AMP Bank today announces its latest product release as it continues to evolve its proposition to meet the challenges and needs of small businesses, the launch of a business overdraft in AMP Bank GO.

AMP Bank’s research found that 70% of Australian small business owners are worried about cash flow and 3 in 5 small business owners worry about paying bills.

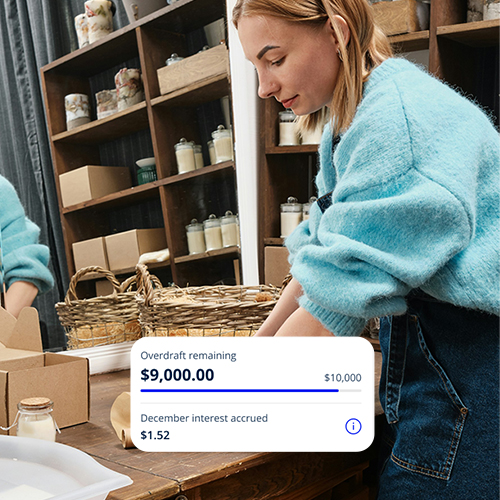

The unsecured business overdraft is a flexible funding option to help manage the ups and downs of day-to-day cashflow, designed to help small businesses have access to funds when they need it.

AMP Bank GO’s instant app notifications help business owners stay on top of their spending, helping them adjust how much they want to spend with the in-app business overdraft cap feature.

AMP Bank GO’s business overdraft has a competitive, transparent interest rate and interest is paid only on what is used. The business overdraft is accessible through the Everyday Business Account; eligible customers can apply in less than 10 minutes to access from $2,000 to $20,000. It’s initially available for sole traders and will continue to evolve further over time.

Redefining banking for small business

AMP Bank first launched its challenger mobile-first proposition in February, now named AMP Bank GO. It has been designed and built to help Australia’s millions of small business owners – including solopreneurs, side hustlers and mini businesses – more effortlessly run their business on the go.

John Arnott, Director, AMP Bank GO said:

“Small business owners don’t need more complexity – they need simple, smart tools that help them stay in control.

“AMP Bank GO’s business overdraft is designed to do just that – giving business owners the flexibility to manage cash flow, smooth out income dips, and handle the unexpected without stress.

“We’re building AMP Bank GO from the ground up to reflect how Australians actually live and work – especially those running small businesses.

“Too often, banking in Australia overlooks the needs of small business owners. We’re changing that by designing solutions that put their experience and success at the centre.”

For more information about AMP Bank GO and the business overdraft, visit AMP's website.

About AMP Bank:

AMP Bank's new mobile experience, AMP Bank GO, gives small businesses and everyday Australians a new way to spend, save and manage their money while on-the-go. Built from the ground-up using the very latest in secure mobile banking tech, AMP Bank GO is full of simple, smart features that move with customers. AMP Bank GO complements AMP Bank's existing offering, which provides customers with highly competitive home loans and savings accounts through direct and intermediary channels.

About the findings:

AMP Bank commissioned research to understand the challenges Australian small business owners face – a survey of 2,000 Australian sole traders and small business owners (20 employees or less) was conducted in January 2025.

Credit and deposit products are issued by AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. Information including interest rates is correct as at 24 June 2025 and is subject to change without notice. Business Overdraft subject to AMP Bank credit approval. Terms and conditions and fees and charges apply. Before making a decision about this product you should consider the Business Overdrafts terms and conditions available from AMP Bank at amp.com.au/appterms.