It has been a weak start to November, a supposedly seasonally strong month for global shares. Over the week, US shares have fallen 1.6%, with consumer discretionary stocks leading the losses, driven by weakening labour market data. Tech stocks also fell – the Nasdaq Composite dropped 3.0% over continued concerns of elevated valuation. Other markets have followed the lead with Japanese shares down 2.0%, Eurozone shares down 1.7%, Australian markets down 1.3%; and the exception was Chinese shares which returned 0.8% over the week.

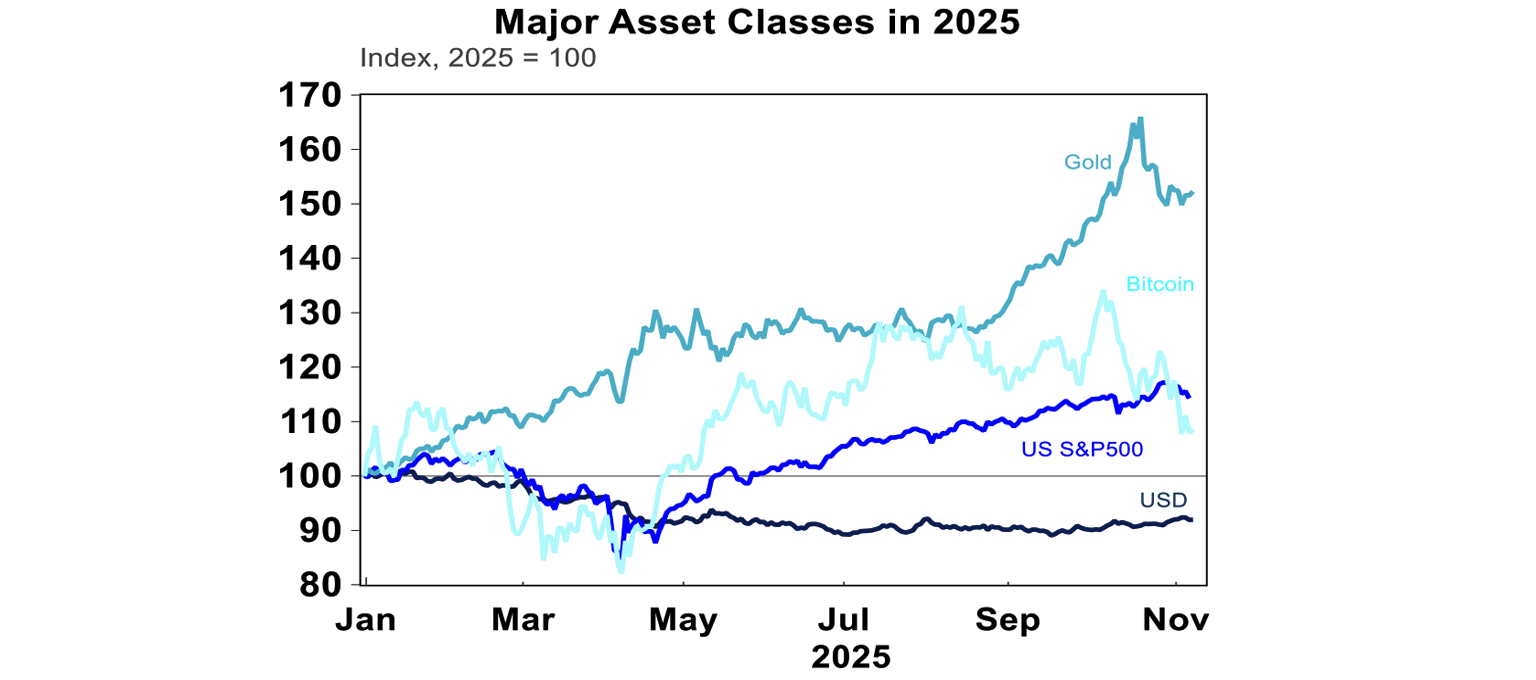

The risk off mood was also evident with Bitcoin falling 6% over the week to around US$103k, a level last seen back in June, while gold remained rangebound around $4000/oz (8% down from the peak but roughly flat versus a month ago).

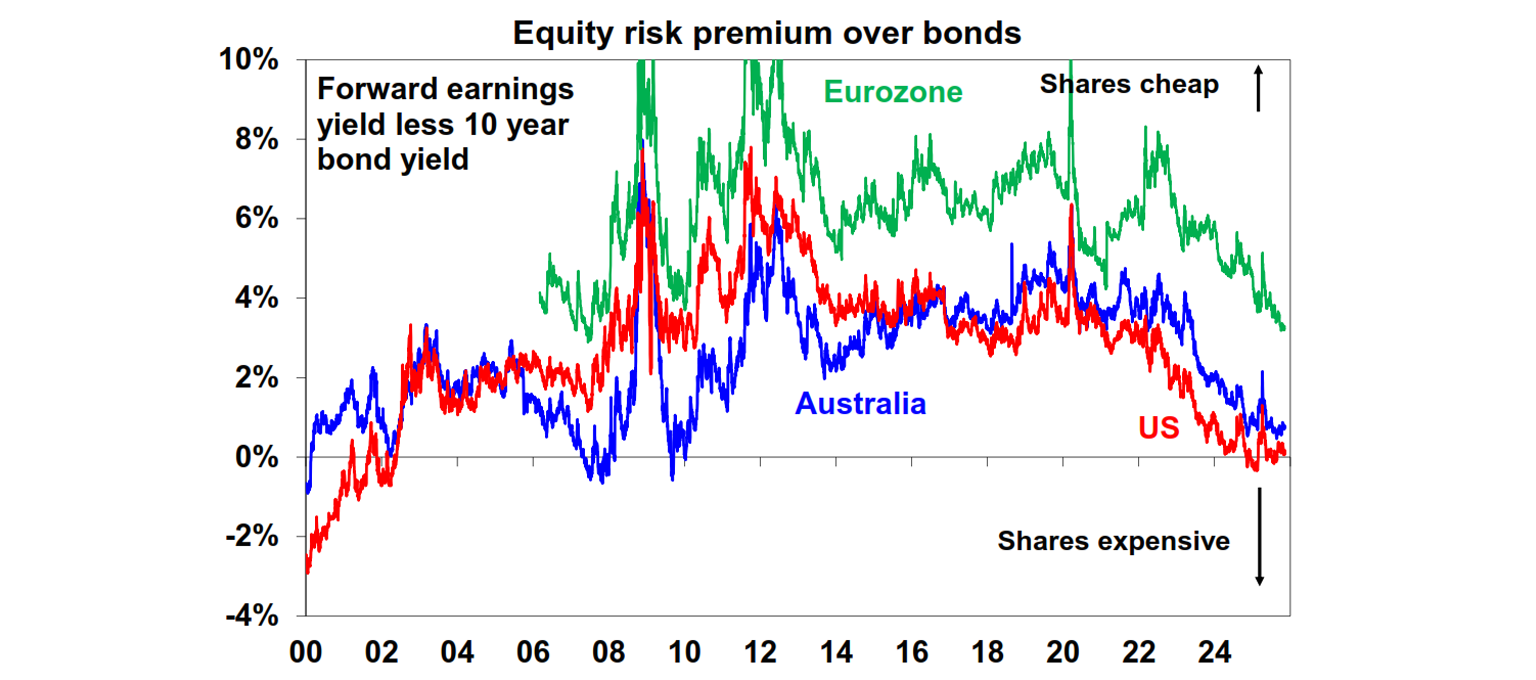

Valuation concerns were voiced by several Wall Street CEOs at the Global Financial Leaders Investment Summit in Hong Kong on Tuesday. This is nothing new: equity risk premium in the US market has been hovering around zero since late 2024, as shares kept rallying higher and bond yields continued to hover above 4%. This week, 10y yields are still at 4.08% after climbing from the October lows of 3.94%; and Australian yields have followed a similar pattern, ending the week at 4.32%. But note that valuation tends to be unreliable at timing markets. In addition, there could be some downward pressures to yields in the near-term driven by an easing in financial conditions, as the Fed continues to cut rates and ends quantitative tightening. All else equal, lower yields would improve equity risk premium.

