Key points

The gold price has surged to record highs. Key drivers have been central banks increasing their gold reserves, rate cuts, a renewed downtrend in the $US and demand for a hedge against public debt worries and geopolitical threats.

While gold is short-term overbought, implying the risk of a short-term correction, more upside is likely over the medium-term as a hedge against a falling $US, public debt and geopolitical worries.

There is a case for gold in investment portfolios, but its speculative nature suggests only a modest exposure and over the very long-term shares have done better than gold.

Introduction

Since the start of last year gold has made a succession of record highs. But what’s driving it? Is it a forewarning of more high inflation, or something more serious? Is gold something investors should have in their portfolios?

Why the historical fascination with gold

Gold has long been a source of fascination. The interest in gold dates back thousands of years to when advances in farming led to surplus food, and eventually the growth of prosperous civilisations. Around this time gold became valued as a medium of exchange, as a store of value, and as a display of power and status. Over the centuries it has acquired a status beyond its now trivial industrial use because it is attractive, malleable, ductile, resistant to corrosion, a conductor of heat and electricity, fungible, scarce and dense. This range of properties has helped drive demand for it as jewellery, as money (i.e. a medium of exchange) and as a store of value. Some see it as the only truly safe way to store wealth as it is highly liquid, portable, accepted globally and lacks any credit or counterparty risk. Further, some see the decision to break the link between gold and paper currencies (starting with the $US in 1971) as being the undoing of the global economic system. Others though see it as “barbarous relic” with no real value beyond its beauty and use in jewellery.

