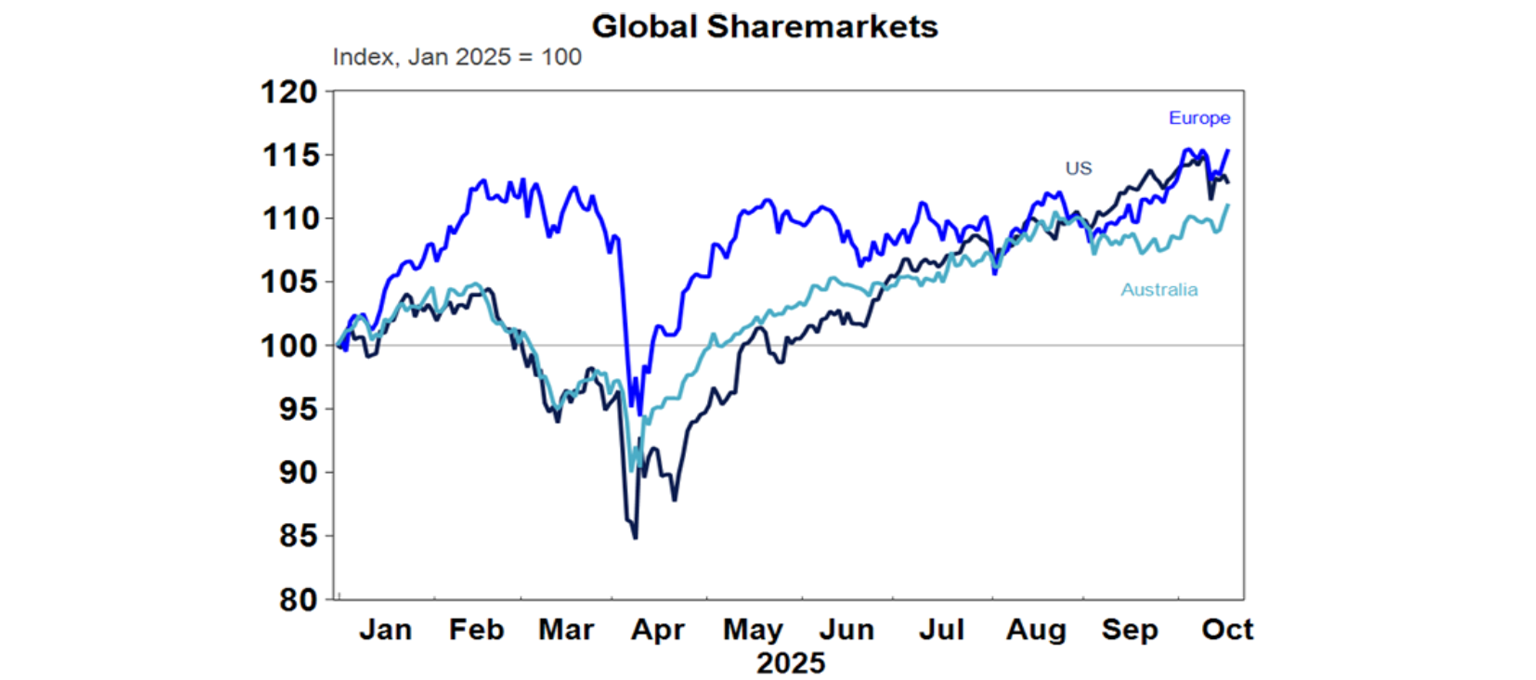

Global shares were mixed over the past week with US and European shares recovering some of their sharp falls in the prior week but continuing to be whipsawed by the US/China trade war. US shares were also hit by worries about credit problems at some banks but got a boost on Friday as Trump sought to sooth trade fears by expressing optimism about a trade deal with China and so rose 1.7% for the week. Eurozone shares were helped by some signs of stabilisation in the French government and rose 0.9% for the week. Japanese shares fell 1.1% though on the back of renewed political uncertainty and Chinese shares also fell 2.2%. Australian shares rose to a new record high helped by renewed expectations for RBA rate cuts but gave up some of their gains on Friday to still leave the market 0.4% ahead. Gains for the week were led by materials, property and health stocks. Bond yields fell reflecting safe haven demand and increased expectations for rate cuts.

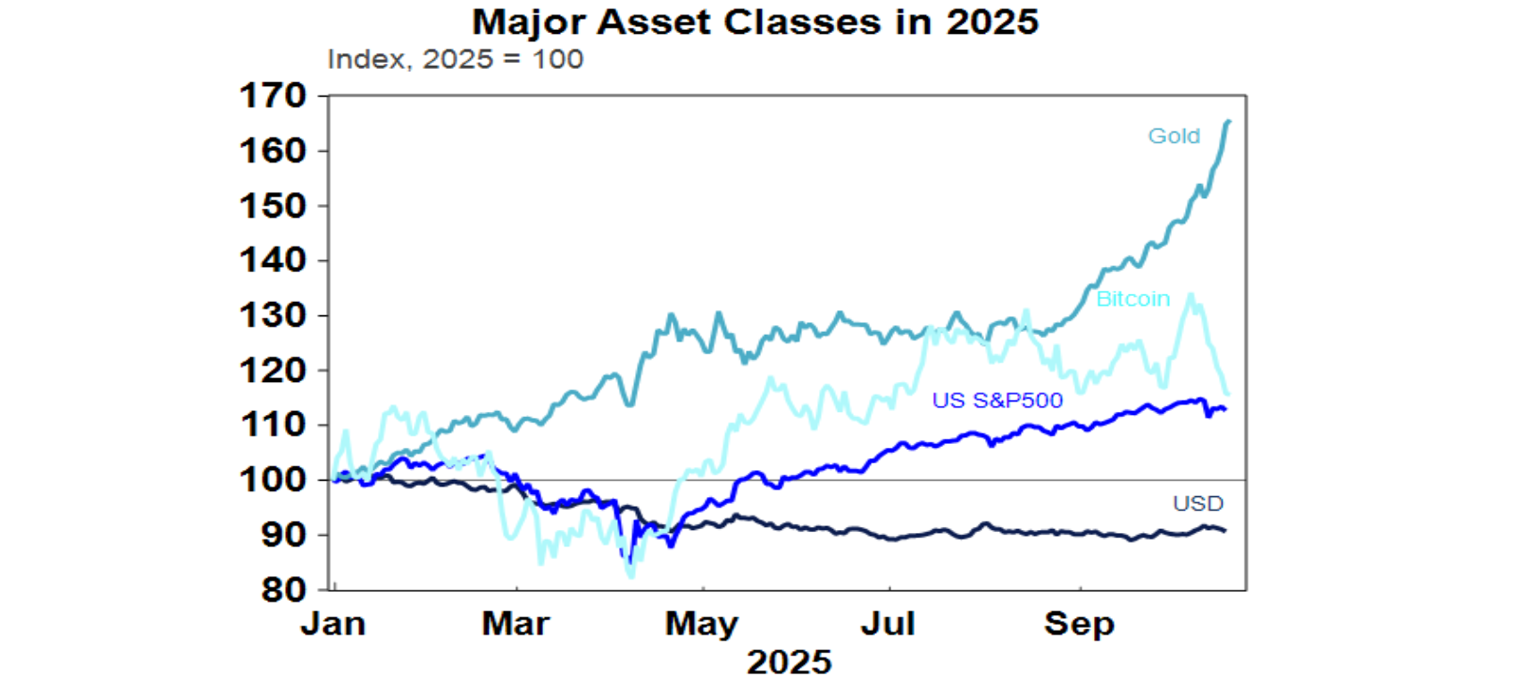

Gold continued its surge making it above $US4300, with silver also reaching a record high, on safe haven demand in the face of the ongoing US/China tensions and against a backdrop of falling global interest rates, the downtrend in the US dollar and worries that high public debt levels could lead to governments tolerating higher inflation and debasing their currencies along with a bit of FOMO now creeping in. By contrast Bitcoin fell further partly reflecting “risk off” sentiment, highlighting that it’s become increasingly correlated with shares in a high beta fashion as it’s become increasingly institutionalised. Metal prices managed a small rise, but iron ore prices fell slightly, and the oil price continued to slump. Trade war fears and an increase in RBA rate cut expectations saw the $A remain below $US0.65, despite a fall in the $US.

Our assessment remains that the 6–12-month outlook is positive for shares as Trump pivots to more market friendly policies ahead of the mid-terms and central banks continue to cut rates. However, the wobbles in the US share market in the last two weeks highlight that the risk of a correction remains high as valuations are stretched and there are plenty of triggers for a deeper fall including: the re-escalation of the US/China trade conflict; the lagged impact of the tariffs particularly on the US economy; the US government shutdown dragging on for longer than expected; slowing US jobs data; public debt sustainability issues in the US, France, UK and Japan; geopolitical risks; uncertainty as to how much the Fed will cut rates; and ongoing uncertainty around further rate cuts in Australia.

