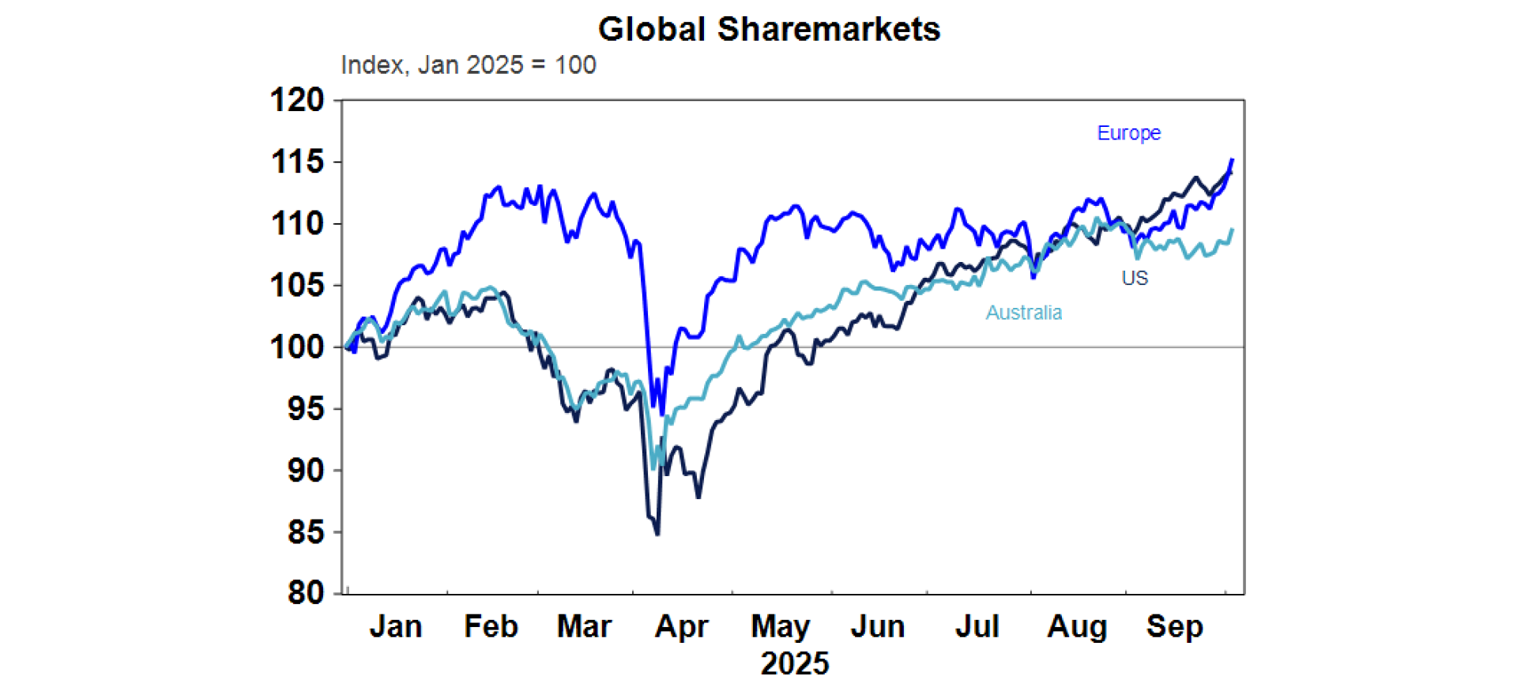

Share markets rose strongly over the last week, with optimism for further US rate cuts offsetting the start of another US partial government shutdown. For the week US shares rose 1.1%, Eurozone shares rose 2.7%, Japanese shares rose 0.9% and Chinese shares rose 2%. Helped by the strong global lead the Australian share market rose by 2.3%, with investors appearing to conclude that while the RBA may not cut rates much more this is okay if its due to better economic growth. The gains in the Australian share market were led by health, financial, industrial and material shares more than offsetting a fall in energy shares. 10-year bond yields rose in Japan but fell elsewhere. Oil prices fell 7.4% on indications that OPEC will further boost supply and the iron ore price fell slightly on reports China had temporarily “banned” the purchase of iron ore from BHP. But metal and gold prices rose providing support for Australian miners. The $A rose back to around $US0.66 as the $US fell, helped along by more hawkish RBA commentary.

Shares held up pretty well through the seasonally weak August/September period, with US, Eurozone and Japanese shares at record highs and the Australian share market now back to just 0.4% below its record high. And we are now coming into a seasonally strong period of the year – particularly once October is out of the way. While there is literally a wall of worry out there investors appear to be taking comfort from still solid US economic and profit growth, signs of improving growth in Australia and the prospect for still more rate cuts smoothing things over. Our 6–12-month view remains positive for shares as Trump continues to pivot towards more market friendly policies ahead of the mid-terms next year, the Fed cuts rates further and other central banks including the RBA continue to cut, albeit to varying degrees. However, the risk of a correction at some point along the way remains high: share market valuations are stretched with low risk premiums against bonds; there are reasonable concerns about public debt sustainability in the US, France, UK and Japan; US tariff uncertainty remains high particularly in terms of their impact over time; geopolitical risks are high including around the possibility of escalating tensions between Russia and NATO countries and the risk of US secondary tariffs on countries importing Russian oil; it’s unclear how long the US government shutdown will last; the US jobs market is continuing to slow posing risks for US economic growth; the Fed may not cut as much as the 4-5 cuts that the US money market expects; and in Australia there is now increased uncertainty around the outlook for interest rates.

The past week has seen the usual mayhem in the US – which many non-Americans may see as entertainment - with even more tariffs (this time on timber), the start of a government shutdown, the deployment of the National Guards to more cities with President Trump proposing to “use some of these dangerous cities as training grounds for our military” and the War Department head railing against overweight people in the military. At least the Supreme Court has delayed Trump’s plans to weaken Fed independence (with Governor Cook set to stay at the Fed into early 2026 making it unlikely that even if Trump wins the case it will be in time to threaten the reappointment of regional Fed presidents) and Taylor Swift’s new album was out on Friday (because the date 3/10 adds up to 13!).

