US and Eurozone shares rose to new record highs over the last week, as the ECB and Fed provided dovish comments, flagging rate cuts ahead, before giving back some of their gains on Friday as a bit of profit taking kicked in. The dip on Friday saw US shares fall 0.3% for the week, but Eurozone shares rose 1.1%. Japanese shares fell 0.6% for the week but are only just below their record high. Chinese shares rose 0.2%, not helped by only a modest stimulus announcement at the National People’s Congress and are around 40% below their 2021 high. Australian shares rose 1.3% for the week taking them to a new record high helped by the positive global lead and marginally enhanced expectations for RBA rate cuts with gains led by financial, property and IT stocks more than offsetting losses in resources shares. Just as major share markets are around record highs helped by prospects for lower interest rates, the most speculative interest rate sensitive “assets” – gold and increasingly now Bitcoin – also rose to record highs in the last week. Bond yields generally fell over the week. Oil prices fell, but metal and iron prices rose as did the $A as the $US fell.

Stretched valuations, increasingly positive investor sentiment and technically overbought conditions after very strong gains mean share markets remain at risk of short-term volatility and possibly a correction – as we saw a bit of in the US on Friday - even though the broad environment of mostly ok economic and earnings news, ongoing expectations for rate cuts and enthusiasm for AI points to a continuing rising trend. Australian shares are lagging global share markets partly because of their low exposure to AI and because of ongoing China worries (with resources stocks down year to date), but they are still managing to benefit from stronger global markets and prospects for RBA rate cuts later this year.

Major central banks still waiting for more confidence regarding the fall in inflation, but they are getting close to cutting. Both the Bank of Canada and the ECB left rates on hold as expected in the last week.

The BoC is still a bit more concerned about inflation, noting it’s still too early to consider rate cuts.

But the message from the ECB was clearly dovish with downwards revisions to its growth and inflation forecasts (with inflation now forecast to be 2% next year) and President Lagarde indicating its watching wages, profits and services inflation for more confidence but noting there is a definite slowdown in inflation, and it will have a lot more data in June suggesting its allowing for a June rate cut.

Fed Chair Powell in congressional testimony across two days seemed confident in a soft landing, saw disinflation as remaining on track and while he said the Fed didn’t want to rush into rate cuts, he also said that the Fed is “not far from” having enough confidence to start cutting rates and that rate cuts “can and will begin” this year.

Our assessment remains that the Fed and ECB will start to cut from around June, with the BoC cutting either June or July. Solid US February payrolls but downwards revisions to prior months and rising unemployment ease concerns that the US jobs market is too hot and are consistent with a June start to Fed rate cuts.

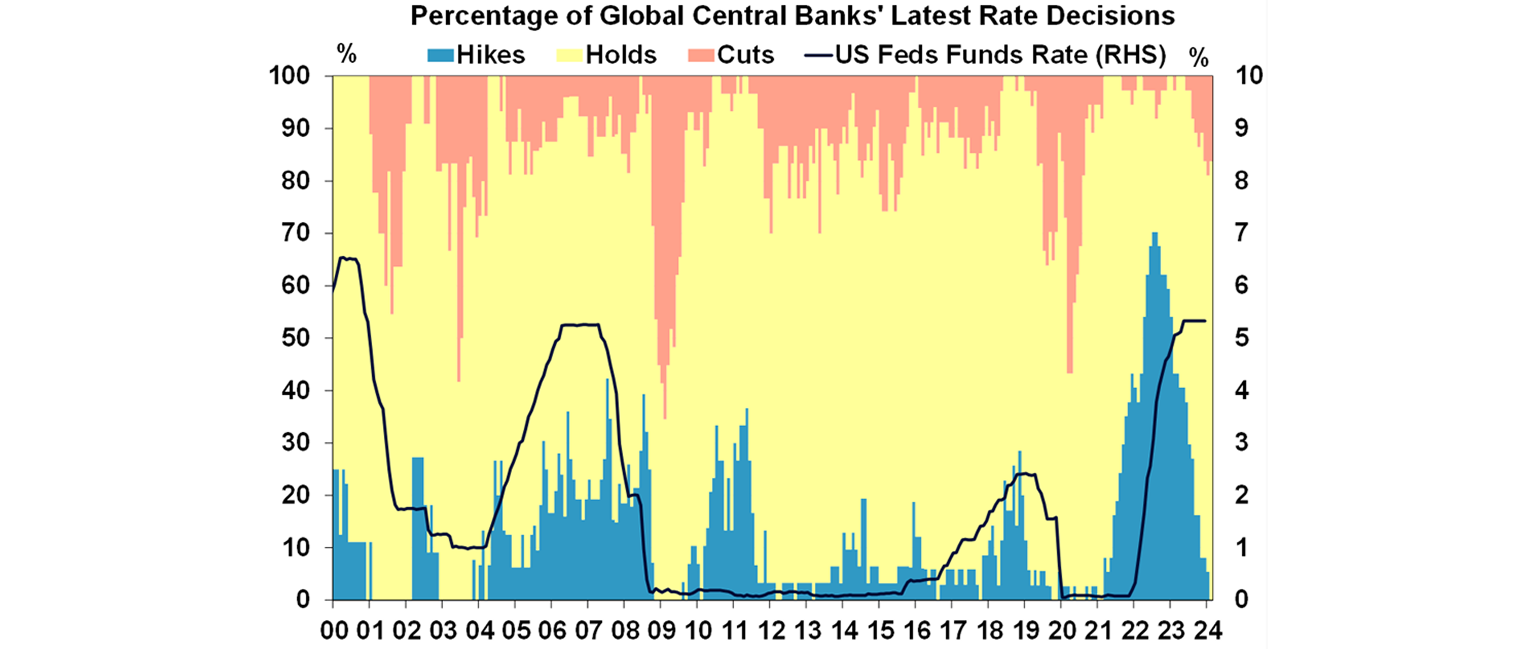

While there is a common perception that many global central banks follow the Fed this is not always the case even though the Fed has an outsized influence. In fact, as indicated in the next chart, 37% of global central banks started raising rates before the Fed did in 2022 (at a time when the Fed saw the rise in inflation as “transitory”) and nearly 20% (all emerging country central banks) have already started to cut rates.

