Key points

The world has already moved from a unipolar to a multipolar world years ago, as China is now the largest economy in the world (in purchasing power parity terms).

China’s increasing influence on the global economy, society and culture forced the US to become more hawkish on China (across both sides of politics) and less reliant on it as a trading partner, especially in recent years.

Despite all the recent talk about the US and China “decoupling” from one another, this has already been occurring for years as the two have become less dependent on each other from a trade perspective.

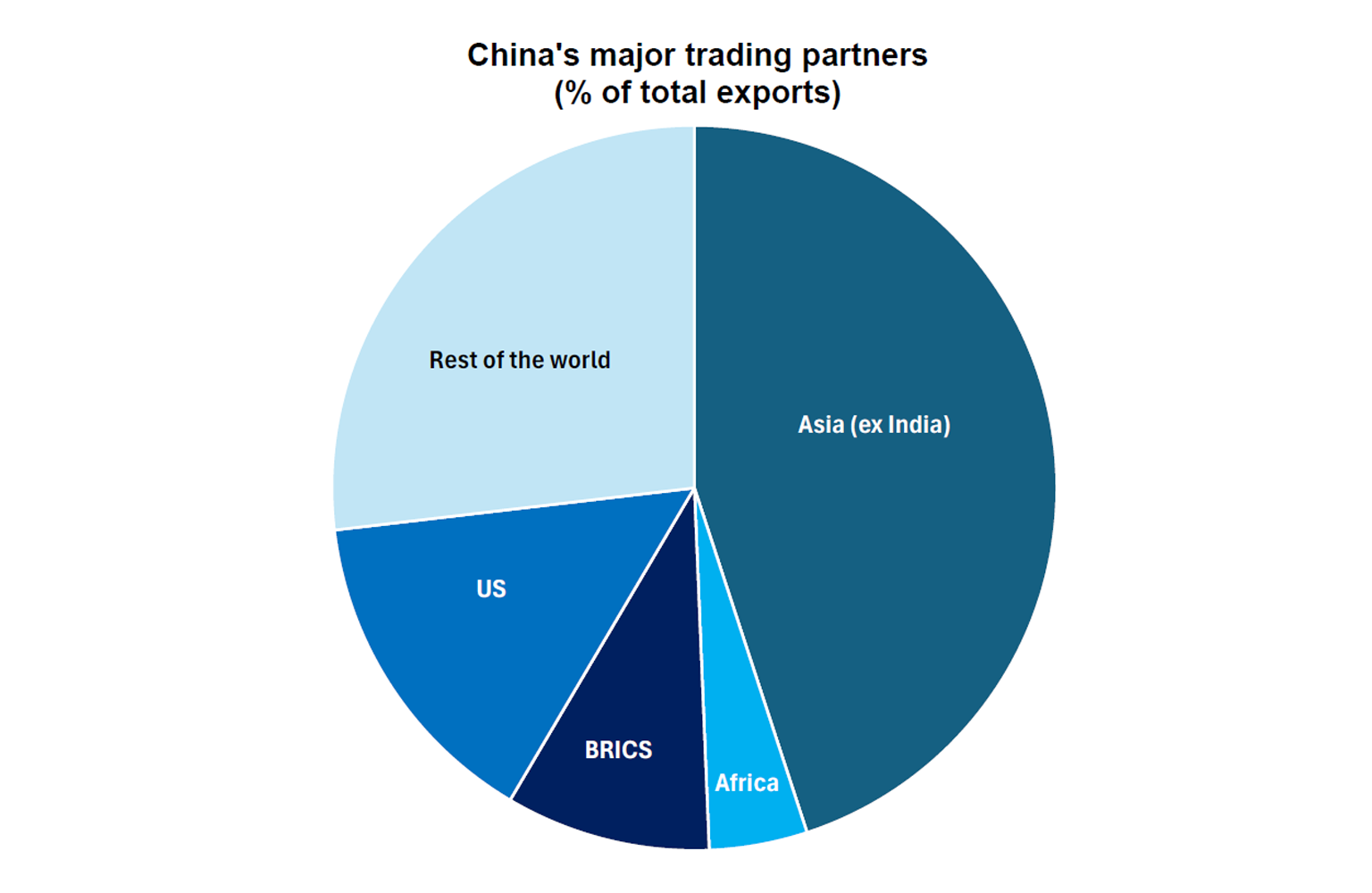

China is now likely to focus on exports to the rest of Asia which is nearly 50% of its exports.

