Global shares, led by the US share market, pushed further into record territory over the last week helped by solid US earnings growth, okay economic data and expectations for the Fed to start cutting rates next month. For the week US shares rose 0.9%, Eurozone shares gained 1.6%, Japanese shares rose 3.7% and Chinese shares rose 2.4%. The positive global lead, the RBA cutting rates and signalling more cuts to come along with a reasonable start to the earnings reporting season also saw the Australian share market rise to a record high with a 1.5% gain for the week led by materials, consumer staples, utilities and healthcare shares. Bond yields rose except in Australia where they fell but are basically range bound. Oil prices fell on hopes of progress towards a ceasefire in the Russia/Ukraine war, but with the Trump/Putin talks not reaching a deal. Metal prices rose slightly with the iron ore price flat around $US102/tonne. The $A was little changed around $US0.65 with the $US down. Bitcoin rose making it to a new high during the week.

The past week has been relatively quiet on the US tariff front with only a 90 day extension of the trade truce with China and Trump flagging again that tariffs on semiconductors (of “200%, 300%?”) are coming soon, but there were more concerning pronouncements coming from the Trump Administration. This included that chip makers like Nvidia would pay 15% of the their revenue from Chinese chip sales to the US Government (begging the question who will be next to face such levies), attacks on Goldman Sachs because their economists produced an assessment regarding the economic impact of the tariffs that Trump didn’t like, the US Government in talks to take a stake in Intel and the appointment of someone ill qualified to head the Bureau of Labor Statistics after Trump sacked the former director for producing down beat jobs data (not that a qualified person would take the job given the risk of getting sacked for reporting any unpleasant news!). The latter will lead to concerns about the trustworthiness of US economic data and the former along with the tariffs, pressure on companies to invest in the US, attacks on universities, the rule of law and Fed independence only add to longer term concerns about the integrity of the US economy (with uncertain Presidential edicts supplanting market forces to drive resource allocation) and the things that have made it so innovative, ie, “US exceptionalism”.

In the meantime though, share markets are continuing to shoot the lights out making new highs as: worst case trade war scenarios now look less likely; global economic data remains mostly okay; profits are coming in stronger than expected globally and expected to pick up in Australia; the Fed is looking likely to start cutting in September as tariffs impact inflation but by less than feared and the US labour market cools; and other central banks including the RBA are continuing to cut rates. The near term risk of a correction remains high as: valuations are stretched; shares are getting technically overbought; the tariffs could still show up in weaker economic data and higher US inflation; uncertainties remain over the Russia/Ukraine war with risks that President Trump could impose secondary tariffs on importers of Russian oil (notably India and China) with Trump/Putin talks on Friday being described by Trump as “productive” but with “no deal” so far; and there is a high risk of a US Government shutdown in September. Beyond the messy near-term outlook though, shares should benefit on a 6-12 month view as Trump continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut.

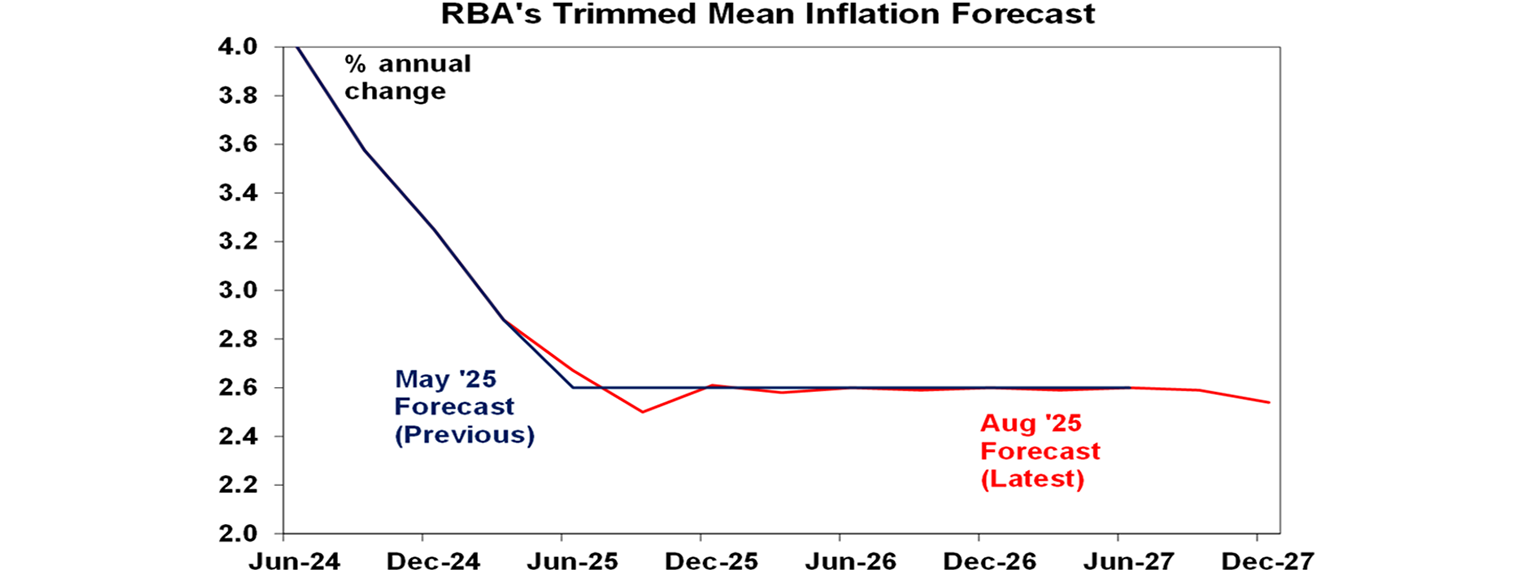

In Australia, the RBA cut its cash rate again with more rate cuts likely. The cut was no surprise and reflected confirmation that inflation is on track to settle around the mid-point of the 2-3% target range in line with the RBA’s forecasts – see the next chart. Surprisingly though the RBA actually revised down its growth forecasts and were it not for its assumption that the cash rate would fall another two or three times into next year its forecasts for growth, unemployment and inflation would be weaker. So, while still low unemployment for now and the RBA’s concerns about poor productivity growth mean that the RBA will remain cautious and gradual in cutting rates, and they will assess the situation from meeting to meeting, we continue to see the RBA cutting rates again in November, February and May taking the cash rate down to 2.85%. Jobs and wages data released after the RBA meeting were roughly in line with RBA forecasts and so do nothing to alter the outlook for interest rates.

