Middle East oil crisis averted so oil down but share markets up to record or near record highs. While the past week started with uncertainty as to how Iran would retaliate against the US strike against its nuclear facilities, things quickly settled down after Iran’s retaliation was seen as merely symbolic and aimed at de-escalation which quickly saw President Trump verbally impose a ceasefire between Israel and Iran. This saw the oil price plunge below levels seen before the war started and shares rebound. US shares were also helped by optimism for trade deals and rate cuts and rose 3.4% for the week to a new record high. Eurozone shares gained 1.9%, Japanese shares rose 4.6% and Chinese shares rose 2%. The positive global lead saw the Australian share market rise but only by 0.1% for the week, with gains led by financials, material and discretionary stocks but with energy shares down sharply. Bond yields fell in the US and Australia with prospects for bigger interest rate cuts than previously expected but rose in Germany, on the back of more defence related fiscal stimulus, and in Japan. While oil prices plunged 13% and gold fell with less safe haven demand, metal prices rose but iron ore prices fell. Bitcoin rose with “risk on” sentiment along with the $A, but the $US fell to its lowest since February 2022.

Key messages for investors from the “12 day” Israel/Iran war:

Constraints helped head off a worst-case outcome. While the US strike added to the risks, Iran prioritised regime survival with its symbolic retaliation, Israel had no choice but to stop its attacks on Iran under immense pressure from the US which supplies most of its weapons and the US under Trump clearly wants lower oil prices and to avoid involvement in another “forever war” in the Middle East. To this end and to help maintain the ceasefire Trump is now providing concessions to Iran, like “allowing” China to buy its oil and talk of easing sanctions on it.

Oil supply is key when it comes to conflict in the Middle East. This is all that investment markets are concerned about. When it became clear that any disruption to oil supplies was unlikely oil prices quickly fell back and shares rebounded.

The US under President Trump is still prepared to play the role of the “global cop”. This was evident in his first term strike on Syria in 2017 in response to the use of chemical weapons and now with his strike on Iran’s nuclear weapons capability. This is not the same as the neo-cons’ focus on “regime change” which Trump seems only to muse about as a threat, but it nevertheless indicates that the US is not retreating into isolationism and there is still an element of the world being uni polar. (Trump deserves credit here I reckon.)

While risks around Iran look to have fallen for now, the longer-term threat from Middle East instability remains. It’s unclear how much damage the US bombs really did, the Iranian regime remains, it likely still wants nuclear weapons and US led interventions in the Middle East often destabilise things for the longer term rather than stabilise them. But at least for a while things should settle down.

Which means that for now at least investment markets were right to not get too negative. Of course, the latest experience will likely reinforce investment markets’ reduced sensitivity to events in the Middle East. The experience of the last two weeks also highlights the difficulty of trying to pick market moves around geopolitical events. The best approach is to maintain an appropriate long term investment strategy with a well-diversified portfolio, but they do throw up opportunities for investors at times, eg cheaper shares and overvalued oil.

