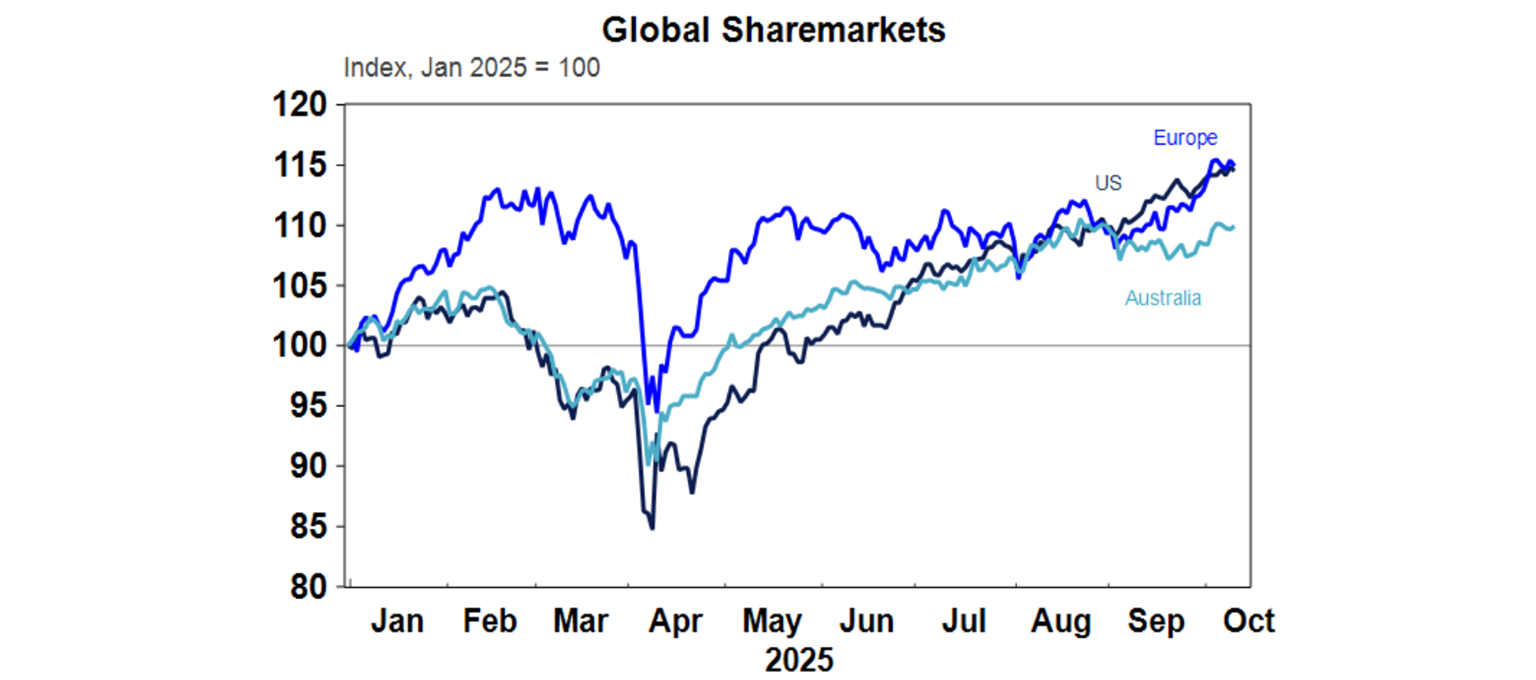

US and European share markets fell sharply on Friday in response to the latest threatened re-escalation in the trade war between the US and China. The 2.7% fall in US shares after Trump threatened additional tariffs on China left it down 2.4% for the week and Eurozone shares fell 1.8% for the week. Earlier Japanese shares had already closed up 5.1% for the week and Chinese shares had fallen 0.5%. Australian shares fell by 0.3% for the week after a 2.3% rise in the prior week with sharp falls in retail, IT, telco and property shares. 10-year bond yields rose in Australia but fell in the US and Europe in response to Friday’s risk off sentiment. Gold rose sharply pushing above $US4000 reinforced by safe haven demand on Friday, but Bitcoin was dragged down for the week with the fall in US shares. Renewed trade war fears also pulled metal and oil prices down for the week and this also dragged the $A back below $US0.65, with the $US rising.

