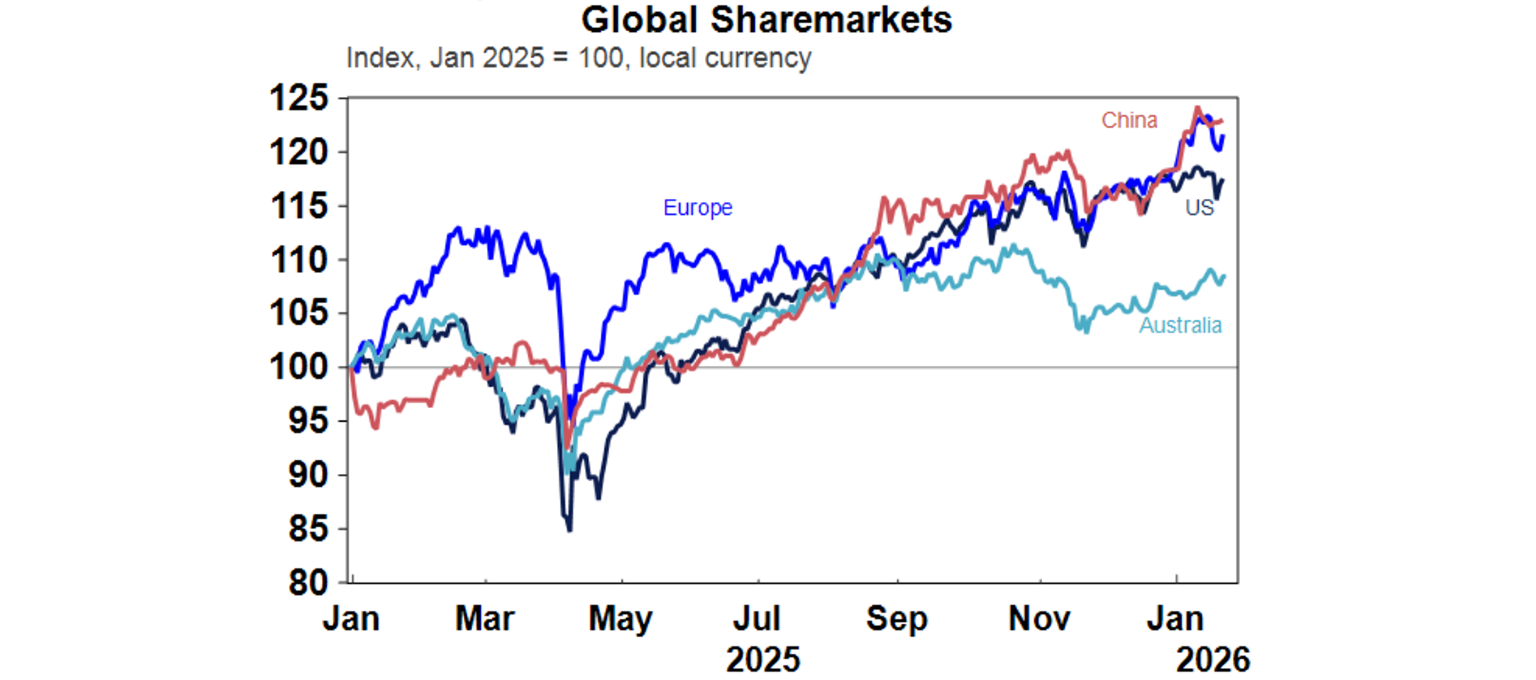

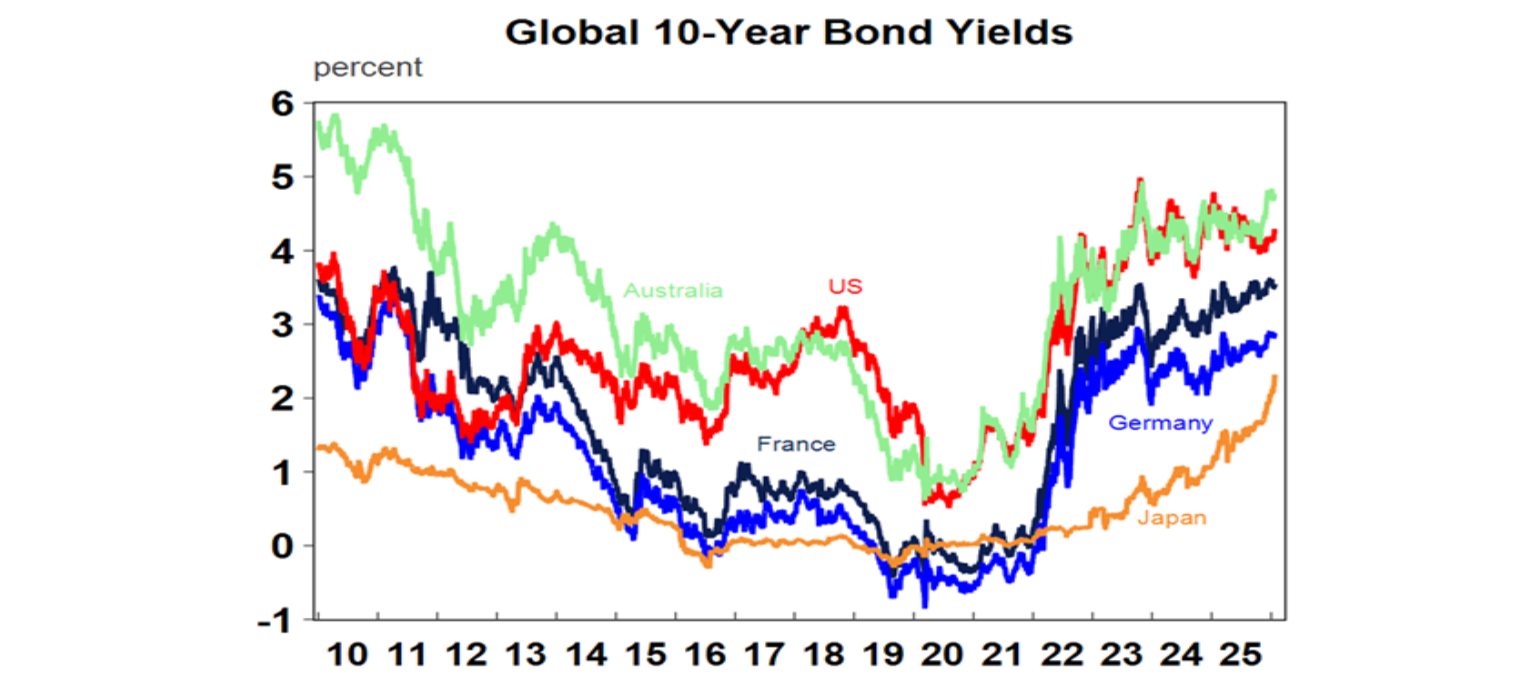

Global shares fell over the last week on fears of a trade war between the US and Europe over Trump’s desire to get Greenland. While shares rebounded once he backed down this still left them lower for the week with US shares down 0.4%, Eurozone shares down 1.1%, Japanese shares down 0.2% and Chinese shares down 0.6%. Reflecting the global uncertainty Australian shares also fell by 0.5% for the week, which is not bad given they rose 2.1% the week before. The falls in the local market were led by financial, property and consumer shares offsetting gains in utility and resources stocks. Bond yields were flat in the US but rose elsewhere as a rise in Japanese bond yields reverberated globally with US rates initially coming under some pressure from fears Europe would allocate away from US bonds.

