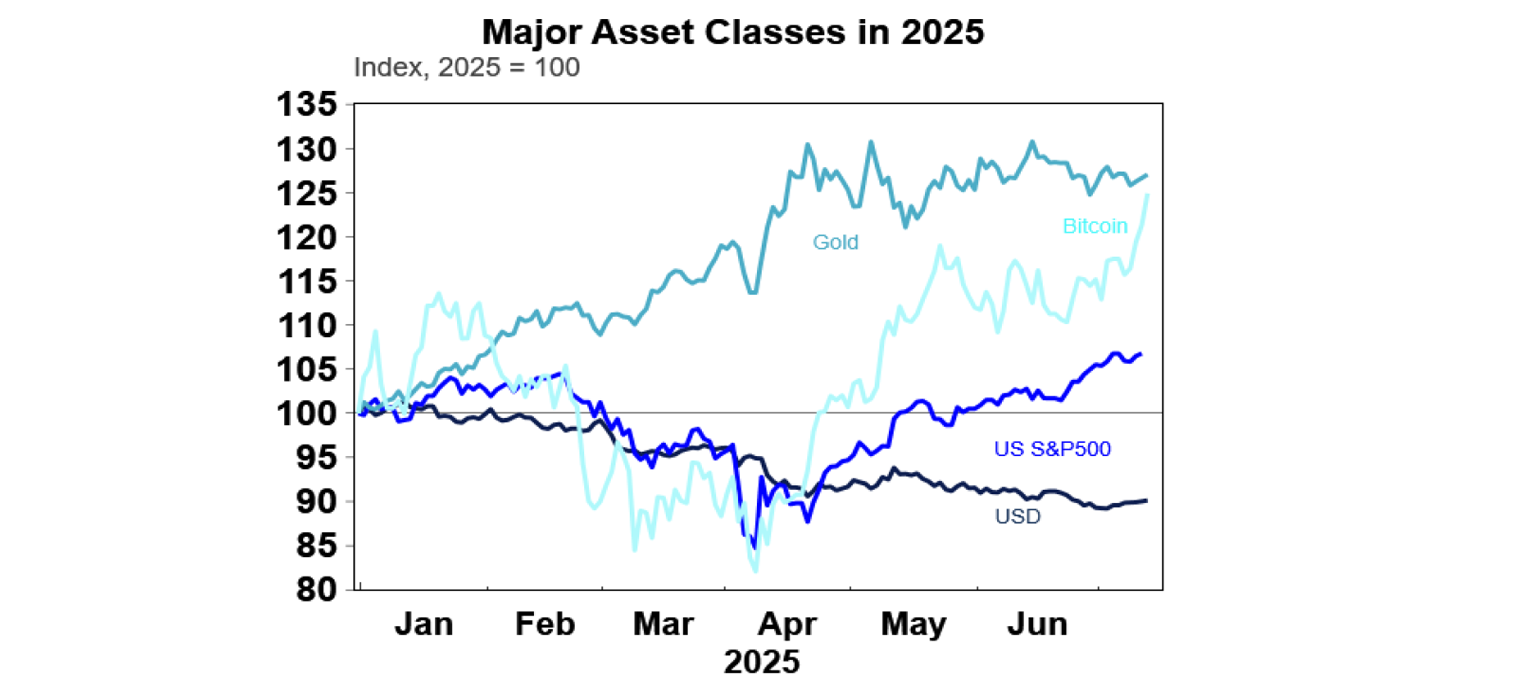

Another week, another tariff fiasco. Initially, the S&P500 brushed off the news and rose to a new record high but then dipped in the Friday trading day and was down 0.3% over the week. The ASX200 was also down 0.3% this week despite the RBA’s surprise decision to keep interest rates unchanged rather than cutting the cash rate, with the largest falls in real estate, tech and consumer staples while utilities, materials and financials were up. Bitcoin had a big week, up to a new record high of $117K, metal prices were mixed with copper down (due to tariffs) but iron ore and steel up. $A didn’t depreciate despite the RBA being on hold, and is still sitting above $0.65 USD and the US dollar rose this week, although is still well down on its levels at the start of the year.

