Freedom to go your own way

All features, no filler

AMP Bank GO is packed with features just for you. Dive in and explore some of them below. And guess what? We’re not stopping here - we’ll keep adding more to the list.

Manage your account anytime, anywhere with My AMP

The AMP Bank app is now available on your mobile

Or login to

Freedom to go your own way

AMP Bank GO is packed with features just for you. Dive in and explore some of them below. And guess what? We’re not stopping here - we’ll keep adding more to the list.

Take part of our Tap. Pay. Win. Competition, which could win you a share of $50,000. It's simple!

Every time you spend $5 or more using your AMP Bank GO debit card – tap, Apple Pay, Google Pay, or BPAY* — you’ll automatically go in the draw to win. Easy.

Here’s what’s up for grabs:

3 x major prizes of $10,000

40 x minor prizes of $500

There’s no limit on entries. The more you tap, or pay, the more chances you have to win. So, go bananas!

But don’t wait too long — the comp wraps up on 28 September 2025.

*Refer to the competition T&Cs here.

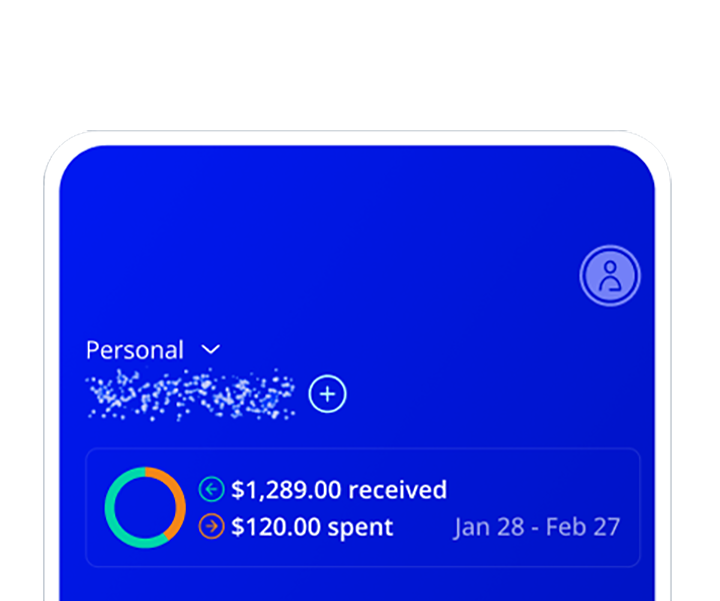

Knowing where your money goes is the first step in taking control of your finances and living your dream life.

What is it?

What if you could earn points on your everyday banking? Now you can with Qantas Frequent Flyer and Qantas Business Rewards.

* Fees apply on approved business overdrafts.

1. Download or sign into AMP Bank GO

2. Tap your profile (top right of screen)

3. Select "Qantas Frequent Flyer" or "Qantas Business Rewards” from menu

4. Add your Qantas Frequent Flyer number and link your accounts for Qantas Frequent Flyer. For Qantas Business Rewards, confirm your ABN matches your Qantas Business Rewards ABN and link your account.

What is it?

Think of Spaces as little pots within your account. You can sort your money, by giving your space a name, add a picture and set a saving goal. Whether it’s for GST, a company car, end-of-year staff party or just a rainy day, you can create Spaces for whatever you want.

1. Tap 'Spaces' and then select 'New Space'

2. Hit 'Space' and then give it a name

3. Set a target amount, and add or withdraw money whenever you like

4. Tap 'Manage' to change the name, add an image or start saving automatically with Round Ups

What is it?

