The cost-of-living crisis isn’t just hurting hip pockets – it’s breaking hearts.

New research from AMP Bank GO reveals a growing “money trust gap” in Australian relationships. While more than 2 in 5 couples are choosing to combine their money, nearly 1 in 14 say they worry their partner may be hiding spending.

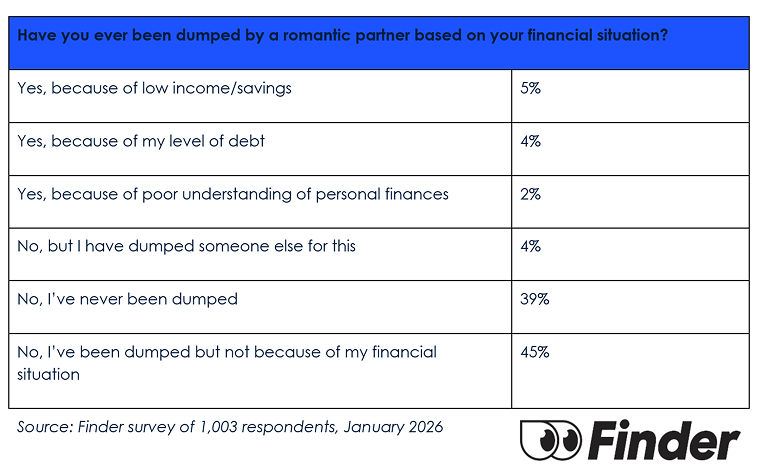

These findings echo new research from Finder, which found that 3.5 million Australians have dumped or been dumped by a romantic partner due to their financial situation. Low income and savings, and high levels of debt, were the leading romance killers, and a strong sign that financial dynamics are defining relationship outcomes.

Finder’s research shows 5% of Australians were dumped for having a low income/savings, 4% due to their level of debt, and 2% because of their poor understanding of personal finances. A further 4% of Aussies said they have been the one to let a romantic partner go.