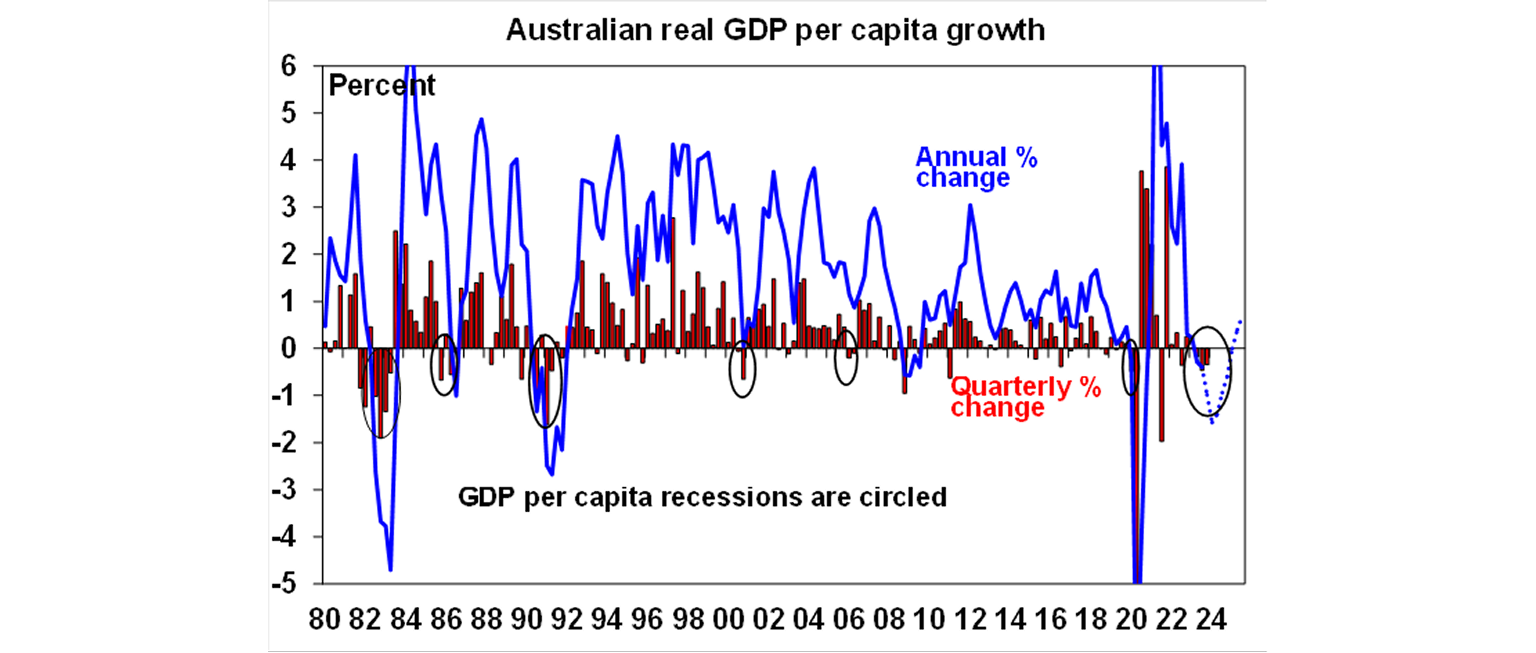

Australian economy still growing but only just. December quarter GDP came in roughly in line with market expectations thanks to strength in public spending, non-dwelling construction and trade, but housing construction fell sharply and consumer spending remains stagnant. Consumer spending is up just 0.1% over the last year, which is below RBA forecasts for a 0.4% rise. Were it not for strong population growth the economy would have gone backwards as the per person (or per capita) recession continued.