My wish list for the Australian Government’s Economic Reform Roundtable. It’s a very good thing that we are at last starting to have a national debate about the importance of productivity, why weak growth in it is a problem and what can be done about it. Productivity growth is basically the secret sauce that enables strong growth in real wages, living standards and profits while at the same time keeping inflation low and its absence in recent years has made this kind of difficult. So hopefully, the Roundtable will kick off a process of economic reform that will boost the ability of the economy to produce goods and services with the aim of boosting long-term living standards. Key reforms on this front should include the following:

Tax reform to rebalance from income tax to a higher and/or broader GST, compensate those adversely affected, index the income tax thresholds and remove nuisance taxes like stamp duty to incentivise work effort and investment, better allocate resources and reduce the burden on younger generations as the population ages. This sounds politically difficult but if combined with an adjustment to income tax scales to offset the regressive nature of the GST, some measures to cap property tax concessions (like cutting the overly generous capital gains tax discount) and better tax gas exports a broad consensus could be reached. While some advocate a wealth tax to deal with rising wealth inequality, a better option may be inheritancetax as it’s a less distortionary tax.

Limit government spending to below 25% of GDP. If we want more government services, we need to find others to cut. This is the best way if we want to ensure budget sustainability and boost productivity (as higher taxes and government spending crowd out more productive private sector activity).

Deregulate product and labour markets to remove red tape, boost flexibility and make it easier to get things done. There is much that can be done here, eg, to speed up home building.

Provide more incentives, eg, by tax deductions, for companies to invest and adopt new technology including AI. At the same we must avoid encumbering companies with AI dos & don’ts.

Boost workforce capability by improving education & training outcomes.

Competition reform to reduce market concentration.

Match population growth to the ability to supply new homes.

Boost service delivery productivity in the care economy, including by focussing more on prevention in healthcare and the faster adoption of automation/robotics.

Maintain high levels of infrastructure spending to reduce congestion, lower transport costs & allow more to live away from expensive cities.

Rely more on market signals as to how best to get to net zero.

The reality of course is that everyone has their wish list and expectations running into the Roundtable appear to be running too high. It’s likely just the start of long process through which (hopefully) the Government will pick the best options and make some compromises. However, in the absence of a serious economic crisis, like when Keating was talking about a “banana republic”, radical economic reform is unlikely. And in any case, serious tax reform involving the GST looks off the table as does labour market deregulation and the inclusion of budget sustainability risks any tax outcomes being dominated by measures to simply raise more taxation revenue. However, there are good prospects for a serious focus on deregulation, with housing at the pointy end of this but other sectors of the economy likely to benefit too, better incentives to invest and competition reforms.

Major global economic events and implications

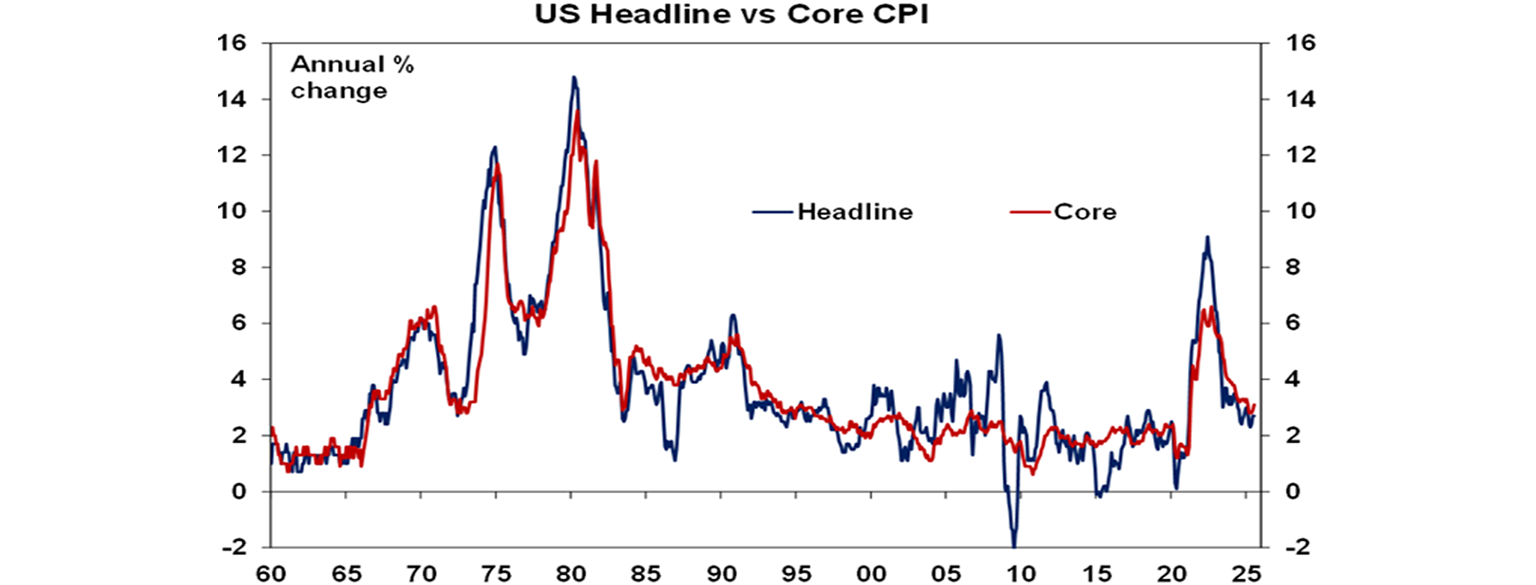

US CPI inflation for July came in roughly in line with expectations with core inflation at 3.1%yoy leaving the Fed on track for a September rate cut. However, producer price inflation and import prices came in stronger than expected. Taken together this suggests that July core private final consumption inflation will be around 0.3%mom or 2.9%yoy. This is well above the Fed’s target for 2% inflation and more evidence is emerging of the impact of tariffs on goods prices, but so far its limited. This may not remain the case as more companies start to pass on the tax hike to their customers but if jobs data remains soft and the tariff impact remains limited then the Fed is likely to cut in September. Following Treasury Secretary Bessent’s call for a 0.5% cut the money market attached a 105% probability to a 0.25% cut next month but it’s since fallen back to around 85% following the strong producer price and retail sales data and a rebound in consumer inflation expectations. The unfortunate thing is that were it not for the tariffs and their threat to inflation expectations the Fed would have likely continued cutting rates earlier this year! Out of interest with US import prices trending flat to up, there is no evidence that foreign exporters are absorbing the tariffs.

