Another week of record highs in shares, but the looming tariff deadline weighed on Eurozone shares on Friday. Share markets mostly pushed higher over the last week, with US shares in a holiday shortened week rising 1.7% to a record high helped by hopes for trade deals, solid US jobs data and as Congress passed Trump’s tax cut bill. The surge in US shares also pushed the MSCI global share index to a record high with Eurozone shares up 0.6% and Chinese shares up 1.5% for the week but Japanese shares down 0.9%. The strong US lead along with expectations for another RBA rate cut in the week ahead also pushed the Australian share market to a new record high with a 1% gain for the week. However, tariff uncertainty did start to weigh again late in the week with Friday seeing Eurozone shares falling 0.8% and US futures falling 0.6%. Bond yields mostly rose on the back of okay economic data. Metal prices fell but iron ore, oil and gold prices rose. Bitcoin saw a further boost with “risk on” sentiment as did the $A, but the $US continued to fall.

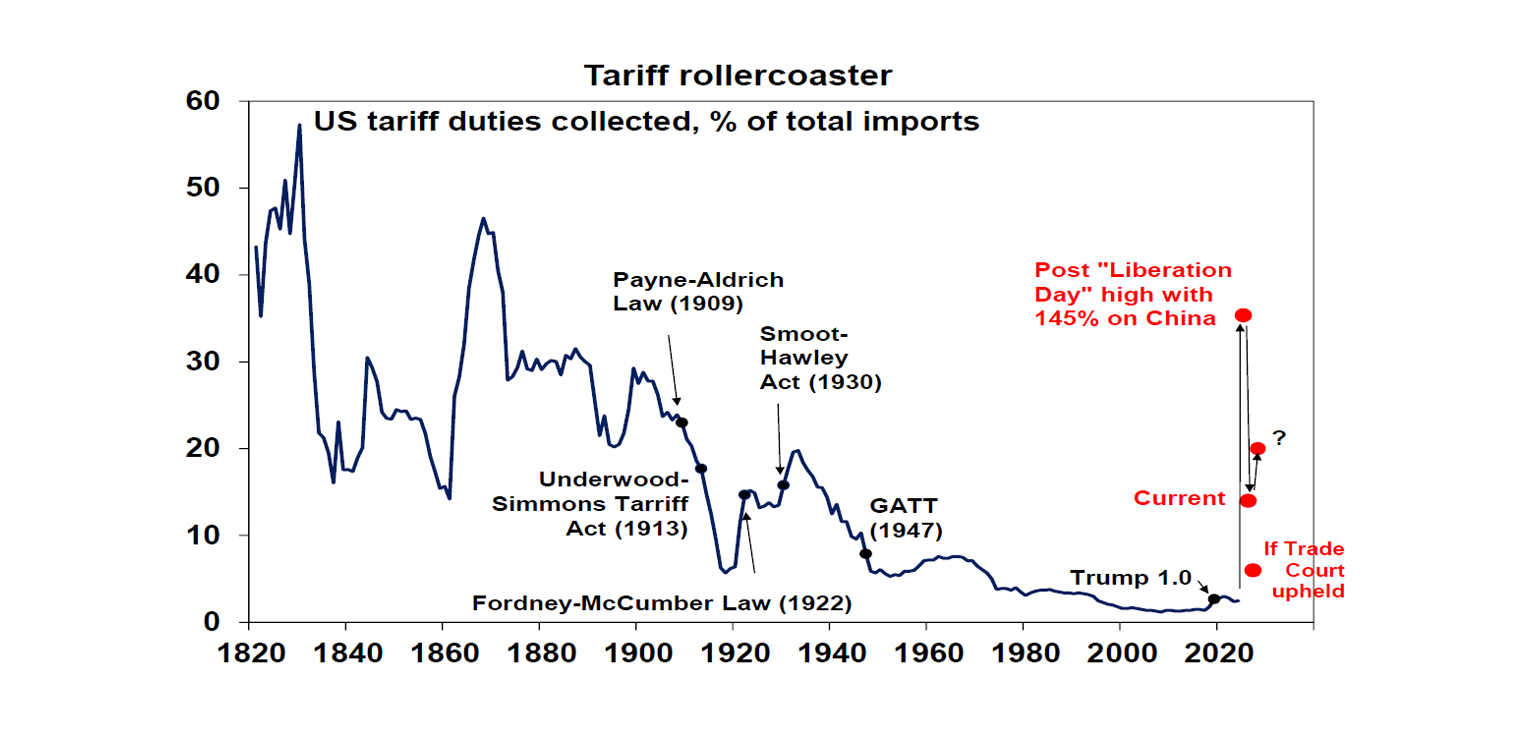

US tariffs – here we go again? With the 9th July tariff deadline just a few days away the US is likely to announce more trade deals and Trump has indicated he will start sending letters to countries without deals notifying what their tariff rate will be, with a range of “maybe 60 or 70%...to 10 and 20%” commencing from 1 August! So, after a few months of relative calm, it could all be back on again!

So far the trade deals that have been announced don’t augur that well. The UK deal a month ago just locked in the 10% rate that had been announced for it on “Liberation Day”. The deal with Vietnam (which is the US’s 6th largest source of imports) saw a 20% tariff imposed on Vietnamese goods going to the US. This is well below the 46% rate threatened on “Liberation Day” but way up on the 3.3% rate before that. A 40% tariff will apply to goods that are transhipped from China and US goods will face no tariff going into Vietnam which seems unfair to Vietnam. Its actually good news for Vietnamese consumers though as they will get cheaper US goods, but bad news for US consumers and businesses who face higher costs – but with the 20% tax not enough to remove Vietnam’s cost advantage over the US as average wages are around one twelve of US levels. So, it won’t bring much production back to the US.

If the 20% tariff on Vietnam is any guide it suggests other countries with deals could see their tariff rate move up from the 10% baseline to maybe around 15% or more. But some without deals – with Japan and Europe at most risk here – could see a rate well above 20% (Trump threatened Europe with a 50% tariff and is now talking about a range up to 70%). This in turn would push the average US tariff rate back to 20% or more, from around 14% at present.