A long-term perspective

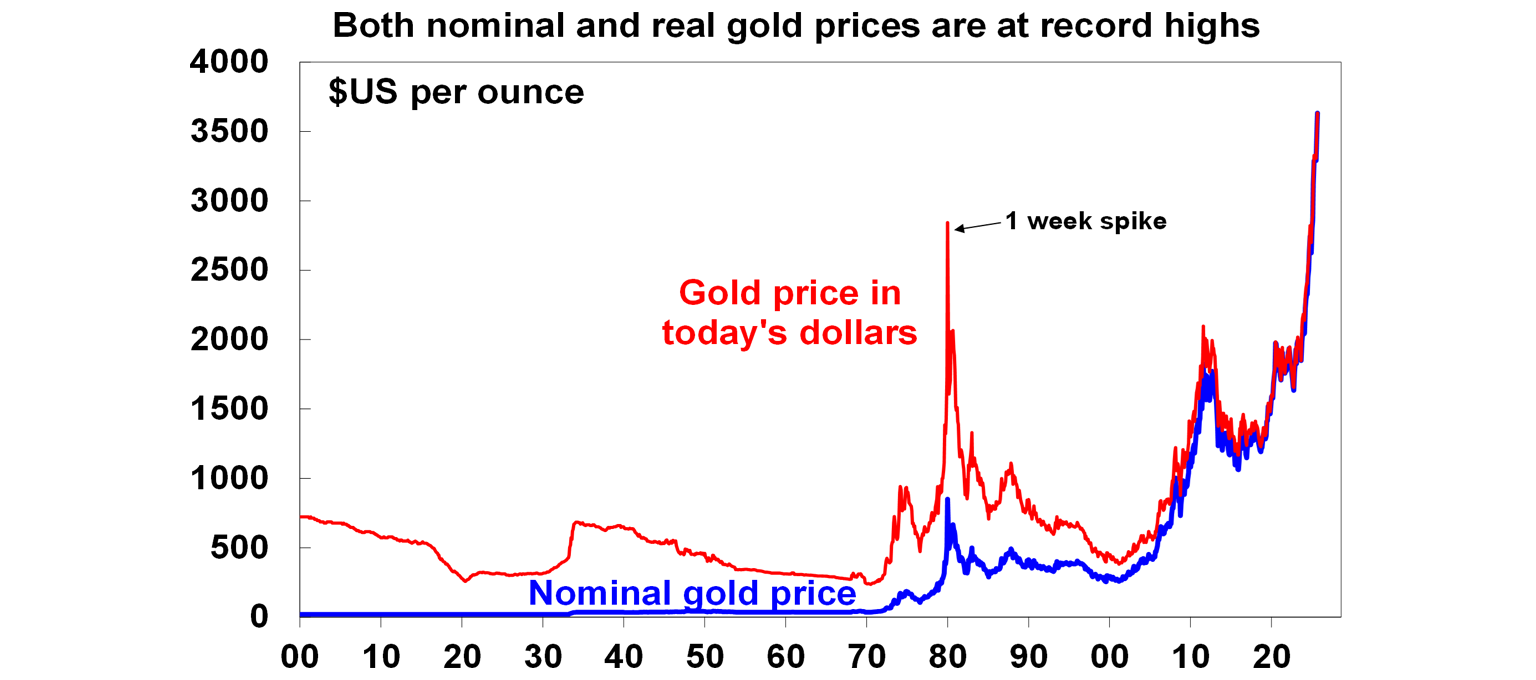

The next chart shows the price of gold since 1900 both in nominal and real terms. Until the early 1970s, the US dollar was fixed against gold. This was subject to periodic devaluations, such as in 1934. After the US ended the link from the US dollar to gold in 1971 until 1980 gold was in a secular upswing as investors turned to gold for protection against inflation. However, from 1980 till around 2000 gold was in a secular downtrend as inflation was brought under control. The 2000s saw gold enter another secular upswing in line with other commodities. This then paused before resuming from around 2020 taking the gold price to new record highs both in nominal and real terms. It is now well above its 1980 high in today’s dollars of $US2484.

What’s driving the gold price higher?

A range of factors have been pushing gold prices up recently:

