Key points

The US “King Dollar” status has been intact for over 80 years. Over that time, there have been episodes when the world was expected to “de-dollarize” and move away from the $US.

Most recently, the stature of the $US is once again being questioned. Arguably, “this time is different” as investors are examining multiple US-driven uncertainties including economic policy uncertainty, government debt sustainability and potential tax changes for foreigners which make US assets look less attractive.

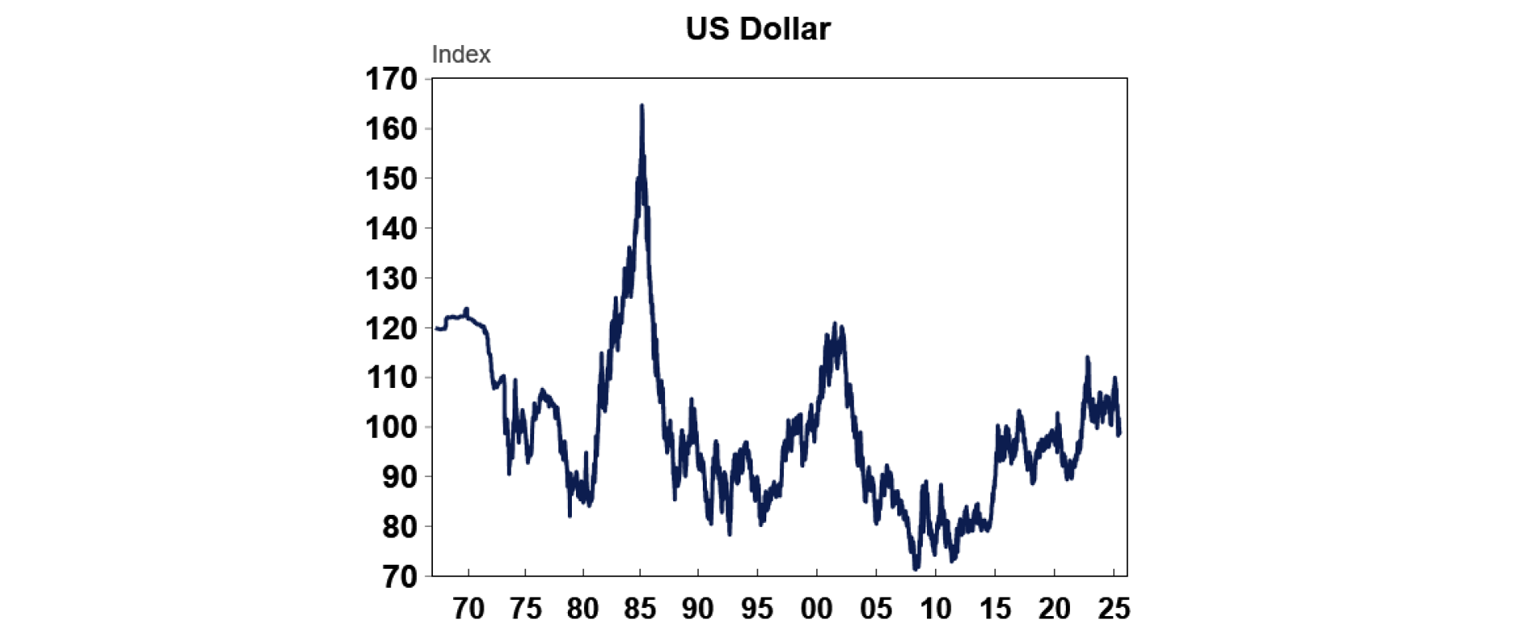

The underperformance of the $US in 2025 reflects some of these fears but is also a reversal of $US strength over the last 10 years, as the $US moves back to “fair value”.

In the next 6-12 months, the $US (as well as other US assets like shares and bonds) are likely to continue to be under pressure from some of these issues.

While foreign exchange holdings of $US may continue to slowly dwindle in the long run from historical levels, there is no strong alternative (at least for now). The answer may be some form of international digital currency.

There is the possibility that the global payment system (which has mainly been $US based) may alter, especially as we go into a multi-polar world with many spheres of influence with powers like China and Russia potentially doing business in non-USD currencies, but it’s not something that’s going to happen overnight.

The $A is likely to appreciate slightly against the $US but remain largely unchanged on a trade-weighted basis as the RBA cuts interest rates more in the next 12 months than its peers.

A history of the US dollar

A country’s currency tends to be seen as a barometer for its economy. A strong and stable currency is seen as a pillar of strength and a depreciating currency can be taken as a signal that investors may be losing confidence in the country.

The US dollar ($US) became the dominant currency in the international monetary system post WWII after the start of the Bretton Woods Agreement. This Agreement was a new international monetary system which started in 1944 (replacing the Gold Standard which pegged currencies to the gold price) and instead pegged the $US to the gold price and other currencies to the $US. The $US was chosen because it was it was one of a few currencies that was easily convertible into gold (the US had the largest gold reserves) and the US economy (mostly its public finances) had stability - as it was not devastated by the war like Europe. And so, countries began accumulating US dollars which was done through the purchase of US Treasury Bonds. As a result, Treasury bonds and the $US became seen as the ultimate risk-free global investment.

Thus “King Dollar”, the reserve currency of the world was born. Being a reserve currency means that the $US is held in large quantities by central banks in its foreign exchange reserves (90% of global foreign exchange transactions are done in $US), it is still used as a peg by some countries like China, it is used internationally for trade and many emerging countries borrow in $US.

The impact of being the world’s reserve currency

For the US economy, being the global reserve currency has many implications including:

Lower interest rates (than otherwise would be the case). Investors can get access to $US through holding Treasury bonds instead of holding direct US dollars (and this also provides an investment). Constant demand for US treasuries (from investors) puts upward pressure on prices for US bonds which puts downward pressure on yields and therefore interest rates.