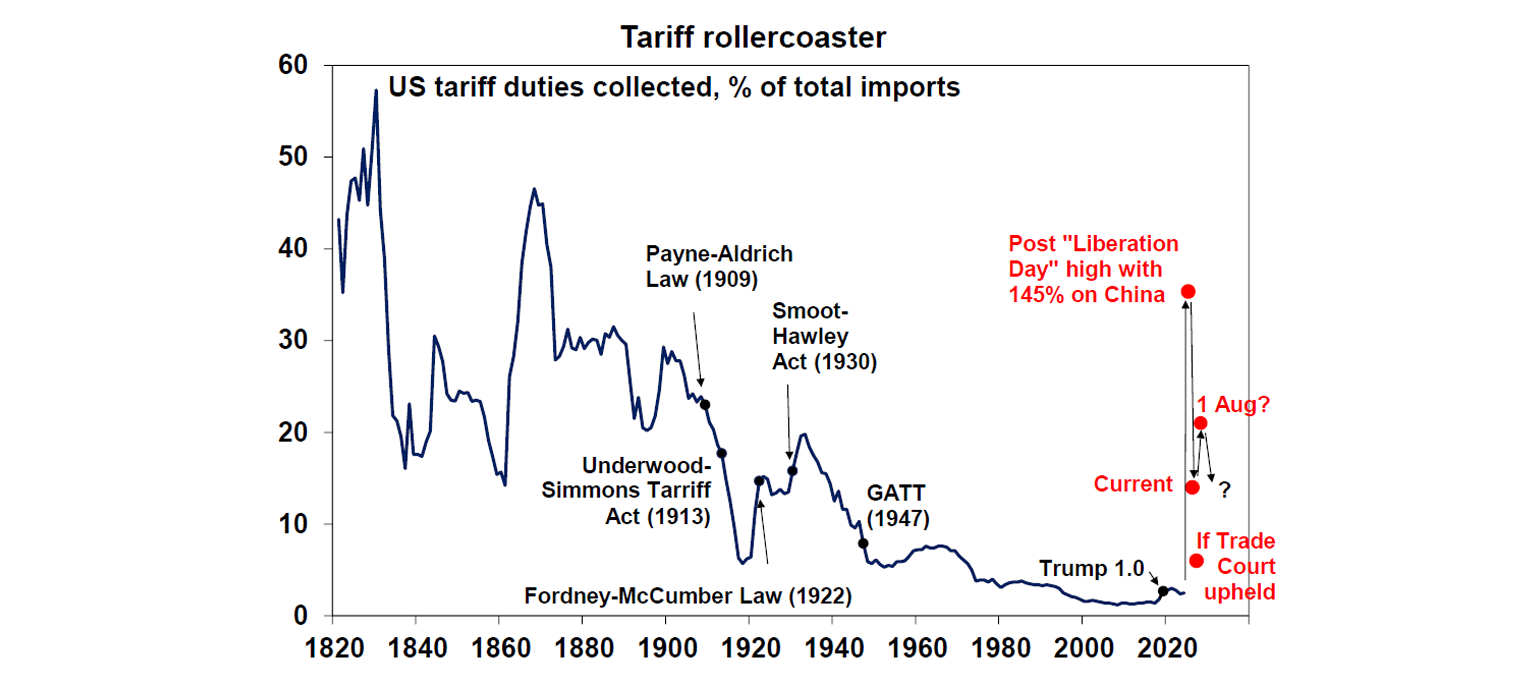

President Trump started sending letters to trade partnerslate last week, detailing the new tariff rates to be applied bythe US on 1 August. Remember that most countries hadgone to a baseline tariff rate of 10% after the high “Liberation Day” tariff rates were postponed until 9 July,along with some specific country and sector carve-outs. There have only really been 2 trade deals announced so far (UK and Vietnam) and a “truce” with China. The US letters were more threatening than conciliatory and most of all they were theatrical as they sounded like love letters! The key take outs from this week’s announcements was a 25% tariff on Japan and South Korea, a 50% tariff on Brazil(which is high because it included pressure to drop charges against former President Bolsonaro), a 50% tariff on copper(and its unclear whether this includes copper products too),a 200% pharmaceutical tariff (which starts in a year) and as I am writing this weekly he has announced a 35% tariff on Canada (which already had 25% with a lower rate for oil and not subject to USMCA products) and a “20% or 15%” rate on the remaining countries. But these tariff rates may endup being watered down, with the President saying he was“not 100% firm” on the deadline. Questions were also asked about what formula was used to calculate the tariffs (after the issue with the Liberation Day rates applied) but this oneseemed just as bad with Trump saying the rate was “based on common sense, based on deficits, based on how we’ve been over the years, and based on raw numbers”. Based on these latest trade threats, the average US tariff rate would go around 20% from 1 August, which still isn’t close to its Liberation Day high (see the chart below) but obviously well above the 3% level pre Trump 2.0.

What is likely to happen from here? Countries that received the letters are likely to start responding as Trump said that if no deal is done then rates will go back to Liberation Dayhighs and if countries add tariffs back on the US, the US will retaliate with that rate. So, we will probably see countriessign vague frameworks while the US declares “victory” and then negotiate the tariffs down as time goes on. It’s clear that Trump and his team are getting annoyed with some countries not bending over backwards to do trade deals with them and they want tariff revenue to keep increasing. The stock market at record high is also probably emboldening Trump to keep going with the tariffs! The major trade deal we are waiting for is the one done with the European Union as it accounts for a hefty 18% of US imports in 2024. There was also news that the US and India are working through a deal that would see Indian tariffs below 20%.

