Global shares mostly rose over the last week as Trump backed down again on tariffs on Europe, the US Trade Court found most of Trump’s tariffs illegal although the decision has been stayed pending an appeal and Nvidia reported a 56%yoy rise in March quarter earnings serving to highlight continued strong US profit growth. This saw gains US shares rise 1.9% for the week, Eurozone shares gain 0.9% and Japanese shares rise 2.2%, Chinese shares fell 1.1%. The positive US lead also boosted Australian shares despite soft local economic data with the Australian share market up 0.9% for the week with gains led by IT, energy, health and financial shares. The weekly gains also wrapped up a solid month with US shares up 6.2% in May, global shares up 5.7% and Australian shares up 3.8% as Trump backed down on tariffs. Bond yields eased in the past week after the previous week’s worries about public debt. Oil, metal and iron ore prices fell with gold and Bitcoin also down on reduced safe haven demand. The Australian dollar fell as the $US rose slightly helped by the slightly better news on tariffs.

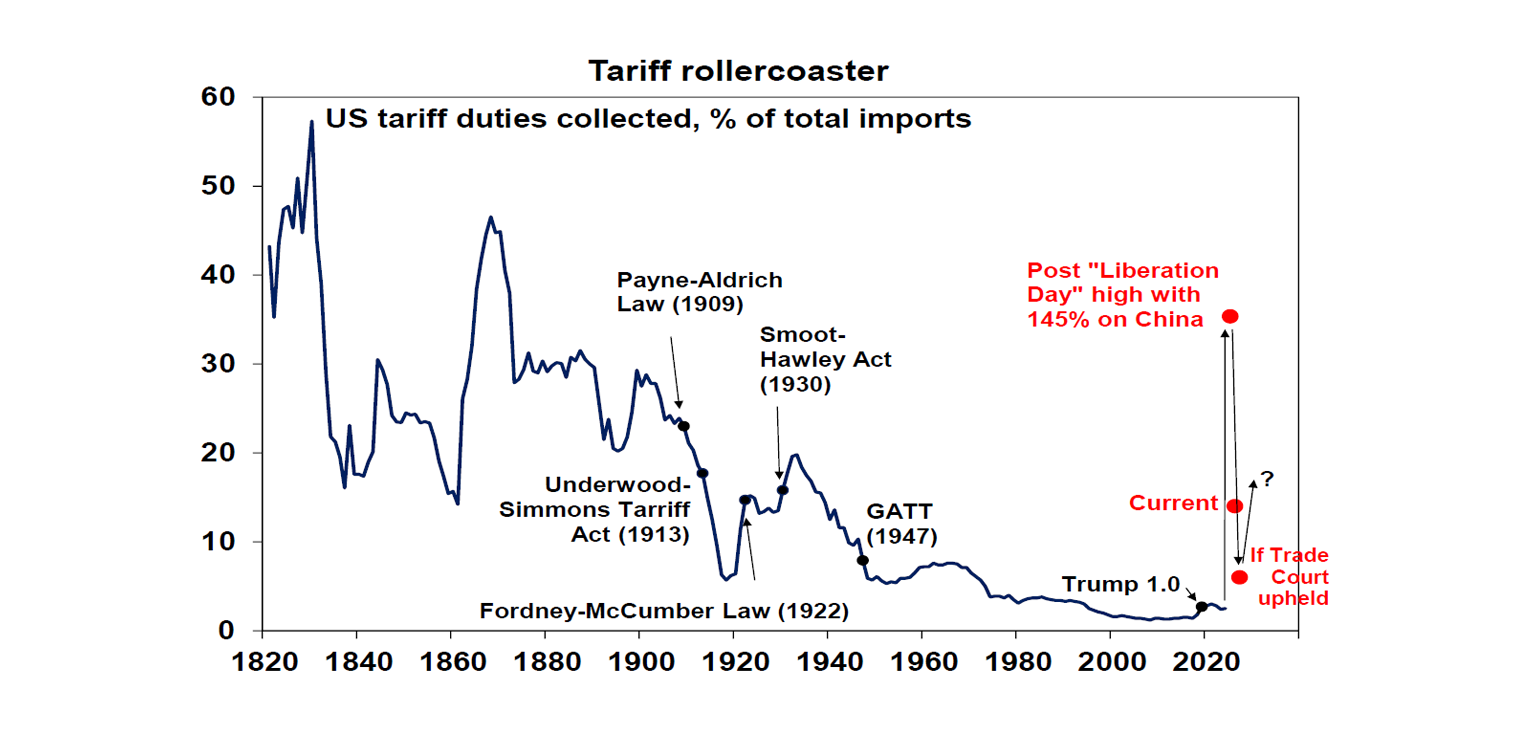

Good short-term news on US tariffs. Trump’s tariffs are becoming a never ending story with new dramas each week. Fortunately, apart from Trump announcing that he would raise the tariff on steel to 50%, the news in the last week has been good.

First, Trump delayed his threatened 50% tariff on European goods from June till 9th July. Trying to keep up with his latest roll of the tariff roulette wheel has become hard – on “Liberation Day” the tariff on Europe was supposed to be 20%, then it was delayed to 9th July pending negotiations, then a week ago he jacked it up to 50% from June and then pushed that out to July. All the flip flopping has given rise to the TACO acronym that “Trump always chickens out”. Naturally Trump took offence at this and said what he is doing is negotiation: “set a ridiculous high number” and then “go down a little bit” but it still looks like he backs off after getting scared about the fallout and the more he does it the less credible his threats become. His weakening credibility is partly why the Australian share market is becoming less sensitive to US tariff news.

More fundamentally Trump’s tariffs imposed under the International Emergency Economic Powers Act have been struck down as illegal by the US International Trade Court as exceeding presidential authority. This covers the “reciprocal” tariffs & fentanyl tariffs but not the tariffs on steel, aluminium and autos as they were applied under Section 232 of the Trade Expansion Act (1962) which allows tariffs where imports threaten national security. If this decision is upheld it means that the average US tariff will fall back to a far less threatening 6% or so, trade negotiations will be far more difficult as the 90 day deadlines will not be taken seriously, tariff revenue will not help to offset the deficit blow out from the tax cuts and the Fed may turn more dovish as the inflation threat recedes.

Of course, this is not the end of the tariff issue though but rather just extends it. The Trump Administration is appealing the decision, the Appeals Court has put a stay on the Trade Courts decision meaning the tariffs remain in place pending the appeal and the Appeal Court may take a more favourable view of the tariffs although the case may go all the way to the Supreme Court. Alternatively, if the appeal fails Trump could choose to apply the tariffs under different authorities – like Section 122 of the Balance of Payments Act which allows up to a 15% tariff for 150 days before moving to use of the same authority as those used for the sectoral tariffs (Section 232) and the pre-existing tariffs on China (Section 301 of the Trade Act (1974)) which allows tariffs to respond to unfair trade. And tariffs on other sectors like pharmaceuticals, semiconductors and smart phones are still on the way. All of which could have some challenges and take time, but it basically means the Trump trade war is far from over. In other words, while the trend in US tariffs has been back down in the last month they still look likely to go back up.

For Australia, while the US tariffs remain in place for now there is some chance that the 10% general tariff on our exports won’t remain. While the tariffs on steel and aluminium and likely on pharmaceuticals are less likely to be struck down by US courts, if Trump’s appeal against the Trade Court decision fails, he may struggle to successfully re-apply the 10% tariff on Australian goods as it will be hard for him to establish a threat to national security or unfair trade practices in order to keep that tariff.

While the rebound in share markets has continued and has been supported by good breadth and signs that economic conditions so far are holding up reasonably well, Trump policies pose an ongoing macroeconomic risk for shares.