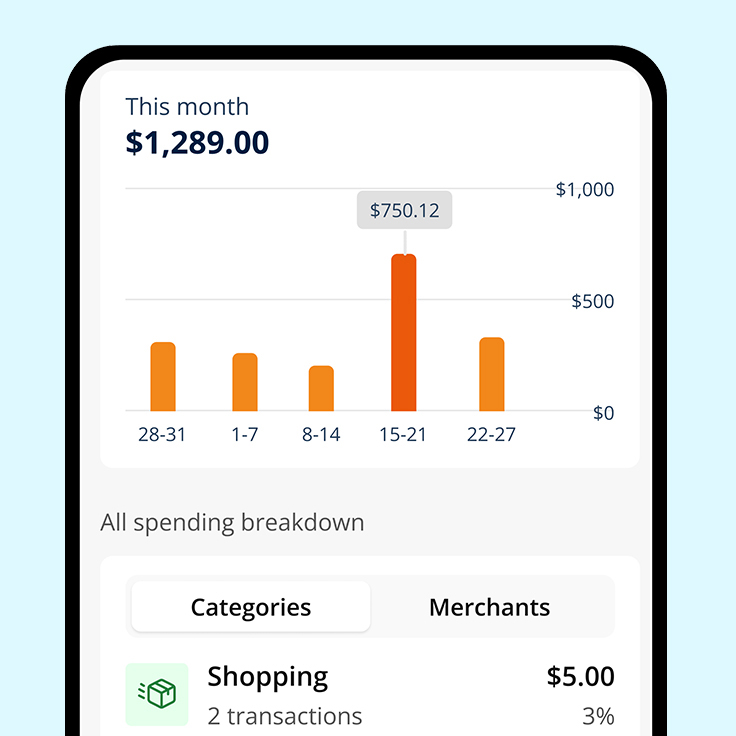

Keep an eye on spending across different categories. Discover trends with intuitive graphs that show you exactly where your money is going and what you’re spending.

Simply switch between category or merchant to get the view you need. Need more details on a transaction? Just tap it.

What is it?

Round up your day-to-day spending to the nearest dollar and transfer the spare change into one of your Spaces. Spend $4.80 on a coffee? We’ll round it up to $5.00 and pop the 20 cents into your designated Space for you.

Want to reach your savings easily in AMP Bank GO? Multiply your spare change by x2, x5 or x10 in your app.

1. Head to ‘Spaces’ at the bottom right of AMP Bank GO.

2. Create a new Space or choose an existing one.

3. Click ‘Manage Space,’ then ‘Round Ups’ and switch the toggle on.

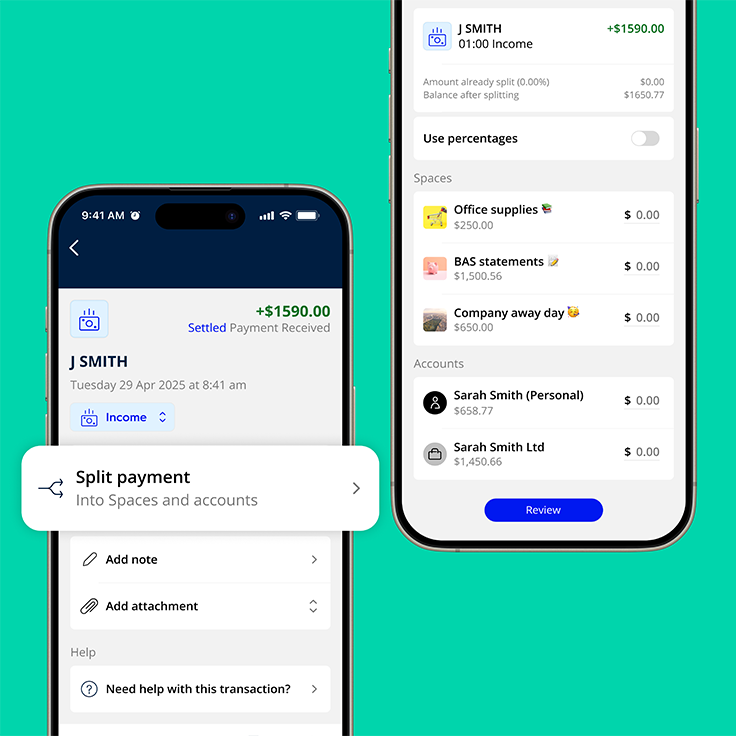

What is Split Payments?

