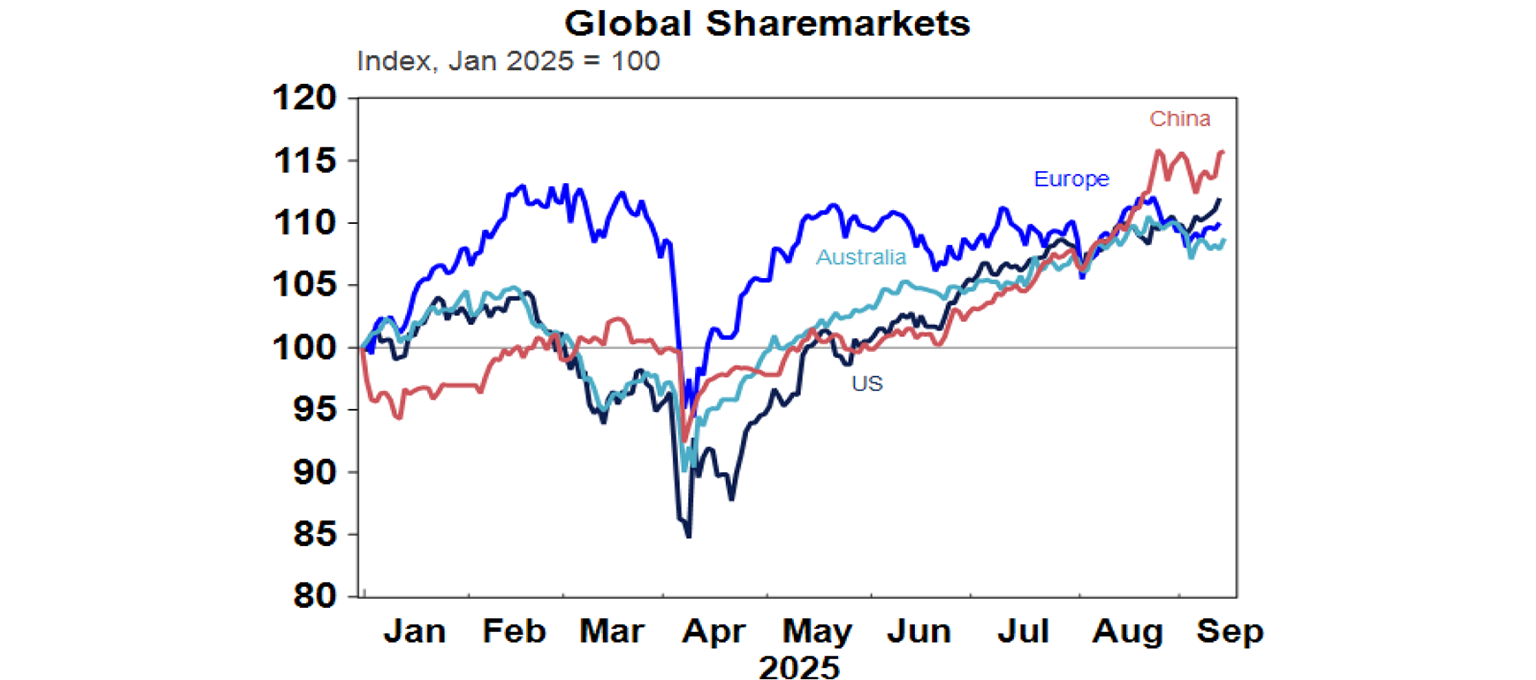

Global shares rose over the last week buoyed by expectations for rate cuts in the US. This saw US shares rise 1.6% and Japanese shares rise 4.1% to new record highs and Chinese shares rise 1.4% to a new recovery high. Despite the latest political upheaval in France, French and wider Eurozone shares (up 1.6%) also rose for the week, as worries about France proved to be another case of sell on the rumour and buy on the fact. Despite a positive US lead the Australian share market fell for the second week in a row but only by 0.1% with gains in IT, property and utility shares offset by losses in energy, consumer and industrial shares. 10-year bond yields rose in Europe and Japan but fell in the US, UK and Australia. Gold prices rose to another new record high on a combination of expectations for more Fed rate cuts and a weaker $US and on the back of demand for a hedge against public debt worries. Oil, metal and iron ore prices also rose. The $A broke decisively above $US0.66 rising to its highest since November last year as the $US fell.

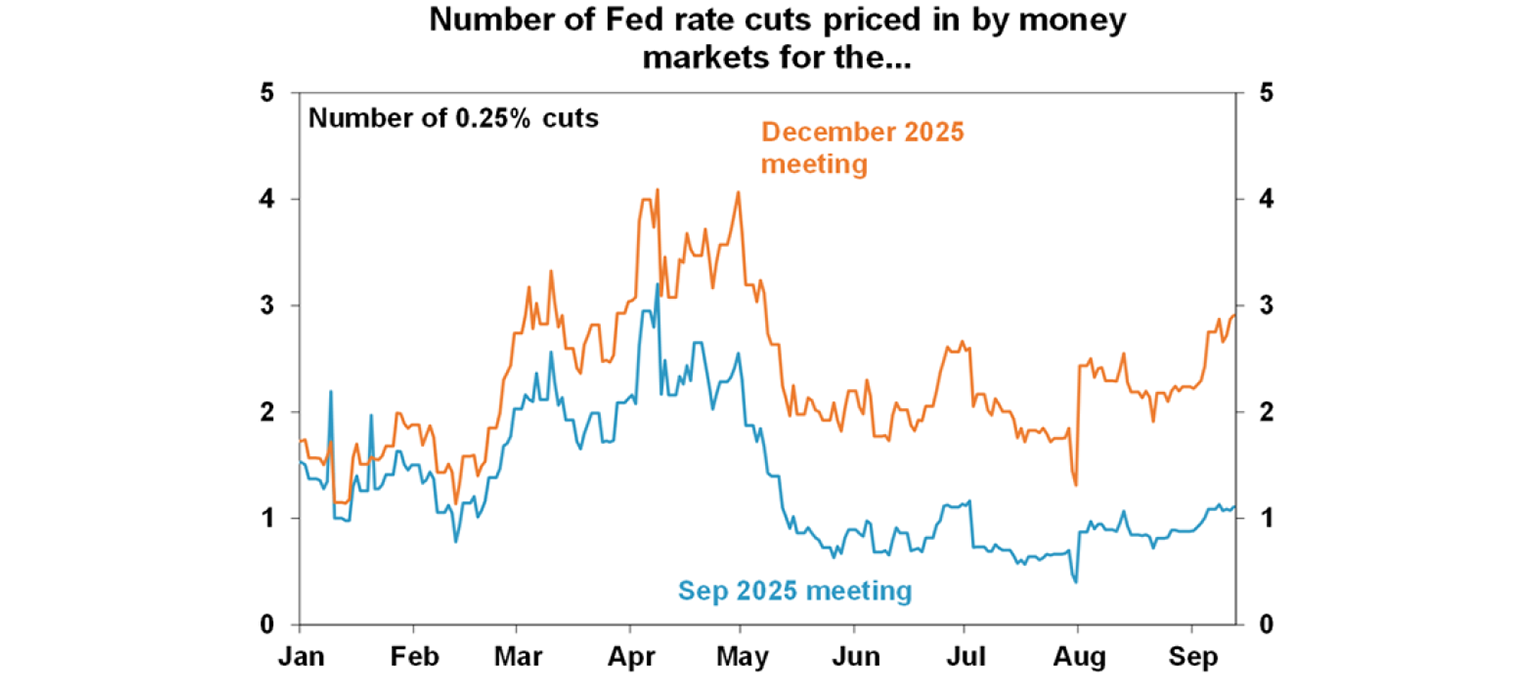

Fed set to resume rate cuts next week as US inflation was in line with expectations clearing the final hurdle for a resumption of cuts. Core CPI inflation at 3.1%yoy in August is consistent with core private final consumption inflation running around 2.9%yoy. This is higher than the Fed’s 2% target and upside risks remain on the tariff front, but the Fed will take comfort that inflation expectations mostly remain well anchored and increasing signs of labour market weakness are now dominating concerns about the impact of the tariffs. This was evident again in the last week with the Bureau of Labor Studies estimating that payrolls were significantly lower than previously reported, adding to evidence that the labour market is slowing. Given all this we expect the Fed to cut rates by 0.25% on Wednesday (with a 20% chance of a 0.5% cut) and signal two more cuts this year and two more next year.

