Key points

Economics has an impact on all parts of the economy. Recent political disruptions in the US reflect some long-term economic changes in the US economy.

Rising inequality, a changing labour market and a decline in housing affordability for younger groups are long-term changes in the US economy. These issues are also felt in other major advanced economies to varying degrees but often other countries may have offsetting social safety nets.

The US sharemarket has hit another record high, looking through all the political noise. But the risk is that long-term, the US looks less structurally sound and will underperform its peers.

Introduction

Recent political chaos in the US is a symptom of long-term structural change. We look at how economics has impacted US politics in this edition of Econosights.

The US has become increasingly polarised

Polarisation refers to the widening gap in political attitudes, where individuals increasingly move away from centrist views and towards ideological extremes on either the left or right.

In the early 1990s, moderates made up the largest share of the American electorate, accounting for 43% of voters. By 2024 this figure had declined to 34%. This drop in moderates has been accompanied by a rise in liberal identification, which increased from 17% in 1992 to 25% in 2024.Meanwhile, the proportion of conservatives has remained relatively stable, shifting only slightly from 36% in 1992 to 37% in 2024 - see chart below.

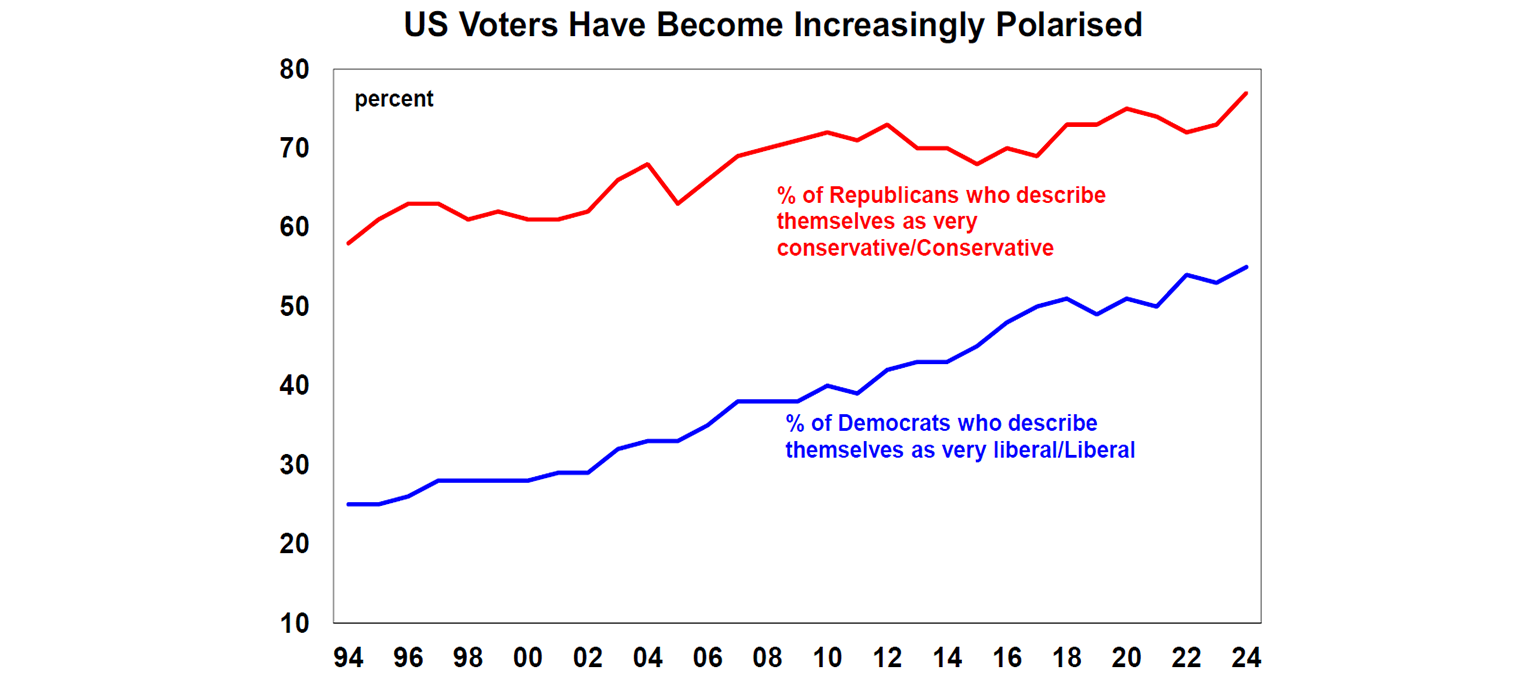

Within that shift, both Republican and Democrat ideologies have moved toward their most extreme positions in over 30 years - see chart below.

As US voters have become more ideologically polarised, so too have the candidates who represent them. This growing divide has contributed to the rise of populist parties, which aim to appeal to the “common person” - particularly those who feel economically and socially left behind.

There are multiple long-term economic factors driving this sentiment, especially over the past two decades, including rising inequality, stagnant wages, and declining housing affordability.

Australia has experienced some degree of this political shift in recent years, but not to the same extent. One key reason is compulsory voting, which tends to encourage parties to adopt more centrist policies — and in turn, influences voters to take a more moderate stance.

