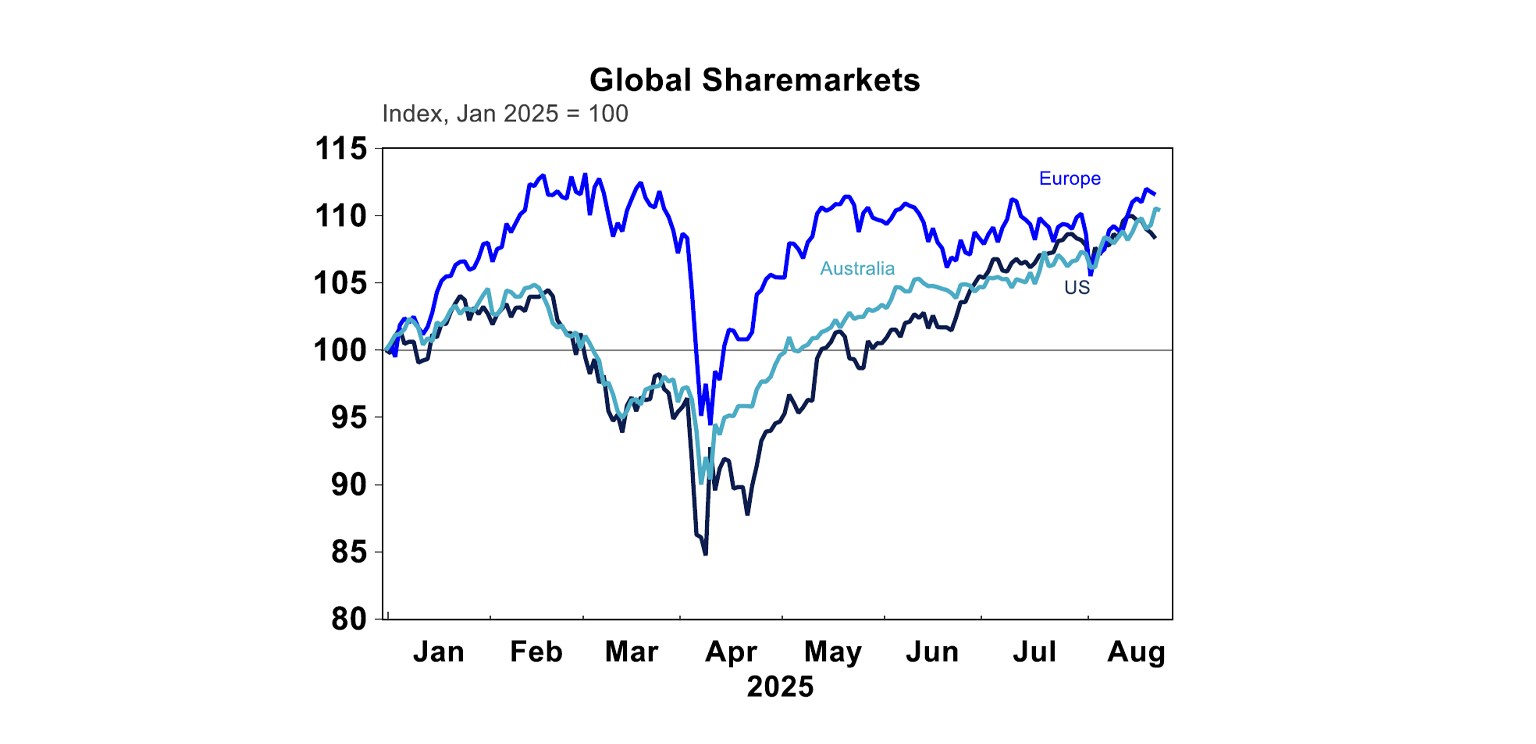

Global shares have been mixed this week with US shares taking a roller coaster ride – falling 1.2% to Thursday but then recouped all the losses following Jerome Powell’s speech, while Aussie shares hit new record highs helped by solid profits results. For the week, Japanese shares were down 1.7% but most other markets ended in the green: US shares were up 0.3%, Eurozone shares gained 0.7%, Chinese shares climbed 4.2% to YTD highs, while the Australian share market saw the ASX 200 climbed above 9000 for the first time on Thursday and ended 0.3% higher. Gains were seen in most sectors, led by consumer discretionary and communication (both benefited from recent positive consumer data) as well as financials. However, healthcare (mainly CSL), materials, and energy stocks were down following earnings results.

Bond yields fell slightly in the US and rose slightly in Australia, but overall, they are still range bound throughout August. The $A fell to $US0.64 with the US$ up slightly, while Bitcoin was also down 4% so far this week.

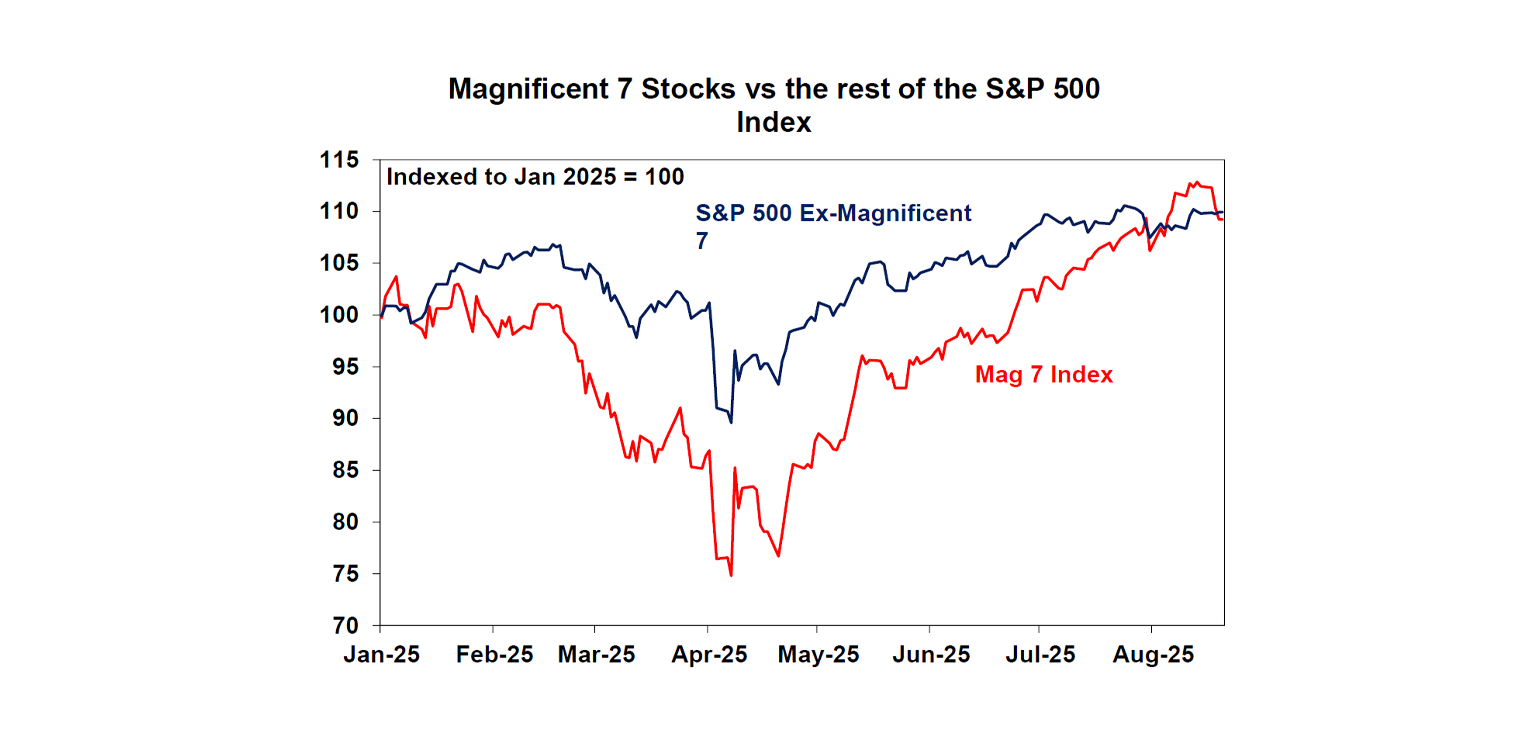

Are markets getting a bit “yippy”? We have talked about elevated risk of a pullback for some time, given that valuations are stretched (with Mag 7 stocks consistently roaring to new record high), high tariff impacts are still to be seen, there will be more noise coming out on the tariff front (especially regarding penalties on importers of Russian oil, sectoral tariffs, and the impending trade deal with China. But looks like the catalyst for the risk off mood this week has come from tech stocks. On Tuesday, NVIDIA fell as much as 3.5% - the biggest drop since April, and other IT darlings such as Palantir and chipmaker Arm also dropped 9.4% and 5%, respectively. The Nasdaq Composite Index is now down 0.6% for the week given the broad selloff. The Financial Times attributed the fall to a report by MIT saying that “95 per cent of organisations is getting zero return” from generative AI investments. In addition, Meta announced a pause in hiring across AI infrastructure teams, while the OpenAI CEO Sam Altman stated “investors as a whole are overexcited about AI” (2 weeks after releasing the “smartest” ChatGPT ever!). Locally, Commonwealth Bank has decided not to proceed with its earlier plan to replace 45 jobs with AI.