While the Trumpian drama around the Fed continues it won’t have much impact in the near term. Trump appointee as Governor, Stephen Miran will likely sit on the FOMC in the week ahead, but a Federal court has ruled that Governor Lisa Cook (who Trump tried to sack) can remain at the Fed while the case against her is considered (arguing its substantially likely that she will succeed in her claim). The Cook decision is now subject to an appeal. But its all academic as the Fed is likely to cut anyway. Rather the weakening of the Fed’s independence from the White House in setting interest rates is more of a longer-term threat (potentially resulting in higher inflation expectations and hence long-term bond yields in the US).

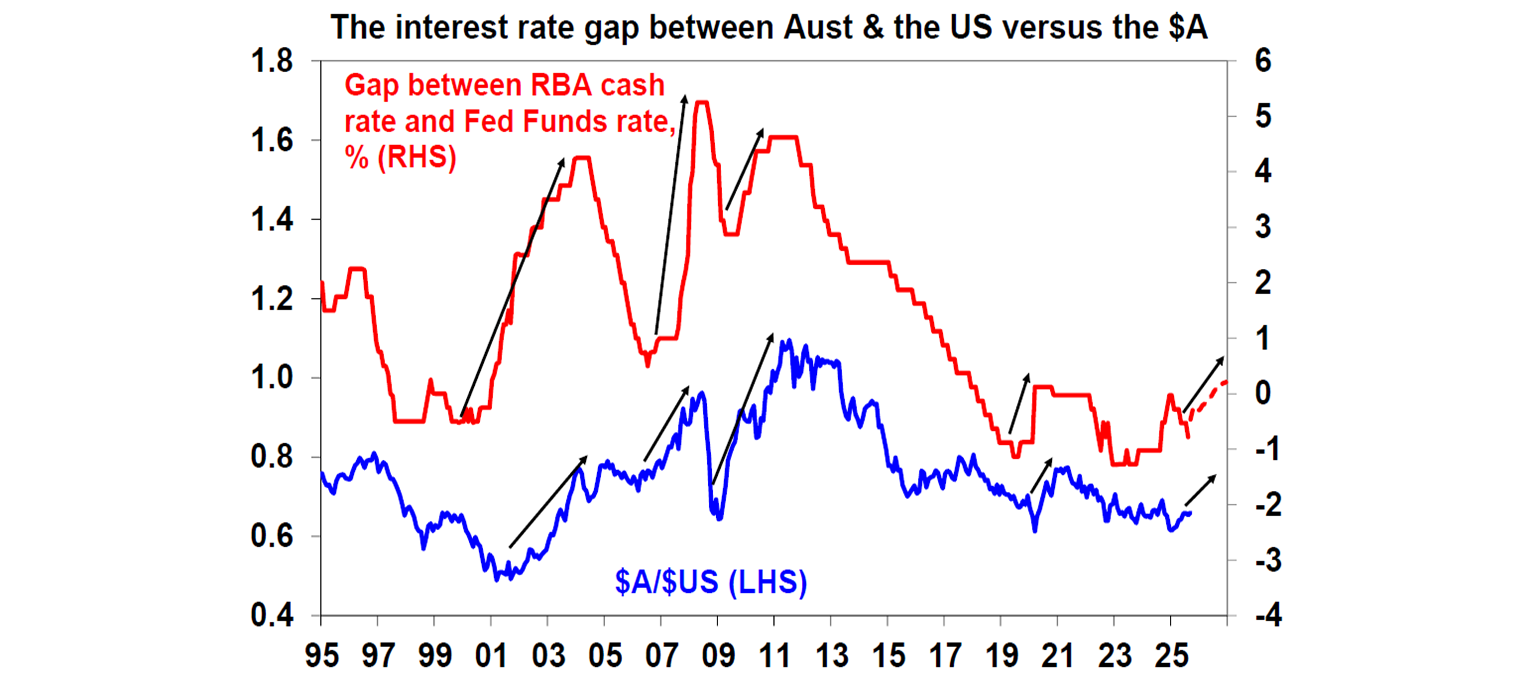

For Australia, the Fed’s likely resumption of rate cuts is positive for the Australian dollar and will marginally increase pressure on the RBA for more rate cuts. Money markets now see the Fed cutting by more than the RBA which will push US short term rates below the RBA’s cash rate. Historically, a rising gap between Australian and US rates has tended to see a rising trend in the Australian dollar (see the arrows in the next chart) and its break above $US0.66 may be a tentative sign that it is moving higher. Its also undervalued versus the $US (with fair value around $US0.73) supporting more upside. Since the GFC the RBA has not always moved rates in line with the Fed, eg in 2009 it started hiking when the Fed held rates low and over 2016-2018 it held rates down as the Fed hiked so just because the Fed is easing doesn’t mean that the RBA will blindly follow. But if the $A heads significantly higher this may add pressure on the RBA to cut by more than the market is expecting because a rising $A will dampen local growth and inflation. And if the Fed is cutting because of a weakening US jobs market and economy it may also add to pressure for more rate cuts here as weaker US growth will impact global and Australian economic growth. For now, our base case remains for 0.25% RBA rate cuts in November, February and May.

Near term risks for shares to keep an eye on. Our 6-12 month view remains positive for shares as Trump continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut. However, there are various risks which mean that there is a high risk of a correction as we continue to traverse the seasonally weak month of September:

Valuations remain stretched with US and Australian shares still offering a very low risk premium over bonds.