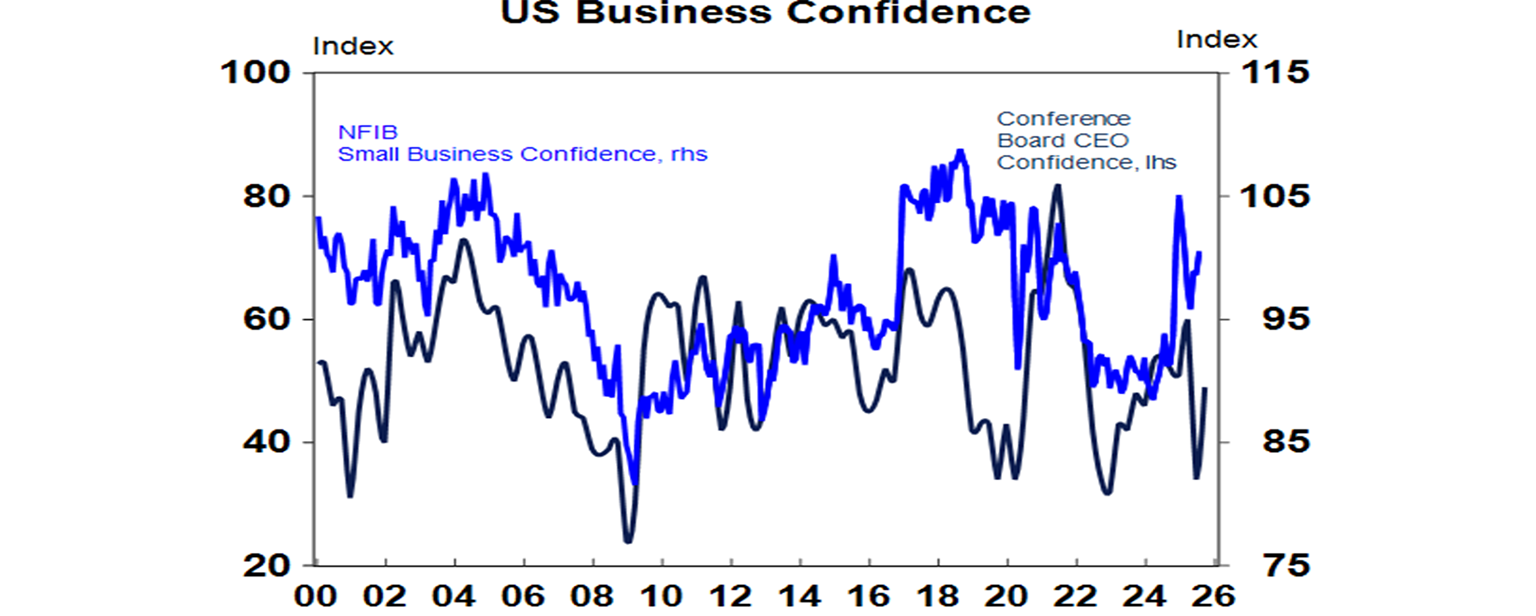

US economic activity data was mixed. Retail sales rose solidly again in July, but consumer sentiment fell. While industrial production fell in July, manufacturing conditions in the New York region and small business optimism rose. Jobless claims were little changed.

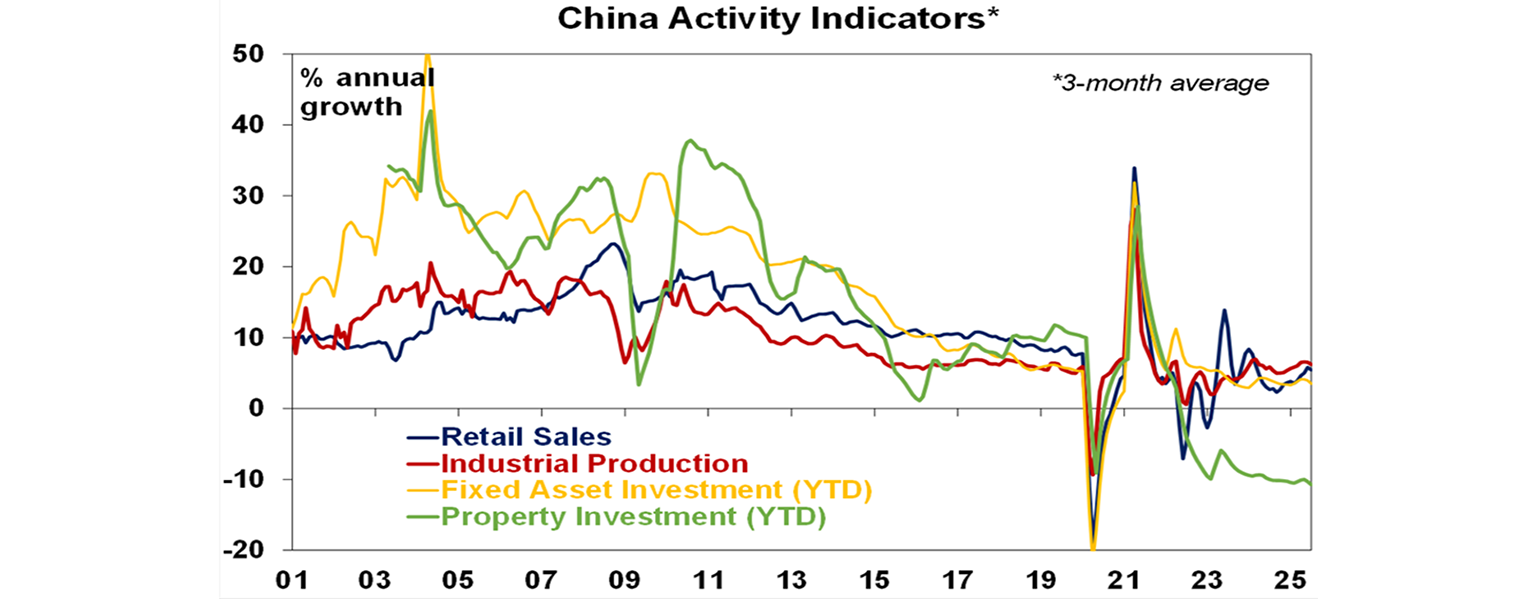

Japanese June quarter GDP also came in stronger than expected at 0.3%qoq or 1.3%yoy. Consumer spending remained soft but businessinvestment and exports were stronger than expected. Chinese economic data for July was soft. Retail sales, industrial production and investment all rose less than expected and residential property investment and sales are continuing to fall as are home prices. Unemployment rose slightly although this possibly due to grad and typhoon season. Underlining weak demand, bank lending actually fell in July, although broader credit growth remained solid at 9%yoy, up from 8.9%. The Government launched interest subsidy programs to boost consumer and some business borrowing, but the impact is likely to be limited. Expect further policy stimulus but it’s likely to only be just enough to avoid a crisis & keep growth around 5%.