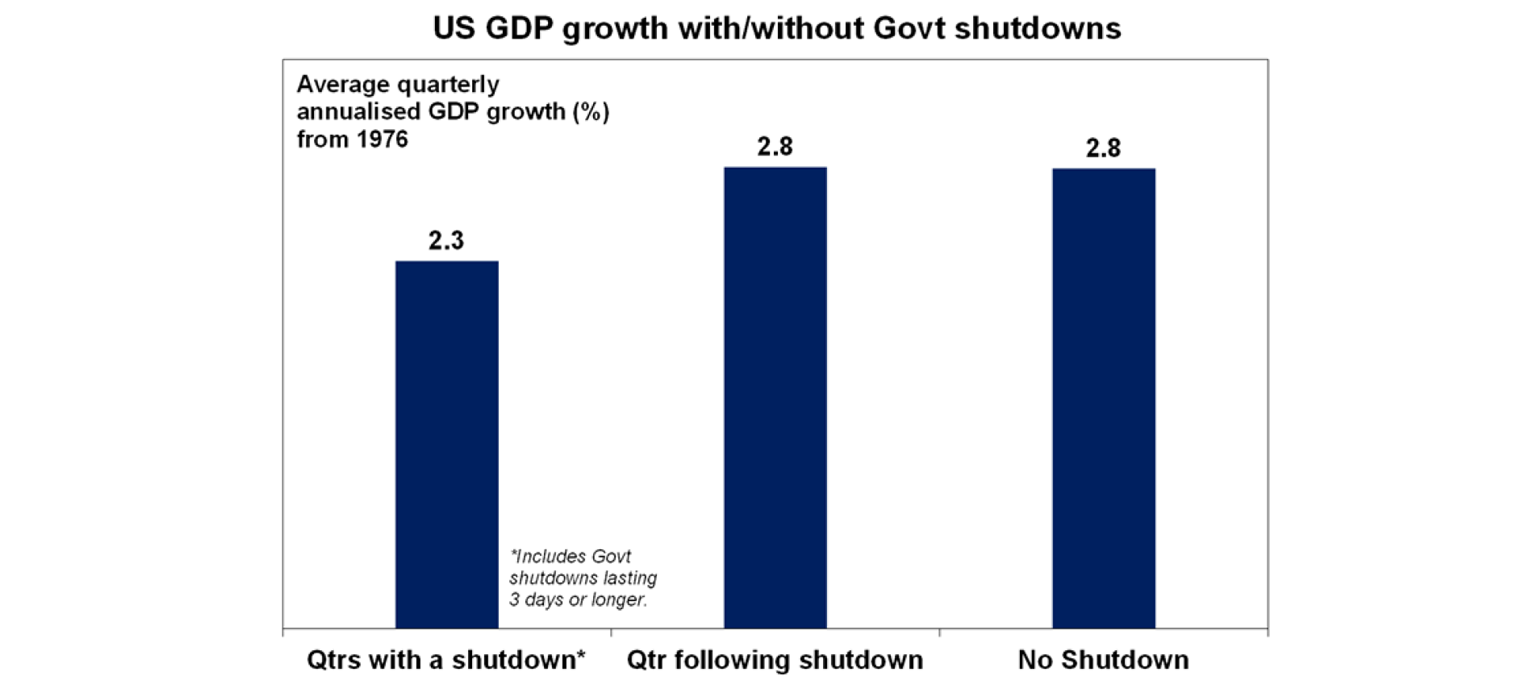

US Government shutdowns usually create a lot of drama but have little impact on the economy and markets – this time could be different. As feared the Senate failed to reach the 60 votes needed to pass a funding bill with Democrats demanding a continuation of expiring health care funding. Note that a shutdown is not the same as a debt ceiling crisis (which is far more serious) and only part of the Federal Government gets shutdown (with eg mail services, air traffic control, passport offices, and Federal courts remaining open). Since 1976 there have been 20 US government shutdowns with an average of 8 days; the last one was in 2018-19 and lasted 34 days; the impact on GDP has been minor as any disruption is made up for immediately after the shutdown ends as furloughed workers return to work and get paid; similarly the impact on share markets has tended to be minor although it can see volatility. That said it is already delaying key data releases including payrolls. And it may be more of a risk now with the Trump Administration threatening to lay off Federal workers (of which there are 2.3 million or 1.5% of payroll jobs) to close down programs they don’t like which could mean a bigger hit to the economy. And the risk now may be higher for shares due to high price to earnings valuations. Lots of layoffs could backfire for the Republicans as could too much intransigence for the Democrats so a deal is likely before too long. Or it could end soon with a stop gap deal while negotiations over health subsidies proceed.

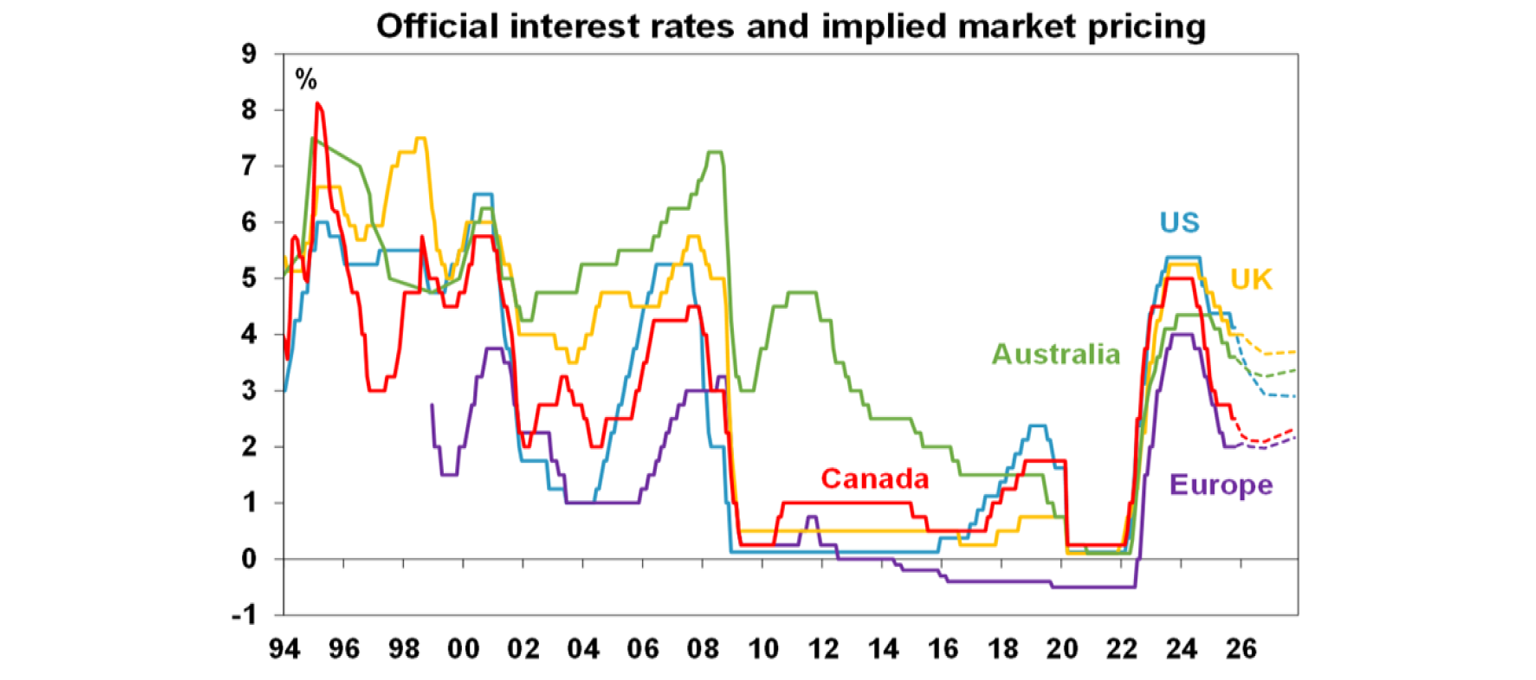

The RBA left rates on hold with a more hawkish tone – we continue to see more rate cuts but there is a high risk that they will be delayed into next year and that we are at or nearer the bottom than we thought. After a run of somewhat higher than expected inflation readings and stronger economic data the RBA’s more hawkish commentary wasn’t really that surprising. But it adds to the uncertainty regarding when and by how much rates will fall any further. RBA Governor Bullock still retained an easing bias noting that at the November meeting it will decide “whether its down again or…hold again” for rates but this is substantially watered down from its easing bias at the last two meetings and is now very dependent on the September quarter CPI to be released at the end of the month and the RBA’s revised economic forecasts to be released with its November meeting. Economic and inflation data runs hot and cold and this tends to be reflected in the tone of RBA commentary and guidance along with money market expectations. So it’s dangerous to read too much into the latest more hawkish swing and we continue to see two more rate cuts as we see growth remaining subpar, underlying inflation likely to remain around the 2.5% inflation target and monetary policy remains tight. And in particular we see September quarter trimmed mean inflation being close enough to RBA forecasts at 2.6-2.7%yoy to allow another cut in November with a final cut in February, but November is a very close call and there is a high risk we may be at or nearer the bottom on rates than we thought. If this is because the recovery is picking up faster than expected it will be a good thing, but if it’s because inflation is proving stickier then it won’t be so good. The Australian money market is allowing for around one a half more 0.25% rate cuts with around a 64% probability of a rate cut by year end.

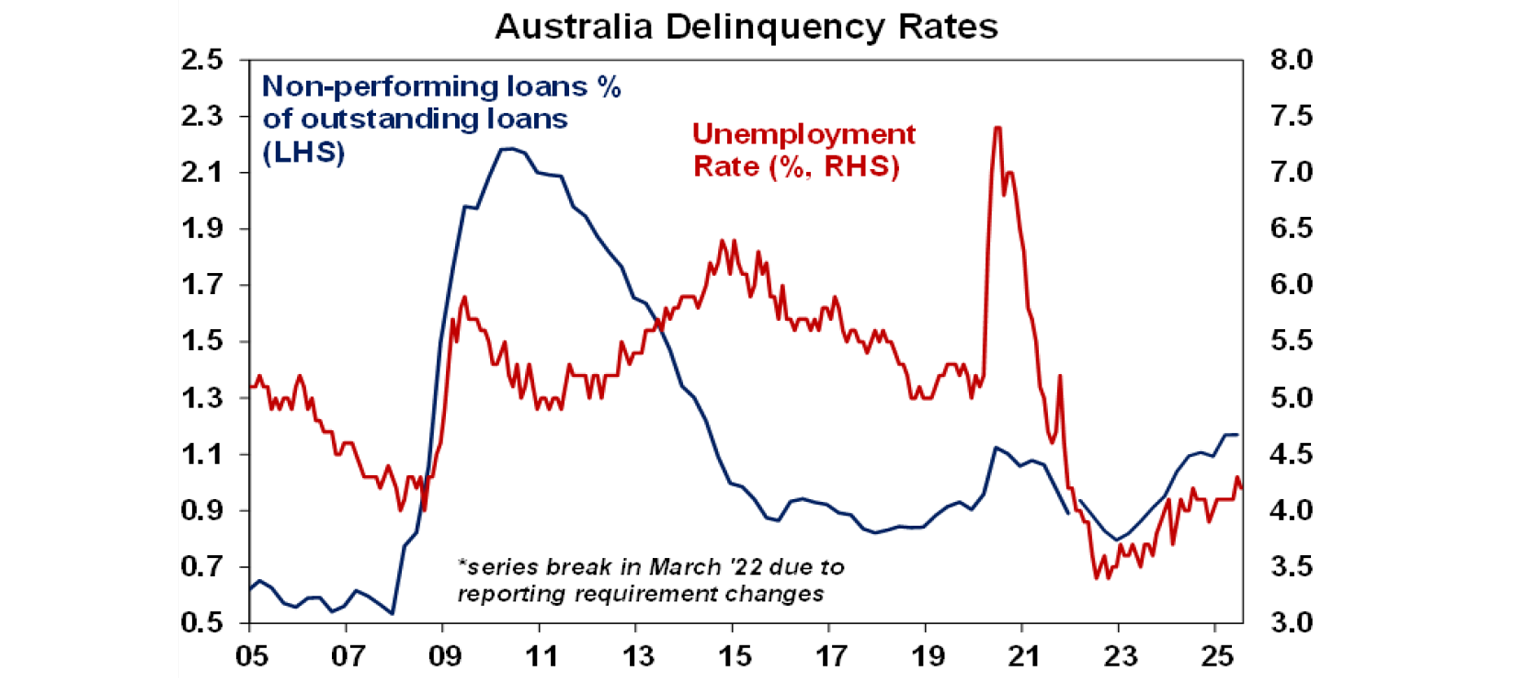

The RBA’s six-monthly Financial Stability Review continues to see the Australian financial system as resilient. While it sees a range of global financial risks – notably around financial markets with low-risk premia, operational vulnerabilities flowing from digitalisation and interconnectedness and China’s financial and property sectors – it sees the Australian financial system as being resilient with banks’ non-performing loans being small. In it notes that the share of home borrowers in severe financial stress is low and declining and mortgage arrears are low (albeit higher for high-risk loans). And it notes that while the corporate insolvency rate is up in some sectors, for the economy as a whole its around its long run average. In other words, there is no urgency to cut rates further from a financial stability perspective.