But AI is never meant to magically boost economic growth and productivity overnight. Similar to computers or the internet, there is an adoption period as companies and individuals to learn how to use it effectively, and material productivity gains are only visible when there is integration of AI across multiple sectors and organisations. Overall, we are not too concerned about a short-term correction in tech stocks; and for the broad market, there are also plenty of positives on a 6-12 month horizon, including further rate cuts from central banks as well as Trump’s likely pivot towards more market friendly policies.

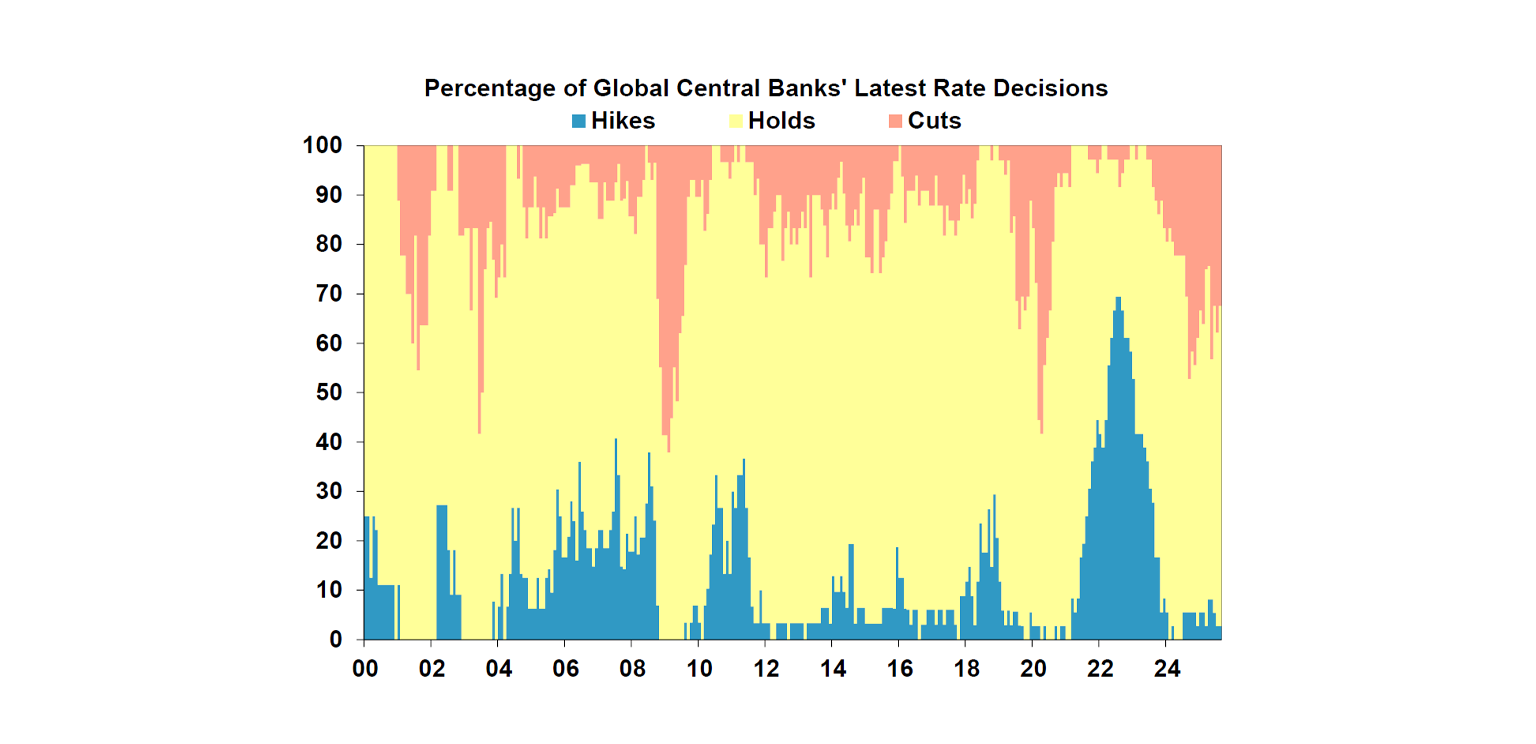

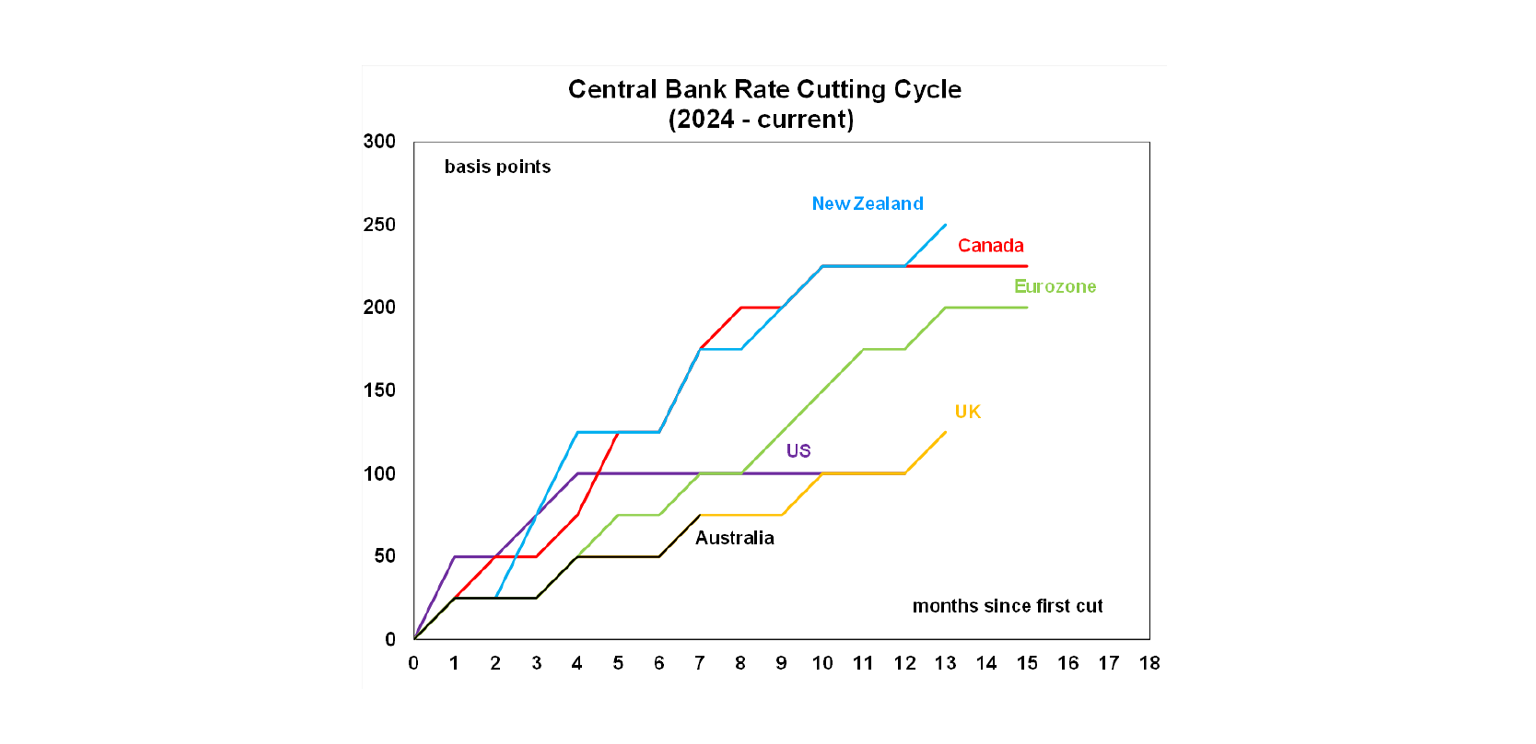

For now, central banks are staying put for the most part, despite the ongoing cutting cycle. 65% of global central banks opted to hold rates in their latest meeting, while about 32% delivered a cut, underscoring the high level of policy uncertainty across the board. The US Federal Reserve is no exception to the wait and hold camp, given the lack of clarity in “timing, magnitude, and persistence” of higher tariffs. In fact, the latest FOMC meeting minutes for August leaned slightly hawkish, with most of the board judging “upside risk to inflation” to be greater than the “downside risk to employment”. However, these were minutes prior to the release of the latest jobs report, where employment gains were cooling a bit faster than previously thought – and as a result, Fed Chair Jerome Powell’s speech on Friday at Jackson Hole leaned more dovish. Powell emphasised that downside risks to employment was rising, and they could deteriorate quickly, which would warrant a policy response. September still looks like a “live” meeting for now, despite President Trump’s efforts to fire FOMC member Lisa Cook (after failing to convince “Too Late Powell” to resign) – but the probability of a cut has risen significantly to ~80%.

In Australia, the long-awaited Economic Reform Roundtable (dubbed as the “productivity summit”) has wrapped up this week. As expected, there were no major policy changes announced by the government nor any consensus on the specifics of tax reform. Nevertheless, there was certainly broad agreement of the policy priorities, which include better regulations & simplifying trade, speeding up approvals & housing supply, developing