Inequality has risen

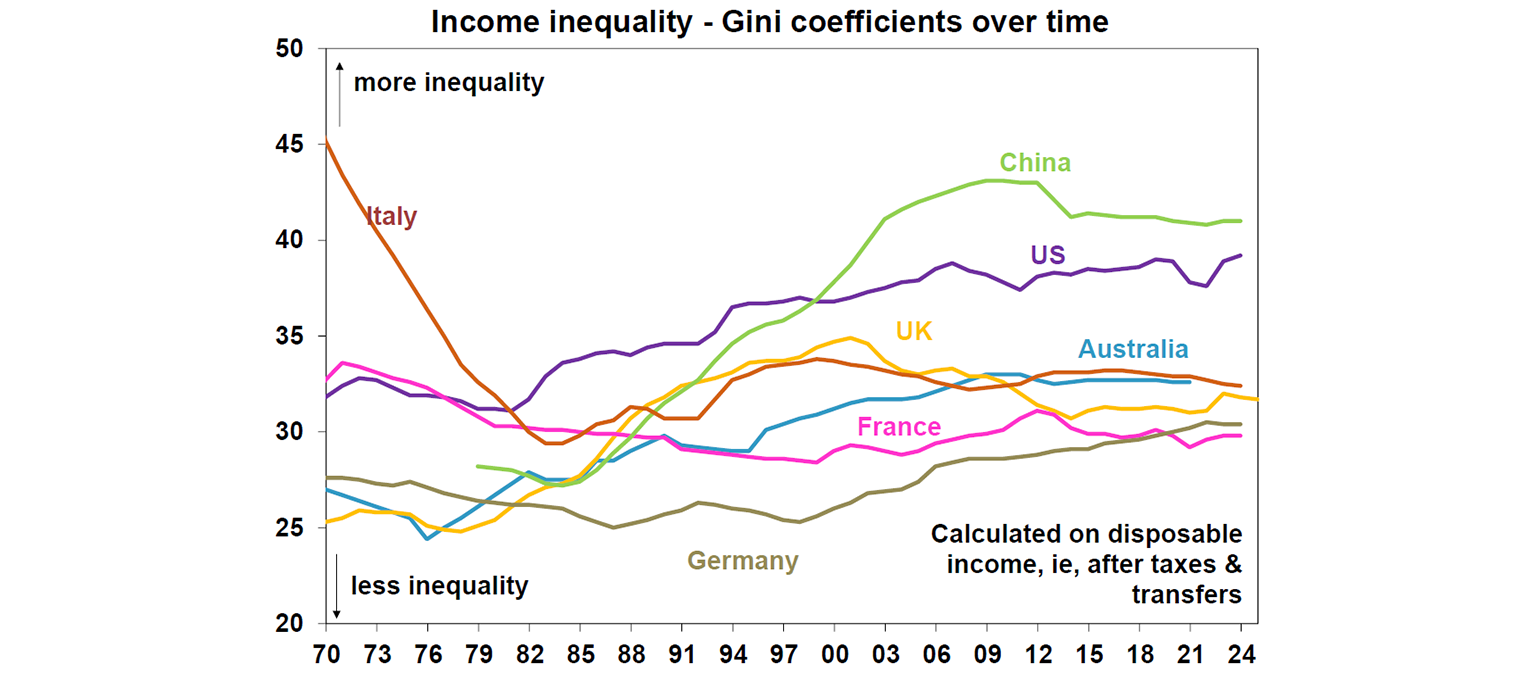

One of the broadest measures of inequality is the “Gini” coefficient, which captures how income or wealth is distributed within a population. A higher Gini coefficient indicates greater inequality, while a lower value suggests a more equal distribution. In the US, the Gini coefficient has been rising steadily over the past 40 years and is higher than in Europe or Australia - see the chart below.

