A handy note before you read the case studies

We get it, these things are dry and sometimes tough to understand. And for some readers, financial jargon and numbers can make it all overwhelming. To help you get the most from the case studies, we've defined some terms below.

The purchase price is what gets reported to Centrelink when you start (or ‘purchase’) a lifetime pension in retirement. It is used to assess if you are eligible for the Government Age Pension and if so, how much you can receive. The lower your reportable purchase price when you retire, the better the likely outcome when it comes to being assessed for the Age Pension.

The benefit of having Lifetime feature switched on is that it’ll lower your assessable purchase price by Centrelink, so you can possibly be eligible for more Age Pension when you retire. And for some members, this might make the difference between getting the Age Pension, or not.

The Lifetime feature can lower your reportable purchase price because it uses the Government deeming rate instead of the actual investment returns on your account balance and contributions to work out a purchase price in the background. The Government deeming rate is expected to be lower than the actual investment returns, especially over the long-term. This means the calculated purchase price is expected to be lower than your future super balance.

This gives you a retirement advantage if you decide to convert some of your super into an AMP Lifetime Pension in the future. At that point you will be able to report the lower purchase price to maximise your Age Pension eligibility. If you decide you do not want to convert any of your super to an AMP Lifetime Pension in the future, then the lower purchase price is simply ignored, there is no impact to your super balance.

These cases are provided for illustrative purposes only to help you understand how the Lifetime feature works and are not intended to replace financial advice. This information doesn’t represent the benefits that you could receive, and the outcome will depend on your personal circumstances.

This information is based on superannuation, tax and social securities laws (including deeming rates) at the time of preparing the case studies. Government policies and laws will change in the future, which may impact this feature, and the benefits discussed. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.

When you retire (or otherwise meet what’s called a ‘Condition of Release’) you’ll have 14 days to decide if you want to convert some, or all your accumulated benefit, to the Lifetime Pension. Otherwise, the added benefit from the Lifetime feature will expire.

The AMP Lifetime Pension is not currently available for members but is expected to be available by mid-2026. The issuer of AMP Lifetime Pension is NM Super.

The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the product.

Lifetime Boost case studies: the proof is in the numbers

Eve, aged 30

Summary

- Eve is aged 30, single and a homeowner

- $50,000 account balance in her AMP Super fund

- $75,000 yearly salary (with employer super contributions of 12%)

- $50,000 other assets at retirement

- Eve wants to retire when she turns 67

How does the Lifetime Boost feature get Eve super close to a better retirement income?

At 30, Eve starts to have Lifetime Boost inside her AMP Super account. Eve knows that the sooner Lifetime is working in the background of her super account, the more options she will have at the time of retirement.

By the time Eve turns 65, her AMP Super balance has grown to $498,000. She decides to split her money equally between an AMP Lifetime Pension and an Allocated Pension, with $249,000 in each account.

Thanks to having the Lifetime Boost feature since she was 30, only $31,000 of the $249,000 in her Lifetime Pension account will be reported as the discounted purchase price by Centrelink for the purposes of assessing her Age Pension eligibility. This means Eve may get more retirement income as this discounted purchase price could make her eligible for more Government Age Pension.

This $31,000 ‘purchase price’ for AMP Lifetime Pension is calculated based on her 2025 super account balance, when the Lifetime Boost feature starts to apply. It also takes into account subsequent contributions, which have the Government’s deeming rate applied (currently 2.75%) instead of Eve’s actual investment returns (which are typically higher). This means the purchase price calculated by the feature ($301,000) at age 65 is lower than her balance ($498,000). The portion of her super balance used to start an Allocated Pension ($249,000) then reduces this purchase price further to $52,000, and the good news keeps coming for Eve because the Government applies a 40% Asset Test discount to the purchase price for all Lifetime Pensions, so this results in a final purchase price of $31,000 for the Lifetime Pension . A total of $280,000 ($31,000 + $249,000) will be assessed under asset test for Eve’s total asset of $498,000 in superannuation.

The result: When Eve retires at 67, she gets to enjoy higher retirement income for no extra effort.

