US, Eurozone and Japanese shares rose to new record highs in the past week helped by key US inflation data coming in as expected and leaving the Fed on track to cut rates from around mid-year. For the week US shares rose 0.9%, Eurozone shares rose 0.4% and Japanese shares rose 2.1%. Chinese shares rose 1.4% on hopes for more policy stimulus. Australian shares rose 1.3% for the week also taking them to a new record high helped by the positive global lead and the earnings reporting season being better than feared with prospects for better earnings ahead once interest rates start to fall. Gains in the ASX 200 were led by IT, retail, property and financial shares. Bond yields rose in Europe, were flat in Japan but fell in the US and Australia. Oil and gold prices rose but copper and iron ore prices fell. The $A also fell slightly with the $US little changed.

With stretched valuations and positive investor sentiment share markets remain at risk of a short term pull back but are still managing to grind higher helped by a combination of mostly ok economic and earnings news, ongoing expectations for rate cuts and enthusiasm for AI. While Australian shares are lagging partly because of their little exposure to AI they are still managing to benefit from stronger global markets, prospects for RBA rate cuts later this year and the earnings reporting season being out of the way without major mishaps.

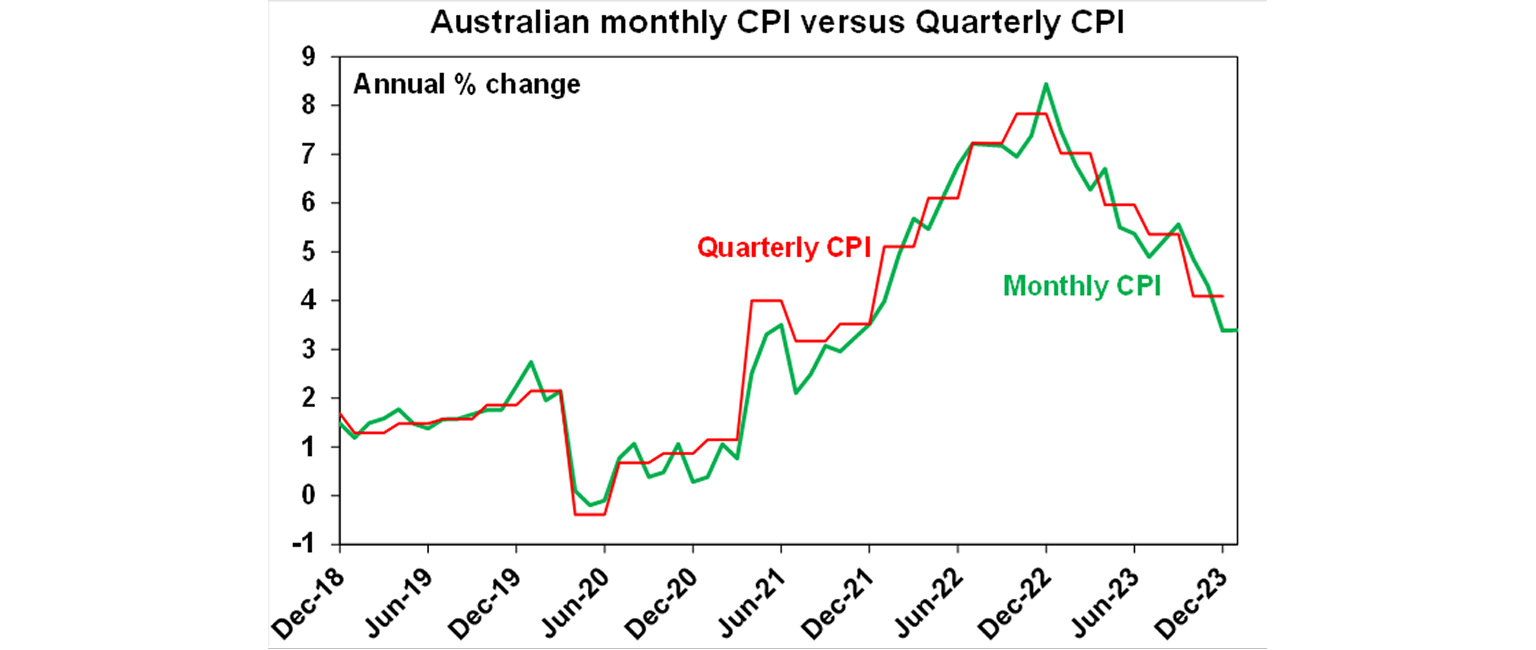

Australian inflation still looks like its falling faster than the RBA expects. The January monthly CPI came in weaker than expected, managing to hold at 3.4%yoy with underlying measures of inflation also falling slightly.

