Who can have an AMP Bank account?

To apply for an AMP Bank account, you must be an Australian resident and meet the following age requirements:

- For personal and sole trader accounts, you need to be 15 years or older.

- For propriety company accounts, you must be 18 years or older.

You'll also need to download our app from the iOS App Store or Google Play Store to complete your application.

At this stage we only support customers who have an Australian mobile number.

We are constantly evolving our product so check back to see if your mobile number is eligible.

Opening additional accounts within the AMP Bank app is simple.

- Log into the AMP Bank app.

- Select the Main menu (top right).

- Swipe down to show the accounts menu.

- Select Open a new account.

- Select Type of account.

- Follow the instructions required to open a secondary account.

Please note, the types of additional accounts you can open will depend on the accounts you already hold within the AMP Bank app.

Personal transaction accounts

If you only hold a business account, then you can apply for a personal transaction account.

Sole traders + Company accounts

You are eligible to apply for multiple Company accounts, provided each account is for a separate entity. Currently, you may only apply for one sole trader account, whether it is registered or unregistered.

Generally, once you close your bank account, it cannot be reopened, instead, you'll need to open a new AMP Bank account which will require you to resubmit your personal documentation.

To open an AMP Bank account you will need a valid government-issued photo ID, such as a passport or Australian drivers licence.

We are unable to accept Medicare cards, birth certificates, or citizenship certificates as primary identification documents.

Please note all of our accounts are subject to eligibility criteria.

Account set up

To open an account, you'll need to provide at least one of the following ID documents:

- A valid Australian passport

- A valid Australian driving licence

- A valid international passport (with Australian visa)

These must clearly show your:

- physical appearance

- full name

- document identity number

- date of birth

- address

Our Personal accounts have no monthly fees, free Faster Payments, Direct Debits, Scheduled, and Recurring Payments, as well as fee-free international ATM withdrawals.

Tip. Whist AMP Bank do not charge ATM fees, the ATM provider may charge a fee.

For more information on our fees, rates, and charges here.

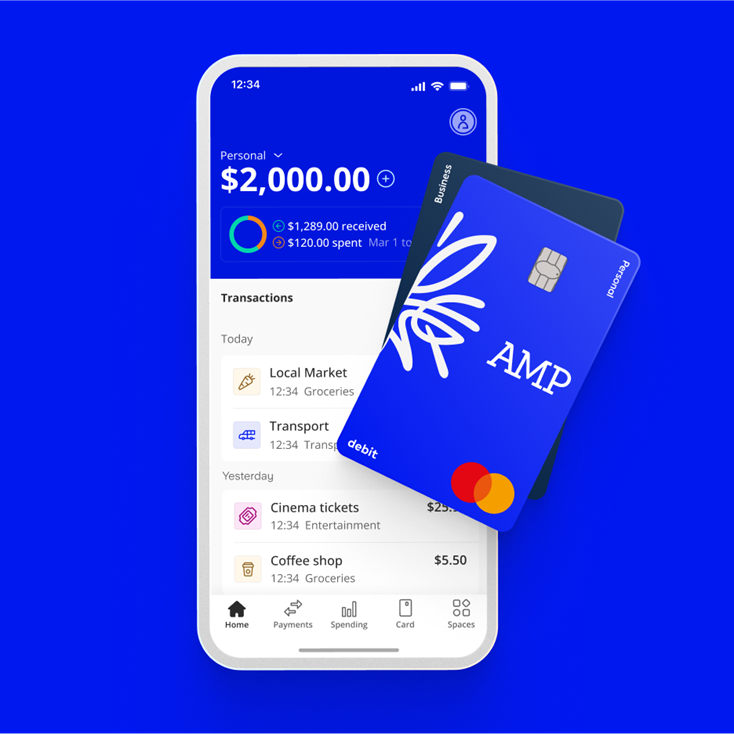

You can apply for a Personal account by downloading the AMP Bank app from:

- iOS - Apple's App Store.

- Android - Google's Play Store.

We’ll ask you for a valid government-issued photo ID and a video selfie. When your account's been verified, we'll send you a notification.

Tip. The AMP Bank app is not available on any other type of stores ie. Huawei etc.

You can apply for a Business account by downloading the AMP Bank app from:

- iOS - Apple's App Store.

- Android - Google's Play Store.

We’ll ask you for a valid government-issued photo ID and a video selfie. When your account's been verified, we'll send you a notification.

Tip. The AMP Bank app is not available on any other type of stores i.e.. Huawei etc.

When you first create a Business account, you will enter the details of other directors or business owners to be able to access to the account.

If you've entered in the wrong details or these individuals haven't received an invite, not to worry, just give us a call on 1800 950 105 and we'll be able to help.

If you're a director or business owner expecting an invite and haven't received one, just have whoever created the application to give us a call.

Account features

For a sole trader business account, the business owner is the only person who can access and manage the business account.

For a company business account, directors must be registered with ASIC and live in Australia to start the application process. Access to the business account will be granted to directors (only) after their approval.

If you are a beneficial owner but not a director, your identity must be verified through the AMP Bank app. However, you will NOT be granted access to the business account.

Additionally, if you are any other stakeholder such as a secretary, who is not also a director, you will not be able to have access to the business account.

We are working on supporting access for different users such as accountants and bookkeepers in the future.

Client money refers to any money that a business receives from or holds for, or on behalf of, a client. Client money accounts are separate from business money. It protects them in case the business goes bankrupt or faces insolvency or liquidation.

We understand that many businesses need these services, but at this time, we are unable to offer these.

For sole traders, the business owner is the only person who can access & manage the business account.

For companies, only Directors will have access to the business account once approved. Directors must be registered with ASIC and must live in Australia to start the application.

If you are not a director and are only a beneficial owner, we will need to verify your identity via the AMP Bank app but you will NOT have access to the business account.

Additionally, if you are any other stakeholder such as a Secretary, who is not a director, you will not be able to have access to the business account.

We are working on supporting more types of access for accountants and bookkeepers in the future.

Other help and support

-

Customer care

We know that you might need additional help, around products, deceased estates, legal documentation or customer care. Please get in touch with us.

-

Needing financial support?

When life throws unexpected challenges your way, your financial situation can change dramatically. In difficult times, we'll support you and help you get back on track.

-

Feedback & complaints

If you are unhappy with our products or service, we want to know about it. We treat every complaint seriously and aim to resolve your concerns as quickly as possible.

-

Ways to contact us

Are you overseas? See our overseas travel support.

Important information

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available here.

For accounts with BSB number 939 900, that you access via the AMP Bank mobile app, the Terms and conditions that apply are available here.

For accounts with BSB number 939 200, that you access via the My AMP mobile app, the Terms and conditions that apply are available here.