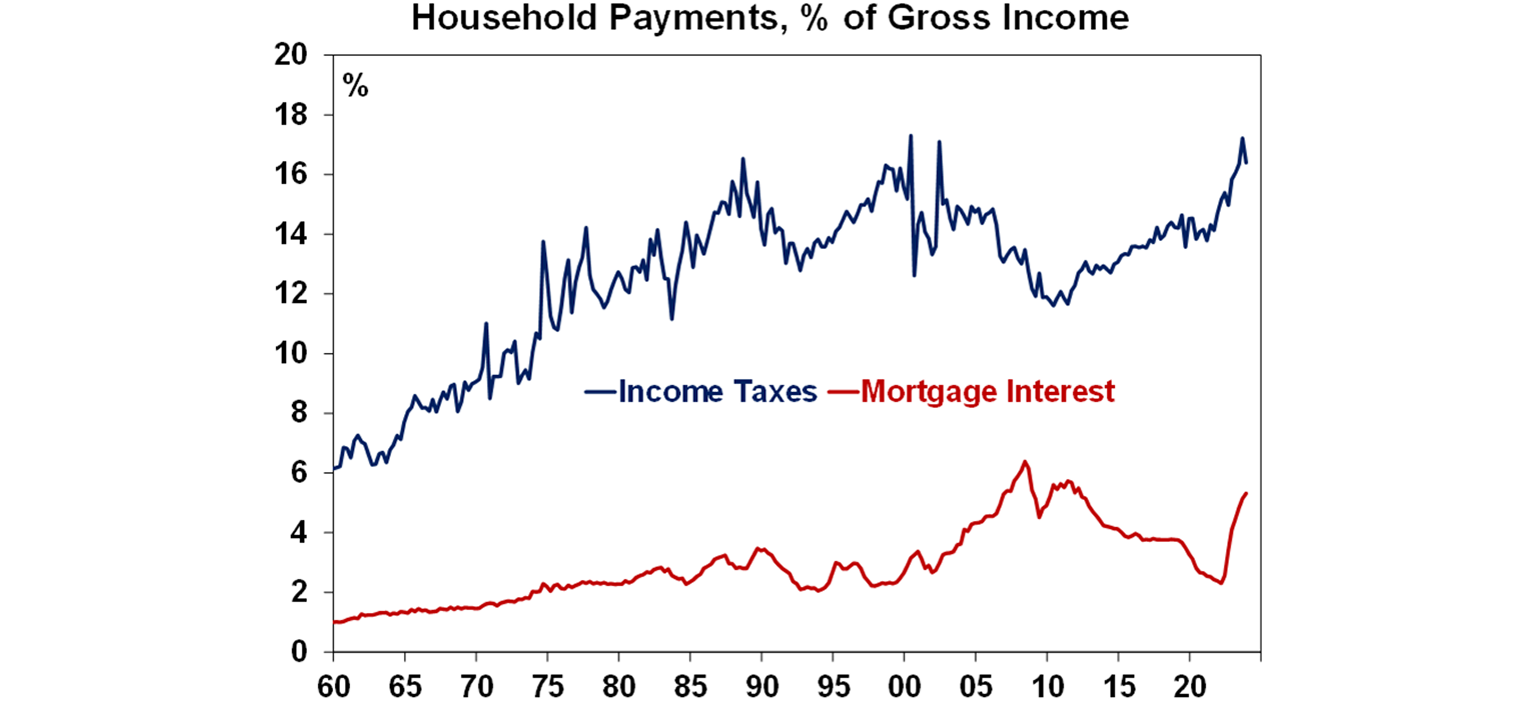

Household income was given a welcome boost by strong public wages growth and a fall in tax payments allowing a slight rise in the household saving rate, but it looks unlikely to be sustained just yet as public wages were boosted by employment associated with the Voice referendum and tax payments fell due to timing issues. Also, the savings built up through the pandemic are continuing to run down and the tax and mortgage interest shares of household income remain very high. Tax cuts are coming but that’s still not till mid-year and they will only lower the tax share of income slightly leaving it well above levels of just two years ago. And weaker employment will likely start to weigh more in the months ahead. So, expect consumer spending to remain depressed for a while yet, before picking up later this year and through next year helped by rate cuts.

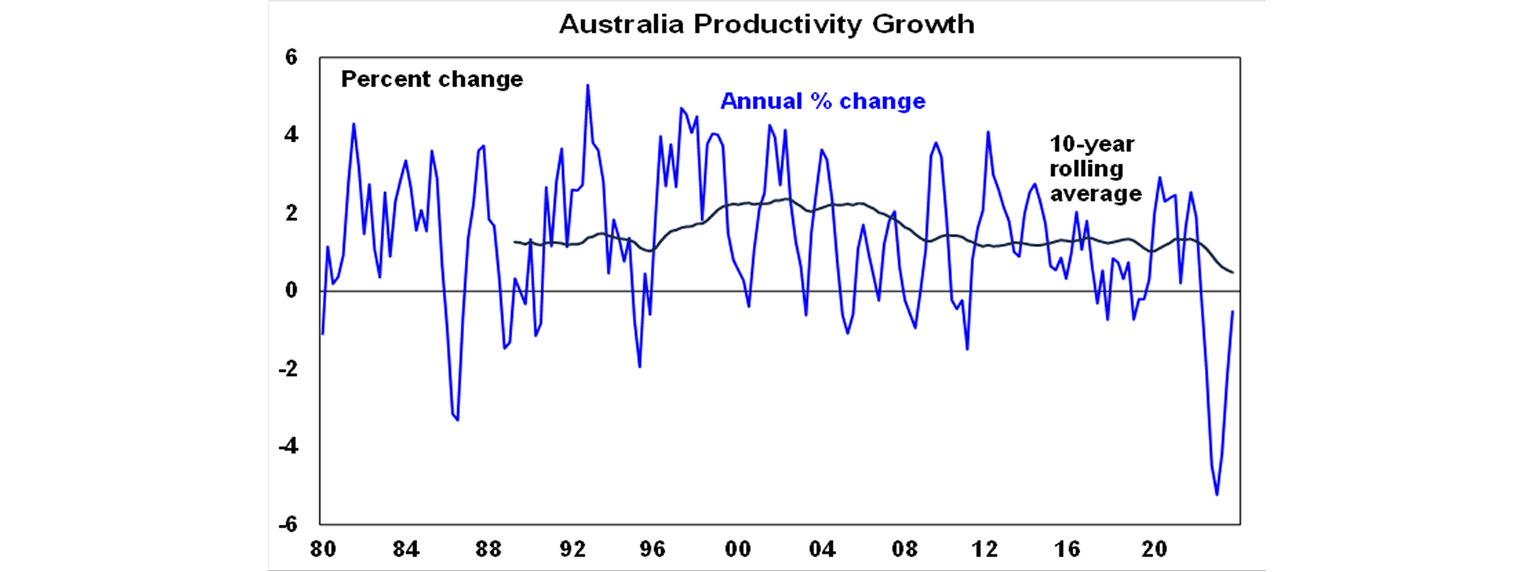

The Australian GDP data add to confidence that inflation is slowing with a further slowing in domestic price deflators, slower growth in private sector wages and productivity rising for the second quarter in a row as hours worked fell resulting in slowing growth in unit labour costs. The pandemic related slump in productivity appears to be receding.