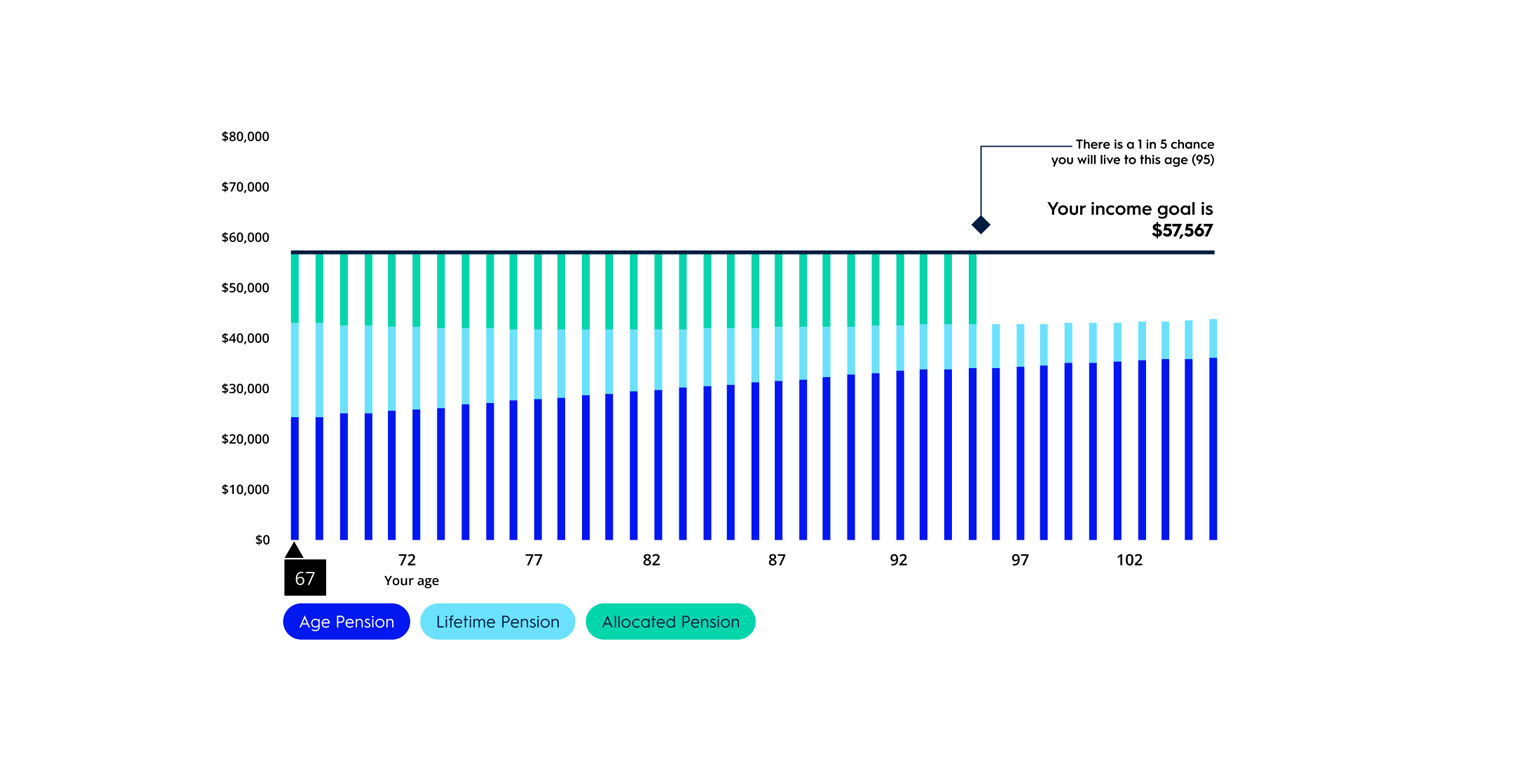

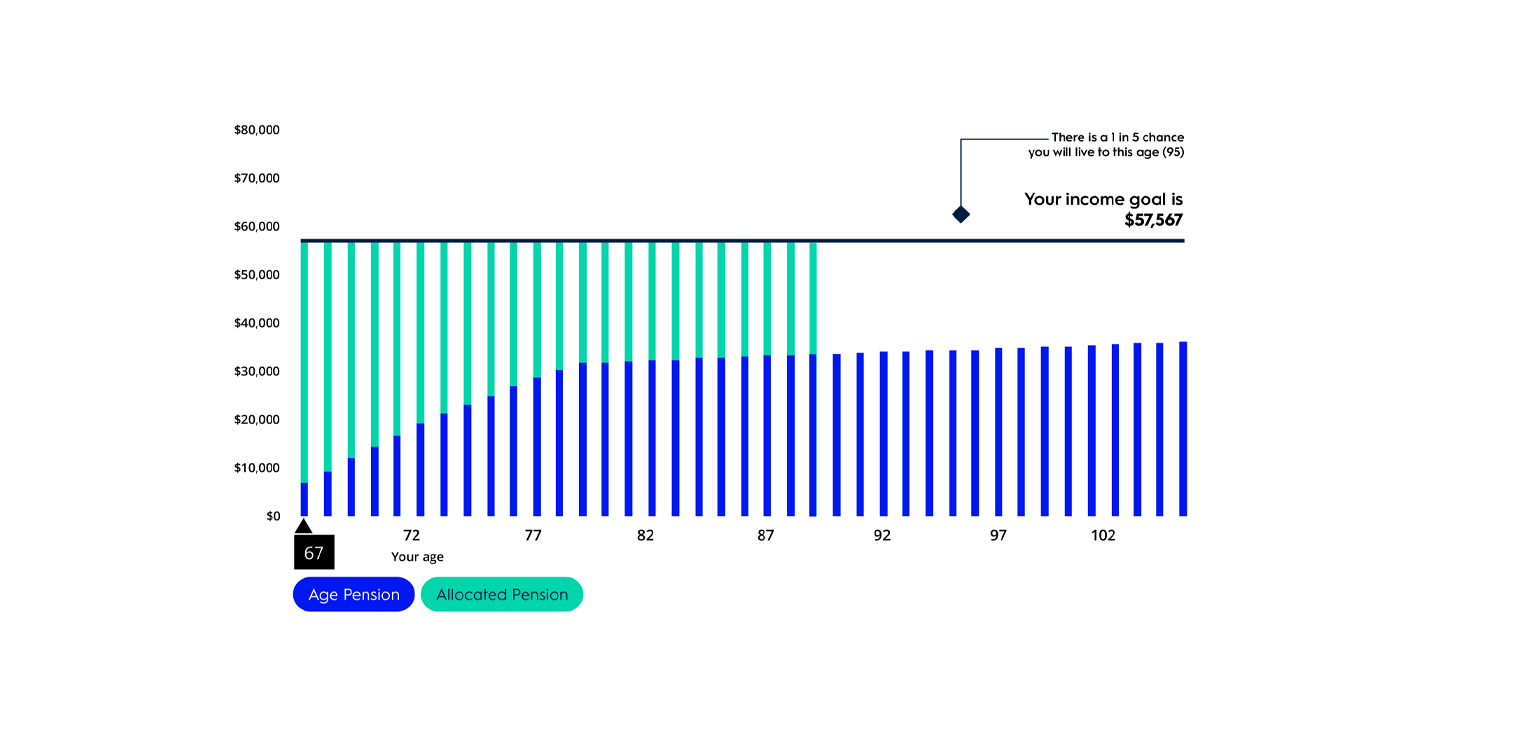

Thanks to Lifetime solution, Eve is expected to get an annual retirement income of $58,000 for 6 years longer, compared to if she put all her super in an Allocated Pension. Lifetime Pension also gives her $10,000 extra every year after her Allocated Pension runs out.

Eve’s retirement income with a Lifetime Pension and Lifetime Boost feature switched on

Eve’s retirement income without a Lifetime Pension and the Lifetime Boost feature

Case study assumptions

*Assumes investment returns of 6.33% p.a., super contributions of 12% of salary, growing by 3% p.a. as expected wage inflation. Figures are rounded for simplicity and expressed in today’s dollars by deflating future values by assumed inflation of 3% p.a.

*Based on assumed salary, contributions and investment returns.

* AMP Lifetime Pension launches in 2026

These benefits do not apply if you do not convert to an AMP Lifetime Pension within the time period specified at law

Important information

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

These cases are provided for illustration purposes only to help you understand how the Lifetime feature works and are not intended to replace financial advice. This information doesn’t represent the benefits that you could receive, and the outcome will depend on your personal circumstances. This information is based on superannuation, tax and social securities laws (including deeming rates) at the time of preparing the case studies. Government policies and laws will change in the future, which may impact this feature, and the benefits discussed.

Any advice is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It’s important you consider the appropriateness of any advice and read the relevant product disclosure statement and target market determination available at amp.com.au, before deciding what’s right for you. AWM Services is part of the AMP group and can be contacted on 131 267 or askamp@amp.com.au.

You can read our Financial Services Guide https://www.amp.com.au/financial-services-guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.