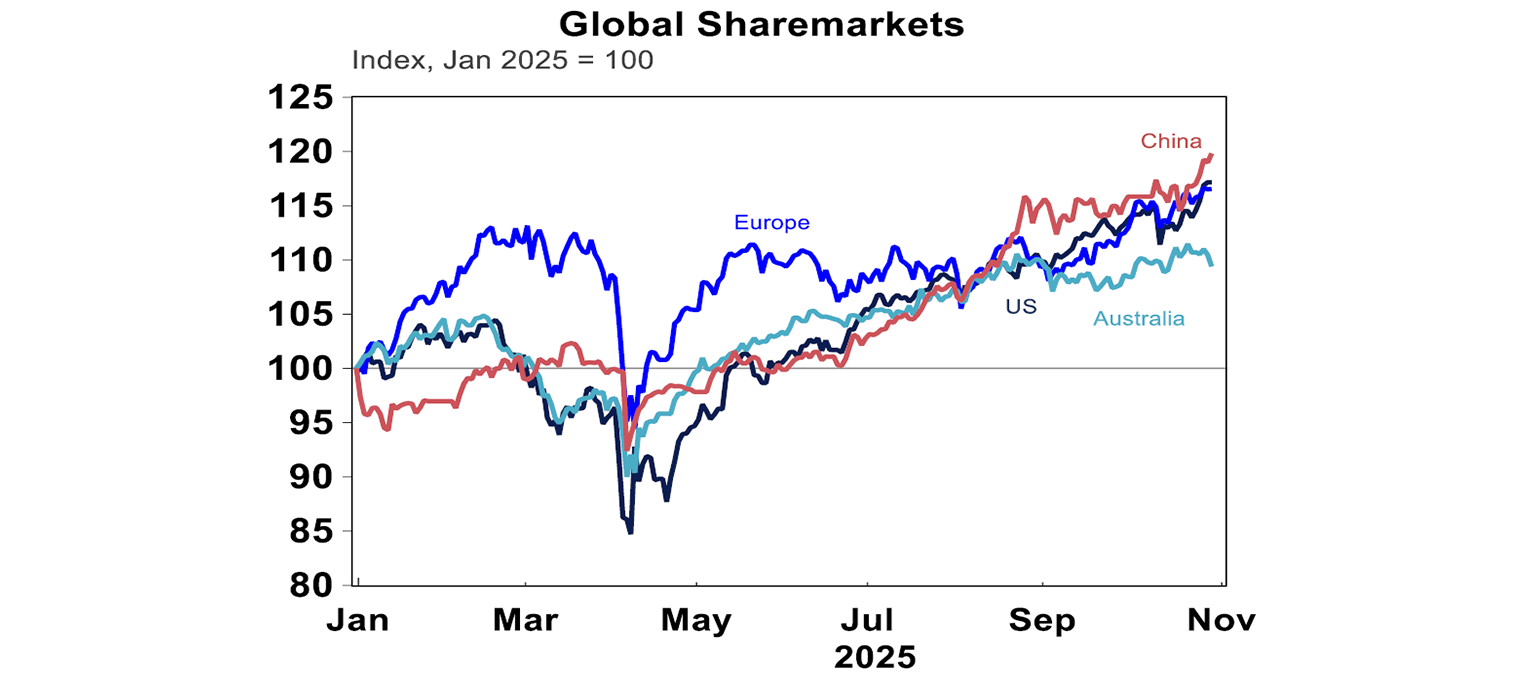

US shares rose over the week, despite a fall later into the week. The meeting between Trump and Xi went well (although markets were probably expecting something better), there were positive US earnings numbers despite some disappointment in tech and the Fed cuts rates again, although future rate cuts look less clear. This is occurring whilst the US data flow is light due to the government shutdown. Australian shares are down over the week after high September quarter inflation data signalled no chance of a rate cut at next week’s RBA meeting and raised doubt about future cuts. There were large falls in healthcare, tech, consumer discretionary and real estate. Energy and consumer staples were up. European equities are down slightly over the week and Chinese shares are flat but this is after reaching a record high early in the week and outperforming year to date (see the chart below).

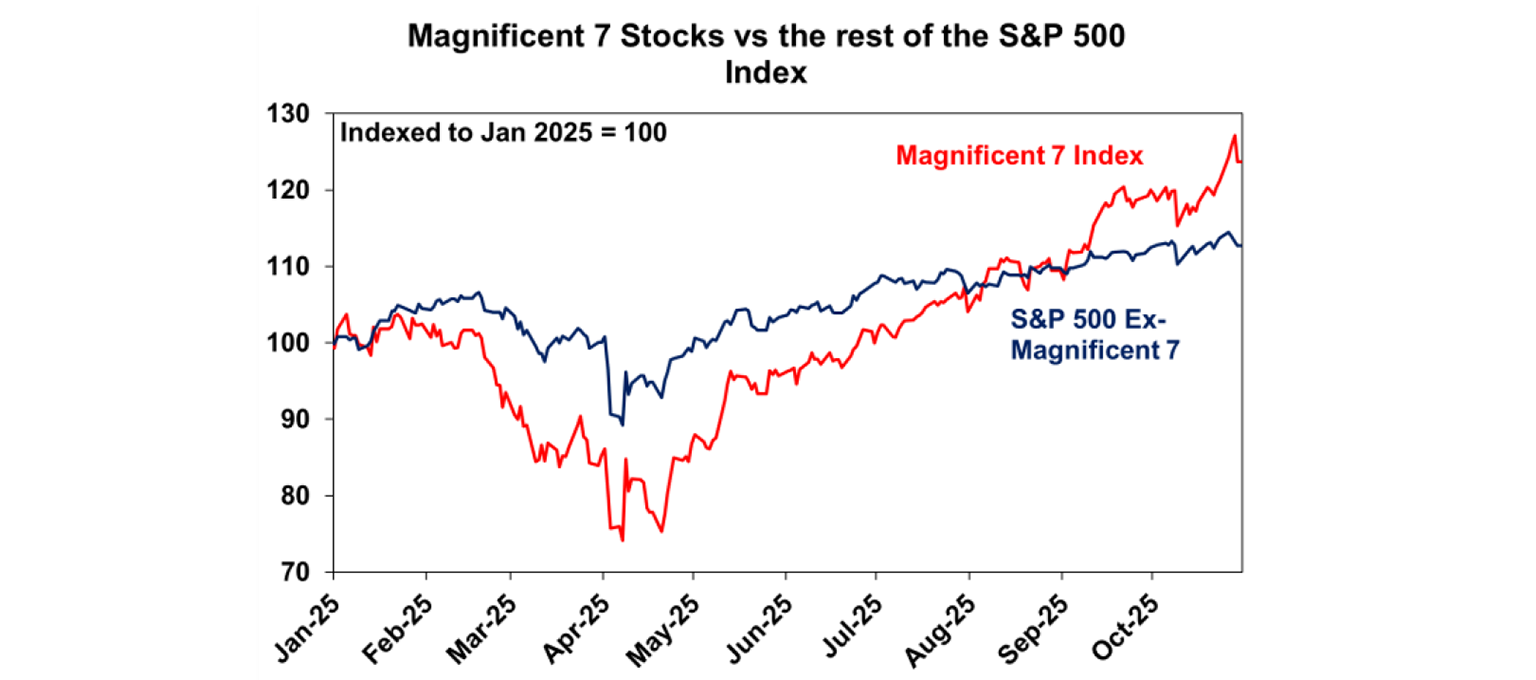

Despite some wobbles recently, Mag 7 US tech stocks have still outperformed the S&P500 since the beginning of the year.

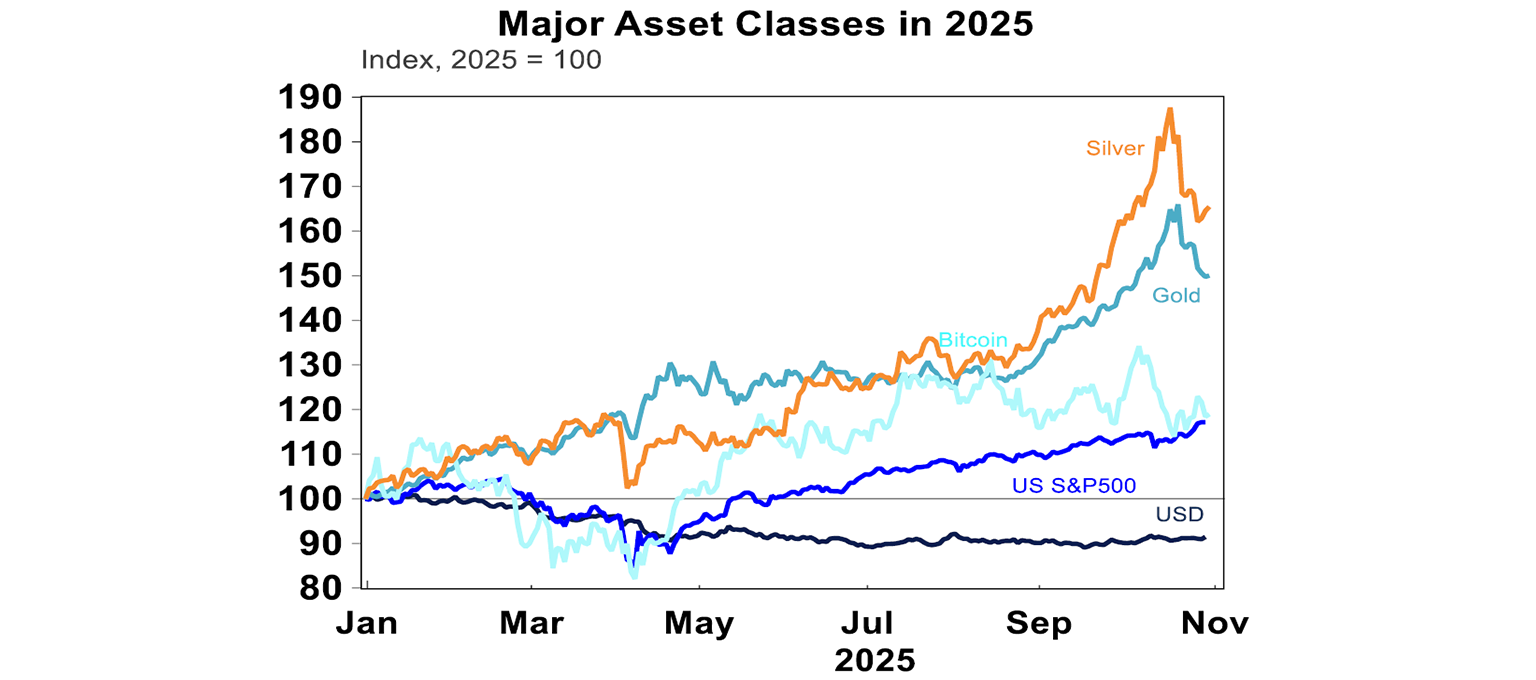

Aluminium, copper (at a record high) and iron ore prices rose this week. Gold prices moderated further and prices are down by 8% since the peak. Longer-term we think gold prices will continue to trend up. The $US improved over the week and is around a 3-month high, although longer-term we are still negative on the $US. The $A remains stuck around 0.65USD.

