Global shares mostly rose over the last week as the Fed resumed cutting rates. For the week US shares rose 1.2% and Eurozone and Japanese shares both rose 0.6%, but Chinese shares fell 0.4%. However, despite a bounce on Friday the Australian share market fell for the third week in a row with a 1% decline as the market continued to correct after the record highs reached last month, with the fall led by energy, consumer stable, health and telco shares. 10-year bond yields rose slightly. Gold prices made another record high and iron ore price also rose, but oil prices were flat and metal prices fell. The $A fell back to just below $US0.66 as the $US rose slightly.

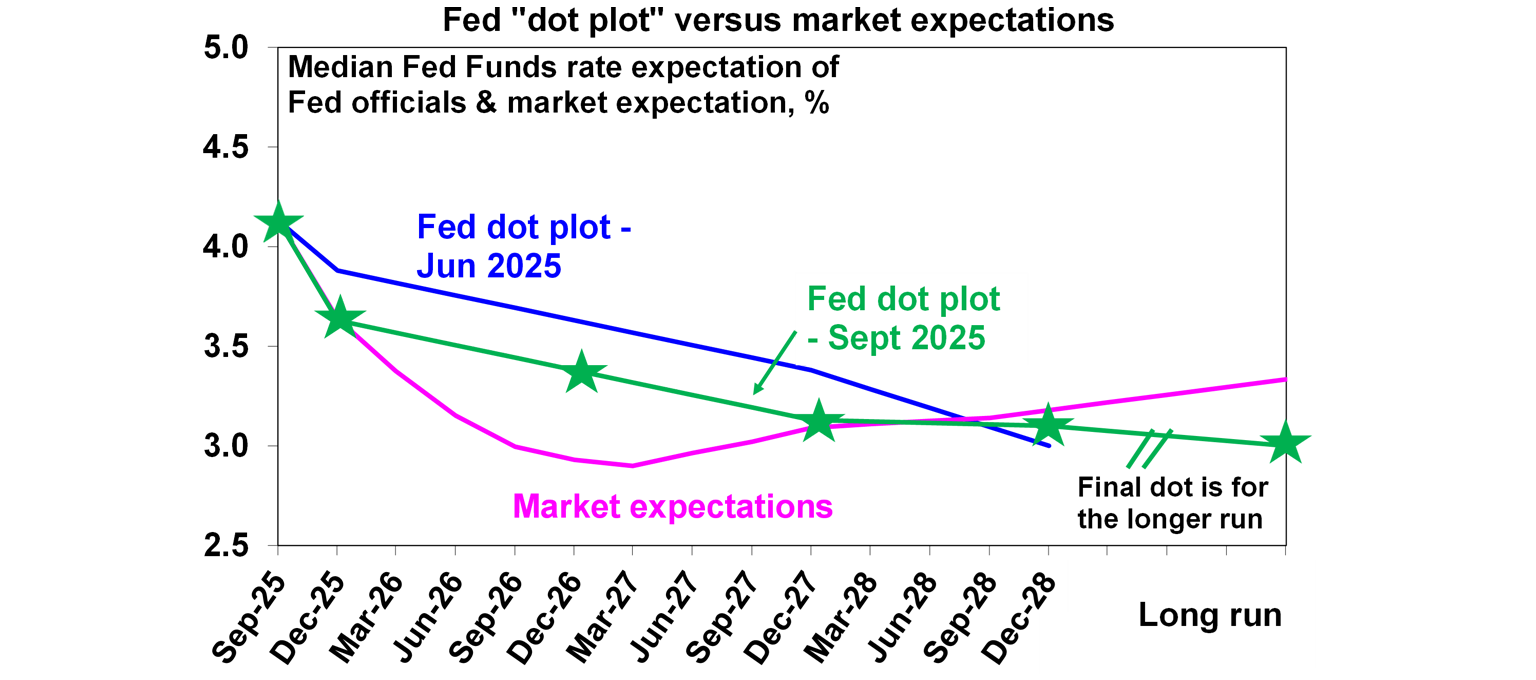

Fed cuts by 0.25% as expected taking the Fed Funds rate to the range of 4-4.25% as expected and signalled more cuts ahead. While the Fed revised up slightly its growth and inflation forecasts for next year and remains concerned about the impact of the tariffs on inflation, in resuming rate cuts it cited a shift in the balance of risks towards higher unemployment with job gains slowing and unemployment edging up. In fact, Chair Powell said labour demand had slowed sharply and by more than labour supply. Given the rise in downside risks the Fed is moving back towards a neutral rate. While Powell described the decision as “risk management” and said the Fed would assess things “meeting by meeting” this is against a dovish trend with the so-called “dot plot” of Fed officials’ interest rate expectations showing another two rate cuts this year and another one next year. Out of interest while Trump’s Fed appointee Stephen Miran made it to the meeting and voted for a 0.5% cut it was academic as the Fed has turned dovish again anyway. And his move against Governor Cook is continuing to work through the courts but looks a bit dodgy. More generally, Trump’s moves to set up a more dovish Fed may not be of much consequence in the short term as the Fed is easing anyway but could impact longer term to the extent that it leads to less faith in Fed inflation fighting resolve and higher inflation expectations.

