How to manage your Term Deposit

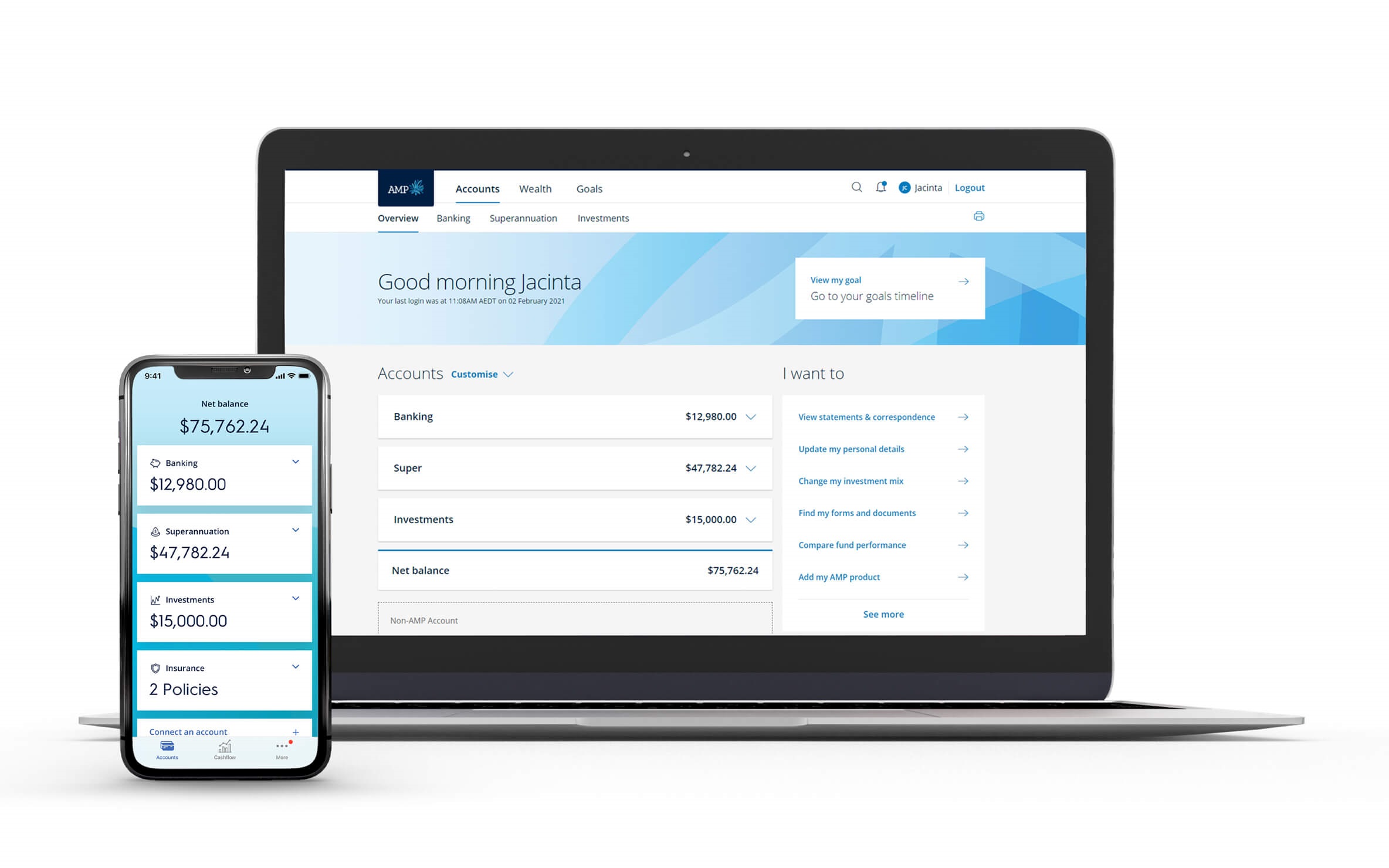

You can change your term deposit in My AMP

- Login or register for My AMP

- Select the term deposit you want to manage

- Choose Change or Break my term deposit in the I want to menu

- Select and complete from the following options:

- Reinvest with the same term and interest payment frequency

- Change the term and/or interest payment frequency

- Withdraw funds at maturity

- Add funds at rollover

- Early redemption/Break term deposit

Once done, you’ll see your term deposit maturity instructions in My AMP.

How can I change my maturity instructions or reinvest my term deposit?

You can also change your maturity instructions by completing the form.

What if I am in hardship and need to break my term deposit?

Term deposit funds can be withdrawn before the end of the term, but you ordinarily need to give 31 days’ notice and an interest rate adjustment is applied. If you’re in hardship and want to break your AMP term deposit, you can fill out the Hardship Assistance Information form. We'll review on a case by case basis and aim to respond to your request within three business days. If approved, you’ll be able to withdraw your funds early, without giving 31 days’ notice. In some cases, the interest rate adjustment may be waived.

How can I change my maturity instructions or reinvest my term deposit?

Funds may be withdrawn on maturity and will be electronically paid to the nominated bank account. If no instructions are received by the maturity date, your term deposit will automatically roll over for the same term at the applicable interest rate offered on that maturity date.

What you need to know

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

It’s important to consider your circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Information including interest rates is subject to change without notice.

Any application is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable. Full details are available in the Fees and charges guide.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.