The slump in GDP growth combined with the rising trend in unemployment and falling inflation add to confidence that the RBA will cut interest rates this year. The slump in GDP growth is not likely to be enough though to see the RBA drop its mild tightening bias at its March meeting as it will likely still be waiting for “sufficient confidence that inflation would return to target within a reasonable timeframe.” But we are getting closer, and the consumer is notably weaker than the RBA has been forecasting. So we continue to see the RBA cutting from around mid-year (most likely June but it could be August) with three 0.25% cuts this year.

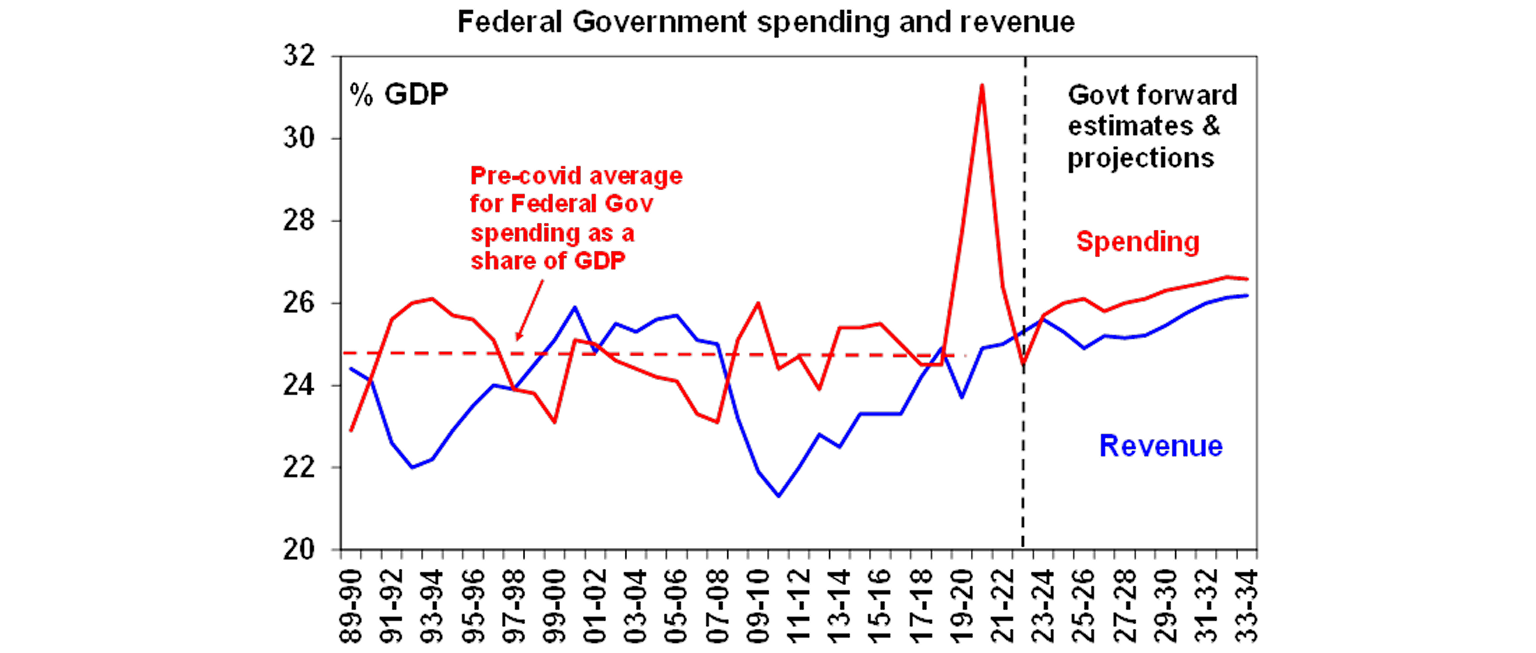

Should the Australian Government consider boosting spending in the May Budget? Reports suggest that the Government is considering a pre-election spending boost. Shifting the focus of the budget from deficit reduction to providing stimulus may be appropriate at some point if the economy looks like its subsiding into recession and the RBA needs some help to get it going again. But we are not at that point yet and may not get there. While there may be some justification for a continuation of energy bill relief and a case to flag possible further tax cuts for say 2025-26, this is not the time to boost spending significantly: the best way to help the most vulnerable households right now remains capping public spending to help reduce inflation and interest rates; in the first instance the RBA is best placed to help stabilise the economy by lowering interest rates; and more government spending risks adding to what is already projected to be a far higher government spending share of GDP over the medium term which in turn risks depressing productivity and hence living standards.

Economic activity trackers

Our Economic Activity Trackers are still not showing anything decisive.