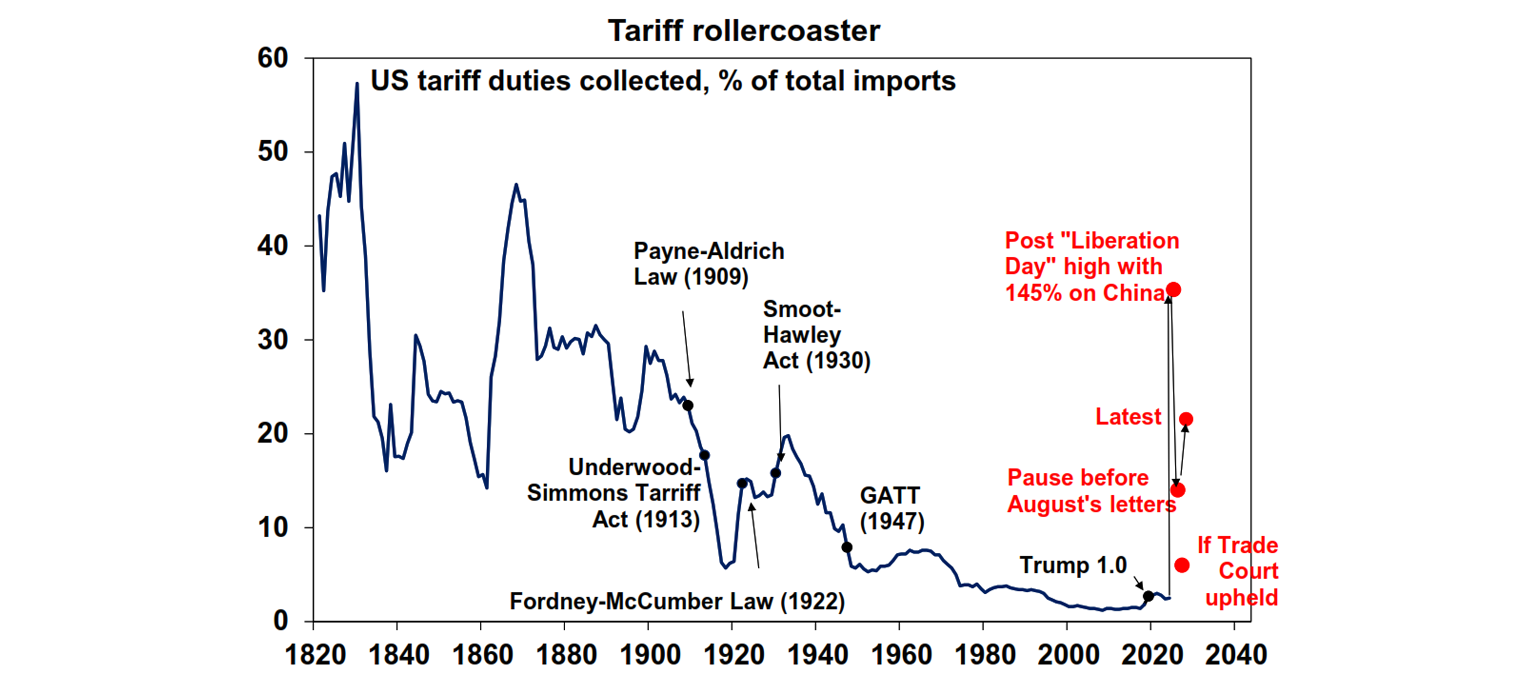

Trump’s tariffs are now in the hands of the US Supreme Court, who debated whether the President’s use of the International Emergency Economic Powers Act (IEEPA) to impose reciprocal & fentanyl tariffs this year could be upheld. In the most basic sense, does IEEPA authorise Trump to impose tariffs anytime he likes and as high as he wants, without approval from Congress? If the court rules these reciprocal tariffs illegal, the average tariff rates would fall back to below 10% rather than the current 21% and companies would get about $165bn of custom duties back! But there are other avenues for Trump’s tariffs policy to be enacted, such as Section 232 to set steel & aluminium tariffs, or Section 301 to address discriminatory business practices with China’s technology companies. But these other options either require a proper Federal investigation or has a limit on duration or tariff rates, so they can’t be introduced as abruptly and freely as we have seen with Liberation Day’s tables or August’s tariff letters. In the meantime, tariffs are still partially being passed on to consumers, with estimates that the annual CPI inflation rate would have been about 2.2%yoy or 0.7 percentage point lower without tariffs, rather than the current 2.9%.

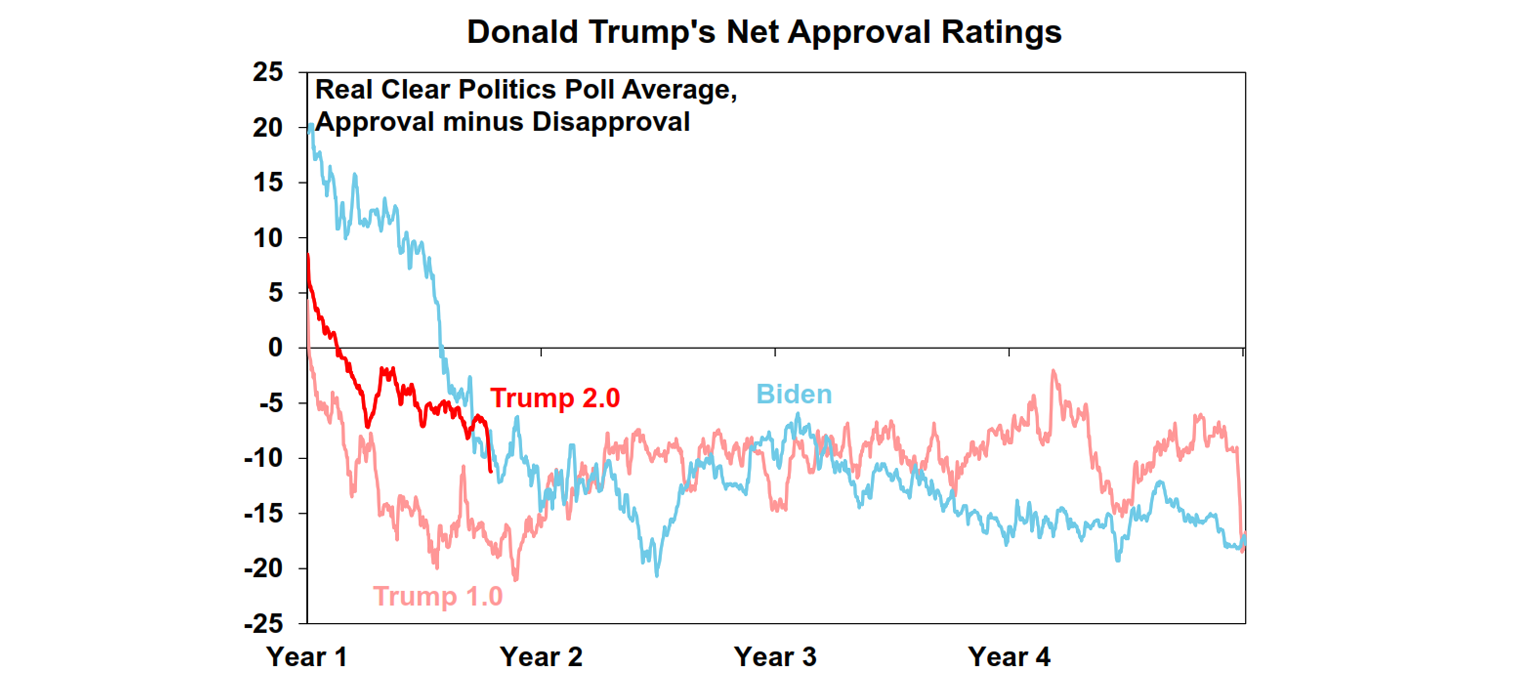

The US government shutdown has reached its 37th day, marking the longest shutdown in the nation's history. Political analysts largely agree that there will be a resolution before the Thanksgiving holiday (27 November); given that many critical federal employees have been working without pay and food stamp benefits for November haven’t been paid out, raising political stakes for both parties. Even Trump himself acknowledged that Americans blame the Republicans for the shutdown and thus delivered gains for the Democrats in several swing states in this week’s State elections. On a related note, Trump’s approval ratings have dropped off in recent weeks, similar to Biden’s ratings at this time (but remember that Biden didn’t get re-elected, so it was a low baseline for comparison).

The blue swing arguably lowered the needs for Democratic Senators to compromise with the Republicans to reopen the Government for now. But ultimately, the encouraging results for the Democrats also showed that political pressures and popularity still matter a lot, especially as the midterms of 2026 inch closer. As a result, we continue to see the Trump administration focus more on containing inflation (rather than just raising tariffs) and delivering more market friendly policies in the next year.

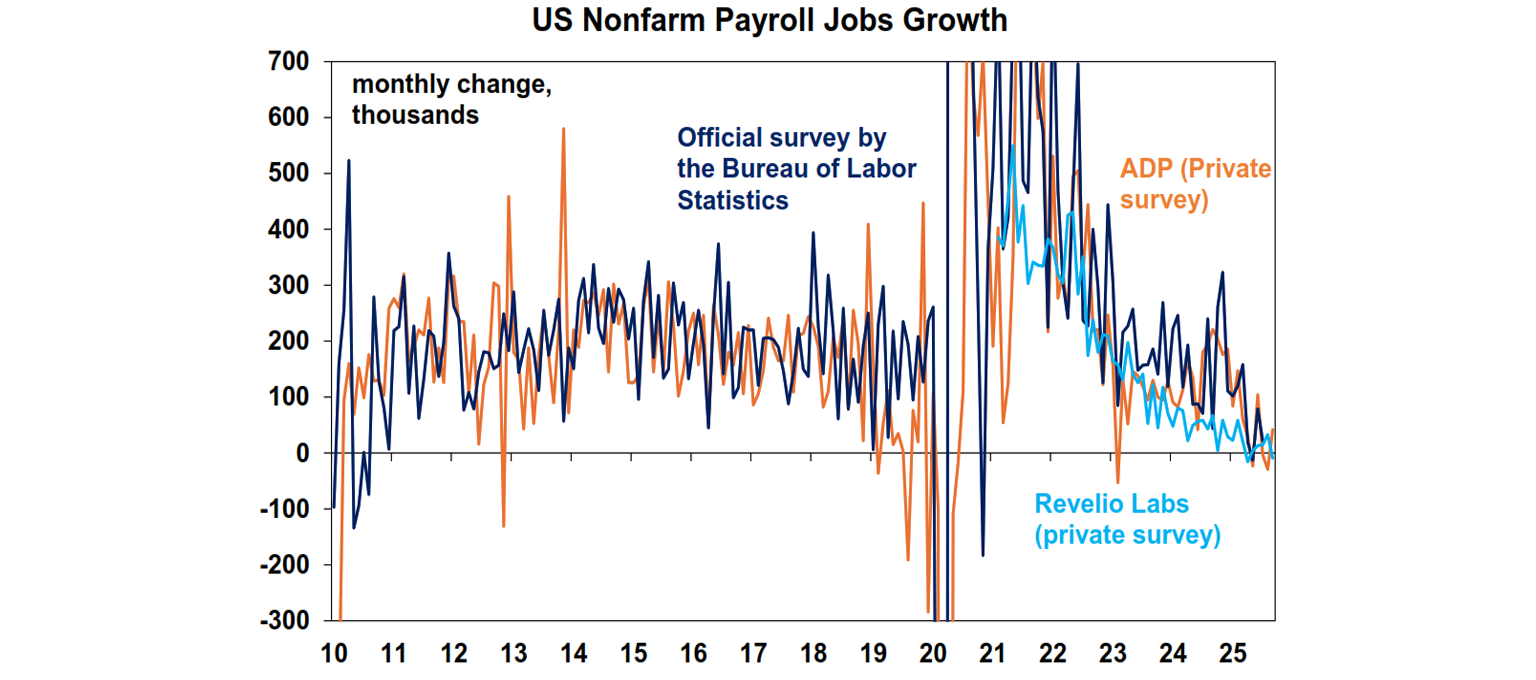

While official data is suspended, markets have relied on alternative private surveys, which showed clear evidence of the US labour market slowing, albeit not collapsing. This week, the ADP Payrolls for October showed a small rebound of 42,000 jobs after two negative prints in the prior months and pointed to ongoing softness in jobs creation. Meanwhile, monthly Challenger Gray’s layoff announcements rose to 153,000, the highest monthly tally outside of March this year and during Covid lockdowns, but this report is quite volatile and likely includes expected government job losses during the shutdown. Overall, the Chicago Fed’s Labour Market Indicators estimated that the unemployment rate remained steady at 4.36% in October, roughly unchanged versus last month. While the labour market is certainly not roaring, it is still not weak enough to guarantee a Fed cut in the December meeting, a sentiment shared by Fed officials in various speeches this week.