Loan problems at two US regional banks may be a sign of wider problems about credit worthiness in the US, with credit spreads being very narrow indicating a degree of vulnerability – but at this stage look to be an isolated issue rather than systemic problems as both banks made loans to the same borrower and allegations of fraud are involved. So regional banks shares rebounded after a brief fall.

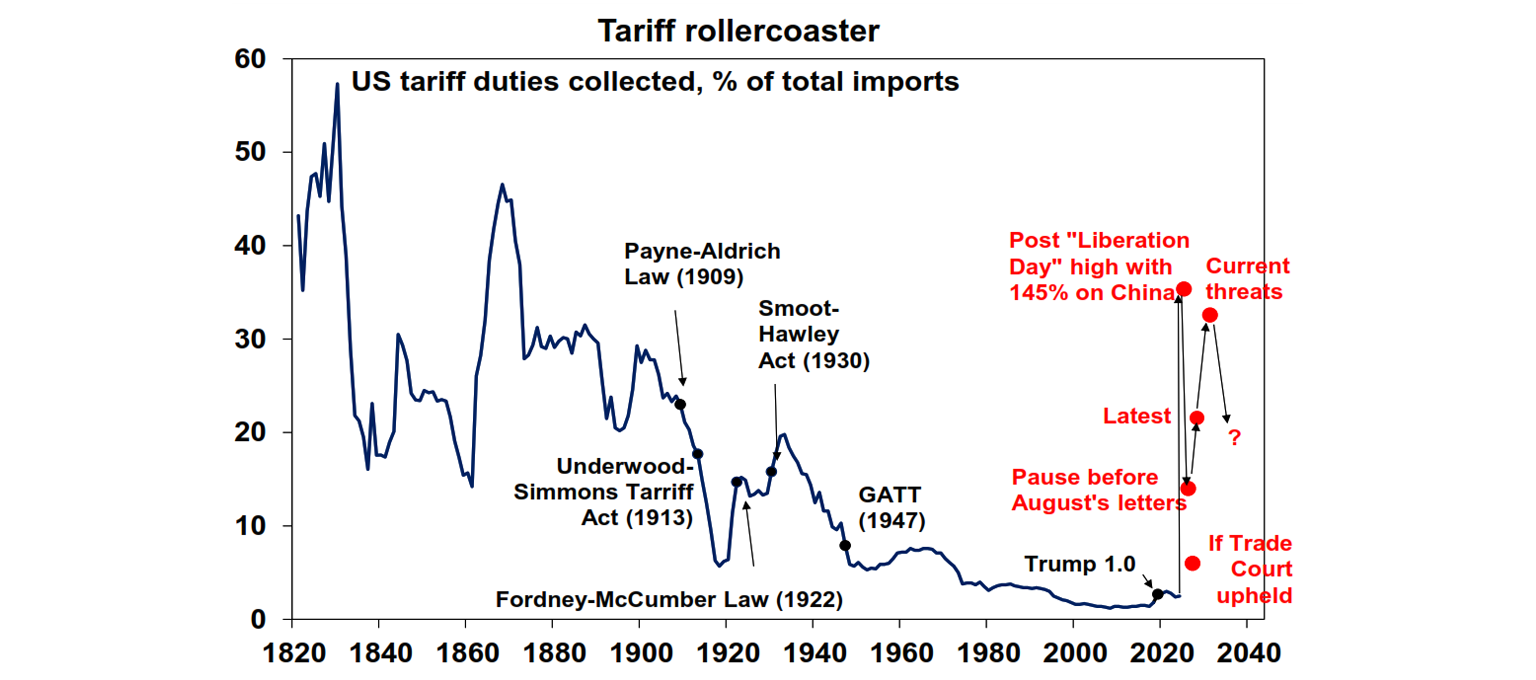

A bigger source of uncertainty is the re-escalation in the US-China “trade war”, including more US pressure on other countries like Australia to “decouple” from China - but its likely part of both sides just positioning ahead of talks. In the last two weeks both sides have announced a raft of measures including export controls on the use of rare earths by China, Trump threatening an additional 100% tariff on Chinese goods and more export restrictions, the US imposing fees on Chinese ships docking in the US with China counter retaliating and Trump threatening to stop the US buying Chinese cooking oil in retaliation for China not buying US soybeans. US Treasury Secretary Bessent’s call for allied countries to decouple from China as part of the trade war – which would not be in Australia’s interest – is part of this. The tit for tat threats could escalate further in the near-term causing more uncertainty. But it looks like both sides positioning ahead of trade talks in order to gain maximum leverage so the extra 100% tariff on Chinese imports – which would take them back to post Liberation Day highs – and other measures are unlikely to be implemented (or if so then only briefly). And the talk of de-coupling is likely to settle back down for a while. Pressure on Trump to resolve the issue without a return to the mayhem of April is now immense as Trump’s handling of inflation and tariffs are unpopular in the US and its not possible for even the US to de-couple from China right now without causing major damage to the US economy – so he needs to find an off ramp and continue pivoting to more market friendly policies going into the mid-term elections. Consistent with this, President Trump indicated the threatened tariffs on China were “not sustainable”, he and Bessent expressed optimism that trade talks set for the week ahead could yield a trade deal and Trump indicated he believed his meeting with President Xi Jinping would go ahead. Of course, he has a habit of whipsawing markets on trade and its not over yet!

Still no progress in ending the partial US government shutdown which is now into its third week. Normally such shutdowns have very little economic or market impact. This one is already longer than average though and there is a rising risk that it will have a bigger than normal impact because the Trump Administration is actually starting to fire some of the roughly 600,000 furloughed Federal workers. And the Democrats are continuing to dig in on indications that the shutdown is going well for them given their stand on health subsidies.

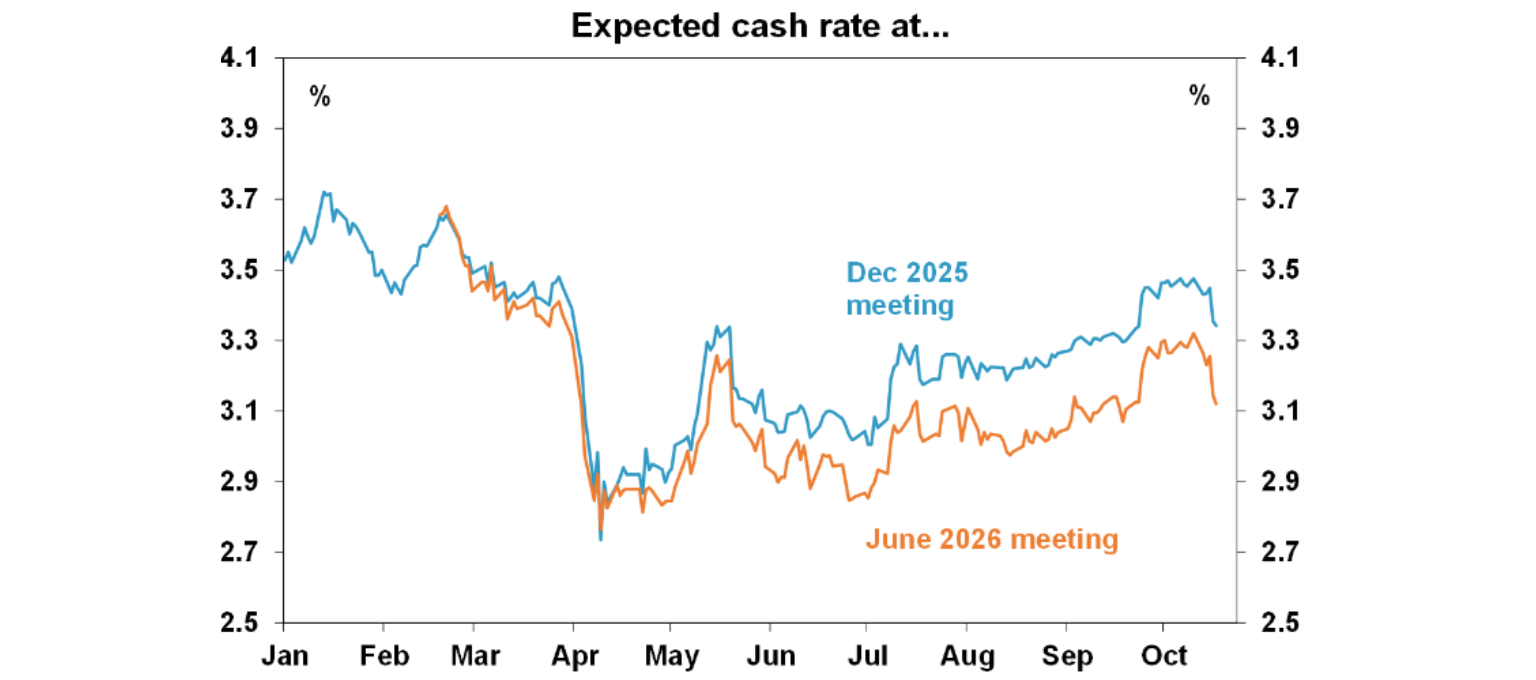

RBA commentary continues to reiterate the cautious and data dependent message regarding the outlook for interest rates that has been the case since the September meeting. This was evident in the past week in the minutes from the last meeting and in comments from Governor Bullock and Assistant Governor Hunter where the basic message has been that private demand has been a bit stronger than expected, the labour market remains “a little tight”, the monthly CPI suggests higher than forecast September quarter inflation and that monetary policy might still be a little tight, “but not that much.” This has seen the RBA in the words of Governor Bullock thinking about “whether there is more easing to come.” This is understandable and it contributed to a significant scaling back in expectations for interest rate cuts.

