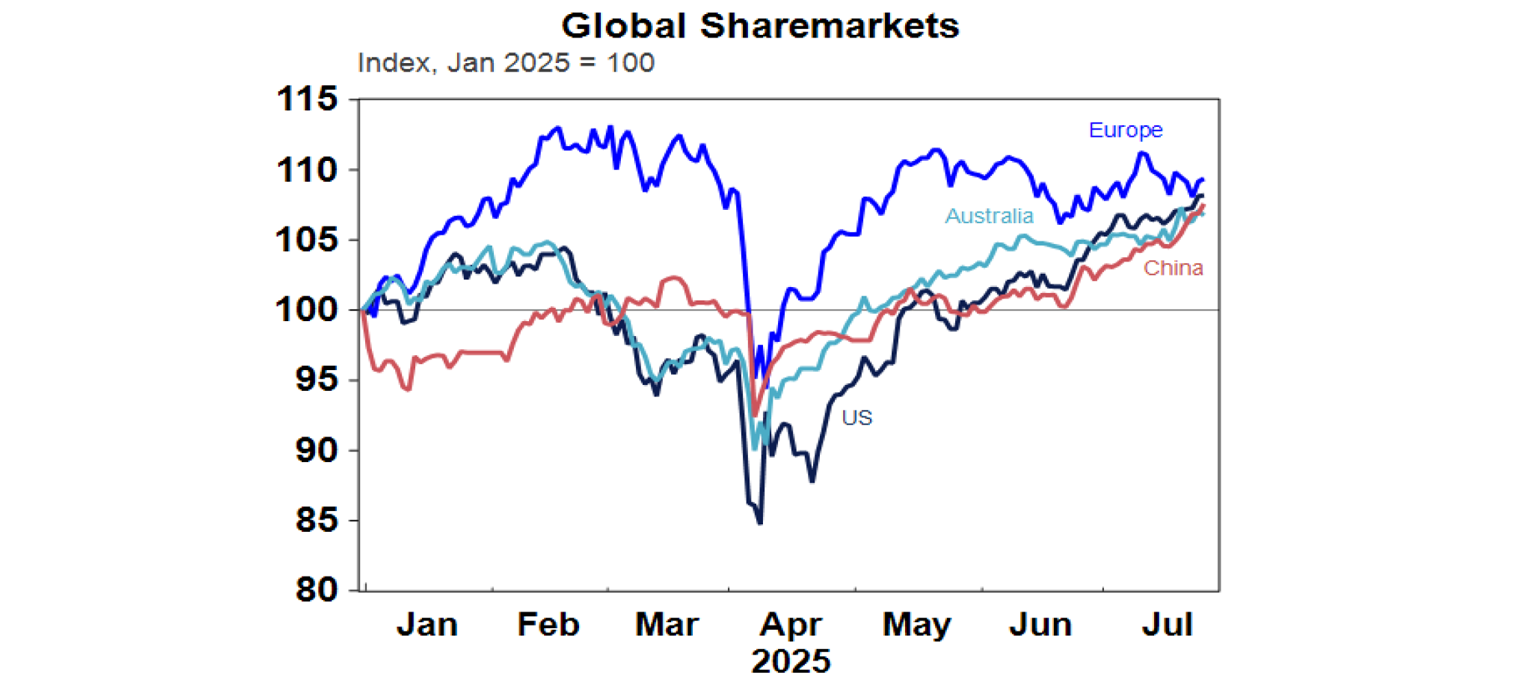

Global share markets pushed higher again over the last week with US shares up 1.5% helped by a trade deal with Japan and good earnings results. Japanese shares rose 4.1% for the week to near record highs helped by the trade deal. Eurozone shares rose 0.3% and Chinese shares rose 1.7%. Despite the positive US lead, Australian shares fell 1% for the week reflecting profit taking after a surge higher the previous week. Resources and health stocks rose but this was more than offset by falls in consumer and financial shares, with CBA down 9.7% from its recent record high after it nearly doubled in price over two years. Bond yields were little changed – down slightly in the US, but up in Germany, Japan and Australia. Oil and gold prices fell but copper and iron ore prices rose. The $A rose as the $US came under renewed downwards pressure. Bitcoin was little changed.