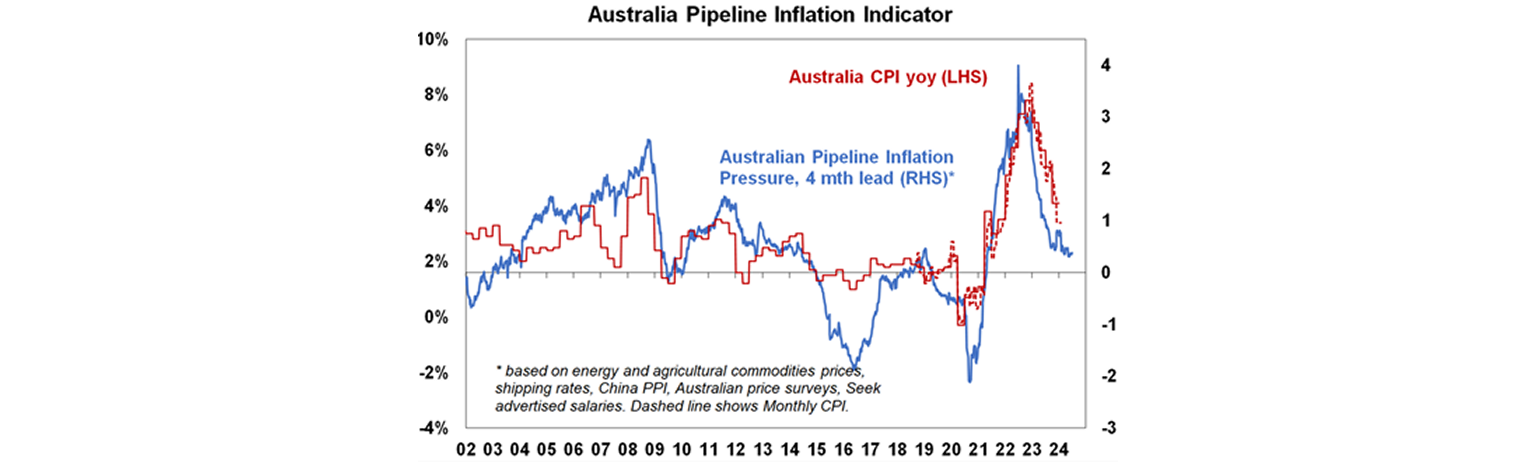

Our Australian Pipeline Inflation Indicator continues to point to a further fall ahead and we see inflation this year falling to just below 3% 12 months ahead of the RBA’s forecasts.

Even with a likely bounce in inflation to around 3.7%yoy in February - owing partly to higher prices for fuel and updated prices for various services like education and insurance – inflation looks on track to come in just below the RBA’s March quarter forecast for 3.5%yoy, with a quarterly rise around 0.6%qoq which will mean two quarters in a row of annualised inflation around 2.5%, ie, in line with target! However, while the lower-than-expected January outcome is good news for the RBA its likely to remain cautious and retain its mild tightening bias at its March meeting as: it will still see inflation as too high; the underlying measures are still higher than headline inflation; services inflation has come down by less; and many services prices were not updated in January. In short, it’s unlikely that by the March meeting the RBA will have “sufficient confidence that inflation would return to target within a reasonable timeframe.” We continue to see the RBA cutting from around mid-year and expect three 0.25% cuts this year.

But has the RBA gone too far? At this stage its still too early to tell but it does seem as if the November rate hike was a bit of an overreaction to the less favourable September quarter inflation data as inflation has since resumed its downswing. Of course, it may become more of an issue in the week ahead as December quarter GDP growth looks like being very weak at 0.1%qoq with an ongoing per capita recession and a high risk of a contraction in GDP.

Further to go in addressing gender financial equality. The publication in Australia of gender pay gaps across major companies indicates there is still a significant gap – with a median gap of 19% in total pay. The good news is that the gender pay gap (based on average weekly earnings data) has been declining and the gap does not mean that women are getting paid less for performing the same job (which is illegal) although there may still be a bit of that. Rather the big driver of the gap is having a higher proportion of men in senior, longer hours or more stressful jobs that pay more and a higher proportion of women in less senior, shorter hours or less stressful jobs that pay less. Addressing this is of course not as simple as just leaving it for companies to fix up but requires a multi-faceted approach – including: removing conscious and unconscious gender bias; making it even easier for women to stay fully in the workforce after having children; encouraging men to take on more unpaid family work; making it easier for young girls to assess the financial consequences of their career choices; encouraging and making it easier for women to take on more senior roles with longer hours and more stress; and maybe even making men more like women in some ways.

Taylor Swift doing her part. In the last few months I have been lucky to have seen two megastars – Paul McCartney and Taylor Swift. They are at different stages in their careers but have some similarities – they both have immense musical talent and produce great music with thoughtful lyrics; they have both tried different things musically; they have avoided the worst of the personal pitfalls in the music industry; they consistently produce quality new material for their fans; they both have an extensive catalogue of popular songs to draw from (Paul has the advantage of age but Taylor now has 17 years to draw on); they are both very energetic; they both play for three hours covering a fan focussed mix; and they are both savvy business people. There have been many female pop sensations (eg, Kylie Minogue) but not quite on Taylor’s scale - witness her domination of the Australian album chart over the last two decades and in the last week (with the top 5 albums) and her being the first artist to sell out Accor Stadium four nights in a row.

Economic activity trackers

Our Economic Activity Trackers are still not showing anything decisive.

Major global economic events and implications

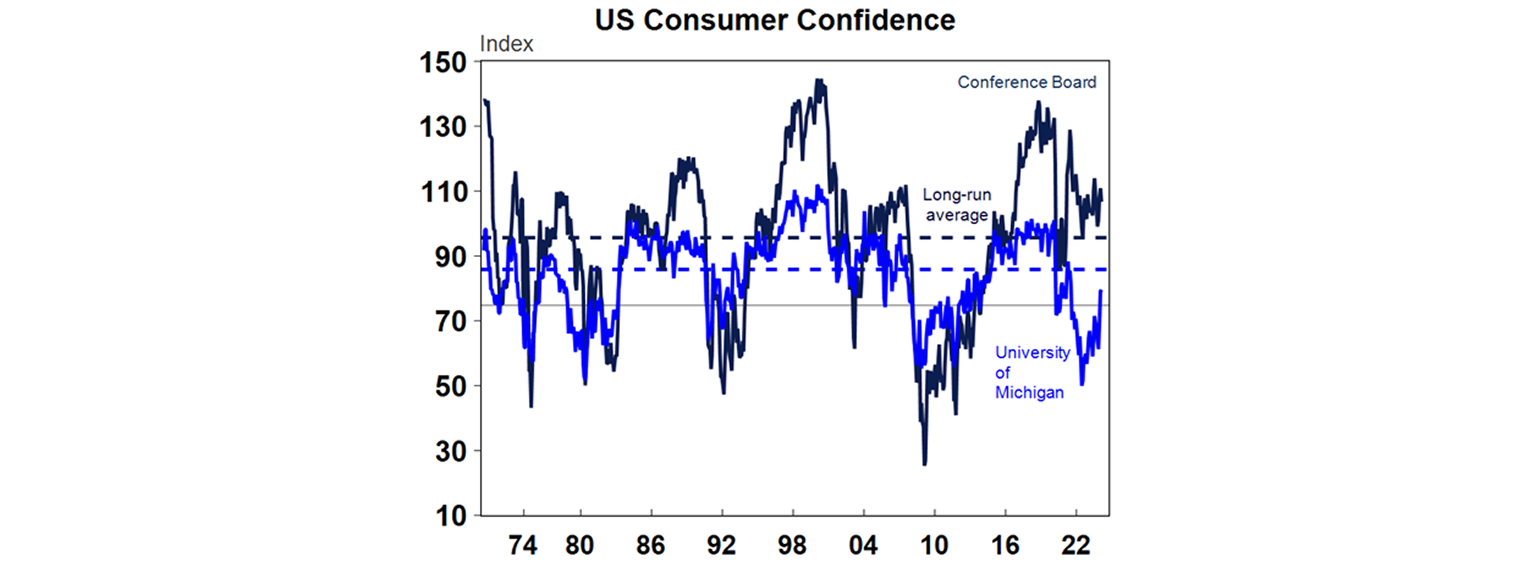

US economic data was mixed with new home sales up but pending home sales down, home prices rising, underlying capital goods orders trending sideways, the ISM manufacturing index down, consumer confidence down, personal income up solidly but real personal spending falling and jobless claims up but still low.