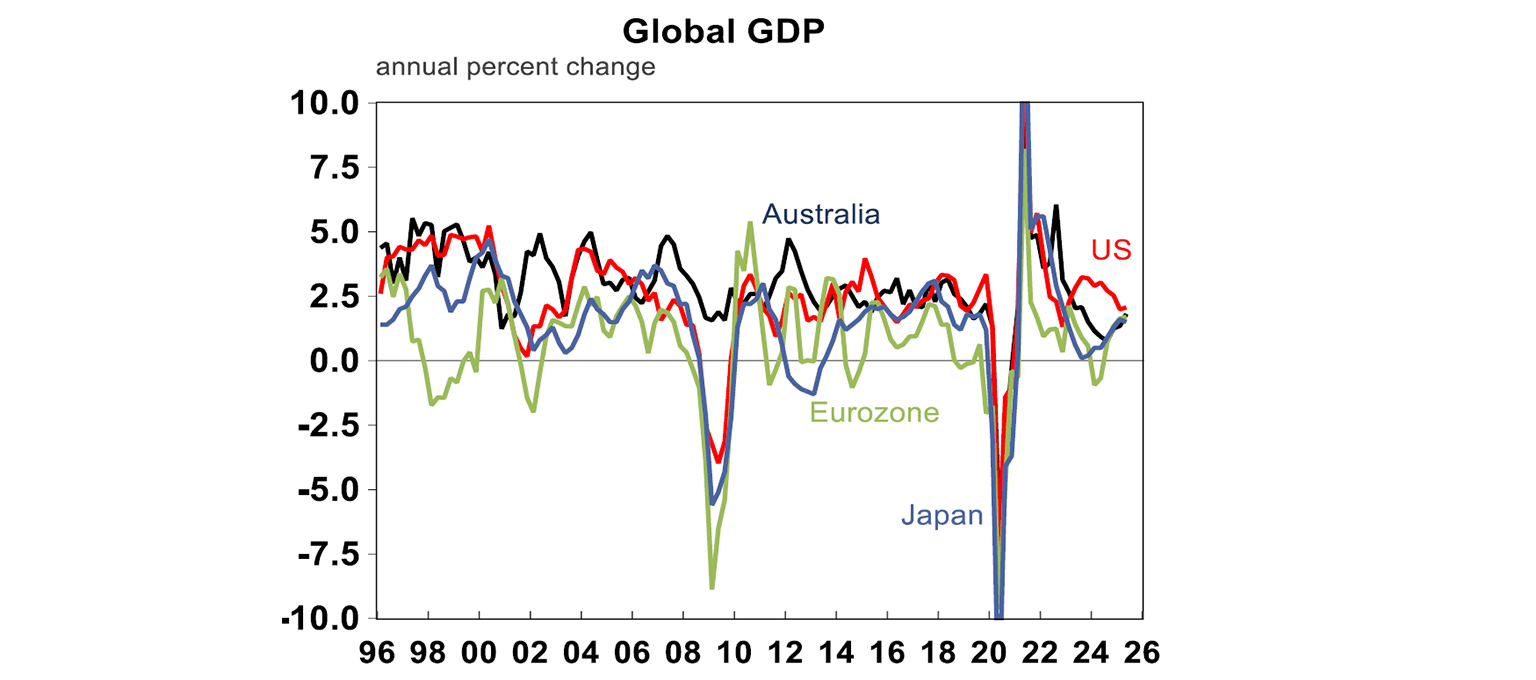

This means that the benefits of economic growth are increasingly concentrated among fewer people. While US economic growth has averaged around 2.5% since 2022 - outpacing its peers (see chart below) - these gains have not been broadly shared across income and wealth groups.

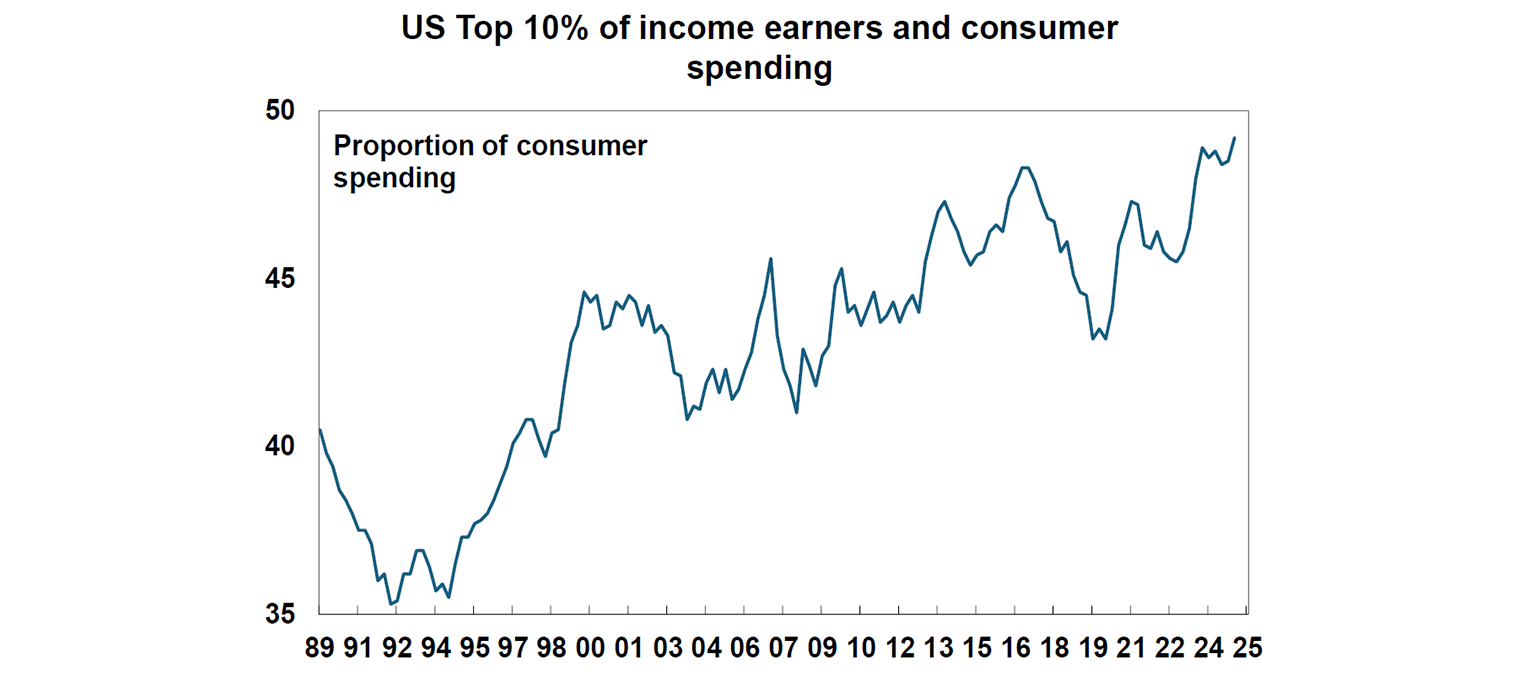

The top 10% of US consumers (on an income distribution) accounted for 49.2% of total spending in the June quarter of 2025, reaching the highest level since the data started in 1989 (see the chart below). And the top 10% of US income earners account for 70% of consumer wealth. Higher inequality limits economic growth, creates more social tensions as people feel left behind, fuels populism and makes the economy less dynamic in the long-term.