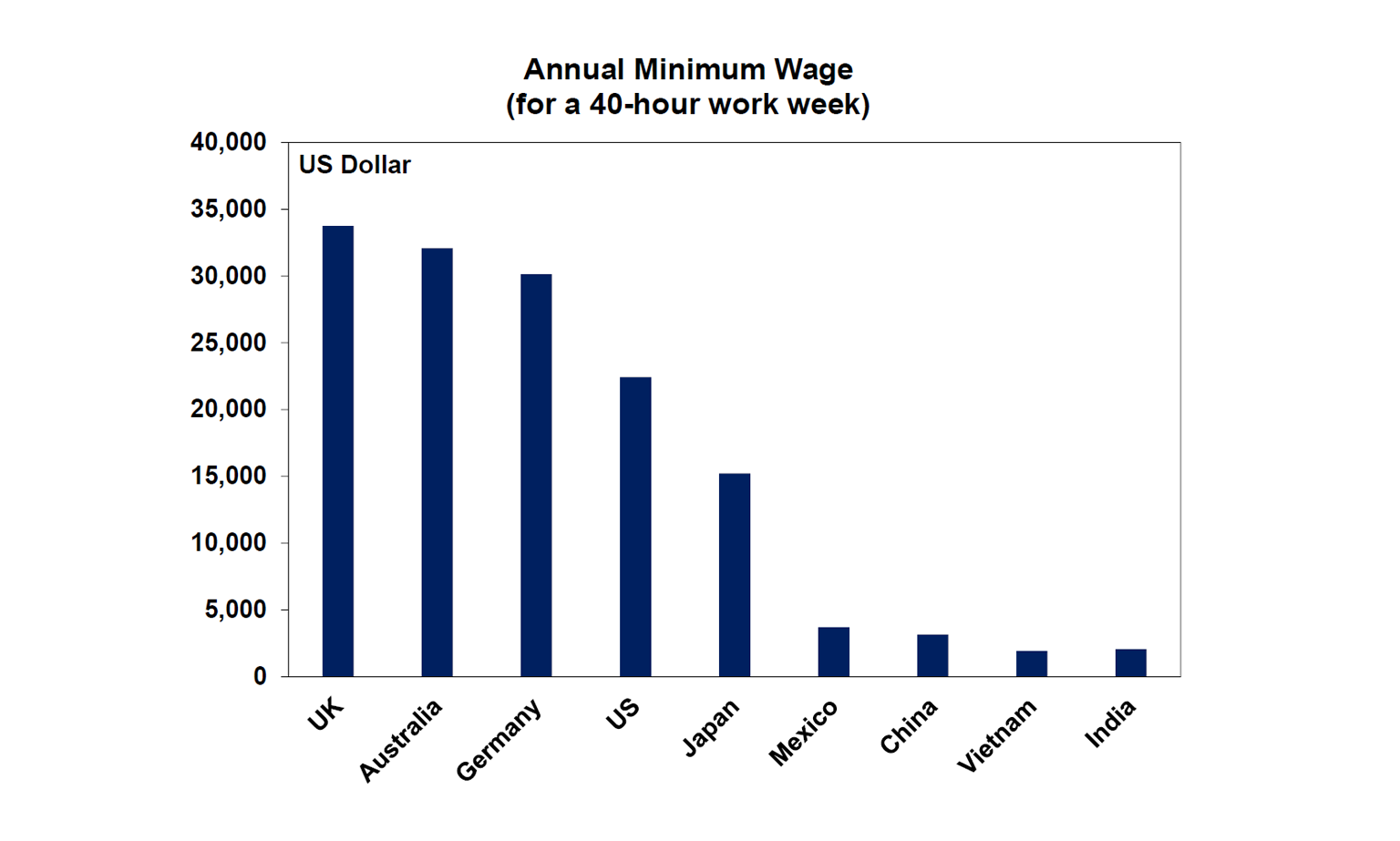

US plans to revitalise its manufacturing base will be difficult to achieve. As economies grow and incomes increase, the services economy becomes a larger share of GDP. As this occurs, manufacturing labour and skills diminishes, and minimum wages rise (US minimum wages are 7x higher than China).

But it is in neither country’s interests to completely loose the other export market, so some deal is likely to eventually be struck but the process will be drawn out. In the meantime, US consumer prices will go up and the choice of products on US shelves will reduce.

Tariffs have hit US consumer and business confidence and the uncertainty around trade deals that more downside to actual growth outcomes is likely. Despite some recent rebound in shares, it is still too early to say that we have seen the low in global shares.

Introduction

Trump has imposed an average tariff rate of 145% on China, up from ~20% pre-Trump 2.0. China has retaliated with its own tariffs on US imports (at 125%) and imposed other measures like restricting imports of Hollywood films, putting US companies on restriction lists and limiting travel between China and the US. Under current conditions, trade between the US and China may effectively half. Is this an effective “decoupling” between the US and China? What does this mean for the global trading order we are used to? We look at these issues in this edition of Econosights.