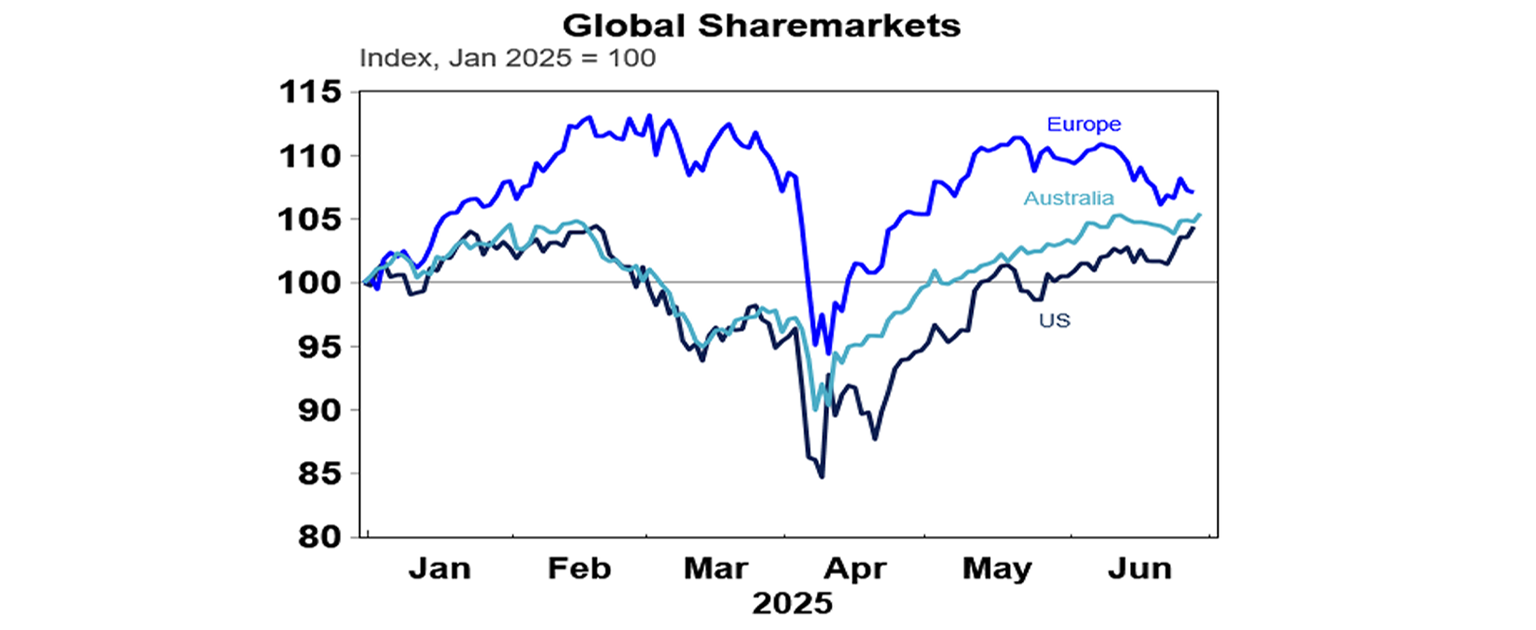

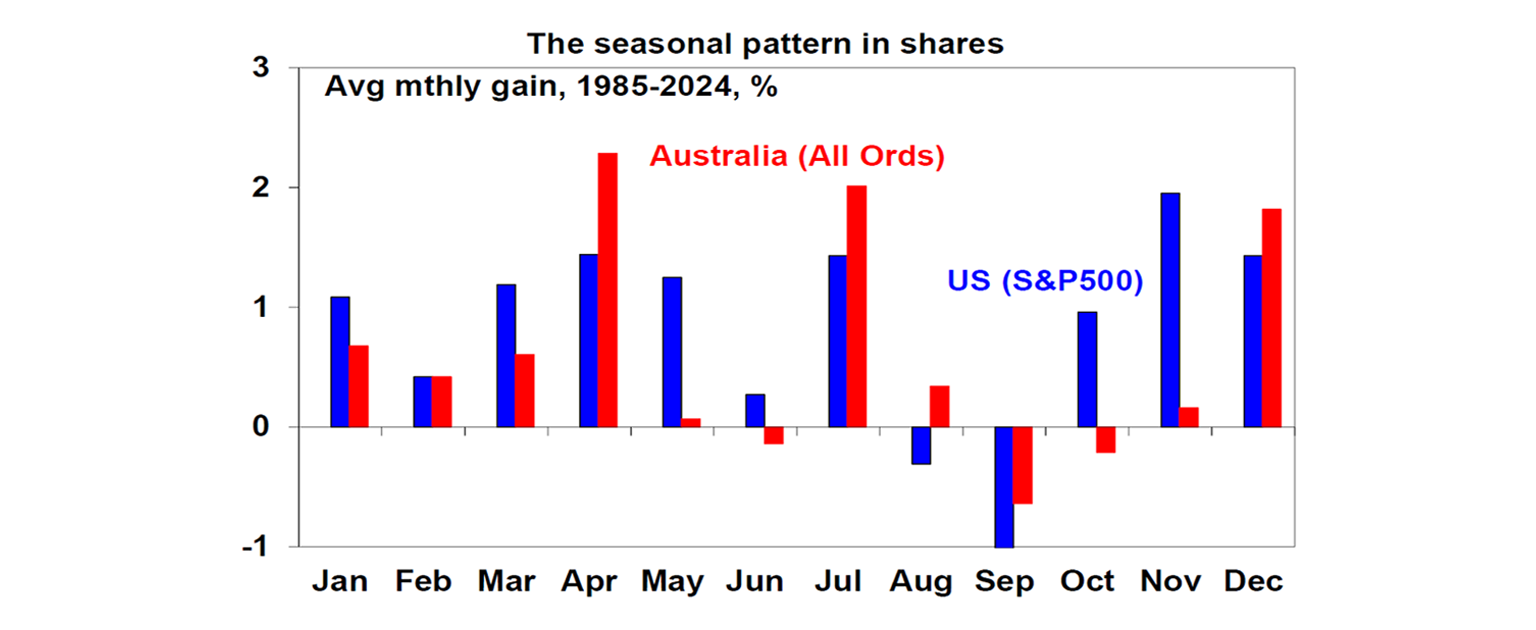

So where to now for shares? Shares have literally climbed a wall of worry over the last six months as Trump has tried to build a new world order and upset the global trading system with big tariff hikes and as conflict in the Middle East threatened to disrupt oil supplies. Fortunately, Trump backed down on the worst of his tariffs for now and the Middle East threat has fizzled seeing US shares rise to a new record high and Australian shares just 0.9% below their record high and on track for another financial year of strong returns for 2024-25 helped by strong profit growth in the US and central bank rate cuts elsewhere, including in Australia. July is normally a strong month for shares. However, volatility is likely to remain high as: US and Australian shares are expensive; Trump’s tariff threat will likely increase again with the 9th July tariff deadline rapidly approaching and some countries likely to see hikes beyond 10% tariffs; the One Big Beautiful Bill (tax cut) Act is now coming back into focus as it moves to a Senate vote with concerns about the US public debt outlook (as it will increase the deficit, particularly with many budget savings being ruled out in the Senate, and raise the debt ceiling); and earnings expectations are at risk in both the US and Australia with softer than expected economic growth. On the tariffs, the Trump Administration is talking up the prospect of deals and a possible delay to the deadline for some but countries are reportedly wary of agreeing to anything not knowing how hard they will be hit by sectoral tariffs (eg on semiconductors and pharmaceuticals) to be announced in a few weeks. And Trump has said he will end all trade talks with Canada in a spat over a digital services tax. All of which could contribute to a new bout of weakness going into the seasonally weak months of August and September.

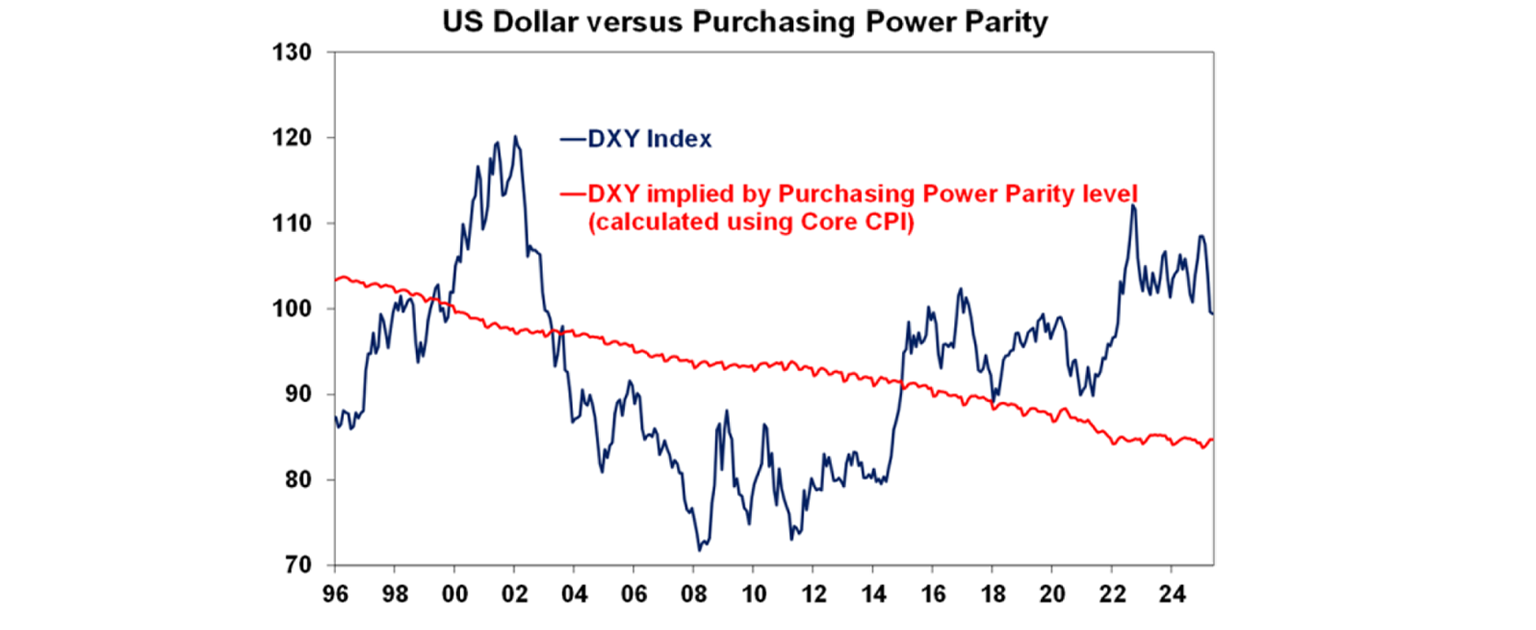

In particular, it’s worth noting that the US dollar has resumed its downswing suggesting foreign investors are continuing to losefaith in investing in the US, not helped by Trump’s erraticeconomic policies, upwards pressure on the US budget deficit andhis attacks on Fed Chair Powell with talk he may announce areplacement for Powell as soon as September/October which mayundermine Fed credibility. Fortunately, the section 899 tax onforeign investors looks like it will be dropped from the OBBBAafter the US Treasury struck a deal with G7 countries to excludeUS companies from the OECD minimum tax – which is good newsfor Australian super funds. While the $US is falling it remains wellabove most estimates of fair value based on relative prices (orpurchasing power parity) because US inflation has been averagingabove that in Europe and Japan, so it was due for a fall at somepoint anyway. See the next chart.

However, while the near-term outlook for shares is still messy,shares should benefit on a 6-12 month view as Trump pivotstowards more market friendly policies, the Fed starts cuttingrates again along with ongoing rate cuts from other centralbanks including the RBA and the threat to oil prices from conflictwith Iran remains contained at least for a while.