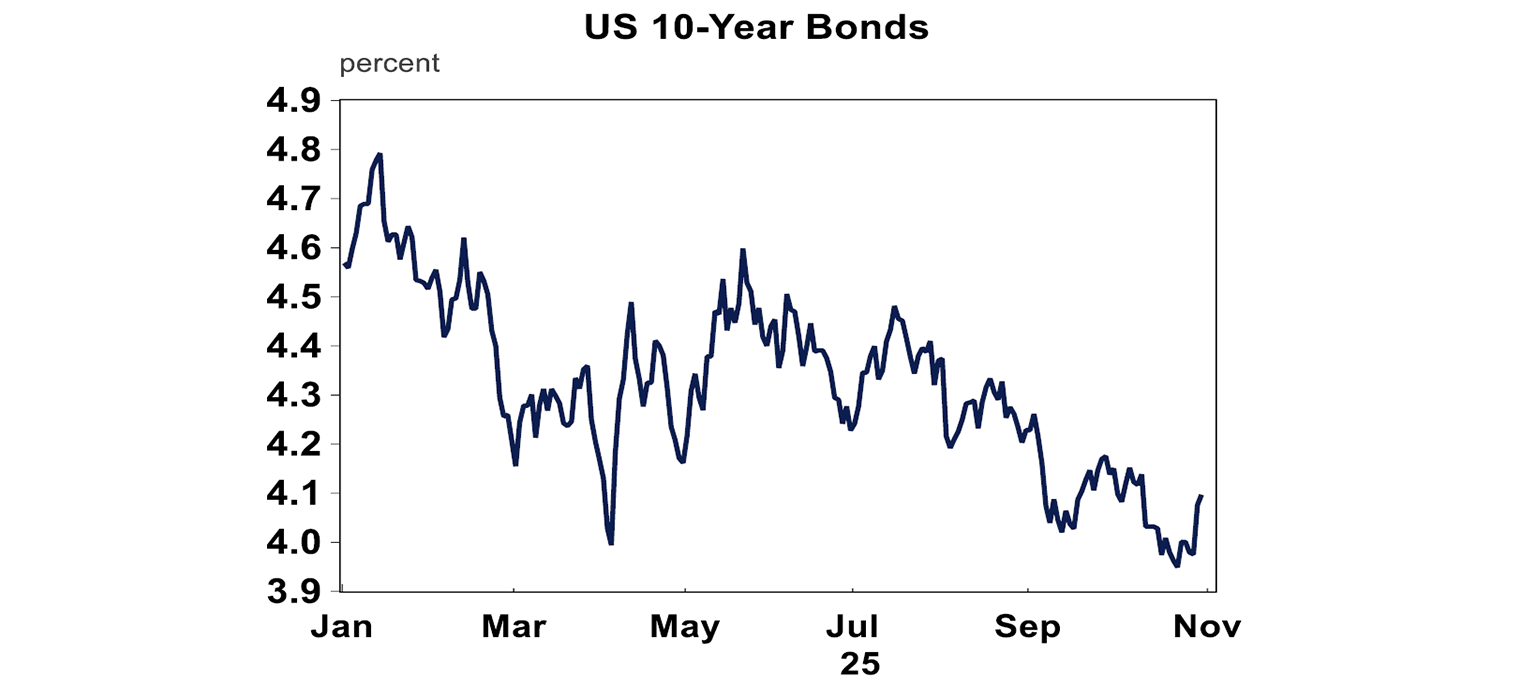

US 10-year yields rose this to just under 4.1% after the hawkish Fed cut, after declining through most of October. There may still be some further downside to yields in the near-term because of concern about US GDP growth, the end of quantitative tightening and investors using bonds a hedge against geopolitical and trade issues.

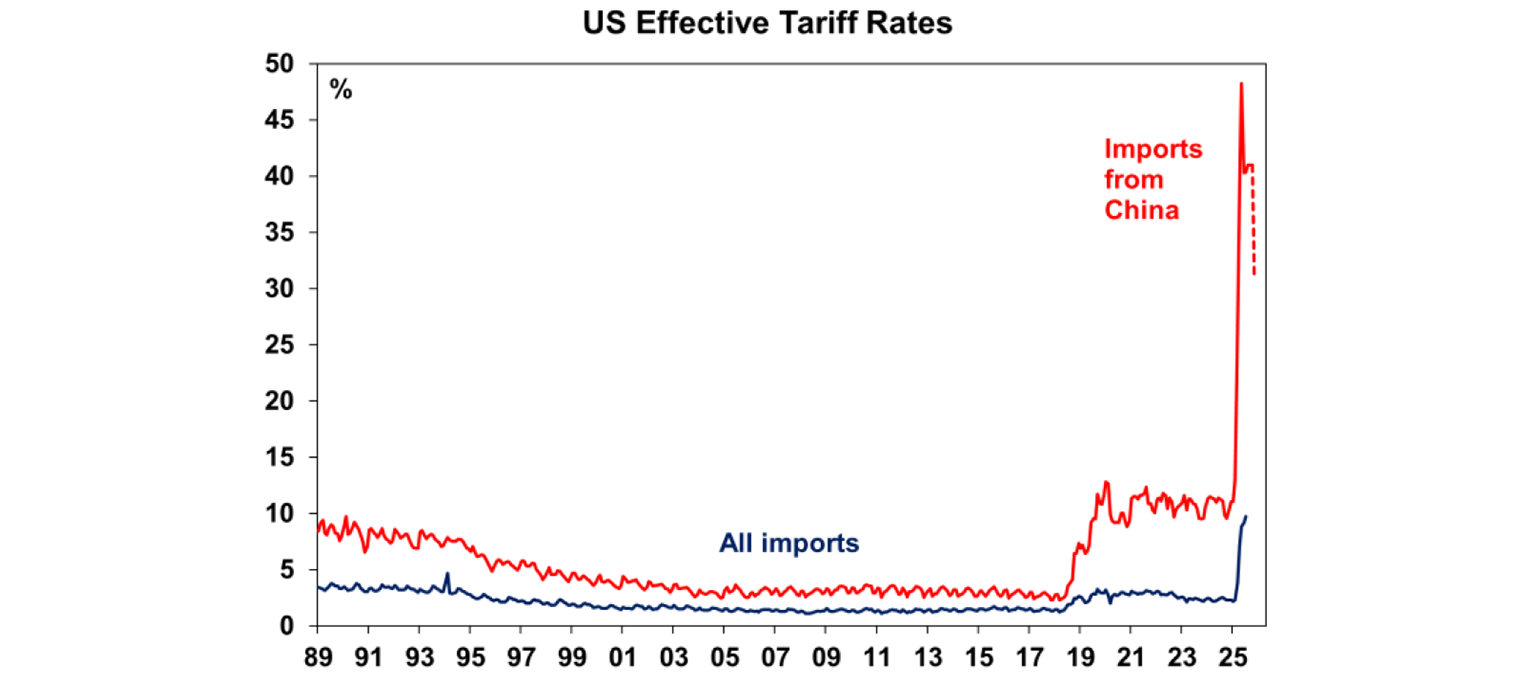

The meeting between Trump and Xi was highly anticipated. The two met at the sidelines of the ASEAN Summit meeting. According to Trump, the “amazing” meeting resulted in the US halving the fentanyl-related tariffs of 20% to 10% (taking the overall US tariff rate on China from ~40% to ~30%), China would also resume soybean purchases, pause its rare-earths licensing regime for at least a year, the US would suspend the rule that blacklisted Chinese firms and there was an agreement to sell the US operations of TikTok. The average US tariff rate with this agreement would decrease from 21.5% to 20% but in reality, the effective tariff rate has been more like 12%, because of the substitution impact – imports from China go down but imports from other countries go up.

But this is a short-term solution that doesn’t change the longer-term strategic picture. In the short-term, China can still export its goods to the US and the US can import critical and rare earths needed for its tech space but longer-term the same issues are going to come up, and both sides know that because both get what they want in the short-term, but give time for both to time to build up parts of their economy before coming to the negotiating table again next year.