Major global economic events and implications

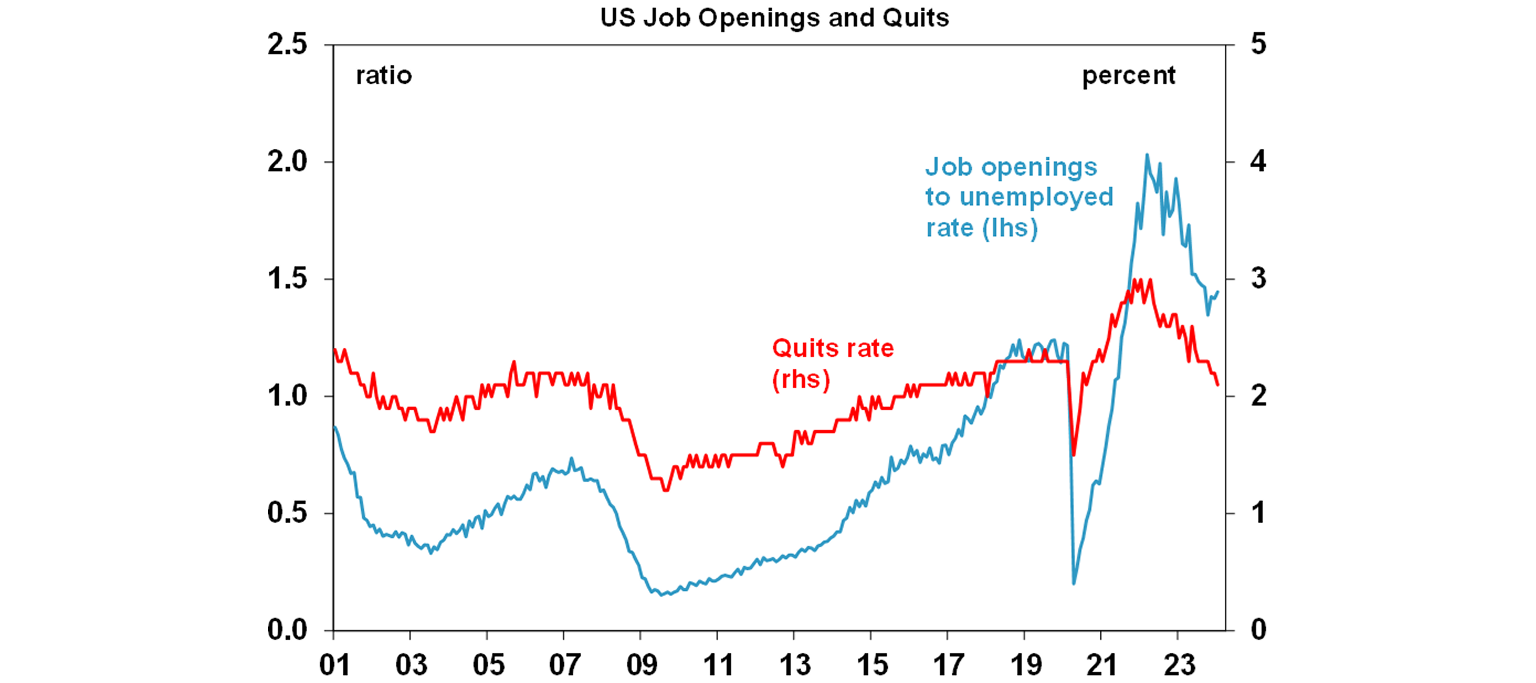

US economic data over the last week was softish with the services conditions ISM down in February and most jobs indicators pointing to a further cooling in the US jobs market. In terms of the latter, payrolls rose a solid 275,000 in February but prior months were revised down by 167,000, temporary employment continues to fall which is a sign of softening, unemployment rose further to 3.9% (from 3.7%) and wages growth was just 0.1%mom with annual wages growth falling to 4.3%yoy (from 4.4%). With the December and January heat revised away the US jobs market still looks solid but is now cooling again rather than strengthening. Meanwhile, the job opening to unemployment ratio edged up slightly in January but quits (which are arguably a better indicator) and hiring continued to fall and the employment survey in the ISM index was weak all of which point to further labour market cooling ahead. Initial jobless claims were unchanged and remain low but continuing claims rose suggesting it’s getting harder to get a new job after losing one.

Eurozone retail sales rose just 0.1% in January and are down 1%yoy and producer prices are down 10.7%yoy.

Japanese wages growth picked up to 2%yoy in January due to stronger bonuses but with basic wage growth unchanged at 1.4%yoy. The money market is now moving to price in a rate hike at the BoJ’s 19 March meeting.

The Chinese National People’s Congress provided only modest macro stimulus. The growth target for this year was set at “around 5%” with inflation “around 3%” which provided no surprises and were unchanged from last year. The budget deficit target was set at 3% of GDP but with extra central and local government bond issuance the actual budget deficit could be closer to 7% of GDP which amounts to a modest extra stimulus as opposed to the big moves of the past. More monetary and fiscal stimulus – particularly to help consumers – will likely be required to hit the growth target. On the data front Chinese exports and imports both rose by more than expected in January and February.

