Global shares fell again over the last week after the huge rebound since the April lows left them overbought, worries about US public debt sustainability increased and as Trump threatened on Friday a 50% tariff on Europe from 1 June and a 25% tariff in imported smart phones by the end of June. For the week US shares fell 2.6%, Eurozone shares fell 1.3%, Japanese shares lost 1.6% and Chinese shares fell 0.2%. Australian shares were closed by the time of Trump’s latest tariff tantrum and so managed a 0.2% gain for the week helped by a dovish rate cut from the RBA with gains in telco, IT and financial shares more than offsetting falls in resources and retail stocks. Bond yields rose in the US, UK and Japan as investors refocussed on worries about public debt but were flat in Germany and fell in Australia helped by the RBA’s dovish guidance. Oil and iron ore prices fell but with oil bouncing around $US60/barrel and iron ore bouncing around $US100/tonne. Copper prices rose though, and gold and Bitcoin also rose with the latter hitting a record high helped by safe haven demand in the face of worries about US debt. Bitcoin came under pressure on Friday though as worries switched back to tariffs. The Australian dollar rose as the US dollar fell further, particularly after Trump’s latest tariff announcements highlighting that global investor confidence in the US is continuing to decline.

Shares have had an impressive rally from their April lows on the back of Trump’s partial tariff pause. US, global and Australian shares recovered more than 80% of their fall into April to be within 2 or 3% of their record high, pushed easily through technical resistance at their 50day and 200 day moving averages and the rally has come with good momentum from cyclical sectors. All of which normally augurs well for more gains.

But the fly in the ointment is that macroeconomic risk for shares remains high. US tariffs may be down from their highs but are still five times last year’s levels, they are still likely to go higher for some countries and sectors as Trump reminded on Friday with his threat of a 50% tariff on Europe and 25% on smart phones, hard economic data is still likely to weaken and profit expectations are softening, US policy uncertainty is very high, geopolitical risk is very high particularly with a possible strike on Iran’s nuclear facilities and debate in the US Congress about Trump’s tax cut bill (called the One, Big, Beautiful Bill Act or OBBBA – which has passed the House and going back to the Senate) has renewed concern about US debt.

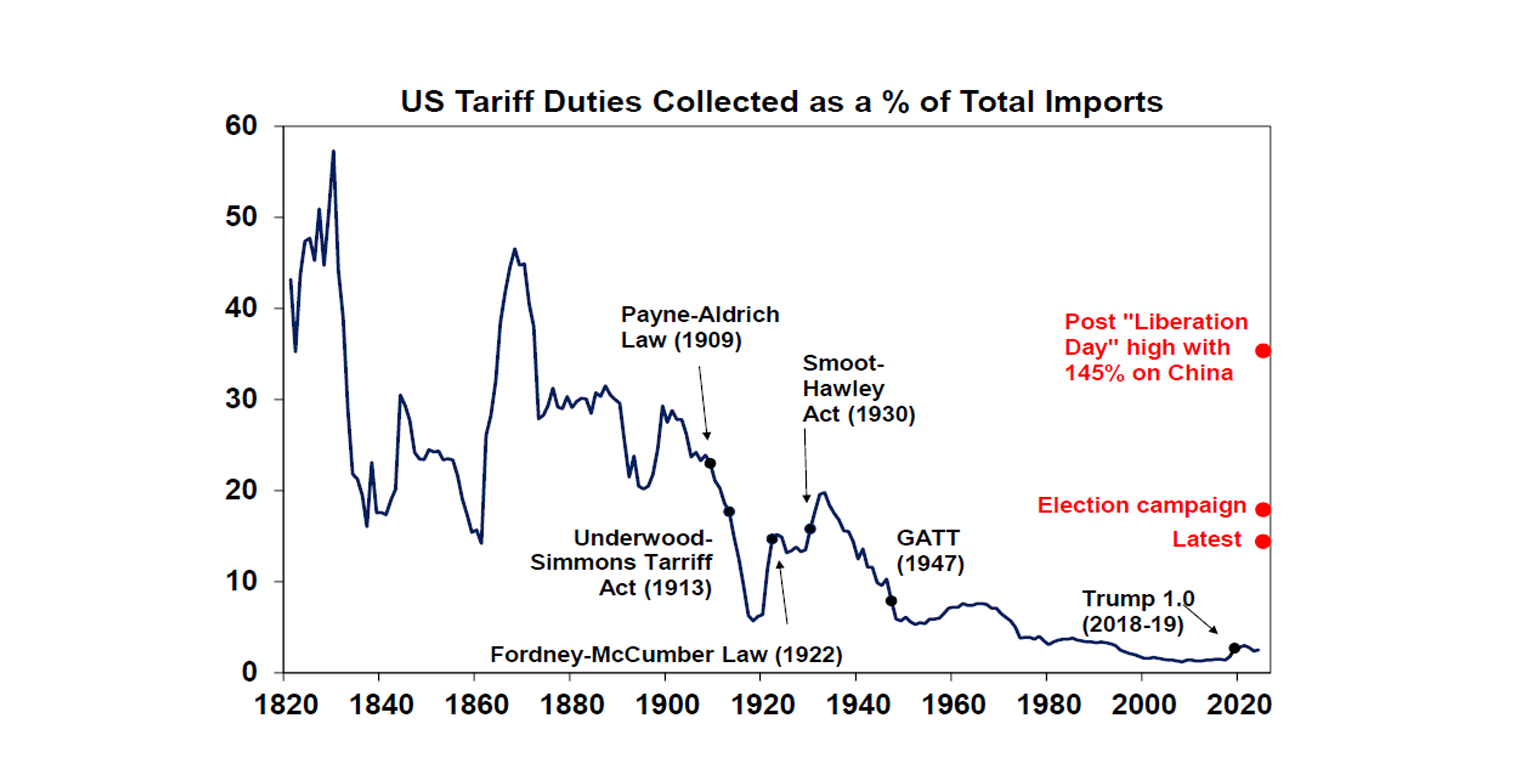

Trump’s latest tariff tantrum is not surprising – he threatened “take it leave it tariffs” of 25%, 30% of 50% on some surplus countries a week or so ago and the 25% on iPhones are likely just part of the sectoral tariffs still on the way. But if implemented they will push the average US tariff up from around 14% currently to around 18.5%. And they provide a reminder that the tariff war is far from over.

