Protect your online banking

We have security measures in place to safeguard your money, because we are committed to providing you with a secure banking experience. When we come across any hoaxes or scams that target customers, we will raise them to your attention. To practice safe browsing behaviour, please remember:

- We'll never send an email containing a link to My AMP.

- We'll never ask for your passwords or full TelePIN.

- When accessing My AMP, always open a new browser window and type amp.com.au.

Learn more about online security such as protecting your online access, preventing card fraud, and NPP fraud monitoring, along with how to distinguish between our SMS and potentially fraudulent SMS.

Below are our recent security alerts.

Recently, several AMP Bank customers have reported receiving fraudulent calls from scammers pretending to be part of our AMP Bank Fraud team. These scammers claim to be calling customers to discuss alleged fraudulent transactions on their AMP accounts, asking for 2FA codes, usernames, passwords, and other personal information.

Please note:

- AMP Bank Fraud Team will never send you a SMS code for verification nor will we ask you to verify your 2FA code.

- AMP Bank will never ask for your username or password over the phone

- Never share your 2FA code with anyone- not even AMP.

If you receive an unsolicited call from someone claiming to represent AMP Bank, to ensure the caller's legitimacy, advise them that you will call back on 13 30 30. If you believe your personal details may have been compromised, contact us immediately by calling 13 30 30 (option 2).

Stay safe and vigilant.

Some AMP customers are receiving email notices related to class actions initiated against AMP some time ago, which AMP is defending. Given the legal process, our contact centre team cannot address specific questions about the matter. If you receive a notice, please contact the lawyers identified in the notice.

There has been reported scam activity in relation to one of these notices. If you are concerned about the legitimacy of any phone call or other communication, please do not share your personal details, and contact Slater and Gordon directly to verify the communication. Thank you for staying vigilant.

We want to warn our customers about the latest variation of the ‘Quantum AI’ investment scam, which now targets cryptocurrency investors. Scammers claim to use artificial intelligence (AI) and machine learning algorithms to generate high returns on crypto trading.

How the Scam Works:

1. Fake Celebrity Endorsements – Scammers create deepfake videos or fake news articles featuring well-known people promoting ‘Quantum AI’ as a revolutionary crypto trading platform. These endorsements are completely fake.

2. Misleading Ads – They may advertise on social media, YouTube, and search engines, directing people to fraudulent trading platforms.

3. Initial Deposit – Victims are asked to deposit an amount, often around $250 in cryptocurrency or cash, to start trading.

4. Fake Trading Dashboard – The scammers provide access to a rigged online platform that shows fake crypto profits to convince victims to invest more money.

5. Remote Computer Access – Some scammers ask victims to install remote access software (like AnyDesk or TeamViewer), pretending they need it to help with setup. This lets them steal passwords, drain crypto wallets, and access banking details.

6. Blocked Withdrawals – When victims try to withdraw funds, scammers demand extra fees or taxes or claim that funds are locked due to “trading regulations.” In the end, they disappear with the money.

How to Protect Yourself:

• Don’t Trust Celebrity Endorsements – If you see an investment promoted by a famous person, double-check its legitimacy. Scammers often use AI-generated fake videos.

• Research Before Investing – Check ASIC’s Investor Alert List – ‘Quantum AI’ is already flagged as a fraudulent and unlicensed platform.

• Never Allow Remote Computer Access – Legitimate investment platforms will never ask to remotely access your device. If someone insists, it’s a scam.

• Be Wary of Crypto Promises – No AI or trading bot can guarantee profits in crypto trading or other financial instruments. Be skeptical of platforms promising “risk-free” or “guaranteed” returns.

• Contact your bank immediately if you’ve made a payment.

• If you paid in cryptocurrency, contact your crypto exchange to see if the funds can be frozen.

• Report it to Scamwatch, ASIC, and the police.

Stay Safe & Informed

For more information on investment scams, visit Moneysmart.

Always double-check before investing your money—if it sounds too good to be true, it probably is.

AMP are aware of scammers impersonating AMP’s Chief Risk Officer, Nicola Rimmer-Hollyman, via email and attempting to trick individuals into business dealings with fake insurance prerequisites with ‘AMP Insurance’.

Please be aware that ‘AMP Insurance’ does not exist, AMP does not underwrite insurance bonds and has no affiliation with ATF Investments.

Fraudulent emails have come from nicola.rimmer-hollyman@ampinsurance-au.com.

Remember to always ask yourself if the message or call is fake. Only contact businesses or government using contact information that you find yourself from their official website or app.

Stop. Check. Protect.

More information on scams can also be found on the ACCC’s website Scamwatch.

Please remain vigilant.

Some of our customers are receiving scam emails from people who claim to work for our AMP Investments business. The emails talk about exclusive term deposit and fixed bond rate investments. These are not related to our AMP Bank or AMP Investments business.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30.

More information on scams can also be found on the ACCC's website Scamwatch.

Be aware of an ongoing scam where customers are receiving text messages or calls from someone claiming to be from the AMP Bank Fraud Team. They're requesting money be transferred to another account, or to share authorisation codes and passwords. These are not related to AMP Bank in any way.

When calling you, we will never send you an SMS code to verify your identity, nor will we ask you to provide your username or password to us. If you receive a call from someone claiming to be from AMP, advise them you will call them back on our publicly listed number 13 30 30 to confirm they're legitimate.

Beware of scammers posing as buyers on online platforms such as Gumtree or Facebook Marketplace. They'll ask if they can pay using PayID and obtain the sellers PayID email or mobile number so they can send a fake PayID email or text. The fake email or text will state there's an issue receiving the payment due to PayID limits and request the seller to transfer funds to increase this limit so payment can be received.

Example of fake email or text:

"Dear Customer, you have received a payment of ($100.00AUD), but we have a problem crediting your account. Your payment of ($100.00AUD) is pending as the status of your account limit being limited and is not a business limit user or Merchant limit. This will not make us credit your account until the limit gets (switched) to a business account limit or merchant limit which gives your account large features and unlimited access to any amount. Take these urgent steps to expand your account to a business(merchant) account limit. Contact the buyer to send in an additional payment of ($500.00AUD) to your account so it can be expanded to a business account limit or Merchant limit. As soon as it verified your account will be fully credit with the sum of ($600.00AUD) and upgraded immediately. Note: An alert has been sent to the buyer in regard of the additional payment of ($500.00 AUD) he/she has to send to you. We will secure this transaction with high priority that neither the payer and the payee will lose their money in this transaction because it a business transaction”.

Be cautious of additional payments - you never have to send money to receive a payment. Block and report the buyer. Don't send any money. If you have been a victim of a scam, please report it to the ACCC to help protect others from being scammed.

If you believe you have shared your details or transferred funds to a scammer, please contact AMP Bank immediately on 13 30 30.

We're aware that there is a WhatsApp group impersonating Dr Shane Oliver and AMP Capital. They're promoting a fraudulent scheme with 'Sockeye Exchange'. The scam has been reported to both the e-Safety commissioner and ASIC.

Dr Shane Oliver is not involved with nor promotes any trading schemes, including on social media. For your financial safety, do not engage with this WhatsApp group.

Please remain vigilant.

Recently AMP has been contacted by several customers who received a call from a scammer pretending to be from our AMP Bank Fraud Team.

The scammer claimed to be calling to discuss alleged fraudulent transactions occurring in the customers' AMP accounts. The scammer asked for the customers' username and password and phoned from a private number.

AMP will never call you from a private number and ask you for your username or password.

If you receive an unsolicited call from someone claiming to be from AMP, to be certain the call is legitimate, please advise you will call them back on 13 30 30.

If you believe your details have been compromised in any way, please alert us immediately by calling 13 30 30.

A Threat Actor has sent malicious emails attempting to impersonate AMP staff using the email format “firstname.surname @ amp-corporate.com” and "firstname.surname @ amp-markets.com". It's likely they will continue with this format, replacing the name following "amp-" so please also be cautious with any address format appearing as "firstname.surname @ amp-[word].com". These are not genuine AMP email addresses. These emails are not authorised or sent by AMP. The malicious emails have the Subject line: “AMP – Promotional Offer”.

Do not click on any link in the malicious email or open any attachment.

The AMP Cyber Defence Centre (CDC) is now investigating instances of these malicious emails to prevent them from continuing to be sent by the Threat Actor.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30.

More information on scams can also be found on the ACCC's website Scamwatch.

Please be aware of scammers falsely representing AMP Bank with an ongoing scam operation targeting customers and the broader community through the use of emails. The scammers are impersonating AMP Bank staff in an effort to entice the customer to invest in a false product featuring the AMP Bank name and brand. Please be aware this is not a legitimate product from AMP Bank.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30.

More information on scams can also be found on the ACCC's website Scamwatch.

AMP is aware of scammers impersonating AMP's Chief Economist, Shane Oliver, on social media and attempting to trick Australians into signing up for fake AMP investment scams.

Please be aware these are not legitimate accounts. AMP will never attempt to solicit information or contact you about investment opportunities through social media.