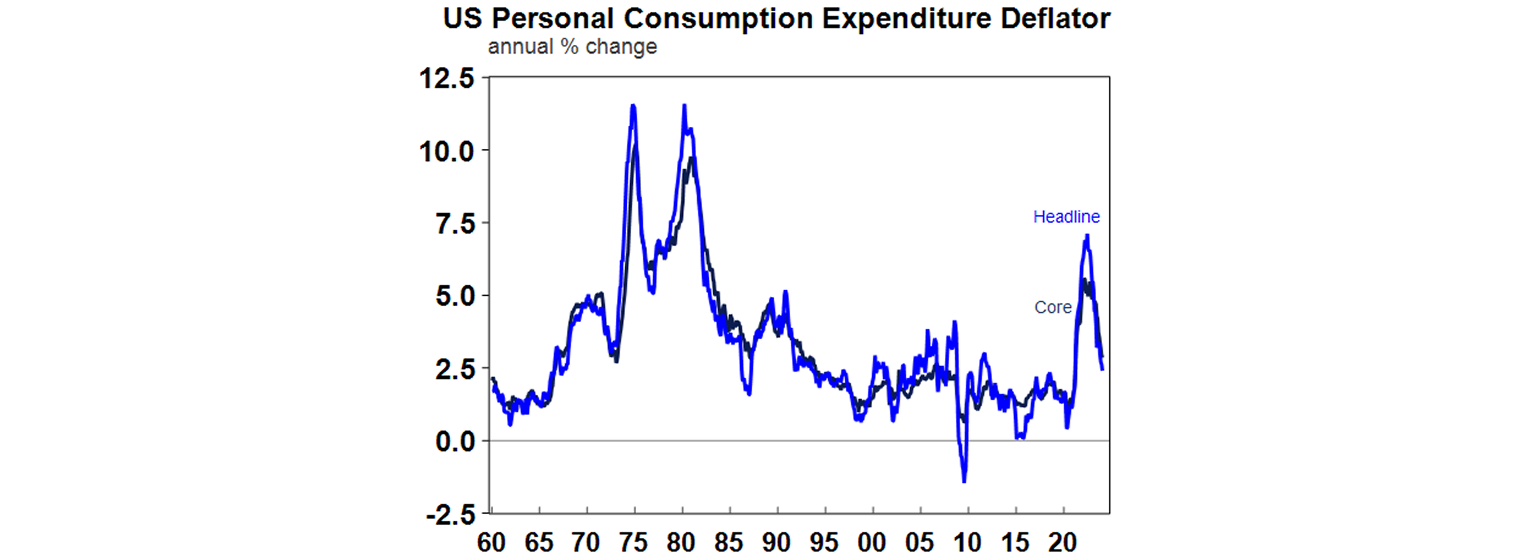

US core private consumption inflation picked up to 0.4% in January as foreshadowed by the CPI but fell to 2.8%yoy from 2.9%. As it was no worse than expected investment markets were happy as it leaves the Fed on track to start cutting rates around June. Of course a run of higher monthly inflation could delay that.

Eurozone inflation slowed to 2.6%yoy in February with core inflation falling to 3.1%yoy. Both were a bit higher than expected but disinflation is continuing. Economic confidence remained soft in February and bank lending continued to contract in January. Unemployment fell to 6.4% in January from 6.5% in December (but this was revised up from 6.4%). The combination of falling inflation and stalled growth keeps the ECB on track to start cutting by June.

