The Australian retail data disappointed across the board today. Nominal retail sales fell by 0.4% over the month, reversing a (downwardly revised) 0.2% rise last month. This figure is lower than all consensus estimates (the median expectation is for a 0.2% rise).

Today’s retail data highlights the depressed state of consumer spending, despite recent talk about a rebound in aggregate demand stemming from hotter than expected employment & inflation data.

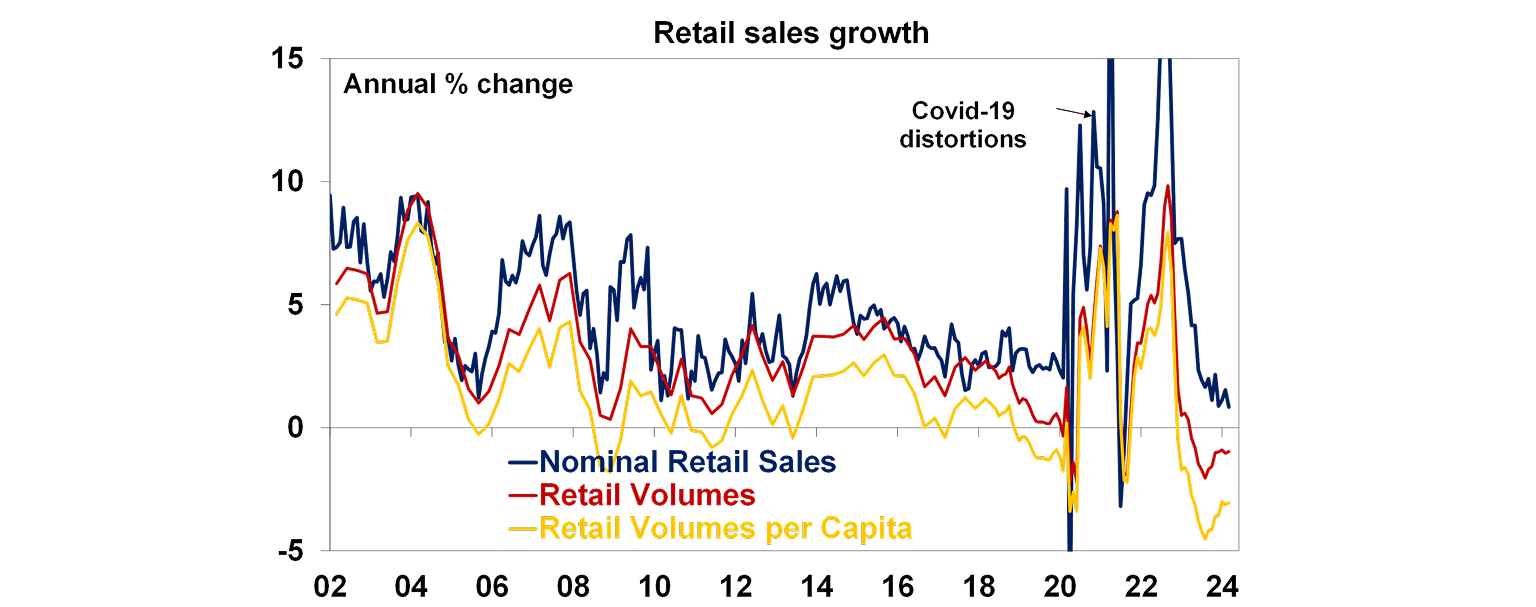

- On a quarterly basis, retail revenue was up a mere 0.2% which means that retail volume growth is likely negative this quarter.

- Over the past year, retail sales only increased by 0.8%, the lowest annual growth since 2000 (outside of the pandemic and the time when the GST was introduced). This pace of growth is much lower than the increase in inflation and population growth, so spending volumes per household have slowed again (see yellow line below).