Please do not engage and if you are concerned that you may have been targeted by scammers, please contact us on 13 30 30.

More information on scams can also be found on the ACCC’s website Scamwatch

AMP Capital is aware of an ongoing scam operation targeting customers and the broader community, offering inflated interest returns available through a fictitious investment vehicle titled Capital Protected Fixed Income Government Fund. Through the use of phishing emails, malicious operators are sending falsified e-brochures to people in an effort to entice them to invest in a false product that features AMP Capital’s branding.

Please be aware this is a not a legitimate product from AMP Capital.

AMP Capital does not approach potential customers via electronic direct mail (EDM) nor does the company solicit personal or financial information via email.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

More information on scams can also be found on the ACCC’s website Scamwatch

This week AMP was contacted by a customer who received a call from a scammer pretending to be from the AMP Bank Fraud team. The scammer was able to share details of recent transactions on the customer's account which provided reassurance to the customer of the authenticity of the call. After the conversation, the scammer attempted to transfer funds from the customer's account.

If you believe your details have been compromised in any way, please alert us immediately by calling 13 30 30.

View previous security alerts

AMP have received numerous calls this week from customers who have been contacted by scammers pretending to be from AMP Bank. Scammers are trying to phish for customer information whilst they sell term deposits from AMP Bank. Commonality with the customers is that they are searching for the best term deposit rates and entering their details on a malicious website. Fake emails provided to the customers were from legal@amp-legal.com, accounts@amp-td.com or @amp_enquiries.com.au.

Please be aware of scammers falsely representing AMP. AMP Ltd and AMP Capital are aware of an ongoing scam operation targeting customers and the broader community. Through the use of phishing emails, malicious operators are impersonating AMP Capital employees in an effort to entice them to invest in a false product featuring the AMP name and brand. Please be aware this is a not a legitimate product from AMP Ltd.

AMP Ltd or AMP Capital do not approach potential customers via electronic direct mail (EDM) nor does the company solicit personal or financial information via email.

If you are concerned that you may have been targeted by scammers, please contact us on 133 030.

More information on scams can also be found on the ACCC’s website Scamwatch.

- The ABA has launched a new campaign to raise awareness of the increasing threat of scams, via emails, phone calls and texts – find out more.

- AMP Bank will never send an email containing a link to My AMP, will never ask for your passwords or full tele-pin and will never ask you to provide personal or financial information over email.

- If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

- More information on scams can also be found on the ABA’s website.

- AMP Bank is aware of an ongoing scam operation targeting customers and the broader community, offering inflated interest returns available through a fictitious investment vehicle titled Ausnet Holdings Bonds. Through the use of phishing emails, cold calling and fake websites malicious operators may be seeking to entice people to invest in a false product that features AMP Bank’s branding.

- Please be aware this is a not a legitimate product from AMP Bank.

- AMP Bank will never send an email containing a link to My AMP, will never ask for your passwords or full tele-pin and will never ask you to provide personal or financial information over email.

- If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

- More information on scams can also be found on the ACCC’s website Scamwatch.

We are aware of an ongoing scam operation targeting customers and the broader community offering financial advice via a group acting as Australian Securities Administration Limited through the use of a falsified website featuring the brand and trading licence details of Australian Securities Administration Limited.

Please be aware that this is not a legitimate service from AMP.

If you are concerned that you may have been targeted by the scammers, please contact us on 131 267 from 8.30am to 6.00pm Monday to Thursday and 8.30am to 5.00pm Friday (Sydney time). You can also make a report to the Australian Cyber Security Centre at ACSC. More information on scams can also be found on the ACCC’s website Scamwatch.

Please be aware of scammers falsely representing AMP Capital. AMP Capital is aware of an ongoing scam operation targeting customers and the broader community, offering inflated interest returns available through fictitious investment vehicles titled the Capital Protected Fixed Income Government Fund and the Woolworths Group Fixed Rate Bonds. Through the use of phishing emails, malicious operators are sending falsified e-brochures to people in an effort to entice them to invest in a false product that features AMP Capital’s branding.

Please be aware this is a not a legitimate product from AMP Capital.

AMP Capital does not approach potential customers via electronic direct mail (EDM) nor does the company solicit personal or financial information via email.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

More information on scams can also be found on the ACCC’s website Scamwatch.

AMP Capital is aware of an ongoing scam operation targeting customers and the broader community, offering inflated interest returns available through a fictitious investment vehicle titled Capital Protected Fixed Income Government Fund. Through the use of phishing emails, malicious operators are sending falsified e-brochures to people in an effort to entice them to invest in a false product that features AMP Capital’s branding.

Please be aware this is a not a legitimate product from AMP Capital.

AMP Capital does not approach potential customers via electronic direct mail (EDM) nor does the company solicit personal or financial information via email.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

More information on scams can also be found on the ACCC’s website Scamwatch

The ACCC partnered with the creative minds behind The Checkout TV series (formally The Chaser) creating a humorous podcast series “This is Not Your Life”. The series is being used to promote Scams Awareness Week 2020 by providing useful information on how to avoid different types of scams and protect your identity.

Scams Awareness Week 2020 is important because the ACCC has highlighted:

- Scammers are targeting personal information more than ever

- Scamwatch has received a staggering 24,000 reports of stolen personal information this year alone

- Australians reported losing more than $22 million to scammers who also stole their personal information

- Financial losses across all scams are up to $91 million so far this year

Check out their This is Not Your Life series now.

If you believe you donated to a scam you should:

- Contact us on 13 30 30 immediately. You can reach us from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

- Report the scam to the website it is hosted on.

- Make a report on the Scamwatch website, or find more information about where to get help.

The ACCC warns that scammers often pretend to be associated with well known charities, large organisations or government departments to make them seem legitimate.

They have seen an increase in the following scams in response to the recent bushfires:

- Calls and text messages impersonating businesses or government organisations seeking ‘donations’ that they will be sending on to well-known charities.

- 'Business email compromise scams' where the scammer impersonates a high level employee in a business claiming the business will be making a donation to the bushfires to the scammers account.

- Individuals on social media and crowdfunding sites claiming to be fundraising where it is dubious that the money raised will actually be donated.

- Impersonation of real charities via calls, text, and even in person through door to door charity appeals.

- Individuals claiming to be relatives of those affected by the bushfires seeking donations.

Ensure your money gets to those who need it by following this advice:

- Do not donate via fundraising pages on platforms that do not verify the legitimacy of the fundraiser or that do not guarantee your money will be returned if the page is determined to be fraudulent.

- Be careful about crowdfunding requests as these may be fake and also come from scammers. Check the terms and conditions of funding platforms and ensure you are dealing with official organisations. If you are unsure, make your donation to an established charity instead.

- The best way to avoid scams and make sure your dollars get where they are needed is to do your research and donate directly to registered charities.

- You can look up registered charities on the Australian Charities and Not-for-profit Commissions website.

If you believe you donated to a scam you should:

- Contact us on 13 30 30 to report the transaction immediately. You can reach us from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

- Report the scam to the website it is hosted on.

- Make a report on the Scamwatch website, or find more information about where to get help.

The ACCC has also set up a dedicated phone number - 1300 795 995, for anyone to report bushfire related scams.

Please remember:

- If our fraud department calls you, they won't ask ask for the primary account number (PAN) of your card during the call.

- A genuine call from our fraud department will only ever ask to confirm the last 4 digits of the card.

- Our fraud department require limited information to confirm high risk transactions with you. Please contact us on 13 30 30 if you are ever unsure or uncomfortable with the legitimacy of their call. This number also appears on the back of your Access Card.

You may contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

The Australian Competition and Consumer Commission (ACCC) has advised scammers have been targeting Australians who are older, Indigenous, or have a disability. The ACCC have asked awareness is raised for the following:

- Australians aged or over 65

The ACCC advises there has been an increase in romance and investment scams. - Australians with a disability or chronic illness

The ACCC advises increased reports of romance and investment scams. - Indigenous Australians

The ACCC advises there has been an increase in investment scams.

Scammers use social media and dating sites looking for older Australians who have recently divorced or lost a long term partner, Australians with a disability or chronic illness, and Indigenous Australians. The scammers are hoping to take advantage of those who may be in a vulnerable state or remote area and mislead them through fake relationships.

With Investment scams, the scammers may start with a phone call, promising low risk investments with high returns but when the time comes to cash in the investment, the scammers and funds are missing.

More information on scams can be found on the ACCC’s website Scamwatch.

If you are concerned that you may have been targeted by scammers, please contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

The Australian Competition and Consumer Commission (ACCC) has issued a warning for people to be careful about being caught out by holiday season scams.

They provided information on three holiday scams to look out for:

- Online shopping scams

Scammers set up fake online stores or post goods for sale in buy-swap-sell groups or onilne classified sites to trick people into buying items that don't exist.

- Travel scams

Scammers trick people into believing they've won a holiday or scored a really good deal on a travel package, like a cruise. Unfortunately the prize or cheap accommodation are phony. - Parcel delivery scams

Scammers ask you to print off a label, do a survey, claim a prize, or view the status of your delivery by clicking on a link or downloading an attachment. These scams are aimed at getting people to download malware onto their computer, or give up their personal information.

