Sharemarkets managed to rally over the week despite mixed US earnings results, especially in tech, better news on trade tensions with Trump expected to meet Xi next week which helped to offset prior news that the US may restrict software exports to China, an increase in oil prices from fresh US sanctions on Russia lifting energy stocks and expectations for a rate cut from the US Fed next week with September CPI coming in lower than expected.

The US S&P500 was up by 1.9%, with large gains in tech, energy and industrials and declines in consumer staples and utilities. The ASX200 is up 0.3%, with large gains in energy and real estate but declines in consumer staples, healthcare and materials. The $A is still going sideways at $0.65USD. Japanese shares rose strongly on stimulus hopes from the new Prime Minister.

US bond yields have been trending down in recent weeks, reflecting the broader risk-off environment, including increased risk in defaults in the auto loan sector and concern about broader flow-on, the ongoing government shutdown, expectations of a rate cut next week and trade war risks with Trump’s hot and cold relationship with China. US 10-year bond yields reached a year low of 3.9% but bounced back to over 4% this week.

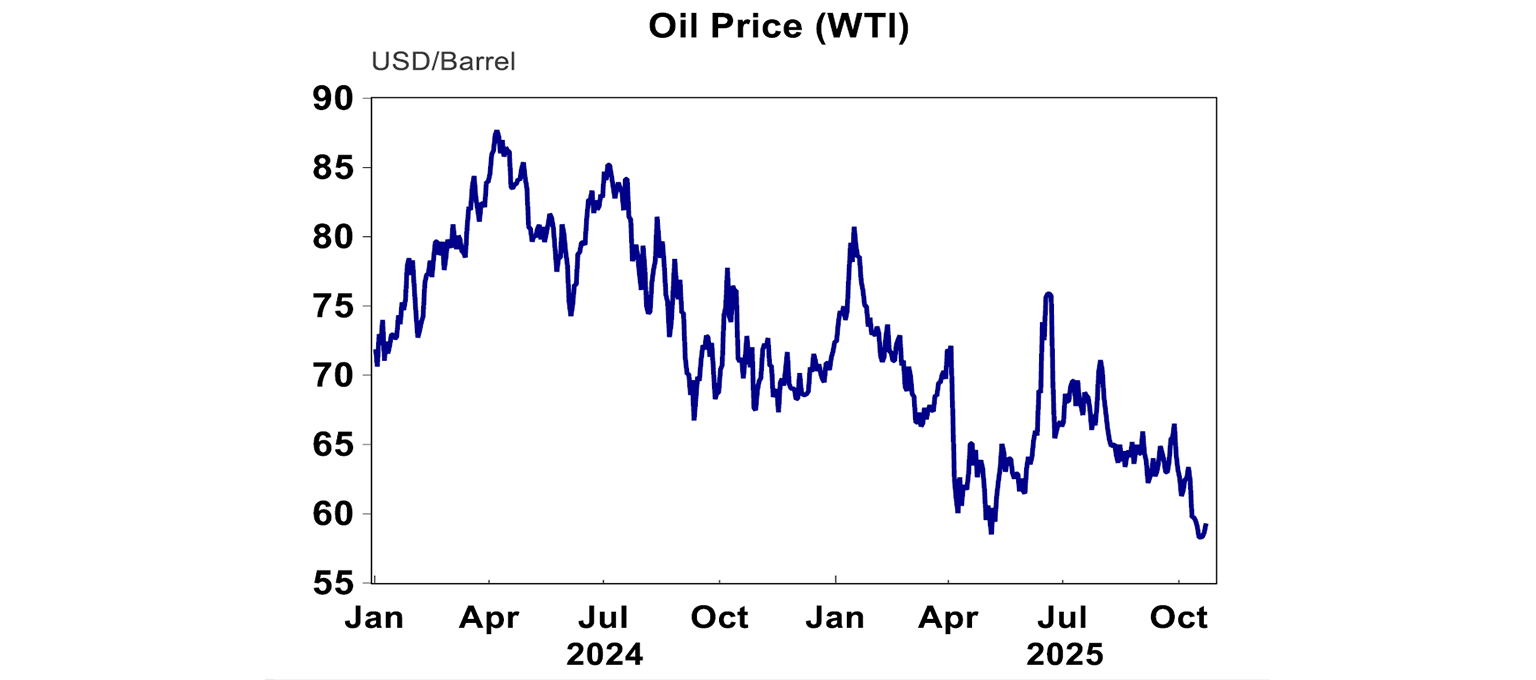

Oil prices rose to just under $62US/barrel after the US imposed sanctions on Russia’s largest oil producers, which may also hurt the supply to countries like India and China.

Trump is using oil sanctions to get some resolution to the war in Ukraine. But oil prices are still low, especially compared to recent years and the latest increase is just a tick off the bottom.

