Key points

The tightening in monetary policy in recent years has had a mixed impact on the major developed economies.

Economic growth in Canada, New Zealand, the Eurozone and Australia (to a lesser extent) has slowed noticeably. In comparison, the US economy has held up better.

Inflation has declined the most in Canada and the Eurozone and is at a level where central banks will start considering cutting interest rates over the next few months.

The US economy is often seen as a leading indicator for the rest of the world, from impact to global economic growth and financial markets.

But the Fed is unlikely to be the first major central bank to start cutting interest rates in this cycle, just as it wasn’t the first major bank to hike rates after the pandemic.

Investors need to remember that domestic growth conditions are the primary factor behind a central bank’s decision on monetary policy.

Introduction

It is often thought that the US Federal Reserve Bank is the first to move interest rates in a tightening or loosening cycle. This perception is the result of a few reasons. The US is the largest economy in the world, so trends in the US economy are often seen as a leading indicator for the rest of the world. The large influence of the US economy through financial markets is also important, through the impact to all asset classes, particularly listed equities, bonds and currencies with the US dollar as the world’s principal reserve currency. In this Econosights we look at whether the US Federal Reserve will be the first major central bank to cut interest rates in this cycle.

Global central bank rate decisions

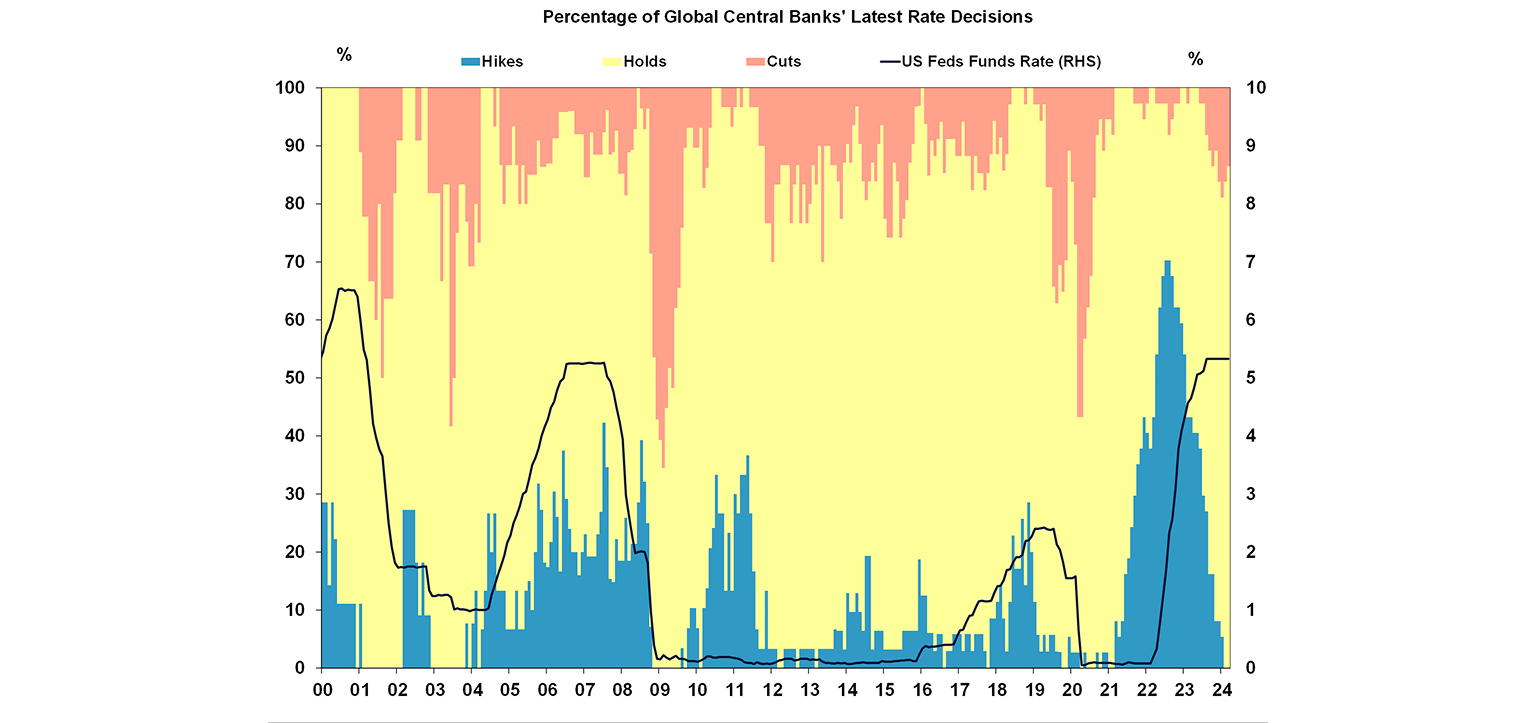

It’s important to remember that there are many central banks around the world apart from the 10 majors that most in the developed world focus on. Most major data agencies track the interest rate decisions for 37 central banks across the developed and emerging world. The next chart looks at the proportion of global central banks cutting and hiking interest rates and the movement in the US Fed Funds rate. It shows that in different cycles, the Fed hasn’t necessarily led the interest rate cycle. In the post-GFC period from 2011-2017 when a moderate chunk of central banks were hiking rates, the US was firmly on hold. In the post-COVID period of interest rate hikes, the Fed started hiking rates after the initial wave of hikes from other central banks had already started.

