Key points

As widely expected, the RBA cut by 0.25% taking its cash rate to 3.85%. This is the second rate cut in this easing cycle.

The RBA remains “cautious about the outlook”, but its overall commentary appears more dovish leaving the door wide open for further easing.

We expect the RBA to cut again in August, November, and February taking the cash rate to 3.1%. There is now close to a 50% probability of another cut as early as July though.

The ongoing rate cutting cycle should help underpin a modest further pick up in Australian economic growth to around 1.8%yoy, but with the tariff threat posing a big downside risk.

RBA to 3.85% and leans more dovish

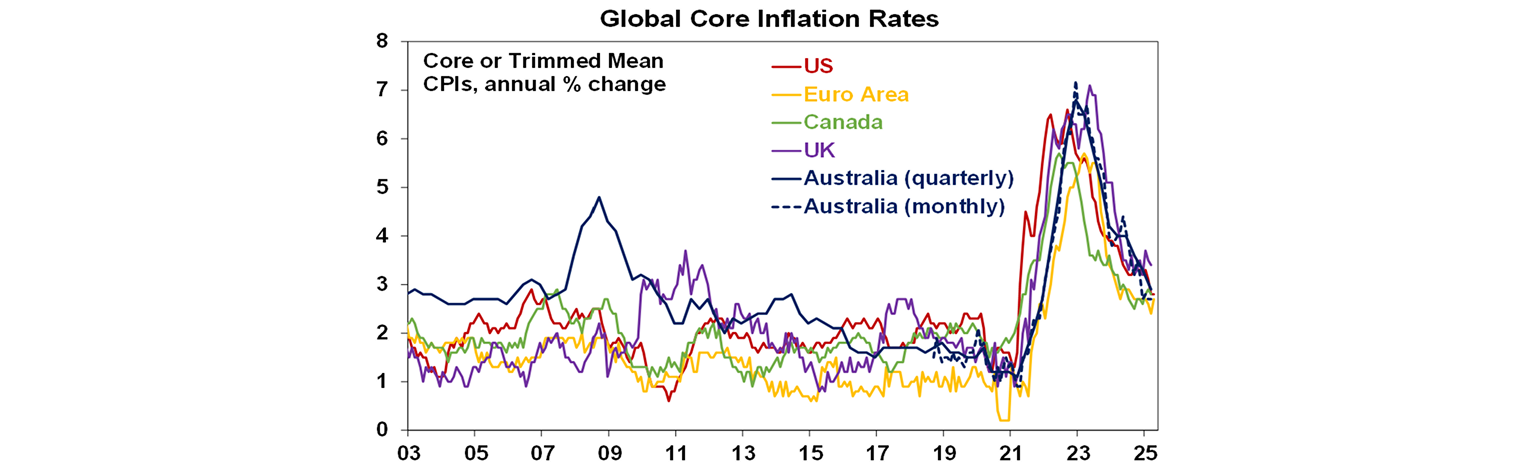

As widely expected, the RBA cut its cash rate from 4.1% to 3.85% on the back of further evidence that inflation continues to ease. In particular, the RBA noted that trimmed mean inflation is now back below 3%yoy and is expected to be around the midpoint of the 2% to 3% target range from June onwards, it now sees the risks to inflation as being more balanced and it sees considerable uncertainty around the US tariffs and geopolitics. It also notes that wages growth has softened and weakness in demand in some sectors makes it difficult to pass on cost pressures. But the RBA also continues to note that the labour market remains tight and productivity growth has not improved, which along with the US tariff pauses likely explains why the RBA did not see the need for a super-sized 0.5% rate cut.

