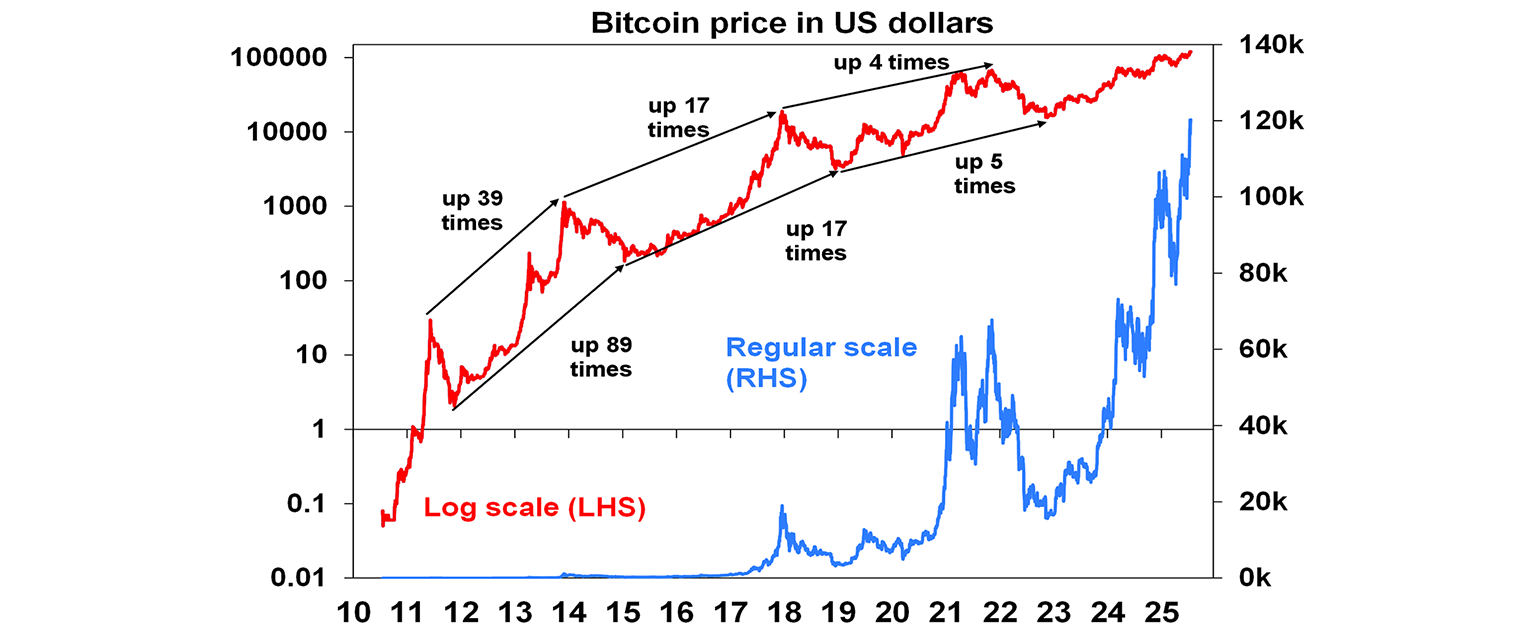

US and Australian shares pushed on to new record highs in the past week. Despite tariff uncertainty, the US share market was boosted by solid economic data and tech stocks getting a boost on indications Nvidia and others could resume chip sales to China. For the week the US share market rose 0.6%. Japanese shares also gained 0.6% and Chinese shares rose 1.1%, but Eurozone shares fell 0.2%. The strong US lead along with increased confidence that the RBA will cut rates in August, a strong production report from BHP and a bit of FOMO as the ASX 200 burst through 8700 saw the Australian share market rise 2.1% for the week led by IT, health, property, energy and telco shares. US, Japanese and Australian bond yields rose but they fell in Europe. Oil and gold prices fell but copper and iron ore prices rose. The $A fell on heightened expectations for RBA rate cuts and as the $US rose from oversold levels, but Bitcoin rose to a new record high.