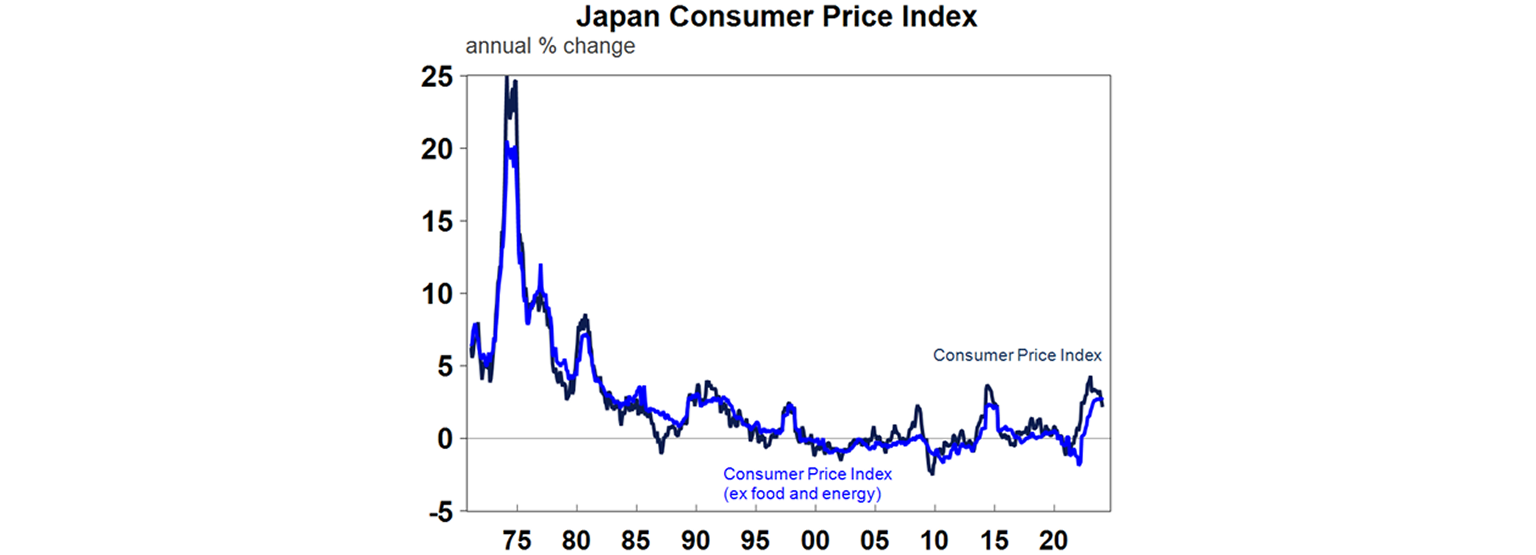

Japanese economic data was mixed with industrial production down sharply in January, unemployment flat and retail sales & consumer confidence up. Japanese inflation fell in January but by less than expected to 2.2%yoy with core inflation at 2.6%yoy.

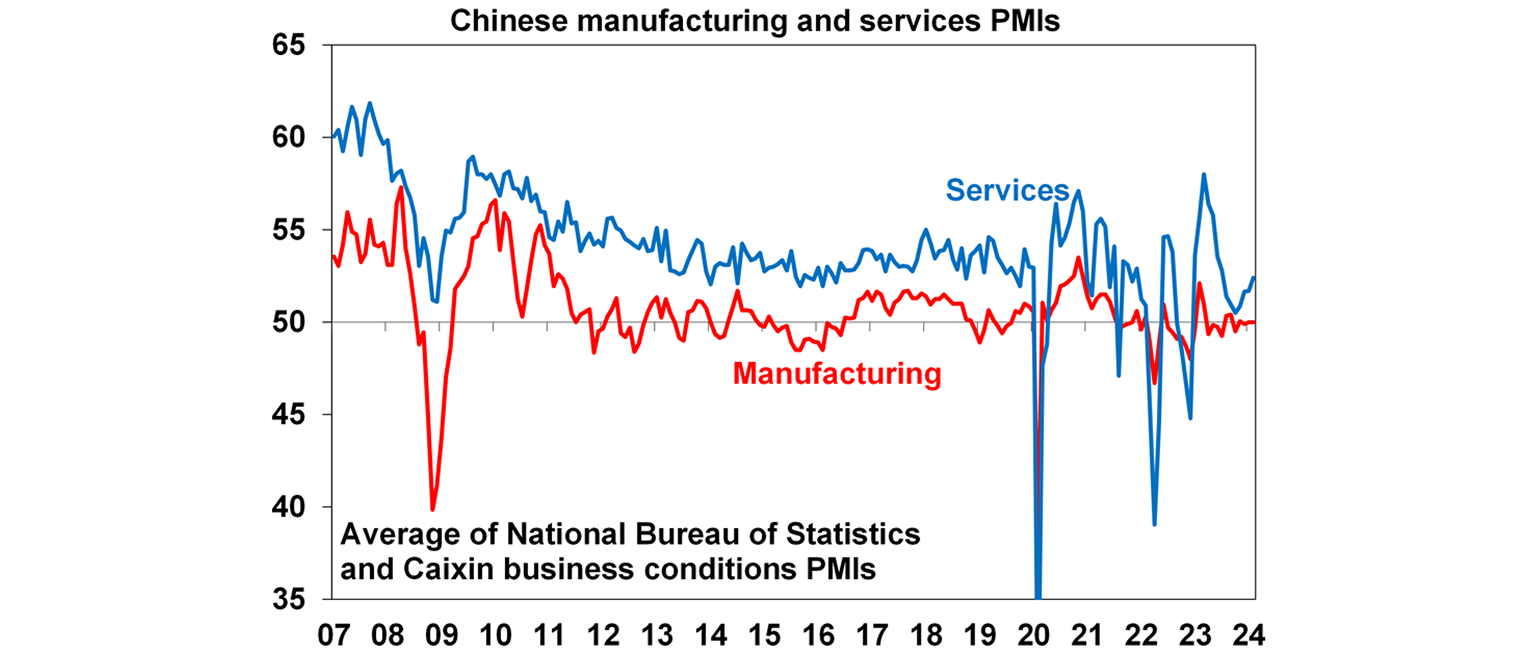

Chinese business conditions PMIs saw unchanged manufacturing and improved services conditions. They are still soft but at least aren’t warning of a slump.

The Reserve Bank of New Zealand left its cash rate on hold at 5.5% as widely expected. Its commentary was dovish with demand now seen as better matched with supply and inflation expected to decline further.