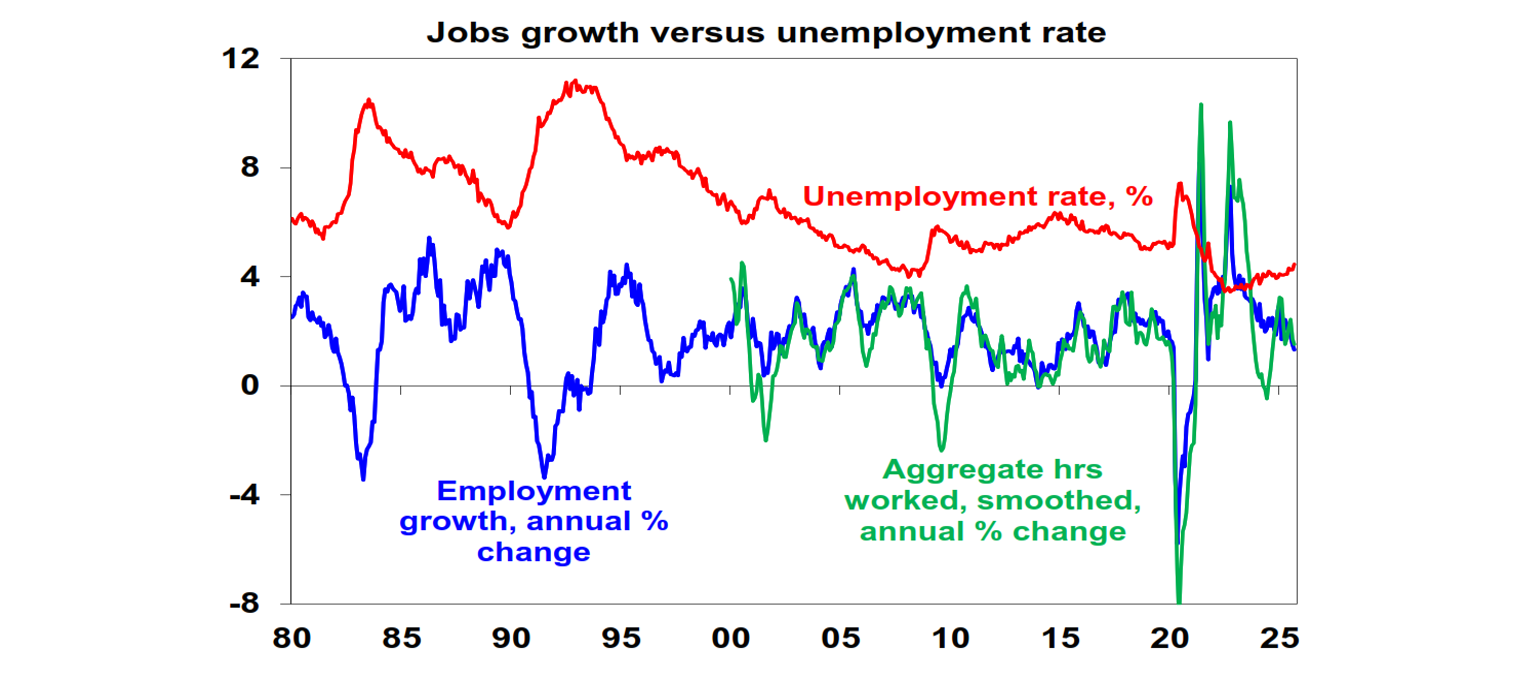

Economic data runs hot and cold though and so far this month Australian economic data has actually been a bit softer warning that the economic recovery is still a bit fragile – this has included further falls in consumer confidence and home building approvals, weaker than expected household spending data and now another rise in the unemployment rate. Unemployment remains in a clear rising trend, its above the RBA’s forecasts and at 4.5% its now in line with the RBA’s estimates of full employment. In fact, a further rise beyond this would arguably be violating the RBA’s full employment objective. Of course, the rise in unemployment may just reflect the lagged impact of weak economic growth last year, but it may also reflect a messy handover from the public sector to the private sector as the key driver of jobs and in any case slowing job openings are pointing to a high risk of a further rise in unemployment.

So given the latest rise in unemployment we are now a bit more confident in our forecast for another rate cut next month and one more in February to take the cash rate to 3.1%. That said, the September quarter inflation data to be released on 29th October remains the key. But the rise in unemployment has likely reduced the hurdle to another rate cut making it easier for the RBA to tolerate a trimmed mean inflation outcome of around 2.6-2.7%yoy, which is our expectation, compared to its forecast for 2.5%yoy and still cut. So given this our base case remains for a November cut and its worth noting that money market expectations – that swing around like a yo-yo – are now back to a 60% chance of a November cut and a 100% chance by year end with more than two cuts now factored in. See the next chart. Of course, if its 2.8-2.9%yoy it will get harder for the RBA to cut in November.

The $3million super tax backdown in Australia is to be commended but of course the lost revenue likely adds pressure to find other ways to raise more revenue. Reducing super concessions for those with very high balances made sense but taxing unrealised returns and introducing yet another tax threshold with no indexing was bad policy. So, it’s great to see that the Government saw sense and will only tax realised gains and will index the $3million threshold to inflation – although the latter is a second best option as it should have been indexed to super returns which are likely to be higher than inflation. That said the backdown opens an annual revenue hole of $0.9bn in four years’ time but likely to grow over time as the growth in people captured by the tax will now be far slower. This in turn will make it even harder for the budget to reach balance in 2035-36 as projected in the March budget. Ideally the Government should now be seeking to slow spending – if it wants to boost productivity - but the focus is more likely to be on raising revenue from other sources.