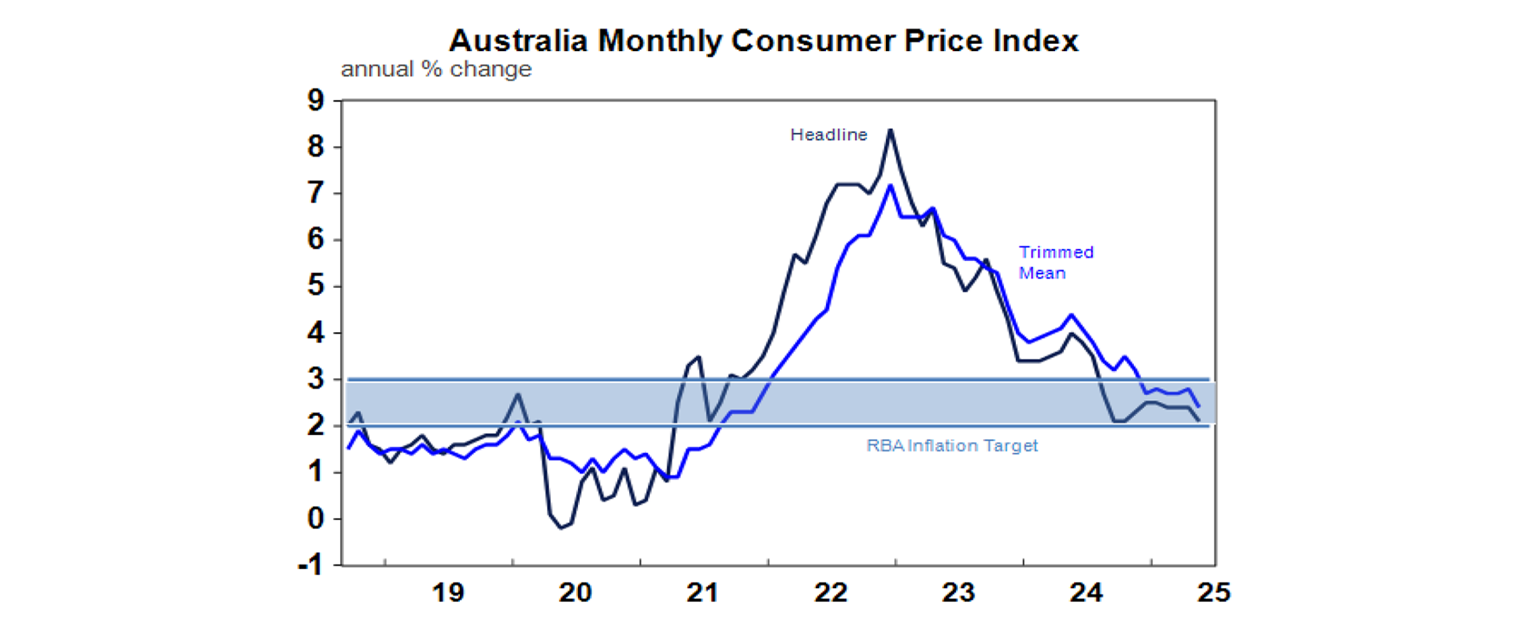

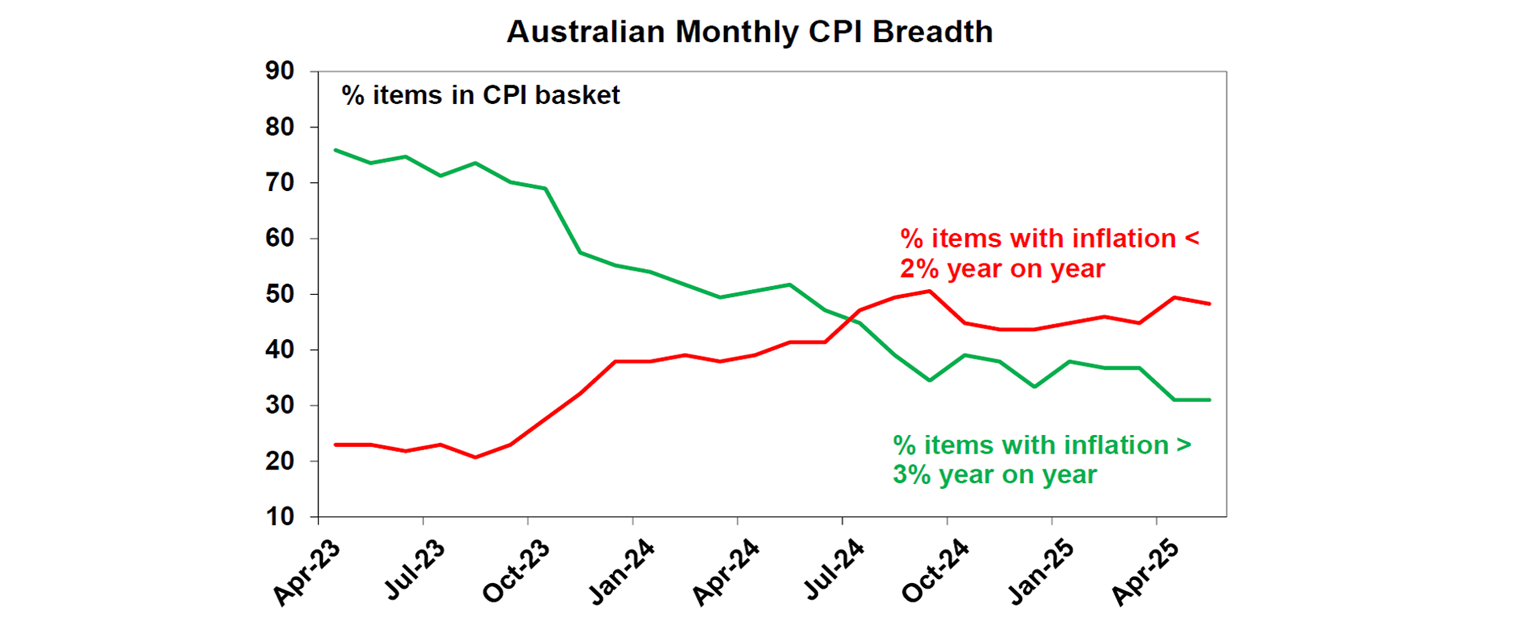

In Australia, underlying inflation is continuing to fall. Maymonthly inflation fell to 2.1%yoy with trimmed mean underlyinginflation falling to just 2.4%yoy, its lowest since November 2021.The slowdown was broad based. Both headline and underlyinginflation are now in the lower half of the RBA’s 2-3% target range.

The broad based nature of the fall in Australian inflation isevident in around 50% of CPI items having inflation below2%yoy. And the slowdown is consistent with easing pricepressures being reported in business surveys.