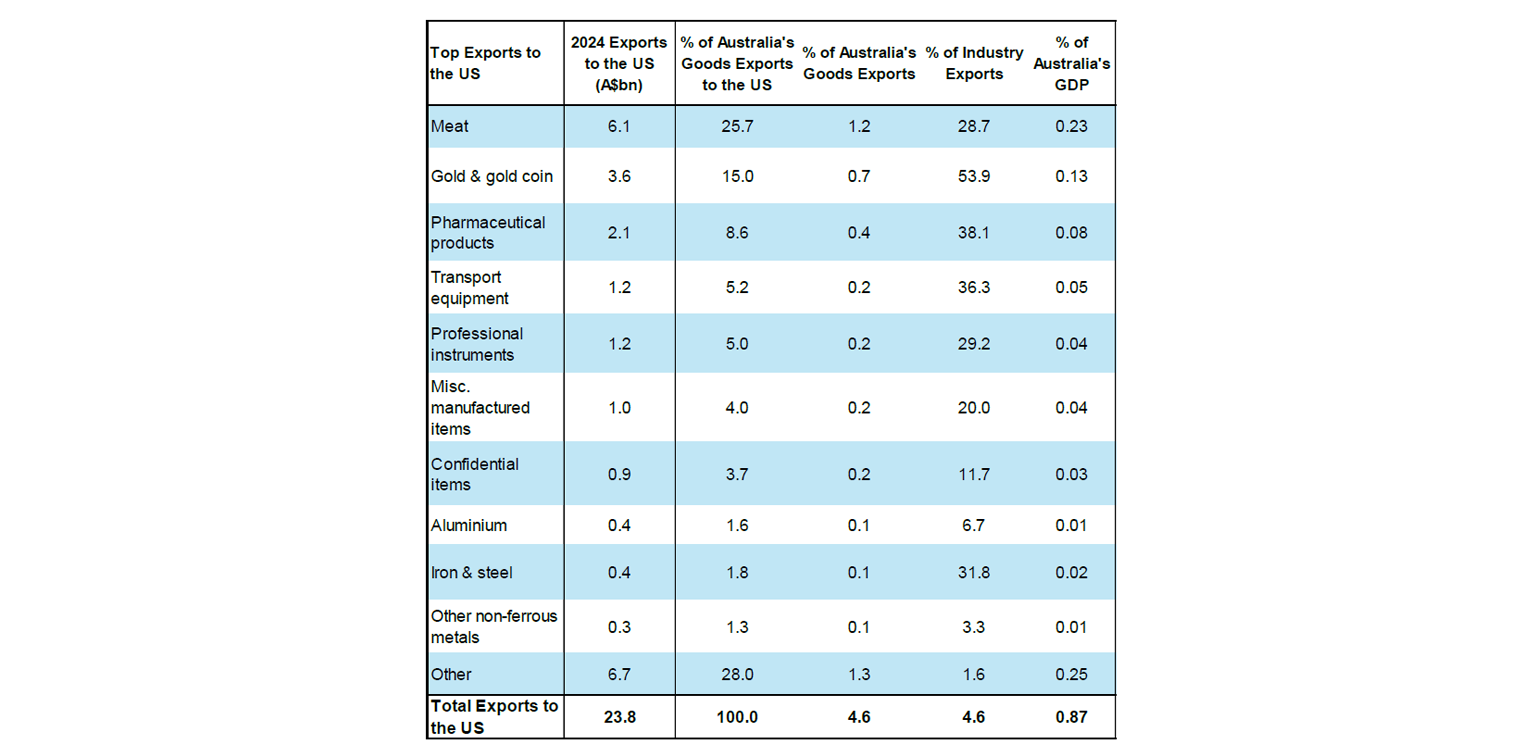

For Australia, the biggest impact from this week’s announcement was in regard to pharmaceuticals and copper. Australia exported only $53mn worth of copper tothe US in 2024 (just 0.2% of total US exports) but pharmaceuticals are worth a larger $2.1bn (see the table below). Most of these products are blood (plasma) which accounts for 88% of pharmaceutical exports to the US, followed by retail medicines, vaccines and gauze/bandages. These tariffs aren’t finalised and are subject to negotiation but is a clear risk for major producers like CSL (which already have US operations and have announced a further increase in those) but from a macro point of view, total US exports are just 4.6% of Australia’s total exports and 0.87%of GDP – this is small.