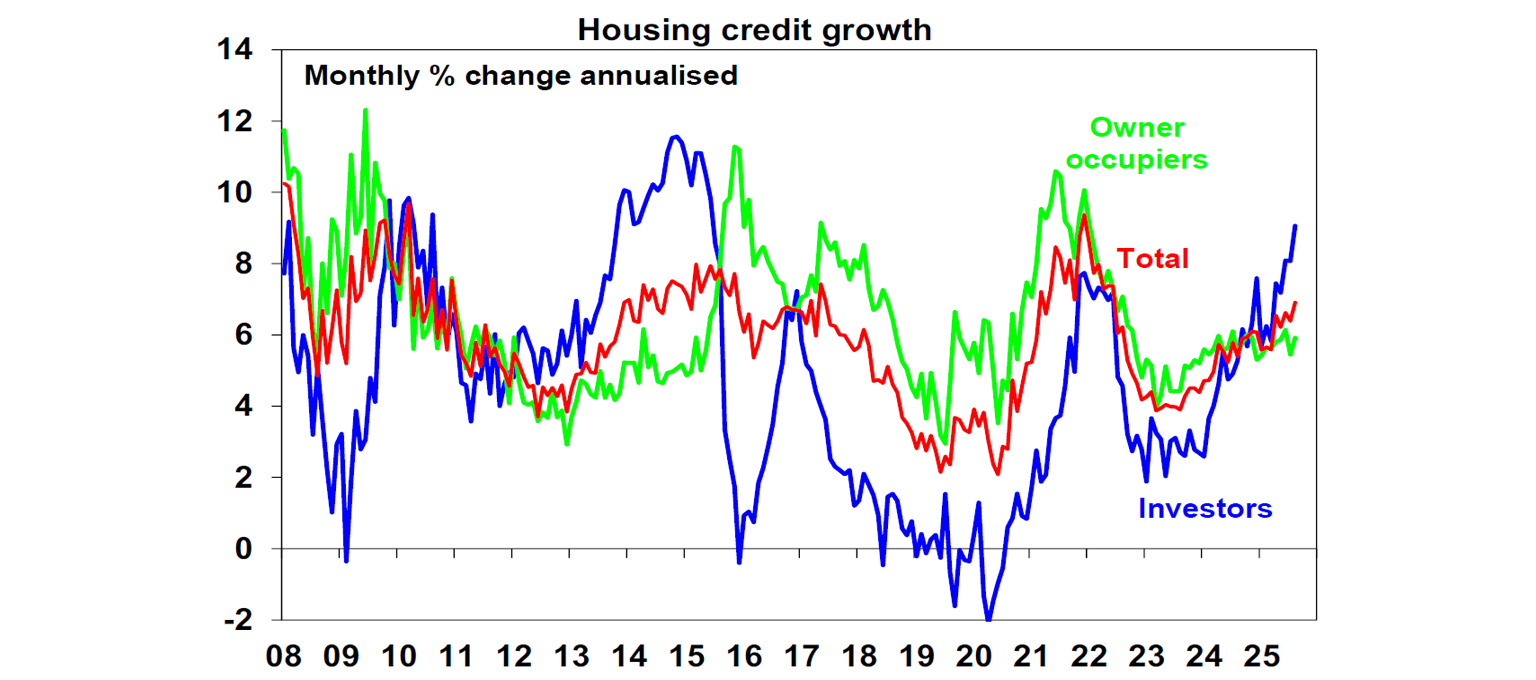

Is the RBA preparing the ground for another round of macro prudential controls to slow risky housing lending? This looks to be the case with its reference in the Financial Stability Review that “a sharp rise in investor activity from already elevated levels could lead to a build-up in financial vulnerabilities if it significantly amplifies the housing credit and price cycle” and that it supports APRA efforts “to ensure a range of macro prudential tools could be deployed in a timely manner if needed.” Housing credit growth appears to be taking off again, reflecting the pickup in home price growth – and for investors is nearing the boom time levels last seen in 2014-15.

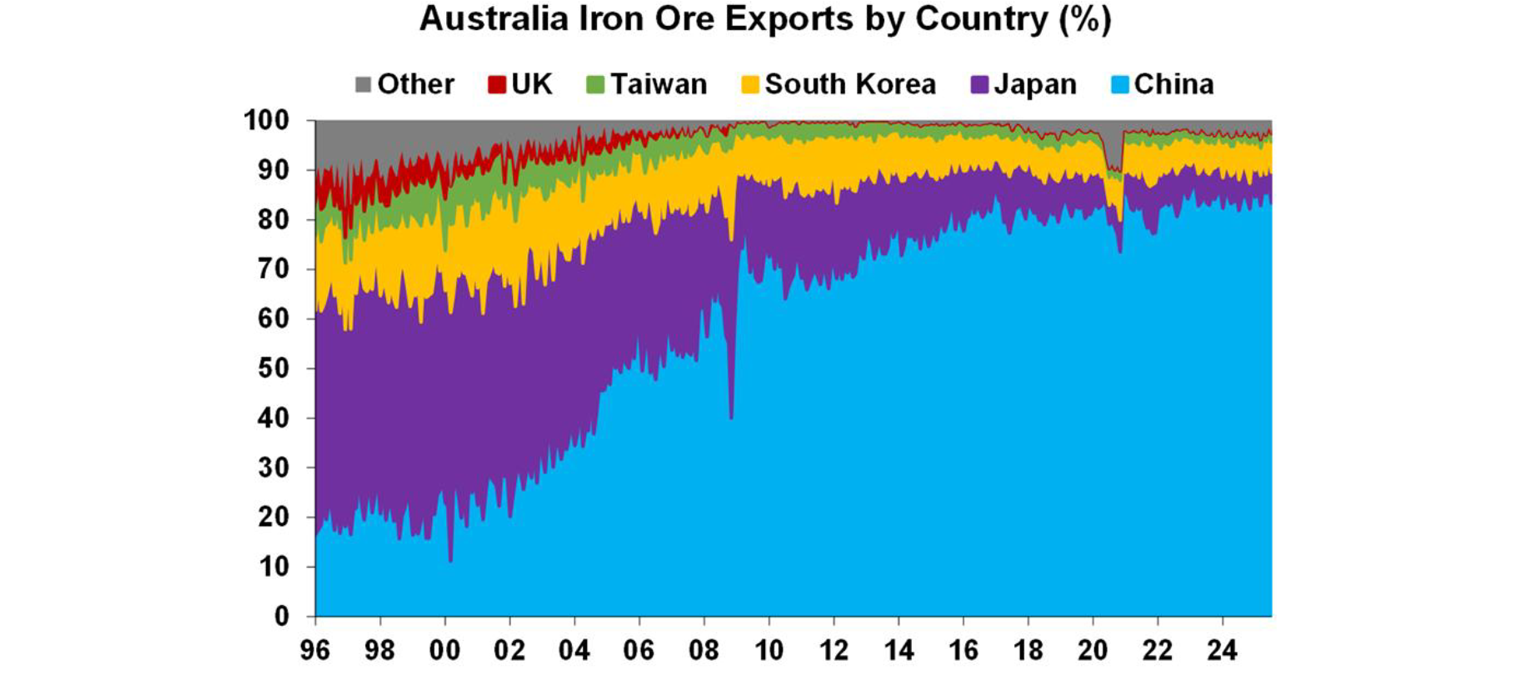

How serious is the threat to BHP’s iron ore shipments and its flow on to Australia? Reports over the last week indicate that China’s state run iron ore trader, the China Market Resources Group, has temporarily “banned” Chinese steel mills from buying iron ore from BHP after contract negotiations partly around more long-term contracts broke down. China reportedly wants to move back to more long-term contracts to reduce the uncertainty associated with spot pricing. The ban appears to reflect a desire to regain some pricing power after the surge in iron ore prices that got underway in the 2000s now that there are more sources of supply and Chinese steel demand is weak. Given the mutual interdependence of China and BHP the ban is likely to be brief. So, we don’t expect a major impact which partly explains why BHP’s share price is only down 2% or so and there has been little noticeable impact on the share market and $A. Of course, if it’s not resolved quickly and spreads to other suppliers then it will be bad news for the Australian economy. Iron ore is Australia’s biggest single export with about 80% going to China which is running at about $100bn a year or close to 4% of Australian GDP!