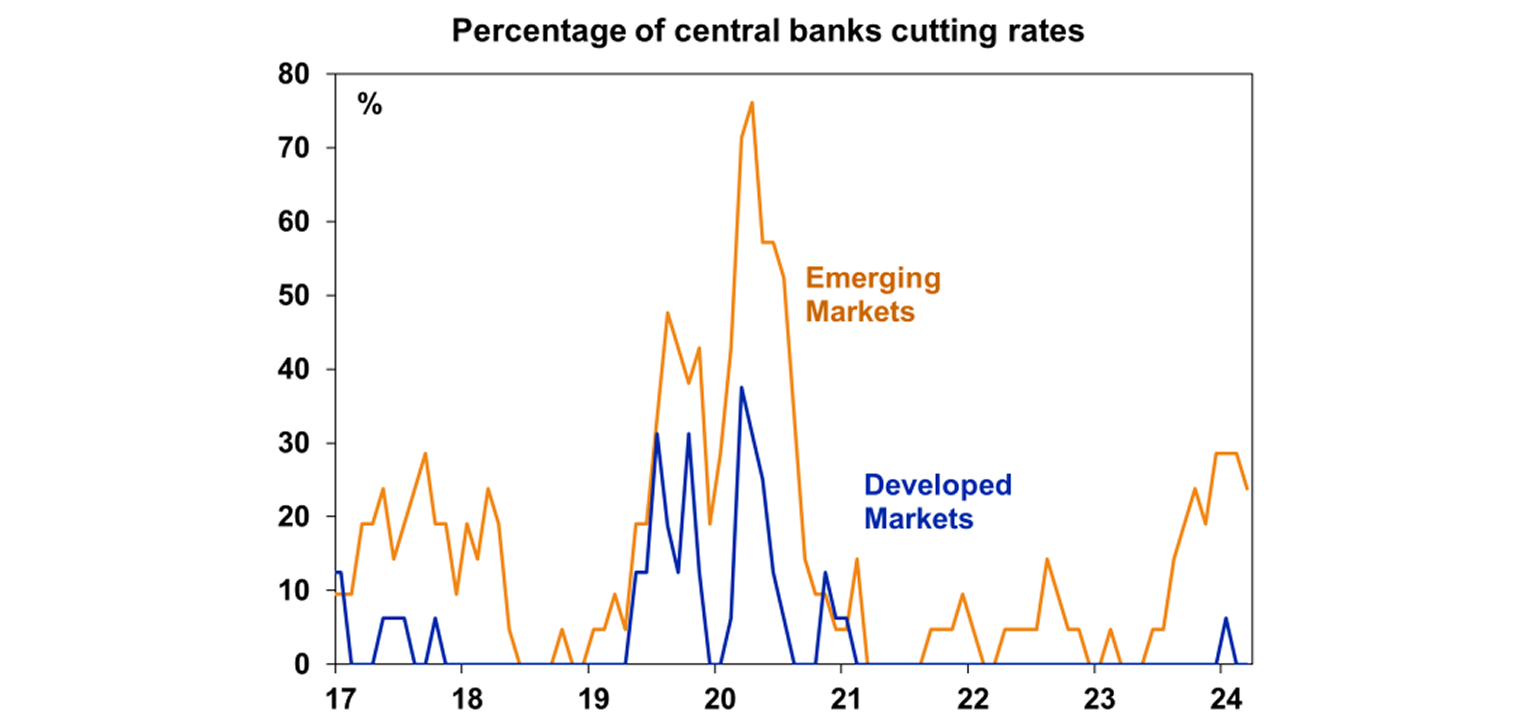

Often, emerging market central banks are the first to either hike or cut interest rates (and by larger amounts) because of higher volatility related to their currencies and to deal with capital inflow.

In the current cycle, most market commentators are talking about when interest rates will start to be reduced across the major developed economies. However, some emerging market central banks have already begun the process of loosening monetary policy (see the chart below).