The threat to global growth remains high. A 20% plus average US tariff rate is well down on the 30% that would have applied post “Liberation Day” but it’s well up on the 10% that we and many were assuming would ultimately apply and the 3% average US tariff rate at the start of the year. So, while share markets have not been too fussed lately about tariffs, they still pose a significant threat to global growth and US inflation. The latter will keep the Fed cautious for now and the threat to growth means a near term threat to share markets. Of course, any “60 or 70%” tariffs will likely just be another negotiating ploy, but they may be taken badly by share markets initially.

For Australia, it’s likely that our goods will continue to face the 10% baseline that was announced on “Liberation Day”. However, without a deal with the US this is not assured given Trump Administration annoyance at things like the media bargaining code and the Pharmaceutical Benefits Scheme. Either way Australian exports to the US are less than 5% of our goods exports and the main threat to Australian will come via the hit to global growth from the tariffs and impacts on local confidence.

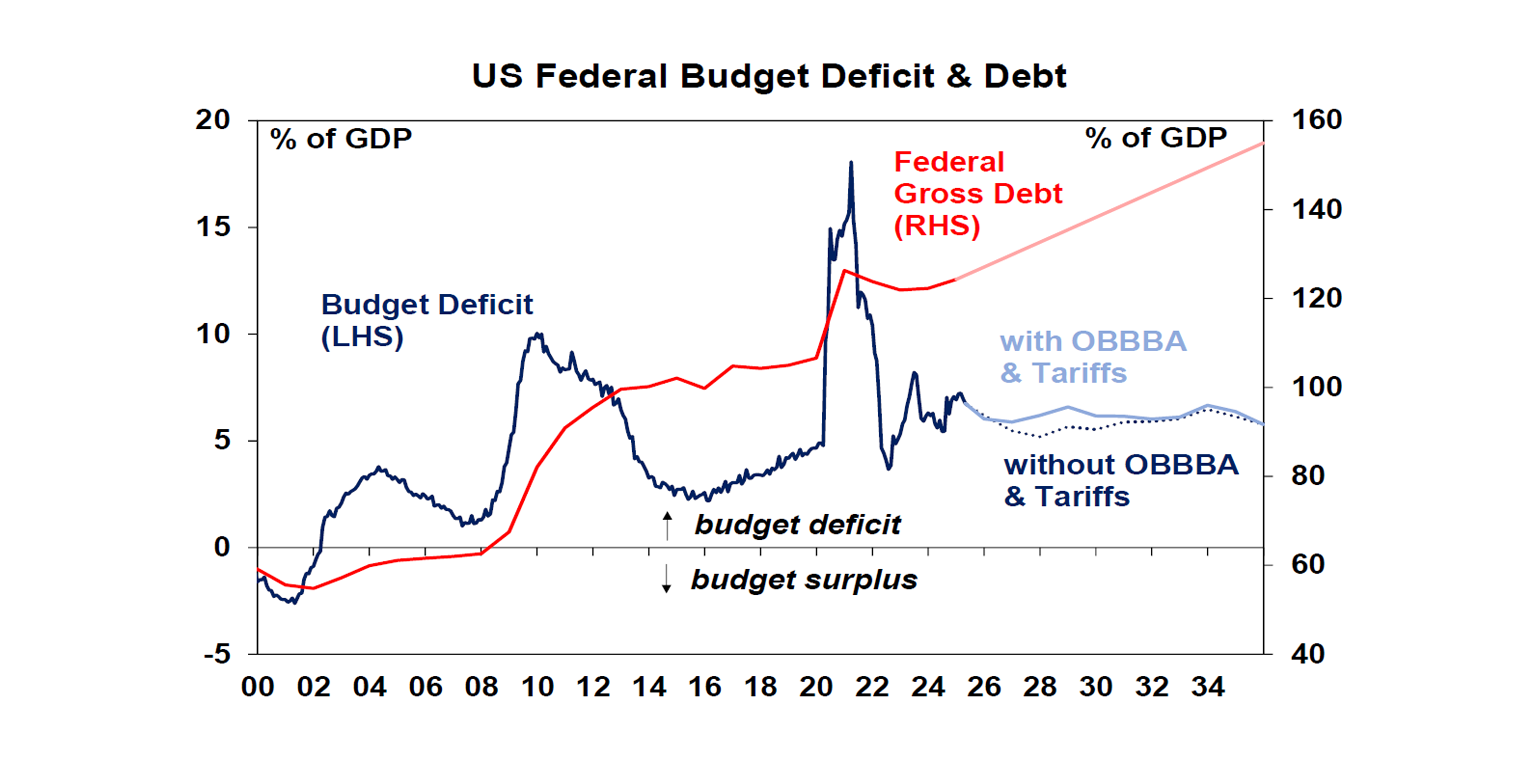

Given the unreasonable and tedious nature of Trump’s bullying and erratic approach on tariffs perhaps the best response is for other countries to collectively do nothing and wait for Trump and co to get “a little bit yippy - afraid” [Trump’s words] again in response to any renewed panic in US share and bond markets as a result of any new tariff tantrum as occurred in April, at which point he will back down again! The pressure this time could prove to be even more intense because of the need by the US for foreign capital to help finance its budget deficit now that the US Treasury will start to issue debt again after the debt ceiling has been raised by the One Big Beautiful Bill (tax cut) Act (OBBBA).

Speaking of which OBBBA has now been passed by Congress and signed into law by Trump. Its economic impact is ambiguous. On the one hand the tax cuts likely provide a supply side boost to the economy, partly offsetting the negative supply side impact of the tariffs. It may provide some near-term stimulus via the front loading of tax cuts but again this is at least partly offset by the tariffs. And with the income tax cuts being skewed to the rich (who don’t change their spending much) and the spending cuts skewed to low-income earners it may mean that it could act as a drag on growth. The big, longer-term concern is that its likely to keep the US budget deficit running around 6-7% of GDP, even once tariffs are allowed for, which will mean a continuous rise in the ratio of Federal debt to GDP. And there may be upside risks to this if spending cuts in the out years and tariff revenue don’t materialise. A spike in UK bond yields in the past week on the back of political uncertainty over whether UK Chancellor Reeves and her attempt at fiscal discipline will remain in place provides a reminder of the risks facing the US if investors start to lose confidence in US fiscal sustainability making it harder to fund the US budget deficit, which could in time put upwards pressure on US bond yields and downwards pressure on the US dollar, which could in turn put upwards pressure on the $A.

