For over 30 years, Australia fought a great national crusade to provide dignity in retirement. Is it working? The numbers suggest so.

Our superannuation coffers now hold $2.3 trillion1 - that’s nearly 150% of GDP. In 2022, pension flows out to members were worth nearly 7% of GDP.

The evolution of our super system has changed our country by altering expectations of how old age is lived. AMP Head of Investment Strategy and Chief Economist Shane Oliver says, “Super underpinned capital flows into our economy and picked up the tab for much of our national infrastructure. It also made us a nation of mini capitalists. Super created a feeling of financial independence.”

We’re getting there – the changing face of retirement

There’s growing evidence the system is doing what it was designed to do. Firstly, the cost of retirements is falling more lightly on the taxpayer. The Retirement Income Review suggests that by 2060 the number of eligible Australians on the age pension will fall from 71% to 62%.

Conversely, the number receiving a part rather than full age pension will rise from 38% to 63%.

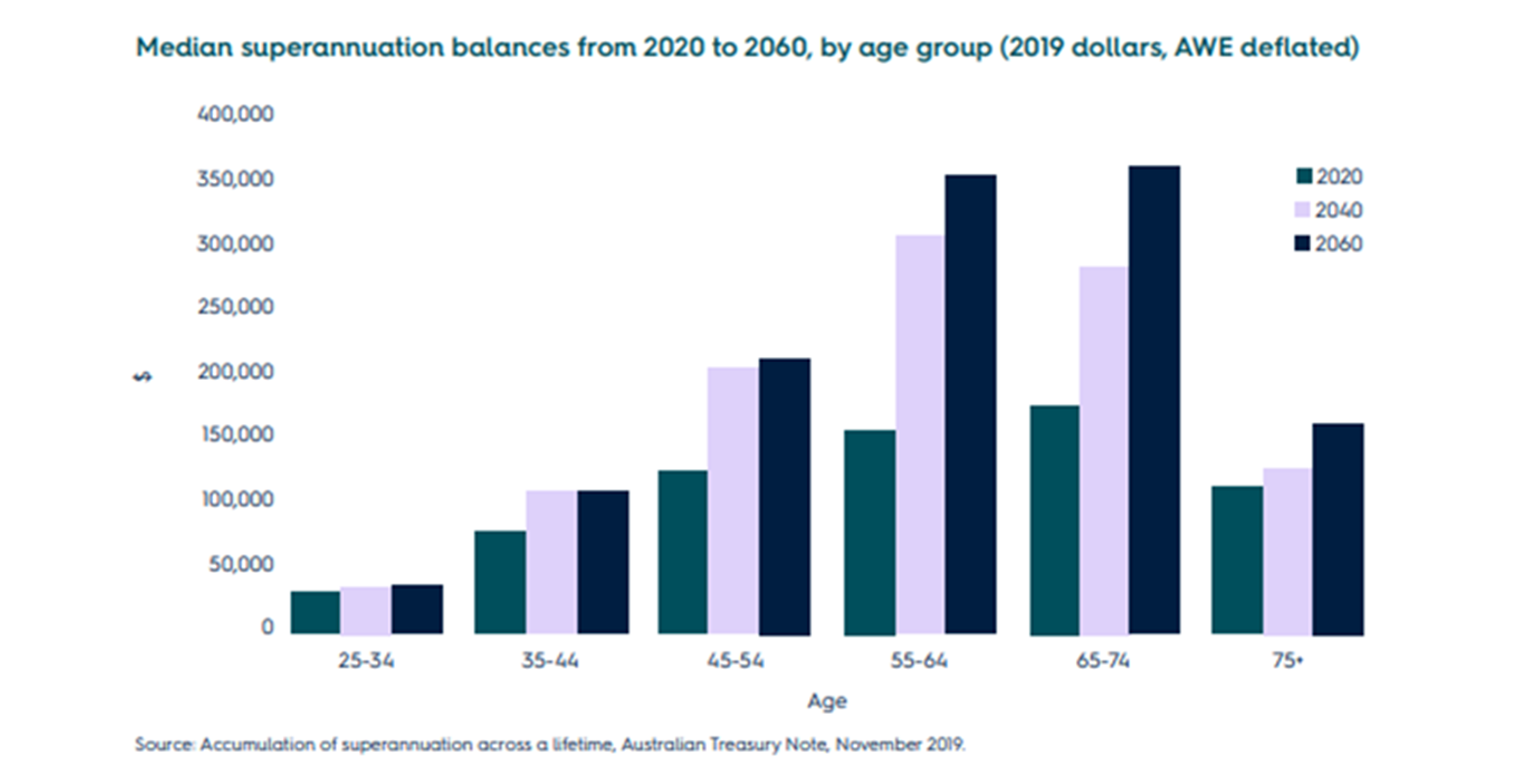

At the same time, a dignified, comfortable retirement could be available to more people. The average range of retirement capital outcomes is getting higher. According to Treasury’s Intergenerational Report, the median super balance at retirement in 2020-21 was around $125,000.

By 2060-61 it will be around $460,000 (measured in 2021 dollars). Healthy retirement balances will be more common. In 2020, 65% of retirees entered retirement with an average super balance under $250,000. By 2060 fewer than a third of Australians are expected to retire with a balance that low.

More Australians will retire ‘rich’. By 2060, 13% will retire with a super balance worth a million or more2. The unknown is how much that sum will really mean by then.

“‘The Great Risk Transfer’3 means we’ve put a whole lot of responsibility on the individual,” says John Perri, Head of Technical Strategy at AMP. “Some people retire without a house, some with multiple houses. We all have completely different super journeys. And that means we’ll have different journeys in retirement.”

The Treasury chart above highlights the effect the maturing of the super system is having on the retirement prospects of Australians.

Yet as always, big numbers obscure distinct human realities. Someone retiring in 2020 after an uninterrupted work life would have spent the first 12 years without compulsory super4.

And while there’s good news in aggregate, individual retirees and pre-retirees face a wall of real worries. For many pre-and early retirees, Fear of Running Out (FORO) is a major anxiety, especially as the growing cost of living eats away at your lifetime savings.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.

1 Mercer CFA Institute Global Pension Index 2022

2 Superannuation balances at retirement, Treasury Information Note, 2019.

3 The Great Risk Shift by Jacob S Hacker in the early 2000s.

4 Treasury Information op. cit