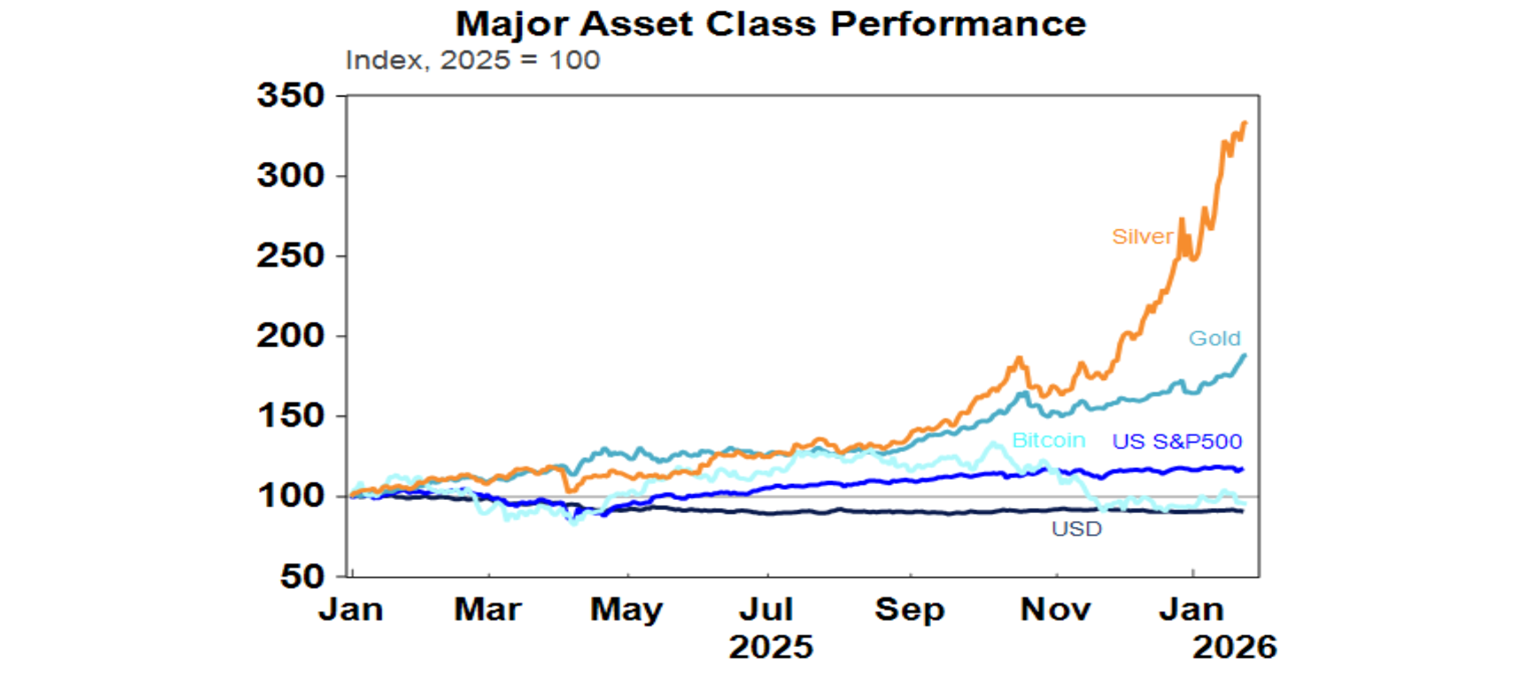

The surge in geopolitical risk around Greenland and ongoing concerns around a US strike on Iran, on the back of threats to Fed independence saw gold and silver pushed to more new record highs. Gold is now just below $US5000 for the first time ever. While they are getting overbought and vulnerable to a correction the broad trend in both is likely to remain up as investors demand a hedge against ongoing geopolitical risks, worries that Trump will weaken the Fed risking higher inflation and associated downwards pressure on the $US. Bitcoin fell though not helped by the weakness in shares. Oil prices rose on renewed concerns about a US strike on Iran and metal prices also rose, but iron ore prices fell slightly. The $A surged higher as the $US fell and Australian strong jobs data added to expectations that the RBA will hike rates.

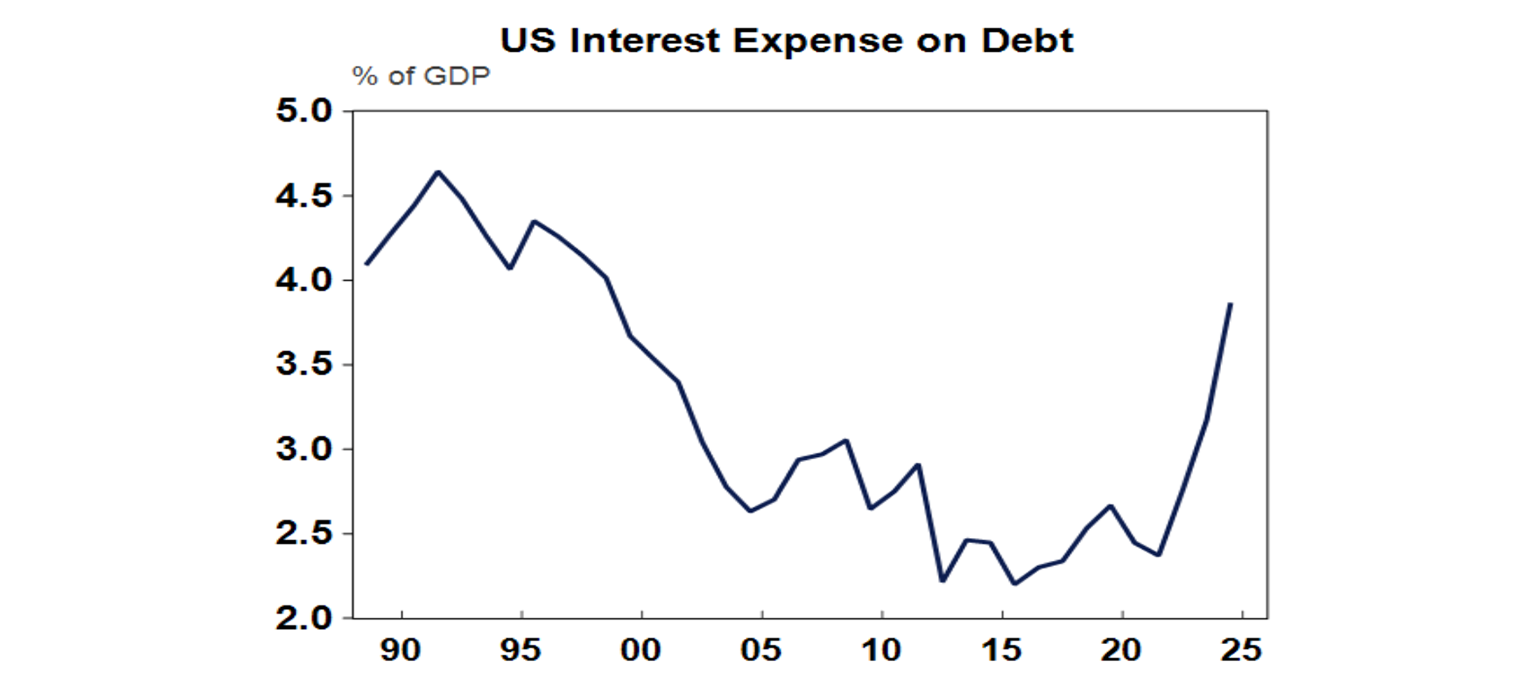

The past week was dominated by Trump’s grab for Greenland and then another TACO back down. Inspired by his intervention in Venezuela, Trump threatened additional tariffs on eight European countries unless Greenland is transferred to the US. The motivation was unclear. The US could already put all the bases it wants into Greenland so maybe it’s just a grab for Greenland’s fossil fuel and mineral reserves motivated by Norway not giving him the Nobel Peace prize. Or maybe a desire for a “wag the dog” type distraction over the failure to release all the Epstein files, the increasing ICE conflict in Minnesota or a potential Supreme Court decision against Trump’s use of tariffs under the emergency powers act. Or maybe he is simply becoming more deranged. His problem was that he faced a barrage of constraints – his Greenland tilt is supported by less than 20% of surveyed Americans, Republicans in Congress spoke out against it, bond yields rose on concerns Europe will cut holdings of US bonds and the US share market fell sharply (with Trump saying it was “because of Iceland”). So, he ruled out the use of military force and then backed down and cancelled the tariffs citing a framework deal on Greenland (involving the US stationing missiles there, mining rights, an increased NATO presence but Greenland remaining with Denmark – but it’s all very vague). Trump regards the share market as a key performance indicator and the US is very sensitive to rising bond yields given its high level of public debt and surging debt interest costs and that bond yields drive fixed mortgage rates, which he wants to cut. So, it was another TACO (Trump always chickens out) moment. Just as occurred after Liberation Day last year.

At the same time, Japanese bond yields surged pushing up global bond yields on concerns the “Japanese carry trade” (borrow cheaply in Japan and invest in bonds in other countries) might reverse. This followed the calling of a Japanese election for 8th February and Japan’s PM announcing fiscal stimulus measures including a temporary cut in consumption tax on food which led to concerns about a further blowout in Japan’s budget deficit and debt levels. While this is a valid concern the main driver of rising Japanese bond yields is a normalisation of nominal growth in Japan partly associated with higher inflation. The surge in yields settled down a bit in the last few days but may have further to go as the BoJ continues to gradually raise rates.

So where does this leave us?

First, TACO is alive and well. Trump is still sensitive to share market falls and rising bond yields and will back down once things go too far. And in particular, he still appears sensitive to political pressures ahead of the elections where the focus is likely to be on affordability.

Second, Trump still faces significant constraints – this includes the Supreme Court which is at high risk of ruling his emergency powers tariffs illegal and appears wary of his bid to sack Fed Governor Cook.

Third, geopolitical risks remain high with Trump a key driver as he continues to try and fill the space and keep himself in the headlines. His claim on Greenland is far from resolved although he might forget about it for a while. But the risk of a strike on Iran is on the rise again with a US naval armada heading to the Middle East and Trump saying “we’re watching them [Iran and its treatment of protestors] very closely.” A strike on Iran could threaten Iranian oil supplies which are around 3.5% of global oil production which could be offset by spare capacity in Saudi Arabia and the UAE. But the threat to oil supplies could escalate if the Iranian regime is pushed towards collapsing as it may conclude it has nothing to lose by disrupting the Strait of Hormuz through which around 20% of the world’s oil supplies flows which could then drive a spike in oil prices. Issues with Russia, China & Canada/Mexico are also all at high risk of flaring up again which will keep volatility high.

Fourth, “US exceptionalism” remains under threat. While Trump backed down on Greenland each of his erratic flareups – attacks on allies, tariff announcements, attacks on universities, attacks on the Fed, sending ICE and potentially troops into Minnesota, interventions in neighbouring countries, attacks on the rule of law and the global rules based system, etc – are weakening “US exceptionalism” and contributing to a “sell America” trade and reducing trust in the US from allies. This means investors will likely demand a higher risk premium to invest in the US meaning upwards pressure on bond yields and downwards pressure on the $US.

Finally, the so far mini Liz Truss moment in Japan reminds that risks remain around high public debt with key culprits being the US, Japan, the UK and France.

Our assessment remains that this year will see a volatile ride for investors on the back of geopolitical threats and Trump bluster, but that ultimately it will turn out okay for shares with reasonable returns on the back of good global economic and profit growth, Trump focussing on policies to help US households, the Fed cutting rates a few more times, and profit growth turning positive in Australia after three years of falls. While the past week was rough, in a big picture sense it was just a normal volatility which saw non-tech shares hold up relatively well consistent with a rotation away from tech. At the same time the US dollar is likely to remain in a downtrend as Trump’s policies continue to dent US exceptionalism and safe havens like gold are likely to continue to push higher as investors seek out a hedge to protect against risks around geopolitical conflict, high public debt levels and the threat to Fed independence.

It’s now one year since Trump was inaugurated and the winners are China, which has seen its global position enhanced and its exports just diverted from the US to the rest of the world, US tech companies and high income earners who have seen a continuation of tax cuts. And the biggest the losers have been US allies like Europe and Canada, US farmers and exporters, US immigrants and US consumers who have seen prices rise more than otherwise.