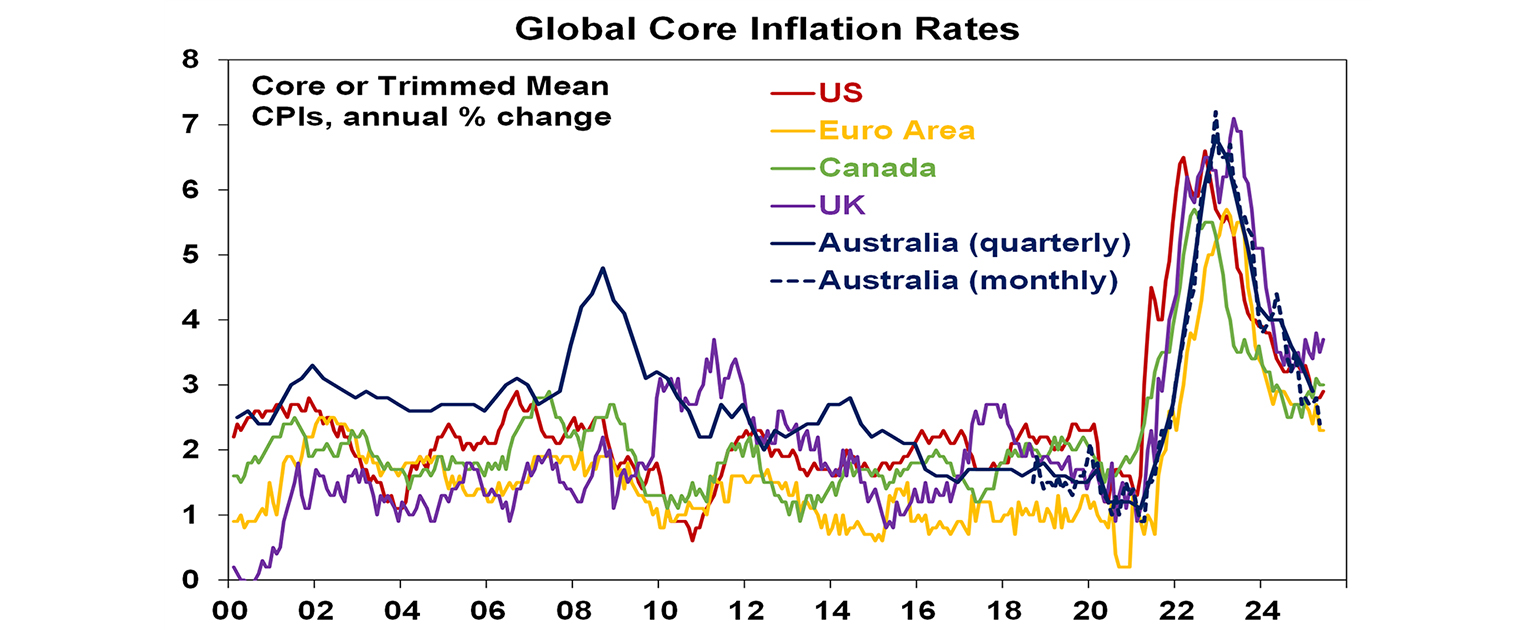

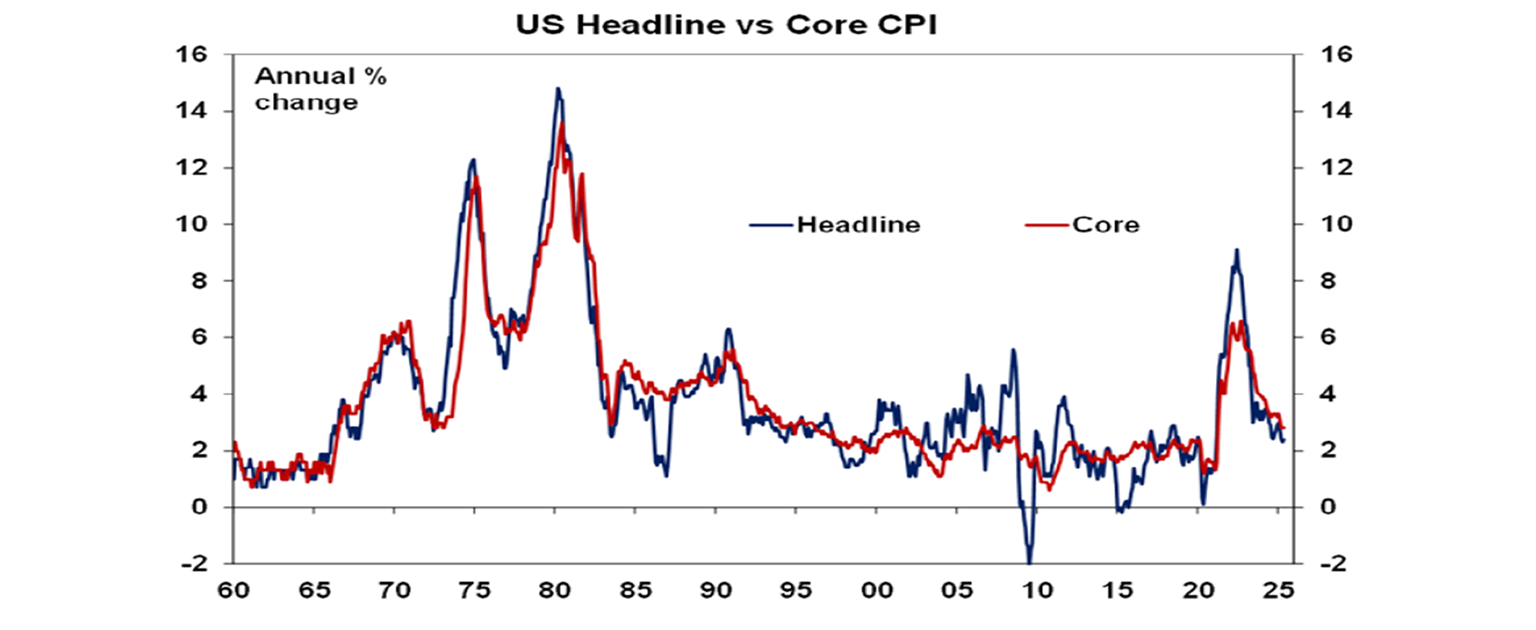

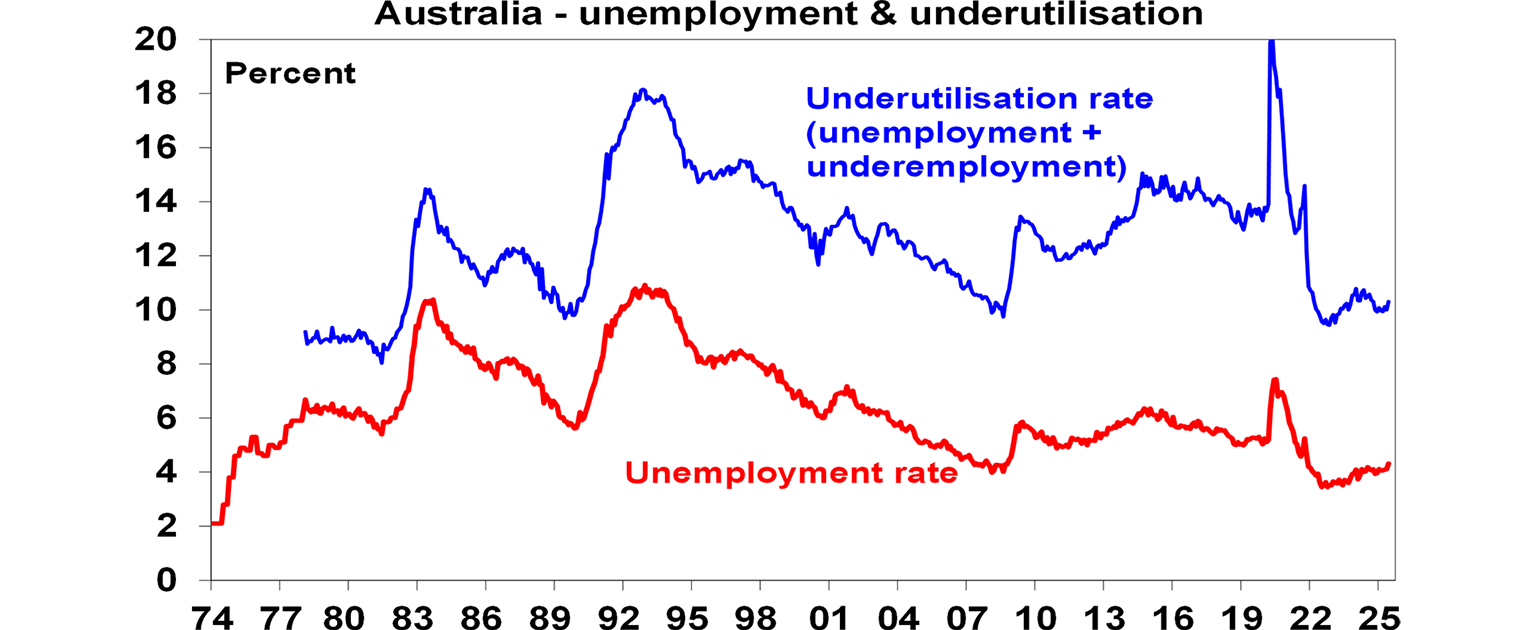

In Australia, soft jobs data leaves the RBA on track to cut rates in August. With unemployment breaking to its highest since the pandemic and June jobs data showing broad based weakness it’s now hard to describe the labour market as tight. It also supports the view that the RBA should have cut this month. Our base case is for 0.25% rate cuts in August, November, February and May, but the softening jobs data suggests the risks may be skewed to faster easing with back-to-back cuts in August and September. June quarter inflation data on 30th July will be key. Meanwhile underlying US, UK and Canadian inflation data over the last week showing flat or a slight rise in core inflation to 2.9%, 3.7% and 3% respectively highlight that Australian underlying inflation at 2.4% compares well. The money market now sees a 98% chance of an August rate cut.

The RBA’s proposed ban on credit and debit card surcharges makes sense but the benefit to the consumer and inflation may not be much. These surcharges are annoying and some are excessive, particularly when you allow that the actual cost of transacting with a card is less than with cash (which must be protected, added up and then banked). But bank transaction charges should just be in the price as with all other merchant costs and will likely simply become so.

The Australian Treasury stated the obvious in telling the Government that to make the budget sustainable it has to raise taxes or cut spending. The good news though is that it favours cutting personal income tax, to “give workers a fair go”, and company tax and appears to support “indirect taxes” like the GST. The danger is that the in the aftermath of the Productivity Summit the Government rejects the latter and focusses on cutting back on tax concessions which would have the effect of further boosting personal income tax adding to the disincentive towards labour force participation and locking in an increasing reliance on Gen Z and Millennials to pay the budgetary costs of an aging population.