The mayhem around the tariffs is causing immense uncertainty which will particularly impact business investment which likely still means weaker economic conditions ahead.

The Trump Administration’s attacks on US universities and research threatens a key source of America’s ongoing technological advantage.

Its attacks on the US court system and rule of law threaten investor and business confidence.

A section in the One Big Beautiful Bill Act (OBBBA, Section 899) will potentially impose taxes on foreign investors in the US if their home country is deemed to discriminate against the US with taxes, which will threaten foreign investment in the US.

The OBBBA tax bill will worsen the US public debt outlook and without tariff revenue will look even worse.

All of which is driving a loss of faith in the US as a safe haven and in US exceptionalism and could see global investors demand a higher risk premium to invest in US shares, bonds and the $US. I suspect its likely to be a slow burn and US tech and particularly AI dominance will serve as a powerful offset for some time to come. But it means ongoing bouts of high uncertainty and volatility.

The bottom line is that shares have had a good rebound – with the ASX 200 just 1.4% below its record high - and may even break to record highs in the near term, but macroeconomic risk flowing from Trump’s policies remains high, so the ride is likely to remain volatile. Ultimately, we continue to see Trump pivoting from the focus on tariffs to tax cuts and deregulation which along with rate cuts from the Fed in the third quarter and other central banks should help shares stage a more sustainable recovery.

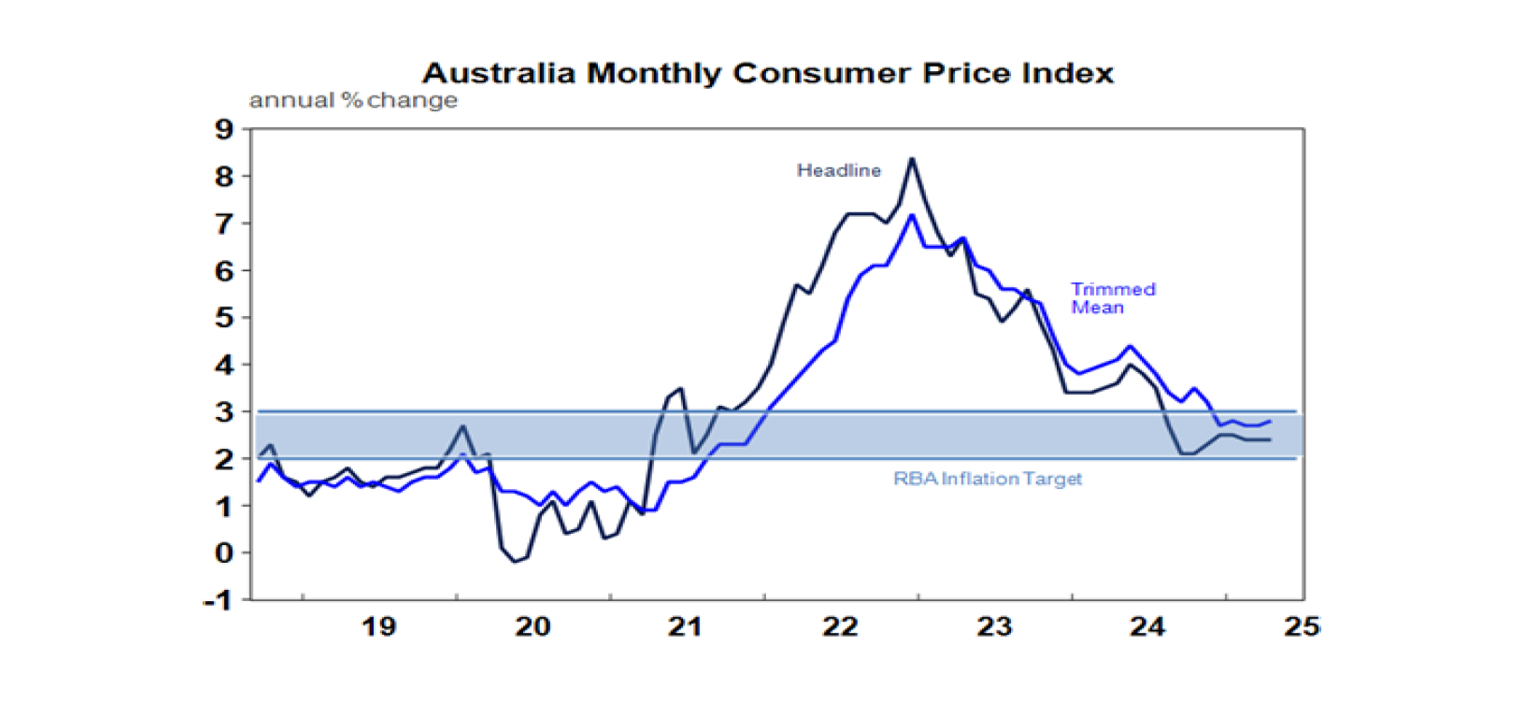

Australian inflation for April was not weak enough on its own to speed up rate cuts, but soft economic data in the past week means that the July RBA meeting still remains “live” for a rate cut. While inflation was a tick higher than expected this looks partly seasonal, both the CPI at 2.4%yoy and trimmed mean at 2.8%yoy are still in the target range and services inflation looks likely to slow further as some items like education are indexed to past inflation which has fallen.