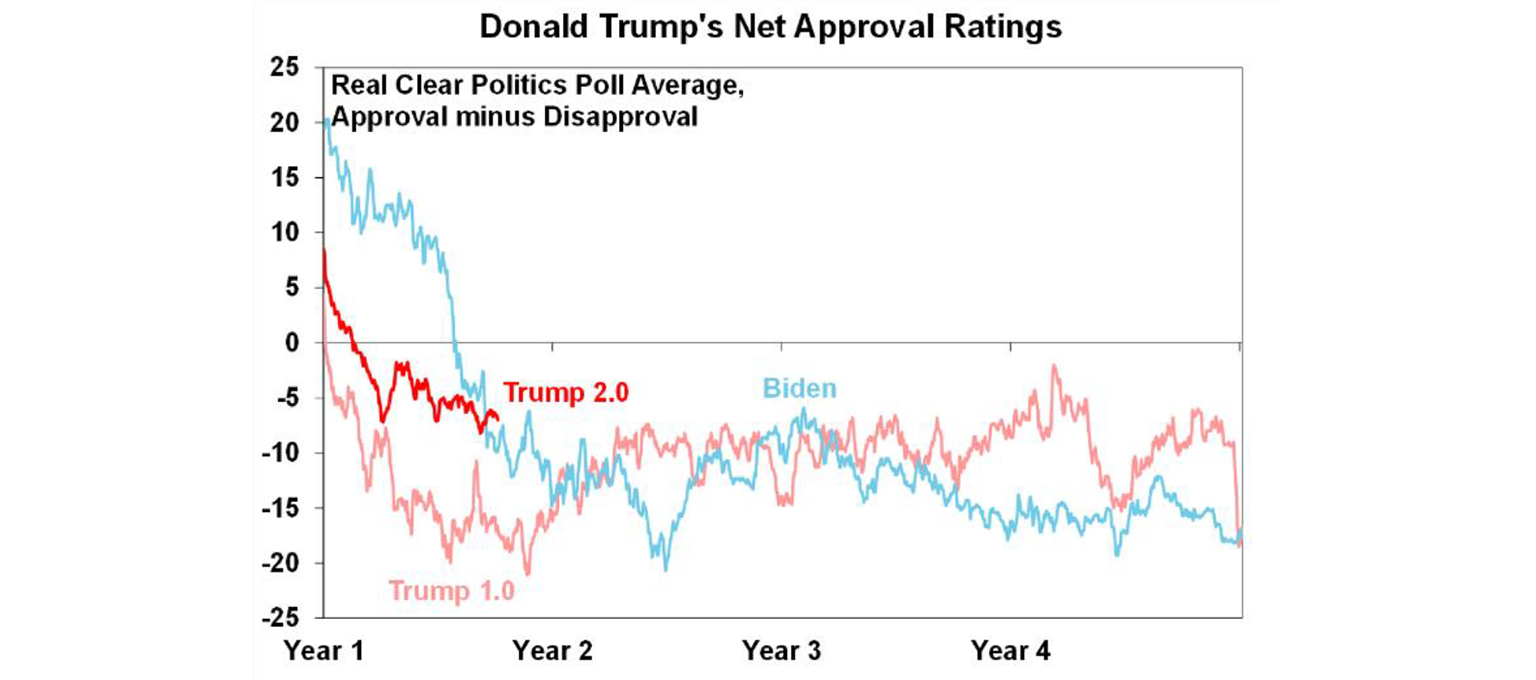

The US government shutdown is ongoing in its 4th week, costing US GDP growth only around 0.1%, which will probably be recouped next quarter. But, it’s likely to get tougher now as more funding is set to expire like including food aid, future military paydays, Affordable Care Act health care premium increases, exhaustion of funds for Women Infants Children program as well as delays in airport from understaffing. So, the impacts to the economy may become more apparent, which means that the catalysts for the end of the shutdown are building. Although, the shutdown hasn’t hurt Trump’s approval rating which is above Trump 1.0 and similar to Biden’s at the start of his term.

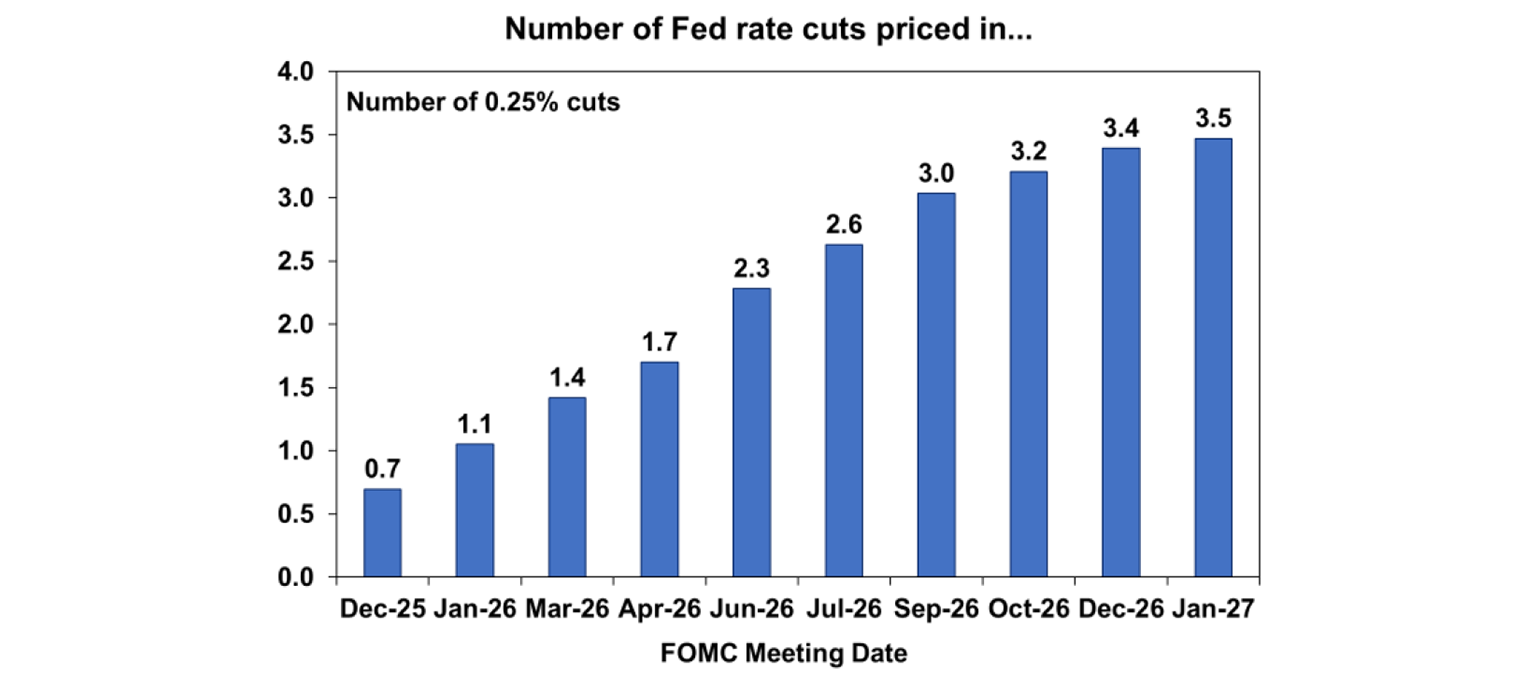

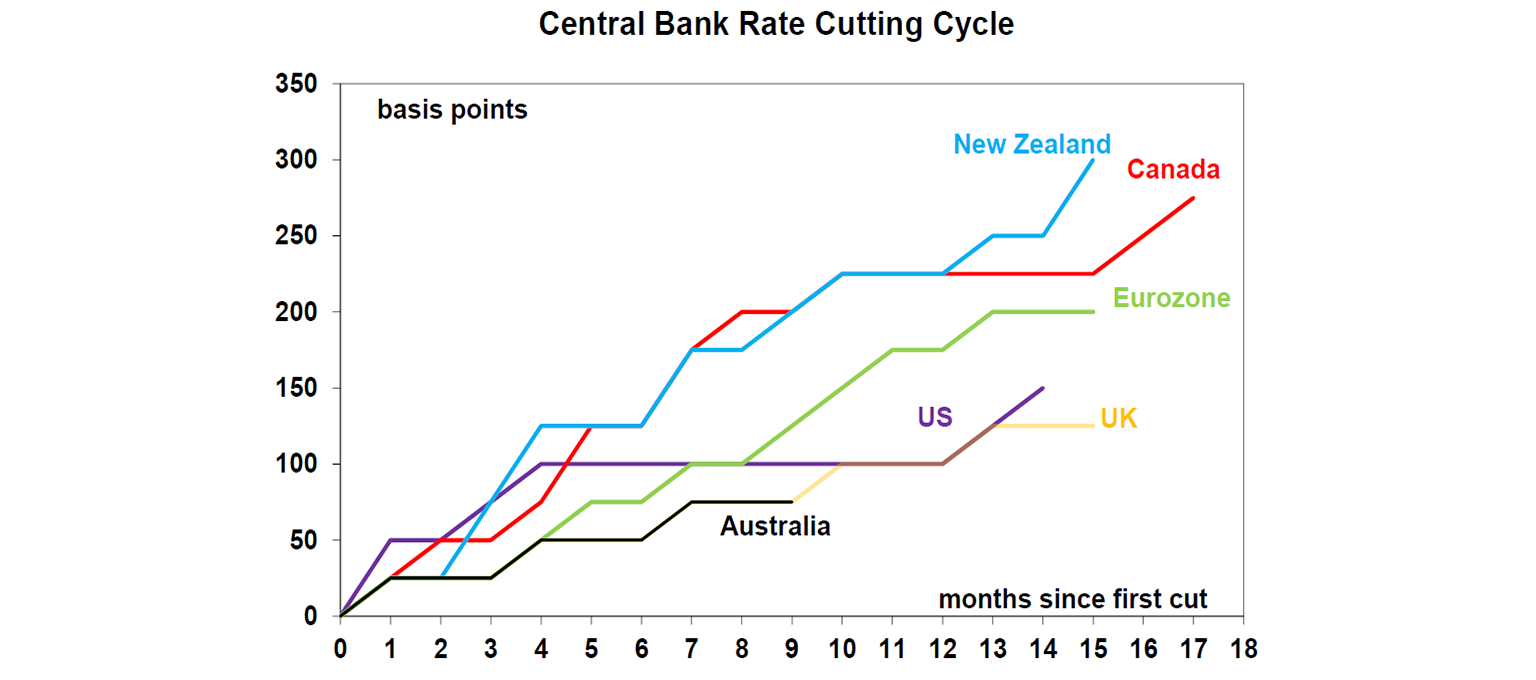

As anticipated by markets and economists, the US Federal Reserve cut interest rates by another 25 basis points for the second month in a row, taking the Fed Funds rate to 3.75%-4%. The Fed has cut by a total of 150 basis points since September 2024. As expected, some Board members wanted a larger rate cut (Trump’s appointee Miran voted for 50 basis points) while another member (Schmid) voted for no change. The lack of the usual monthly data due to the shutdown would have created some issue for the Fed, although the shutdown issue wasn’t raised. The Fed’s commentary indicated that they still view the labour market as having slowed this year, inflation has moved up and economic growth was expanding at a moderate pace. This indicates a more cautious approach to cutting rates from here. Powell made it clear that a Dec rate cut was “not a foregone conclusion”, correcting market pricing which had been expecting a December rate cut. The Fed also announced that quantitative tightening (QT) will end 1 December. The end of QT means that the Fed will stop reducing its balance sheet. This will involve reinvesting maturing Treasury bonds into Treasury bills, rather than letting maturing assets roll off. This should help to ease financial conditions. Markets are pricing in another rate cut by early 2026, but were looking for one in December prior to this meeting.

