Other findings:

Transition to retirement remains complex

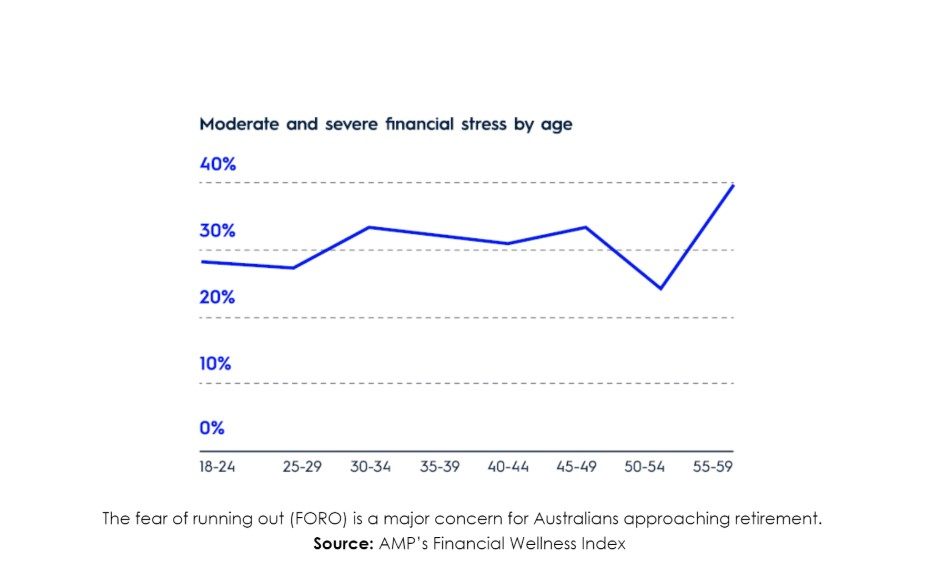

After a short period of relief between the ages of 51 and 54, stress levels lift sharply. In fact, Australians approaching retirement age have the highest levels of stress of any age group surveyed, with almost two in five being moderately to severely stressed. For many Australians, this fear is heightened when the rising cost of living eats away at your lifetime savings.

Sharp rise in stress for those earning between $100,000 and $150,000

A growing number of Australians earning between $100,000 and $150,000 reported to be less financially secure. Nearly one in four Australians in this income bracket said they were ‘severely’ or ‘moderately’ financially stressed, up by 150% in the space of just two years and nearly triple of those who reported the same during 2020 – raising further questions around how much is needed to feel financially secure.

Financial secrets

The findings also point to a growing number of financially stressed Australians keeping secrets about their finances. Close to one in three have financial secrets, worries, or behaviours they have not shared with anyone else. Of those, almost two in three said they feel ‘embarrassed’ or ‘guilty’ about them and almost one in four believe there is no need to share them.

Letting go of discretionary spend

Faced with the rising cost of living, more Australians are drawing down on accumulated savings and cutting down on their everyday spending, finding new ways to save on non-essential services. Three in five Australians spent less on groceries this year, two in five went without a holiday and one in three spent less time engaging in regular hobbies and interests. Meanwhile, over half of Australians strongly agree that the cost of living will continue to rise significantly, with less than a third saying they will be financially secure over the next two years. In addition, one in three have cancelled streaming subscriptions and gym memberships due to financial pressures.

More ‘alone time’

Financially stressed Australians are more likely to reduce both spending and social behaviours or reach out for professional support. Half of those that were ‘severely’ or ‘moderately’ financially stressed spent less time with friends, two in five were more likely to internalise their stress and spent more time in isolation, while over one in three spent less time with family.

Tips for building financial wellbeing

1. Speak to a Super Coach to get reliable information and support: AMP Super coaches can help you get close to your super, with digital tools and simple advice all with no extra fees. AMP also offers a free ‘Retirement Health Check’ with dedicated financial wellbeing support available for customers. Learn more at Superannuation - AMP.

2. Check your home loan is right for you: Speak to your bank or broker and learn how a better rate on mortgage can help you save more. There are a range of home loan products on the market which come with different features based on customers’ preferences, needs and eligibility. Consider what loan options best suit you and your individual circumstances.

3. Get assistance when you need it: There’s plenty of research showing that people who draw on expert advice are less financially stressed and make better decisions. Use reputable sources such as your financial institution, government resources, and trusted third-party comparison websites.

4. Subscribe to our podcast: AMP’s Simplifying Investing podcast with Shane Oliver and Diana Mousina features regular insights from two of Australia’s leading economists to help you demystify the world of superannuation, investing, retirement, home loans and beyond.

5. Check out our Insights Hub: Helpful resources are often available on lenders’ websites, and budget/tracking apps can provide a clear view of your spending patterns. Some examples include AMP’s Insights Hub, our budget planner calculator and expense planner calculator, and ASIC’s MoneySmart tools.

About the research

AMP commissioned The Behavioural Architects in July 2024 to conduct a survey of 2,475 Australians aged 18 years and over in relation to their attitudes to financial stress and levels of financial wellbeing. The survey included Australians who are currently employed, unemployed, retired and also small business owners (0-19 employees).