Split Payments does exactly what it says on the tin. You can instantly split incoming payments like your salary or income into your AMP Bank GO accounts or Spaces either as percentage splits or dollar amounts.

Scammers are forever shifting tactics, so our security’s ever evolving. Always on, with eyes everywhere, it scans, alerts, and blocks threats in real-time before they hit.

Explore our in-app security features, designed to protect you at every tap.

What is it?

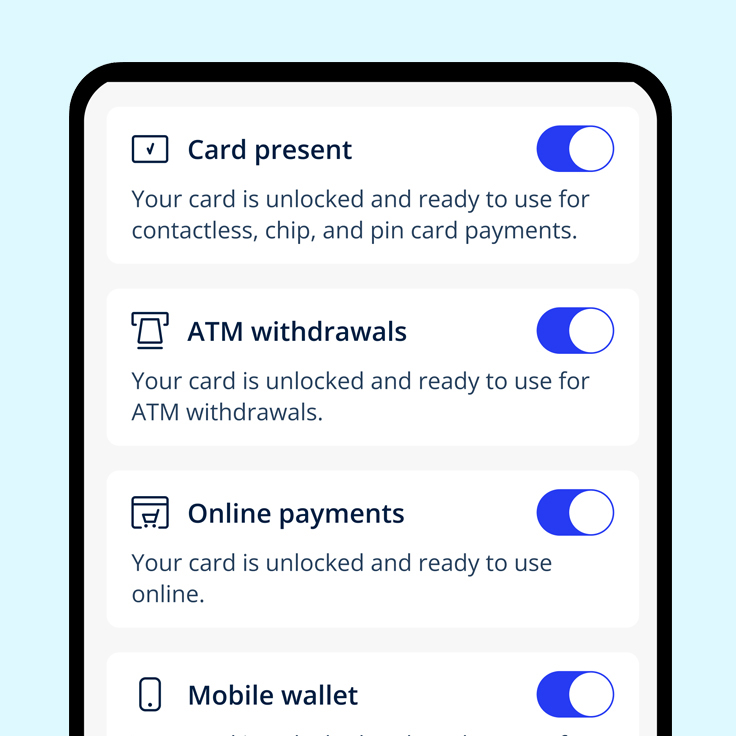

Whether you’ve had your card stolen, simply misplaced it or want further controls around how you use your card. You can instantly lock, block or cancel your card all from within AMP Bank GO.

Head over to card controls where you can easily toggle to enable or disable contactless and chip & PIN payments, ATM withdrawals, online payments, and mobile wallet. You can also freeze your card or activate the gambling block with just a tap.