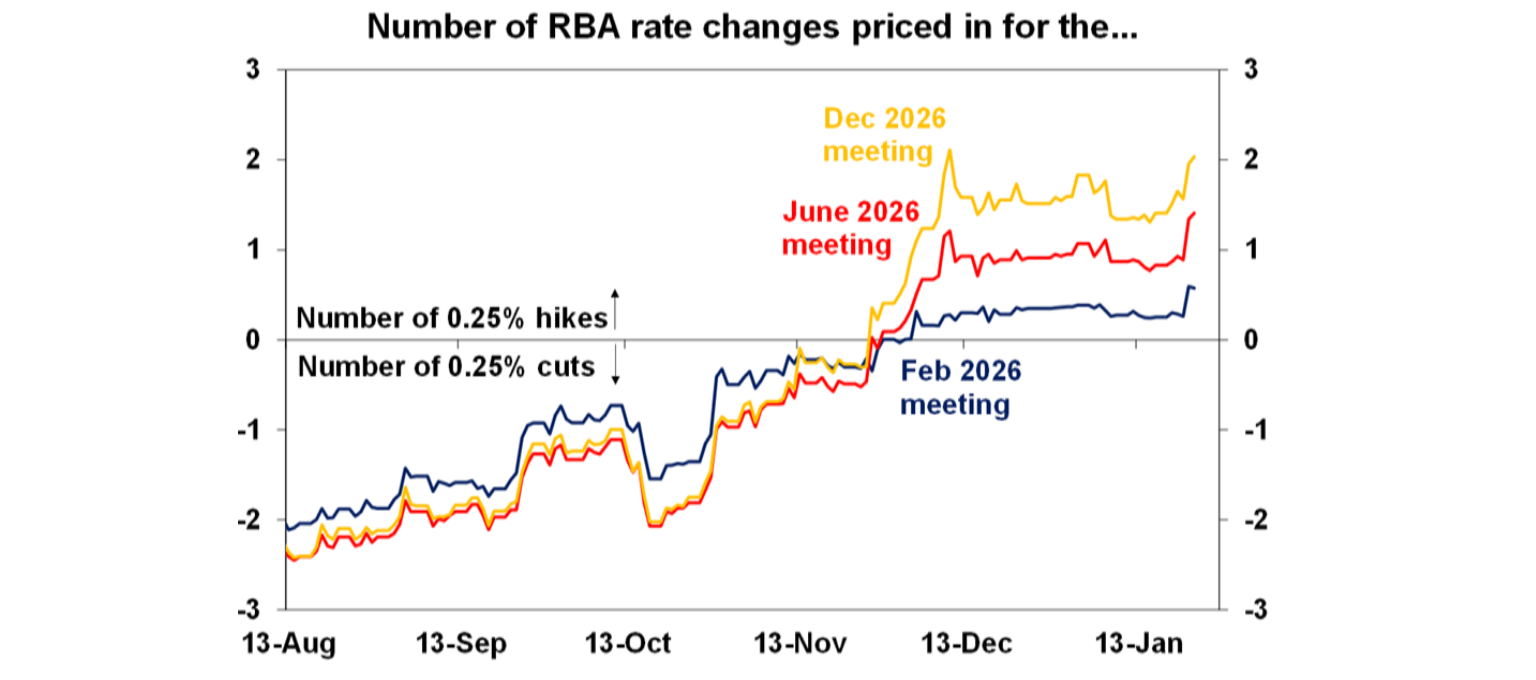

For Australians, the last week saw mixed news – rate hikes versus a higher $A. On the one hand strong jobs data for December added to the chance that the RBA will soon hike rates again – although this will ultimately depend on inflation data in the week ahead which we think will enable the RBA to hold for now, but it’s a very close call. The money market though now sees around a 58% chance of a February rate hike and sees two rate hikes this year.

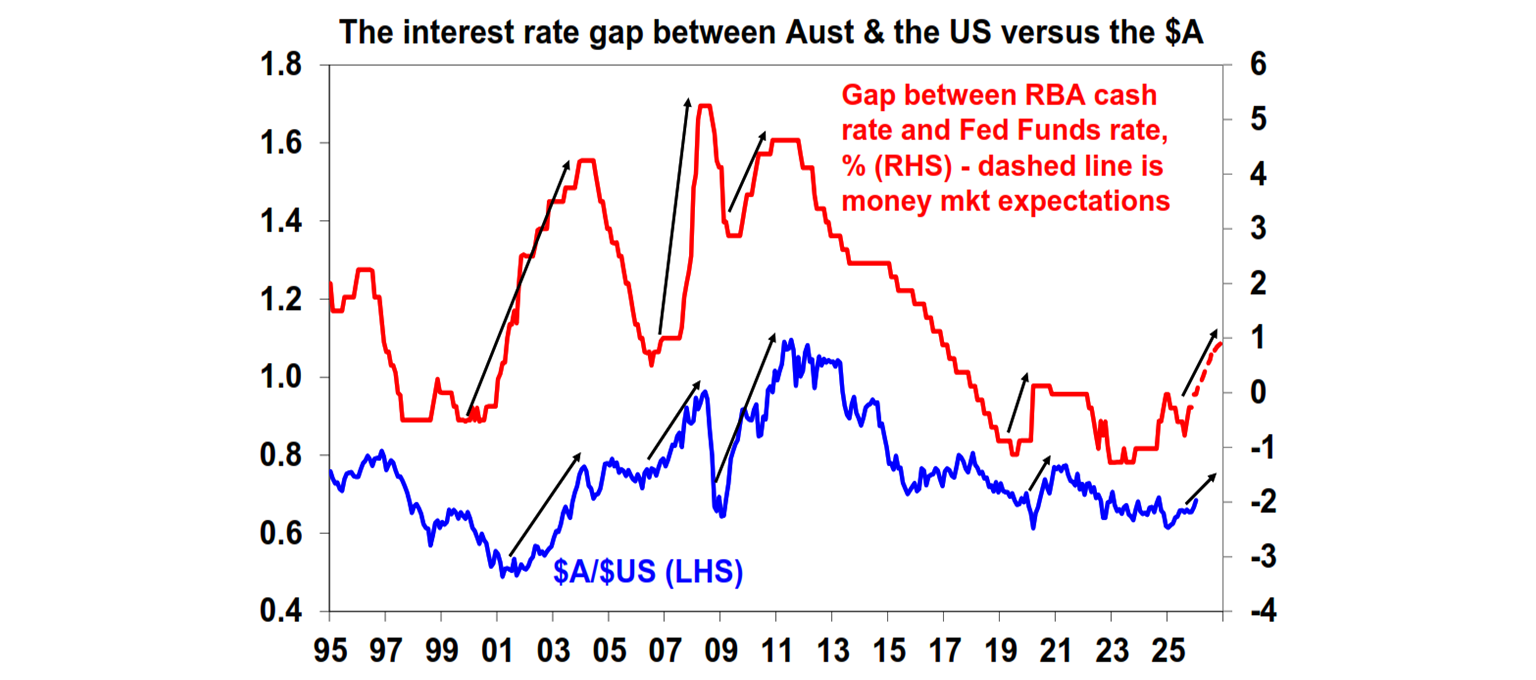

On the other hand, the $A rose to nearly $US0.69, its highest since September 2024 reflecting a fall in the $US and heightened expectations of RBA rate hikes when the Fed is still expected to cut rates. As can be seen in the next chart periods when the gap between Australian and US cash rates widens invariably see the $A rise.

The rising $A means that while Australian shares underperformed US shares in local currency terms (see the first chart above), they have outperformed US shares over the last year when measured in US dollars. Since Trump was inaugurated the $A is up 9% against the $US.

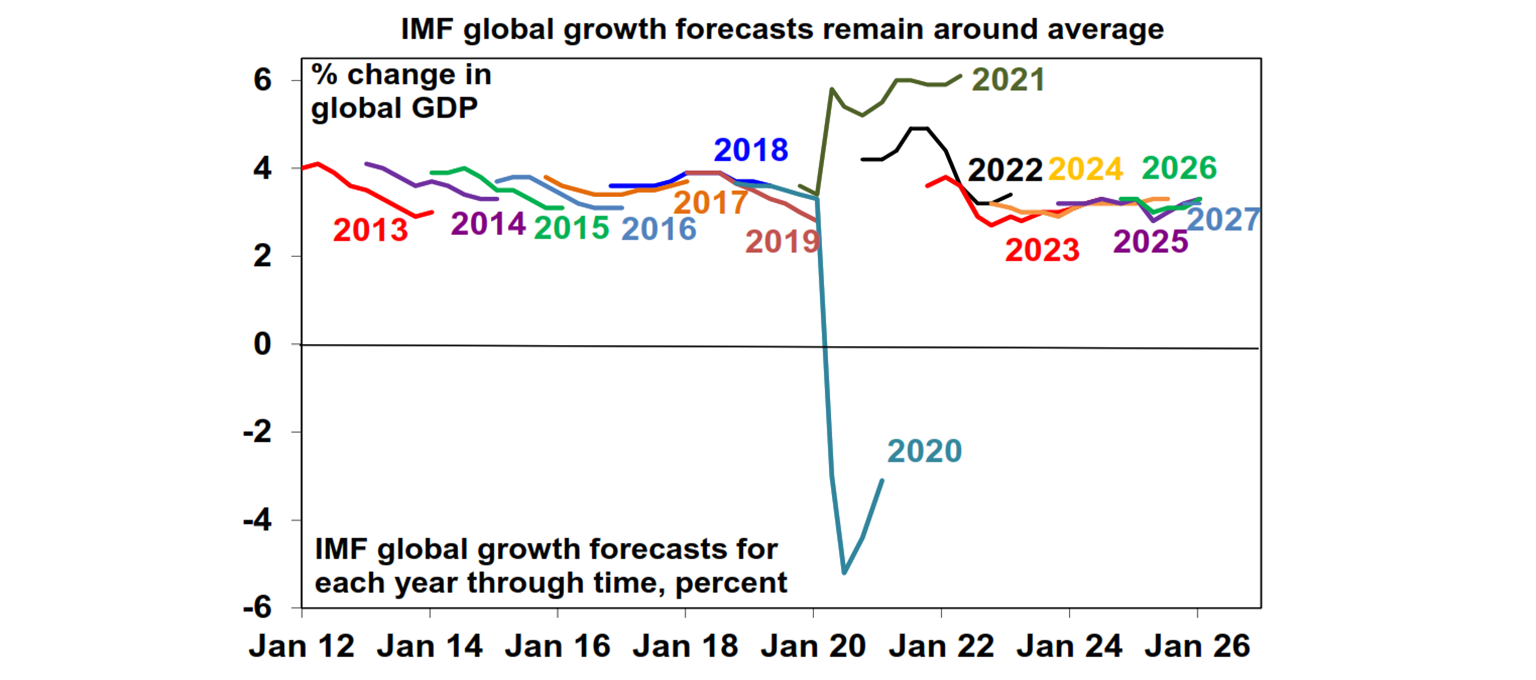

Despite all the noise the IMF is forecasting global growth of 3.3% this year and 3.2% in 2027. This is around normal levels. For Australia it sees year average growth picking up from 1.9% last yar to 2.1% this year and 2.2% next year. And it sees developed country inflation falling to 2.2%. This is basically a benign outlook for investment markets.