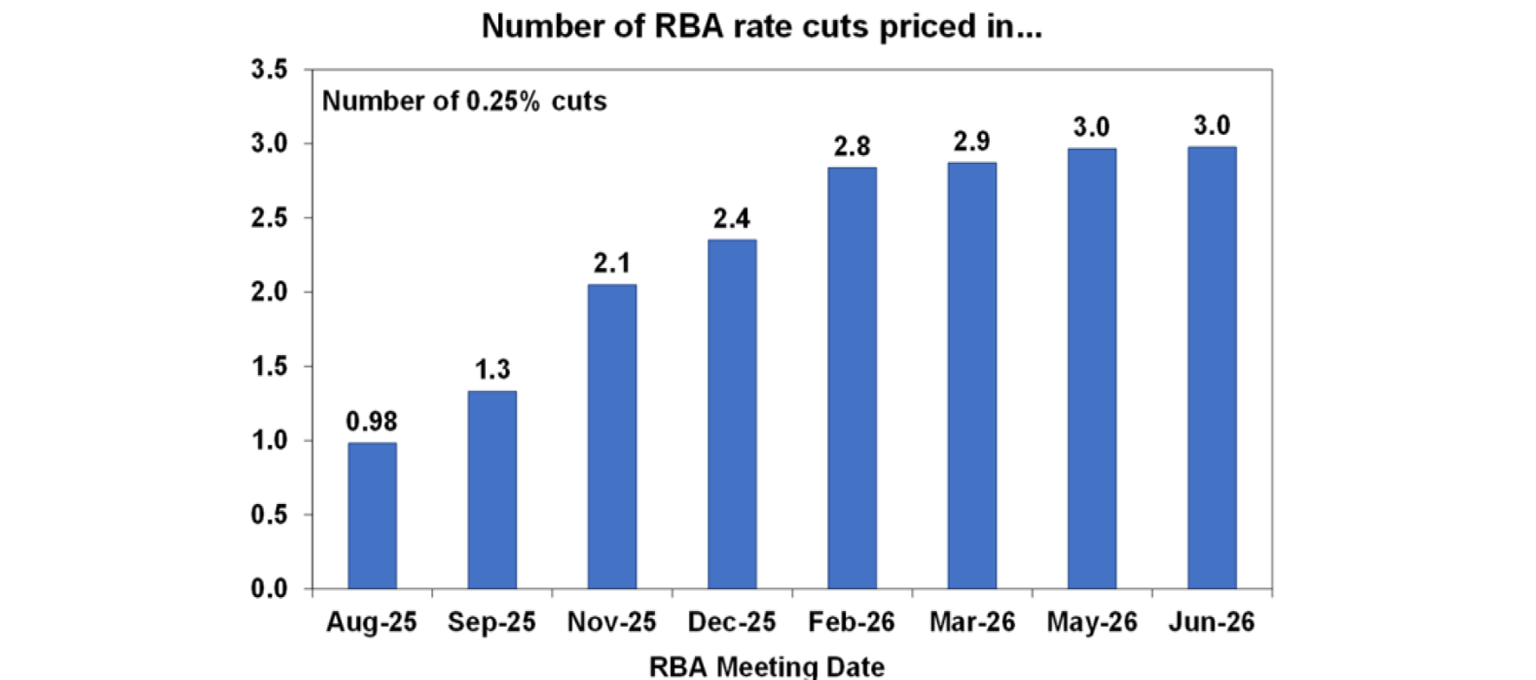

In Australia, the message from the RBA remains of a “cautious and gradual” approach to easing monetary policy – with Governor Bullock RBA noting that the risk of a severe trade war appears to have diminished, monthly CPI data suggests that June quarter trimmed mean inflation may not fall as much as forecast in May and that monthly unemployment data “pop up and down” and so the June rise in unemployment should not be over interpreted. Our base case remains for 0.25% rate cuts in August, November, February and May. June quarter inflation data on Wednesday will be key, and we expect the all-important trimmed mean to come out in line with RBA forecasts for a 2.6%yoy rise. However, there is some upside risk to this, so in terms of sensitivity around what it will mean for the August RBA meeting, we would regard a 2.8%yoy rise in trimmed mean inflation or less as consistent with a rate cut, but 2.9%yoy or more would mean a high risk of the RBA remaining on hold again. See the “What to watch over the week ahead” section below for more details. The money market sees a 98% chance of an August rate cut, which is probably a bit too high – we would put it at around 80%.

A full monthly Australian CPI is on the way – but it’s unlikely to make a difference to interest rate setting, at least for a while. The ABS confirmed it will have a full coverage monthly CPI starting with the month of October to be released in November. This will replace the Monthly CPI Indicator which only covers about two thirds of items each month and as such should in theory remove the RBA’s inclination to wait for the quarterly CPI before adjusting monetary policy. But in reality, it’s unlikely to make any difference at least initially if the RBA is still wanting to be “cautious and gradual” and with Governor Bullock indicating it may take time to gain comfort with the new monthly CPI. Even then it may not make much difference if the monthly CPI is volatile which may cause the RBA to wait a few months to confirm any trend. Of course, if it feels its behind where it needs to be the RBA will adjust rapidly anyway as it did with hikes back in 2022-23. And the RBA is now meeting less than it used too which may slow any required adjustment in interest rates. Our assessment has been that there is no evidence that the absence of a monthly CPI has been hampering monetary policy in Australia relative to other countries and that the ABS could have spent the money to create a monthly CPI more usefully elsewhere. It’s a classic case of where having more (data) is not necessarily better than less!

Some of the reforms to the RBA since its 2023 Review appear to be making its communications less effective. After the Review was released, there was some concern the recommendations around the Board could lead to a loss of RBA authority and potential confusion around its intensions. Unfortunately, the surprise around the RBA’s decision to leave rates on hold this month suggests that this may be happening. Prior to the new RBA Board structure, the RBA more regularly communicated its view to the markets and would push back against expectations it thought were wide off the mark. A concerning aspect of the new post Review situation evident after this month’s rate decision is that the RBA appears to think it can’t communicate to markets to adjust a perceived mispricing of expectations for rate movements ahead of RBA meetings because it’s now a decision for the Board and not just the RBA. Economists and market traders complaining after they get an RBA call wrong (like we did this month) can be dismissed as just a case of sour grapes. But this is concerning because market pricing for rate moves can have a big impact on community expectations which if dashed could lead to confusion about the RBA’s intentions and arguably more importantly slow the transmission of monetary policy through the economy. This confusion may be accentuated when the independent Board members start doing speeches and public appearances.

