The spread of COVID-19 is first and foremost a health crisis and our thoughts are with all those dealing with the direct impacts. The virus, and the world’s reaction, have also destabilised financial market causing concern to investors. AMP is here to support advisers and the critical work you’re doing during these challenging times with access to financial hardship assistance for clients, expert market and investment insights, regulatory updates, modelling tools, resources and investment choice. AMP is also helping clients with support and insights, see our client hub here.

News and Insights

TapIn: COVID-19 income support measures extended

22 July 2020

The government announced extensions and changes to the JobKeeper Payment and the JobSeeker Payment arrangements.

Shares climb a “wall of worry” - but is it sustainable?

10 June 2020

AMP Capital’s Chief Economist, Shane Oliver, looks at what the share market outlook means for Australian investors.

Early release of super client communication

20 May 2020

The Federal Government is providing temporary early access to super for people experiencing financial hardship.

Impact of COVID-19 on buy/sell transaction costs

20 May 2020

As COVID-19 is having a significant impact on global markets, the buy / sell spreads needed to be changed to reflect the increased market transaction costs.

Public debt due to the Coronavirus: can we afford it?

13 May 2020

Dr Shane Oliver looks how the Australian Government will pay for its coronavirus response.

Why super and growth assets must be long-term investments

28 April 2020

AMP Capital’s Chief Economist, Shane Oliver, looks at what COVID-19 market volatility means for Australian super investors.

ASIC grants relief to provide affordable advice

14 April 2020

ASIC has announced relief measures that will assist in providing consumers with affordable and timely advice during the COVID-19 pandemic.

AMP Capital COVID-19 insights

AMP Capital economic and market insights, after the bell podcast and webinars.

Tips and tools

Superannuation early access scams

10 June 2020

A fact sheet from the ACCC provides tips on how to avoid superannuation scams.

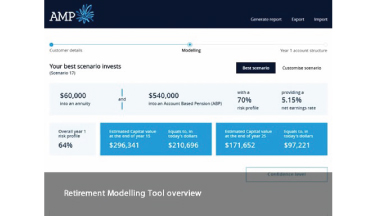

Retirement Modelling Tool

If you’re looking to revisit your client’s retirement strategy, AMP’s Retirement Modelling Tool can help you compare 900 MyNorth Pension, Centrelink and other retirement product strategies.

Guarantees to help protect your clients’ accounts

MyNorth Guarantees can help clients protect their investments from downside market risks, while still participating in any market upside.

Product news and insights

We’re here to help

If your AMP client is experiencing hardship, we'll take the time to listen, understand their situation and do our best to help. Like many organisations, we’re seeing a significant increase in clients and advisers getting in touch. Our teams are working hard to help but we’re experiencing some impact to service times through our contact centres and operational teams at peak periods.

Find out more about how AMP can help your:

North

8:30am - 7pm, Monday to Friday

(Sydney time)

AMP Super

8.30am – 7pm, Monday to Friday

(Sydney time)

Banking

9am – 5pm, Monday to Friday

(Sydney time)

Client support and insights

See the insights we’re sharing with clients and how they access support during these challenging times.

Find out moreWhat you need to know

© NMMT Limited ABN 42 058 835 573, AFSL 234653 (NMMT). This webpage, provided by NMMT, is for adviser use only and must not be made available to retail clients. It contains general advice only and hasn’t taken any person’s personal circumstances into account. You should consider the appropriateness of this advice for you or your clients. Visit amp.com.au to obtain the relevant disclosure documents before deciding whether to acquire or vary these products for any person. NMMT is part of the AMP group and can be contacted on 1800 667 841 or north@amp.com.au. If a person decides to acquire or vary a financial product or service, companies within the AMP group will receive fees and other benefits, which will be a dollar amount or a percentage of either the premium they pay or the value of their investments. Contact AMP for more details. MyNorth is a registered trademark to NMMT. The issuer of MyNorth Super and Pension is N.M. Superannuation Pty Limited ABN 31 008 428 322, AFSL 234654 and the issuer of MyNorth Investment and MyNorth Managed Portfolio is NMMT. MyNorth Investment Guarantee is issued by National Mutual Funds Management Limited ABN 32 006 787 720, AFS Licence No. 234652.