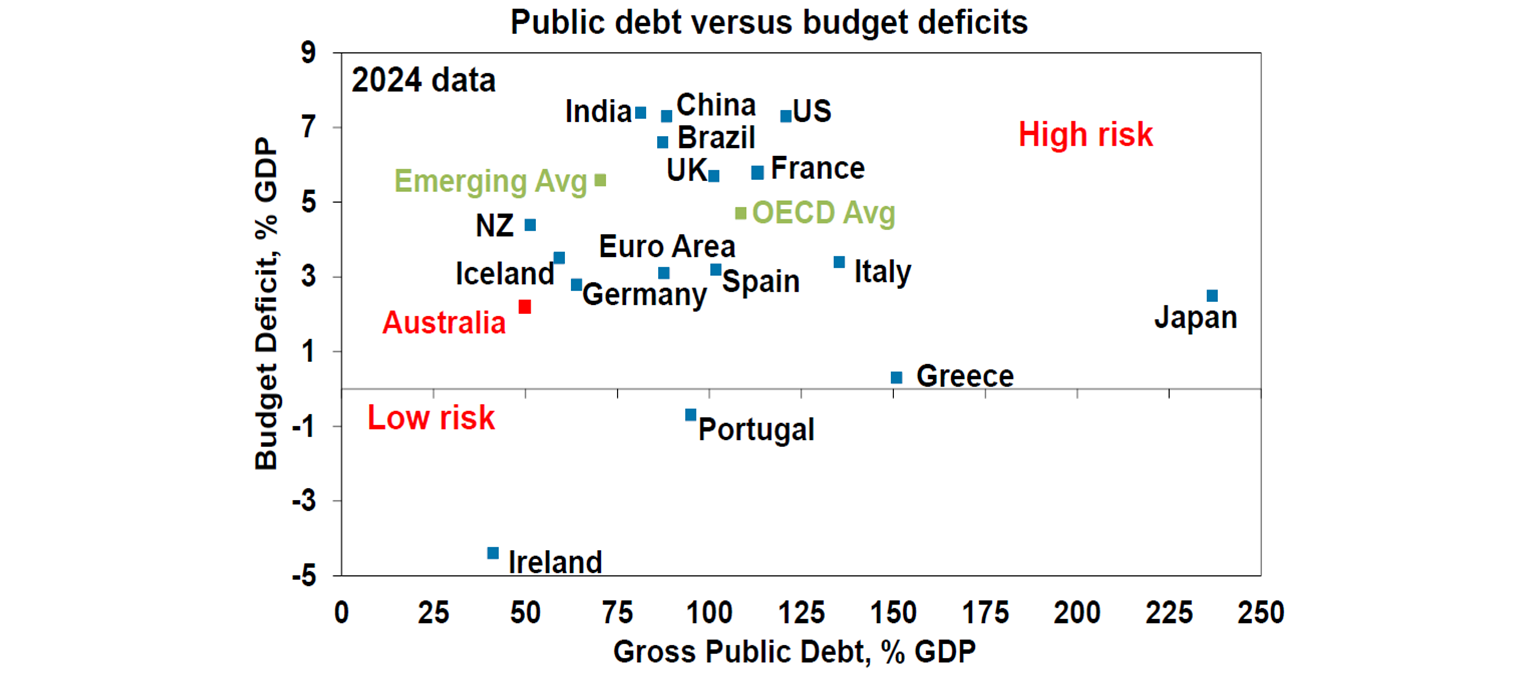

Concerns about public debt sustainability are at risk of flaring up again more significantly at some point – notably in France where the fifth prime minister in two years has been appointed to try and reduce the budget deficit, the UK, Japan and the US. Fortunately, as can be seen in the next chart Australia’s budget deficit and gross public debt position is in relatively good shape. And more generally public debt concerns have a habit of flaring up every so often then settling down again even though the underlying trajectory may be unsustainable, so trying to time when they will become a problem is hard. Muddle through looks more likely for now as opposed to a major crisis, particularly given the ongoing level of institutional demand for government bonds in developed countries. This includes in France where the 10-year bond yield spread to Germany is little changed from a week ago and is down slightly from the start of the year – which also means there are no grounds for ECB intervention in the French bond market. Gold will likely act as a hedge though if public debt worries escalate significantly and this likely partly explains why the gold price is around record highs.

Considerable uncertainty remains around US tariffs with Trump to announce more sectoral tariffs soon along with legal challenges and the weakening jobs market is likely a sign they are starting to hit the US economy.

Related to this there is now big uncertainty around how Trump will respond to Putin’s failure to play ball in ending the Ukraine War. Trump has threatened secondary sanctions (tariffs) on countries purchasing Russian oil (notably China and India) and if he doesn’t he will look weak. Against this if he does it means less hope of a trade deal with China and bad news economically (via a return to even higher tariffs on Chinese goods and higher global oil prices) which will further damage Republican mid-term election prospects. So, Trump is in a bind. It’s noteworthy that talks between the US and EU towards some sort of sanctions on China are occurring.

There remains a high risk of a US Government shutdown in September.

And once the Fed cuts on Wednesday, if its perceived as still being a bit cautious on how much to cut in the face of the tariffs still feeding through to inflation then it could be a case of “buy on the rumour (of Fed rate cuts) and then sell on the fact” for shares.

Major global economic events and implications

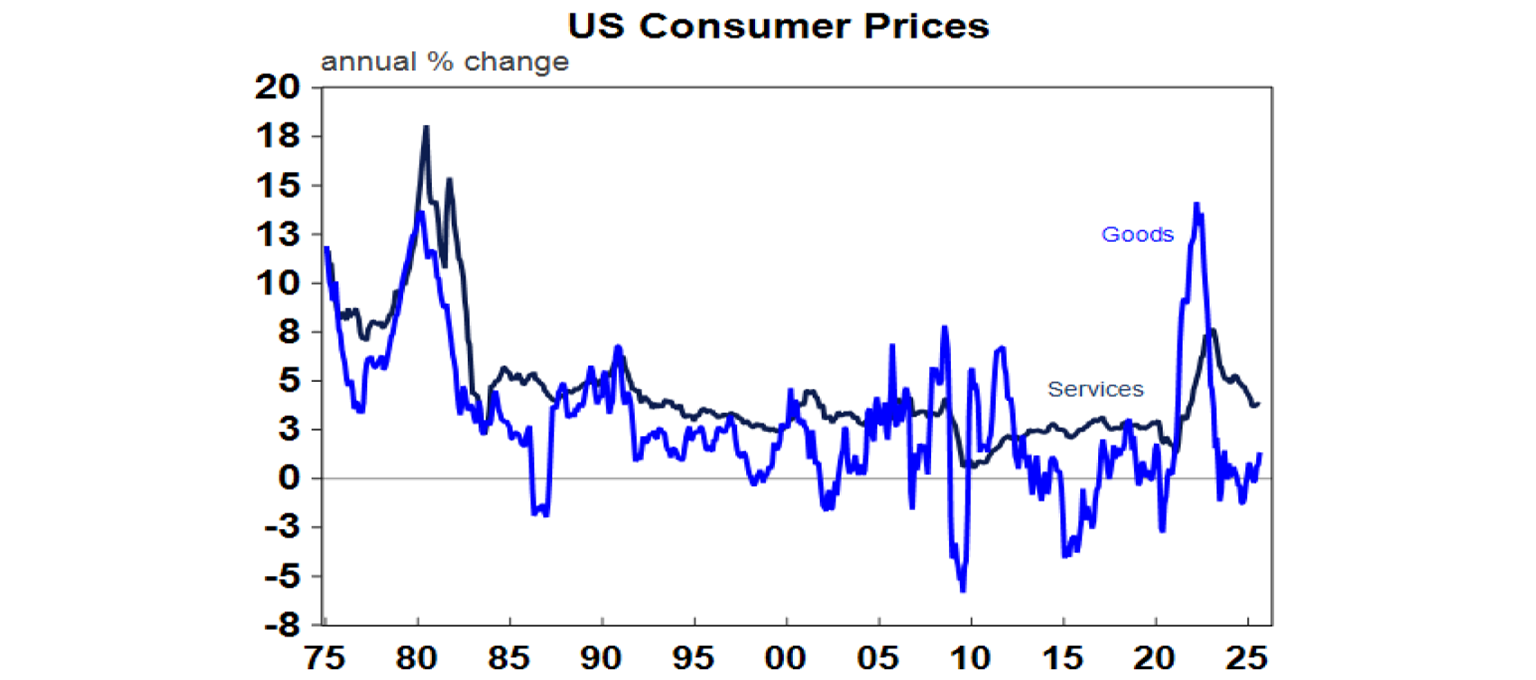

US inflation was roughly in line with expectations. Core CPI inflation rose 0.3%mom in August remaining at 3.1%yoy. This and softer than expected producer price inflation for August is consistent with core private final consumption inflation running around 2.9%yoy. There is still no evidence foreign exporters are absorbing the tariffs (with US import prices flat to up this year) so its US companies largely and US consumers to a lesser extent footing the bill which is evident in the rising trend for goods inflation, but so far the pass through to consumers is moderate. A rough estimate is that the tariffs have added 0.3-0.4% to inflation so far.