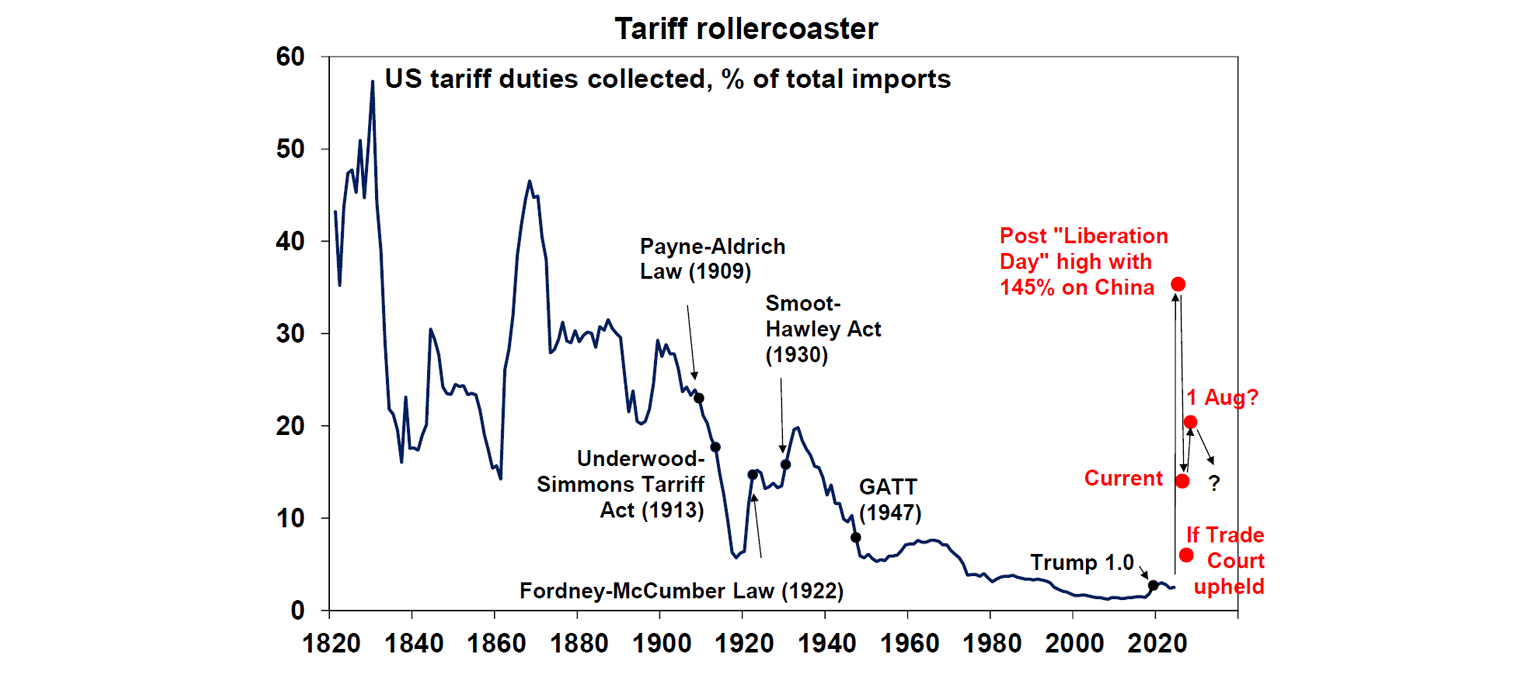

US trade deals are reducing tariff uncertainty but still point to high tariffs. The past week has seen more US trade deals announced with the Philippines and Japan bringing the total to six if the truce with China is included. And reports indicate that a deal with the EU may be close (Trump says its 50/50). The good news is that the deals are removing the level of uncertainty around the tariffs and they are less bad than flagged on Liberation Day and this is enabling markets to rally. However:

While Japan has been able to get tariffs on its autos down from 25% to 15% (and the EU and Korea may achieve the same) Trump is now implying a baseline tariff of 15% for countries that haven’t received letters or deals up from 10%;

This implies a high risk that without a deal the general tariff on Australian exports might rise from 10% to 15%, although the removal of the ban on US beef may head that off;

More sectoral tariffs are still to be announced;

The deals for Vietnam, Indonesia and Philippines imply an average tariff for southeast Asian nations of around 19-20%;

The lack of details in the trade deals which are so far nothing more than grand announcements and the high risk that the much-hyped investments in the US don’t materialise (like $500bn from Japan) and their skew in favour of the US suggests that the issues could flare up again at some point;

The deals announced to date still imply a rise in average US import tariffs to 20% on 1st August from 15% at present;

This is way up from 2-3% at the start of the year resulting in higher prices (taxes) for US consumers and businesses and a hit to non-US exporters posing risks to global growth.

So, while the country deals are removing some uncertainty, US tariffs still pose a significant threat to the economic outlook. And there is a high risk that some key countries or regions like the EU may not reach a trade deal by the 1st August deadline with the EU reportedly preparing retaliation in case. Ultimately, a combination of more trade deals and Trump being forced to back down in the face of market volatility and or the economic impact are likely to see the tariffs settle back down around current levels, but this may take a while to become apparent.