If the data flow resumes in the US, we expect softer labour market prints which should see the Fed cuts rates again in December before a pause for a few months to assess the impact of recent rate cuts. But, a chorus of central bank officials came out this week after the Fed meeting to say that they did not support the decision to cut interest rates. So, the December meeting is going to be close.

Major global economic events and implications

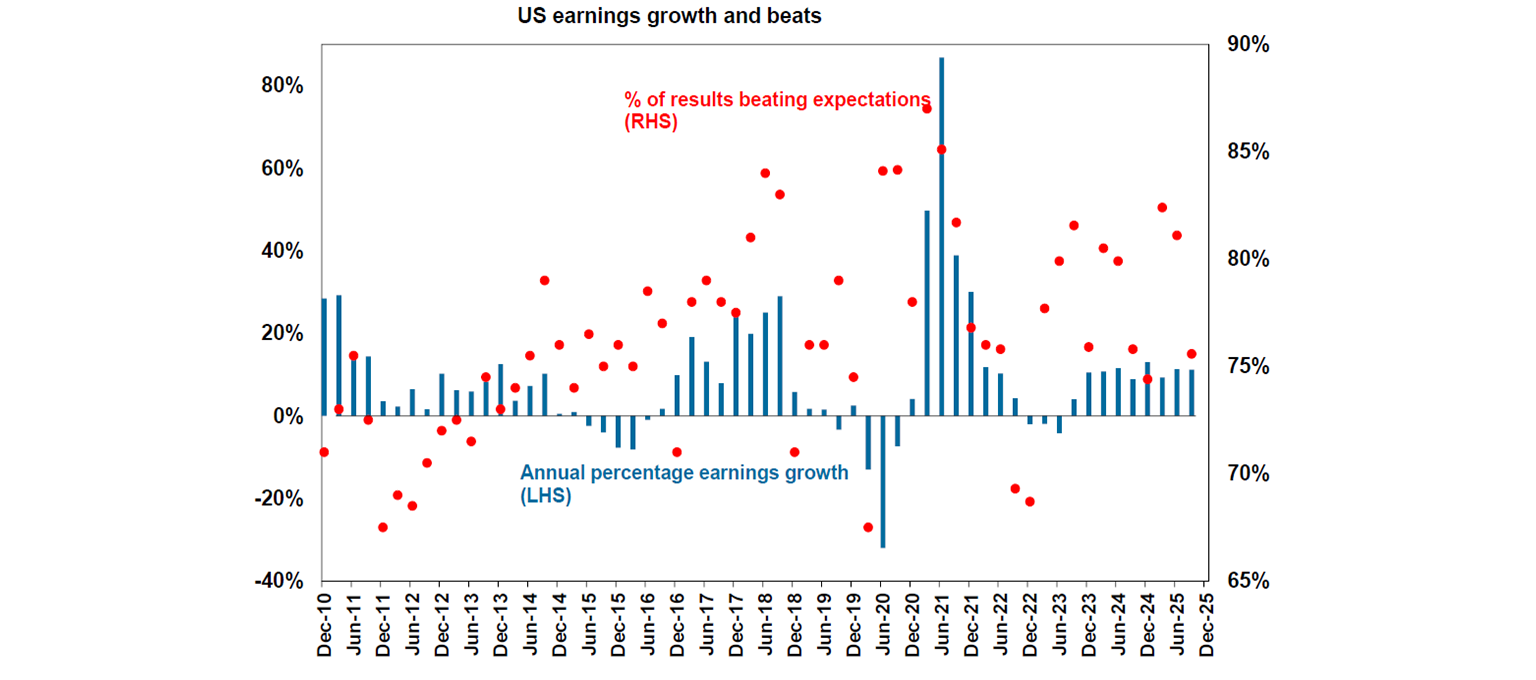

September quarter US tech earnings were mixed. 61% of companies have reported results and earnings growth has been running at 11% and 76% of results beat expectations. Tech results have been mixed this quarter. Alphabet’s earnings beat estimates thanks to its cloud unit performance, boosting shares while Meta reported significant increases to expenses in 2026 from data centre and AI spending which weighed on the stock and led to concern in the broader sector. Profit growth in tech companies remains incredibly strong but will moderate, so tech stocks are likely to have a bit of a pullback especially on high valuations. Apple and Amazon reports (after markets closed) were positive.