Australian economic events and implications

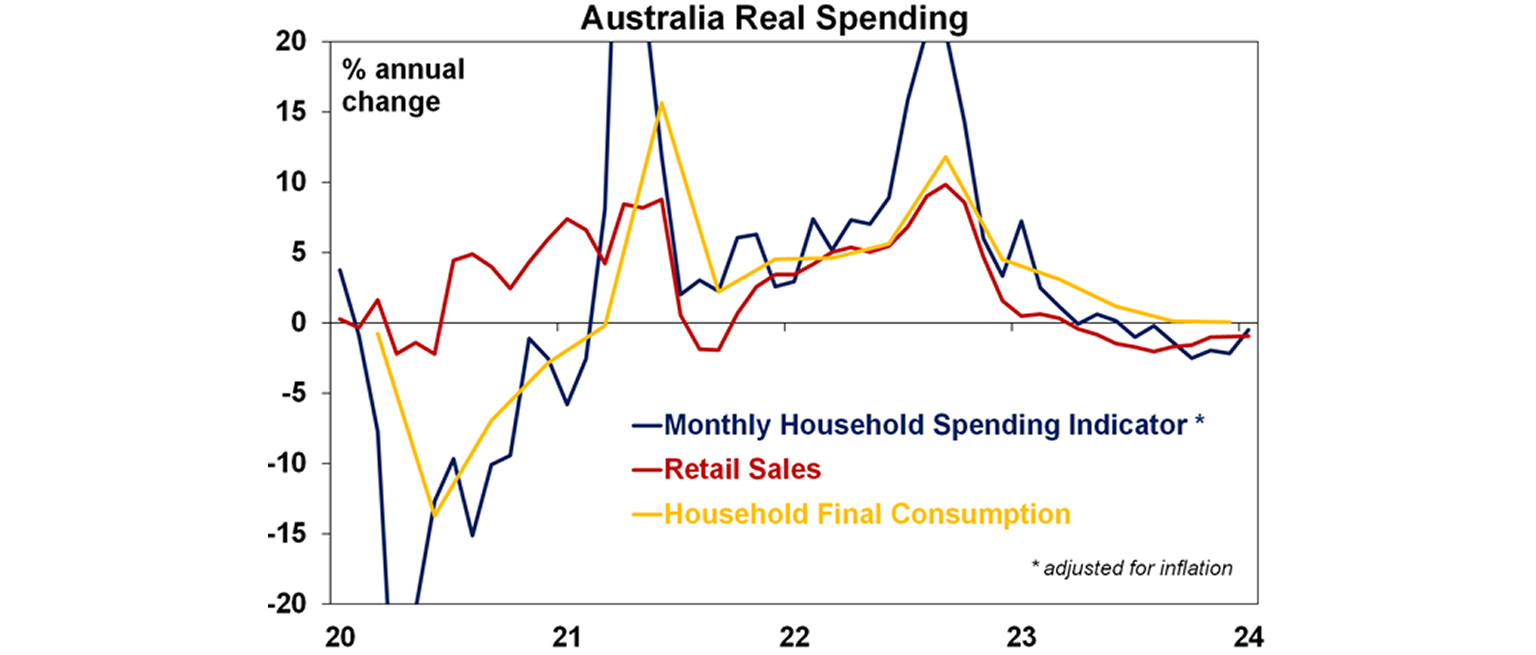

Along with soft December quarter GDP, Australian economic data over the last week was mostly soft. The ABS’ monthly household spending indicator edged up in January thanks to spending on essentials which is underpinned by strong population growth, but remains weak at 3%yoy which is about flat in real terms.