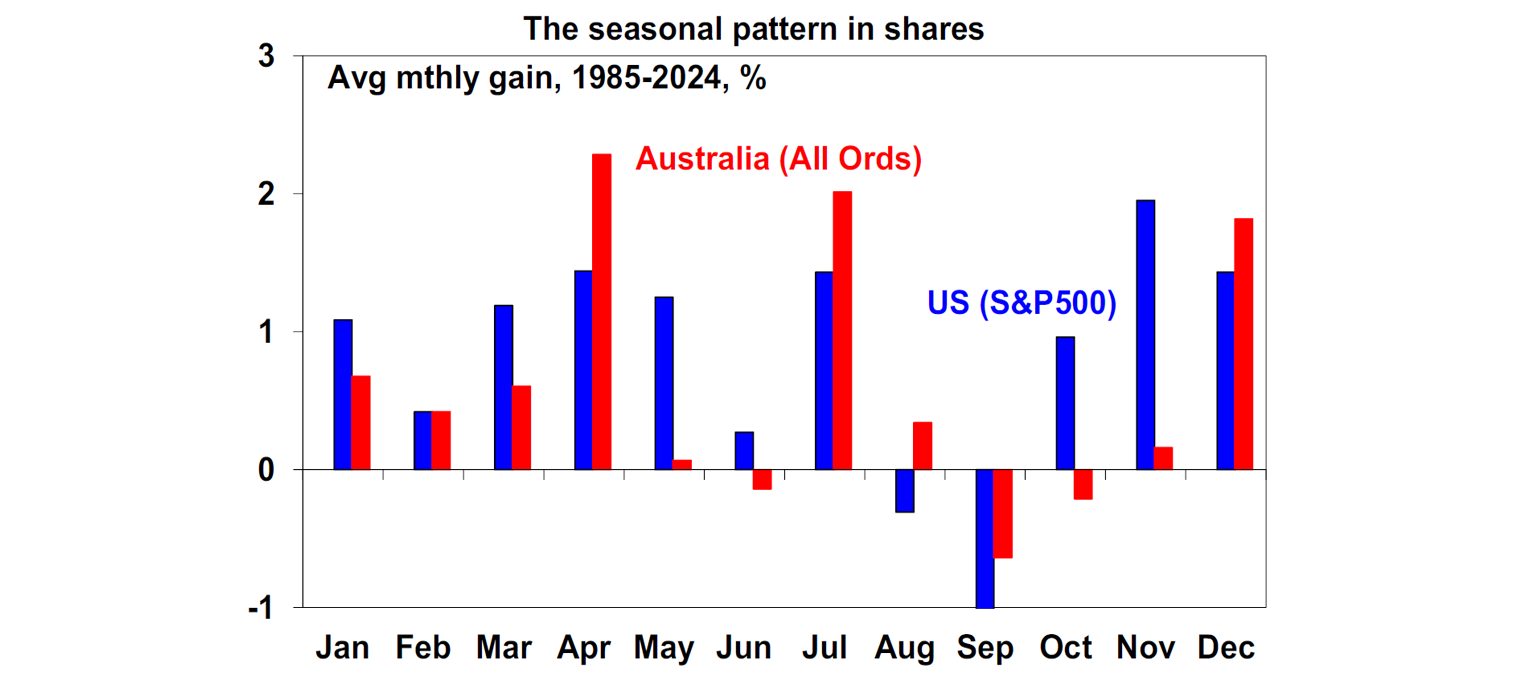

Shares markets are on track for a solid July with US shares up 2.6% for the month to date, global shares up 2.5% and Australian shares up 1.4%. With lots of good news already factored in and valuations stretched markets are a bit vulnerable to a correction over the seasonally weaker months of August and September with a long worry list around US tariffs, a steadily increasing threat to Fed independence, Trump potentially looking for distractions if the Epstein issues continues to intensify, the high risk of a US Government shutdown in September and rising bond yields in Japan partly associated with potential political instability running the risk of another unwind to the Yen carry trade. Beyond the messy near-term outlook though, shares should benefit on a 6–12-month view as Trump backs down from extreme tariff threats again and continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut.

Trump’s increasing attacks on the Fed risk undermining its credibility which could push up long term bond yields. Trump wants lower rates and like many authoritarians wants the central bank to do what he wants. The Supreme Court advised that the President does not have the power to sack Fed Chair Powell (whose term as Chair runs out to May next year) without cause (like fraudulent behaviour). So he and his team are looking for reasons – like the Fed’s building renovations (where costs have blown out like with most building projects lately including the RBA’s renovations) or an overreach in its non-monetary operations – to sack Powell. This has all arisen because Powell and the Fed has held interest rates at 4.25-4.5% this year because it’s fearful that Trump’s tariffs could boost prices and boost inflation expectations, whereas were it not for the tariffs it would have already cut rates. The problem is that if Trump does anything to sack Powell or force his resignation so he could instal a more dovish Chair it would be seen as undermining the Fed’s independence in the setting of monetary policy and hence faith in its commitment to keep inflation at the 2% target over time. If this were to occur it would likely push up long term bond yields as investors would require a higher premium to compensate for inflation risk to buy them. So, while a Trump driven intervention at the Fed could lead to lower short-term interest rates, longer term bond yields would likely rise. Which in turn would mean that the US Government could actually end up paying higher interest rates on its debt. Higher bond yields in such a scenario would likely also threaten share markets and the US dollar would likely fall.