Major global economic events and implications

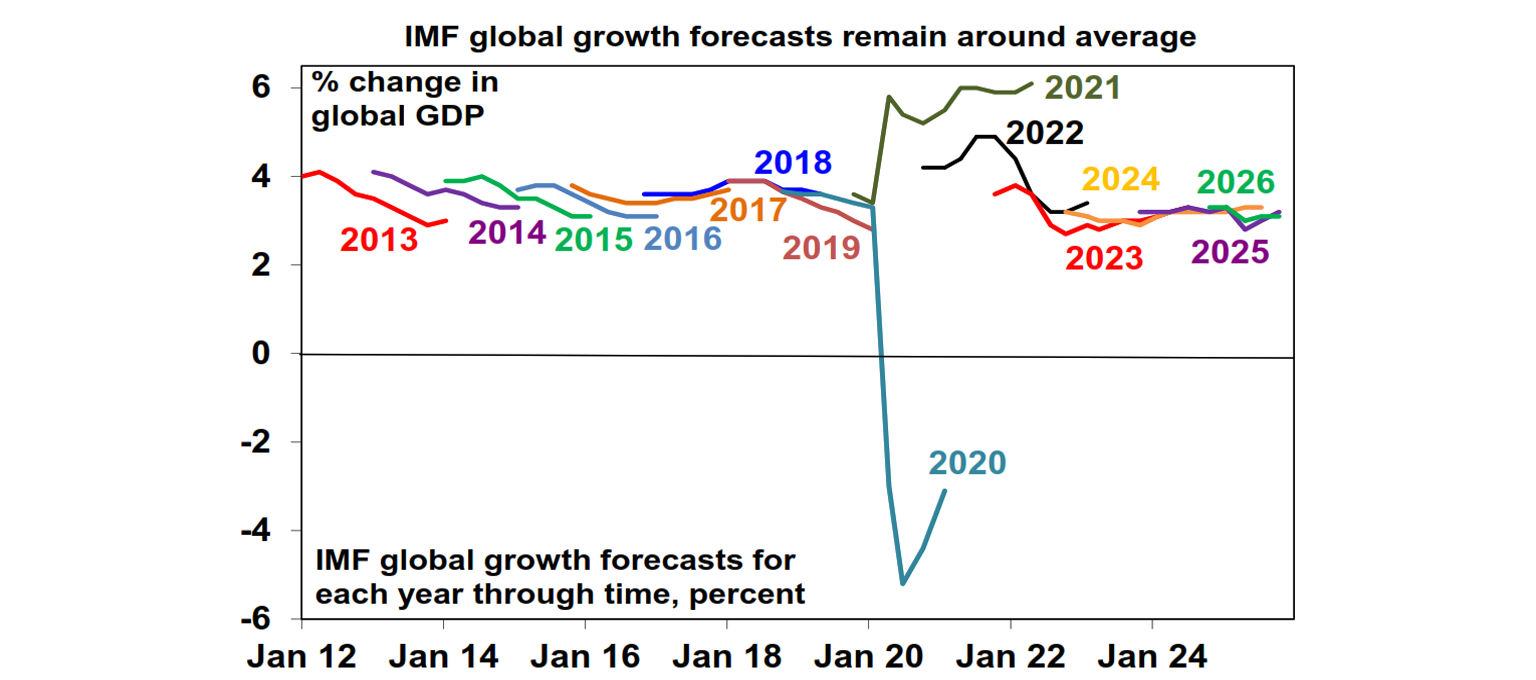

The IMF revised up its global growth forecasts slightly – seeing 3.2% growth this year and 3.1% next. The IMF is just catching up with the rebound in share markets and it leaves its growth forecasts around average levels.

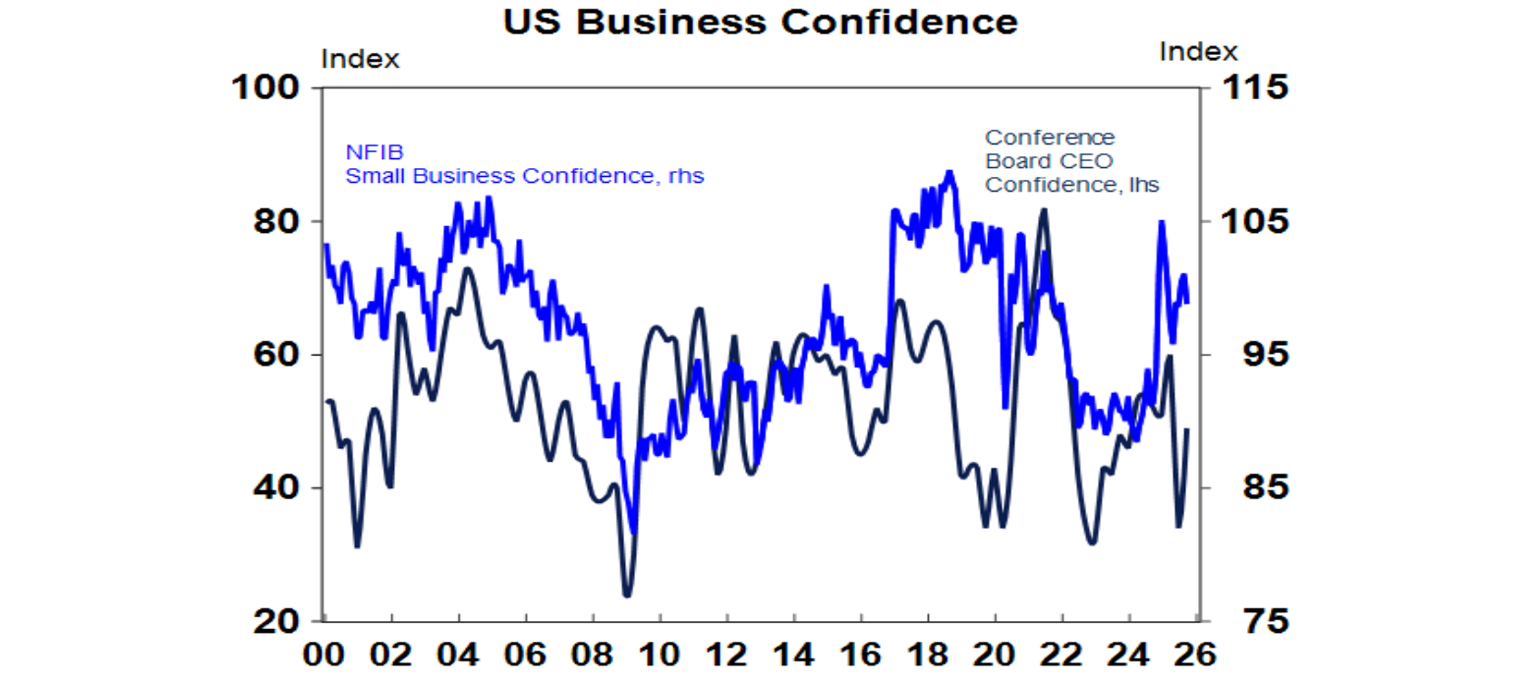

It was another quiet week for data in the US thanks to the partial government shutdown. Business surveys were mixed with stronger manufacturing conditions in the New York region in October but much weaker conditions in the Philadelphia region but with both showing still high price pressures. Small business optimism fell slightly in September and while home builder conditions rose they remain weak. The Fed’s Beige of anecdotal evidence suggests that economic growth has moderated slightly.

Meanwhile, a speech by Fed Chair Powell indicated that the Fed is on track to cut rates again later this month – with the outlook for employment and inflation little changed from in September when the Fed flagged two more rate cuts this year – and that with liquidity conditions tightening it may be getting closer to ending the rundown of its balance sheet, ie quantitative tightening. Another cut in December is also likely, but this could still be headed off if strong economic growth leads to improving jobs data as suggested in remarks by Fed Governor Waller.

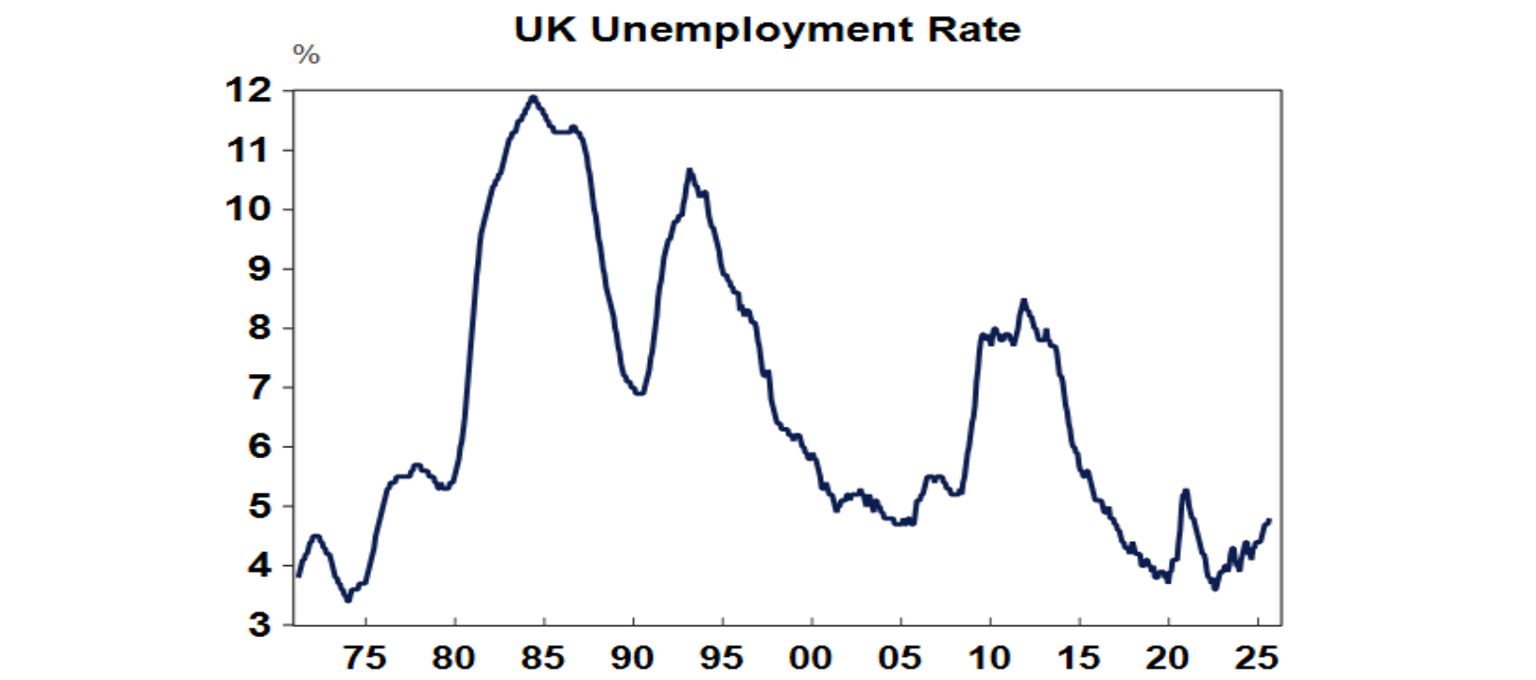

Unemployment rose further in the UK to 4.8%. While high inflation has constrained the Bank of England’s ability to cut rates more rate cuts are still likely.