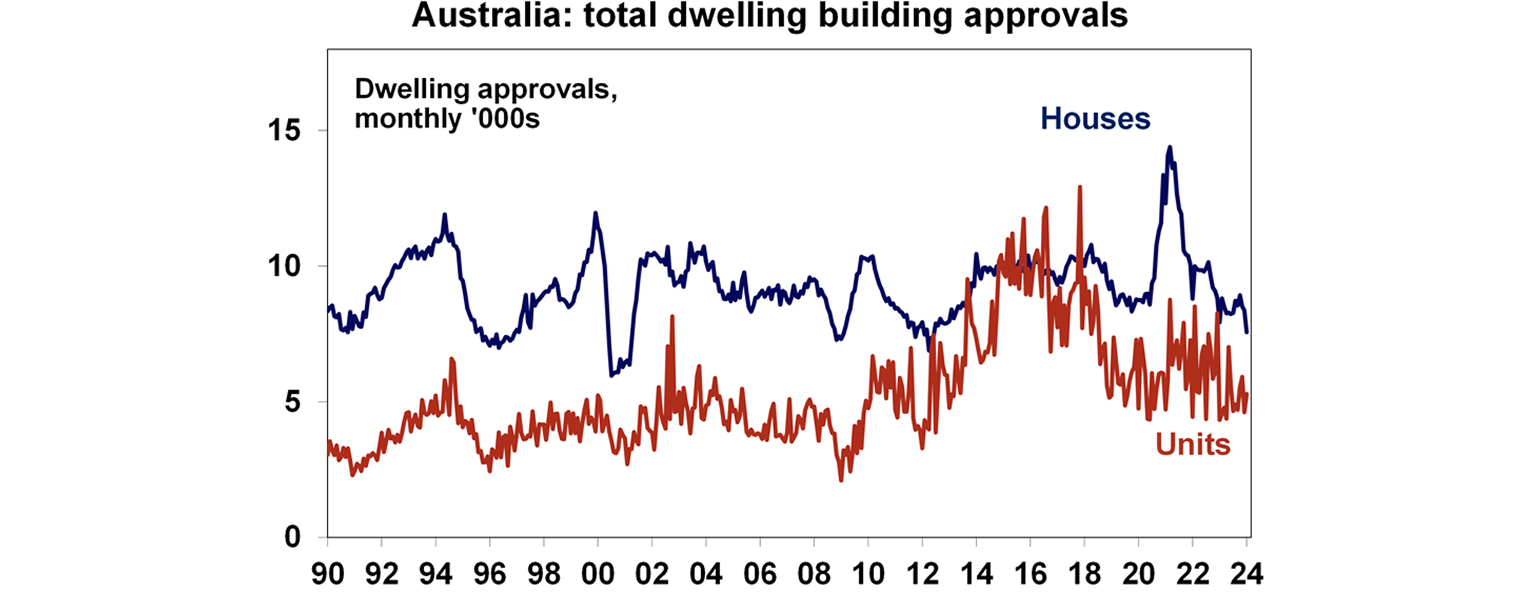

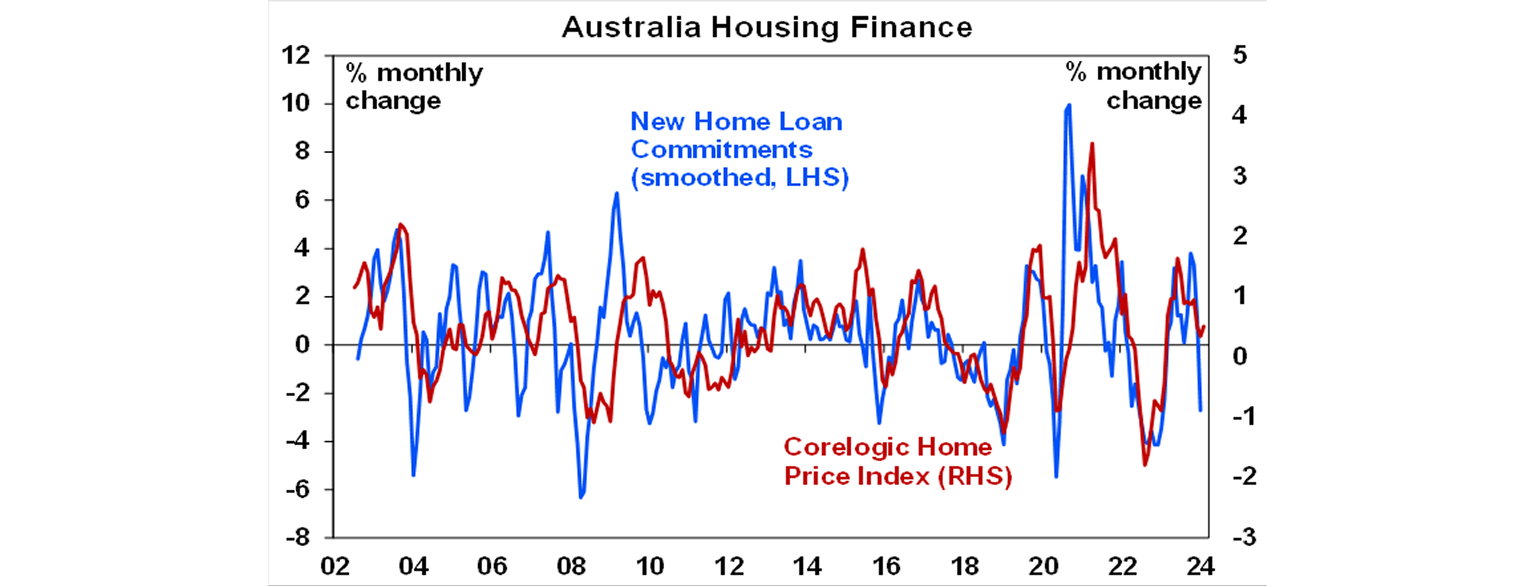

Home building approvals and housing finance both fell again in January. The former does not augur well for Australian government plans to build 240,000 dwellings per annum over the next five years as approvals are currently running around 166,000 dwellings a year.

The weakness in housing finance growth is consistent with soft momentum in home prices.

ANZ job ads fell 2.8% in February and are down 12.4% on a year ago pointing to softer jobs growth ahead.

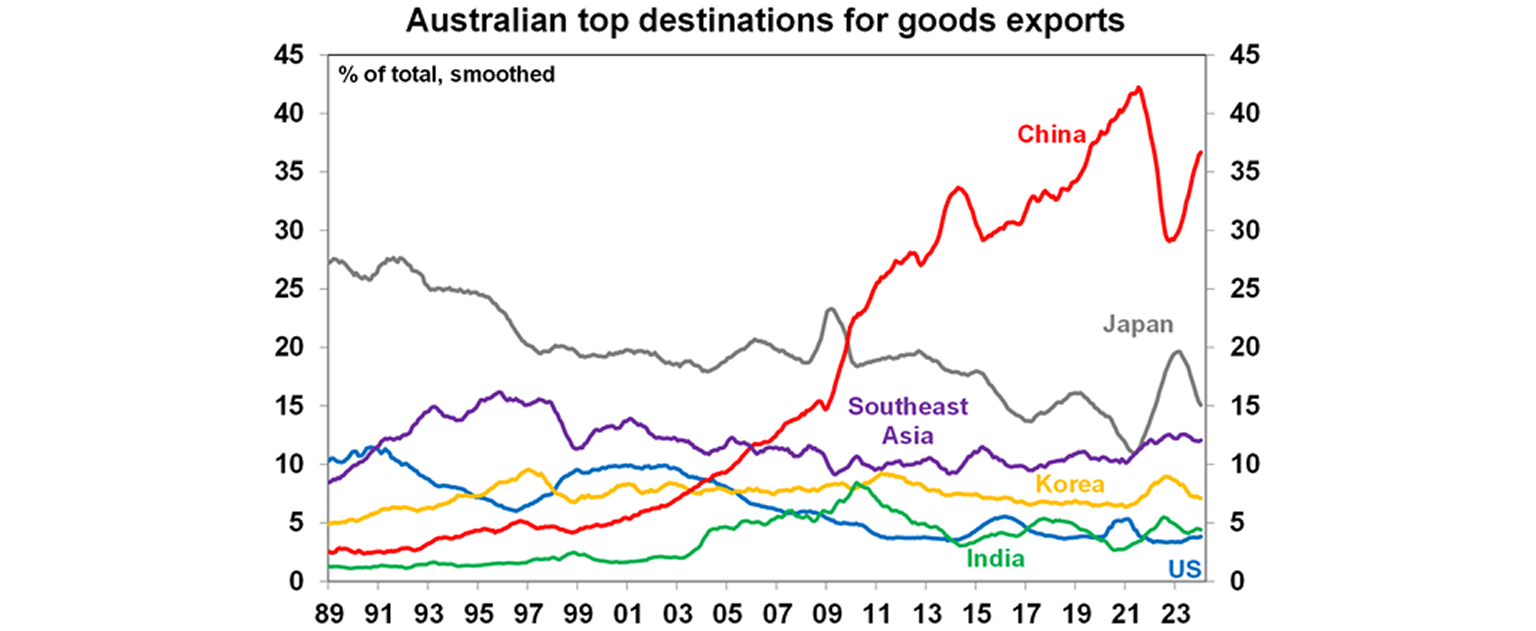

Australia’s trade surplus rose slightly to $11bn helped by continuing strength in exports and constrained consumer imports. China’s export share continues to recover and that to South Asia (given interest with the ASEAN conference in Melbourne) is stable at around 12%.

