AMP Bank announces that SuperEdge is now officially in market, marking the Bank’s return to residential SMSF property lending for brokers and their clients.

SMSFs are a major part of Australia’s retirement system, with more than 1.2 million Australians as members and over $1 trillion in assets. As more trustees move closer to retirement, many are looking for ways to build long-term wealth with greatercontrol and flexibility, supported by strong safeguards.

Shaped by broker feedback, SuperEdge is backed by AMP Bank’s credit and compliance framework and delivered through a broker-first digital experience designed to reduce rework and improve turnaround times. The launch follows a pilot testing phase.

Michael Christofides, AMP Director of Lending & Everyday Banking said, it was great to be in market with a solution that delivers on demand from brokers and their clients for a secure, bank backed SMSF lending solution.

“With competitive rates and features like optional offset and interest-only, SuperEdge gives trustees greater flexibility in how they manage cash flow while keeping strong safeguards in place.”

Features

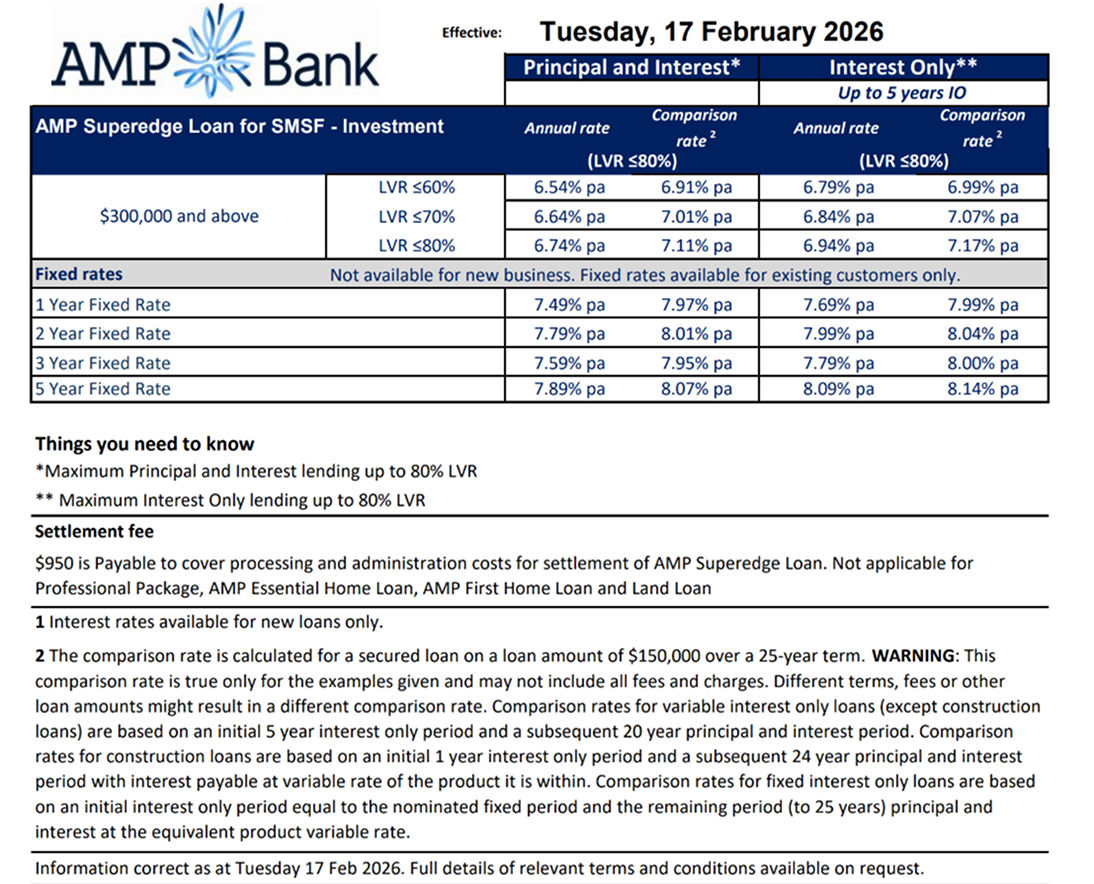

- Competitive rates: Rates will start at 6.54% for principal interest and 6.79% for interest only (more details over the page)

- Repayments: Principal & Interest or Interest-Only, supported by a documented transition plan and annual check-ins

- Optional offset: Supports SMSF cash flow management while maintaining asset separation (no redraw)

- Eligibility and safeguards: Corporate trustee structure only; max 80% LVR; minimum $300,000 SMSF net assets; ≥10% post-settlement liquidity; residential Zones 1 & 2 only (excludes off-the-plan and construction)