While Trump clearly wants companies to bring production back to the US. the case of Apple and smart phones highlights the difficulty in doing this without huge problems for US consumers and companies. If Apple were to shift all of the production for its US destined iPhones back to the US from China or India, it would push the price of an iPhone 16 prop from around $US1000 to around $US2500. Even if Apple were to wipe out all its US retail margin it would still rise above $US2000. This simply reflects the reality of US wages being five times or more above those in China and India. In any case it would take years to make the move, and it would be doubtful that Apple and all other manufacturers would find the workers needed. So, it would mean a huge hit to Apple and US consumers.

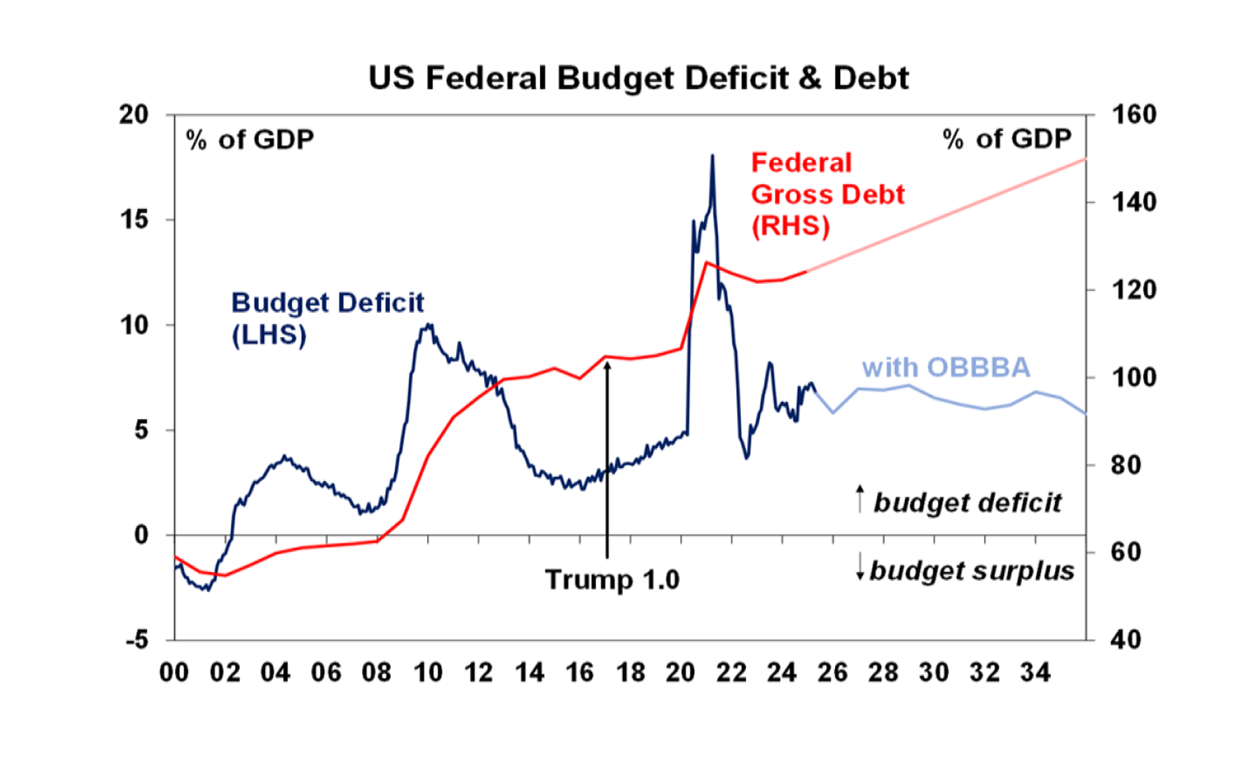

Trump’s policies are increasing the risk of a US debt crisis. Worries about the size of the US budget deficit and public debt have been around for decades with periodic flareups. In fact, the debt clock near Times Square first appeared in 1989. But because bond yields have been mostly low despite ever rising debt it hasn’t really been a problem. However, this has changed with: higher bond yields pushing Federal interest payments to a record 18% of tax revenue; debate in Congress about the OBBBA tax cut bill and its impact on debt; Moody’s downgrade of the US credit rating from AAA to Aa1; and concerns about US Treasuries’ safe haven status and US exceptionalism flowing from Trump’s chaos around tariffs, Fed independence, the rule of law, universities, etc. All of which is refocussing concern on ever rising US public debt. While Moody’s was just catching up to earlier downgrades by S&P and Fitch, US Federal debt is now much higher than it was when S&P downgraded the US credit rating in 2011 and projections by the US Congressional Budget Office indicate that the tax cut bill will keep the budget deficit around 7% of GDP which is well above the 3% or so of GDP necessary to stabilise the debt to GDP ratio. Which means that the debt to GDP ratio will keep rising indefinitely. This in turn will mean that net interest costs will rise further into record territory. And the falling US dollar suggests foreign investors may be becoming less keen on buying US Treasuries and hence financing ever rising US public debt. Which in turn runs the risk of even higher US bond yields putting pressure on Trump and Congress to put the deficit and debt on a more sustainable path. This would require Congress to agree on some sort of fiscal austerity but the process to get to this could be quite volatile. Out of interest, US gross public debt at around 125% of GDP is below that in Japan but above the average of advanced countries at 110% and well above that in Australia at 50% of GDP. (At least the Supreme Court appears to have protected the Fed Chair and Governors from removal by the President – which is a good sign for continued Fed independence, at least for now as the issue could still come back again particularly once Jerome Powell’s term ends.)