AI capacity & a better workforce, attracting more capital investment, and a better tax system especially for younger generations. There were also some “quick fixes” to be enacted immediately (though they had mostly been announced before the summit) such as developing a national AI capability plan, speeding up environmental approvals for new homes, and removing hundreds of nuisance tariffs.

Despite the lack of details, we think that these outlines are a step in the right direction, given that Australia hasn’t had any major economic reform since the 1980-90s. Weak productivity in Australia has been a long-term issue (at least since 2016) which has depressed our growth potential, our real wages growth, and our living standards; and it’s never going to be solved in three days. It’s also politically difficult to enact some of the most radical measures without a crisis. But there is some room for hope as Treasurer Jim Chalmers (interestingly) did not rule out tax changes before the next election. He highlighted the need to improve intergenerational equity, incentivise business investment, and make the tax system simpler & more sustainable – all very valid points which overlapped with our wish list!

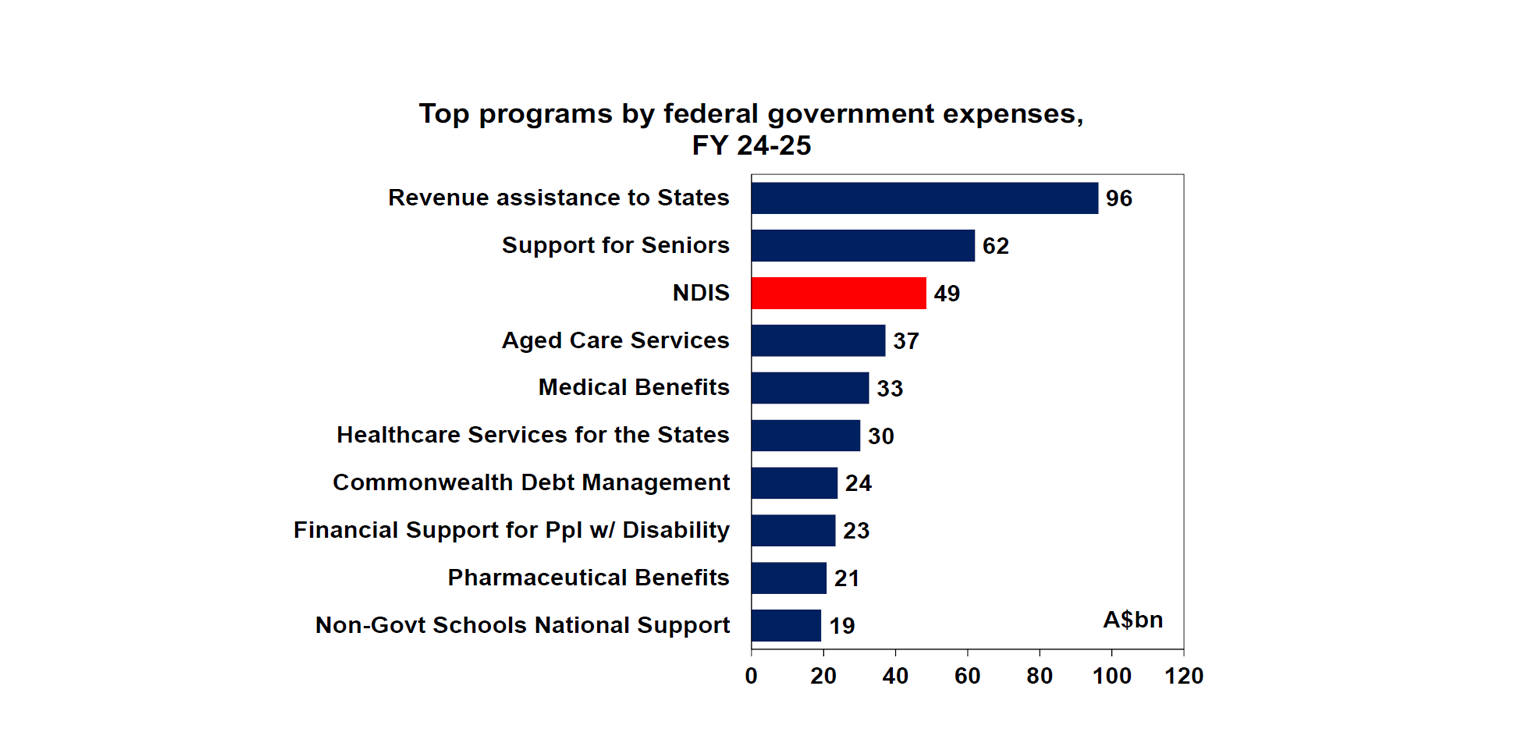

In addition, it looks like there is some willingness from the government to reduce federal spending (which is currently sitting around record high levels of 28% of GDP) by announcing some tightening in the National Disability Insurance Scheme eligibility. It is notable that since 2020, annual NDIS expenses have grown at an average pace of 21%pa and is now the third largest government expense program, more costly than Aged Care or Medicare.

My favourite stock of the week is Pop Mart – the Chinese pop toy maker behind Labubu. I. Its share price rose 18% this week after the announcement of a new mini Labubu and the release of earnings that exceeded estimates, with revenues increasing 204%yoy in 1H25. Year-to-date, Pop Mart has risen by more than 250% and partially contributed to the outperformance of the Hang Seng Composite and the MSCI EM Index (vs developed markets). Yes, there probably is a bubble here, but the rise of Pop Mart (and many other brands) shows that China is now increasingly positioning itself as a trendsetter and leader in soft power, especially among younger generations.