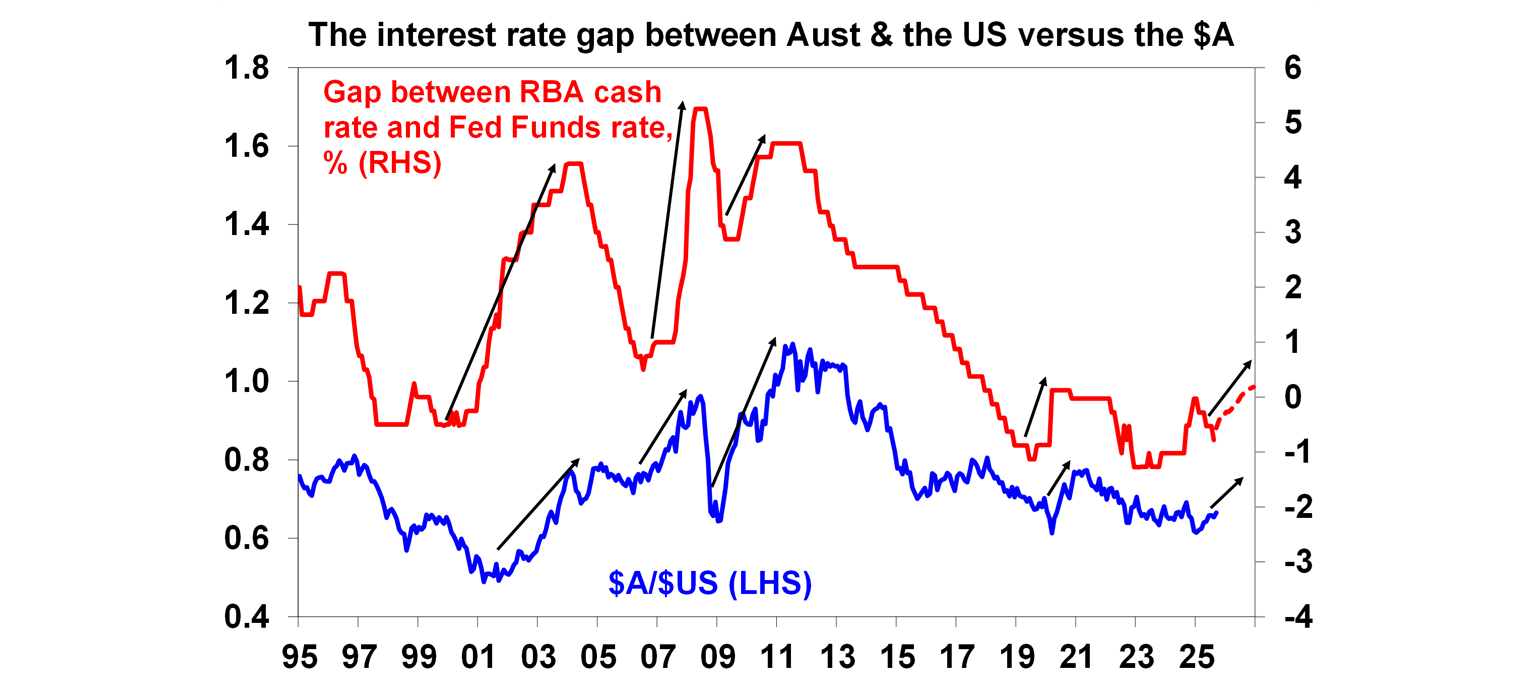

For the RBA, the Fed’s resumption of rate cuts does not mean that it will automatically follow suit, but it may add some pressure to cut by more than it otherwise would have. Just because the Fed is easing doesn’t mean the RBA will blindly follow. However, right now the Fed and the RBA’s interest rate cycles are in alignment and the main way the Fed’s moves could impact the RBA is via a stronger $A. Money markets now see the Fed cutting by more than the RBA which will push US short term rates below the RBA’s cash rate. Historically, a rising gap between Australian and US rates has tended to see a rising trend in the $A. So far the rise in the $A is trivial but if it heads significantly higher it may add pressure on the RBA to cut by more than the market is expecting because a rising $A will dampen growth and inflation. And if the Fed continues to cut because of a weakening US jobs market it may also add to pressure for more rate cuts here as weaker US growth will impact global and Australian growth. Our base case remains for 0.25% RBA rate cuts in November, February and May.

Correction risk remains high for shares. Our 6-12 month view remains positive for shares as Trump continues to pivot towards more market friendly policies, the Fed cuts rates further and other central banks including the RBA continue to cut. However, the combination of: stretched valuations; concerns about public debt sustainability in the US, France, UK and Japan; uncertainty around US tariffs with more still coming; geopolitical risks including around Russia and US secondary tariffs on countries importing its oil; and a high risk of a US government shutdown on 1st October mean that there is a high risk of a correction. The much anticipated phone call between President’s Xi and Trump made progress on trade and other issues according to Trump but with China’s readout striking a more cautious tone. Any grand bargain trade deal still seems a way off.

Trump is right to push for listed company reporting moving from quarterly to half yearly. As is often the case his justification exaggerates things: “China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis…Not good.” In fact Chinese listed companies have to report quarterly. And quarterly US reporting which has been required since 1970 has not stopped lots of productive innovation by US companies. But short-termism resulting in a focus on what is best for the share price in the short term as opposed to the long term is a significant concern and quarterly reporting requirements are arguably adding to it and adding to unnecessary costs for US listed companies. Trump first asked the US SEC to look at it in 2018 but it went nowhere. This time it might have more legs as Trump has more authority than he did back then. Fortunately listed Australian companies only have to report half yearly.