Protect yourself by researching online stores to confirm they're legitimate and don't be fooled by big discounts. With travel deals, call the accomodation provider directly to check the deal is legitimate. We're all expeciting parcels this time of year, but be careful about online links and never download attachments. Call Australia Post or the delivery company using a number you find from an online search or the phone book.

Further information about holiday season scams is available at scamwatch.gov.au.

We are aware that some customers have received scam text messages advising of fraudulent transactions on their card and for them to contact a mobile telephone number or click on a link to confirm personal data.

If we need to contact you, we will always identify ourselves as AMP Bank, and we will never ask you to click a link to go online and verify personal information. We will ask that you contact our card monitoring team 24 hours, 7 days a week on 1300 705 750.

You may also contact us on 13 30 30 from 8am to 8pm Monday to Friday and 9am to 5pm Saturday and Sunday (Sydney time).

The ACCC has advised that scammers are increasingly catching people out by impersonating well known businesses such as Telstra, NBN, Microsoft, or the police for the purpose of gaining access to computers to steal money or banking information.

Their website Scamwatch is reported to have recorded an increase in these types of scams with now more than 8,000 reports submitted in 2018 so far with losses totalling $4.4 million.

The previous scams were to call people and say there is a virus on their computer that needed fixing but today they are calling and saying they need help to catch hackers. They say the persons computer has been compromised and is being used to send scam messages. They want 'help' by allowing access to the persons computer and online banking to trap the (fake) scammer.

Once the scammer has access to the persons account, they pretend to deposit money in. Actually they just move funds between the persons accounts which makes it appear as if a deposit has been made. The funds are then sent from the persons account as part of the con to 'catch the scammer', straight into the scammer's own bank accounts.

The ACCC has reported that these types of scammers may become threatening if the person starts to doubt the situation. They might even say there could be legal consequences for refusing to help.

Never give an unsolicited caller access to your computer or provide your personal, credit card or online account details over the phone.

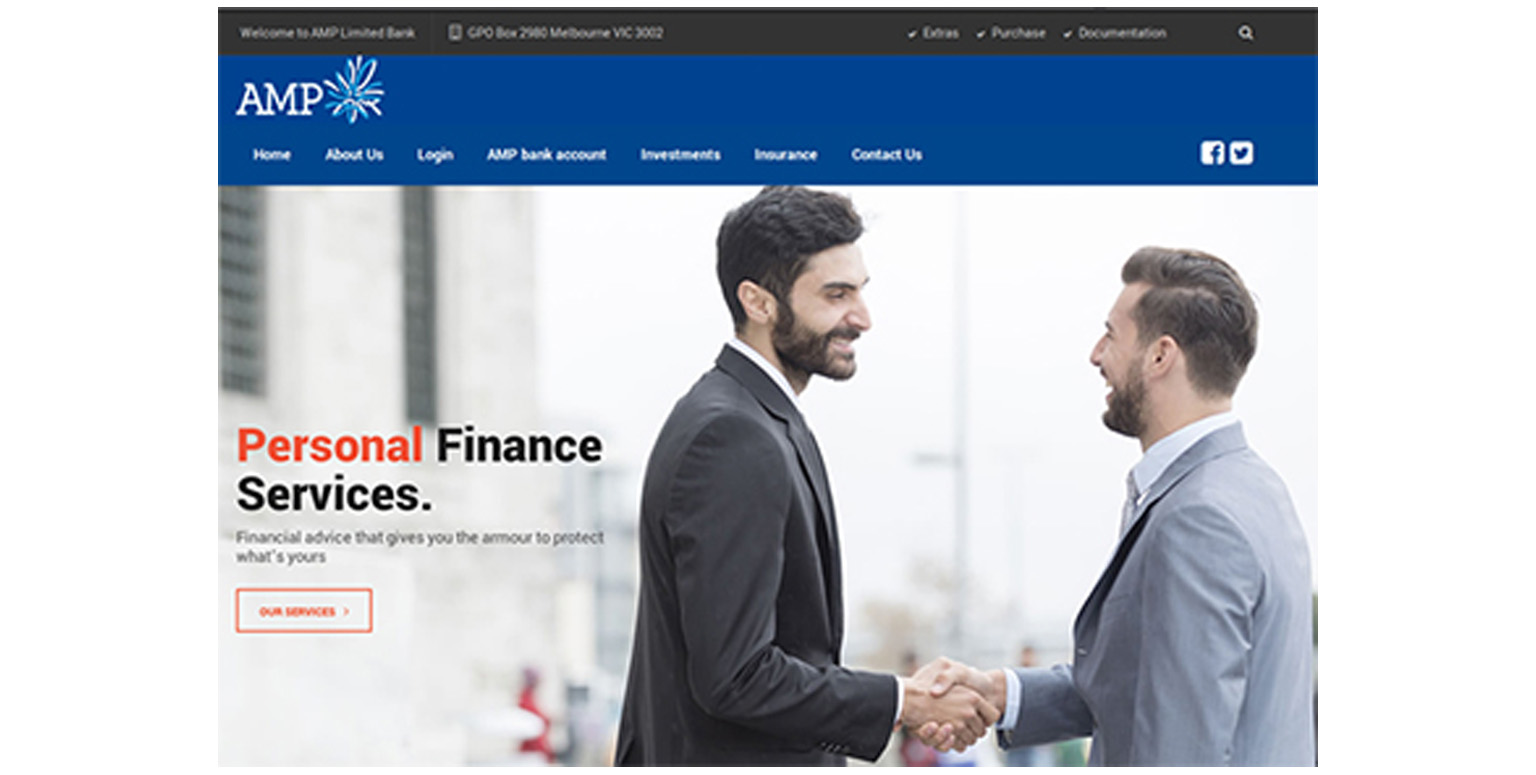

We are aware of a website pretending to be AMP Bank. It comes complete with menu items and and an email address which appears similar to ours. Our team is working on having the site closed down and the email address disabled. A copy of the site is shown. If you encounter it, close the browser immediately. Do not click on any links or attempt to log into your account from here.

If you have inadvertedy attempted to access your accounts we recommend running up-to-date virus detection software and changing your password. Remember to access your internet banking from our website amp.com.au and not from a link in an email.

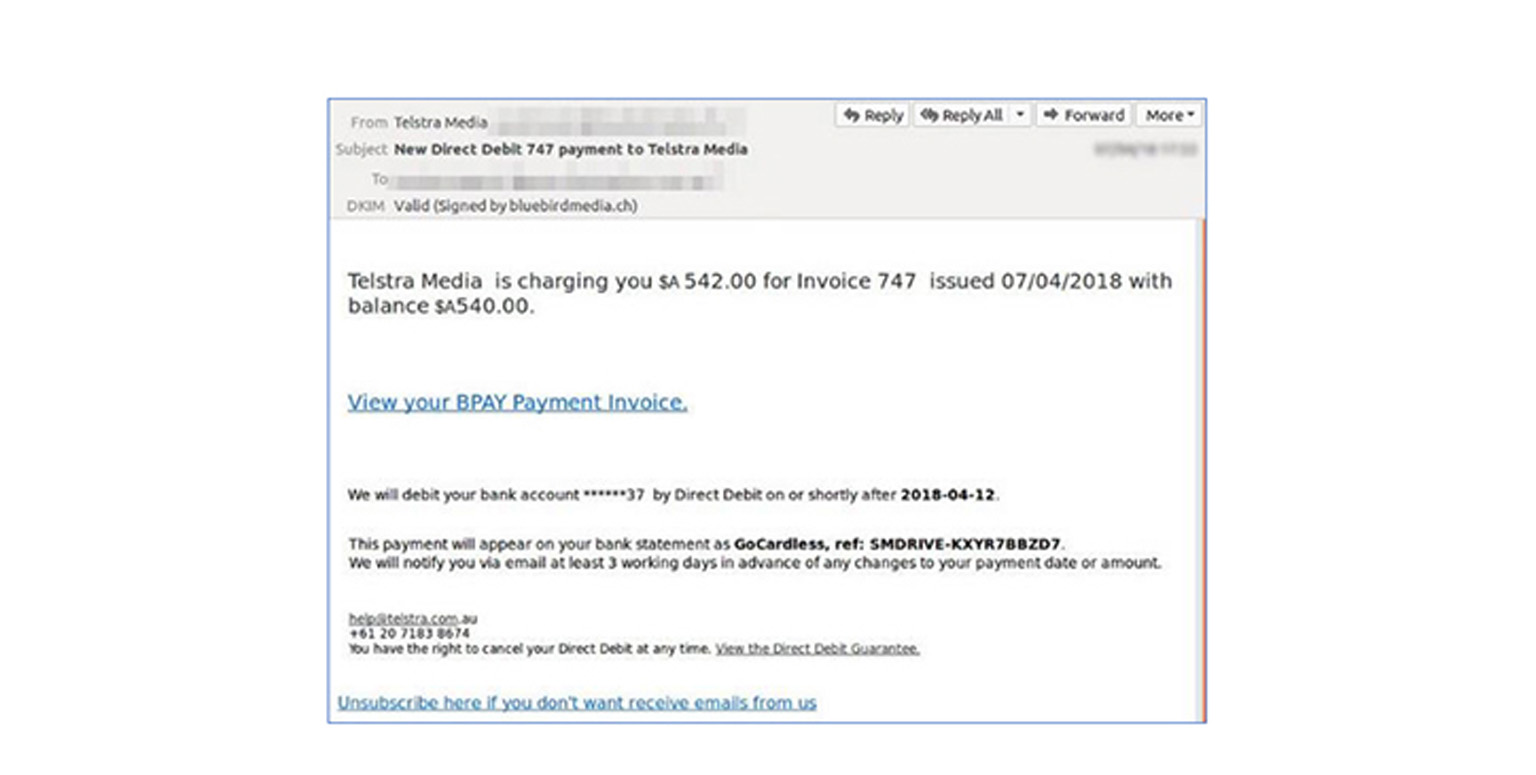

BPAY scheme have advised of an email scam currenlty in circulation which makes reference to BPAY payments.