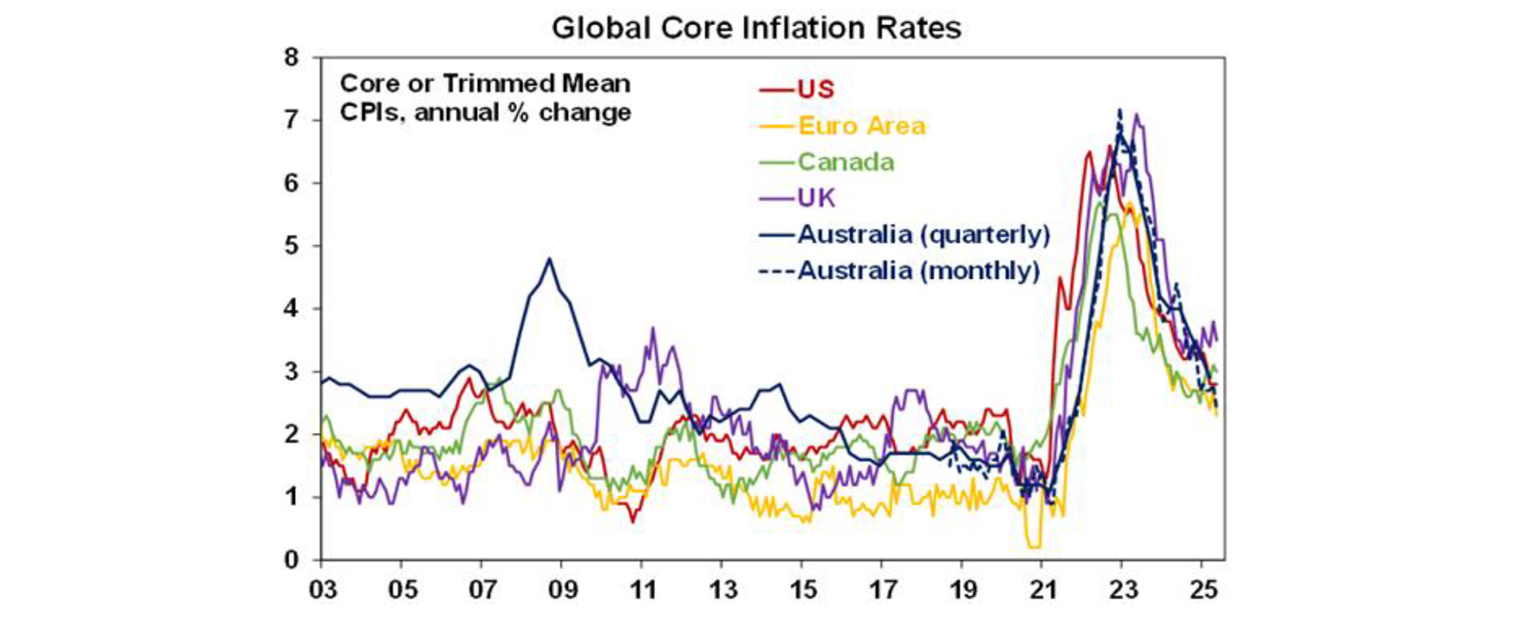

Its also worth noting that inflation is in line with or below that inother comparable countries. So much for the claim last year thatAustralia has more of an inflation problem than other countries!

We continue to expect the RBA to cut rates again in July, August,November and February. The continuing fall in underlyinginflation, with June quarter trimmed mean inflation on track tocome in at the RBA’s forecast of 2.6%yoy or just below, along withweaker than expected March quarter GDP growth andsubsequent economic indicators and the threat to growth posedby Trump’s trade war is consistent with the RBA cutting ratesagain in July and taking the cash rate down to 2.85% by early nextyear. Fortunately, the settling of the war with Iran and fall in oilprices back to levels seen before Israel attacked Iran, hasremoved, for now at least, the threat of a surge in petrol pricesadding to inflation which could have seen the RBA delay rate cuts.

Like so many good groups The Pointer Sisters had a few iterations. Starting in the 1970s they had a hit with Fairytale which was a country song, subsequently recorded by Elvis, and for which they won a Grammy. But by the 1980s they had changed to high energy dance music of which I’m So Excited is one of their best.

Major global economic events and implications

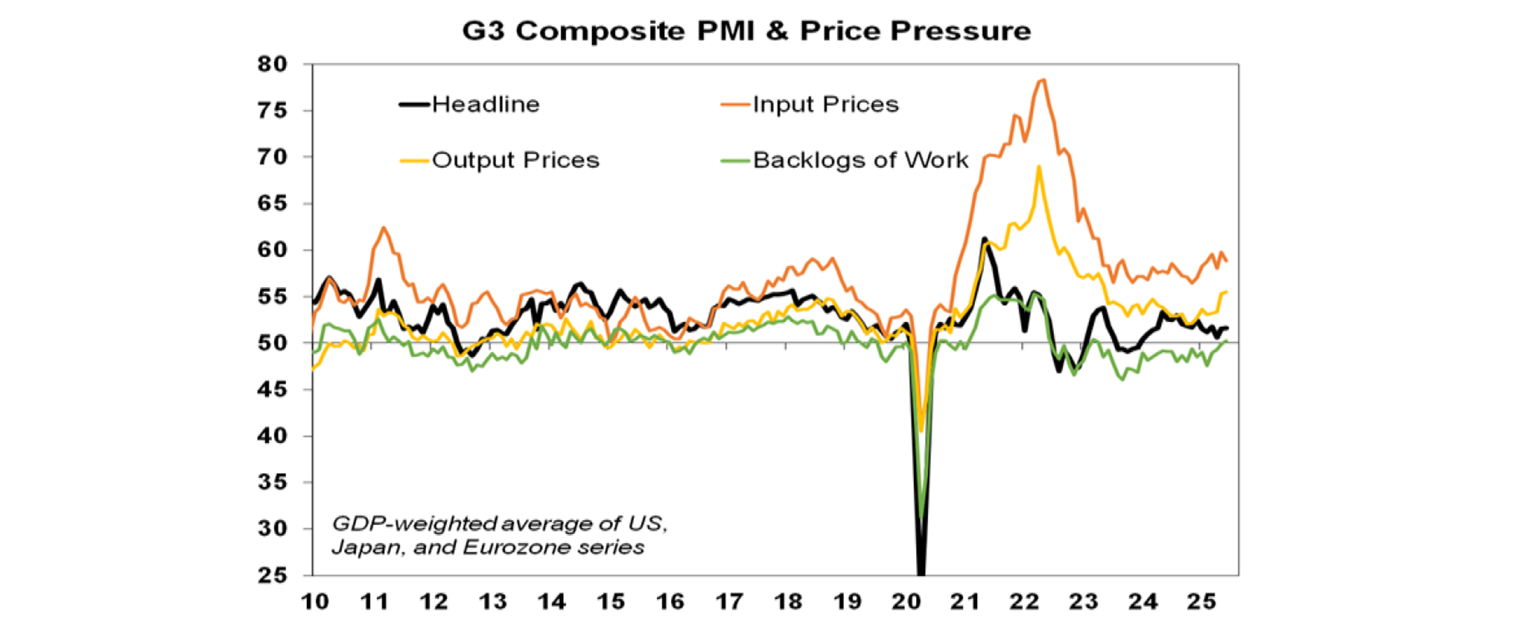

Aggregate business conditions PMIs in developed countries were little changed in June pointing to subdued but okay global growth. The bad news remains that price pressures remain elevated due to high US readings.