We have already moved from a unipolar to a multipolar world

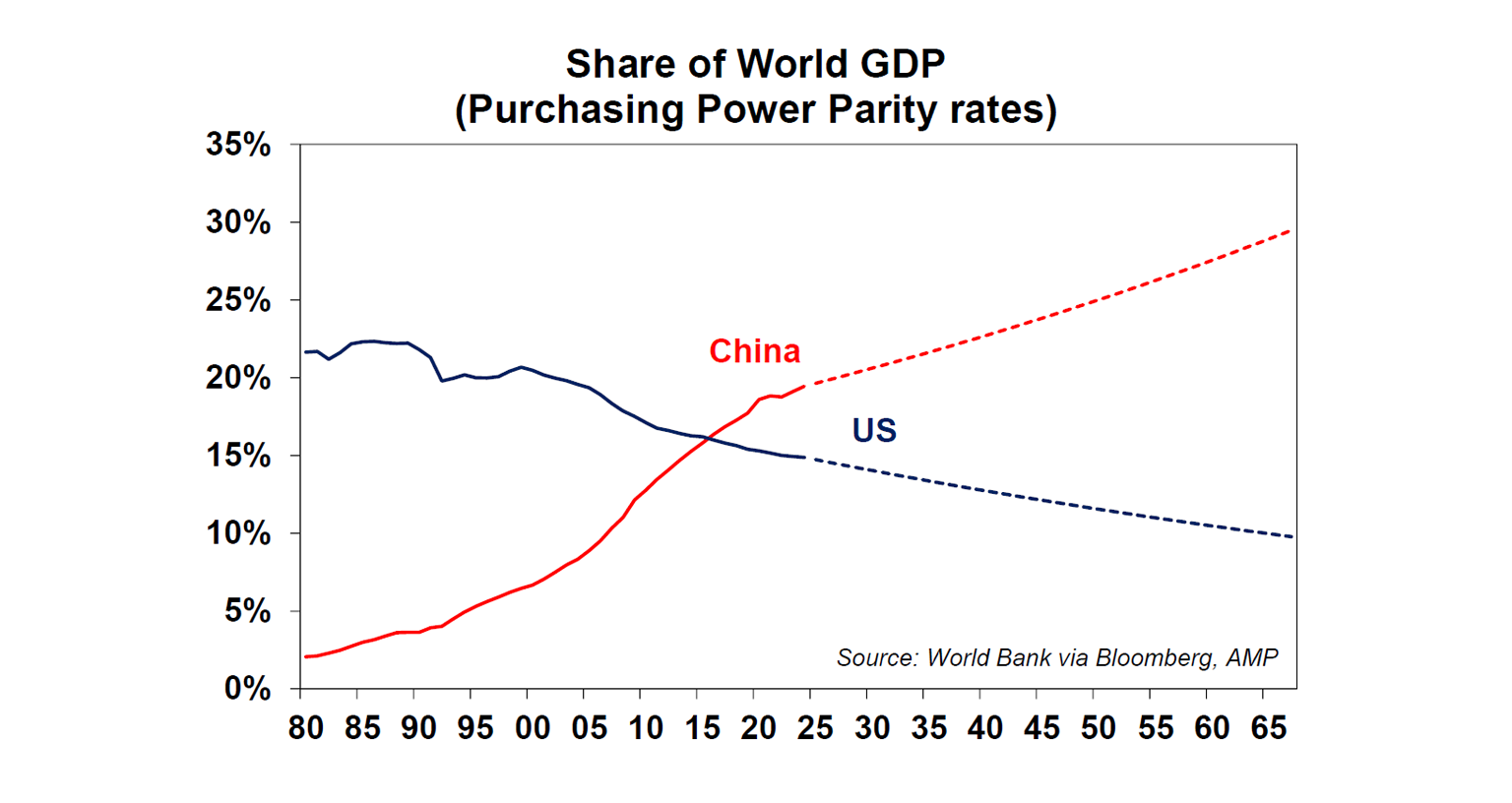

A unipolar world refers to a global country with one major power that spreads its influences onto the global economy, society and culture. The US has been the effective global power or “hegemon” since WWII, after the collapse of the Soviet Union (where we had a bi-polar world). The exponential acceleration in the Chinese economy in the past 20 years means that China has played catch up to the US as it has become a richer economy, expanding its middle class and lifting its urbanisation rate (the proportion of the population living in urban areas) to over 66% (developed countries have urbanisation rates above 80%). China accounted for 2% of world growth in 1980 and is now 19%, surpassing the US which has declined from 22% in 1980 to 15% on recent measures. This measure is in “Purchasing Power Parity” terms (not market terms) which considers actual buying power based on differences in exchange rates. On this measure, China surpassed the US as a share of world GDP in 2016 (see the chart below), although it’s still behind the US when measured in US dollars.

The falling influence of the US and the rising influence of China explains the geopolitical tension that exists between the two countries, especially in the age of artificial intelligence, with both trying to get dominance in the space. The difficulty for both nations, is that the global trading system is highly linked between these countries, especially with China being the producer of the world and the US being the consumer of the world. As a result, it will be difficult for the US and China to completely move away or “decouple” from one another.

