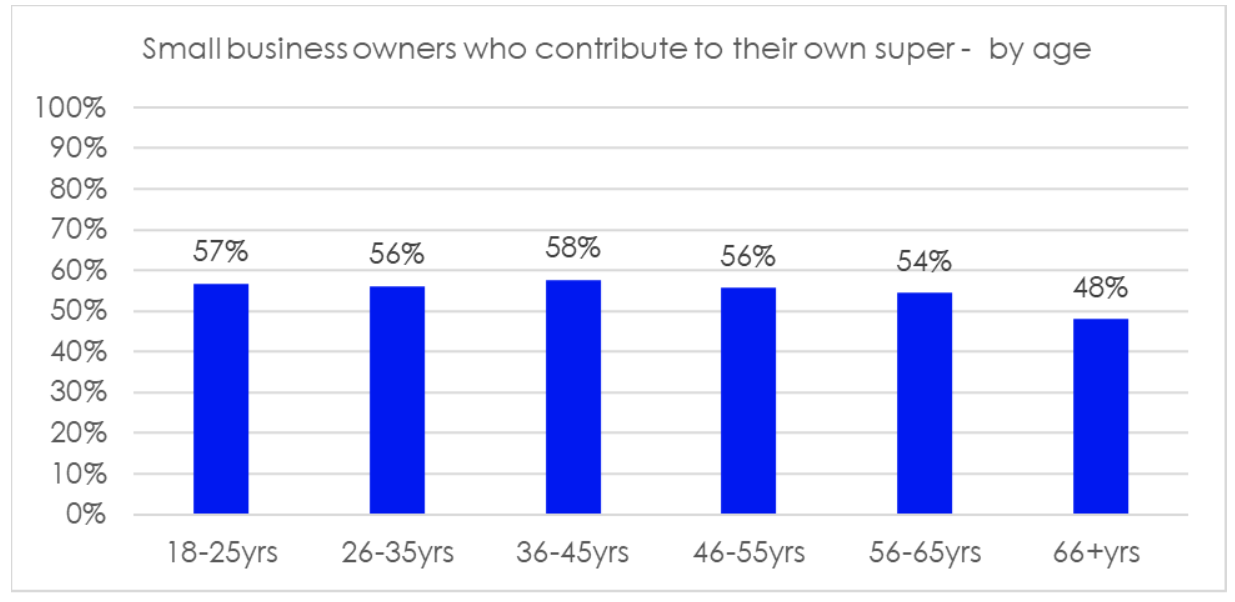

~ Across all ages, a significant proportion of small business owners are not contributing to their superannuation

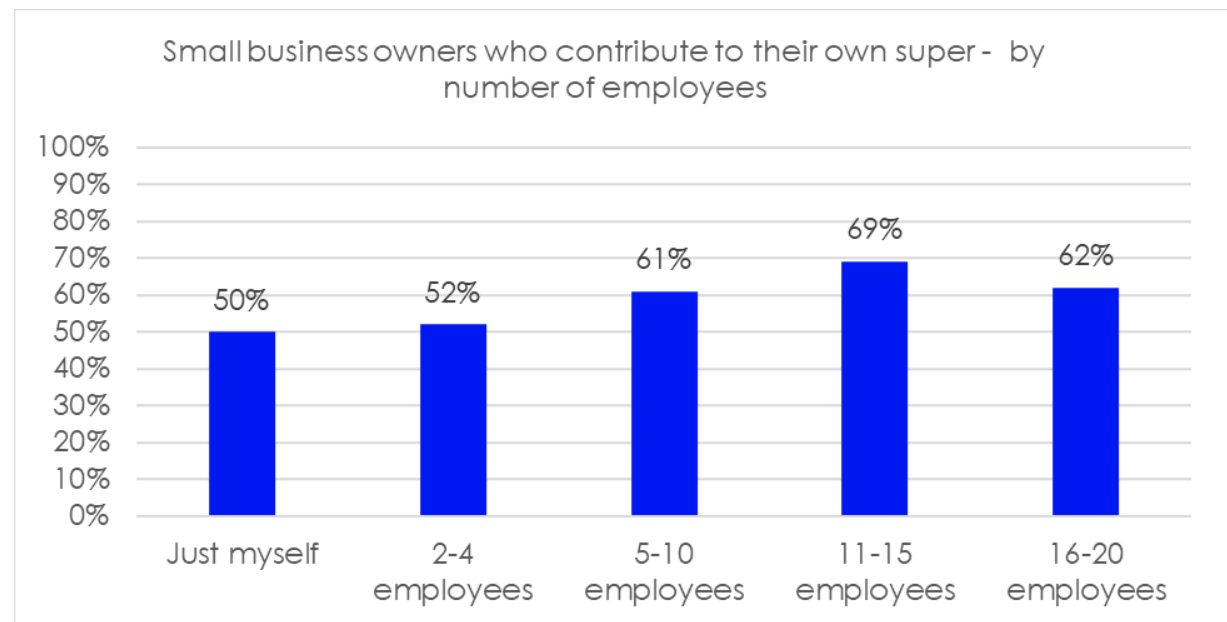

~ Solopreneurs and micro-businesses with 4 or fewer employees are less likely to put money into their super; 50% and 55% respectively