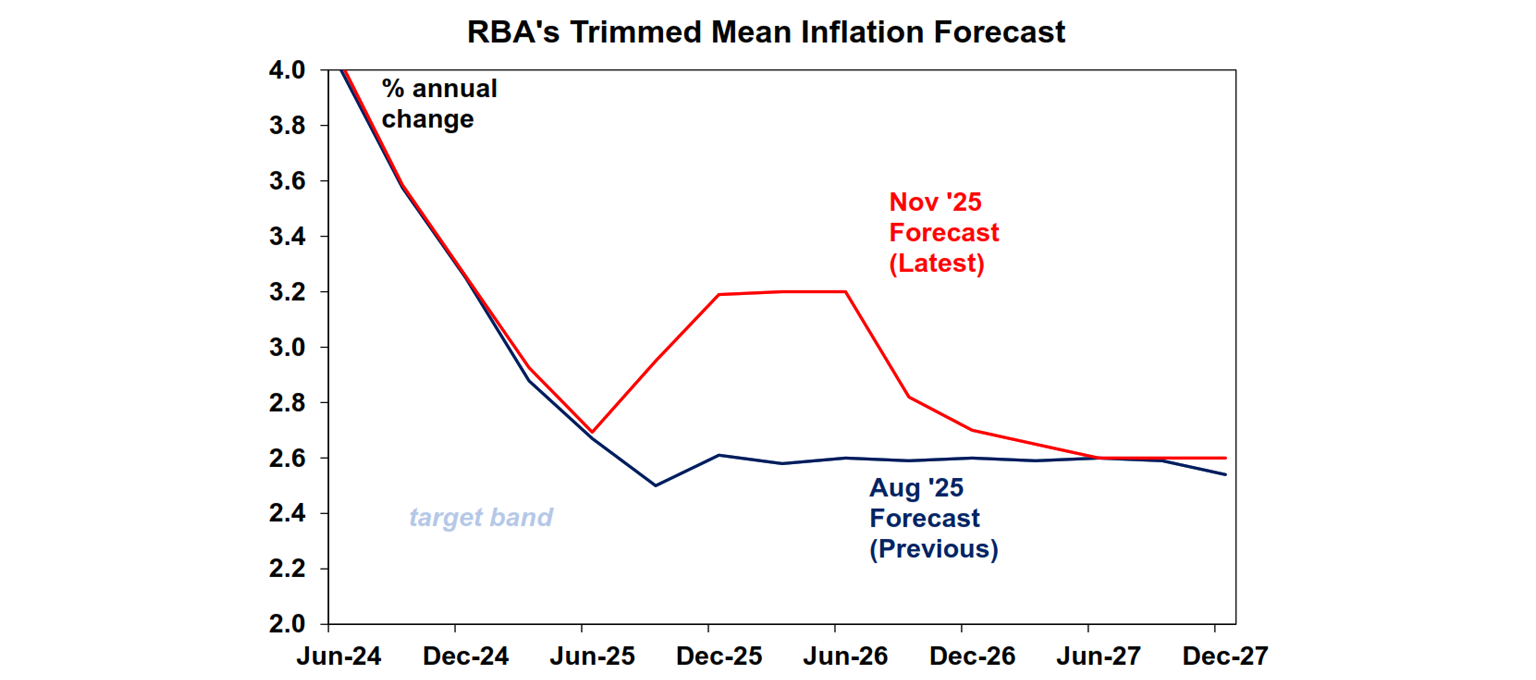

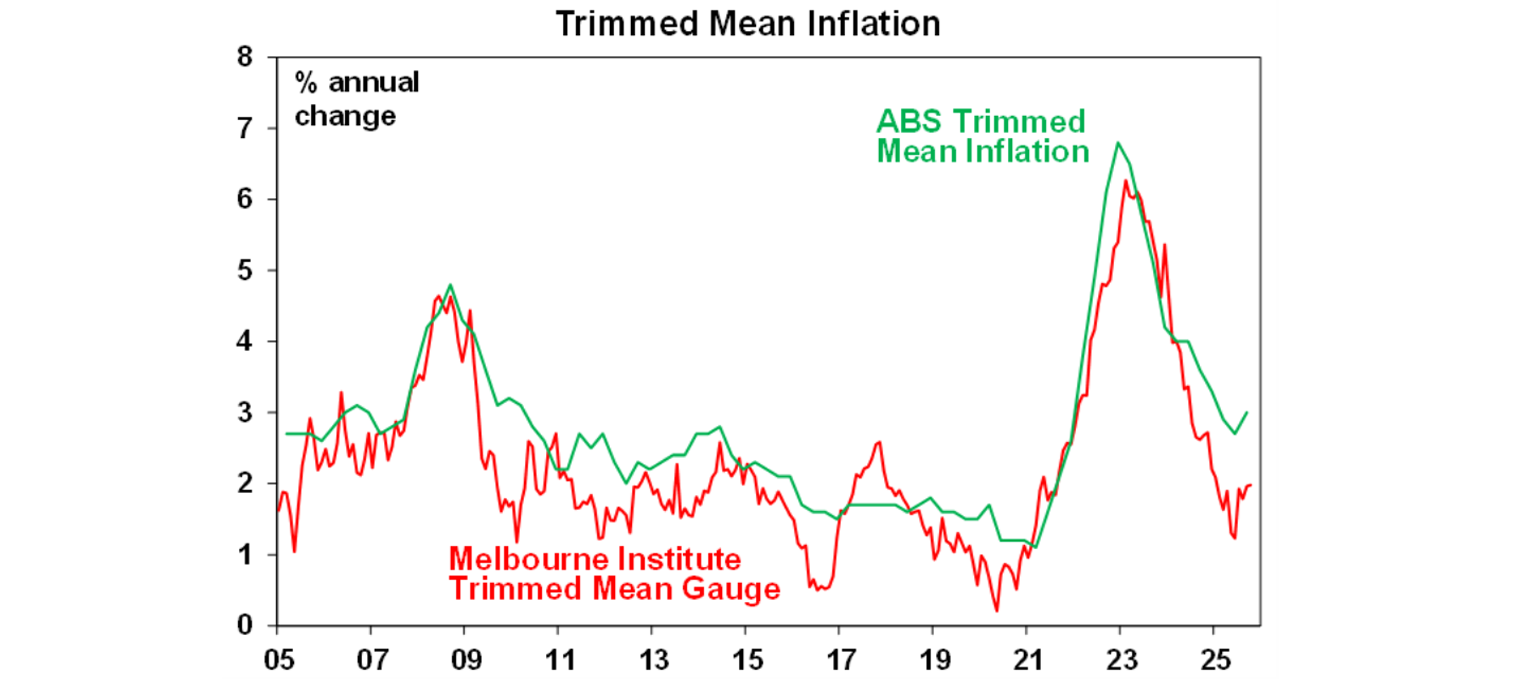

The RBA kept interest rates on hold and tempered expectations for any near-term rate cuts in its November’s Melbourne Cup Day meeting. The board voted to keep the cash rate unchanged with a unanimous decision, significantly upgraded their trimmed mean inflation forecasts to above 3%, and projected the unemployment rate to stabilise at just 4.4%. These hawkish forecasts were made under an assumption of one more rate cut in the first half of 2026. Meanwhile, the Governor explicitly stated, “The board is definitely targeting 2.5% inflation” and even inflation “just below 3 is not good enough”. Taken together, in layman’s terms, the RBA thinks that another rate cut would mean “too hot” of an economy to handle, and hence we shouldn’t hope for a rate relief anytime soon. A key reason for this hawkish stance is the pickup in underlying inflation pressures in the September quarter, evident by a 1%qoq/3%yoy trimmed mean reading, with acceleration in rental prices, new dwelling costs, and market services, all of which are “reflective of a recovery in private demand”. The base effect also means that this hot 3Q inflation number will be carried forward into future annual figures, or in other words, trimmed mean inflation will be at least 3%, missing the target band in the next six months. Overall, do not expect any more cuts this year from the RBA and the bar to any further easing next year is extremely high.