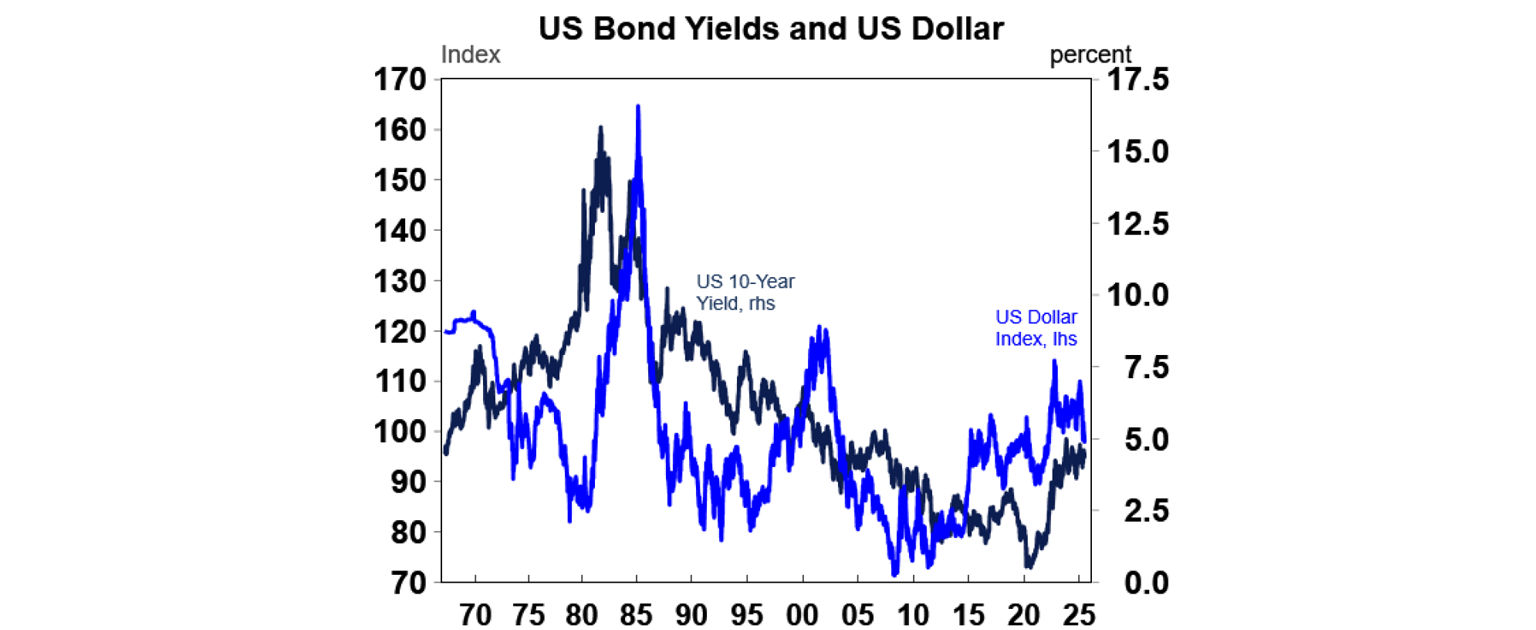

Lower interest rates means lower borrowing costs. This means that the US government can more easily finance its debt, this is otherwise known as the “exorbitant privilege” of being the reserve currency. The chart below looks at this relationship between bond yields and the US dollar. The two often move in similar patterns (although not always).

Constant demand for the US dollars keeps the currency elevated. A higher currency keeps imported inflation lower than otherwise (and a depreciation in the currency increases imported prices).

In some cases, being the reserve currency may lead to higher inflation, because if a country can borrow easily this may lead to higher than usual government spending, stoking inflationary pressures. It depends on the stage of the cycle to see which impact on inflation is stronger.

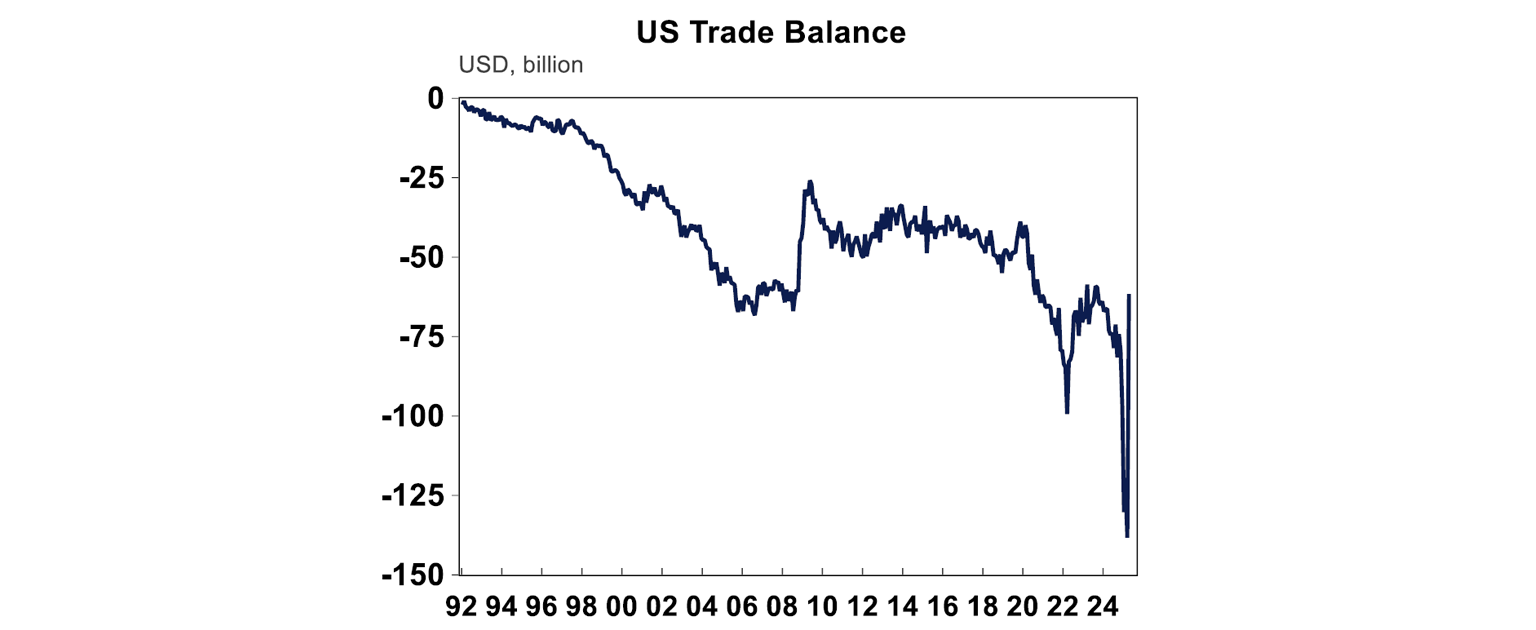

Upward pressure on the currency also means that US exports may be more expensive on the global market, relative to other countries which may supress export growth and lead to trade deficits (where imports run above exports). This is partly why the US runs chronic trade deficits (see the next chart).

But this also reflects that the US as a nation tends to spend more than it earns which by definition results in a current account or trade deficit and the natural demand for US dollars and Treasuries helps the US get away with this because it means a constant reliance on foreign capital. The US budget deficit is a big part of this.

The implications for the rest of the world are:

Countries still peg their currencies to the US dollar.

Emerging economies tend to borrow in US dollars because they may not be able to issue debt in their own currency (therefore when the $US goes up and their currency depreciates it becomes more expensive for these countries to pay back debt).

Some global goods are priced in US dollars (like commodities).

Why are investors questioning the status of the US dollar now?

The $US has been on an appreciating trend since 2010 (with numerous cycles inbetween). Over 2020-2022, the $US appreciated by just under 30% and has given up about half of those gains so far.

But, the risk is that the $US depreciates further from here as investors are questioning the “King Dollar” status of the US currency due to:

Lower US GDP growth in the medium-long term if Trump’s tariffs drag on economic growth through consumer and business uncertainty, lower spending and a hit to exports. GDP growth projections for 2025 have been revised down by 0.3-0.4 percentage points (at least) with most now expecting 1.5% GDP growth this year, and sub 2% in the forward years.