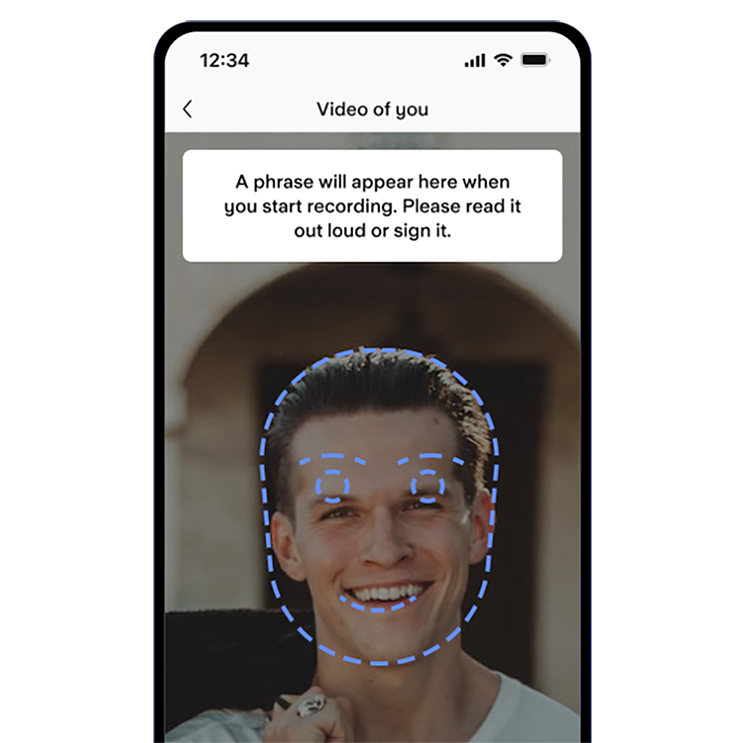

When you open a bank account with AMP Bank GO, we ask for a quick video selfie. This protects your account from the moment you open it, because we use it to confirm it’s really you - not someone using stolen ID details. It only takes seconds and is one of the safest ways to prevent scammers from impersonating you and stealing important bank info.

1. When you open your account, you’ll be prompted to take a short video selfie.

2. Using encrypted storage and liveness detection, we confirm your identity securely.

3. Your video is only used for onboarding and fraud protection. Never for anything else.

Pinching your card numbers is one of the easiest ways fraudsters can steal your money or identity. So we created numberless physical cards. They don’t show your card number, making it harder for fraudsters to get your details if your card is lost or stolen.

1. Use your physical card for everyday purchases as usual.

2. When you need your card number, open the AMP Bank GO app, go to the ‘Cards’ tab, and tap to see your card details securely.

What is it?

Sometimes you need to check your bank balance when you’re out, or in places that are less than ideal, surrounded by strangers, friends or family. Whether it’s a large number or a small one, your balance is no one’s business but yours, which is why we’ve made it easy to keep it that way, with our hide your balance feature.

1. Tap and hold your finger over your balance in the phone to hide or unhide it.

What is it?

To reduce the anxiety associated with phone calls from the bank, we’ve made our app even smarter. Now, with the ‘Your bank is calling’ feature, we can help you verify whether the call you’ve received is actually from AMP Bank GO.

1. When you get a call from someone who says they’re from AMP Bank GO, you can use your app to help confirm.

2. If the caller is from AMP Bank GO, we will display a simple 'Your bank is calling' message in the app.

3. If not, it means the person calling isn’t who they say they are and could be a scammer.

AMP Bank GO keeps you moving forward, whatever direction suits you.

What is it?

Get notifications every time you’re paid or paying a bill so you can keep on top of the ins and outs of your money.

No need to lift a finger. Every time you spend on your card or digital wallet, or receive a payment, we'll send a notification straight to your phone.

Feeling overwhelmed? You can turn off alerts anytime with just a tap.

What are they?

At AMP Bank GO, we prioritise your convenience, so we won’t send you paper statements. Instead, you can easily check your spending month-by-month or download custom statements with just a few taps in the app.

1. Just tap the top right icon in the app to open the account menu

2. Tap on ‘Statements’, then ‘Statement history’ and select your desired date range

3. Choose the option to export in PDF or CSV

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.

For accounts with BSB number 939 900 and accessed via AMP Bank GO, Terms and Conditions apply and are available here.

For accounts with BSB number 939 200 and accessed via the My AMP app, Terms and Conditions are available here.

Qantas Frequent Flyer

You must be a member of the Qantas Frequent Flyer program to earn and use Qantas Points. A joining fee usually applies. However, AMP has arranged for complimentary membership for new customers who join here. Membership and Qantas Points are subject to the Qantas Frequent Flyer program Terms and Conditions.

Qantas Business Rewards

Your business must be a Qantas Business Rewards member to earn and use Qantas Points for the business. Membership of Qantas Business Rewards and the earning of Qantas Points as a business are subject to the Qantas Business Rewards Terms and Conditions. A joining fee usually applies. However, AMP has arranged for complimentary membership for new customers who join here.