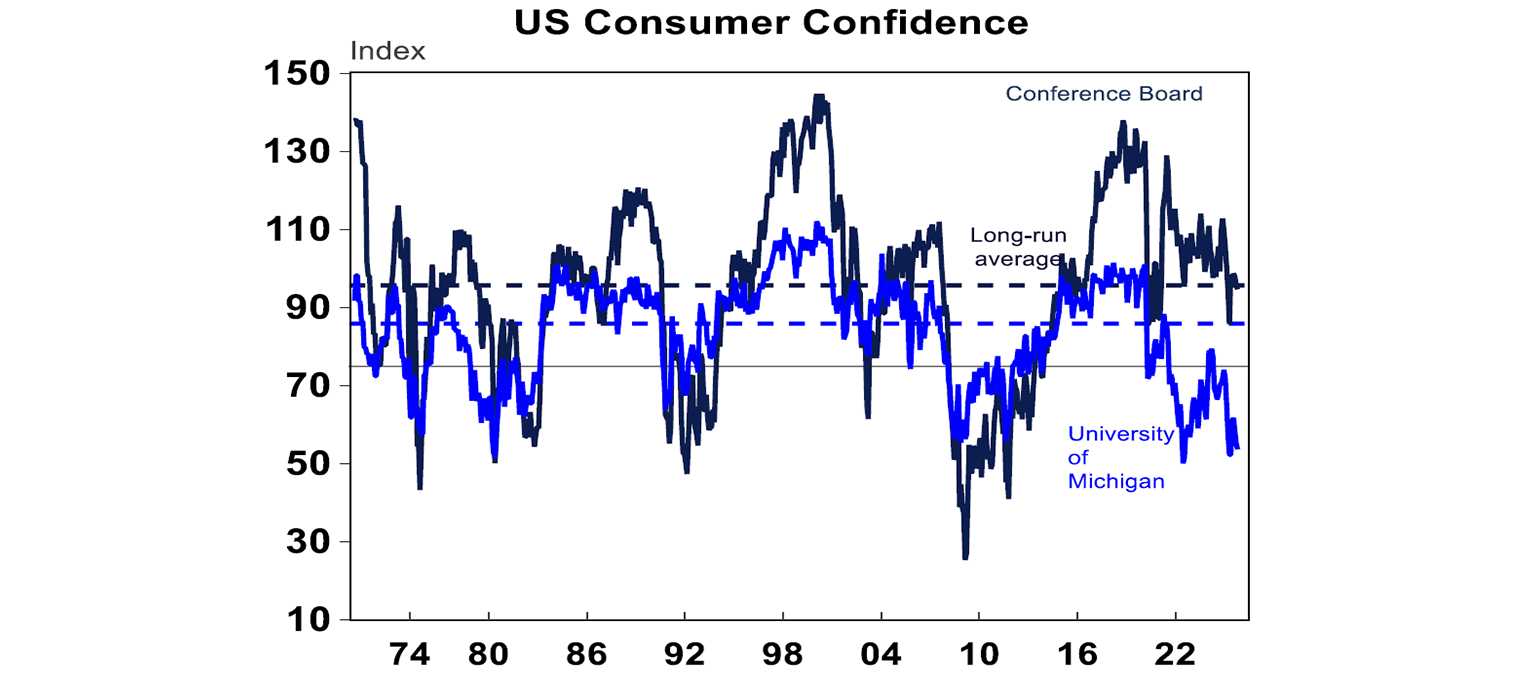

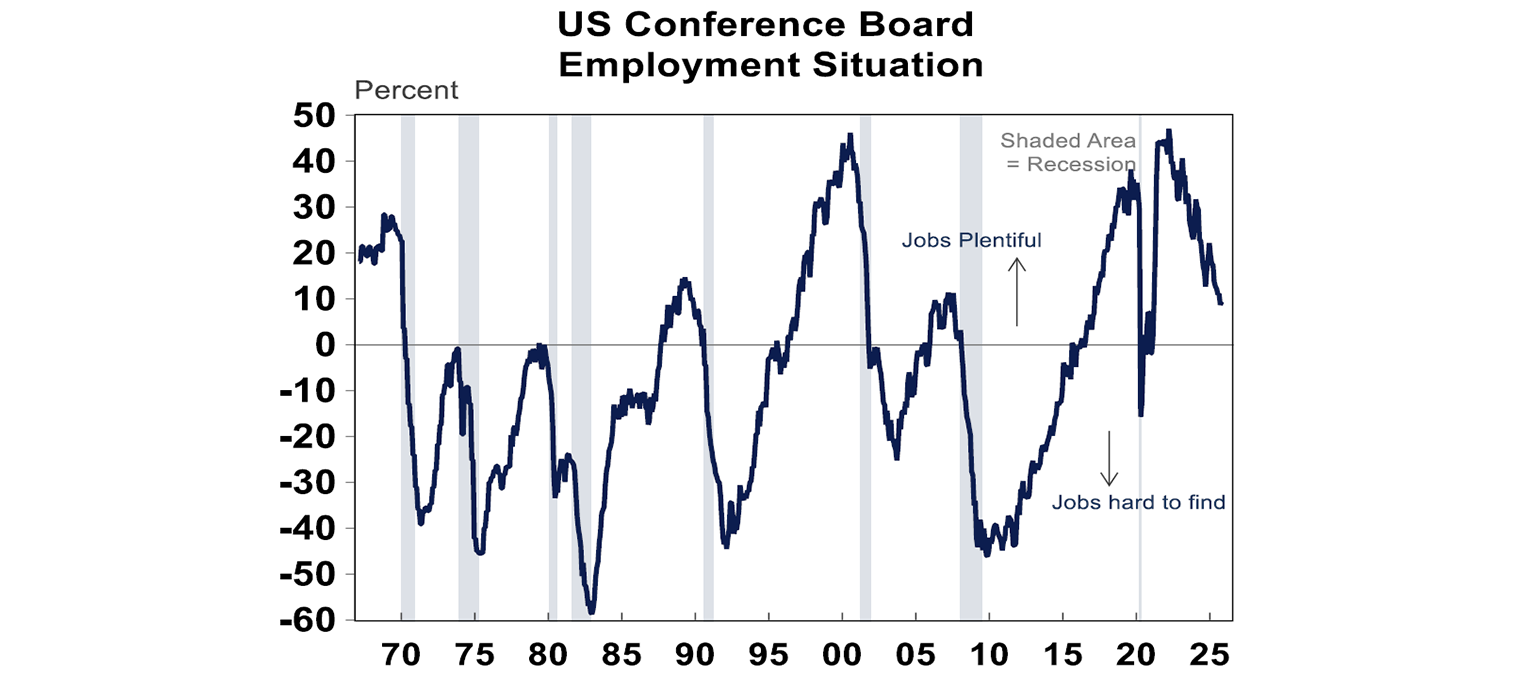

US Conference Board consumer confidence fell a little in October, as expected. Future economic conditions declined, with respondents citing the government shutdown as a concern.

There is a component of the survey that asks consumers about the job situation. Consumers are still reporting that jobs are plentiful (vs hard to get), but not as high as it has been in the past year, suggesting some further slowing in the labour market.

The Bank of Canada cut interest rates again by 25 basis points to 2.25%, taking total interest rate cuts to 275 basis points, the most out of any central bank (see the chart below). The risks for the Canadian economy are still to the downside. Growth momentum still appears to be fading and there are cyclical disruptions from trade to the economy. Another rate cut is possible, but the Bank of Canada is not in a rush yet given that policy is now accommodative.

Meanwhile the Bank of Japan kept rates unchanged at its October meeting. Governor Ueda said more data on the economy and global conditions is needed before delivering another hike, but kept the possibility of a December increase open, although the outcome still put downward pressure on the Yen.

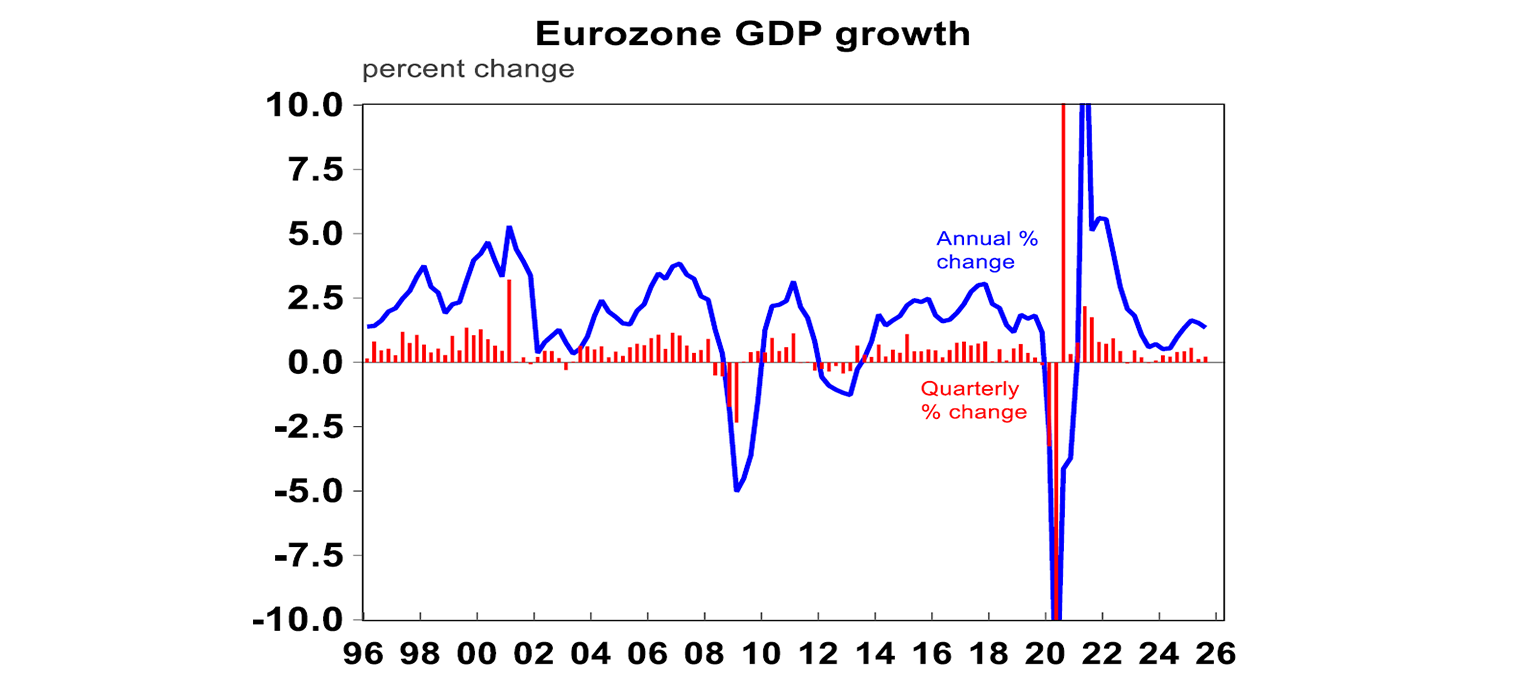

The European Central Bank kept interest rates on hold for the third consecutive meeting and appears comfortable keeping interest rates at 2%. The September quarter GDP rose by 0.2% and 1.3% year on year. Whilst there was strength in countries like Sweden, Portugal and France, weakness in Germany, Ireland and Finland offset these increases.

Meanwhile the Bank of Japan kept rates unchanged at its October meeting. Governor Ueda said more data on the economy and global conditions is needed before delivering another hike, but kept the possibility of a December increase open, although the outcome still put downward pressure on the Yen.

The European Central Bank kept interest rates on hold for the third consecutive meeting and appears comfortable keeping interest rates at 2%. The September quarter GDP rose by 0.2% and 1.3% year on year. Whilst there was strength in countries like Sweden, Portugal and France, weakness in Germany, Ireland and Finland offset these increases.

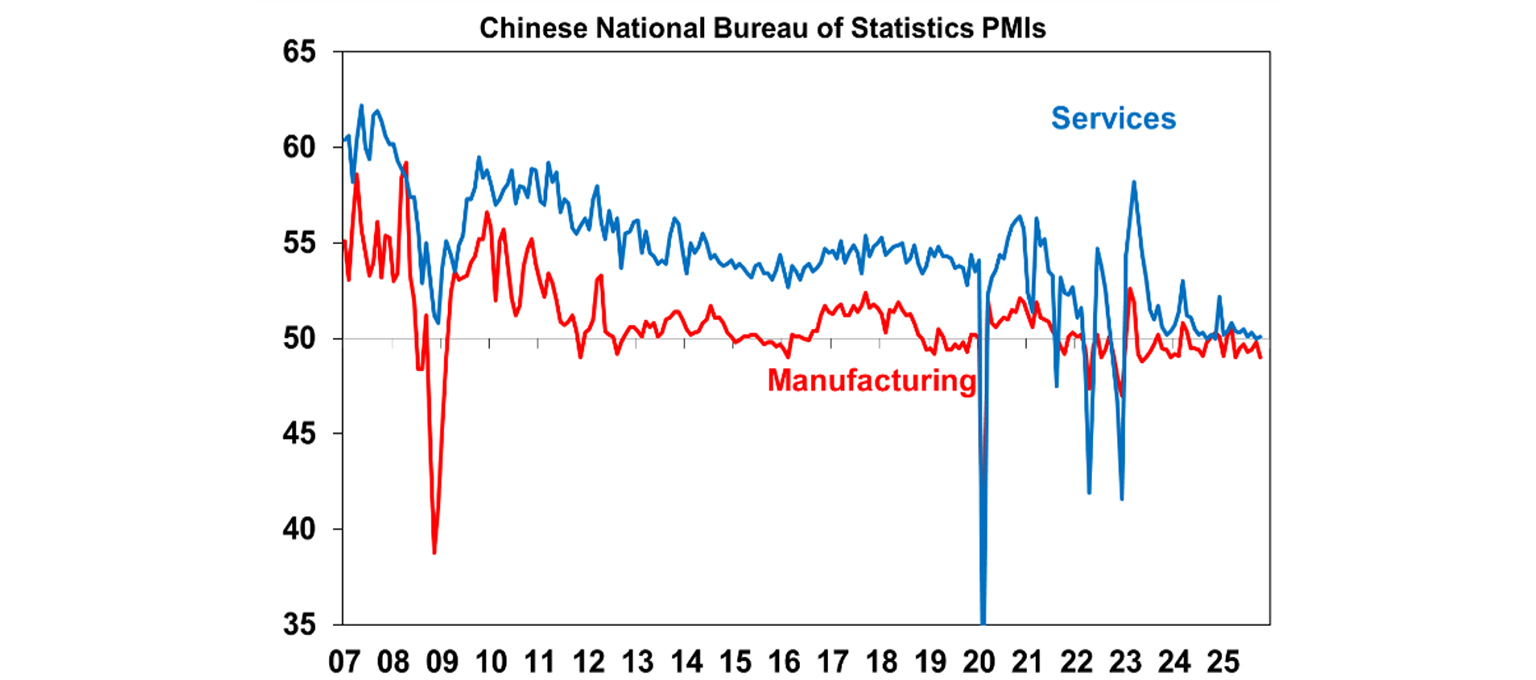

The Chinese official PMI figures showed a deterioration in the manufacturing PMI (down to 49.0 from 49.8) and the services PMI improved marginally to 50.1 (from 50.0).