A changing labour market and role for AI

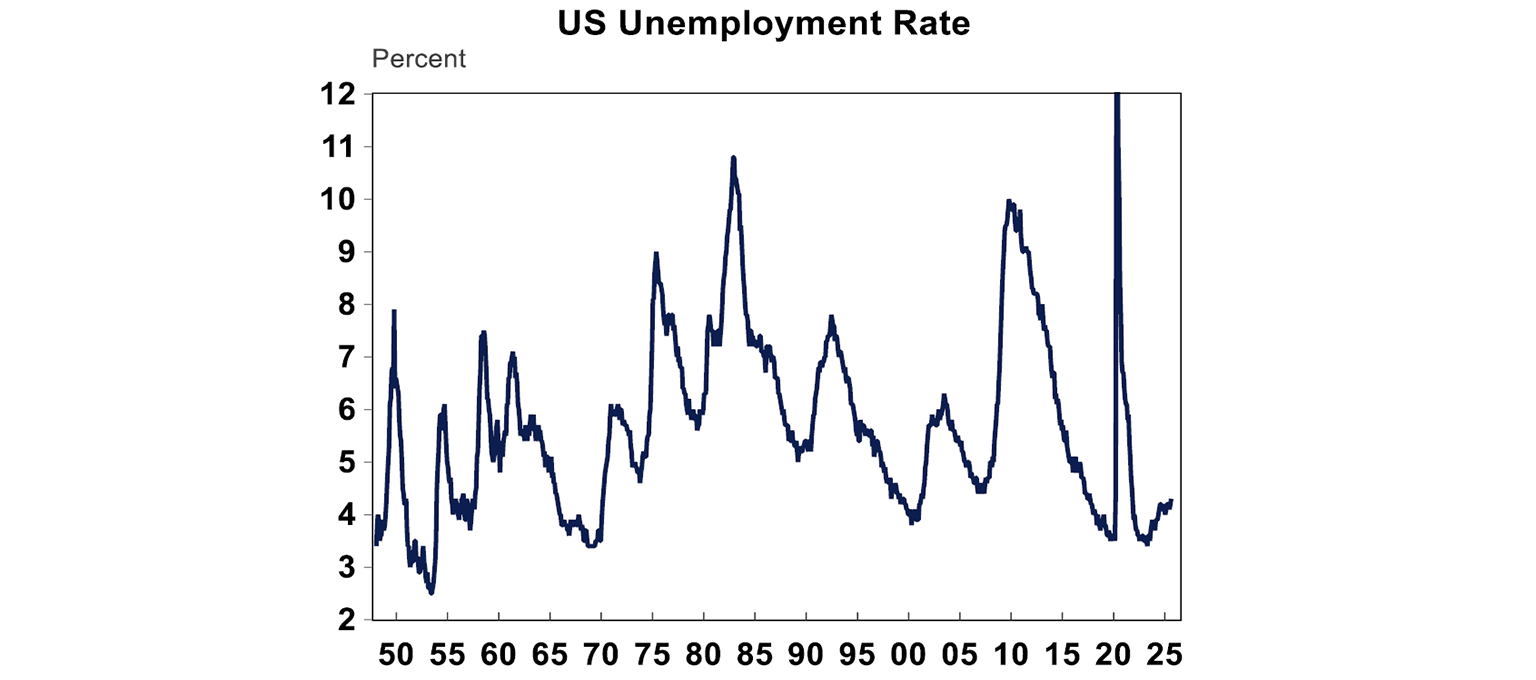

There’s no doubt that the US labour market has been strong in recent years. The unemployment rate reached a low of 3.4%, close to historical record lows — see chart below.