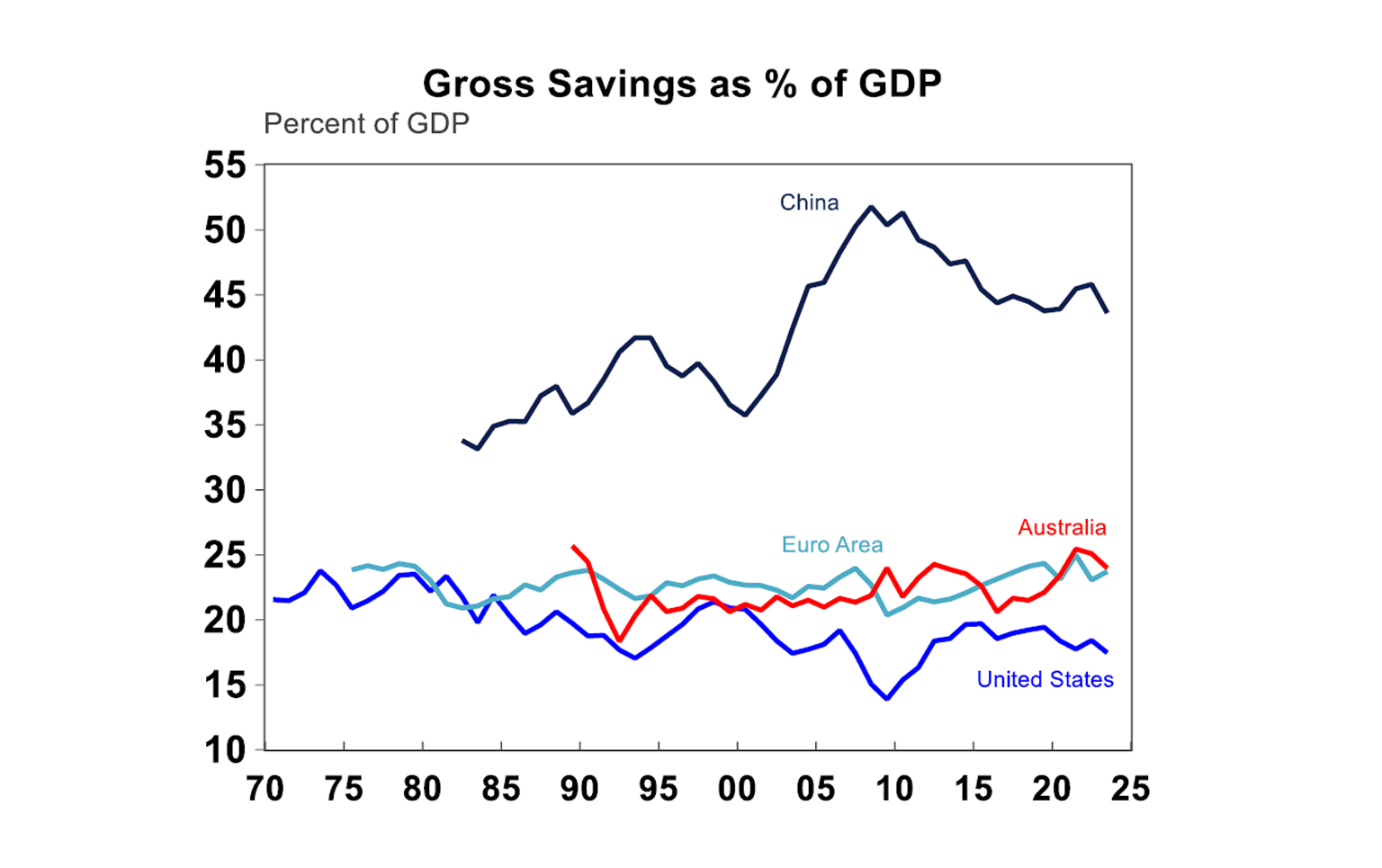

The basic problem for China as the producer of the world, is that it does not spend enough (i.e. its gross savings rate is too high at 44% – see next chart). And the US needs to save more, with the US gross savings rate at 17.5% versus 24% in Australia and Europe.

How much do China and the US rely on one another?