Australia’s major exports to the US

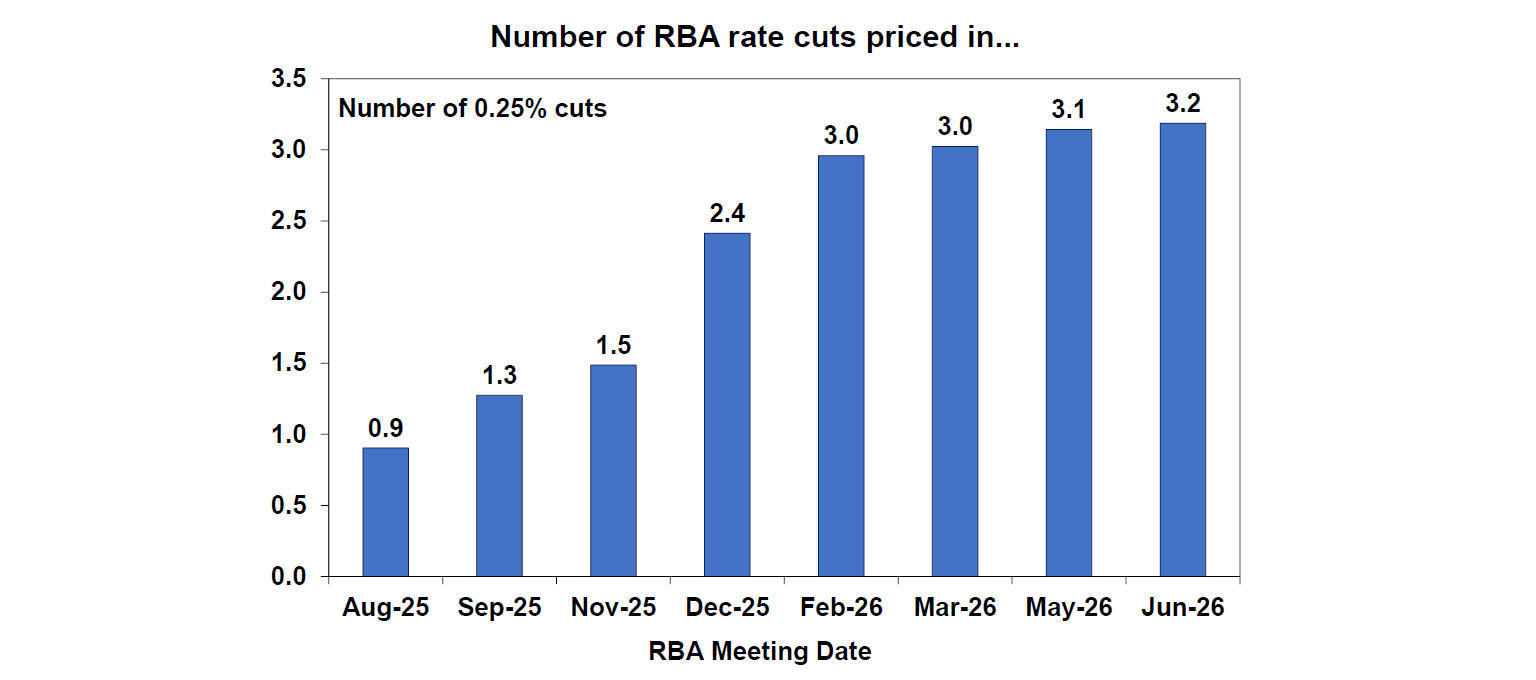

The Reserve Bank surprised market and economist expectations (including ourselves) by keeping the cash rate at 3.85% at this week’s meeting while expectations were fora 0.25% rate cut (with markets pricing in over a 90% chance of a cut and 27/32 economists surveyed by Bloomberg also expecting a cut). It doesn’t happen too often that the RBA surprises markets like this. While we think the RBA should have cut interest rates because monetary policy is still restrictive which is evident in the poor March quarter GDP data, the slowing in May jobs growth and the May monthly consumer price indicator showing trimmed mean inflation around the middle of the 2-3% target band, the RBA said it was more of a question of timing, rather than direction and was waiting for more confirmation that inflation is headed sustainability back to target. This indicates that the RBA is not willing to shift policy based on the monthly CPI prints preferring to wait for the full quarterly data (because the monthly data is not reliable yet). The Board noted that dwelling costs and durable goods inflation in the monthly data looked elevated. We get the full quarterly inflation data later this month, so it will just mean waiting a matter of five weeks (the next meeting date) for the central banks assessment on inflation, with the high probability that a rate cut will occur at the next meeting. While delaying a rate cut by five weeks does not risk a downturn, it probably does risk seeing growth take longer to pick up to more normal levels and the chance that inflation could undershoot the 2-3% inflation target. We are a bit more pessimistic about the Australian growth outlook over the next 6 months than the RBA.

This was also the first time that the unattributed votes ofthe 9 person board were publicised and in this meeting 6 members voted for no change and 3 voted for a rate cut. So the no change decision in July was a “dovish hold” and we expect the rate cutting cycle to now be extended, with another interest rate reduction in August, November, February 2026 and May 2026. Financial markets are pricinga 90% chance of an August rate cut, with the cash rate expected to be at 3% by mid-2026.