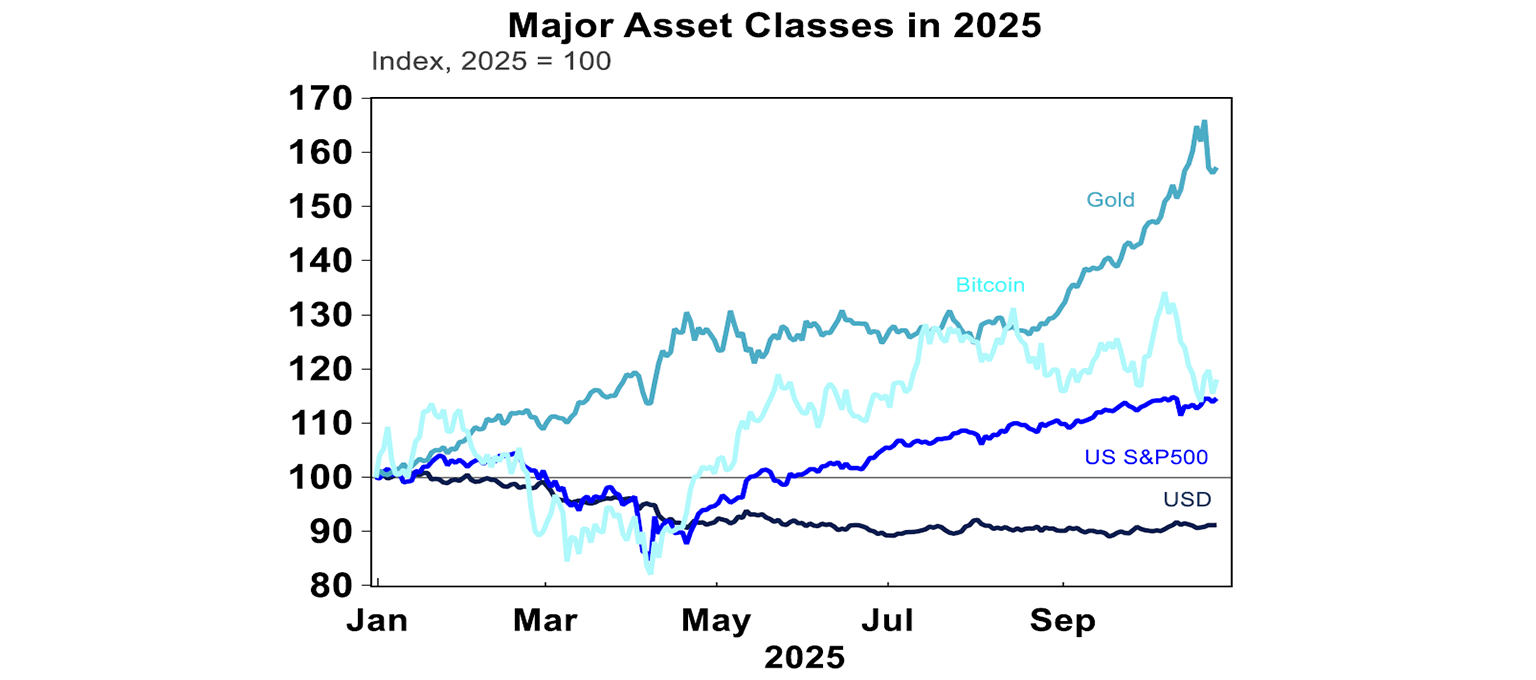

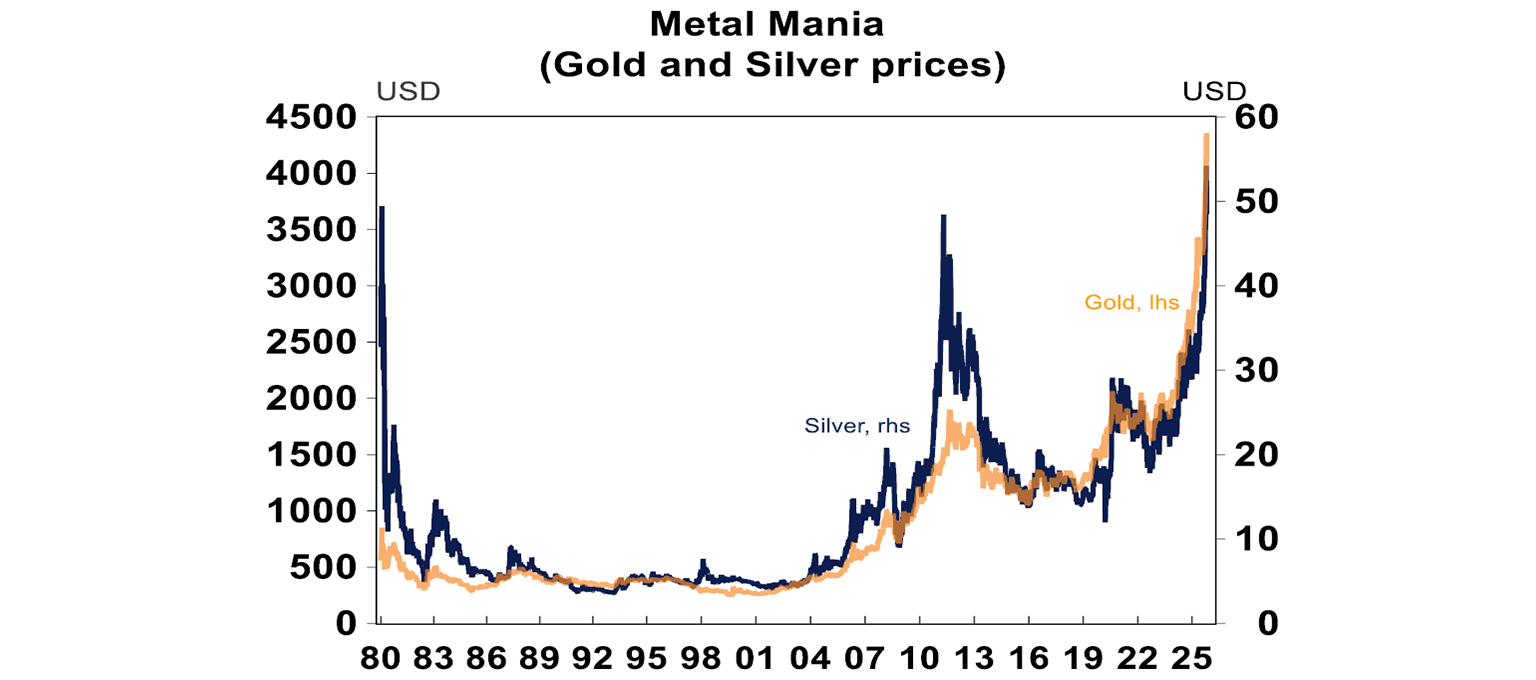

Gold has outperformed other asset classes in 2025, up by 57% since the beginning of the year with investors seeing it as a hedge against elevated inflation, high government debt, a declining US dollar and geopolitical risks, otherwise known as the “debasement trade”, which has also helped bitcoin this year. But after reaching a record high of ~$USD 4,380/ounce, gold had its largest one-day decline in more than 12 years, although price falls stabilised late into the week, reaching $4113.

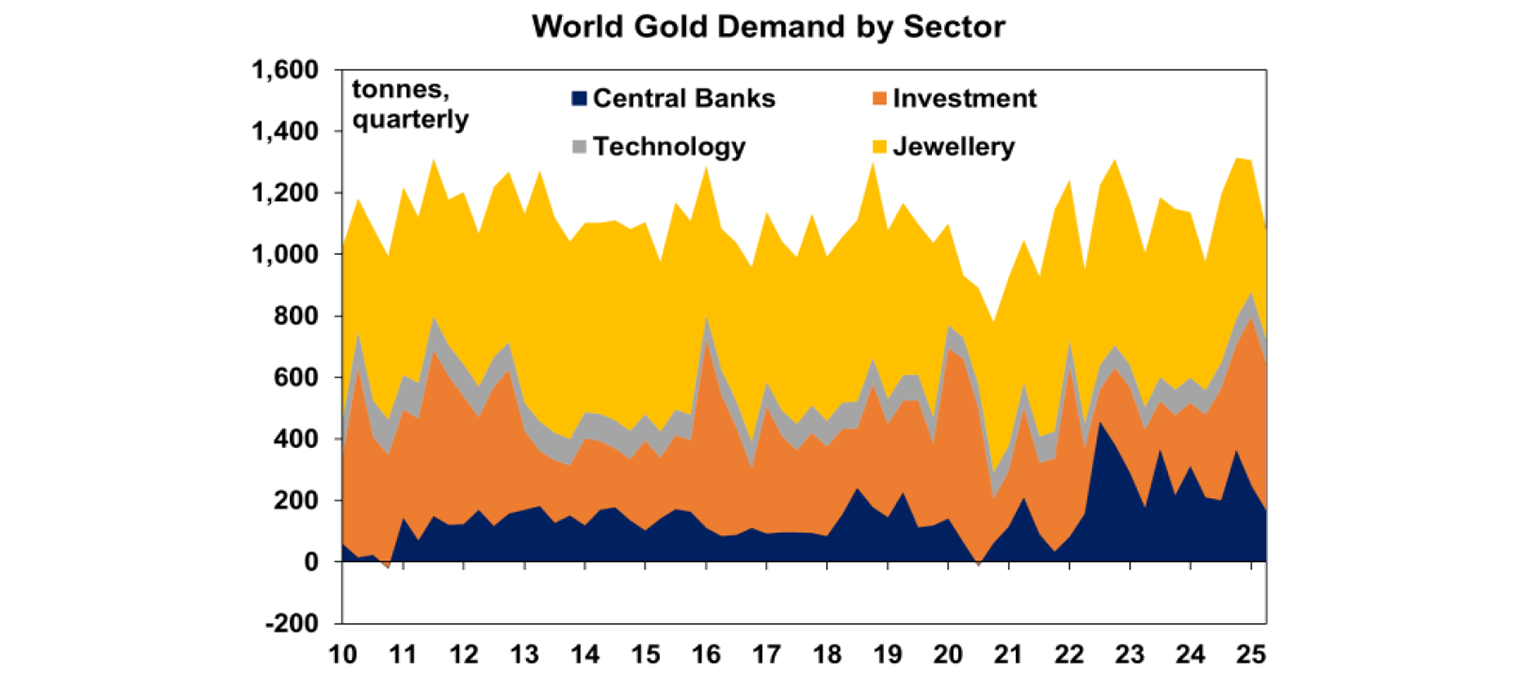

There was no real catalyst for the large decline, much like there wasn’t much of a catalyst for the strong rally in recent weeks! There are genuine structural factors that are helping to lift the gold price, mostly higher central bank purchases (which has been trending up since 2020) and an increasing case for gold in the “debasement trade” and these factors are still important in the medium-long term, which should keep prices elevated, although more downside can’t be ruled out in the short-term given the large run-up.

Silver prices have also been outperforming this year, continuing the “metal mania” theme of 2025. Silver is up by 69% this year, with investors also using silver as a hedge, an alternative to expensive gold and for industrial use including in technology, including solar panels, electric vehicles, 5G and advanced electronics.