The email is a fake billing notice purporting to be from Telstra. Contained within the body of the email is a hyperlink titled 'View your BPAY Payment Invoice' which is understood to be linked to malicious software (malware) which could lead to your device being compromised if clicked.

BPAY advise that they never distribute BPAY Payments Invoices via email and should you receive such an email, treat with caution and delete immediately.

BPAY have provided an example of the fake email.

ASIC issued a warning today about a scam where cold callers are claiming to be undertaking a ‘shadow shop’ on behalf of ASIC. A shadow shop is where real consumers are recruited to purchase services such as financial advice to help assess the standards in the market.

The scammers claim to be looking for shadow shoppers as part of an ASIC compliance and monitoring campaign. They indicate you will be paid for your time and money and may encourage you to meet in person or attend a presentation after which you will receive a questionnaire. The scammers are promoting the scam at www.theshadowshoper.com.

ASIC has reported they have no involvement with this website or its operators. They urge anyone who receives contact in these circumstances or is referred to this website to not respond.

From time to time ASIC caries out genuine consumer research. If you are contacted by a company representing that they are undertaking research for ASIC, you can call ASIC’s Infoline on 1300 300 630 to check.

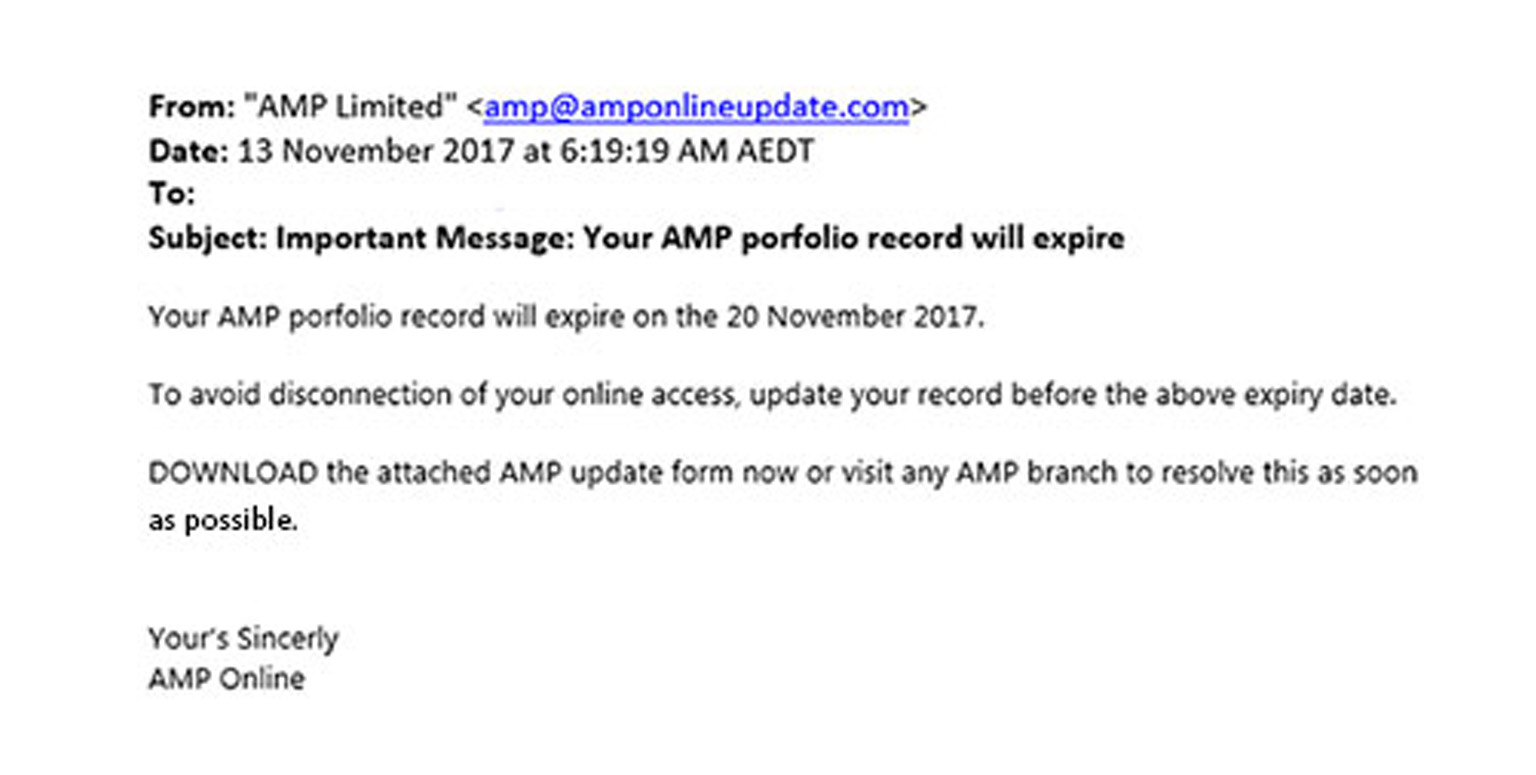

There is currently a phishing email pretending to be from us circulating. The content is suggesting that your AMP portfolio record will exipire shortly and that you need to update the record by downloading an attachment.

The attachment will direct you to a site that looks like ours but is not. The intent of the site is to capture your username and password.

If you have received the email, downloaded the file and entered your information, please contact us on 13 30 30.

Please remember that we will never send you an email asking for you to provide your username, password or sensitive information.