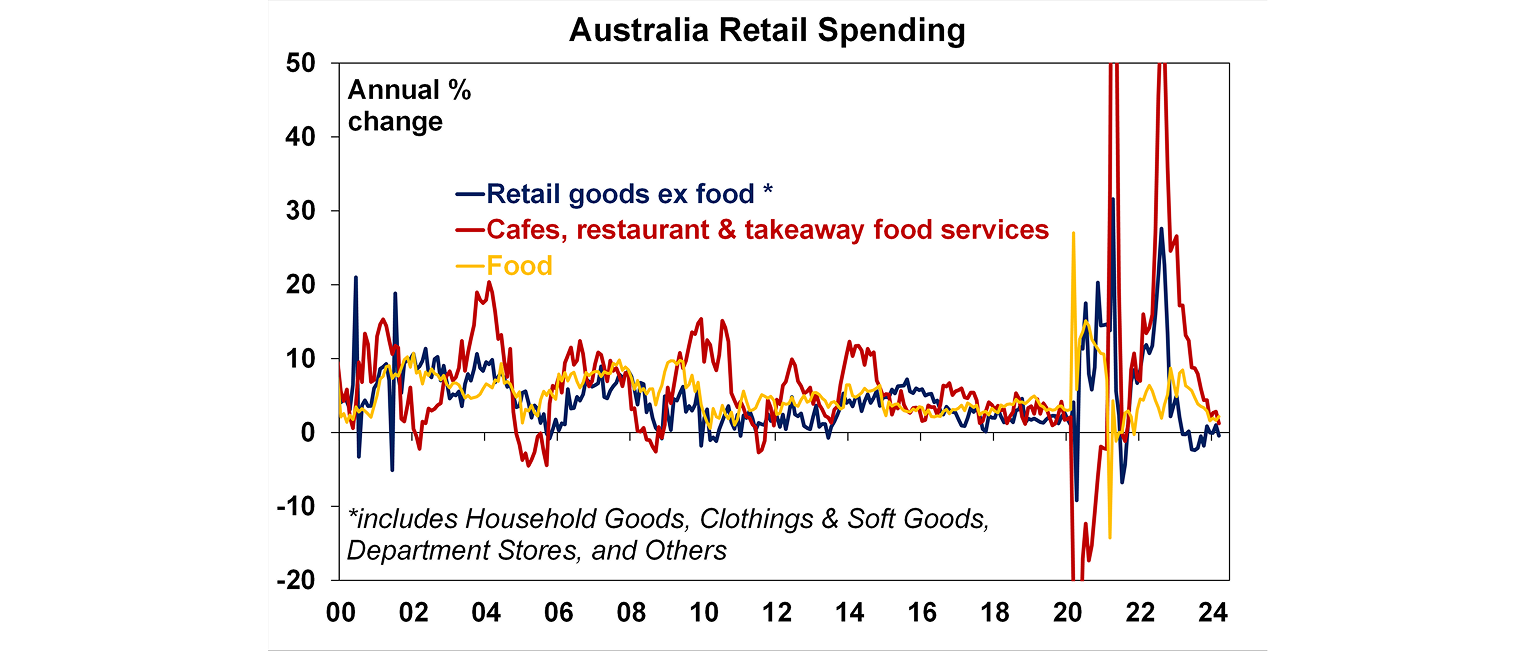

Retail revenues are weak across the board, with sales in all categories falling this month (except for food). This is significant because:

- Food sales rose by a large 0.9%, and were likely boosted by the Easter long weekend (Easter is the second biggest spending event after Christmas and should be seasonally adjusted “away” but it gets complicated because Easter occurs at different times every year).

- Any Swift lift last month proved to be short-lived. Clothing (-4.3%mom) & department store sales (-1.6%) both fell in March, which means that consumers tightened budgets elsewhere to make up for the concert-related spending in the prior month.

- Household goods spending fell by 1.4% and “other” retailing was down by 0.2%.

- Dining out & takeaway sales also fell by 0.4%, despite elevated services prices (red line in the chart below) and is also experiencing slower growth than before the pandemic.