Australian economic events and implications

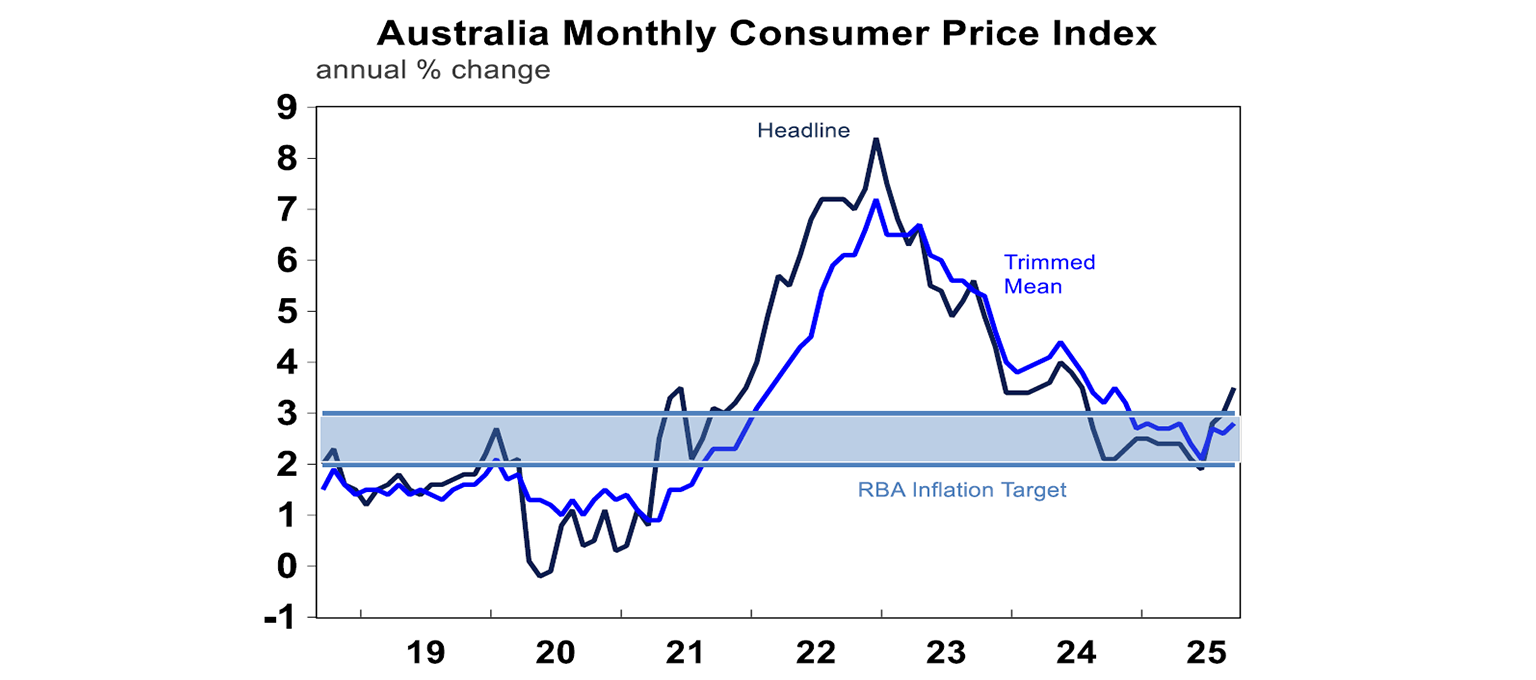

Happy Halloween indeed with the horror September quarter Australian inflation data this week. The headline rate of inflation rose by 1.3% in the quarter (the largest quarterly increase since March 2023 and higher than our forecast of 1%) and annual growth rose to 3.2% (from 2.1% last quarter). Annual headline inflation is running at its highest level since June last year. The increase in headline inflation looks so large, because the end of government electricity rebates has resulted in a normalisation in household utility bills, which appears as a big rise in prices.

The headline rate of inflation rose by 1.3% in the quarter (the largest quarterly increase since March 2023 and higher than our forecast of 1%) and annual growth rose to 3.2% (from 2.1% last quarter). Annual headline inflation is running at its highest level since June last year. The increase in headline inflation looks so large, because the end of government electricity rebates has resulted in a normalisation in household utility bills, which appears as a big rise in prices.

Most of the components of inflation appeared a little higher than we expected, so it was a cumulative impact. For headline inflation, the top contributors (which accounts for price change and the weight of the item) to the quarterly inflation was electricity (price growth of 9% over the quarter), domestic holiday travel (+3.2% due to higher demand during school holidays – could we please come up with a national agreement to make school holiday at different times??), property rates and charges (+6.3%), new dwelling construction costs (+1.1% due to home builders reducing promotional offers), international holiday travel (+2.7% due to higher demand for European travel), rents (+1%), gas (+6.7%), petrol (+2%) and tobacco (+2.9% due to the excise increase). Prices fell for toys and hobbies (-3.3%), vegetables (-1.7%), spare parts and accessories for motor vehicles (-1.3%), and garments (-0.7% from discounting).

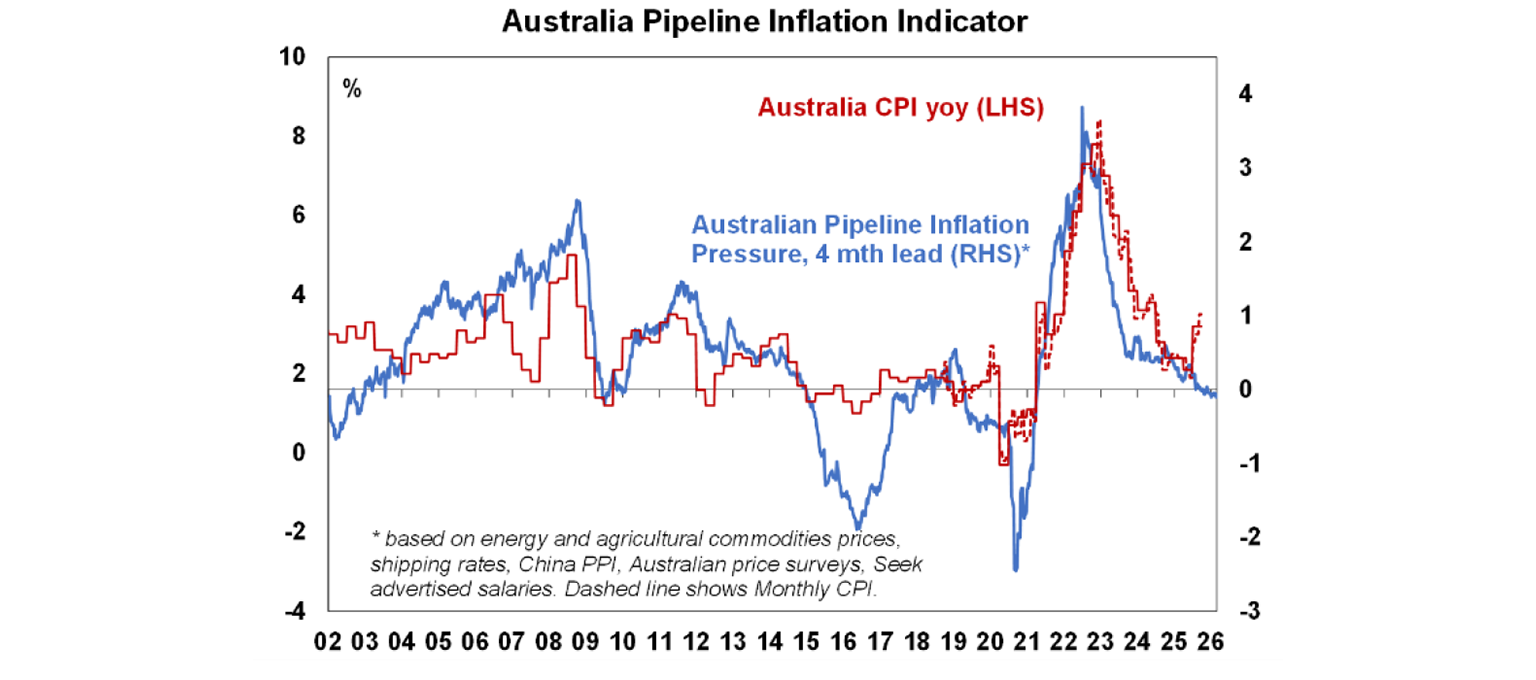

Our pipeline inflation indicator which accounts for domestic and global factors is also still indicating a trend down – see the chart below.

So, in our view, inflation can still track back down into the RBA’s target band (rather than running above it), but it will take longer to get there than we had expected.

