Global shares had a messy week pushed around by tariff news in the US, better than expected US inflation data and Israel’s attack on

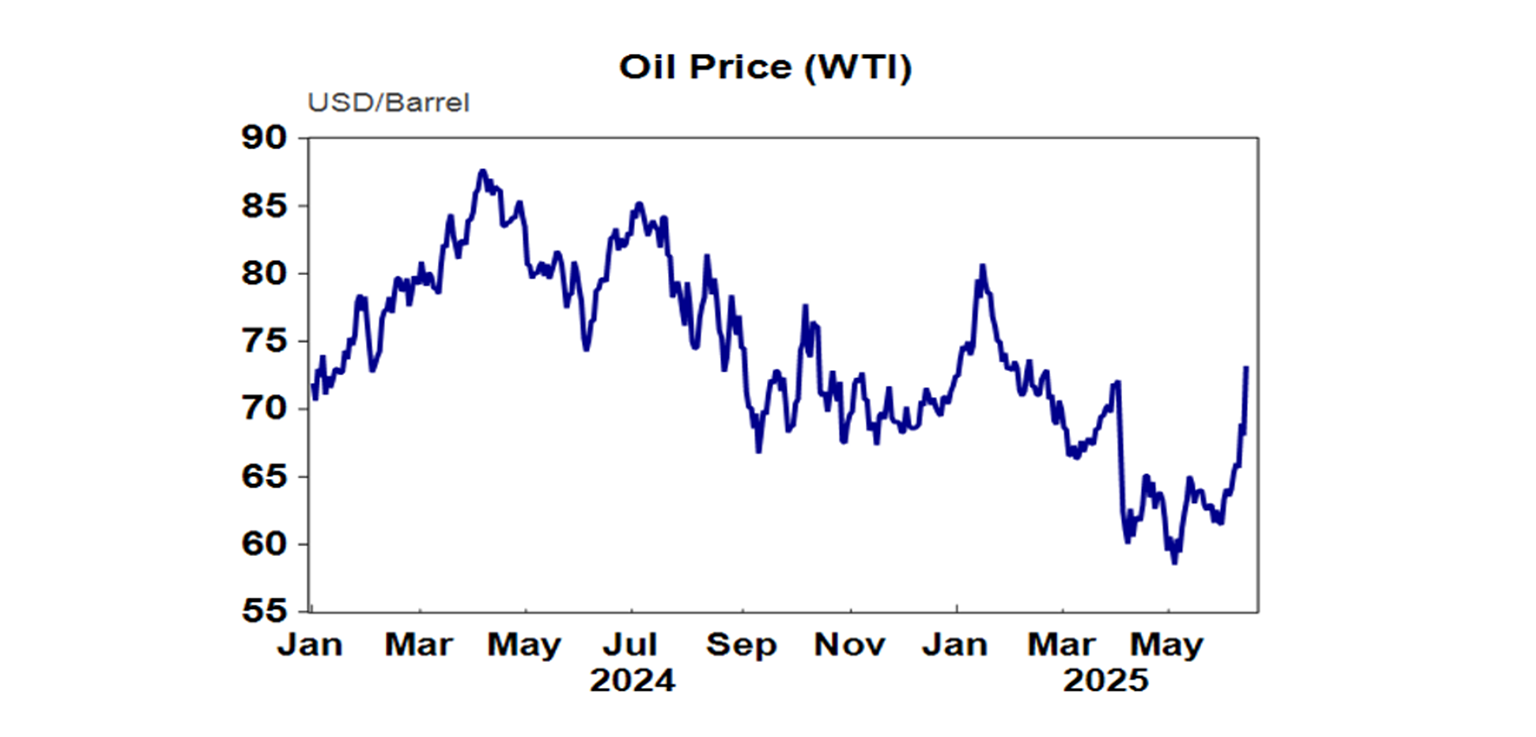

Iran’s nuclear capabilities later in the week. Prior to Israel’s attack the US S&P 500 was up slightly, but it fell 1.1% after the attacks and Iran’s retaliation leaving it down 0.4% for the week. Eurozone shares also fell 2.2% for the week with Chinese shares down 0.3%, but Japanese shares rose 0.2%. Despite falling on Friday after Israel’s attack, Australian shares bucked the global trend and rose 0.4% for the week after having hit a record high mid-week with the gains led by energy, utility, property and consumer stocks. Bond yields surprisingly rose in the US and Europe in response to the Israel/Iran strikes possibly on inflation fears, but they fell over the week including in Australia and Japan. Oil prices surged 13% for the week on fears of supply disruptions in response to the Israel/Iran conflict and gold rose with safe haven buying but copper and iron ore prices fell. Bitcoin rose slightly for the week, although it fell from a high above $US110,000 again as shares pulled back. The Australian dollar fell in response to the latest Israel/Iran flare up but was little changed for the week with the US dollar falling.

Geopolitical risk in the Middle East is up again with Israel launching attacks against Iran’s nuclear program, signalling more to come and Iran firing missiles and drones back at Israel. Oil prices were already rising this month on signs of increasing risks and spiked another 7% after the attacks – with the rise so far this month threatening a flow on of around 12 cents a litre for Australian petrol prices if sustained at these levels (although this may be lost in the discounting cycle which typically ranges more than 30 cents a litre in most cities). What happens in the very near term will depend on how Iran retaliates. It has already fired drones and missiles at Israel, but the main risk would be if it attacks US bases in the region (which is possible but likely to be limited) and neighbouring oil producers (which is unlikely) or if it disrupts/blocks the Strait of Hormuz through which roughly 20% of global oil consumption and 25% of global LNG trade flows daily (which is possible). It is the latter which poses the biggest upside risk to oil prices, but the good news so far is that Israel has not attacked Iran’s energy infrastructure which may dissuade it from doing anything like disrupting the Strait of Hormuz. In any case central banks including the RBA will likely look through any near-term boost to inflation from higher petrol prices. And don’t forget that oil prices have just gone back to levels seen over much of the last year. Beyond the near term, the key will be if Iran returns to the nuclear talks with the US. It’s possible that Israel by its attacks (and the US behind it) is trying to force Iran to do this by sending a warning that if it doesn’t comply it faces an even worse attack from the US. In fact, Israel’s National Security Adviser has said that the intention was to “create the conditions for a long-term deal…that will completely thwart the nuclear program” and Trump has urged Iran to make a deal “before it is too late.” So maximum pressure is back on. But for shares it likely means a renewed period of uncertainty given the risk of even higher oil prices in the near term. Interestingly, while gold received its usual safe haven boost from the Israeli strike, the US dollar rose only slightly and US bond yields actually rose, providing another indication of the reduced safe haven status of US assets.

Still on the US tariff roller coaster. The past week saw lots of US tariff noise but for now they remain around 14% on average:

The US and China agreed a rather vague “framework to implement the Geneva consensus” but tariffs remain. The Geneva consensus saw a reduction in reciprocal and retaliatory tariffs to 30% on Chinese goods (or about 41% if previous tariffs were allowed for) and 10% on US goods for a 90-day period. The latest talks just reverse the export controls on rare earths flowing to the US from China and various technology exports from the US to China and a ban on Chinese students in the US that had been put in place since the Geneva agreement. But it does not resolve the underlying trade dispute and Trump’s threat to put the tariffs on China back up again if no fundamental deal is reached by 12 August.

The US Appeals Court extended the stay on the Trade Court’s ruling that the bulk of Trump’s tariffs were illegal and had to be stopped with refunds given. This means the 10% “reciprocal tariffs” and the Fentanyl tariffs on China, Canada and Mexico can remain in place while the Trump administration’s appeal is heard. And as we noted two weeks ago Trump has other laws on which to base his tariffs if his appeal fails – although they are a bit messier. But for now, the tariffs remain and can still be ramped back up again on 9th July once the 90 day negotiating period ends.

On this front, Trump has reiterated that he will set unilateral take it or leave it tariff rates for trading partners in two weeks. He said something similar in May, and it came to nothing – but he is also known for throwing tantrums every so often. Europe and parts of Asia are most at risk of renewed flareups. It’s unclear as to how Australia will fit into this as we were always allocated the base 10% tariff rate and the PM has indicated he won’t be budging on the pharmaceutical benefits scheme, biosecurity laws and the digital media laws.