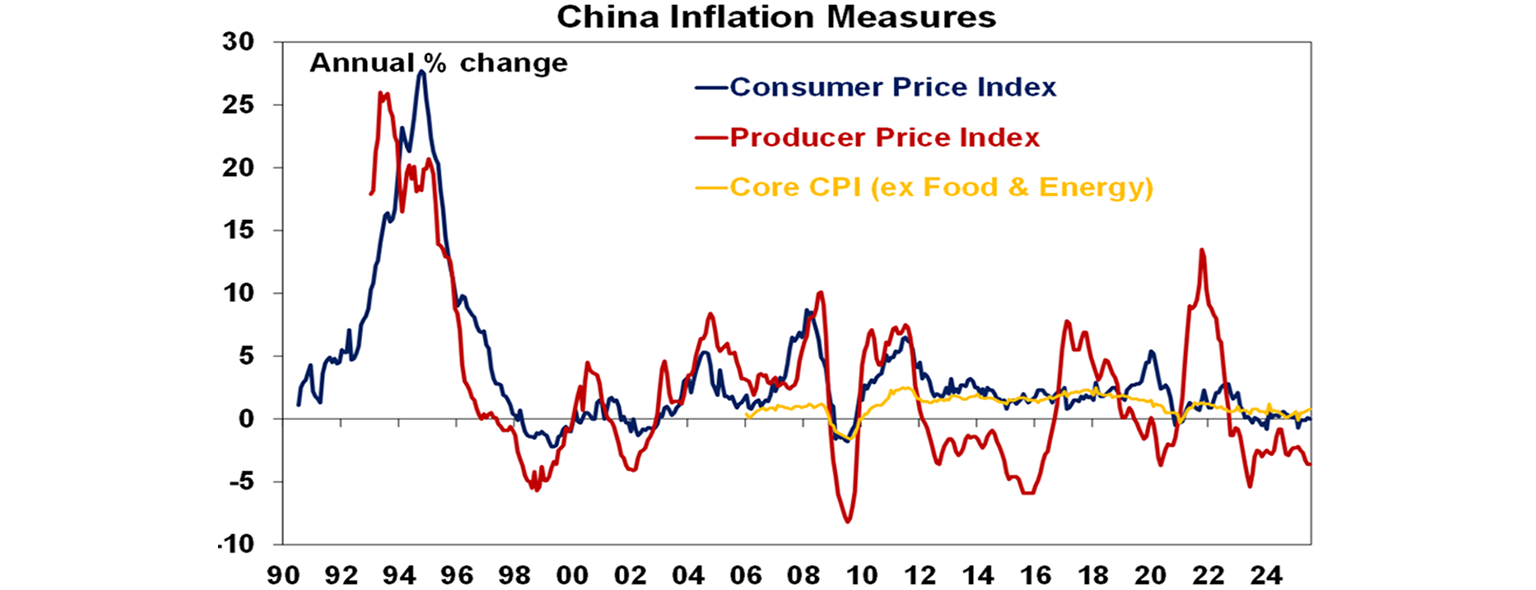

Deflationary pressures continue in China. July consumer price inflation was zero with producer prices down 3.6%yoy.