Major global economic events and implications

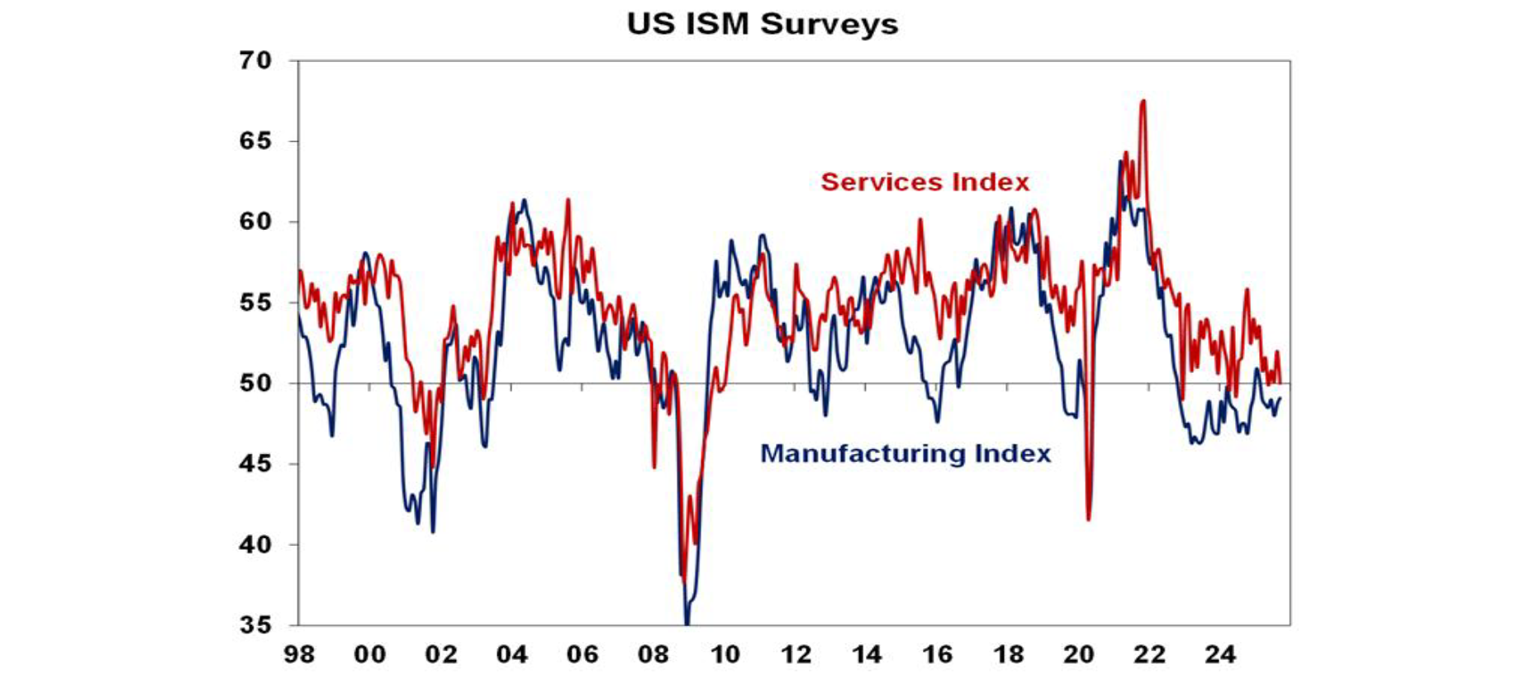

In the US, most economic data was on the soft side. The ISM manufacturing and services conditions indexes were both soft and home price growth continues to slow.

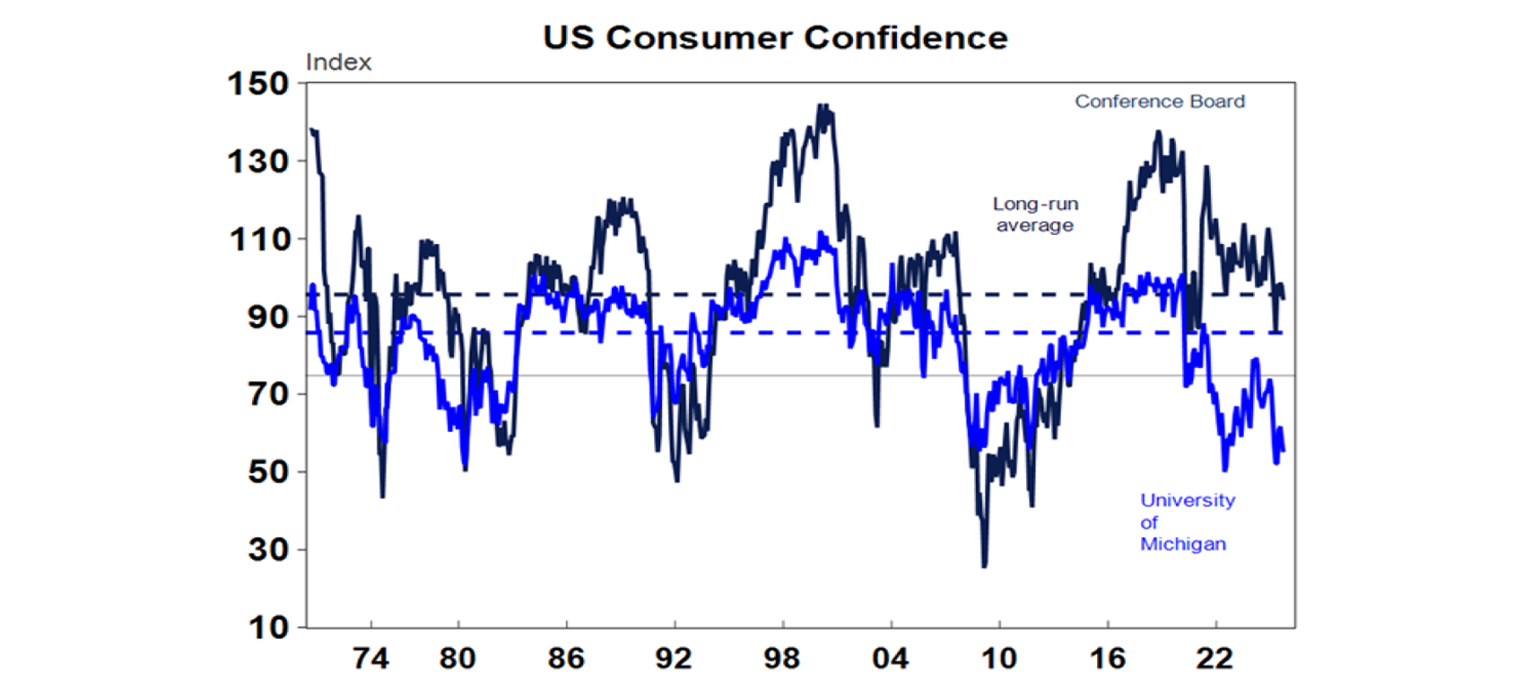

Consumer confidence fell in September.