Trump has also floated raising the auto tariff from 25% and more sectoral tariffs are still on the way.

So while the last few weeks have been relatively calm on the tariff front it’s a long way from resolved and is at high risk of flaring up again as the 90-day deadlines approach. Ultimately, we see Trump settling for somewhat lower tariffs given pressure from financial markets and Americans who don’t want another cost of living blow out – so TACO will rule. But we have a way to go yet.

That said Trump may be setting up an off ramp from the trade war by pivoting to immigration and what better way to do this than with a fight on the issue with “liberal” California. Trump’s tariffs are not vote winners and his OBBBA tax cut bill threatens economic stability if it adds to debt. By contrast, as most populist governments find, being tough on immigrants can be a vote winner and come with less cost than most other economic policies. Hence his move to commandeer the National Guard and use Marines to inflame LA protests against immigration officials’ (ICE) raids to round up people, which up until then had been contained and mostly peaceful. This can be a negative for investment markets as the hit to immigration means possible labour shortages and a hit to potential economic growth. But a shift away from tariffs could mean less of a threat to the economy.

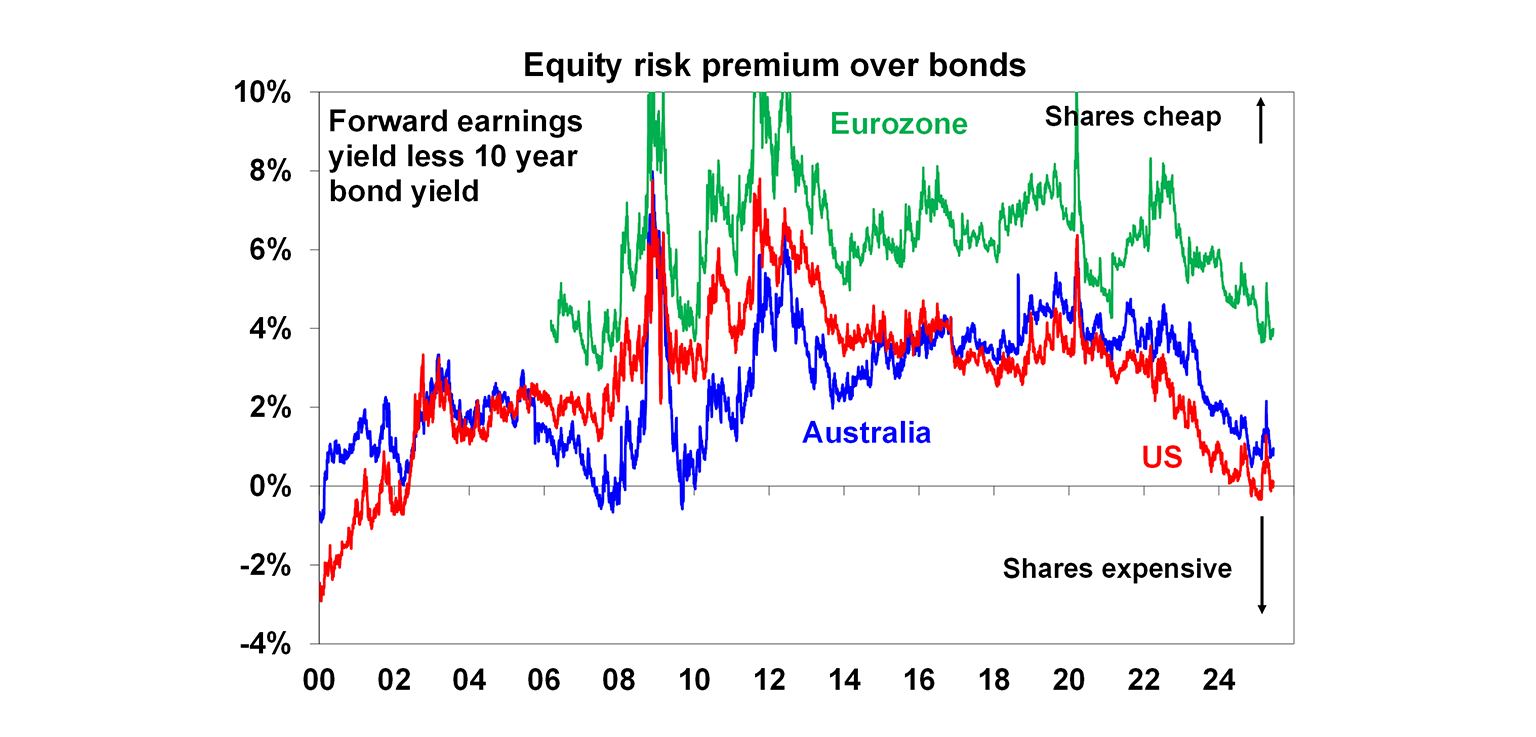

The bottom line remains that shares have had a good rebound – with US and global shares getting within 2% of a new high and the ASX 200 making a record high - but macroeconomic risk flowing from Trump’s policies and the latest Israel/Iran flare up are high, so the ride is likely to remain volatile in the near term. This is particularly the case with US and even Australian shares offering a very low risk premium over bonds suggesting that they are vulnerable from a valuation perspective. See the next chart.

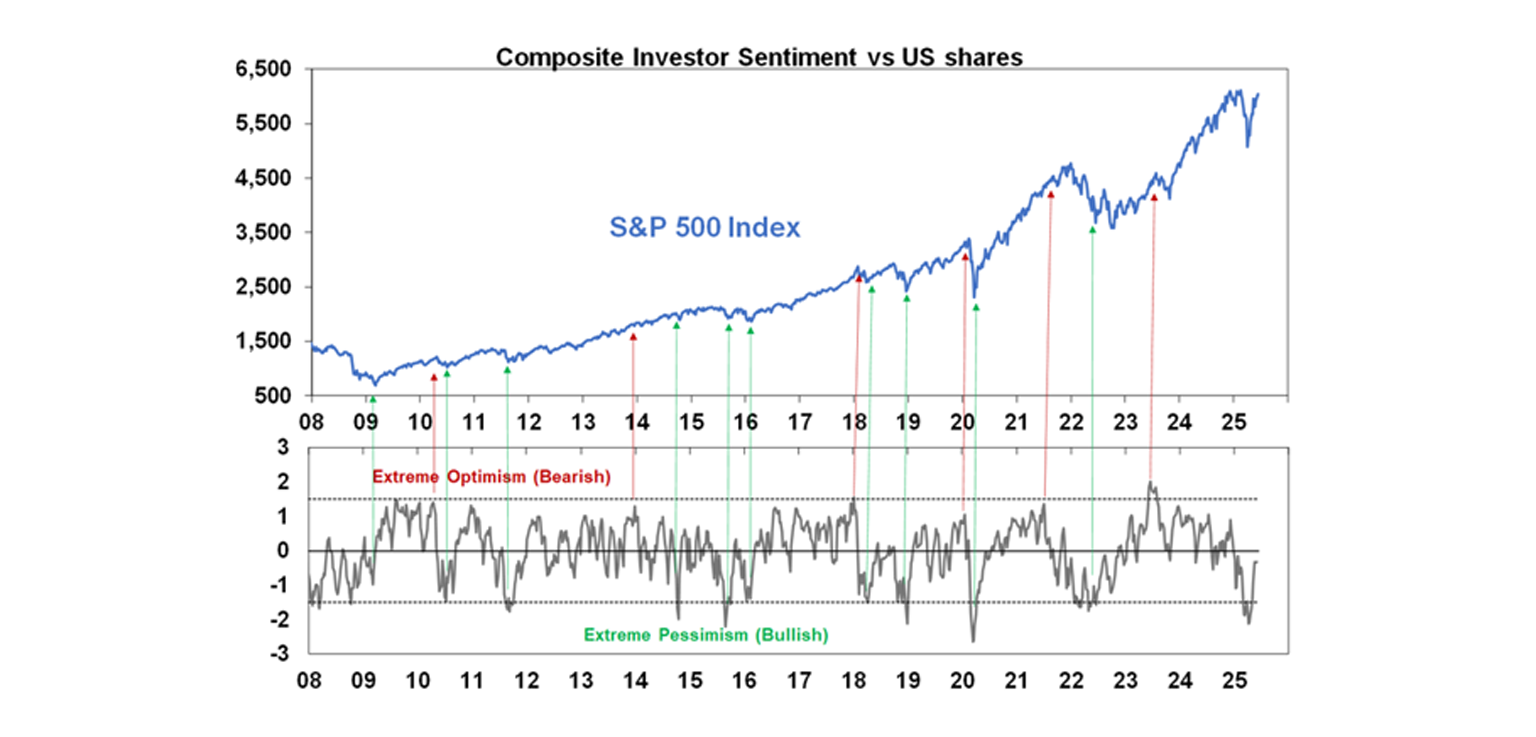

Investor sentiment is now back to around neutral levels having unwound the extreme pessimism seen at the April low in shares. So its neutral in terms of supporting further upside but doesn’t stand in the way of renewed falls either.

Ultimately, we continue to see Trump pivoting from the focus on tariffs to more market friendly policies which along with rate cuts from the Fed in the third quarter and other central banks including the RBA should help shares stage a more sustainable recovery into year end. And just bear in mind that tensions regularly flare up in the Middle East, escalate for a while and then settle back down again so there is a danger in getting too negative on it and the key for investors is to look for the opportunities thatthe latest conflict will throw up.

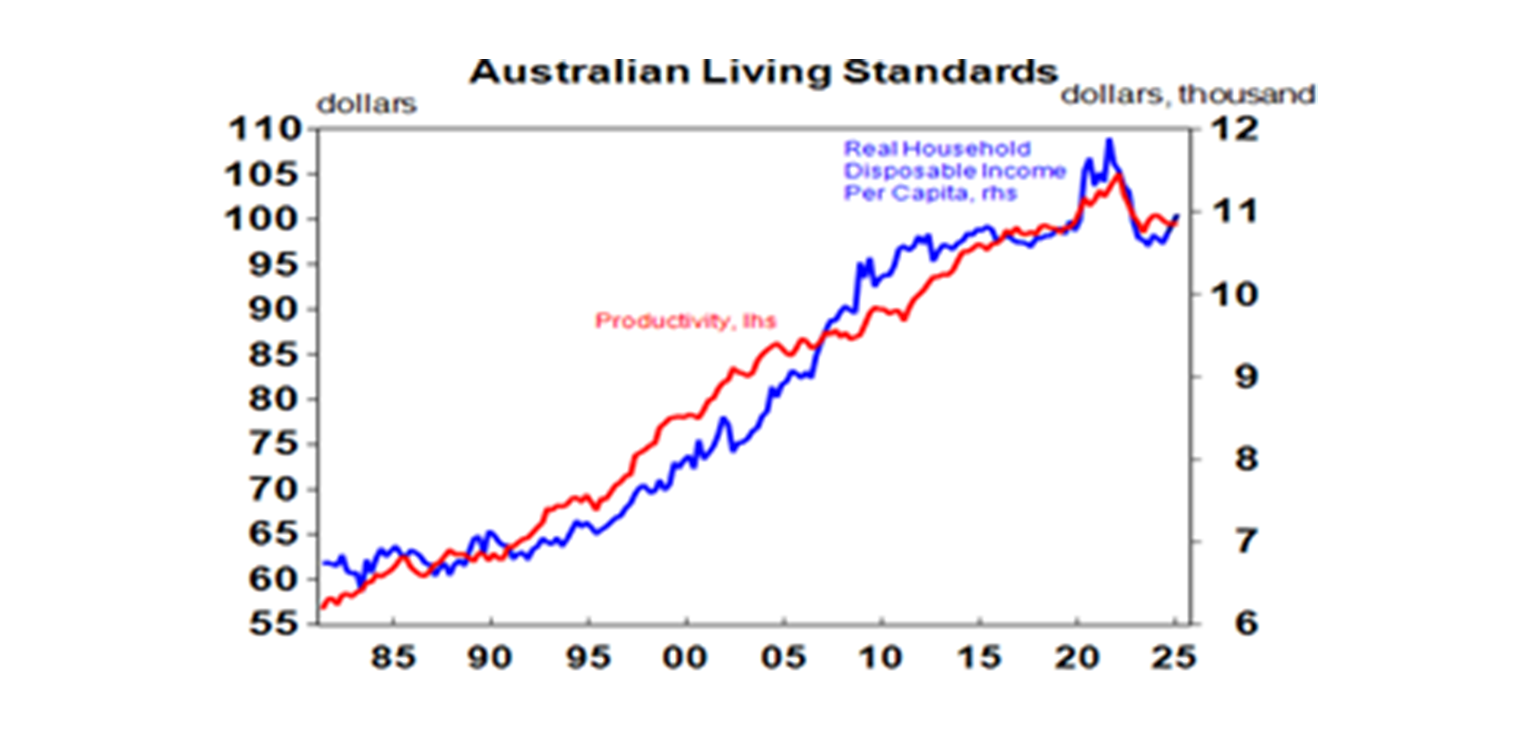

In Australia, the Government’s announcement of a productivity summit in August to create consensus around an agenda to boost productivity is good news. There is a strong long term correlation between productivity as measured by output per hour worked and living standards defined as GDP per person or real household income per person. So if we want to sustainably boost living standards we have to boost productivity growth – both of which have been close to stagnant over the last decade.

Top of the list of reforms to boost productivity should be the following:

1. Tax reform to rebalance from direct tax to a broader GST, compensate those adversely affected, and remove nuisance taxes like stamp duty to incentivise work effort and investment, better allocate resources and reduce the burden on younger generations as the population ages. This sounds politically hopeless but if combined with some measures to cap property tax concessions and better tax gas exports a broad consensus could conceivably be reached.

2. Limit government spending below 25% of GDP. If we want more government services, we need to find others to cut.

3. Deregulate product and labour markets to remove red tape and boost labour market flexibility. Unfortunately, the Government has ruled out industrial relations changes.

4. Provide more incentives to invest & adopt new technology.

5. Boost workforce capability by improving education and training outcomes.

6. Competition reform to reduce market concentration.

7. Match population growth to the ability to supply new homes and make it easier to live away from congested cities.

8. Boost service delivery productivity in the care economy.

9. Rely on market signals as to how best to move to net zero.

Brian Wilson. The Beach Boys started having hits soon after I was born but I didn’t really discover how great they were until I was in my twenties after buying a cassette called 20 Golden Greats and it wasn’t until the CD explosion led to endless remastered re-releases that I discovered the depth of their talent and Brian Wilson’s creative genius. Pet Sounds was a classic but for some reason I regard 20/20 (with Our Prayer which was part of the abandoned Smile sessions) and Sunflower (with This Whole World) as better. Fortunately after troubled times from the late 1960s Brian got a happier new lease on life from the mid-1990s creating lots more beautiful music and touring including the completion of Smile and The Beach Boys 50th anniversary tour leading to the classic That’s Why God Made The Radio. Fortunately, I got to see The Beach Boys/Brian Wilson in various iterations at least 8 times including at Narrabeen (which was straight out of Surfin USA) although Brian wasn’t there that time.

Major global economic events and implications

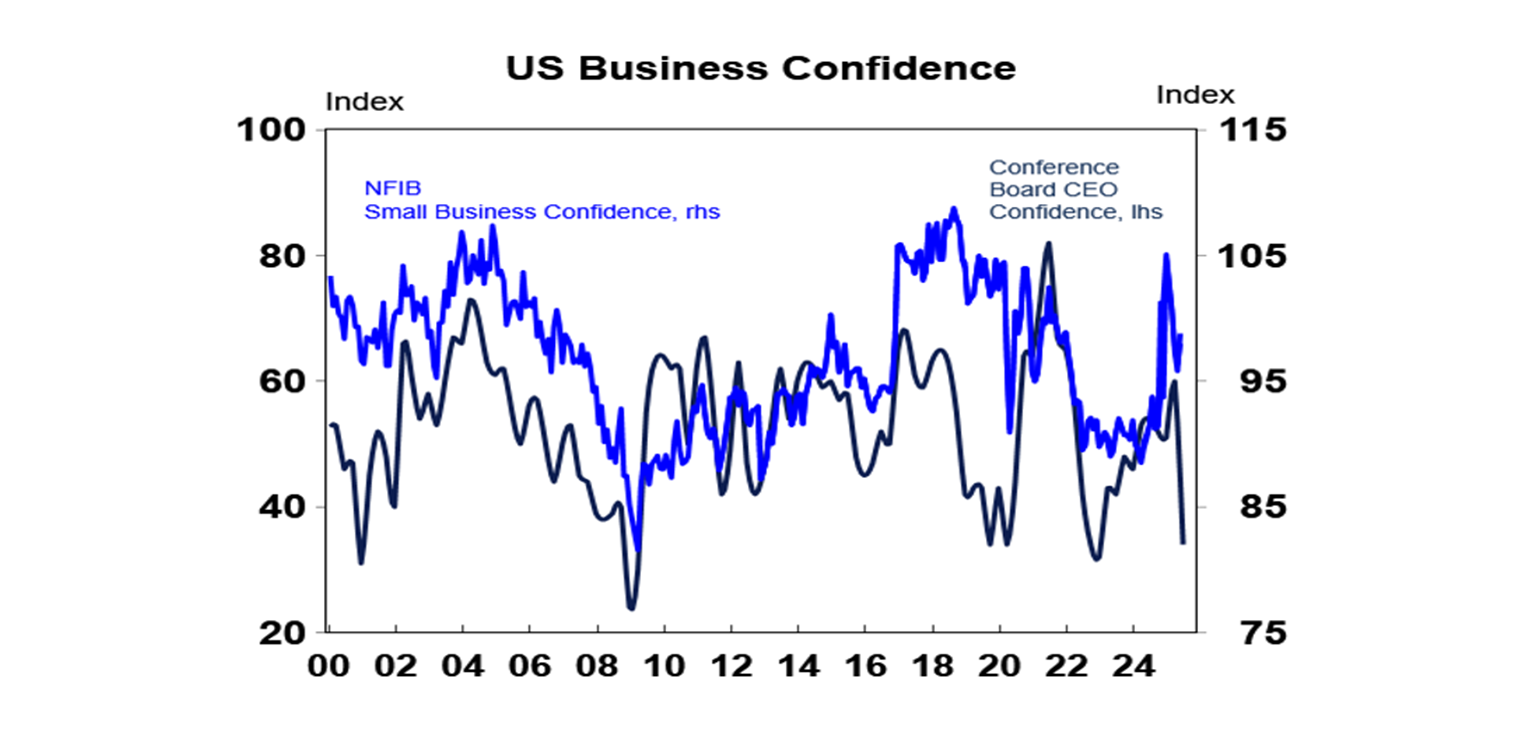

US data releases were mixed. US small business optimism improved a bit, but CEO confidence is poor. Initial jobless claims were flat but the trend is up and continuing claims broke out to a new high which is all adding to evidence the labour market is cooling. The latest University of Michigan consumer survey showed some improvement in confidence and lower inflation expectations but 5-10 year inflation expectations remain high at 4.1%.

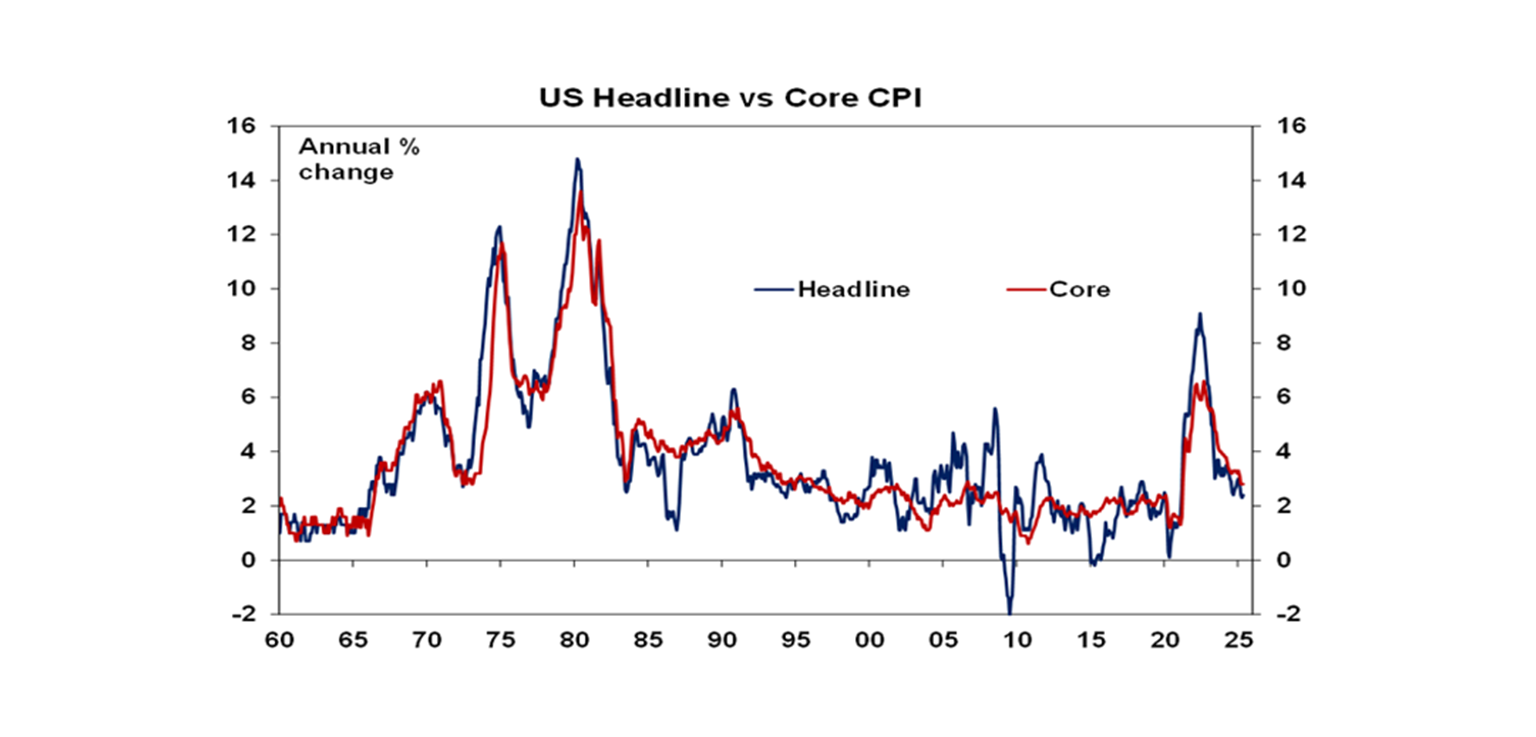

US inflation came in weaker than expected in May with the core CPI up just 0.1%mom and remaining at 2.8%yoy, suggesting little impact from the tariffs so far, although this may reflect businesses getting their supply orders in earlier than normal to avoid the tariffs and a seasonal adjustment issue which may have knocked 0.1% off inflation, both of which are likely to be temporary. What’s more the Trump administration’s hit to immigration is likely to depress labour supply which could lead to higher wages growth and higher services inflation.

The good news on inflation won’t be enough to tip the Fed over into a rate cut just yet though because it remains concerned that tariffs will still add to inflation and the hit to immigration won’t help either and that this could lead to higher inflation expectations, particularly when unemployment remains low. This will see the Fed continuing to ignore for now the pressure from Trump who posted that the Fed should cut by “one full point” as the “Government would pay much less interest on debt coming due. So important!!!” In fact, if the Fed did cut by one percentage point just now bond yields would probably shoot higher to compensate for the higher inflation expectations that such an easing could generate leading to higher, not lower, interest for the US Government! The US money market still sees around two Fed rate cuts this year, with the first around September by which time the impact of the tariffs should be clearer.

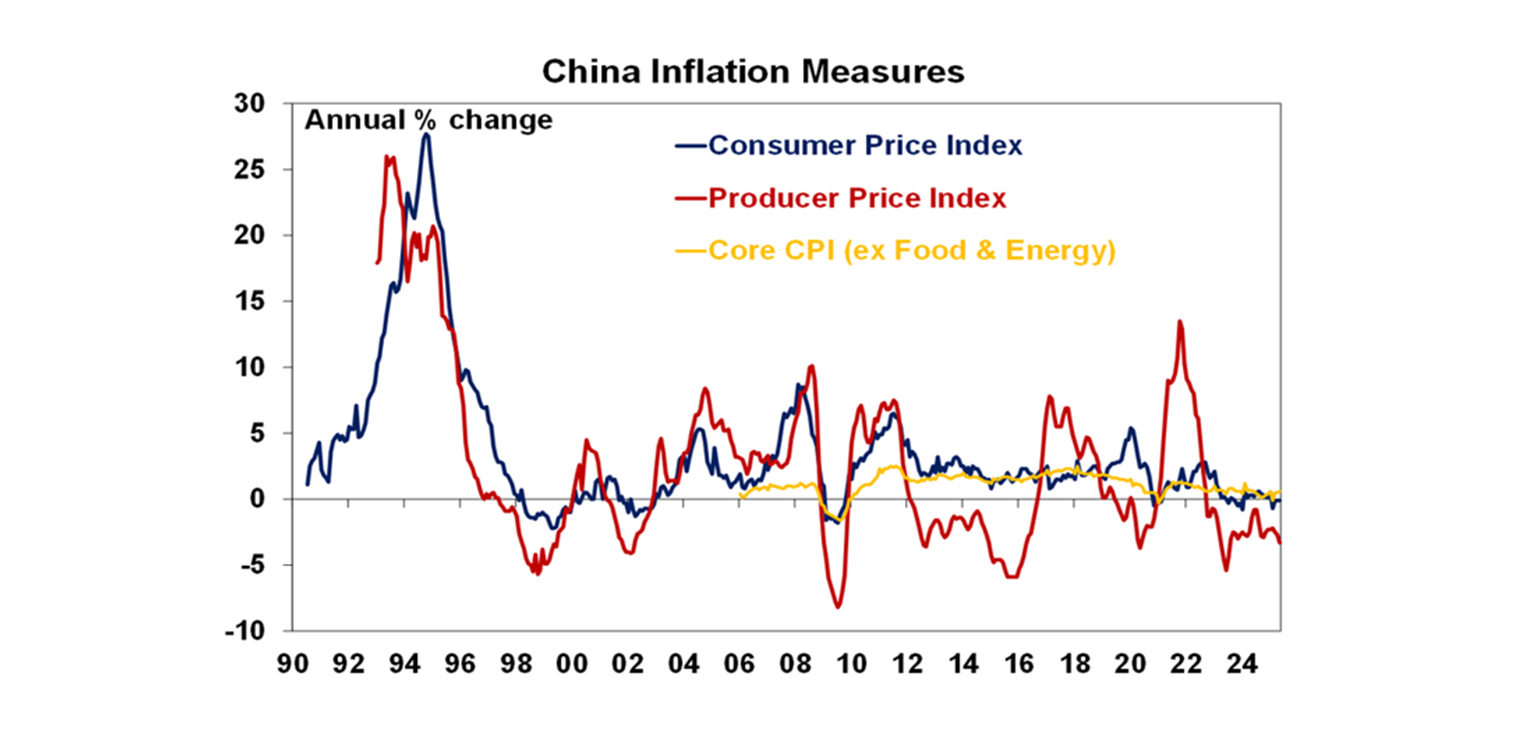

China remained in deflation in May with both consumer and producer prices down on a year ago.

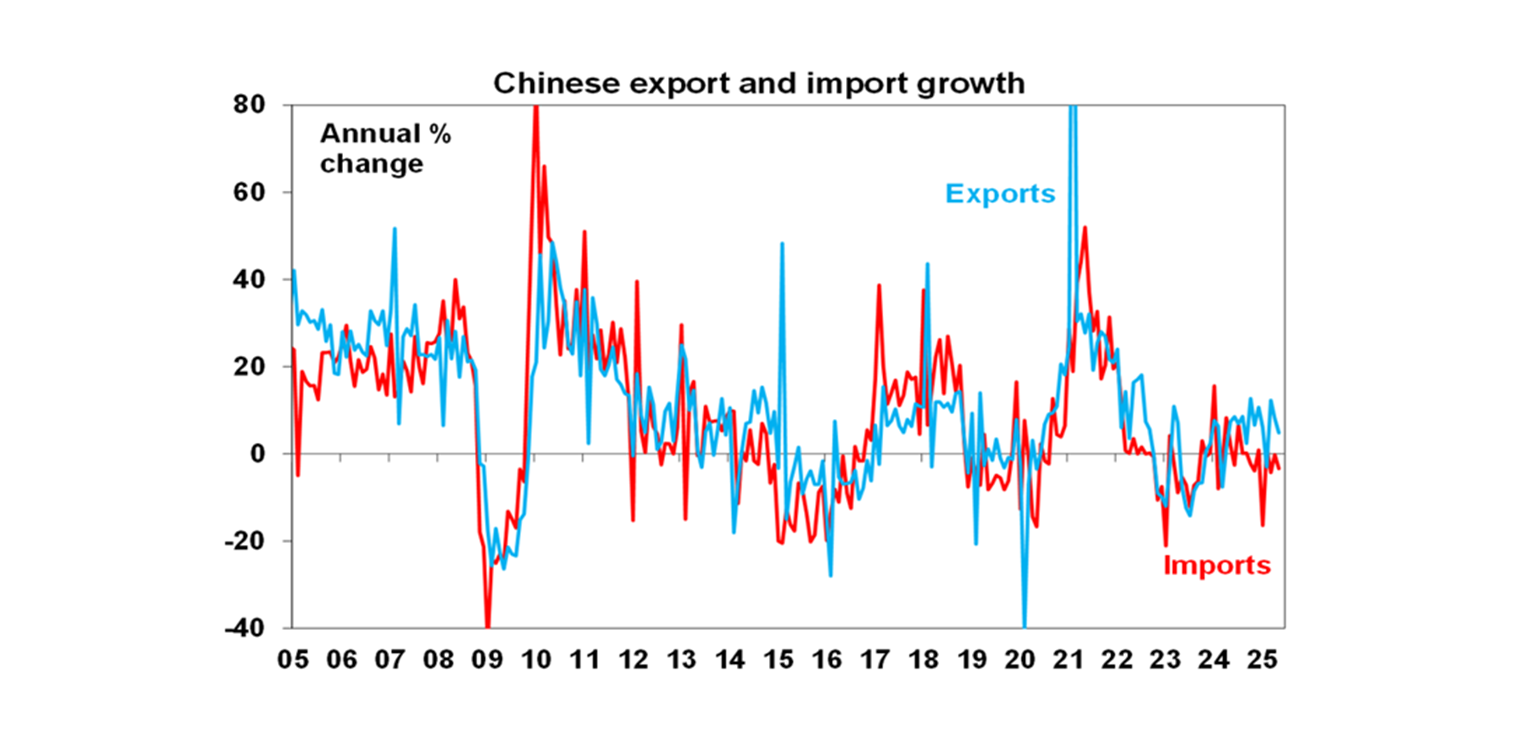

Meanwhile, Chinese exports slowed less than expected in May with exports to the rest of the world partly offsetting a further fall in exports to the US. Interestingly shipping data shows a pickup in June. Imports remained down on a year ago which is normally suggestive of weak domestic demand. Credit growth was roughly in line with market expectations in May with annual growth stable at 8.7%yoy.

Australian economic events and implications

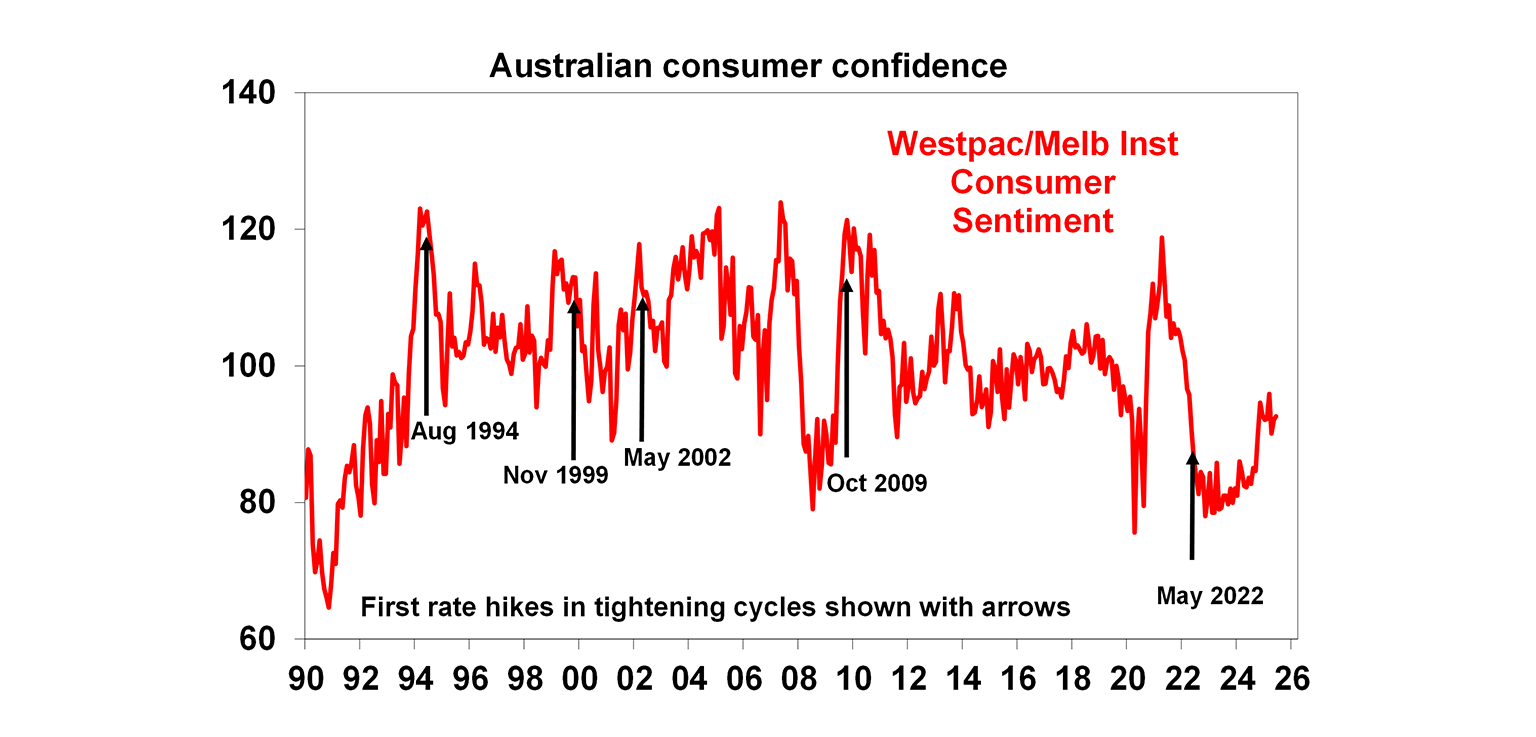

The June Westpac/MI consumer survey showed a rise in confidence, helped by the latest RBA rate cut with increased prospects of more to come, but only by 0.5% to a still softish 92.6, consistent with still subdued consumer spending.

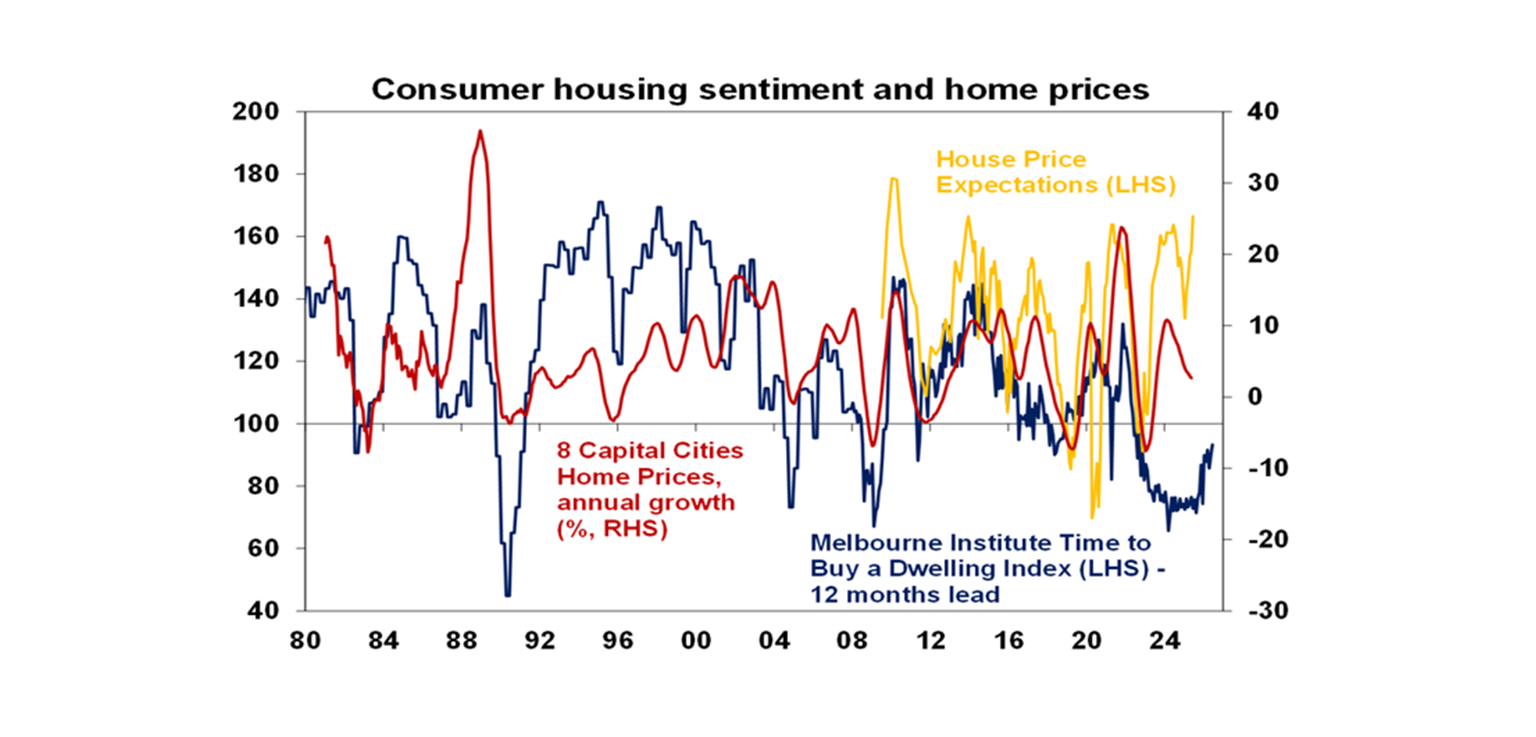

While the consumer survey showed consumers remain cautious in their use of savings, home price expectations rose to high levels and perceptions regarding “the time to buy a dwelling” continued to improve clearly propelled by rate cuts.

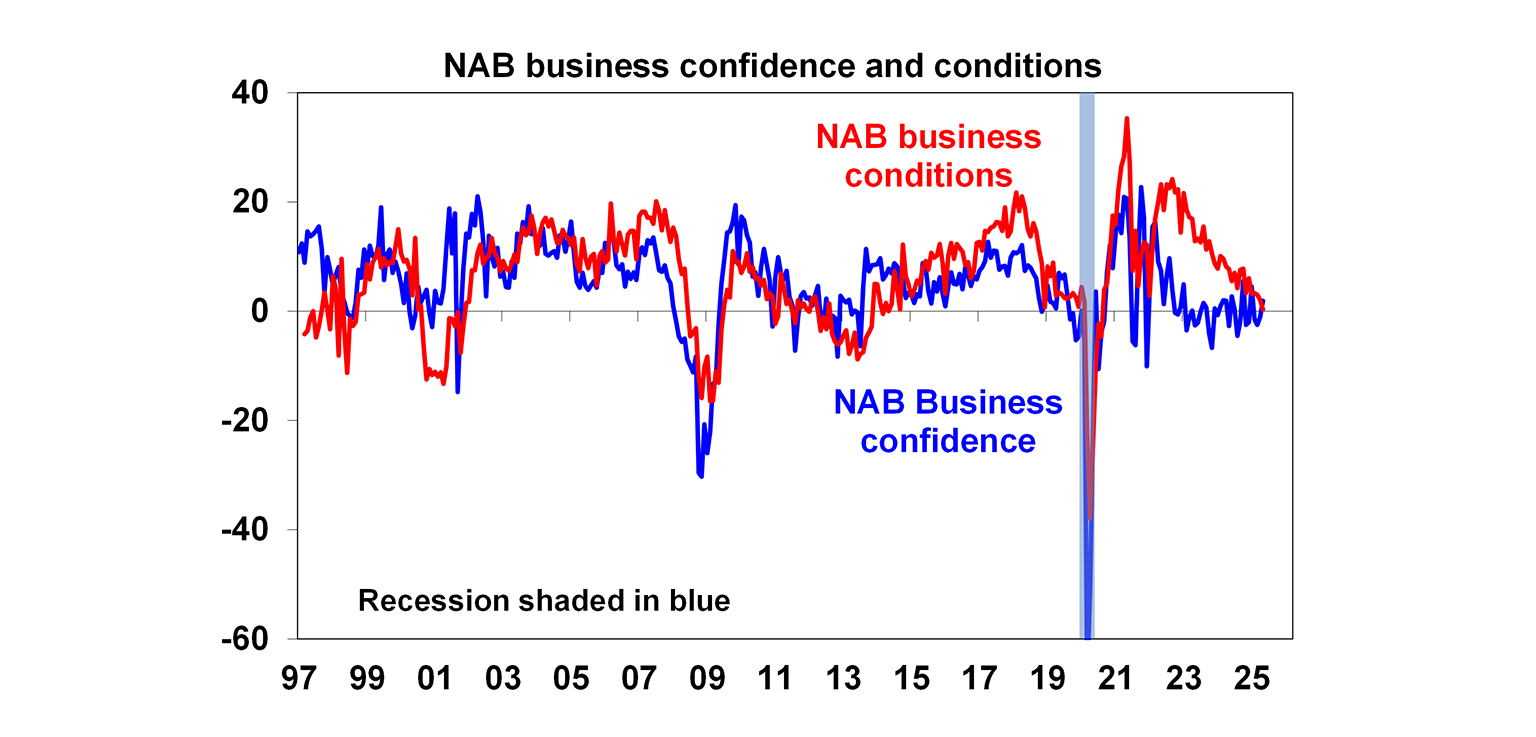

Business confidence improved slightly in the May NAB business survey, but conditions fell further.

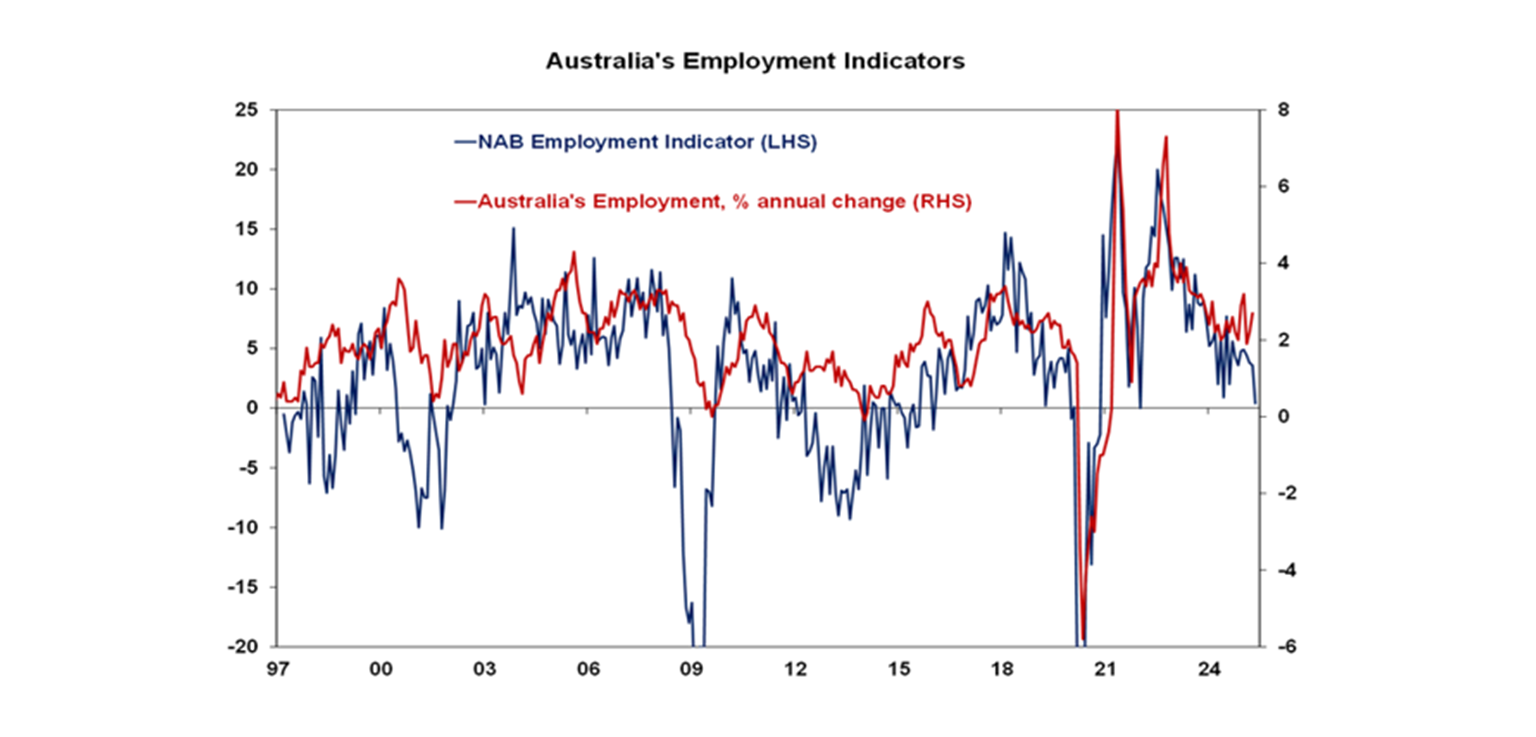

The NAB business survey showed a sharp fall in employment plans suggesting weaker jobs growth ahead.

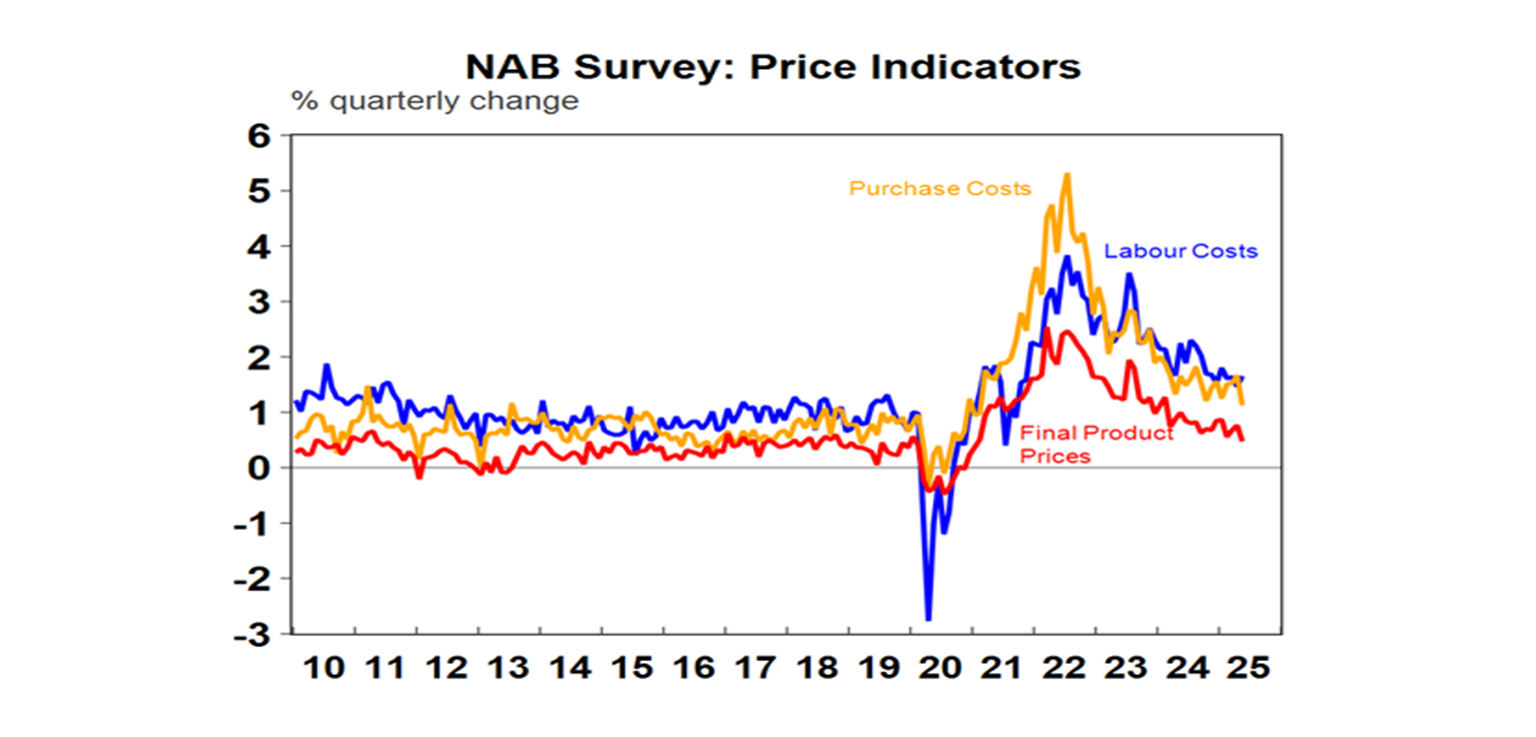

The good news remains that while labour costs remain a bit elevated, the trend remains down for cost and price pressures, suggesting inflationary pressures remain in retreat.

Subdued consumer confidence and business conditions along with easing inflation pressures are consistent with the need for further RBA rate cuts. While petrol prices could spike on the latest Israel/Iran conflict the RBA is likely to look through any boost to inflation as temporary and focus more on any drag to growth. Following the weak March quarter GDP data our base case is for 0.25% rate cuts in July, August, November and February taking the cash rate to 2.85%. The money market sees about an 88% chance of a 0.25% cut in July and just over three cuts by year end.

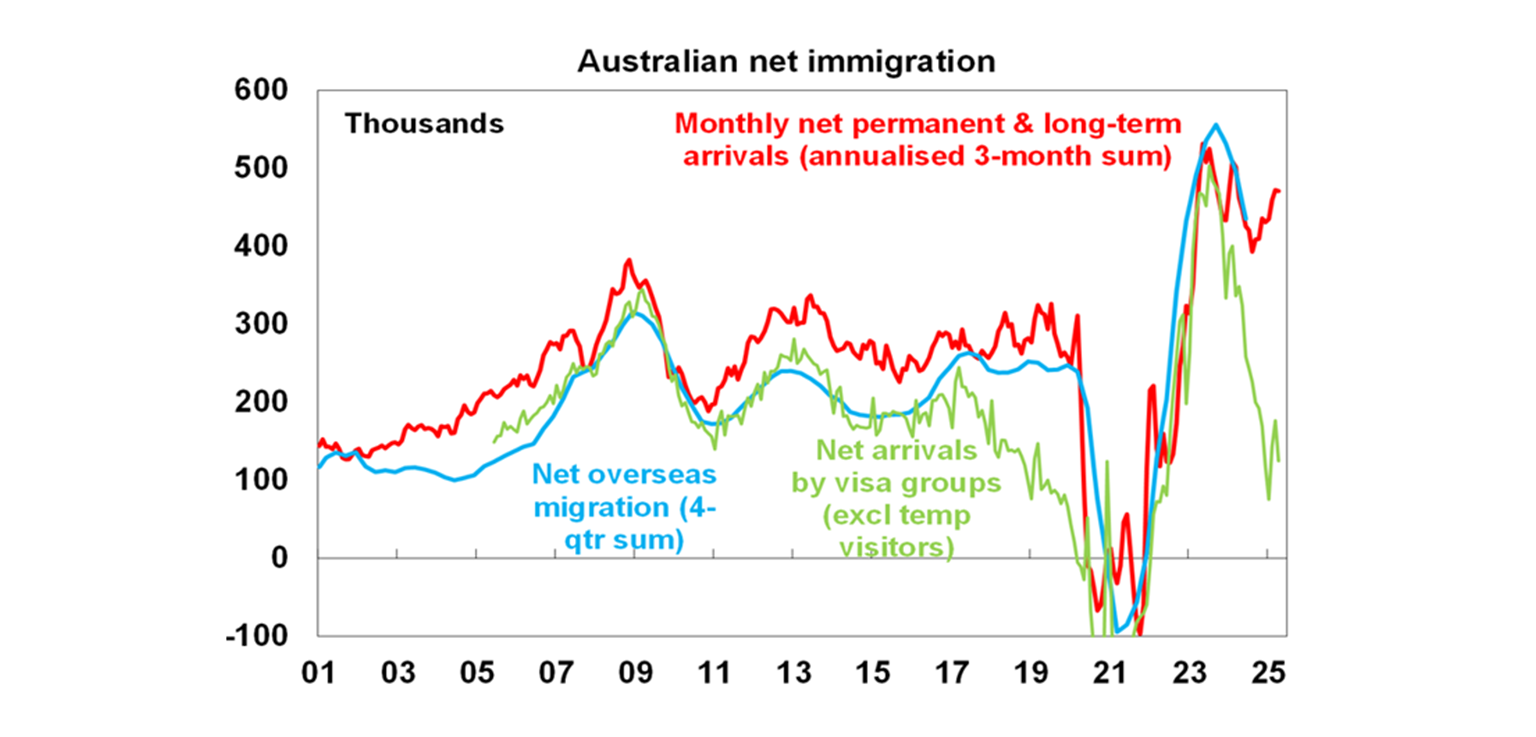

Monthly visa data excluding tourists and net permanent and long-term arrivals data are providing a conflicting picture on the trend in net migration with the former pointing down but the latter going sideways. It’s possible that the arrivals data is just being slow to catch up with the slump in visas.

What to watch over the week ahead?

In the US the Fed (Wednesday) is expected to leave the Fed Funds rate on hold at 4.25-4.5% as it remains in “wait and see” mode in relation to the impact of the tariffs on inflation with still low unemployment providing them with the cover to do so. On the economic data front expect to see a 0.4% gain in underlying retail sales for May and flat industrial production but continued weakness in home builder conditions (all Tuesday), a slight fall in May housing starts (Wednesday) and a slight improvement in the New York and Philadelphia Fed manufacturing indexes (due Monday and Friday).

The Bank of England (Thursday) is expected to leave rates on hold at 4.25% but with dovish guidance and UK inflation for May (Wednesday) is expected to fall slightly.

The Swedish central bank (Wednesday) is expected to cut its cash rate by 0.25% to 2% and the Swiss central bank (Thursday) is expected to cut by 0.25% to zero and signal a possible return to a negative policy rate as it tries to contain Swiss Franc strength from leading to deflation.

The Bank of Japan (Tuesday) is expected to remain on hold at 0.5% with cautious guidance. Japanese inflation for May (Friday) is expected to fall slightly to 3.5%yoy with core (ex food and energy) inflation rising slightly to 1.7%yoy.

Chinese activity data for May on Monday is expected to show slowing retail sales growth to 4.9%yoy and a slowing in industrial production to 6%yoy, but with investment growth unchanged at 4%yoy and unemployment flat at 5.1%.

Australian jobs data (Thursday) for May is expected to show employment growth of 10,000 and unemployment rising to 4.2% after a surge in participation pushed employment up by 89,000 in April.

Outlook for investment markets

Shares are at high risk of renewed falls given the ongoing tariff uncertainties, concerns about US debt, likely weaker growth and profits and the Israeli strike on Iran’s nuclear capability. But with Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further shares are likely to recover on a more sustained basis into year end. It’s likely to be a rough ride though.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We now see home prices rising around 5 or 6% this year given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar. This could leave it weak around $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.