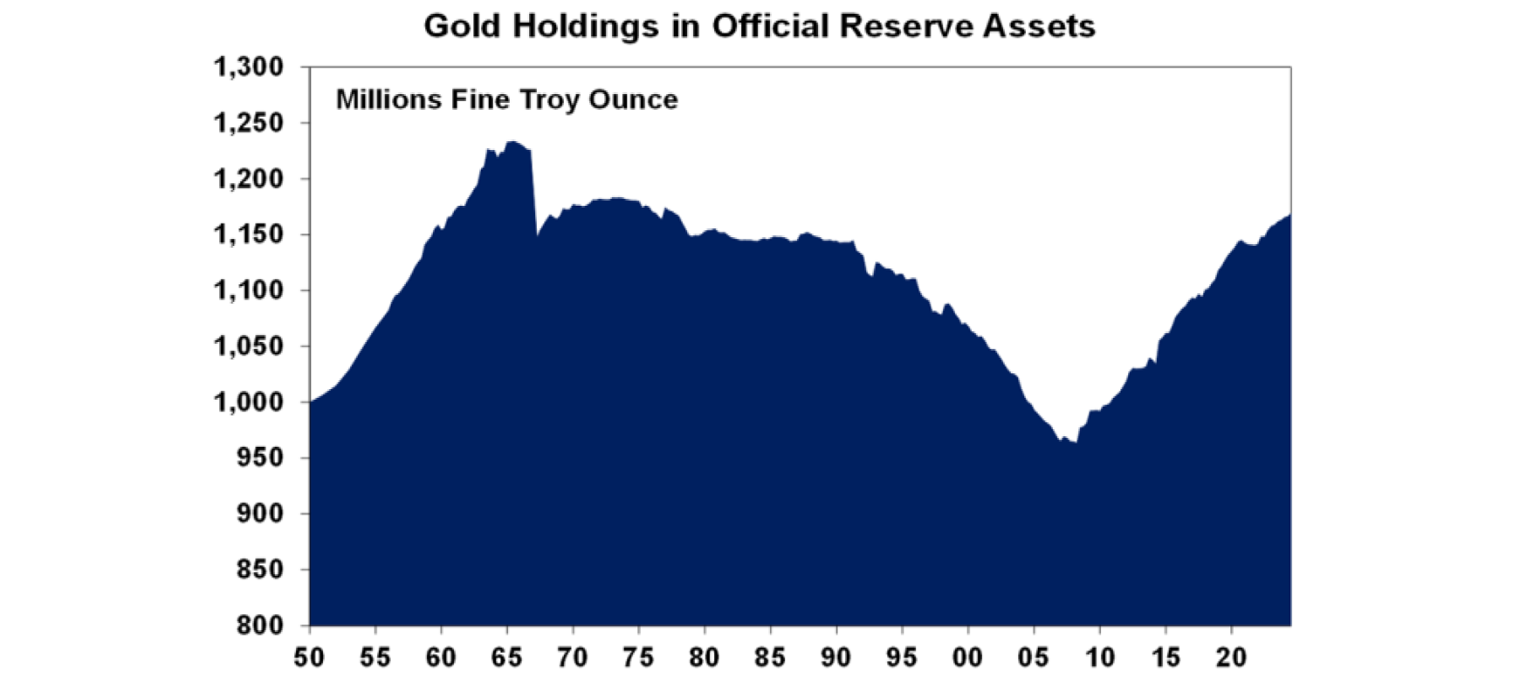

First, after slumping into the 2000s central bank gold holdings have been rising. This has accelerated for emerging central banks since the Ukraine War as some are seeking to diversify away from the $US.

Second, central bank rate cuts since 2023 are lowering the opportunity cost of holding gold. Expectations for a resumption of Fed rate cuts are adding to this. Low interest rates mean the missed income from holding a non-income producing asset like gold is low.

Third, the resumption of the downtrend in the $US in place since 2022 has also helped boost the gold price as gold is priced in $US.

Fourth, gold is also seen as a hedge against geopolitical tensions which have been on the rise given the relative decline of the US and the rise of China and various regional powers, increasing political polarisation and rising signs of authoritarian leadership.

Fifth, some may have been buying gold as a hedge against another wave of inflation.