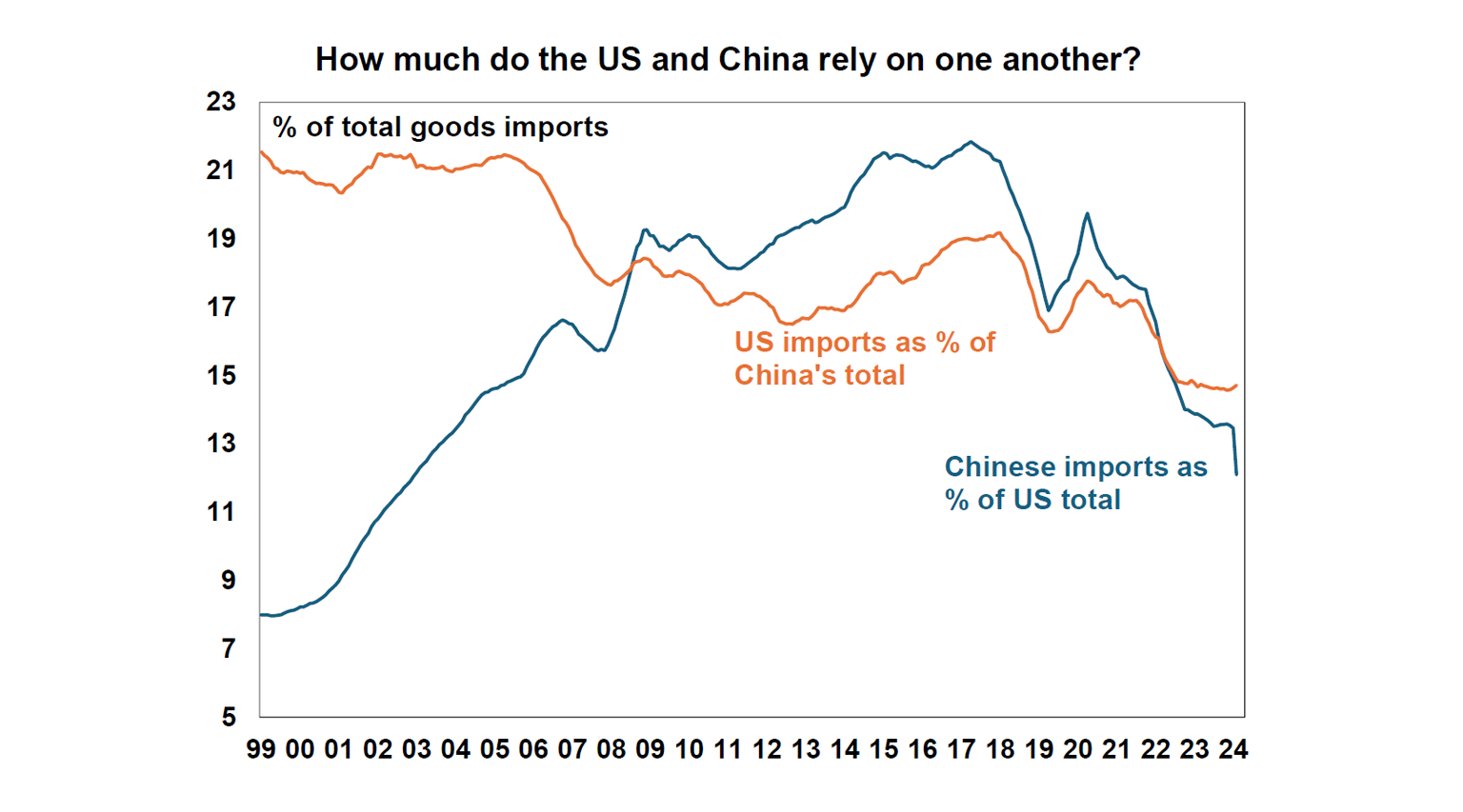

Historian Niall Ferguson coined the term “Chimerica” in 2006 to describe the increasingly linked relationship between the two countries, you could almost see the two turning into one economy. China and America accounted over 50% of world growth in the late 1990s and early 2000s. But the relationship started cracking after the Global Financial Crisis in 2009 as the longer-term implications of the US being the global consumer became more evident. The US manufacturing base continued to erode, US indebtedness increased, US savings rates declined (and China’s soared) and the US became increasingly concerned about (in their opinion) unfair Chinese trade practices including depreciation of its currency, subsiding domestic industries and stealing intellectual property and technology. Geopolitical concerns around China’s interest in the South China Sea and Taiwan also inflamed tensions between the US and China, further being compounded by Covid-19 and the second Trump term. So, despite a lot of concern about “decoupling” between the US and China, the two had already been moving away from one another, at least from a trade perspective. US imports as a share of China’s total imports peaked at 21% in the mid-2000s and have been slowing since, currently at 15%. Chinese imports as % of US total imports peaked at 22% in 2018 and have now dropped to 12% (see the chart below).

While the US has been a major export partner for the US, the rest of Asia is arguably more important to China (and will become more so) at just under 50% of China’s export market.

Can the US revive manufacturing?

