~ Digital advice is leading to an almost 13-fold increase in the number of members seeking guidance on their retirement planning, according to the latest AMP figures

~ Over 12,000 members have engaged with AMP’s digital advice service since launch

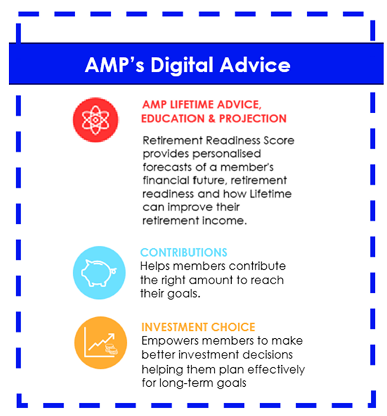

~ AMP’s digital advice offering now also includes education and advice around AMP’s Lifetime feature, a market-first retirement income boost for super members

AMP has unveiled major enhancements to its digital advice solution, giving members 24/7 access to personalised investment and contribution advice, alongside Lifetime retirement projections — all available via My AMP with no extra fees.

This latest enhancement empowers members to make confident, well-informed decisions about their superannuation. Members already received a ‘Retirement Income Score’ showing retirement readiness, and now they can also see how they can improve that score if they opt in to the industry-first AMP Super Lifetime feature.

New modules offer personal advice to select the right investment option and optimise their contributions. Members get a Statement of Advice (SOA) and access to phone-based adviser support to help them understand their options and take action.

The move comes in response to growing demand for retirement guidance, with over 12,000 members engaging with AMP’s digital advice service since its launch on 30 January this year.

Over 14,000 Retirement Health Check journeys have been initiated since then and more than 6,700 members have completed a Retirement Health Check journey, which includes a retirement income projection, Age Pension insights, and the ability to set income goals. That is nearly a 13-fold increase in total members getting guidance on their retirement planning last year, according to the latest AMP figures1.

The advice journey also features the “Ways to Improve” tool, giving members the ability to explore and test different financial strategies to improve their retirement outcomes.