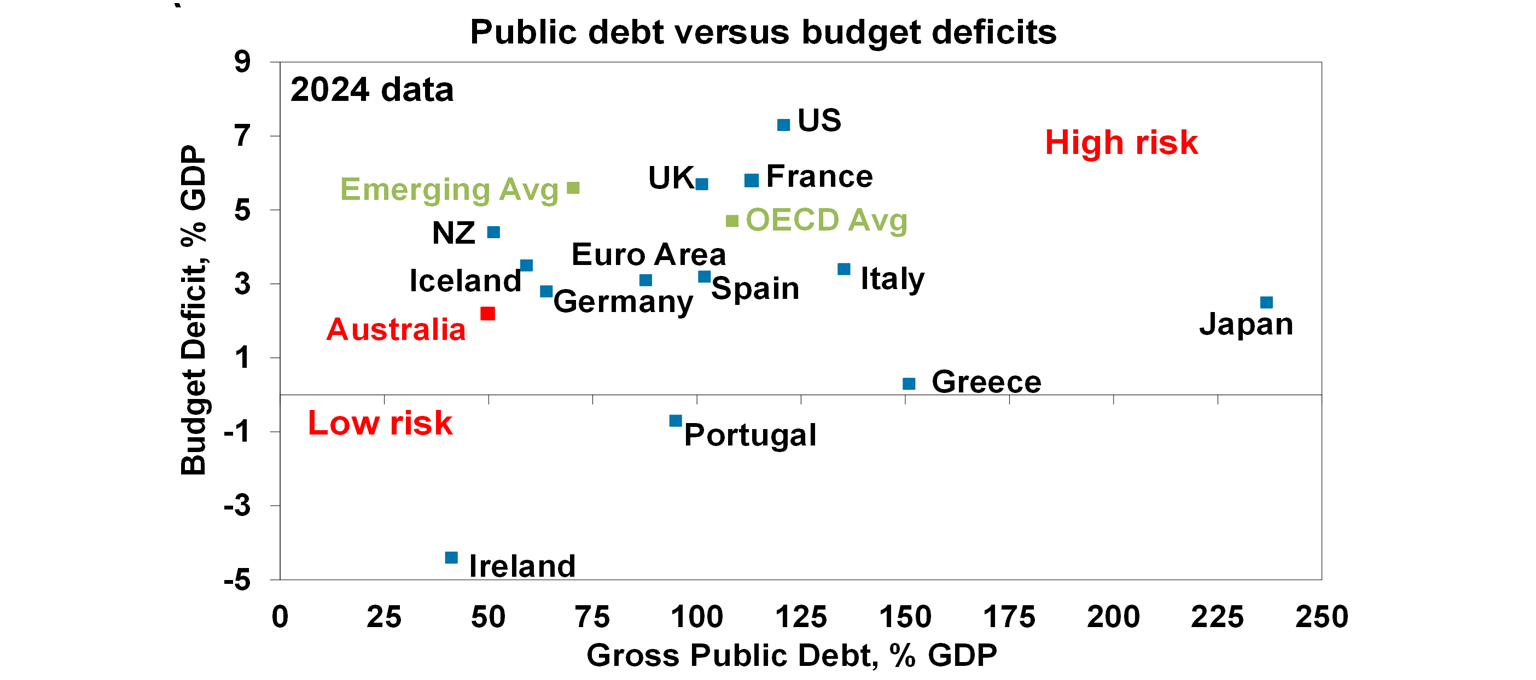

Finally, gold demand is up as a hedge against governments seeking to boost inflation and hence lower the real value of their currencies to ease public debt burdens. Concerns have been rising given unsustainable budget deficits & debt levels in the US, the UK, Japan, and France where its credit rating was cut to A+ (Australia is AAA).

Can it continue?

In the near term, the risk of a correction in the gold price is high. After rising 40% year to date to $US3680 an ounce, gold is technically overbought and due for a pullback.

Secondly, it’s not clear that inflation is about to take off with Trump’s tariffs threatening to dampen global trade & growth and public debt worries often flare up only to settle down given the huge level of institutional demand for government bonds in developed countries. So, some of the things gold is sought to protect against may not happen.

Thirdly, even if there is a new financial crisis (say around excessive public debt), crises have often seen the gold price fall as investors are forced to sell their liquid assets to cover losses elsewhere – as occurred initially in the GFC with the gold price falling 29% between its high in March 2008 to its low in November that year. (Shares fell more though in the GFC.)

However, the medium-term picture remains positive for gold. Global interest rates look set to fall further keeping the opportunity cost of holding gold down. The US dollar is likely to fall further. Deglobalisation, bigger more interventionist government (particularly under Trump) and the falling ratio of workers to retirees makes the world more inflation prone than it used to be. At some point there is a risk of a more severe public debt crisis, and geopolitical tensions are on the rise – albeit timing either will be hard. So, demand for gold is likely to remain strong.