From gloom to boom with climate related projections for the Australian economy over the last week – best to be sceptical! First up on Monday the National Climate Risk Assessment report painted a pretty gloomy picture. It found that climate change could lead to annual disaster costs of around $40bn, up to 2.7 million work days lost each year by 2061, a $600bn loss in property values by 2050 and up to a 0.8% hit to productivity costing the economy up to $423bn by 2063. But such projections need to be treated with a degree of scepticism given the difficultly in modelling the impact of climate change (eg, does it mean more drought or more rain down east coast Australia? – the economic implications are very different) and they likely under allow for the boost to economic activity from disaster recovery spending in the short term and mitigation, adjustment and technological change in the long term. Over the last forty or so years I have seen numerous modelling exercises showing a big impact on the economy from a particular event – like holding the Olympics, free trade deals or a natural disaster and yet the economy has just kept motoring along with no big lasting impact. Grand prognostications of doom can be particularly alluring, and wrong. For example, calls that the world is about to bump into some physical limit, causing some sort of “great disruption” (famine, economic catastrophe!), have been made with regularity over the last two hundred years: Thomas Malthus; Paul Ehrlich’s The Population Bomb of 1968; the Club of Rome report on The Limits to Growth in 1972; and the “peak oil" fanatics. Only to be proven wrong. Such analyses underestimate resources, technological advances, the role of price increases in driving change and human ingenuity in facilitating it. Hopefully, worst case predictions flowing from climate change will prove wrong for similar reasons! And in terms of home prices, while they may be depressed in high risk areas (eg subject to sea level rises) there will likely be an offsetting boost in lower risk areas, ie people have to go somewhere. But then on the Thursday and maybe just to confuse things the Government released Treasury modelling showing that something like its “orderly transition” to reducing energy emissions would result in the economy being $2.2 trillion larger by 2050. But this big hairy number also needs to be treated with scepticism. It seems we went from gloom to boom in less than a week regarding the impact of climate change on the economy. None of this is to deny that climate change is most likely happening, that it will have an economic impact or that the world needs to act to minimise its impact. It’s just that we need to treat big projections of damage and any boost to the economy with caution (just like predictions for lower electricity prices!).

Freedom – both in speech and economic decisions – has been integral to US and western countries’ economic success. Messing with it as we are seeing in the US – both in terms of the assassination of Charlie Kirk, the suspension of the Jimmy Kimmel show & Trump’s threat to TV licences if they are too critical of him and more broadly with increasing government intervention in the workings of US companies – could threaten it.

Major global economic events and implications

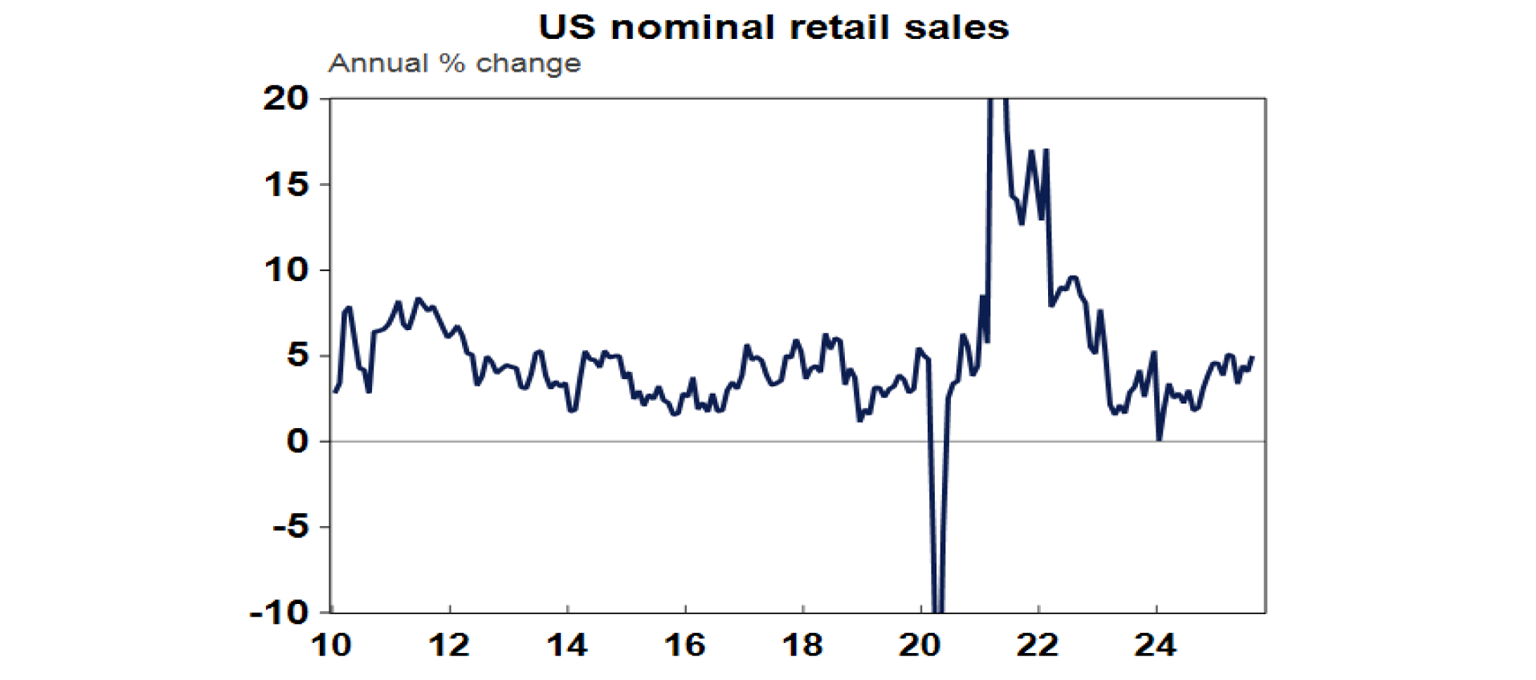

US economic data was a mixed bag. Retail sales rose solidly for the third month in a row in August. This was possibly boosted by rising goods prices and the early Labor Day holiday resulting in related spending being concentrated in August, but nevertheless suggests consumer spending remains solid. Against this though industrial production is trending flat to down. Regional manufacturing conditions indexes for September painted a conflicting picture with a sharp deterioration in the New York region but a sharp improvement in the Philadelphia region – both these surveys can be quite volatile though. Initial jobless claims fell back after an increase in Texas the previous week partly due to fraudulent claims, but continuing claims are continuing to trend up.