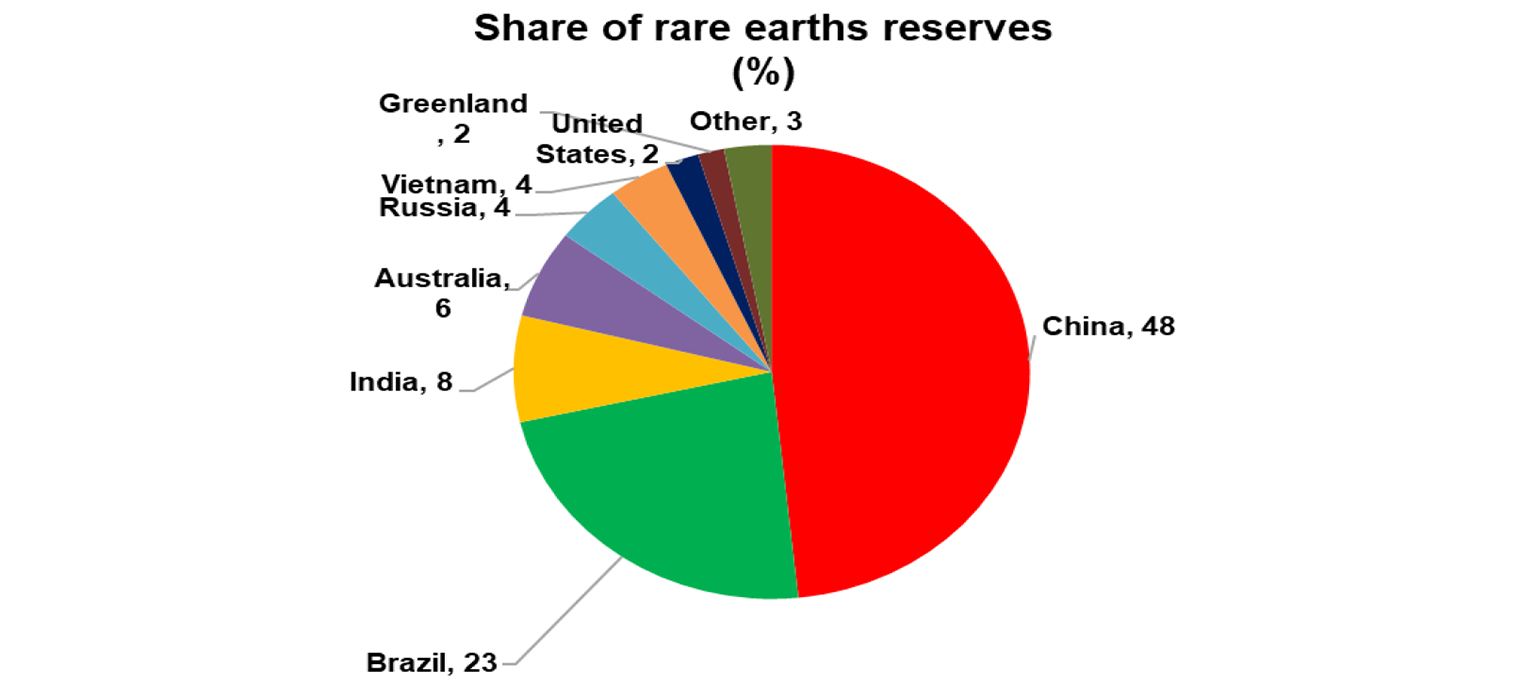

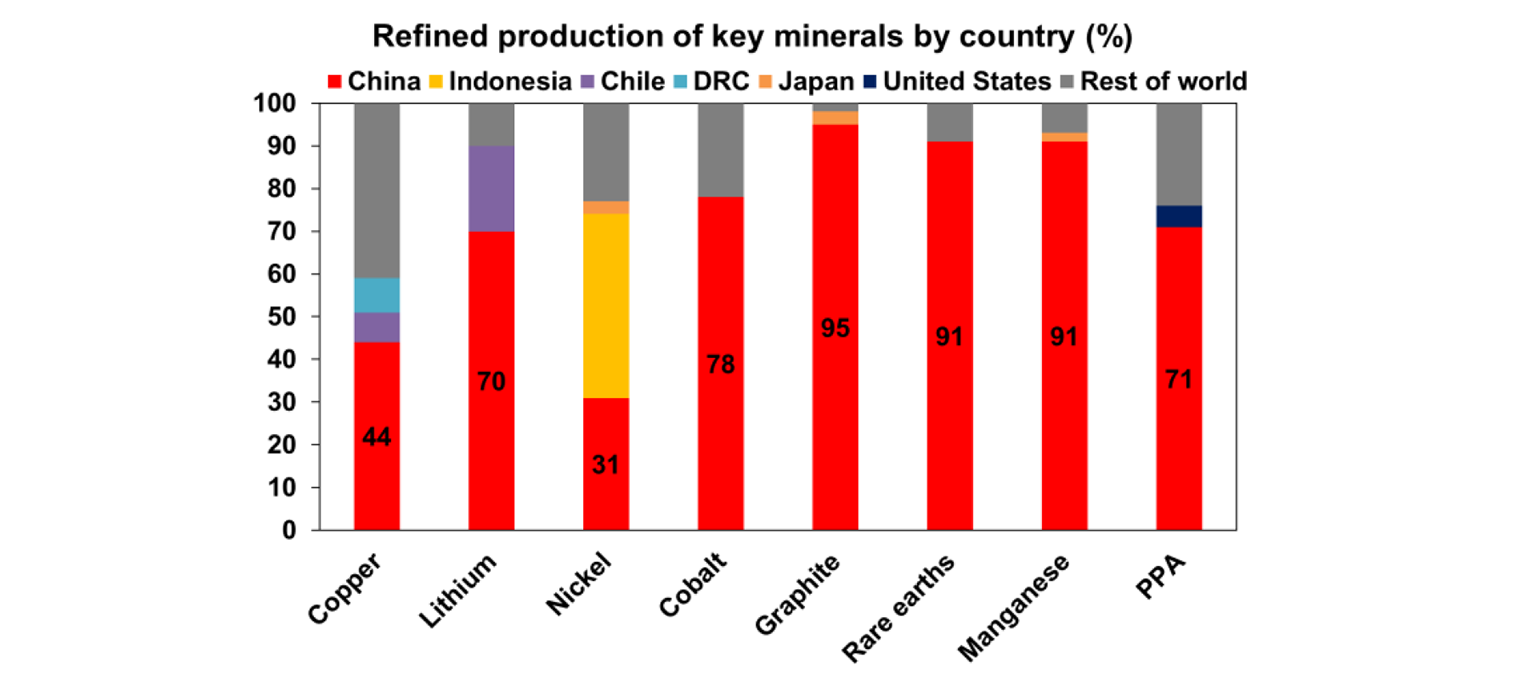

Australia and the US signed a “framework” on critical minerals and rare earths in Washington, in the first meeting between Albanese and Trump. My colleague My Bui wrote a great piece about it here. The “deal” is basically financing for mining projects that have a total pipeline value of $8.5bn USD, with an initial US$2bn (~$A3bn) investment in the next 6 months. Critical minerals are a broad term (which includes rare earths) for commodities are being increasingly utilised in defence, semiconductors, robotics and electric vehicles. Rare earths, a subset of critical minerals, are unique magnets. The strategic element of the deal is that China currently dominates the global supply of rare earths through its refining capabilities which it has been building for decades. The availability of critical minerals is also dominated by China, although other countries also have some reserves (see the chart below).

Australia does have a decent supply of critical minerals but actual spending on mining of these minerals has been small as a share of the economy at around 0.1% of GDP but a larger 6% of our exports (because of high prices for these items).

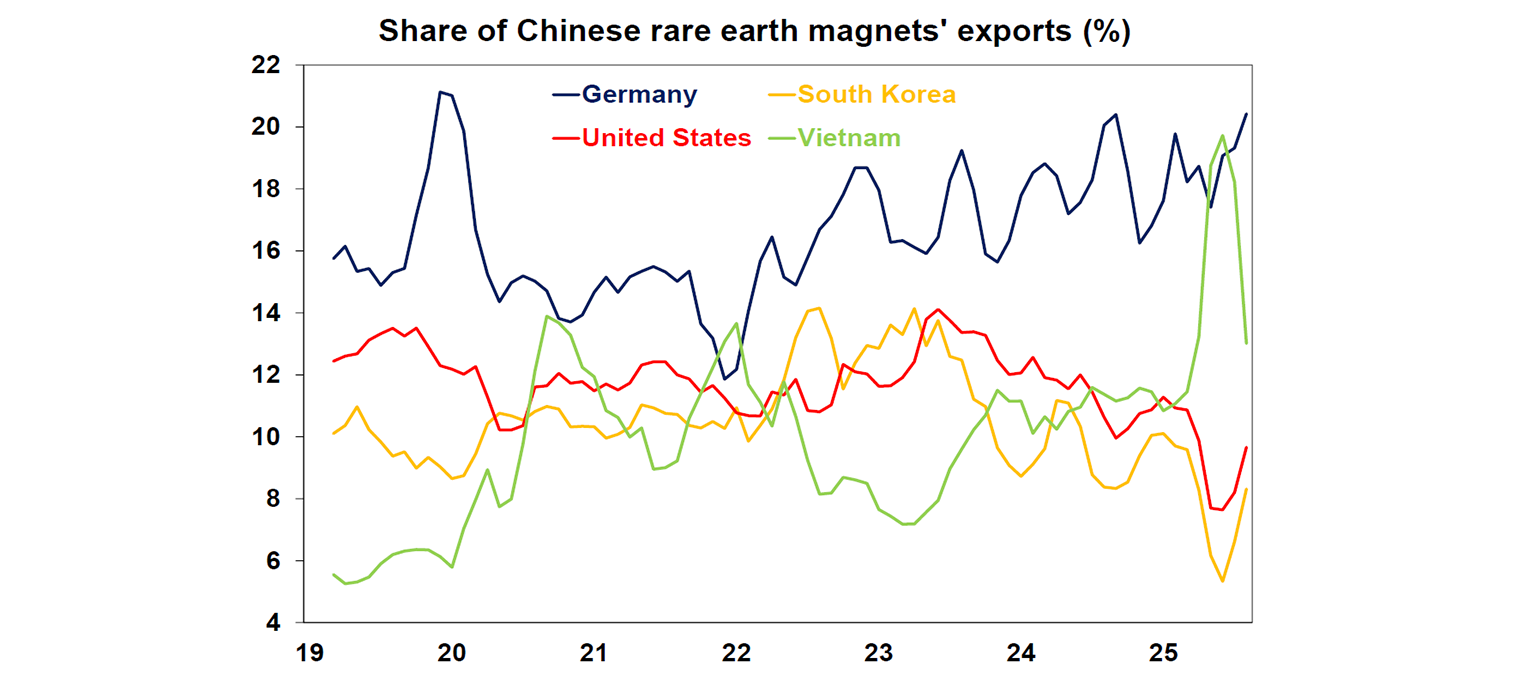

At least in the short-term, the US can’t compete with China’s dominance in the critical minerals space. Even with US restrictions on these imports from China, China can divert its exports to other countries like Germany, Vietnam and South Korea (see the chart below) which already receive a decent share of its exports.

When Trump meets with Xi next week, the top issues are going to be rare earths, fentanyl, soybeans, Taiwan and the upcoming Nov 1 trade deadline (after which time US tariffs on Chinese imports may go up).

The second longest US government shutdown in history continued, now on its 24th day. The only other longer shutdown was the one in Trump’s first term and lasted 35 days. While there hasn’t been an overly large negative impact to financial markets, the lack of US data makes the Federal Reserve’s job harder, with the central bank meeting next week. Republicans need 8 Democrat senators to pass a continuing resolution (which the House has already passed) to reopen the government. Around 3-4 Democratic senators have signed willingness to reopen the government. But there are also other upcoming budget deadlines on November 21 and 31 December when enhanced Obamacare subsidies expire, so the government shutdown issues may persist until the end of the year. It would make the most sense to extend the Obamacare subsides beyond the midterms for both parties, but that probably won’t happen.