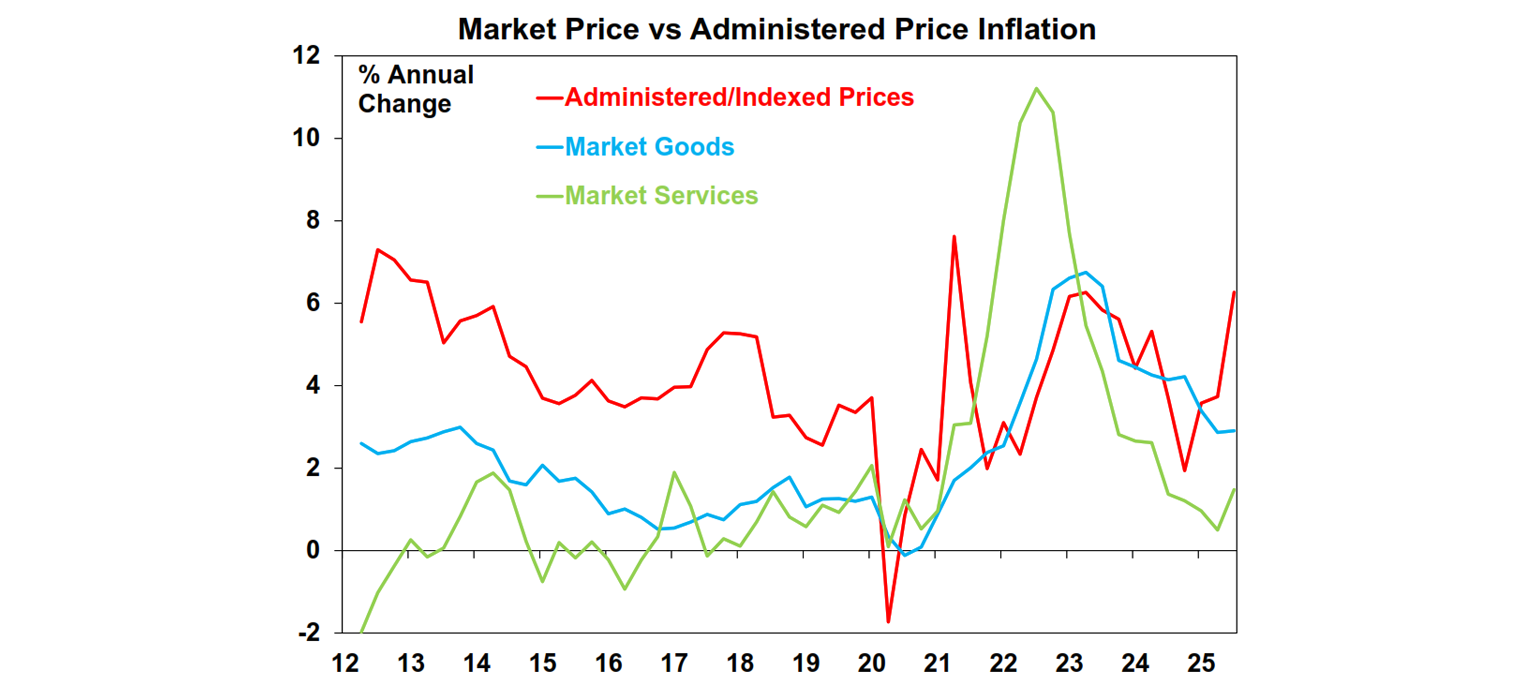

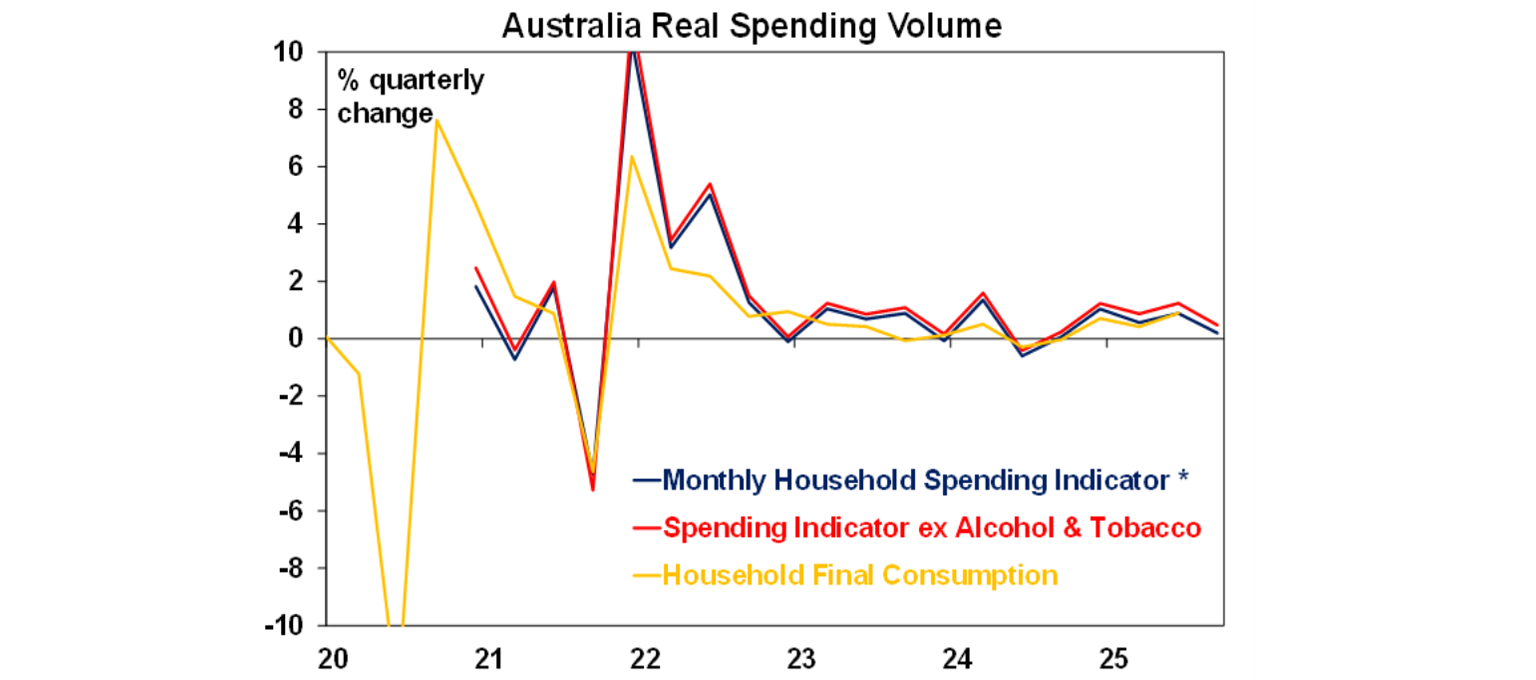

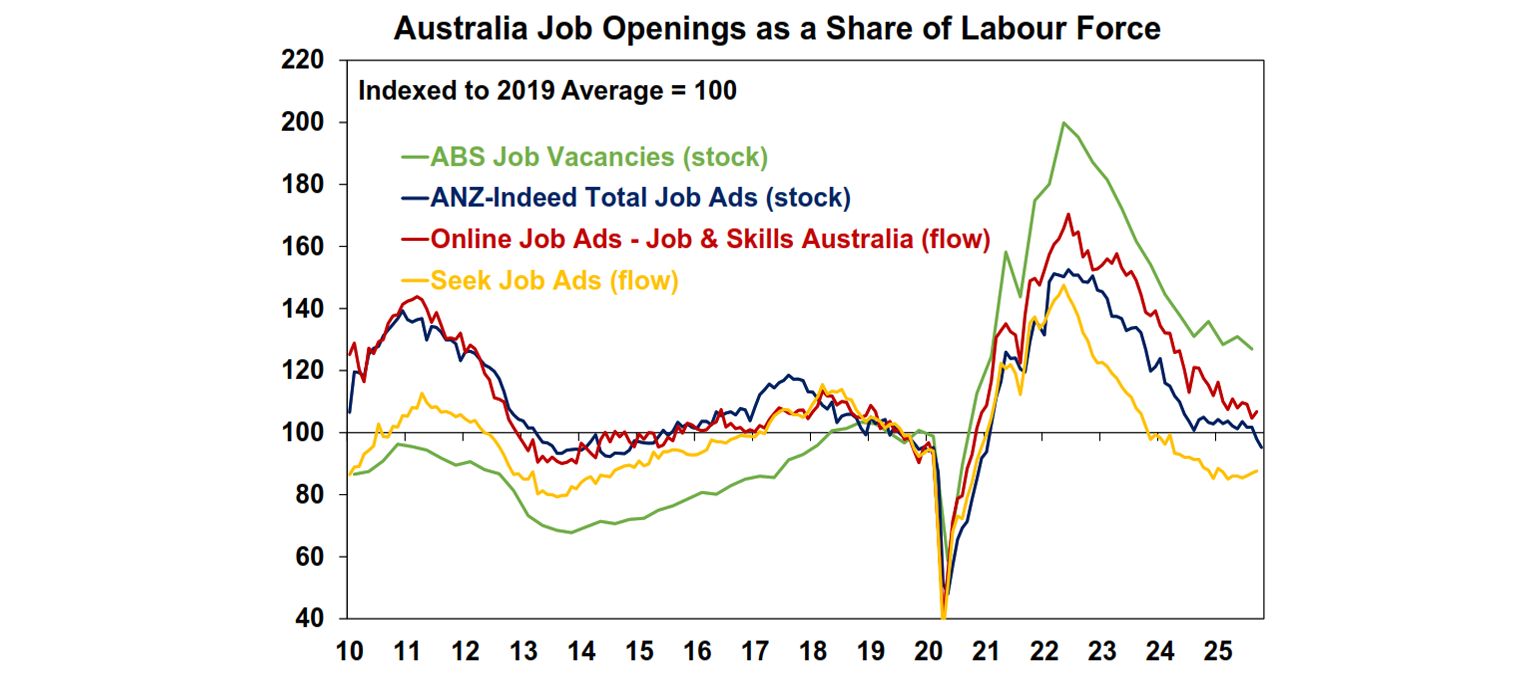

But the RBA also mentioned the word “uncertain” 45 times in its Statement and acknowledged that there are risks on both sides. At AMP we continue to see more risks on the downside especially for the labour market. This week’s consumer spending data has disappointed (see more details in the “Australian data” section below), suggesting a still fragile private sector. The tailwind for jobs in the past 2 years – hiring in public health, education, public admin – has now peaked, and with jobs creation continuing to slow since May, it is hard to see the unemployment rate settling below the current level as projected in the RBA forecast. As a result, we see an unemployment rate rising to 4.6% next year. On inflation, the 3Q trimmed mean surprise has largely been driven by administered price items (eg. property rates, insurance, health) and shouldn’t be extrapolated into future quarters. Market services inflation, the more concerning category according to Governor Bullock, is also likely to temper as market wages growth decelerates. The bottom line is that we see household and business demand still sluggish and not feeding into an inflationary spiral, and the economy still require one or two more rate cuts next year.

If the news about the hawkish RBA is a bit too gloomy, here are some memes to lift your spirits.