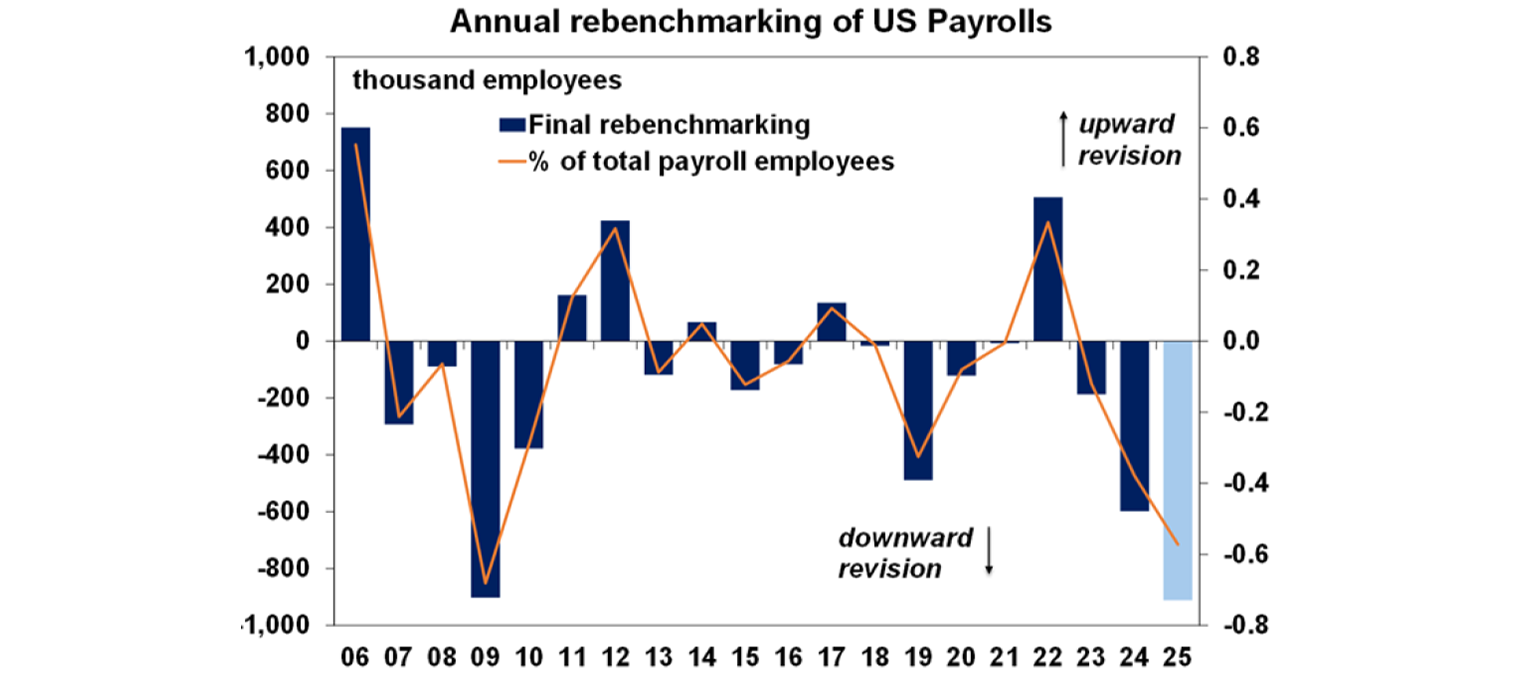

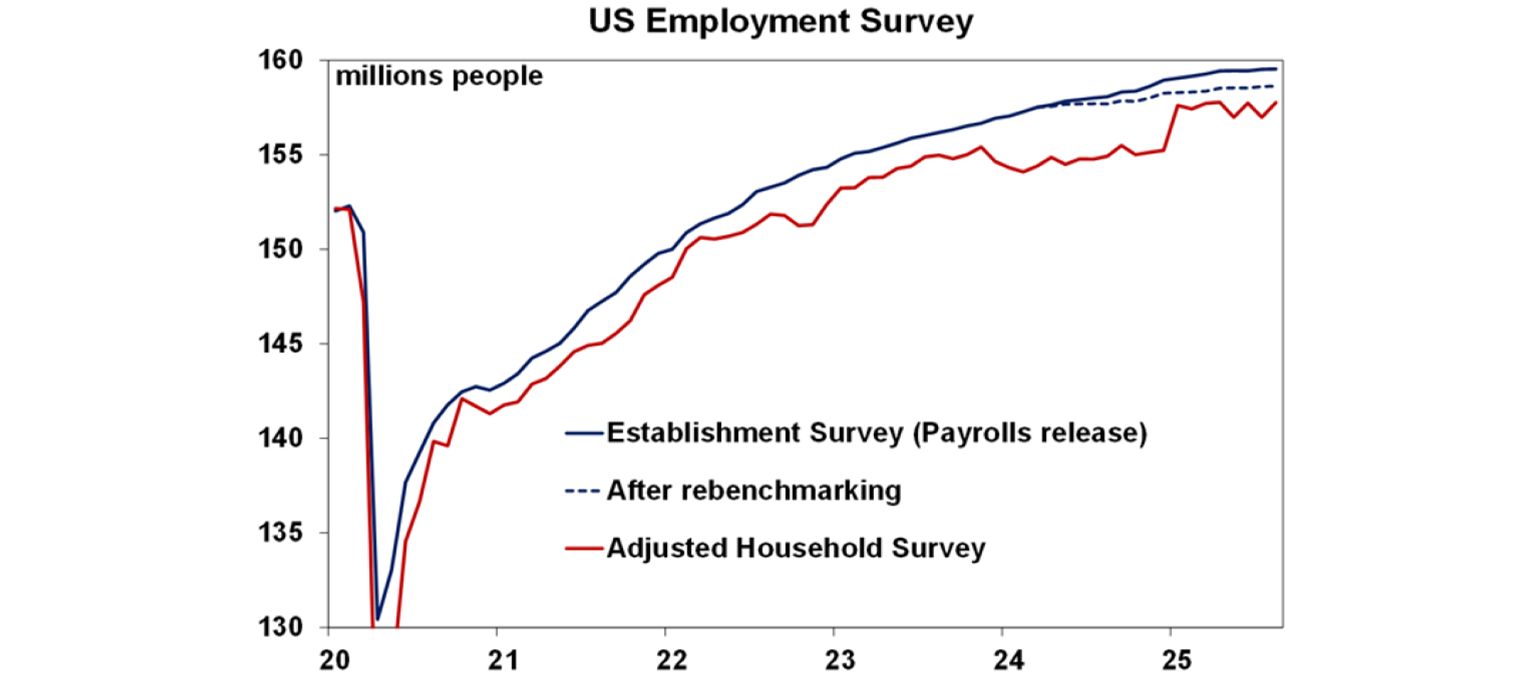

Further evidence of a weakening jobs market in the US. Of course, goods stockpiling ahead of the tariffs may explain the modest flow through to consumer price inflation with more yet to show up particularly given the end of the tariff pause in August. But the Fed will take comfort that inflation expectations mostly remain well anchored so far (with the New York Fed survey showing consumer inflation expectations stable around 3%) and increasing signs of labour market weakness are now dominating concerns about the impact of the tariffs. Following the soft jobs data for August this was again evident in the last week with the Bureau of Labour Statistics estimating that payrolls were 911,000 (or 0.6%) lower than previously reported. This reflects the annual benchmarking of the payroll survey to updated data on the number of companies and does not impact the unemployment statistics (which are from a household survey) or GDP data (so productivity may be revised up). But it does indicate that the monthly pace of payie up when things are good and down then they are slowing.

Its noteworthy that adjusting the payroll (establishment) survey for the lower level of payrolls (the dotted blue line in the next chart) brings it more into line with the level of employment indicated by the separate household survey. Both are showing a flattening trend so far this year.