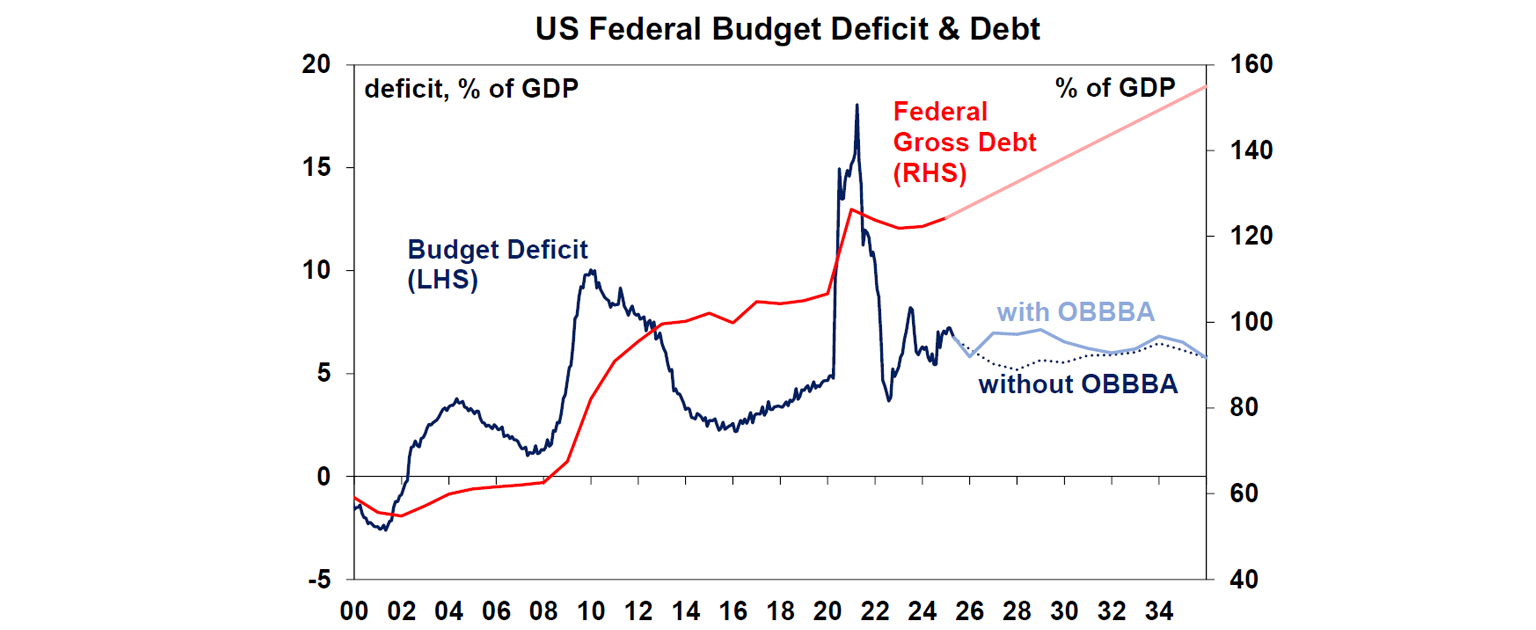

Investor concern that US debt is not on a sustainable footing with the US budget deficit running at around 7% of GDP and likely to remain around this level or a tad higher with the passage of the “One Big Beautiful Bill Act” (see the chart below).

The US pursing a more “America First”, nationalist foreign policy and therefore may not be seen as a reliable global partner by its peers. Although, the recent example of the US involvement in Iran shows that the US may still pursue the role as a global balancing power, perhaps it just won’t be as interventionalist as it once was.

There is also concern that Trump’s erratic policy making, attacks on university innovation and research, and his attacks on Fed independence will weaken the US and faith in its exceptionalism.

Some countries/central banks are looking to diversify from holding assets subject to US jurisdiction like Treasuries after seeing Russia have some of its assets restricted or frozen in response to the Ukraine war.

Prior concern that Section 899 or the “revenge tax” which was included in the “One Big Beautiful Bill Act” would have seen a new addition to the US tax code called “Enforcement of Remedies Against Unfair Foreign Taxes” which would have given the US Treasury Secretary the authority to apply higher withholding taxes to individuals and corporations from foreign countries and would have been another disincentive for investors to avoid the US. But, recent comments from Treasury Secretary Scott Bessent suggest that this is no longer going ahead after conversations with global counterparts.

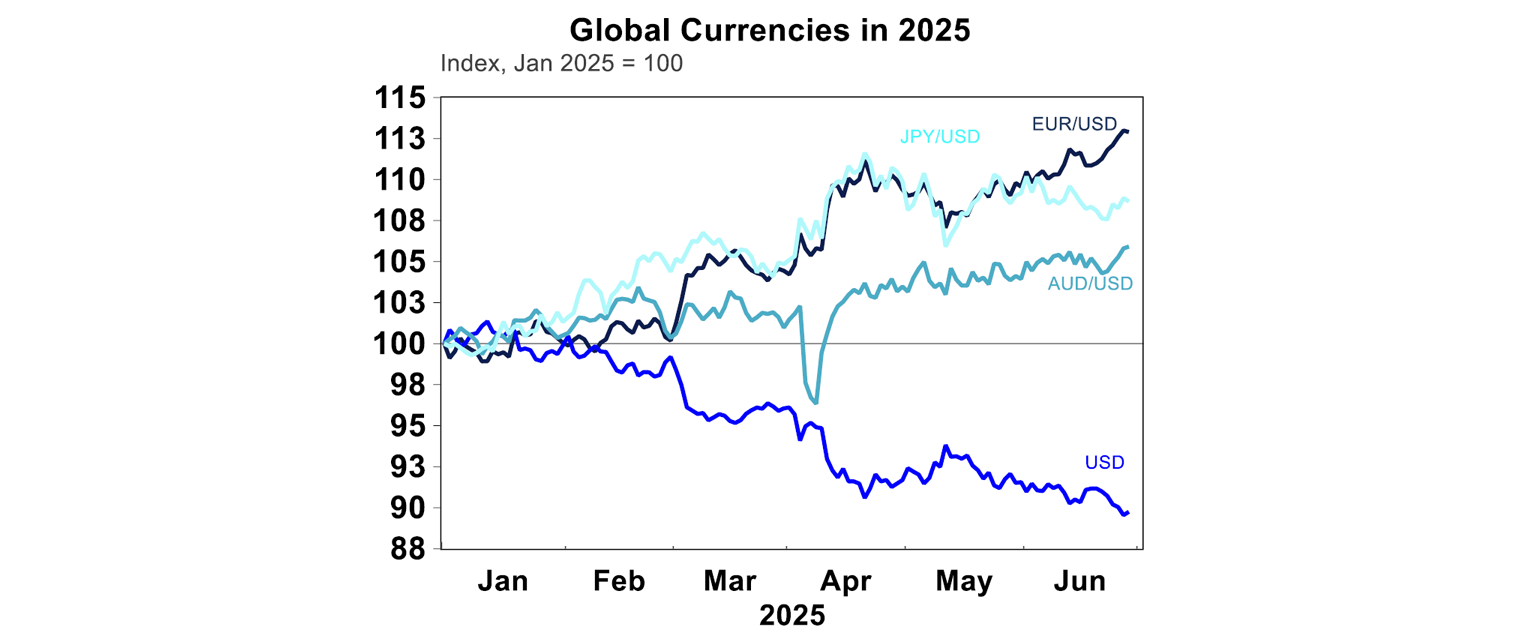

The US dollar has depreciated by 11% against since Trump came into office in 2025 (see the chart below), which has naturally seen other currencies appreciate.