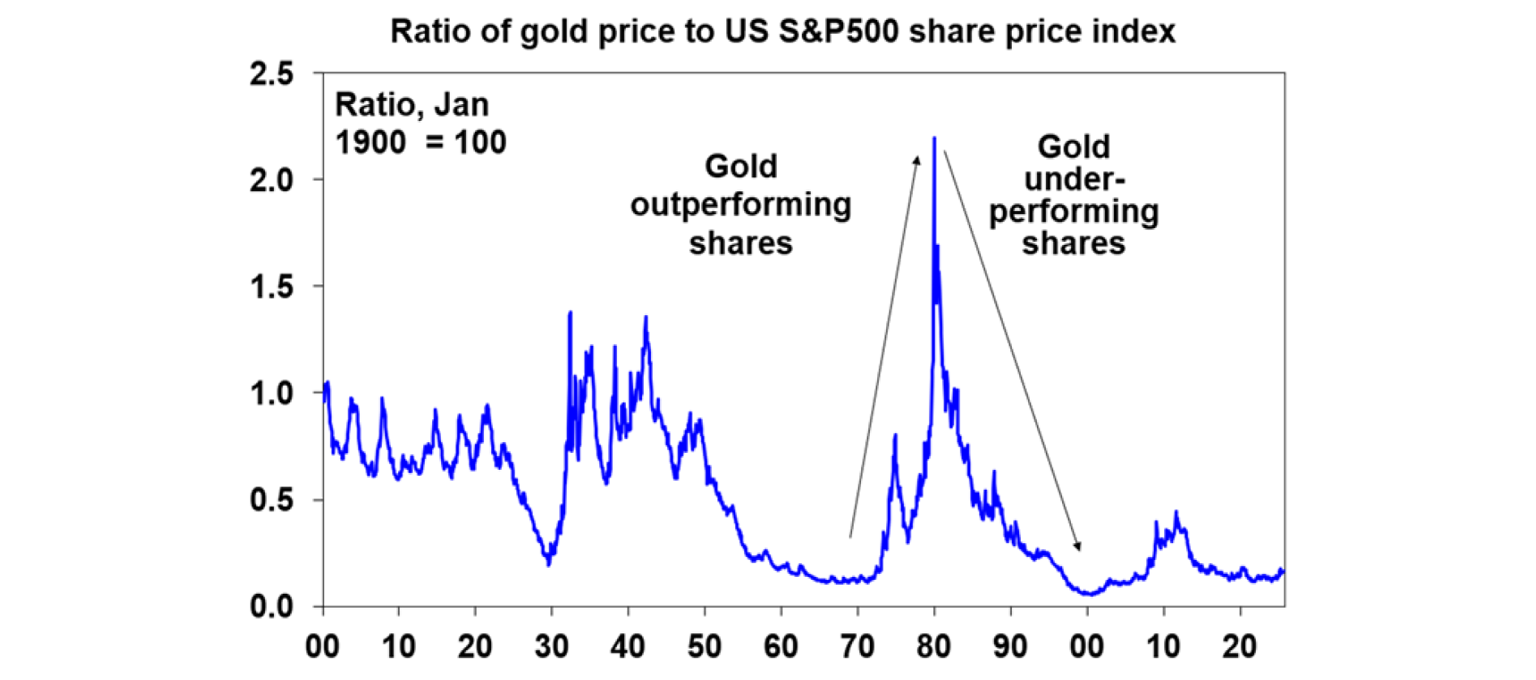

The next chart shows the relative performance of gold versus the US S&P 500. Gold outperformed shares in the depression, underperformed in the post war years, outperformed in the high inflation 1970s and underperformed during the equity bull market of the 1980s and 1990s. Gold is only now just starting to perk up. So, on the basis of this chart, the outperformance of gold versus shares may have further to go. It’s worth noting though from this chart that over the very long-term shares have done better than gold, particularly if dividends are allowed for.