Sad songs displacing happy songs. Another study, this time by MusixMatch, has found popular music is getting sadder. Since 2000 the percentage of Billboard Hot 100 songs expressing despair, angst and heartbreak have each risen by between 10 to 20 percentage points. No wonder Spotify claimed my listening age was 77 as I am stuck in the 1960s and early 1970s listening to happy songs like Happy Together or Can’t Take My Eyes Of You. When you are already feeling down thanks to Trumpian destruction and social media outrage, sad songs only add to depression, so the world needs more happy songs.

Major global economic events and implications

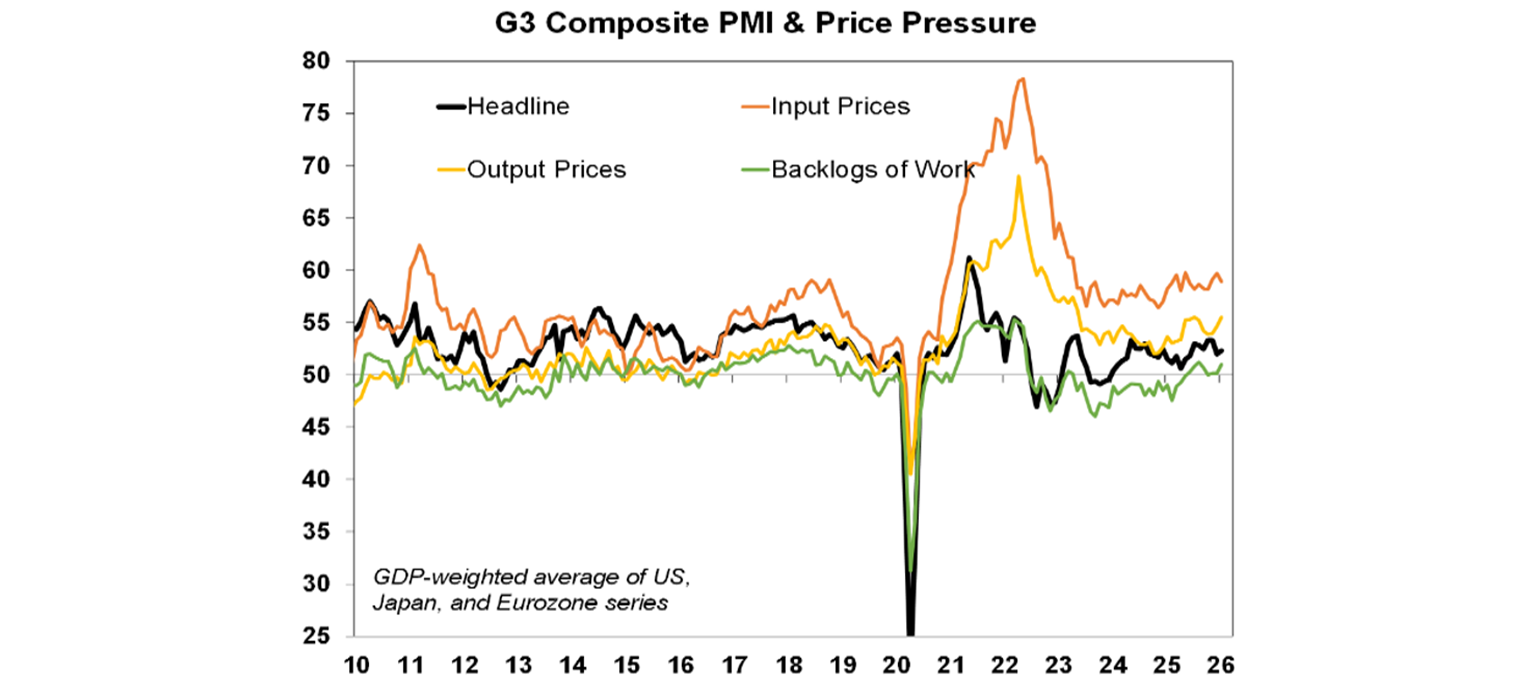

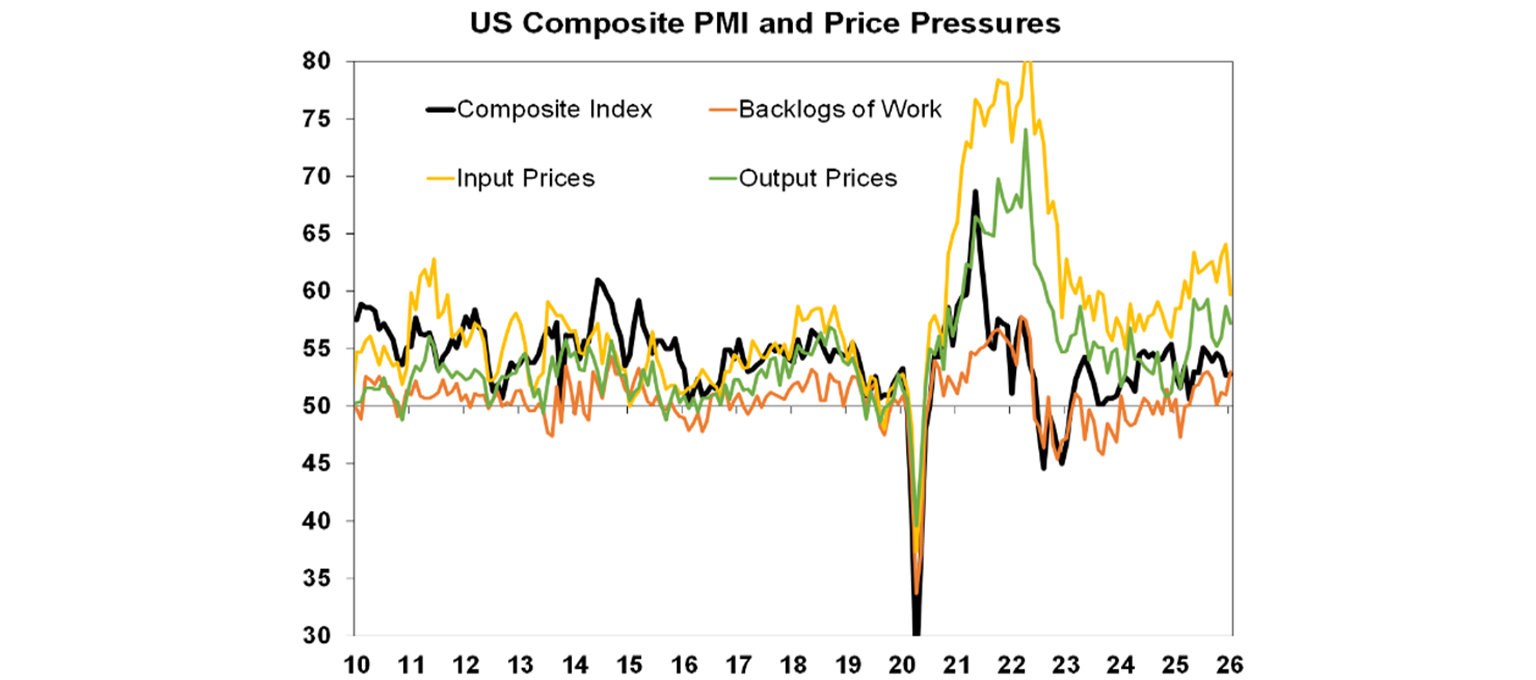

Aggregate business conditions PMIs in developed countries improved slightly with the US and Europe little changed but solid increases in Japan, Australia and the UK. They remain at levels pointing to okay but moderate economic growth. Input prices fell but output prices rose.ahead.

The US composite PMI was little changed in January and remains at a reasonable level. Input and output prices both fell but remain elevated thanks to tariffs.