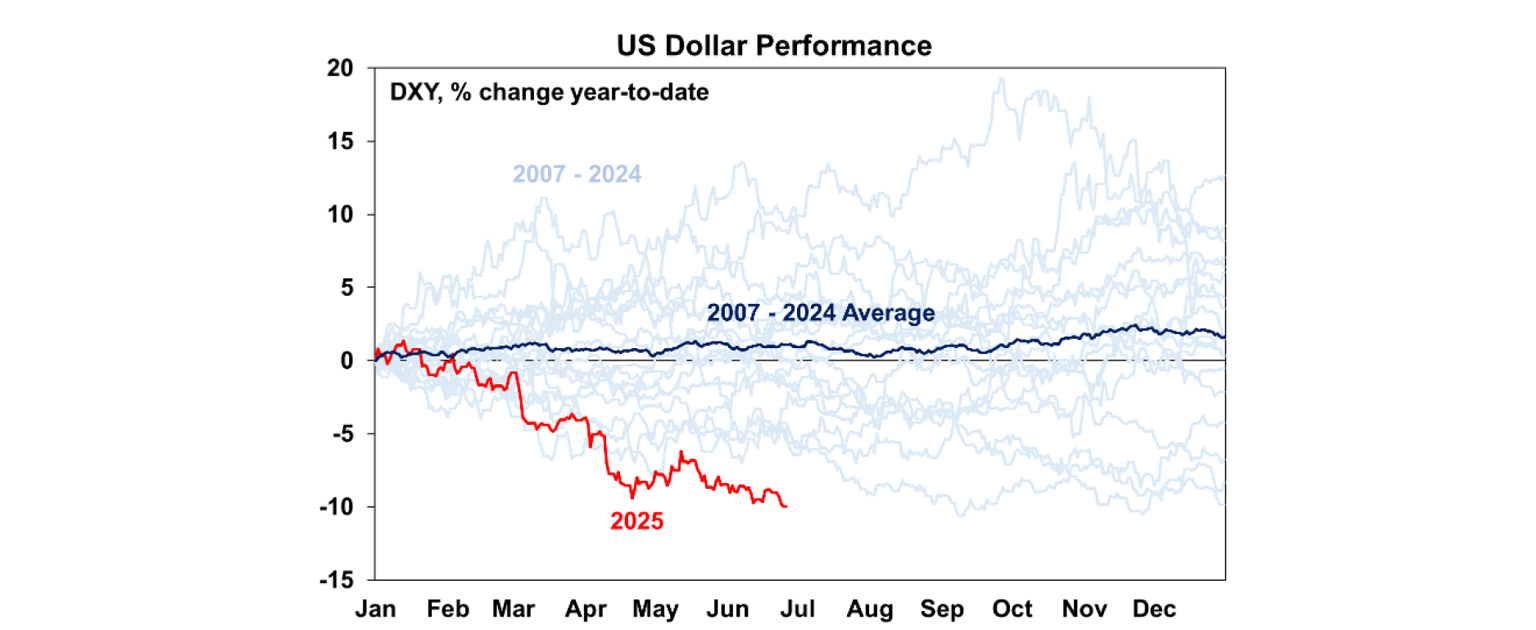

This has been one of the worst starts to the year for the $US, relative to its historical performance (see the next chart).

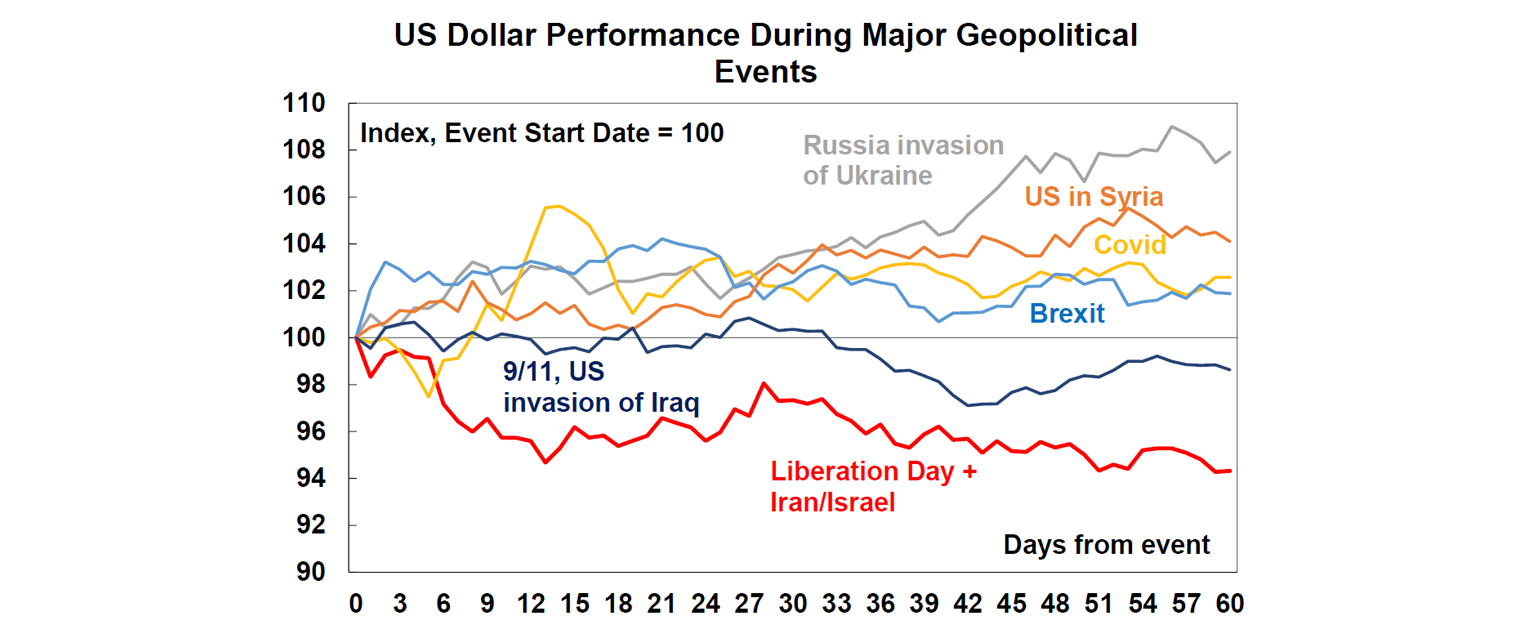

Geopolitical events also often see the $US benefitting, because investors view it as a safe haven (see the chart below). However, the recent geopolitical events between Israel and Iran have not seen the $US like it usually would.