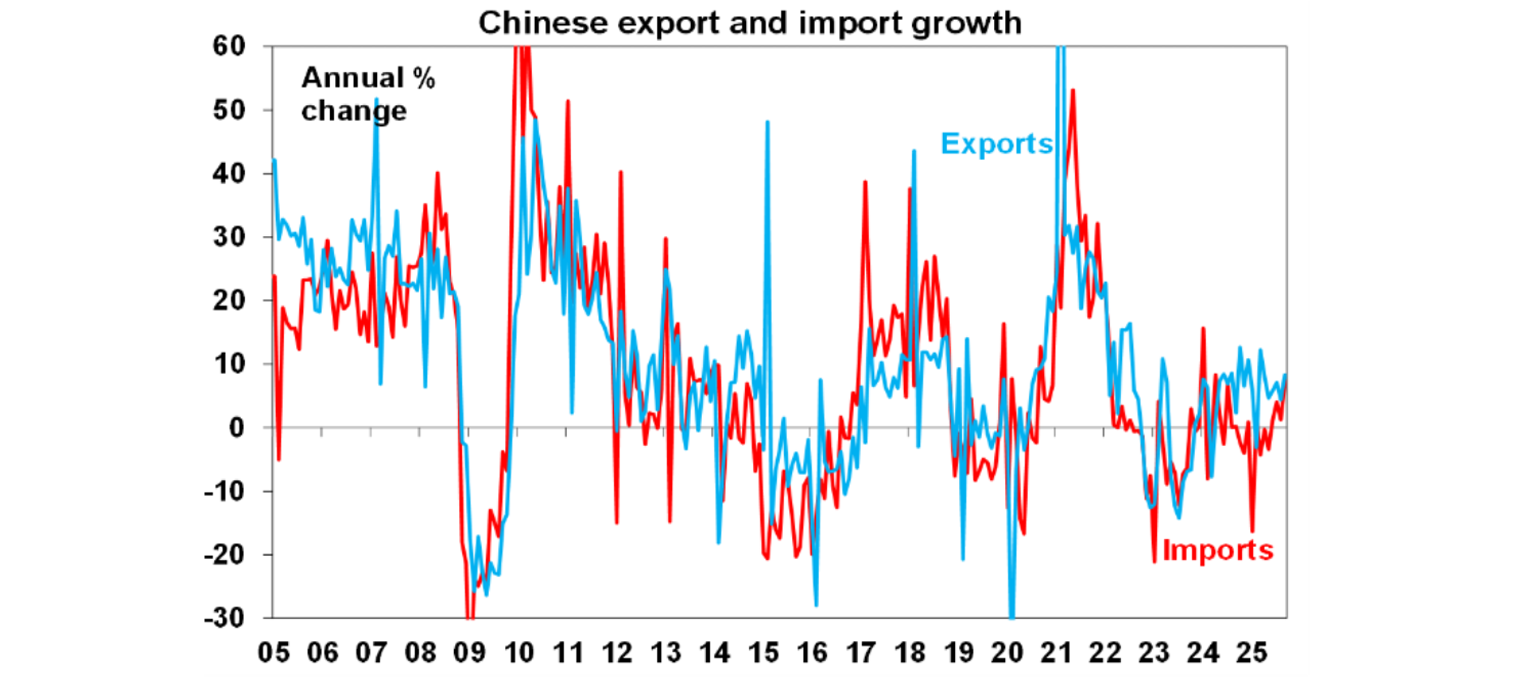

Chinese export and import growth both rose more than expected in September with exports rising to the US (albeit they remain low after a sharp fall), Africa and South America. Meanwhile, bank loan and credit growth slowed further in September.

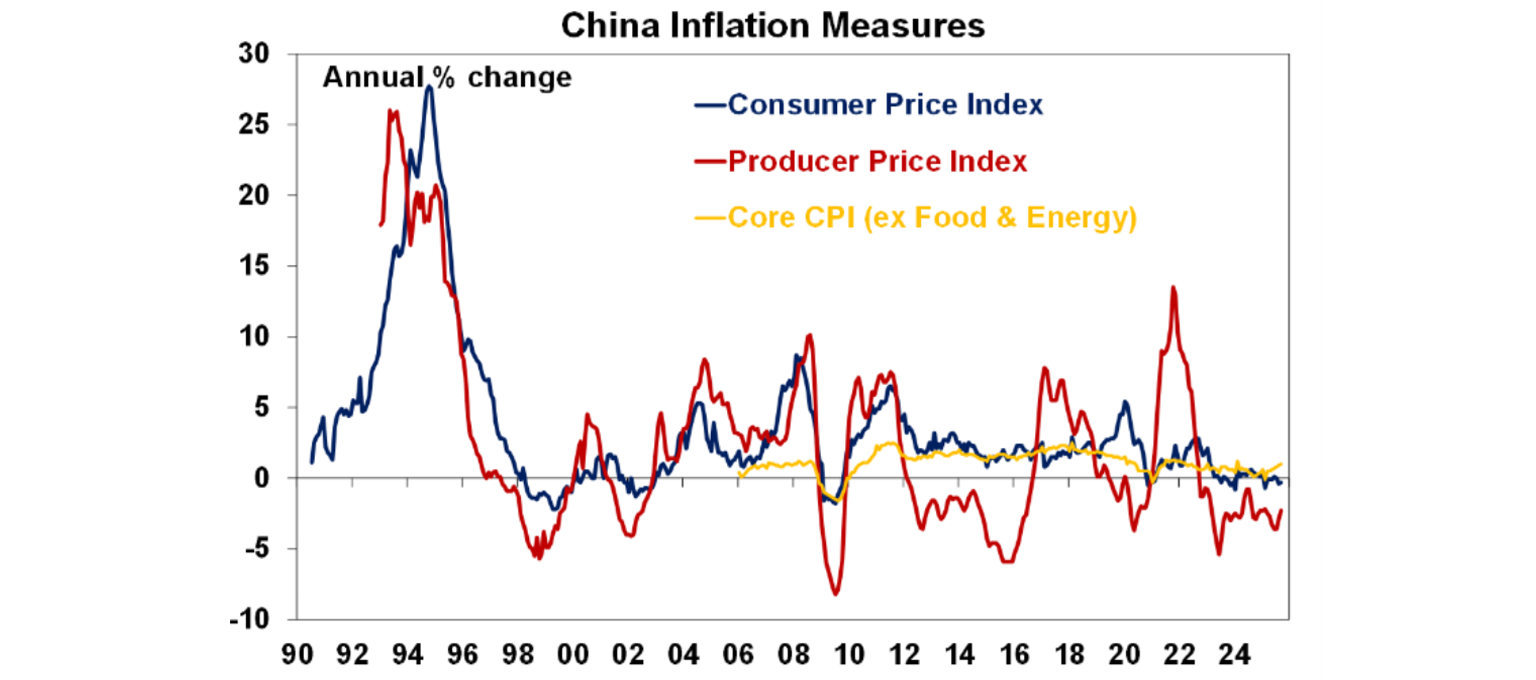

China remained in price deflation in September, but it eased slightly with core inflation rising from 0.9%yoy to 1%yoy - possibly reflecting “anti-involution policies” to reduce spare capacity.

Australian economic events and implications

September jobs data was once again softer than expected. Annual job growth at 1.3%yoy is at its slowest since 2021, unemployment is also at its highest since 2021 and is tracing out a gradual rising trend.