The current cycle

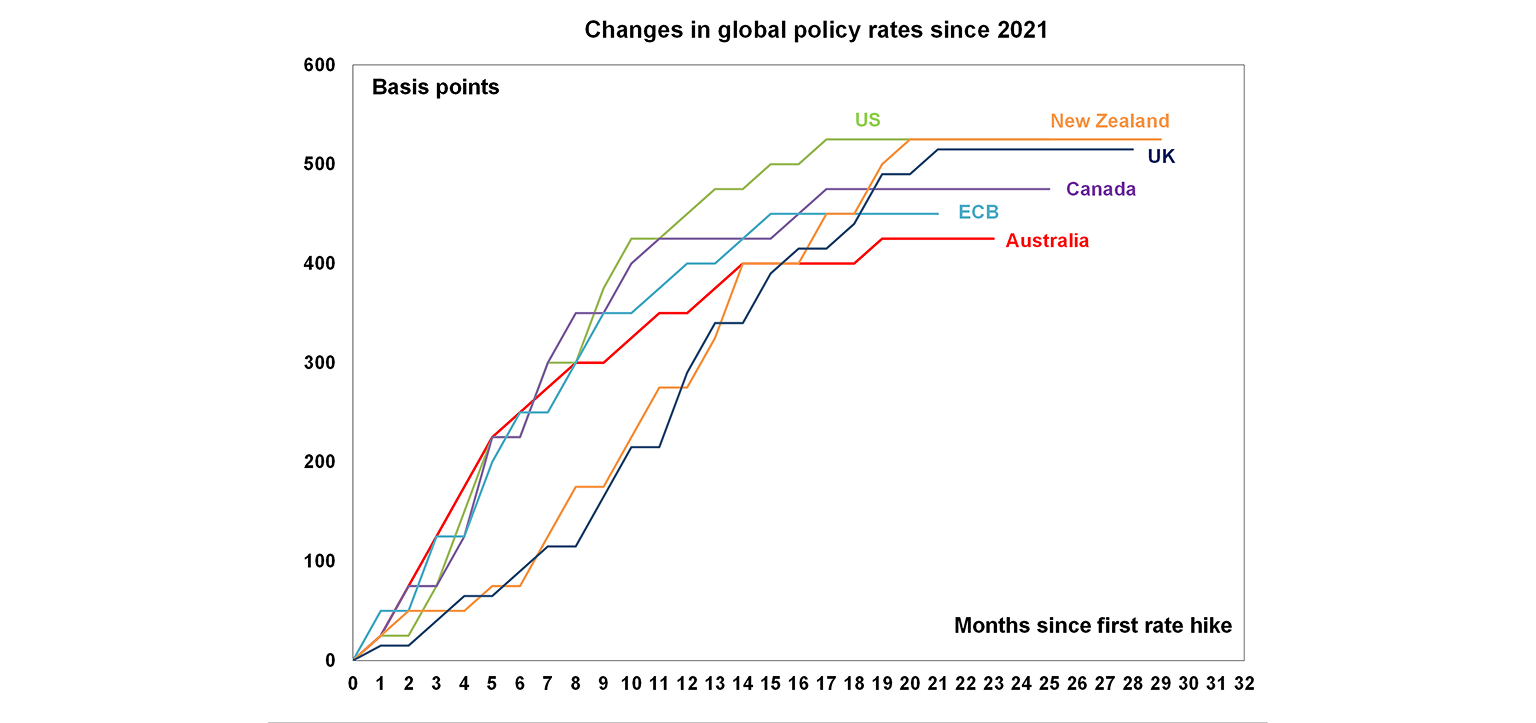

Since 2021, most major central banks that we track have increased their policy rates by 425 – 525 basis points (or 4.25-5.25% - see the next chart).