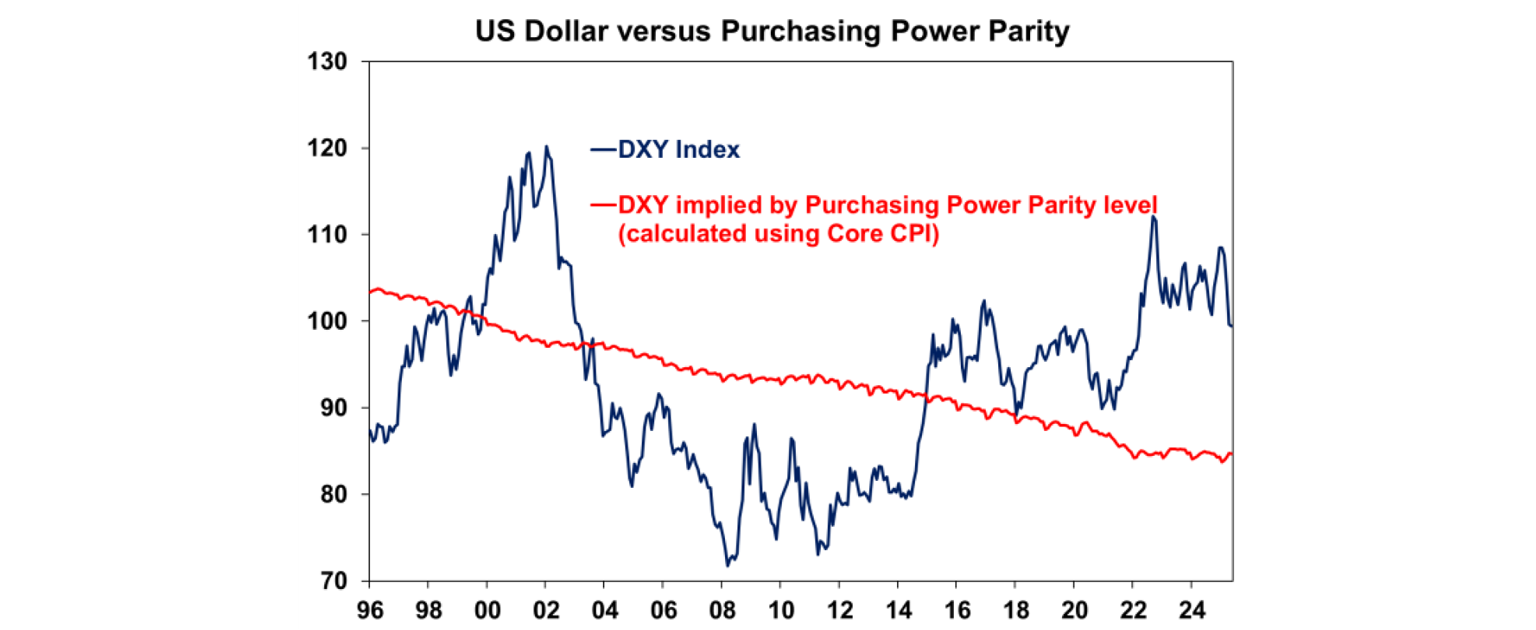

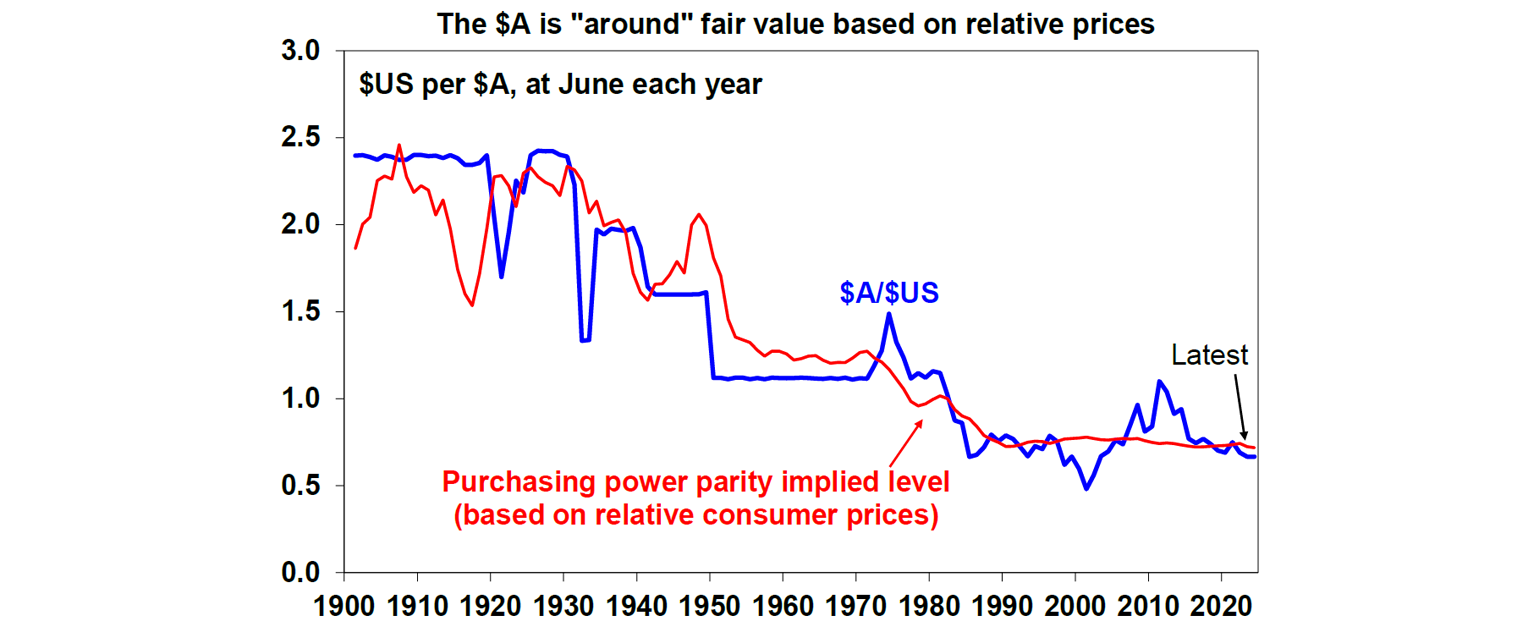

While the recent economic policy uncertainty has led to some underperformance of the $US, the depreciation in the currency is probably also an adjustment back to fair value. Given the strength in the $US in recent years, it has looked overvalued (based on purchasing power parity), especially since the pandemic (see the next chart). So, the recent depreciation is probably also a normalisation closer to fair-value.