Australian economic events and implications

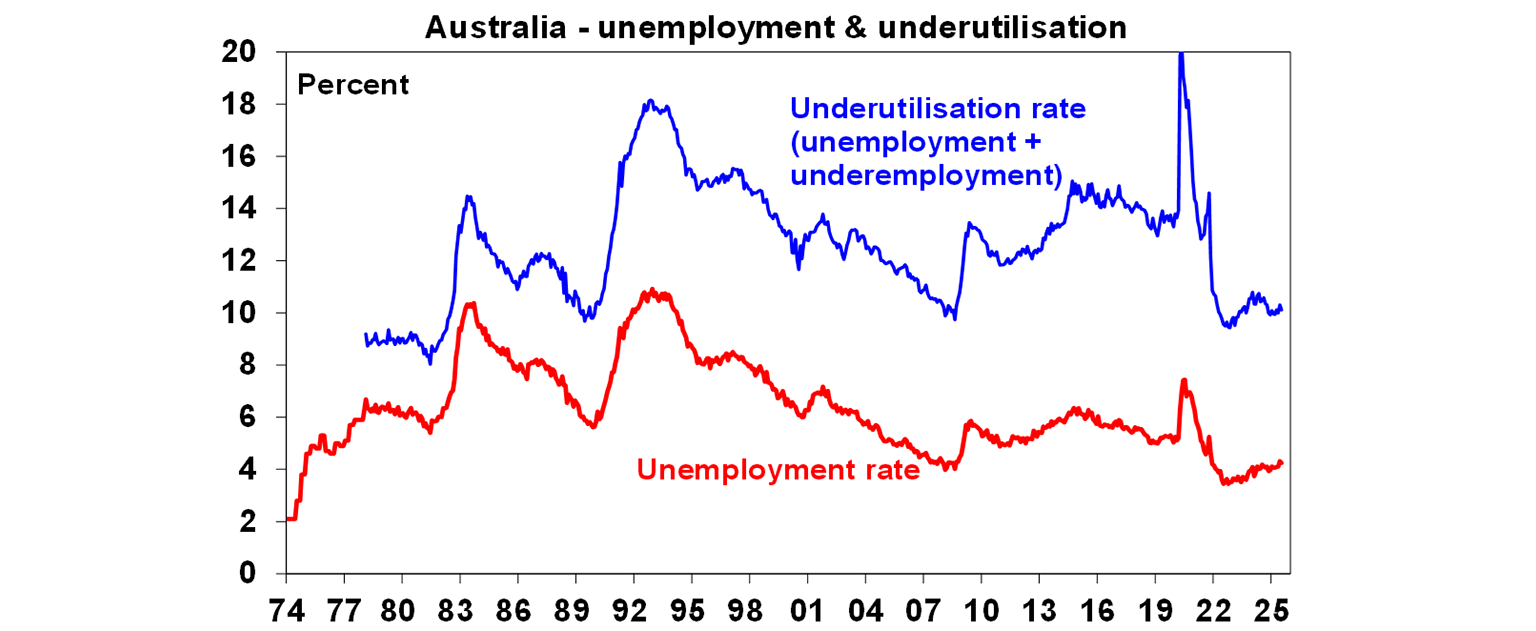

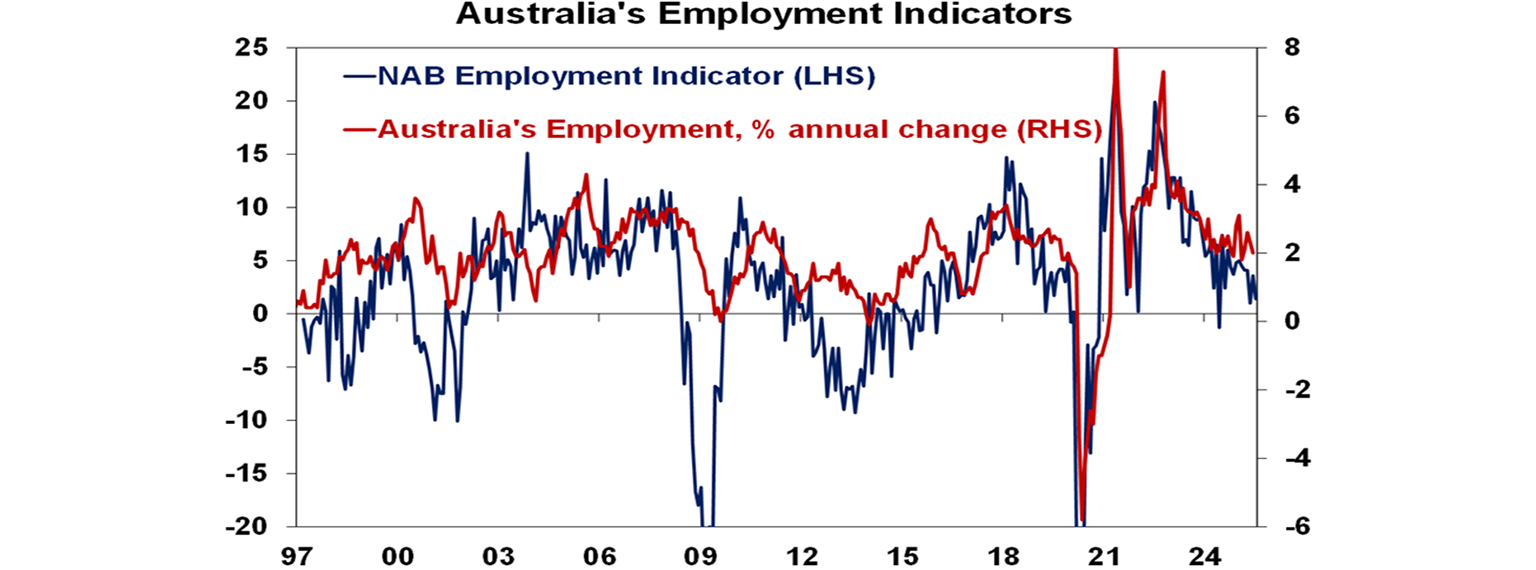

July jobs data was largely as expected and unlikely to alter the outlook for continued gradual rate cuts. Employment rose 25,000 after stalling in May and June, hours worked rose, unemployment fell back to 4.2% and labour underutilisation fell 10.1%. There remains a slight rising trend in unemployment but at present its in line with RBA forecasts which see a rise to 4.3% by year end.

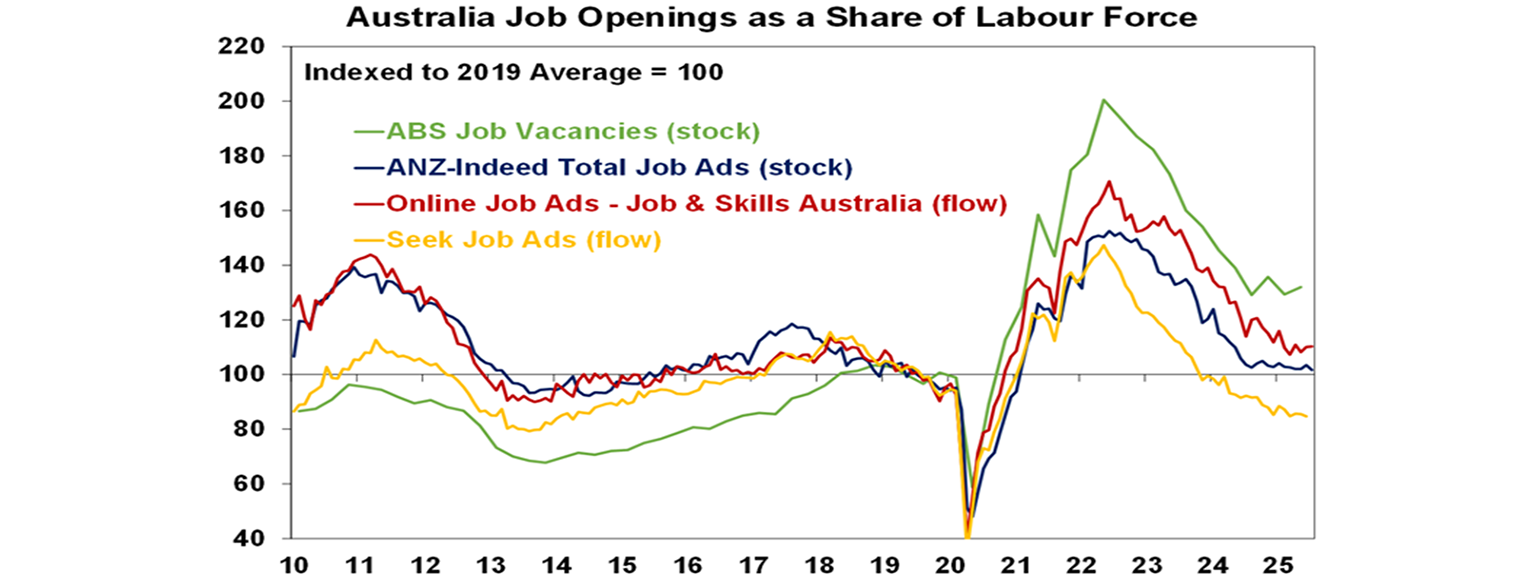

Forward looking jobs data have slowed but paint a mixed picture with ABS job vacancies stabilising at a relatively high level but the flow of new job ads on Seek continuing to trend down, warning of potentially higher unemployment ahead.