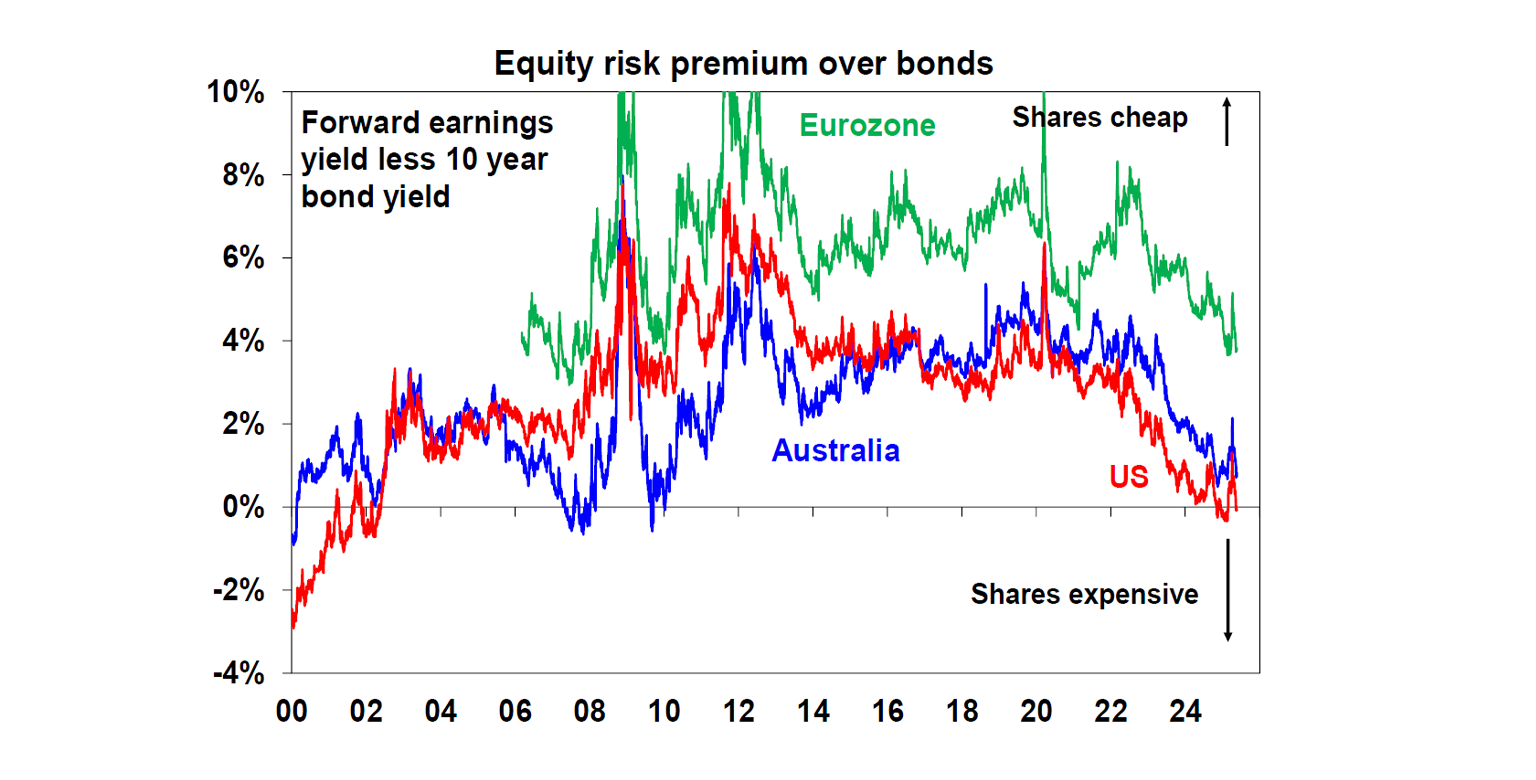

The return of the “bond vigilantes” resulting in even higher US bond yields could in turn put pressure on shares by further reducing the already low risk premium they offer over bonds.

The bottom line is that while technical indicators are positive for shares, high macroeconomic risk around tariffs, the growth outlook and US debt sustainability mean that the ride is likely to remain volatile in the months ahead and another leg down remains a high risk. Ultimately though we continue to see Trump pivoting from the focus on tariffs to tax cuts and deregulation which along with rate cuts from the Fed in the third quarter and other central banks should help shares stage a more sustainable recovery.