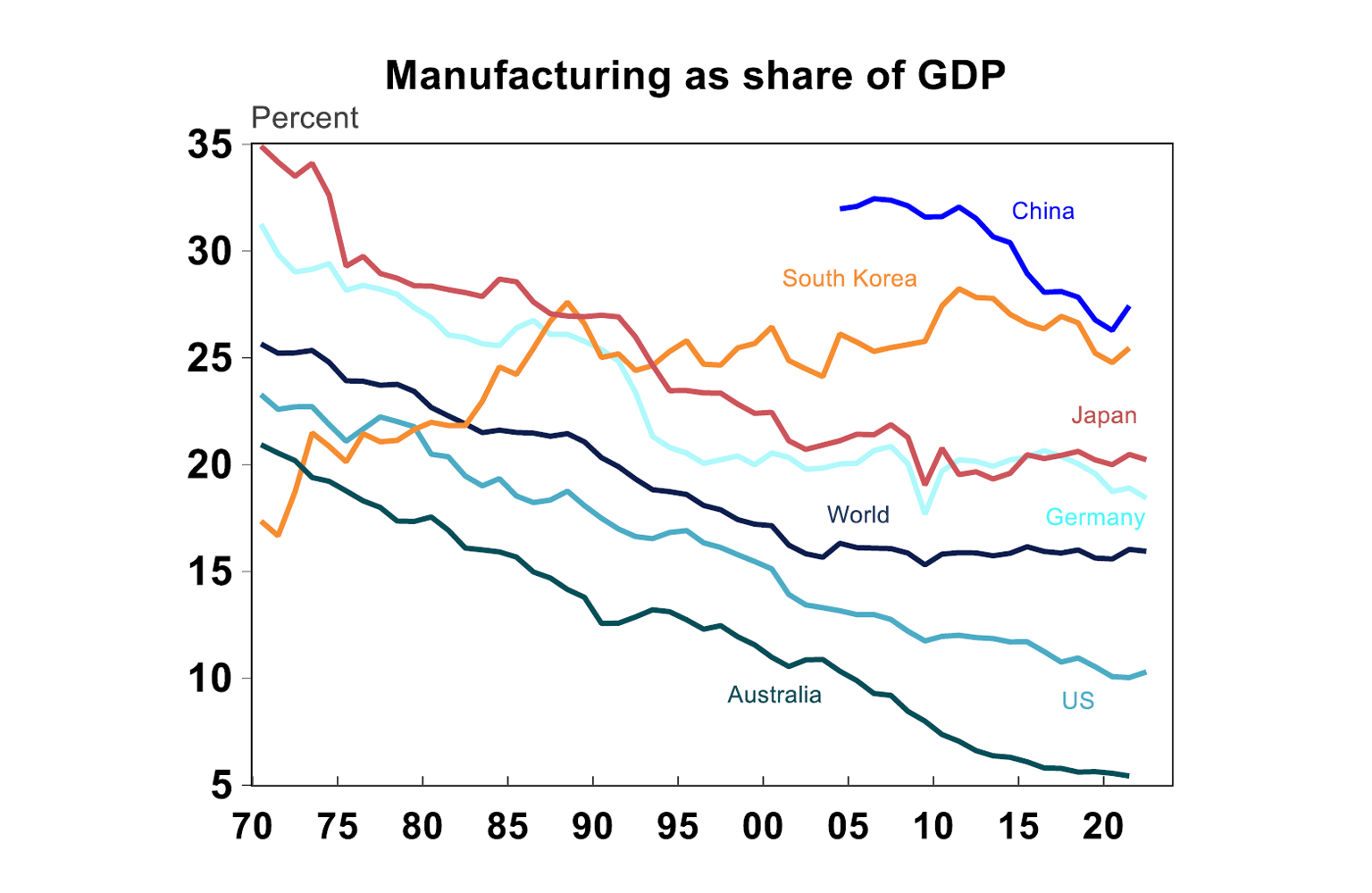

One of the main reasons behind pursing a high tariff policy is for the US to revive its manufacturing base, bring production of goods back onshore, increase foreign investment into the US and generate domestic jobs in the process. But it is unclear if this can actually be achieved in today’s environment as the US has moved to become a services-based economy (with services accounting for nearly 80% of GDP). As an economy’s income increases and its middle-income population expands, secondary industries like manufacturing and construction tend to become a smaller share of the economy, as services grows as a share of the economy. This is true in other major markets (see the chart below). Across the world, manufacturing has declined from 26% of global GDP in 1970 to 16% in recent times.

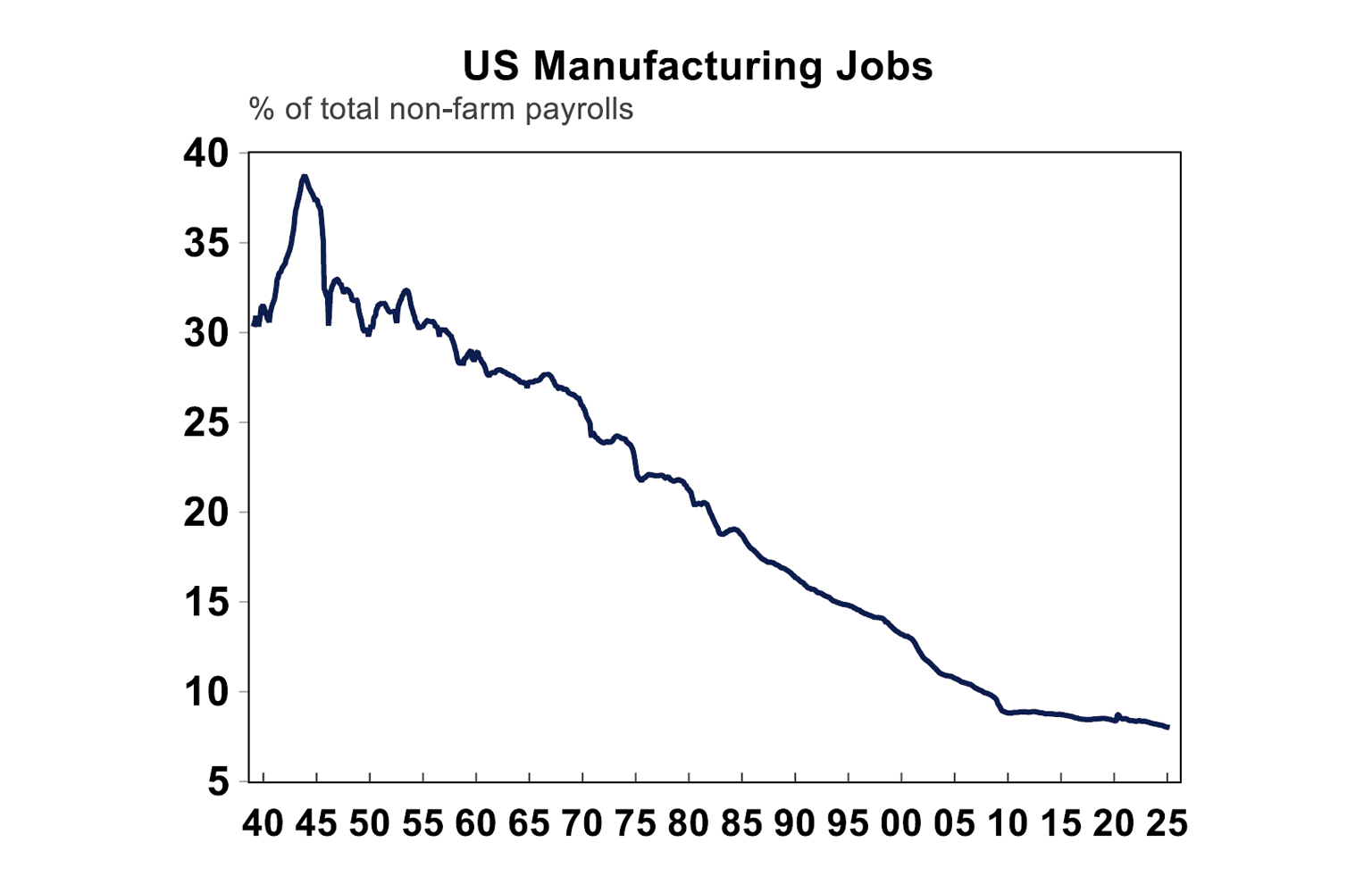

The manufacturing process of today which utilises AI and robotics looks very different today to manufacturing 50 years ago when it was reliant on manual labour and assembly lines. Social media images and videos mocking the futuristic Trump’s America which had American workers sitting in factories making consumer goods are not necessarily a reflection of what Trump and his team are trying to do with revitalising manufacturing (i.e. they want more of the technical knowledge for the AI and robotics involved although this won’t mean lots of additional manufacturing jobs). This will involve a huge effort to bring back the technical experience for these roles. Manufacturing as a share of total jobs has fallen significantly, from ~35% in the 1940’s to 8% today.