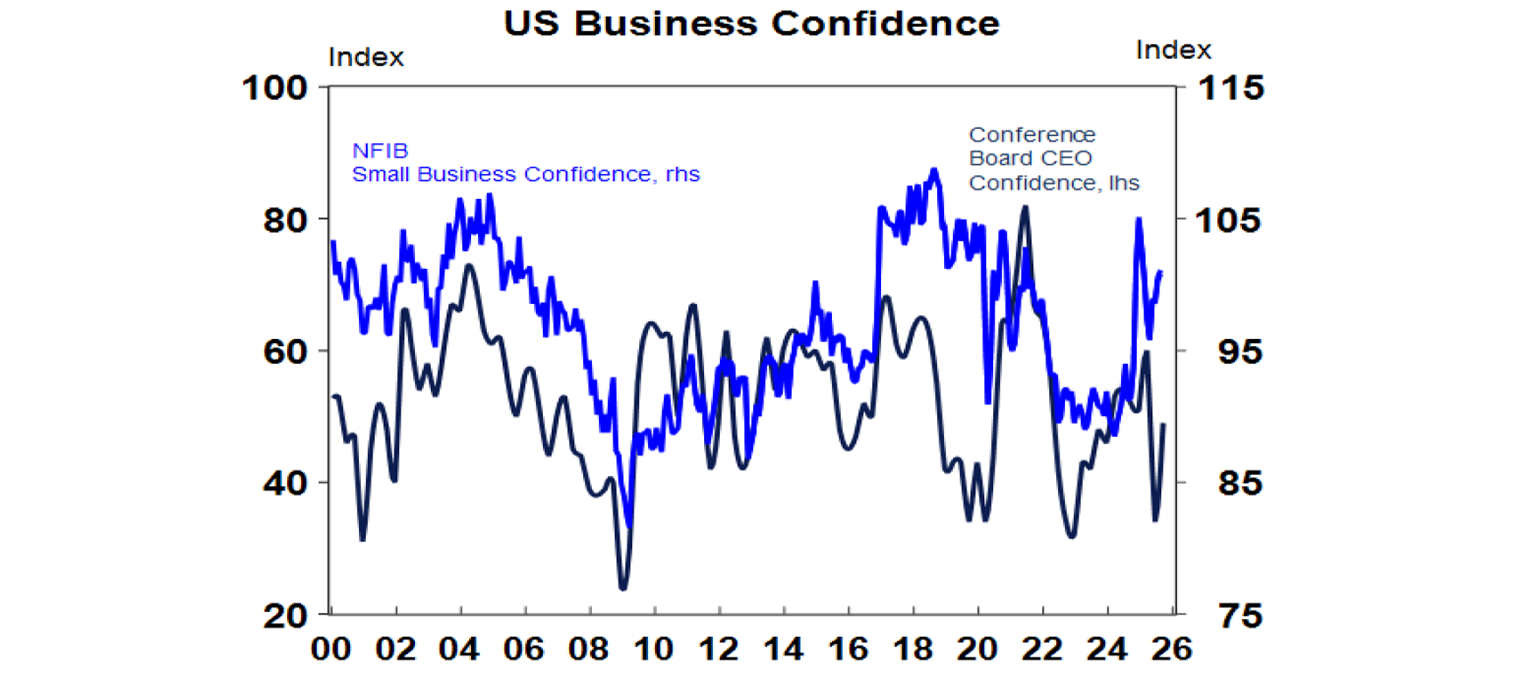

Meanwhile, US small business optimism rose slightly in August. Initial jobless claims rose sharply but this was mainly due to Texas and possibly reflected the end of Disaster Unemployment Insurance associated with flooding. Continuing claims were flat but continue to trend up.

As expected, the ECB left rates on hold at 2% characterising inflation as being around 2% and President Lagarde seeing the risks around growth as being balanced and appearing willing to tolerate a mild inflation undershoot. However, with ECB staff seeing core inflation at 1.8%yoy in 2027 one more rate cut still looks likely, particularly as the Fed cuts putting upwards pressure on the Euro.

In Japan the resignation of the Japanese PM raised political uncertainty, although regularly changing PMs in Japan are nothing new. An LDP leadership vote looks set for 4th October with the new PM likely to have a bias towards fiscal stimulus as the ruling coalition lacks a parliamentary majority. The good news is that Japanese GDP growth was revised up to 0.5%qoq in the June quarter reflecting stronger consumer spending and inventories.

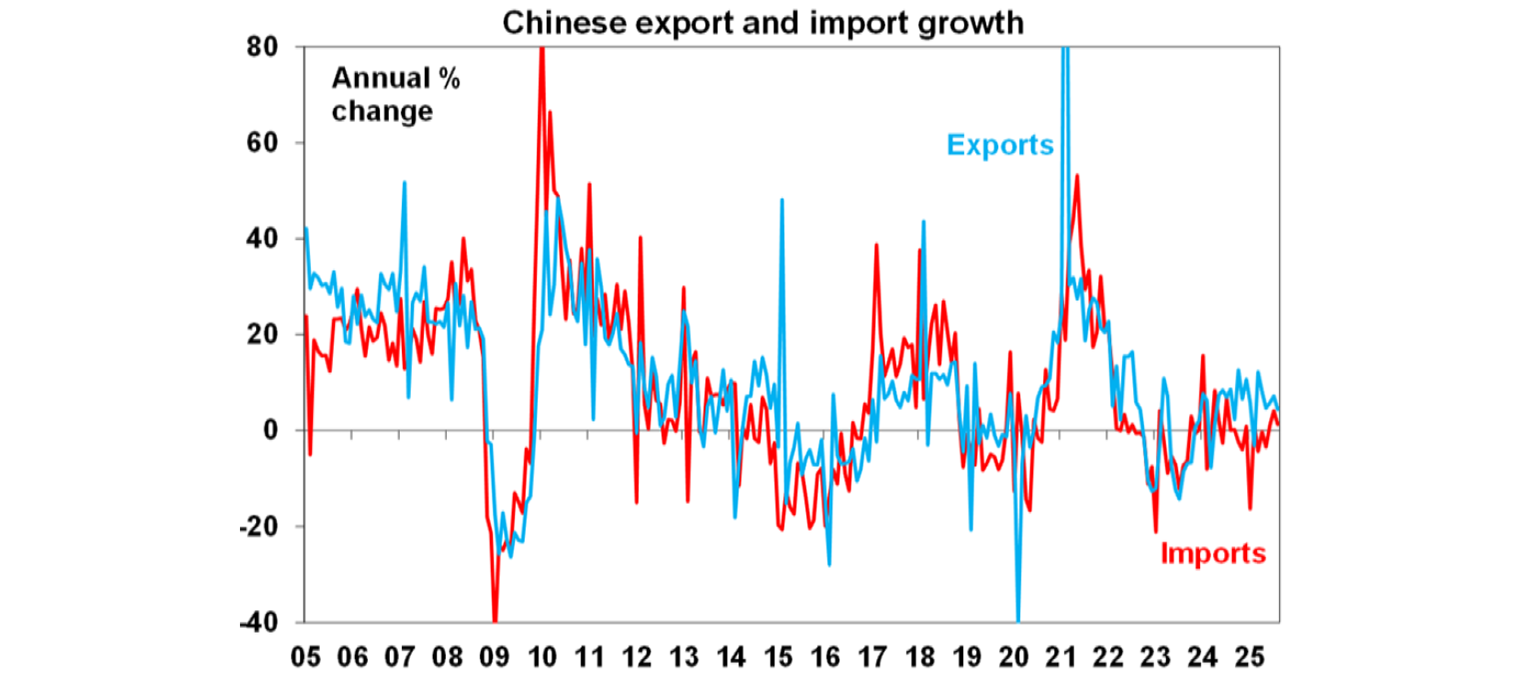

Chinese export and import growth slowed in August with exports slowing to 4.4%yoy from 7.2%yoy with a sharp tariff related fall to the US and import growth also slowed, possibly due to there being less working days in August.