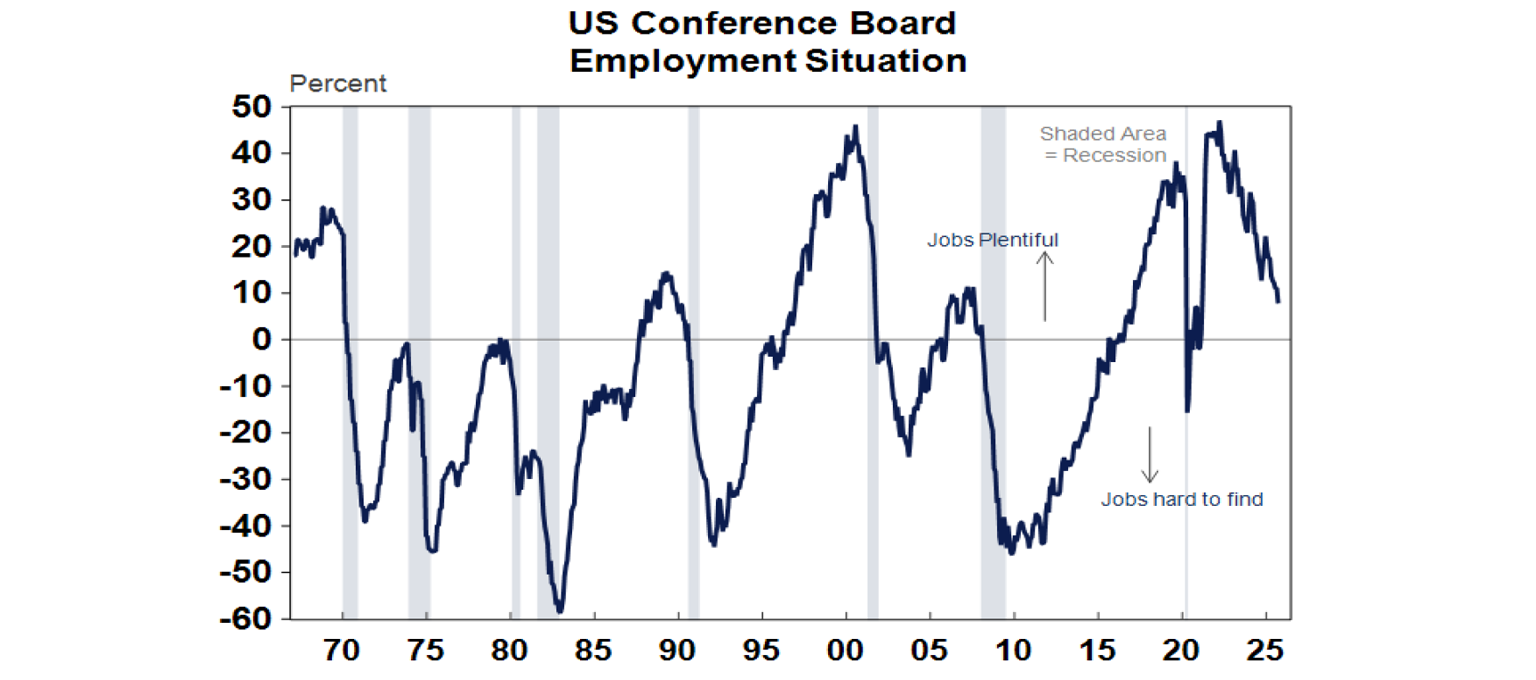

US jobs data generally remained soft, supporting the case for a Fed rate cut this month. Data from outplacement firm Challenger showed layoffs remain lowish but a range of indicators are pointing to soft conditions. The employment component of the ISM survey remained in negative territory, the ADP employment survey fell in September continuing a weak trend, the Challenger data showed very low hiring and consumer perceptions of whether jobs are plentiful or hard to get deteriorated further.

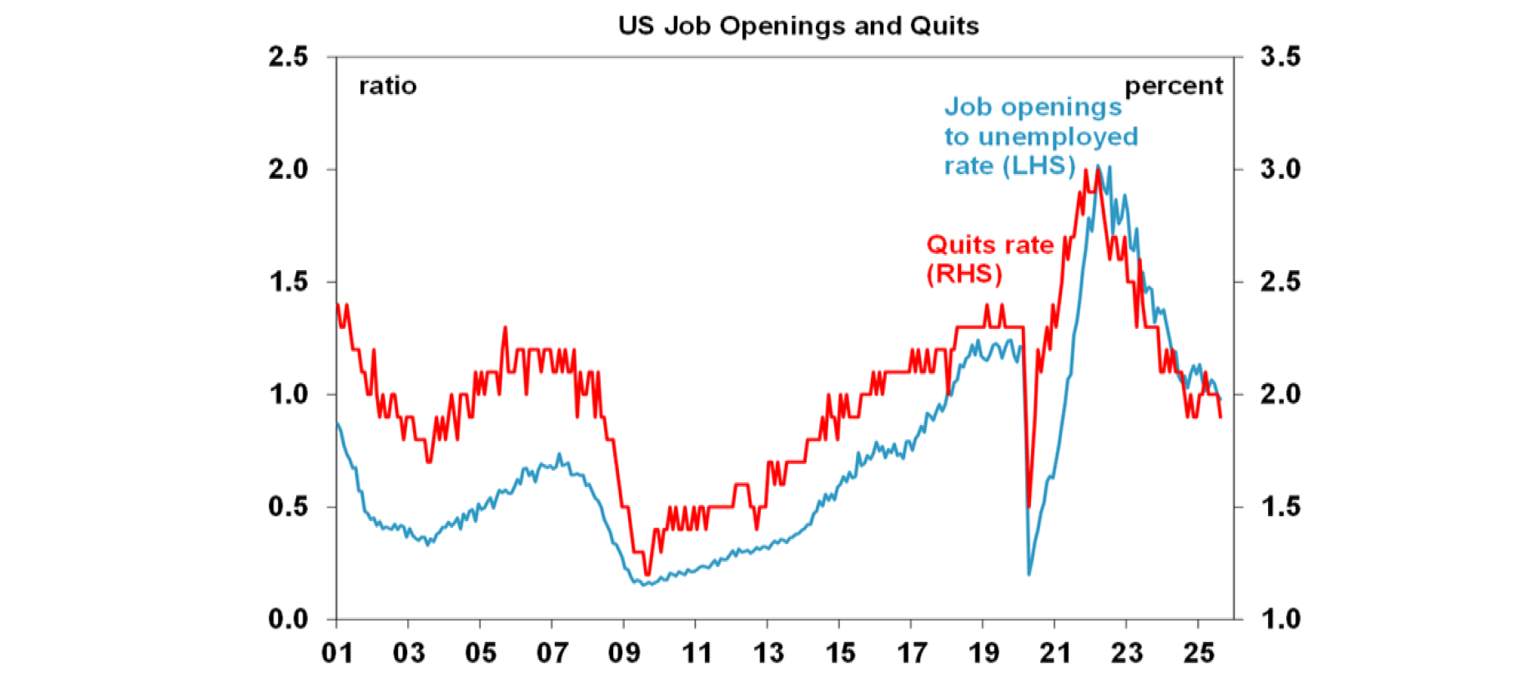

The ratio of job openings to unemployed, the quits rate and the hiring rate all fell.

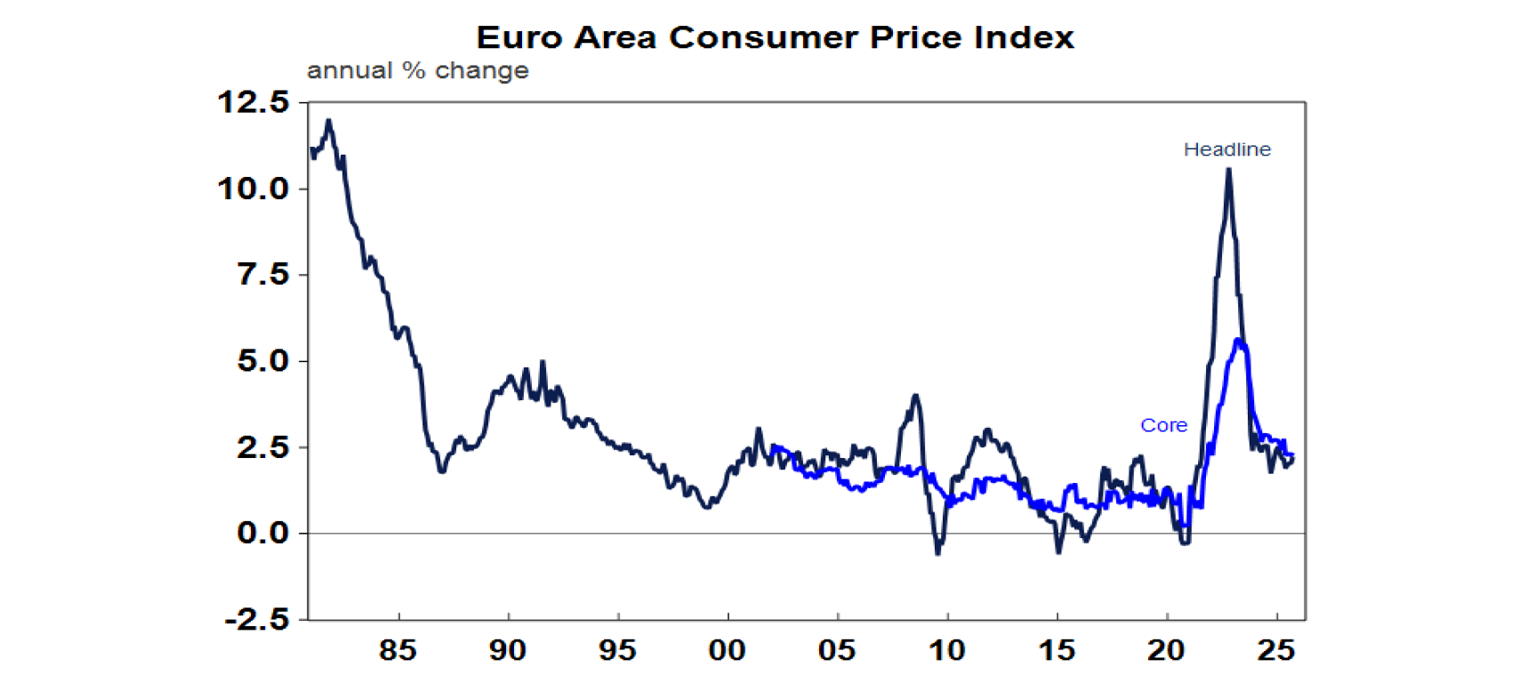

Eurozone inflation rose to 2.2%yoy in September reflecting energy base effects, with core inflation unchanged at 2.3%yoy. Both are around the ECB’s 2% target and likely leave it on hold this month. Unemployment rose to 6.3%.

The Japanese Tankan business survey for the September quarter showed business conditions little changed at around mostly solid levels with firm business investment plans. This is consistent with a rate hike soon by the BoJ.