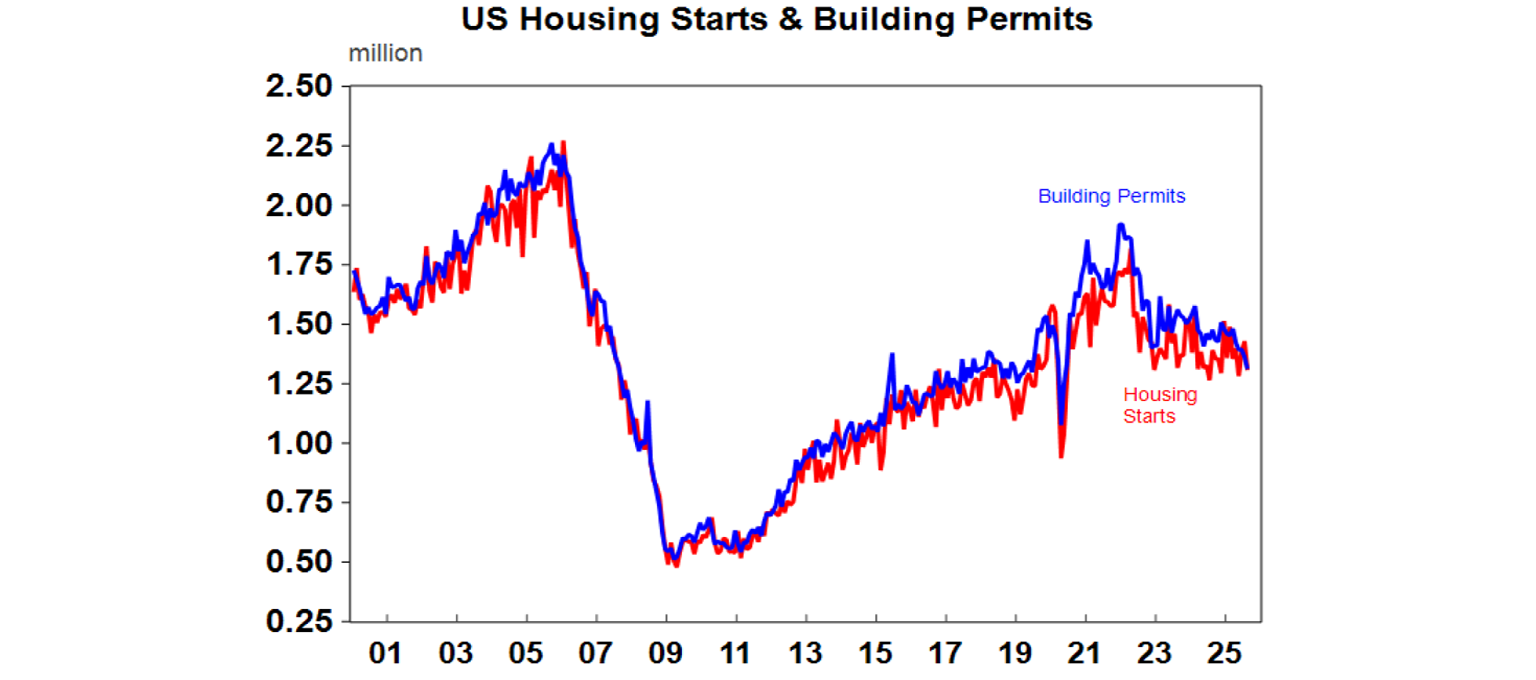

And US housing remains weak with housing starts and permits to build new homes down in August and home builder conditions remaining weak. At least mortgage applications are starting to rise as mortgage rates fall.

Meanwhile, rising import prices in the US indicate that foreign suppliers are not “eating” the tariffs, suggesting they are largely being borne by US producers & consumers.