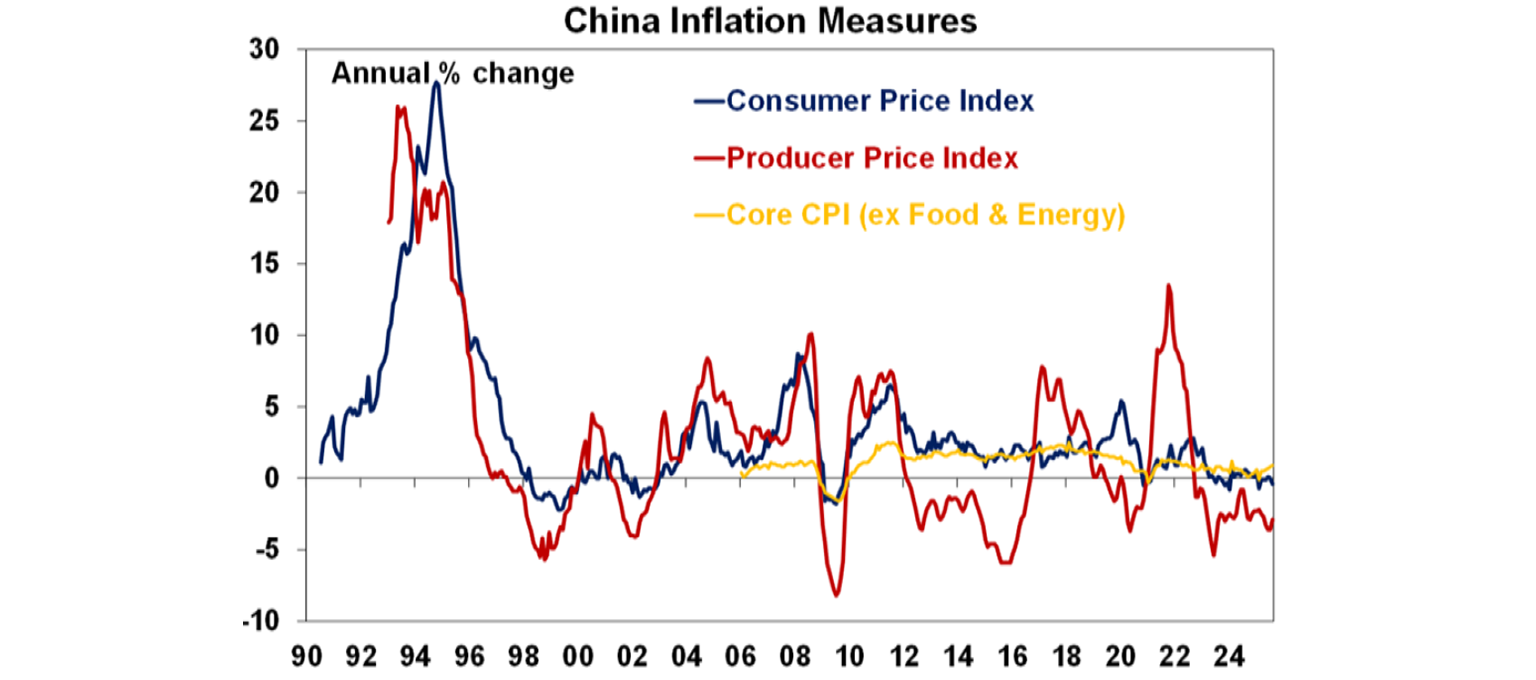

Meanwhile deflationary pressures remained with consumer price inflation slipping back into negative territory and producer prices falling by 2.9%yoy. That said the fall in consumer prices was largely due to lower food prices with CPI inflation excluding food and energy actually rising slightly to 0.9%yoy.

Australian economic events and implications

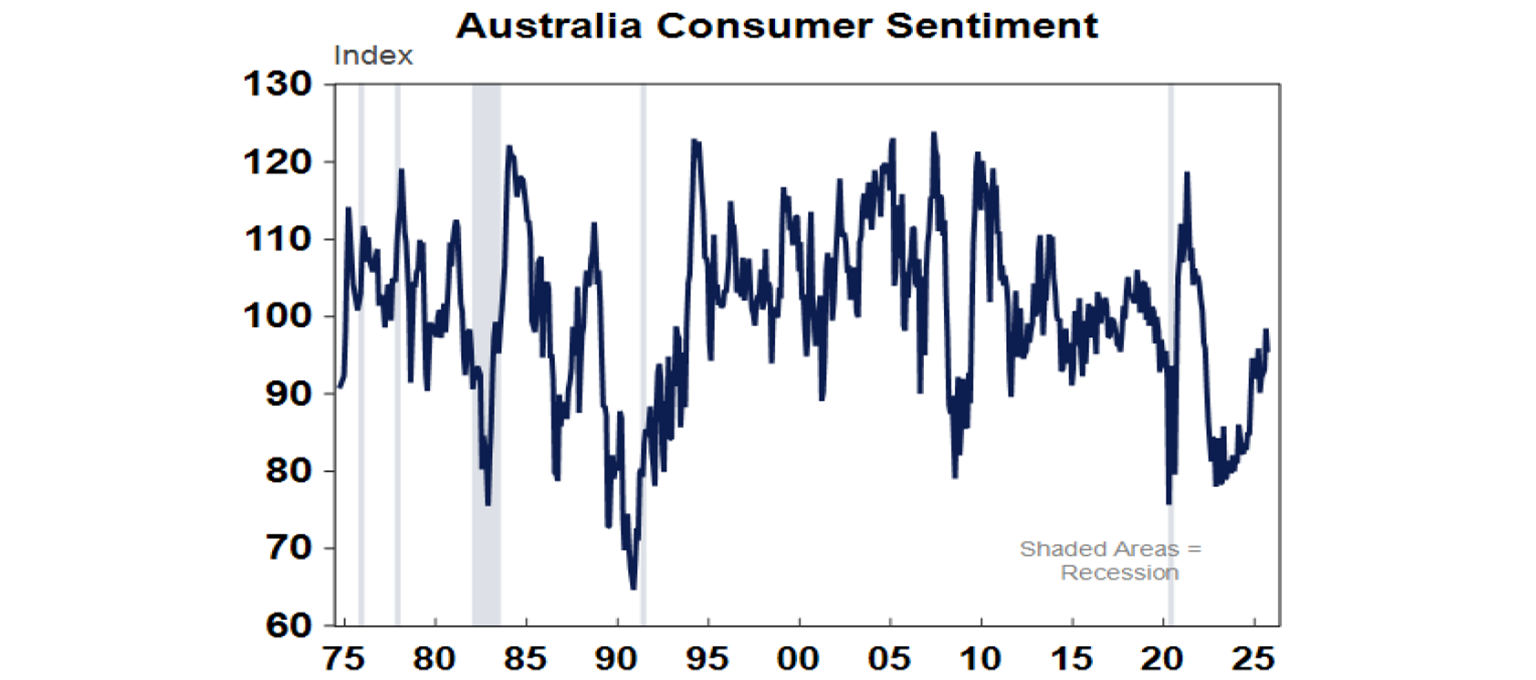

Consumer confidence dipped in September according to the Westpac/Melbourne Institute consumer survey but remains in a rising trend and consumers continue to feel better about their family finances.

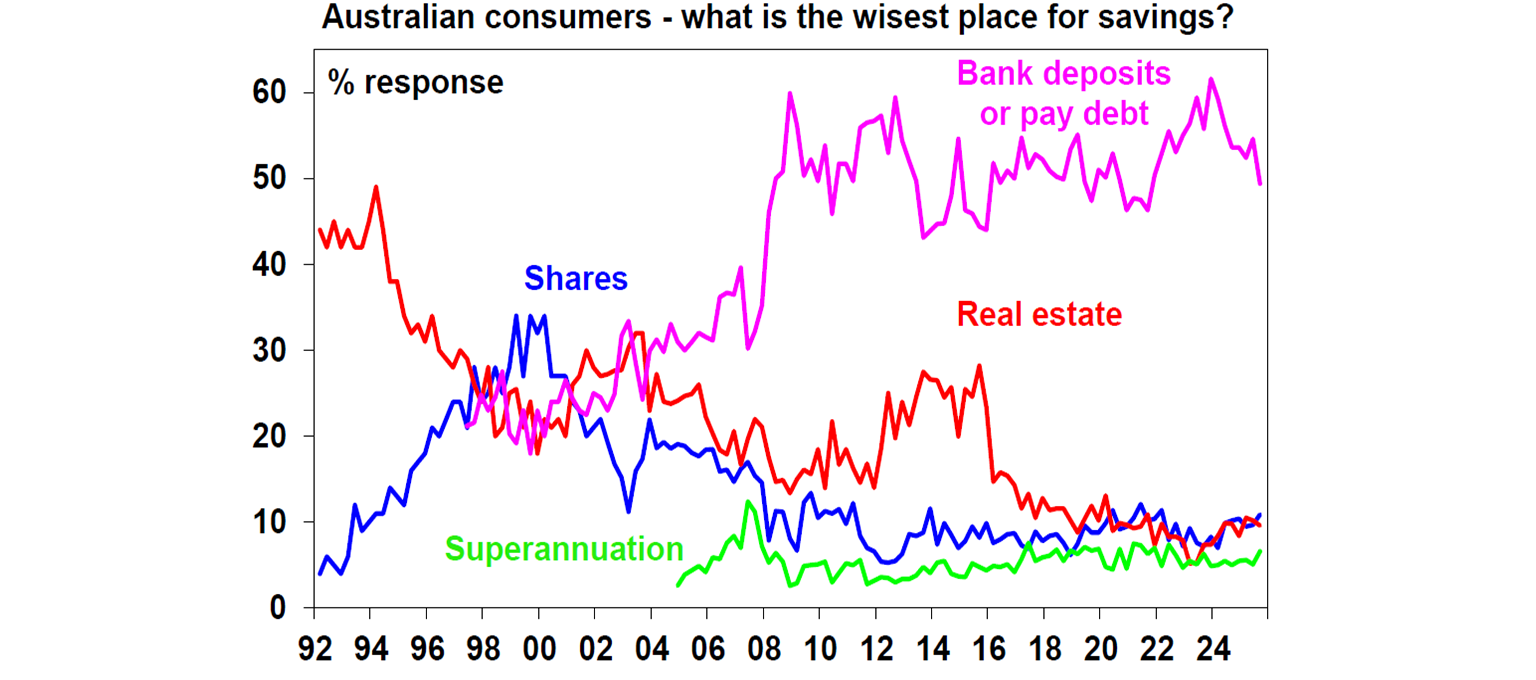

The September Westpac/MI survey also showed a further reduction in consumer caution with less seeing bank deposits and paying down debt as the wisest place for saving with slight improvements in perceptions towards shares, super and spending. There is not a lot in it though.