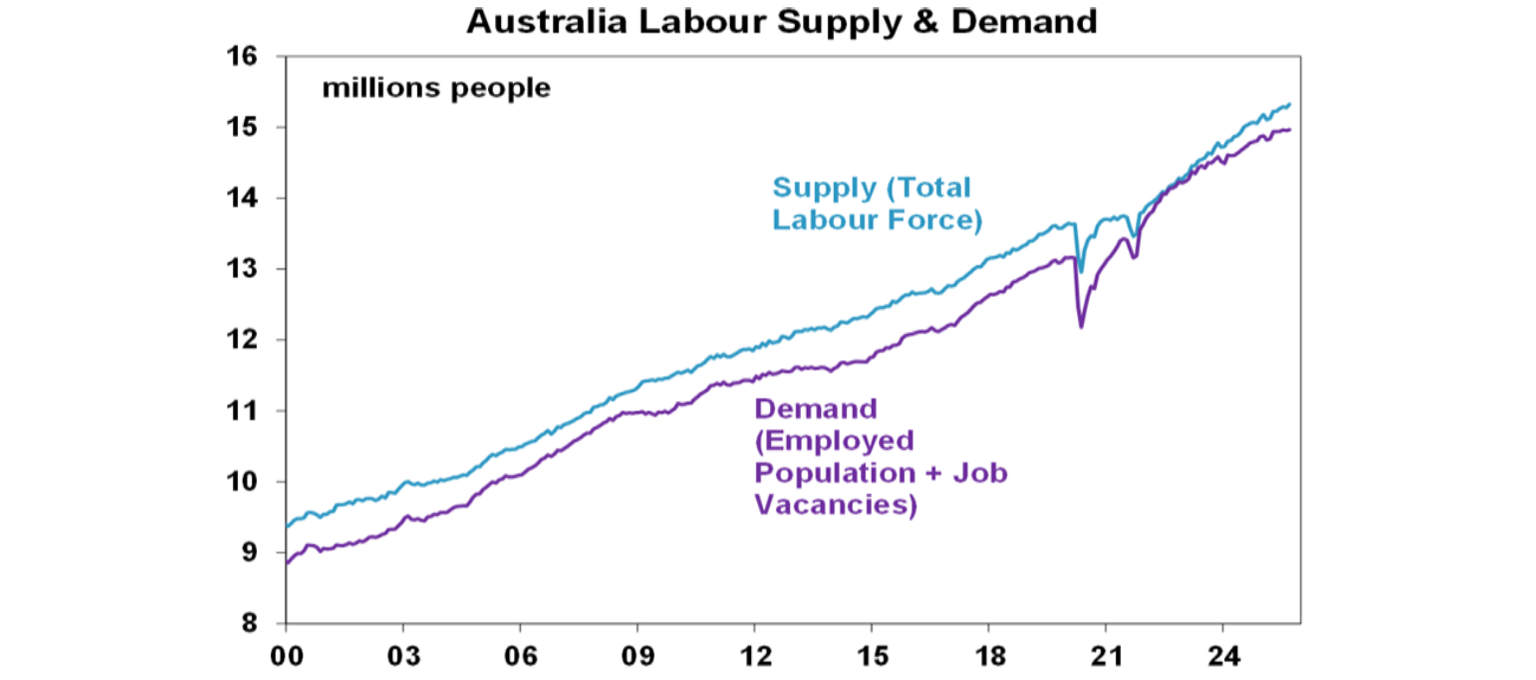

As can be seen in the next chart, while the supply of workers (as proxied by the total labour force) is still trending up the demand for workers (as proxied by employment and job vacancies) appears to be flattening out all of which is consistent with an ongoing softening in the Australian labour market.

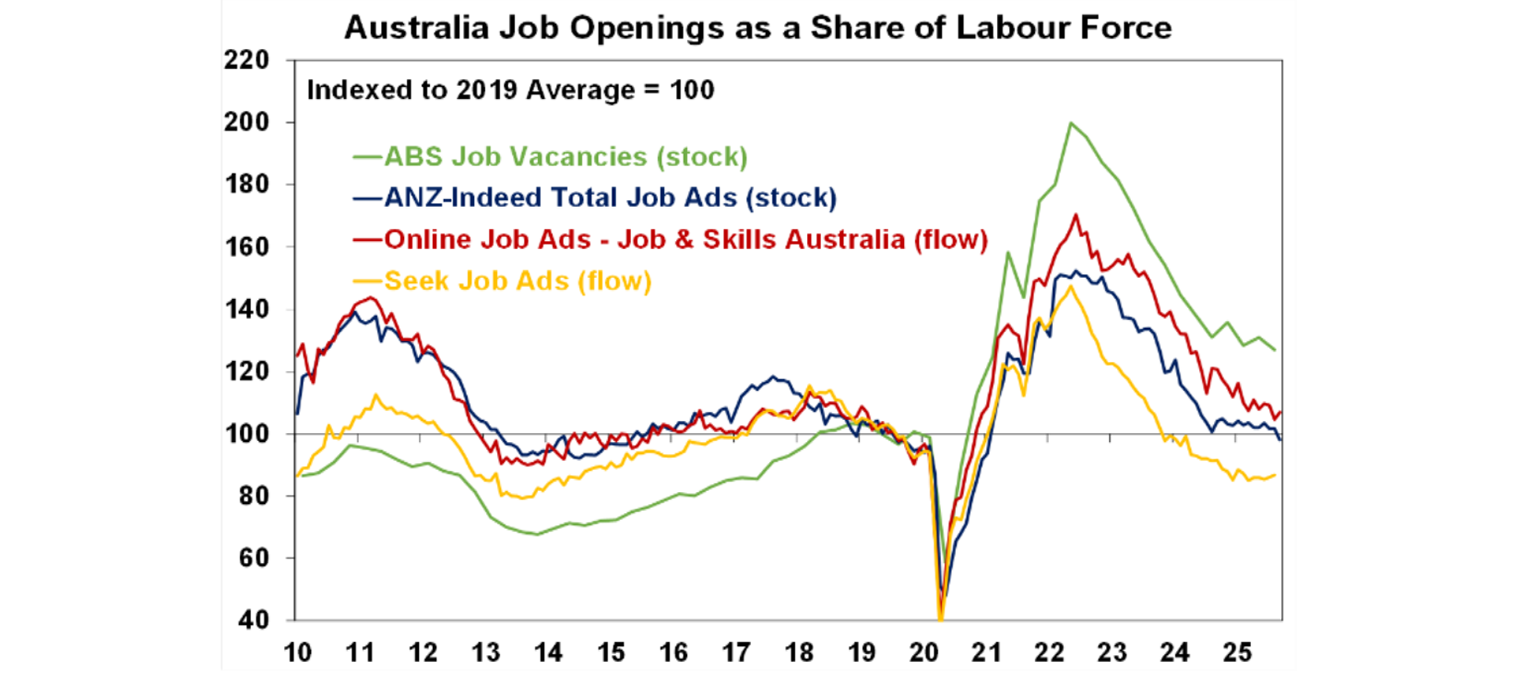

Forward looking jobs data relating to job ads and vacancies continue to trend down with most warning of slower jobs growth ahead.