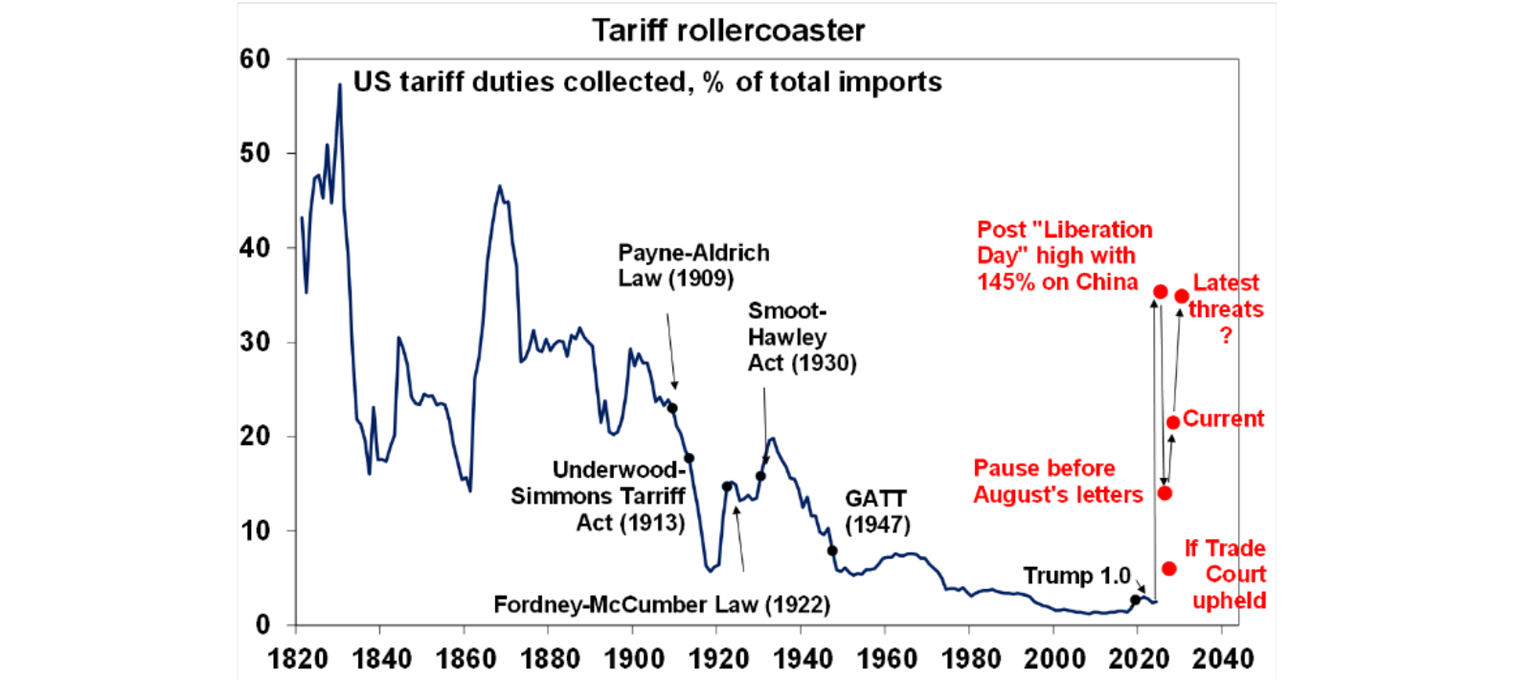

Back to the escalating US-China trade war. President Trump’s threat to impose an additional 100% tariff on imports from China from 1 November after China announced controls on its rare earths starting in November would push the average US tariff rate back above 30% (before substitution), which would be back to around where it was after Liberation Day. This and his threat to cancel his planned 31 October meeting with President Xi along with China’s export controls look like classic negotiating ploys to boost each sides’ leverage, although its worth noting that the tariffs on China would have gone back up to 145% on 10 November anyway when the trade truce expires if no deal had been reached. Time will tell, but pressure on Trump to resolve this is now immense as Trump’s tariffs are very unpopular in the US so he needs to continue pivoting towards more market friendly policies going into next year’s mid-term elections.

Friday’s sharp fall in US shares provides a reminder that the risk of a correction is high given stretched valuations and numerous potential triggers including around: US tariffs and their impact; slowing US jobs data; public debt sustainability issues in the US, France, UK and Japan; the US government shutdown; geopolitical risks around the possibility of escalating tensions between Russia and NATO countries although another Israel/Gaza peace deal is good news; uncertainty as to how much the Fed will cut rates; and increased uncertainty around further rate cuts in Australia. However, our 6–12-month view remains positive for shares as Trump will likely continue to pivot towards more market friendly policies ahead of the mid-terms next year, the Fed cuts rates further and other central banks including the RBA continue to cut, albeit to varying degrees.

Still no progress in ending the partial US government shutdown with rising risks of a bigger than normal economic impact. There have been 20 shutdowns over the last 50 years and the economic, and share market, impact has been minor as disrupted activity is made up for immediately after the shutdown ends as furloughed workers return to work and get paid. But there is a rising risk that this shutdown will have a bigger than normal impact because the Trump Administration is actually starting to fire some of the roughly 600,000 furloughed Federal workers and is threatening to provide any back pay when then those who still have a job return to work. The latter would mean a roughly 0.02 percentage point hit to annualised quarterly GDP for every week of the shutdown according to Evercore ISI. In the meantime, the Democrats appear to be digging in on signs that the shutdown is going well for them given their stand on health subsidies. The longer it goes on the more it also highlights concerns about dysfunctional politics in the US including around unsustainable government deficit and debt levels.