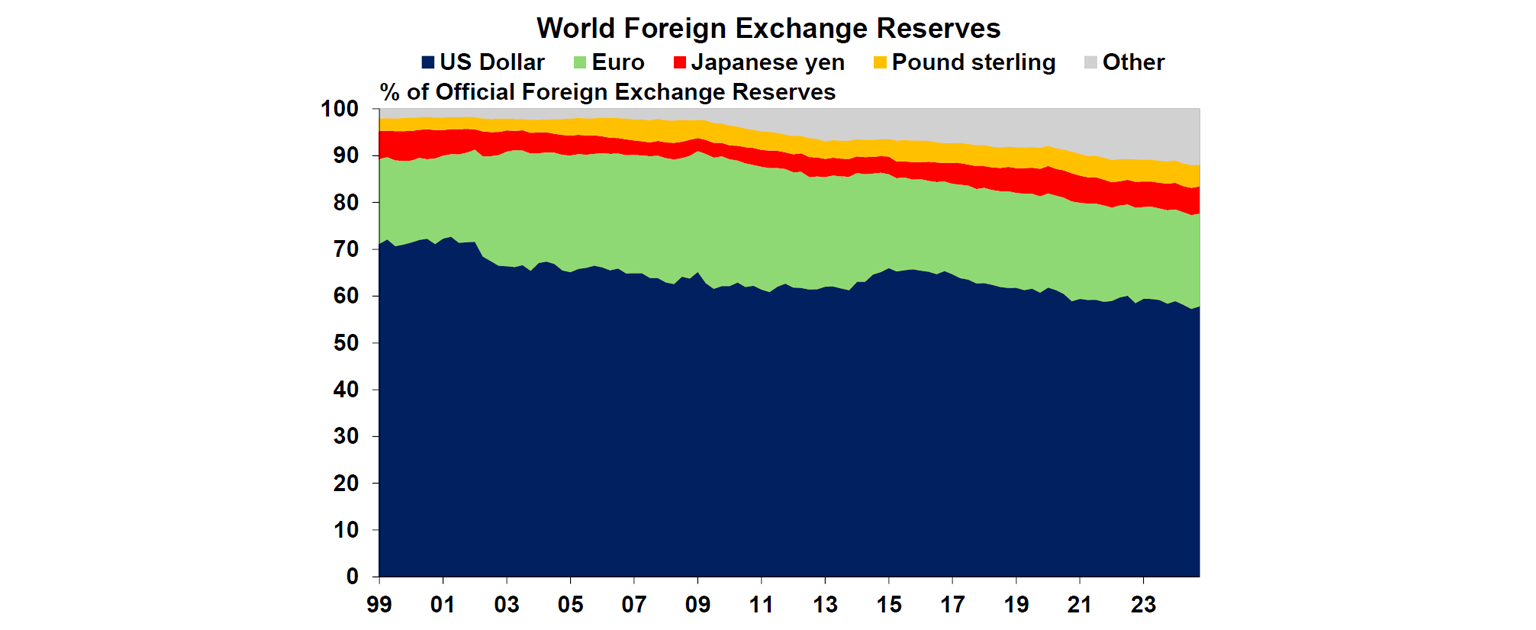

Nevertheless, longer-term drivers of the $US also show some move away from the currency. Global official US dollar foreign exchange reserves have declined from ~70% in the early 2000’s to under 60% now (see the chart below).

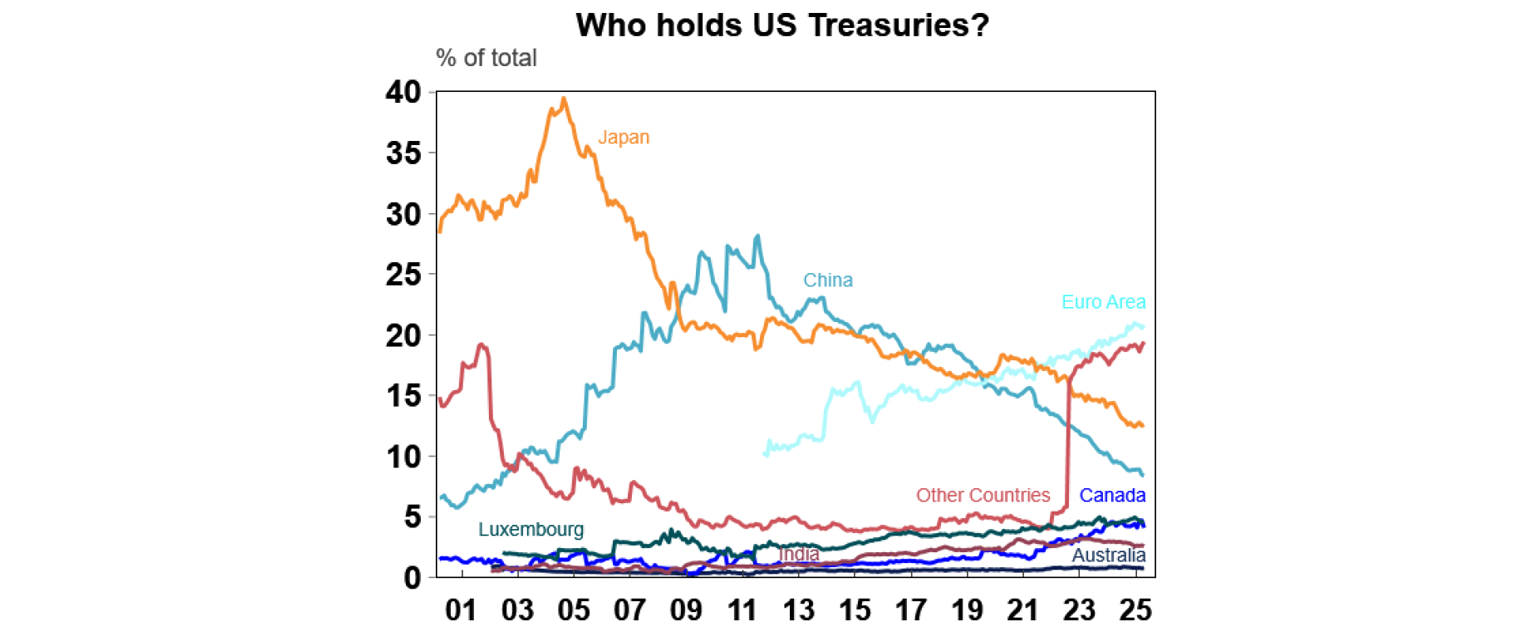

US treasury holdings, a proxy for $US demand, also show a long-term decline in Japanese and Chinese holdings of US treasuries over the past 20 years, although this has been offset with higher holdings from the Euro area and other countries.

The impact on Australia

The Australian dollar is what is known as a “pro cyclical and risk -sensitive currency” because we are exposed to global trade through our large commodity export sector. This means that in times of positive global growth and sentiment, the Aussie dollar tends to appreciate and in times of lower global growth and uncertainty, it tends to decline.