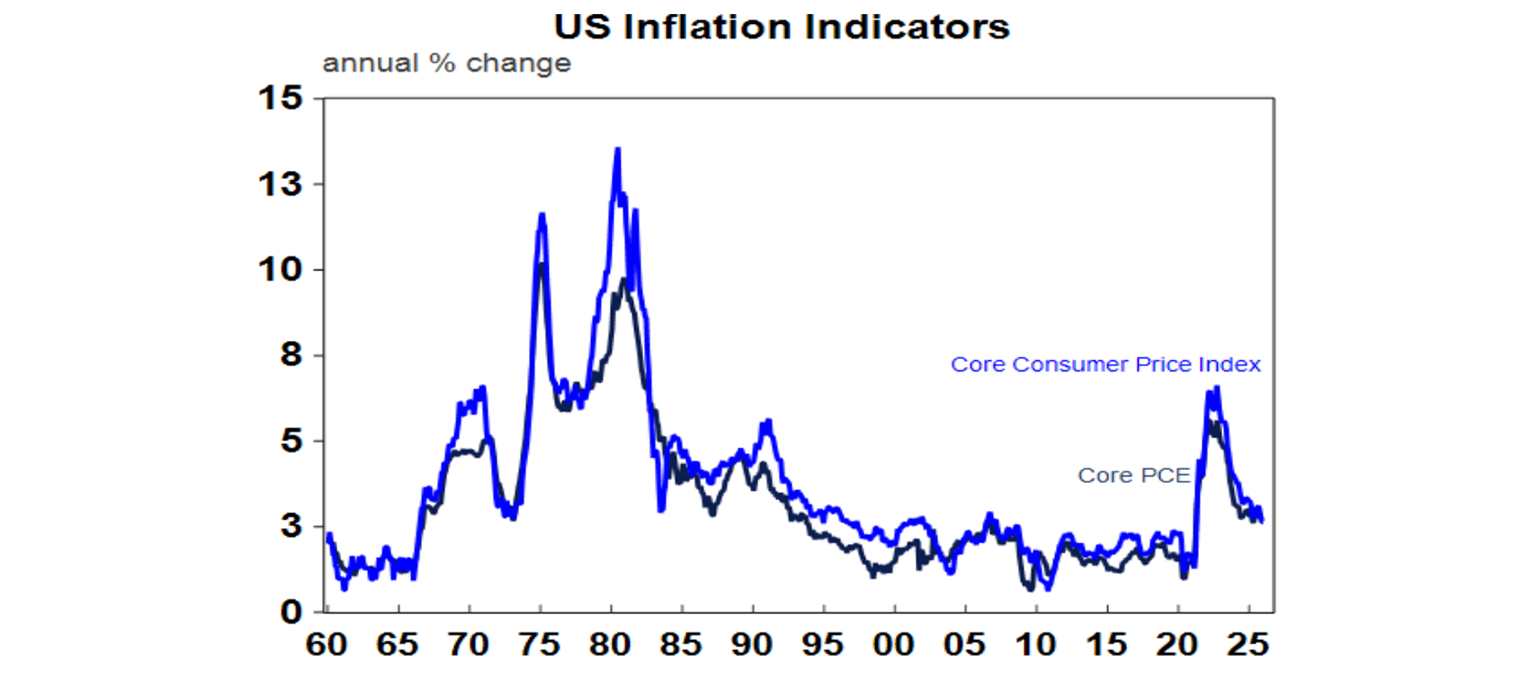

Other US economic data was solid with consumer spending remaining strong in November and jobless claims remaining low. Core private final consumption deflator inflation, which is what the Fed targets, was 2.8%yoy in November as expected. There is nothing here to dissuade the Fed from leaving rates on hold in the week ahead.

Canadian inflation rose slightly to 2.4%yoy, but underlying measures slowed, but not enough to alter expectations for the Bank of Canada to remain on hold.

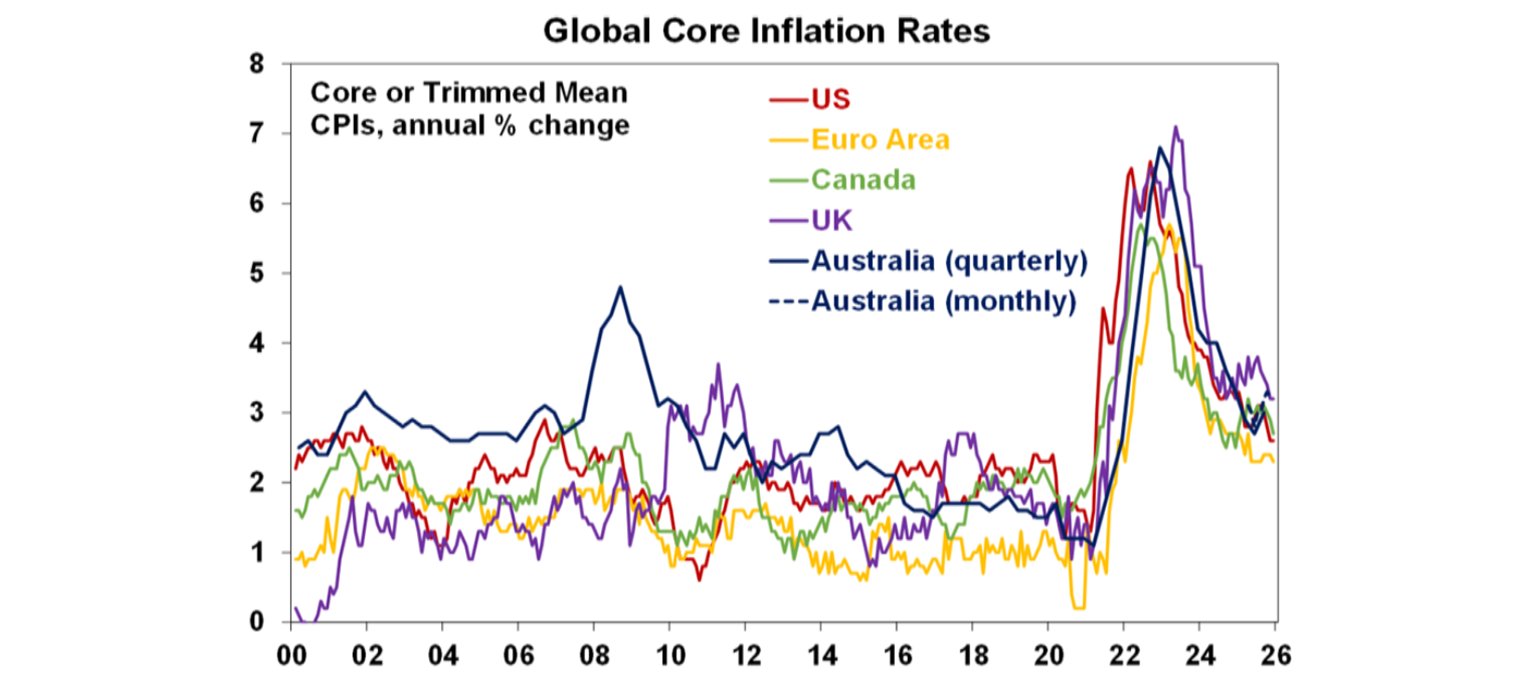

UK inflation data was mixed in December but with core inflation remaining at 3.2%yoy and with weak jobs data the Bank of England likely remains on a gradual rate cutting path. The interesting thing to note from the chart above is that several countries had a bit of a set back in the inflation downtrend last year, ie Australia was not alone.

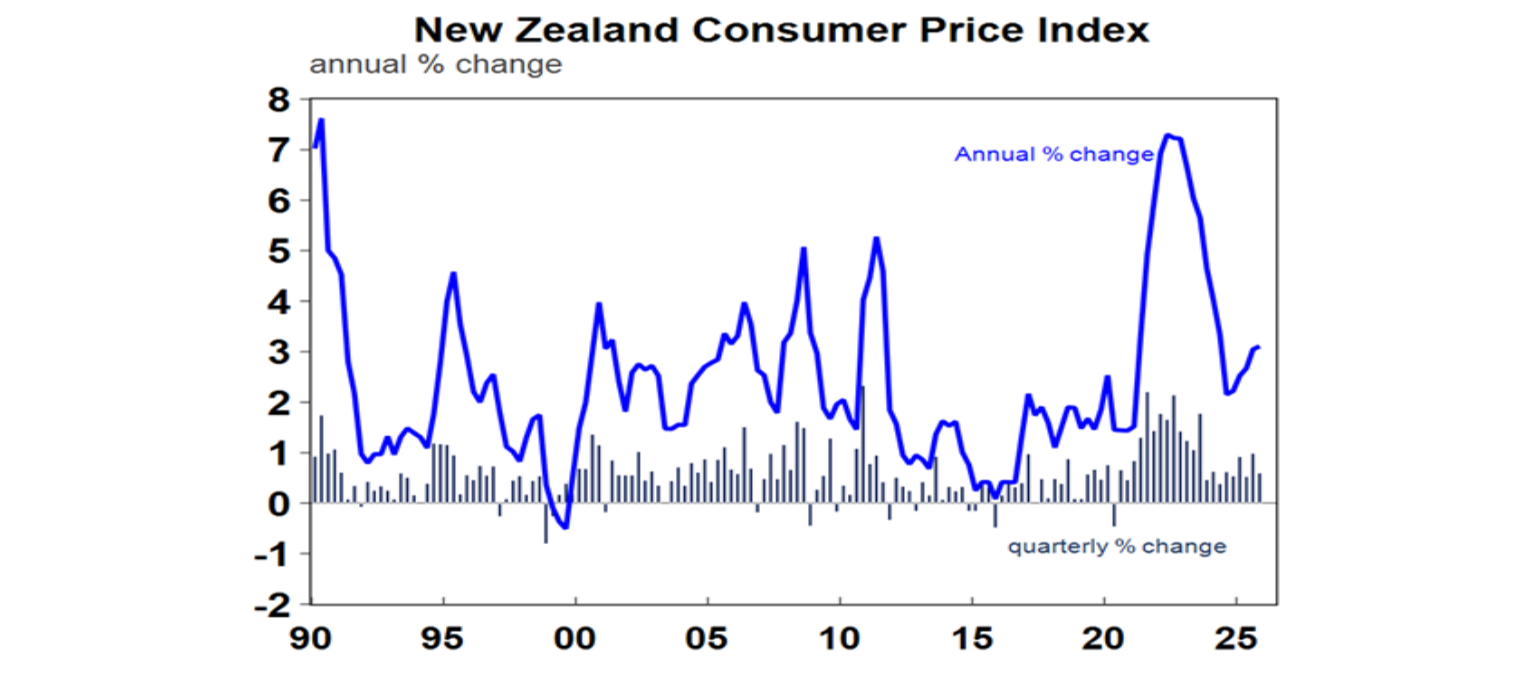

Inflation in New Zealand in the December quarter came in stronger than expected at 3.1%yoy but with core (ex food and energy) inflation little changed at 2.5%yoy. The RBNZ is expected to leave rates on hold at 2.25%.