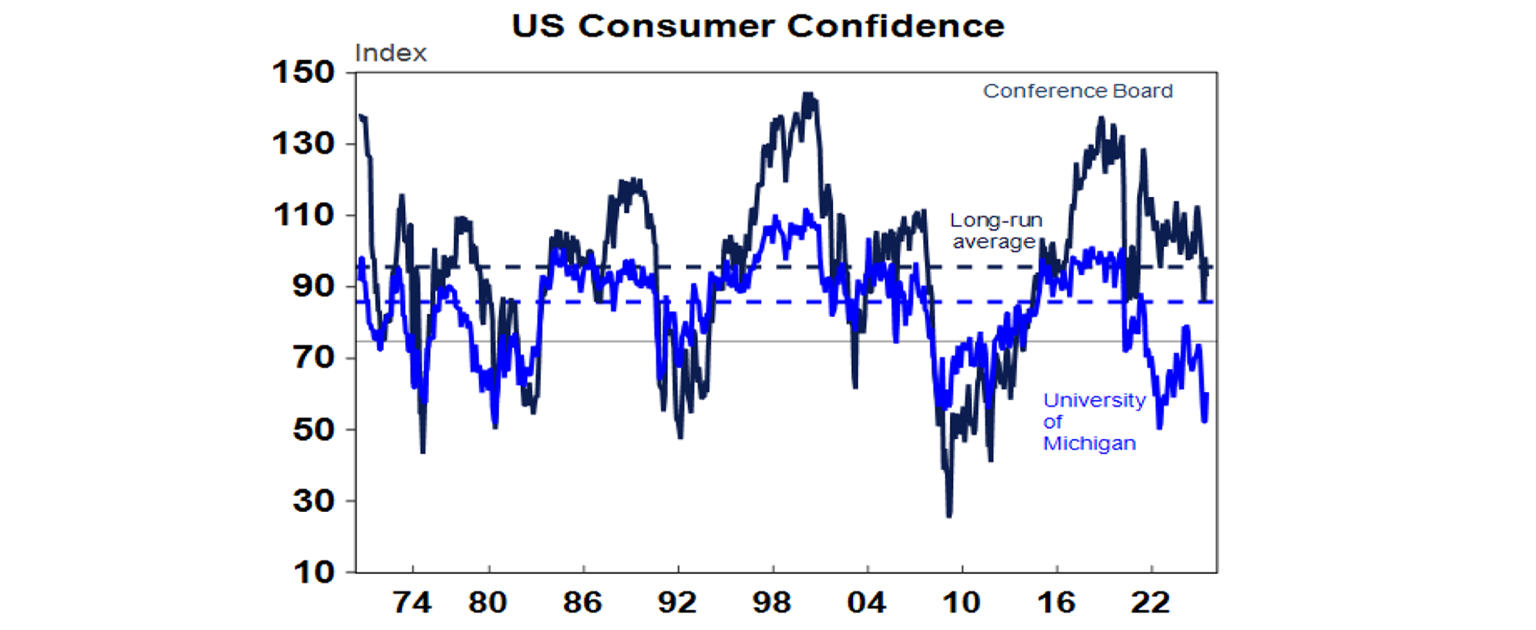

The US PMI for June was also little changed but with price pressures falling slightly but still high on the back of the tariffs. Other US economic data was mixed. Personal spending fell in May with consumer spending revised down in the March quarter adding to concerns the consumer is flagging. The Conference Board’s consumer confidence index also fell with tariffs the main concern.

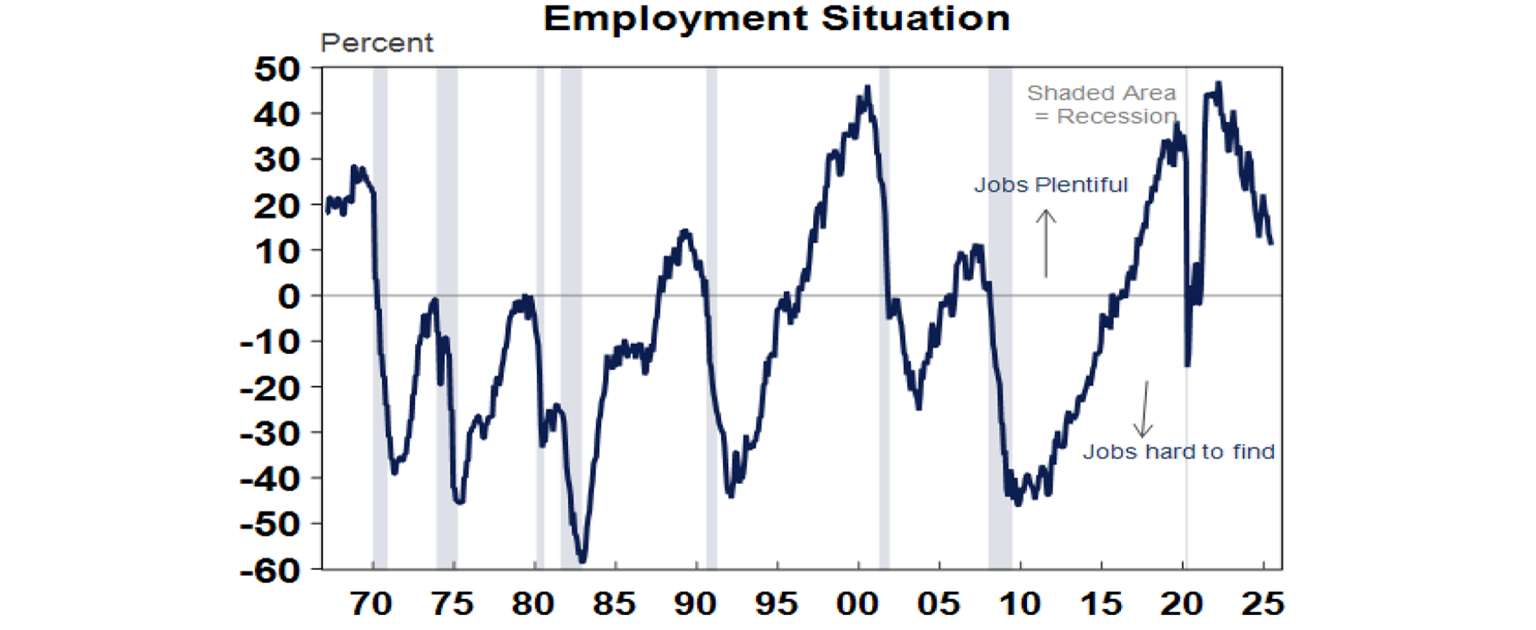

Consumers’ perceptions of whether jobs are plentiful versus hard to find deteriorated further suggesting the labour market while strong is continuing to slow. This is consistent with rising continuing jobless claims even though initial claims are still low, ie companies have slowed hiring but not started firing.

Meanwhile, core durable goods orders rose 1.7%mom in May but this followed a 1.4% fall , home price data showed a further softening and home sales remain very weak.

The Fed remains in wait and see mode. While Fed Governors Waller and Bowman suggested that they could support rate cuts as soon as July, Fed Chair Powell repeated that the Fed remains in wait and see mode given the uncertainty around the impact of tariffs on inflation and with unemployment still low.