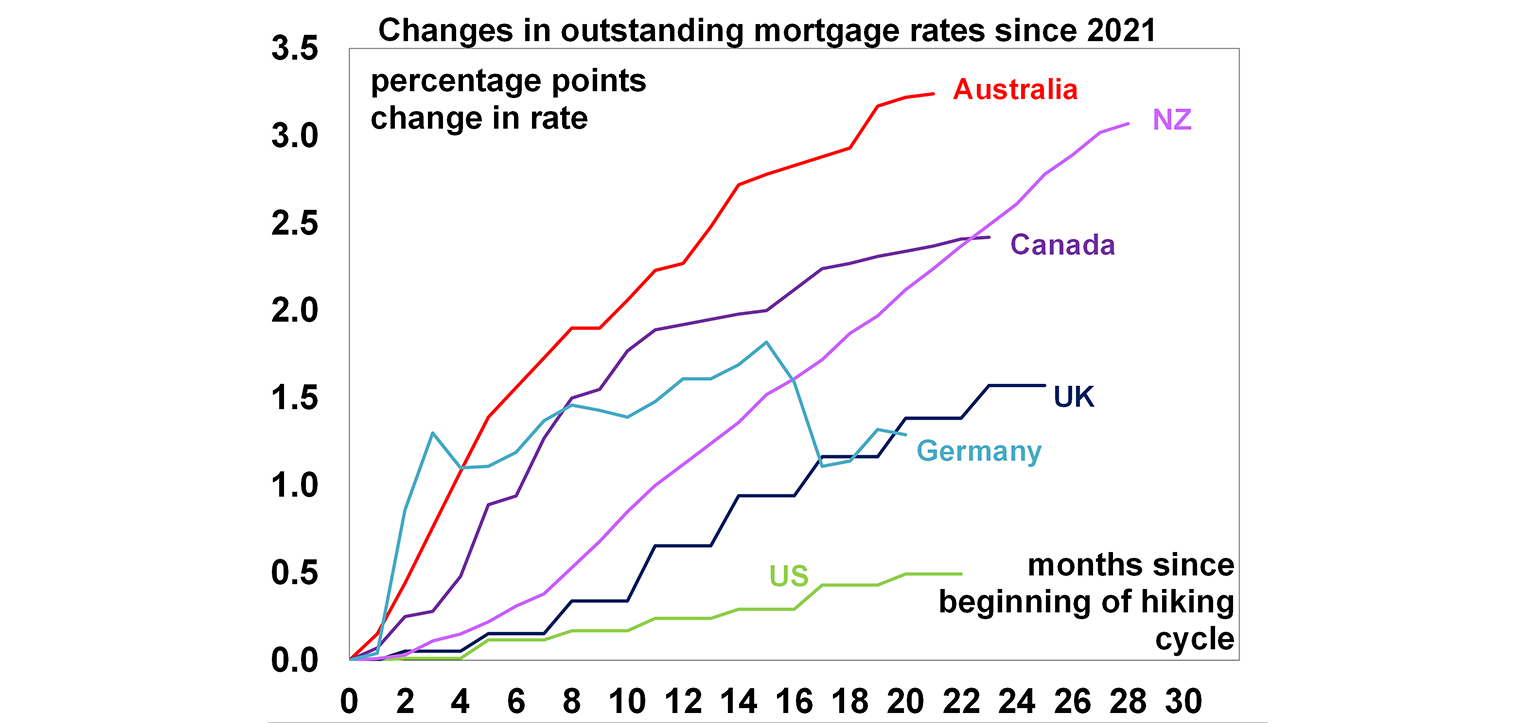

The impact on the economy from interest rate changes occurs through the pass-through to borrowing rates, both to businesses and households. In each economy, the pass-through of changes to borrowing rates has occurred at a different pace, depending on the structure of housing lending (including the length of fixed loans and share of fixed versus variable loans). The chart below looks at the changes in outstanding mortgage rates since 2021. Australia has had the largest increase in outstanding mortgage rates despite having the lowest increase in interest rates compared to its peers. In contrast, US outstanding mortgage rates have barely risen, despite having one of the largest increases in rates across the major central banks.