Major global economic events and implications

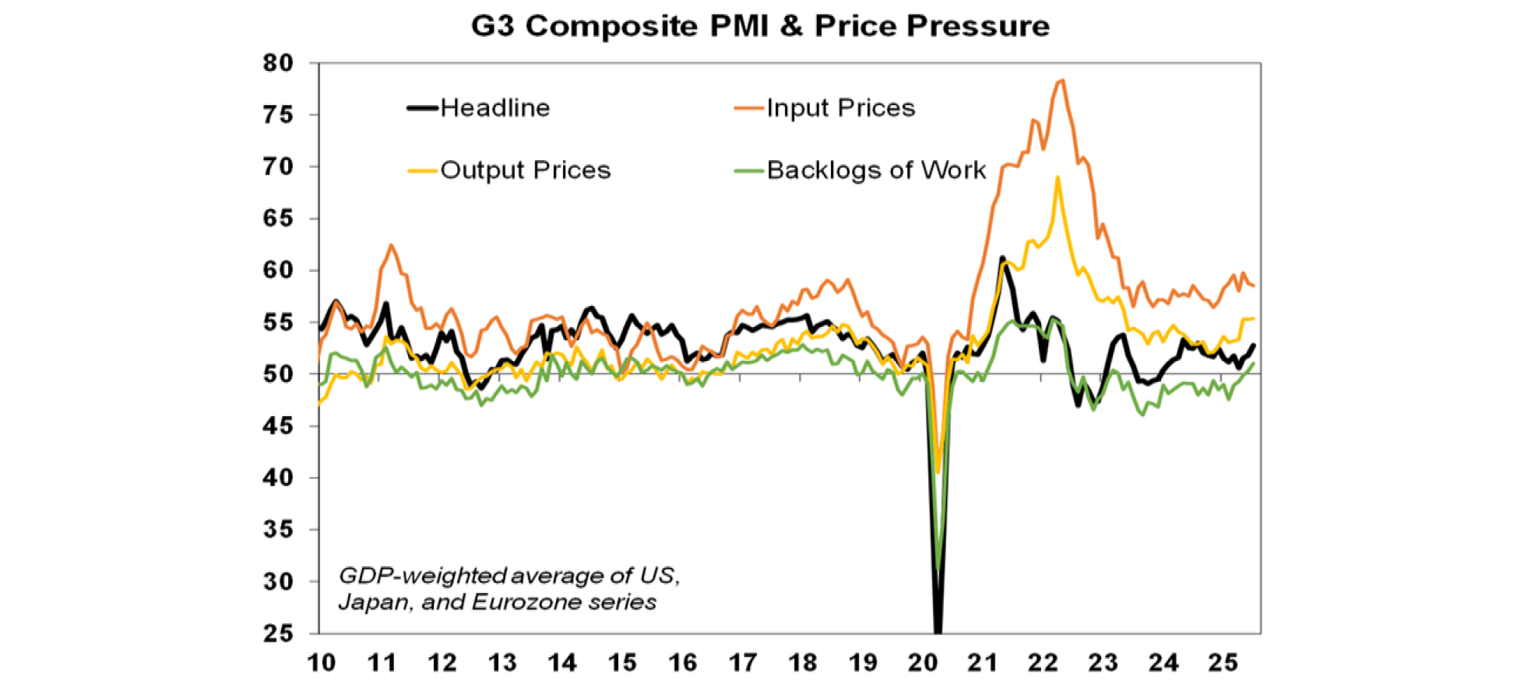

Aggregate business conditions PMIs in developed countries improved on average in July driven by the US and Europe with services conditions up but manufacturing down. The bad news is that price pressures remain elevated due to high US readings.

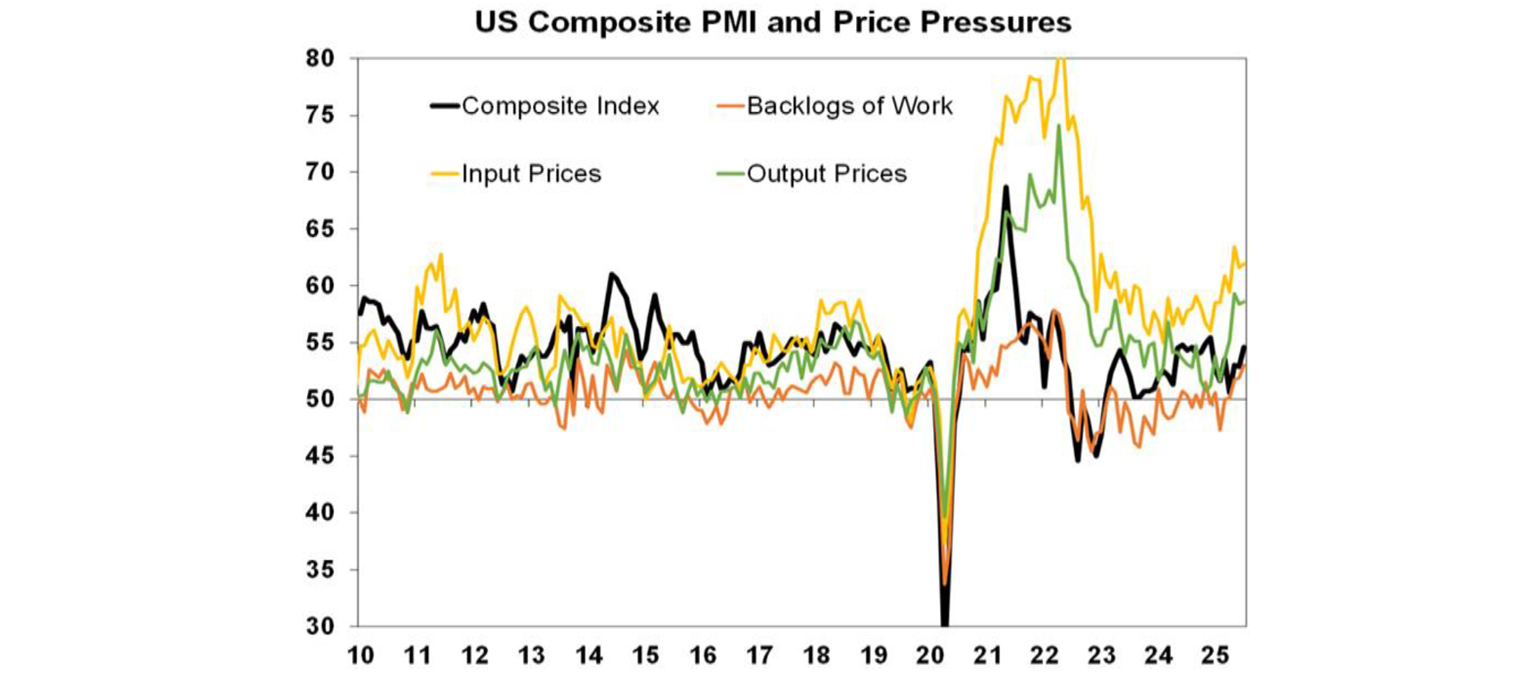

The US composite PMI for July rose with manufacturing down sharply but services up. Input and output price pressures remain elevated reflecting the impact of tariffs underscoring Fed caution.