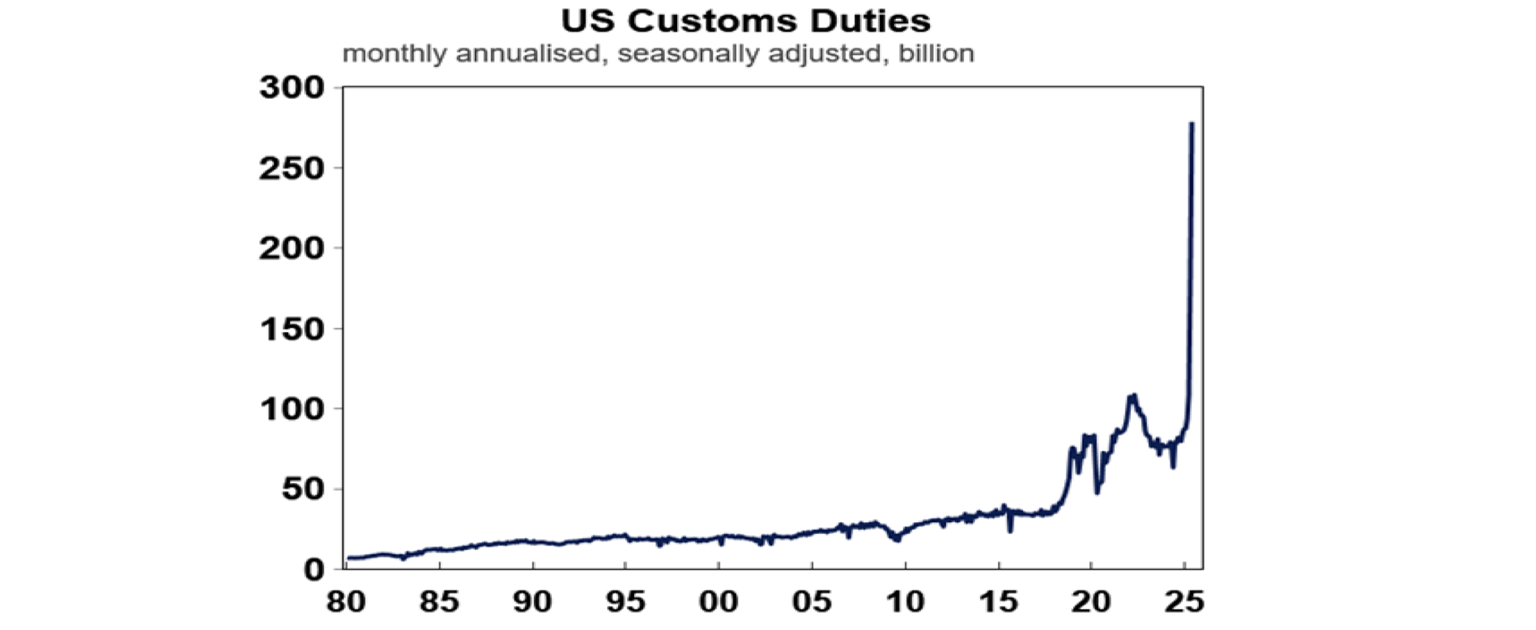

US tariff revenue is continuing to surge so someone is paying the tariffs. It’s a likely a mix of home country suppliers and importers with higher input prices in surveys pointing to some flow on to inflation and hit to margins. But there could also be a mix of higher prices for tariffed goods and lower prices for those items without tariffs. As Powell acknowledged if inflation pressures remain contained rate cuts may come “sooner rather than later”. This along with the combination of soft data and lower oil prices saw the money market factor in nearly 3 Fed rate cuts this year.

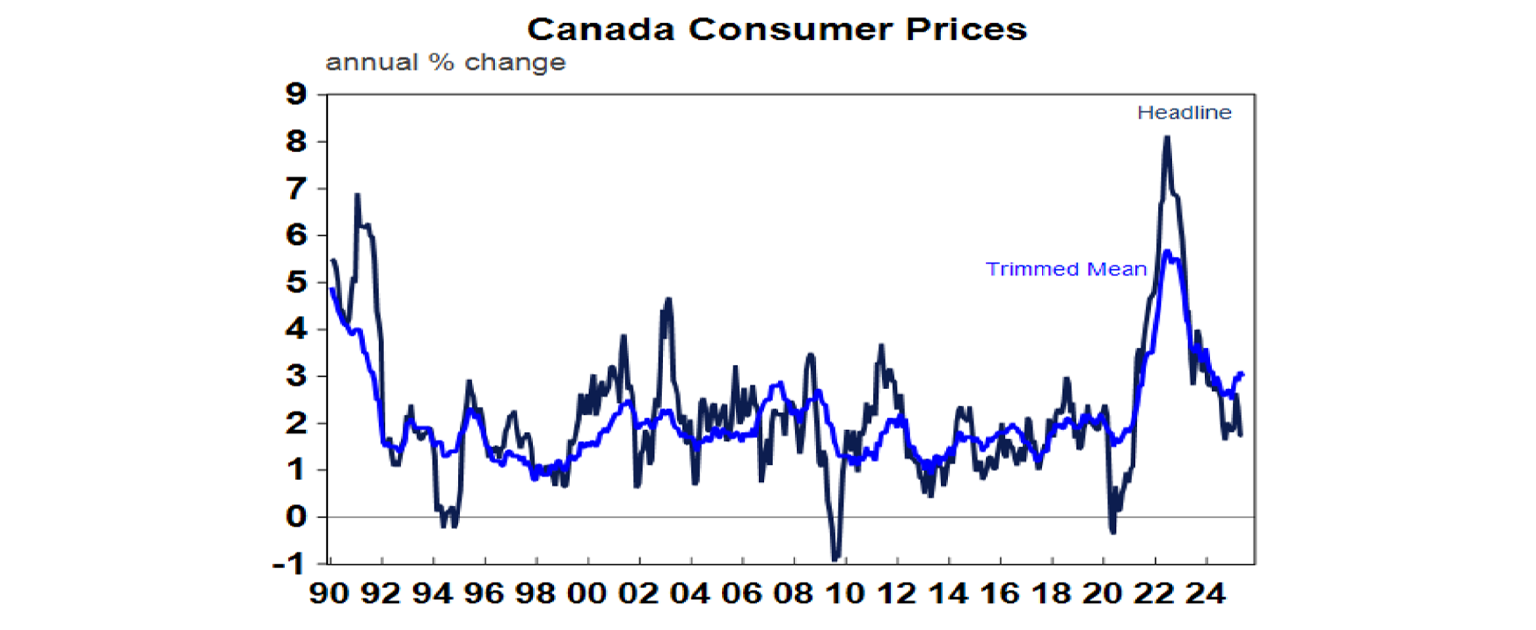

Canadian inflation for June was unchanged at 1.7%yoy with core underlying measures at 3%yoy. This adds to the likelihood that the Bank of Canada will leave rates on hold at 2.75% in July.

NATO countries commitment to raise defence spending from 2% of GDP to 5% over time will mean a big fiscal stimulus. Of the 5%, 1.5% is defence related infrastructure spending so could be fudged and partly privately financed but 3.5% is actual defence spending and will be a big increase. Germany was already heading there and it will be largely debt financed. Other countries will likely lag but it will be a big fiscal stimulus which could boost growth in the short term and take some pressure of the ECB.

Japanese May retail sales fell slightly & unemployment was flat at 2.5%, with Tokyo June inflation showing a fall in core inflation to 1.8%yoy, which is consistent with the BoJ staying on hold.