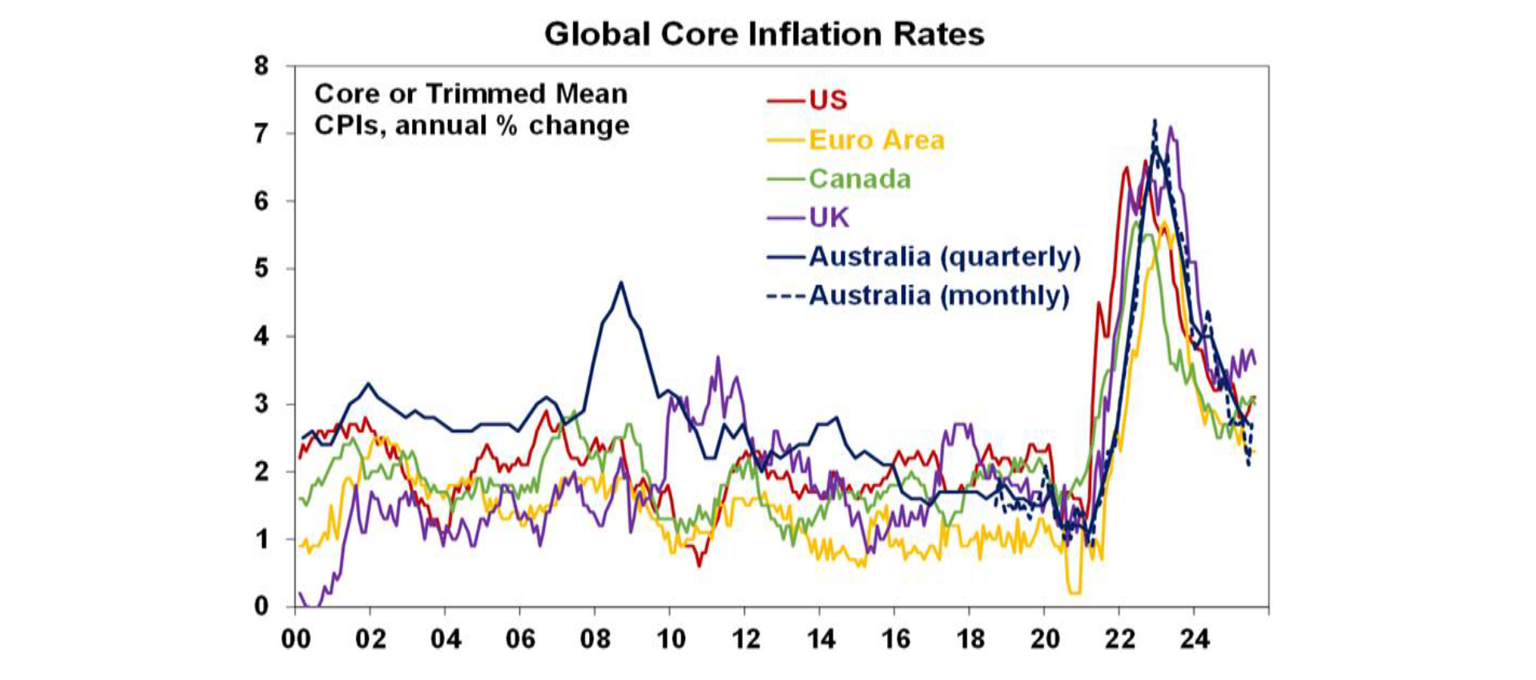

The Bank of Canada also cut its policy rate by another 0.25% taking it to 2.5% citing weaker economic conditions and fading upwards pressure on inflation. Governor Macklem indicated that it would “proceed cautiously”. Meanwhile, underlying inflation remained stable around 3%yoy in August. The Canadian money market is allowing for a cut to around 2.25% by early next year.

The Bank of England by contrast left rates on hold as expected reflecting still high inflation and guidance remained for “a gradual and cautious approach” to rate cuts. August CPI inflation remained at 3.8%yoy but at least core inflation fell to 3.6%yoy. This is keeping the BoE cautious but further rate cuts are still expected by early next year as growth remains weak leading to lower inflation.

The Bank of Japan also left rates on hold at 0.5%, but its bias is to continue raising rates with two board members voting to raise rates. It also announced it will start selling ETFs which is a form of quantitative tightening. Meanwhile, Japanese inflation fell back to 2.7%yoy in August with lower rice prices but core inflation was flat at 1.6%yoy.

New Zealand June quarter GDP came in much weaker than expected with a 0.9%qoq fall leaving it down 0.6%yoy. This reflected a slowdown in consumer spending, falling investment and a detraction from trade. Expect more RBNZ rate cuts with another reduction next month.