So far, there has been little market impact of the shutdown to markets. The impact to the economy is small, Evercore ISI expect that every week the government is shutdown, there is roughly a 0.02 percentage point hit to annualised quarterly GDP, but then this is mostly offset when the government reopens. The shutdown also doesn’t appear to have hurt Trump’s approval polling.

Major global economic events and implications

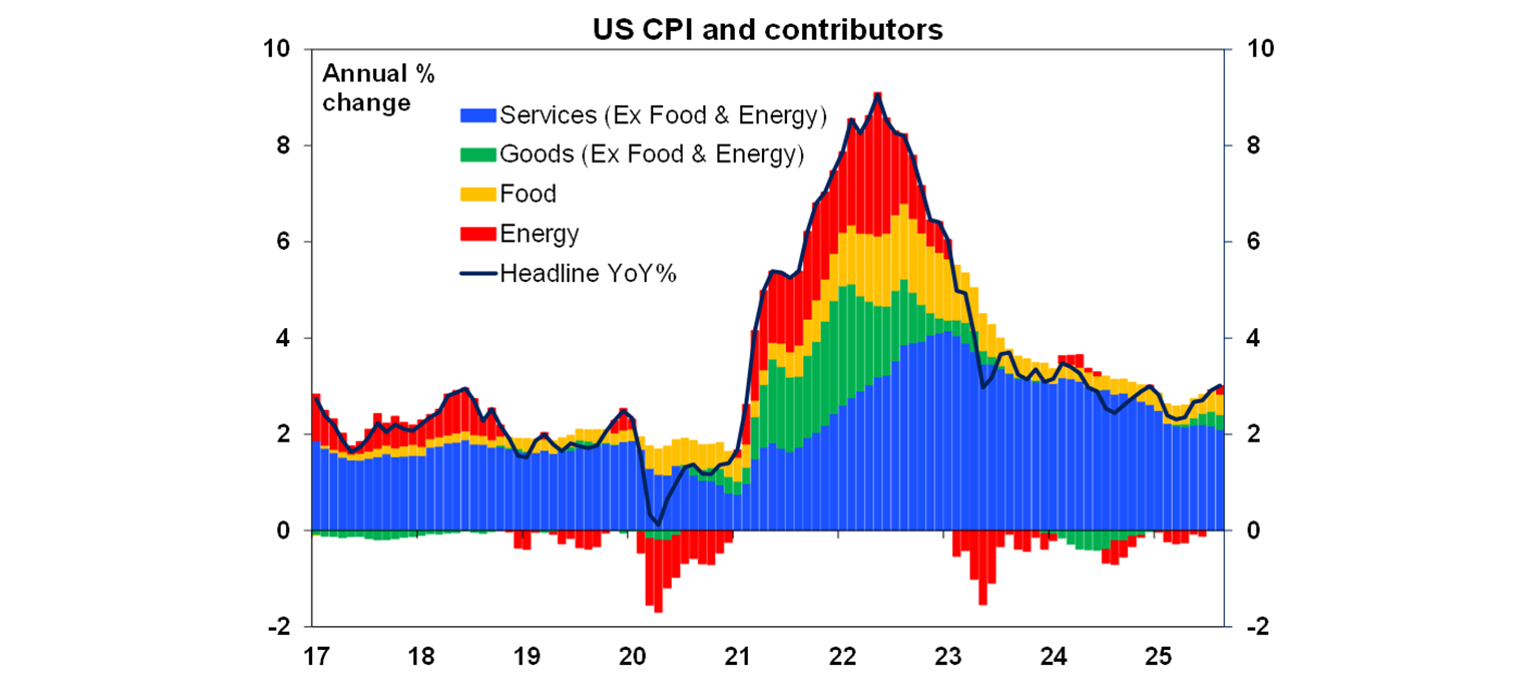

Despite the ongoing government shutdown, the Bureau of Labor Statistics recalled staff to prepare the September inflation report. September consumer prices rose by 0.3% over the month or 3% over the year and 0.2% on the core measure and 3.0% over the year, slightly lower than expected.

Softer growth in housing costs and cheaper used car prices helped inflation to surprise lower. Some signs of higher goods prices related to tariffs were evident in household furnishings, recreational goods and apparel prices. Services prices also remained high. Gas prices made a decent contribution to inflation.

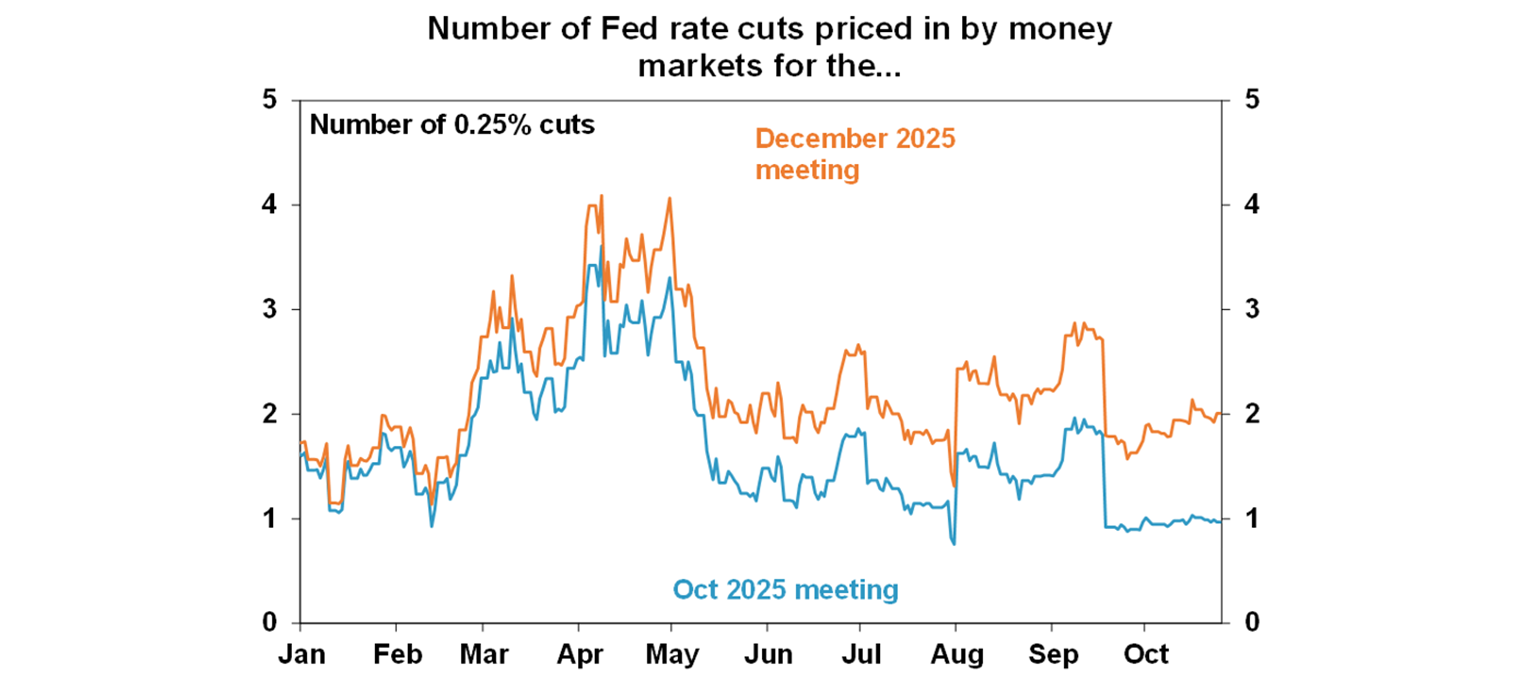

According to Bloomberg, a lot of the data collection occurred before the shutdown so economists weren’t concerned about data quality. However, there was still more use of “imputed prices” for data the BLS couldn’t gather. The October inflation report is unlikely to be published (for the first time ever) because of the shutdown. The softer inflation report paves the way for a Fed rate cut at next week’s meeting.