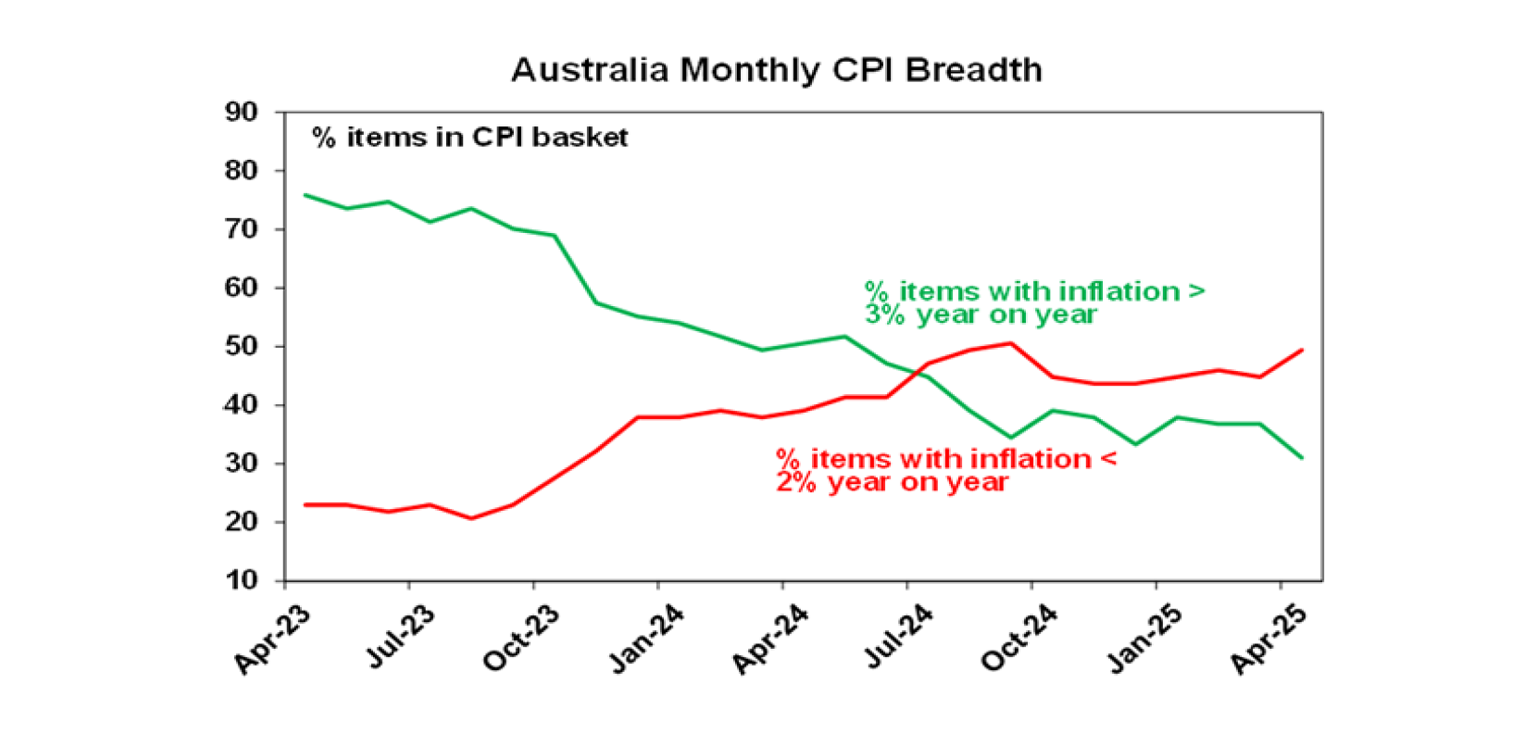

What’s more the proportion of items with greater than 3%yoy inflation is continuing to fall.

All up we regard the April inflation data as consistent with RBA forecasts for trimmed mean inflation of 2.6%yoy this quarter but being slightly higher than expected it’s not enough on its own to speed up rates cut. Working the other way though is weak data for business investment, consumer spending and housing approvals all of which suggest that growth may be coming in weaker than expected. So, our base case remains for 0.25% rate cuts in August, November and February taking the cash rate to 3.1% but with the risk that the cuts come faster, and we reach 2.85% by early next year. So, the July RBA meeting still remains “live” for another rate cut. The money market sees about a 70% chance of a 0.25% cut in July and three cuts by year end.