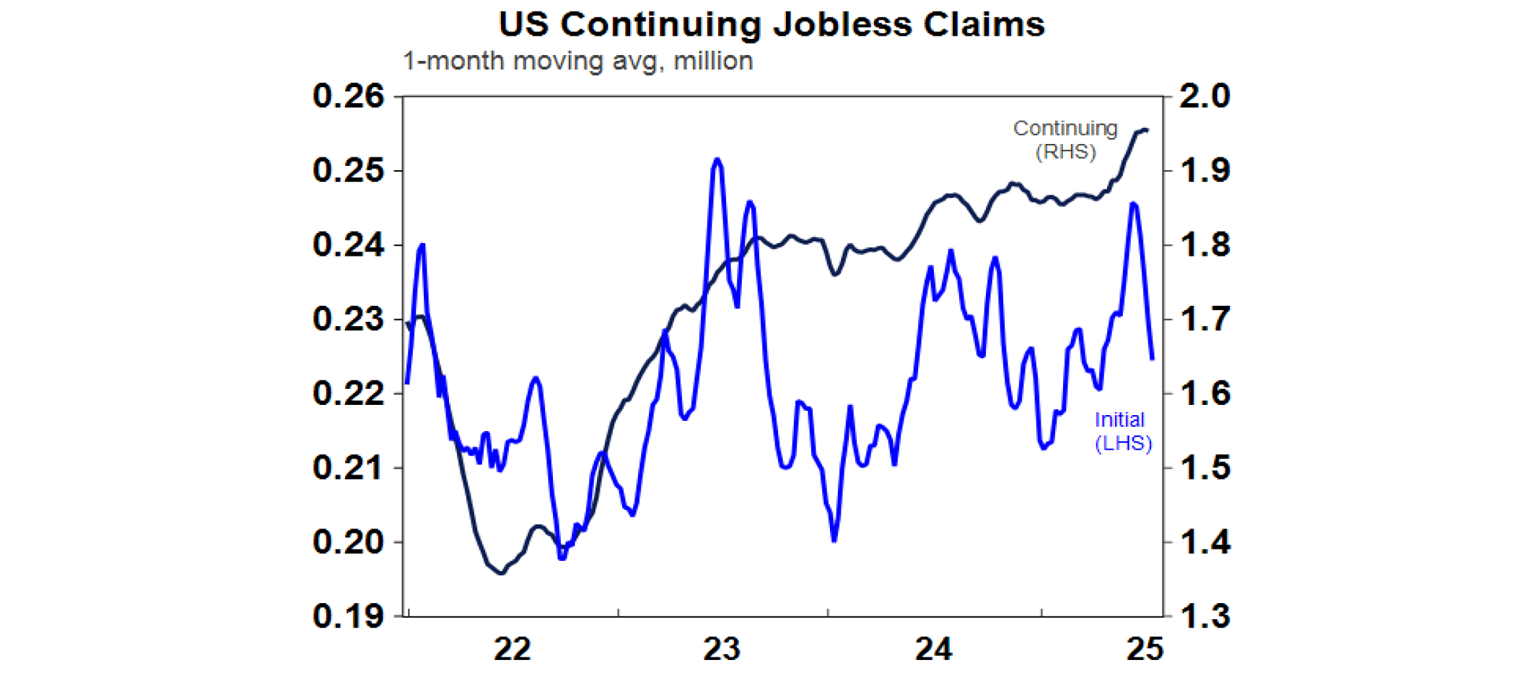

In other US data home sales remained depressed on the back of still high mortgage rates, durable goods orders fell back after a spike in May, initial jobless claims remained low but continuing claims continued to trend higher.

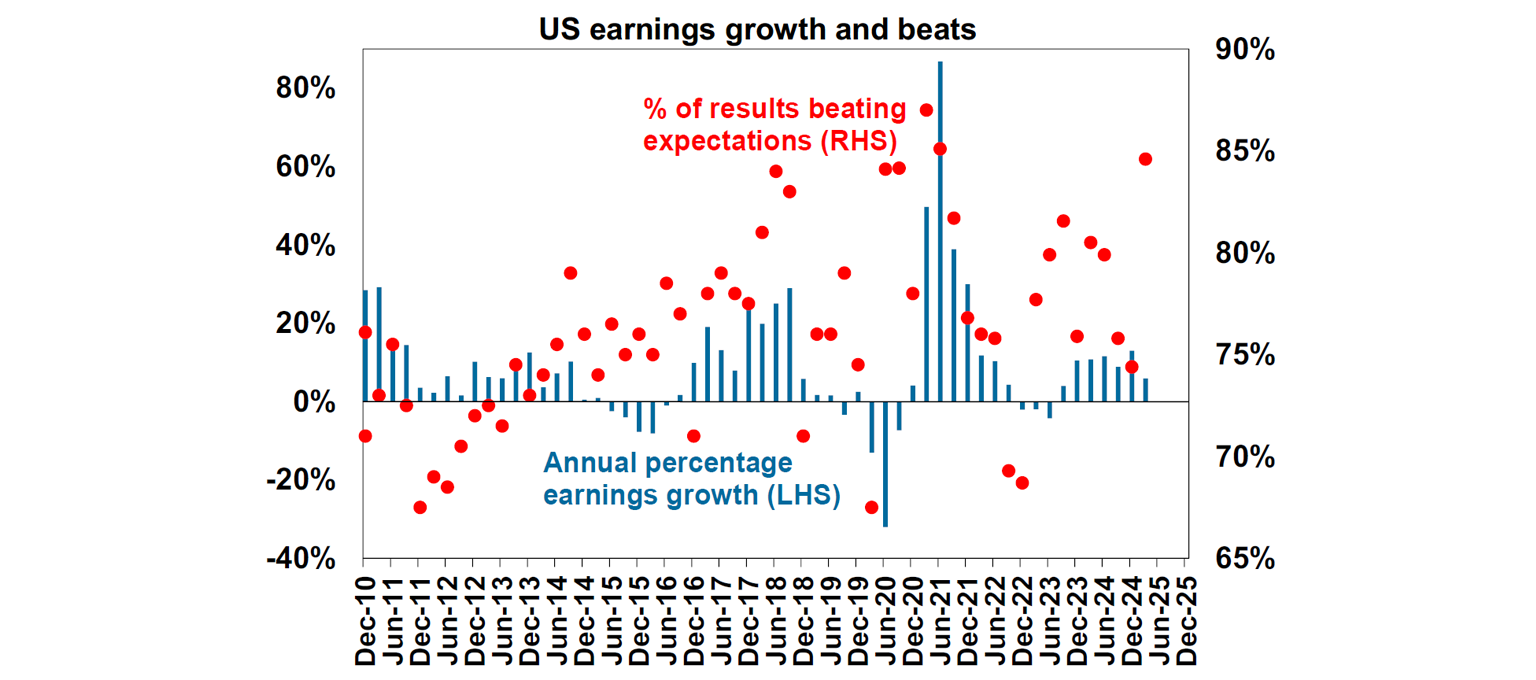

So far so good for US June quarter earnings results. 34% of S&P 500 companies have so far reported results with 84% beating expectations which is above the norm of 76%. Consensus earnings expectations for the quarter have risen to 5.9%yoy up from 4.1% four weeks ago with strong profit growth in tech and financials but most other sectors seeing profits down. Past earnings surprises suggest an outcome closer to 8%yoy but there is more than normal uncertainty given the impact of tariffs on margins.