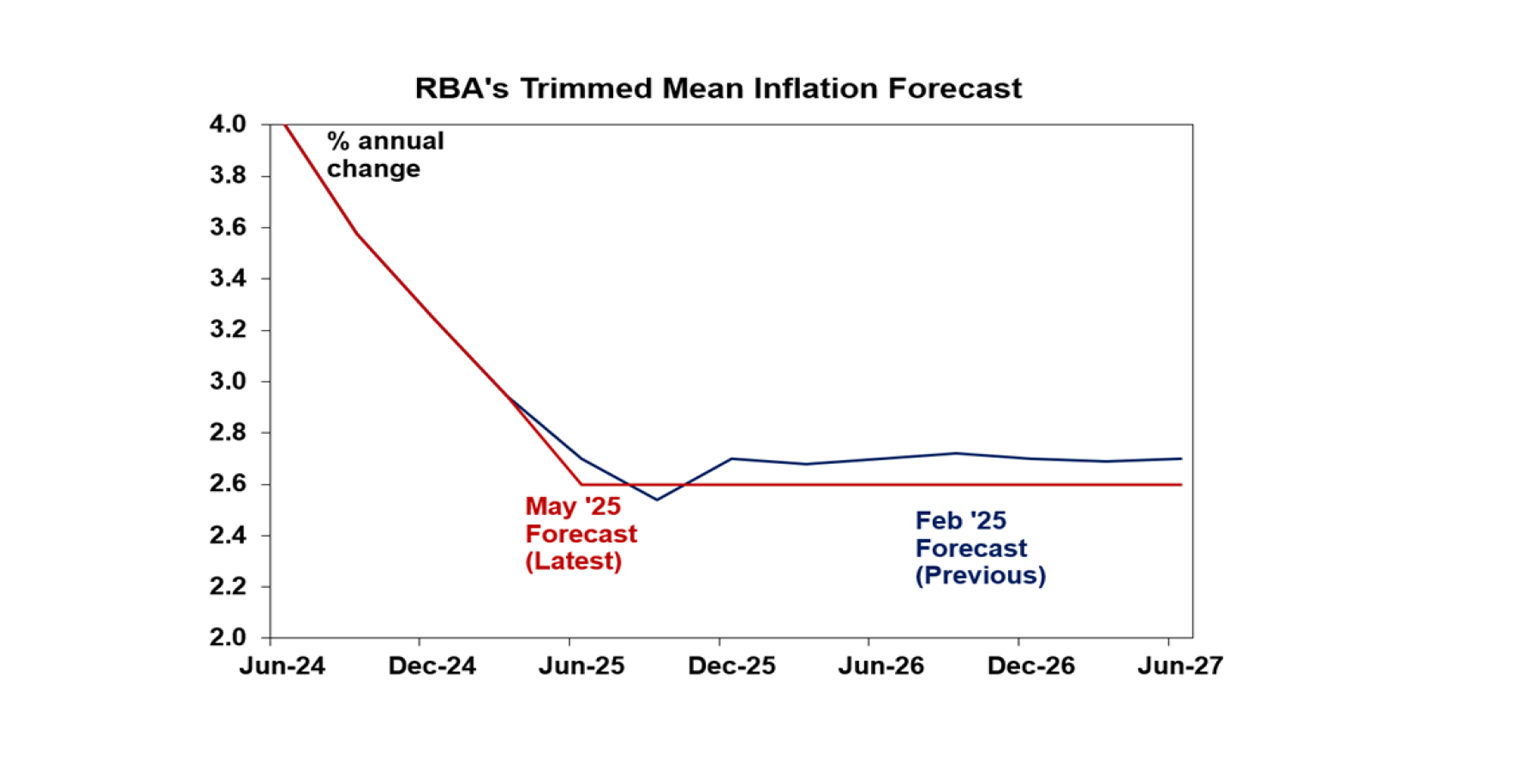

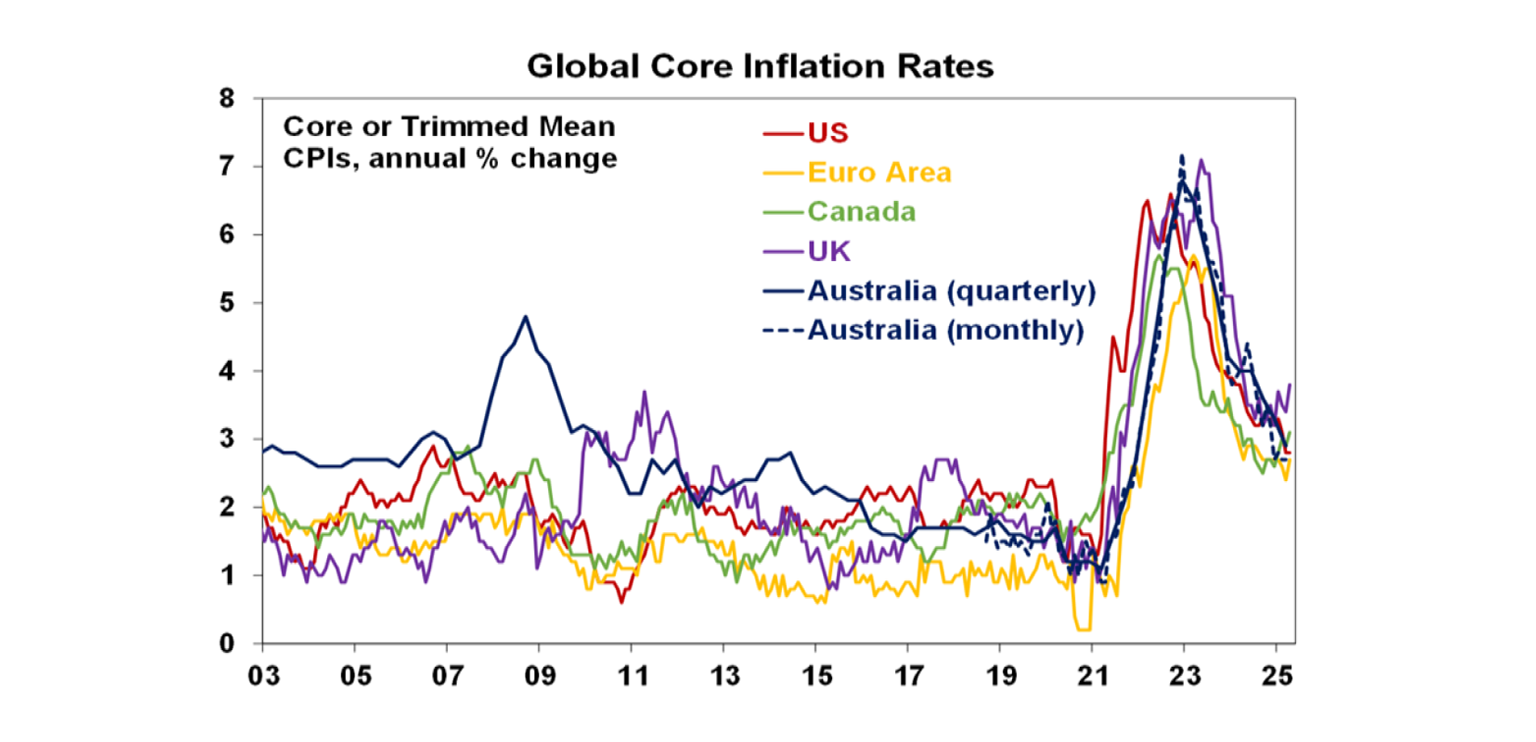

Meanwhile there was good news in Australia with the RBA cutting rates again, from 4.1% to 3.85%, with more cuts ahead. The really good news is that it’s now less worried about inflation but the bad news is that it’s getting more worried about the growth outlook. The key messages from the May RBA meeting were that the risks to growth coming from Trump’s trade war are rising threatening higher unemployment, but with inflation back to target and forecast to remain there and monetary policy still being restrictive - with a cash rate of 3.85% against an average of neutral estimates around 2.8% - the RBA is able to cut interest rates and is likely to cut further.