Major global economic events and implications

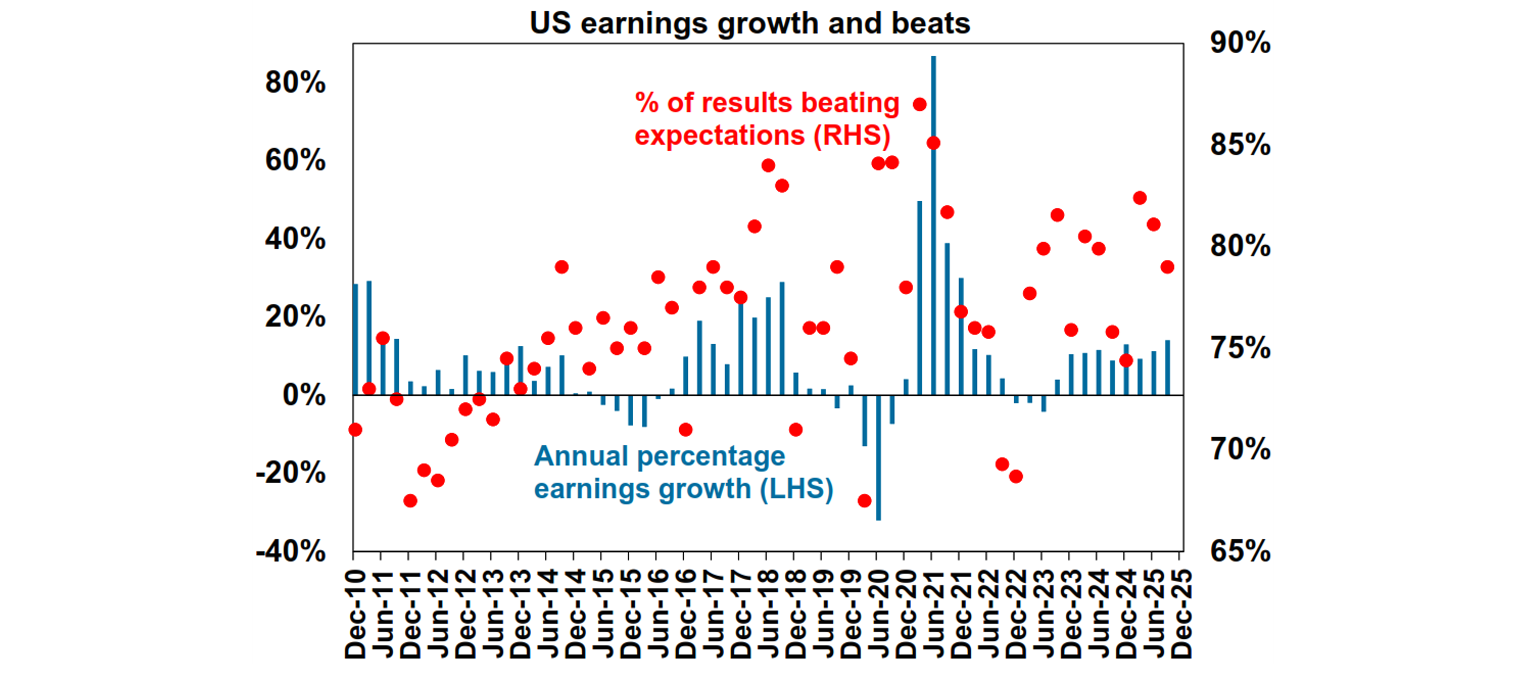

The US earnings season is wrapping up with 80% of the S&P 500 market cap already reported, and the big picture is still rather positive. 79% of companies are topping projections, above the historical average of 76%. Earnings growth is also positive at a pace of 14%yoy, while tech earnings are estimated to be up 27.9% over the last twelve months – so while the gains in tech stock prices have been significant, they have been supported by earnings rather than just hot air!

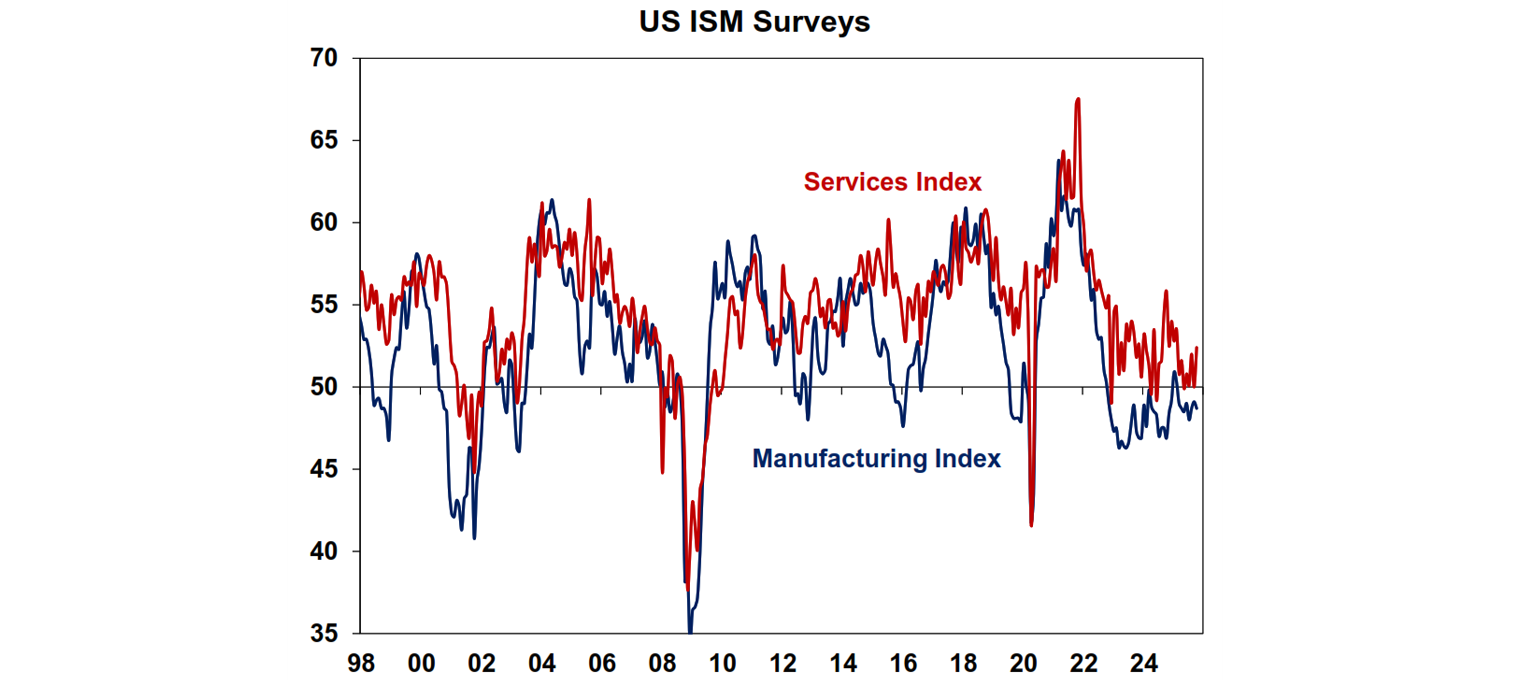

US ISM surveys for October showed mixed signals about the economy. The manufacturing survey slipped to 48.7, the eighth consecutive month of negative readings (an index below 50 means that more companies reported contracting economic activity). Manufacturing prices are also moderating. Meanwhile, the services index surprised on the upside, rising to 52.4 from a neutral 50 last month. The services ISM is a bit more volatile though so the increase should be taken with a grain of salt, compared to the more stable manufacturing survey. Both surveys are now being dragged down by sub-50 employment readings, corroborating evidence from other private surveys that the labour market is weakening, though not to recessionary levels.

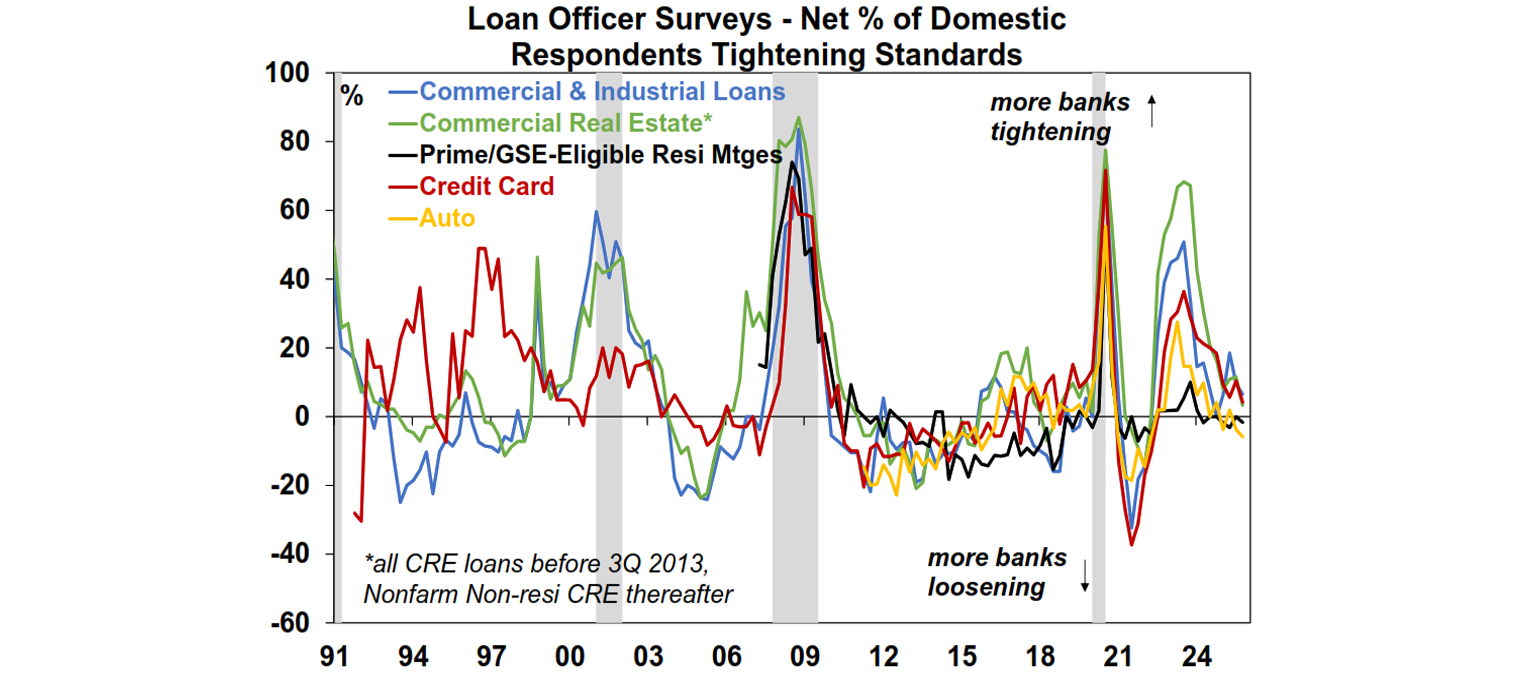

The Fed’s latest quarterly Senior Loan Officer Survey indicated that banking credit conditions have been easing, with auto, credit card, and mortgage loans’ lending standards posting the lowest reading since 2022, while demand for mortgages have started to inch up again after a long period of high rates. Commercial lending conditions are still tighter, however.

