Key facts:

- Mini businesses – owner-operators and those with up to 4 employees – make up close to 90% of all businesses

- These businesses are diverse and contribute significantly to employment, innovation, and our economy – yet the term ‘small business’ is used as a catch-all.

- Data on business owners themselves is lacking, and definitions of small business are confusing, compounding the lack of understanding of the sector.

- Better data is critical to enabling stronger support and improved policy for Australia’s smallest and often most vulnerable enterprises.

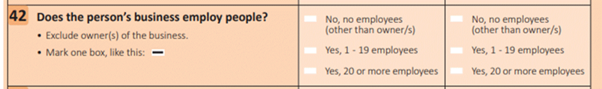

- The ask is simple; update the 2026 Census to include a distinct "mini business" response category.

AMP Bank GO is calling on the Australian Bureau of Statistics (ABS) to count “mini businesses” in the 2026 Census, warning that a failure to capture the unique scale and needs of our smallest enterprise owners risks leaving them overlooked when it comes to policy, lending and support.

AMP Bank GO is championing for the Census to capture data on mini business owners – people with genuinely small businesses – those with up to 4 employees, as well as side hustlers who are not counted and often aren’t represented in industry data.

The reality on the ground

New research from AMP Bank GO highlights the challenges facing mini business owners:

- 7 in 10 mini business owners say running a business is harder than they expected

- More than half (54%) worry about their business failing

- 3 in 5 (62%) don’t feel government support reaches them in starting and running their business, with 2 in 5 (41%) instead relying on family and friends for start-up help.

These finding come amidst debate on the definition of what constitutes a small business. A Fair Work Ombudsman review this July did not make recommendations on updating the small business definition in the Fair Work Act (currently defined as an employer with less than 15 employees). Some employer groups were disappointed by the outcome, arguing that it does not reflect modern business realities.

Australia is home to 2.4 million mini businesses (owner operators and those with up to 4 employees) and growing, representing 88.5% of businesses1. This segment is vital toAustralia’s economy.

Understanding mini businesses is critical to how we can support their success

Through greater understanding of business owners themselves, we will be better equipped to identify support and appropriately equip minibusinesses to survive and thrive.

More granular data can help:

- Government to target grants and tailor support programs, set workplace regulation and compliance, and better calibrate tax and financial relief measures.

- Financial services, tech and other support service providers to innovate and design solutions to meet different needs of mini businesses, including mobile-first solutions, dynamic cashflow tools, flexible lending products, embedded compliance and admin support.