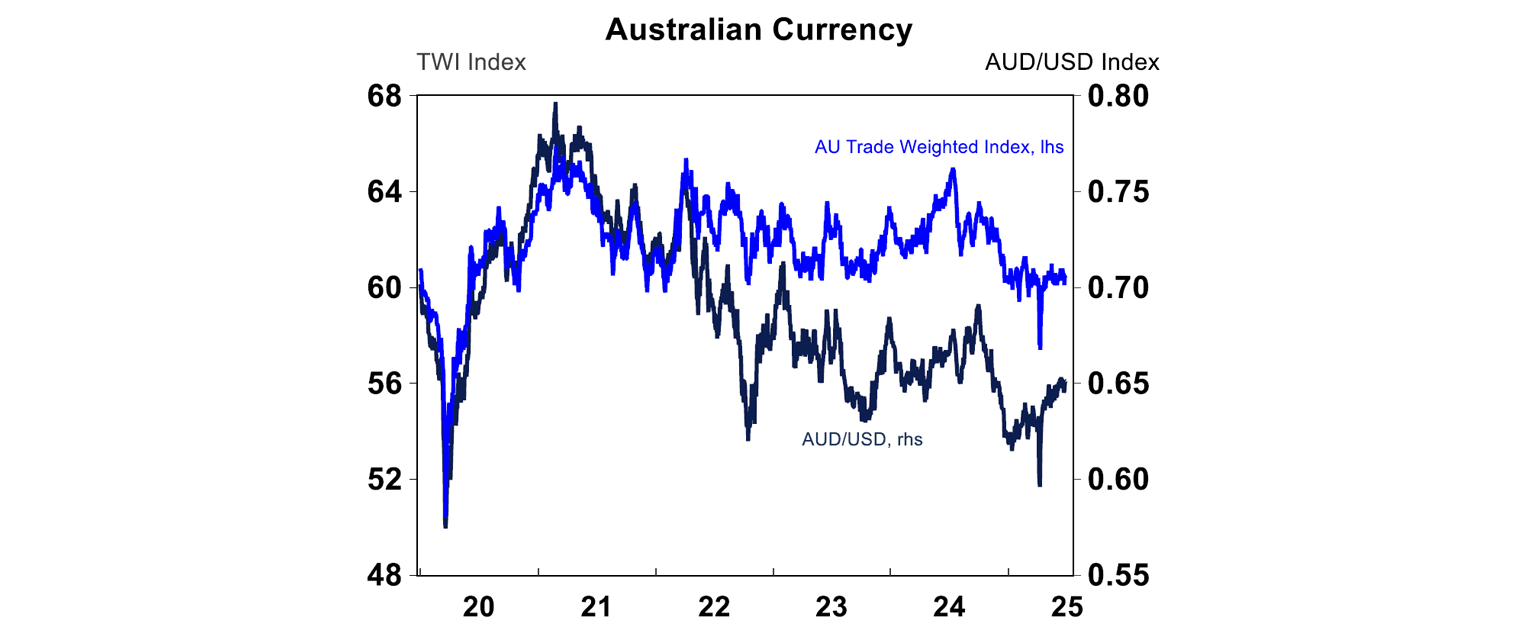

The Australian currency is often referenced against the US dollar but the impact to the Australian economy occurs is more related to changes in the trade weighted index (or TWI, a broad index of the Australia currency against a basket of currencies weighted by their share of trade with Australia). Over 2025, the Australian dollar has appreciated by 6% against the US dollar (after depreciating by 9% over 2024), and on a trade-weighted basis has basically been flat (see the chart below) so far this year and depreciated by 5% in 2024.

Changes in the Australian TWI matter most for inflation. Given that the Australian TWI has been unchanged in 2025, there has been immaterial impact to imported inflation so far this year.

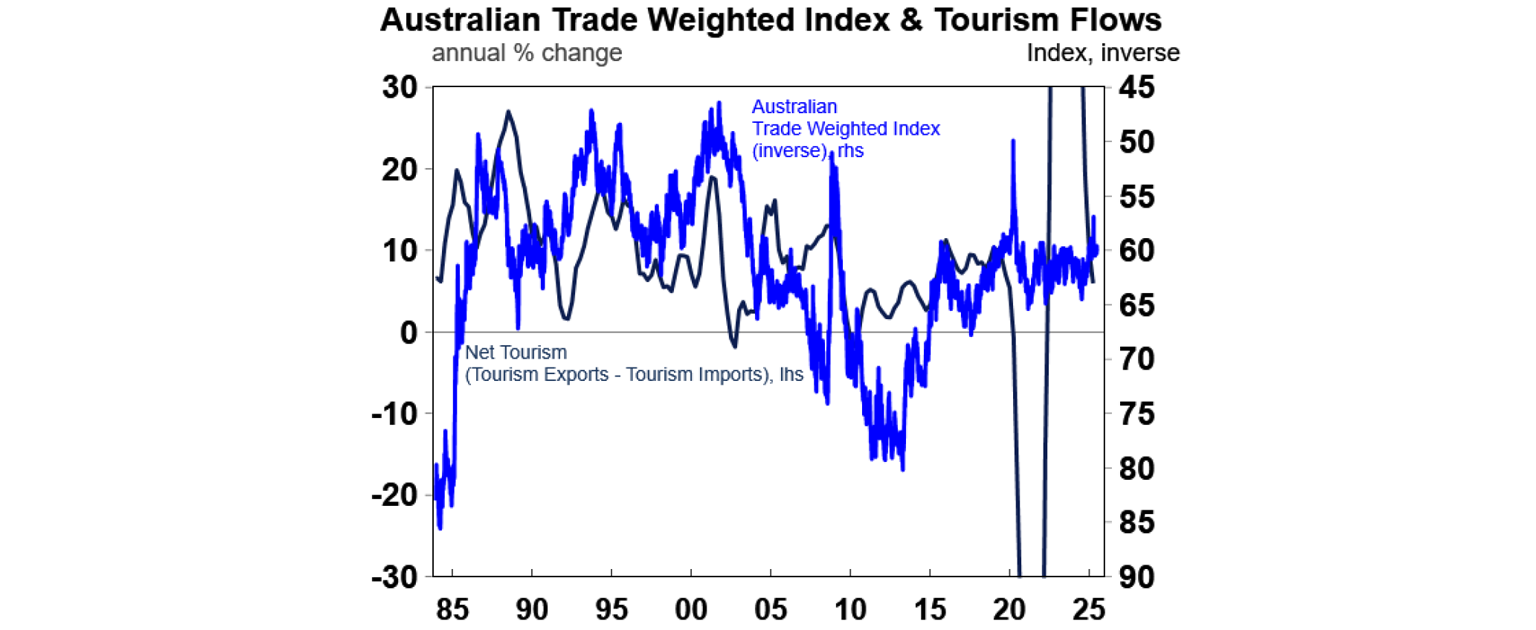

The other major impact from currency movements is on tourism flows in and out of Australia. During periods when the $A is strong (therefore cheaper for Australians to travel overseas but more expensive for tourists to come to Australia), net tourism tends to decline and drag on GDP growth (as tourism exports decline but tourism imports rise). And when the $A is weak (therefore more expensive for Australians to travel overseas and cheaper for tourists to come to Australia), net tourism tends to rise and add to GDP growth, (as tourism exports rise and tourism imports fall) – see the next chart. Most recently, these trends have been hard to make out and have been distorted by the pandemic.

What are the implications for investors?