Major global economic events and implications

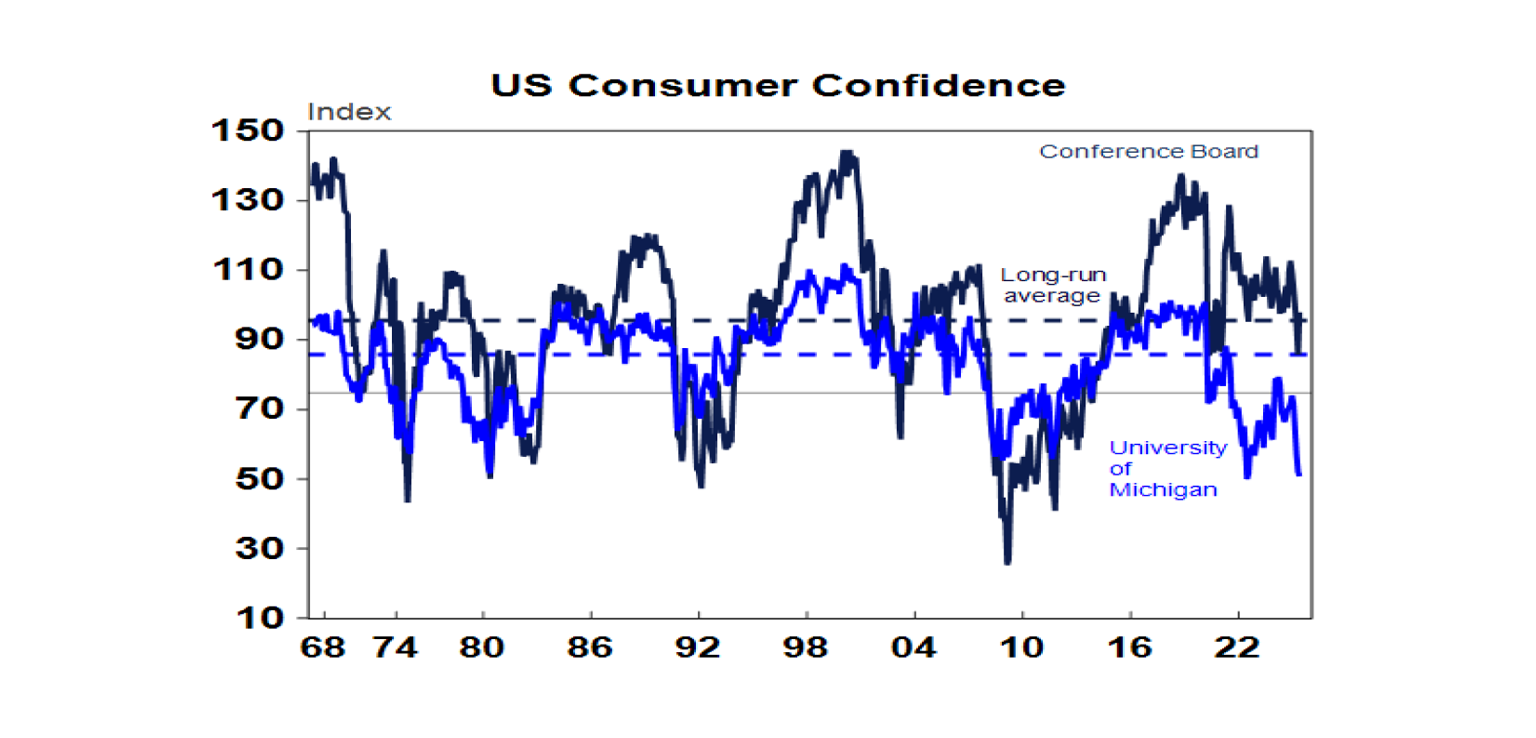

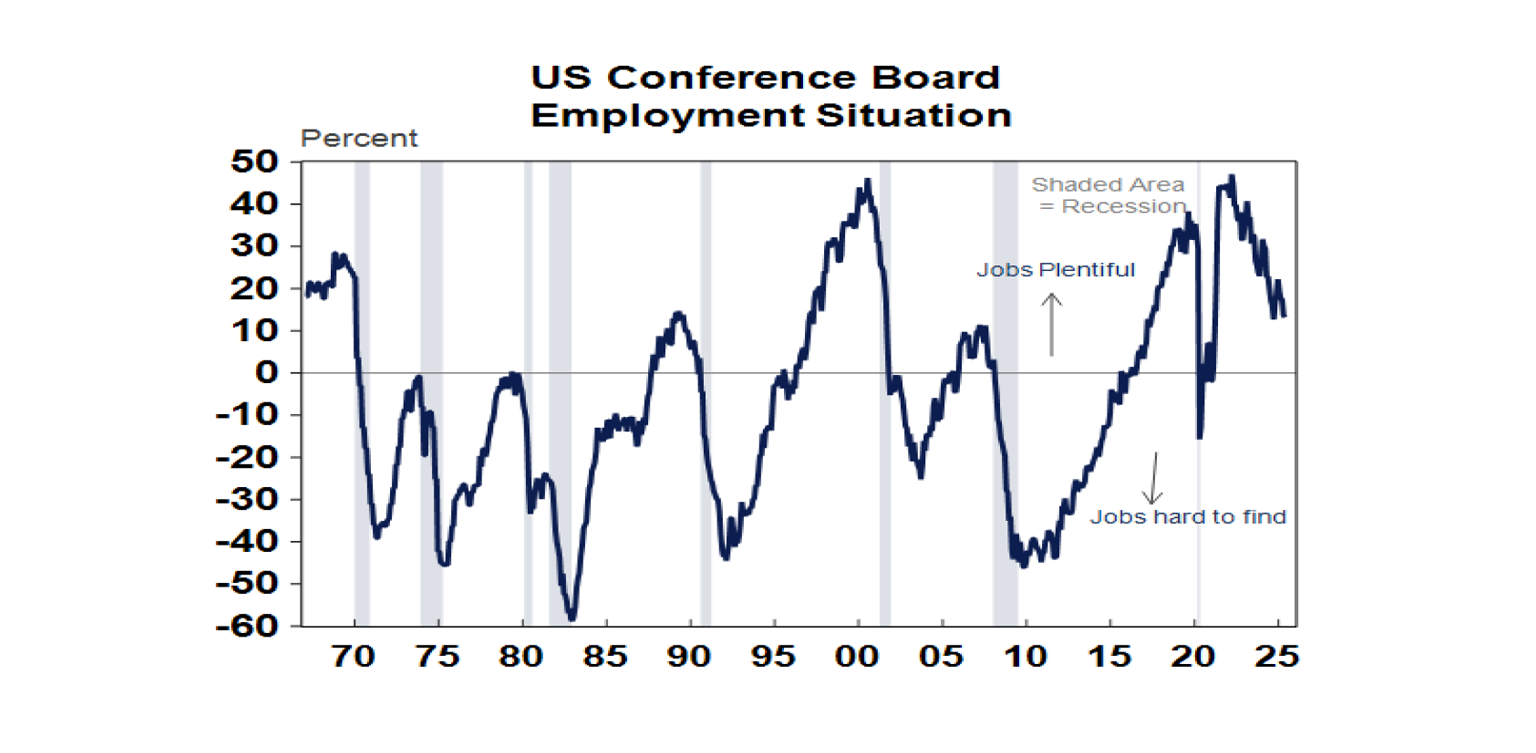

US data releases were a mixed bag. Consumer confidence as measured by the Conference Board rebounded in May in response to Trump’s tariff backdown, but its still down from the levels of earlier this year and the University of Michigan’s consumer sentiment reading remains much weaker. While March quarter GDP growth was revised up fractionally, to -0.2% annualised, consumer spending was revised down to just 1.2% annualised growth. And it looks to be remaining soft this quarter with real personal spending up just 0.1% in May and consumers boosting their saving rate.

Despite the rise in consumer confidence, consumers’ perceptions of the job market – comparing those seeing jobs as plentiful versus hard to get – fell. Initial jobless claims remain low but rose again in the last week and appear to be starting to trend up with continuing claims continuing to rise.

While underlying US capital goods shipments only fell slightly in April and are consistent with still solid business investment, underlying capital goods orders fell sharply suggesting that tariff uncertainty may be starting to impact.

Meanwhile the minutes from the Fed’s last meeting were slightly hawkish and suggest that the Fed is in no hurry to start cutting rates again. Core private consumption inflation remained soft in April with a further fall to 2.5%yoy which is good news but with the tariff threat remaining the Fed is likely to remain in wait and see mode. Its doubtful Trump’s meeting with Powell will have changed this but if the Trade Court ruling on the tariffs is upheld then the Fed could move earlier. The US money market is pricing in a cut by September with just over two cuts by year end.

German unemployment rose again in May highlighting ongoing weakness in the German economy. Fortunately, the rest of Europe has been a bit stronger resulting in stable unemployment in recent times and German fiscal stimulus is on the way.

Japanese unemployment remained low at 2.5% in April with retail sales up but industrial production down.

The Reserve Bank of New Zealand cut its cash rate from 3.5% to 3.25% as expected citing weaker demand and inflation and spare capacity. Its guidance was mixed but it lowered its expected terminal cash rate to 2.9% from 3.1%, so there are another one or two rate cuts to come, but they may come more slowly.