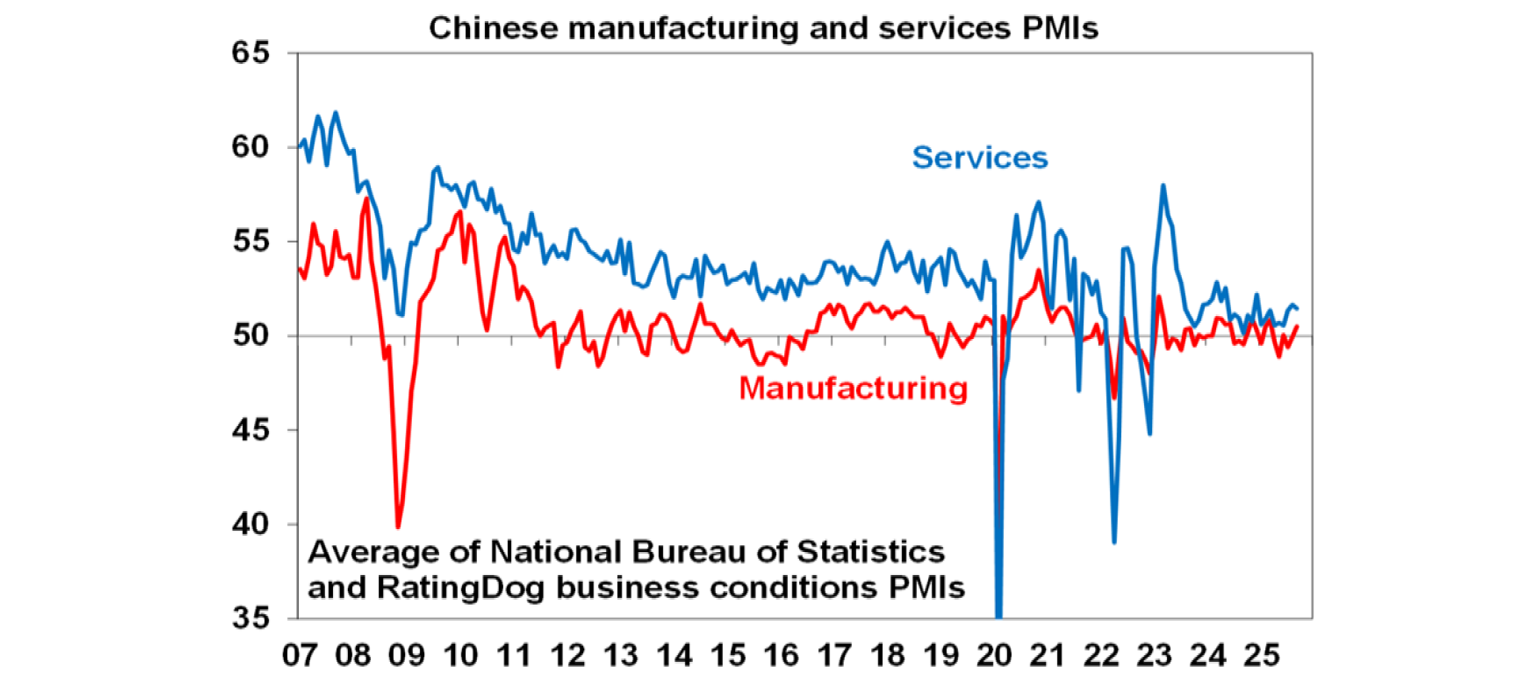

Chinese composite business conditions PMIs improved, with services down but manufacturing up by more. They remain consistent with growth around or just below 5%.

Australian economic events and implications

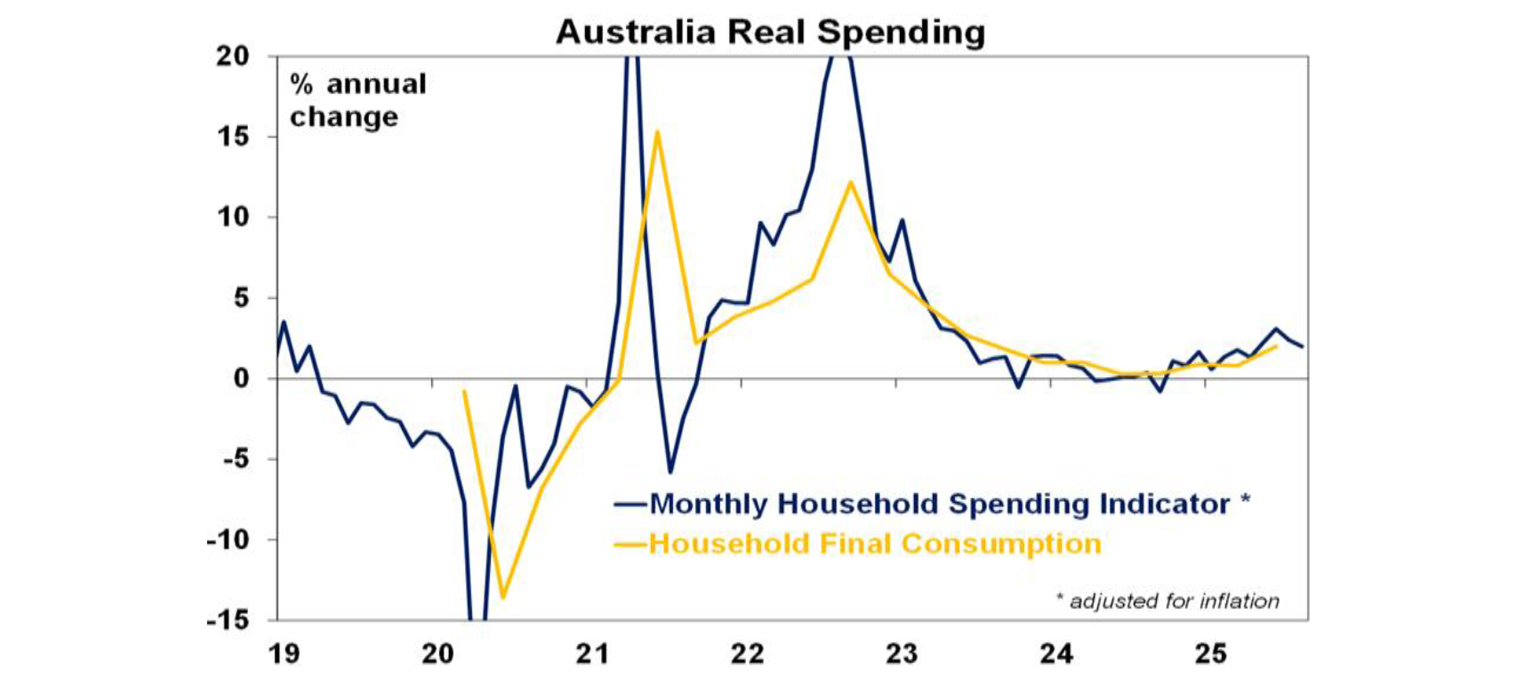

Australian data was a bit on the soft side over the last week. Household spending rose just 0.1%mom in August marking a distinct slowing in monthly growth since May. But don’t forget that spending in July was boosted by school holidays and increased health spending on the back of a bad flu season. The trend likely remains up – helped by rate cuts, rising real wages and rising wealth – but just a bit slower than looked to be the case up to July.