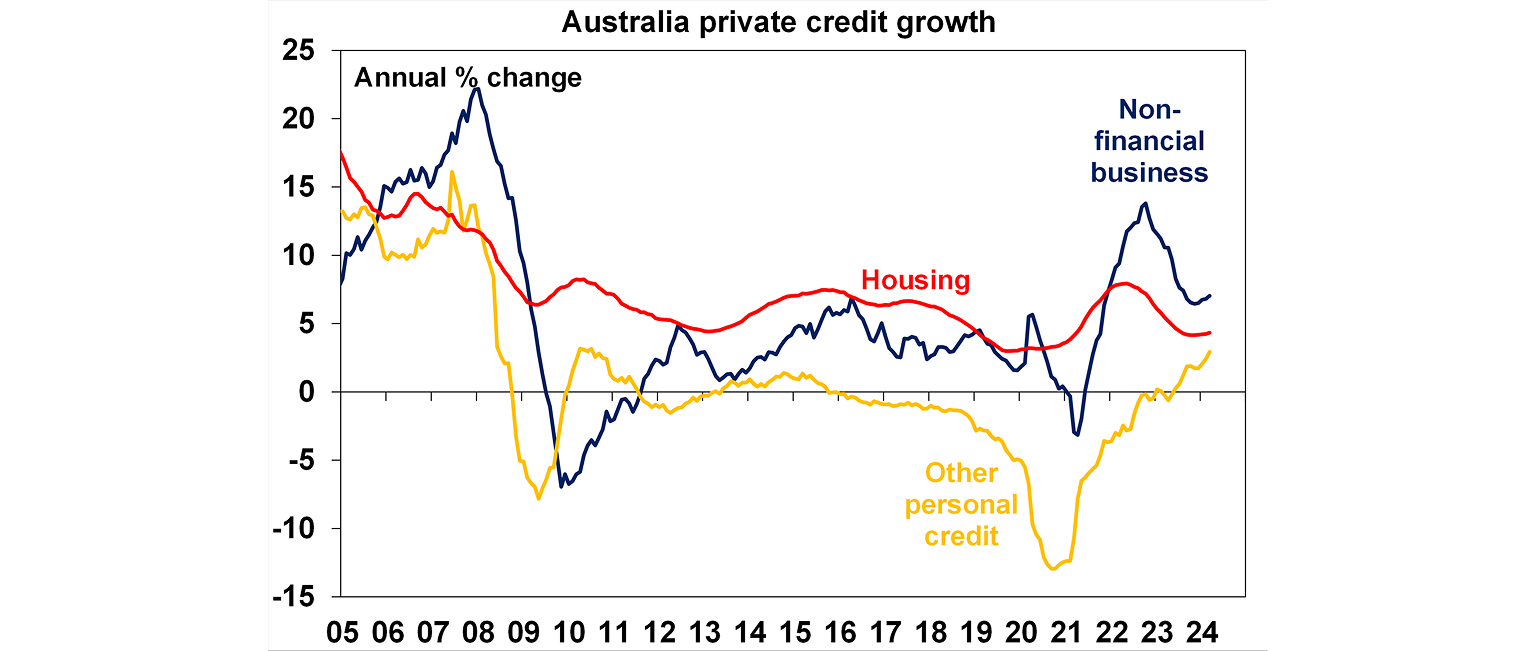

Meanwhile, the RBA credit data also disappointed and showed a further slowing in credit growth from 2023 levels. Private sector credit grew by 0.3%mom, slower than the 0.4% expected by economists and 0.5% pace last month.

- Housing credit growth remained stagnant despite continued increase in home prices, growing at 4.3%yoy which is much lower than the peak of 7.9% in 2022. This is because home sales volume is still very low, as affordability worsens for the average mortgage payer.

- Business credit has improved from the recent trough but is only running at 7% over the year, half the pace at the peak.

- On the other hand, personal credit has returned to positive annual growth at 2.9% after a prolonged period in the negative territory. This is a sign that people are taking on more personal loans & credit card loans.

