Super and retirement faqs

Changing jobs or just joined us?

It’s easy to make sure your super is paid to your AMP Super account. Just download a Choice of Fund form and send it to your employer.

When you start a new job, you don’t have to choose a new super fund. It’s easy to give your employer your AMP Super details. Otherwise, you may end up having a new super account opened for you, which can mean multiple sets of fees, and more paperwork.

It’s important to make sure your super account is right for your needs, whether you stay with AMP or choose another provider. If you’ve compared funds and decided you’d like to stay with AMP Super – great! The next steps are easy.

Filling out a form and need details? You can find our ABN, and USI/SPIN numbers to help you complete a Choice of Fund form. You can also find our SPNs and SFNs.

Started a new job, or just joined us? Enter your name and account number and you can generate a completed Choice of Fund form to give to your employer.

It’s easy to send a form directly to your employer or HR representative once you’ve logged in. Simply select your superannuation account, and click ‘Tell your employer’ (you may have to click ‘See more’ to see all the menu options).

The average fees and costs across AMP’s MySuper option are lower than the average super fund, including the average industry fund1.

AMP MySuper 1970s option returned 15% for year ending 31 December 2024. The '70s option has outperformed industry median across long, medium and short term2.

In partnership with TAL, AMP Super offers flexible Lifestages insurance, so you only pay for the cover you need based on your stage of life.

Past performance is not a reliable indicator of future performance.

When you start a new job, you should tell your employer the details of the super fund you’d like your contributions to be paid into. Otherwise, they may end up being paid into the super fund nominated by the ATO.

It’s important to make sure your super account is right for your needs, whether you stay with AMP or choose another provider.

If you’ve compared funds and decided you’d like to stay with AMP super – great! The next steps are easy, just follow the instructions below.

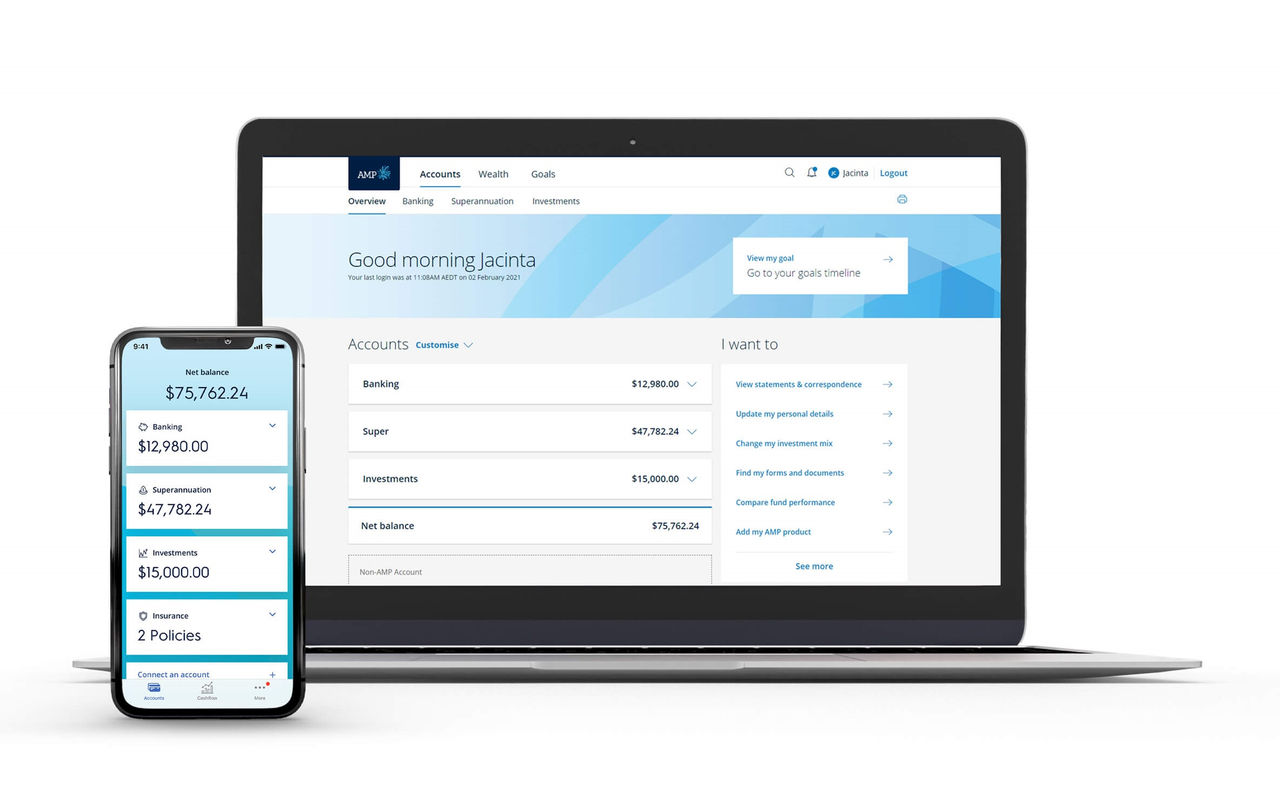

You will need to complete the Choice of Fund form and provide it to your new employer. You can access this form via the AMP website, My AMP or the My AMP app.

Understanding the basics of super and how it works, can help you make better choices now which could make a big difference to your retirement.

Discover a range of free educational webinars, to help you make the most of your super. You’ll get information, tips and tools across a range of topics. Find one suited to your needs.

If you want to find out more, our team is here to help.

Standard Hours

Monday to Friday

8.30am to 7pm (Sydney time)

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Pty Ltd (NM Super), ABN 31 008 428 322.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product disclosure statement, Target market determination or Terms and conditions, available on this website or by calling 13 12 67.

Read AMP’s Financial services guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice provided is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It is provided by AWM Services Pty Ltd (AWM Services), ABN 15 139 353 496.

All information on this website is subject to change without notice.

1Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2025 at balances of $50,000 to $750,000.

2 Investment performance is as at 31 December 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). Industry median refers to the “MySuper – Growth Median” and is taken from the Chant West Super Fund Performance Survey December 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.