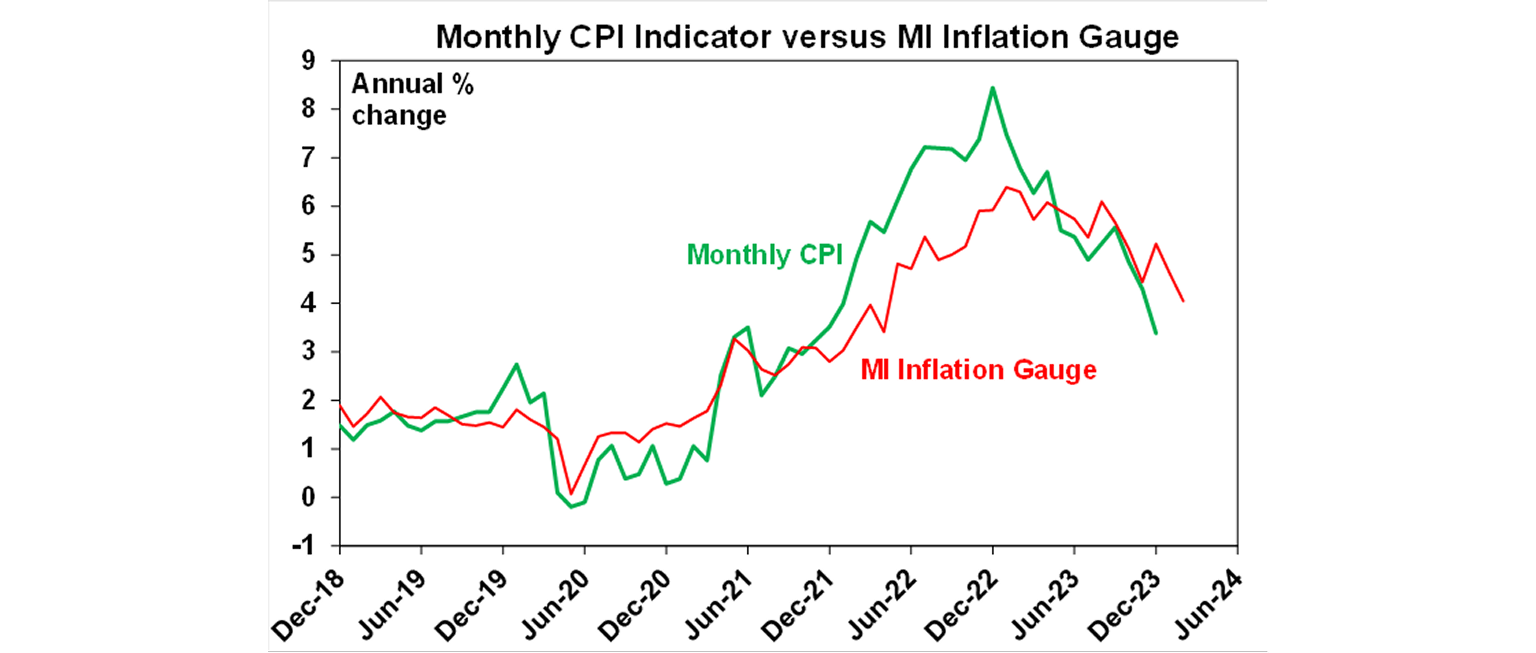

The Melbourne Institute’s Inflation Gauge for February showed an ongoing slowing in inflation, but it has lagged the ABS’s monthly inflation data.

What to watch over the next week?

In the US, the focus will be back on inflation with likely another month of elevated CPI increases partly as a reweighting towards houses in the owners’ equivalent rent component continues to feed through. The February CPI (Tuesday) is expected to rise 0.4%mom with annual inflation unchanged at 3.1%, but core inflation falling to 3.7%yoy from 3.9%yoy. Producer price inflation data will also be released Thursday. In other data, expect a bounce back in February retail sales (Thursday), flat industrial production and continuing weak manufacturing conditions in the New York region (both Friday).

In Australia, March consumer confidence data will be watched for further improvement after that seen in February and the NAB business survey for February will provide an update of business conditions and confidence (Tuesday). RBA Chief Economist Sarah Hunter’s participation in a panel discussion (Tuesday) will likely also be watched closely for any updates on how the RBA is seeing things.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for good investment returns this year. However, with a very high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

We expect the ASX 200 to return 9% this year and rise to around 7900. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains compared to 2023 as still high interest rates constrain demand and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price growth later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US and the Fed moving to cut rates earlier and by more than the RBA.

You may also like

-

Weekly market update 06-02-2026 Global share markets mostly fell over the last week amidst increasing worries about tech valuations and overinvestment in AI, some weak US jobs data & ongoing fears of a US strike on Iran. -

Making sense of the start of 2026 In this Econosights we look at some of the key headlines that have been impacting financial markets in early 2026 and what the implications are for investors. -

Oliver's insights - RBA starts the year off with a rate hike The RBA’s decision to hike rates to 3.85% was no surprise with it being about 70% factored in by the money market and 22 of the 28 economists surveyed by Bloomberg expecting a hike.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.