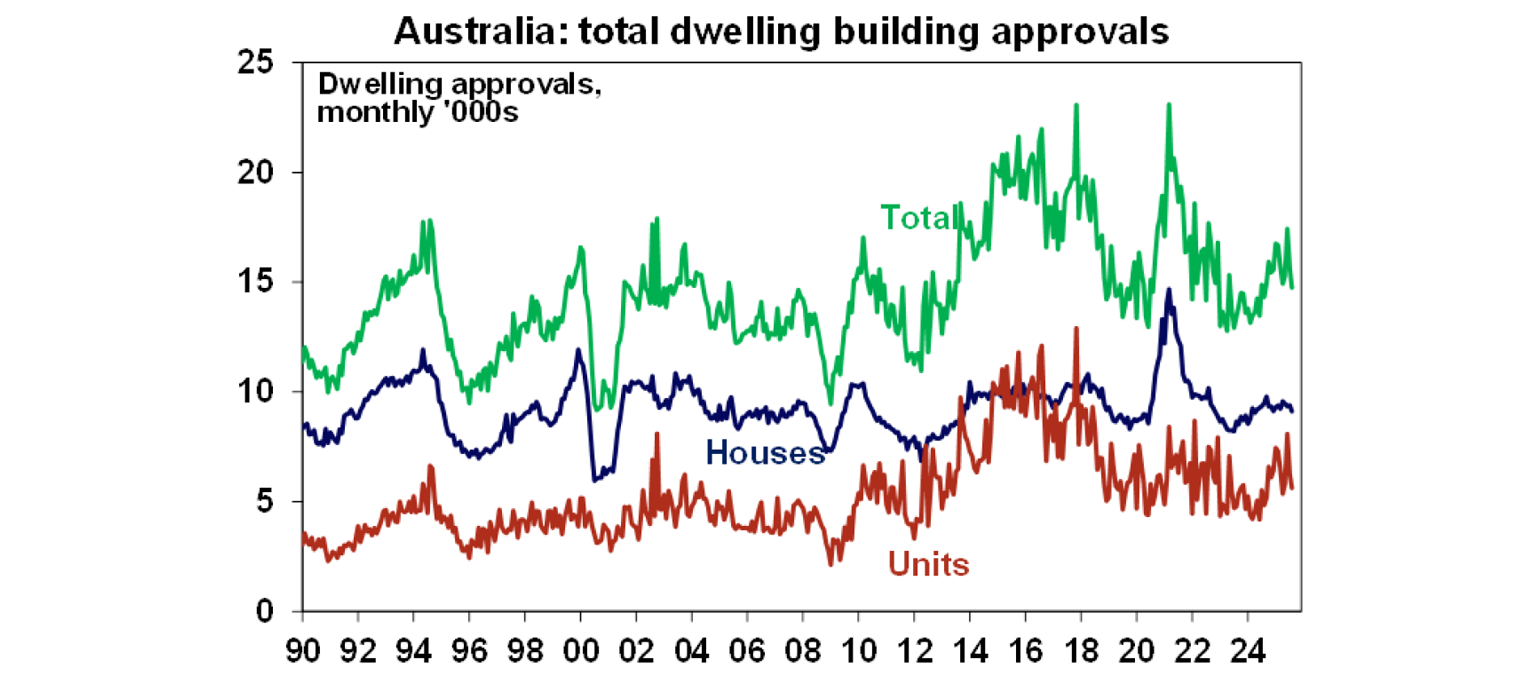

Home building approvals are continuing to run well below target. They fell another 6% in August after a 10% fall in July, driven by volatile units. Approvals are trending around 190,000 a year pace which is up from 2023 lows and roughly in line with population driven housing demand, but it won’t reduce the 200,000 to 300,000 housing shortfall and is well below the 240,000 Housing Accord target.

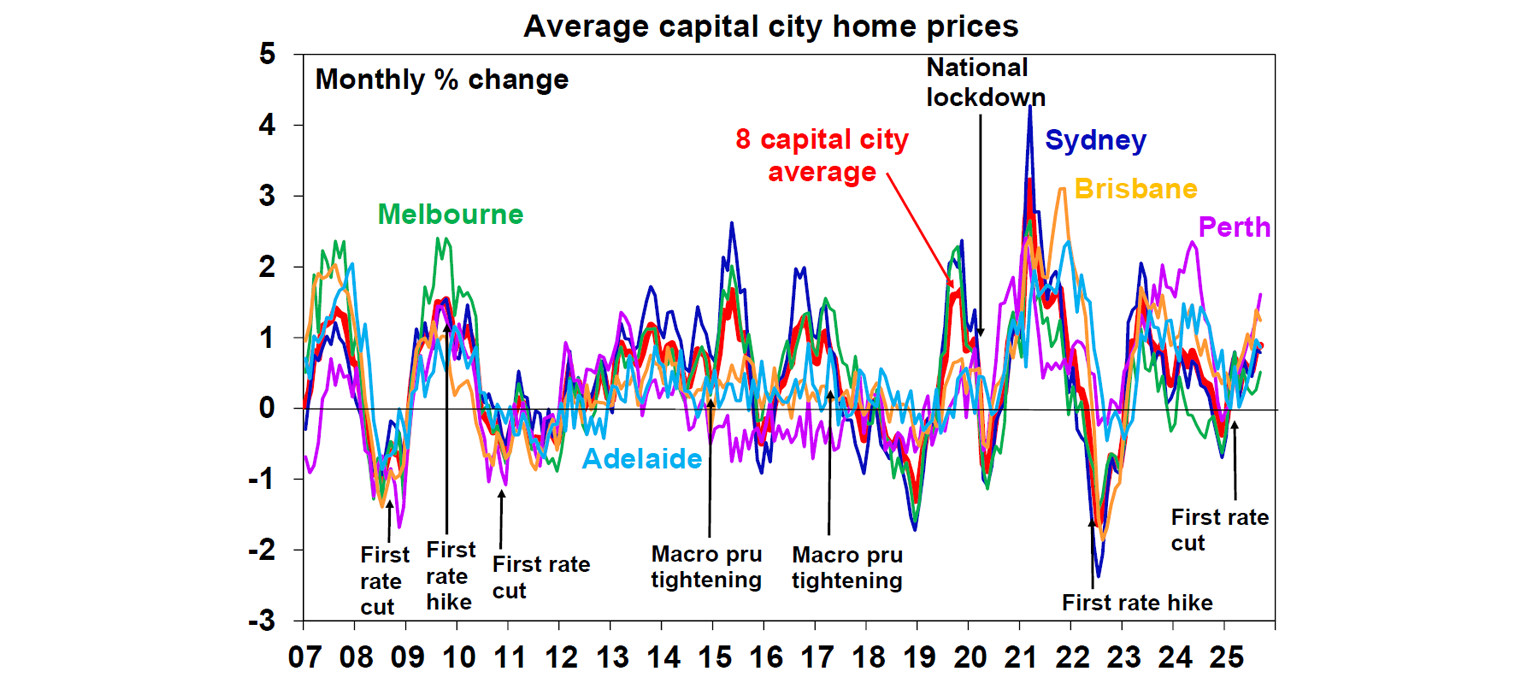

Reflecting the combination of falling interest rates, rising real wages, improved consumer confidence and the shortage of housing, national average home price growth remained solid in September at 0.8%mom and accelerated to 0.9%mom for capital city prices. Uncertainty about the timing and extent of future rate cuts along with poor affordability will act as a constraint, but with FOMO ramping up again and demand now getting a boost from the expanded 5% deposit scheme for first home buyers we expect average prices to rise 7% this year, accelerating to 8-10% next year.

The expanded 5% deposit scheme will likely prove very popular with first home buyers as: with the income caps gone and price caps raised most FHBs will now get access to it; it will cut 6 years at least off the time to save for a deposit; thereby avoiding paying rent; and it avoids having to pay lenders mortgage insurance. The trouble is that the bring forward of demand at a time when supply is constrained will mean a boost to prices. More first home buyers in the market may encourage more supply but this will take years to flow through and will likely be from a position of much higher prices. So, all up the expanded scheme will worsen, not improve housing affordability.

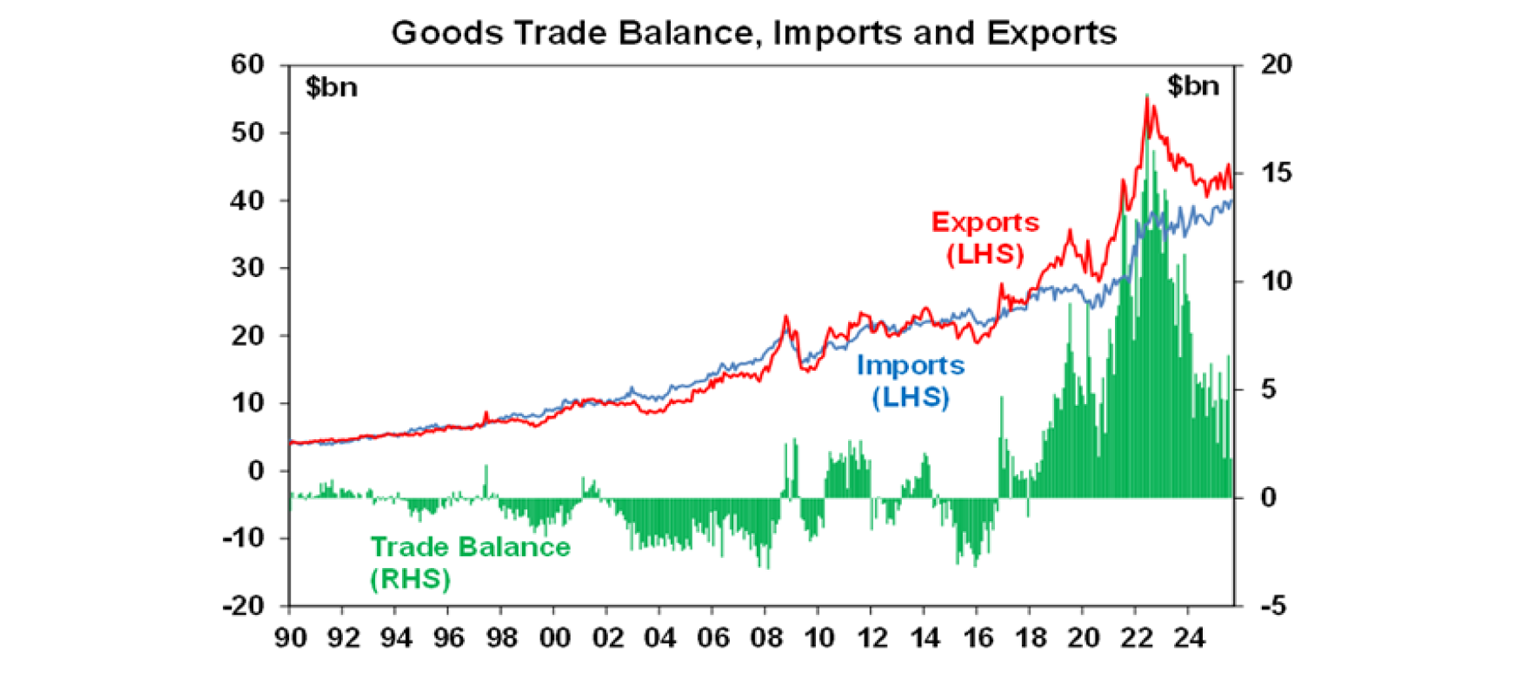

The trade surplus fell to $1.8bn in August reflecting a 7% fall in exports (due to a 47% plunge in volatile non-monetary gold exports) and a 3% rise in imports.