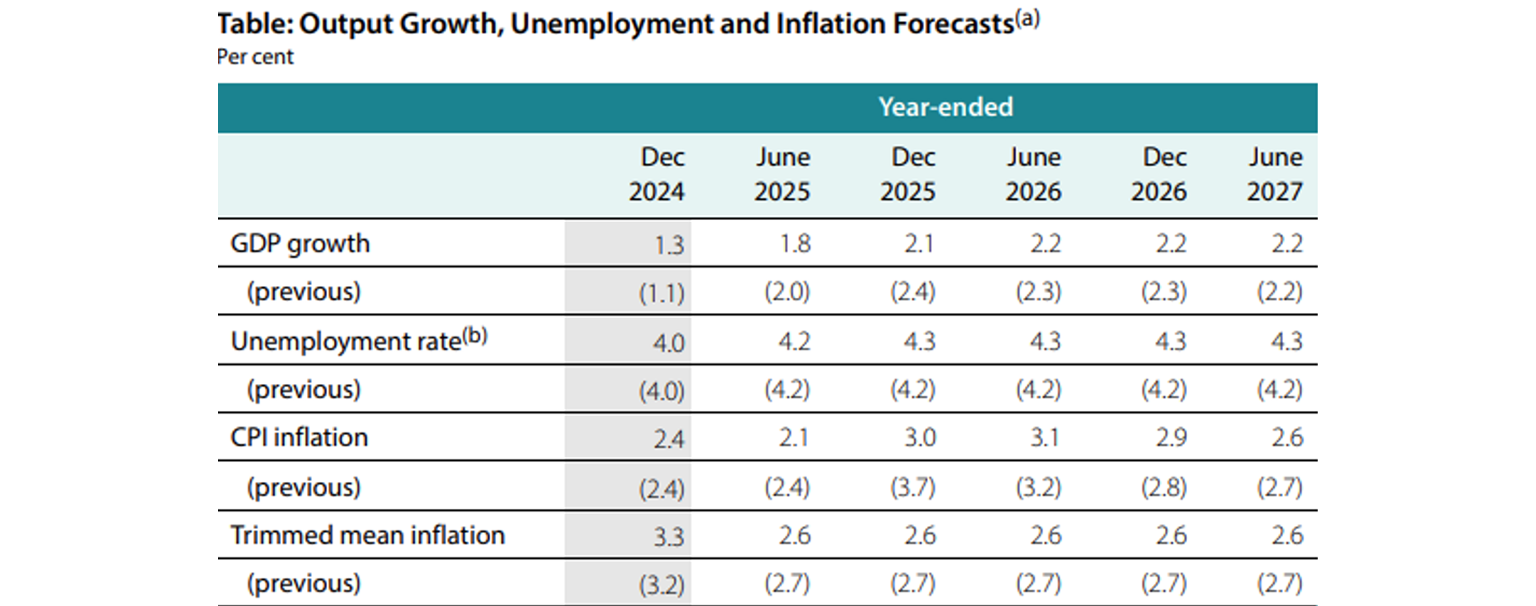

Consistent with its decision to ease again the RBA revised down its growth forecasts for this year, mainly due to weaker growth in consumer spending and business investment and it now sees slightly higher unemployment. More significantly it revised down its underlying (or trimmed mean) inflation forecasts to 2.6%yoy.

The modest downwards revision to the RBA’s underlying inflation forecasts means that its now effectively seeing it back at the midpoint of the target range right through its forecasting period.