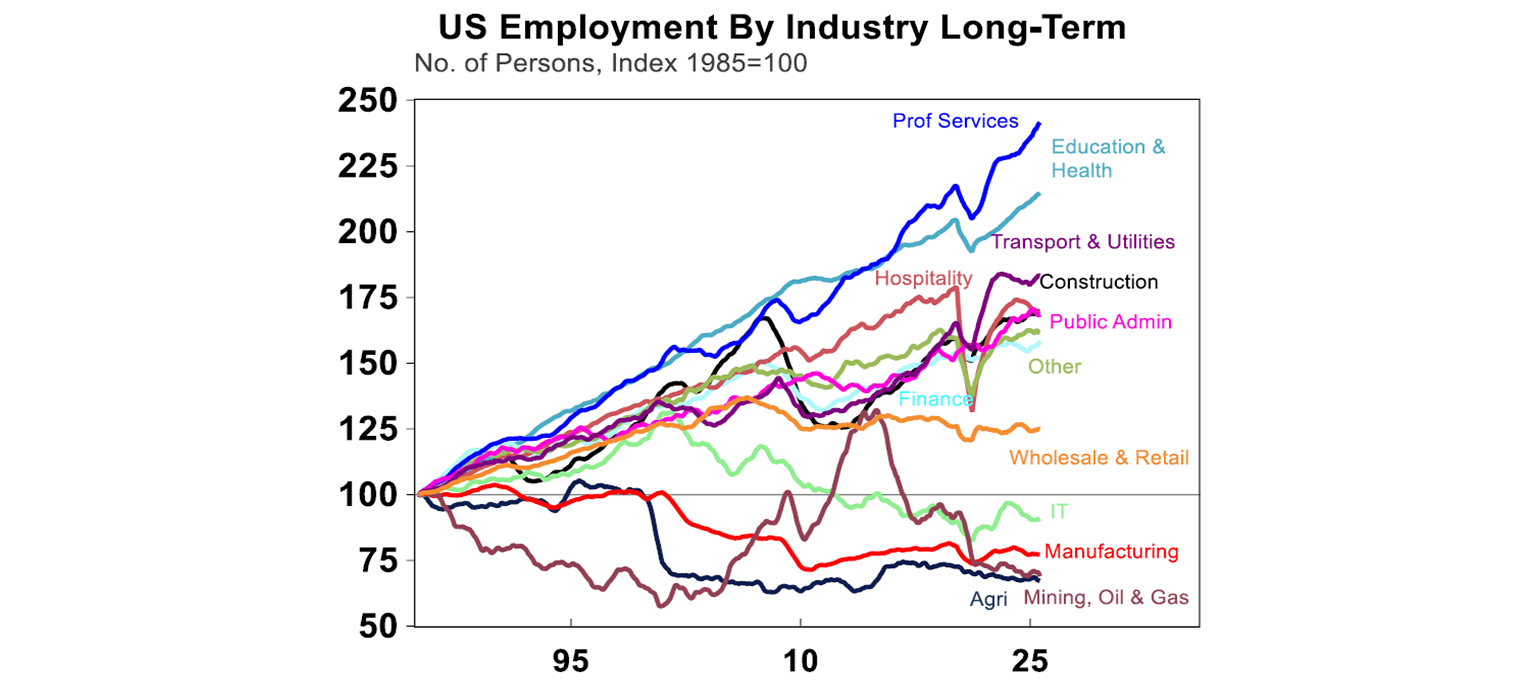

But the nature of the labour market has changed. Traditional jobs in manufacturing, mining and agriculture have declined over time (see the chart below) while service-based roles like professional services and education and health have seen the largest growth in employment.

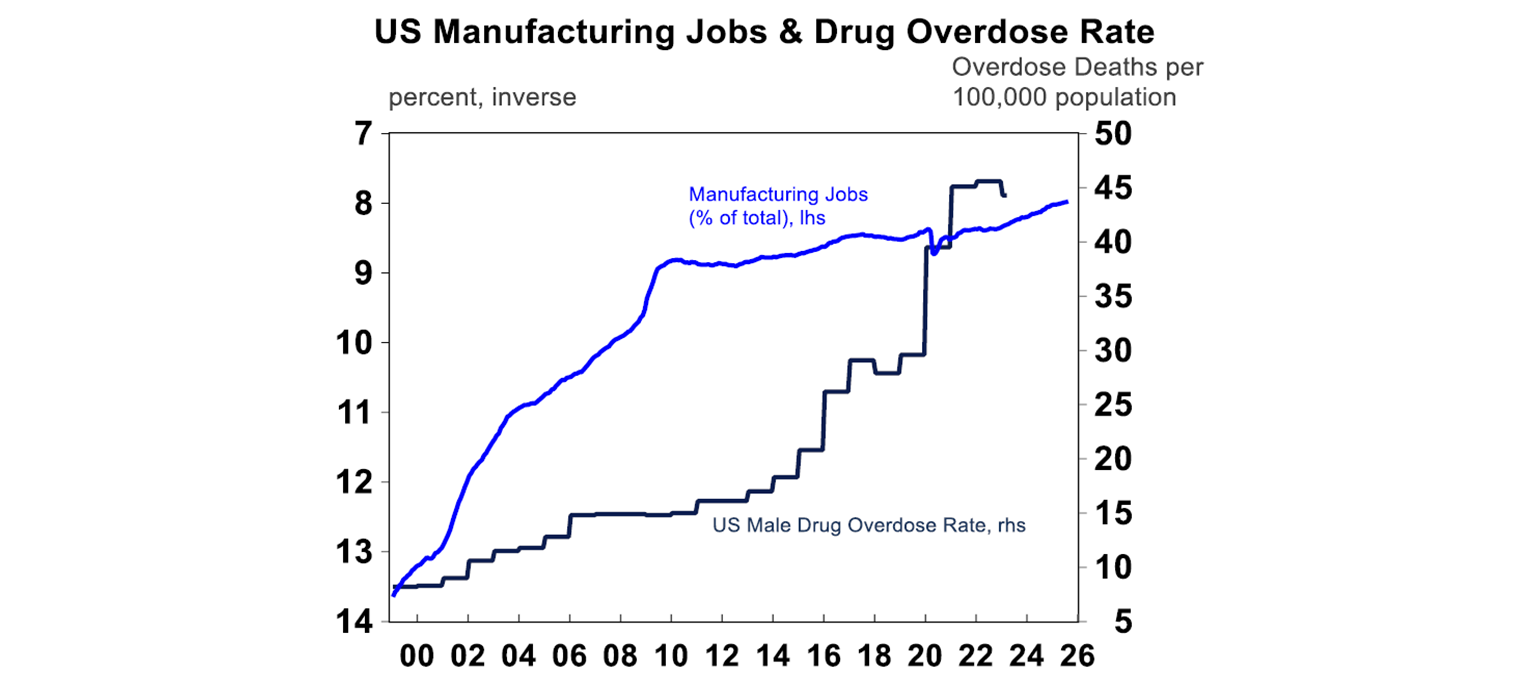

While many displaced workers have likely found work elsewhere (some possibly shifting into construction), the need for retraining and the loss of occupational identity may affect long-term wellbeing. Some even link the rise in drug use and overdose – especially among young men – to the decline in long-term employment amongst traditional male-dominated industries like in manufacturing (see the chart below), though evidence is inconclusive. Nevertheless, these factors have to an extent contributed to the rise of far-right groups that appeal to young males.