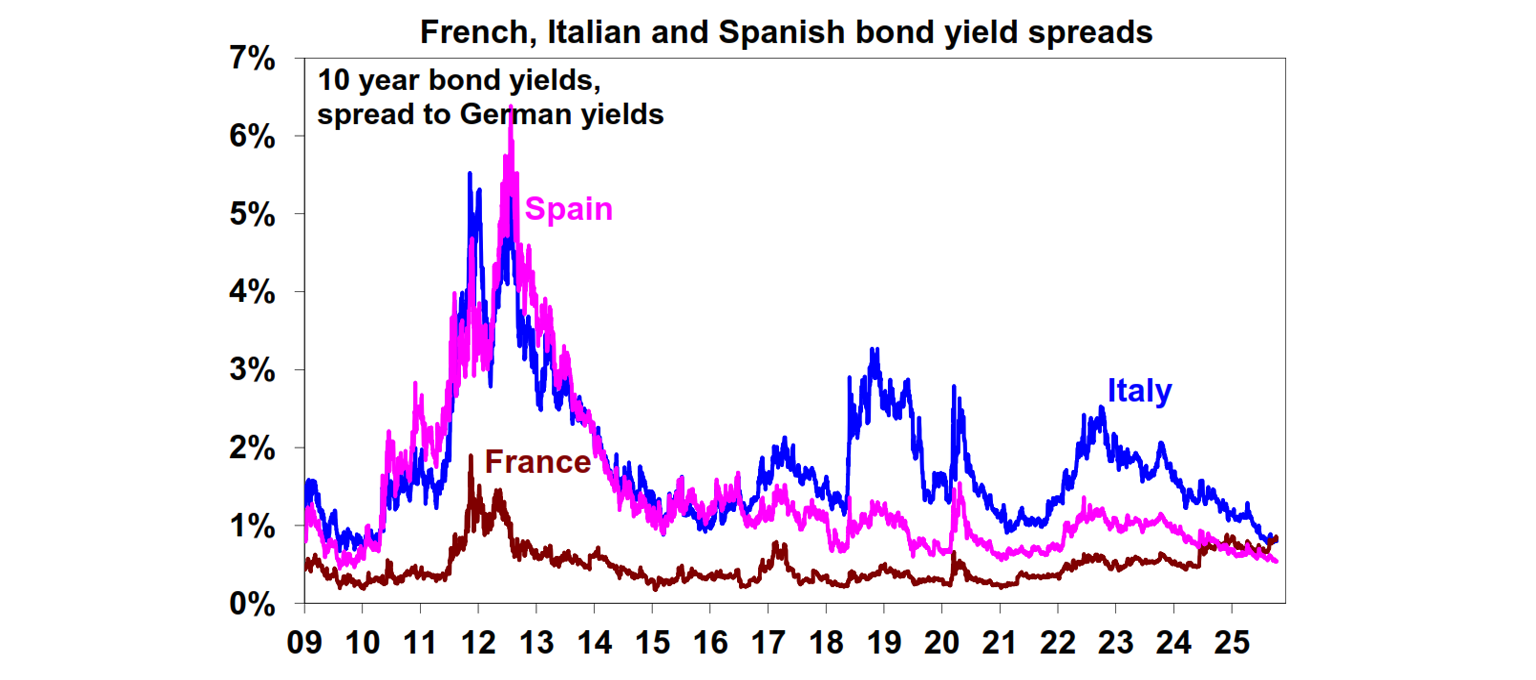

The problems around unsustainable public debt were highlighted again over the last week with the latest French PM resigning, reflecting ongoing problems in getting support for a contractionary budget. The basic issue is that the centrist parties in the French parliament do not have a majority and are struggling to get support from the extreme right and left to bring the budget deficit (which is around 5.7% of GDP) back under control. If President Macron calls another parliamentary election, it risks a further loss of support for his centrists, so he looks set to nominate a new PM with another attempt to muddle along. In the meantime, the spread between French and German 10-year bond yields are edging higher and are now higher than Italian and Spanish yield spreads. As it threatens French economic growth it biases the ECB towards more rate cuts.