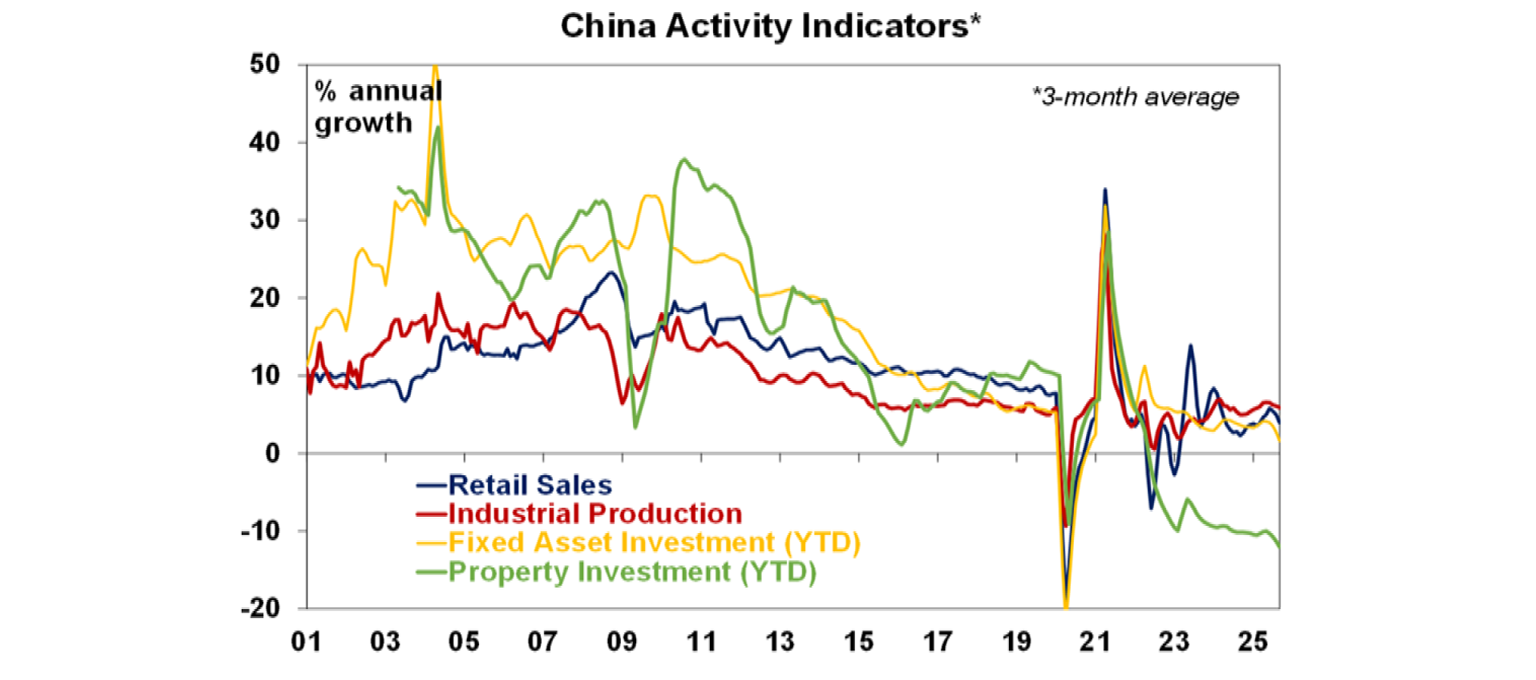

Chinese economic data for August was soft again. Retail sales, industrial production and investment all slowed more than expected with property related data all remaining weak, particularly for investment. Maybe it’s not as bad as it looks though as retail sales growth of 3.4%yoy is ok given zero inflation and population growth and the data was likely depressed by bad weather and government policies to reduce excess capacity (“anti-involution”). That said growth does appear to be trending down again and more policy stimulus is likely on an incremental basis. The anticipation of the latter largely explains why there was little impact on Chinese shares or the iron ore price.

Australian economic events and implications

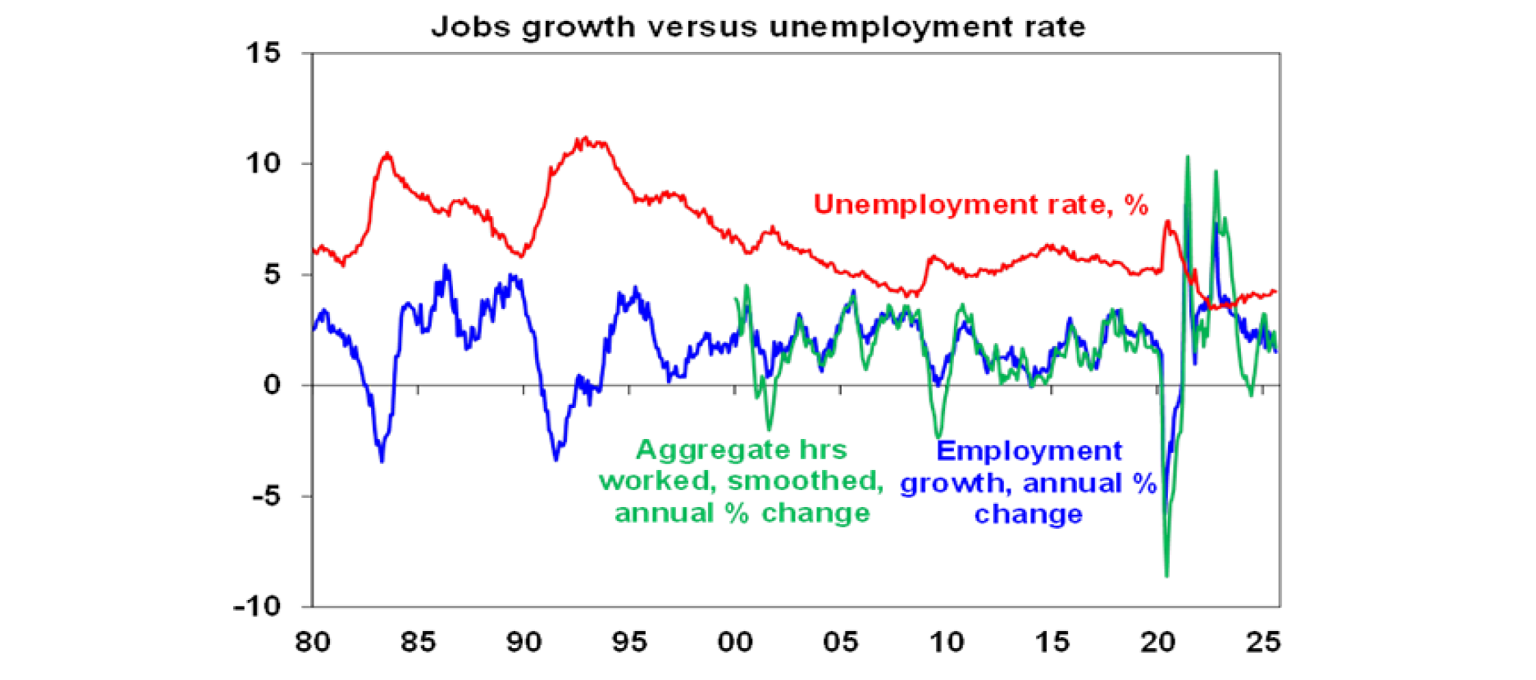

August jobs data was a bit softer than expected but is unlikely to alter the outlook for continued gradual rate cuts. Employment surprisingly fell by 5400 and hours worked also fell. Unemployment was stable at 4.2%, but only because of a decline in the participation rate. Jobs growth has slowed - averaging just 7700 a month over the last three months compared to 37,000 a month in the prior three months - but with unemployment still low and underemployment at its lowest since the early 1990s, the RBA will likely remain gradual in cutting rates.