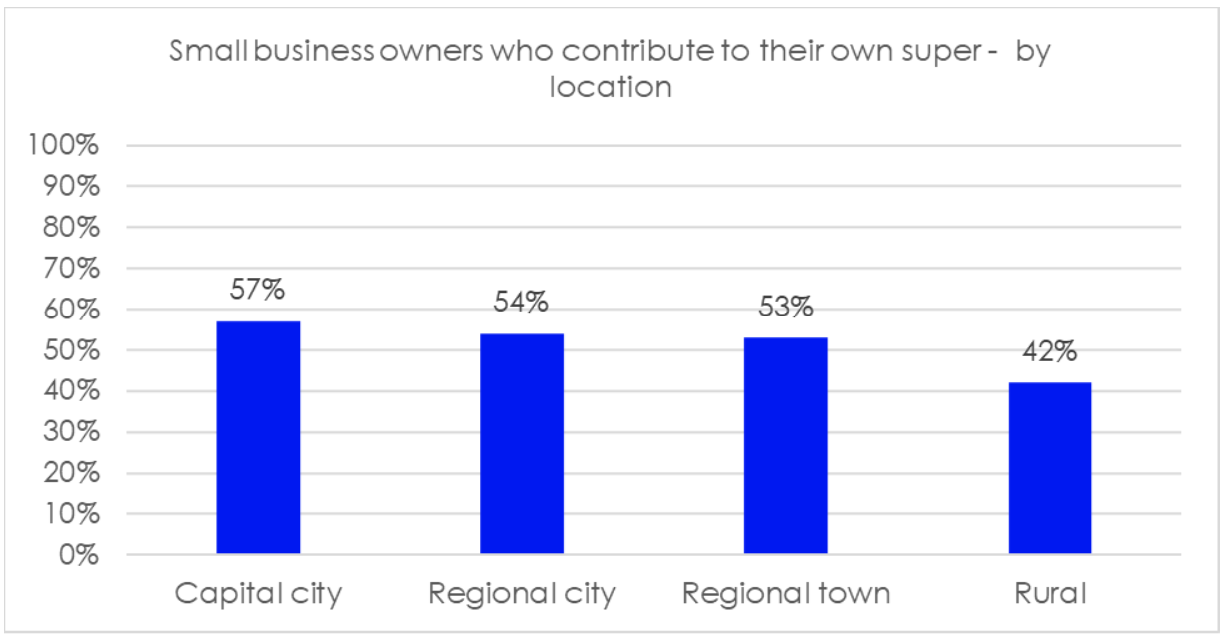

~ Owners with newer businesses, between 1-3 years old, and those in rural locations, are among the least likely to contribute to super