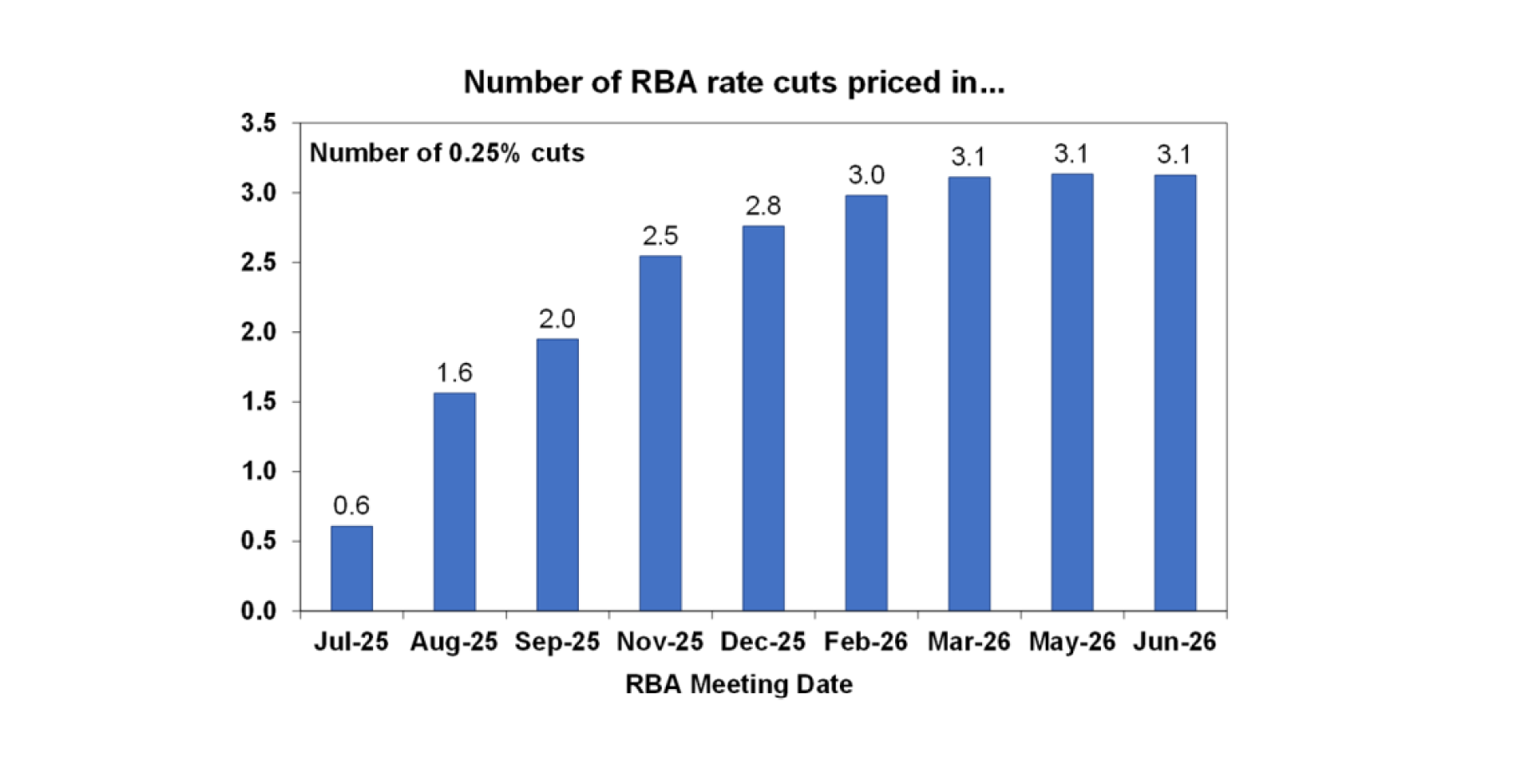

Our base case is for the RBA to cut three more times to 3.1% by early next year with cuts in August, November and February, but given the threat to growth and allowing for the RBA’s newfound dovishness, there is a high risk that the cuts come faster and we reach 2.85% by early next year. In particular, there is now a good chance that the next cut will come at the July meeting if monthly inflation data for April and May remain benign and the risks out of the US around trade and other things remain high or get worse. In fact, the money market now sees about a 65% chance of a 0.25% cut in July and 2.8 cuts by year end.

Victoria’s budget disappoints with more deficits and debt. Its nowhere near as bad as the US public debt situation, but Victoria’s 2025-26 Budget lacked the fiscal restraint necessary to provide confidence that its already high level of debt will come under control. While the Government projects a small operating surplus this was only because of a windfall $3.7bn in extra revenue from the GST carve up which then allowed a new spending spree leaving the total budget in deficit through the forward estimates, net public debt still on the rise at a level of GDP well in excess of other states and an ongoing rise in total public sector debt interest payments which are projected to take up around 9.5% of revenue by 2028-29. Prioritising spending on families is admirable but will cost future taxpayers and runs the very high risk of yet another credit rating downgrade which will mean that more and more tax revenue will have to be devoted to paying interest on past debt. Ideally, spending should have been cut, and the GST windfall should have been used to pay down debt. In the absence of a crisis or a change of government it’s hard to see what will put Victoria on to a more sustainable path. In the meantime, other more fiscally responsible states which lost GST revenue to Victoria are naturally starting to protest why they should have to run tougher budgets while Victoria continues to ramp up spending at their expense. Victoria already faces borrowing costs around 0.35% to 0.5% pa higher than NSW reflecting its lower AA credit rating compared to NSW’s AAA rating. Another rating downgrade to say AA- could add around 0.1% to 0.2% or so to its borrowing rates and add another $150m to $300m to its net annual interest bill.