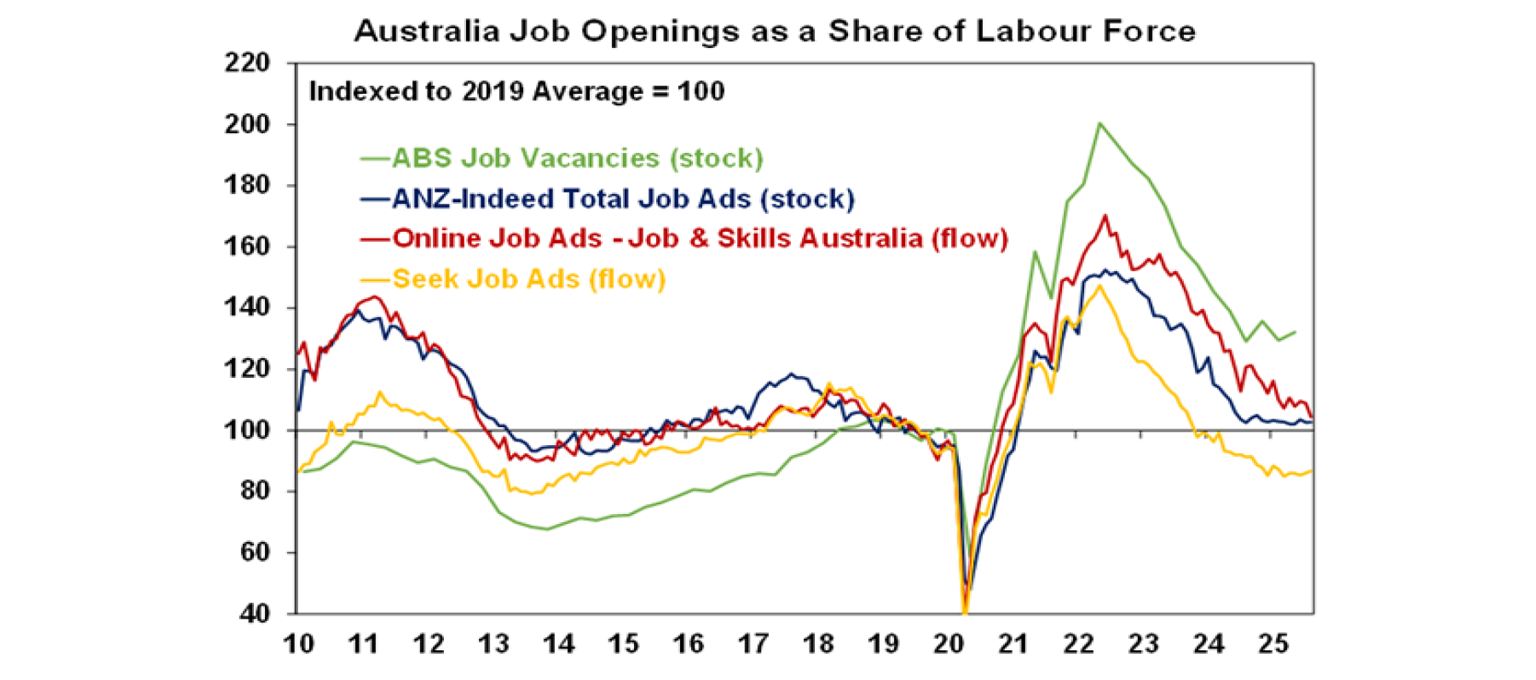

Forward looking jobs data have slowed but continue to paint a mixed picture with ABS job vacancies stabilising at a relatively high level but the flow of new job ads on Seek remaining weak.

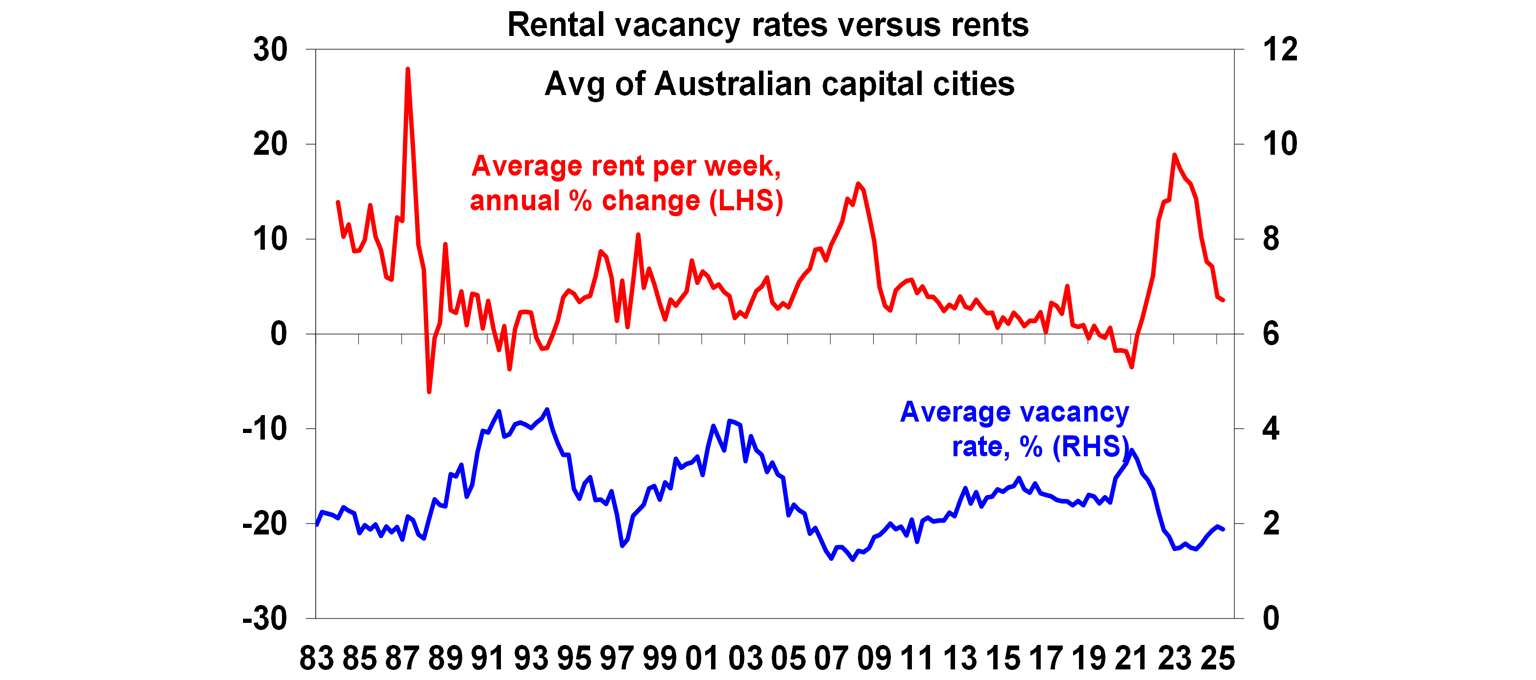

Real Estate Institute of Australia data for the June quarter shows rental growth continuing to cool (but ranging from very strong in Brisbane, Adelaide and Perth to soft in Melbourne) but low vacancy rates on the back of ongoing demand for housing running ahead of supply suggest rental growth may not slow much further and data on asking rents suggests that its bottomed.