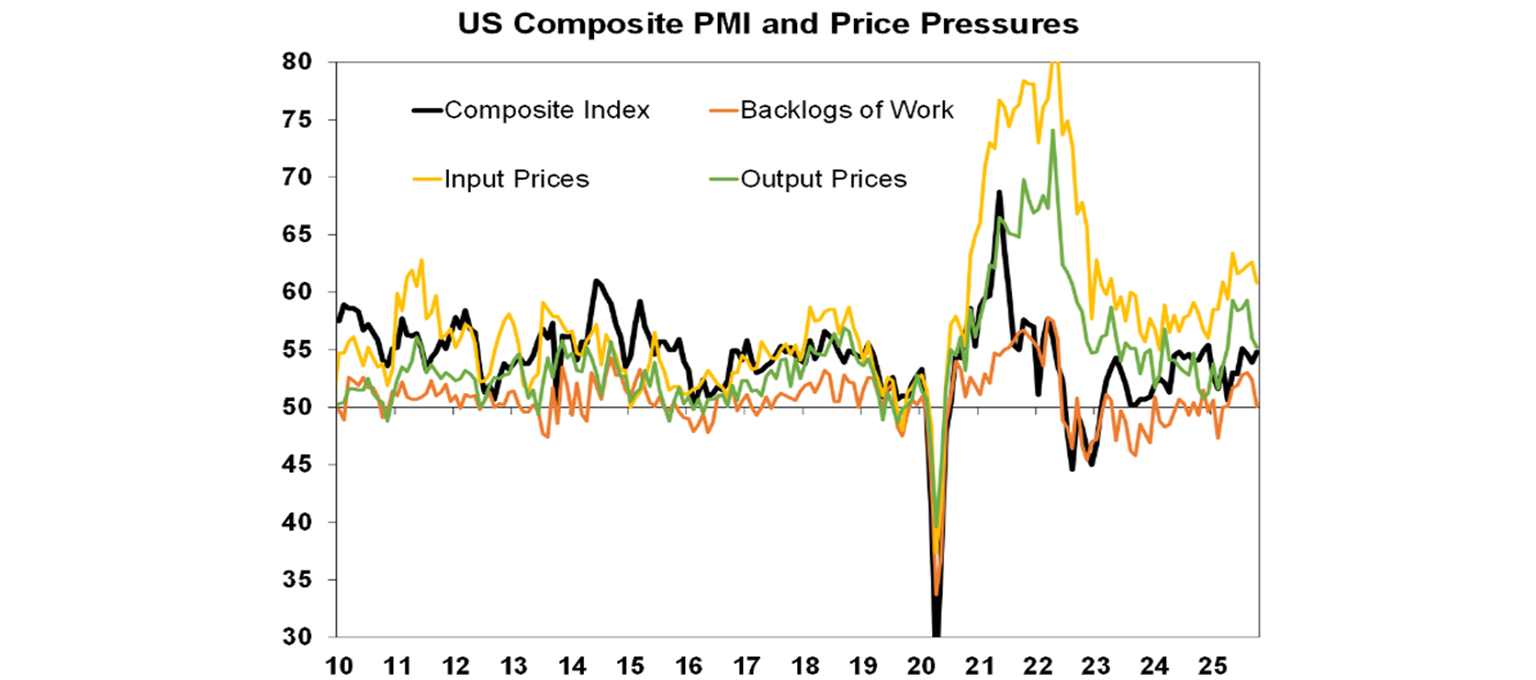

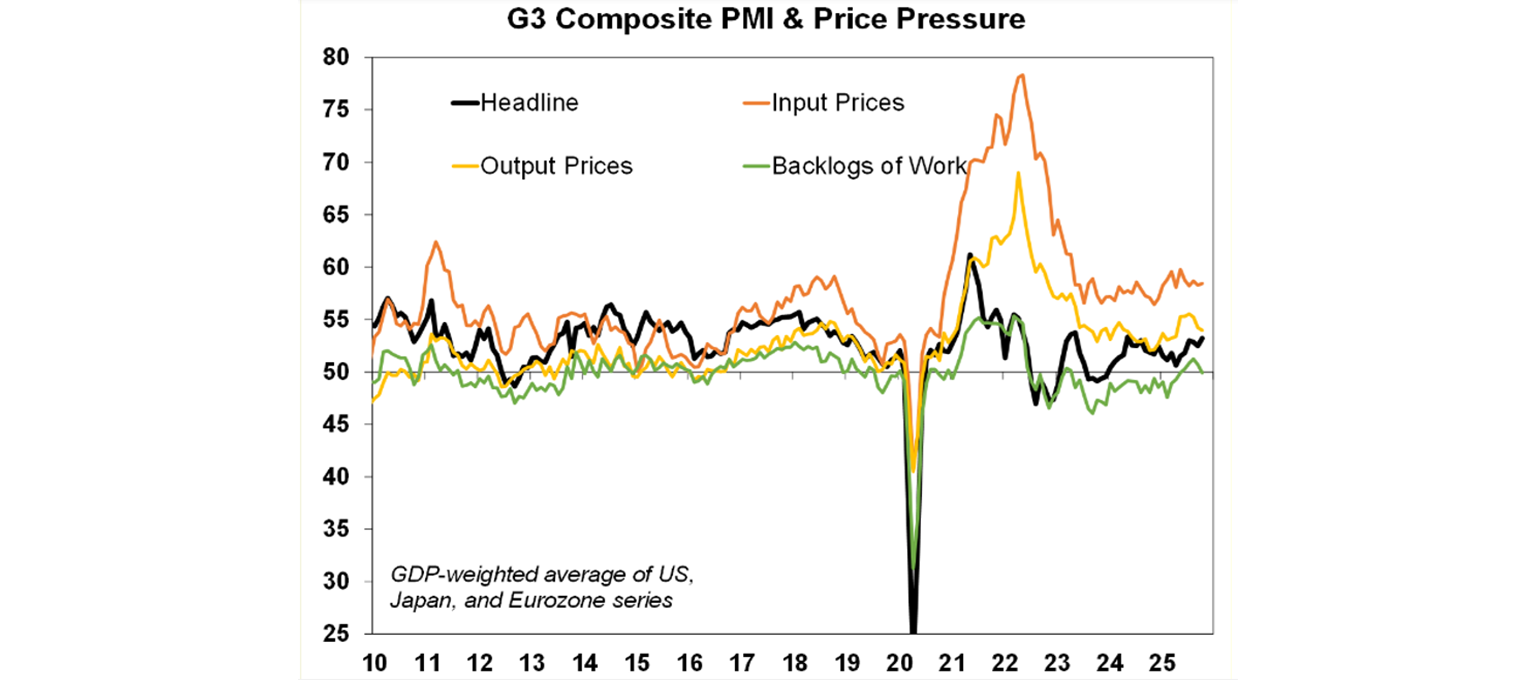

The October PMI improved for manufacturing and services, with the composite rising to 54.8 from 53.9 last month. Price pressures eased and the backlog of work also slowed.

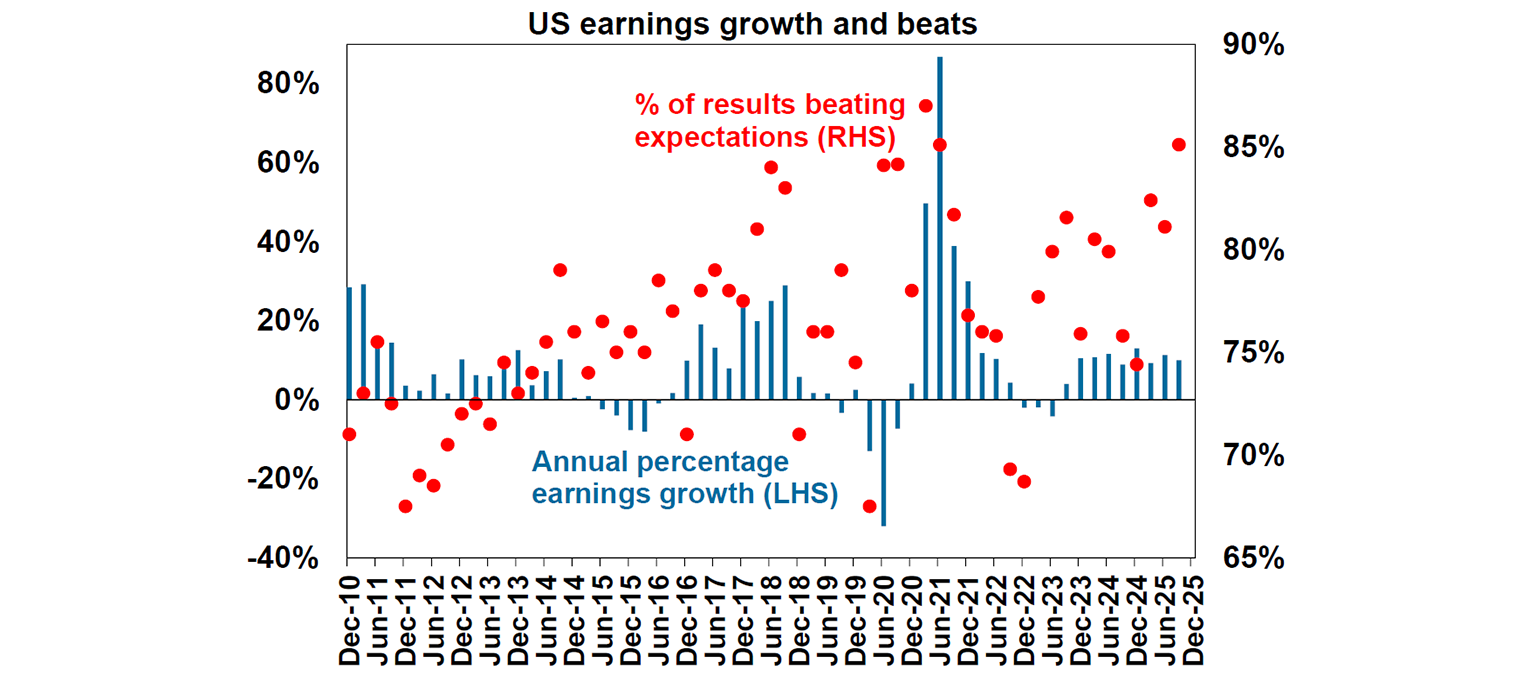

US September quarter earnings season is underway with around 30% now reported. So far, results have been fairly good and earnings growth is expected to be up by 10% over the year to September, with tech at 17%. There were some disappointing results this week with Netflix, along with Tesla profits, despite record EV sales. Around 85% of results are beating expectations, above the historical average of 76.5%.