With lots of noise I need a good song. Here’s a classic extended remix of a-ha’s Take On Me. Do yourself a favour and check out 12-inch remixes of 1980’s classics. Back then I didn’t realise they were quite so good! (Well apart from The Pet Shop Boys, Kylie and Bananarama that is.)

Major global economic events and implications

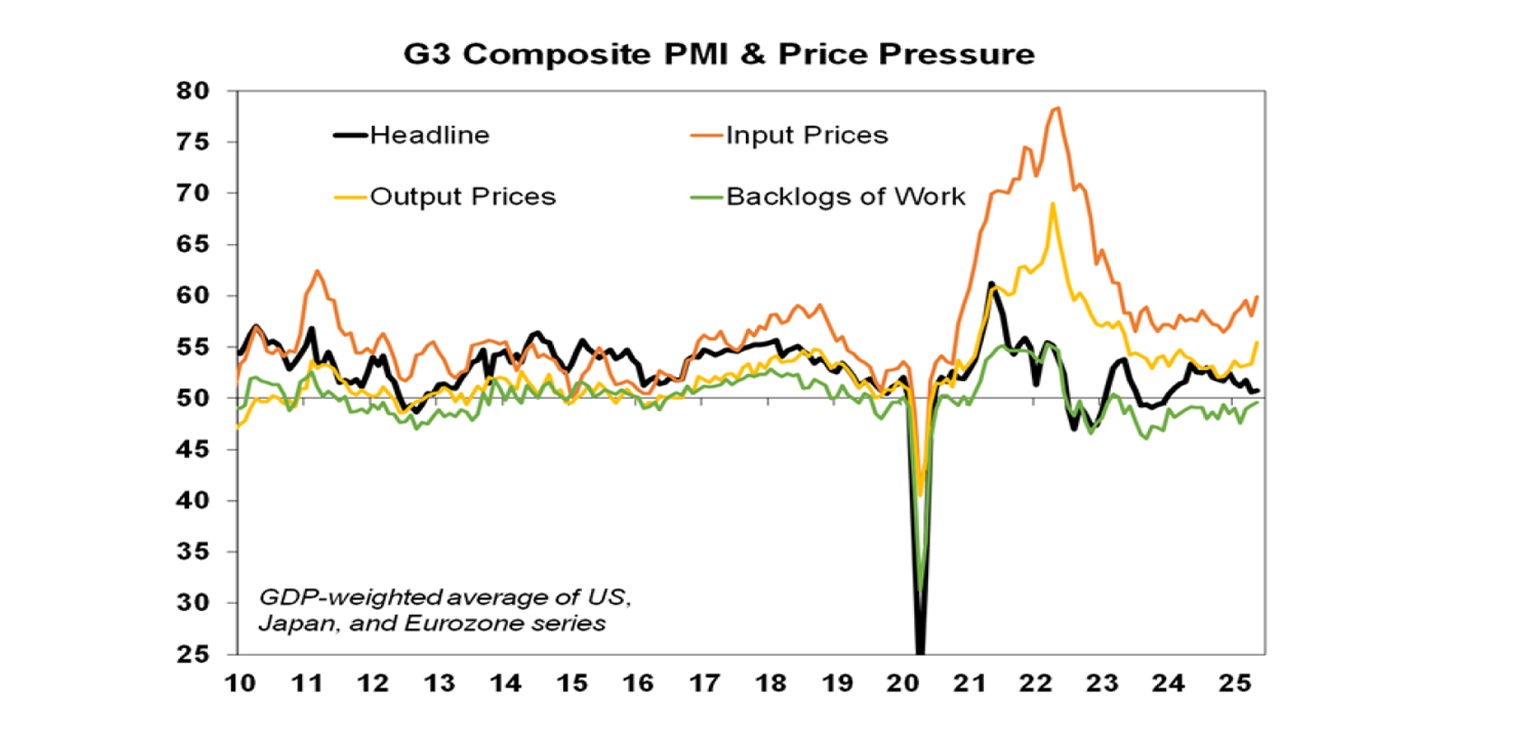

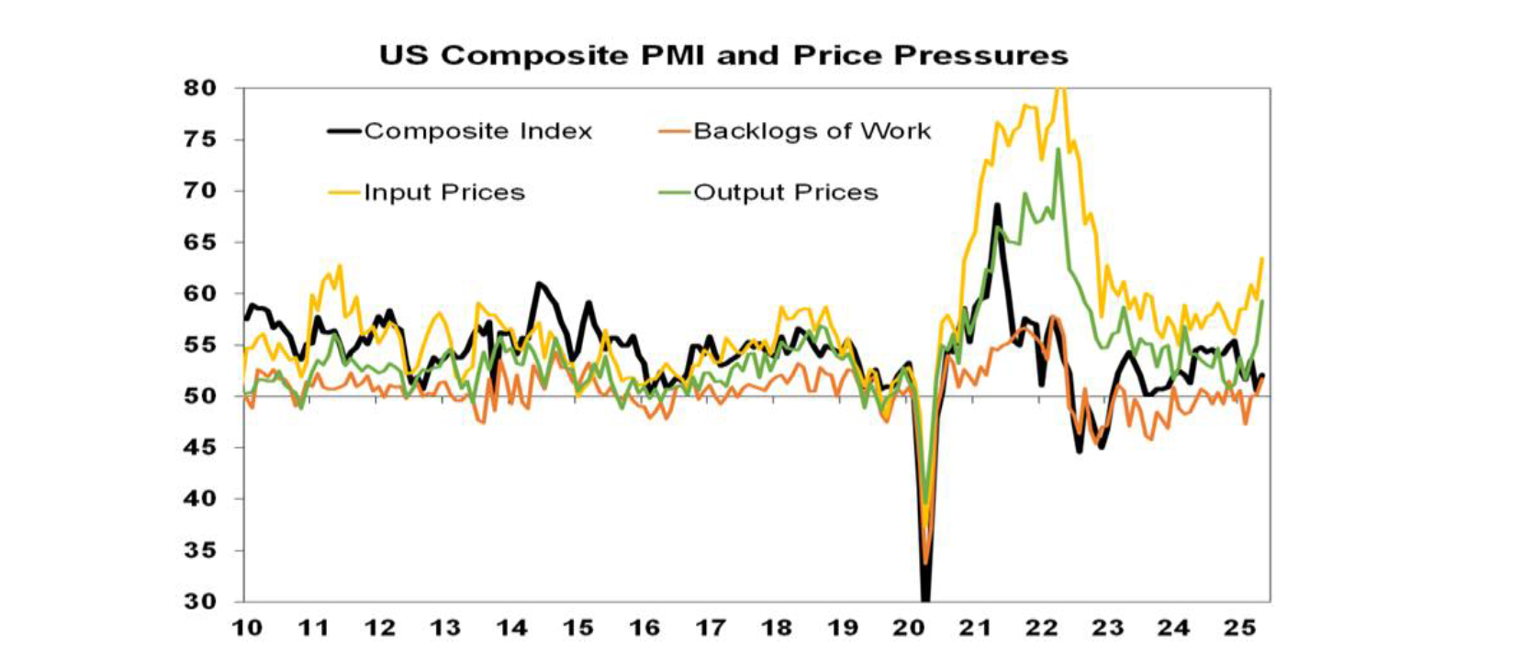

Aggregate business conditions PMIs in developed countries improved very slightly in May with Japan and Europe down but the US back up helped by Trump’s partial tariff pauses. The bad news though was that there was a further rise in input and output price pressures due to increases in the US.

While the partial tariff pause saw the US composite PMI rise to an okay reading of 52.1 in May, the tariffs are still leading to a sharp rise in US input and output price pressures. This in turn will contribute to the Fed remaining in wait and see mode for now.

Other US data was mixed. Jobless claims remained low suggesting the labour market is still okay. But the leading indicators index for April fell more than expected with annual growth becoming more negative again warning that recession risk is intensifying again. And while existing home sales rose, they are just bouncing around low levels.