Australian economic events and implications

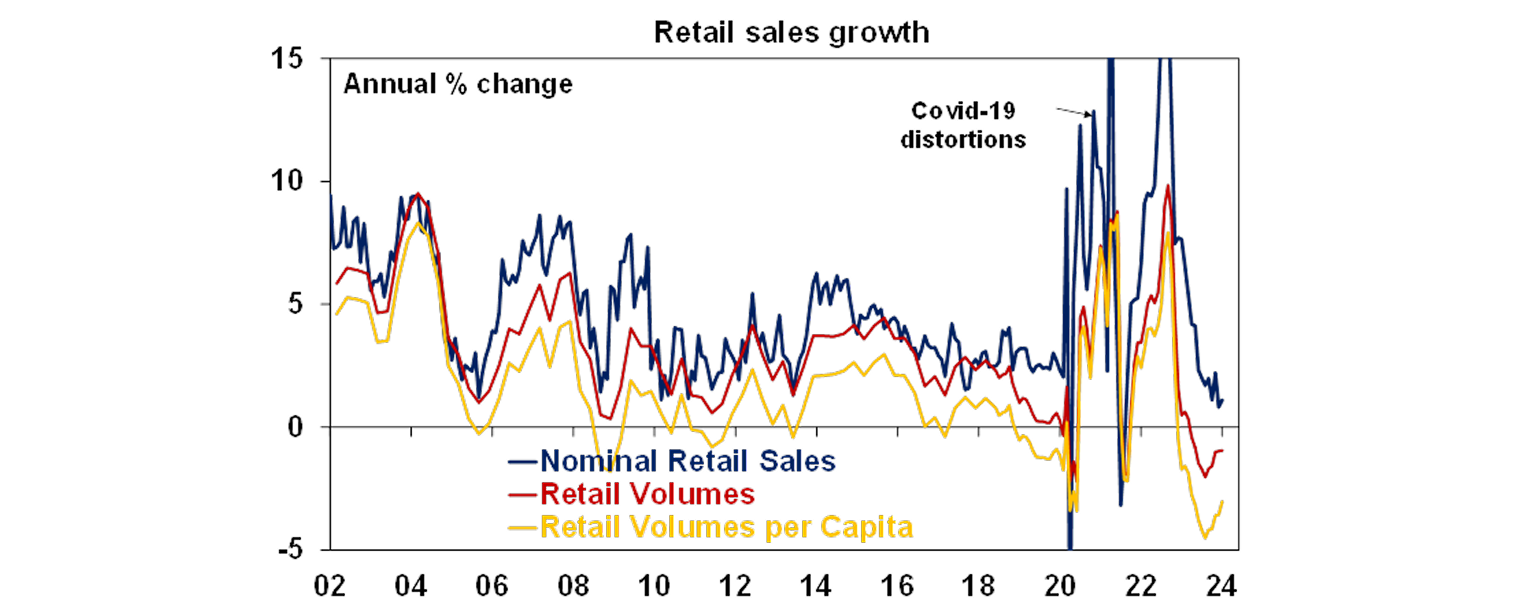

Australian economic data was mixed. Retail sales rose by less than expected in January after a slump in December leaving sales flat since September & down in real per capita terms.

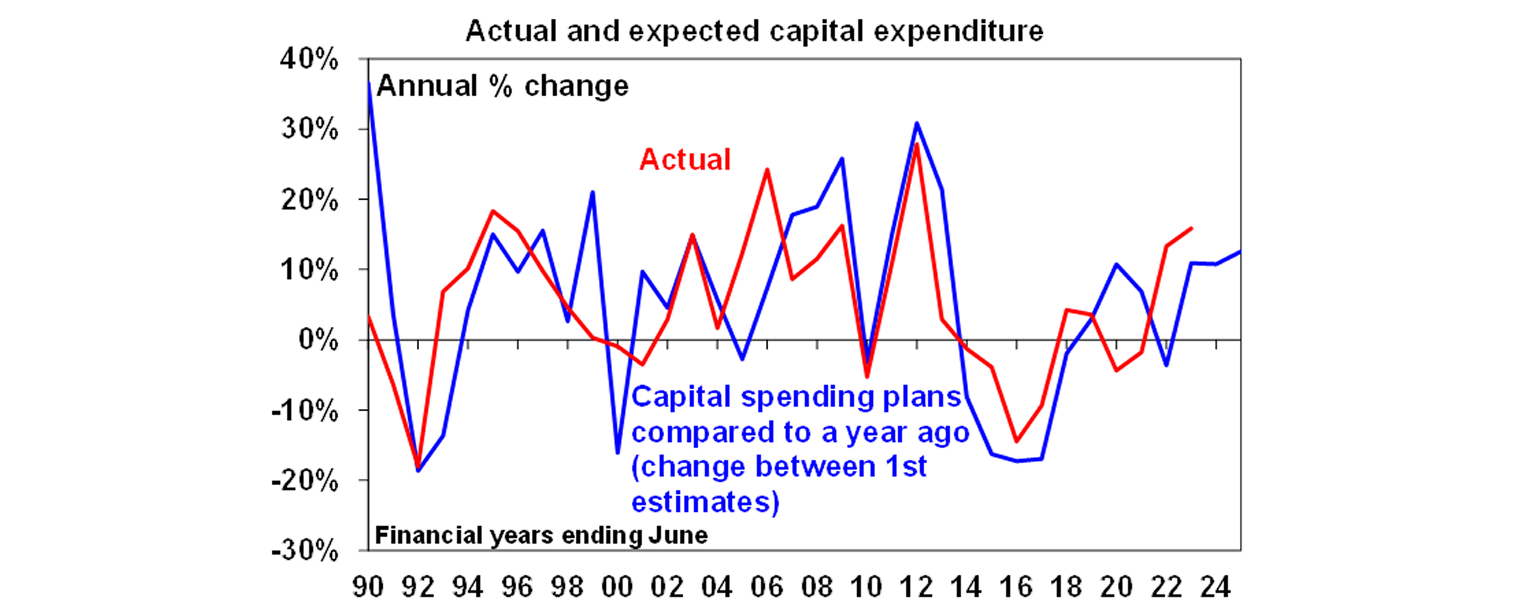

Business investment rose a slightly stronger than expected 0.8% in the December quarter (helped by strong growth in renewable energy investment). This was comprised of solid growth in building and structures investment but a fall in equipment investment. Separate construction data also showed a modest rise in the quarter but with housing investment down and non-residential up. The good news is that business investment plans for this financial year and next imply nominal capex growth of around 12% each year suggesting that investment remains reasonably resilient.