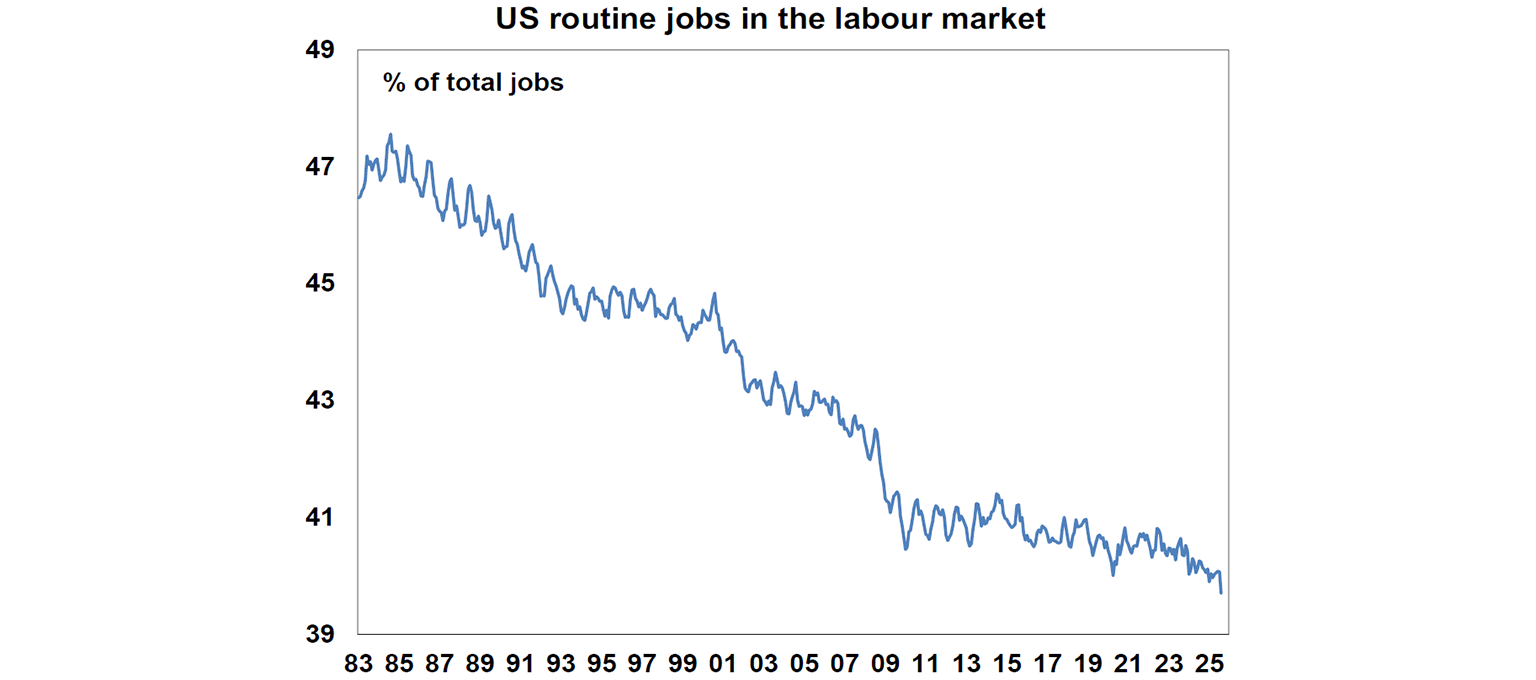

Workers are also increasingly concerned about the impact of AI on job security. They have a right to be concerned. If you read news articles, estimates around the potential job losses in the US range from 6% of jobs all the way up to 50%. The jobs most at risk are “routine” jobs, which now account for round 40% of total jobs (see the chart below), down from around 47% in the early 1980’s as the initial round of tech changes led to factory automation, impacting manual routine work. Non-routine manual work is likely to be the next frontier of disruption.