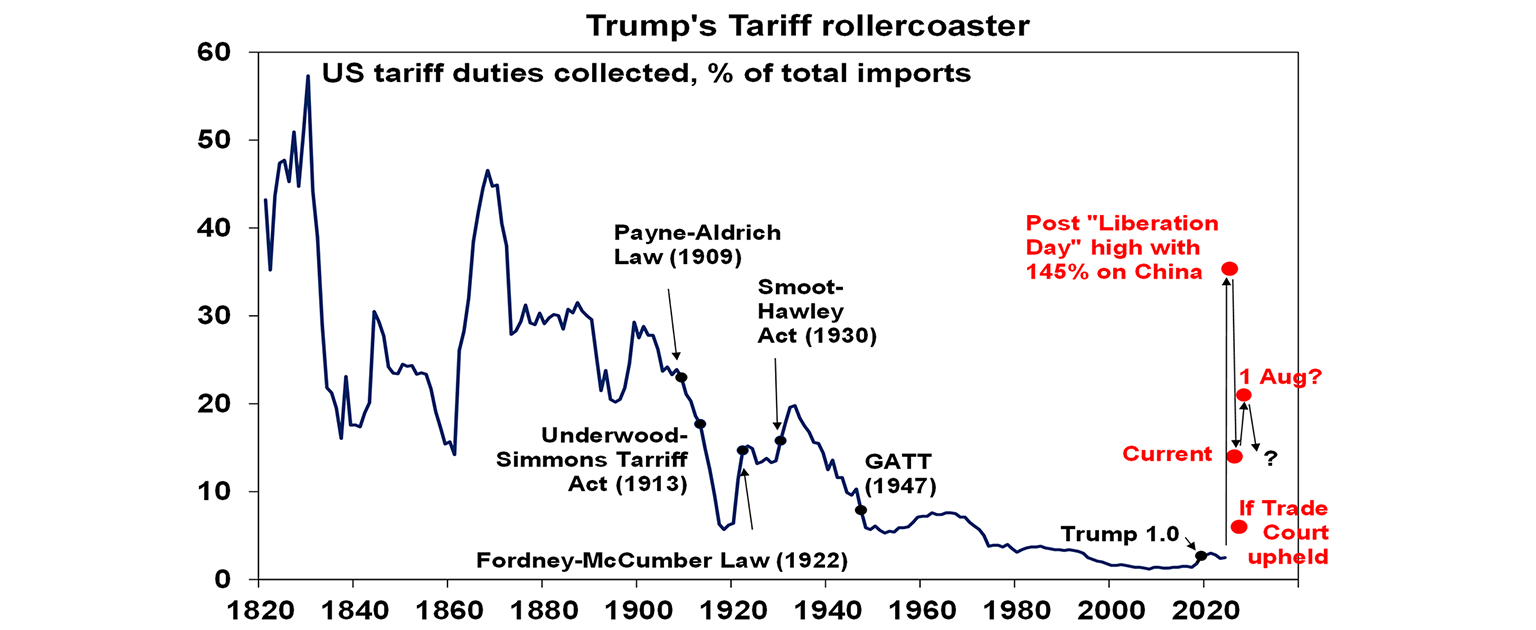

Tariff Man is back. Empowered by record high shares, still low unemployment and inflation, the passing of the tax cut bill, “victory” over Iran and frustration at the lack of trade deals Trump has escalated tariffs. While the delay to 1st August is good, in the last two weeks Trump has: announced reciprocal tariffs on 25 countries ranging from 20% to 50% including on Japan, Canada, Mexico and Europe; announced various sectoral tariffs including on copper and pharmaceuticals possibly from 1st August with more on the way; announced that other countries could face tariffs of 10-15%, although a week ago it was going to be 15-20%; and basically told us that there is no economic rational with Press Secretary Levitt saying he just looks at the global map to see where “they are ripping off the American people” with 50% on Brazil justified on the grounds that he didn’t like their previous president being prosecuted for inciting an insurrection.

The tariffs announced so far imply a spike in the average US tariff rate to around 21% from around 15% currently. Of course, the 1st August deadline could be extended again, and more trade deals may be announced. However, many countries seem reluctant to reach agreements with unknown sectoral tariffs yet to come and the deals reached so far are not so good. The deal with China is just a truce. The UK deal saw little in it for the UK. And those with Vietnam (which is yet to be confirmed by Vietnam!) and Indonesia are very lopsided with zero tariffs on US goods but 20% and 19% on goods from those countries going into the US. Ultimately, a combination of trade deals and Trump being forced to back down in the face of market volatility and or the economic impact are likely to see the tariffs settle back down around current levels, but this may take a while to become apparent. In the meantime, the risks to the economic outlook and hence for markets will likely build.