Australian economic events and implications

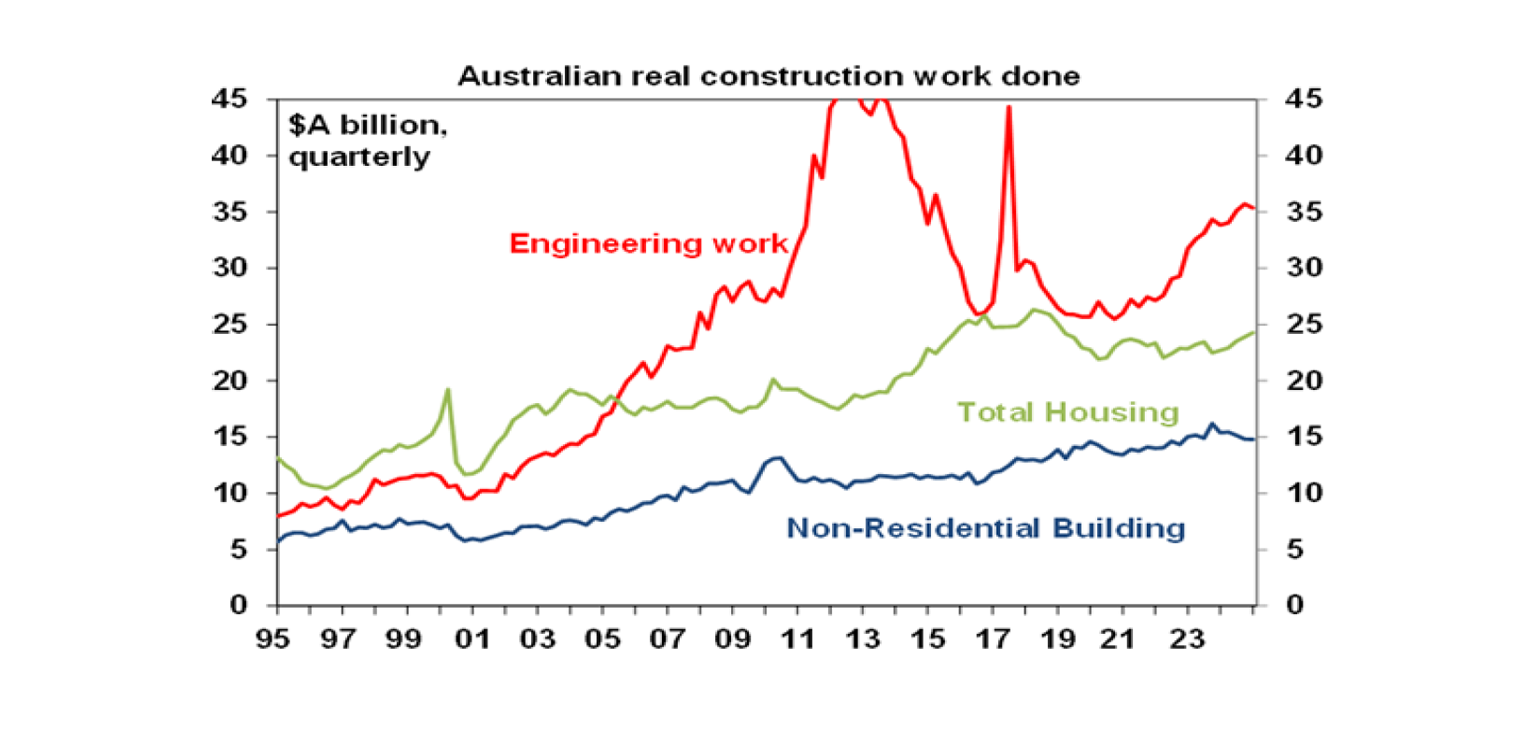

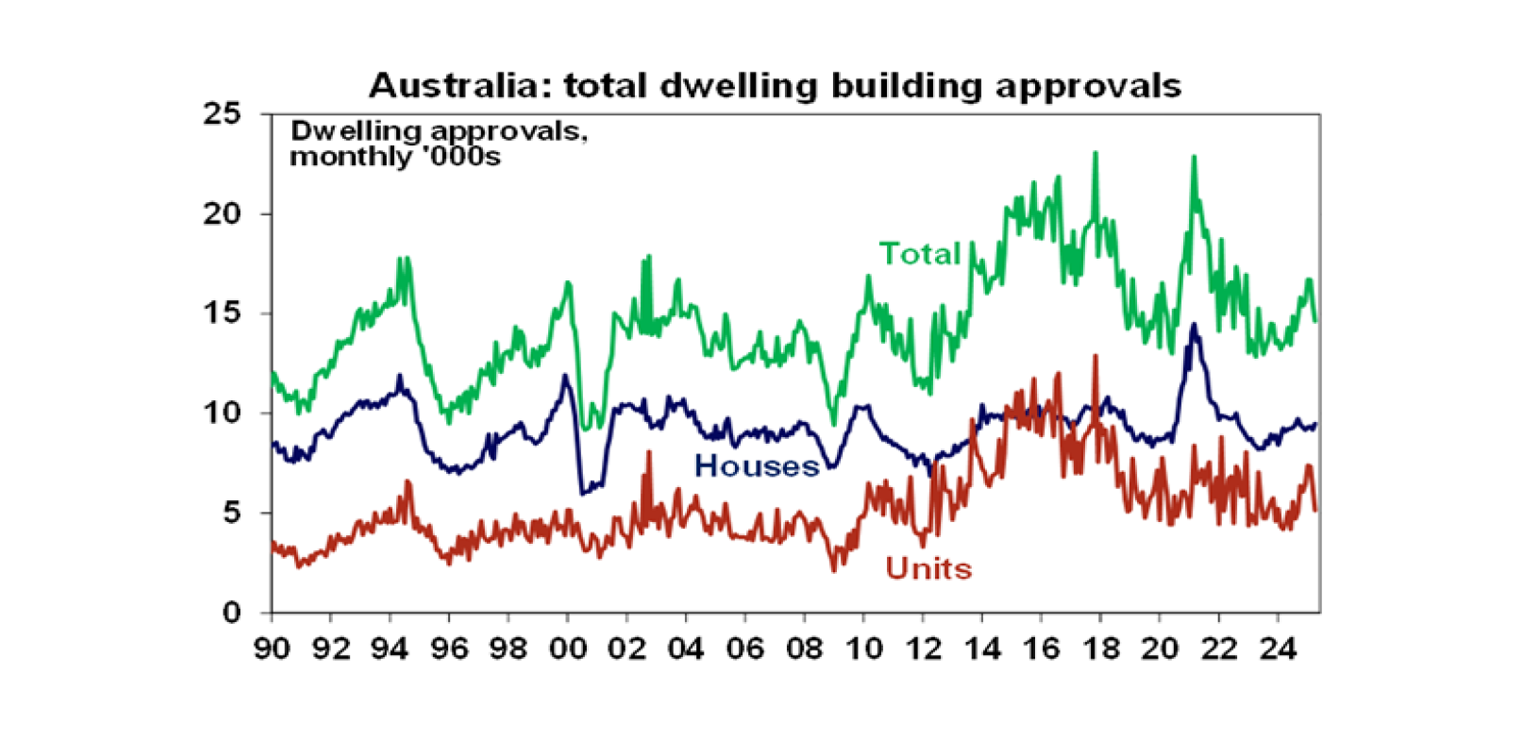

Australian data was soft, with bad news for March quarter GDP growth and productivity. Construction activity was flat in the March quarter with residential building up, consistent with a rising trend in housing approvals but non-residential building and engineering work down suggesting a drag on business investment.

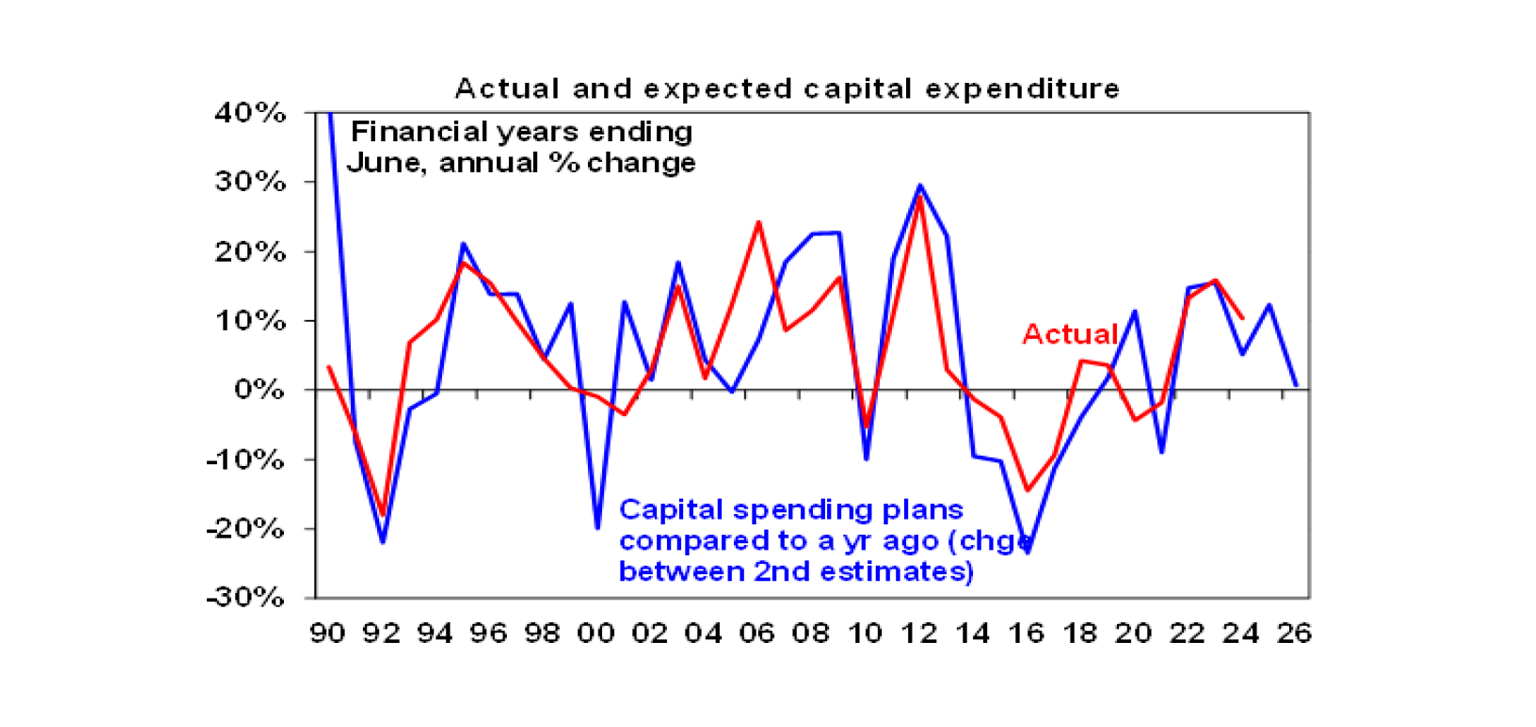

Business investment fell slightly in the March quarter with pretty weak plans for the year ahead. Private new capital expenditure fell 0.1% against expectations for a 0.5% gain. Mining investment rose but non-mining investment fell. What’s more investment plans for 2025-26 were just 0.7% higher than the same plans a year ago for 2024-25 suggesting pretty soft business investment growth in the year ahead.