Housing affordability has deteriorated in younger groups

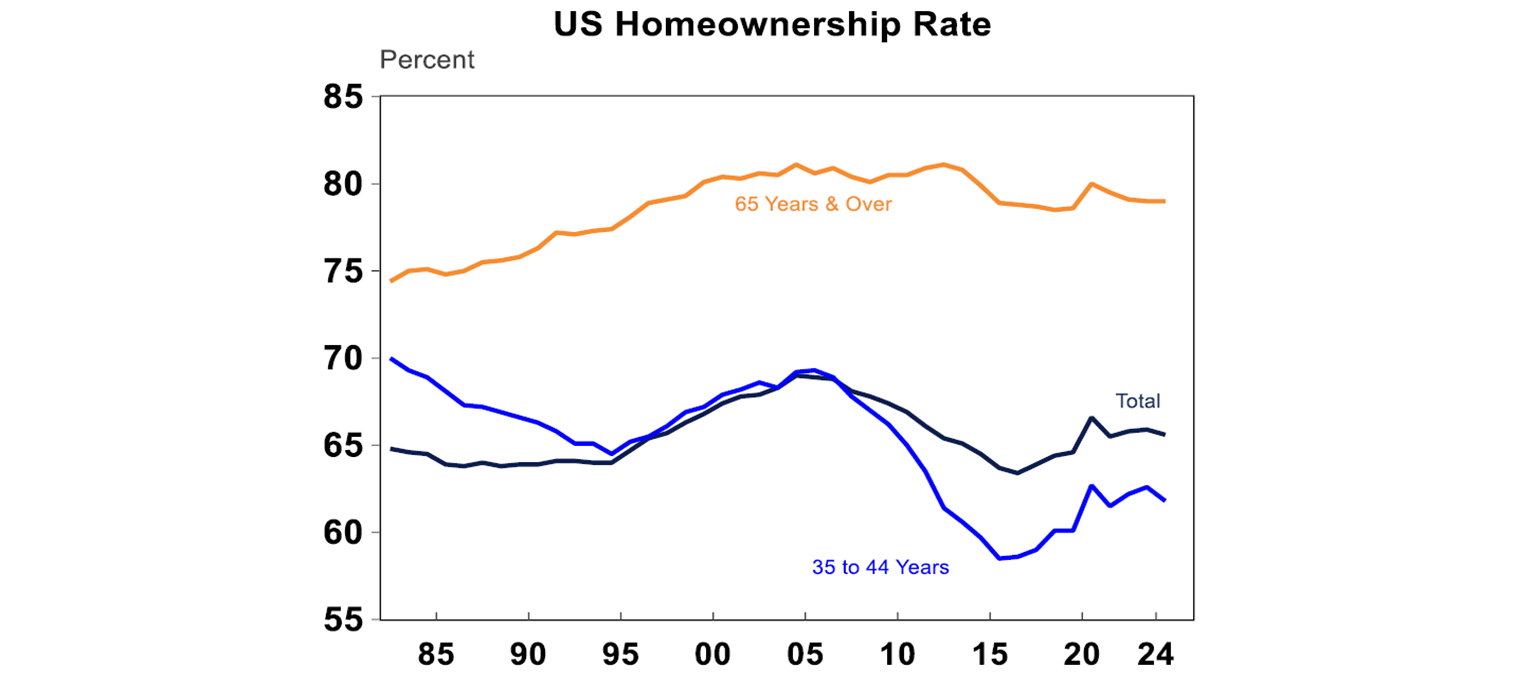

Homeownership trends add another layer of concern. While the overall homeownership rate fell to 65.6% in 2024 from a peak of 67.4%, this is only slightly below the 1982 level of 64.8%. However, the decline has been concentrated among younger age groups. For example, those aged 35 to 44 have seen a decline in their homeownership rate from 70% back in 1982 to 61.8%.

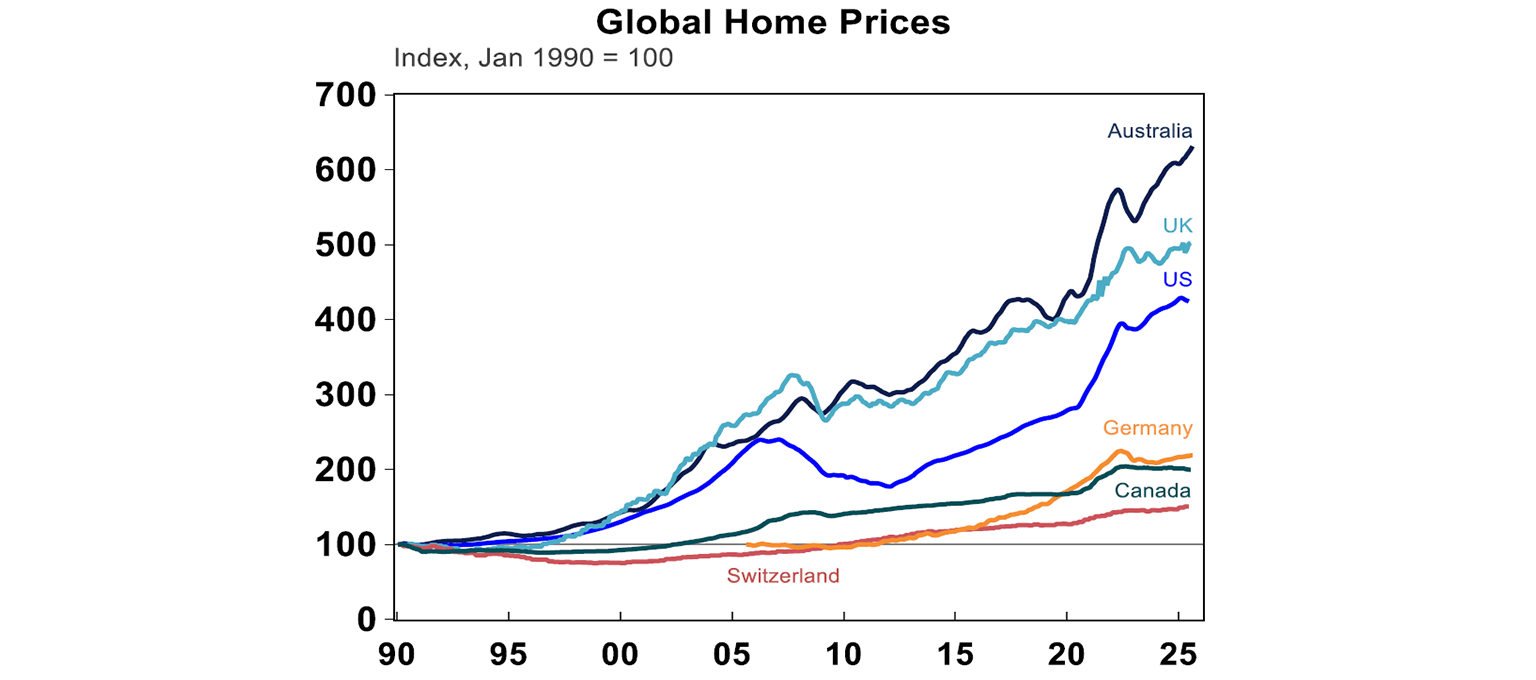

It is this middle-aged group of households that feel like housing is no longer affordable to them, as home prices have had strong gains over the long-term (although not as high as Australia or the UK!).