Shares could push further into record territory this month as July is normally a strong month. However, worries about a renewed round in the tariff war, the US fiscal outlook and signs of softer economic growth against a backdrop of stretched valuations and shares being technically overbought could see a renewed share market correction into the seasonally weak months of August and September. Beyond the messy near-term outlook though, shares should benefit on a 6-12 month view as Trump backs down from extreme tariff threats again (remember TACO) and continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut.

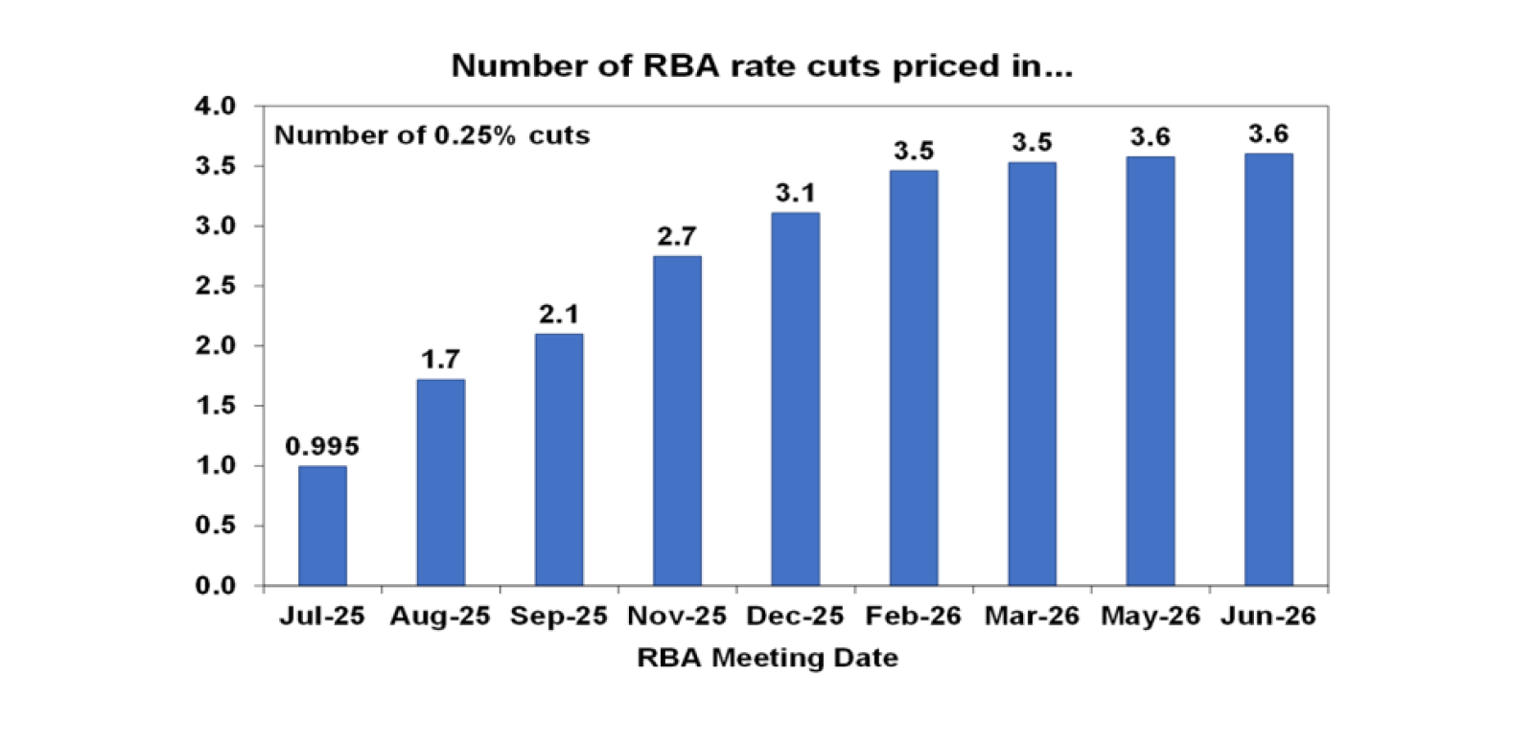

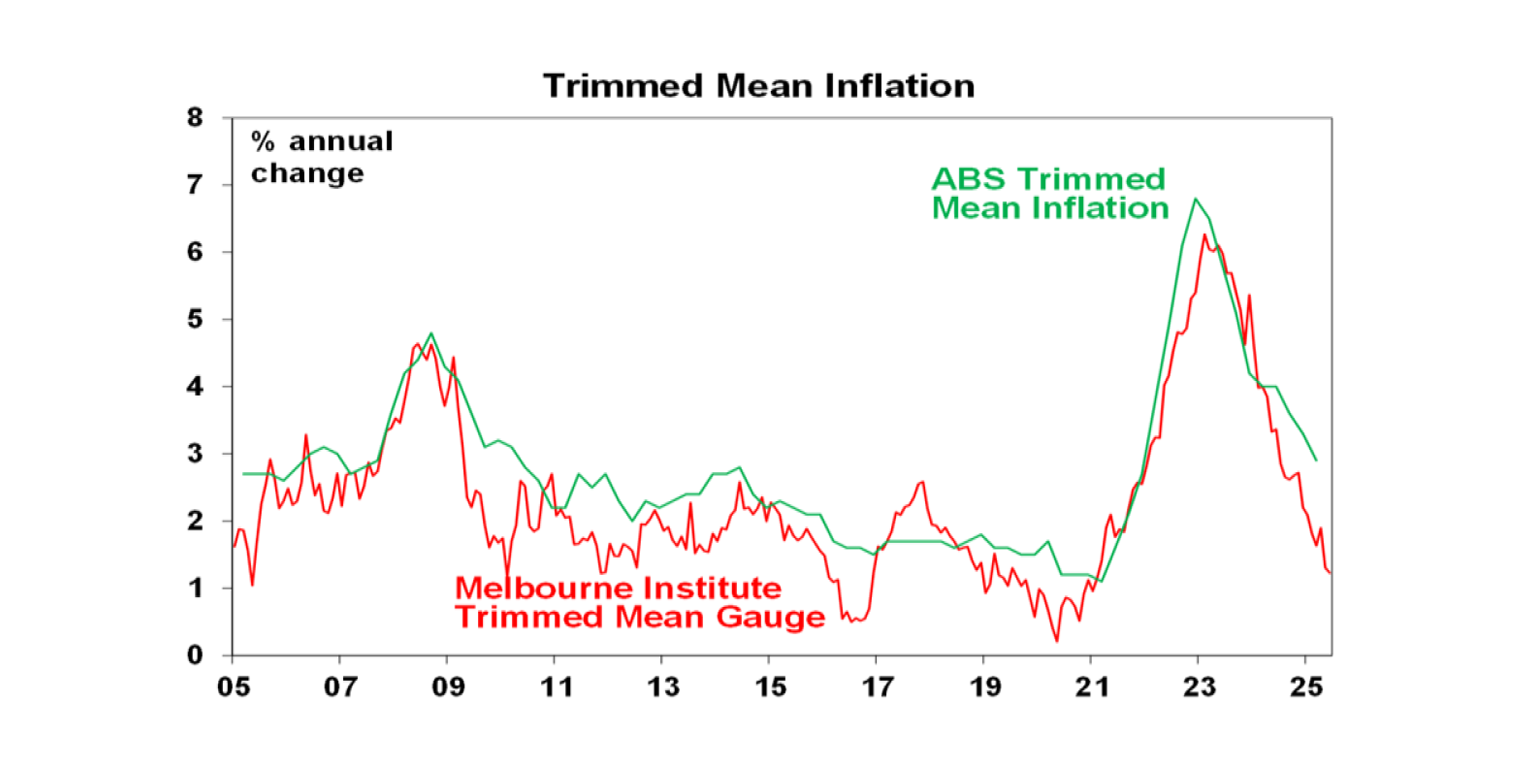

In Australia, we expect that the RBA on Tuesday will cut the cash rate by another 0.25% taking it to 3.6% with guidance likely to remain dovish. This will be the third cut since the RBA started to ease in February. At its May meeting the RBA signalled less concern about inflation which it saw as being at target and more concern about the growth outlook. Since then we have seen monthly trimmed mean inflation drop further to 2.4%yoy, which is in the bottom half of the RBA’s target range, business surveys point to a further easing in inflationary pressures, March quarter GDP growth come in weaker than expected with subsequent monthly economic data also looking soft and Trump’s trade war continue to threaten the growth outlook all of which point to another cut. A rate cut is not guaranteed though with the main arguments to hold being that unemployment is still low, home prices are rising again and share markets are more settled. But we believe these are weak reasons to hold as: there is no evidence that low unemployment is putting upwards pressure on wages growth and forward-looking jobs indicators along with anecdotal evidence point to slower jobs growth ahead; the RBA has to set rates for the average of the economy not just the housing market and there is not much it can do to fix poor housing affordability; and while share markets are calm the threat to growth from Trump’s tariffs remains high. So, on balance, we think it’s both appropriate and likely that the RBA will continue normalising interest rates with another cut on Tuesday and we expect it to cut again in August, November and February. The money market has priced in around a 100% probability of a cut in the week ahead (we think it should be around 80%) and nearly four cuts out to early next year, which is in line with our own view.