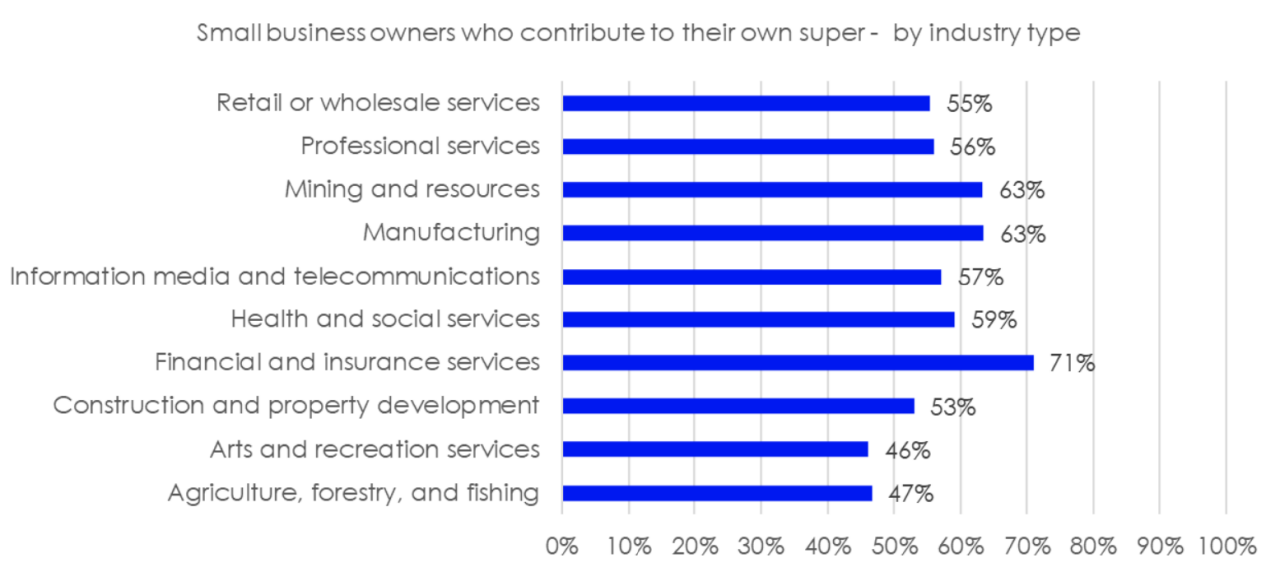

~ Small business owners in financial services are most likely to contribute to their super; this figure rises to 71%. Creative industries have the lowest rates of contribution at 46%.

Australia could be heading toward a retirement crisis hidden in plain sight, as new AMP Bank research reveals a worrying lack of superannuation contributions among the country’s smallest business owners.

n a national survey of 2,000 small business operators – most running small or micro businesses with 4 or fewer employees – 55% said they regularly contribute to their superannuation – meaning that close to half aren’t. Many prioritise reinvesting in their business or managing cash flow over long-term financial security.

By contrast, around 90% of the Australian workforce is covered by the Superannuation Guarantee and are receiving regular superannuation entitlements, now increased to 12%. There are approximately 2.2 million self-employed people in Australia not obligated to make super contributions, however doing so would serve to boost superannuation balances and diversify retirement savings1. But it would also reduce their ability to invest in their businesses.

Sole traders consistently make up the majority of Australia’s business owners, however our superannuation system is designed for a nation of employed workers. Super has never been compulsory for the self-employed, reflecting the need for flexibility. But that flexibility comes at a cost – and it’s fuelling a retirement savings gap that compounds with time.

Don’t play super catch up; the earlier the habit starts, the greater the reward

Because super is a long-term investment, even small regular contributions can grow into a large sum over time. AMP’s modelling shows that contributing $100 to super per week from age 30, assuming a 6% annual return, by age 65 they would have over $500,000.

John Arnott, Director, AMP Bank GO, said:

“It’s understandable that many small business owners prioritise reinvesting in their business, which can mean super contributions fall by the wayside. In the early stages, cash flow is often tight – paying a wage, let alone contributing regularly to super, can be a real challenge.

“On top of that, Australia’s superannuation system can be complex, and it’s not always clear where to begin. My advice to small business owners is to strike the right balance between managing short term business health and longer-term financial goals. Fortunately, there are practical tools and information available to help guide you build smart financial habits efficiently and confidently.

“Time is precious, and the admin and mental load are very real. Resources like the ATO’s website, your banking app, can help automate processes and provide valuable cash flow insights, visibility and control.

“And importantly, understand how to make the most of the super system. It offers significant tax advantages for long-term investing, and even small, regular contributions can grow substantially over time thanks to the power of compounding.”

Super and business success; 5 tips for small business owners

1. Stay informed

Keep learning – whether it’s new tech or changing regulations, keeping up with industry trends, and using financial tools like AMP’s retirement calculator, helps you make smarter decisions. Tap into trusted sources like the ATO and ASIC’s MoneySmart websites, or resources from your bank, to help make confident, informed decisions.

2. Make super work for you

Super contributions offer long-term benefits, including tax advantages and compounding growth. You can contribute by:

- Paying yourself a wage and setting up regular before-tax contributions.

- Using business profits to make lump sum contributions when cash flow allows.

3. Use government incentives

Take advantage of programs like the super co-contribution for eligible income earners, or tax-deductible personal contributions. These can help boost your retirement savings while reducing your tax bill.

4. Streamline with tech

Use digital tools – like banking apps and accounting software – to automate admin, track spending, and improve cash flow. Less time on paperwork means more time for growth.

5. Get support

Professional advice can make a real difference – especially when it comes to complex areas like superannuation. Talk to your super fund about options and resources available. But also, don’t underestimate the value of peer support: connecting with other small business owners can offer fresh perspectives and practical strategies.