What do voters care about now?

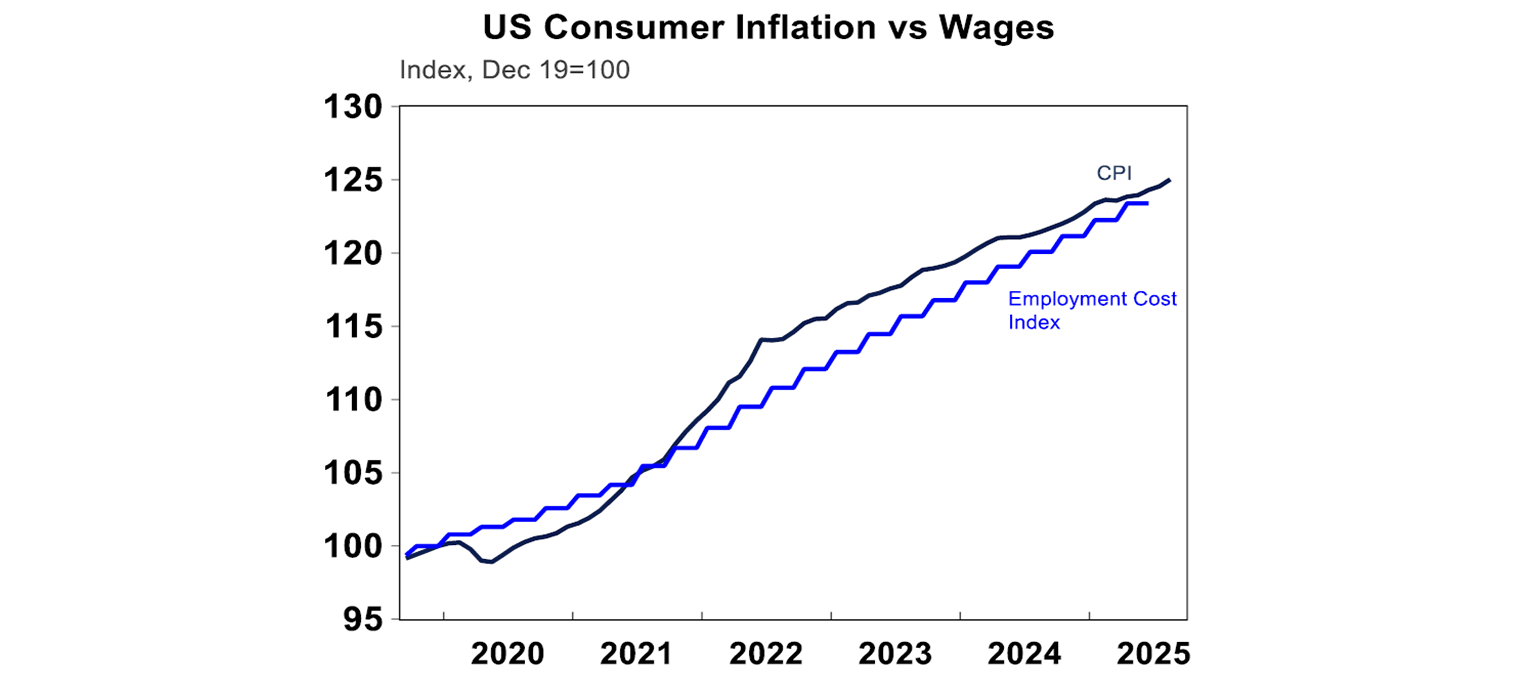

Heading into the US 2024 Presidential election, consumer surveys show the economy was the top concern for 70% of voters, followed by health care (44%) and immigration (44%). Within “The Economy”, voters most cared about inflation, taxes, social security, national debt and housing. The “cost of living” challenge is getting better, as the gap between inflation and wages has narrowed (see the chart below), taxes are slightly lower under the “One Big Beautiful Bill” (although most tax cuts benefit the wealthier) but social security arguably looks worse with spending cuts, the national debt situation looks worse and housing is neutral to worse with rents still high, the supply of new homes declining but home price gains slowing.

Implications for investors

The long-term economic issues discussed in this article—rising inequality, labour market disruption, and housing affordability—are also evident in other advanced economies like the Eurozone and Australia, though often to a lesser extent.

In 2024-25, more than 70% of incumbent governments lost power, reflecting widespread voter disillusionment. And recent political chaos in the UK and France further highlights this trend. The difference is basically that the US is the US! This means that it was historically seen to be a global safe haven with trusted institutions and a country that influences others by displaying best practices. Or at least was seen as this!

The US sharemarket has looked through this political noise and is back at a record high, mostly due to growth in the tech sector. However, the concern is that the US will not keep outperforming over the long-term with all this political baggage, as it could depress long-term potential GDP growth. In the short-term, US tech earnings are likely to keep motoring ahead given solid earnings projections and further upside in AI adoption. But longer-term, other share markets in countries like Australia and in Europe offer solid potential for investors that are looking for developed market exposure. In the near-term, assets like gold and Bitcoin also tend to provide a hedge against geopolitical uncertainty.

Diana Mousina

Deputy Chief Economist, AMP

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.