The Bank of Japan left its policy rate on hold at 0.75%, but raised its growth and inflation forecasts and signalled further tightening ahead. Core CPI inflation for December fell slightly to 1.5%yoy.

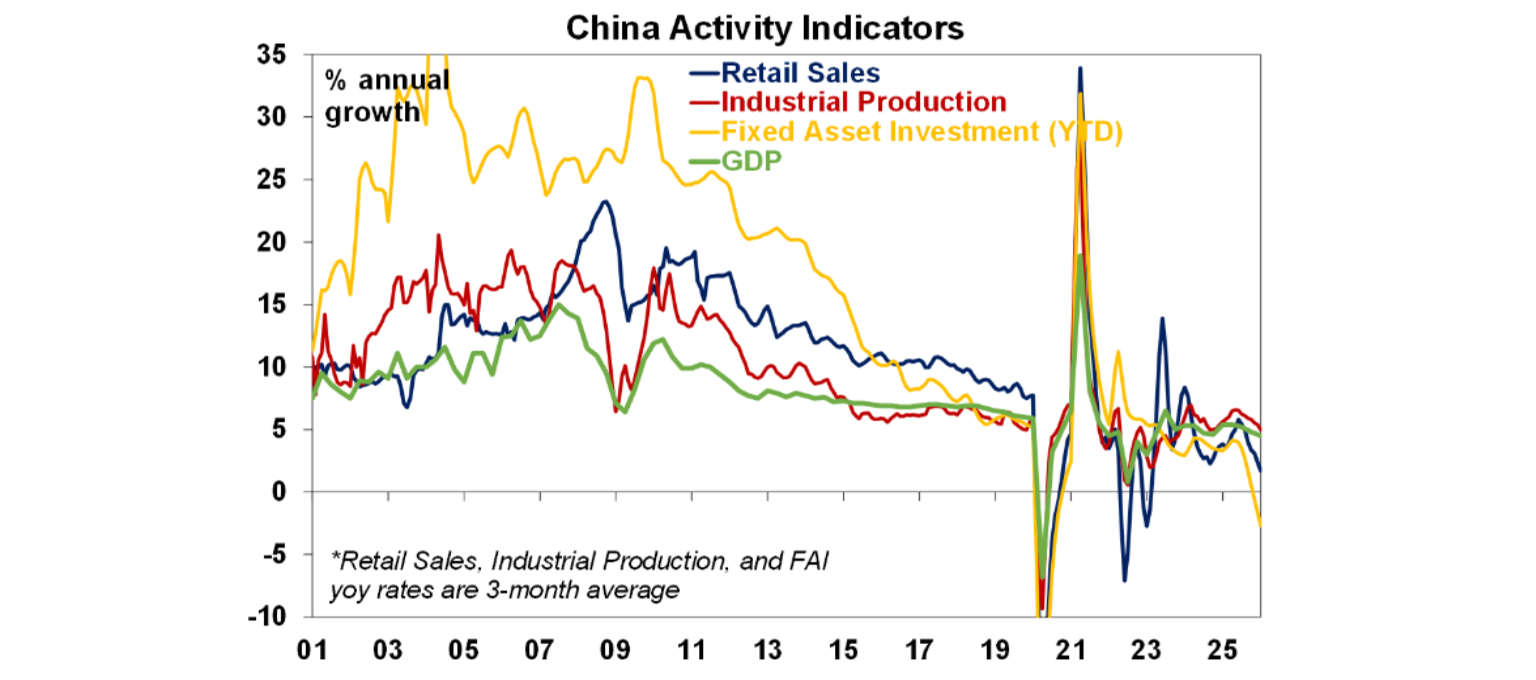

Chinese GDP growth for 2025 of 5% was on target, but momentum slowed to 4.5%yoy in the December quarter. And growth was lopsided with trade accounting for a third of growth, its highest since 1997 as exports were diverted from the US following Trump’s tariffs. In December growth in industrial production accelerated slightly but the downtrend in retail sales and investment remained with property investment, sales and prices remaining a drag. Further policy stimulus is likely, but its likely to remain incremental as the growth target is cut to 4.5% for this year.

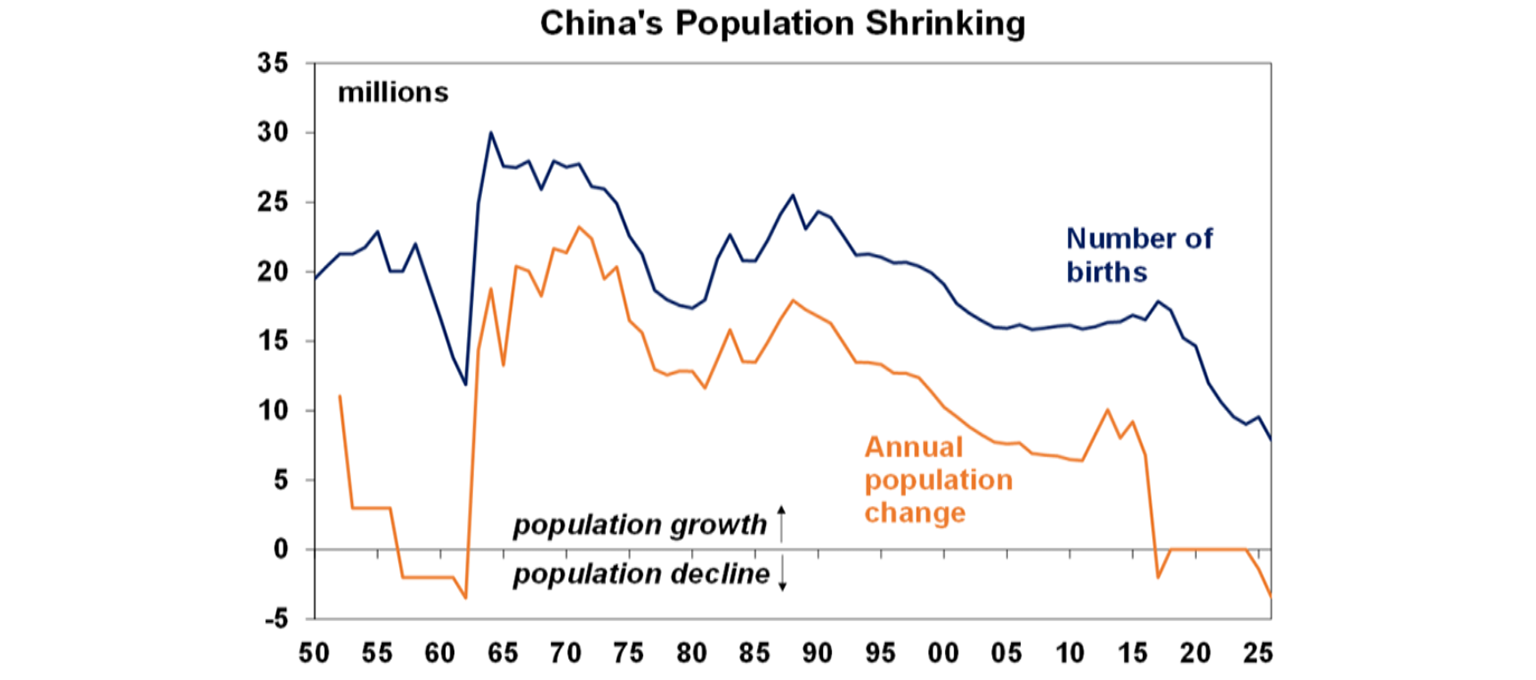

China’s birth rate fell to its lowest since at least 1949 with the population falling by 3.5 million. This is despite numerous measures designed to encourage having more babies, which is similar to the experience in many other countries – once having lots of babies goes out of fashion its hard to change as countries develop.