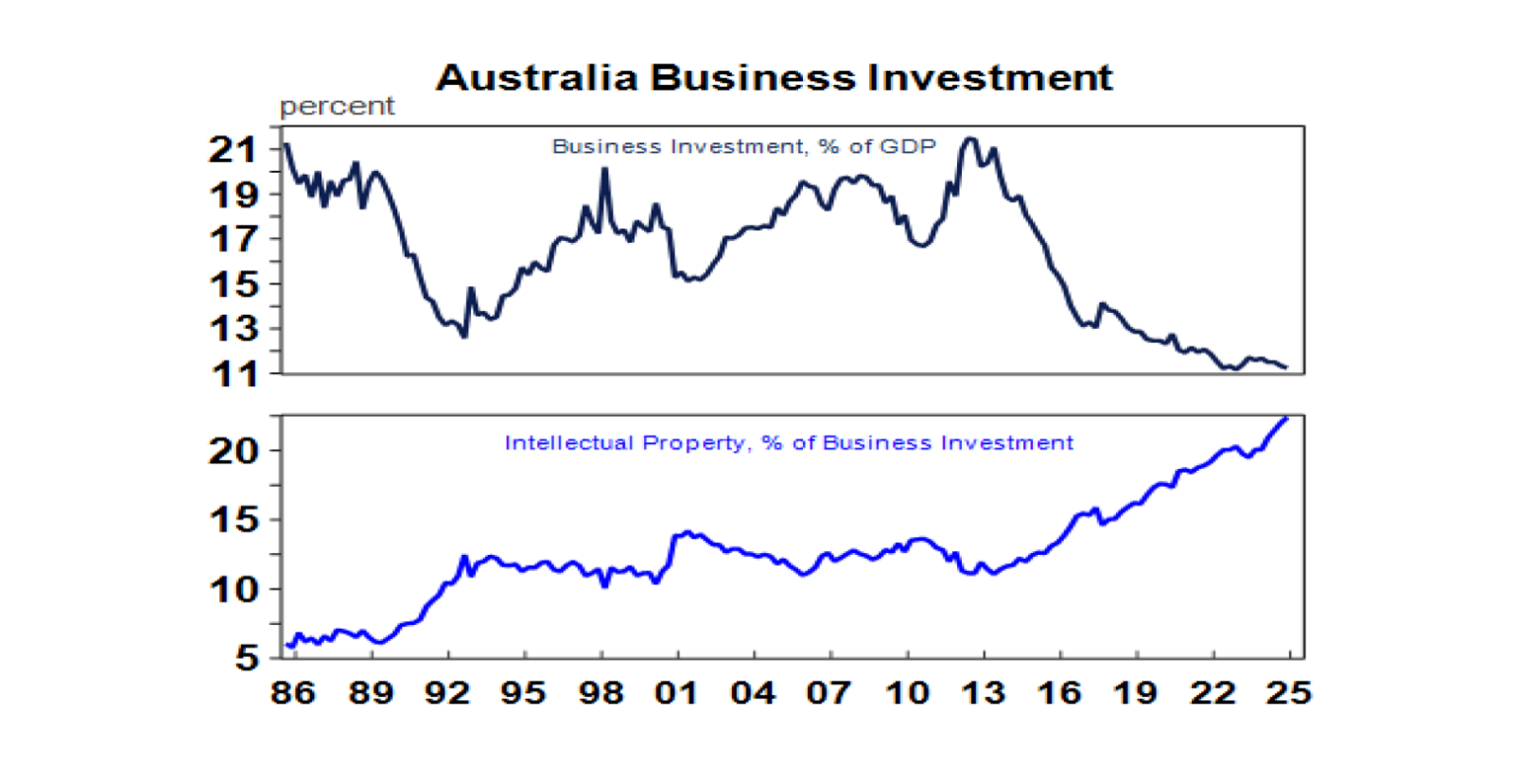

The dismal business investment numbers point to downside risks to our forecast for 0.4% March quarter GDP growth but more importantly are bad news from a productivity perspective. Sure, intellectual property investment is rising solidly but overall business investment as a share of GDP in Australia is running around its lowest in at least 40 years. Investment in new capital is critical if we are going to push up productivity growth again, but this does not augur well. Short term concerns are Trump’s tariff war, weak consumer demand and still relatively high interest rates may fade somewhat. But a high corporate tax rate and excessive regulation are also weighing and must be eased to encourage a more supportive environment for investment.

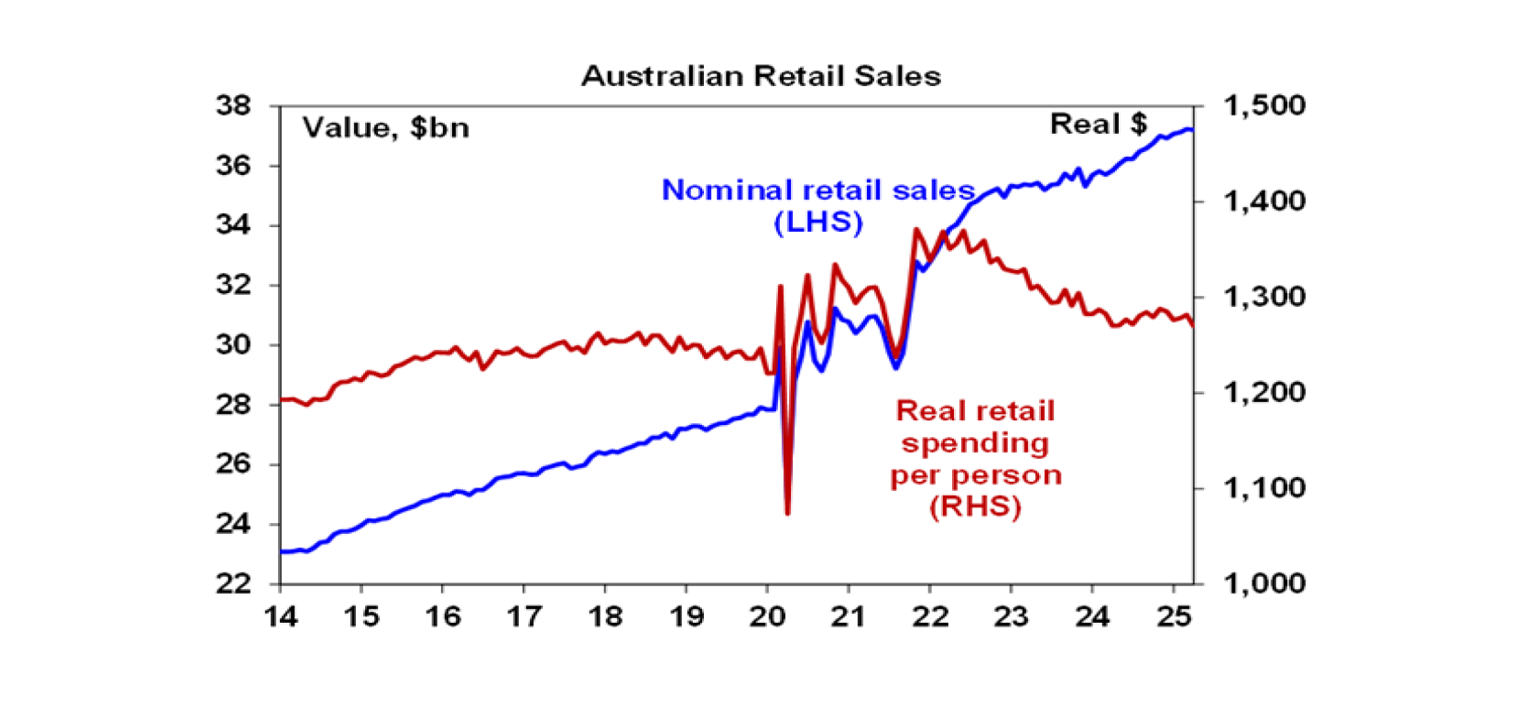

Meanwhile retail sales surprisingly fell in April despite sales in Queensland rebounding from Cyclone Alfred and the double Easter/Anzac long weekend. Tax and rate cuts will help but the consumer is still clearly struggling with real retail sales per person trending down so far this year after a mild rise into late last year. The cost of living remains a problem – falling inflation is not the same thing as falling prices!