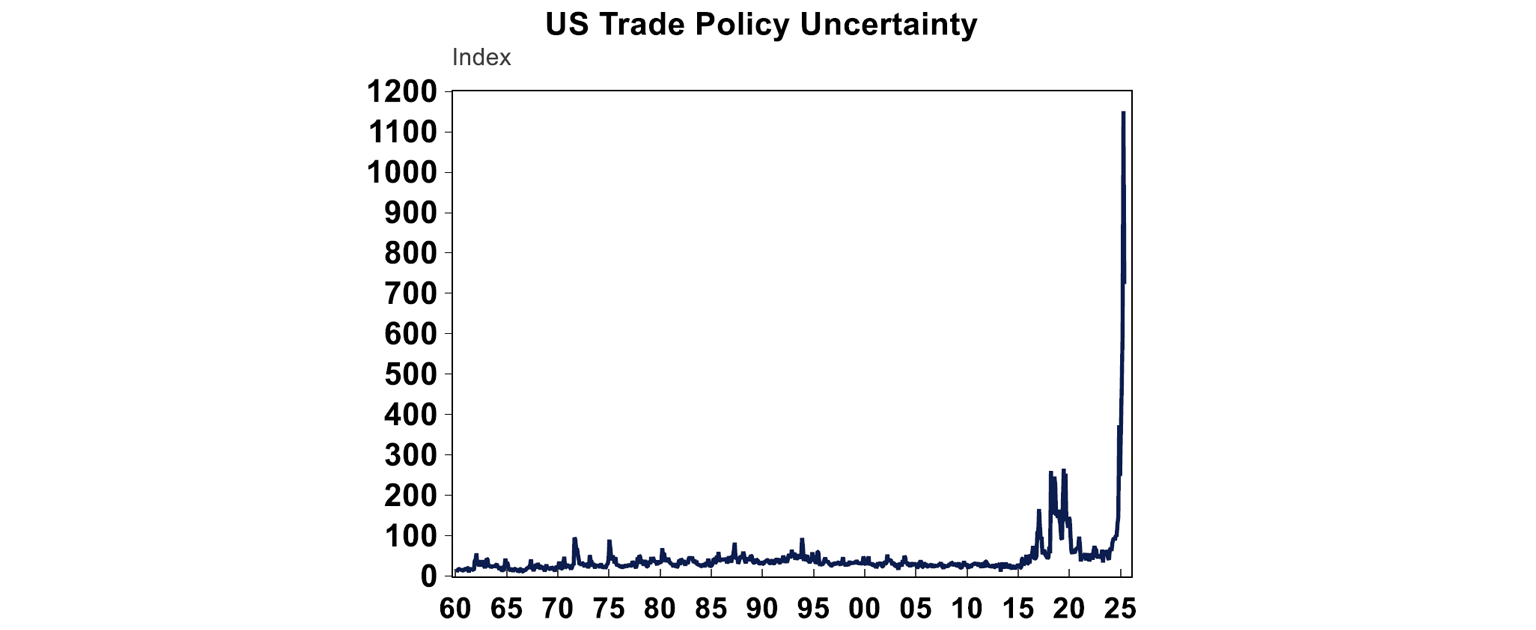

Continued economic policy uncertainty in the US (see the chart below) and a normalisation of the $US back to “fair value” levels means that in the near-term, a lower $US is likely. Trump and his team may actually favour a weaker currency, as a strong $US will hamper export growth and the Republicans want to see a lower US trade deficit.

A weaker $US means that the Australian dollar (against the $US) can probably strengthen a little in the longer-term against the $US. We see it lifting just slightly to 0.65USD by the end of 2025 and just under 0.70USD by mid-late 2026. But it’s hard to see significant upside for the $A while the RBA is cutting interest rates more than its peers over the next 12 months. Over the long-term, this is low for the $A and on a fair value basis, the $A should be valued around 0.72 USD (see the chart below).

For the Australian Trade Weighted Index, a lower $US in the near-term means more support for the Euro and Yen in the near-term, so it’s hard to see much movement for the Australian Trade Weighted Index. But longer-term, if the $US loses its safe haven status then the $A may fall less in times of uncertainty which will impacts its role as a shock absorber for the Australian economy (like when it fell in the GFC and pandemic which boosted our exports and supported the economy). This may put more pressure on the RBA to support growth in time of global shocks.

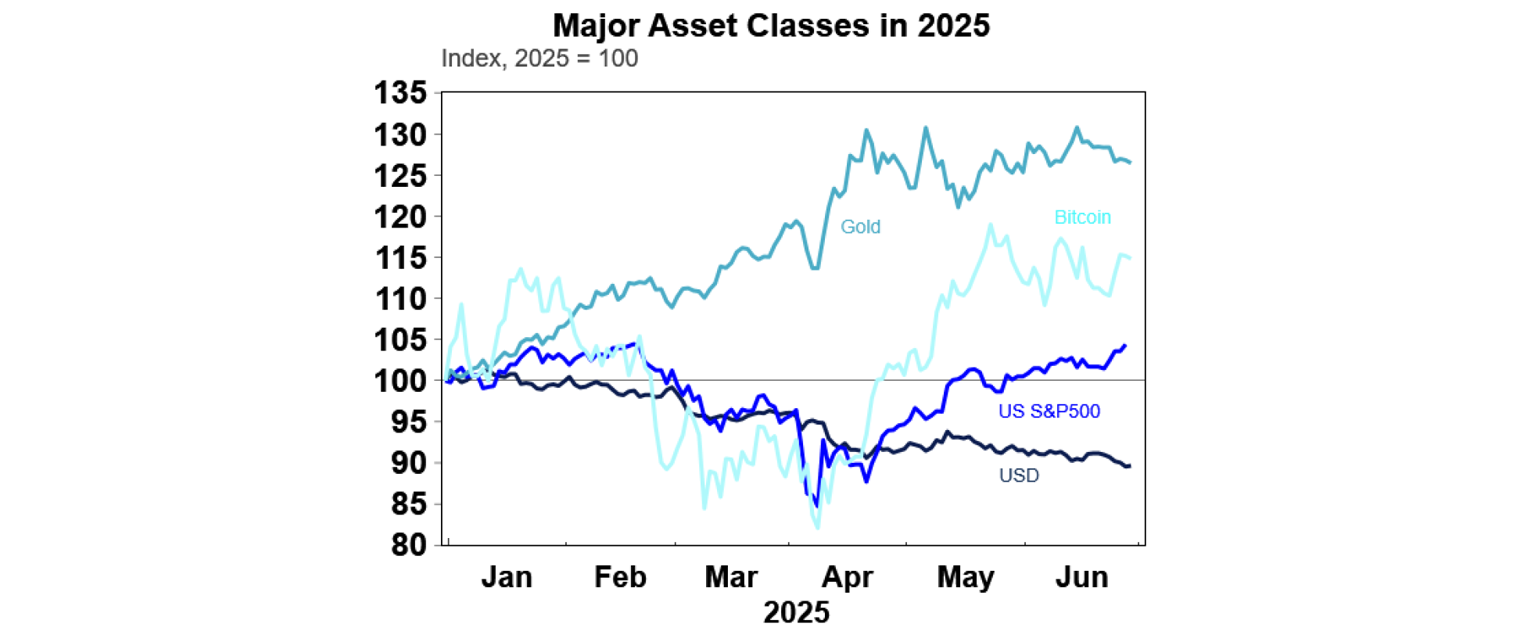

What about the talk of an alternative international currency? While the $US is clearly facing some headwinds as outlined in this note, the case for the US dollar is that there are no strong alternatives. The “BRICS” countries (Brazil, Russia, India, China, South Africa, Saudi Arabia, Egypt, United Arab Emirates, Ethiopia, Indonesia and Iran) have long proposed an alternative currency to the $US (and this has ramped up more recently given sanctions and geopolitical tensions). More recently, there has been talk about these countries using a new currency called “The Unit”, which would backed by 40% gold and 60% BRICS currencies and would be a digital currency on the blockchain. The BRICS countries make up 48% of the world’s population and 38% of global GDP (in purchasing power parity terms), an do have a large global sway. But, setting up a potential new currency faces many hurdles, particularly from the Western world that dominate the financial markets and global payments system. Nevertheless, this arrangement would benefit gold and cryptocurrencies, which have been outperforming this year (see the chart below).

The $US is not the only US asset class likely to be impacted by concern over the long-term trajectory of the US economy. Non-US investors are likely to adopt a “home bias” in the near-term, with surveys like the Bank of America Global Fund Manager Survey indicating that over 50% of investors favour international stocks, over the US. So, US equities and bonds may also be relative underperformers in the near-term (although this is partly a reversal of the “US exceptionalism” theme that has led to significant US equity outperformance in recent years).

For the rest of the world, a weaker $US means higher domestic currencies which could hurt some export-driven countries but would help those with US-denominated debt. It also means non-US investors may need to look at hedging any international exposures.

Diana Mousina, Deputy Chief Economist, AMP

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.