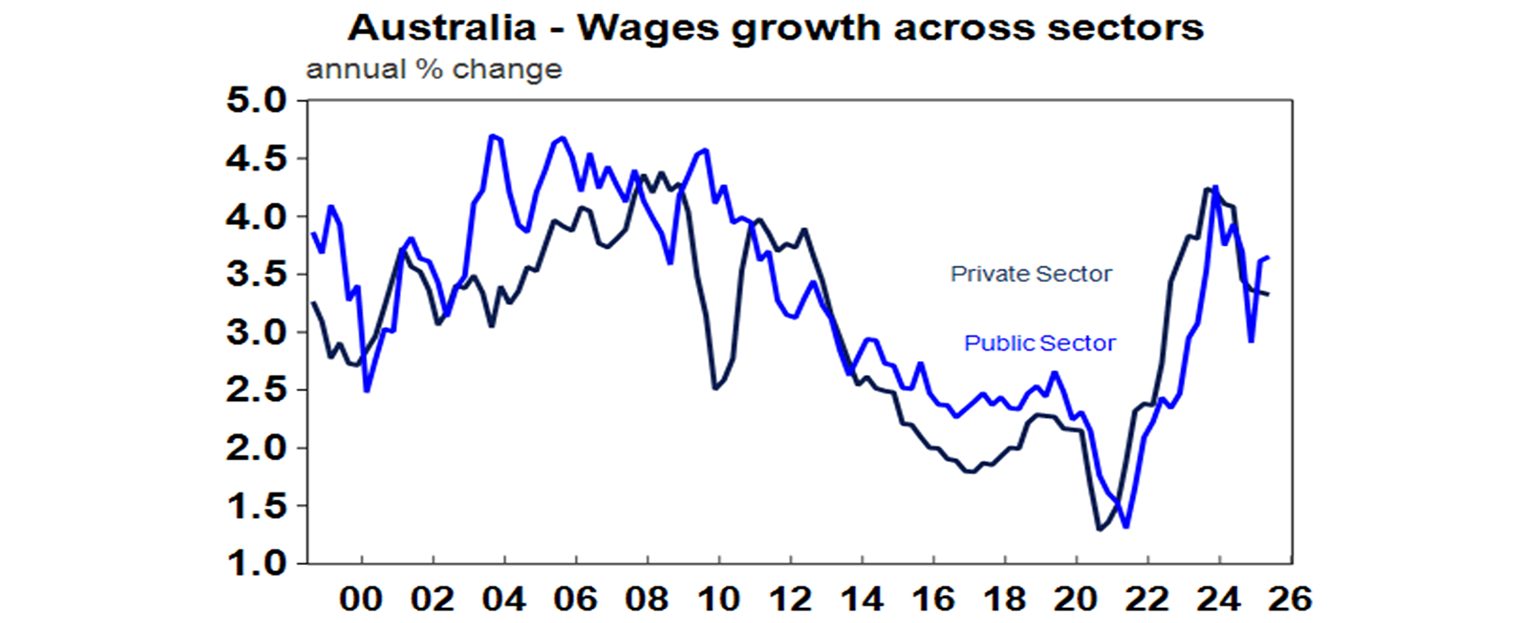

Wages growth held at 3.4%yoy in the June quarter. This was a bit stronger than expected mainly due to faster rises in the public sector. The gradual slowing in the jobs market points to some further slowing in wages growth.

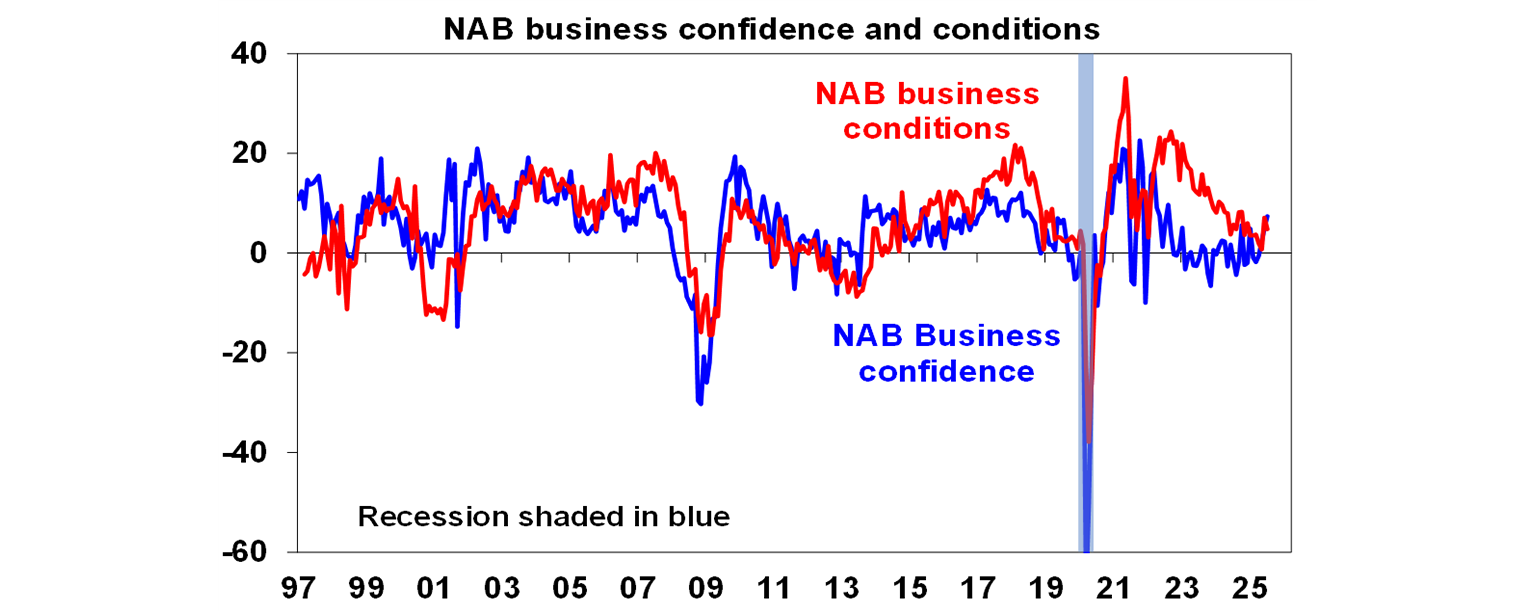

The July NAB business survey was mixed with confidence up but conditions down a bit, with soft orders.

The NAB survey also points to softer jobs growth ahead.