For Australia, there is some risk that Trump may threaten to raise the 10% general tariff if there is no deal given the 50% tariff imposed on Brazil for political reasons despite the US having a trade surplus with Brazil and his talk of a 10-15% general tariff. In terms of sectoral tariffs, that on pharmaceuticals poses the biggest threat to Australia, but our exports to the US are very small share of our exports (less than 5%) and economy and the main threat will continue to come via any hit to global growth from the tariffs.

So far markets have been relaxed but the risk is high. Investors appear to be assuming that Trump will back down (TACO) but the risk is that it will require a market panic for this to happen, as was the case in April. At the same time there are several other threats.

First, Trump is continuing to make noises about sacking Powell threatening perceptions of Fed independence. While he denied it yet again saying “we’re not planning on doing anything” his qualification that “unless he has to leave for fraud” is a refence to allegations that he lied over cost over-runs in the Fed building renovation. There is no evidence so far of the latter, but Trump may try and continue to find a way to remove Powell ahead of the end of his term as Chair next May, even though this has been made difficult by the Supreme Court signalling he lacks the power to do so. If he does move to do anything that is seen to weaken Fed independence – like sacking Powell or nominating a political replacement who is seen as soft on inflation - it’s likely to be taken badly by markets. This was seen on Wednesday when the latest threat emerged and saw US shares plunge 0.8% and the $US fall 1.2% before the moves were reversed as Trump backed off.

Second, Trump threatened a 100% “secondary tariff” on Russian trading partners if Russia did not agree to a ceasefire with Ukraine. This could force countries that rely on Russian oil to switch to other suppliers pushing oil prices up given limited OPEC spare capacity. So far oil prices have not really reacted and it’s probably a low risk.

Third, the US Treasury will soon start to resume bond issuance after the OBBBA tax cut act raised the debt ceiling which could put upwards pressure on bond yields.

Fourth, the challenge to Trump’s reciprocal tariffs may reach the Supreme Court in September.

Fifth, the threat of a Government shutdown will loom ahead of the end of the government’s fiscal year in September.

Finally, if the furore with the Epstein files refuses to go away – with Trump calling some MAGA supporters “stupid people” and Musk pushing it further – Trump may seek a “wag the dog” distraction like even more tariffs or sacking Powell. This arguably explained the decision to use the National Guard and Marines in LA riots after Musk first raised the Epstein files.

Shares could push further into record territory on hopes for trade deals this month as July is normally a strong month. However, the renewed tariff escalation, threats to Fed independence, worries about the US fiscal outlook and signs of softer economic growth against a backdrop of stretched valuations and shares being technically overbought could see a renewed share market correction into the seasonally weak months of August and September. Beyond the messy near-term outlook though, shares should benefit on a 6-12 month view as Trump backs down from extreme tariff threats again and continues to pivot towards more market friendly policies, the Fed starts cutting rates again and other central banks including the RBA continue to cut.

Partly reflecting uncertainty around the US dollar Bitcoin has made it to new record high. Bitcoin’s latest surge reflects a combination of friendly US regulation (with stablecoin regulation passed this week), geopolitical uncertainty, increasing institutional adoption, demand for a digital version of gold along with demand for a hedge against a falling US dollar in the face of US uncertainty. While it’s doubtful that Bitcoin will become widely used for transactions it is carving out a role for itself as a form of digital gold. Investors need to allow that volatility will likely remain high with the risk of another crypto winter drawdown, even though the longer-term trend in Bitcoin’s price is likely to remain up. This has been slowing as the easy gains from its inception have been seen, but even a 2 or 3 fold gain from its 2021 high would take it to around $US135,000 to $US200,000. See the next chart.

With Trump’s ICE putting on a show of force in LA’s MacArthur Park it reminded me of the song the Park inspired. Here’s the disco version. Hopefully they looked after the cake in the rain!

Major global economic events and implications

US economic data was mostly solid. Industrial production and retail sales both rose more than expected, although the latter was after several soft months and partly reflected higher goods prices. Both the New York and Philadelphia regional manufacturing indexes bounced with stronger readings for orders and employment. Initial jobless claims fell but continuing jobless claims remain in a rising trend continuing a low firing but low hiring pattern. And housing starts, permits to build new homes and home builder conditions remain weak.

Meanwhile, US inflation in June was slightly weaker than expected. Core inflation came in slightly weaker than expected at 0.2%mom or 2.9%yoy and core producer price inflation was also weaker than expected at 2.3%yoy. However, there are increasing signs of tariffs impacting US inflation – in furnishings, apparel, appliances and recreational goods. While consumers’ 5-10 year inflation expectations fell back to 3.6%pa they remain elevated. And both the regional manufacturing indices showed high price pressures. Further tariff impacts are likely as inventories built up ahead of the tariffs run down. Relevant components from the CPI and PPI also point to slightly higher core private final consumption deflator inflation. This is likely to keep the Fed in “wait and learn” mode despite Trump’s ravings and Fed Governors Waller and Bowman who are in a dovish minority for now. The Fed is still likely to cut twice this year though.