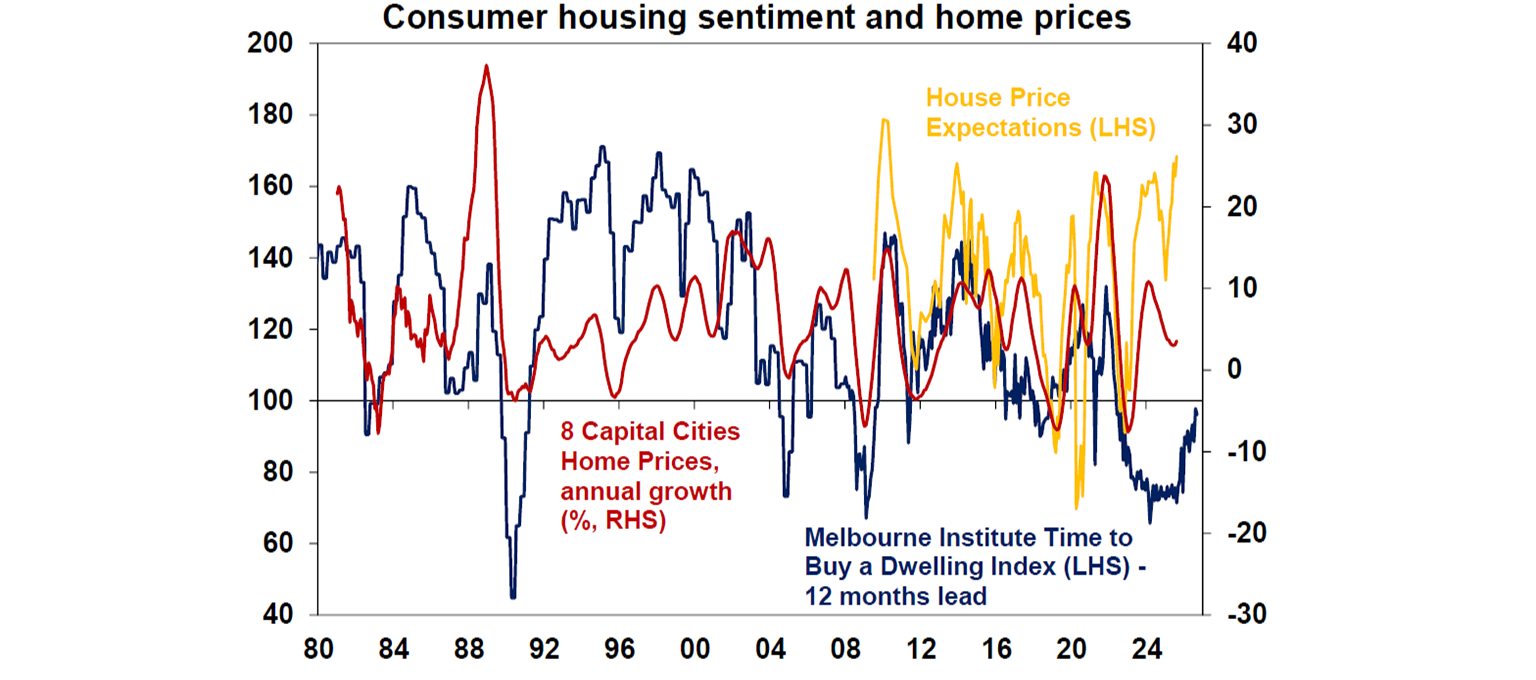

The consumer survey also showed a further rise in home price growth expectations to their highest since 2010. Perceptions as to whether now is a good time to buy a dwelling fell slightly but are continuing to trend up.

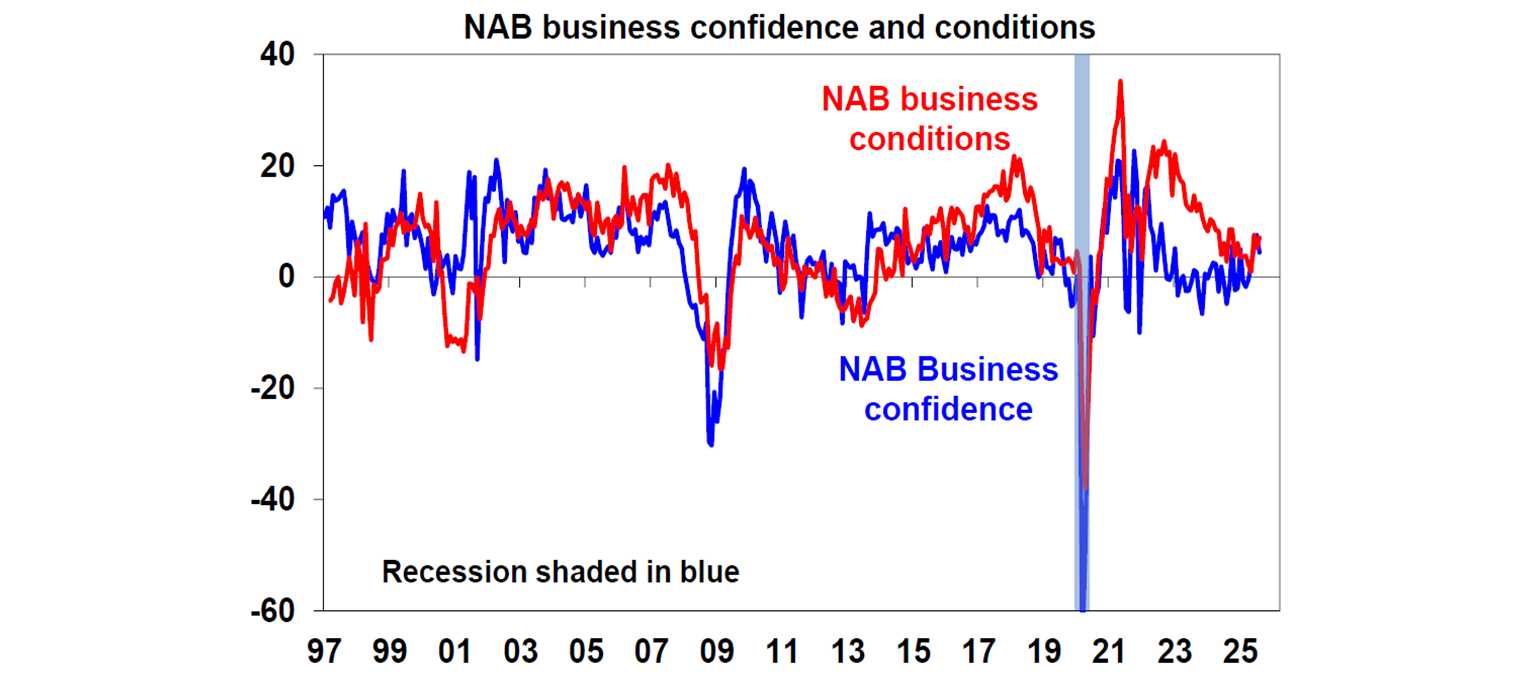

Business confidence fell slightly in the August NAB survey, but business conditions improved slightly and the trend remains towards some improvement in both.