The ECB left rates on hold (at 2% for its deposit rate) as widely expected but with President Lagarde providing neutral wait and see guidance regarding the outlook for rates, saying policy is well position with inflation at 2% and some optimism regarding growth. Another rate cut is still likely with tariffs likely to be a drag (tariffs will either be 15% with a deal or higher without), but this may not come till October.

Japanese bond yields rose further in the last week as the Government lost its majority in upper house elections leading to concerns of political instability and a loss of fiscal discipline at a time when investors are already nervous about high public debt levels. Japanese PM Ishiba has indicated he will stay but passing legislation will be hard and he may still be forced to step down. While the right wing Sanseito (with a tedious Japanese first agenda) was a winner so was the centre left DPP so its not really a sign that Japan is lurching to the populist right!

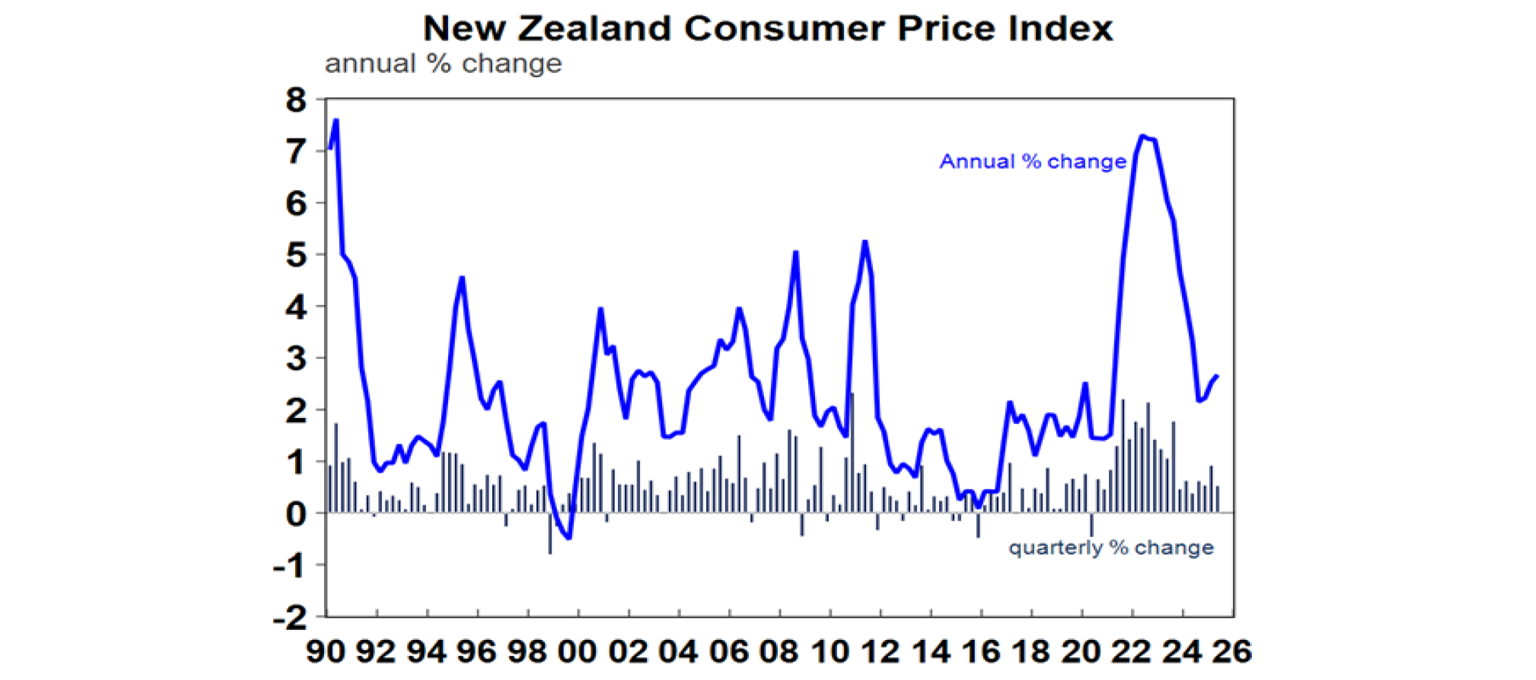

New Zealand saw annual inflation edge up in the June quarter but by less than expected with quarterly inflation slowing to 0.5%qoq for headline and trimmed mean leaving the RBNZ on track to cut rates again next month.