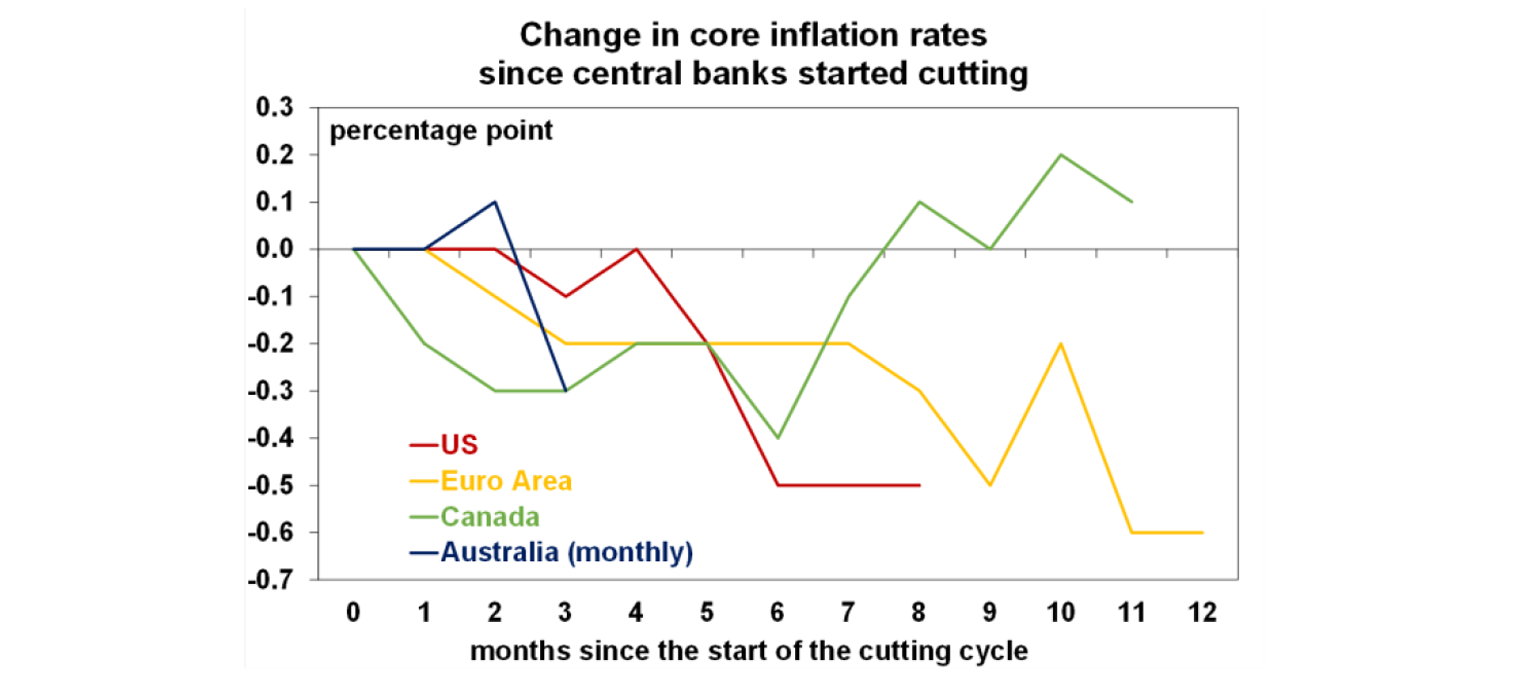

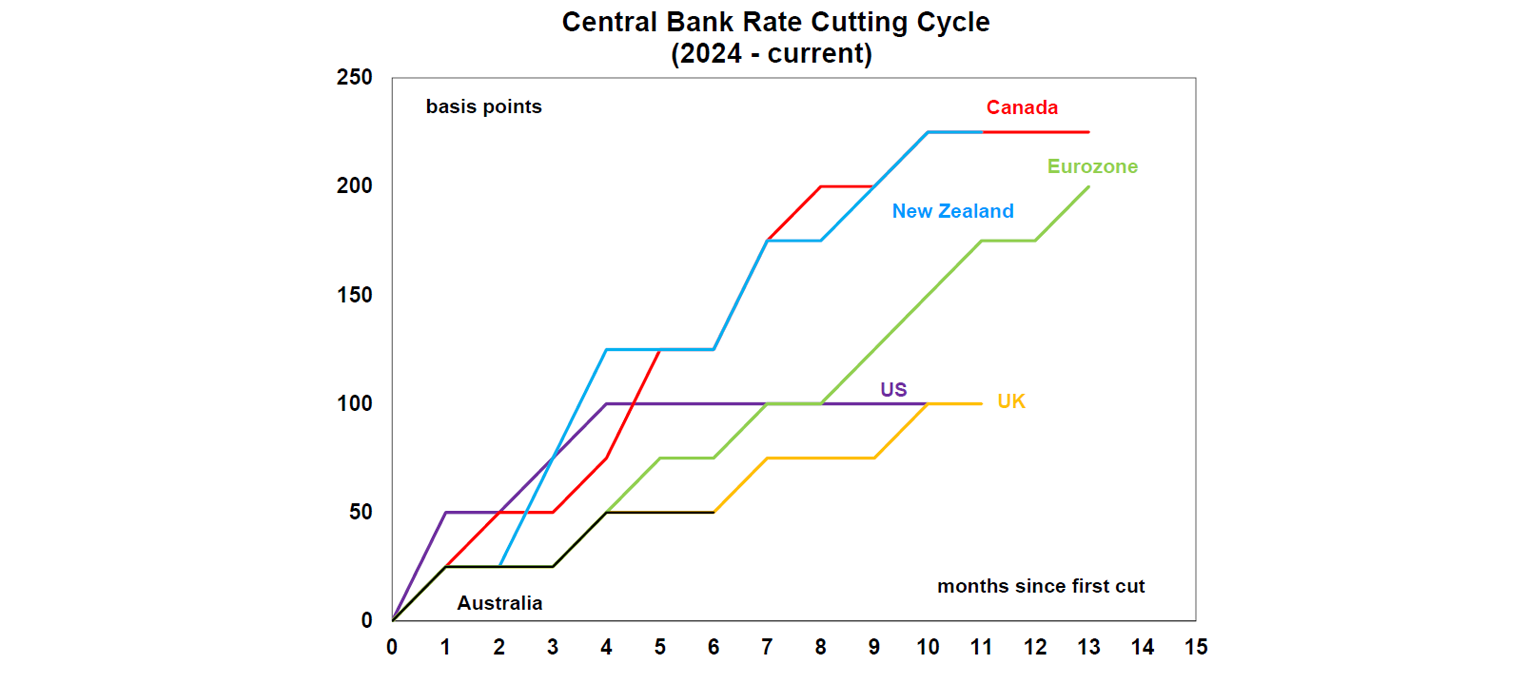

If the RBA is worried about the impact of inflation, the experience from around the world shows that rate cutshave not led to a big re-acceleration in inflation (see the chart below).

If this was America then the PM or Treasurer may be calling Bullock “too late” like Trump has been critiquing Powell! Even this week he said that Powell was “whining like a baby about non-existent inflation” and again said that Powell should resign if he mislead Congress over renovations to the Fed Reserve headquarters. This puts Chalmers prior comments that the RBA was “smashing the economy” into perspective!

Answering a journalist question, Governor Bullock said that the RBA now (post review) would not be guiding the marke to a certain position on interest rates (via speeches ormedia) if it believed market pricing was wrong. This makes sense as the whole point of the Board meeting is that experts debate the right path for monetary policy, and there should not be an expected outcome before the Board meeting or blindly accepting the RBA’s staff recommendation. The need to guide the market to a certain position may be done if a tantrum in markets is expected toa surprise decision which has happened before in the US.The market reaction to the RBA this week was minimal with shares flat and only a small rise in the $A.