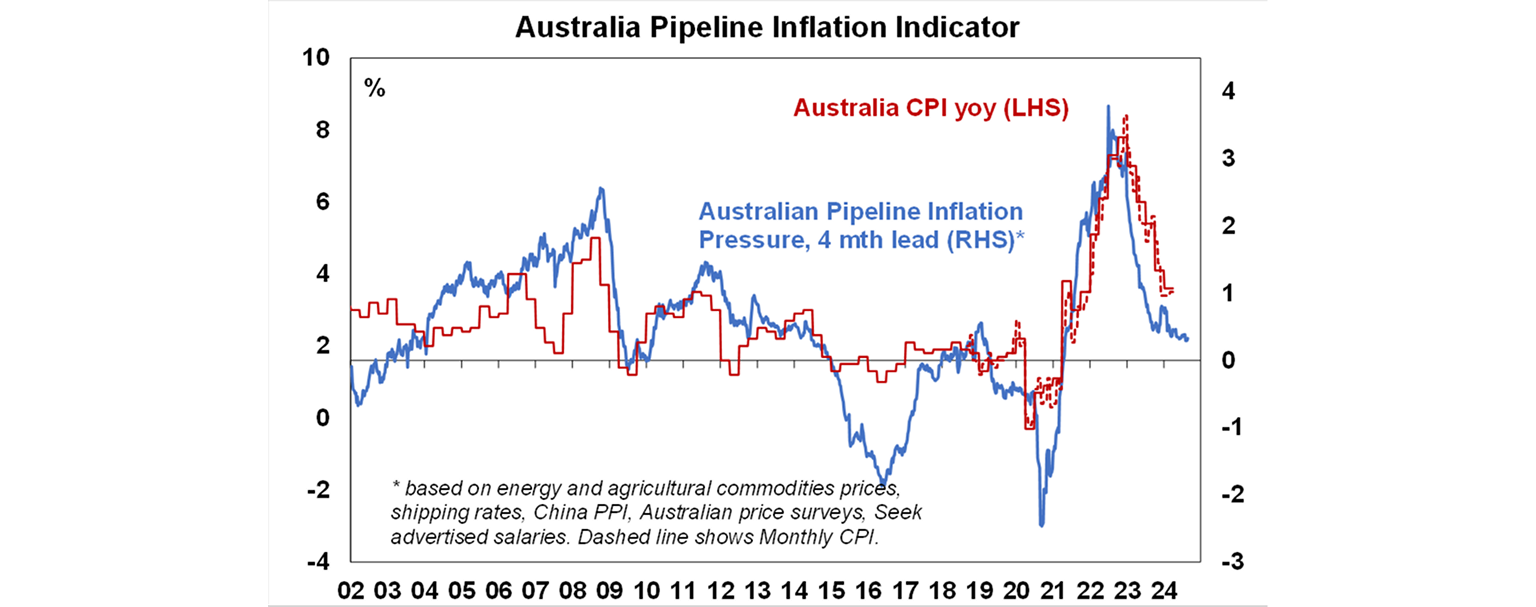

After last week’s stronger than expected March quarter inflation data, financial markets (and some economists) have started debating the risk of further RBA rate hikes. Market pricing has taken out any expectations of rate cuts this year and now even has a ~30% rate hike priced in by November.

But today’s retail data is not consistent with an economy that needs further tightening.

- There are multiple signs that the consumer remains under pressure: consumer spending is soft, housing debt payments as a share of income have increased to their highest levels since 2011, consumer accumulated savings are well down from their Covid-highs and the skew of these savings sits with older households who are less impacted by high interest rates and consumer sentiment remains depressed.

- A lot of the categories that had an upside surprise in the March quarter inflation data were not related to demand-driven areas (rather in areas like medical services, education and housing).

- Inflation needs to decline further, as it is still outside the 2-3% inflation target – but on the broad range of indicators like commodity prices, shipping rates, Australian price surveys and wage indicators, our Inflation Indicator is still pointing down in coming months (see the chart below).

We see a rate rise by the RBA at next week’s meeting highly unlikely, although the central bank is likely to debate the need for a rate rise and may shift its neutral bias on interest rates to a tightening bias. Although you could also argue that Michelle Bullock’s comments that the RBA is not ruling “anything in or out” is consistent with the Board debating the options to hold interest rates steady or to hike. We think that the next move in rates will be down, but it will come later (probably around November) than we initially expected.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.