Australian economic events and implications

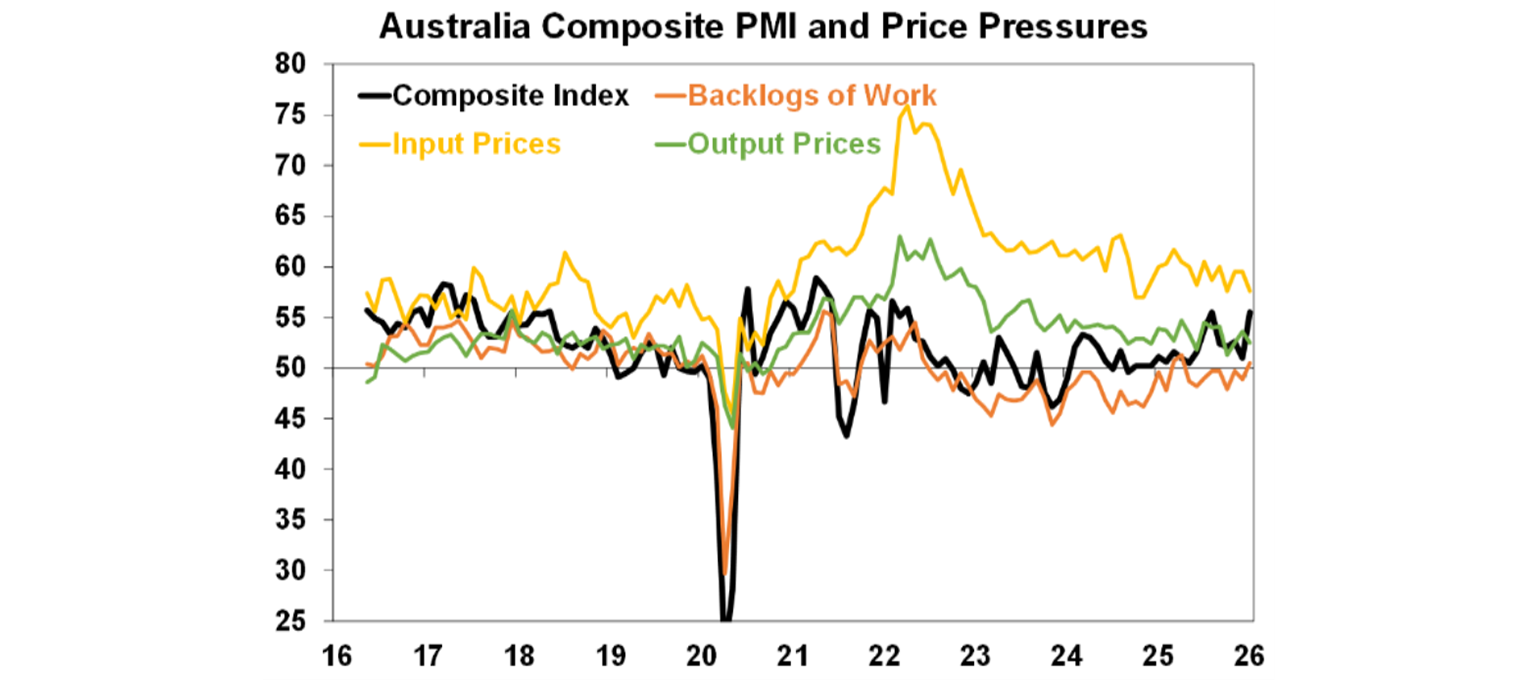

Australia’s January composite PMI rose suggesting stronger growth. Price pressures moderated though with a fall in the input and output price indicators with the latter in the same moderate range it’s been in for the last two years, suggesting the rise in CPI inflation lately may be temporary.

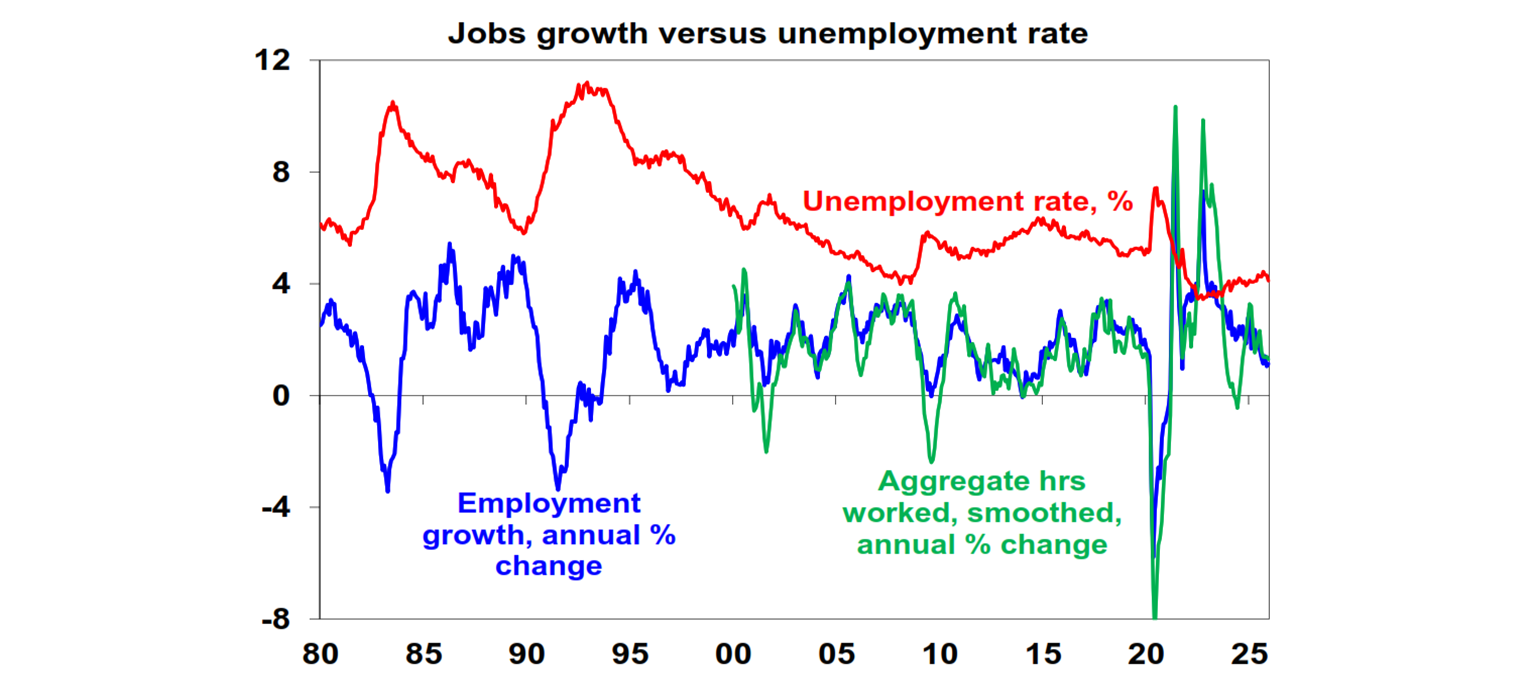

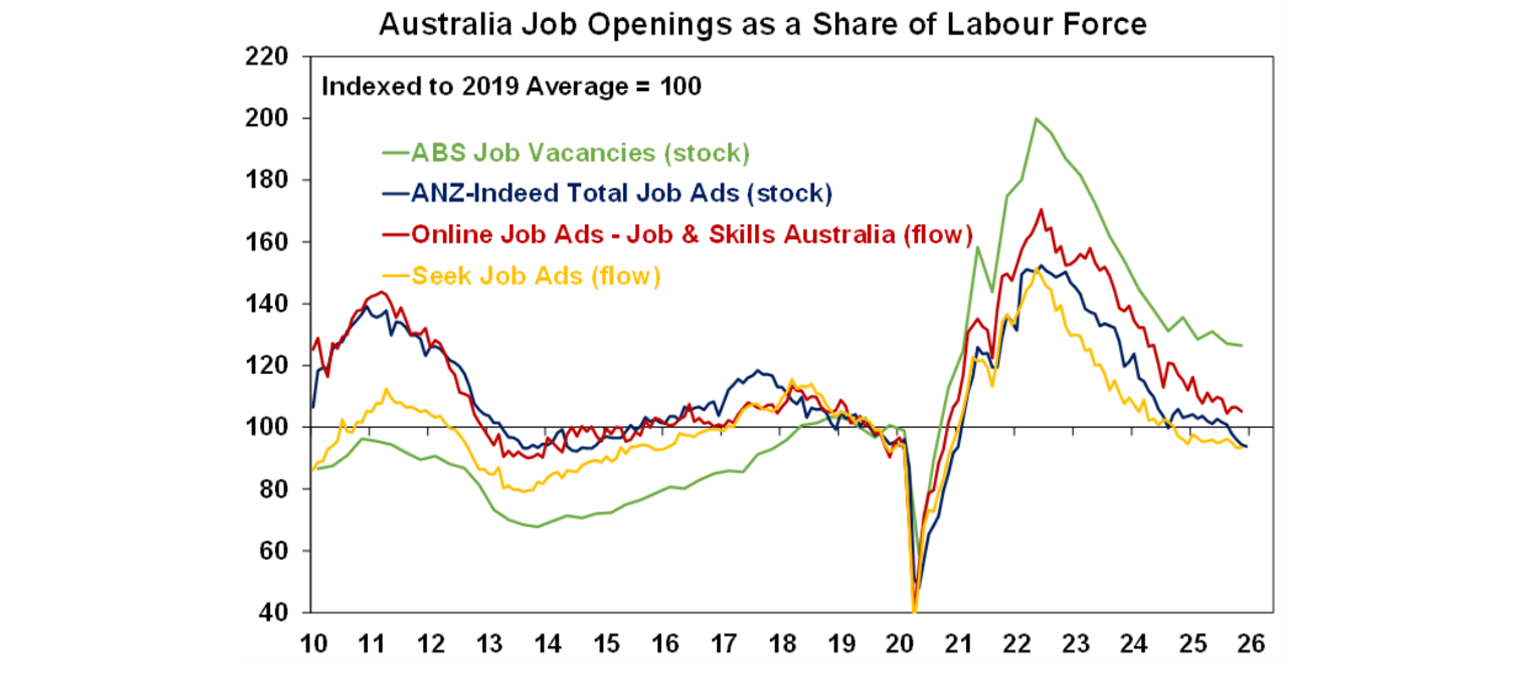

December jobs data was strong on all fronts, adding to the case for a rate hike. But it can be volatile around year end/new year. Employment rose by 65,000, hours worked rose solidly, unemployment fell to 4.1% and underemployment fell to 5.7%. At the same time participation rose surprisingly slightly allowing unemployment to fall. This came after several weak months which saw employment growth almost stall. Its likely to reflect normal volatility over the year end/new year period where flows into the workforce and between jobs can be hard to seasonally adjust with the ABS noting a surge in young workers. So, it’s best to wait for a few more months’ worth of jobs data before concluding that the labour market is really strengthening again. As can be seen in the next chart the trend slowing in annual growth in jobs and hours worked remains in place. Nevertheless, the RBA will still characterise the labour market as a “little tight” and the strong jobs data for December makes a February rate hike more likely if December quarter trimmed mean inflation data due out next week comes in greater than the RBA’s November forecast for a 0.8%qoq or 3.2%yoy rise.

Supporting the case for not reading too much into the strong December labour force data is the ongoing softness seen in job ads which are continuing to trend down.