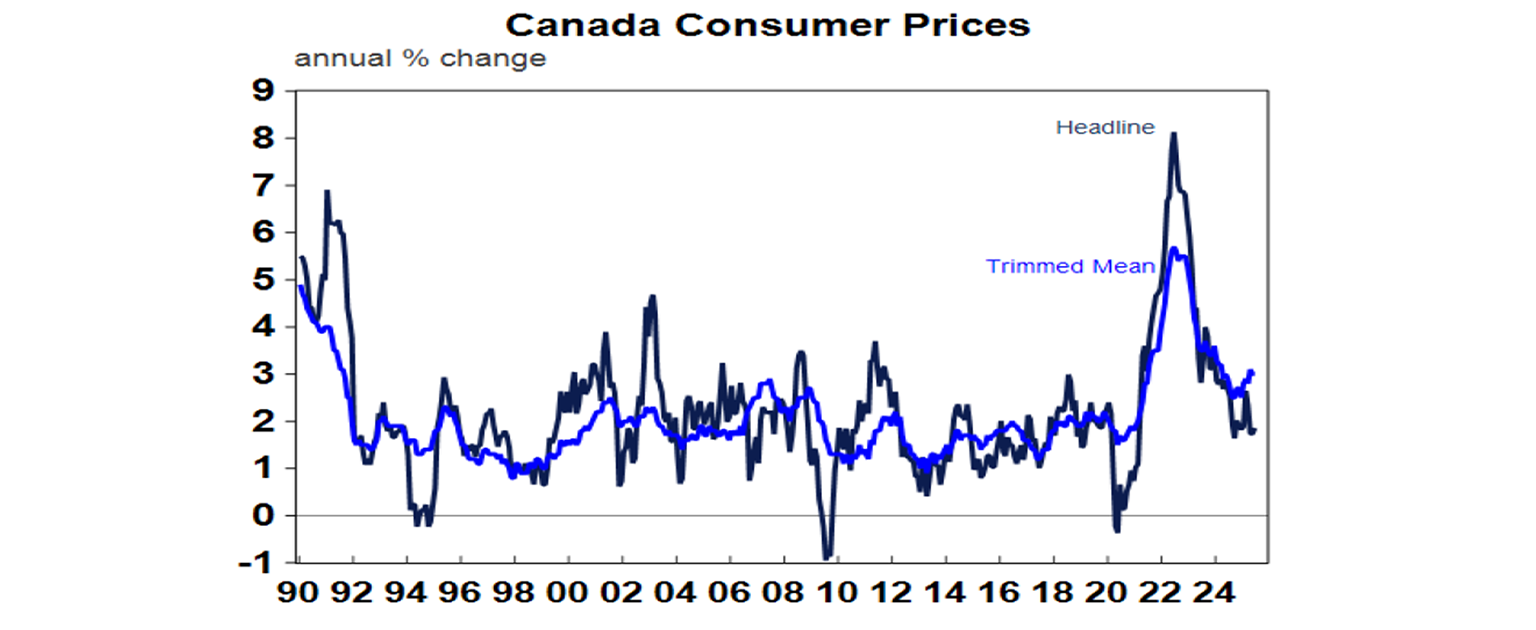

Bank of Canada likely to hold rates for a while. Canadian inflation for June rose to 1.9%yoy with underlying measures remaining around 3%yoy, which will likely keep the Bank of Canada on hold at 2.75% for now, but another rate is still expected by year end.

UK inflation also rose in June to 3.6%yoy with core at 3.7%yoy, but weakening economic activity highlighted by falling payrolls and rising unemployment in June suggests its temporary with the Bank of England still expected to cut rates again next month.

Japanese bond yields rose further in the last week on concerns that the Government may lose its majority in weekend upper house parliamentary elections which could lead to a further loss of fiscal discipline at a time when investors are already nervous about high public debt levels. Japanese inflation fell to 3.3%yoy in June with core inflation flat at 1.6%yoy leaving no reason for the BoJ to hike rates soon.

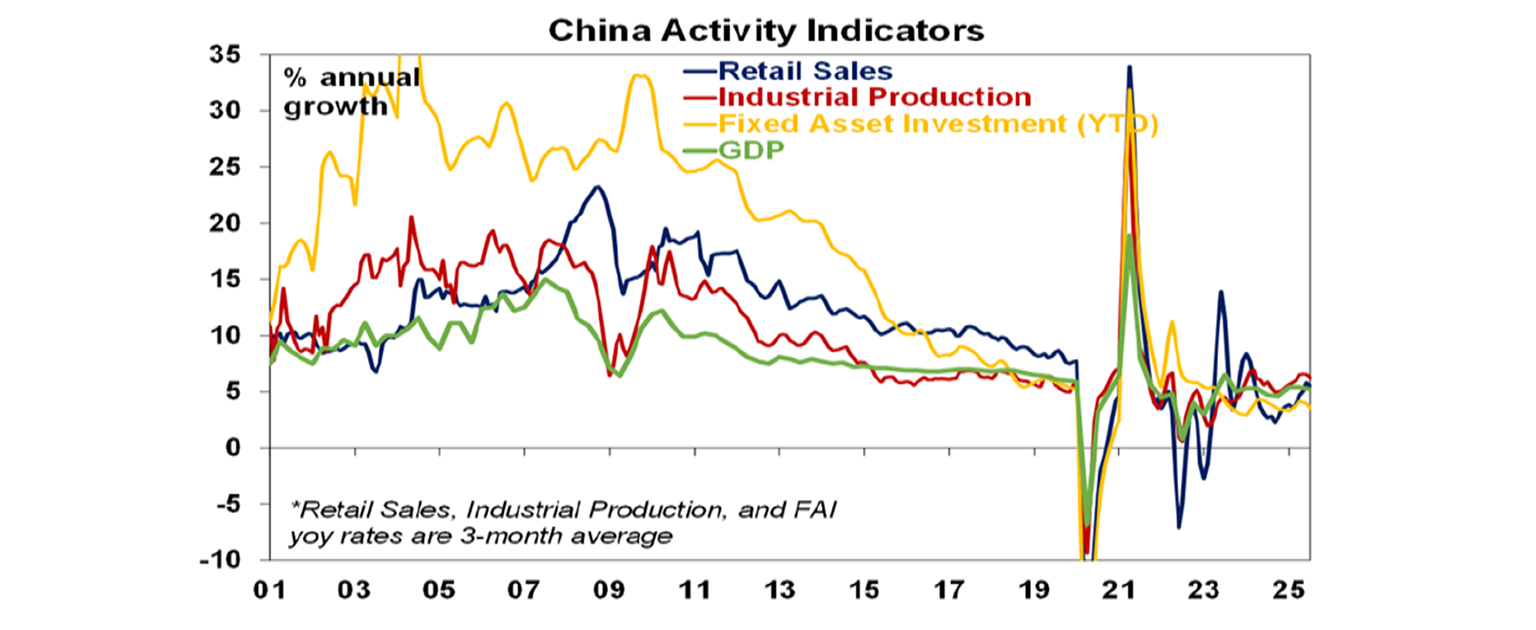

Chinese economic data for June was okay, but not great. Retail sales and investment came in weaker than expected but industrial production, credit growth and GDP at 5.2%yoy came in stronger than expected helped by stronger than expected exports. Chinese property data remains weak. Expect further policy stimulus but it’s likely to be just enough to avoid a crisis & keep growth around 5%.

Australian economic events and implications

The Australian jobs market looks to be easing (again). June data showed broad based softness with weak employment for the second month in a row, a fall in full time employment, a fall in hours worked, a rise in unemployment to 4.3% (it’s highest since the pandemic), with most states seeing higher unemployment and labour underutilisation rising to 10.3%.