Labour in China is also much cheaper relative to the US, with the annual minimum wage 7x lower in China relative to the US – see the chart below. Maybe the US will have to start increasing immigration to bring in the right skills (which will defeat the point of the tariffs and is contrary to Trump’s crackdown on immigration!

Implications for investors

So where do the US and China go from here? It seems that the countries are currently at an impasse. The US has said that China needs the US more than the US needs China. Meanwhile China has said the opposite and repeated that it will not back down and will stand up to a “bully”. In the next two months the US will be making trade deals with its trading partners around the reciprocal tariffs. Trump’s team is also yet to announce other sector specific tariffs. For now, a deal with China does not look to be on the cards, although they are moving closer to talks which is a positive first step.

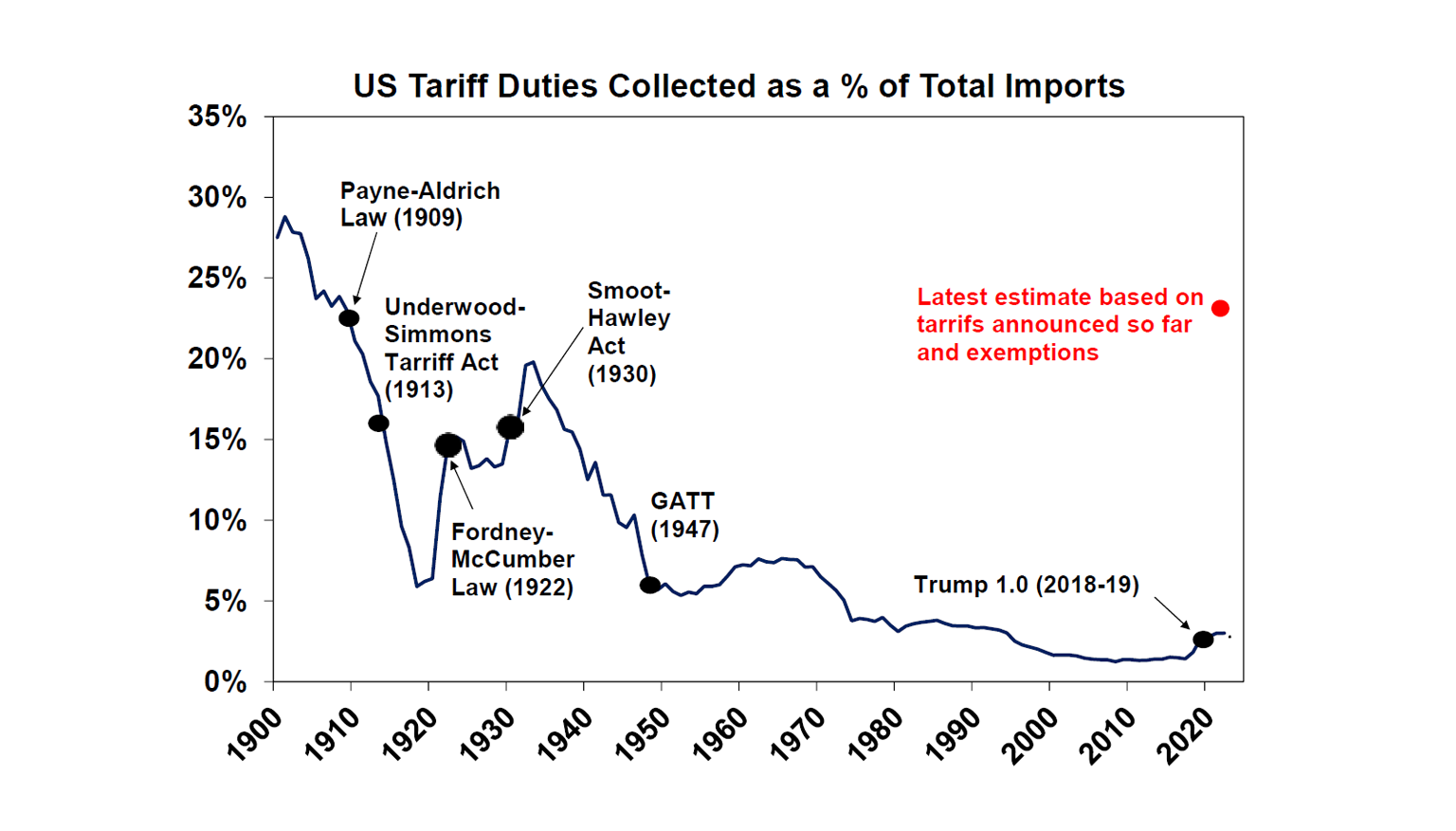

In late 2024, the average US tariff rate was 3% on total imports and with the latest announcements from Liberation Day, including the exclusions so far, the average tariff rate will rise to ~23% (see the chart below), the highest rate since the early 1900s. This rate will hopefully decline a little after some deals are made, but the average US tariff rate is unlikely to get below 15%.