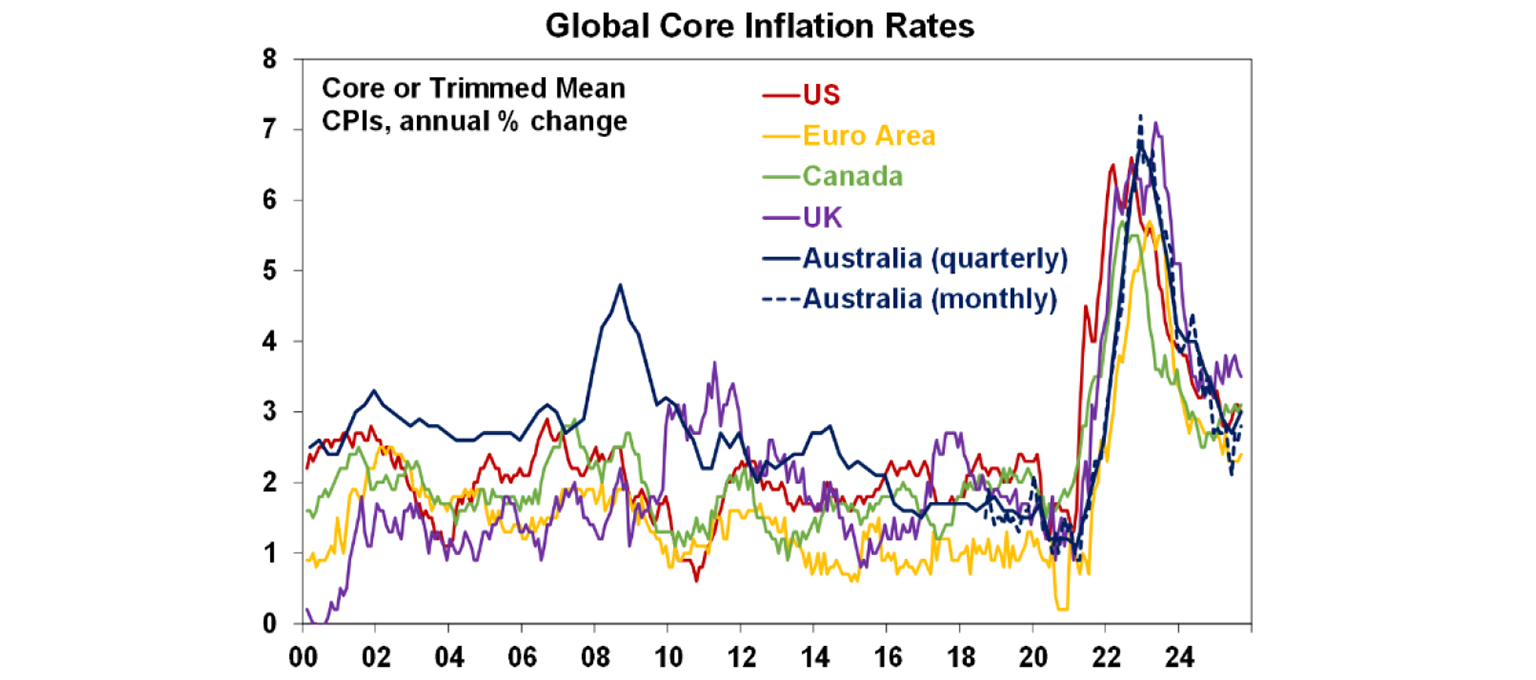

If we compare the Australian situation to our global peers, Australian inflation is not out of whack with comparable countries (see the chart below). Most of our counterparts have experienced sticky services inflation and inflation running above where central banks would like it to be.

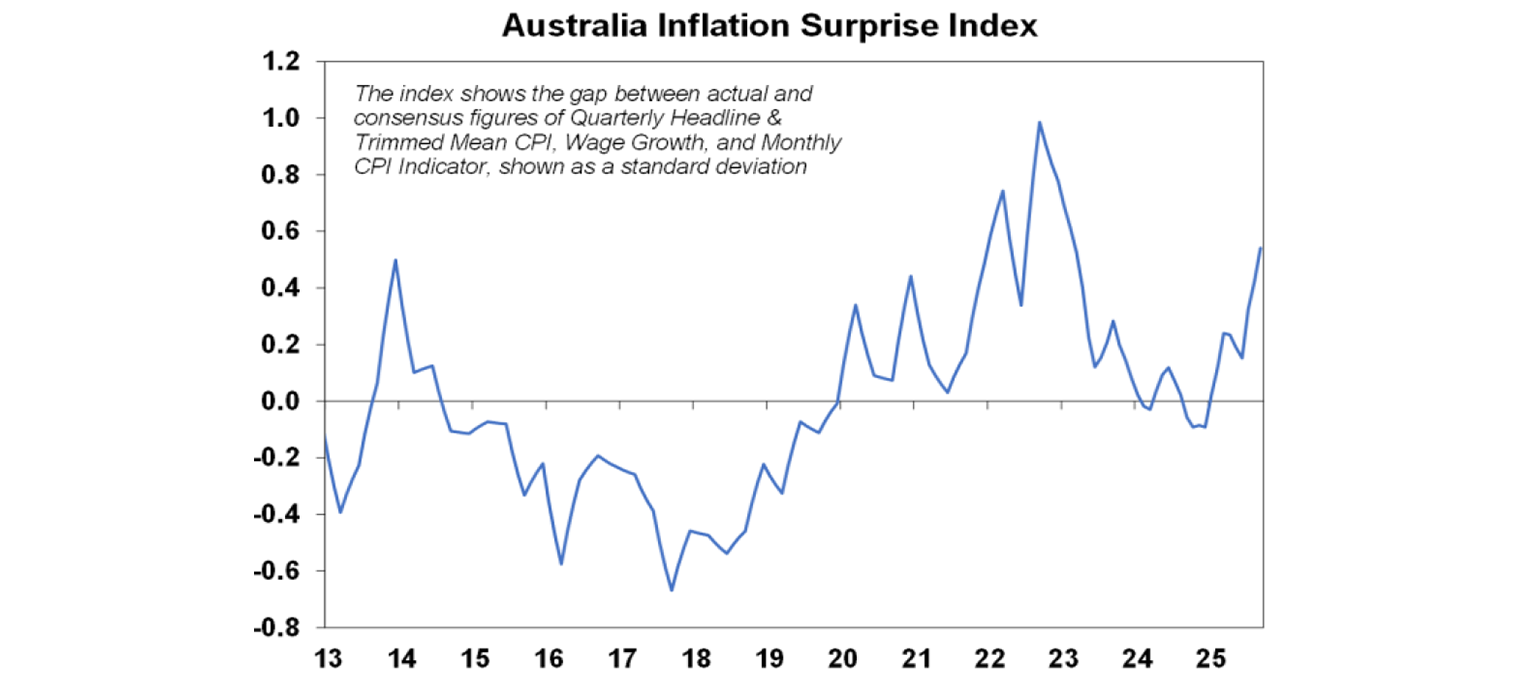

The Australian inflation surprise index has been turning up lately which means outcomes are above forecasts (see the chart below) but the index usually runs hot and cold so the recent upside surprise in is likely to revert to downside surprises over the next few months.

RBA Governor Michelle Bullock spoke to Head of Economic Analysis Michael Plumb at the annual dinner but before the inflation figures were released. Bullock downplayed the increase in the unemployment rate, indicating that it may just be part of the normal monthly volatility and indicating that we need more time to assess the data. She said that a trimmed mean number above 0.9% would be a “significant miss” (although the increase to the unemployment rate at 4.5% wasn’t seen as that significant) so there is no doubt that the RBA would see the September quarter inflation data as too high.

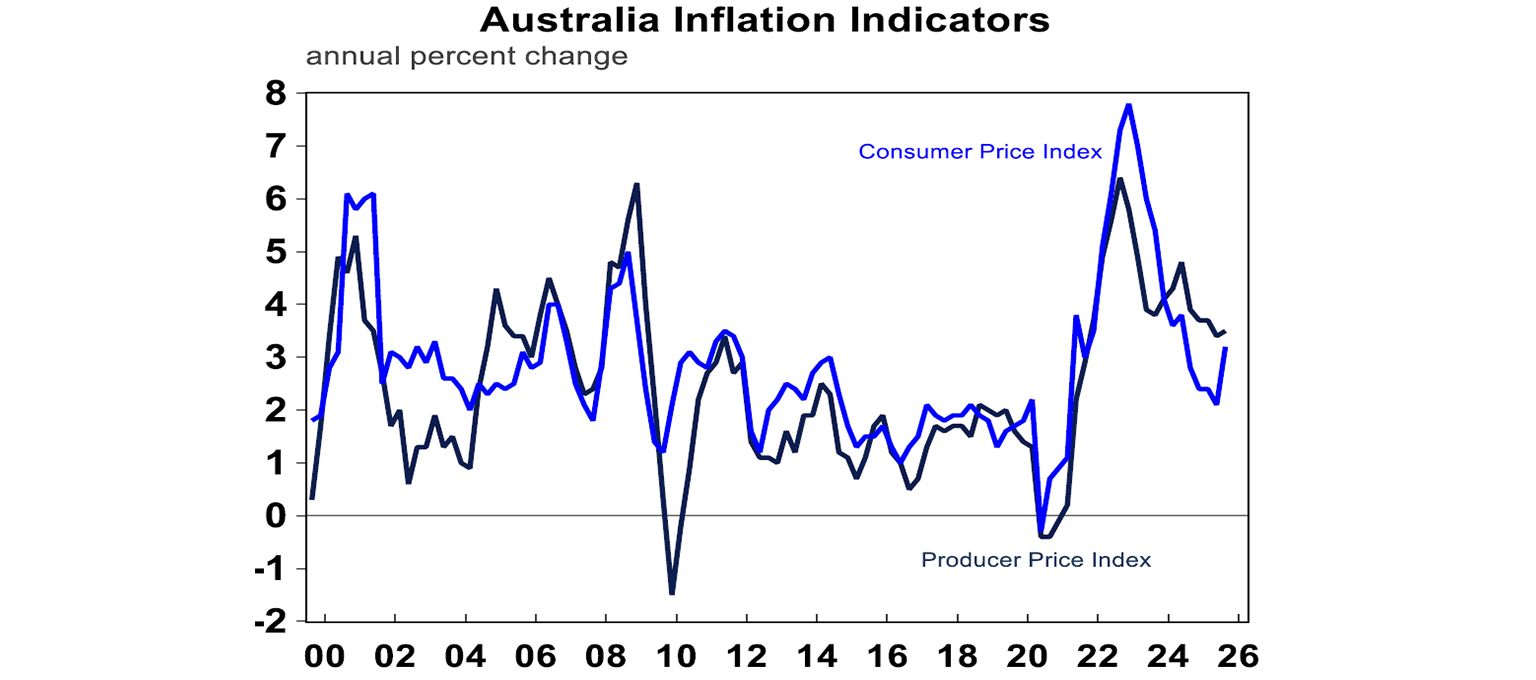

Australian September quarter producer prices rose by 1% over the quarter or 3.5% over the past year, similar to the trend indicated from the CPI figures.