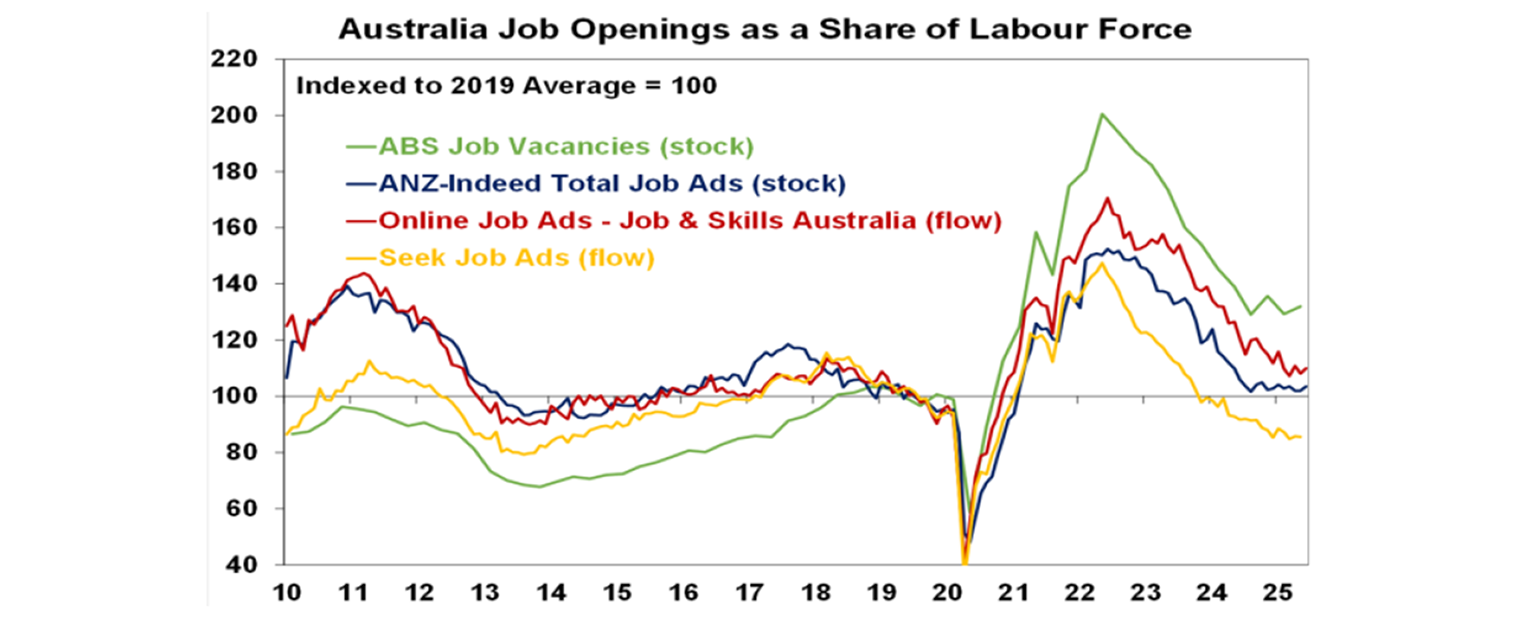

Jobs data can be quite volatile, but it now appears to be softening consistent with job openings indicators. It will now be harder for the RBA to characterise the labour market as tight, and the June jobs data is a tick for an RBA rate cut next month.

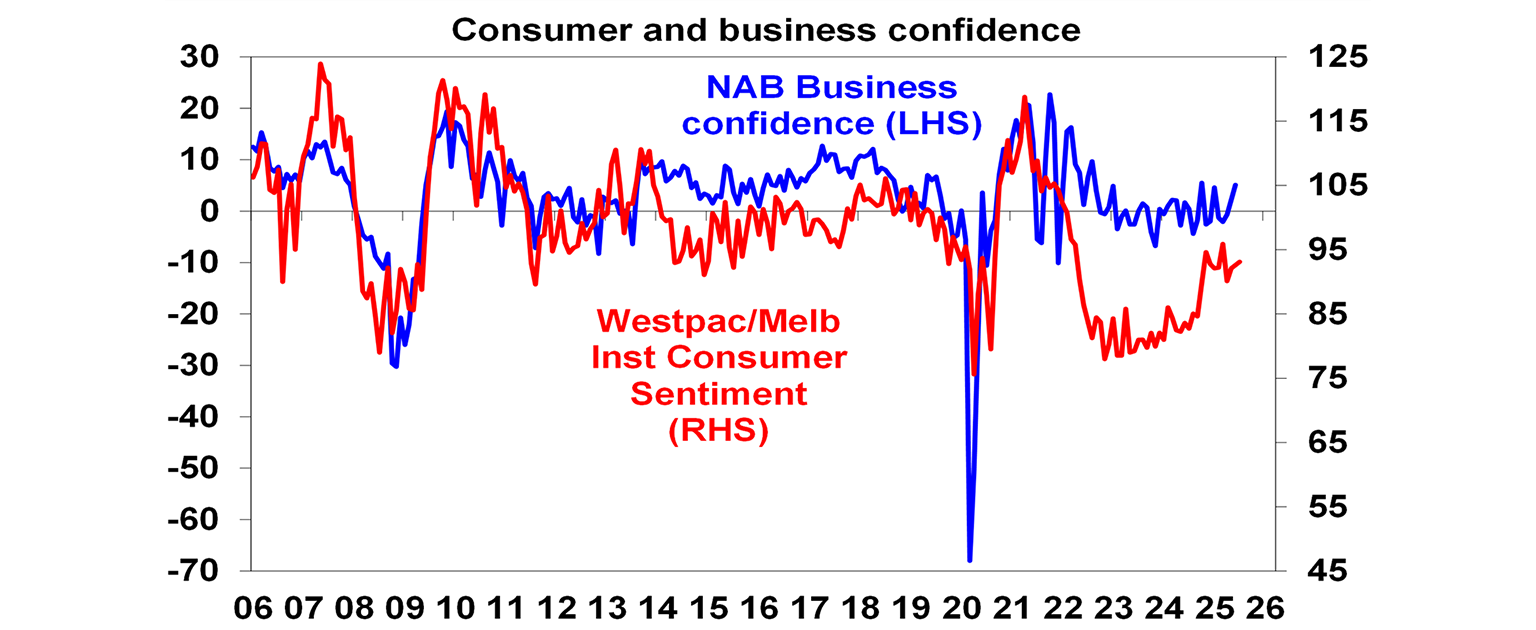

Consumer sentiment improved but remains soft, suggesting constrained consumer spending.