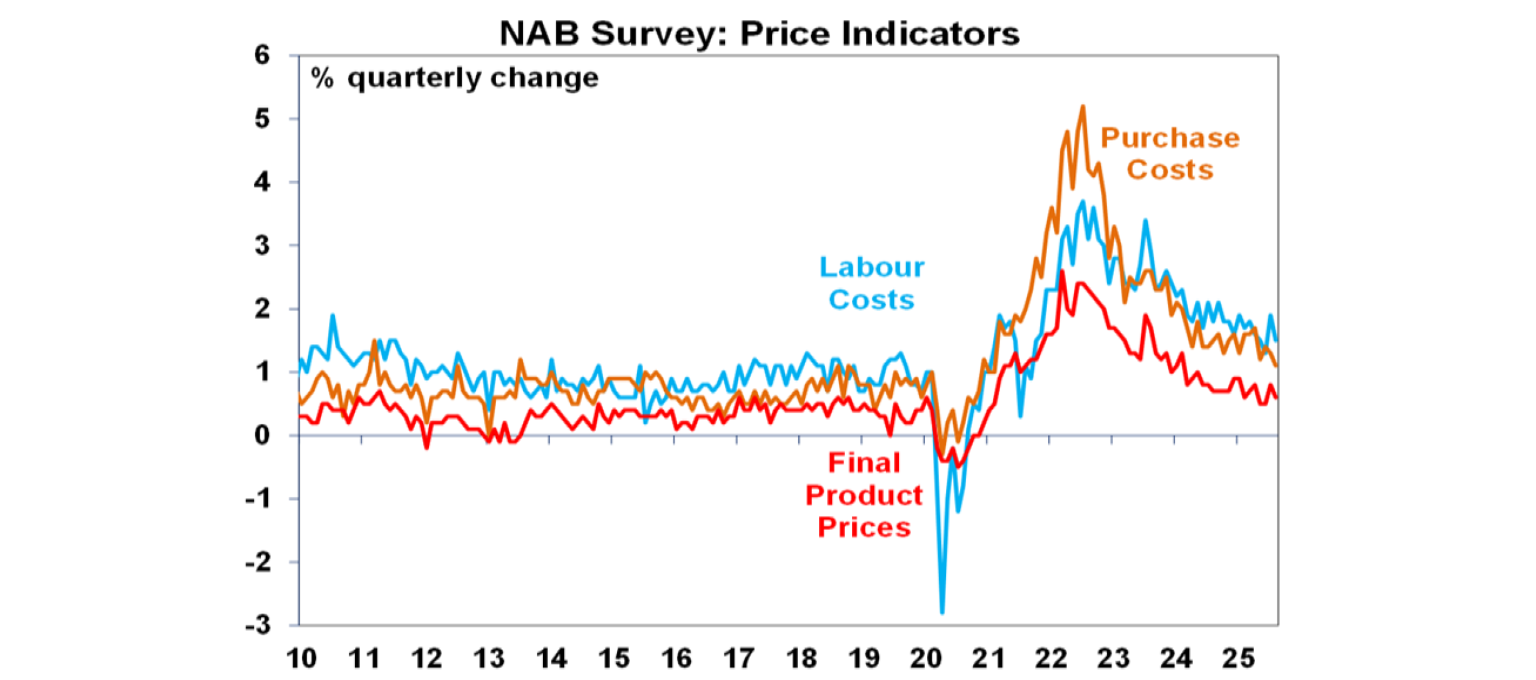

Fortunately, cost and price pressures eased in August consistent with the slowing seen in the Melbourne Institute’s Inflation Gauge, suggesting that inflation may have cooled a bit after the rise in July.

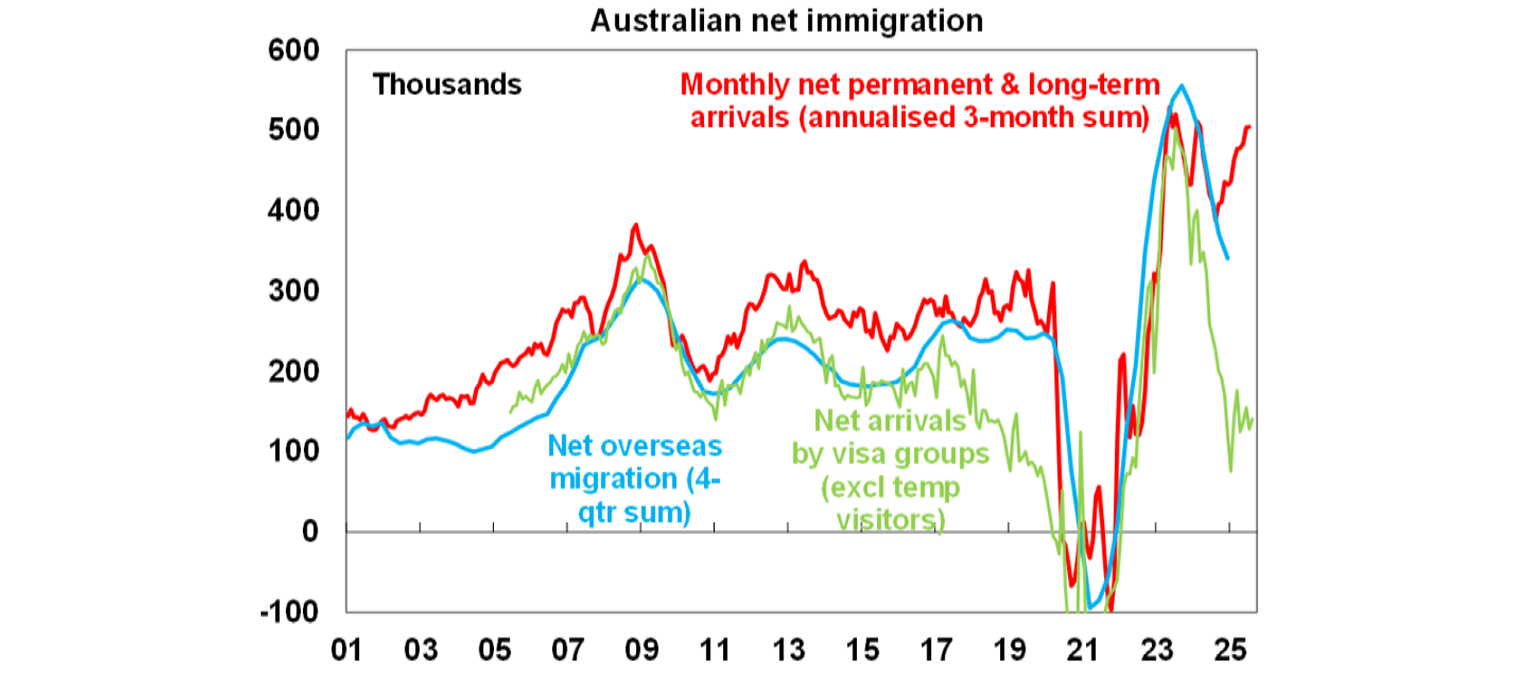

Monthly visa data (excluding tourists) and net permanent and long-term arrivals data are continuing to provide a conflicting picture on the trend in net migration with the former pointing down but the latter going back up to around record highs again. If the latter is correct its not good timing given the increasing concerns about excessive immigration and poor housing affordability.

What to watch over the week ahead?

In the US, the Fed (Wednesday) is likely to resume rate cuts as increasing signs of a softening labour market are starting to dominate concerns about the threat to inflation from Trump's tariffs. We expect the Fed to cut by 0.25% taking the Fed Funds rate to the range of 4-4.25%. The so called "dot plot" of Fed officials rate expectations are likely to flag another two rate cuts by year end and another two next year.

On the data front in the US, expect a modest rise in August retail sales, flat industrial production and continuing weak home builder conditions (Tuesday), a fall in housing starts (Wednesday) and mixed readings for September regional manufacturing conditions indexes with a fall in the New York region but a rise in the Philadelphia region.

The Bank of Canada (Wednesday) is also expected to cut rates by another 0.25% taking them to 2.75% following recent weak jobs data. Canadian inflation data for August (Tuesday) is expected to show underlying inflation stable around 3%yoy.

The Bank of England (Thursday) by contrast is expected to leave rates on hold at 4% reflecting inflation remaining too high with August core inflation (Wednesday) likely to have remained around 3.8%yoy.

The Bank of Japan (Friday) is expected to leave rates on hold, but signal that another rate hike is still possible by year end, despite political uncertainty, given resilient economic and wages growth.

In Australia, jobs data for August (Thursday) is expected to show a 22,000 gain in employment but with unemployment edging back up again to 4.3%.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more, as central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may be breaking higher now with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.