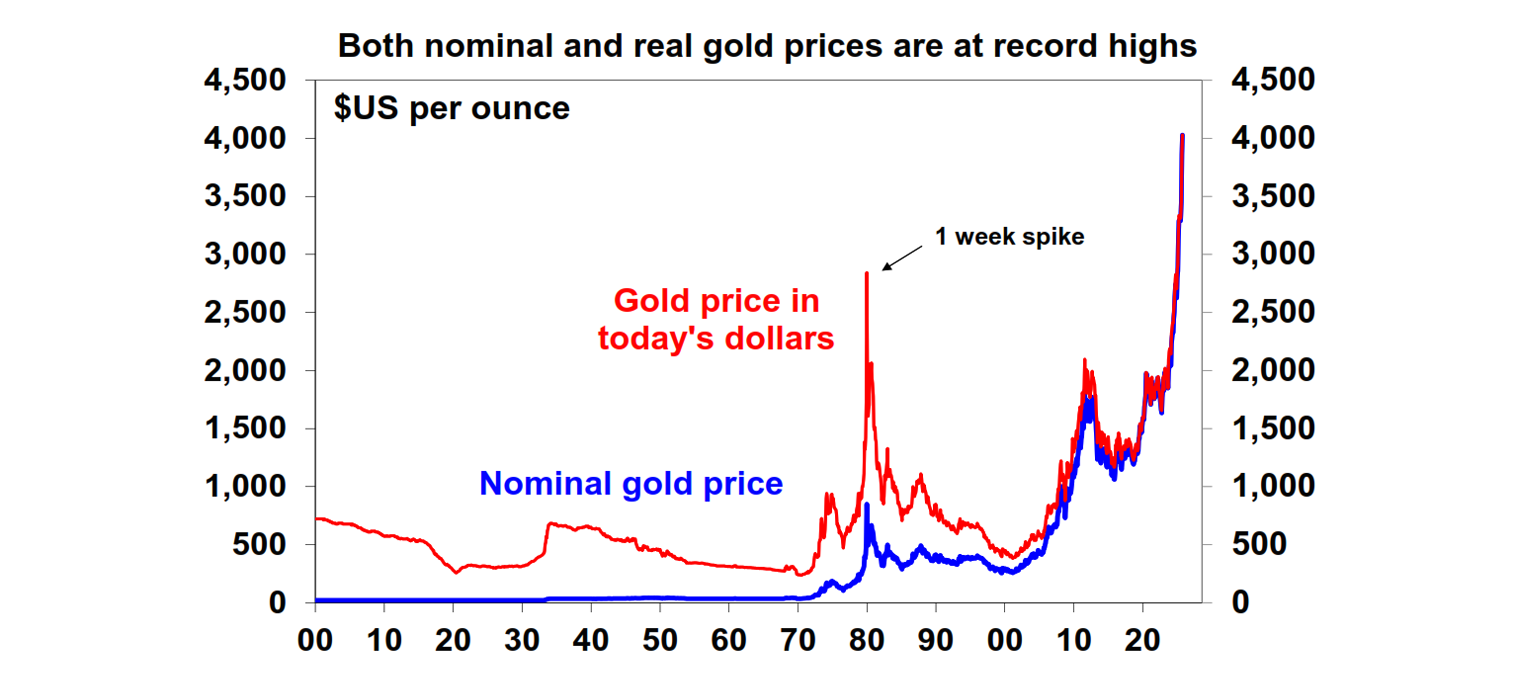

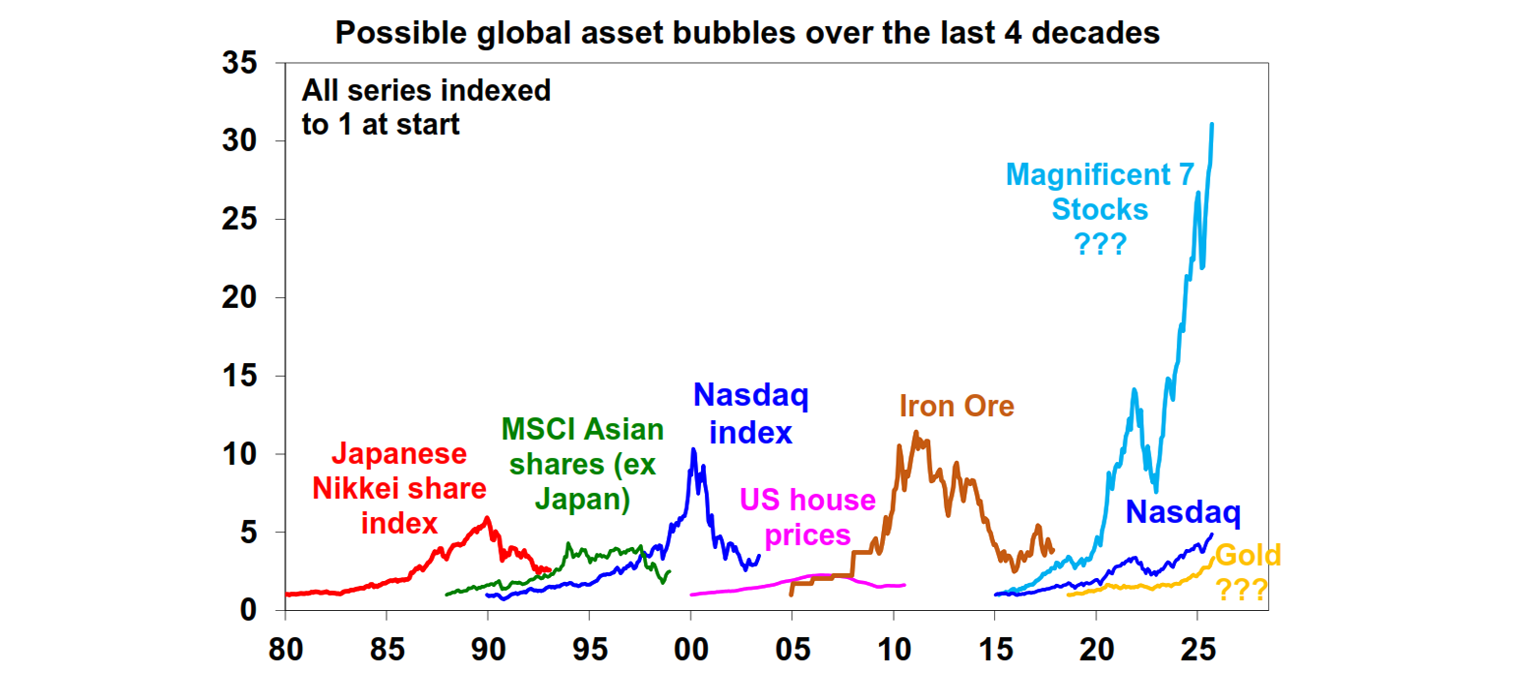

What’s driving the strength in gold and bitcoin? Both made new highs in the last week with gold rising above $US4000 an ounce, before pulling back a bit. Both are being driven by similar things: a downtrend in global interest rates; a downtrend in the $US; a desire for a hedge against governments seeking to inflate their way out of high public debt levels (ie debase their currencies); a desire for a hedge against geopolitical threats; in the case of gold central banks allocating more of their reserves to gold; and bitcoin gaining more institutional acceptance. But overlaying on both now is an element of momentum driven demand from ordinary investors who have a fear of missing out (FOMO) – a sign of this is the queue outside ABC Bullion in Sydney’s Martin Place. Our assessment is that the fundamental drivers could push both higher (see here regarding gold), but the increasingly speculative nature of the rally means it could be vulnerable to a short-term pullback. Investors also need to allow that both assets are very volatile. As can be seen in the next chart the gold price can go through long term swings up and down. In terms of the latter, from its high in 1980 around $US850 to its low in 1999 it fell around 70%, before then rising to nearly $2000 in 2011 and then fell around 45% into 2015.

But while the surge in the gold price may be in the process of becoming a bubble, so far it’s a bit of a non-event compared to past alleged bubbles suggesting it may have further to go. See the next chart.