Major global economic events and implications

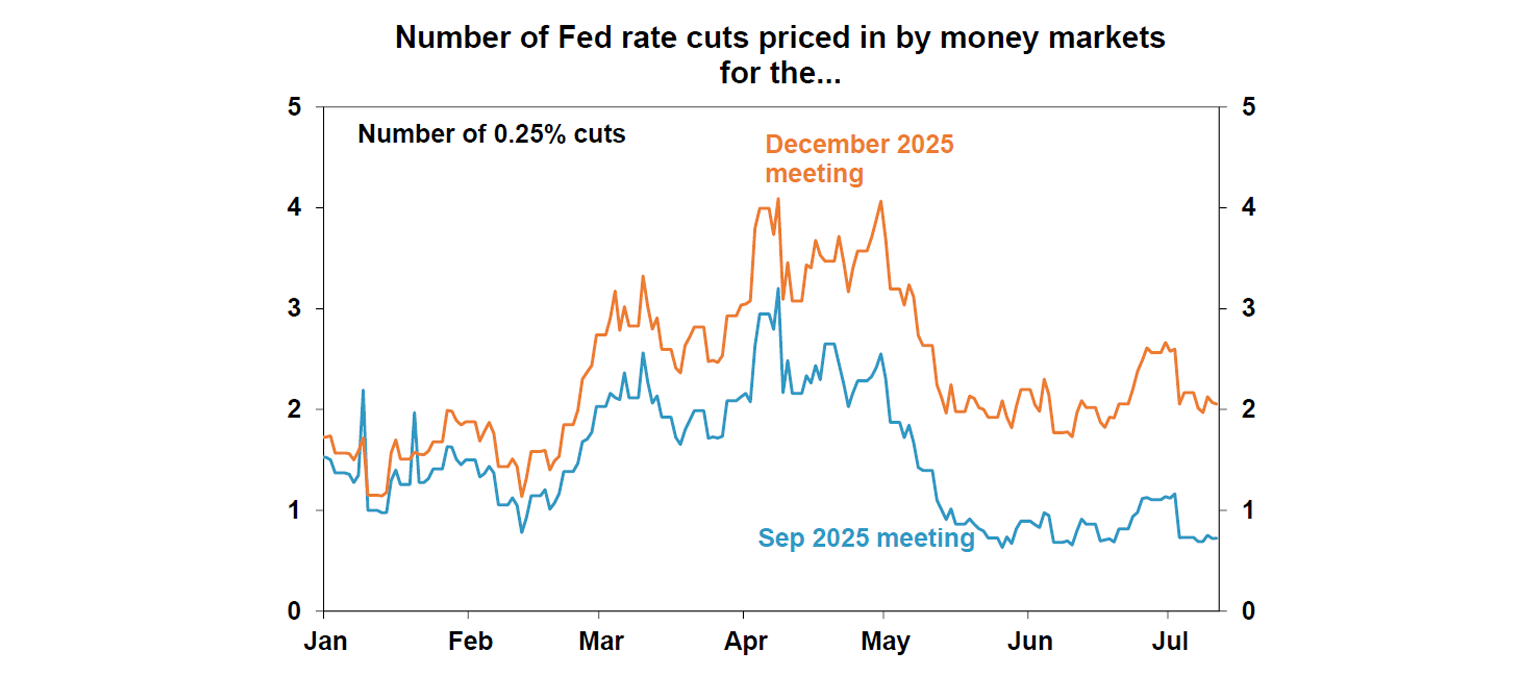

The Fed’s meeting minutes for the June meeting when the Fed funds rate was kept unchanged at 4.25-4.5% showed a split board, with “a couple of participants open to considering a reduction in the target range for the policy rate as soon as the next meeting” but “other participants saw the most likely appropriate path … as involving no reductions in the target range” which means that some Fed members are of the view that interest rates have already reached neutral. In terms of the tariff impact on the economy, views were mixed (as expected), with many expecting tariff impacts to hit the inflation data over the(US) summer, several members worried about unrelated (totariffs) price increases, “many” thought the tariff impacts could be limited if trade deals are reached quickly, or companies adjust supply chains and “several” thought price resistance from consumers could limit pass-through. There was broad agreement that monetary policy was “well positioned”but that a “gradual softening” of labour market conditions was expected. A September Fed rate cut is likelyif the economic data continues to weaken.

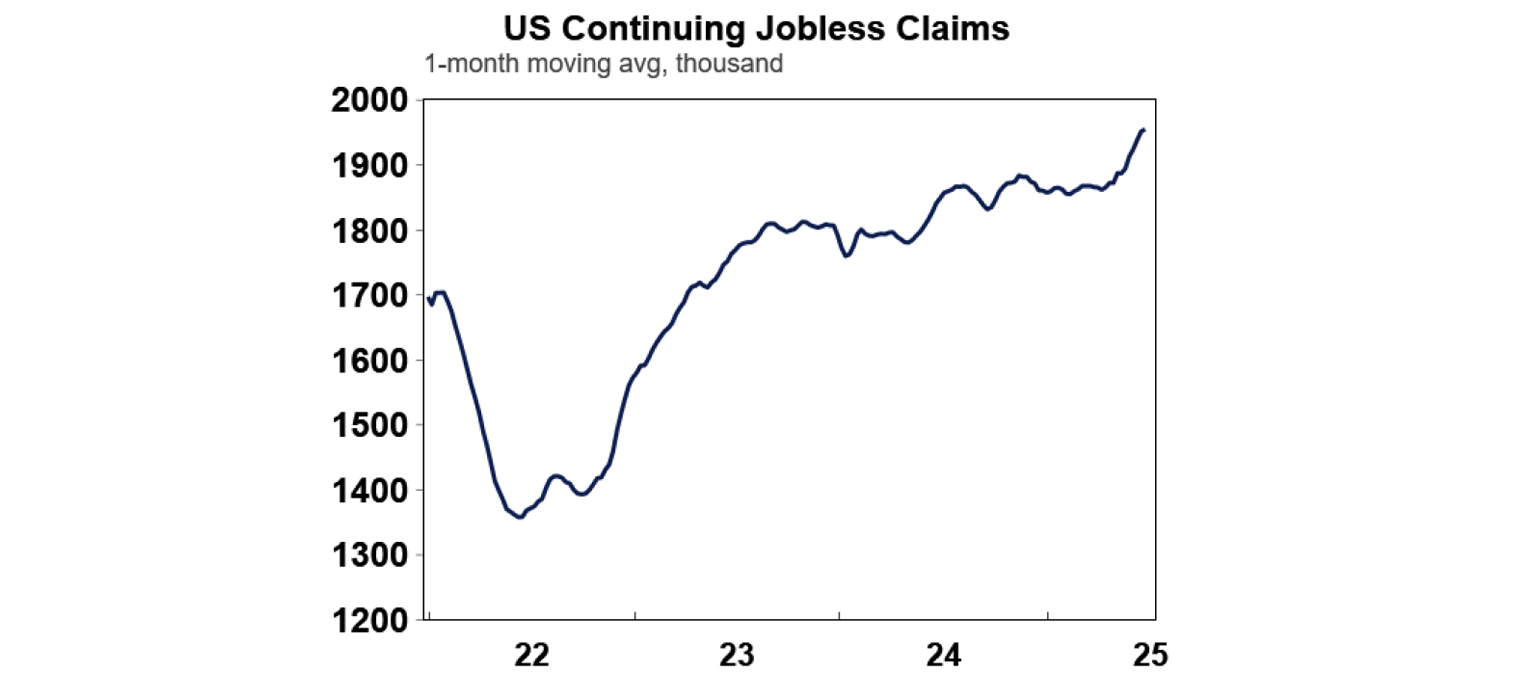

US initial jobless claims were lower than expected, droppingto a 7-week low but continuing claims rose by 10K to a 3 ½year high (see the chart below), a sign that those who are unemployed are having trouble finding work.