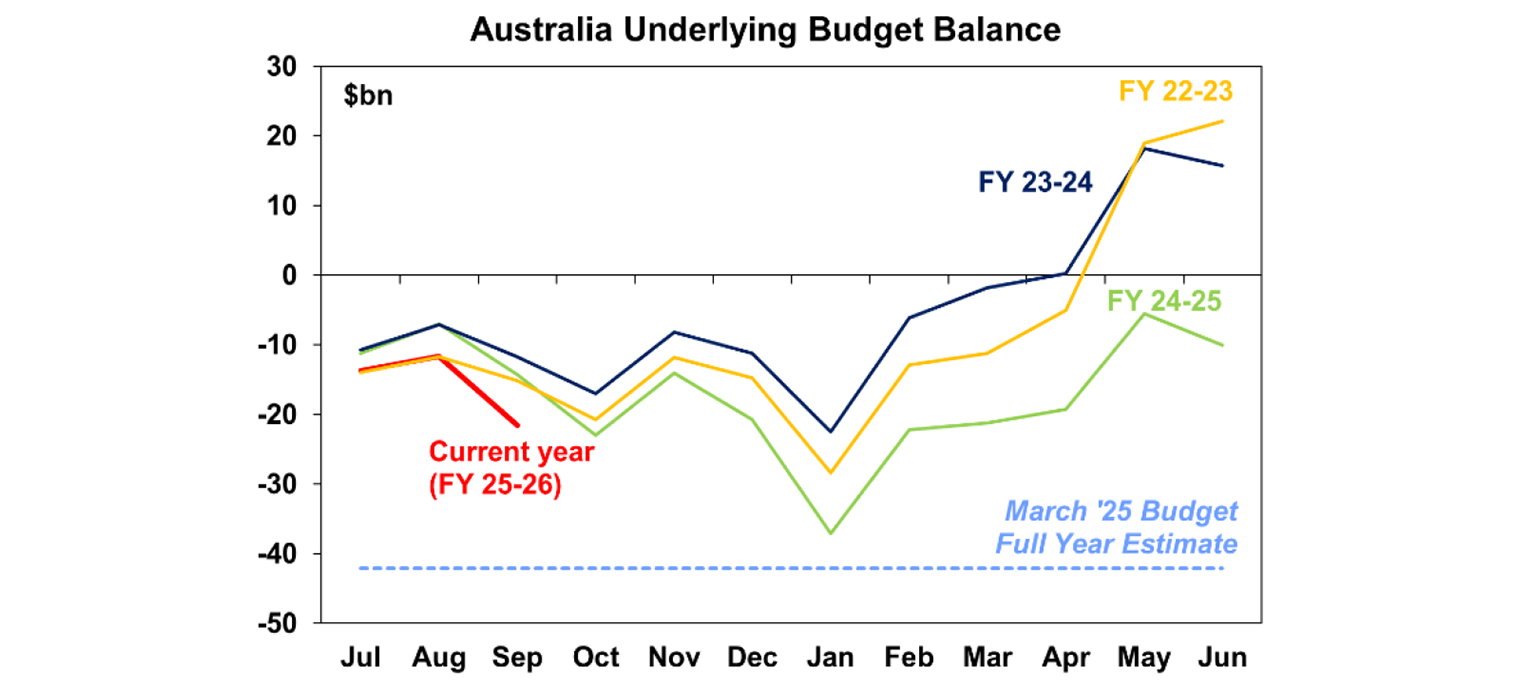

The monthly Australian government finance figures came out showing that the 2025-26 figures are running at $-21.5bn year to date versus the budget estimate of $-26.8bn, so better than expected so far, probably as commodity prices have been elevated supporting government revenue.

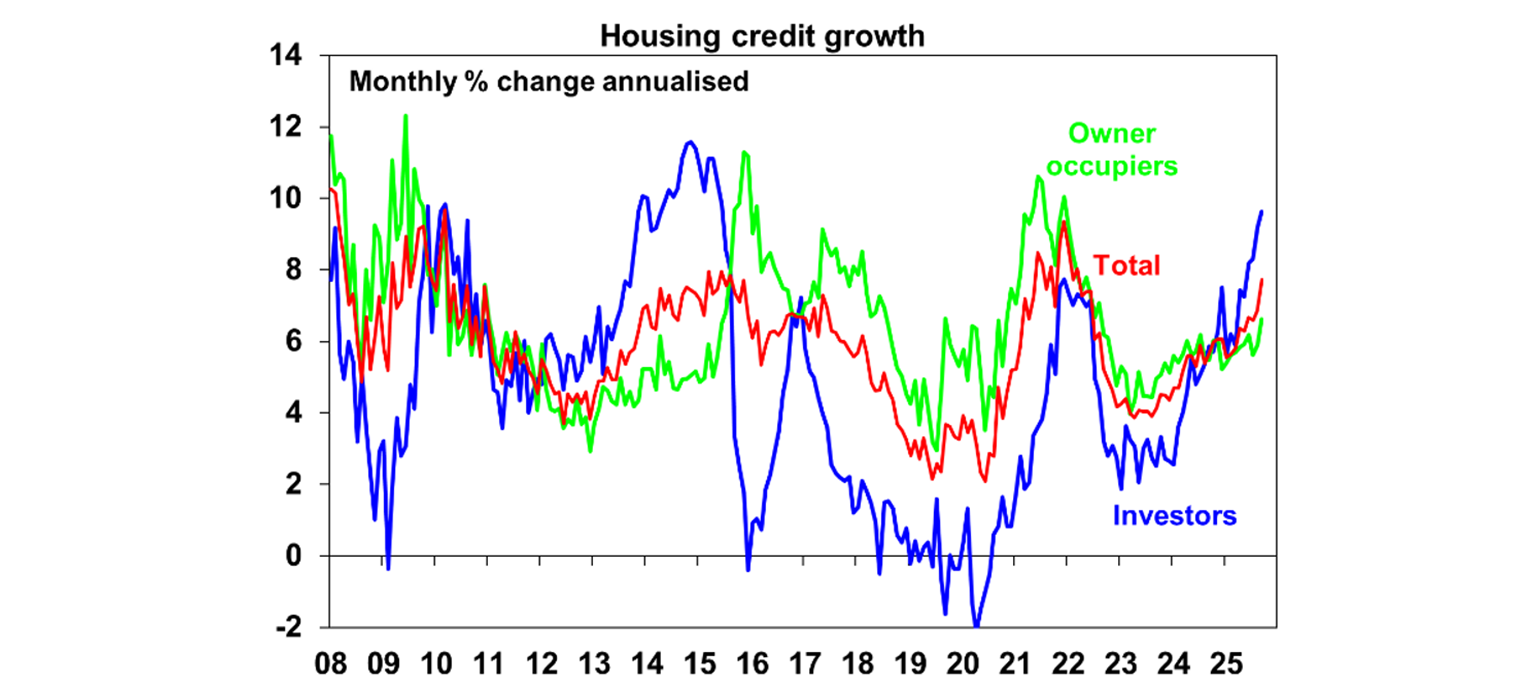

The RBA credit figures showed monthly credit growth of 0.6% over September, with annual growth rising to 7.3%. Housing credit is growing strongest on a monthly basis (especially for investors) whilst business credit is slowing after strong growth.

What to watch over the next week?

US earning season continues, although companies scheduled are not as significant as those reporting this week. While we should be getting job openings and non-farm payrolls next week (for September), it’s unlikely to happen given the shutdown. The manufacturing and services ISM reading (for October) is still expected as it’s a private survey. The PMI data, basically another indicator for the ISM, was solid so a positive outcome is expected. ADP employment for October is a private survey and provides some perspective on jobs outside of the usual payrolls. The University of Michigan consumer sentiment and inflation expectations is a good guide to how consumers are faring with tariffs. There is also a lot of Fed Speak next week.

In Australia, the key event is the RBA meeting on Tuesday on Melbourne Cup Day. Historically this has been a month where a rate move has occurred because it follows the September quarter inflation data. Any hopes for a rate cut were thrown out the window after this week’s inflation figures (detail on that data above). The RBA will also revise its forecasts in the Statement of Monetary Policy. Near-term inflation projections will look higher because of the September inflation data. But by late 2026, trimmed mean inflation could still be forecast to be around or just above the mid-point of the inflation target, especially as the cash rate assumption (based on market pricing) will look higher and the unemployment rate forecast is likely to increase. GDP growth forecasts will likely be left unchanged. The Board is likely to be unanimous in its decision to keep rates steady and in the commentary its likely that the Board to indicate that it has optionality around rates in the future and that it is currently in a good position to adjust monetary policy, if required. Financial markets are pricing in some chance of another rate cut and pricing is unlikely to change after the meeting.

Australian CoreLogic home prices on Monday are expected to be strong at around 1% based on the daily data. The Melbourne Institute inflation gauge has been suggesting downside to consumer prices, but the data has been moving the other way so perhaps the Melbourne Institute index will trend higher. October ANZ job advertisements are likely to move sideways. September building approvals are expected to be strong, up by 8%. Household spending is expected to be moderate up by 0.3% and September trade balance should remain in a solid surplus of $4.4bn.

Non-official China manufacturing and services PMI for October should show the economy holding up, with both sectors in positive territory.

The Bank of England meet next week and it’s going to be a finely balanced decision. UK data has been on the soft side but inflation, particularly for services is still elevated.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more as central banks continue to cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices are in an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may brake higher with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.