Major global economic events and implications

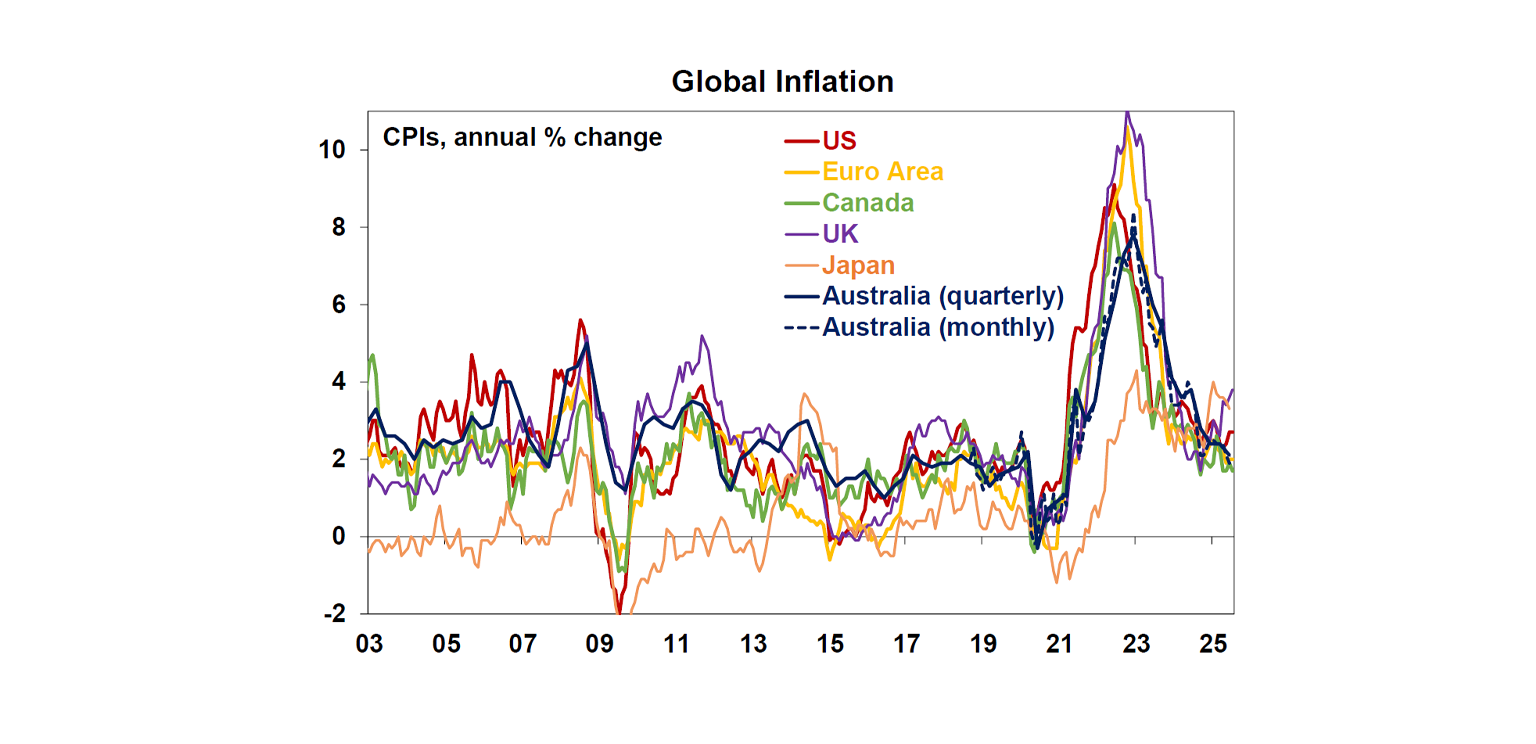

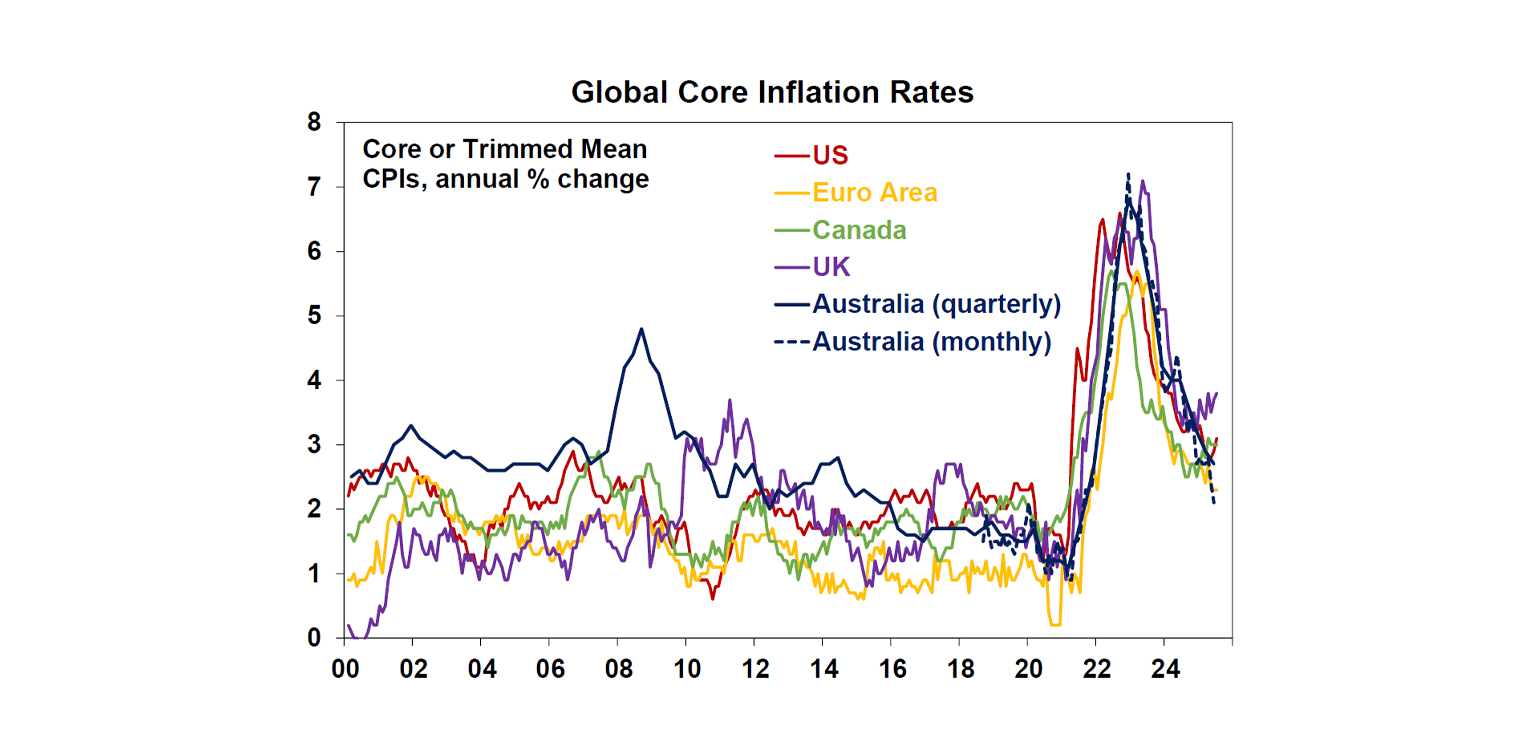

It's a big week for inflation data around the globe with Canada, UK, and Japan all releasing July inflation figures. UK headline CPI growth has been picking up for some time now, surprising markets with a 3.8%yoy print in July (3.7% expected), while services inflation hit 5%. There is still scope for the Bank of England to cut rates once more this year given the ongoing weakening of the labour market and slowing wages growth. But the very high and sticky core number of 3.8%yoy means that there is very little room for error, and markets are still pricing in a much higher chance (~75%) of a hold in the upcoming meeting.

Canada July CPI was slightly softer than expected: Headline CPI fell to 1.7%yoy (from 1.9% prior and 1.8% expected). However, the trade war between the US and Canada has seen some input costs rising, and core inflation (on both median & trimmed-mean measures) have ticked up lately to just above 3%. We expect only one more cut between now and year end.

Meanwhile Japan’s core CPI also rose more than economists expected printing at 3.1%yoy (consensus was for a 3% rise). While this is a step down from last month’s 3.3%, core inflation has been firmly above 3% since the beginning of the year, much above the BOJ inflation target.