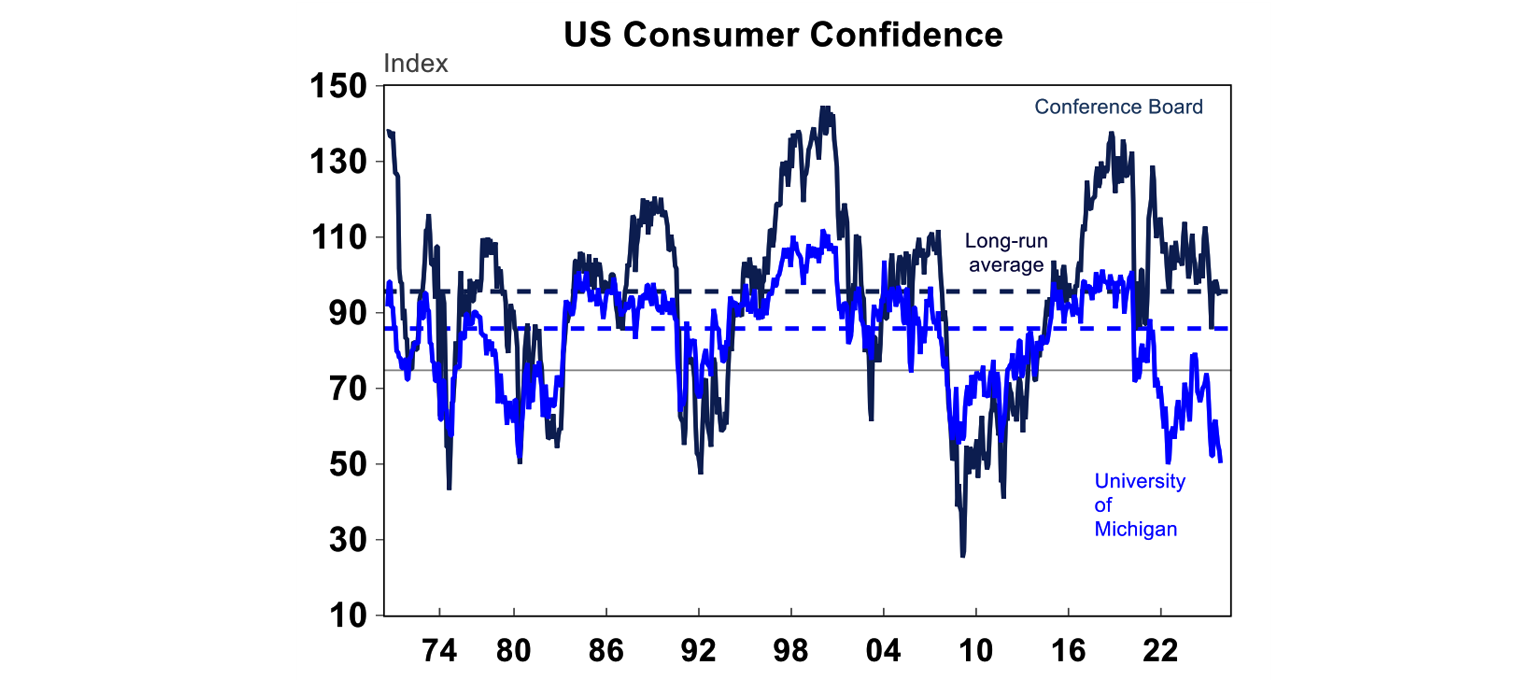

US consumer confidence deteriorated to a new cycle low, according to the University of Michigan survey. Clearly the prolonged government shutdown is now dampening sentiment, as households downgraded their assessment of current personal finances, labour market, as well as expectations for future business conditions. The softer confidence readings were found in most consumer groups, except for the top tercile of stockholders, who saw confidence improve over the month.

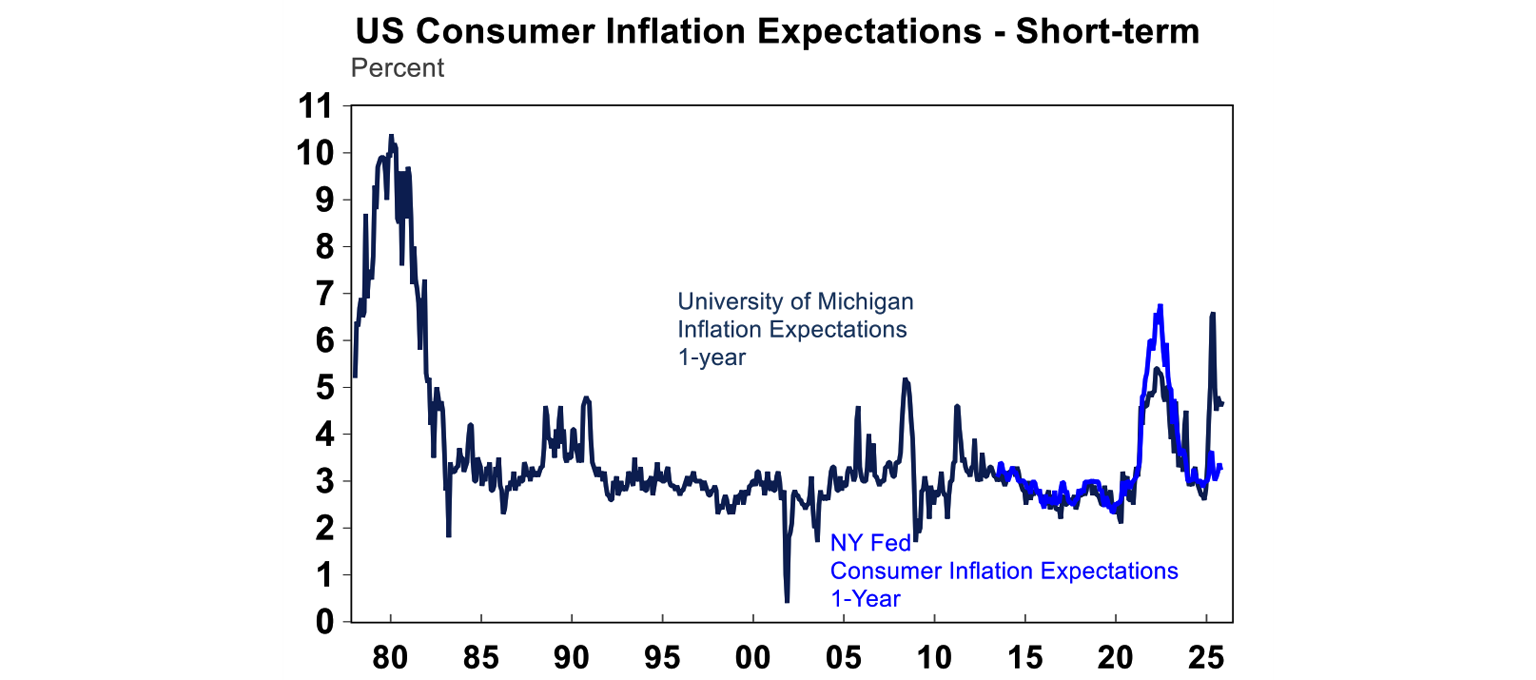

Consumer inflation expectations also remained elevated, albeit not at the peak level. The UMich survey showed the median year-ahead inflation expectations up slightly to 4.7% from 4.6% prior, while the New York Fed survey’s inflation expectation was lower at 3.25%.

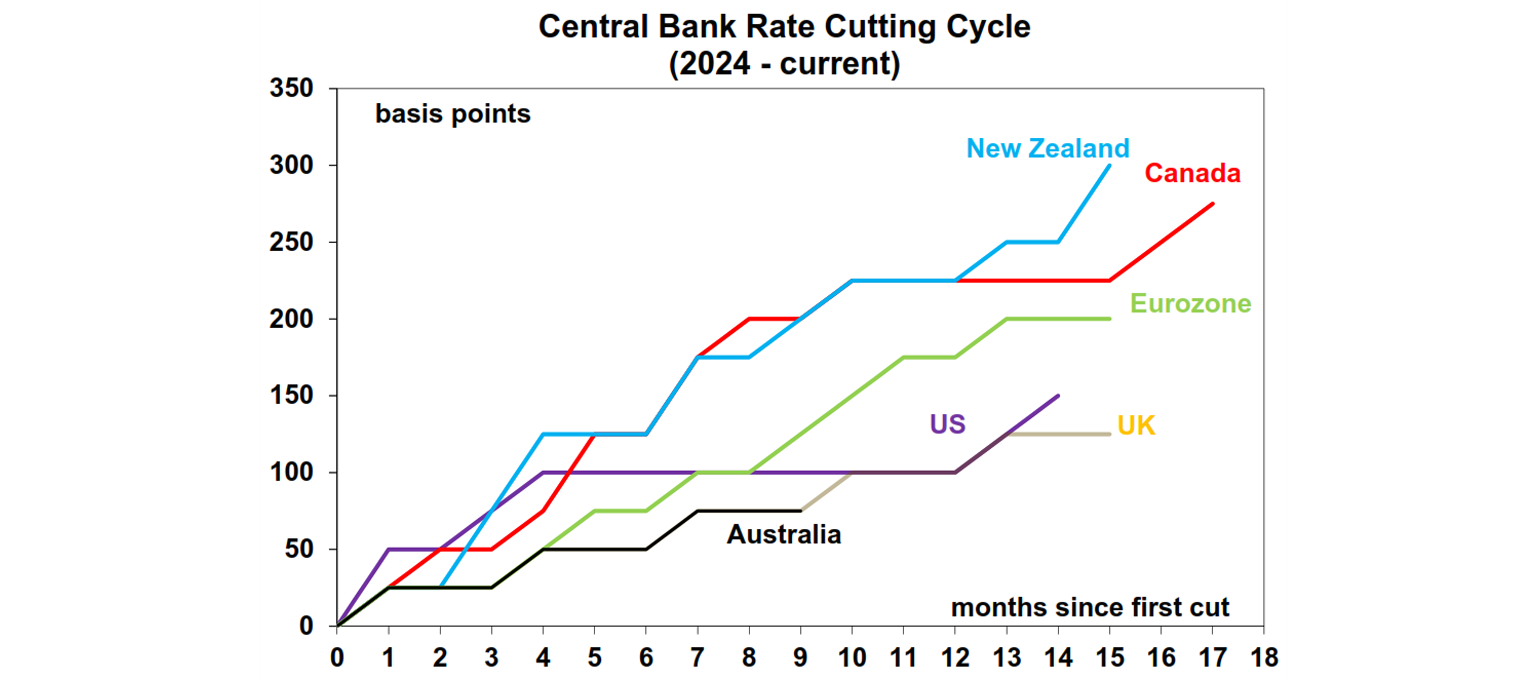

The Bank of England kept rates unchanged at 4% in a split 5-4 vote but clearly signalled an easing bias from here. As the services disinflation path stalled in the UK (similar to many global peers), the BoE has opted to pause rate cuts in the past three meetings. However, with recent soft labour market data including falling payrolls, declining job vacancies, higher unemployment rate, and slowing wages growth, it is likely there are still more cuts coming, albeit not at a set pace like in 2024 and early 2025.