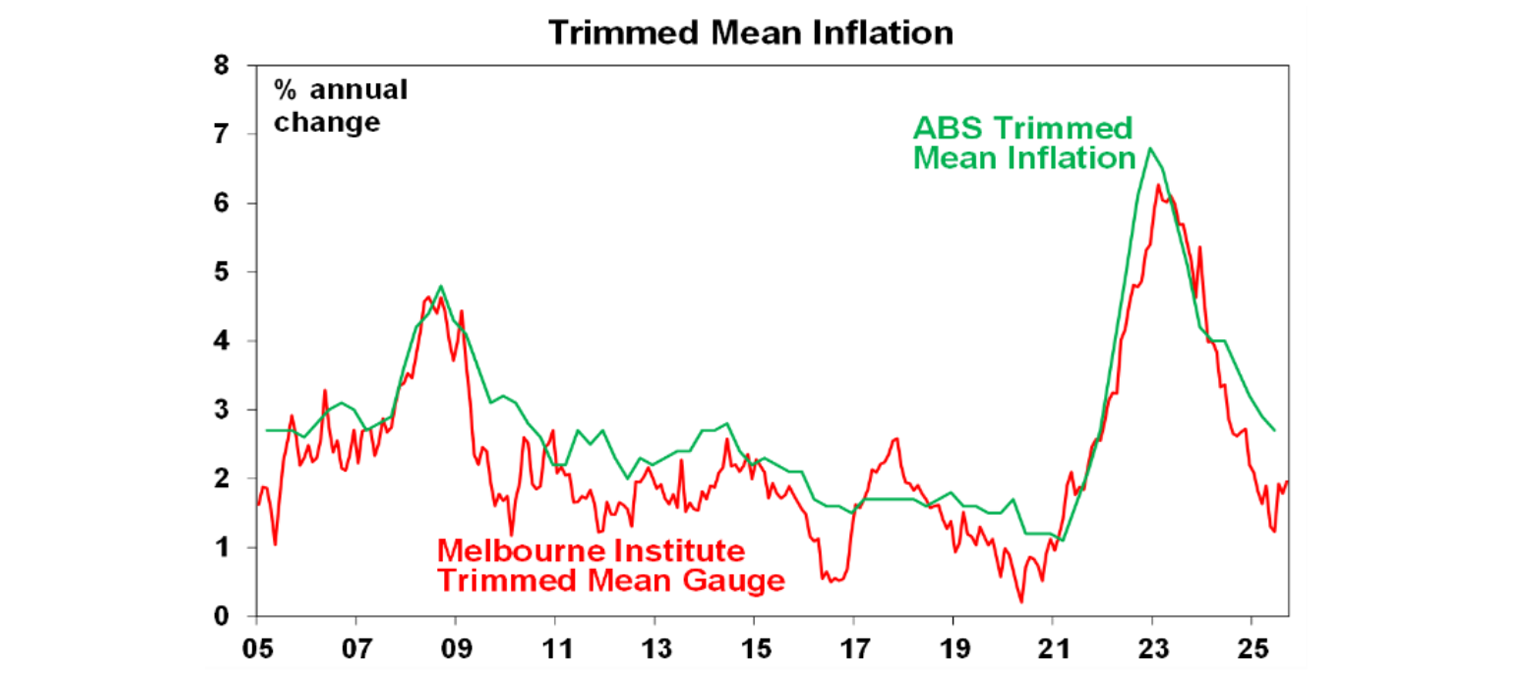

RBA Governor Bullock in Senate testimony reiterated the RBA Board’s cautious data dependent message regarding the cash rate outlook. Our assessment remains that economic and inflation data runs hot and cold and it would be wrong to read too much into the recent patch of somewhat hotter data including the higher than expected August CPI, the recovery is still likely to be subdued and inflation is still likely to head back to target so we continue to expect two more 0.25% cuts in November and February. However, November is a very close call dependent on September quarter trimmed mean inflation coming in around 2.6-27%yoy and there is a high risk we may be at or nearer the bottom on rates than we thought.

I like boppy, catchy music and The Life of a Showgirl is a big step up from Taylor Swift’s last four albums. It’s not as boppy as Lover but most the songs are really catchy. My favourite at present is Opalite.

Major global economic events and implications

It was a quiet week on the data front in the US, made quieter by the ongoing partial Federal government shutdown. While national jobless claims data has not been released due to that, UBS estimates based on state releases point to modest increases in the last two weeks which would still leave initial claims being relatively low but with a rising trend in continuing claims. Meanwhile, the minutes from the last Fed meeting provided no hawkish surprise, with the Fed cutting and prepared to cut by more – with two more cuts already flagged by year end - to manage risks around the softening US jobs market. Of course, if economic growth remains strong and tariff related inflation risks stay high, but the labour market starts to strengthen again then more rate cuts are less likely. So, jobs are the key for now.

In Japan, Senae Takaichi won the LDP leadership and is set to be Japan’s next PM – despite Komeito announcing it will leave the coalition with the LDP - favouring a mix of Abenomics and Thatcherism. In the near term this likely means easier fiscal policy and a delay in further BoJ rate hikes as it assesses things. However, big fiscal stimulus is unlikely given debt constraints and the BoJ is still likely to hike again by year end. Meanwhile, nominal wages growth of just 1.5%yoy in August leaves the BoJ in no hurry to hike just yet.