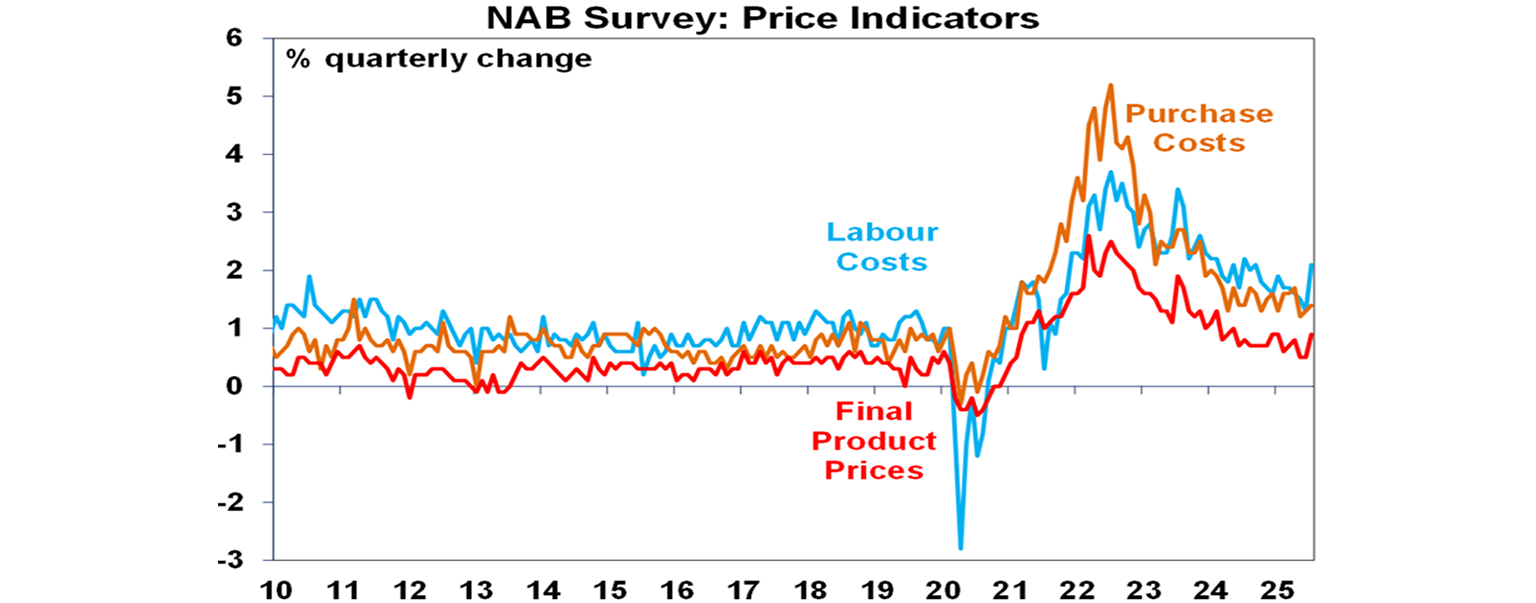

The NAB survey showed a rise in labour costs in July, although this is common at this time of year and reflects the national wage rise and increases in the super guarantee. Final product prices also picked up although the trend remains low.

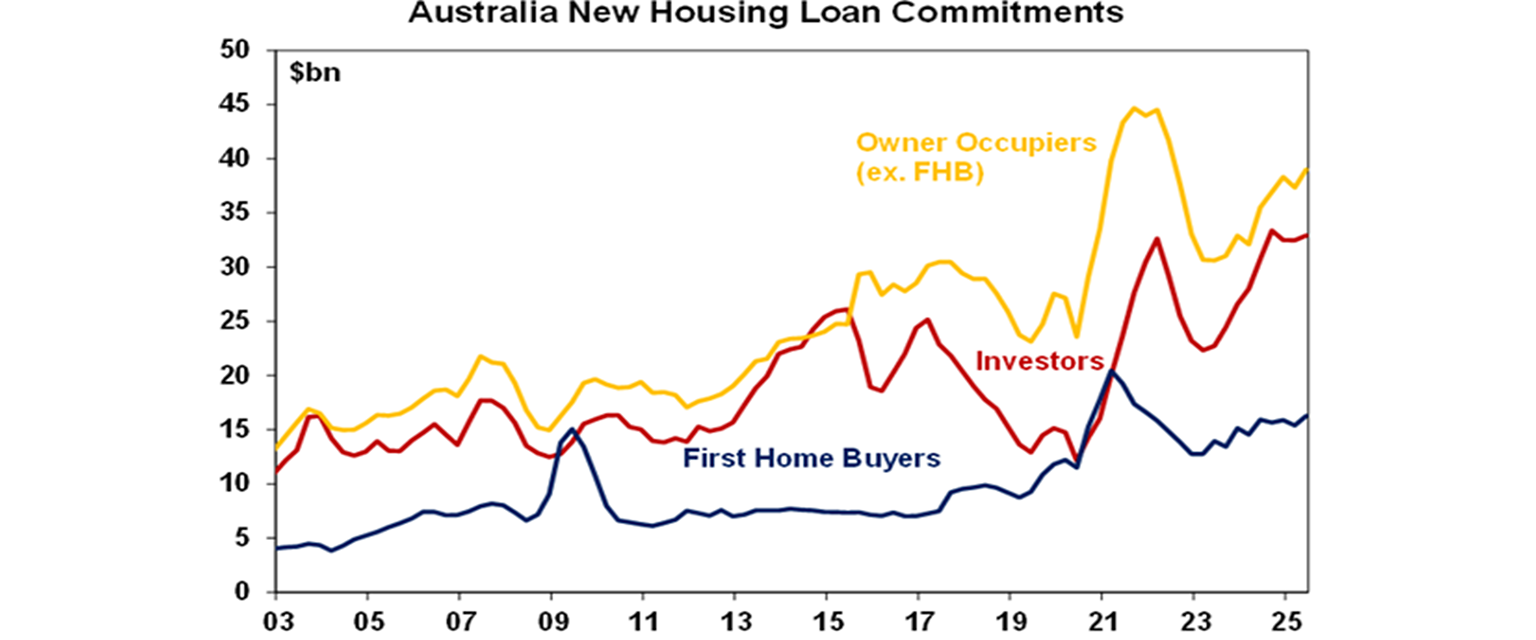

Housing finance rose by 2% in the June quarter with broad based gains across first home buyers, owner occupiers and investors consistent with the pickup in the property market.