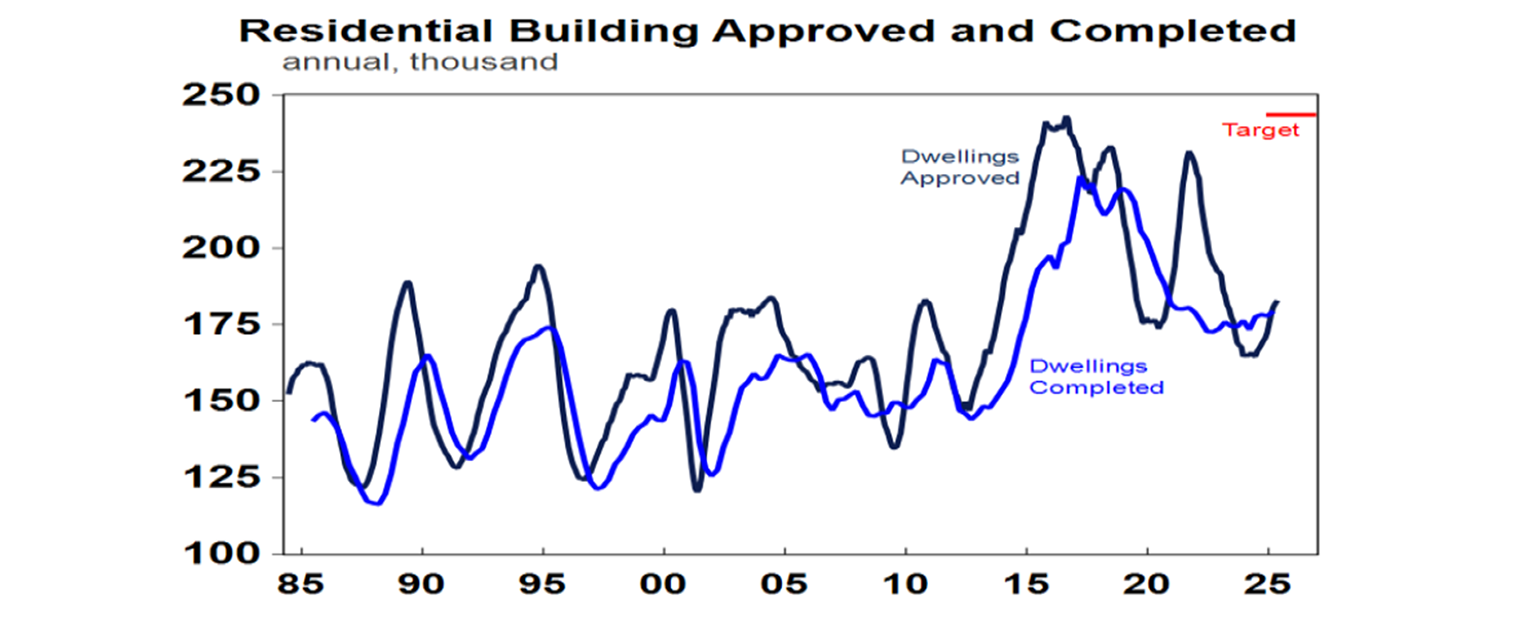

Completions of new homes are trending up but are only track for 180,000 dwellings in the 2024-25 financial year. This is well below the Housing Accord target of 240,000 homes a year.

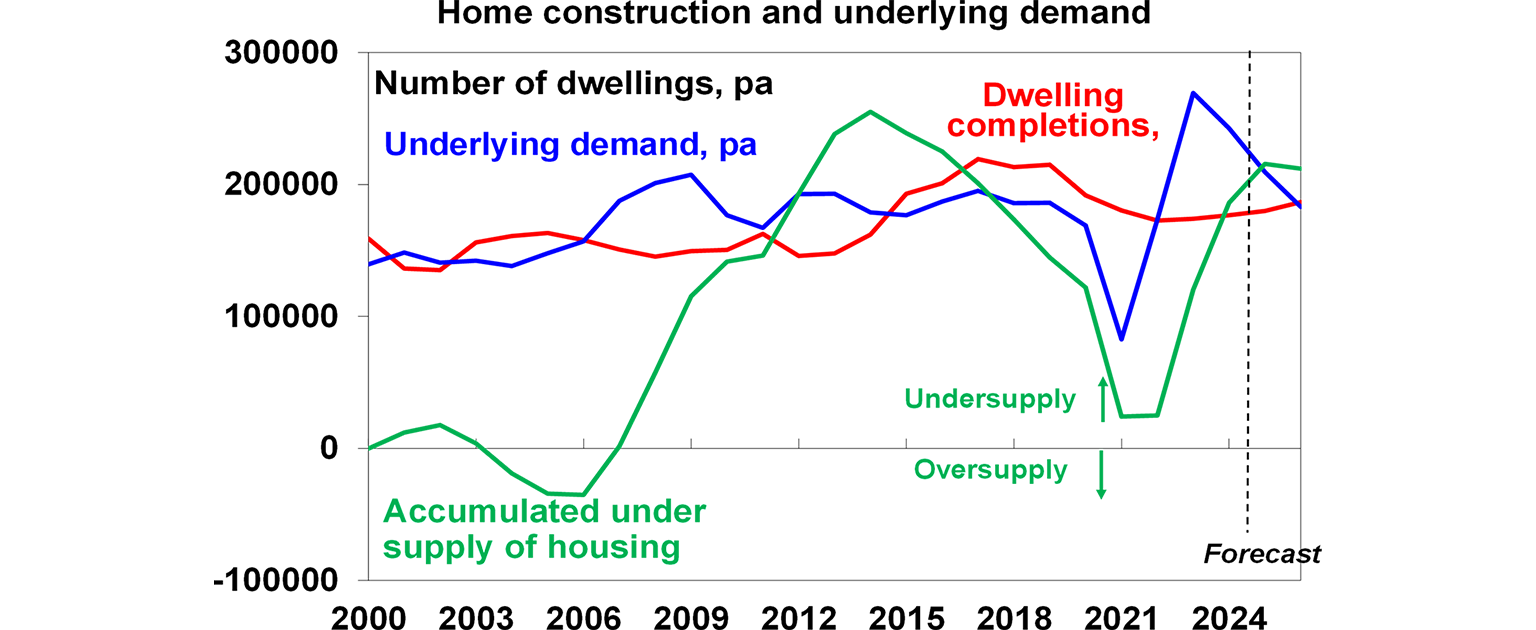

This means completions (see the red line in the next chart) were again way below underlying population driven demand for housing (the blue line) resulting in a further lift in the accumulated under supply of housing (the green line). While slowing population growth and a further lift in completions this year should bring the housing market into somewhat better balance in terms of new supply and demand, if we want to reduce the accumulated housing shortfall – which we estimate to be at least 200000 dwellings - its critically important that Federal and state governments retain the Housing Accord commitment to build 240,000 dwellings a year and step up measures to make sure this is achieved – including building industry deregulation, training and supplying more homebuilders, encouraging a greater focus on units and finding more ways to lower costs (like pattern plans in NSW, smaller houses and greater reliance on wood than bricks and concrete). Just because the Housing Accord objective has not been achieved in the first year is no reason to drop it.