UK inflation in April rose more than expected to 3.5%yoy from 2.6%yoy mainly due to higher administered utility prices which also pushed up core inflation to 3.8%yoy from 3.4%yoy. Underlying inflationary pressures still appear to be trending down but this will keep the Bank of England to a quarterly pace of rate cuts with the next cut looking like it won’t come till September.

Canadian inflation for April also fell less than expected to 1.7%yoy with core trimmed mean inflation rising 3.1%yoy. This will keep the Bank of Canada cautious and on hold at 2.75% for now with the next cut likely around September.

Japanese inflation remained at 3.6%yoy in April reflecting sharp rises in energy and food prices with core (ex-energy and food) inflation stable at 1.6%yoy. The BoJ is likely to remain on hold.

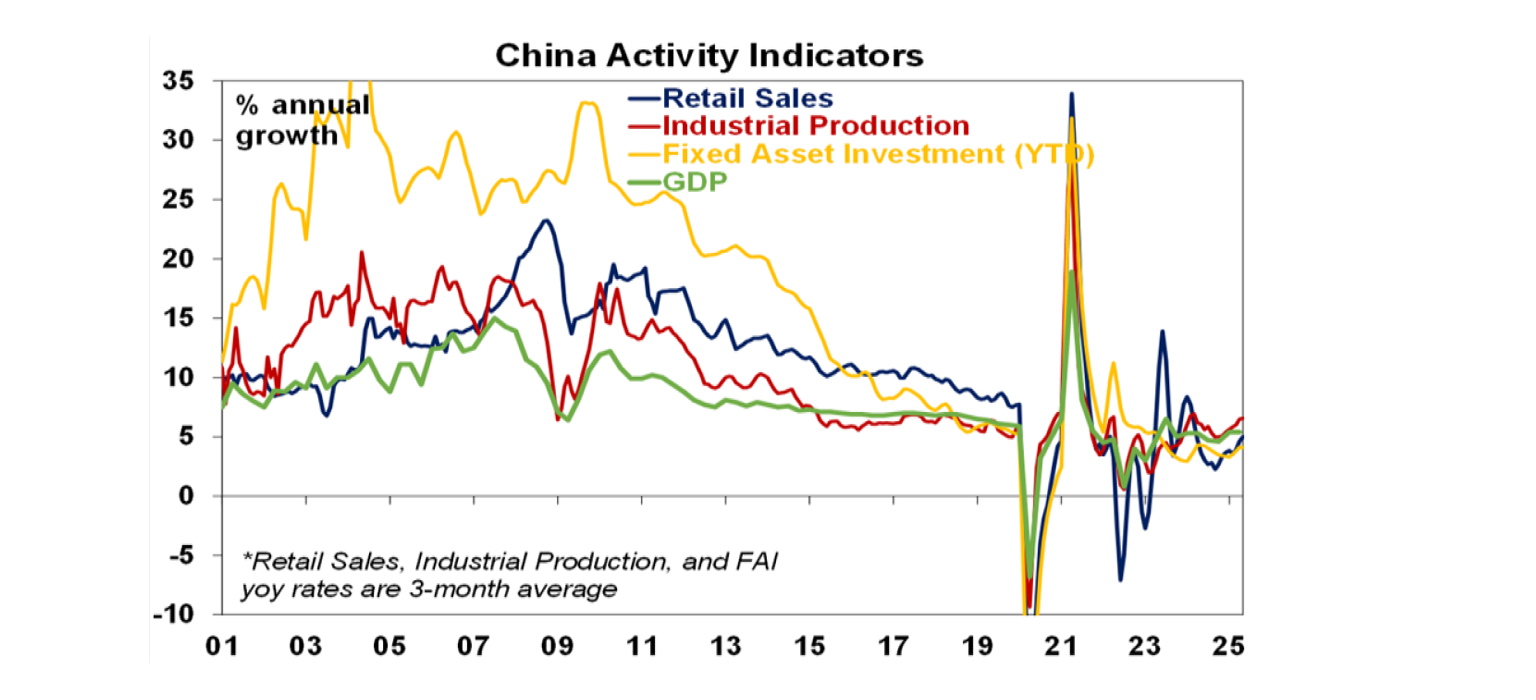

Chinese retail sales, industrial production and investment were a bit softer than expected in April but the trend in growth remains slightly up. Property investment continues to fall at a 10%yoy pace, but the pace of decline in property sales and home prices have slowed. This along with Trump’s tariff backdown has seen some economists revise up their growth forecasts for this year. More policy Chinese stimulus is still likely to be needed though to keep growth “around 5%” as the Trump trade threat remains.