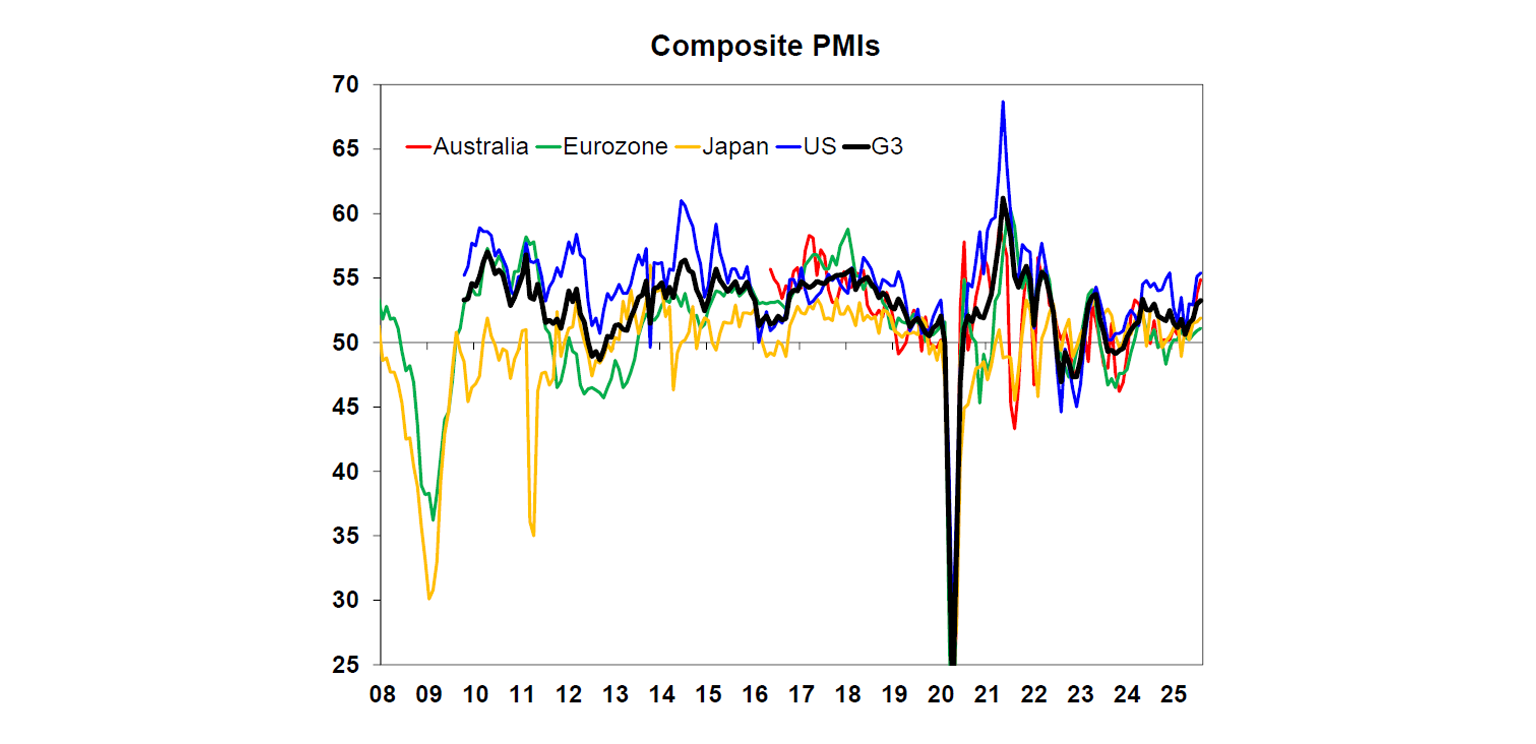

Looking forward, aggregate business conditions PMIs in developed countries improved in August with both manufacturing and services up in most countries. The more cyclical manufacturing surveys have been weaker than services readings, but they are now all in expansionary territory and have broadly trended up since April.

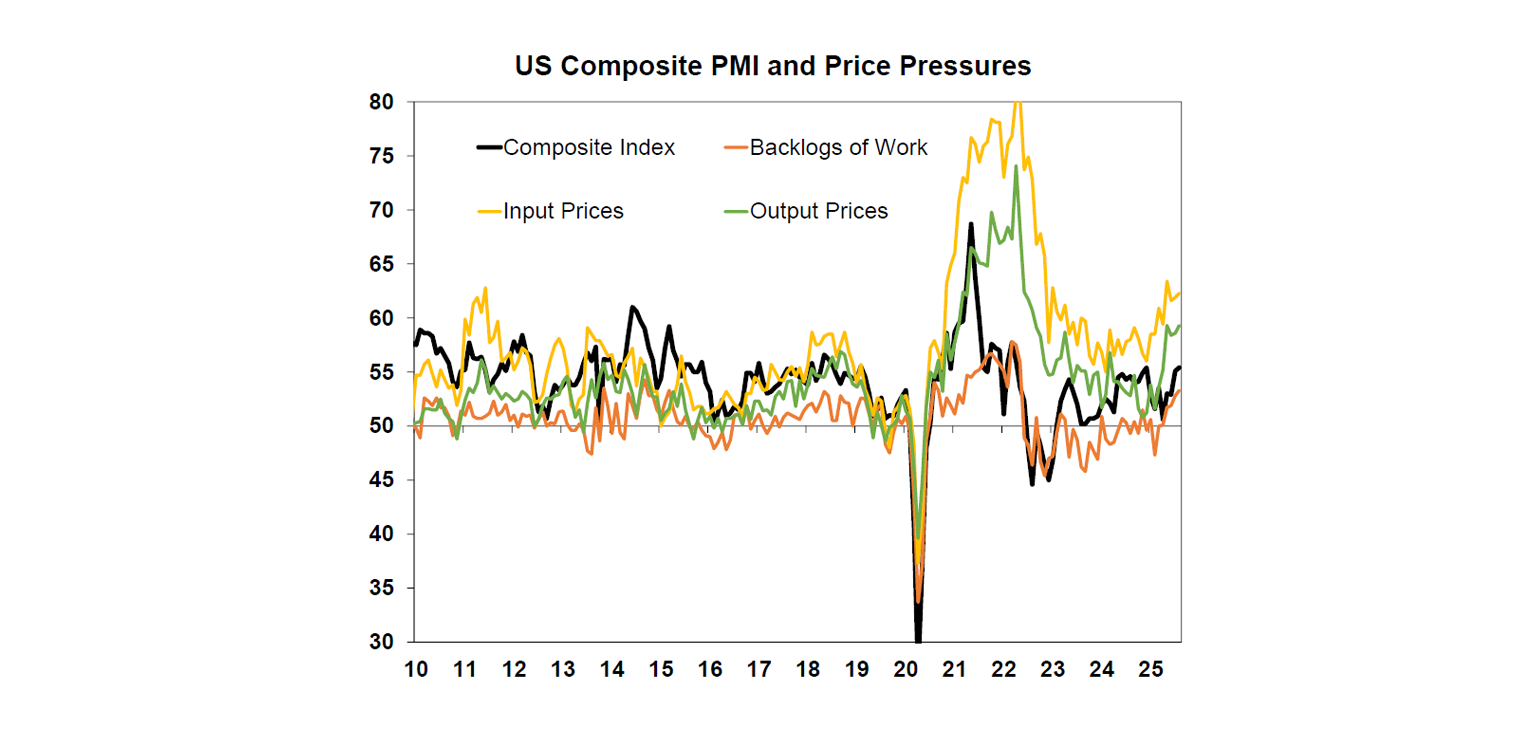

US composite PMI for August also exceeded expectations, with both manufacturing and services improving. The employment survey ticked up, consistent with mild initial jobless claims data this week (despite continuing claims moving up). However, unlike other developed countries where price pressures have stabilised, US input and output prices are hovering around the highest levels since late 2022 highs, suggesting the Fed should stay cautious.