Home building approvals fell again in April, due to a sharp fall in volatile unit approvals, possibly due to the double long weekend causing processing backlogs. There should be a rebound next month, but trend approvals are now running at just 187,000 pa which is below underlying demand and well below the Housing Accord goal of building 240,000 homes a year which is necessary if we are to reduce the estimated housing shortfall of between 200,000 to 300,000 dwellings.

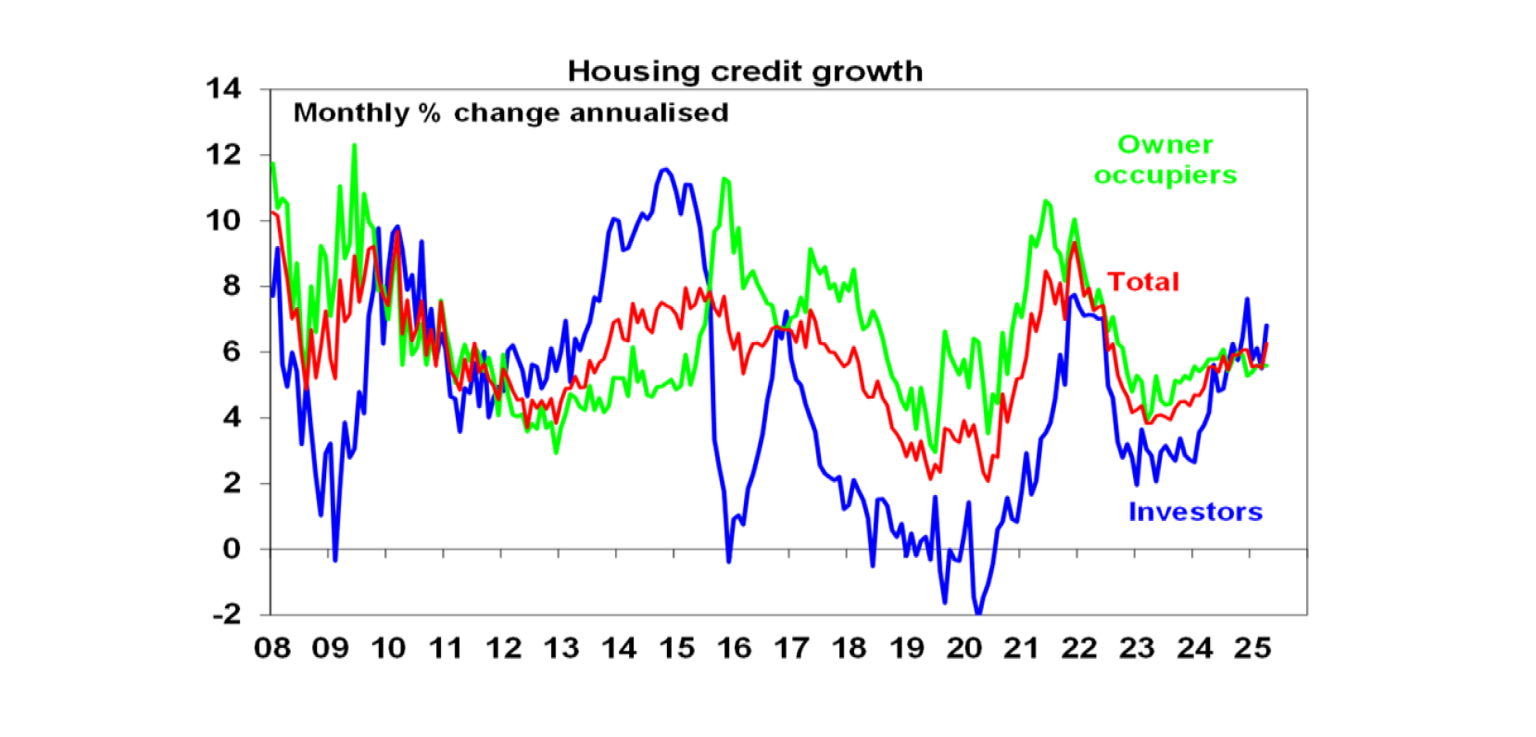

Private credit growth picked up in April due to stronger business lending. Housing credit growth was relatively stable at 0.5%mom. It’s likely to rise with rate cuts.