Australian economic events and implications

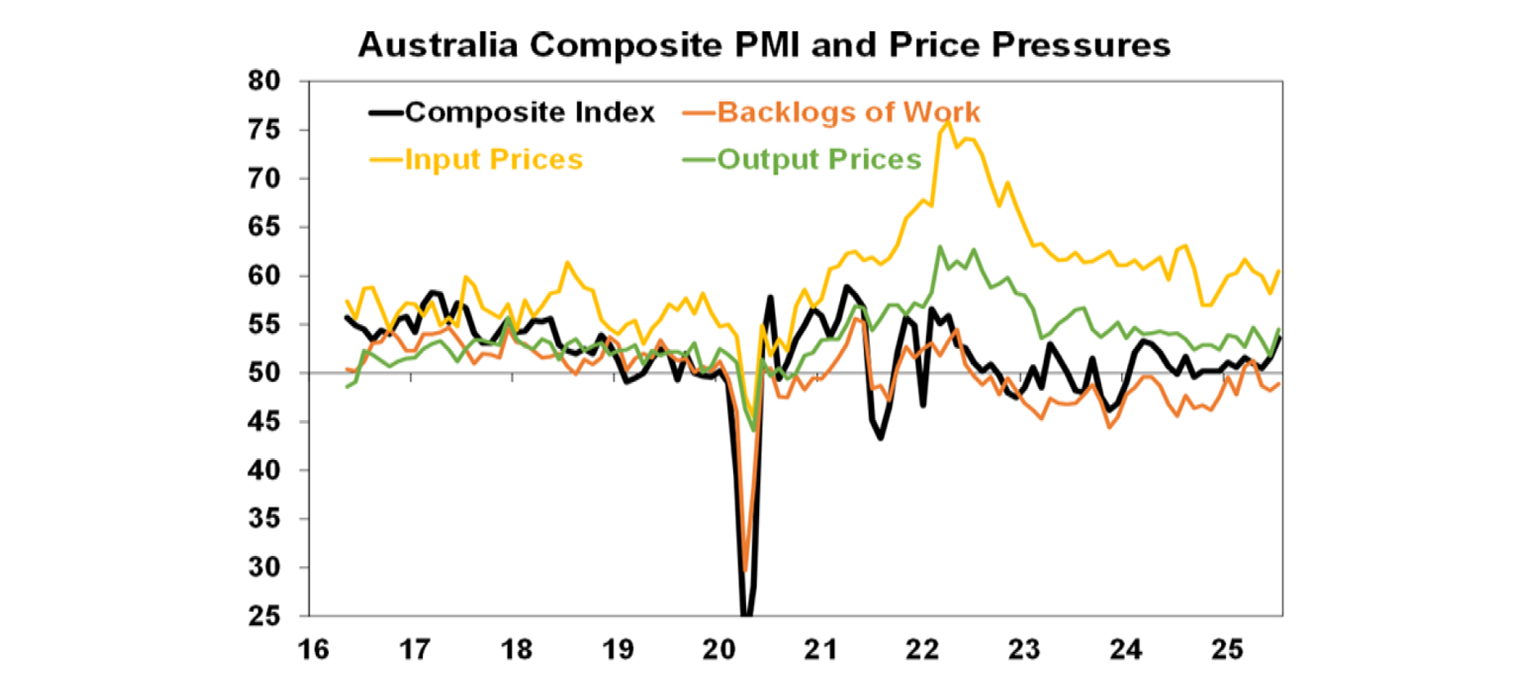

Australian business conditions PMIs for July improved again with gains in both manufacturing and services and a rise in new orders. Input and output prices rose but the latter is in the same low range it’s been in for two years.

What to watch over the week ahead?

Unless many more trade deals are announced uncertainty may be high ahead of the 1st August US tariff deadline.

In the US expect the Fed (Wednesday) to remain in “wait and learn” mode regarding the impact of the tariffs on inflation but indicate that its still expecting to cut interest rates this year given ongoing uncertainty around the impact of the tariffs. June quarter GDP growth (Wednesday) is expected to rebound to 2.5% annualised growth after -0.5% in the March quarter as trade bounces back after the hit from tariff front running and consumer spending growth remains moderate. June quarter employment cost data (Thursday) is expected to show a further slowing to 3.5%yoy. July jobs data (Friday) is expected to show a 100,000 gain in payrolls, a rise in unemployment to 4.2% and wages growth rising to 3.8%%yoy. In other data expect a fall in job openings, a further slowing in home price growth and a slight rise in consumer confidence (all due Tuesday), the July manufacturing ISM to show a slight improvement to a still soft 49.5% but with price pressures remaining high and core private final consumption inflation for June to show a rise to 2.8%yoy (both due Friday). June quarter profit results will continue to flow with 166 S&P 500 companies due to report.

The Bank of Canada (Wednesday) is expected to leave rates on hold at 2.75% reflecting recent higher than expected inflation data but indicate that it retains a mild easing bias.

Eurozone GDP growth for the June quarter (Wednesday) is expected to slow to 0.3%qoq after a boost from strong exports to the US in the March quarter is reversed, June unemployment (Thursday) is expected to remain at 6.3% and July core CPI inflation (Friday) is expected to hold at around 2.3%yoy.

The Bank of Japan (Thursday) is expected to leave rates on hold at 0.5% and indicate that it retains a tightening bias. With the trade deal reducing some uncertainty a hike in October is possible, but soft economic data means this is far from clear. Japanese data for industrial production and retail sales (Thursday) are expected to show modest trend growth and jobs data (Friday) is expected to show unemployment around 2.5%.

Chinese business conditions PMIs (Thursday) for July are expected to remain softish.

Australian June quarter CPI data is expected to show headline inflation of 0.9%qoq which will see the annual inflation rate fall to 2.3%yoy (from 2.4%) with the all-important trimmed mean (or underlying inflation) falling to 0.6%qoq or 2.6%yoy which would be in line with RBA forecasts and along with the soft jobs data for June should clear the way for another RBA rate cut at its August meeting. Expect solid increases in prices for clothing, health and travel with a modest rise in new dwelling costs offset by softness in transport and petrol prices, communication, education and insurance. However, as the RBA has noted some of the components in the recent Monthly CPI suggest upside risk to the trimmed mean inflation. In terms of sensitivity, we would regard a 2.8%yoy rise in trimmed mean inflation or less as consistent with an August rate cut as it will still be consistent with forecasts for inflation to head back to the mid-point of the RBA’s target, but 2.9%yoy or more would mean a high risk that the RBA will remain on hold again.

In terms of other Australian economic data, expect a 0.5%mom rise in June retail sales, a 0.2%qoq rise in June quarter real retail sales, a 2%mom rise in June building approvals, credit data to show continued moderate growth in housing credit (all due Wednesday) and Cotality home price data to show another 0.6%mom gain in July.

The Australian June half profit reporting season will also start to get underway in the week ahead with a handful of companies reporting including RIO and Resmed. Consensus earnings expectations are for a 1.7% fall in earnings growth for 2024-25 which will mark the third year in a row of falling profits. Resources earnings are expected to be the main drag along with modest falls consumer sector profits but growth elsewhere. Key to watch will be outlook statements given the boost coming from lower rates but the threat posed by US tariffs. The danger is that consensus earnings expectations for a 5.3% rise in profits this financial year are pushed out again.

Outlook for investment markets

Share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth slows, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 5 or 6% this year.

Cash and bank deposits are expected to provide returns of around 3.75%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.