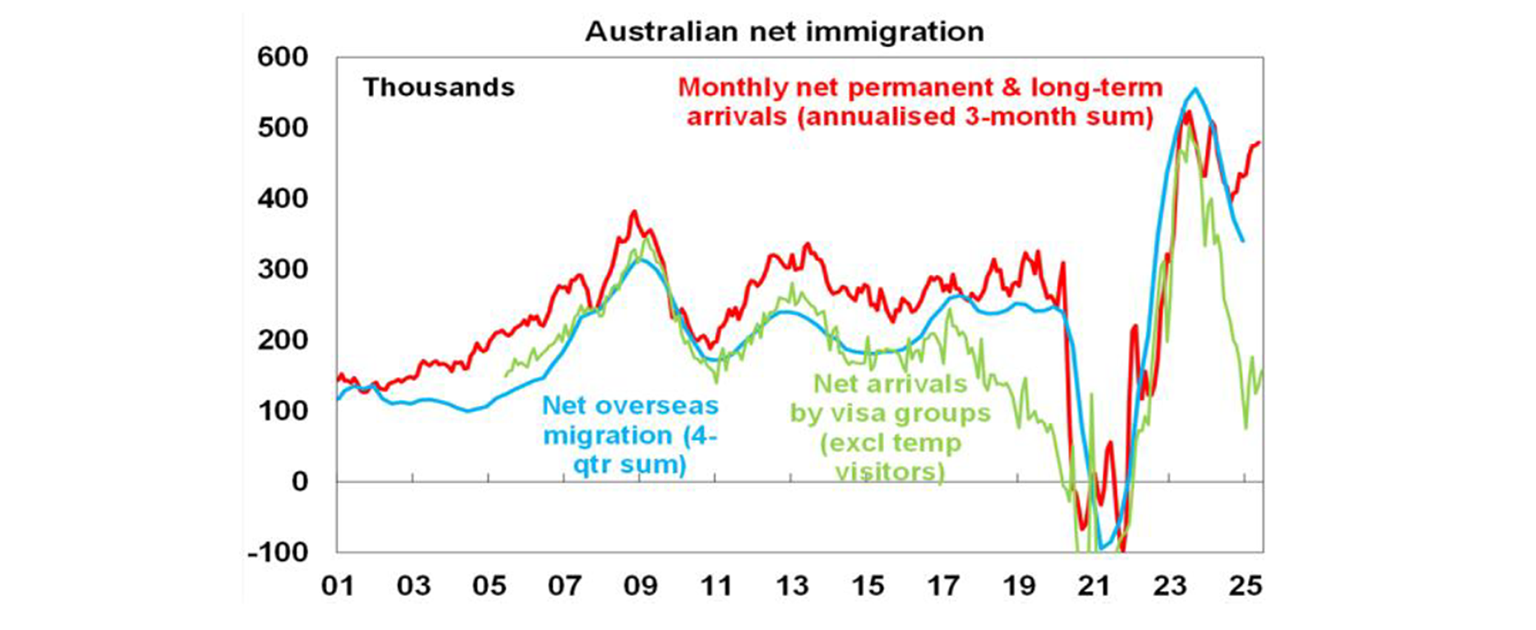

On the housing demand side, immigration has been falling to more sustainable levels, but the latest monthly arrivals data are continuing to give conflicting signals. Visa based data still points down whereas net permanent and long arrivals data points up.

What to watch over the week ahead?

Business conditions PMIs for June for major countries to be released on Monday are expected to remain subdued reflecting tariff uncertainty which has escalated again.

In the US expect ongoing softness in June data for home sales and softer durable goods orders (Friday). The June quarter earnings reporting season will also start to ramp up with the consensus expecting a 4.7%yoy rise. Past earnings surprises suggest an outcome closer to 8%yoy but there is more than normal uncertainty around this given the impact of tariffs on margins. Excluding the tech sector, earnings are expected to fall.

The ECB (Thursday) is expected to leave its key policy rates on hold (at 2% for the deposit rate), but with a strong easing bias.

In Japan the focus will be on the outcome from the upper house election, where a loss by the ruling coalition could lead to concerns about political instability and a further deterioration in the outlook for public debt.

New Zealand’s June quarter inflation is expected to rise to 2.8%yoy from 2.5%, driven by volatile and tradeable items with non-tradeable inflation falling.

The minutes from the last RBA meeting (Tuesday) will likely shed more light on the RBA’s decision to leave rates on hold but should indicate that it retains an easing bias. It’s a bit dated now though given the latest jobs data.

Outlook for investment markets

Share market volatility is likely to remain high in the next few months given tariff uncertainties, concerns about US debt and likely weaker growth and profits. But with Trump pivoting towards more market friendly policies and central banks, including the Fed and RBA, likely to cut rates further, shares are likely to provide reasonable gains into year end.

Bonds are likely to provide returns around running yield or a bit more, as growth slows, and central banks cut rates. A US public debt crisis is the main threat to this.

Unlisted commercial property returns are likely to improve as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have started an upswing on the back of lower interest rates. But it’s likely to be modest initially with US tariff worries constraining buyers. We see home prices rising around 5 or 6% this year.

Cash and bank deposits are expected to provide returns of around 3.75%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted in the near term between the negative global impact of US tariffs and the potential positive of a further fall in the overvalued US dollar. Undervaluation should support it on a medium-term view with fair value around $US0.73.

You may also like

-

The outlook for Australian shares – is the long underperformance over? Australian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009. -

Weekly market update - 20-02-2026 Global share markets mostly rose over the last week. Worries about AI and tech valuations took a breather and the US Supreme Court decision to strike down Trump’s emergency power tariffs with Trump immediately announcing a replacement were seen as having little impact on the US growth outlook but were seen as positive for other countries. -

Econosights - An update on global debt and fiscal policy With the International Monetary Fund releasing their Global Fiscal Monitor recently, AMP's Senior Economist, Diana Mousina provides an update on the global debt situation and recent fiscal policy announcements.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.