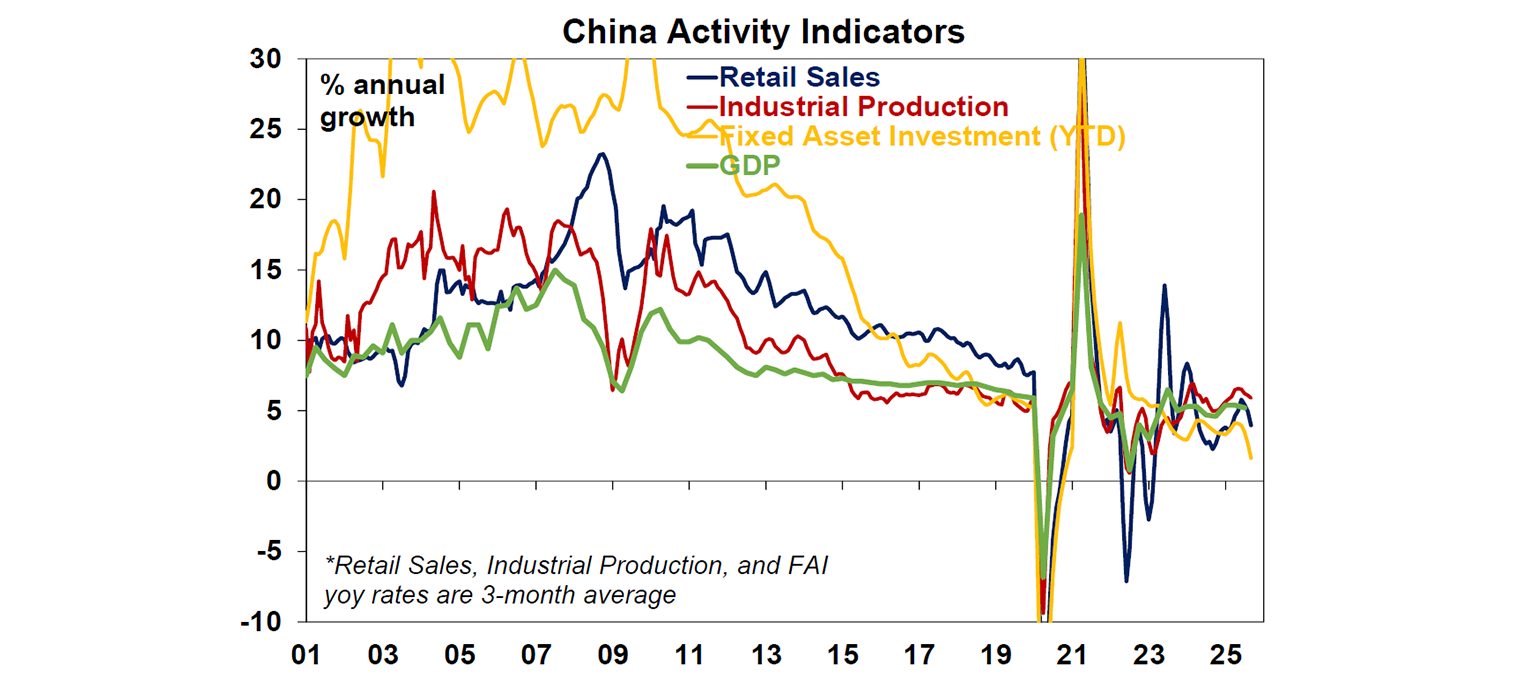

Chinese economic data this week showed GDP growth of 4.8% over the year to September, just above expectations of 4.7%. Retail sales rose by 3% over the year, industrial production was 6.5% higher and fixed asset investment fell by 0.5% year to date. Property investment is still down (13.9%) since the beginning of the year. So the economy is mixed but export growth is the key driver of economic activity.

Chinese policymakers held their “4th Plenum” this week, a political gathering that deliberates on major long-term policy decisions. The key takeouts included: reiterating a long-term growth target which implies maintaining an average growth rate of 4.5% over the next decade, an increasing focus on lifting household consumption and the property market, continuing focus on innovation and technological self-reliance given the trade tensions between the US and China.

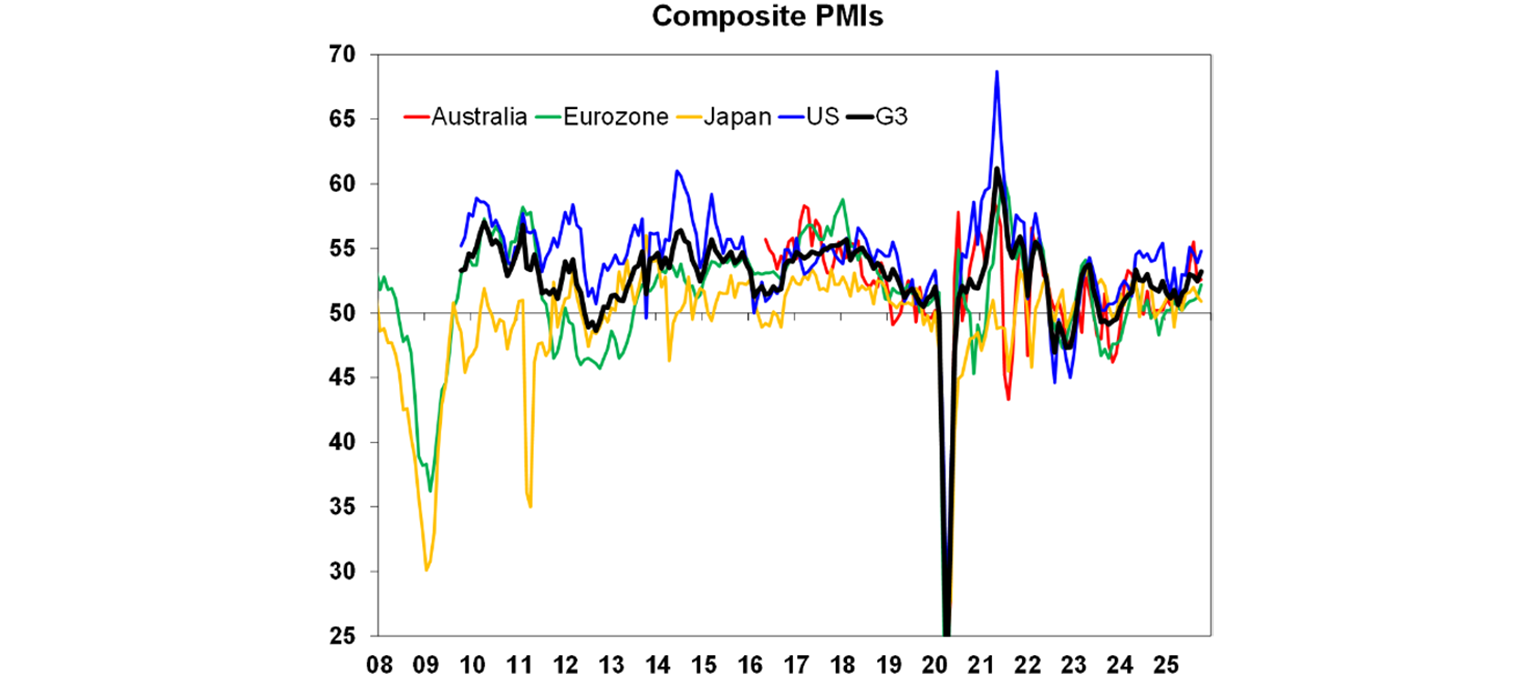

Global composite PMI’s showed an improvement across the US and Eurozone, especially in services, a good sign for global growth.

Output prices moderated, input prices were flat and the backlogs of work slowed.