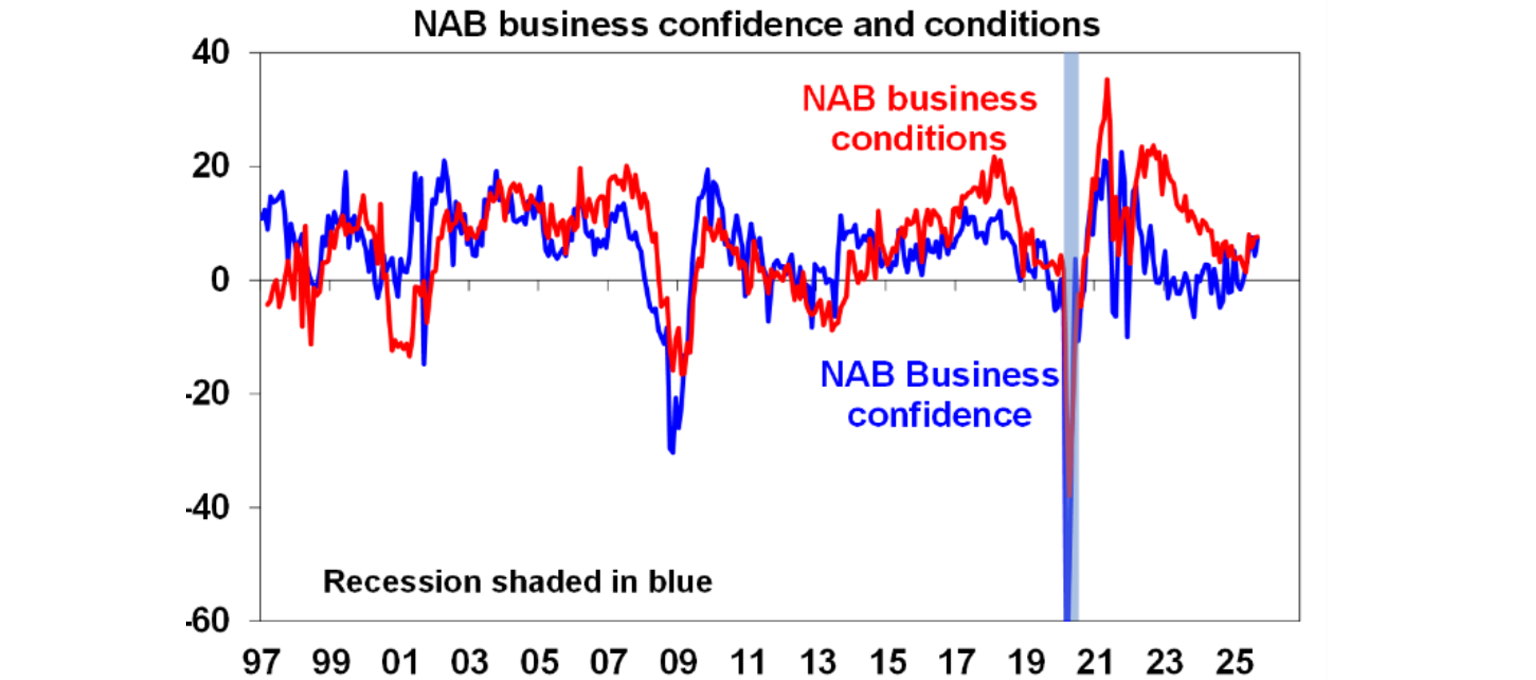

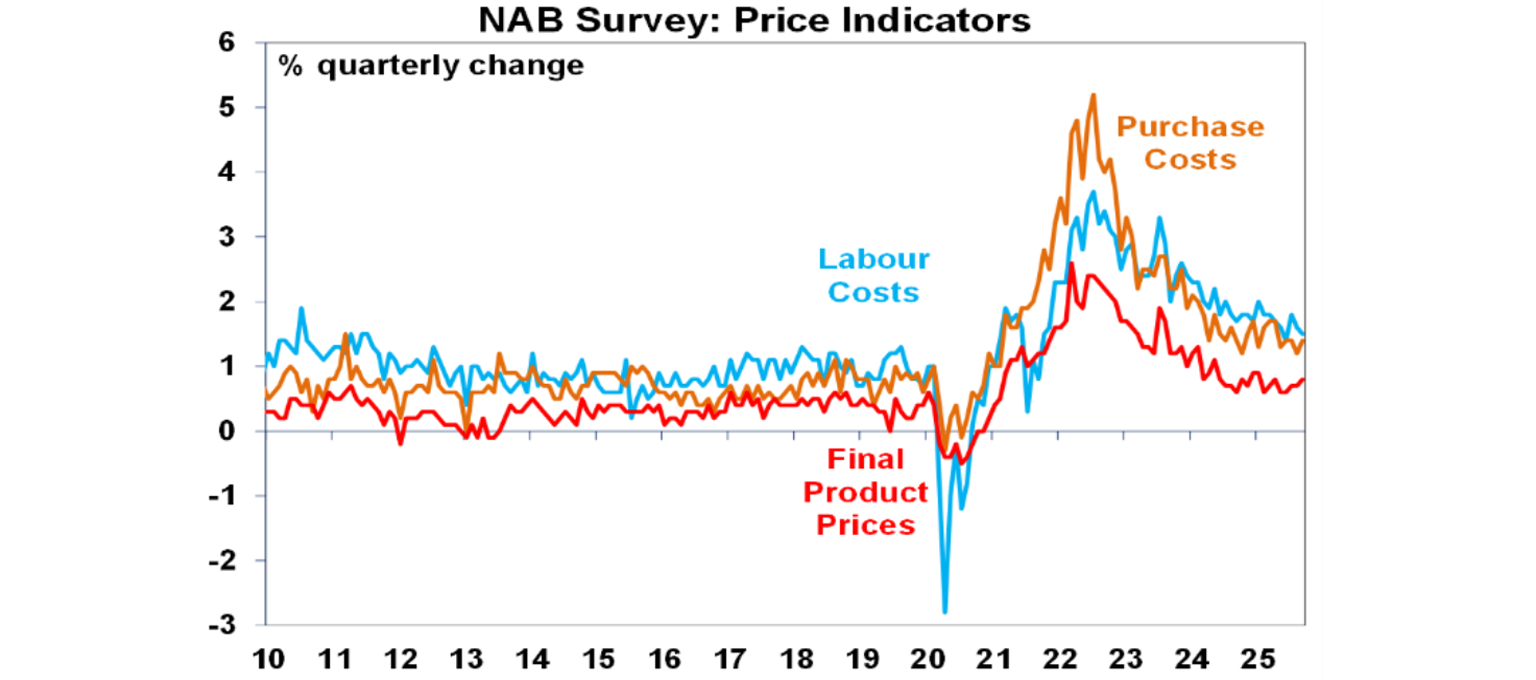

Business confidence improved slightly in the September NAB survey and business conditions were unchanged with both around okay levels. Employment fell slightly and is still pointing to some slowing in jobs growth.

Final price pressures rose slightly with overall cost and price pressures contained.

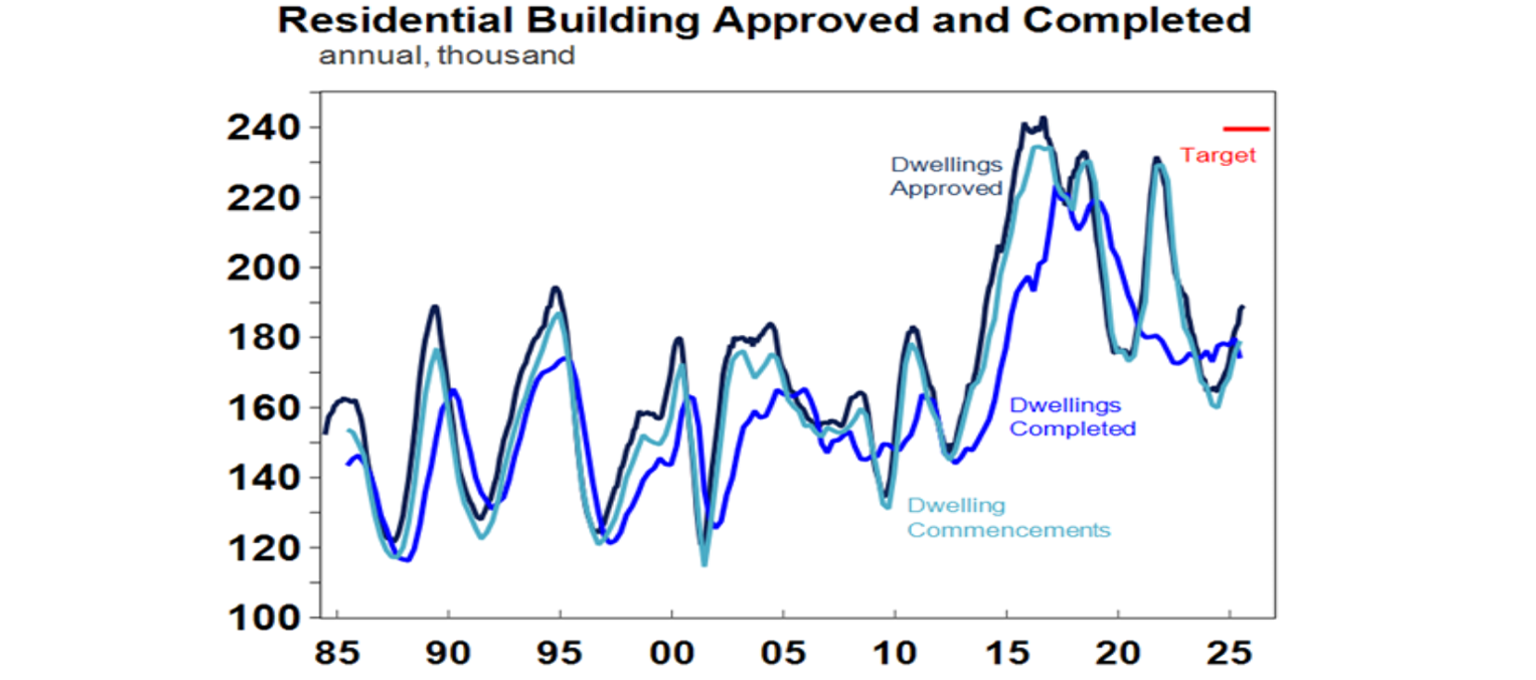

Dwelling completions were just 174,000 in 2024-25, with commencements just 179,000, both way below the Building Accord target for 1.2 million new homes over five years or 240,000 a year. At least approvals are trending up but are they are still way below the 240,000 homes a year target. A 26% spike in the HIA’s new home sales survey is a positive sign but will need to be sustained.