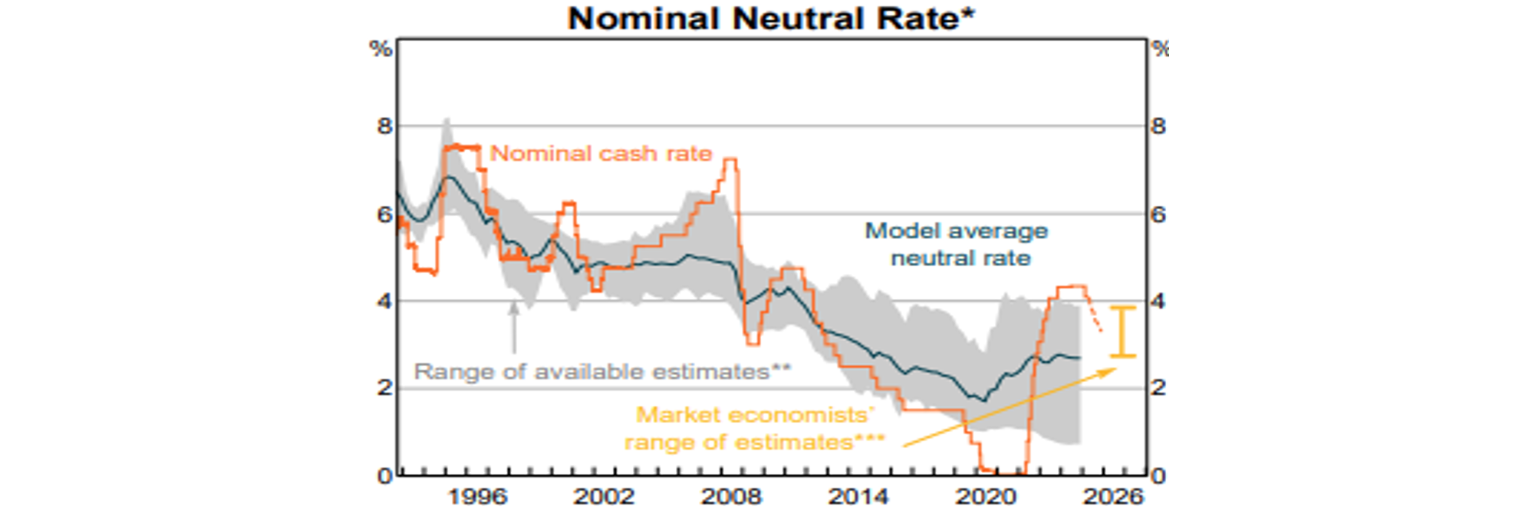

It’s worth noting that even after the latest rate cut monetary policy is still judged to be restrictive by the RBA, seeing it as being only “somewhat less restrictive”, with the cash rate still above most of the RBA’s estimates of the neutral rate which now average around 2.8%, based on the next chart from the RBA. This in turn provides plenty of scope for further rate cuts to get monetary policy back to neutral.

What’s more the latest cut means that just two of the 13 rate hikes between May 2022 and November 2023 which totalled 4.25% have been reversed. For mortgage payments it will reverse another $1260 of the $16,800 increase in annual payments on a $660,000 since May 2022. Or a total saving of $2520, which still only reverses 15% of the increase in payments since May 2022.

The RBA remains “cautious about the outlook”, but it has become progressively more dovish since its February meeting. The RBA is no longer referring to a further tightening in the labour market, nor is it referring to the risks of easing “too much too soon”, it now sees underlying inflation back at target, it sees the risks to inflation as having become “more balanced” and its now more concerned about the threat posed by the US tariffs and sees this as being disinflationary for Australia. And as in April, RBA Governor Bullock is no longer pushing back against market expectations for further easing as was the case in February. The RBA reiterated that it will “be attentive to the data and the evolving assessment of risks”, but overall, it appears to be leaving the door open for further easing.

Its concerns about the still tight labour market and poor productivity suggest the easing process will remain gradual though, although a worsening of the US trade war could easily see it speed up.

We expect the RBA to cut again in August, November and February, and a July cut is a distinct possibility

We continue to see further rate cuts ahead as we see economic growth picking up more slowly than the RBA is forecasting, monetary policy remains tight and annual underlying inflation is close to being back at the midpoint of the target range earlier than the RBA was expecting.

Yes, unemployment is historically low at 4.1% but there is still no sign of a wages breakout with wages growth down from its 2023 high implying that the non-accelerating inflation rate of unemployment (NAIRU) is likely lower than the RBA’s assumed 4.5% and RBA Governor has said they are “open” to this.

As the RBA suggests, monetary policy is still restrictive, albeit less so.