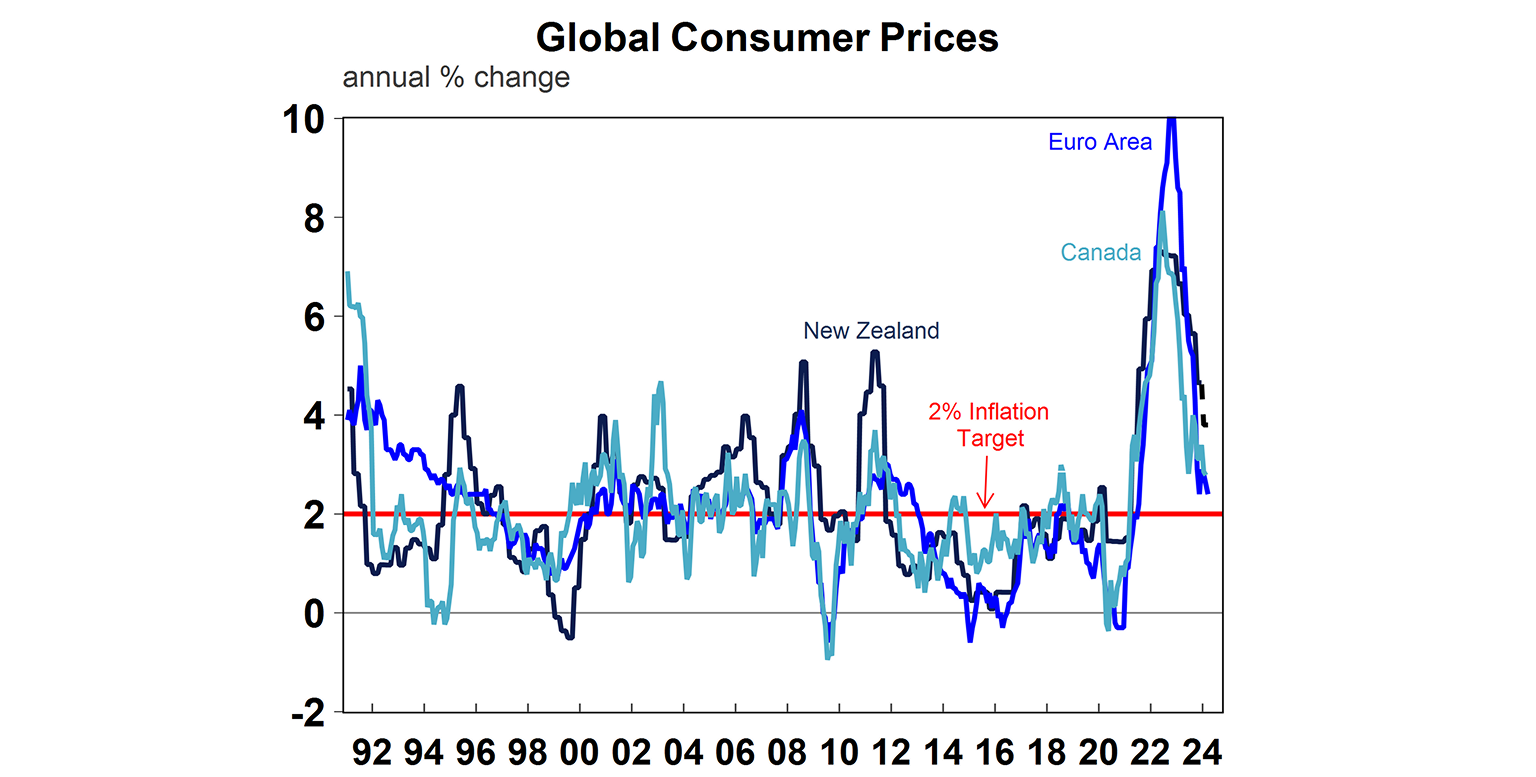

The three major economies that have seen the largest slowing in economic growth in the past year are Canada, New Zealand and the Eurozone. Canada and New Zealand have had some of the largest increases in outstanding mortgage rates across the major economies. And economic growth has clearly softened from the impact of higher rates. New Zealand GDP growth was negative in the second half of 2023 (a technical recession). Canada narrowly avoided a technical recession in the second half of 2023, but growth is low at under 1% per annum. While mortgage rates in the Eurozone have only increased moderately (using Germany as a proxy), Eurozone growth has been basically flat over 2022-23 from the impacts of high energy prices. Inflation has come down considerably in Canada and the Euro area, with headline consumer prices just above the 2% inflation target (see the next chart). Services inflation in New Zealand is still high, despite the slowing in economic growth.

As a result, the Bank of Canada and the European Central Bank are likely to cut interest rates at their June meetings, ahead of the US Federal Reserve who are likely to delay the start of rate hikes until the second half of 2024 given the recent upside surprises to inflation. Lower inflation in New Zealand is needed before the Reserve Bank of New Zealand starts loosening monetary policy, which is likely by July or August. For Australia, we have been expecting the Reserve Bank of Australia (RBA) to start cutting rates in June but the risk is a later start to cuts (like in August) as the RBA appears reluctant to cut interest rates before further confirmation of a slowing in inflation.