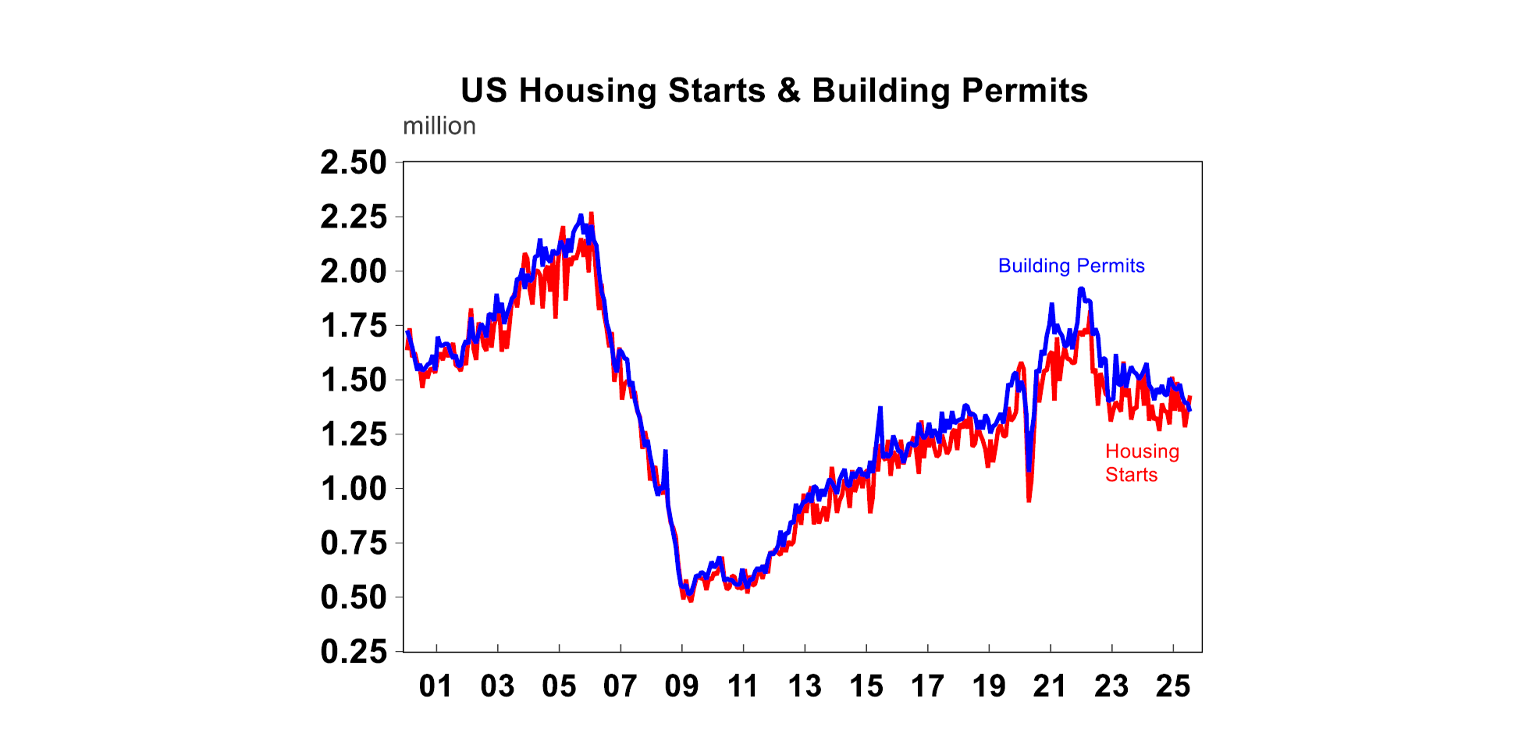

The US housing market remains very tepid. Homebuilder sentiment fell and is around cycle lows, similar to levels seen in late 2022 and during Covid; meanwhile new building permits fell 2.8% over the month. Housing starts and existing home sales unexpectedly increased in July, however, potentially thanks to lower mortgage rates over the summer – but they are still a long way down from the peak in 2021.

The Reserve Bank of New Zealand cut its cash rate by 25bps to just 3%, the lowest level in three years, accompanied by a clearly dovish statement where the Board considered a larger cut. New Zealand continued to see multiple headwinds that supported further rate cuts, including slow population growth, an unemployment rate that equals the peak during the pandemic, declining house prices, and a stalling economic recovery. The RBNZ also lowered its policy rate guidance, implying at least one to two more cuts for this cycle.

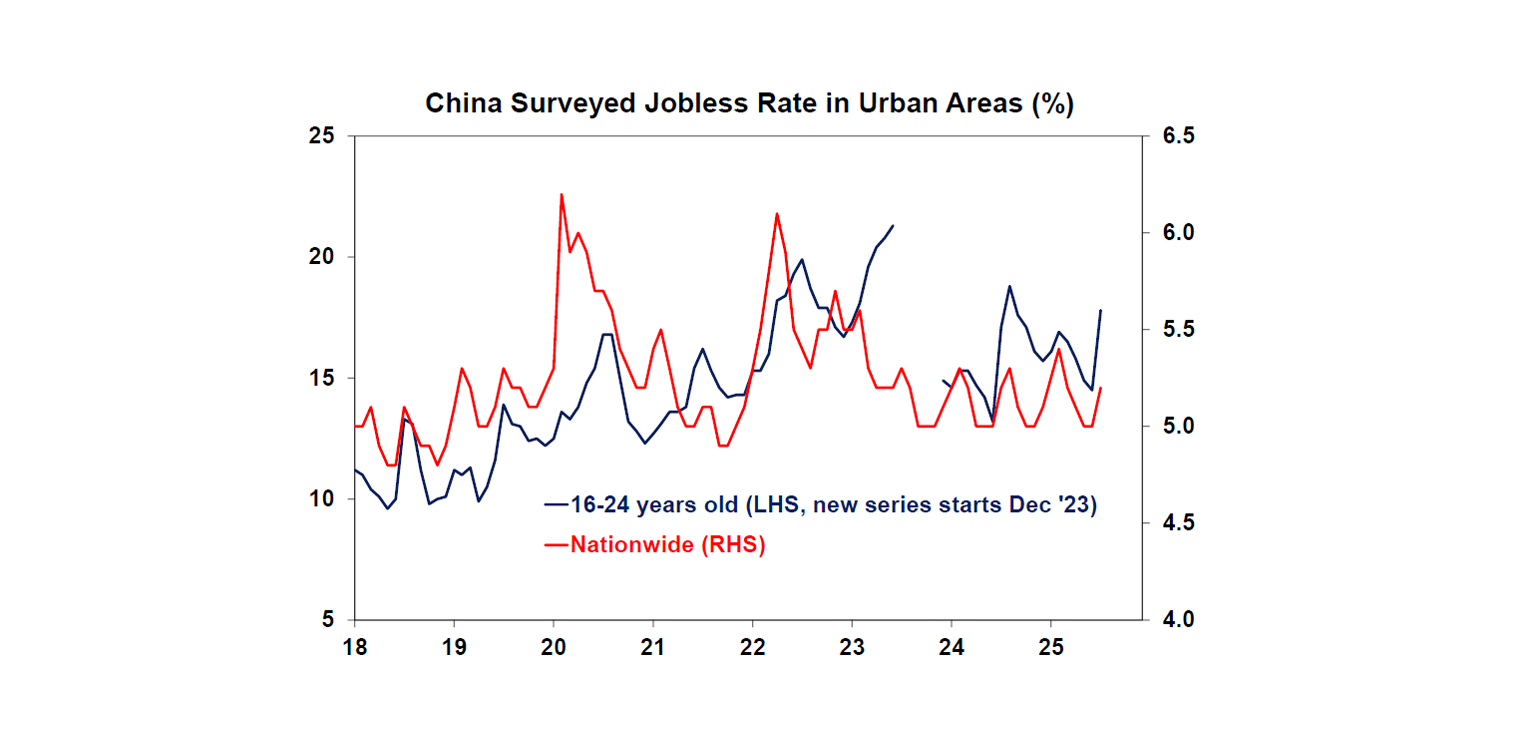

China’s July economic data disappointed (again). After last week’s sluggish spending & home price data, this week’s youth unemployment rate also ticked up to 17.8% (from 14.5% in June). Part of the rise is seasonal, as students graduate and start looking for jobs, but this is still higher than last year’s July rate of 17.1%. There will be more policy stimulus but they’re likely going to be gradual to keep growth just around 5%.