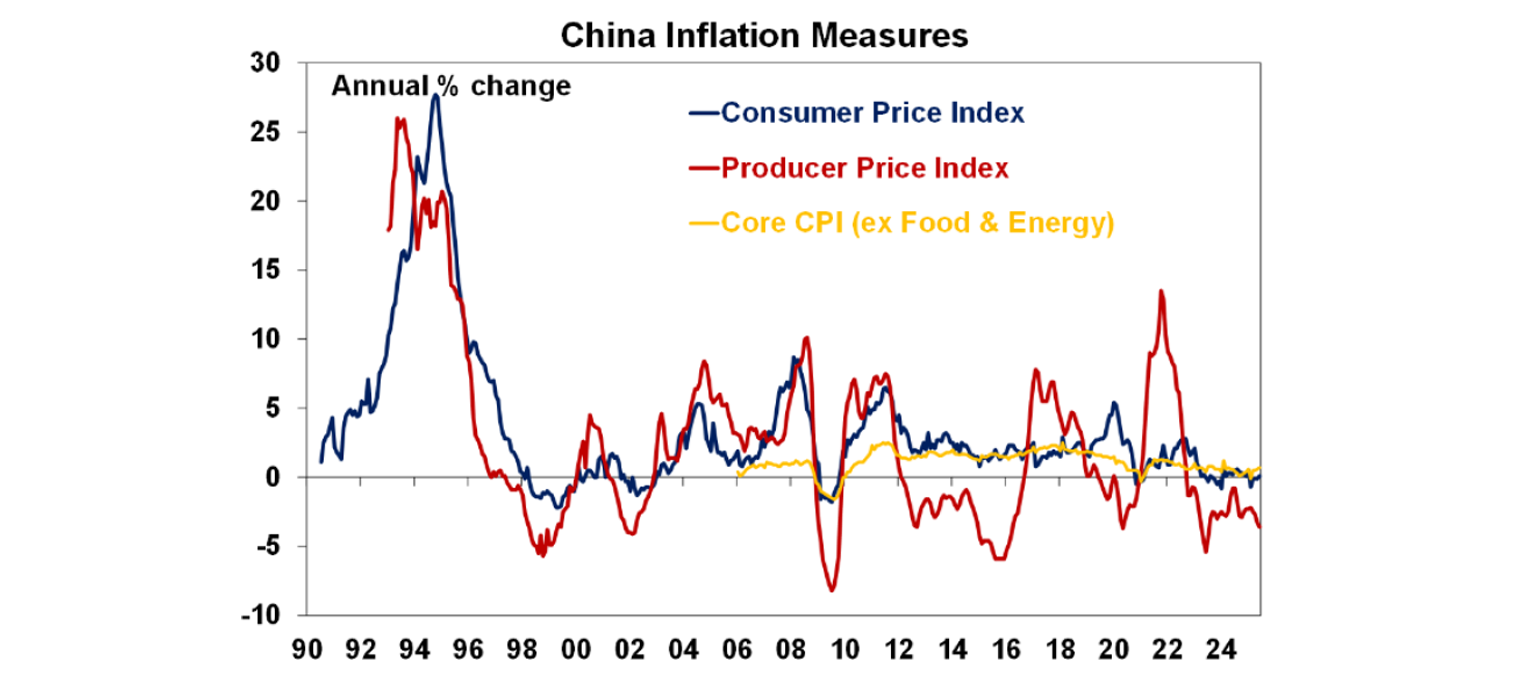

Chinese consumer prices surprised on the upside (finally!), up 0.1% over the year to June, although this is still very low. Producer prices disappointed though, down 3.6% over the year which means that business profits are still under pressure and this was occurring before tariffs started.

The RBNZ decided to keep the overnight cash rateun changed at 3.25% (as expected) but have already cutrates by 2.25% but are still likely to cut again by 0.25% atthe next meeting in August.

