AMP employer super

Digital tools and simple advice with no extra fees, get super close to your super.

Why AMP

Speak with a qualified adviser about advice for your AMP Super across investment, insurance and more with no extra fees.

Lifetime is a feature designed to maximise your overall future retirement income as you grow your super. All for no extra fees.

Assess your investment style and plan for the retirement you envision with smart tools that give you confidence.

AMP Super is there to support you and your family with flexible Lifestages insurance, so you only pay for the cover you need.

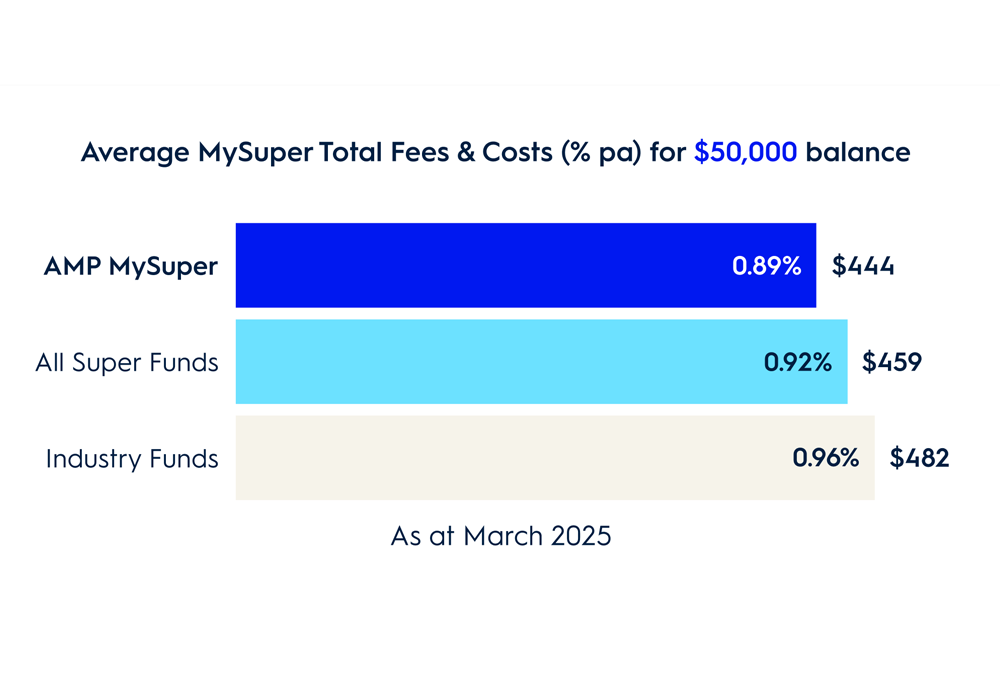

The average fees and costs across AMP’s MySuper options are lower than the average super fund, including the average industry fund2.

Check your balance, switch investment options and manage your insurance all in real time in one place – using desktop, tablet or mobile.

Past performance is not a reliable indicator of future performance.