Australian economic events and implications

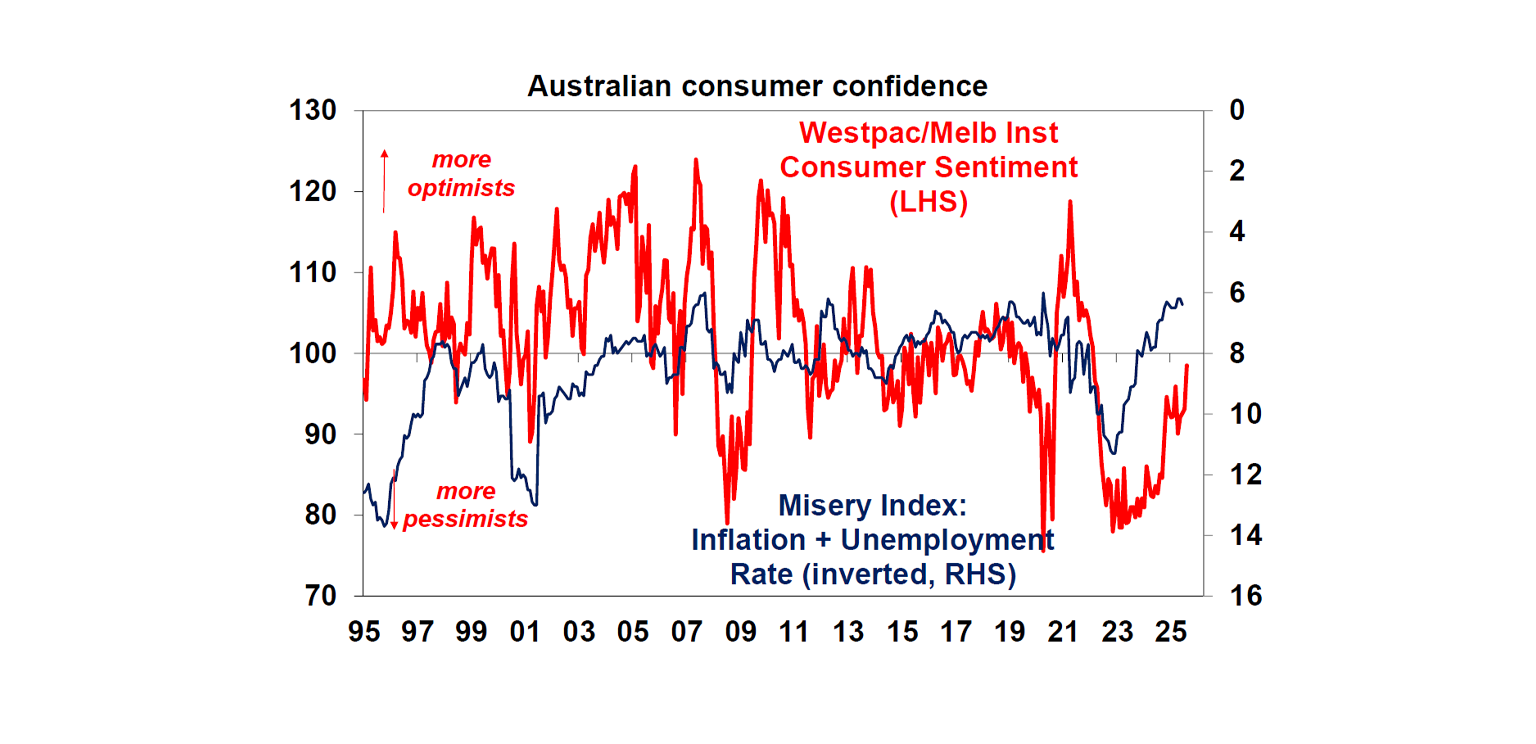

More Australian consumers are feeling optimistic this month about their family finances, economic outlook, and purchasing intentions, according to the Westpac-Melbourne Institute Consumer Sentiment Survey. The confidence index ticked up to an almost neutral level of 98.5, much higher than last month’s 93.1 and the previous 12-month average of 91.3, signalling some pickup in household spending in the upcoming months.

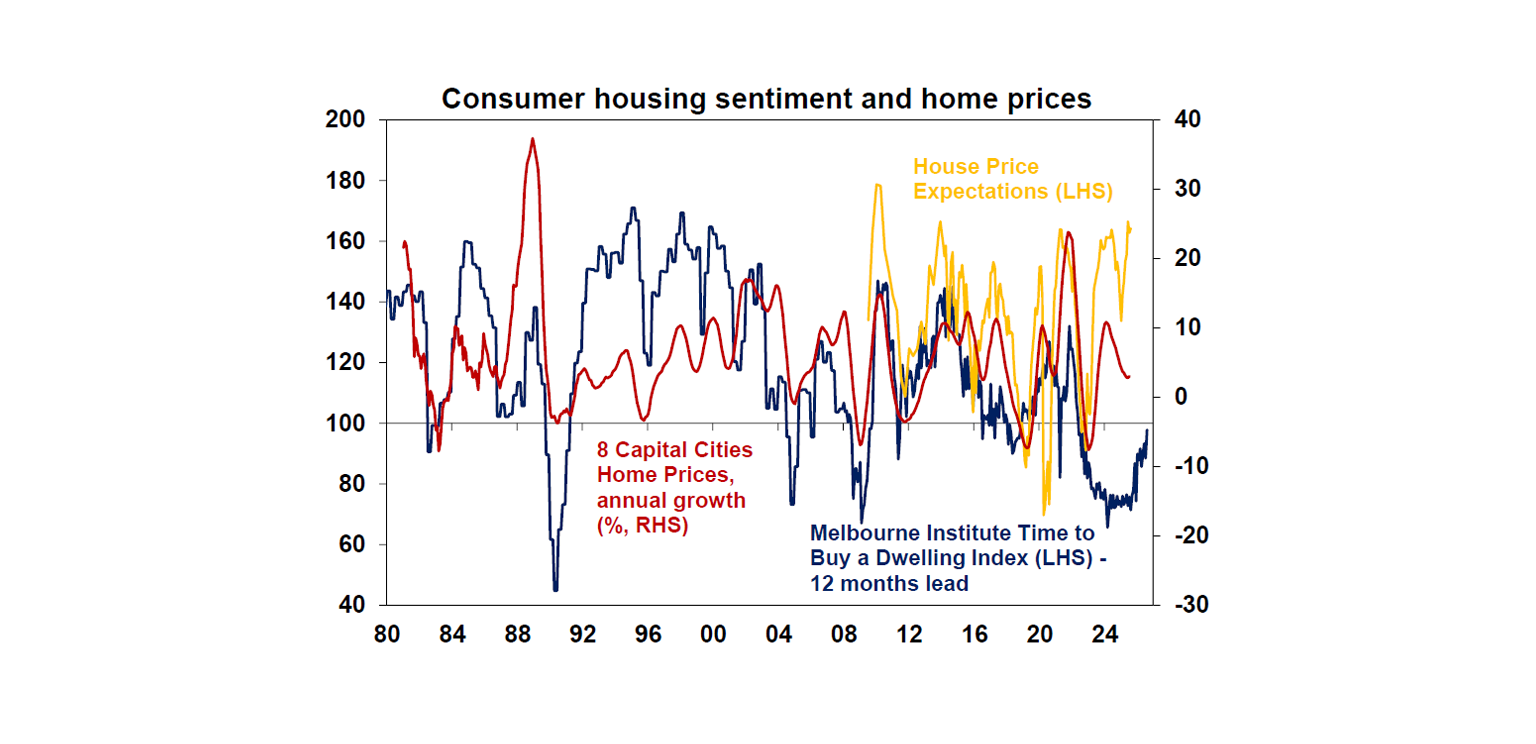

Households are also turning very bullish on property prices, with house price expectations survey hovering around record highs and the “time to buy a dwelling” index reaching a 4-year record.