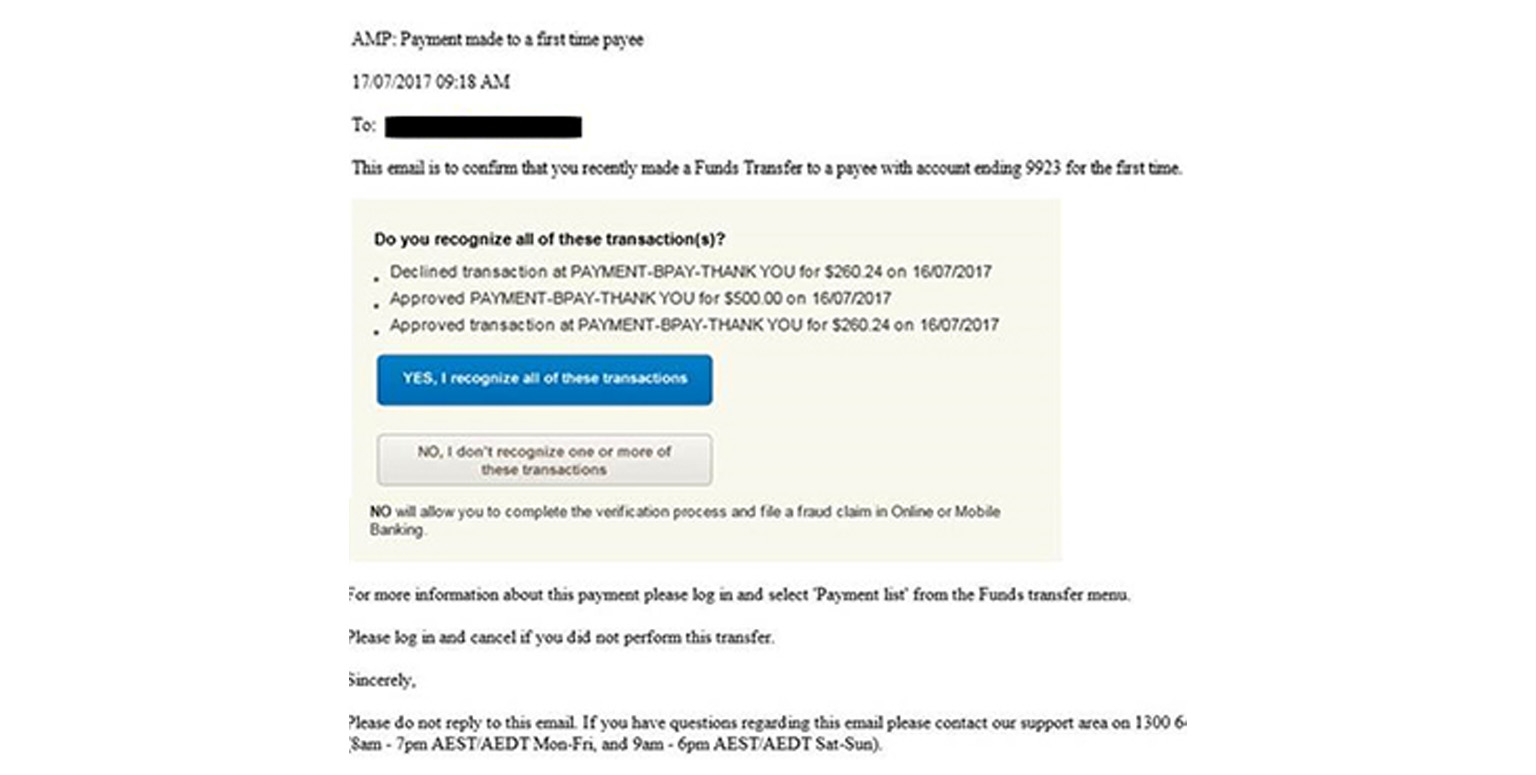

A number of AMP customers may have recently received a phishing email pretending to be from us, requesting them to confirm recent payments. (see an example on the right).

The email is not from AMP. Clicking on the button will open a login page similar to our MY AMP page - but it is not ours.

Do not click on the buttons or enter any details, as the information is being collected for misuse.

If you have entered your details, please use our website amp.com.au (always type our address into your browser rather than click on a link) to login to My AMP and change your password. You should also check that your security software is enabled and up to date.

If you have further concerns please contact us on 13 30 30.

The Australian Competition and Consumer Commission (ACCC) has issued a warning for people to watch out for investment scammers who offer great investments that don't exist.

The scams typically start with a unexpected phone call or email, or through online forums and social media. The scammers use high pressure tactics and language like "financial opportunity not to be missed", "high and quick returns for low risks" and "needs to be acted on quickly or you will miss out". The scams can involve multiple calls or emails building your trust and encouraging you to invest more.

Protect yourself:

- hang up or hit delete on all cold calls and emails offering unsolicited advice on investing

- visit the Australian Securities and Investments Commission's MoneySmart website to check companies you shouldn't deal with and ASIC's professional registers to see if someone you are dealing with has an Australian Financial Services License

- block the scammer on your social media accounts so they can't contact your family and friends

- conduct thorough research before making any investment

- don't commit to any investment at a seminar - always seek independent financial advice

Further information is available at scamwatch.gov.au and moneysmart.gov.au.

The Australian Competition and Consumer Commission (ACCC) has issued a warning for people to stay alert to 'phishing' scammers. So far this year, they have received more than 11,000 reports of this type of scam.

Phishing scammers could email or phone, pretending to be from well-known businesses like your bank or phone company, or a government department like Centrelink or the Australian Tax Office. They will attempt to obtain personal information such as bank account numbers, passwords, credit card numbers, or even online passwords for PayPal, Apple or social media accounts.

They often use tricks like:

- suggesting they need to verify their customer data as a technical error has wiped out customer data

- asking you to fill out a customer survey and offering a prize for participating

- asking you to login to confirm you can still access your account

If you think your information has been stolen by a scammer, report it immediately. For example, if it was your bank account information, call us on 13 30 30 straight away; if you think they have your login to a social media account, contact that site to report it.

The Australian Competition and Consumer Commission (ACCC) issued a warning for people to watch out for dodgy internet pop-up windows claiming there are viruses or other tech problems affecting their computer.

Known as remote access scams, these pop-up windows are used as a ploy to get undudpecting victims to call a fake support line - usally a 1800 number. The scammer will then ask for remote access to their victim's computer to 'find out what the problem is'. Once a scammer has access to your computer they can install malicious software, steal your personal data, con you into paying for a 'service' of your computer or sell you unnecessary software to fix a problem that doesn't exisit.

These pop-ups may appear to have frozen your computer as clicking on the close button on your browser may not work. This tricks people into thinking there really is a problem and calling the fake support line for help. Affected users can close the pop up manually through Windows Task Manager (for PC users) or by using the Activity Monitor (for Mac users). If this fails to work, shut down and restart the computer.

The ACCC have said that even if you call the number, no matter how legitimate they sound, never give a stranger remote access to your computer. The ACCC recently updated their Little Black Book of Scams publication to include remote access scams.

If you think you have been caught by this scam, please call us on immediately on 13 30 30. You should also run an updated virus scan on your computer.

BPAY have advised that they are aware of an email circulating, reporting to be from BPAY.

Emails have the subject heading "BPAY Deposit Instructions" and there is a .doc attachment and with the BPAY logo clearly displayed.

The emails are being sent from service@bpayemail.com.au which is not a BPAY email address.

BPAY advises the following:

- the email is not from BPAY

- do not open any attachements

- delete the email from your inbox

BPAY have also advised that they do not send our direct mail communication to customers.

The Austalian Competition and Consumer Commission (ACCC) is warning people to be wary of scammers when looking for romance online with social media now the most common method scammers use to contact potential victims.

In 2016, 4100 Australians contacted the ACCC’s Scamwatch service to report dating and romance scams and more than $25 million was lost: the largest amount of money lost to any type of scam.

Please refer to the article on the Scamwatch website for details of the dating & romance scams and for tips on how you can protect yourself.

Cardholders are being warned to ensure investment companies advertising Binary Options are licenced to operate financial services in Australia.

Binary Options are financial products where the buyer simply selects whether the price will go up or down on a particular asset, for example exchange rate, share price, oil price, gold price etc. If the buyer is correct they receive a return but they lose their money if they are wrong.

While not all binary websites are scams, Australian Securities and Investment Commission (ASIC) has set up a website page where it lists unlicenced operators. If you are looking to invest in Binary Options make sure the company is licenced to operate financial services within Australia.

We have made the decision to not permit any card transactions from an AMP Bank account to operators or websites that are not licensed by ASIC to trade in these types of financial products. We are also blocking such card transactions from overseas merchants. We are doing this to protect our cardholders from potential fraudulent scam operations. Contact us on 13 30 30 if you have any questions regarding blocked card transactions.

Please refer to the ASIC Moneysmart website for merchants who are not licenced to operate financial services within Australia. If you need further information please refer to the ASIC website at www.asic.gov.au.

Losing access to your funds and access card can be distressing at any time but add it to the increased pressure of Christmas commitments and the whole festive season can turn very unpleasant. Luckily, these consequences can be easily avoided by taking some minor steps to secure your personal information and funds.

Online:

- Use strong and hard to guess passwords.

- Access your bank’s website by typing the address directly into the browser.

- Avoid clicking on hyperlinks in unsolicited emails.

- Keep your ant-virus software up to date.

- Prior to making a purchase, research for unknown retailers and their products and services.

- When making an online payment, ensure website’s address starts with ‘https://’ and look for padlock icon in the toolbar.

- Avoid entering card information on public computers.

Mobile Devices:

- Keep your device operating system up to date.

- Turn on the security features on your device.

- Set a password or PIN to unlock your device.

- Only install reputable apps/software.

Card Security:

- Don’t share your PIN with anyone.

- Guard your PIN by covering it with your hand.

- Always keep your card in sight when making in-store payments.

- Be aware of your surroundings.

- Advise your bank of your travel plans.

- When travelling, avoid keeping all cards in one place in case your purse or wallet gets stolen.

- Monitor your account statements regularly.

- Report missing cards immediately.

Rather than worrying about the restoring access to funds, we would rather see you concentrate on more important things in life like your loved one. The above steps might just help you do exactly that.

Please contact us on 13 30 30 if you see any suspicious activity on your accounts held with us.

Avoid tax scams

Scammers are using personal information they find online to try and convince you they are from The Australian Taxation Office (ATO). They may phone or email and ask for payment for an 'unpaid debt' via wire money transfer, credit card, direct debit cards or even iTunes cards. The call may look like it is coming from a local phone number but the scammer is using a voice over internet protocol (VOIP) phone number disguising the fact that they are actually calling from overseas.

While the ATO makes outbound calls to taxpayers, they have indicated they:

- would never cold call you about a debt

- would never threaten jail or arrest

- would never behave in an aggressive manner

- would never request the payment of a tax debt via gift or pre-paid cards such as iTunes and Visa cards

- would never ask for direct credit to be paid to a personal bank account

If you receive an unexpected email or phone call from the 'ATO' claiming that you are entitled to a refund, that you owe money or asking you to confirm, update or disclose confidential details like your tax file number (TFN), press 'delete' or hang up. Verify the caller or sender by contacting the ATO on its official contact number 1800 008 540.