This means that even if China and the US soften their current tough talk on trade and work to some sort of resolution, tariffs are still going be multiple times higher in the US compared to the pre-Trump 2.0.

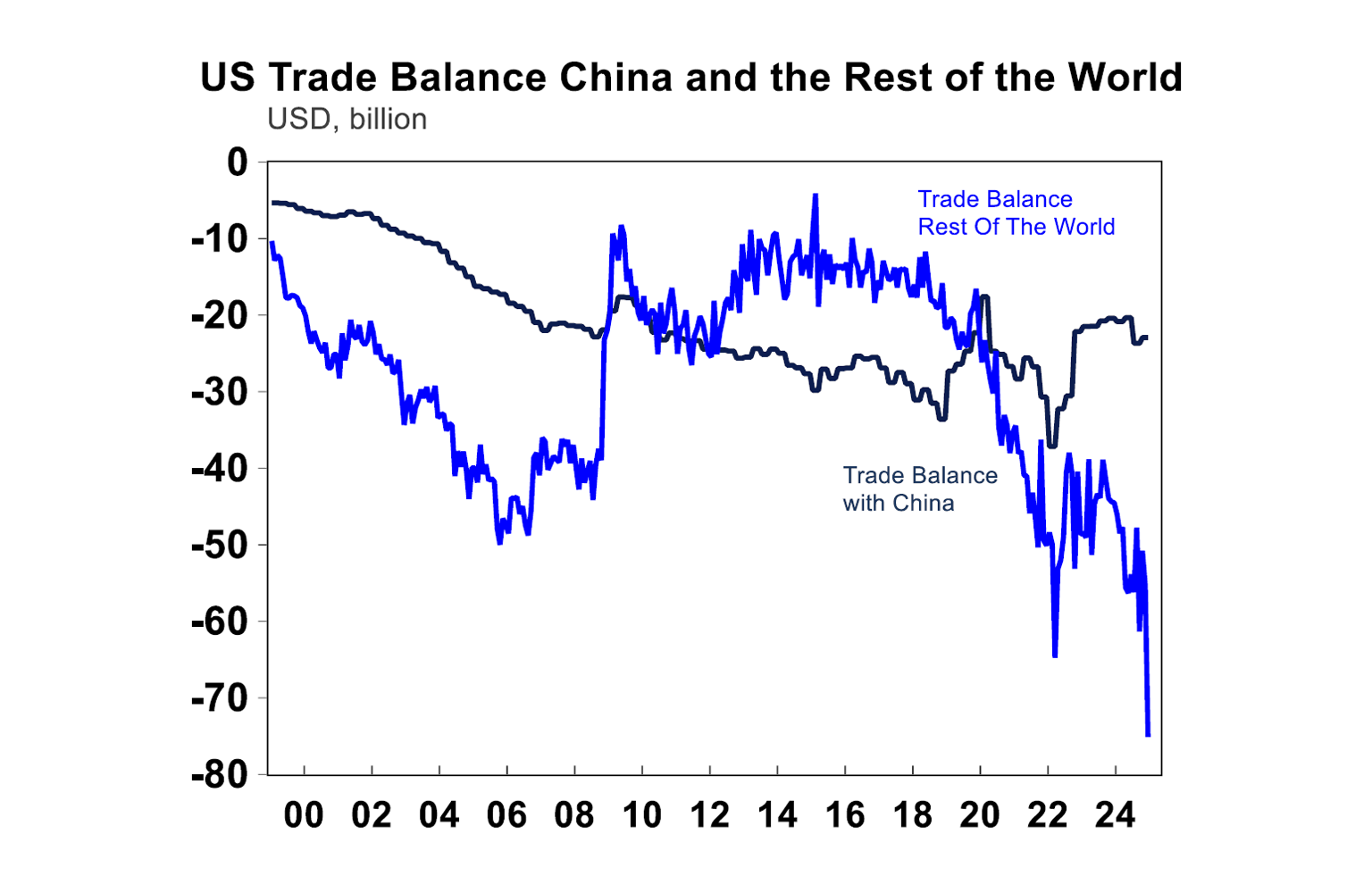

This means that US consumer products are going to get more expensive. In the short-term to fill demand gaps, the US may have to start importing manufactured consumer items from countries like Vietnam, India and Thailand who will have lower tariff rates imposed compared to China. However, this rerouting of trade ultimately defeats the point of tariffs, as it will mean increasing trade deficits with another country or set of countries. This is already occurring (see the chart below). As the trade deficit with China has fallen (moving closer to zero), the trade deficit with other countries has gotten worse.

As the consumer impacts from higher tariffs become more evident, political pressure for Trump and his team will increase to alleviate some of the pain. While Trump may quip now that “American children might have two dolls instead of 30 dolls”, if cost of living starts to become a big problem again for consumers, this could hurt the Republicans in the mid-term elections next year.

Higher tariff rates have already hurt US consumer and business confidence, but more damage is likely as it’s not clear that we are past the worst. This is a concern for US, Australian and global sharemarkets. US shares have had a good rally in the last 2 weeks from no other “bad” announcements around tariffs but given that that there is still a long way to go before there is a clear resolution or future around trade, the risk is that global sharemarkets decline again.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.