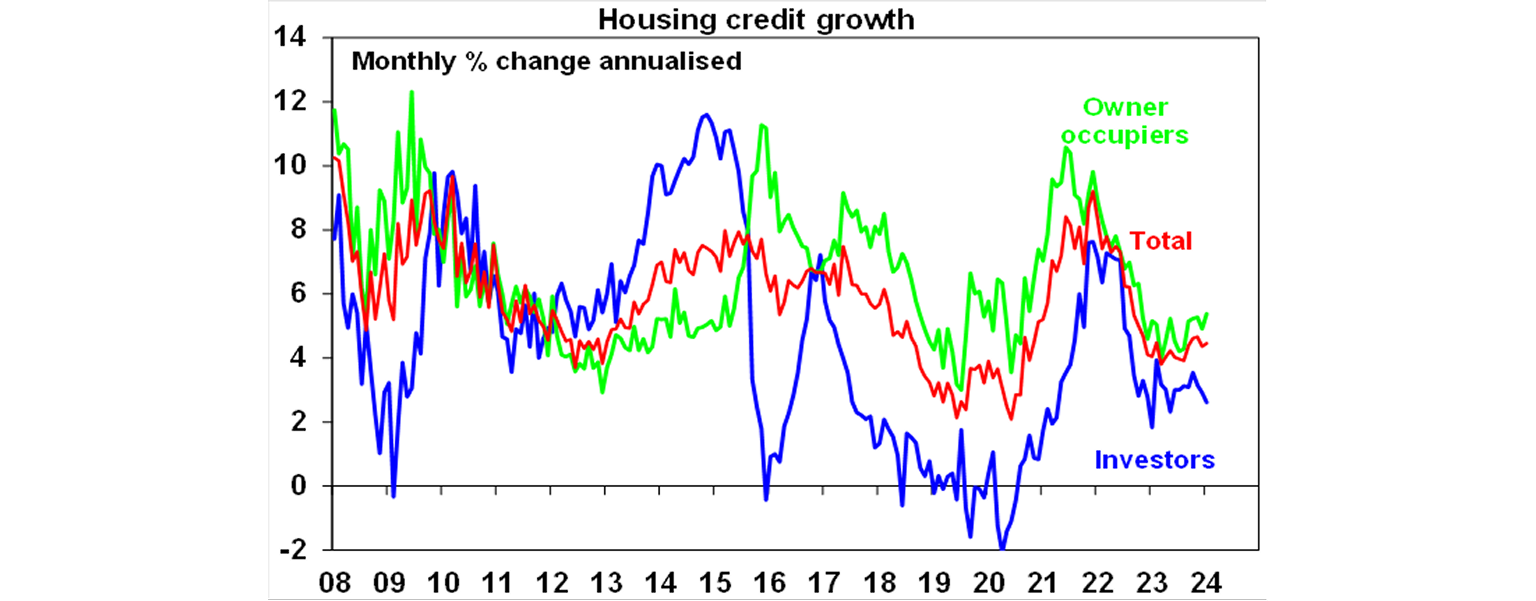

Credit growth remained modest in January. Housing credit growth has edged up from last year’s lows but remains well below its 2022 highs despite record home prices – consistent with the rebound in home prices over the last year coming on lower volumes and being less bubbly or speculative than that seen into early 2022.

Budget data to January adds to confidence the Federal budget will show a surplus this year. Financial year to January data is showing the budget running around $700m better than projected by MYEFO but with Treasury continuing to assume conservative commodity prices its likely that the MYEFO projection for a $1.1bn deficit for this financial year will turn into another surplus. Against this we are now getting closer to the next election and the May Budget is likely to include increased spending, cost of living supports and maybe flag more tax cuts.

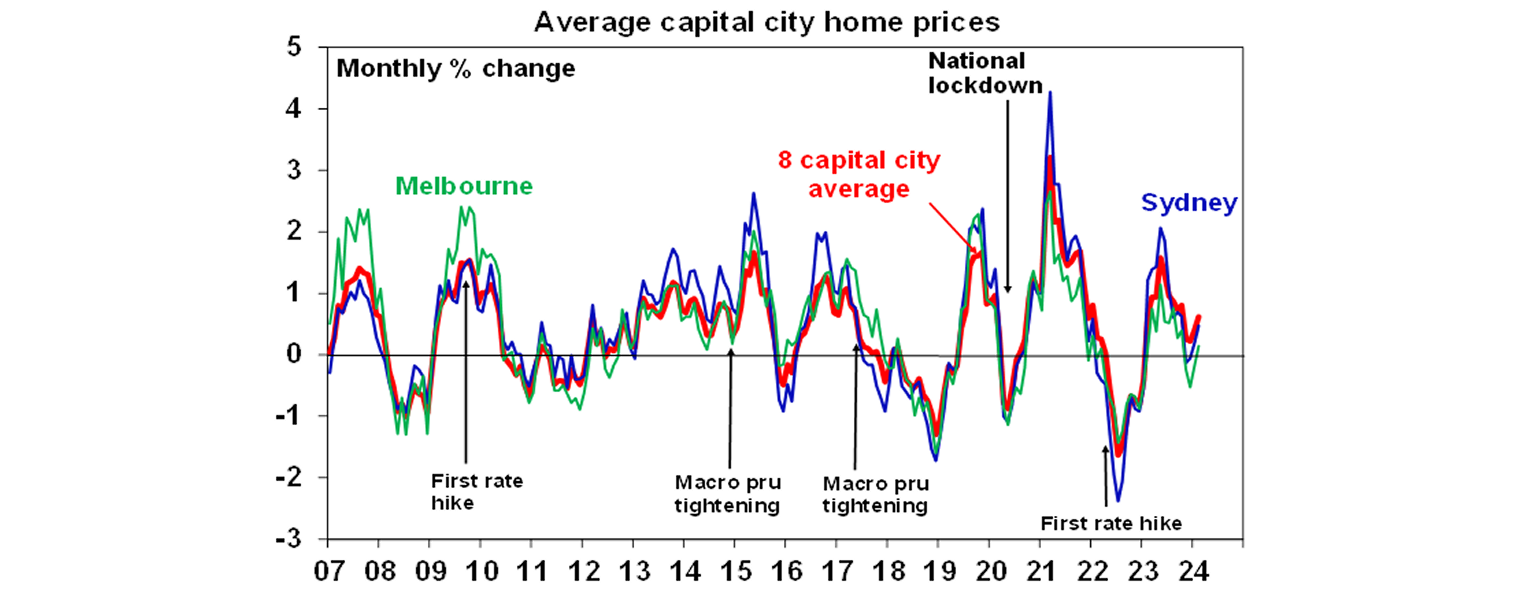

Home price gains picked up pace to 0.6% in February, with Sydney and Melbourne hooking up and continued strong increases in Adelaide, Brisbane and Perth.