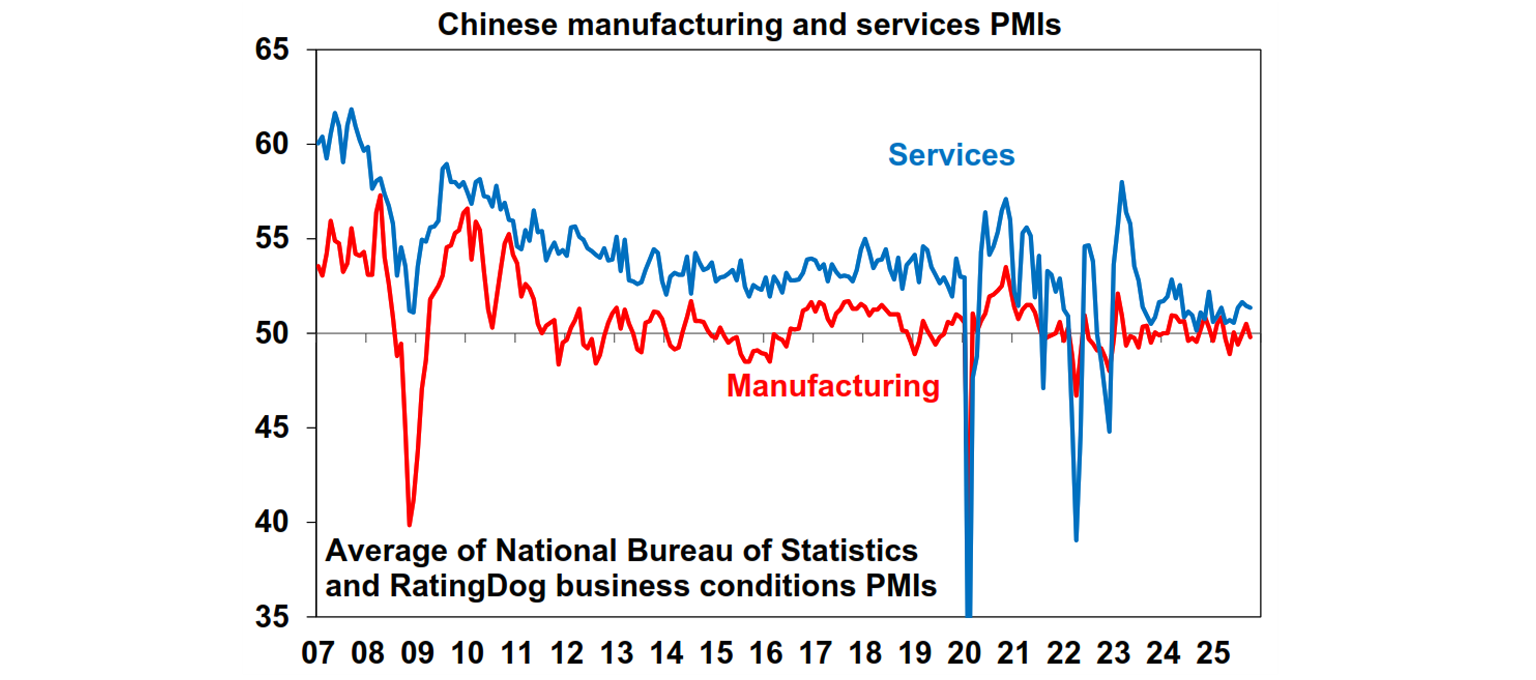

China’s suite of official and private PMI surveys implied some softening in economic activity over October, but PMIs have been roughly unchanged since the beginning of the year. New export orders have started to fall, with companies’ commentaries suggesting that foreign demand has been impacted by global trade uncertainty. On the other hand, new product launches have led to some improvement in domestic demand.

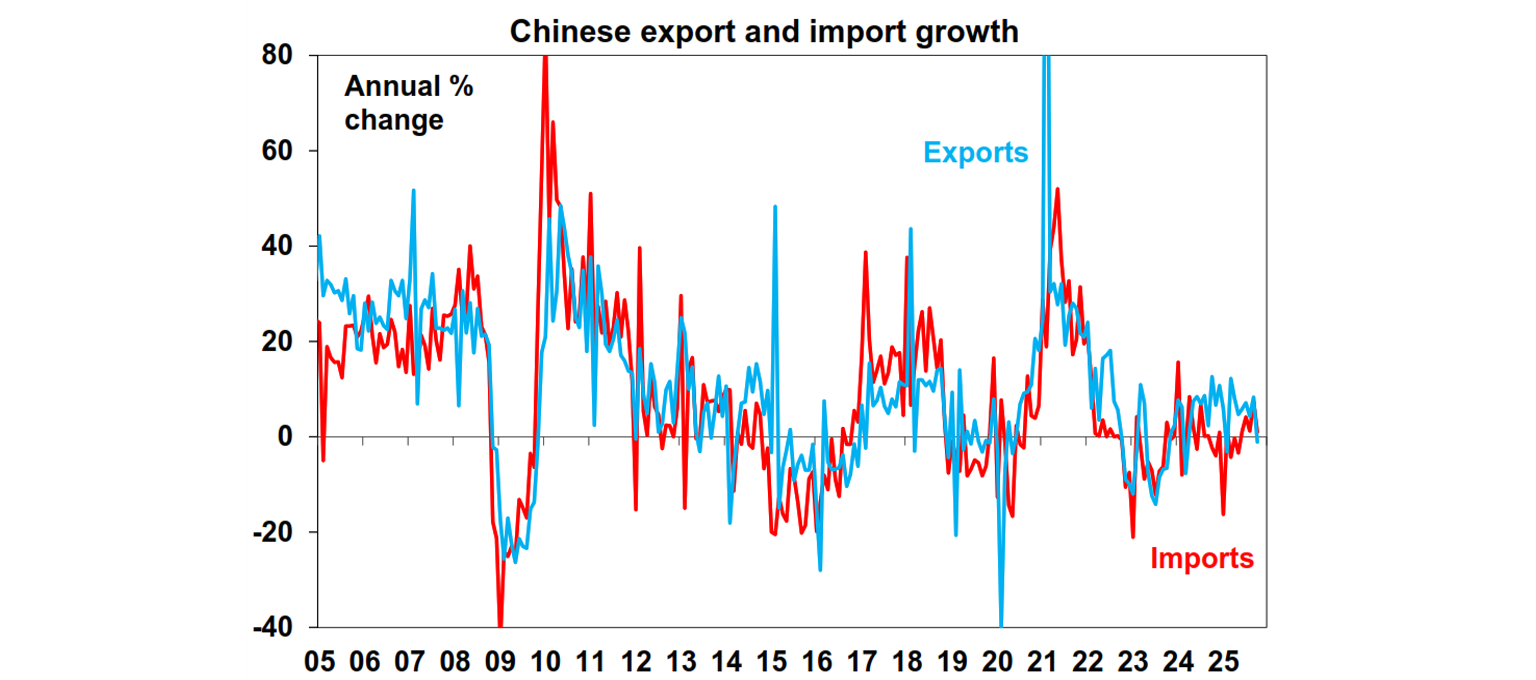

These commentaries from companies are consistent with a 1.1%yoy contraction in Chinese exports in October. Year to date, Chinese exports have been very resilient, as declining shipments to the US (-17.8% in USD terms) were offset by rising trade with ASEAN countries and the European Union. But October’s surprised fall was driven not just by US exports but also lower sales to major markets including South Korea, Russia, and Canada. Looking forward, there could be some reversal in momentum next month, as the US has agreed to reduce tariffs on Chinese goods by 10 percentage point following Trump and Xi’s meeting.

Australian economic events and implications

Australian household spending disappointed and likely contracted in per-capita terms over the third quarter. Nominal spending increased just 0.2% in September (vs expectations for a 0.4% rise), while August’s figure was downwardly revised to flat. In volume terms, spending increased a minimal 0.2%qoq, mostly driven by essential categories such as health and food rather than discretionary items. Clearly consumption momentum has contracted after getting a short-term boost in 2Q from weather events, holiday timing, and one-off promotions. In addition, we see evidence that the hotter inflation reading in 3Q was unlikely driven by demand, and in fact, has dragged down spending volume.

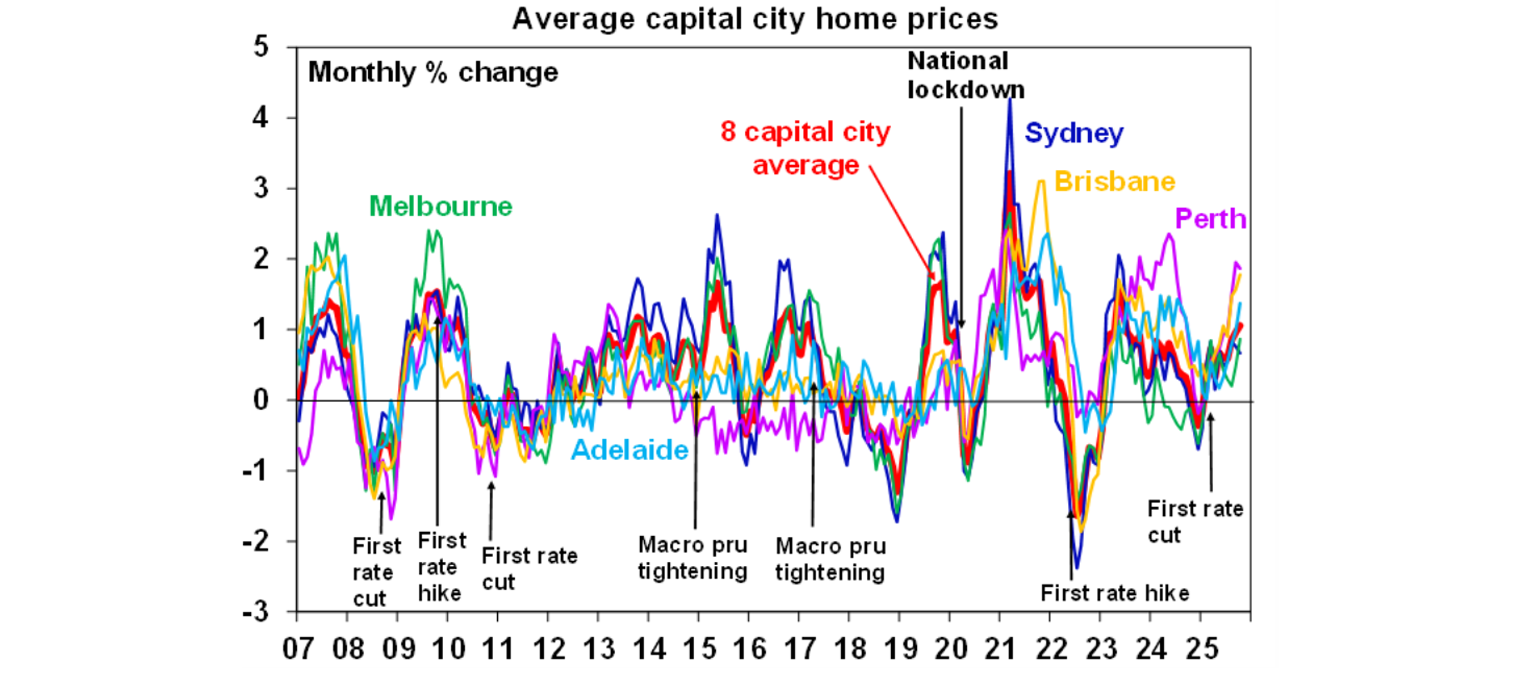

Housing data was hotter over October, however. Cotality national average home prices accelerated to 1.1% monthly growth, the highest pace in two years. This is the 9th consecutive month of gains, driven by the three rate cuts, rising real wages, better consumer sentiment, as well as the recently expanded 5% deposit scheme – all of which has improved buyers’ capacity and willingness to pay for a home. But as the RBA is likely to be on hold in the next meeting, the pace of growth will slow somewhat from here.