The financial confidence upside that comes from getting it right

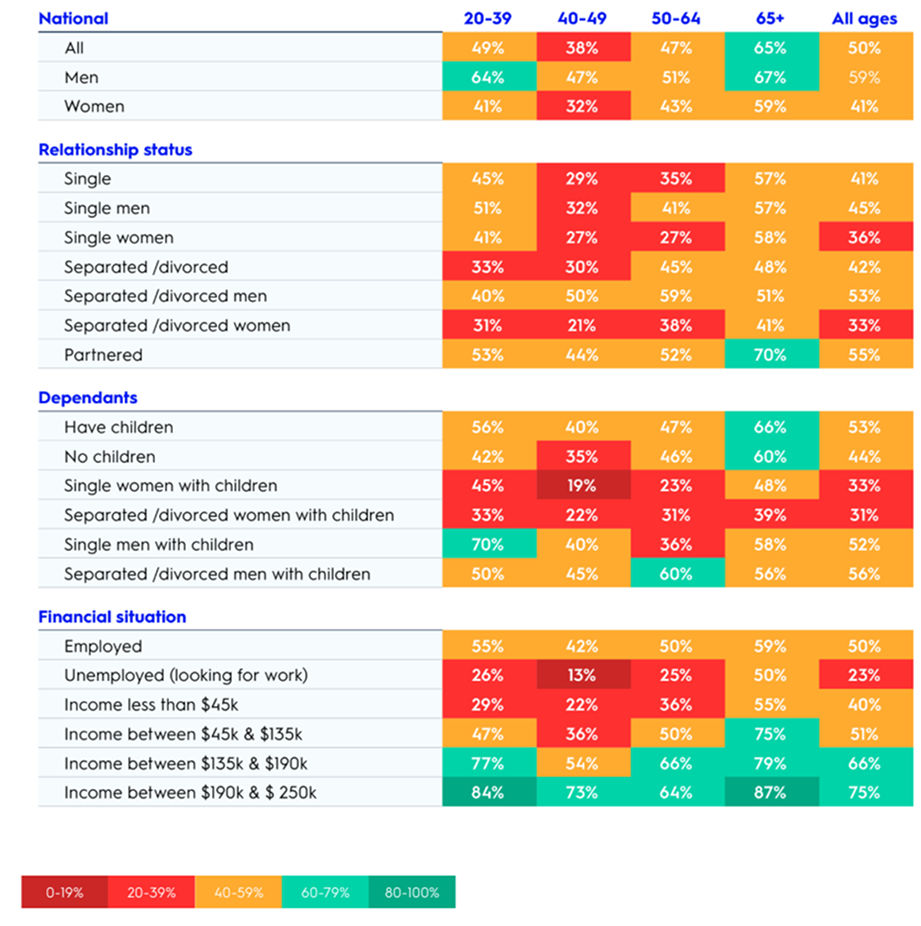

AMP Bank GO says the upside of getting money conversations right is long term financial confidence – not just fewer arguments. AMP’s Retirement Confidence Pulse shows that partnered Australians are significantly more likely to feel confident about their financial circumstances in retirement (55%, compared with 41% of singles). That gap widens later in life, with 70% of partnered Australians aged 65+ feeling confident, compared with 57% of singles.

John Arnott, Director, AMP Bank GO, said money remains one of the most sensitive – and consequential – topics in relationships.

“We know money is one of the most sensitive topics in any relationship, and our customers have always told us they value joint accounts to help manage money more easily together.

“Couple therapists will say that moments of financial uncertainty can quickly escalate if those in a relationship aren’t aligned.

“When partners set shared goals and combine parts of their finances, it can help build trust, reduces surprises, and can allow them to feel more in control together.”

Rebecca Pike, money expert at Finder, said financial chemistry is becoming as important as physical attraction

“Financial stability is no longer just a bonus in a partner, it’s a requirement. “With housing costs and inflation at the forefront of people’s minds, many are realising they simply can’t afford to be with someone whose money habits don’t align with their own.

Start talking early – and keep talking

Finder’s research shows younger Australians are much more likely to have been affected, with 24% of gen Z and 21% of millennials admitting they’ve experienced a breakup triggered by financial reasons, compared to 10% of gen X and just 3% of baby boomers.

Men (15%) were twice as likely as women (7%) to have been broken up with for financial reasons. Women (4%) were slightly more likely than men (3%) to say they’d dumped someone else for this reason.

Rebecca Pike said younger generations are entering a tougher economic landscape than their parents and urged couples to talk about money early on.

“When you’re struggling to pay for groceries and rent, a partner with significant debt or ‘head in the sand’ money habits can especially feel like a liability rather than a partner.

“You don’t need to share bank statements on a first date, but you do need to know you’re on the same page before moving forward.

“Transparency is so important - be honest about where you are today so you can build a stable future together.”

Sharing financial tools

As younger Australians face rising rent, bigger debts, and tougher economic conditions than previous generations, tools that facilitate honest, ongoing communication are more important than ever.

John Arnott added: “Having tools that encourage open conversations helps couples stay aligned, work as a team and avoid the stress that can come from hidden costs or unequal expectations.

“It’s not about combining all your money and losing independence – it’s about having shared visibility and conversations about where your money is going, and your financial goals.”

Tips for approaching finances in a relationship:

1. Start small, but start early.

Before combining finances, have simple conversations about spending habits, savings goals and financial responsibilities. Establishing honesty early helps avoid misunderstandings later.

2. Agree on what’s shared – and what’s not.

Not every couple wants to merge everything. Decide together what expenses will be joint, what will remain separate, and how each partner will contribute. The clarity itself builds trust.

3. Take advantage of shared banking tools to stay accountable and aligned.

Features like joint accounts – including realtime notifications, shared budgeting tools and insights – help couples stay on the same page, reduce friction, and make financial decisions together with confidence.

About AMP Bank GO

AMP Bank GO is a mobile-first banking app with real-time insights, smart alerts, goal tracking through Spaces and round-ups to help people manage their finances on the go and stay on budget. It includes numberless debit cards and selfie-video ID checks for enhanced security.

Uniquely, AMP Bank GO offers the only joint account in Australia that lets couples earn Qantas Points together on their shared average monthly account balance – giving them another meaningful way to work towards shared goals.

To learn more about AMP Bank GO and its joint Everyday Account feature, visit our website.

The product issuer is AMP Bank Limited ABN 15 081 596 009, AFSL 234517.

About the research:

AMP’s Retirement Confidence Pulse is based on a survey of 2,000 respondents conducted in July 2025, and AMP Bank GO’s research surveyed 1,003 people across Australia in October 2025. Both were conducted by independent research company, Dynata.

Finder surveyed 1,003 respondents across Australia in January 2026.