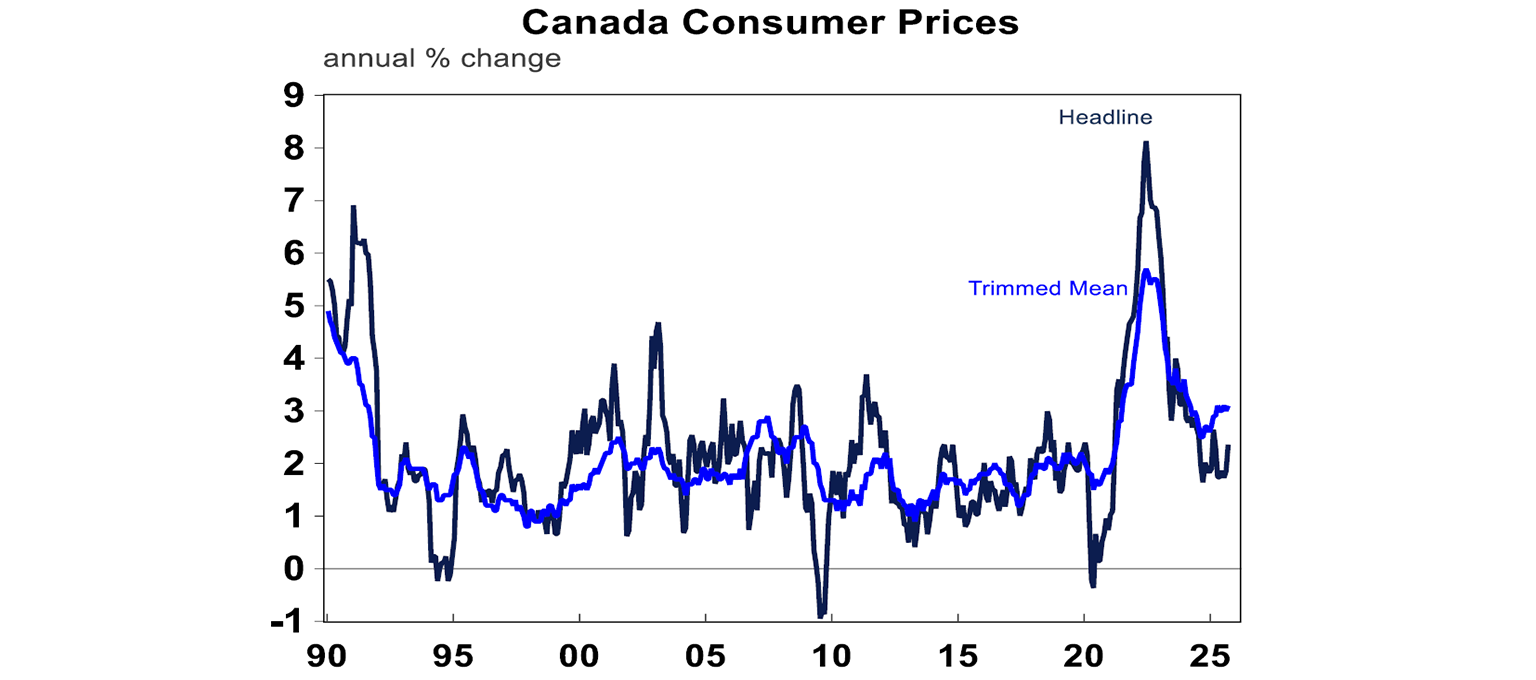

Canadian inflation figures where hotter than expected, headline up 2.4% over the year to September and core trimmed at 3.1% (see the chart below).

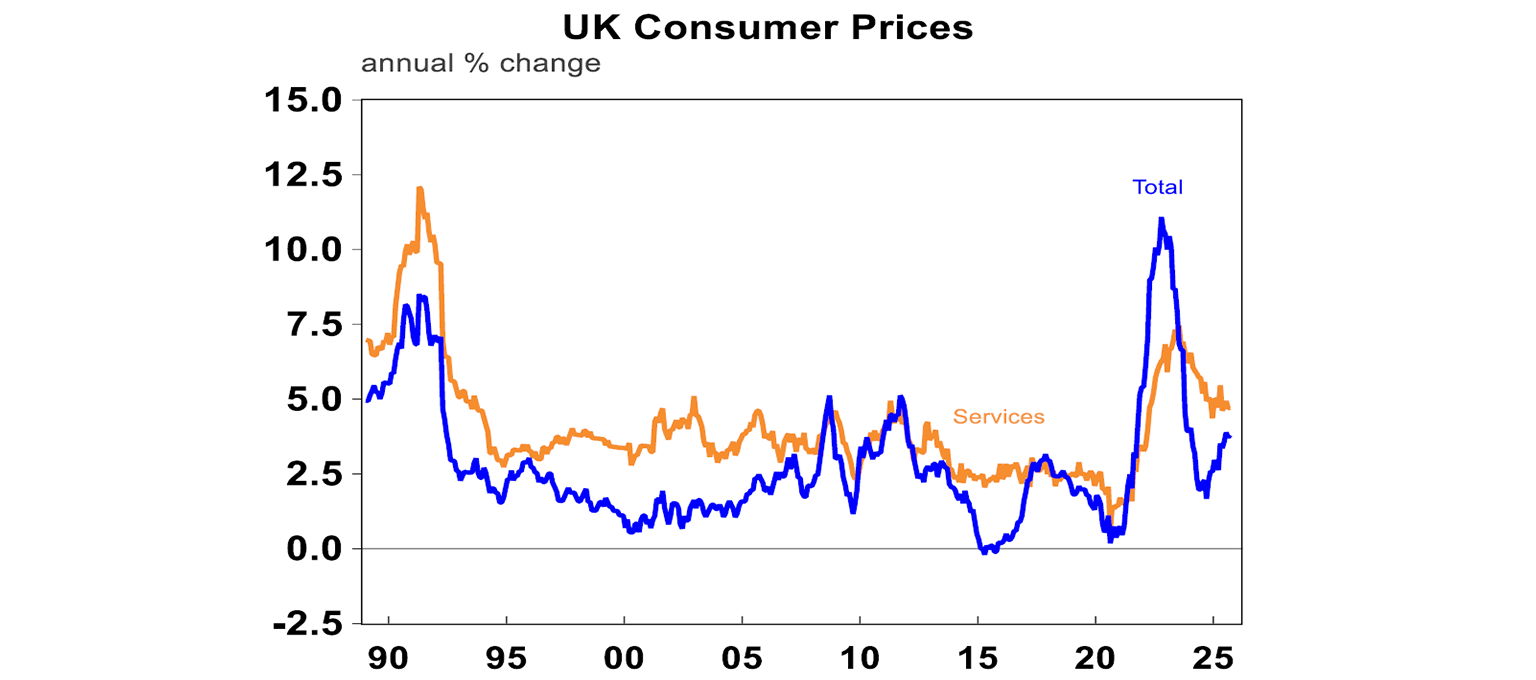

UK inflation rose by 3.8% over the year, which is high but actually below expectations. UK services inflation is still a problem, up by 4.7%. Another 0.25% rate cut is still expected from the Bank of England in either November or December.

Japan appointed its first female prime minister, Sanae Takaichi who is implementing a package of economic measures to ease the burden of inflation and cost of living including subsidies for electricity and gas charges, regional grants, encouraging small and medium-sized businesses to raise wages and capital investment.