The ATO has also advised that you should never share your TFN, myGOV or bank account details on social media. Furthermore, do not write your TFN on your resume - only provide it to an employer after you have started your job. If using a tax agent, you can make sure they are registered by checking at www.tpb.gov.au/onlineregister.

If you think you have provided your account details to a scammer, contact us on 13 30 30 immediately.

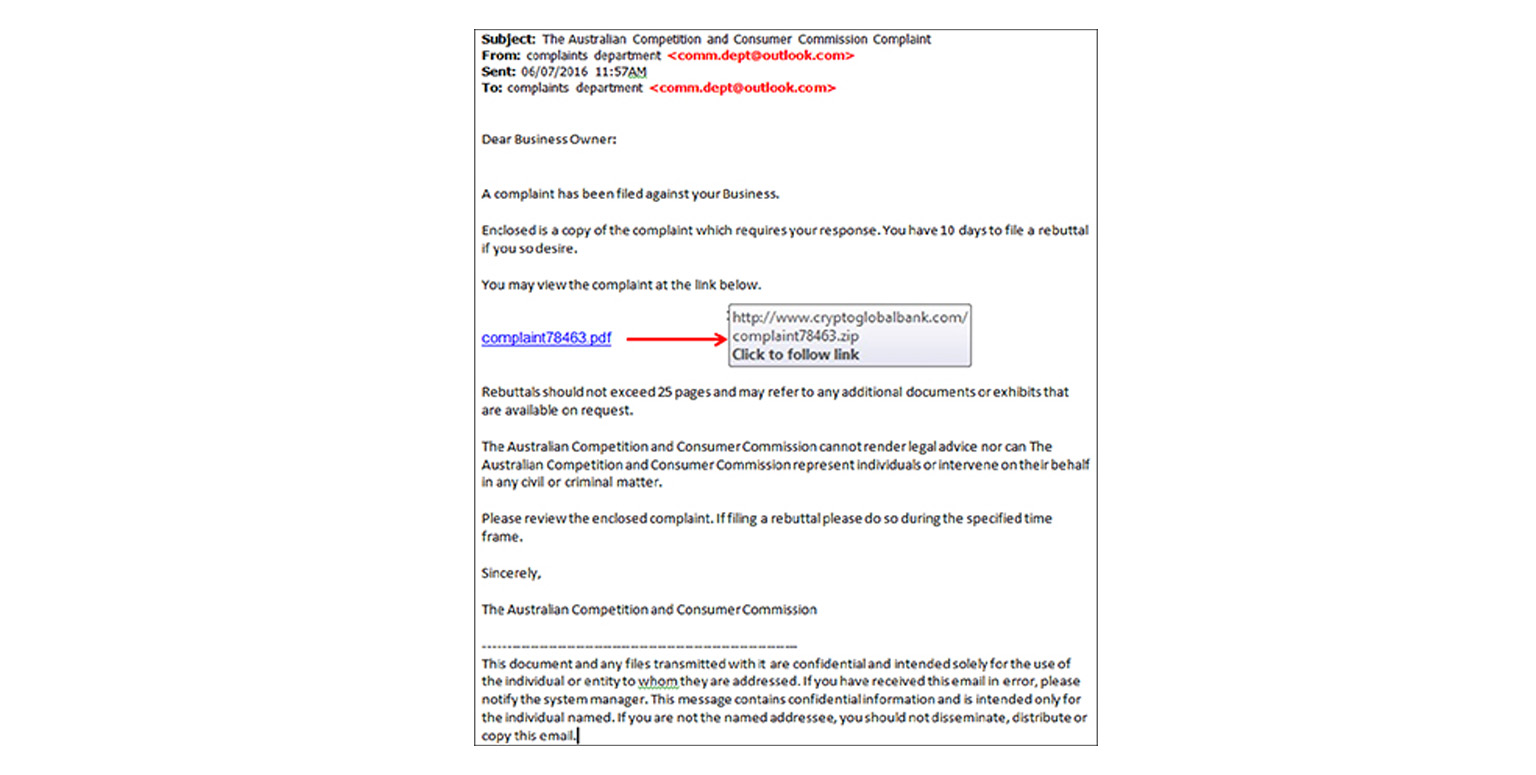

The Australian Competition and Consumer Commission (ACCC) has warned businesses to watch out for scam emails claiming to be from them.

Several businesses have reported receiving bogus requests from the ACCC to respond to a complaint that has been made about their business or seek payment for an infringement notice for breach of copyright.

Both scams encourage the recipient to find out more by clicking on a link disguised as a .pdf file. In the first scam, the embedded link is actually a .zip file that will download malware on to your computer or device.

The ACCC advises:

- Do not click on any suspiciou links in email and check the sender's address very carefully. If you think it is a scam, delete the email.

- Ensure your business has up-to-date virus protection and firewall software installed.

- Regulary back-up your computer's data on a separate hard drive. If you computer is infected by malware or ransomware

Malicious software targeting Android devices

AMP is aware of media reports relating to malicious software currently targeting Android phones.

We can confirm that this particular malware does not impact AMP. We however advise AMP customers using Android devices to be vigilant and only download and update apps from legitimate app stores (e.g. Google Play).

The most likely way to get malware on android devices is by installing software from sources other than the official Android Google Play app store.

Mistaken internet payments

When making payments online, please take extra care when entering or selecting the information about the account you are transferring funds to. If you make a mistake we may not always be able to recover the funds for you.

A mistaken internet payment can occur if you make a payment to the wrong account by mistake or if you enter the wrong BSB and account number when adding bank account details. You should double-check that you have selected the correct account before confirming the transaction.

More information on mistaken internet payments can be found in our Account Access and Operating Terms and Conditions.

Report a mistaken internet payment to us as soon as possible by calling us on 13 30 30.

Don’t let fake sellers ruin Christmas

Scamwatch issued a media release today warning Christmas shoppers to be cautious when looking online for gifts. They indicated that they experience an increase in reports of fake online sellers during the festive season.

Scammers are using designer labels to trick consumers who are looking online to find a cheaper price. They set up fake websites that look just like genuine online stores, copying websites of legitimate companies and designer labels. They may even pretend to be Australian based by using a ‘.com.au’ domain.

Scamwatch shared that the biggest tip-off that a website is a scam is by the way they ask for payment. Scammers often ask you to pay by wire transfer, pre-loaded debit cards or even bitcoins. These payment methods are not secure and are rarely used by legitimate retailers. If you send your money this way, it’s just like sending cash – you’re unlikely to receive the goods or get your money back.

Online shopping tips:

- When shopping online, find out exactly who you are dealing with. If it is an Australian company, you are generally in a better position to sort out the problem if something goes wrong.

- Check for external user reviews about the website. If someone has had a bad experience they are likely to have written about it somewhere.

- Never send money or give credit card or online account details to anyone you don’t know or trust.

- When making online payments, only pay for items using a secure payment service—look for a URL starting with ‘https’ and a closed padlock symbol, or a payment provider such as PayPal.

- Avoid any arrangement that asks for up-front payment via money order, wire transfer, international funds transfer, pre-loaded card or electronic currency. It is rare to recover money sent this way.

- Think twice before using virtual currencies such as bitcoin—they do not have the same protections as other transaction methods so you can’t get your money back once you send it.

- Check the website's refund or returns policy, and if there is a complaint or dispute handling processes in case something goes wrong.

- Consider using an 'escrow' service if you're buying from an online auction. Escrow services will only release your payment to the trader or seller when you've confirmed that the product has arrived and is what you paid for. Only use a reputable escrow service—online auction sites may provide a list of recommended providers.

- When buying from an online classifieds website, only pay when you have physically inspected or received the goods. If you have any doubts about the product or the person selling it, don’t go ahead with the deal.

The Australian Securities and Investments Commission(ASIC) warns Australian borrowers about online lending scams

ASIC issued a media release today, warning borrowers about scammers who appear to be operating from overseas though have impersonated genuine Australian companies.

After making an online loan enquiry the victim is contacted by the scammer advising they qualify for a loan and issued with fake loan contracts. The scammers may also request insurance or fees be paid prior to providing the loan however even after payment, proceeds of the loan are not received.

Borrowers also put themselves at risk of potential identity theft when giving out personal information to parties they don't know or can't contact through publicly available contact details.

Online scam prevention tips:

- Only deal with reptuable online institutions.

- Ensure you can locate the institution and contact numbers from publicly available information such as searching for the company via your web browser or phone book.

- Do your background checks, but be aware that scammers can pretend to be a licensed credit provider located in Australia. If there is anything you are unsure of, contact ASIC on 1300 300 630.

- Be very suspicious of any requests for upfront payment, even if making a deposit into an Australian bank account.

My AMP is ours.

Many of you will have noticed that we have been talking about combining BankNet and My Portfolio into a single online secure site.

Today we launched this new online secure site - My AMP.

You can use your existing log in details from either BankNet or My Portfolio to access the site. For now, both BankNet and My Portfolio are also available, but they will be closing down soon leaving My AMP as our single online secure site.