Major global economic events and implications

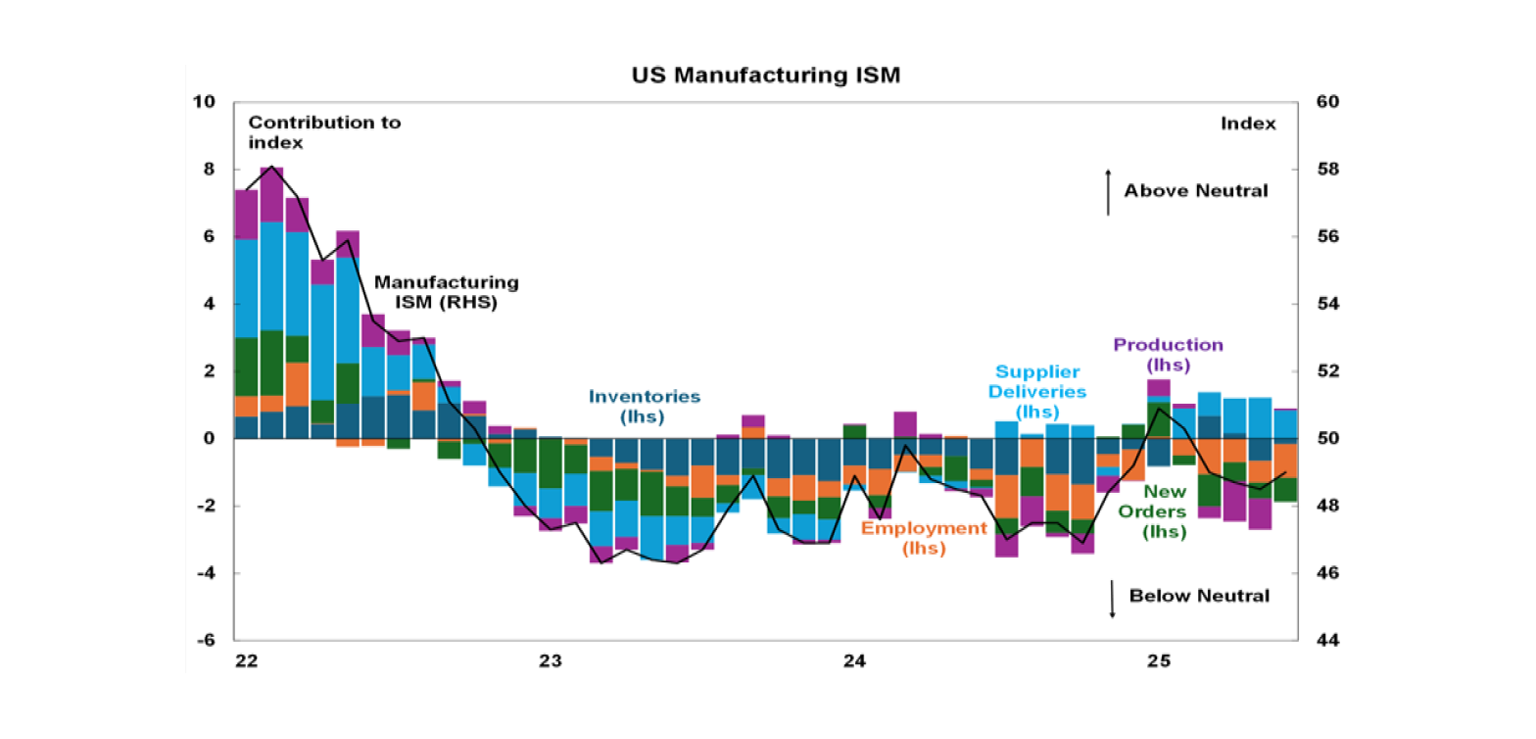

US economic data was mixed. The ISM business conditions indexes improved slightly for June but remain soft. Readings for employment remain weak and readings for prices remain high as the tariffs continue to impact.

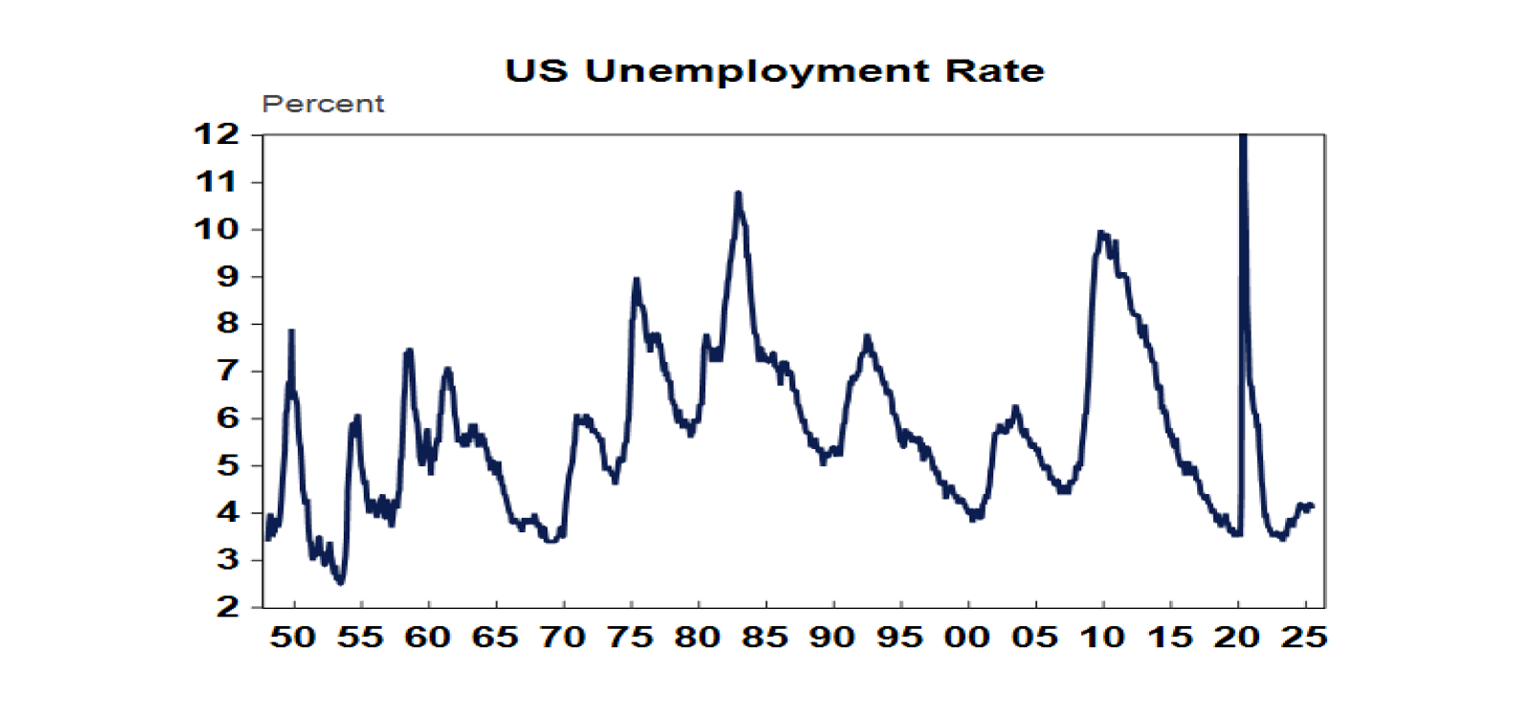

US jobs data for June was solid, but there are signs of softening. Payrolls rose a more than expected 147,000 and unemployment fell to 4.1% which will likely keep the Fed in wait and learn mode this month. However, there were some signs of softening with private sector payroll growth slowing to just 74,000, the fall in unemployment was due to a fall in participation, the household survey is weak and wages growth slowed to 3.7%yoy.

