Lower super fees?

Yes, AMP

Switch to AMP Super and pay less in fees, keep more of your super and enjoy the secure way to grow your financial future¹.

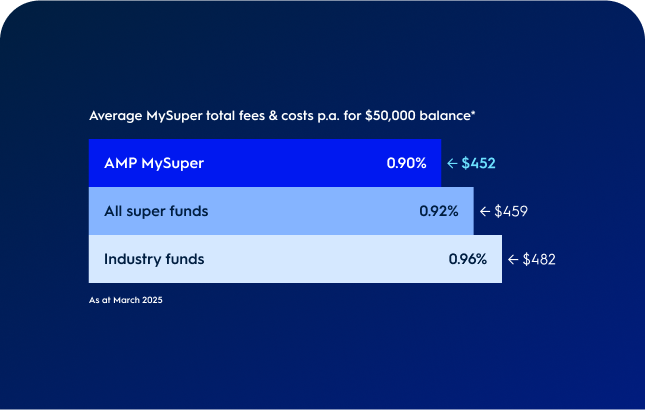

Enjoy a strong 13.3% return* with our MySuper 1970s option+, plus take advantage of fees and costs that are below the industry average, so you get more of your future money.

Become an AMP Super member and take advantage of intuitive, always-on digital advice to help maximise your retirement savings.

AMP Super gives you customisable Lifestages insurance, providing tailored protection that fits your lifestyle and budget.

We recommend you supply your:

It will only take a few minutes

We take our members' security seriously. Find out how we protect you.

You’ll need to be prepared to:

Bring all your super together in one secure place easily with My AMP in a few simple steps - no hiccups.

Book a 20-minute session for no extra fees to get expert advice and answers tailored to your super goals.

Use our calculator to discover the right level of insurance, so you’re only paying for what you need.

See how your super could grow and find out what steps you can take to boost your retirement savings.

Simulate your retirement

Our retirement simulator lets you see how different choices like adding a lifetime solution might impact how much income you have in retirement.1

John Ulkowski, GM Business Operations, AFL Players’ Association

AMP Super Employer Partner

Paul O'Hern

AMP Super Customer

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination from AMP at amp.com.au or by calling 131 267.

Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd (AWM Services) ABN 15 139 353 496 AFSL 366121, which is part of the AMP group (AMP). All information on this website is subject to change without notice.

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.

The retirement health check is a general advice conversation only, provided by AWM Services to eligible members of the AMP Super Fund.

Simple Super (Intrafund) advice is provided by AWM Services Limited (AWM Services) ABN 15 139 353 496, AFS Licence No. 366121 (AWMS) to eligible members of the AMP Super Fund. AWM Services is a wholly-owned subsidiary of AMP. This service may not be offered where it is deemed it is not within the scope of the service or your best interest.

Issued by SuperRatings Pty Ltd (SuperRatings) ABN: 95 100 192 283 a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings use proprietary criteria to determine awards and ratings and may receive a fee for the use of its ratings and awards. Visit superratings.com.au for ratings information. © 2023 SuperRatings. All rights reserved.

Footnotes

*AMP MySuper Lifestages investment options are based on your decade of birth and take you through your working life, continuously evolving as you approach retirement. AMP MySuper 1970s, 1980s, or 1990s Plus investment options delivered an average return of 13.30% for the year to 30 September 2025. Past performance is not a reliable indicator of future performance. Investment performance is as at 30 September 2025 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees).

1This is illustrative only and isn’t an estimate of the investment returns you’ll receive or fees and costs you’ll incur. Past performance is not a reliable indicator of future performance. Investment performance is as at 30 September 2025 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees).