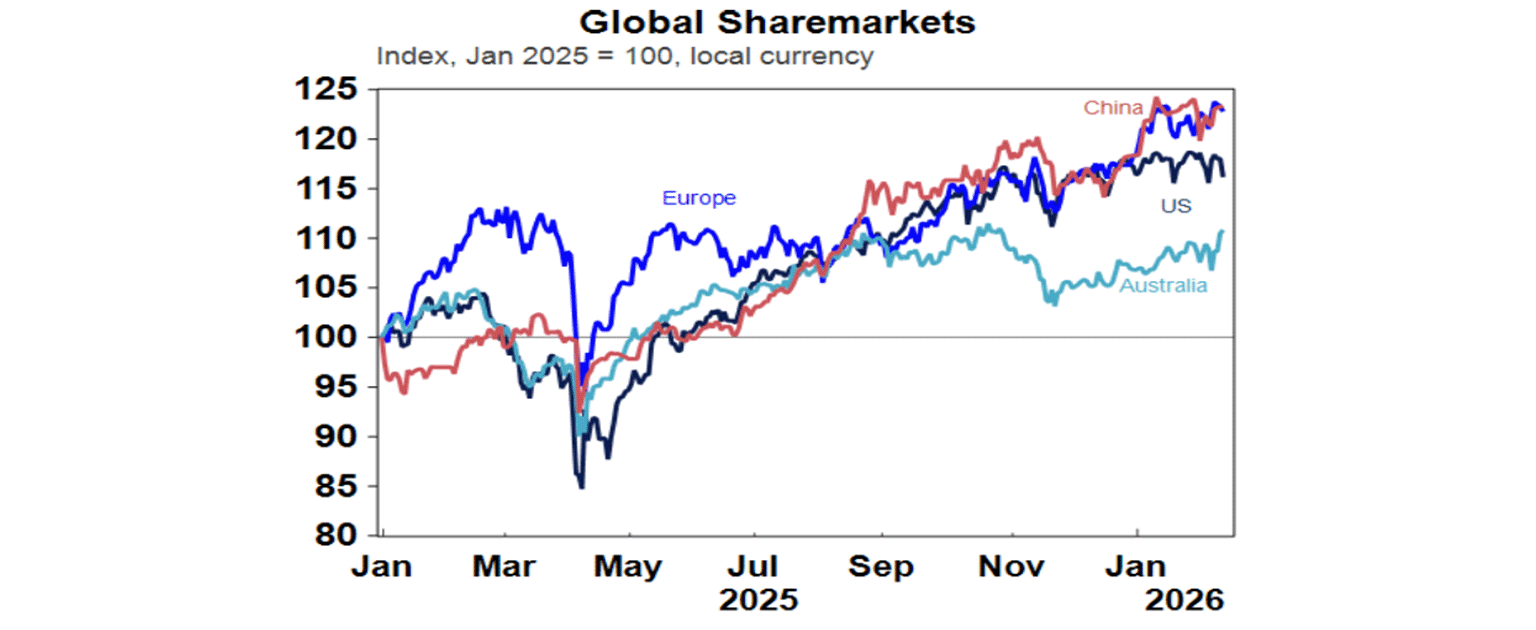

US shares fell over the last week on the back of ongoing concerns about AI disruption, excessive related capital spending and tech sector valuations. For the week the US share market fell 1.4%. Eurozone shares also fell but only by 0.3%. But Japanese shares surged 5% on the LDP’s election victory and Chinese shares rose 0.4%. The relatively better performance for non-US shares partly reflects an ongoing rotation away from the AI/tech heavy US share market. Australian shares were buoyed by the return of profit growth after three years of falls with the local share market almost surpassing last year’s high before giving up some of its gains on Friday. It still rose 2.4% for the week with gains led by utility, financial, material and consumer staple shares. Bond yields fell led by the US on the back of safe haven demand. This included in Australia, but they were flat in Japan.

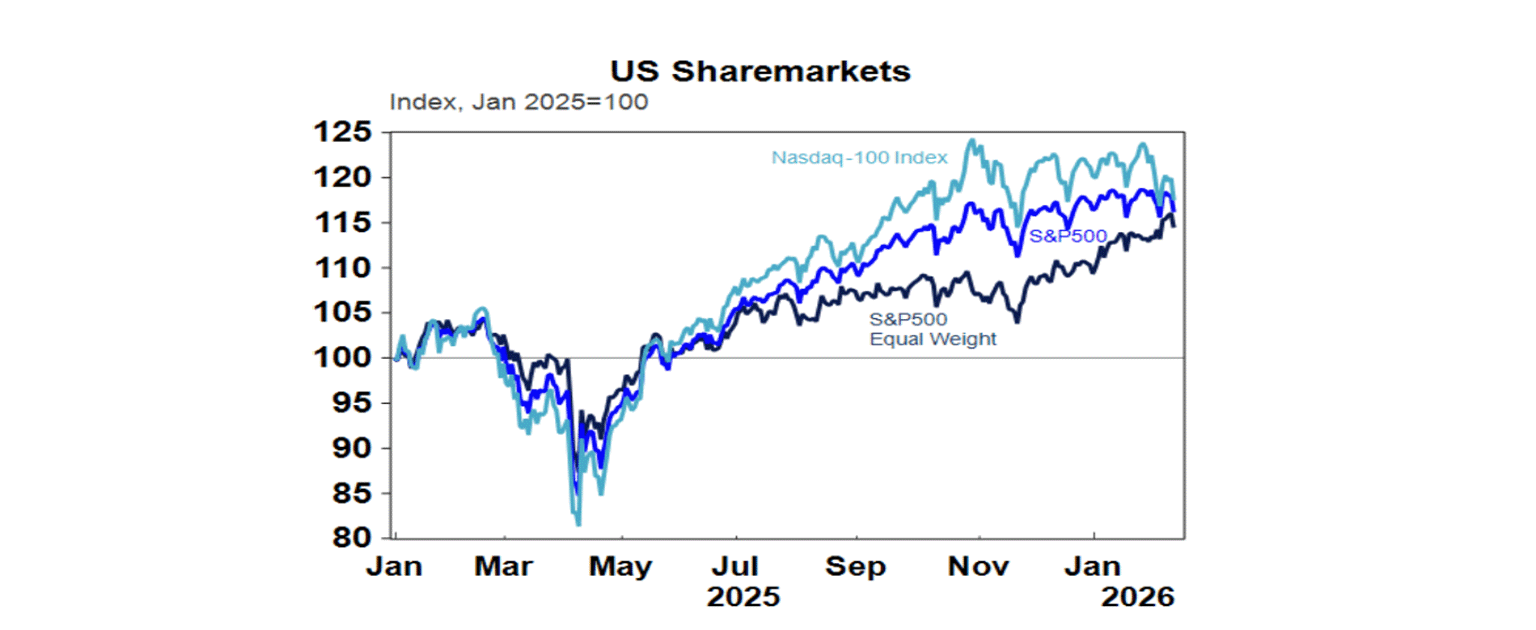

Rotation from tech to non-tech. The rotation away from US tech shares and the Magnificent Seven is also evident in the outperformance of the equal weighted S&P 500 which is up 5.7% year to date compared to the tech heavy market cap weighted S&P 500 which is down 0.1%, Nasdaq which is down 3% and the Magnificent Seven which are down 7.2%. This rotation is likely to continue and should help the overall share market end with gains, providing of course tech doesn’t come under too much pressure.

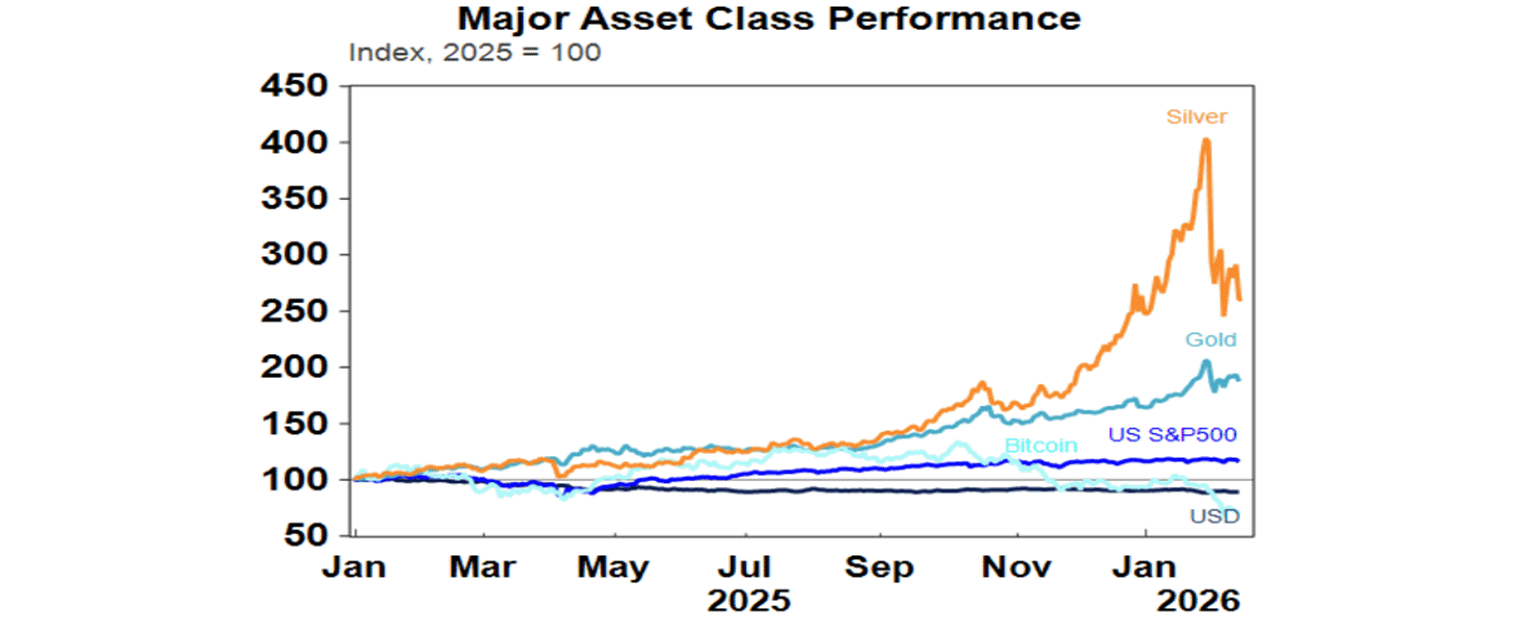

Gold prices rose slightly for the week and may have bottomed. It’s likely to be supported by ongoing erratic US policy making and high levels of geopolitical risk. Bitcoin remained under some pressure but may be attempting to form a short-term base. Oil, copper and iron ore prices fell. The $A rose even making it briefly above $US0.71 for the first time since 2022 as the $US fell.

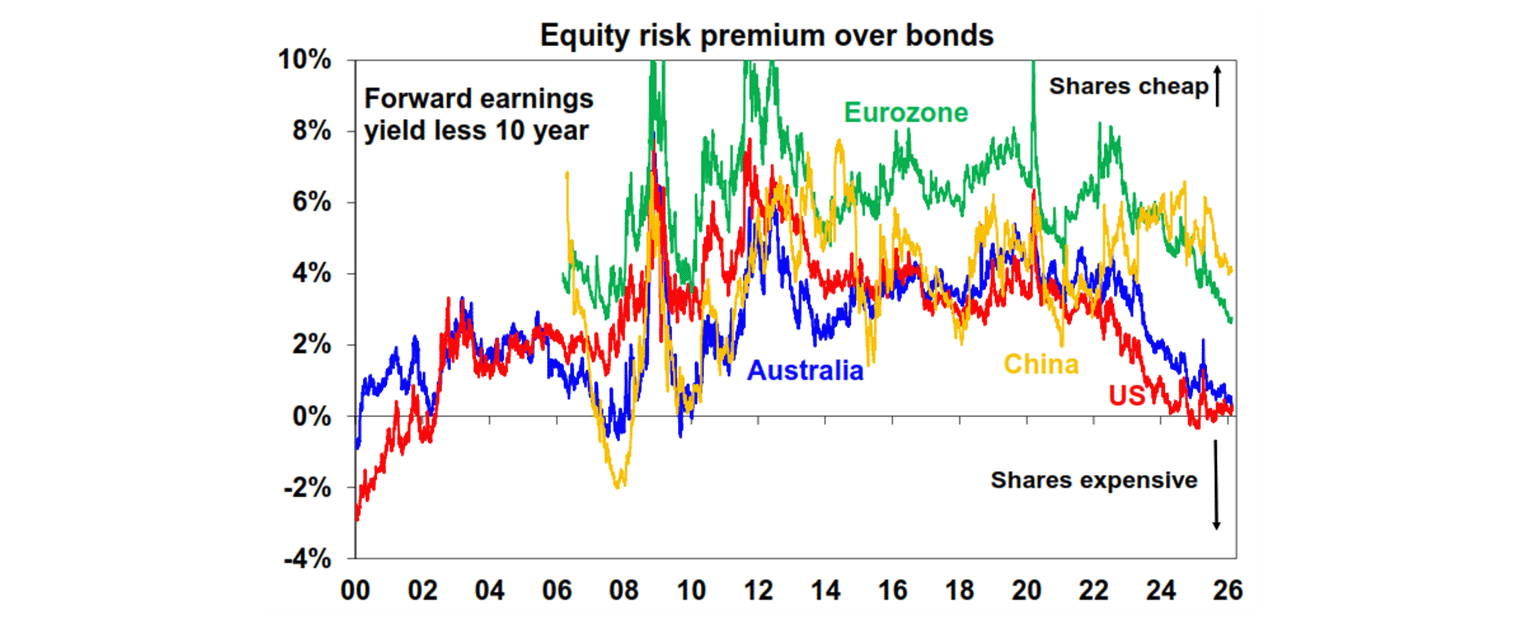

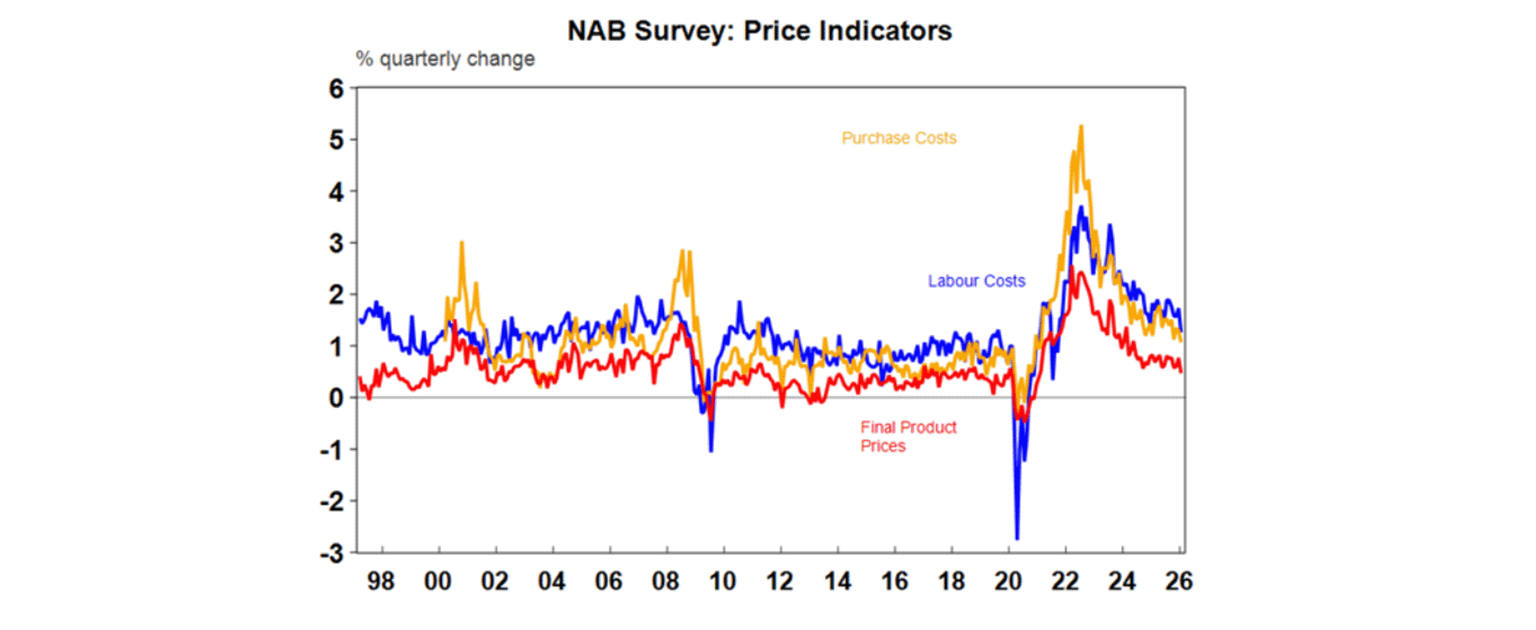

The Australian share market made it back to its record high only to fall back a bit – what’s the outlook? Despite lots of volatility the Australian share market has had a good start to the year (up 2.3%) and is outperforming the US (which is down 0.1%). It’s been boosted by company earnings starting to rise again after three years of falls led by the miners and banks with earnings results over the last week, while mixed, supporting this and a global investor rotation away from the tech heavy US. This should support positive gains this year, particularly if we are right and the RBA is able to avoid further rate hikes this year with latest NAB survey providing some support with businesses saying final product price increases are running around levels consistent with the inflation target. Against this: valuations are rich with the forward PE of around 19.7 times running well above average which is around 15 times and Australian shares offering virtually no risk premium over bonds just like the US share market; the RBA having raised rates is continuing to warn of more hikes to come if higher “inflation is entrenched”; and global uncertainty around US policies and geopolitics remains high which will impact our market if it flares up. So while we see more upside for the Australian share market it may have run ahead of itself in the near term and its likely to be a volatile ride.

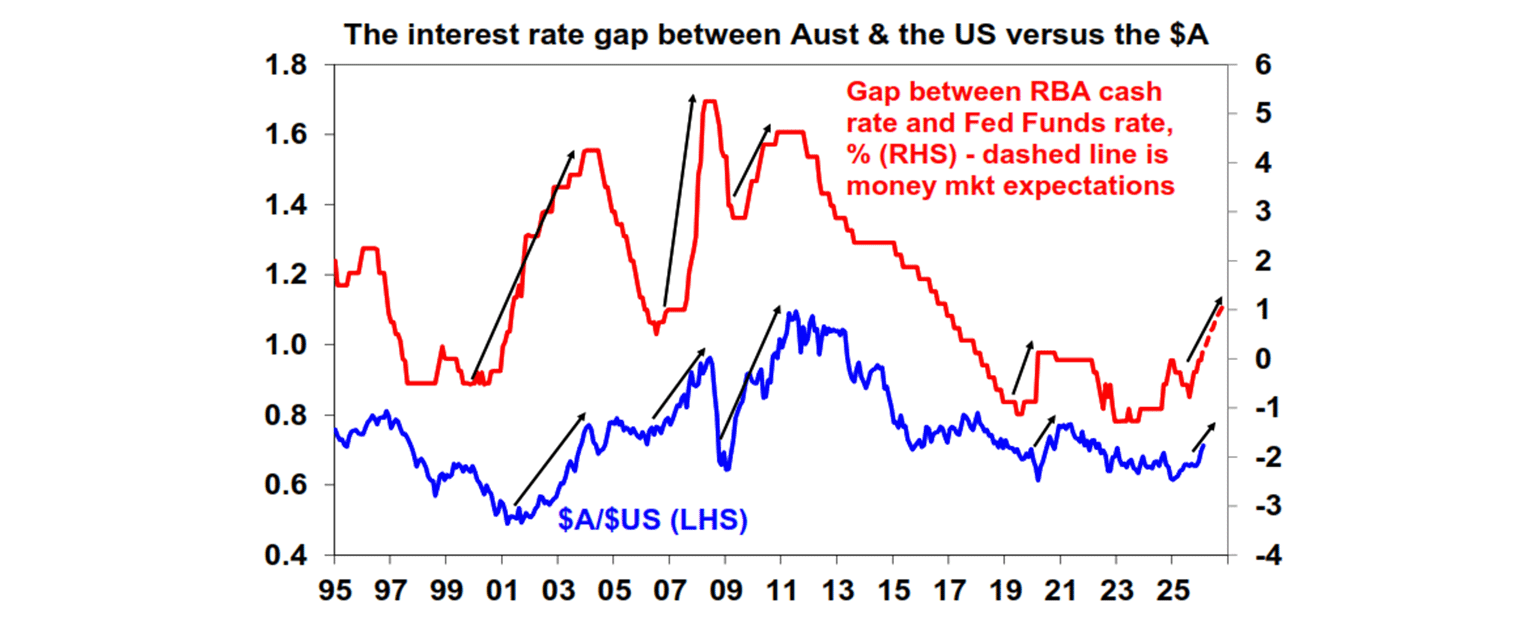

The Australian dollar likely has more upside. The key drivers are a downtrend in the overvalued US dollar as Trump’s policies are seen as threatening “US exceptionalism”, strong commodity prices and market expectations for a widening in the interest rate differential. See the next chart. Our assessment remains that these three forces will remain in play for a while yet so there is likely to be more upside for the $A at least to around $US0.73 which is our rough estimate of fair value.

Overall, our view remains that this year will see a volatile ride for investors on the back of geopolitical threats including the risk of an imminent US strike on Iran, Trump bluster, the US midterm elections, interest rate uncertainty and worries around an AI bubble and wider tech valuation issues. So, the risk of a 15% or so correction sometime in the next six months is high. But ultimately, we see it turning out okay for shares this year with reasonable returns on the back of good global economic and profit growth, Trump focussing on policies to help US households ahead of the midterms, the Fed cutting rates once or twice more, and profit growth turning positive in Australia.

Major global economic events and implications

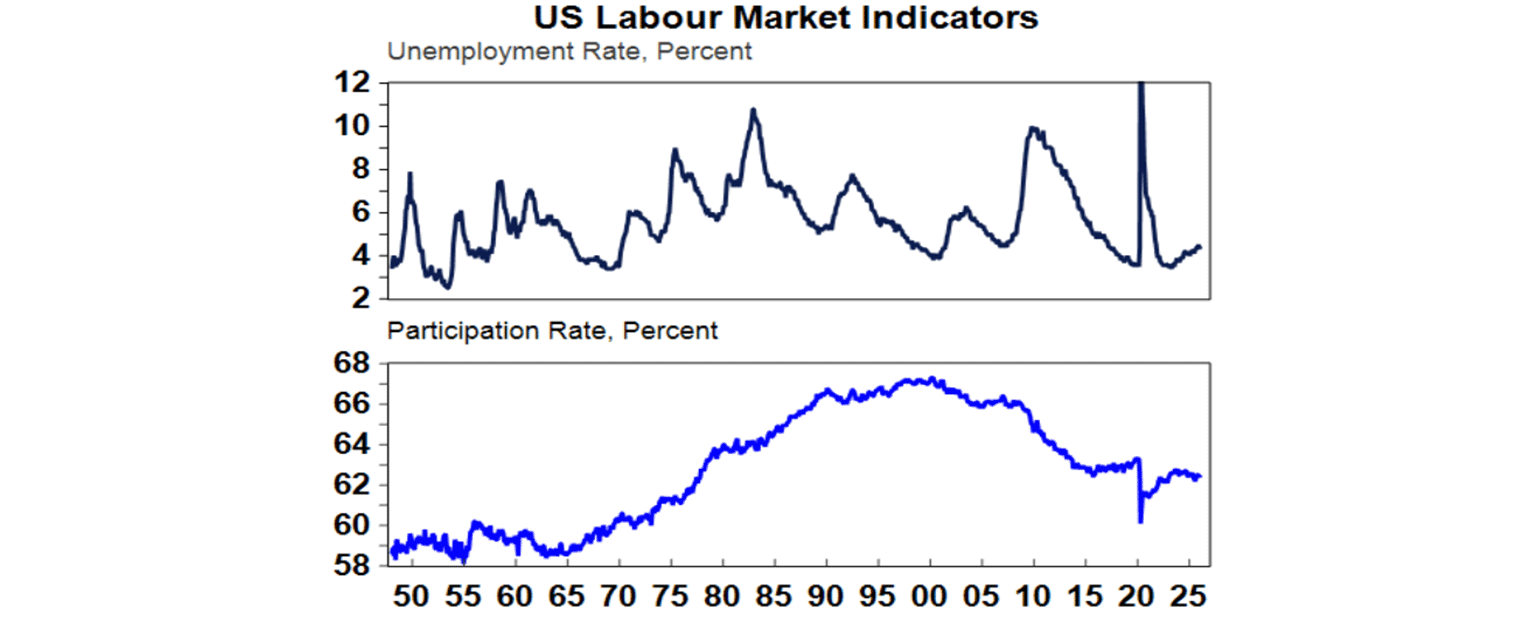

US economics data was mixed over the last week. January jobs data showed the level of payrolls last year revised down by 862,000 in the regular annual revision but this was largely expected and January data showed a stronger than expected rise in payrolls of 130,000 and a rising trend. This along with a slight fall in unemployment, a fall in underemployment and increased hours worked helped allay worries about a weakening jobs market. Meanwhile jobless claims remain low.

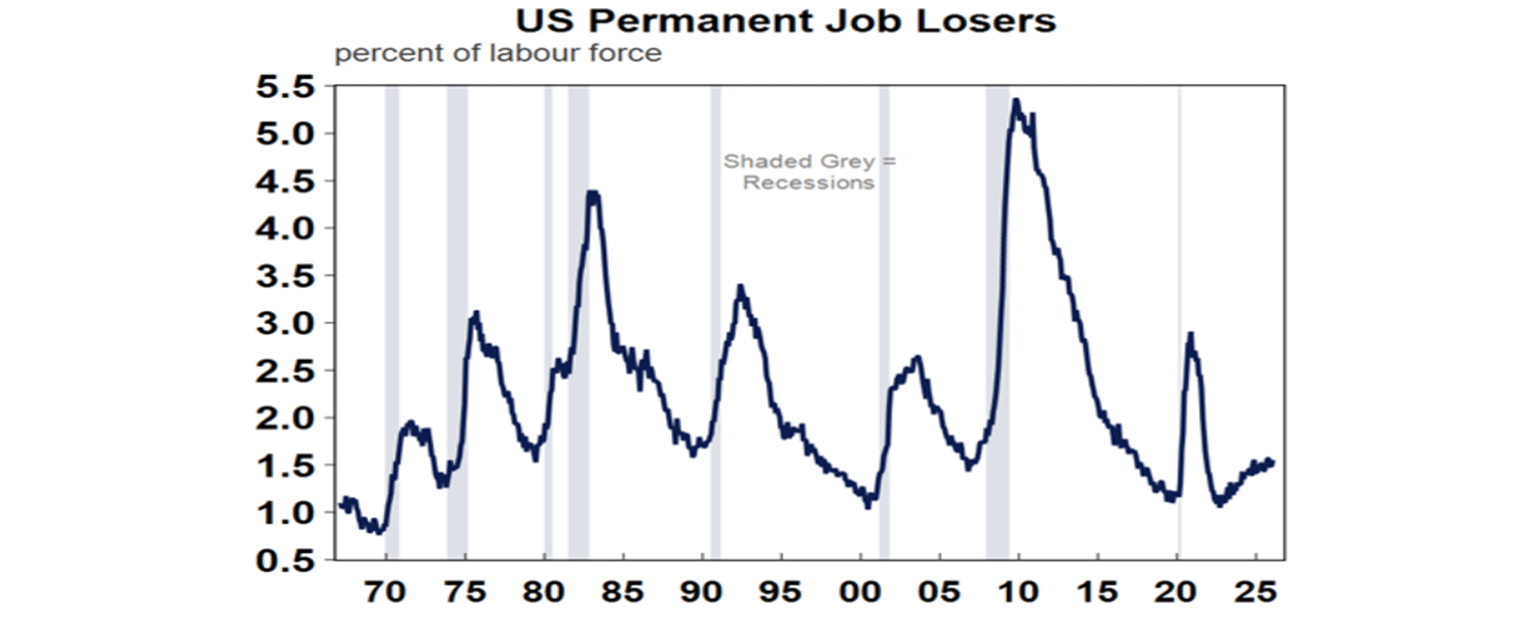

The still rising trend in unemployment and permanent job losers and weak trends in other indicators like job openings along with expectations for inflation to fall as the tariff impact drops out still leave open prospects for Fed rate cuts in the second half.

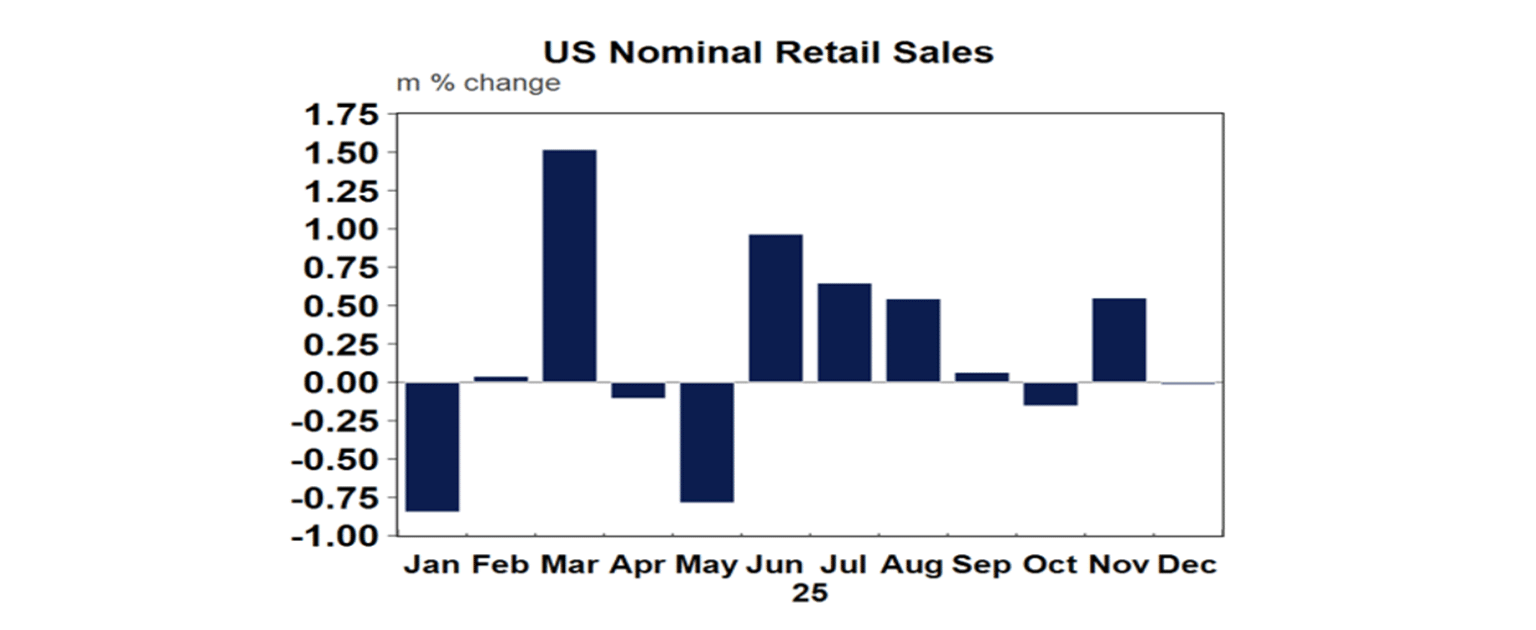

Although US consumer spending is on track for a solid real increase in the December quarter, retail sales were soft in December, although this may be due to severe weather. Existing home sales fell 8.4% in January and are yet to show any sustained rise on the back of lower mortgage rates.

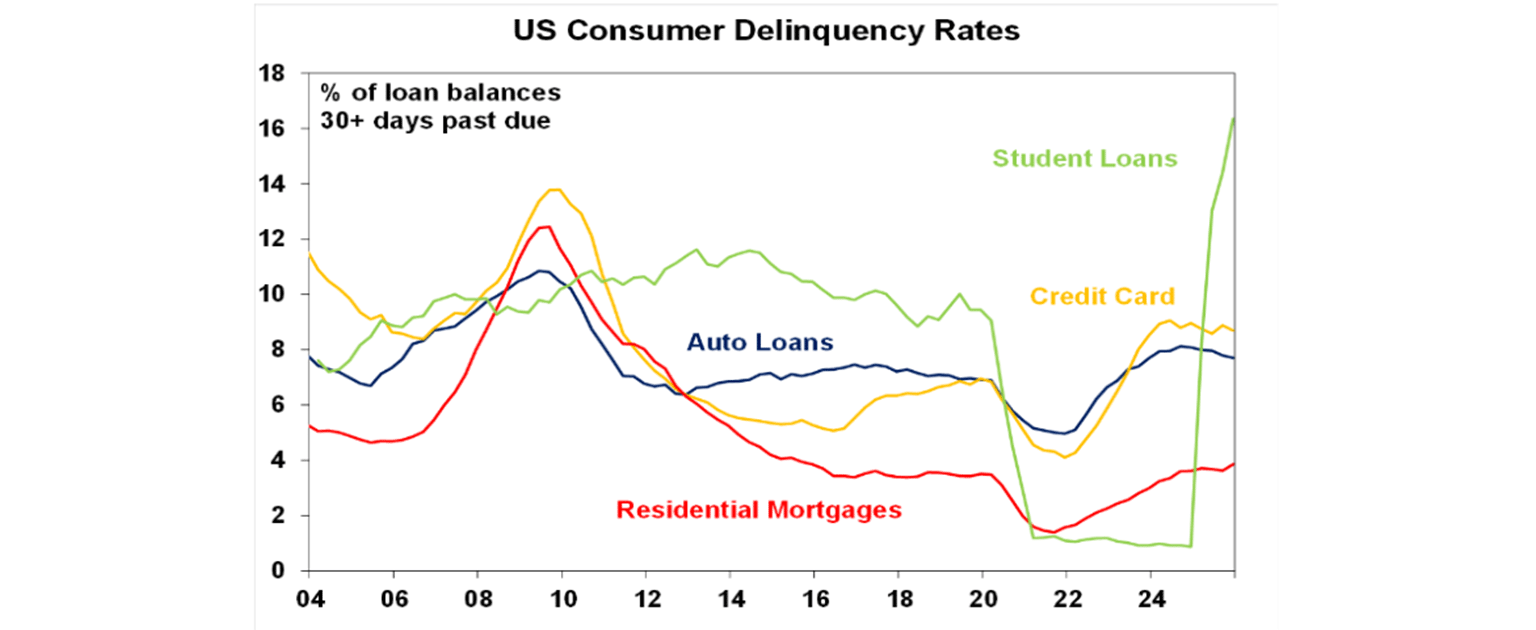

US consumer delinquencies are up but not dangerously so – except for maybe student loans but this likely reflects a bounce back after a debt waiver for several years.

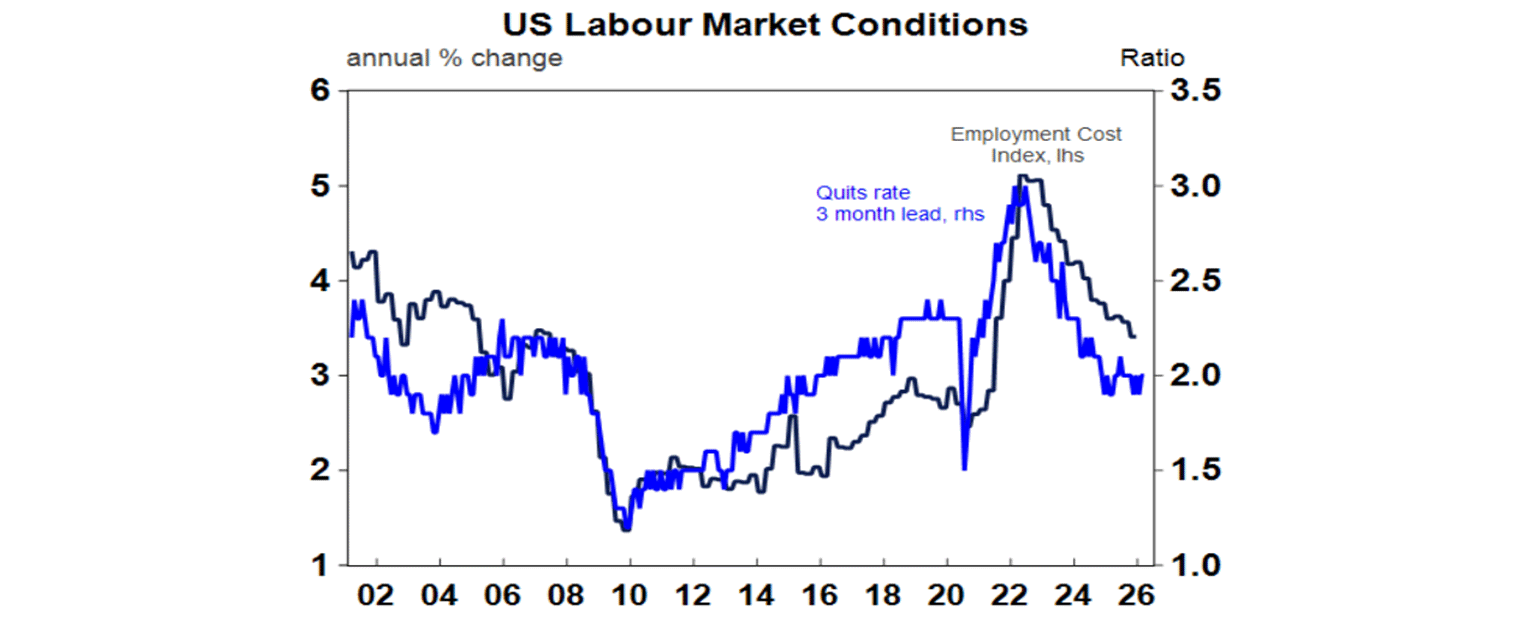

December quarter employment costs slowed to 3.4%yoy, with weak quits pointing to a further slowing.

The US CPI for January was benign relative to fears for a spike with core inflation at 0.3%mom falling to 2.5%yoy from 2.6%yoy in January. Core goods ex transport inflation rose 0.5% likely reflecting the pass through of tariffs to consumers but it was offset elsewhere, eg by lower used car prices. While it suggests that January core PCE inflation remained around 3%yoy, it reinforced expectations for Fed rate cuts from around midyear with the US money market now allowing for 2.5 0.25% rate cuts this year.

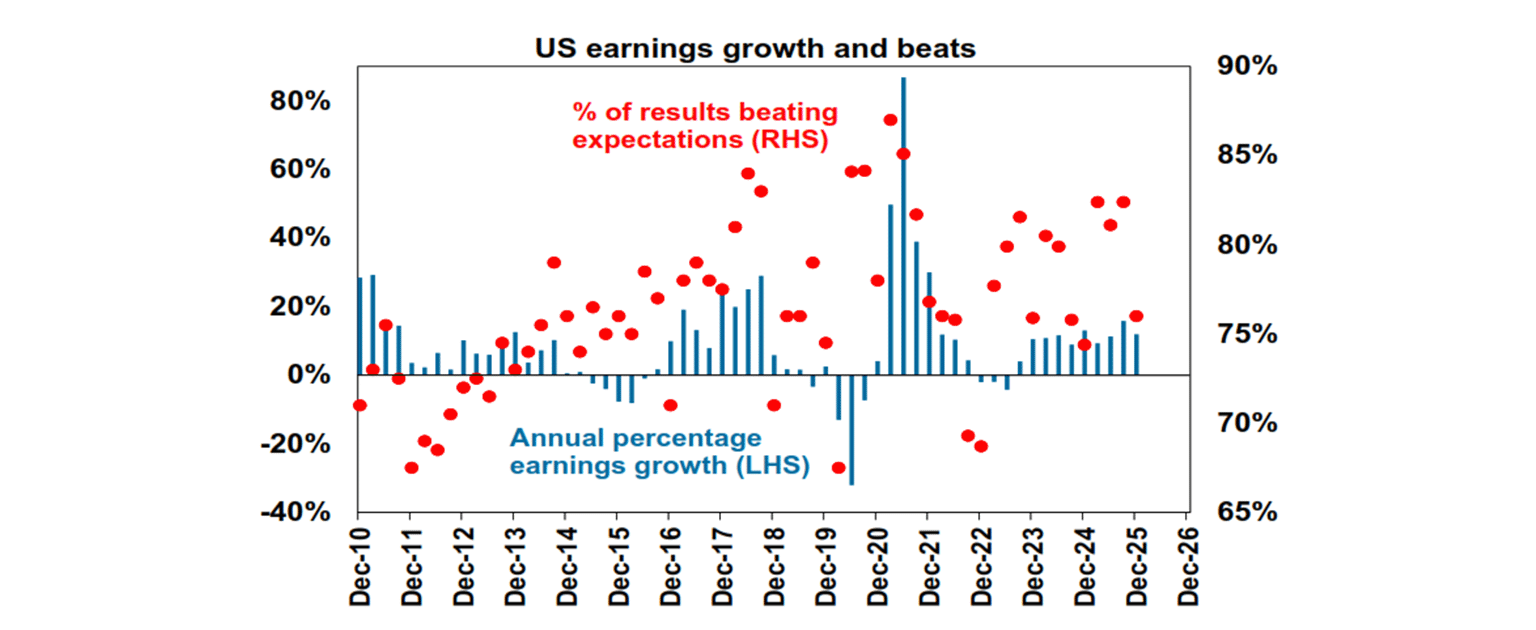

Around 75% of S&P 500 companies have reported December quarter earnings, with 76% beating expectations, which is slightly below the norm of 76.6%. Consensus earnings expectations have increased to 11.9%yoy. Tech is leading the charge again with earnings up 26%yoy, financials up 13%yoy and materials up 9%yoy.

In Japan, the governing LDP saw a landslide victory in lower house elections leading to around a two thirds majority. This will enable it to override bills that are rejected by the upper house. On the policy front expect more fiscal stimulus with a focus on defence spending. The landslide LDP victory continues the trend towards nationalism and more intervention in economies being seen globally. It points to ongoing relative strength in the Japanese share market, a higher Yen and higher Japanese bond yields. The latter risks an unwind of the “carry trade” but it’s likely to be gradual.

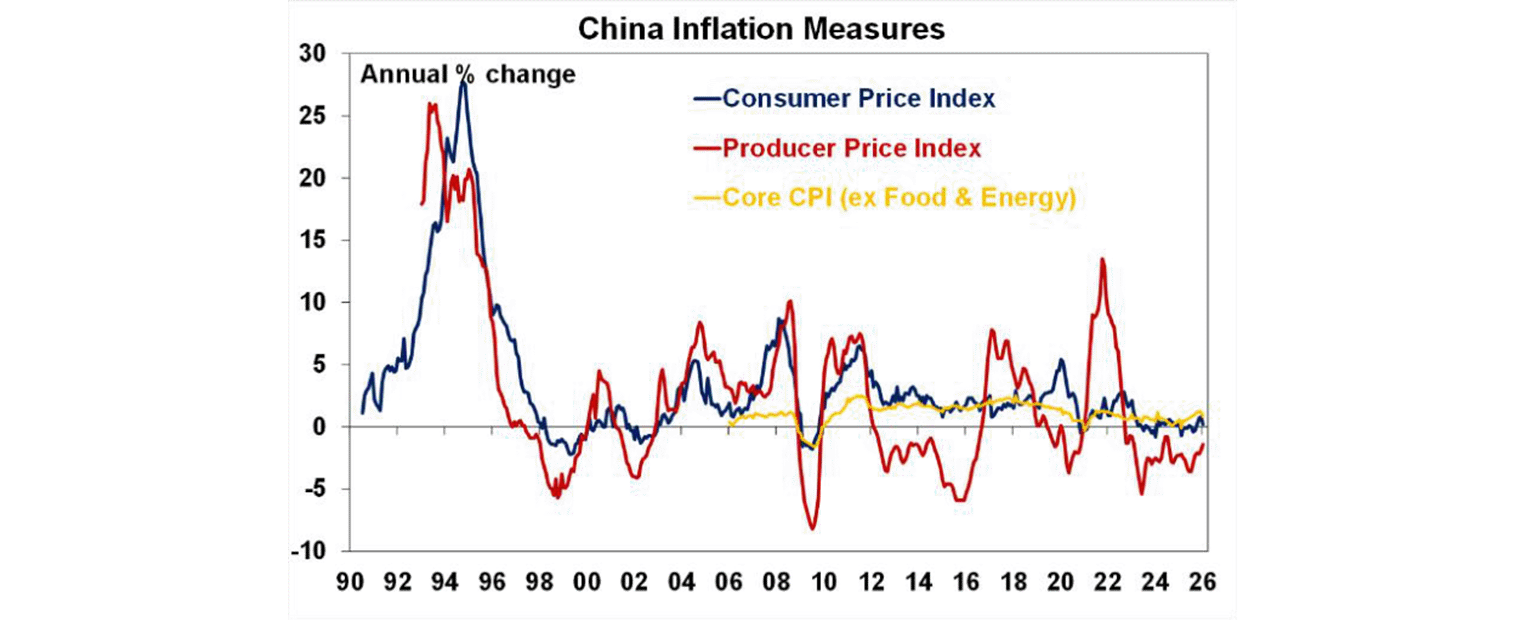

Chinese consumer price inflation for January dropped more than expected to 0.2%yoy, with core inflation also dropping to 0.8%yoy. This likely reflects the later timing of the Chinese New Year being February this year and January last year along with still weak demand. Produce price deflation eased to -1.4%yoy from -1.9%yoy. Chinese home prices continued to slide in January.

Australian economic events and implications

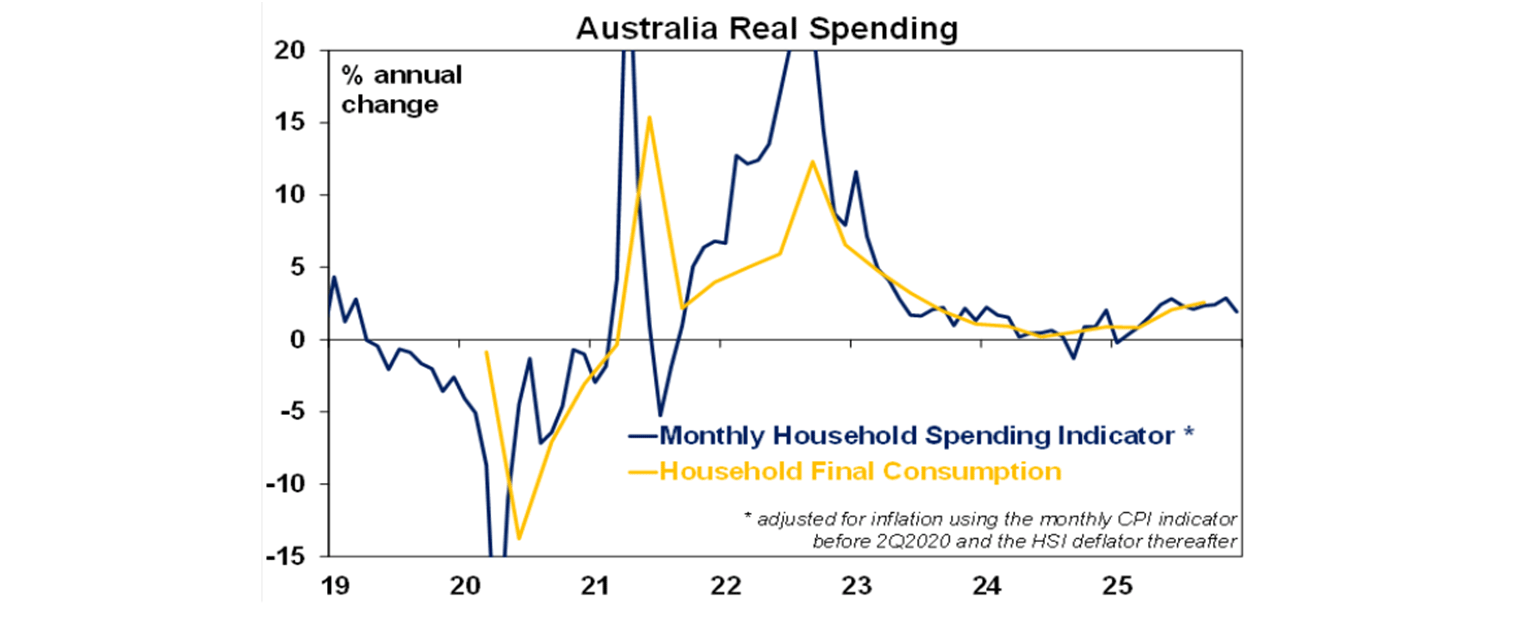

Household spending rose a solid 0.9% in real terms in the December quarter pointing to strong growth in consumer spending on the back of events and discounting activity but fell 0.4% in December after the boosts faded.

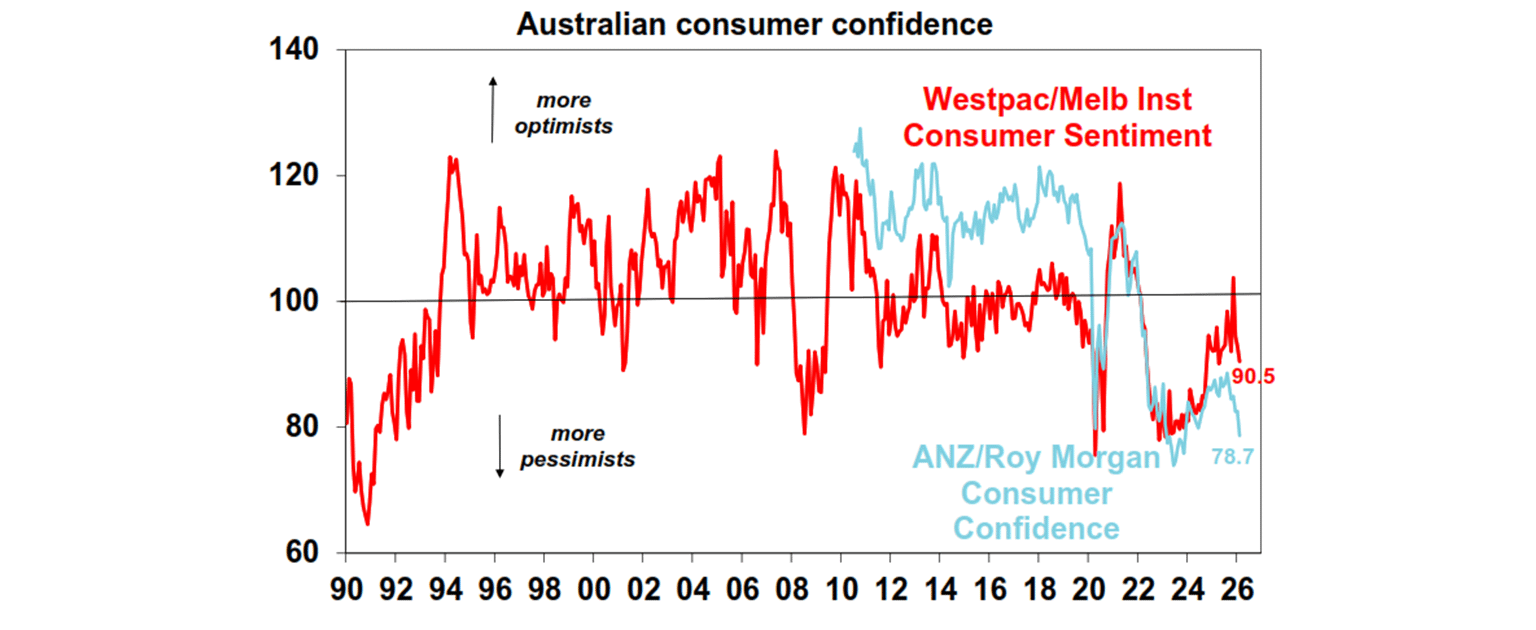

A sharp fall back in consumer confidence suggests that the slowdown in spending could continue into the current quarter.

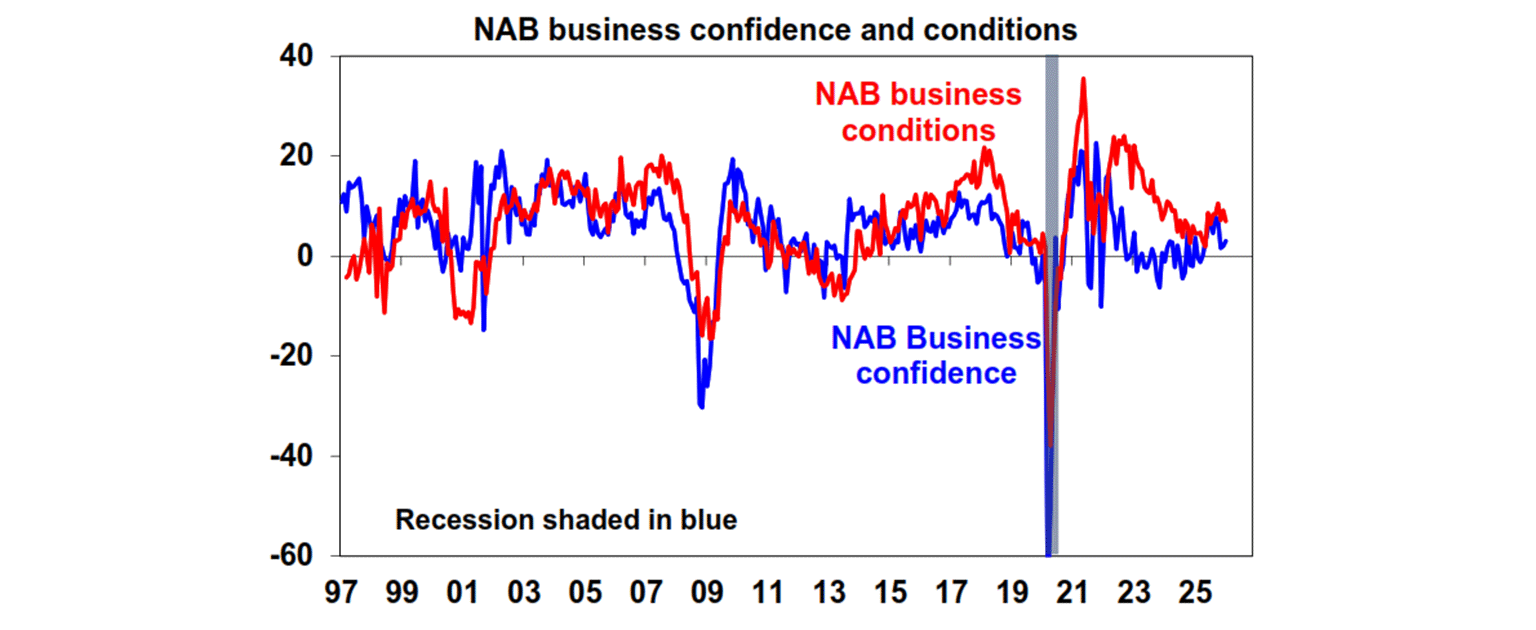

Australian business conditions remained around okay levels in January according to the NAB business survey.

Interestingly, the NAB survey continues to show little sign of the spike in inflation evident in the CPI or at least suggests that underlying inflation will resume falling. Cost and prices pressures fell in January, with final product prices remaining around levels consistent with the inflation target. This adds to confidence that the spike in inflation seen in the last half of last year could prove to be an aberration.

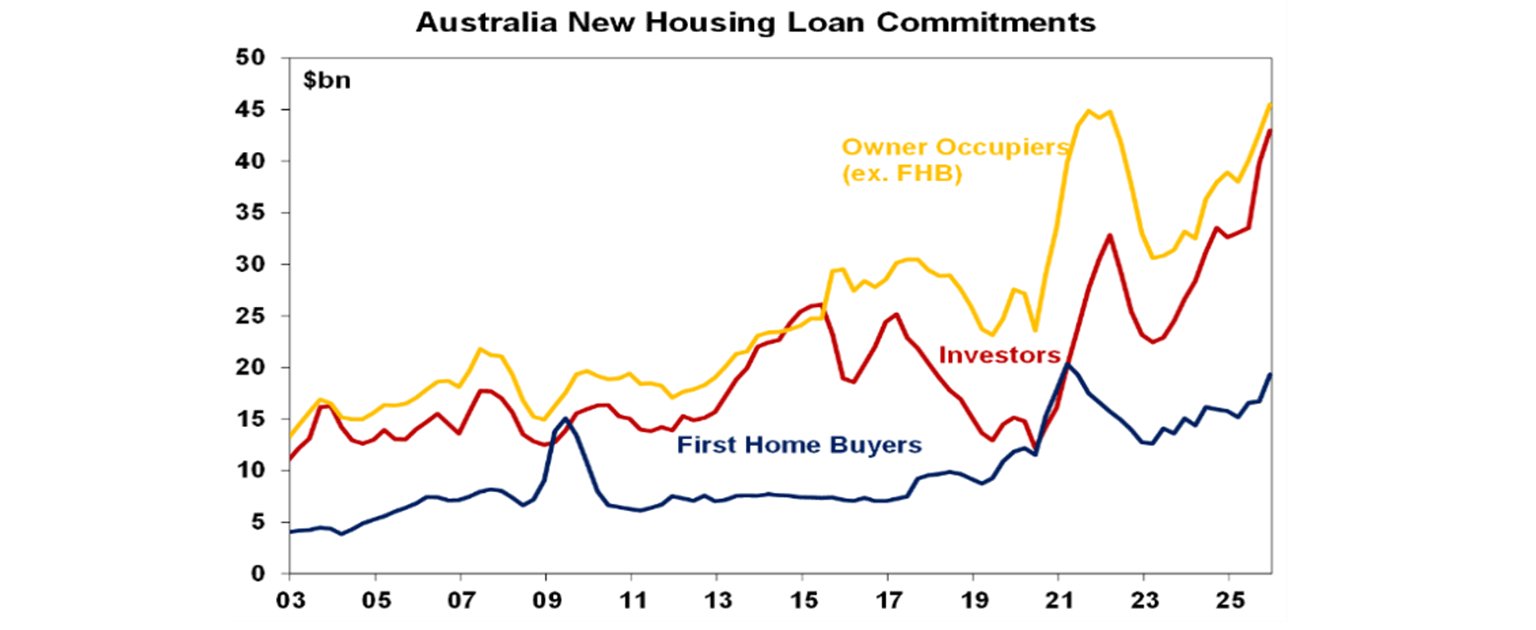

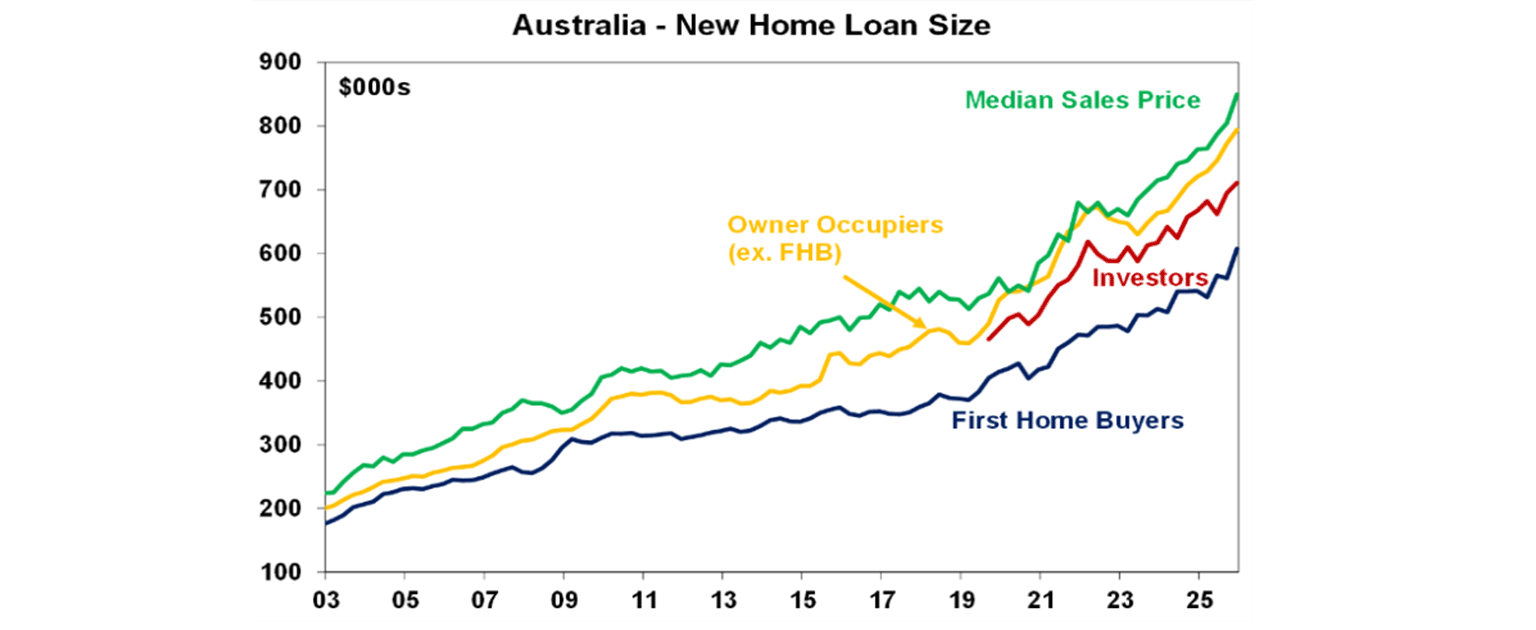

Housing finance commitments surged another 9.5%qoq in the December quarter reflecting strong home prices.

Housing finance for first home buyers surged 15.5%qoq in value partly reflecting the start of the expanded 5% low deposit scheme and a sharp increase in average loan sizes for first home buyers. This may help FHBs get in earlier but just means higher than otherwise house prices and higher debt levels. So, it’s no solution to poor housing affordability.

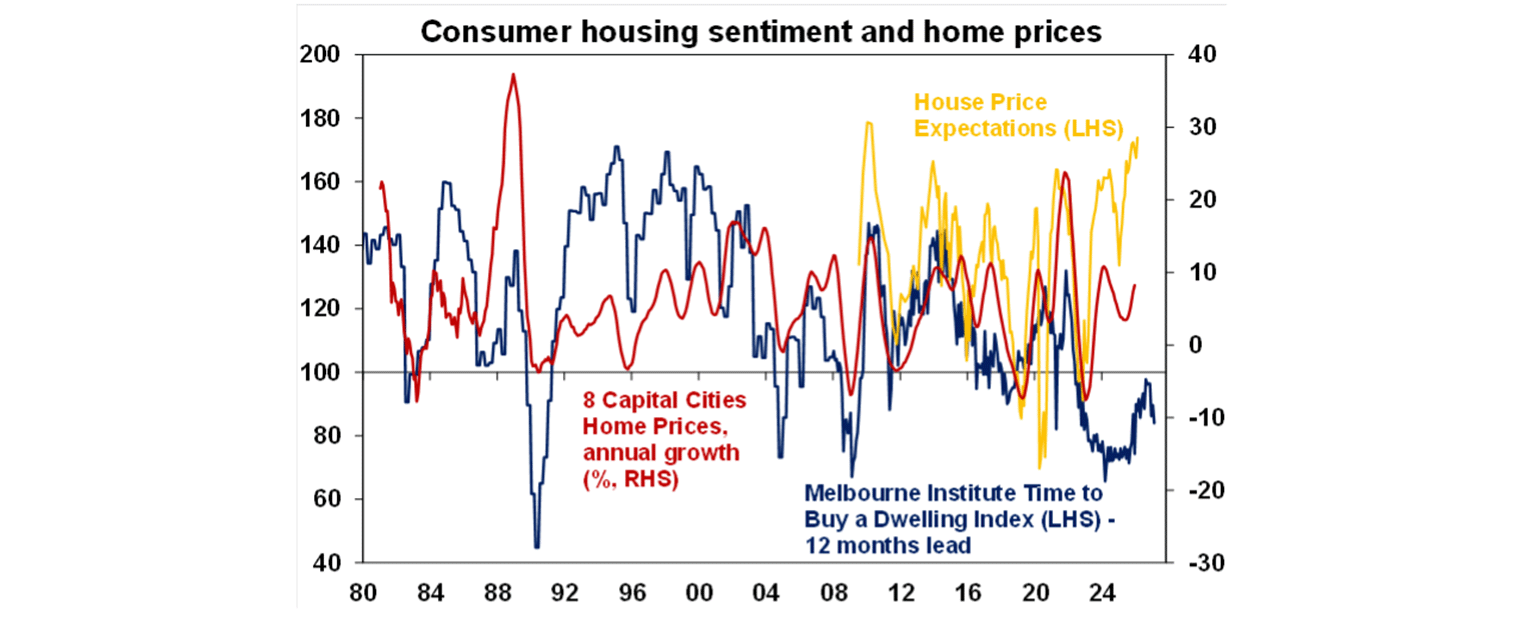

The Westpac/MI consumer survey showed home price growth expectations remain very strong and in fact rose further, but perceptions as to whether now is a good time to buy a dwelling weakened further.

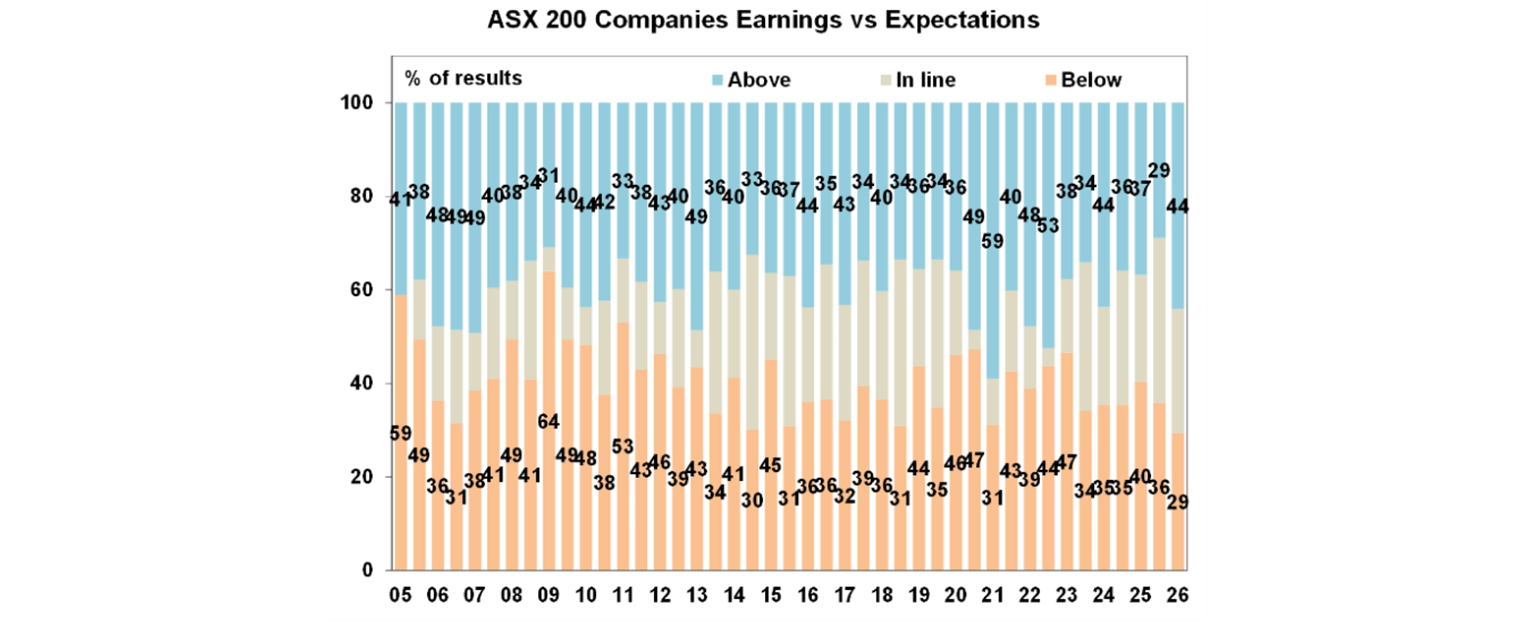

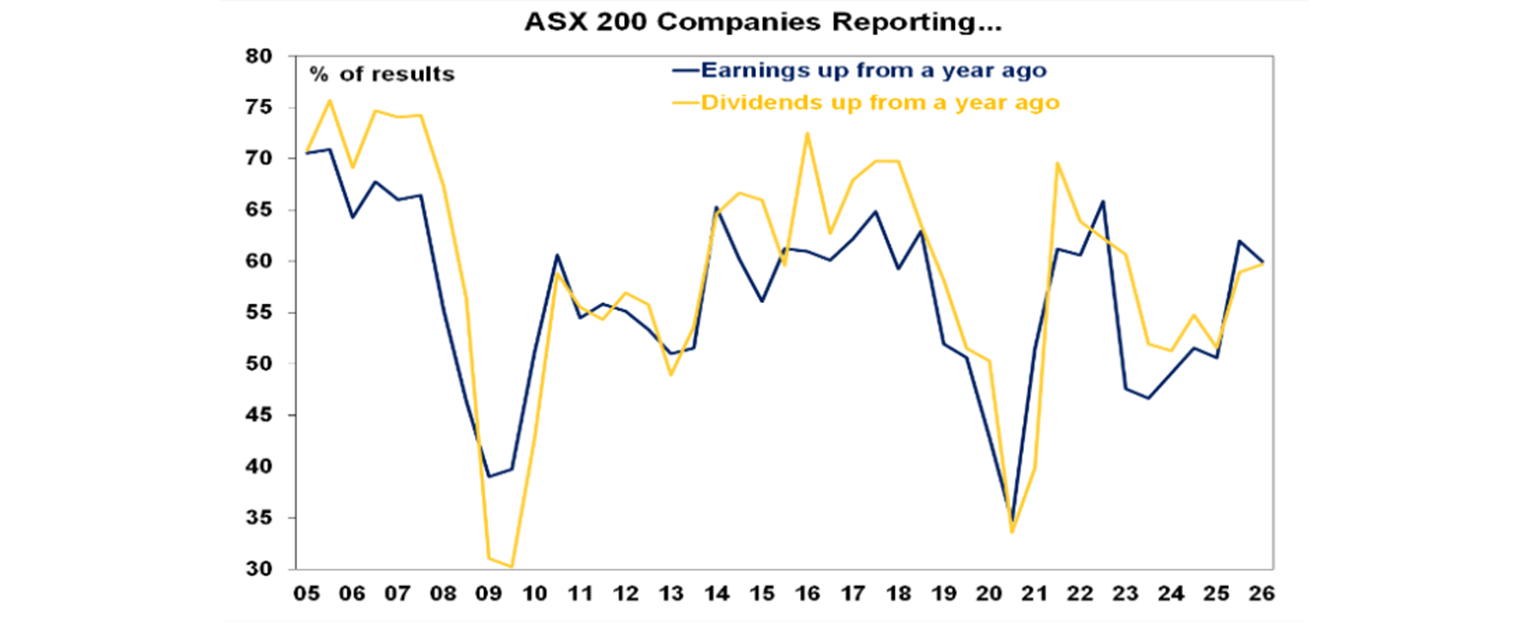

Its early days in the Australian December half earnings reporting season with only about 20% of major companies having reported. The consensus expectation is for earnings growth of 11.7% this financial year mainly driven by a 30% surge in mining sector profits, with banks seeing around 9% growth, energy seeing a 19% fall and the rest of the market seeing profit growth around 6%. So far results have been consistent with this with more than normal upside surprises and more companies reporting profits or dividends up on a year ago compared to what was occurring in 2023 and 2024. This helped the share market rise over the last week, but it was a messy ride with more companies actually seeing their share price fall on announcement day than rise whereas in the June half reporting season it was the other way around. The outsized negative share price reactions even to strong results highlights just how much good news has been factored into share prices. Just bear in mind too that there is a tendency for companies with good results to report early so results may soften over the next couple of weeks.

So far beats are running well above misses with 44% of results surprising consensus earnings expectations on the upside, which is more than the norm of 40%, and just 29% have surprised on the downside which is less than the norm of 41%. But its early days.

60% of companies have seen earnings rise on a year ago, and while down from the June half reporting season this is better than the norm of 56%.

60% of companies have increased their dividends on a year ago which is above the norm of 59%.

What to watch over the next week?

Developed country business conditions PMIs (Friday) for February will be released in the week ahead and will likely remain consistent with global growth around 3%.

In the US, December quarter GDP data (Friday) is likely to show annualised growth of 2.8% with solid consumer spending and investment. Data for housing starts, industrial production and underlying durable goods orders (Wednesday) will likely show gains, business conditions indicators for the New York and Philadelphia regions will likely come in around okay levels and core private final consumption deflator inflation for December (Friday) will likely come in around 3%yoy. The minutes from the last Fed meeting (Wednesday) will likely indicate the Fed is set to remain on hold for a while.

Canadian inflation data for January (Monday) will likely show the core measures around 2.5-2.6%yoy.

UK inflation data for January (Wednesday) is likely to show a further fall in core inflation to 3.1%yoy.

Japanese December quarter GDP (Monday) is likely to show a return to growth with a 0.4%qoq gain with January inflation data (Friday) showing a fall to 1.4%yoy for core inflation.

The Reserve Bank of New Zealand (Wednesday) is expected to leave rates on hold at 2.25%.

Australian wages growth for the December quarter (Wednesday) is likely to show it unchanged at 0.8%qoq or 3.4%yoy. Jobs data for January (Thursday) is likely to show a 5000 fall in employment after the surprise 65,000 surge in December with unemployment rising to 4.2%. The minutes from the last RBA meeting (Tuesday) will likely reinforce the RBA’s hawkish stance with more warnings that it will raise rates again if inflation data does not improve enough. The Australian December half earnings reporting season will ramp up with 80 major companies due to report including Bendigo Bank, JB HiFi, BHP, RIO, Wesfarmers and QBE.

Outlook for investment markets

Global and Australian share returns are expected to slow to around 8% this year. Stretched valuations, political uncertainty associated with Trump & the midterm elections, AI bubble & tech valuation worries, and geopolitical risks are the main drags. But returns should still be positive thanks to Fed rate cuts, Trump’s consumer friendly pivot and solid profit growth. A return to profit growth should also support gains in Australian shares even though the RBA has increased rates. Another 15% or so correction in share markets is likely along the way though.

Bonds are likely to provide returns around running yield.

Unlisted commercial property returns are likely to be solid helped by strong demand for industrial property associated with data centres.

Australian home price growth is likely to slow to 5% or less due to poor affordability, the RBA raising rates with talk of more to come and APRA’s move to ramp up macro prudential controls.

Cash and bank deposits are expected to provide returns around 3.85%.

The $A is likely to rise as the interest rate differential in favour of Australia widens as the Fed cuts and the RBA holds or hikes. Fair value for the $A is around $US0.73.

You may also like

-

How women can build financial wealth, confidence and security Practical tips for women to grow their wealth. Learn about budgeting, saving, super advice and more to take control of your finances. -

Oliver’s Insights – Oliver's Insights - Gulf War-3 US/Iran war Geopolitical shocks have been a rising feature this year with US “interventions” in various countries – Nigeria, Venezuela, Greenland and now Iran. -

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.