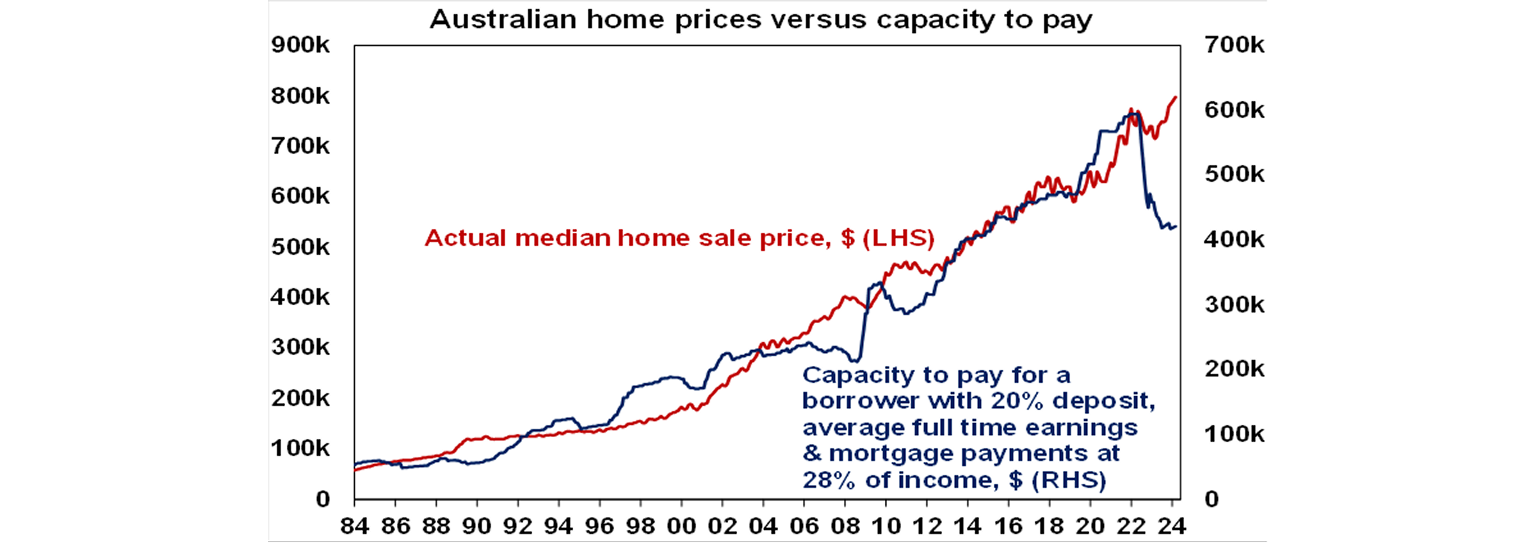

Our home price forecasts for this year revised up. Our assessment has been that high mortgage rates along with signs that immigration levels have peaked, waning saving buffers and access to “the bank of mum and dad” and higher unemployment would see property prices fall by 3-5% this year, albeit with significant divergence between cities. The impact of high mortgage rates by reducing the capacity to pay of home buyers and by adding to the risk of distressed sales continues to pose a major threat to property prices. However, the ongoing resilience in the property market suggests it’s still being dominated by the supply shortage and by the prospect of lower interest rates later this year boosting buyer confidence. As such we have revised up our national home price forecast for this year to a 3 to 5% rise, with help from lower rates later this year. This could easily be upset though by the RBA not starting rate cuts until next year and/or a sharp rise in unemployment – say above 5%.

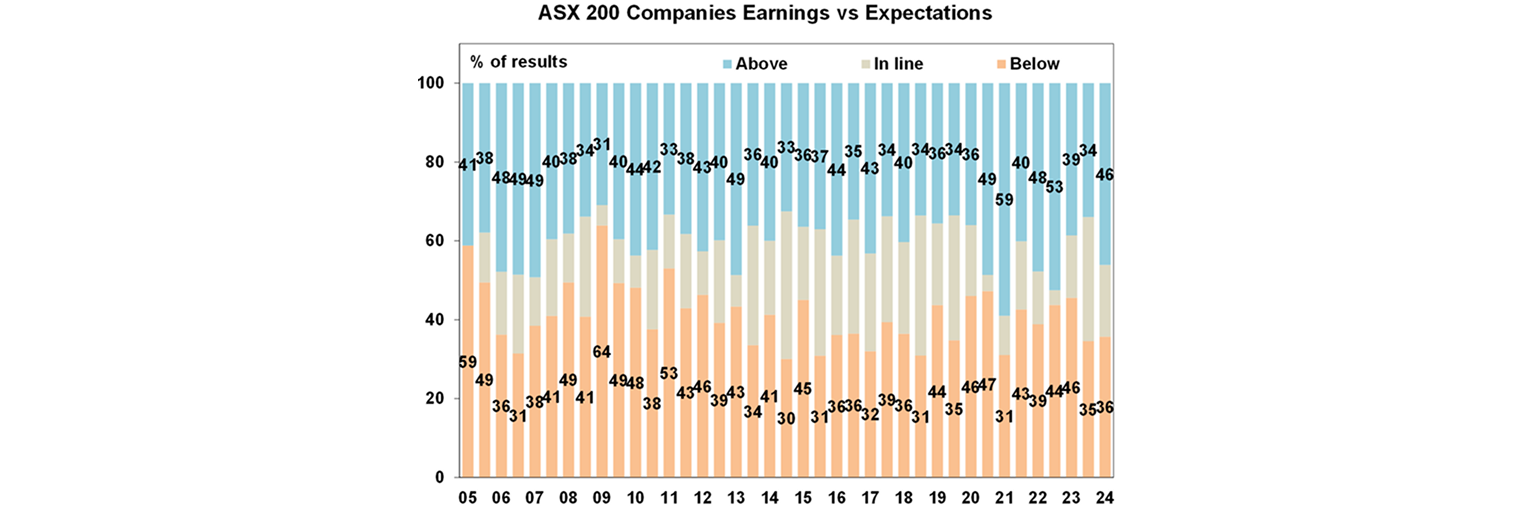

The Australian December half earnings reporting season is complete and actually improved over the final week with companies beating earnings expectations clearly exceeding those missing. That said, consensus expectations remain for a 5.5% or so fall in profits this financial year (down from -4.9% a month ago) with a big fall in energy sector profits on the back of lower energy prices and a small fall in bank profits but most other sectors seeing flat to up profits. The bad news has been that revenue growth has slowed and high interest expenses are a problem, but the good news has been that the peak in cost growth may be near, labour market pressure appears to be starting to normalise, cost control remains strong and guidance has been stable. So, the bottom line has been that results have been better than feared, but profits are still likely to be down this financial year. The share market focussed on results being better than feared and rose above the record high it saw early in February on hopes that better conditions might be ahead once interest rates start to fall.