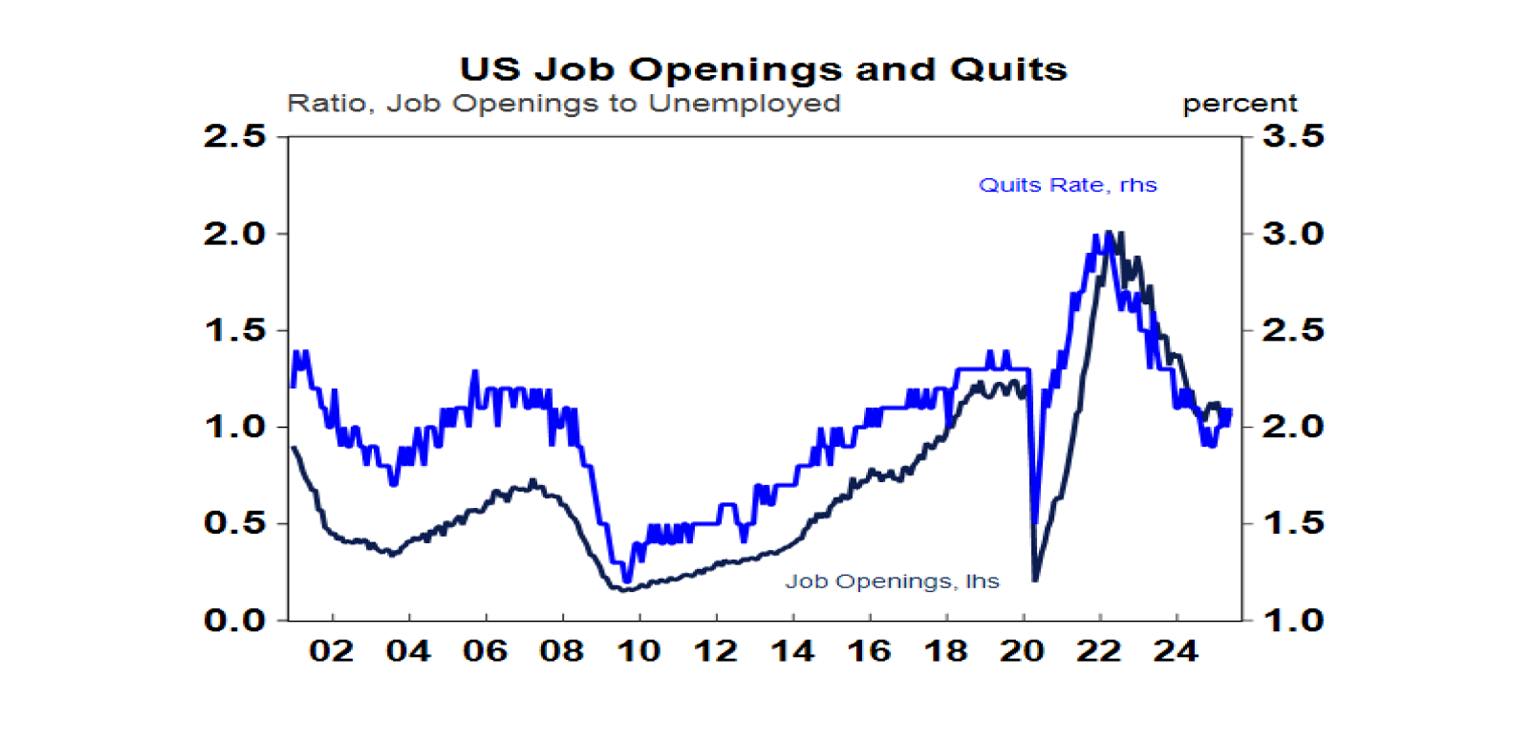

And, US forward looking jobs indicators are mixed, but with the broad trend pointing towards weakness. Job openings and quits improved slightly and hiring fell but all have softened significantly from their 2022 highs, continuing jobless claims are still trending up (suggesting that its harder to get a job once lost) and the ISM surveys are pointing to weaker employment. This aligns with consumer surveys showing softer perceptions of the jobs market.

While Fed Chair Powell reiterated that the Fed remains in “wait and learn” mode he did say that were it not for the tariffs the Fed may have cut by now (basically putting the blame back to Trump for not cutting rates). The stronger than expected June jobs data makes a July cut even less likely and tariffs looking like they are on the way back up will not provide a lot of comfort to the Fed, but we continue to expect at least two rate cuts this year with the first move coming in September.

Eurozone inflation remained around target in June and unemployment rose slightly to 6.3% in May. This leaves the ECB on track to cut further but it’s not likely to move again till the September or October meetings.

The Japanese June quarter Tankan survey showed solid conditions for large businesses and small non-manufacturers but softer conditions for small manufacturers.

China planning a baby bonus to boost population growth and economic growth. Reports indicate its planning to pay RMB3600 (about $A765) a year for each child born from this year on until age three. China’s population has been falling for three years but it’s doubtful that it will be enough to make a difference given the loss of interest in having children and the rising costs in doing so. Chinese business conditions PMIs remained soft in June with a slight improvement in manufacturing in June but services weakening slightly on average. Overall, it suggests growth remains subdued and price pressures remain weak or negative.