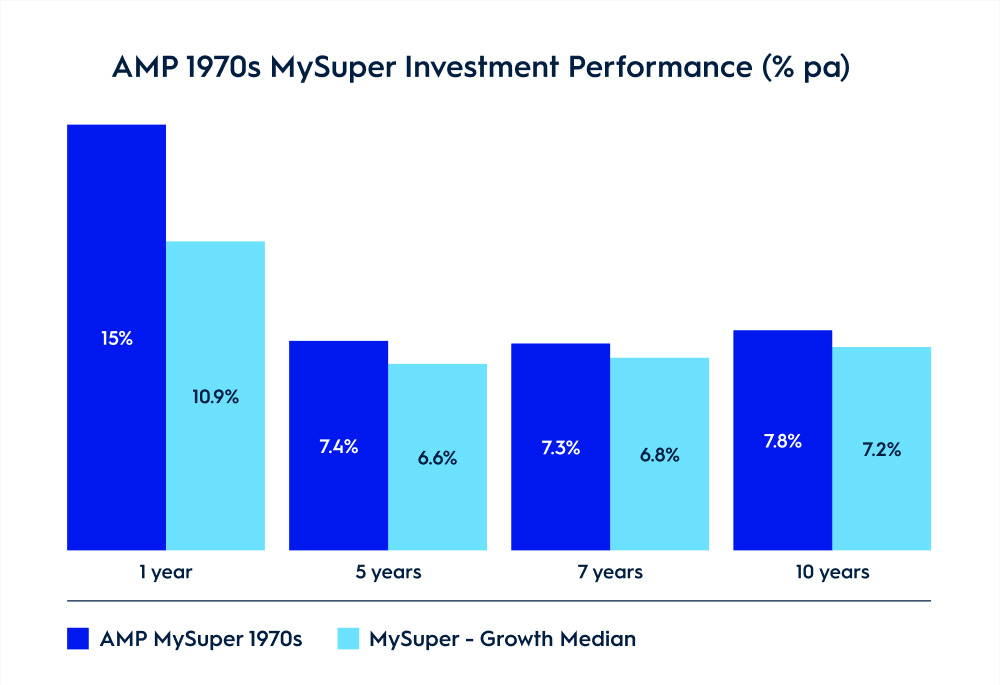

We deliver consistent strong returns versus the industry median, meaning more money for you to retire with.

AMP Super is proud to deliver consistent strong returns for our members across market conditions1.

For investment performance across all AMP MySuper Lifestages options, visit our MySuper dashboard.

The “MySuper-Growth Median” is taken from the Chant West Super Fund Performance Survey December 2024, being the median of all options contained in the MySuper-Growth Table with a growth asset allocation of between 61%-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

AMP’s MySuper fees are lower than the average super fund, including the average industry fund2. Plus, the percentage administration fee that members pay is capped for account balances over $500,0003. This means more money for when you retire.

For a full list of fees and costs applicable to your super account, please see the Product Disclosure Statement (PDS).

Investment performance is as at 31 December 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). Past performance is not a reliable indicator of future performance.

Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey December 2024.

Insurance through super can help protect you and your family if something happens to you. AMP has worked with your employer to provide insurance specially designed for members of the plan. Eligible members may be able to access Death, Total and Permanent Disablement and/or Income Protection insurance without having to provide medical history. Members may also be able to transfer their insurance from other super funds to AMP, so that it’s all in the one place. For further information including eligibility requirements, refer to our Insurance Guide.

Learn more about insurance in super.

1. Get to know the benefits

2. Sign-up to AMP super

3. Tell your employer

4. Make it work for you

AMP Super has been recognised and awarded by the industry for many years. And we’re proud to add more awards to our long list.

Call us 131 267

Email us ampsuper@amp.com.au

Standard Hours

Monday to Friday 8.30am – 7pm (Sydney time)

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

* Eligible members must be born before 19 May 1967, have never met a condition of release, not be part of a Defined Benefit arrangement, and have not started a Transition to Retirement strategy.

* More members can expect to get a higher retirement incomewhen investing in AMP Lifetime Pension, along with an AMP Allocated Pension. Based on analysis performed by a third-party consulting firm, assuming most members are in good health. The analysis made certain assumptions including about the AMP membership profile, product allocation, investment strategy, returns and draw down rates, and the age pension rules and laws at the time of the analysis.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination from AMP at amp.com.au or by calling 131 267.

Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.

The Super Projection is provided by AWM Services to eligible members of the AMP Super Fund.

Simple Super (Intrafund) advice is provided by AWM Services Limited (AWM Services) ABN 15 139 353 496 AFSL 366121 (AWMS) to eligible members of the AMP Super Fund. AWM Services is a wholly-owned subsidiary of AMP. This service may not be offered where it is deemed it is not within the scope of the service or your best interest.

Issued by SuperRatings Pty Ltd (SuperRatings) ABN: 95 100 192 283 a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings use proprietary criteria to determine awards and ratings and may receive a fee for the use of its ratings and awards. Visit superratings.com.au for ratings information. © 2023 SuperRatings. All rights reserved.

Footnotes

1Investment performance is as at 31 December 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). Industry median refers to the “MySuper – Growth Median” and is taken from the Chant West Super Fund Performance Survey December 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

2Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2025 at balances of $50,000 to $750,000.

3If a member holds more than one account, a separate percentage administration fee cap will apply to each account held by the member. For more information, please refer to the product disclosure statement.