Australian economic events and implications

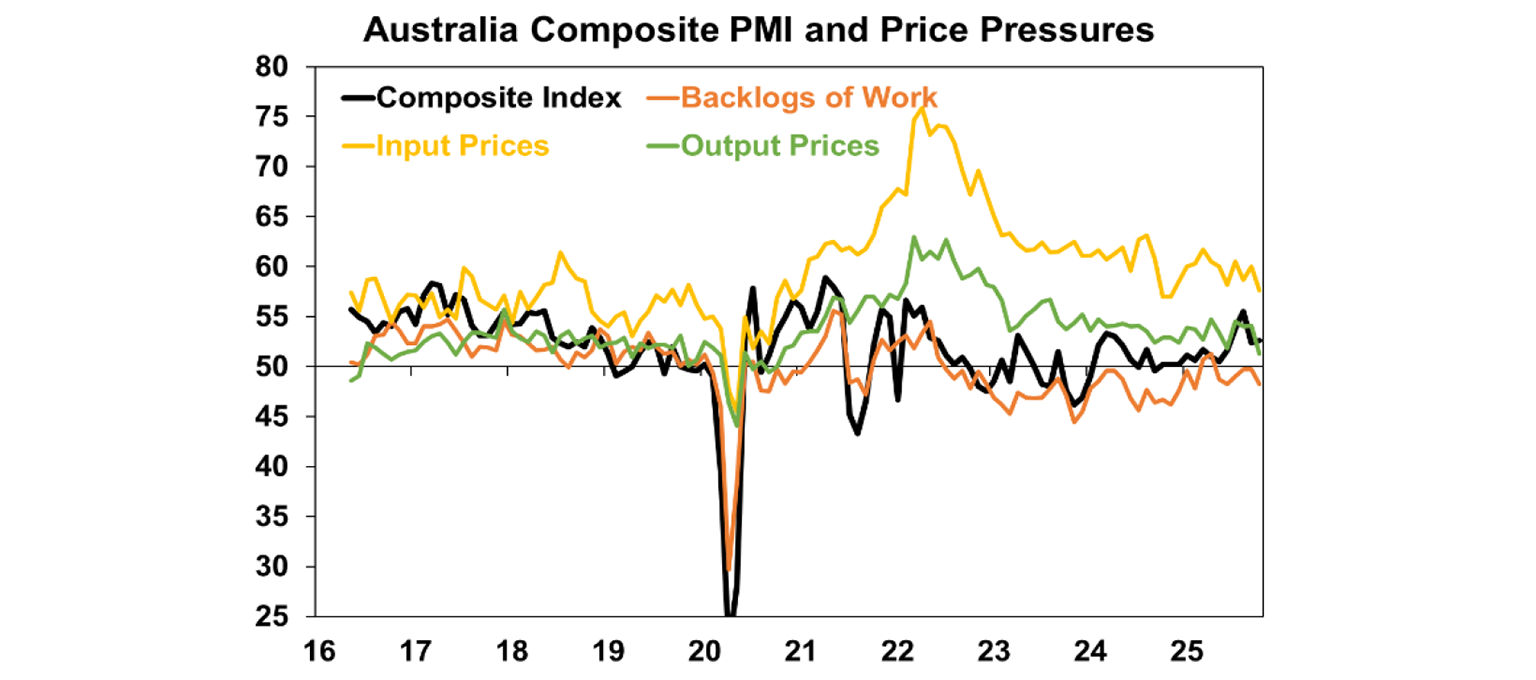

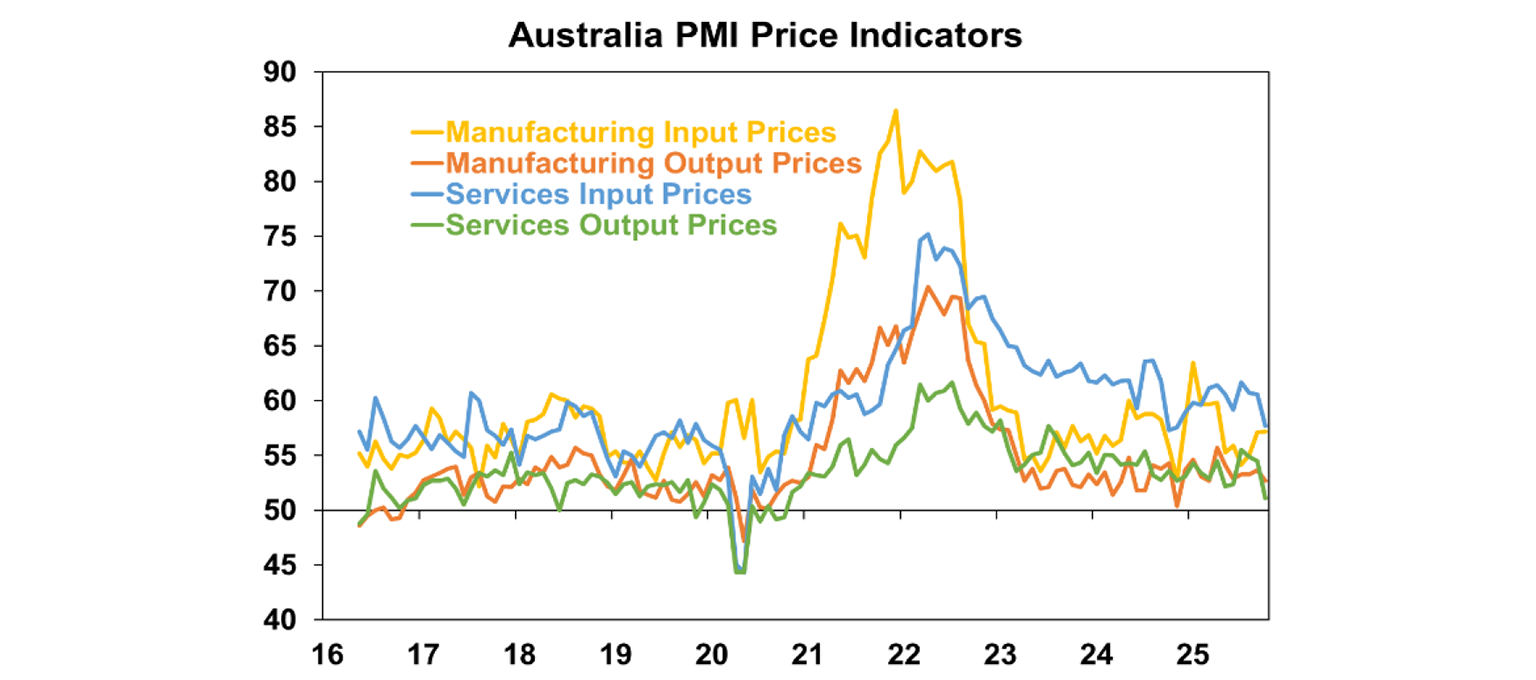

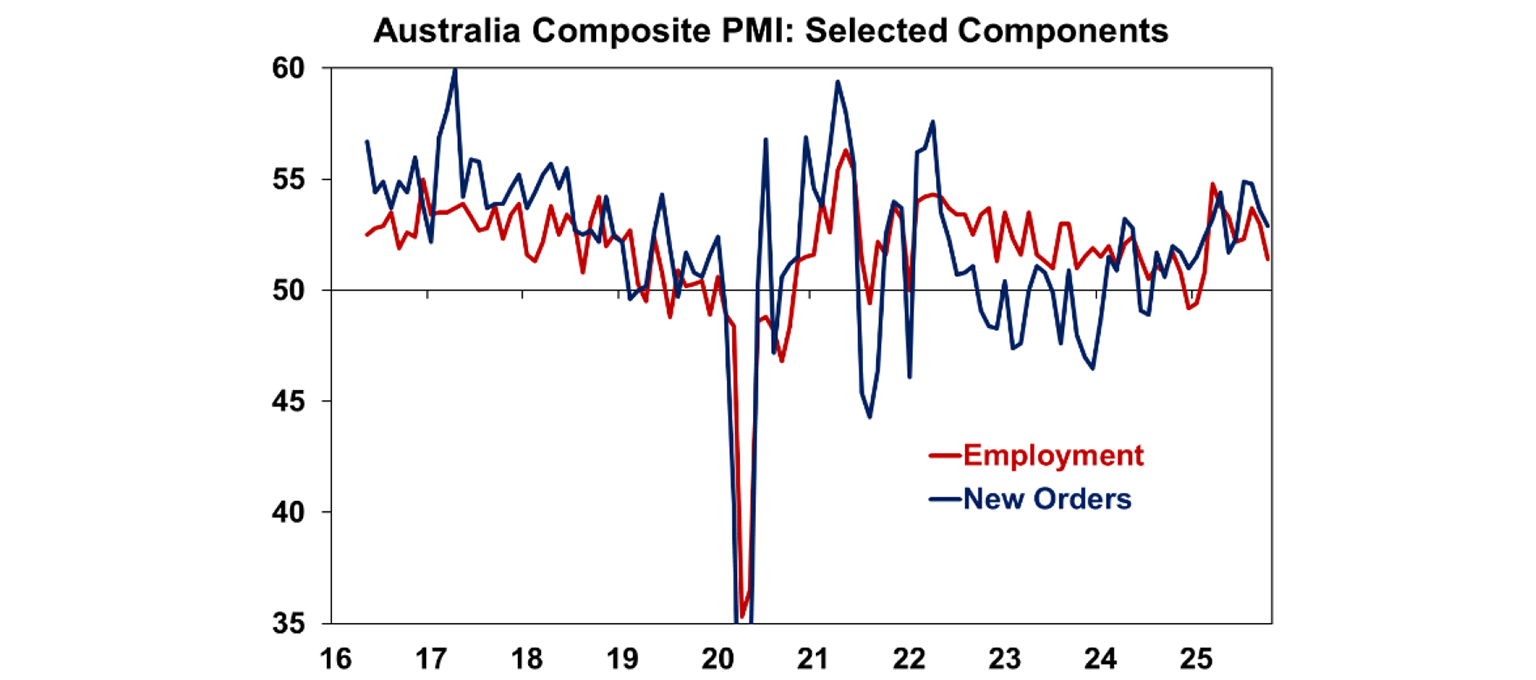

The October PMIs showed a deterioration in the manufacturing index (down to 49.7 from 51.4 last month) and an improvement in services (to 53.1 from 52.4). The composite PMI rose to 52.6 from 52.4.

The components showed a slowing in most price indicators (see the chart below), although manufacturing input prices went up. This is a good sign for inflation.

The employment sub-index also dropped, which doesn’t bode well for employment growth which is already moderating.

What to watch over the next week?

The September quarter US GDP data is scheduled for next week but its unclear if it will be released given the shutdown. Economists expect annualised GDP of ~3% which is still very strong, especially with tariffs still being a background issue.

US September quarter earnings season continues with many of the large tech companies like Microsoft, Google, Amazon and Meta reporting.

In Australia, the September quarter inflation figures are key as it’s the final piece of key data before the early November RBA Monetary Policy Board meeting. The monthly CPI indicator for July and August has been surprising higher and the concern is that the full quarterly set of inflation figures will be significantly higher than the RBA forecasts of 2.5% over the year to September (on the trimmed mean) which implies a 0.6-0.7% increase over the quarter. We expect quarterly growth of 0.8% for the trimmed mean, with annual growth of 2.7%. On headline figures, we expect a 1% rise over the quarter and 2.9% over the year. If numbers come in line with our forecasts we expect a November rate cut, given the downside risks in the labour market. But the breakdown in inflation will also be important to see if higher inflation is occurring in demand-driven parts of the economy.

In Australia we also get international trade prices and we expect import prices to be down 0.3% over the quarter to September (no sign of tariffs increasing global prices just yet) and export prices flat. Monthly credit growth figures are likely to be up by 0.6%, with ongoing momentum in housing. RBA Governor Bullock will speak at the annual Australian Business Economists dinner.

The European Central Bank meet and are not expected to cut interest rates, after already reducing interest rates by 2%. The Eurozone deposit rate is currently at 2%. There is Eurozone September quarter GDP data which is looking low at 0.1% and just 1.2% over the year. October consumer price inflation is expected to rise by 0.1% and 2.2% over the year or 2.4% for core which is not an issue for the ECB.

The Bank of Canada meet and expectations are mixed but a rate cut is likely, from 2.5% to 2.25%. The Bank of Canada has already cut rates by 2.5% and has been one of the most aggressive central banks in reducing rates given some weakness in the labour market and inflation within the target range.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more as central banks continue to cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices are in an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may brake higher with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.