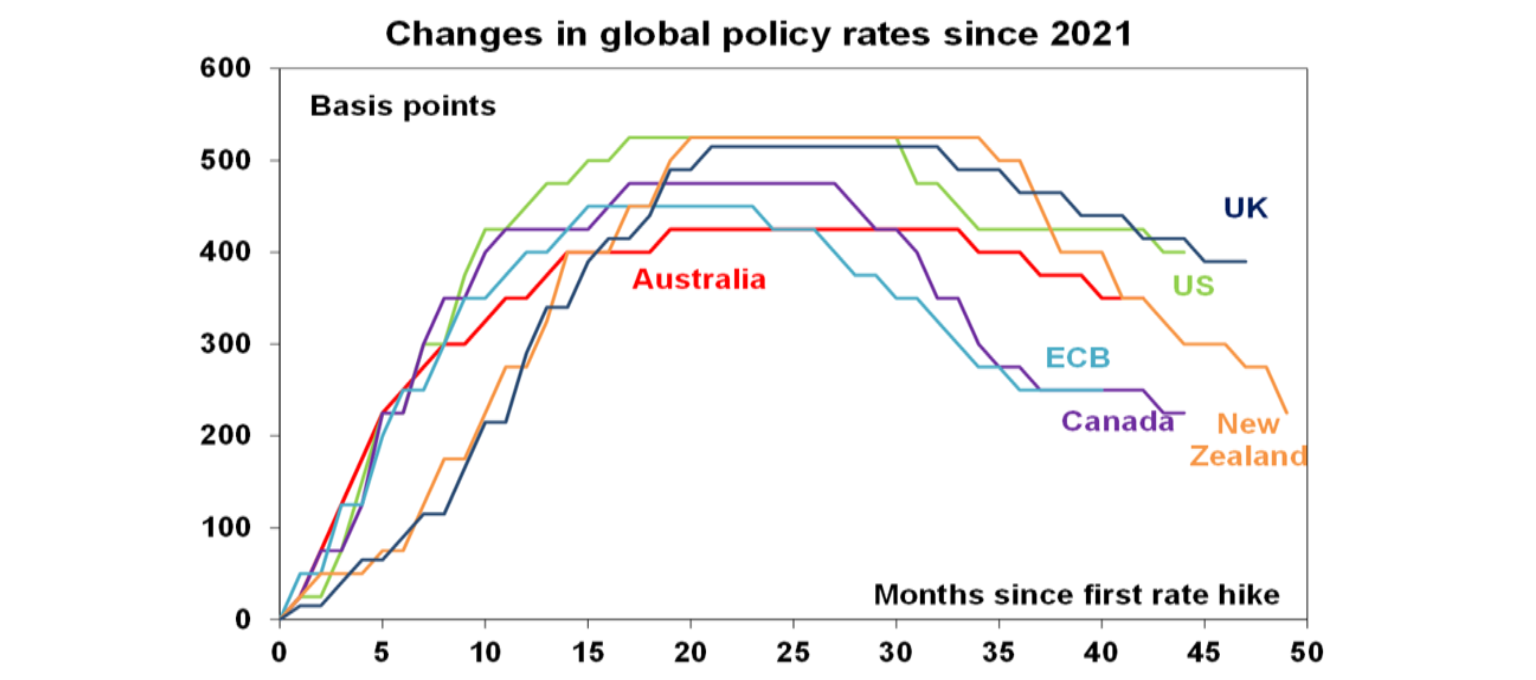

The Reserve Bank of New Zealand cut by 0.5% taking its cash rate to 2.5% reflecting concerns about prolonged spare capacity and to provide a boost spending. The read through to the RBA is minimal. With inflation in the target range, the economy flirting with recession and unemployment at 5.2% the RBNZ is clearly concerned and so wanted some shock value in moving by more than the consensus for a 0.25% cut. Its guidance was dovish with the money market allowing for one or two more cuts. While the RBNZ has been amongst the most aggressive in cutting rates this largely reflects it being amongst the most aggressive in tightening which it overdid. It will probably end up overdoing the easing too! By contrast the RBA was far more measured on the way up and so can be more measured on the way down.

Australian economic events and implications

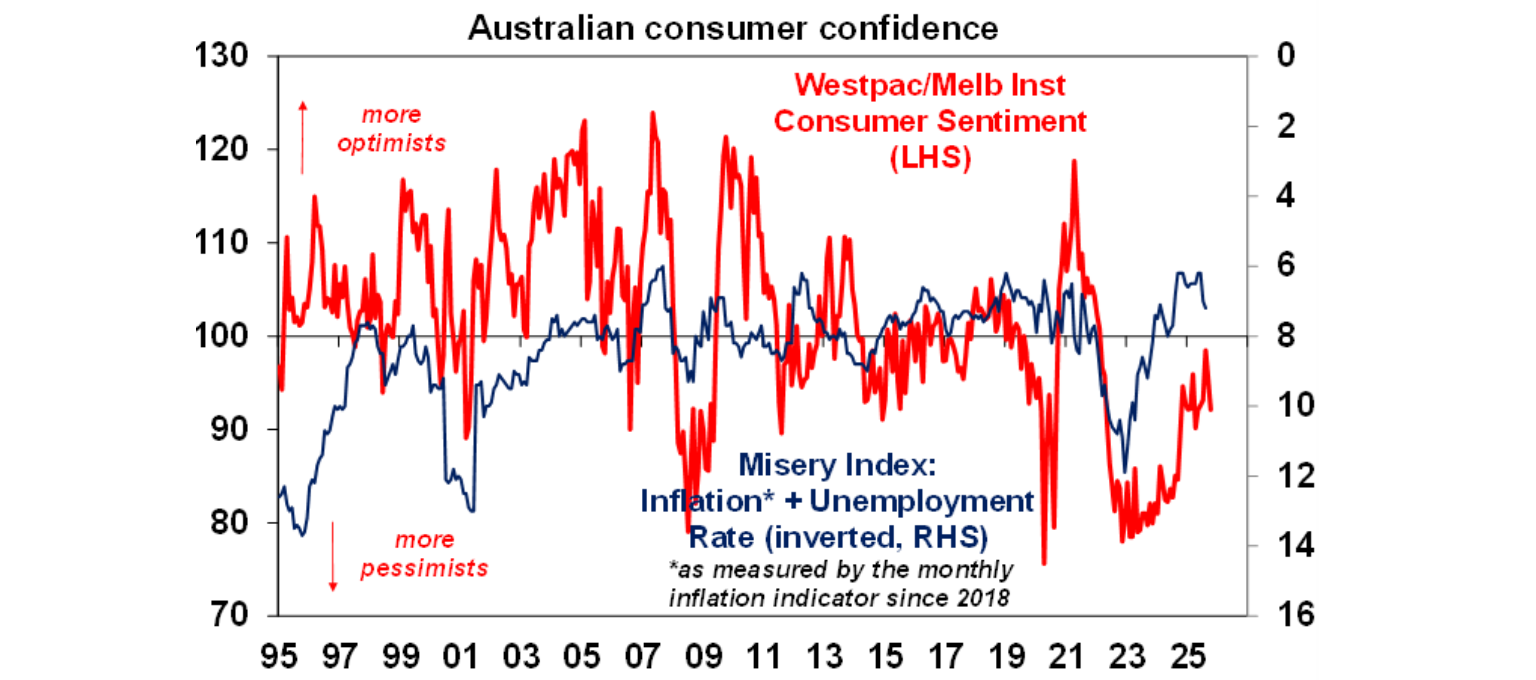

Consumer confidence dipped again in October following higher than expected inflation data and hawkish RBA commentary. Confidence is well up from its lows but it’s still subdued pointing to still constrained consumer spending.