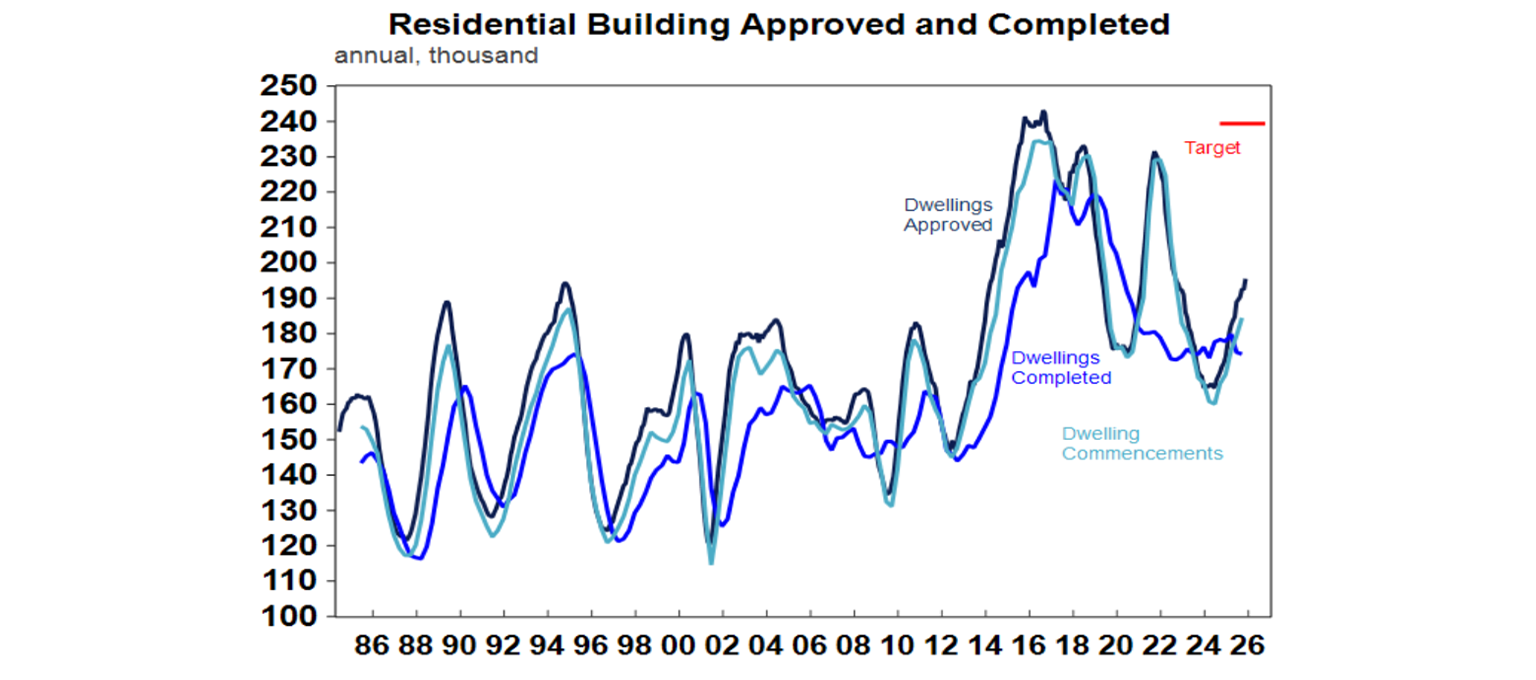

Dwelling commencements rose in the September quarter tracking approvals higher but remains well below the Housing Accord target of 240,000 pa. Completions remain weak so the housing shortfall will be around for a while yet.

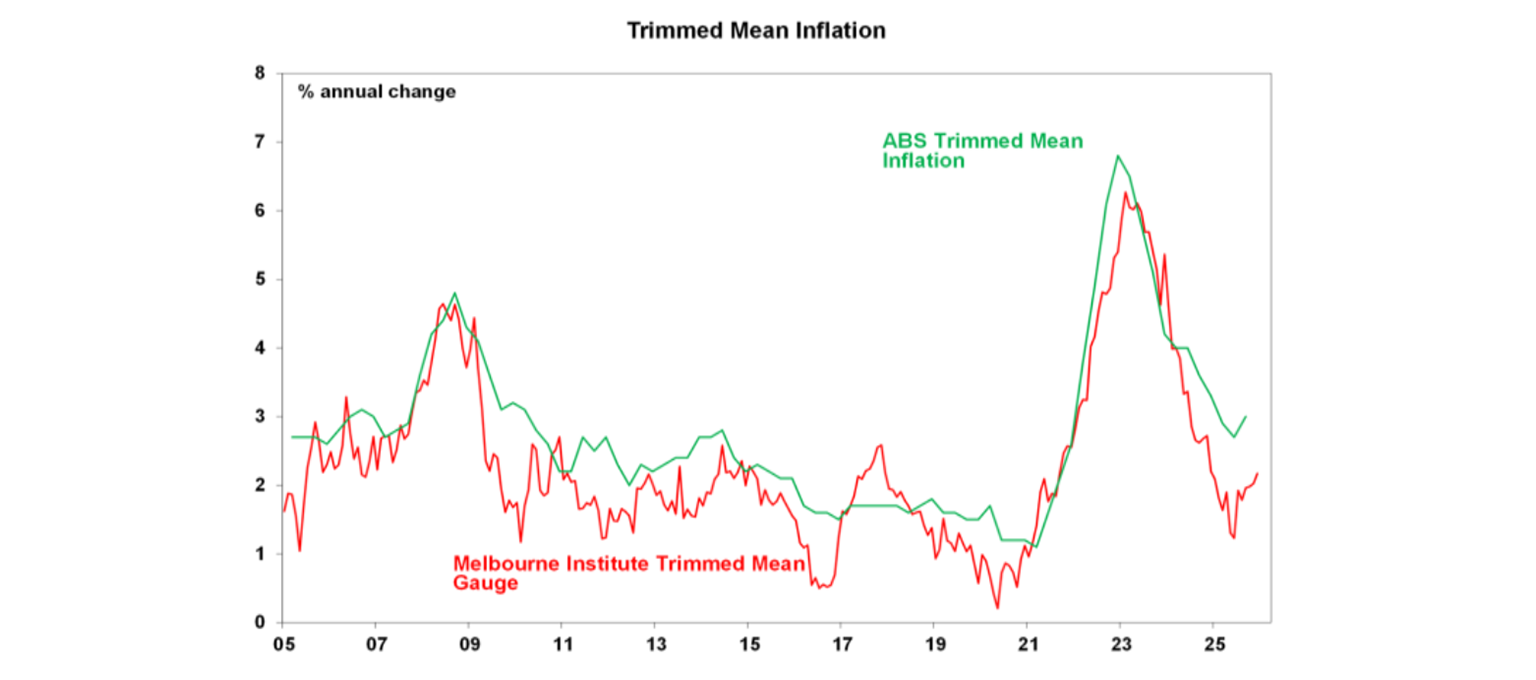

Meanwhile, the Melbourne Institute’s Inflation Gauge rose to 3.5%yoy with the trimmed mean also up. It’s still running below the ABS’ trimmed mean which is good, but its rising trend is a concern.

What to watch over the next week?

In the US, the Fed (Wednesday) is likely to leave rates on hold at 3.5-3.75%, with the US money market pricing in only a 5% chance of a cut. Having cut three times late last year the Fed is back into wait and see mode before considering a further cut. Inflation is still running around 3% but should slow as the tariff impact recedes. Meanwhile, jobs data has been mixed but some indicators suggest the economy may be picking up pace. So the best thing for the Fed to do is pause. Further easing may not occur until the new Fed Chair arrives in June although there remains much uncertainty about who this will be, whether it will occur on time and whether the new presumably dovish Chair is able to convince other Fed officials. On the data front, expect continuing growth in underlying capital goods orders (Monday) and consumer confidence (Tuesday) to remain weak. So far only around 12% of S&P 500 companies have reported December quarter earnings, but reporting will ramp up in the week ahead with the consensus expecting earnings growth of 8.8%yoy, although it’s likely to come in around 12% allowing for normal beats.

The Bank of Canada (Wednesday) is also expected to leave rates on hold having already cut to 2.25%. It’s likely to have a very weak easing bias.

Eurozone December quarter GDP (Friday) is expected to show a 0.2%qoq or 1.3%yoy rise with unemployment remaining at 6.3%.

In Australia, December quarter CPI data due Wednesday will be key to whether the RBA holds or hikes in February. We expect quarterly inflation to fall to 0.6%qoq but because it’s replacing a 0.2%qoq rise a year ago annual inflation will rise to 3.6%yoy which is just above the RBA’s forecast. More importantly, though the RBA will focus on the trimmed mean inflation rate which we expect to fall back to a 0.8%qoq rise resulting in a 3.2%yoy rise which is consistent with RBA forecasts. If this is correct, then the RBA is likely to hold as it will provide confidence that inflation is tracking back to target in line with its forecasts. However, if trimmed mean inflation rises by 0.9%qoq or more then a rate hike is likely, with strong December jobs data adding to the odds. The December monthly CPI is expected to show inflation at 3.6%yoy with trimmed mean at 3.2%yoy.

In terms of other data, the December NAB business survey (Tuesday) will likely show moderate conditions and confidence and hopefully still benign selling price increases. Private credit data (Friday) for December will likely show continuing strength in home mortgage credit growth.

Outlook for investment markets

Global and Australian share returns are expected to slow to around 8%. Stretched valuations in the key direction setting US share market, political uncertainty associated with Trump and the midterm elections and AI bubble worries are the main drags, but returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA may have finished cutting rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to be solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to 5-7% due to poor affordability, rates on hold with talk of rate hikes and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.6%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds or hikes. Fair value for the $A is around $US0.73.

You may also like

-

How women can build financial wealth, confidence and security Practical tips for women to grow their wealth. Learn about budgeting, saving, super advice and more to take control of your finances. -

Oliver’s Insights – Oliver's Insights - Gulf War-3 US/Iran war Geopolitical shocks have been a rising feature this year with US “interventions” in various countries – Nigeria, Venezuela, Greenland and now Iran. -

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.