After narrowing a week ago, the gap between beats and misses widened over the last week such that for the reporting season as a whole 46% of companies surprised consensus earnings expectations on the upside and 36% surprising on the downside, which is clearly better than the long-term average for both of around 41%.

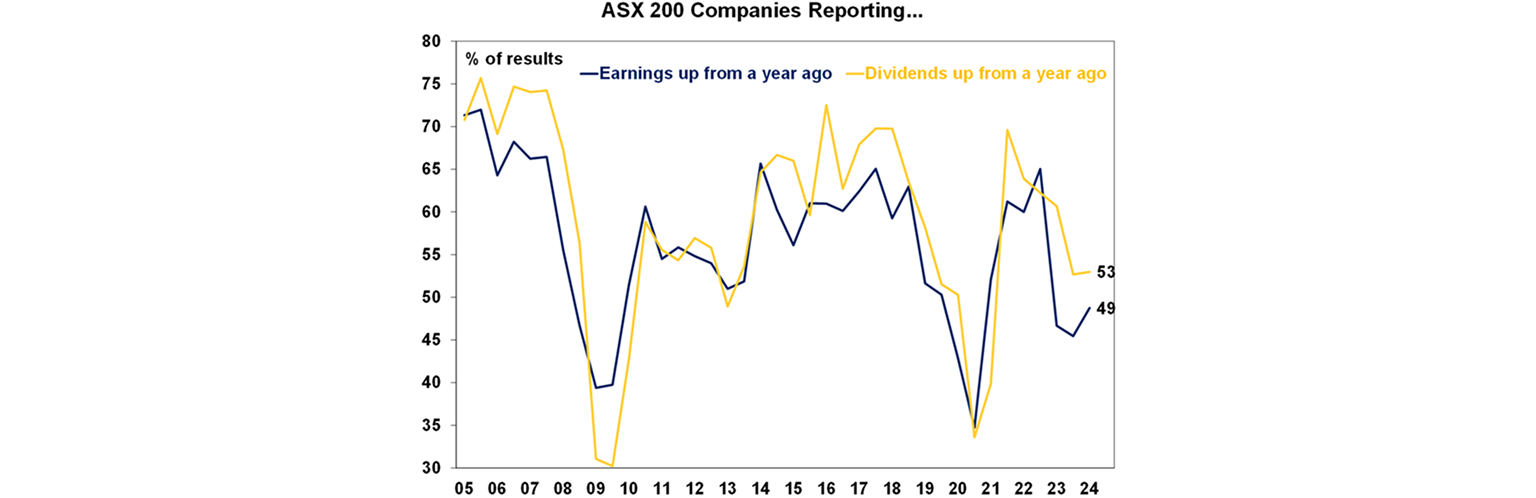

Against this though, only 49% of companies have seen earnings rise from a year ago which is up from the August reporting season but below the norm of 56%. This is consistent with aggregate earnings being likely to fall this financial year, albeit the falls are concentrated in energy stocks.

Similarly, 53% of companies have increased their dividends on a year ago which is below the norm of 59% and a greater than usual 31% have cut their dividends, which overall suggests a degree of caution.

What to watch over the next week?

In the US, the February services conditions ISM (Tuesday) is likely to have remained solid at around 53 and job openings and hirings data (Wednesday) is likely to confirm ongoing labour market cooling. Jobs data (Friday) is likely to show a 190,000 rise in payrolls, unemployment flat at 3.7% and a slowing in wages growth. Fed Chair Powell will provide an update on the Fed’s monetary policy views before House and Senate committees on Wednesday and Thursday. Having pushed the can down the road a week, the US Congress also needs to progress a spending package to pass a Continuing Resolution extending spending authorisations to avoid a partial government shutdown from 8 March.

The Bank of Canada (Wednesday) is expected to leave interest rates on hold at 5% and retain a neutral bias.

The European Central Bank (Thursday) is expected to leave its official interest rates on hold and confirm a neutral bias awaiting more confidence inflation is heading back to target.

China’s trade data for January and February (Thursday) is likely to show ongoing soft growth in exports and imports and CPI data (Saturday) is likely to inflation rising to +0.1%yoy. China’ National People’s Congress which begins Monday will likely announce a growth target for this year of “around 5%” but will be watched closely for more widely expected policy stimulus.

In Australia, the focus is likely to be on December quarter GDP growth (Wednesday) which is likely to show ongoing softness and a continuation of the per capita recession with growth of just 0.1%qoq or 1.3%yoy with weak growth in consumer spending and a fall in home building, modest growth in business investment and public spending and a slight contribution from net exports. While a 0.1% rise in GDP is our base case the normal forecasting error around this suggests that there is a high risk of GDP contracting for the first time since September quarter 2021. In other data, building approvals for January are expected to bounce 3.5% after a 9.5% fall in December, housing finance in January is expected to rise 1% after a fall in December and the January trade surplus is likely to remain around $11bn (with both due Thursday).

Outlook for investment markets for 2024

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns this year. However, with shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

We expect the ASX 200 to return 9% in 2024 and rise to around 7900. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains compared to 2023 as still high interest rates constrain demand and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price growth later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US and the Fed moving to cut rates earlier and by more than the RBA.

You may also like

-

Weekly market update - 24-10-2025 The US S&P500 is up by 1.1% so far this week, with large gains in energy, industrials and consumer discretionary stocks and declines in communication, consumer staples and utilities. The ASX200 is up 0.3%, with large gains in energy and real estate but declines in consumer staples, healthcare and materials. The $A is still going sideways at $0.65USD. Japanese shares rose strongly on stimulus hopes from the new Prime Minister. -

Econosights - Is China winning the trade war China’s economy is slowing, but resilient exports (especially high-tech goods and rare earths) lessen its need to respond to US pressures. -

Oliver's Insights - Investment cycles Whether it be the cycle of day and night, seasons, tides, the weather, fertility cycles, birth and death, etc, cycles are integral to life. And so too for economies and investment markets. Some are regular, some just rhyme. Despite attempts to end or subdue them via economic policy and regulation they live on.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.