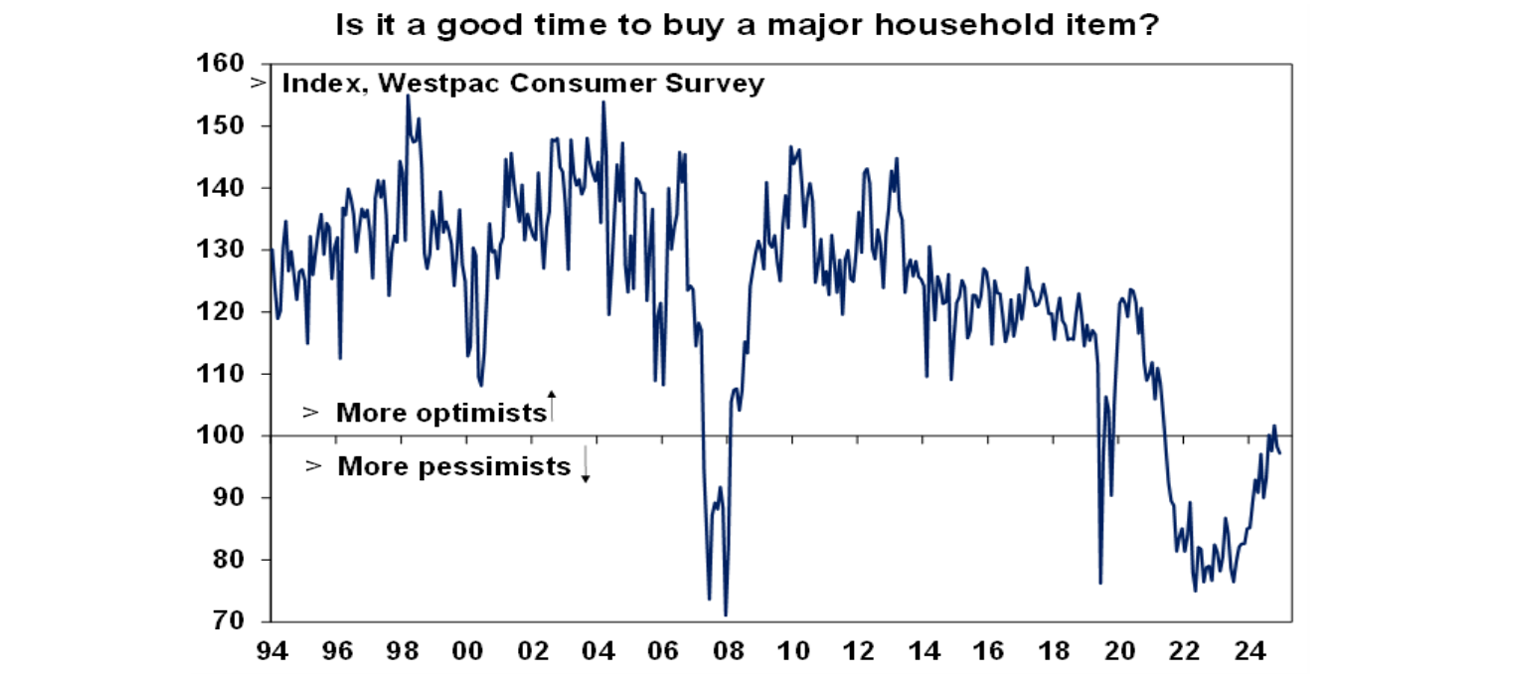

This is particularly evident when consumers are asked whether now is a good time to buy a major household item – it’s better than it was but still soft.

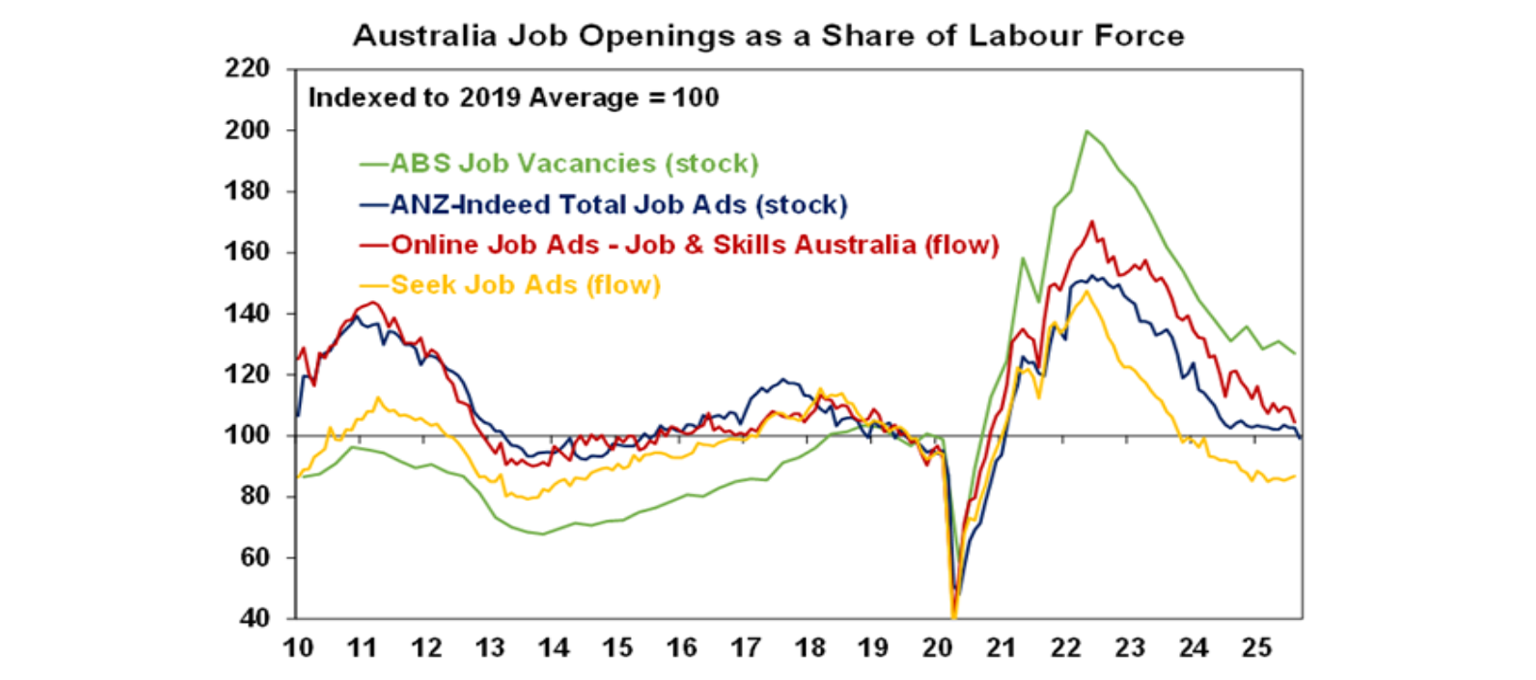

Partly justifying consumer caution, job ads in September as measured by the ANZ-Indeed index fell 3.3% & remain in a downtrend, warning of softer employment ahead.