Australian economic events and implications

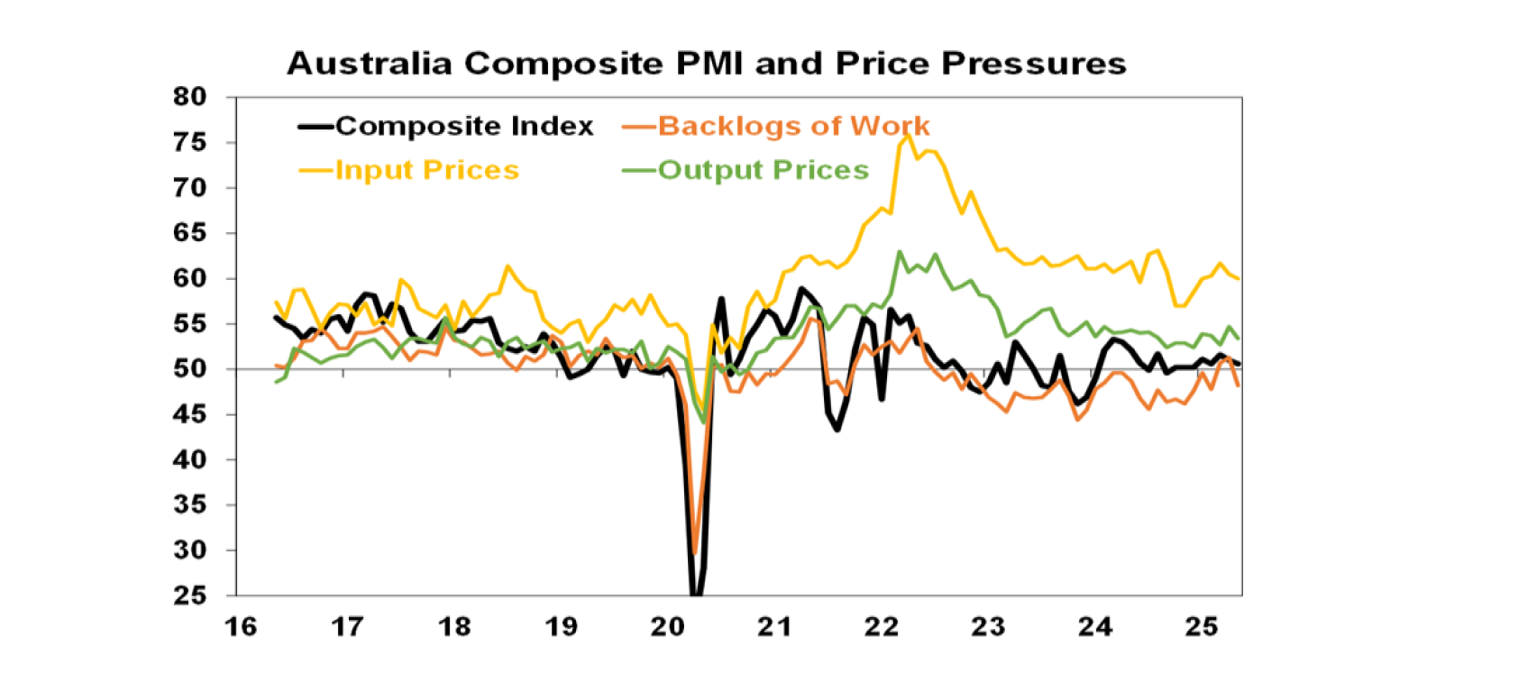

Australian business conditions PMIs for May fell slightly to a soft reading of 50.6 for the composite index with weaker services, new orders and jobs. Input and output price pressures fell, and backlogs remain negative with the output price index around levels consistent with the inflation target.

What to watch over the week ahead?

US data due Tuesday is expected to see flattish underlying capital goods orders, a further slowing in home price growth and a slight improvement in consumer confidence for May (all due Tuesday). April data for core private final consumption inflation (Friday) is expected to show a rise of just 0.1%mom taking the annual rate down to 2.5%yoy.

Japanese data for jobs, retail sales and industrial production will be released Friday.

The Reserve Bank of New Zealand (Wednesday) is expected to cut its cash rate again by another 0.25% taking it to 3.25%.

In Australia, the focus will be back on inflation with the April CPI indicator (Wednesday) likely to show a 0.7%mom rise on the back of higher prices for health insurance, food, household goods and travel but with the annual rate falling to 2.3%yoy from 2.4%yoy. Monthly trimmed mean inflation is expected to stay at 2.7%yoy. September quarter construction (Wednesday) is expected to rise 0.6%qoq with business investment (Thursday) up 0.8%qoq and investment plans likely to point to modest growth. April retail sales are likely to show a 0.3%mom gain with building approvals up 8%mom (after a sharp fall in March) and credit growth is likely to have remained modest (all due Friday).

Outlook for investment markets

Shares are at high risk of renewed falls given the ongoing tariff uncertainties, concerns about US debt, likely weaker growth and profits and the risk of a US/Israeli strike on Iran’s nuclear capability if diplomacy doesn’t work. Even if the low has been seen volatility is likely to remain high. But with Trump likely to pivot towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further shares are likely to recover on a more sustained basis into year end. But it’s likely to be a rough ride.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest with US tariff worries constraining buyers and posing a near term threat of a reversal in prices and affordability remaining poor. We see home prices rising around 3% this year but the risk is now on the upside given more the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar. This could leave it weak around $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.