Business Overdrafts

No, we only offer Business Overdrafts to business customers.

Yes, we currently offer Business Overdrafts of between $2,000 and $50,000 for Single Director Companies and between $2,000 and $20,000 for Sole Traders.

Overdraft limits are assessed by us when you apply to ensure any amount we offer to you is appropriate. We do not currently offer Business Overdraft limit increases.

We’ll always try and stop payments that take you over your limit but if this does happen (for example, for offline transactions, pre-authorisations and interest, fees and charges) we won’t apply any additional fees or charges. You can manage the amount you need within your agreed Overdraft Limit in AMP Bank GO by setting a Cap.

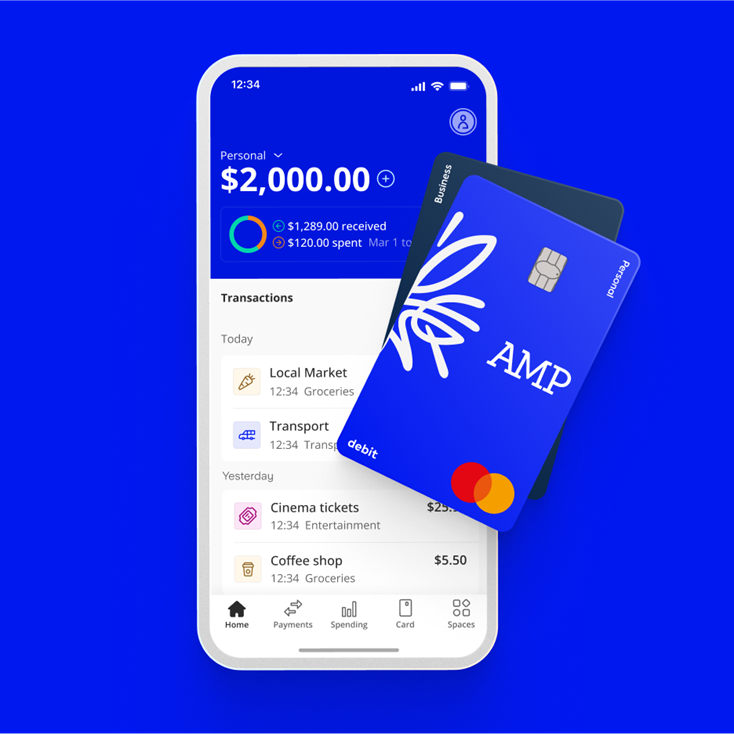

You can see the Business Overdraft Interest Rate applicable to your Business Overdraft in AMP Bank GO. If you have a Business Overdraft already, just tap on your agreed Business Overdraft Limit on the main screen. If you don’t have a Business Overdraft yet, you can check our website for the current interest rate.

You can apply for a Business Overdraft in the app. We currently offer Business Overdrafts to sole traders with an ABN and to single director companies.

For a single director company as part of the application process, we will ask you some questions to assess your eligibility and what limit you can afford, as well as run a credit check on you and your business (in the instance of single director companies only). Sole directors will be required to provide a personal guarantee.

If you are struggling to manage your Business Overdraft, we're here to help. Please contact customer service via AMP Bank GO we’ll be able to discuss the options available for paying off your overdraft.

If you meet the following criteria, you may be eligible to apply for a Business Overdraft:

- A registered Sole Trader or Single Director Company with an ABN or ACN

- Registered more than 6 months ago

- Registered for GST

- Over 18 years of age

- You are a citizen or permanent resident of Australia

- If you haven't been declined on a previous Business Overdraft application in the past 30 days

- Business Overdraft must be used for business purposes

- Single Director: Will be required to provide a personal guarantee.

A Business Overdraft includes an upfront establishment fee, interest on any amount you use and a monthly service fee calculated as a percentage of your approved Business Overdraft Limit.

For current fees and charges, visit our Business Overdraft page or refer to our Account Limits, Fees & Charges brochure. For current rates, refer to our website.