Australian economic events and implications

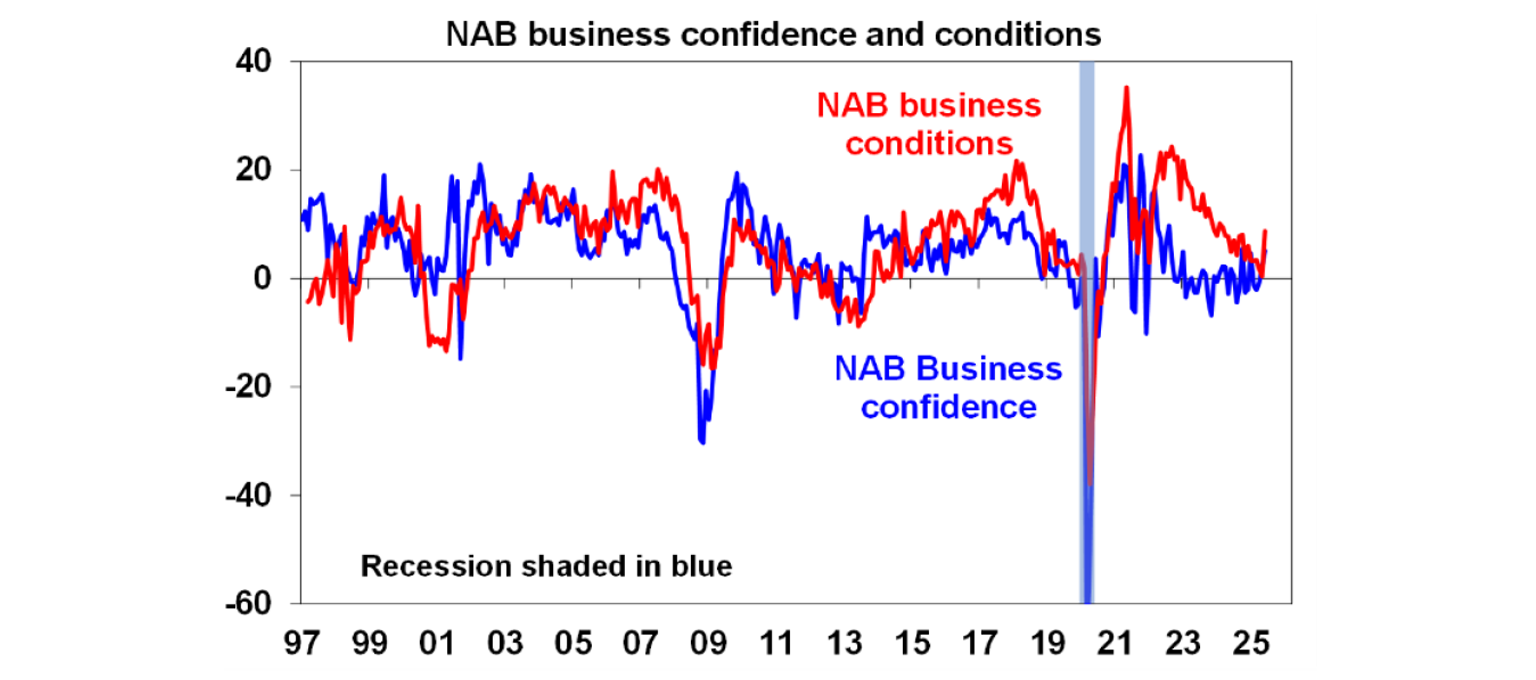

The monthly NAB business survey surprised higher in June, with business confidence up 3pts to a reading of 5 and business conditions up 8pts to a 9 index point reading (see the chart below). This follows the recent trend up in consumer confidence but its unclear if this is just a one-off boost or a genuine lift in activity.

The price indicators continue to trend down, but are still above pre-Covid levels.

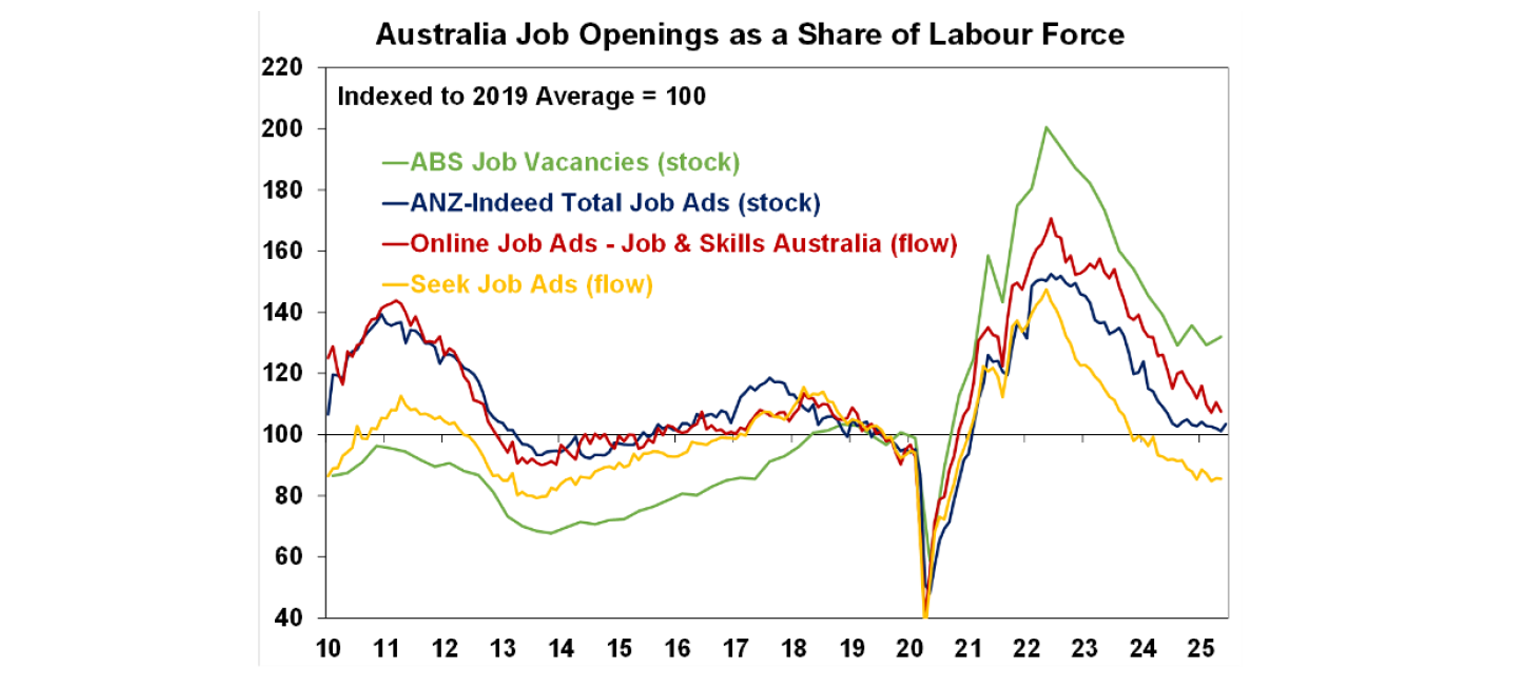

ANZ job advertisements rose by 1.8% in June but are 0.4% below a year ago. Job openings as a share of the labour force have been declining and are now mostly back to pre-Covid levels (see the chart below). We expect a further lift to the unemployment rate from here.

What to watch over the next week?

In the US, June consumer price figures are expected to be up 0.3% over the month of June, or 2.7% over the year with core at 0.3% or 3.0% which is a tad higher than the Fed would like. Import prices for June are expected to be up by 0.2%, but customs duties (tariffs) are not measured here, so there is no direct tariff impact.

US June retail sales are likely to be flat in June, after a decline in the prior month and a sign of a weakening consumer.

Other US data includes June housing and building starts. And the University of Michigan consumer sentiment figures and inflation expectations.

Chinese data next week is June exports (expected to be up) and import data, the June quarter GDP (likely to be 5.1% over the year to June), the June retail sales figures, industrial production and fixed asset investment data.

In Australia, the June labour force data is expected to show a rebound in jobs growth but only by 10K which would take the unemployment rate up to 4.2% (from 4.1%). While the labour market is not weak, it is softening with public sector jobs slowing and the private sector not improving. The July consumer confidence figures are also released.

Outlook for investment markets

Share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We now see home prices rising around 5 or 6% this year given the more dovish RBA.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.