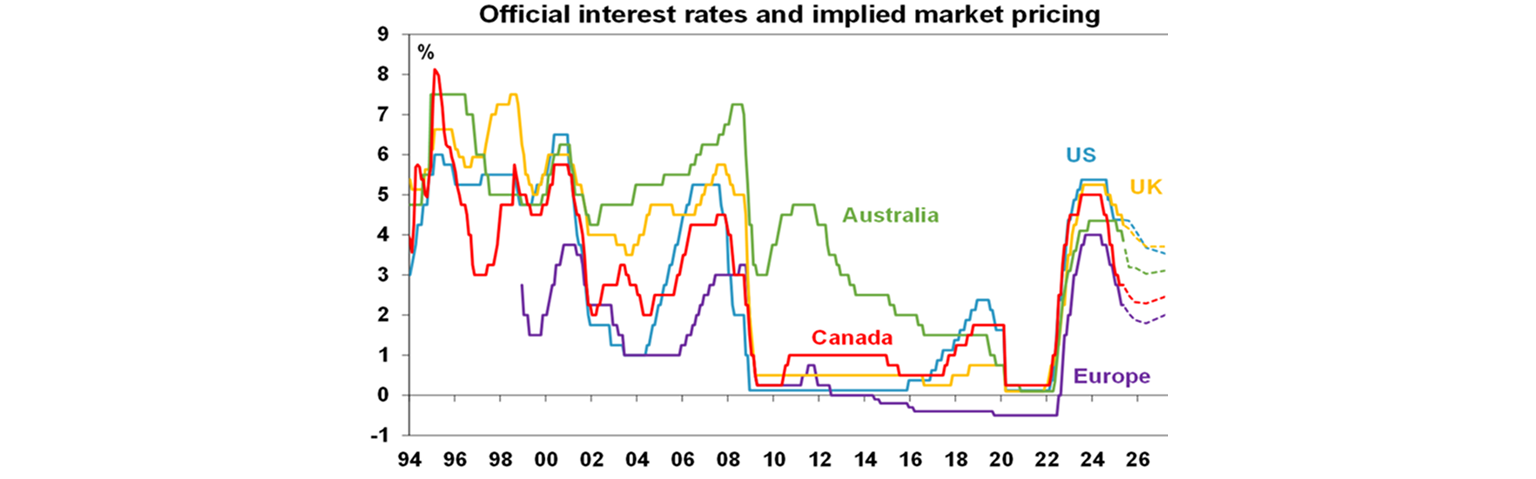

Underlying inflation in Australia is in line with other countries which are continuing to cut rates with the March trimmed mean rate of 2.7% similar to core inflation in Europe and Canada, which have rates well below the RBA’s cash rate.

While the tariff threat has fallen back with Trump pausing the tariffs, the average tariff on US imports is still five times greater than last year’s level and his trade war is at high risk of flaring up again. So, Trump’s trade war is still going to be a drag on growth.

So, while low unemployment and poor productivity growth mean that the RBA will remain cautious and gradual in cutting rates, we continue to see the RBA cutting rates again in August, November and February taking the cash rate down to 3.1%, revised down from 3.35%. With inflation now expected to be at target and the US trade war posing downside risks to the growth the chance of a cut in July is now likely close to 50%. In fact, the money market has moved to a price in a 65% probability of a July cut.