Australian economic events and implications

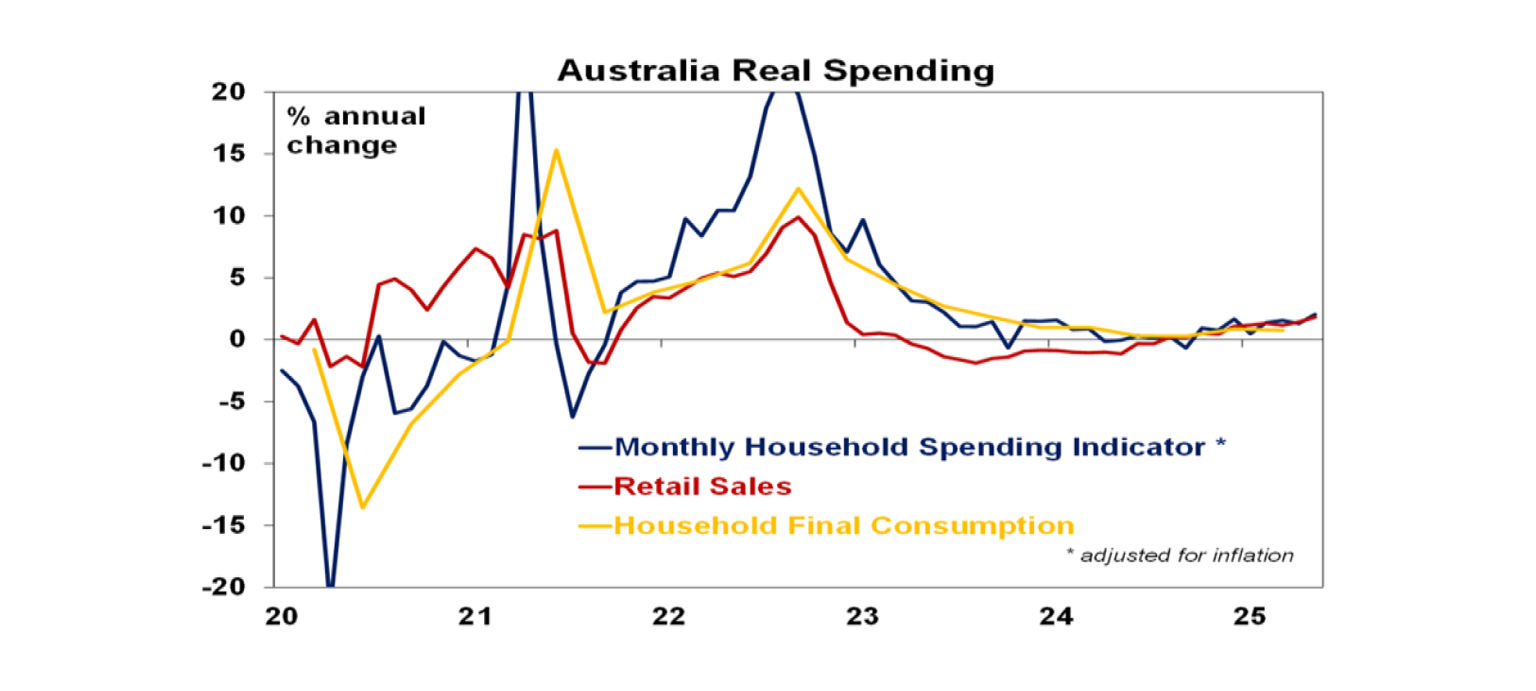

The past week saw another run of softer than expected economic data. Despite a boost to clothing sales from colder weather retail sales rose just 0.2% in June after a run of soft months. Household spending was stronger with a 0.9%mom gain in May but, looks more like a rebound after several months of stagnation than a decisive break higher. Particularly with bounces in clothing and transport looking temporary and related to cold weather and EOFY sales. A gradual improvement is likely on the back of rising real wages, low unemployment and improved confidence but it’s likely to require more rate cuts.

Home building approvals rose in May, but are well down from their recent high after several months of falls in unit approvals. Approvals are up from 2023 lows but remain soft and are running around 181,000 dwellings a year which is well down from the Housing Accord’s commitment to build 240,000 homes a year. It’s going to take a long time to reduce the estimated accumulated housing shortfall of between 200,000 to 300,000 dwellings!

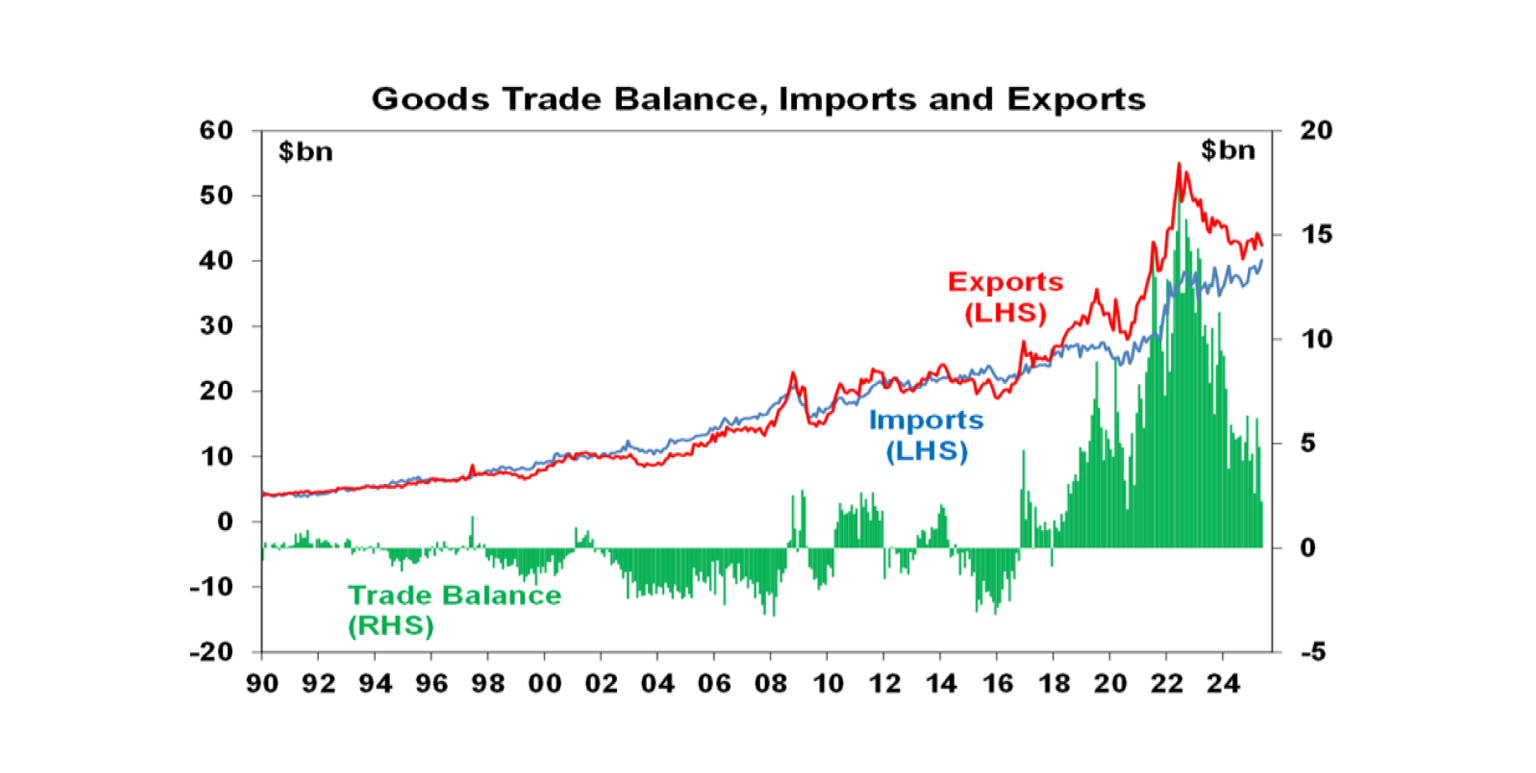

Australia’s goods trade surplus fell to $2.2bn in May, with exports down, on the back of lower gas exports and gold exports to the US continuing to normalise, and higher imports. The trade deficit with the US has returned after tariff front running boosted exports to the US earlier this year.