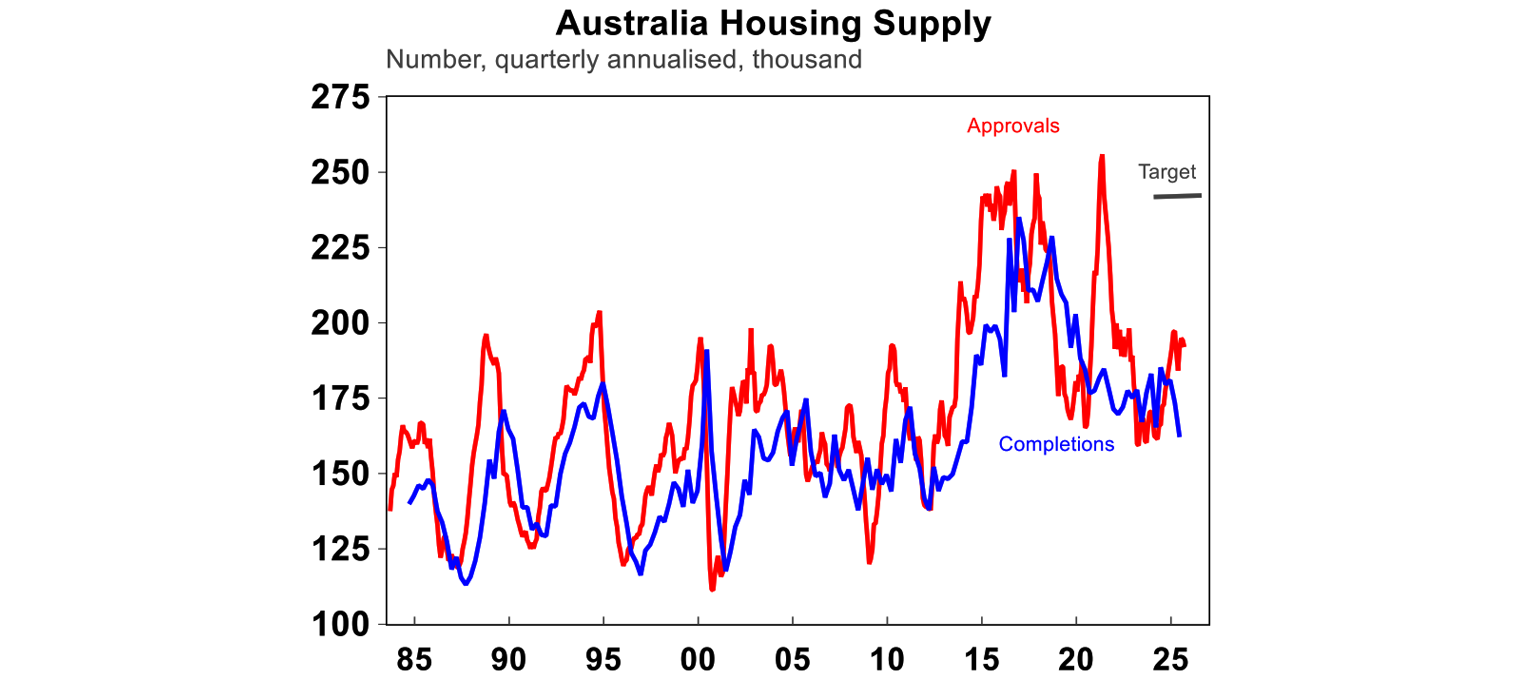

That being said, we continue to see annual home price growth rising to 8%yoy within the coming year, because the long-term driver for property prices in Australia is still a supply & demand imbalance. A good leading indicator for housing supply is building approvals, which showed a 12%monthly rise in September, driven by an uptick in apartments. But over the longer term, both apartment and total dwelling approvals remained rangebound at an annualised pace of 192 thousand units per annum. This is a long way to go from hitting the 240k target in the National Housing Accord and does not solve the chronic undersupply issue that has been worsening over the past decade.

Job advertisement counts, as measured by ANZ-Indeed, fell 2.2% in October. Leading indicators of the labour market have been mixed on a monthly basis but are still trending down in aggregate.

The Melbourne Institute inflation gauge pointed to an unchanged monthly trimmed mean measure in October around 2%. It has been diverging from the official inflation measures lately.

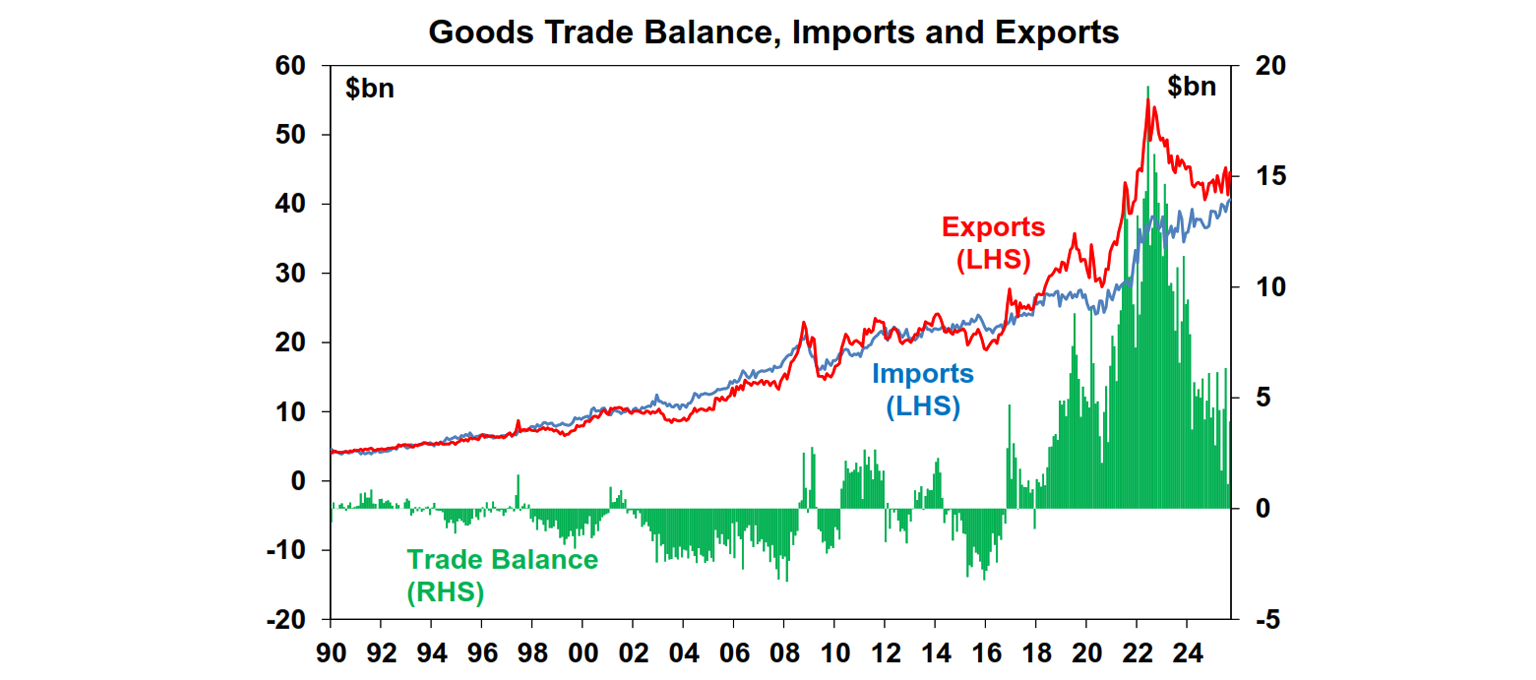

Australian trade surplus increased to $4bn in September from $1.1bn last month, driven by an 8%mom rise in exports while imports value only increased 4%. Iron ore, coal, and especially gold posted significant increases in revenues, benefiting from favourable commodity prices. We expect net exports to contribute 0.1 percentage point to GDP growth over the September quarter.

What to watch over the week ahead?

With the US government shutdown still underway, we’re likely going to miss out on payrolls employment data again. The October US CPI, which was planned for release on Thursday, will not be published since data for the month has not been collected. If the government and the Bureau of Labor Statistics reopens, the inflation reports for October and November will be combined.

UK September quarter GDP data (Thursday) is expected to show a tepid growth rate of just 0.1%qoq, lower than the 0.3% rise in 2Q25.

China’s monthly activity data which includes home prices, retail sales, industrial production, and fixed asset investments will come out on Friday. We expect no major surprise on the upside and economic growth is likely muddling along around 5%yoy.

In Australia, the most important figure will be the October unemployment rate coming out on Thursday, which is likely to show a small pullback to 4.4% (from 4.5% last month, similar to the RBA forecast), given its volatile nature. However, employment gains will likely remain weak at just 18k with a participation rate still around historical high of 66.9%. Sentiment data for both consumer (aka Melbourne-Westpac survey) and businesses (NAB survey) will be out on Tuesday, with household confidence likely deteriorating slightly versus last month, following recent hawkish comments by the RBA. 3Q home loans value is released on Wednesday and is likely to show a very small uptick of 0.2%qoq, with home prices up strongly over the quarter offset by lower sales volume and low levels of listings.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and the Fed likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield or a bit more as central banks continue to cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices are in an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 8% this year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may break higher with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.