Please only use our website www.amp.com.au to access internet banking from the Login button and never use links in emails - as they won't be from us. We will never email a link to Internet Banking asking you to log in or provide other personal details such as your user name or passwords.

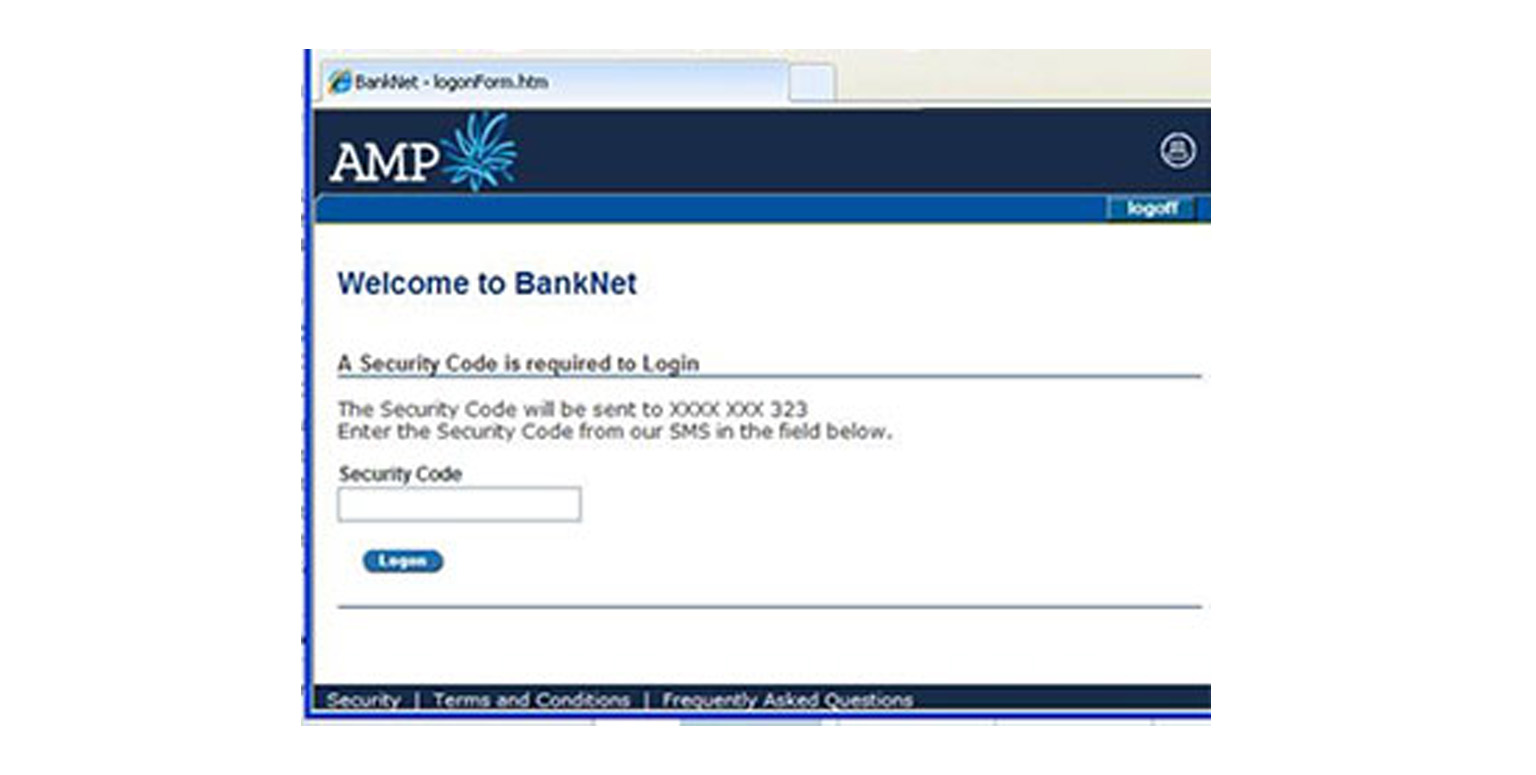

BankNet login screen

Some AMP Customers have encountered a fraudulent BankNet login screen. They have accessed it using our website as normal but suspected malware on their computer has redirected them to a fraudulent site which instead of asking for their Customer Number and Password, is asking for the Security Code which they received on their mobile phone.

If you receive a log in page asking for a Security Code, please call our Contact Centre immediately on 13 30 30 to have your BankNet password reset.

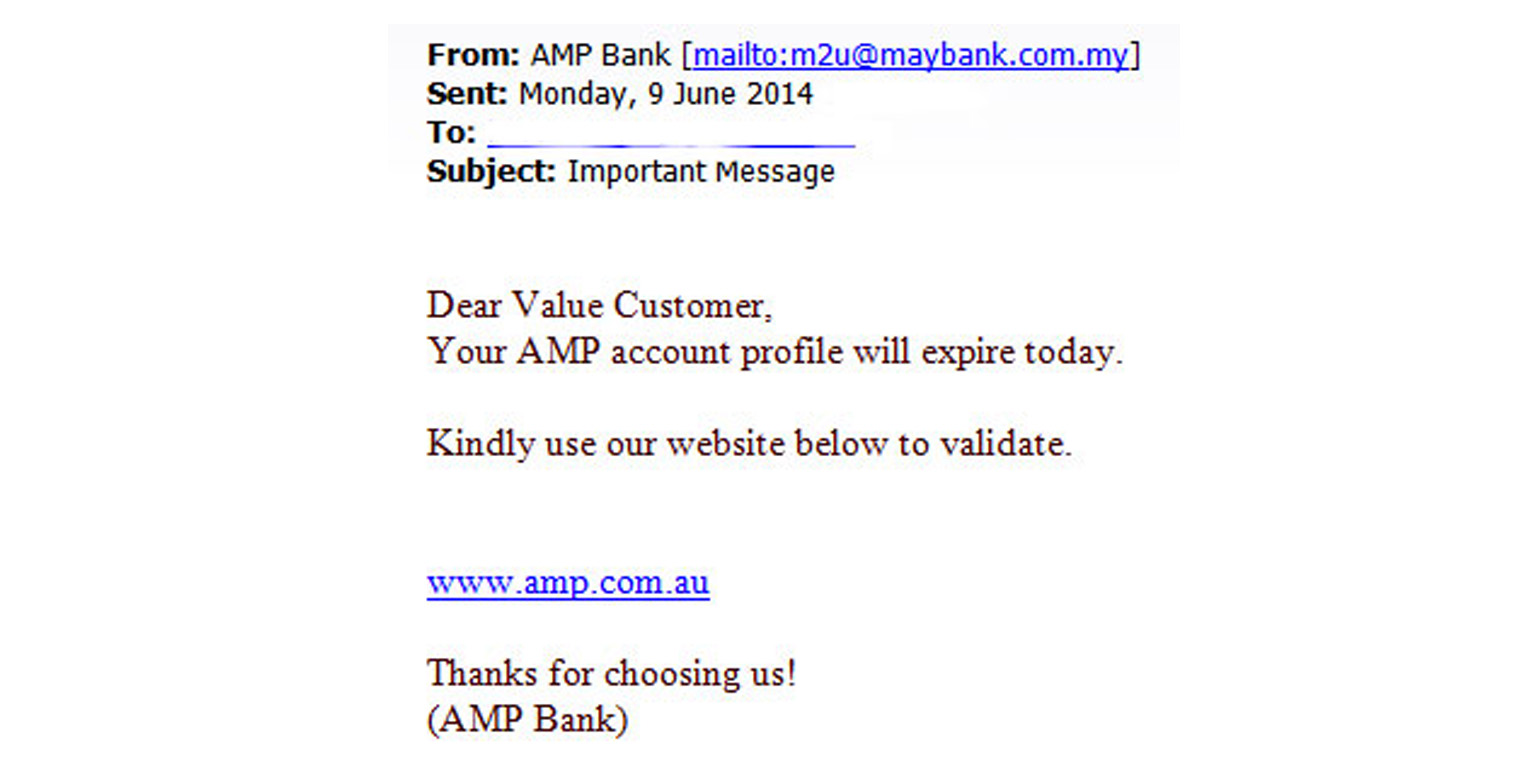

A number of AMP customers may have recently received a phishing email purporting to be from AMP, advising customers that their AMP account profile will expire today (see an example on the right). It then asks the customer to access a link from the email. The link visually looks like it is an AMP link, but it is not.

Do not click on the link or enter any details, as the information is being collected for misuse.

If you have entered your details, please call our Contact Centre immediately on 13 30 30 to have your BankNet password reset.