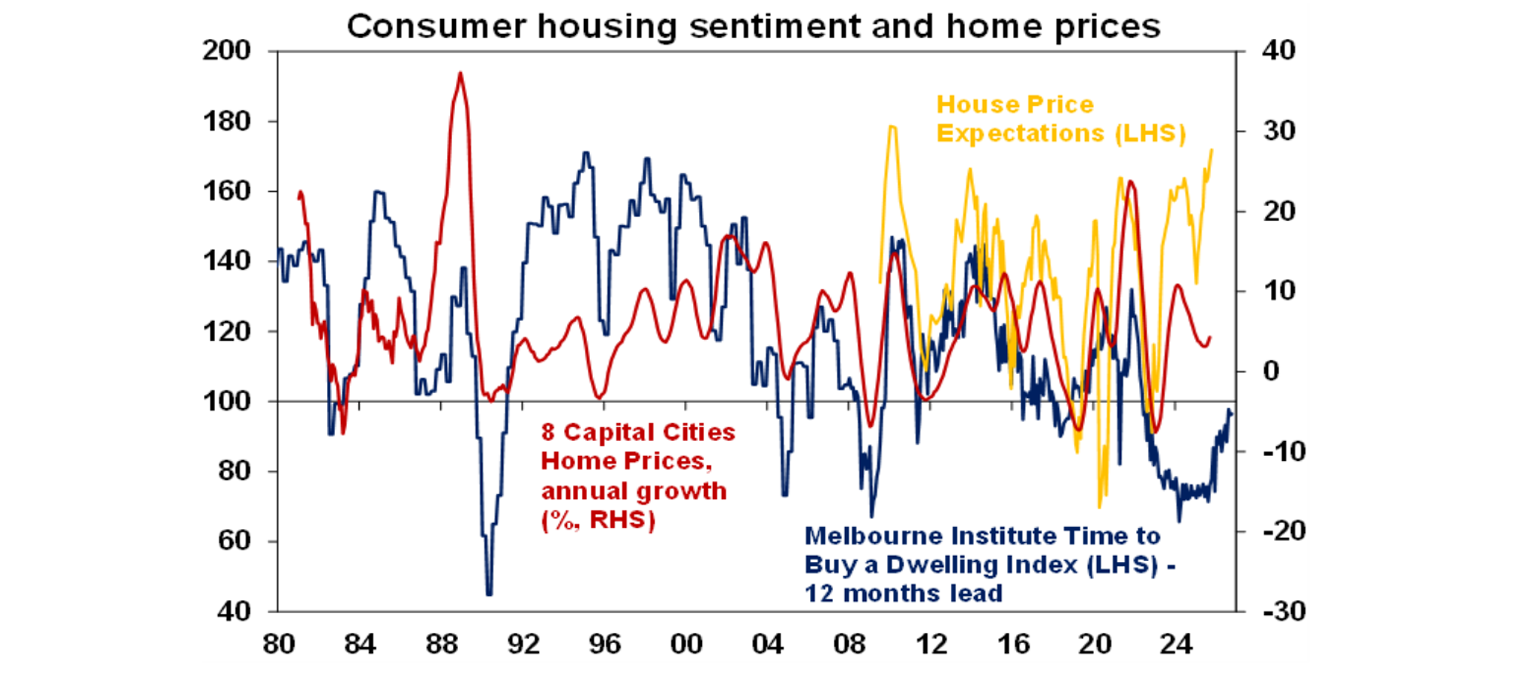

The consumer survey also showed a further rise in home price growth expectations. Perceptions as to whether now is a good time to buy a dwelling improved slightly but remain soft reflecting poor affordability.

The Melbourne Institute’s Inflation Gauge continues to point to lower underlying inflation. That said it does appear to exaggerate on the downside compared to the ABS trimmed mean and it appears to have stopped falling.

What to watch over the week ahead?

In the US uncertainty remains around the timing of official data releases given the partial government shutdown. Normally the focus would be on September CPI data (which was due Wednesday) which is expected to show monthly CPI inflation of 0.4%mom taking the annual rate to 3.1%yoy and core inflation unchanged at 0.3%mom or 3.1%yoy. But the Bureau of Labor Studies has indicated this will be released on 24th October. In other data also subject to release uncertainty, September retail sales (Thursday) are likely to show a solid underlying rise of 0.3%mom but industrial production is likely to be flat and housing starts are likely to rise slightly after a sharp fall in August (both Friday). If the shutdown ends soon, delayed jobs data for September is likely to show a 40,000 rise in jobs and unemployment remaining at 4.3%. October manufacturing indexes for the New York and Philadelphia regions are likely to show softish conditions as will the NAHB home builder conditions index. The September quarter earnings reporting season will also start to get underway. GDP growth looks to have been solid in the quarter pointing to good earnings growth. The market consensus is for a 7.7%yoy rise in earnings per share but based on past beats is likely to end up around +11.5%yoy with growth led by tech stocks. GDP growth looks to have been solid in the quarter pointing to good earnings growth.

Chinese trade data (Monday) is likely to show a bit of an improvement in export growth but ongoing soft import growth with consumer and producer prices remaining in deflation (Wednesday).

In Australia, the focus will be on jobs data for September (Thursday) which are likely to show a 20,000 gain in employment with unemployment rising to 4.3%. The NAB business survey will also be released on Tuesday. The minutes from the last RBA meeting (Tuesday) and public appearances by RBA Governor Bullock and Assistant Governor Hunter are likely to reiterate the RBA’s cautious and data dependent message regarding rates.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield as central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices are in an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may be breaking higher now with the Fed looking like it will cut more than the RBA.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may be breaking higher now with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.