A Business Overdraft enables you to access funds up to an agreed limit via your Everyday Business Account to help you manage the ups and downs of your day-to-day cashflow. An overdraft is an extension to your Everyday Business Account to be used for short-term lending.

You can access your Business Overdraft through your Everyday Business Account, using the usual methods: your debit card or via AMP Bank GO including money transfer, PayID or BPAY.

A Business Overdraft can be used for business expenses such as cashflow management, to pay suppliers, for payroll or to purchase supplies.

For further details on why you may not be eligible for our Business Overdraft right now, please contact our customer service team via AMP Bank GO and we would be happy to assist you.

A Business Overdraft can help you maintain cashflow, provides easy access to funds and you only pay interest on what you use.

A personal guarantee is a commitment made by a business owner (in this case, the single director) to personally repay a business loan if the business fails to do so. Our Business Overdrafts require a personal guarantee from the director for single director companies.

If you exceed your Business Overdraft Limit you will be required to immediately repay all amounts that exceed your approved limit.

Before you submit your Business Overdraft application, we will ask for your consent to complete a credit check. The credit check involves AMP Bank accessing credit reports from credit reporting bodies. These reports contain information, such as your credit history that assists us in assessing your application.

Yes, you will need to first open an Everyday Business Account in order to be eligible to apply for a Business Overdraft. This is because the Business Overdraft product is a feature of an Everyday Business Account.

If you are declined for a Business Overdraft, you won't be able to re-apply for 30 days.

Yes, you'll be able to re-apply if your Business Overdraft expires. You will need to re-enter your application details and we will need to run a new credit check.

| If you are offered a Business Overdraft, the offer is only valid for 14 days before it expires, in which case you'll have to apply again. We will also need to run a new credit check. |

In the case that the interest rate on your Business Overdraft changes, we'll notify you via AMP Bank GO as soon as we can and no later than the day when the change takes effect.

We calculate interest at the end of each day, Sydney time, using the daily percentage rate (the annual interest rate divided by 365, even in a leap year). On the final day of each month we calculate the accrued daily interest for that month and charge it to your Everyday Business Account on the first day of the following month so that it forms part of the amount you owe us.

If you close your Business Overdraft we will charge any accrued interest on the first day of the following month. For examples of how interest is calculated on a Business Overdraft, please read our Business Overdraft Terms and Conditions.

To repay your Business Overdraft, simply deposit funds into your Everyday Business Account. Any money deposited into your Everyday Business Transaction Account after you have used any part of your Business Overdraft Limit is used first to repay your Business Overdraft.

| There is no set minimum amount that you will need to pay back each month. However, to minimise interest you should try to pay it back as quickly as you can. |

You can manage your Business Overdraft in AMP Bank GO by setting a Cap. This will reduce the amount available for you to use. By setting a Cap, you’re instructing us to decline any transactions that exceed your Cap, except for offline transactions, pre-authorisations and interest, fees and charges payable.

You can request to reduce your Business Overdraft Limit via AMP Bank GO at any time. First make sure you've repaid any drawn amount to the new limit, and then reach out to our customer service team to assist you further.

You are able to cancel your overdraft via AMP Bank GO at any time. First, make sure you've repaid any of the outstanding balance on your overdraft. Interest that has been accrued in that month will be debited to your Everyday Business Account on the first day of the following month.

Other help and support

-

Customer care

We know that you might need additional help, around products, deceased estates, legal documentation or customer care. Please get in touch with us.

-

Needing financial support?

When life throws unexpected challenges your way, your financial situation can change dramatically. In difficult times, we'll support you and help you get back on track.

-

Feedback & complaints

If you are unhappy with our products or service, we want to know about it. We treat every complaint seriously and aim to resolve your concerns as quickly as possible.

-

Ways to contact us

Are you overseas? See our overseas travel support.

Important information

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available here.

For accounts with BSB number 939 900, that you access via AMP Bank GO, the Terms and conditions that apply are available here.

For accounts with BSB number 939 200, that you access via the My AMP mobile app, the Terms and conditions that apply are available here.