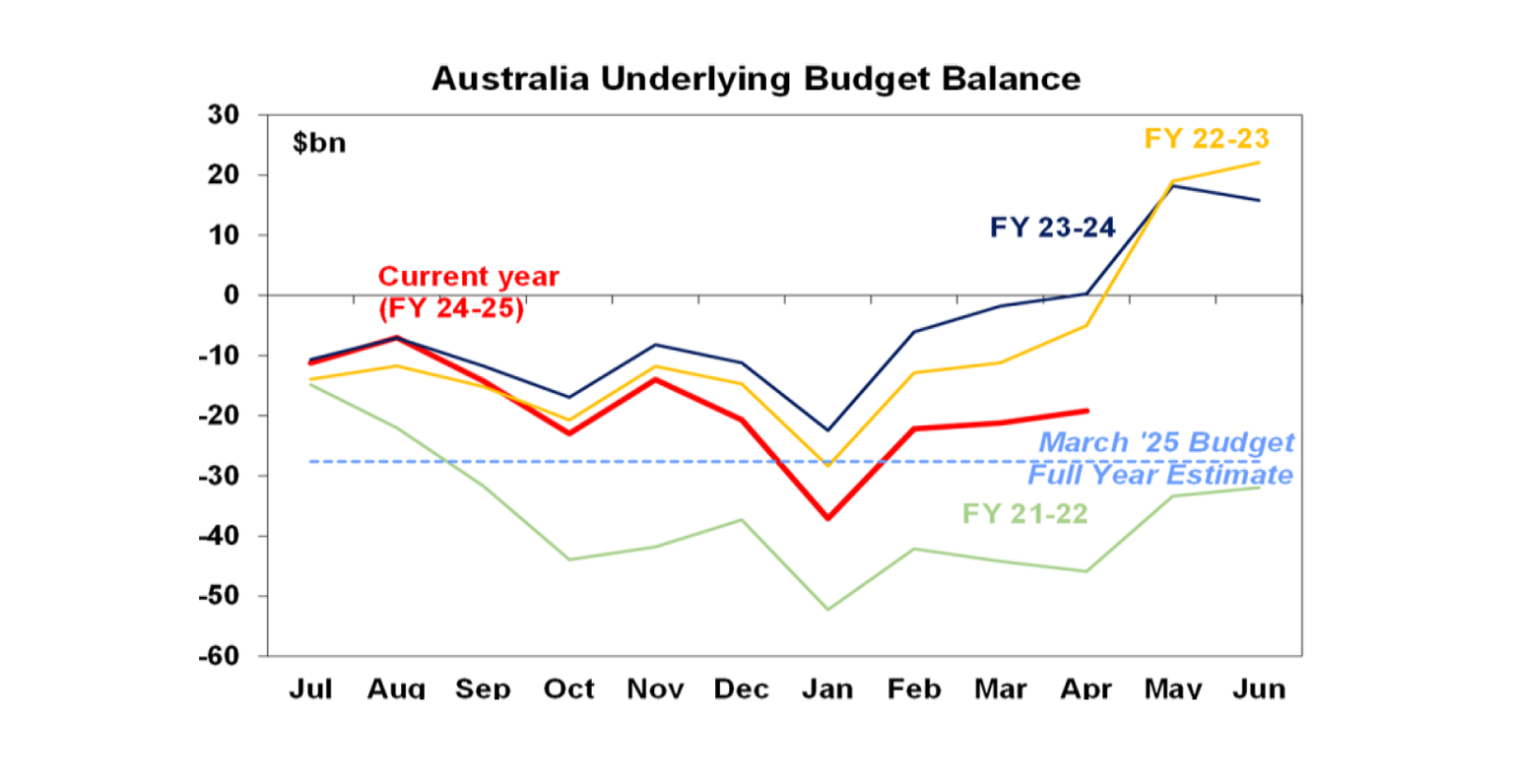

Finally, Federal budget data for the 2024-25 year to date to April shows the budget deficit continuing to run better than projected. It looks on track for a deficit but likely to be around $10bn-$15bn rather than the $27.6bn forecast in the Budget.

What to watch over the week ahead?

US non farm payrolls for May (Friday) are expected to show a slowing in jobs growth to 130,000 with unemployment unchanged at 4.2% and wages growth cooling to 3.6%yoy. The May ISM manufacturing conditions index (Monday) is expected to lift to around 49 with the services conditions index improving slightly to 52. Data on job openings and quits for April will be released on Tuesday.

The Bank of Canada (Wednesday) is expected to leave its policy rate unchanged at 2.75% with mild dovish guidance.

The European Central Bank (Thursday) is expected to cut its policy rates by another 0.25% taking its deposit rate to 2% and signal that more rate cuts are likely. Eurozone inflation data for May is expected to show a slowing to 2.1%yoy with core inflation falling to 2.6%yoy with unemployment for April likely to be unchanged at 6.2% (both due Tuesday).

In Australia, the focus is likely to be March quarter GDP growth which is expected to show a slight slowing in quarterly growth to 0.4%qoq (or flat in per capita terms), reflecting weak consumer spending and investment, a small contribution to growth from trade, modest growth in public spending and solid growth in dwelling investment. This will see annual growth rise to 1.5%yoy from 1.3%yoy. In other data expect Cotality home price data for May (Monday) to show around a 0.5%mom lift as rate cuts provide a boost, April household spending to a show a 0.2%mom or 3.6%yoy rise and the trade surplus to fall to $6.5bn (both due Thursday). The minutes from the last RBA meeting (Tuesday) will likely leave the door wide open for further rate cuts if inflation remains benign, growth subdued and Trump’s tariffs continue to pose a threat to the outlook.

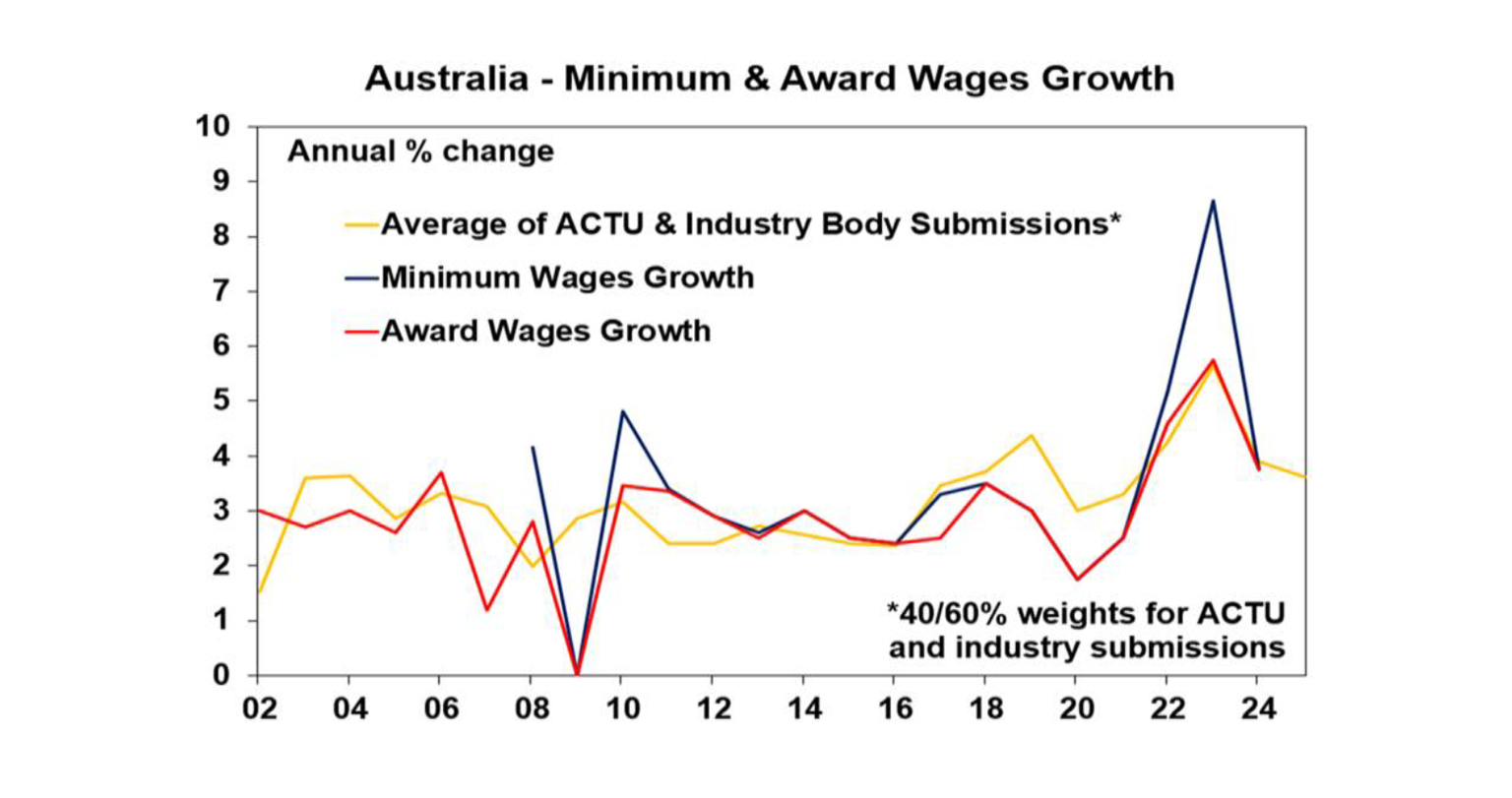

The Fair Work Commission is due to deliver its decision on the annual increase in minimum and related award wages on Tuesday. This impacts around 25% of workers. A rough guide to the likely increase is to take an average of the ACTU (for a 4.5% rise) and industry groups (for a rise around 2.5%) submissions which is 3.5%. This would be lower than last year’s 3.75% consistent with falling inflation, would give workers a real wage rise, it’s not so high as to add to the risk of a wage price spiral and it’s around current wages growth.

Outlook for investment markets

Shares are at high risk of renewed falls given the ongoing tariff uncertainties, concerns about US debt, likely weaker growth and profits and the risk of a US/Israeli strike on Iran’s nuclear capability if diplomacy doesn’t work. But with Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further shares are likely to recover on a more sustained basis into year end. It’s likely to be a rough ride though.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We see home prices rising around 3% this year but the risk is now on the upside given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar. This could leave it weak around $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts.

Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.