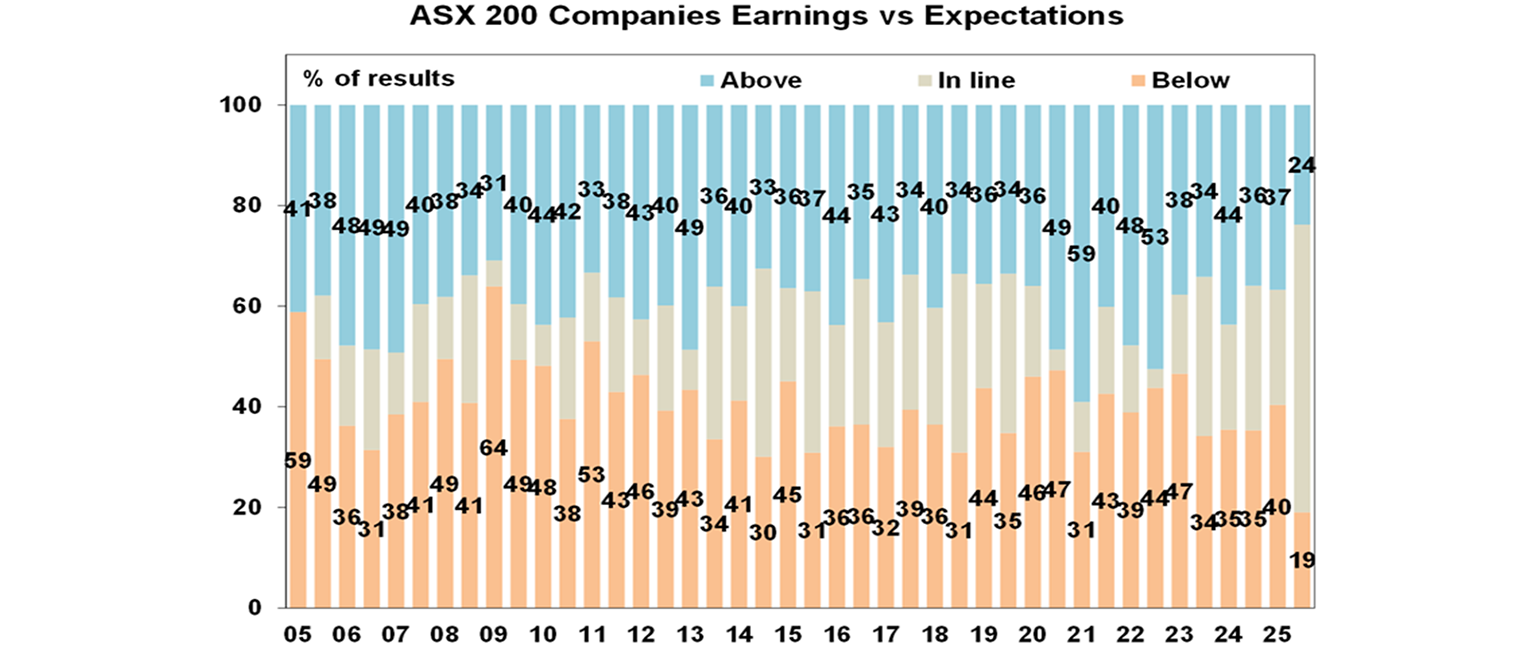

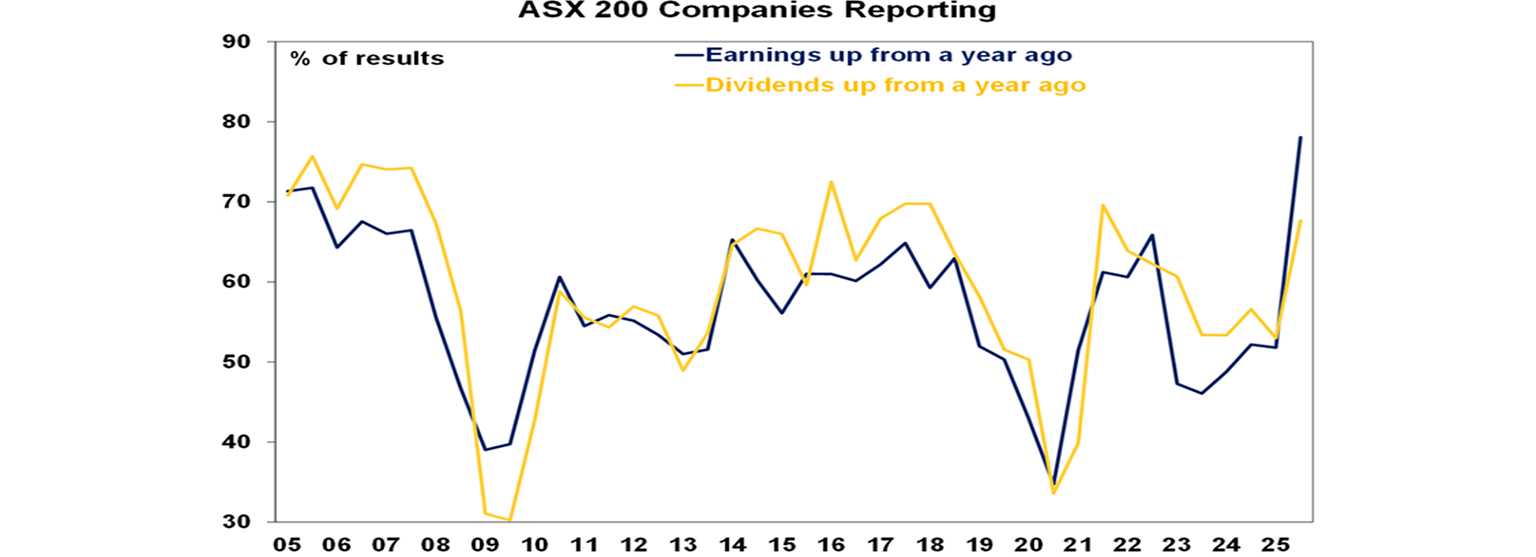

Its early days in the Australian June half earnings reporting season with only about 28% of major companies having reported. Consensus earnings expectations are for a 1.6% fall in earnings for 2024-25, the third year in a row of falling profits. Resources earnings are expected to be the main drag (as evident in Rio’s profit slump), but with mostly modest growth elsewhere. So far results have been good with more upside than downside surprises, although most results have been in line, and a big increase in the number of companies reporting profits or dividends up on a year ago than in the December half reporting season. The signal on consumer spending has been reasonable with solid results from JB HiFi and Nick Scali and REA seeing a stronger property market. Profits were also up at CBA and Westpac. Just bear in mind though that it was much like this at the start of the last reporting season as there is a tendency for companies with good results to report early so results may soften over the next couple of weeks.

So far beats are running above misses with 24% of results surprising consensus earnings expectations on the upside, which is below the norm of 40%, but just 19% have surprised on the downside which is also less than the norm of 44%.

78% of companies have seen earnings rise on a year ago, and this is better than the norm of 57%. But don’t forget thatfalls in profits in 2024-25 are likely to be concentrated in resources.

68% of companies have increased their dividends on a year ago which is above the norm of 59%.

What to watch over the week ahead?

Business conditions PMIs for July for major countries, including Australia, to be released on Thursday are expected to remain consistent with okay but constrained growth.

In the US, Fed Chair Powell’s comments at the Jackson Hole Symposium (Friday) will be watched for any guidance regarding prospects for a September rate cut. On the data front, expect home building conditions (Monday), housing starts (Tuesday) and homes sales (Thursday) to remain weak and the Philadelphia Fed’s manufacturing index (Thursday) to fall back a bit.

Canadian inflation data for July (Tuesday) is expected to show underlying inflation remaining around 3%yoy.

UK inflation data for July (Wednesday) is expected to show underlying inflation remaining around 3.7%yoy.

Japanese inflation data for July (Friday) is expected to show a fall to 3.1%yoy with core inflation falling to around 1.5%yoy.

The Reserve Bank of New Zealand (Wednesday) is expected to cut its cash rate by another 0.25% taking it to 3%.

In Australia, consumer confidence (Tuesday) is expected to show a rise on the back of the latest rate cut. The June half profit reporting season will see its busiest week with 82 major companies reporting.

Outlook for investment markets

Share markets are at risk of a correction through the seasonally weak months of August and September given stretched valuations and risks around US tariffs and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more, as growth slows, and central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 6% this year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.