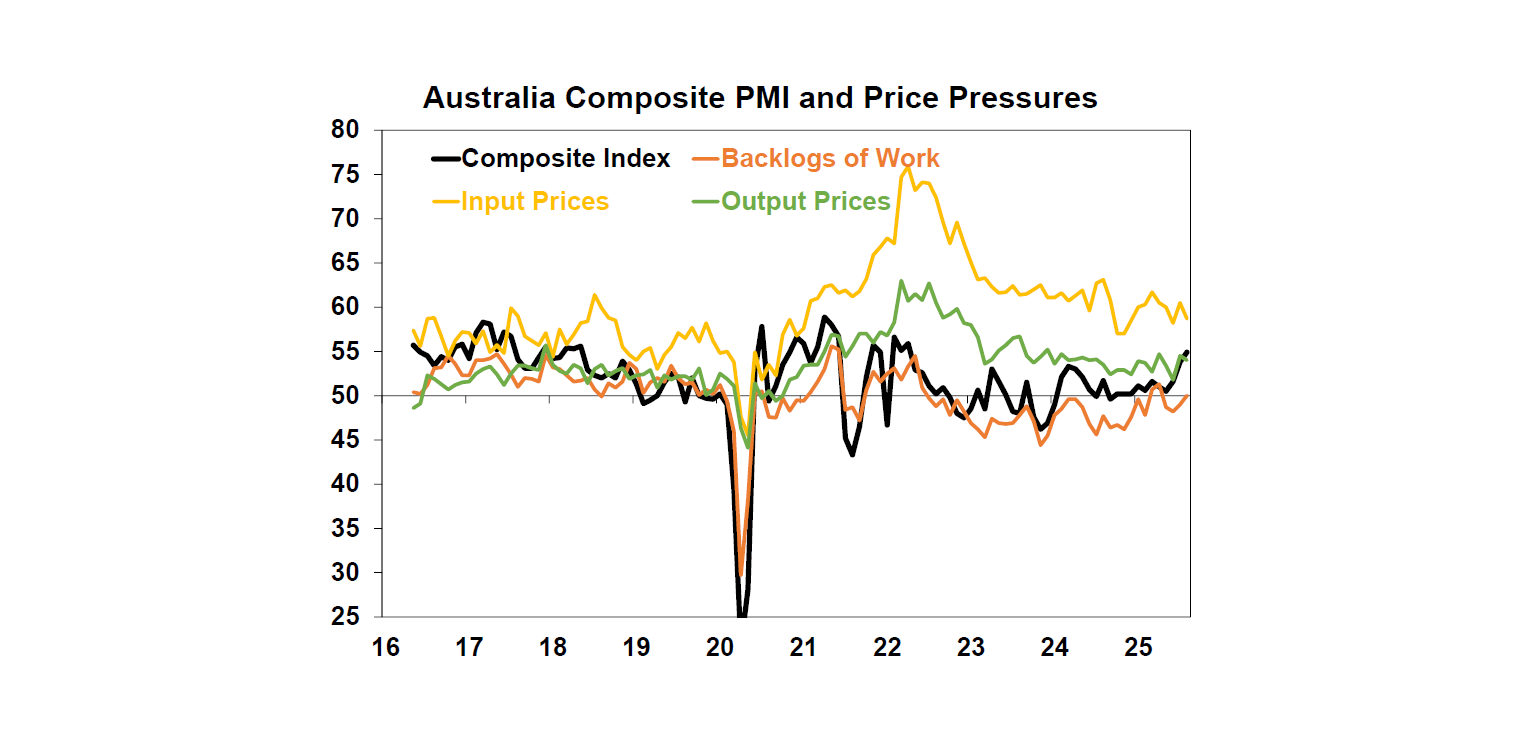

Australian business conditions PMIs for August improved again with gains in both manufacturing and services, while new orders remain around 3-year highs. Most positively, input and output prices both fell slightly after posting a seasonal pickup in July. Overall, the PMI surveys point to improving Australian economic growth throughout this year.

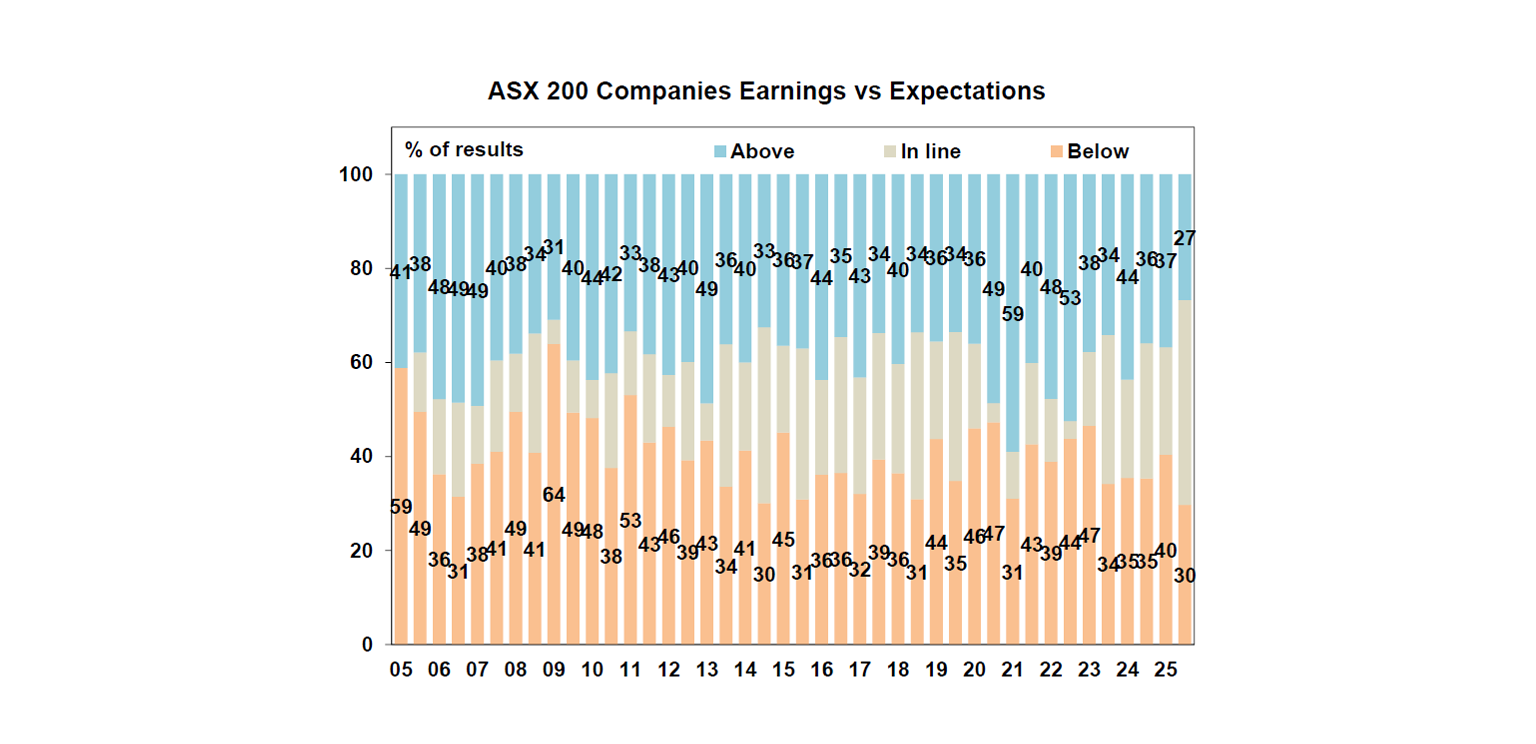

The second week of the Australian June half earnings reporting season saw some decent results (albeit compared to low expectations, which were for a 1.6% fall in profits for the year). The majority of results have been in line with similar levels of upside vs downside surprises, though there is now an increasing number of companies reporting profits or dividends up on a year ago (compared to the previous December half reporting season). This week financial sector results have been solid; but materials and mining earnings were much weaker given declining iron ore and commodity prices throughout 1H25.

27% of results have seen earnings beating consensus estimates, which is below the norm of 40%, but just 30% have surprised on the downside which is also less than the norm of 41%.

65% of companies have seen earnings rise on a year ago, and this is better than the norm of 56%. This is because the falls in profits this year have been rather concentrated in materials & mining.

66% of companies have increased their dividends on a year ago which is above the norm of 59%.

What to watch over the week ahead?

The US will see some more high frequency housing indicators released next week, with new home sales (likely remain weak) released on Monday, as well as CoreLogic 20-City house price index on Tuesday (it’s currently falling). We also receive July preliminary durable goods order and various Fed manufacturing surveys throughout the week. Friday will be important with July PCE inflation figures and trade balance being released, both of which are expected to show some modest impact from recent tariffs.

Canada’s June GDP (Friday) is expected to show a small 0.2% monthly rise and still low annual growth of just 1.3%.

In Australia, all eyes will be on RBA meeting minutes for August (Tuesday) and the July Consumer Price Index indicator (Wednesday). The July indicator is goods-heavy and while we expect some pickup, it is likely to remain within the RBA target band at 2.2%yoy. We also expect the trimmed mean indicator to remain around 2.1%. June quarter construction work done (Wednesday) is expected to rise a solid 1.4%qoq with business investment (Thursday) up 1.1%qoq, and firms showing some positive but modest growth in capital expenditure intentions. Friday’s private credit outstanding data is expected to rise 0.6% over the month as new housing loan volumes have picked up lately. The profit reporting season will also wrap up with 72 companies reporting.

Outlook for investment markets

Share markets are at risk of further correction through the seasonally weak months of August and September given stretched valuations and risks around US tariffs and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more, as growth slows, and central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 6% this year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week as worries about AI and tech valuations took a breather but concerns about a US strike on Iran acted as a constraint. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements. -

Oliver's Insights - Nine key charts for investors Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.