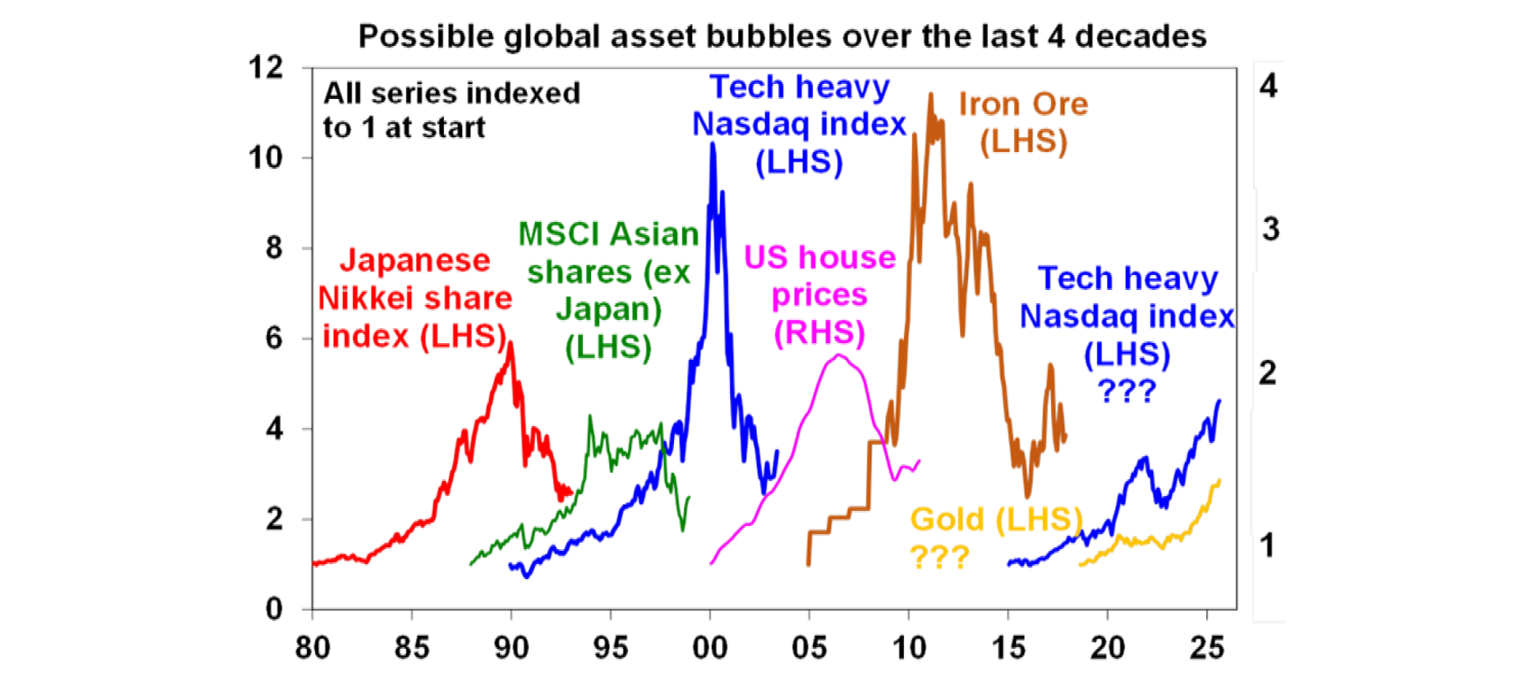

Of course, gold may be in the process of becoming another bubble. Assessing whether this is the case is not easy and compared to past major bubbles over the last 4 decades so far it looks pretty modest.

Investing in gold

There are numerous ways to get exposure to gold, all with pros & cons:

Physical gold – gives pure exposure but it’s costly to store.

Gold futures – no storage problem, easy to leverage and trade but need to roll futures contracts over as they expire.

Gold ETFs – these are highly liquid but do involve counterparty risk.

Gold shares – these reflect the movement in gold prices but are also affected by the performance of the individual companies.

Gold funds are offered by fund managers that provide an exposure to gold – these may reflect a combination of the above.

Gold accounts/digital gold – convenience but counterparty risk.

It’s worth stressing that gold is highly speculative. It’s not grounded by an income stream like most shares, property, bonds and cash. Virtually all the gold ever produced still exists and can potentially come back on to the market. At the same time, actual production and demand for jewellery and industrial use is trivial. This means that “animal spirits” can play a huge role in the driving the gold price. This can make for a volatile ride and history has shown that just as the gold price goes has long term upswings, it also has long downswings. And over the long-term shares have done better than gold. Overall we think there is a role for gold in investors’ portfolios as a hedge against major currency weakness and financial turmoil, but it should be limited to maybe no more than 5% (depending on an investor’s circumstances). Most diversified investors would have some exposure via gold miner shares.

What about Bitcoin (digital gold)?

Bitcoin is a whole extra issue, but it appears to be carving out a role for itself as a form of “digital gold”. Apart from not having the fall back of jewellery demand and not being able to see and touch, Bitcoin has many of the characteristics of gold – notably limited supply and independence of government making it gold-like as a store of value against debasement of paper currencies. And so many of the factors driving gold are likely also impacting Bitcoin (it’s also hit a record recently). Gold has proven itself historically and is tangible, whereas Bitcoin has a shorter track record (it’s had exceptional returns since 2009 but it’s like a startup) and is more volatile but is arguably scarcer than gold, more easily portable and infinitely divisible. Bitcoin could have more upside over time as younger digital savvy buyers are attracted to it, reducing some of the demand for gold. So, there is arguably a role for it too, but investors need to weigh up the characteristics of each and allow for Bitcoin’s greater volatility.

Concluding comment

Gold is vulnerable to a correction, but the trend is likely to remain up as global interest rates fall and scepticism about paper currencies remains.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP

You may also like

-

How women can build financial wealth, confidence and security Practical tips for women to grow their wealth. Learn about budgeting, saving, super advice and more to take control of your finances. -

Oliver’s Insights – Oliver's Insights - Gulf War-3 US/Iran war Geopolitical shocks have been a rising feature this year with US “interventions” in various countries – Nigeria, Venezuela, Greenland and now Iran. -

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again.

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.