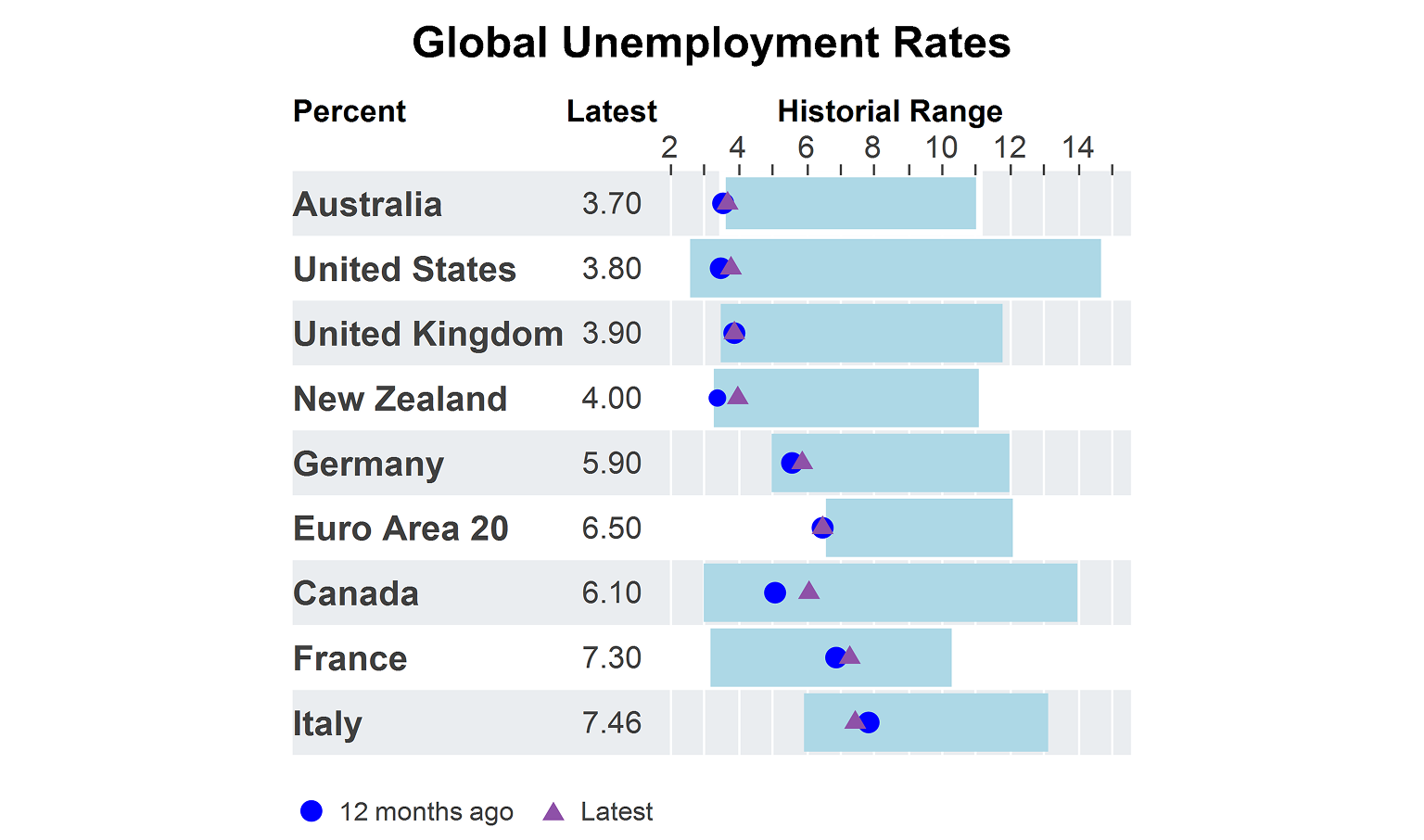

One factor which may delay potential rate cuts is the strength in labour markets which has kept wages growth elevated. Unemployment rates have generally remained low around the world (see the chart below), with unemployment rates around where they were a year ago. Canada and New Zealand have seen some of the larger increases in unemployment.

Implications for investors

Expectations for US interest rates have an important bearing on financial market pricing for interest rates, which influences bond yields and equities. However, investors need to remember that domestic growth conditions are the primary factor behind a central bank’s decision on monetary policy and the Fed is unlikely to be the first major central bank to cut rates in this cycle.

You may also like

-

Weekly market update 06-02-2026 Global share markets mostly fell over the last week amidst increasing worries about tech valuations and overinvestment in AI, some weak US jobs data & ongoing fears of a US strike on Iran. -

Making sense of the start of 2026 In this Econosights we look at some of the key headlines that have been impacting financial markets in early 2026 and what the implications are for investors. -

Oliver's insights - RBA starts the year off with a rate hike The RBA’s decision to hike rates to 3.85% was no surprise with it being about 70% factored in by the money market and 22 of the 28 economists surveyed by Bloomberg expecting a hike.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.