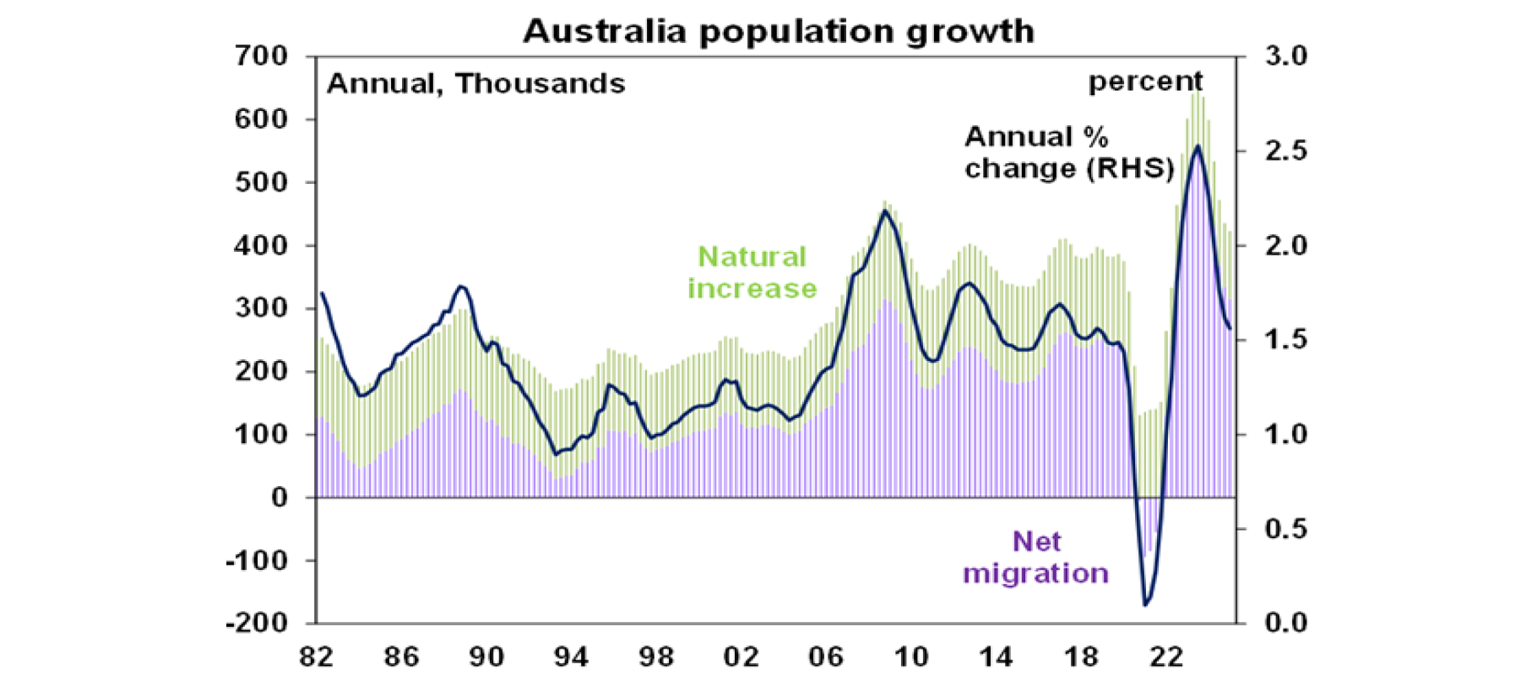

In terms of housing demand…population growth in the March quarter came in at 0.5%yoy resulting in a further slowing in the annual growth rate to 1.6%yoy. This is well down from the peak of 2.5%yoy in the September quarter 2023 and reflects a slowdown in annual net migration from a peak of 556,000 to 316,000, but it’s still relatively high. Pre covid it averaged around 240,000 a year.

What to watch over the week ahead?

Business conditions PMIs for September for major countries, including Australia, to be released Tuesday are expected to remain consistent with okay economic growth with the focus on whether their recent bounce, particularly in the US and Australia is sustained.

In the US, expect existing and new home sales data (Tuesday and Wednesday) to remain soft, durable goods orders (Thursday) to fall slightly, personal spending for August (Friday) to show a modest rise with core private final consumption deflator inflation rising 0.2%mom or 2.9%yoy.

In Australia, expect RBA Governor Bullock in Parliamentary testimony to reiterate that the RBA will take a gradual and measured approach to lowering interest rates. The Monthly CPI Indicator for August (Wednesday) is expected to rise slightly to 2.9%yoy despite a 0.2%mom fall consistent with a fall back in travel costs and more getting electricity rebates. Trimmed mean inflation is expected to ease to 2.6%yoy. The Melbourne Institute’s Inflation Gauge and the NAB business survey also point to some softening in price pressures in August. ABS Job Vacancy data for August (Thursday) is expected to show a small fall.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more, as central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may be breaking higher now with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.