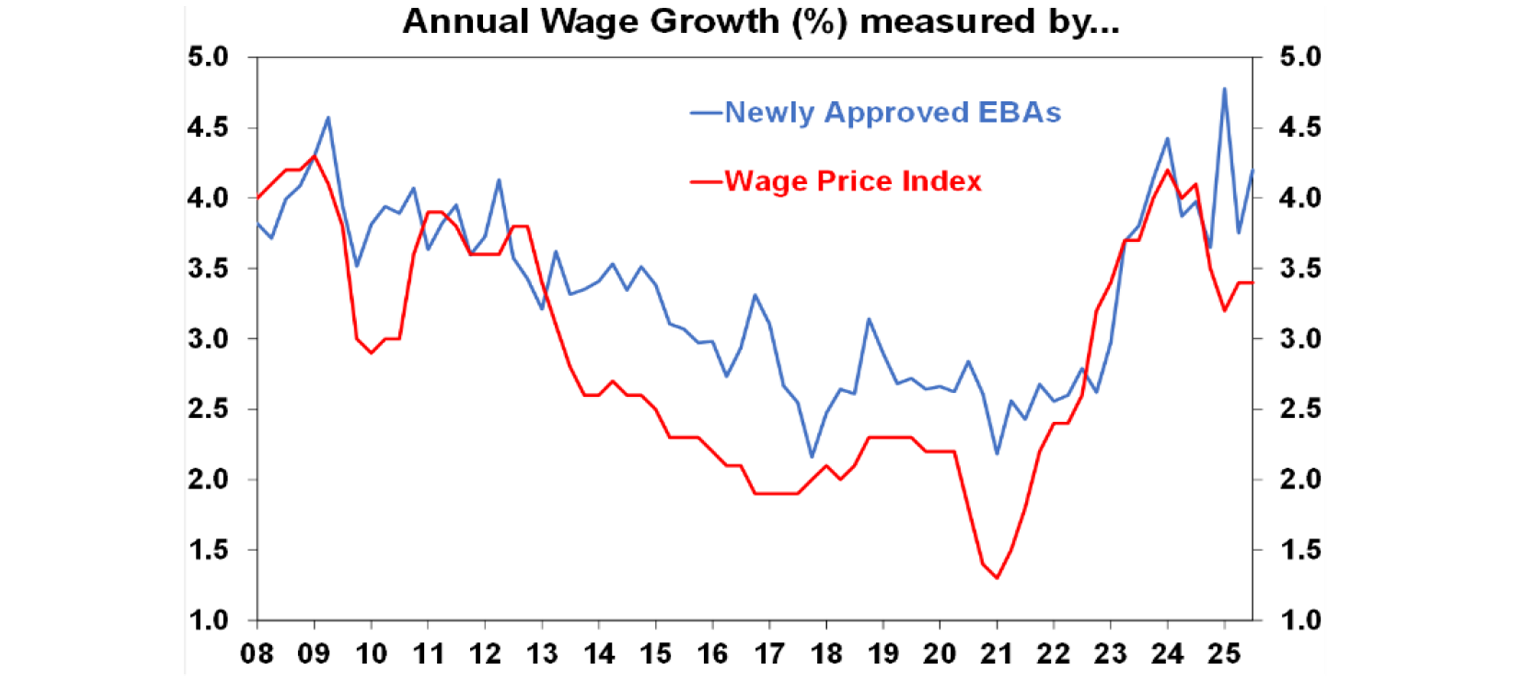

Newly approved Enterprise Bargaining Agreements regarding wages growth remained solid at 4.2% in the June quarter. This risks keeping wages growth at higher levels than consistent with the 2-3% inflation target.

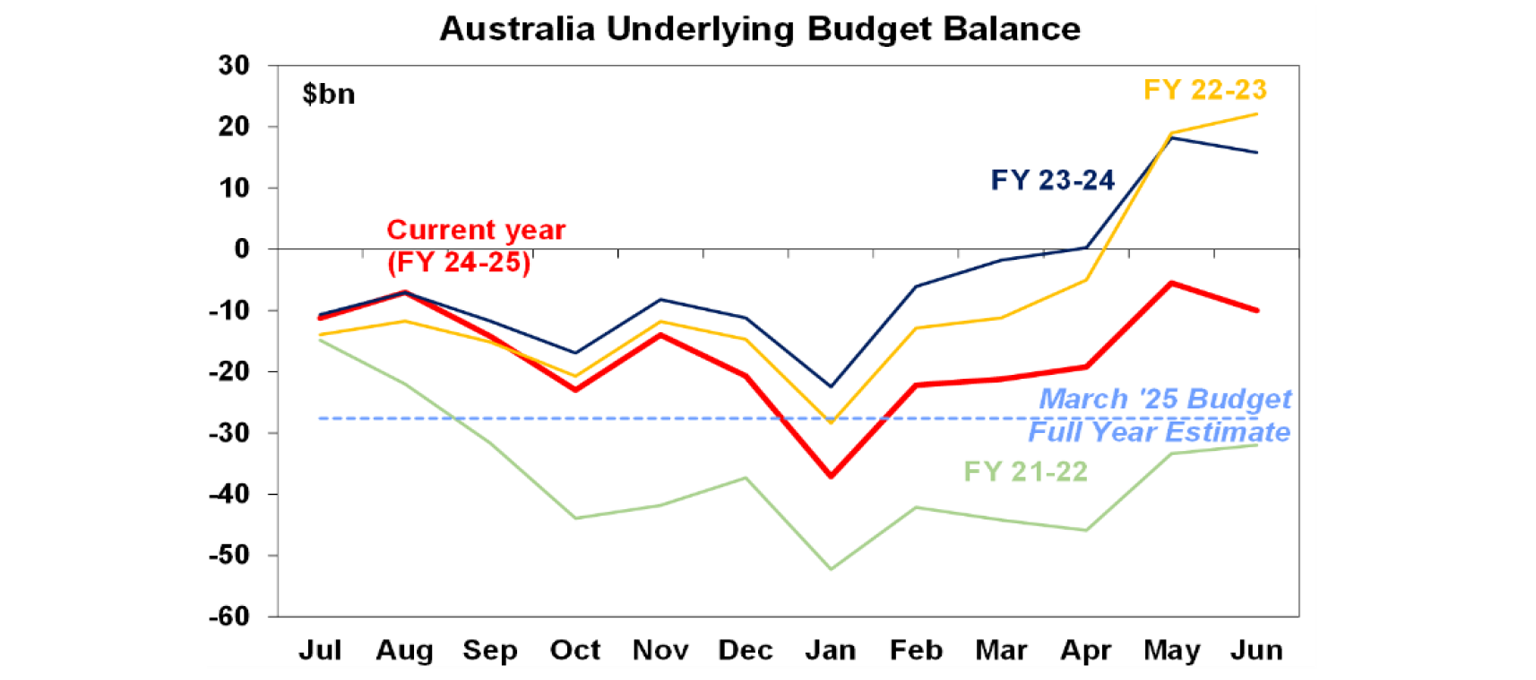

Australia’s 2024-25 budget deficit came in at $10bn, far better than the $27.6bn forecast in the March Budget thanks to stronger corporate and personal tax, Future Fund earnings and delayed payments to the states. It should have been another but bigger surplus though & would have been were it not for 5.5% real growth in government spending. Expect more deficits ahead as spending pressures remain.

What to watch over the week ahead?

The week ahead is scheduled to be relatively quiet on the economic data front. In the US the minutes from the last Fed meeting (Wednesday) will likely confirm the Fed’s dovish bias on the back of concerns about a softening jobs market starting to dominate concerns about the impact of tariffs on inflation. Delayed jobs data could be released though if the government shutdown ends.

The Reserve Bank of New Zealand (Wednesday) is expected to cut its cash rate to 2.75% or possibly 2.5% from 3% reflecting poor economic growth.

In Australia, RBA Governor Bullock’s appearance before the Senate Economics Committee (Friday) is likely to reiterate the Board’s cautious and data dependent message regarding the cash rate outlook from its September meeting. The Westpac/MI consumer confidence index for September (Tuesday) is likely to show a further small fall in reaction to the RBA’s more hawkish commentary on the interest rate outlook.

Outlook for investment markets

Share markets remain at risk of a correction given stretched valuations, risks around US tariffs and the softening US jobs market. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains on a 6-12 month horizon.

Bonds are likely to provide returns around running yield as central banks cut rates.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to working from home.

Australian home prices have started an upswing on the back of lower interest rates and more support for first home buyers. But it’s likely to be constrained a bit by poor affordability and only gradual rate cuts constraining buyers. We see home prices rising around 7% this year, and 8-10% next year.

Cash and bank deposits are expected to provide returns of around 3.5%, but they are likely to slow.

The $A is likely to be buffeted in the near term by the impact of US tariffs but may be breaking higher now with the Fed looking like it will cut more than the RBA. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.