Implications for the economy, shares and property

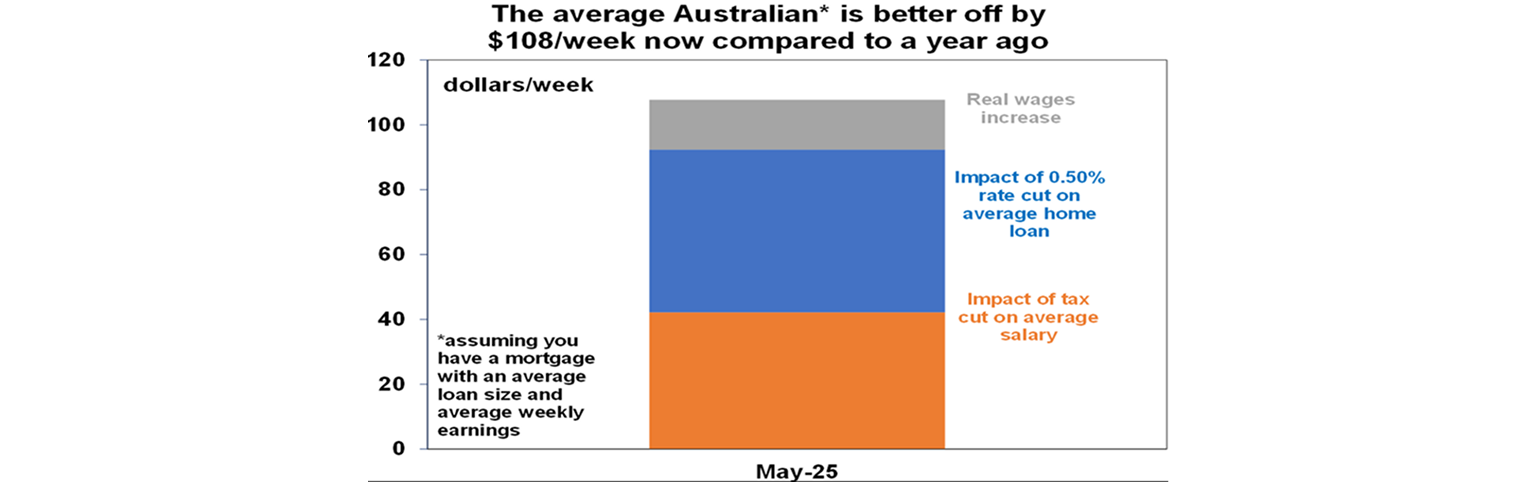

Growth to rise to 1.8%yoy. The continuation of the RBA rate cutting cycle is likely to support a modest uptick in Australian economic growth this year to around 1.8%yoy, which is slightly below RBA forecasts. The further 0.25% rate reduction (which the banks are passing on) will cut roughly another $105 off monthly mortgage payments on a $660,000 mortgage freeing up some more spending power. The combination of the two mortgage rate cuts, last year’s July tax cuts, and wages growth running above inflation will provide roughly a $108 a week boost to someone on average earnings with a mortgage compared to a year ago. However, the impact on spending is likely to be modest initially as: it takes a while for interest rate moves to start impacting spending as we saw in 2022; rate cuts into early next year are expected to reverse only 5 of the 13 hikes; and rate cuts will likely still be gradual.

Positive for shares but expect a rough constrained ride this year. RBA rate cuts are positive for Australian shares because they help boost future profit growth and make shares relatively more attractive relative to cash. However, this assumes recession is avoided. The experience since 1982 suggests no boost to shares after 3 months on average from the first rate cut but a 2.6% median boost after 6 months and a 5.3% median boost after 12 months. However, this masks a huge range, with shares having a rougher ride at least initially if there is a recession. Fortunately, a recession is unlikely. But shares saw strong gains into February in anticipation of RBA rate cuts and despite a fall into early April are now just 3% below their record high, valuations are stretched and Trump’s trade war and various other risks will no doubt make for a volatile ride. However, the continuation of rate cuts in the absence of recession still point to reasonable gains on a 12-month view.

Positive for property too but expect only modest gains this year. Lower rates are positive for home prices because they take pressure off existing homeowners who may have been struggling with their mortgages and as they increase the amount a borrower can borrow from a bank and hence pay for a property which supports demand. Buyers anticipate this and so we have seen auction clearance rates in Sydney and Melbourne move up since late last year. Roughly speaking the two 0.25% rate cuts will add about $19,000 to how much a buyer on average earnings can borrow which along with three further rate cuts will drive a significant increase in the capacity of buyers to pay for a property. However, with housing affordability remaining poor, the capacity to pay set to remain well below the 2021-22 high with a wide gap to home prices as mortgage rates remain well above the 2 to 3% level seen in 2021 and early 2022 and rate cuts likely to be gradual, we are only anticipating a 3% rise in average home prices this year.

You may also like

-

How women can build financial wealth, confidence and security Practical tips for women to grow their wealth. Learn about budgeting, saving, super advice and more to take control of your finances. -

Oliver’s Insights – Oliver's Insights - Gulf War-3 US/Iran war Geopolitical shocks have been a rising feature this year with US “interventions” in various countries – Nigeria, Venezuela, Greenland and now Iran. -

Weekly market update - 27-02-2026 Australian shares are a key beneficiary of the rotation trade helped by the now concluded December half earnings reporting season confirming that listed company profits are rising again.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.