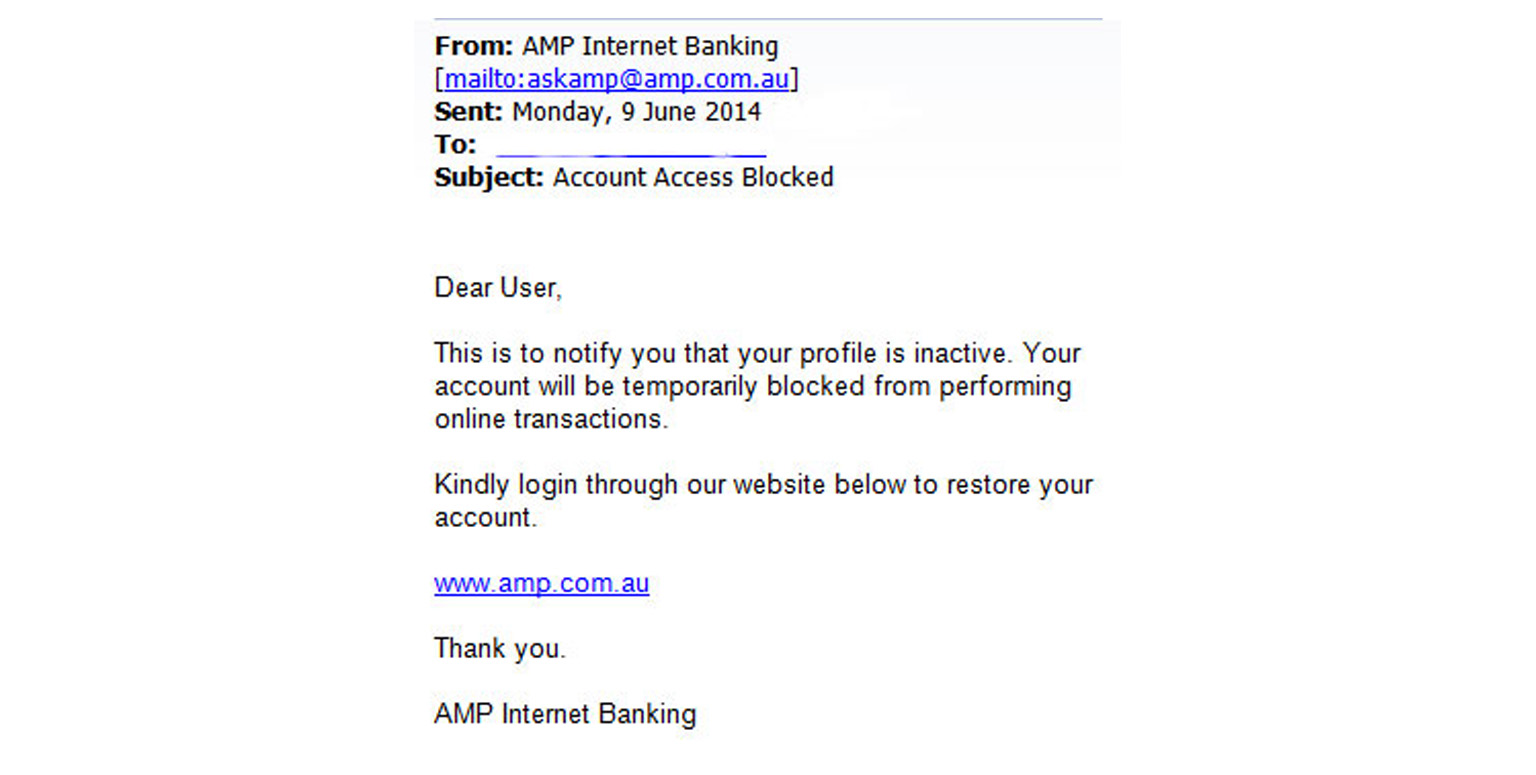

Phishing email

A number of AMP customers may have recently received a phishing email purporting to be from AMP Banking, advising customers that their profile is inactive and that their account will be temporarily blocked (see an example on the right). It then asks the customer to login through a link provided in the email. The link visually looks like it is an AMP link, but it is not.

Do not click on the link or enter any details, as the information is being collected for misuse.

If you have entered your details, please call our Contact Centre immediately on 13 30 30 to have your BankNet password reset.

AMP websites unaffected by 'Heartbleed' security vulnerability

A number of customers have contacted us to check if they were safe from the Heartbleed (heartbleed.com) security vulnerability. The AMP websites were unaffected by this issue, as they do not use, and haven't previously used, the vulnerable software.

You can rest assured that your AMP account data has not been exposed by this issue.

Phishing email

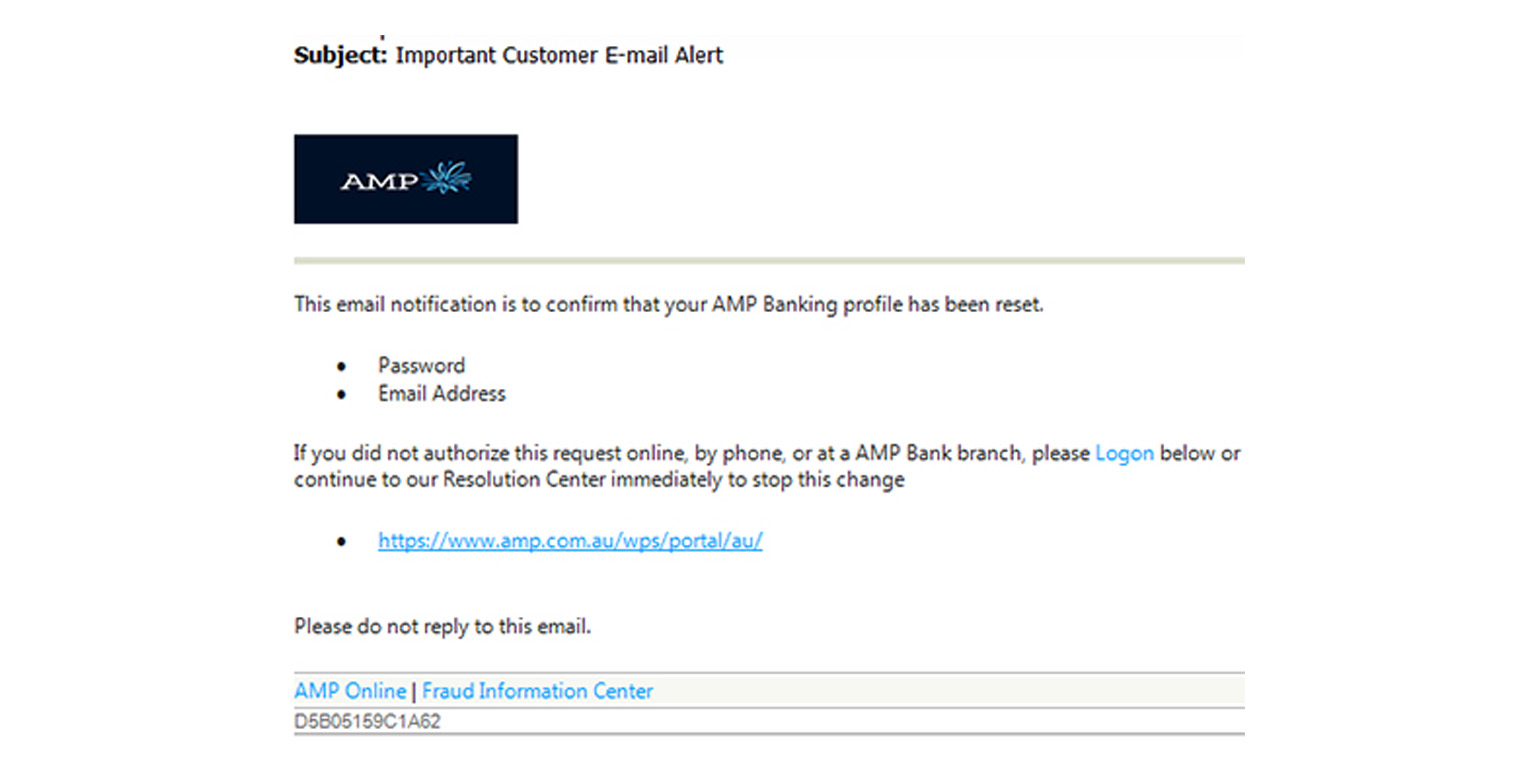

A number of AMP customers may have recently received a phishing email purporting to be from AMP, advising customers that their AMP Banking profile has been reset (see an example on the right). It then asks the customer to logon below, if they did not authorise the request. The link visually looks like it is an AMP link, but it is not.

Do not click on the link or enter any details, as the information is being collected for misuse.

If you have entered your details, please call our Contact Centre immediately on 13 30 30 to have your BankNet password reset.

Phishing email

A number of AMP customers may have recently received a phishing email purporting to be from AMP, advising customers that their AMP Banking profile has been reset. It then asks the customer to logon below, if they did not authorise the request. The link visually looks like it is an AMP link, but it is not.

Do not click on the link or enter any details, as the information is being collected for misuse.

Contact us

If you believe your online banking has been compromised, alert us immediately:

Monday to Friday, 8am - 8pm Sydney time

Saturday and Sunday, 9am - 5pm Sydney time

Lost / Stolen cards, 24 hours x 7 days a week

What you need to know

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account.

This information is provided by AMP Bank Limited. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

The credit provider and bank product issuer is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517.