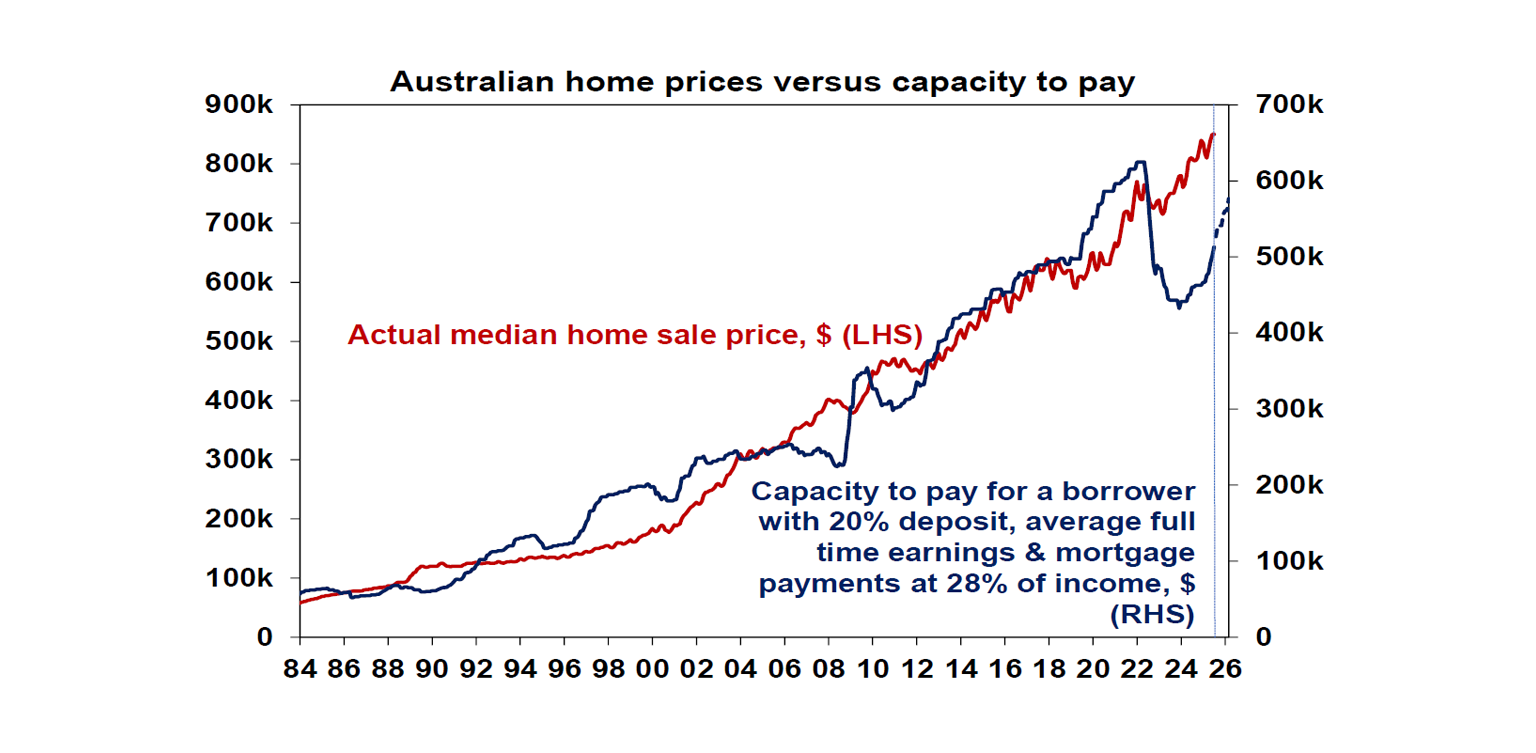

Australian home price growth accelerated further to 0.6%mom growth in June as rate cuts and the housing shortage continue to boost prices. Expect further gains ahead, although poor affordability, as illustrated by the still weak capacity to pay for a home for a worker on average earnings compared to when prices soared in 2021, will act as a constraint.

The Melbourne Institute’s Inflation Gauge for June showed a further fall in underlying, or trimmed mean, inflation pointing to more downside for the ABS’ quarterly trimmed mean inflation rate and supporting the case for more RBA rate cuts.

Federal budget data for the 2024-25 year to date to May showed a deficit of just $5.5bn, way better than implied by the May Budget forecast for a $27.6bn deficit. This suggests the budget could come in with a deficit below $10bn and maybe a small surplus. Structural problems still point to deficits ahead though.

What to watch over the week ahead?

Globally, the focus will be on Trump’s 9th July tariff deadline which may see some deals announced and countries face higher tariffs again.

In the US, the minutes from the last Fed meeting (Wednesday) are likely to confirm its “wait and learn” stance for now. The June quarter earnings reporting season will also kick off with the consensus expecting a 4.1%yoy rise. Past earnings surprises suggest an outcome closer to 7.5%yoy but there is more than normal uncertainty around this given the impact of tariffs on margins. Since April, 2025 earnings expectations have been revised down by around 2%.

Chinese inflation data (Wednesday) is expected to show -3.2%yoy producer price inflation and flat consumer prices.

The Reserve Bank of New Zealand (Wednesday) is expected to leave rates on hold at 3.25% but signal one or 2 more cuts ahead.

In Australia, the RBA on Tuesday is expected to cut its cash rate by another 0.25% taking it to 3.6% with guidance likely to remain dovish. See earlier in this report for details of our view.

Outlook for investment markets

Share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We now see home prices rising around 5 or 6% this year given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest. |