Australian economic events and implications

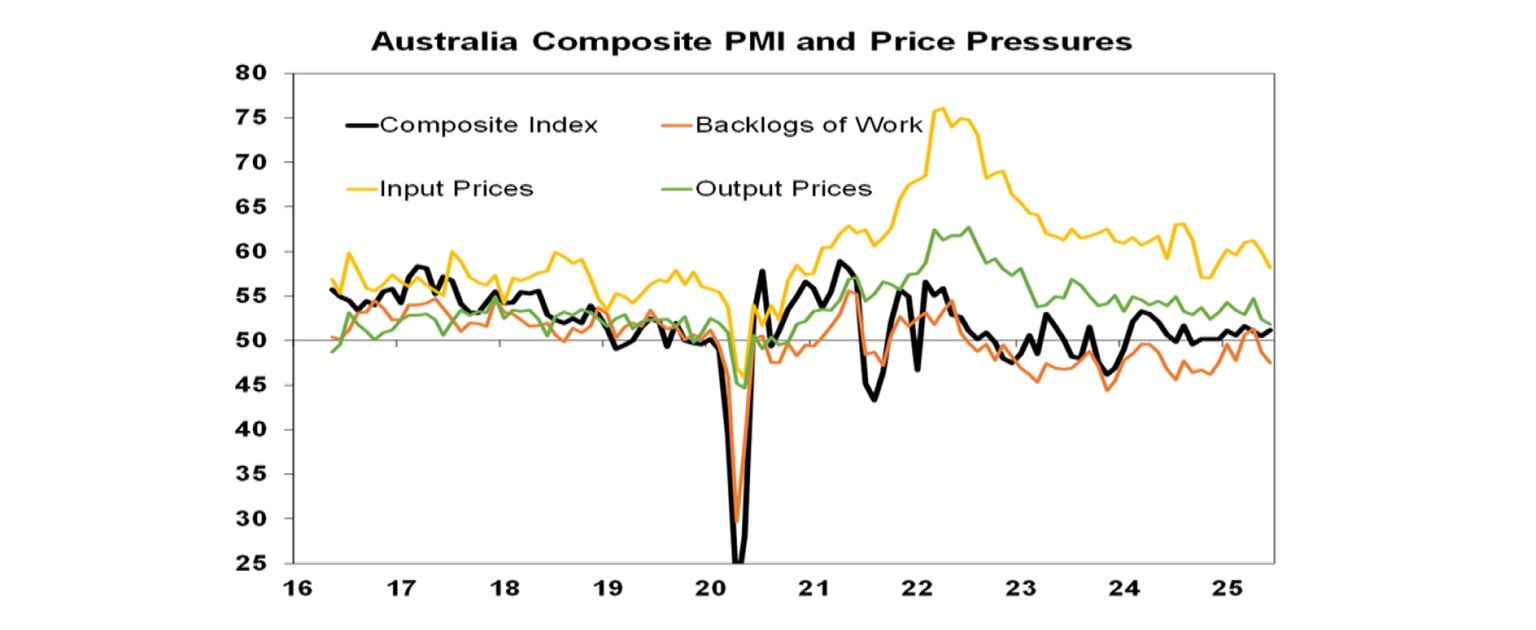

Australian business conditions PMIs for June improved slightly, with stronger services, but has been in the same range for around 18 months. The good news is that input and output price pressures fell suggesting a further easing in inflationary pressures.

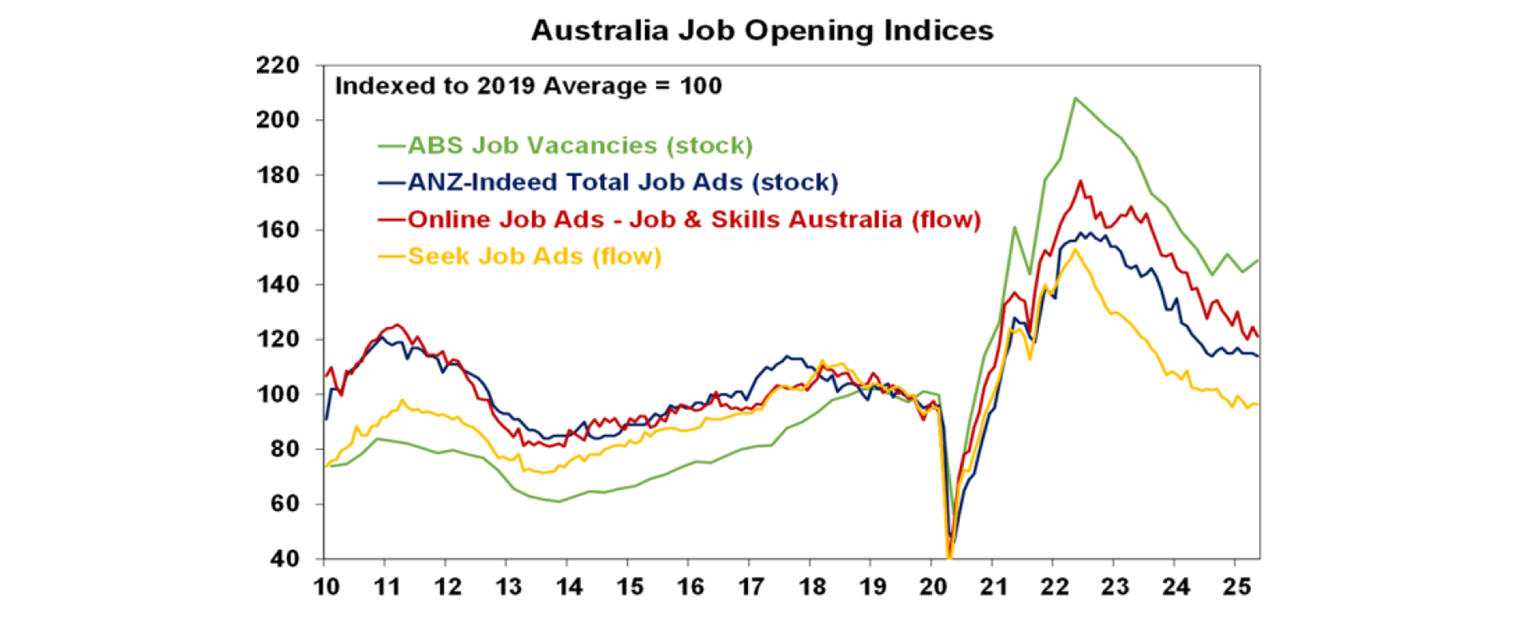

Job vacancies rose over the 3 months to May according to the ABS and remain high historically confirming that the labour market remains strong. However, other job opening data is not as strong. See the next chart. And while the strong labour market on its own is an argument against RBA rate cuts it hasn’t prevented a slowdown in wages growth and inflation, and economic growth is sluggish so we don’t see it preventing the RBA from cutting rates in July and beyond. What’s more I am hearing lots of anecdotes of a softening in the labour market.