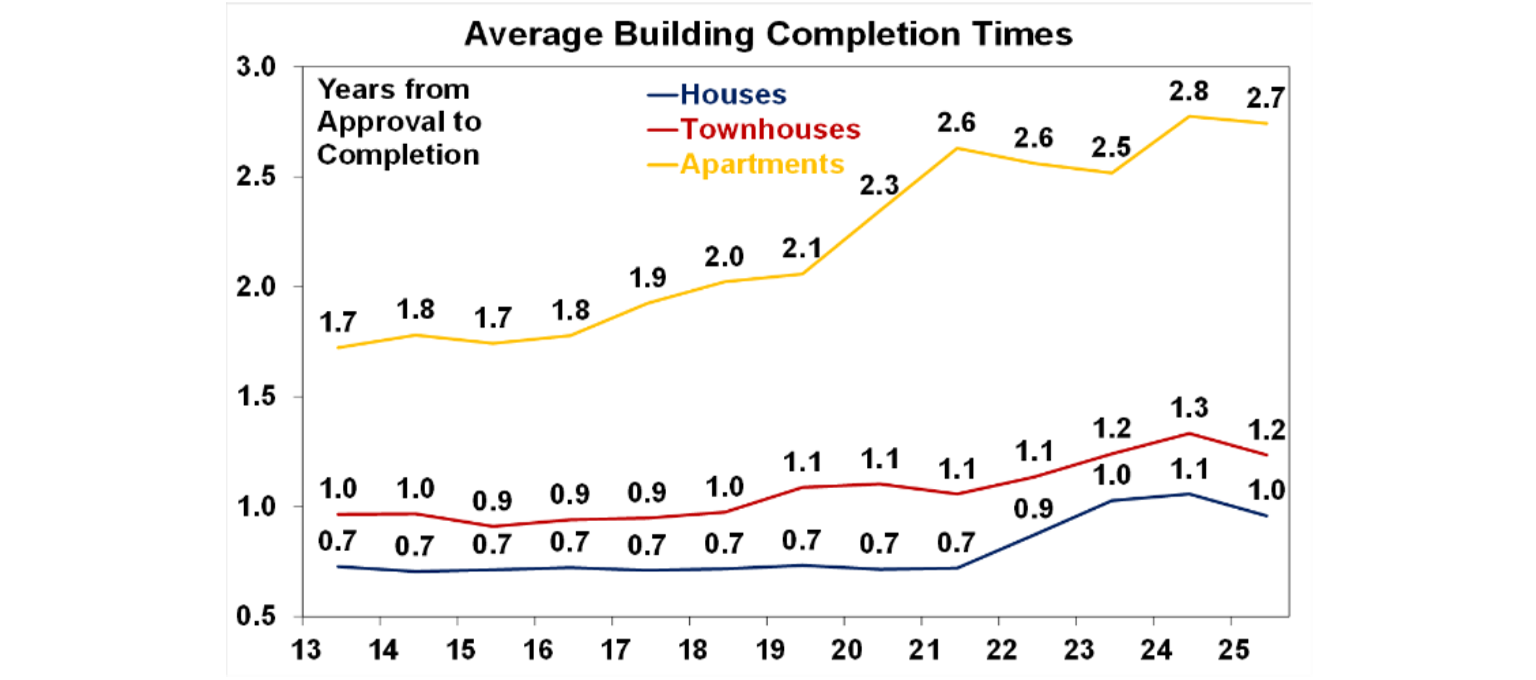

Home building completion times are still running way up on a decade ago (reflecting excessive regulatory requirements, labour and material issues, etc) and are one key reason why we can’t build enough homes.

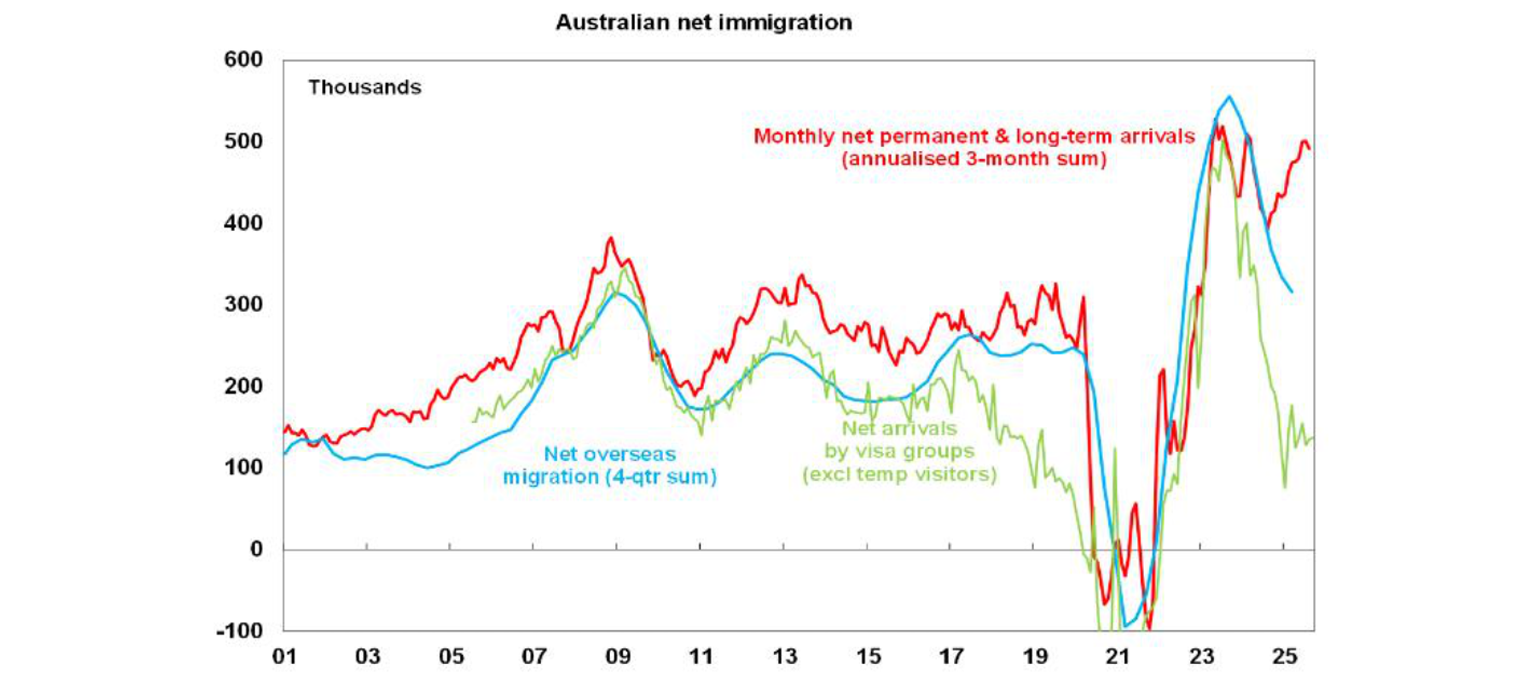

Monthly visa data and net permanent and long-term arrivals data are continuing to provide a conflicting picture on the trend in net migration. Actual net overseas migration data is running in between but trending down.

What to watch over the week ahead?

Business conditions PMIs for October for major countries, including Australia, to be released Friday are expected to remain consistent with okay economic growth.

In the US uncertainty remains around the timing of official data releases given the partial government shutdown. However, the BLS has indicated that the September CPI will be released on Friday, and this is expected to show monthly CPI inflation of 0.4%mom taking the annual rate to 3.1%yoy and core inflation unchanged at 0.3%mom or 3.1%yoy. Other data to be released includes existing and new home sales (Thursday and Friday) both of which are likely to remain weak and business conditions PMIs (Friday) which have been strong but slowing. If the shutdown ends soon, delayed jobs data for September is likely to show a 40,000 rise in jobs and unemployment remaining at 4.3%. The September quarter earnings reporting season will also start ramp up. The market consensus is for an 8%yoy rise in earnings per share but based on past beats is likely to end up around +11%yoy with growth led by tech and financial stocks.

Canadian inflation data for September (Tuesday)is likely to show underlying inflation remaining around 3%yoy.

UK underlying inflation for September (Wednesday) is likely to remain around 3.6%yoy.

New Zealand inflation data for the September quarter (Monday) is likely to show a rise to 3%, in line with RBNZ expectations but it will likely look through it given weak economic data and still cut rates again in November.

Japanese core inflation for September (Friday) is likely to slow slightly to 1.5%yoy.

Chinese economic activity data (Monday) is likely to show a slowing in growth with September quarter GDP growth cooling to 0.8%qoq or 4.7%yoy, retail sales growth slowing to 2.9%yoy and industrial production slowing to 4.9%yoy. Investment is likely to contract under the weight of an ongoing fall in property investment.

In Australia, “remarks” by RBA Governor Bullock (Friday) are likely to reiterate the RBA’s cautious data dependent message regarding the outlook for interest rates, but it will be interesting to see how she responds to the higher unemployment rate.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more as central banks continue to cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices are in an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may brake higher with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.