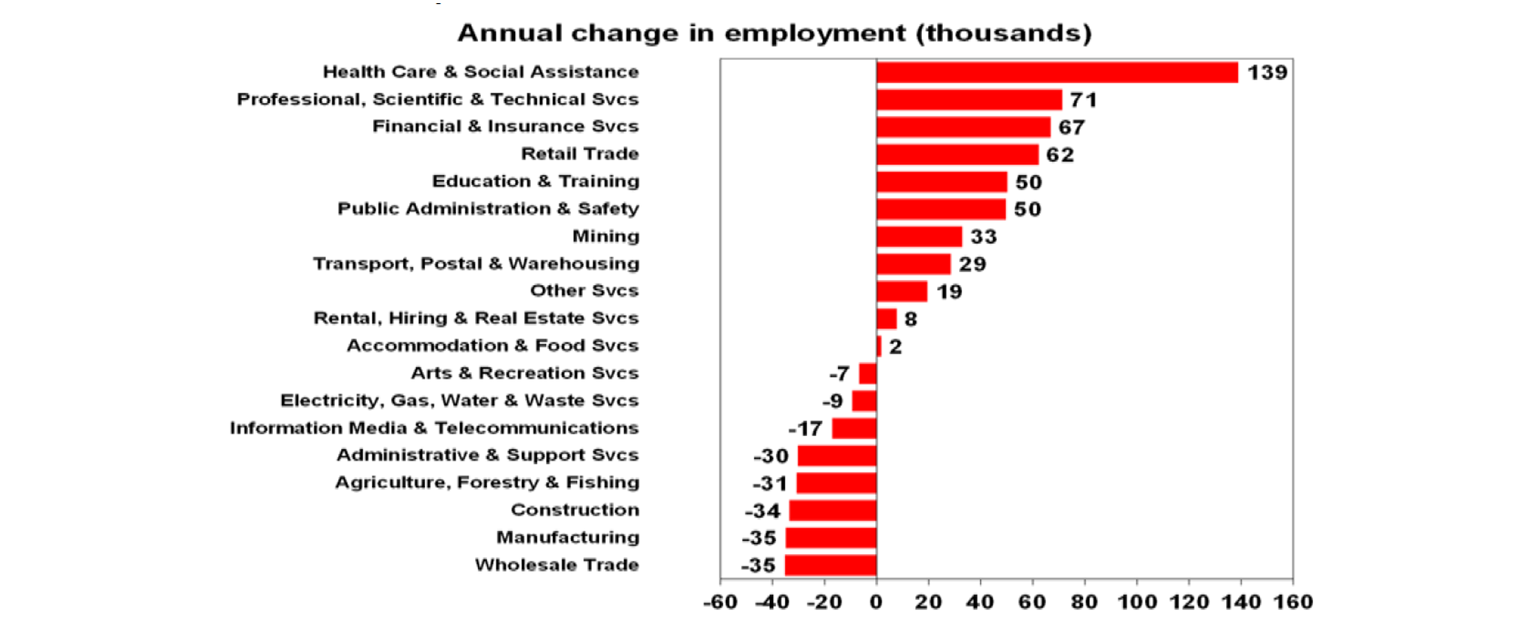

The main industries for jobs growth over the year to May were health care, professional services and financial services.

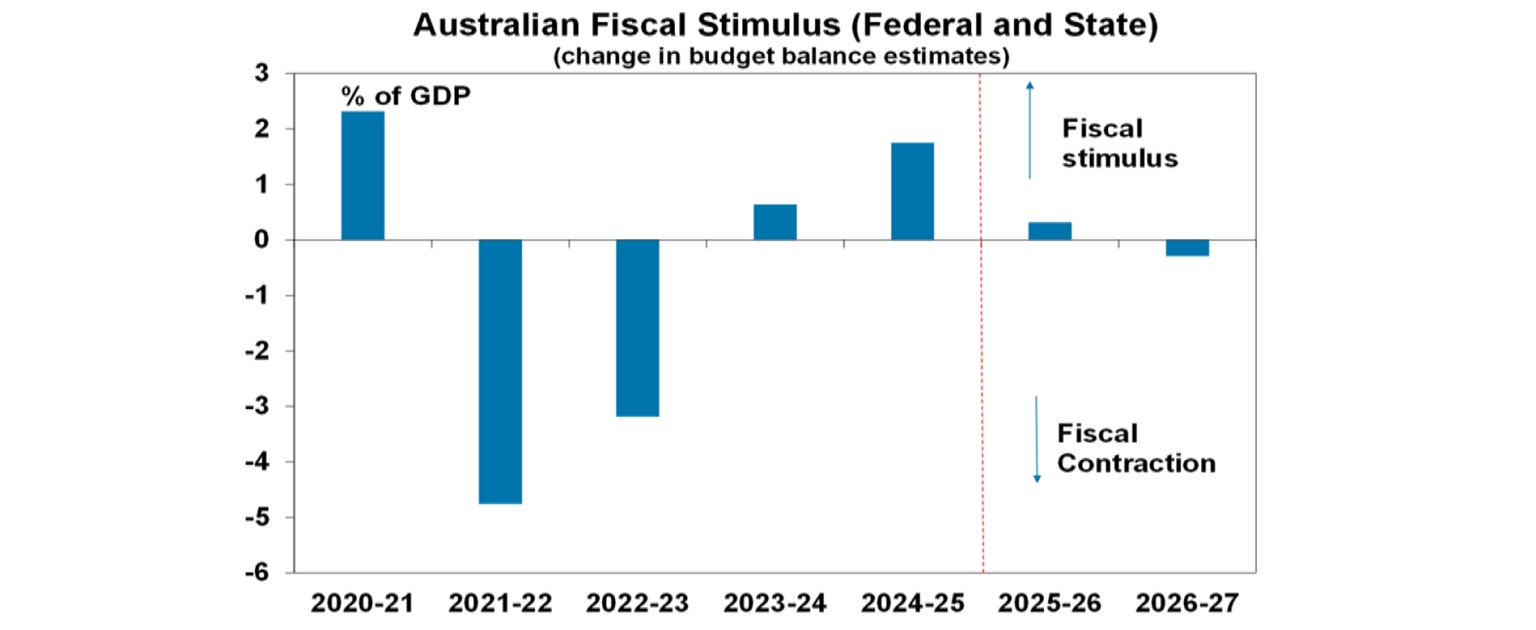

State budget projections point to an ongoing rise in public debt with a high risk of ratings downgrades in some states. State budgets point to a reduction in deficits from the next financial year. The concern though is that budget deficits will still be large (except in WA) and so public debt will still be rising for the next few years, and what’s more the projected deficit reductions look vulnerable as spending growth is at high risk of coming in stronger than projected and revenue growth could disappoint in some states. This leaves several states at risk of ratings downgrades. From a macroeconomic perspective, Federal and state budget deficit projections shown an easing in fiscal stimulus in the next financial year and a shift to a slight fiscal drag in 2026-27. But overall fiscal policy implies a close to neutral impact on the economy for the next couple of years, which means the private sector will need to play a bigger role in growing the economy which in turn will be dependent on more RBA rate cuts.

What to watch over the week ahead?

In the US the focus will be on jobs data for June (Thursday) which is likely to show a further slowing in employment growth to around 120,000, with unemployment rising to 4.3% and wages growth remaining at 3.9%yoy. Employment growth is set to slow if for no other reason than immigration is falling. In other data, expect the ISM manufacturing and services conditions indexes for June (due Tuesday and Thursday) to remain softish and job openings (Tuesday) to fall.

Eurozone inflation data for June (Tuesday) is expected to show core inflation remaining around 2.3%yoy with May unemployment (Wednesday) remaining at 6.2%.

Japanese data for industrial production will be released on Monday and the Tankan business survey will be released Tuesday.

Chinese PMIs for June (Monday) are likely to remain soft.

In Australia, expect May housing credit growth (Monday) to remain moderate, June Cotality home price data (Tuesday) to show a slight rise in growth to 0.6%mom, building approvals to bounce 10%mom after two months of falls and retail sales to rise 0.7%mom (both Wednesday), the trade surplus (Thursday) to fall to $4.7bn and household spending (Friday) to rise 0.5% mom.

Outlook for investment markets

Share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We now see home prices rising around 5 or 6% this year given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.